‘Ground breaker’ insurance for $2bn mangrove system

• Bahamas benefits most from storm surge barrier

• Insurer: This is something for World Bank take up

• Ecosystems to save nation $306m over 10 years

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE Bahamas stands to benefit most out of all hurricane-prone Western Hemisphere nations from investing in the $2bn worth of natural storm surge protection provided by its mangrove ecosystems, it has been revealed.

A series of reports produced by The Nature Conservancy (TNC) and its partners, exploring the feasibility of creating a mangrove insurance product for this and other nations, found that The Bahamas enjoys the highest benefit-to-cost (BCR) ratio of any location in the

region - including Florida and Mexico - when it comes to funding the preservation and post-storm restoration of these ecosystems.

The Bahamas’ BCR ratio was pegged at 1.52, higher than both Mexico (1.47) and Florida (0.36).

A BCR higher than one, according to the study, means that the benefits from financing mangrove placement and restoration significantly outweigh the costs involved given the natural barriers they provide to protect housing, businesses and other key coastal infrastructure from the worst effects of storm surge and flooding during a major hurricane.

The reports also assessed whether there was sufficient interest in, and appetite for, the structuring and development of a mangrove insurance product that would finance the upkeep and restoration of key ecosystems in The Bahamas. The TNC said it they assessed the feasibility of a “first-of its-kind mangrove insurance policy that can be groundbreaking for coastal protection in The Bahamas”, although it conceded that much more work is required to make this a reality.

Anton

Saunders,RoyalStar Assurance’s managing director,

SEE PAGE B4

A COURIER company has refuted reports it is closing its Bahamian operation while also dismissing suggestions that the move was sparked by outstanding tax arrears owed to the Government.

Jean Williams, described as Blue Postal’s registered agent in corporate filings with the Florida state authorities, told Tribune Business that “reports in the media are wrong” about the company closing its Bahamas-based operations.

This was despite a widely-circulated letter that last week informed clients its Bahamian operations had been experiencing challenges that “drastically affected” their service. As a result, the company had decided to wind down the Bahamian entity and instead customers will have to clear their shipments through other local couriers.

“Here at Blue Postal we are accustomed to delivering a standard of excellence to our customers. Over a period of time, we have experienced

challenges which have drastically affected our service lines and our ability to serve you at the standard to which you are accustomed to,” the notice read.

“After much review and consideration, we have decided to wind down our clearance/courier arm of our Bahamas operations and provide an alternative shipping option locally through other couriers (freight forwarders) to make your packages available for collection. This alternative option will also include the transfer of Customs fees to these couriers to facilitate clearance of your packages.”

Blue Postal said it would provide a list of couriers for people to choose from.

“Once you select a courier, please reach out to that courier for information regarding how to collect your package as they will be responsible for your shipment once it arrives in Nassau. We will make the list of couriers available by Thursday, April 6,” the company said.

“We know that your packages are important to you and we are working to make this a smooth

Village Road: ‘Don’t drag out’ relief for roadworks

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netBAHAMIAN petroleum retailers yesterday reiterated that a margin increase is “definitely what’s needed to get us over the finish line” as they voiced optimism that this week’s meeting with the Government will achieve a solution all can live with.

Raymond Jones, the Bahamas Petroleum Retailers Association’s (BPRA) president, told Tribune Business that while gas station operators are still waiting on a definitive time and date from the Davis administration he has “no doubt” that the two sides will meet given that they have already been contacted by the latter.

Speaking after Michael Halkitis, minister of economic affairs, last week said the Government is assessing separate proposals from the retailers and wholesalers (Esso, Rubis and Shell), he added that gas station operators were confident they have “made our case” for a margin increase equivalent to a 7 percent increase in the cost of landed fuel given that many are already “in the red”.

Mr Jones told this newspaper that “2 percent would probably do” if the petroleum

SEE PAGE B6

VILLAGE Road businesses are urging the Government to “not drag out” the provision of tax breaks and other financial compensation for their roadworks “nightmare” with some firms preparing individual damages claims.

Gov’t generates $6m surplus for January

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE Government generated a modest $6m Budget surplus during January 2023, which enabled it to enjoy a rare month when its direct debt actually shrank albeit only by $8.5m.

The Ministry of Finance’s fiscal report for the first month

Branville McCartney, the former Democratic National Alliance (DNA) leader, told Tribune Business that his Halsbury Chambers law firm was in the process of drafting a letter to Alfred Sears KC, minister of works and public utilities, setting out its case for $250,000-plus in compensation after an “outage” completely “knocked out” its

SEE PAGE B5

of the calendar year, which typically marks the start of the richest revenue quarter for the Government, disclosed a second monthly surplus for the 20222023 fiscal year following Julys $41.3m. A surplus means that the Government earned more in taxes and other revenue than it actually took in for the month. Total revenues, aided by $132.1m in VAT collections, stood at $266.9m while January’s total expenditure came in at $260.9m. The VAT figure represents December payments, including the peak Christmas sales period,

SEE PAGE B6

Only margin increase will ‘get us over the finish line’

Bahamas in three-city Texas promotional tour

THE Bahamas is embarking on a three-city tour of Texas as the next stage in the Ministry of Tourism, Investments and Aviation’s drive to promote this nation to potential visitors and investors.

The marketing effort will be led by Chester Cooper,

deputy prime minister and minister of tourism, investments and aviation, who will be accompanied by Latia Duncombe, the ministry’s director-general and other senior executives.

Building on the success of the 2022 initiative, the ‘Bringing The Bahamas to

you’ tour will visit Dallas, Austin and Houston. It will also celebrate the country’s 50th independence anniversary, highlighting a year-long calendar of events that visitors and Bahamian residents can join and enjoy.

The US State Department found that 1.6m Texas

residents received a passport in 2022, the largest single-year distribution in the past five years, thereby enhancing the ability of Texas residents to travel to The Bahamas.

“With statistics showing an increase in international travel among Texans, now is

the time for Texas residents

to choose The Bahamas for their short haul vacations this summer and beyond,” said Mr Cooper. “We want The Bahamas to be the initial stamp in first-time traveller’s passports, but we also look forward to welcoming back our repeat visitors who continue to choose us for their Caribbean vacation.”

Direct flights enable travellers from Texas to reach The Bahamas in just three hours. Frequent airlift makes the destination easily accessible for Texans, with daily and weekend service via American Airlines and United Airlines, respectively, from Dallas; Saturday service from Austin via American Airlines; and daily service from Houston via United Airlines.

The ‘Bringing The Bahamas to you’ tour will continue throughout summer 2023 with stops in Los Angeles and Atlanta. The Ministry of Tourism, Investments and Aviation will also be heading to the UK this fall.

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Travellers who book their 2023 Bahamas vacation can expect year-long celebrations, events and festivities as the destination commemorates a golden jubilee of 50 years of independence. Highlights from the upcoming 50th independence celebrations include the National Family Island Sailing Regatta; the 50th on Bay Street Festival, showcasing Bahamian art, cuisine, performances and more; and Bahama Rock, a celebration of Bahamian music.

BTC ELIMINATES PARENTAL LEAVE QUALIFYING PERIOD

THE Bahamas Telecommunications Company (BTC) and its ultimate parent company say they have eliminated the standard qualifying period for all full-time employees to obtain parental leave.

The carrier, in a statement, said this was removed for all full-time staff with effect from April 1 regardless of their date when they were employed. The move was initiated by BTC and its parent, Liberty Latin America.

K. Darron Turnquest, BTC’s people director, said:

“We firmly believe that our people are our most important asset, and as a business we are committed to supporting them in whatever way we can. The removal of the qualifying period for parental leave is major, and a huge step in redefining our culture and cultivating the workplace of the future.

“From day one, all fulltime employees have access to these benefits and previous restrictions have been lifted. BTC continues to be a trendsetter, and we believe in providing equal opportunities for all employees.” The qualification for parental leave has previously followed locallyaccepted policies. However, under the latest version, BTC said any full-time employee, regardless of their date of employment, will receive paid parental leave from the company.

BTC described its parental leave policy, which was launched in 2019, as one of the most generous in the country. Mothers receive 16 weeks paid leave, fathers receive eight weeks’ paid leave and adoptive parents also receive eight weeks’ paid leave.

Sherry Benjamin, the Bahamas Communications & Public Officers Union (BCPOU) president, added:

“The BCPOU welcomes and supports this major change for all full-time colleagues. This is a move in the right direction, and we continue to work closely with the management team to improve the livelihood for our members.”

Mr Turnquest said: “We are continuing to work with our colleagues amid a postpandemic environment, and we’ve implemented flexible work arrangements. The reality is the world has changed and we must continue to change with it.”

CIVIL REGISTRY RESTORED AFTER ‘INORDINATE DELAY’

registry. The latter also holds births, marriages and death certificates.

PUBLIC access to the civil registry at the Registrar General’s Department was restored last week as its top official apologised for what she described as an “unexpected and inordinate delay” and disruption.

Camille Gomez-Jones, the Registrar General, explained at the Prime Minister’s Office media briefing that public access to the civil registry - known as CRIS - had to be “disabled” from last September to preserve the integrity of its data while the digital platform was redesigned.

Tribune Business previously reported how attorneys and realtors had branded the loss of access as “a horror”, given that they were no longer able to conduct rapid and relatively inexpensive online searches for title deeds and particular conveyancing documents via the civil

Ms Gomez-Jones, though, said public access had to be disabled so that sensitive data could be migrated to the new civil registry system without being lost, damaged or breached. “Some time in September, it came to our attention that it would become necessary for us to disable the public access to the Registrar General’s civil registry information system, which I refer as CRIS.”

Noting that government officials in multiple departments, as well as attorneys and realtors, use the civil registry’s functions, she added: “So there was a disruption in that service and we were attempting to resolve the issue as swiftly as possible but, unfortunately, we were met with an unexpected, inordinate delay.

“In dealing with the issue it came to our attention that the platform needed to be redesigned in order to maintain the integrity of

the data and, in that process, we connected with the Department of Transformation and Digitisation, who were the project managers on redesigning the platform so that we did maintain the integrity of the data.

“Unfortunately, in that exercise, it took a little longer than expected and the disruption ensued for a lot longer than we intended. I am here today to announce some happy news that we are no longer disrupted, but we have maintained the integrity of the data,” Ms Gomez-Jones continued.

“We have redesigned the platform and it is now available for public use. We have engaged in testing and we have successfully completed the project without incidents, no breaches. No damage to any data and the platform is now available for the public to use and to resume regular functions... I wish to extend sincere apologies for the inordinate delay.”

Following a presentation on April 4, the

Registrar General said she had authorised that fill public access to the civil registry be restored. Ms Camille-Jones added: “Rather than us going back and forth between four systems to track your data, we have one system that you can use at the touch of a button. You will be able to order and receive your documents from the comfort of your home.... We are on the road to full digitisation.”

Meanwhile, the Attorney General said the new digital corporate registry, which deals with company name reservations and incorporations, will be operational by May-June 2023 for new entities. Ryan Pinder KC, addressing the same briefing, said: “What we’re looking to do is, by the end of this month, be able to have what I call a closed dummy pilot.

“[This] would allow some of the major users of the company registry, generally, the banks and the law firms and some of the financial corporate service providers, to have use of the system

Village Road seeks ‘two relief umbrellas’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.netVILLAGE Road businesses are seeking “two umbrellas” of relief for damages and losses due to prolonged roadworks impacting the area.

Michael Fields, spokesperson for the Village Road Business Collective, which represents impacted companies, told Tribune Business he does not want to pre-empt the Government’s promised “counter-proposal” on a relief and economic stimulus package while voicing optimism that it is circling back to address the situation.

He explained that the business community’s request for support falls under “two umbrellas”, with the first being the “repair, restoration and cleaning” of companies that were affected by the prolonged roadworks. They want their businesses to be returned to the state their premises were in prior

to the roadworks, which lasted for more than one year, whether the assistance comes in “grant or in-kind support”.

The second priority is “economic relief” that can come through “various tax incentives, tax rebates, Business Licence and real property tax waivers”. Stimulus can come from the business continuity grants available via the Small Business Development Centre (SBDC), as well as marketing and promotional support to bring customers back to the area.

Michael Halkitis, minster of economic affairs, addressing the Prime Minister’s Office media briefing, indicated that the Government is examining what tax breaks and other relief it can offer to the Village Road businesses but provided no specific details.

“We have had several meetings with them. They have submitted to us a list of businesses, and a proposal for some form of relief they would like to see.

“We are studying that, and we expect to come back to them with a

Embassy of the United States Vacancy Announcement

counter-proposal very shortly so that we can move towards a conclusion. The Ministry of Finance will be working in conjunction with the Ministry of Works, because there are some instances where slight repairs need to be made to property, for example, to driveways and walks, etc.”

The last Christie administration set a precedent for providing such relief when it offered tax breaks and other assistance to businesses located on corridors impacted by the New Providence Road Improvement Project, especially in the areas of Blue Hill Road, Robinson Road and Prince Charles Drive.

Mr Halkitis, meanwhile, said the Government is still seeking a resolution to petroleum retailer calls for margin increases. “We’ve been having discussions with the retailers and wholesalers to see how we can adjust the system that is currently in place to bring some relief, particularly to the retailers who have been clamoring. And, of course, I say, once again, our view is that any solution should

Th e American Embassy in Nassau is accepting applications for the following position:

Commercial Specialist

Open to:

All Interested Applicants / All Sources

Duties:

As a member of the U.S. Embassy's dynamic Political-Economic Section, the Commercial Specialist (CS) leads on all aspects of work related to Embassy Nassau's efforts as a Commerce Department Partner Post, including the planning, coordination, and implementation of multiple complex commercial services. The CS provides support for business matchmaking programs such as the Gold Key Service and International Partner Search and conducts market research to fulfill trade infonuation requests from U.S. exporters and host country importers. The CS leads on the promotion of trade missions, local trade exhibits, and other export promotion activities, including coordinating the participation of a combined Embassy Nassau/Government ofBahamas delegation and up to 30 bilateral meetings between U.S. finns, local companies, and ministry representatives directly following a trade mission.

Interested candidates are required to possess the following skills and qualifications:

• Education: Bachelor's Degree in Business Management, Economics, Marketing, Finance, International Trade or related major is required.

• Experience: Al least five years of progressively responsible experience in business or govenunent in the fields of marketing, trade promotion, economics, international trade, business development or sales is required.

• Language: English level - Fluent, Reading/Writing/Speaking.

The complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

Applications will not be accepted at the Security Gate of the Embassy, by Mail, E-mail or other means of delivery. Opening Period: Monday March 27, 2023 - Fridav April 14, 2023.

ue to the high volume of applications, unsuccessful candidates will not be contacted.

not lead to the immediate impact of increasing prices at the pump or Bahamians,” he said.

“So that is something that we continue to work on. We have another meeting scheduled for this this week upcoming following the holidays, and it’s a very complex issue that involves private contracts between individuals. And so we want to make sure that any solution that we propose, the foremost thing for us is that it actually brings relief and it does not lead to a direct increase at the pump immediately.”

so they can advise us from the user point of view if any tweaks need to be done to the system. That we hope to be hosted this month. Again, that’s not for real incorporations. That’s just for their user experience and feedback.

“Shortly thereafter, hopefully by May or June, we will look to have the system launched for new incorporations.” Mr Pinder said the final phase will involve the migration of historical data to the new portal and platform. Ms Gomez-Jones said the new corporate registry will effectively merge five systems into one.

Under the present companies registry, she explained that e-services is where banks, law firms and financial and corporate services providers go to reserve names and incorporate companies. However, another system is used to store all the data, and others track the payment of fees and record the images of scanned documents. Paper files serve as a back-up.

“When you want an update to your company I have to go into all these systems because they don’t talk to each other and make sure everything is considered so we can give an accurate report on the status of your company,” Ms Gomez-Jones said.

“What we are seeking to do is remove all of these systems and merge them into one. In doing that, we want to make sure that the data we are merging is accurate and error free.

“When we were doing that migration phase, because we were prepping for the civil registry, we discovered we needed to do some work to the civil registry to prevent any breaches or disruption to the data. We were able to redesign the civil registry without any breaches and have it available for use.” Family Island administrators will now encounter a second security tier when they access the system.

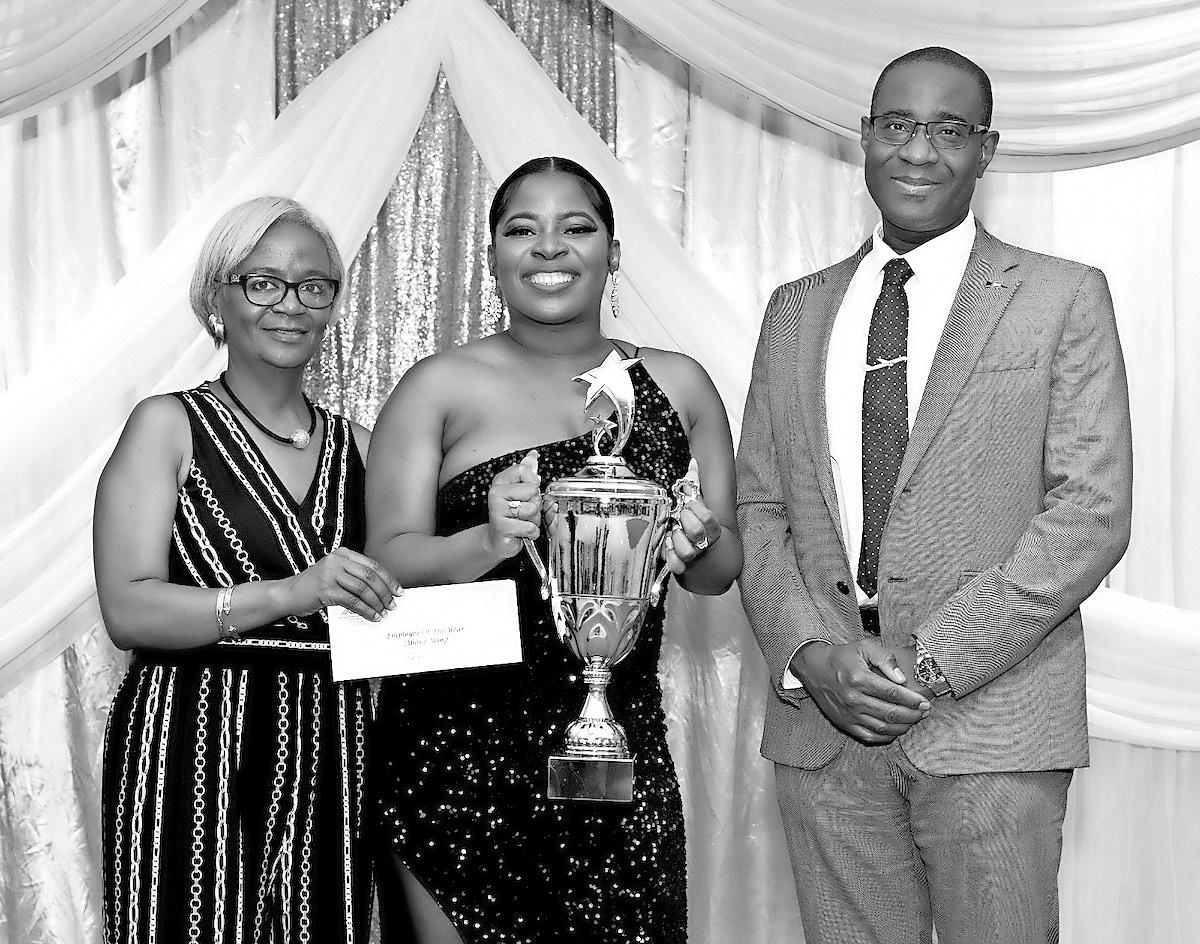

NASSAU FLIGHT SERVICES

REWARDS TOP EMPLOYEES

NASSAU Flight Services held its Employee of the Year 2022 award ceremony on March 31 at the National Training Agency, Gladstone

Road. Kaya Moxey (pictured) won Employee of the Year - Above Wing, and Bianca Rahming (also

SEE PAGE B6

‘Ground breaker’ insurance for $2bn mangrove system

yesterday told Tribune Business that creating such a mangrove insurance policy was something best left to the likes of the World Bank and international reinsurers to develop rather than Bahamian property and casualty insurers such as his own.

Confirming that he had read The Nature Conservancy’s reports, he added that he did not possess enough “technical knowledge” about mangroves and the associated hurricane risks to devise a solution.

“That is something that the World Bank and reinsurers would have to take up,” Mr Saunders said.

“It’s great that it helps us with hurricanes and the restoration of those things, but I’m not technical enoughand I don’t think anyone in The Bahamas is technical enough - to come up with an insurance solution. Everything is risk and reward. I’m not going to insure something unless I know it can technically be insured and what is the risk analysis for these things.

“I’m not technical enough to come up with a solution as to how to do it. It’s a concept. We all know they help in reducing storm surge along the coast, but how do you plant more and how do you plant. I’ll wait for the experts to tell me what the best solution is.’

The Nature Conservancy reports suggested that The Bahamas could model any

mangrove insurance policy, and especially how they were financed and who paid for them, on the existing reef insurance policy in Quintana Roo, Mexico. There, the insured is a trust fund financed by contributions from local governments, donors, private coastal property owners and other investments.

“Our results show that mangroves provide over $2bn in flood protection benefits in The Bahamas with a country-level BCR above one,” one of the reports said, zeroing in on two areas - the northern Port area of Freeport, Grand Bahama, and The Marls in central Abaco.

Asserting that these two areas, combined, account for 15 percent of Bahamian gross domestic product (GDP), the reports identified them as “primary focal areas for a potential mangrove insurance policy”.

In Grand Bahama, these ecosystems were said to provide natural flood and storm surge defences for residential and industrial areas, and Grand Bahama International Airport, with Marsh Harbour’s airport among the Abaco-based assets that are protected.

“In Grand Bahama, mangroves provide over $900m in flood protection benefits. In Abaco, mangroves provide over $26m in flood protection benefits,” The Nature Conservancy reports said. “Both islands are home to large areas of

mangroves, including mangroves that are adjacent to key public infrastructure, such as airports.

“Both also intersect with potential blue carbon sites, and stakeholders expressed interest in understanding whether and how mangrove insurance and blue carbon payments might be pursued jointly. Grand Bahama and Abaco Islands are two of the islands in The Bahamas that are most frequently impacted by hurricanes.

In 2019, Hurricane Dorian caused significant damage to mangroves on both islands, and an estimated $1m over the next five years is still needed to complete restoration of the damaged areas.”

Who pay for mangrove insurance, and how much, remain key questions to be answered. A self-insurance or captive solution are among the potential options, while the Government will almost inevitably have to be involved given that many mangroves sit in Crown Land that it controls.

However, The Nature Conservancy reports suggested that The Bahamas Protected Areas Fund provides a potential mechanism or vehicle for financing mangrove insurance.

“The Bahamas Protected Areas Fund - a national conservation trust fund established in 2014, with a mandate to provide sustainable financing for protected areas management and biodiversity conservation,

among other things - could likely fund an insurance premium,” the reports said.

“With modest changes to its structure and governance, the trust fund could also serve as the hub for all activities related to mangrove insurance, similar to the trust fund in Quintana Roo, Mexico. While Bahamian insurance law does not explicitly address insurable interest related to property policies, the common principle requiring an economic interest will likely apply since Bahamian law tends to follow English common law.

“In nearly all of the conversations with stakeholders, the primary concerns were how much an insurance policy would cost, who or which entity would pay for it, and/or how funds could be secured to pay for it. Identifying ways to fund the purchase of the insurance premium is critical,” The Nature Conservancy reports continued.

“With the work that we have done to date, we are optimistic about the potential for establishing mangrove insurance policies to fund restoration of mangroves damaged by hurricanes. While this phase of work focused on the feasibility of a mangrove insurance policy in specific locations, the next phase of work will focus on how to design the insurance scheme and manage the payouts to ensure the appropriate restoration work takes place.”

The reports used discount rates of 4 percent and 7 percent, respectively, to establish the present value of mangroves to The Bahamas and other locations

over a 30-year lifespan. They projected that, without mangroves to guard against hurricane-related storm surge and flooding, The Bahamas would suffer some $729m worth of damage over a ten-year period.

However, with fully intact mangrove ecosystems, these damages would be reduced by $306m or 42 percent over the same ten-year period to $423m. And, over a 100-year span, the reports forecast that mangroves could reduce the storm surge-related damages suffered by The Bahamas by $4.3bn or 31 percent - dropping them from $13.871bn to $9.565bn.

Using the 4 percent discount rate, the reports said:

“The total Present Value of mangroves across the Caribbean is $25.17bn. The top five regions in terms of present value of mangroves for flood protection are Mexico ($6.26bn), Florida ($13.1bn), The Bahamas ($2.29bn), Cuba ($1.24bn), and Guatemala ($0.42bn).

“Among the three focal areas, The Bahamas presents the highest mean present value per hectare ($54,570) followed by Florida ($34,680) and Mexico ($6,659)..... At a discount rate of 7 percent, the mean 30-year present value per hectare of mangroves across the wider Caribbean in five kilometre study units was $5,877 per hectare.

“Among the three focal areas, The Bahamas presents the highest mean present value per hectare ($39,625), followed by Florida ($25,183) and Mexico ($4,835). The total present value of mangroves across

Courier firm

refutes

closure, tax arrears

FROM PAGE B1

transition.... We know that change isn’t easy, but please rest assured that we are committed to the safe delivery of your packages and we sincerely apologise for the inconvenience caused.”

Ms Williams, though, reiterated that the report is not true. She added that Blue Postal, whose principal, Heather Saunders-Bartlett, is also named in Florida corporate documents, does not owe any tax arrears to the Government and the “truth will come out, just wait and see. Not everything in the news is the truth”.

Ms Williams said workers were still employed, and there were no plans to lay off any Blue Postal staff. “I’m still employed and I don’t know of anybody else not being employed,” she said. “One thing I know about my boss is that she’s a woman of integrity and she’s been paying her bills. For whatever is not paid, there has to be a dispute, but I know that about her. She doesn’t believe in

Human Resources Specialist

the Caribbean is $18.28bn. The top five regions are Florida ($9.5bn), Mexico ($4.55bn), The Bahamas ($1.66bn), Cuba ($0.9bn), and Guatemala ($0.31bn).” The studies estimated that some 21,027 persons on an annual basis enjoy protection from Bahamas-based mangrove ecosystems. And, for Nassau, Grand Bahama and Andros, the benefitto-cost (BCR) from their maintenance and upkeep soars to five. However, The Bahamas’ mangroves were shown to be the most vulnerable to loss and damage in hurricanes, with 6.8 percent facing such a fate annually.

“In The Bahamas, all the islands have more than 4 percent of expected losses. The highest damage is expected to happen in Exuma and Long Island (7.9 percent), followed by Crooked Island (7.8 percent). The island of New Providence where the capital, Nassau, is located had 7.2 percent annual expected mangrove loss,” The Nature Conservancy reports found.

Using the 4 percent discount model, the studies said: “We assume a median restoration cost of $4,538 per hectare in Mexico, $54,653 per hectare in western Florida, $118,524 per hectare for projects in eastern Florida, and $35,955 per hectare across The Bahamas.”

At a 7 percent discount: “We assume a restoration cost of $4,538 per hectare in Mexico, $54,653 per hectare in Western Florida, $118,532 per hectare for projects in Eastern Florida, and $39,599 per hectare across The Bahamas.”

owing anybody any money. That’s her.”

Tribune Business sources, speaking on condition of anonymity, last week said Blue Postal executives were called in to a meeting by Ministry of Finance officials who, alarmed at reports the company was ceasing operations, feared it would close down without settling due tax liabilities to the Government.

Ms Williams, though, bristled when this was put to her and refused to confirm whether such a meeting took place. She said: “I cannot help you. I am a woman who trusts in God, and I am believing that what God has started he is going to begin, and there is no person higher than the supreme authority of God Almighty and he never lost a battle and he never will.

“So I am keeping my faith and my focus on our mighty God. Governments come and governments go. God remains the same.”

The Blue Postal saga comes after it was revealed by Tribune Business that several

Open to:

All Interested Applicants / All Sources

Duties:

Incumbent is the technical advisor and principal assistant to the Human Resources Officer (HRO) in all areas of Human Resources Management for Mission Nassau. Under the general supervision of the HRO, the incumbent is directly responsible for the full perfonnance of a wide range of HR functions at post for Department of State employees and employees of other Agencies (CBP, USCG, DOD, ICE, ATF, FBI/LEGATT) as well as Locally Employed Staff. Oversees management of recruitment, salary and benefits, HR infonnation systems, training, check-in and check-out processing, awards, policy fonnulation, the American employee program, and employee relations issues. The incumbent supervises the HR Office and HR Assistants.

Interested candidates are required to possess the following skills and qualifications:

• Education: Bachelor's degree in Human Resources, Psychology or Business Administration is required.

• Experience: Five years of progressively responsible experience in the field of Human Resources (HR) with proven experience covering compensation and benefits, employee relations, recruitment, performance management, and social security laws and benefits. Application must illustrate a thorough knowledge of Bahamian local labor laws and prevailing practices. One year of supervisory experience is required. Experience must have been gained in a global organization with 150 or more employees.

Language: English level - Fluent, Reading/Writing/Speaking.

The complete Vacancy Announcement and Application fonns are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

Applications will not be accepted at the Security Gate of the Embassy, by Mail, E-mail or other means of delivery. Opening Period: Monday March 27, 2023 - Friday April 14, 2023.

Due to the high volume of applications, unsuccessful candidates will not be contacted.

courier companies had been temporarily blocked from clearing imports on behalf of customers because they had failed to pay due import duty and VAT to the Government on their clients’ behalf. There is nothing to suggest Blue Postal was among them Simon Wilson, the Ministry of Finance’s financial secretary, declined to comment on Blue Postal when contacted by this newspaper. “I don’t want to talk about any particular taxpayer,” he said.”We have an audit programme focused on courier companies which we are rolling out right now. This programme is designed to assist with compliance. We’re not targeting any particular courier company; we’re trying to get them to comply.”

He previously told this newspaper that there were several couriers who owe the Department of Inland Revenue (DIR) tax arrears that go into the millions. Michael Halkitis, minster of economic affairs, addressing the Prime Minister’s Office media briefing last week, said the Government was using compliance tools that had not been employed before given the increased focus on revenue administration and enforcement.

Village Road: ‘Don’t drag out’ relief for roadworks

computer system on July 15 last year.

Asserting that this claim was “separate from the discussions” between the Government and the Village Road Collective, which represents all area businesses in their fight to secure some financial redress, he added that while the Davis administration’s latest words were “encouraging” it should “not delay” addressing their plight.

The Halsbury Chambers chief spoke after Michael Halkitis, minister of economic affairs, told last week’s Prime Minister’s Office media briefing that the Government was readying “a counter-proposal” to the Village Road Collective’s submission for tax breaks and other economic stimulus to offset lost sales revenue due to the roadworks.

“As you know, the Village Road businesses have approached the Government to bring some relief.... to in some way compensate for some of the disruption and also some of the damage to property on the occasion of the Village Road Improvement Project,” Mr Halkitis said.

“We have had several meetings with them. They have submitted to us a list of businesses and a proposal for some form of relief they would like to see. We are studying that, and expect to come back with a counterproposal very shortly so this can move forwards to a conclusion.

“The Ministry of Finance will be working in conjunction with the Ministry of Works because there are some instances where slight repairs have to be made to drive ways and walls etc....

We are working with the Ministry of Works to finalise that, and expect it to be done very shortly...... That’s something that’s coming along very well, and we expect to have that concluded in the coming weeks.”

However, one Village Road businessman voiced frustration over his personal efforts to obtain relief and other forms of compensation. Brent Fox, Montague Motors’ principal, told Tribune Business he felt he was being “brushed off” after suffering an estimated $165,000-$200,000 loss of sales revenue due to the roadworks and the inability of customers to access his company.

Readily acknowledging that any compensation offered by the Government will “not come close” to offsetting these losses, he added: “I’m not asking for the moon and the

sky.” However, Mr Fox said the prospect of Business Licence fee waivers - his is around $8,0000 - had receded for a year at least given that the March 31 deadline for payment has already come and gone.

Mr McCartney, though, said Mr Halkitis’ comments do offer some hope. “If he said that it’s encouraging to hear,” he added of the minister’s comments. “Nothing has transpired in terms of any concrete details from the Government in terms of their stance on compensation as to what they’re looking to do.

“I know they [the Collective] had a few meetings previously, and the Government at the time seemed to be open to discussing some form of compensation for business owners in regards to the Village Road roadworks. If he’s saying a counter-proposal, that I guess means they’re studying the proposal by the group, they’re considering it, looking at it and coming back.

“What he’s saying is that they want to negotiate, which is to be expected dealing with the Government. They’d want to negotiate what type of compensation they will give the business owners.”

Mr McCartney, though, urged the Davis administration not to stall any relief effort over the roadworks, whose completion date was extended several times and lasted for around 15-16 months.

“Certainly it’s been more than a year in terms of the roadworks, and inconvenience and loss as a result of that,” he said. “We’d certainly want the Government to not delay and, if they’re talking from the group standpoint in relation to a counter-claim, let’s get the counter-proposal in so discussions can be had.

“We certainly don’t want them to drag this out. It’s been going on for too long, too long, and caused tremendous loss among businesses and a lot of inconvenience among businesses and residents alike. The roadworks were really a nightmare.”

Revealing that individual businesses will have compensation claims beyond what the Village Road Collective is seeking, Mr McCartney said different companies and landowners had suffered varying degrees of damage to their properties. In the case of Halsbury Chambers, he added that its parking lot was a “complete mess” with asphalt damage caused when construction equipment was parked there. Landscaping, too, had suffered.

CALL 502-2394 TO ADVERTISE TODAY!

NOTICE is hereby given that THANIS FRANCOIS of #1 Timothy Lane, Fox Hill, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 11th day of April, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

And Mr McCartney also disclosed that his law firm is in the process of writing to Mr Sears, as well as the main Village Road contractor, Knowles Construction, over the loss of computer equipment and IT systems that brought it to a two-week “standstill” last summer.

Confirming that he had “briefly discussed” the matter with Emil Knowles, Knowles Construction’s principal, the former DNA leader said: “I’d imagine by next week that the minister will get a letter copied to Mr Knowles about the damage occasioned on July 15. That’s separate from the discussions of the group.

“That incident that occurred took out my equipment, knocked out the computers, Internet, alarm systems and cameras. We were at a standstill for

almost two weeks trying to replace that equipment and the like. We’ve started to craft a letter about the circumstances, damages and loss as a result, which will include the replacement of equipment and loss of business.

“We had initially estimated it at over $100,000 in terms of equipment and loss of business when we were going through it earlier last week. Now I’m probably looking at close to $250,000plus for the outage and loss of business. That aspect is now $250,000-plus when we were calculating that up last week.”

Mr Fox, meanwhile, said he had failed to achieve a satisfactory resolution despite visiting Mr Halkitis’ office several times. “They were supposed to have a meeting with all the Village Road people to knock

out the details and it never happened,” he added. “I was holding off, but I have to pay my Business Licence this week. This would have been the time to deal with that issue because this is when we submit our Business Licence fee payments.

“I was just delaying another few days. Now I have to pay the full fee and the money is gone. There’s nothing happening as far as I am concerned. I don’t see any sort of compensation coming. How can they address what is going on on Village Road unless they take into account facts and figures. Every time I take them the accounts, the loss of sales, they say they don’t need that. How can they address it if they don’t see what we’re talking about?” Besides a Business Licence fee waiver, Mr Fox said he was also hoping

Montague Motors could be granted a VAT “holiday” lasting for at least two quarters or six months.

“Anything at all,” he urged.

“If you are even considering that, you should be reaching out to business people for facts and figures. I’m somewhere between $165,000 and $200,000 down. It could even be a little bit higher.

“I’m not asking for the moon and the sky. I don’t expect them to compensate me for all the money I lost. They could help me by giving a waiver on the Business Licence fee or waiver on VAT. That does not come close to what I lost. My sales were down 30-40 percent over the roadworks months. It adds up: $10,000$12,000 here, $15,000 there.”

NOTICE is hereby given that SHANTEANNA JOSEPH of #224 Flying Fish Street, Carvel Beach, Freeport, Grand Bahama, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of April, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Gov’t generates $6m surplus for January

and includes receipts from both monthly as well as quarterly filers. As a result of the modest surplus, the Government’s fiscal deficit for the first seven months of the year stood at $270m or 46.9 percent of the $575.4m projected for the full year.

“During the month, revenue receipts firmed by $38.8m (17 percent) to $266.9m when compared to the prior year. This improved performance was primarily driven by

increased international trade and transaction tax collections ($16.3m), VAT collections ($12.8m), and property tax collections ($8m),” the Ministry of Finance said in a statement.

“Month-over-month, total revenue grew by $77.8m (41.1 percent) owing to improved VAT collections ($58.3m) and other non-tax revenue collections ($17.9m). On the expenditure front, total expenditure rose $19.7m (8.2 percent) to $260.9m relative to the prior year.

“Outlays primarily increased for the acquisition of non-financial capital assets ($12.4m) and insurance premiums ($6m). Month-over-month, spending was contained by $21.1m (7.5 percent) mainly due to a reduced outlays on subsidies ($19m). As a result of the above, Government’s fiscal position for January 2023 resulted in a $6m surplus and a decrease in the net debt position by $8.5m.”

The Ministry of Finance, breaking down how the

Government’s direct debt had reduced, added: “Proceeds of borrowings during the period totalled $260.2m via $15m in Bahamas Registered Stock, $205m in Central Bank advances, $0.2m in Treasury Bill placements and $40m in domestic loans. “Repayments totalled $268.8m owing to repayments of $205m for Central Bank advances, $25m for maturing Treasury stock, $22.2m for domestic loans and $16.2m for foreign currency loans.” On the

revenue front, the Ministry of Finance said: “Tax collections totaled $223.6m, supported by $132.1m in VAT receipts; $50.7m in international trade and transactions taxes; $23.1m in other taxes on goods and services; and $17.4m in property taxes. “Non-tax revenue collections of $43.3m were explained by $17.9m from the sale of goods and services, and $25.4m in other non-tax revenue.” As for expenditure, the Ministry of Finance said: “Recurrent

Only margin increase will ‘get us over the finish line’

FROM PAGE B1

industry and, by extension, the wider Bahamian economy had not experienced the “very crazy” cost increases seen especially over the last three years post-COVID. He added that the “2 percent” rise would have sufficed without the recent 24 percent minimum wage increase, which has sent petroleum industry wage bills soaring, and if insurance premiums had remained at 2019 levels.

The core problem facing Bahamian petroleum retailers is that they are being asked to absorb a multitude of ever-increasing costs from price-controlled, fixed-margins that have remained at 54 cents and 34 cents per gallon of gasoline and diesel, respectively, for more than a decade since 2011. However, Mr Halkitis last week reiterated the Government’s longstanding position that any

solution must not involve an “immediate” increase in gas prices at the pump.

“We haven’t got a definitive time as yet, but they said we should expect to hear something this week,” Mr Jones said of the retailers’ contact with the Government. “The fact they reached out to say means we will have a meeting. I don’t have a doubt that will take place. The results are what I am more intent to focus on.

Hopefully this will be the meeting we come to a final conclusion at.”

He based this on the outcome, and subsequent media release, by the Government following the last meeting with the petroleum retailers on March 13, when it said the two sides’ next meeting would seek to find a resolution. “They’ve met with the wholesalers, met with us, had a debate about what they can and cannot do,” Mr Jones said. “We’re

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000 T & T INVEST SA (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(6) of the International Business Companies Act, 2000, as amended, the winding up and dissolution of T & T INVEST SA is complete.

Kim D Thompson Sole Liquidator

Kim D Thompson Sole Liquidator

Address: Equity Trust House Caves Village West Bay Street P O Box N-10697 Nassau, Bahamas

waiting to hear what their proposal in comparison with what we requested so we can assess what they came up with.....

“I think we made our case in explaining to them the plight of the retailers in the industry and the need for an improvement in the margins that will allow us to achieve a reasonable profit. People are in the red. We understand the Government’s position as well, but we are investors and business owners and the price-controlled margin needs to be reflective of the current cost environment.

“It doesn’t solve everything all the time for everyone, but it means that businesses within the sector will have a chance to make a reasonable profit and reasonable return on investment. We’ve been looking at operating costs, but a margin increase is definitely what we need to get us over the finish line..... Costs have gone up in a very crazy way, especially in the last three years, and there’s no sign of that stopping.”

With crude oil prices having risen again after the global oil producing cartel, OPEC, announced a production cutback equal to 3.7 percent of global demand, Mr Jones said gas station operators as well as motorists/consumers will feel the increase in local

NASSAU FLIGHT SERVICES REWARDS TOP EMPLOYEES

pump prices that will ultimately result.

Dealers will now have to “pay more for the same gallon of fuel” on fixed, inflexible margins that do not change. As a result, they will incur higher credit card and overdraft fees to make those fuel purchases from the three oil majors. “That needs to be changed to allow us a reasonable level of profit,” Mr Jones reiterated. “That’s what we need to achieve.”

Sir Franklyn Wilson, chairman of BISX-listed FOCOL Holdings, which operates under the Shell brand, previously told this newspaper that while the retailers had made their case for a margin increase he was not convinced it should be of a magnitude equivalent to 7 percent of the cost of landed fuel.

In response, Mr Jones said: “That’s something for the Government to debate.” He added that gas station operators had already shown why “asking for a 7 percent increase compared to the cost of doing business” was, in their view, reasonableespecially when set against the 24 percent minimum wage increase, 15 percent jump in insurance costs and other hikes.

“Asking for 7 percent on higher volumes that are anticipated to grow and

stabilise seems to be very palatable compared to the cost impact already,” the Association president argued. “We stand committed to work with the Government and listen to what their proposal is. The 7 percent we ask for we consider to be reasonable.... The reality is these costs we’re encountering are significant, and we’re sinking without getting something reasonable.”

Mr Halkitis, though, said the Government remains against any solution that will lead to “an immediate increase in the price at the pump”, while acknowledging that the petroleum industry’s issues need to “be looked at in a comprehensive manner”, both from the retail as well as the wholesale perspective.

He added: “We’ve been having discussions with the retailers and wholesalers to see how we can adjust the system that is currently in place to bring some relief, particularly to the retailers who have been clamoring. And, of course, I say, once again, our view is that any solution should not lead to the immediate impact of increasing prices at the pump or Bahamians.

“So that is something that we continue to work on. We have another meeting scheduled for this this week upcoming following

expenditures totaled $236.1m, a 2.7 percent ($6.2m) increase compared to the prior year. “Outlays comprised $64.4m in personal emoluments; $39.5m on the use of goods and services; $47.9m in public debt interest payments; $33m in subsidies; and $19.2m in social assistance and transfer. Capital expenditures increased by 119.3 percent ($13.5m) to $24.8m comprised of $22m to acquire non-financial assets and $2.8m in capital transfers.”

the holidays, and it’s a very complex issue that involves private contracts between individuals. And so we want to make sure that any solution that we propose, the foremost thing for us is that it actually brings relief and it does not lead to a direct increase at the pump immediately.”

Mr Halkitis reiterated that the situation has to be assessed “in its entirety straight down from the wholesalers to consumption at the pump. Both [retailers and wholesalers] have put in a proposal, we’re analysing them now, more meetings are scheduled for this week upcoming and hopefully we will be able to come up with something that is workable. It’s a longstanding issue, and not an easy issue to deal with. It’s like pulling a thread. Pull a thread and something else is impacted”.

The minister, though, said the retailers’ plight was also directly linked to the “onerous” rental and other agreements they have with their wholesaler landlords - issues that did not affect the Government or which it could influence. With gasoline prices impacting all segments of the economy, Mr Halkitis said any solution must “must not undermine the economic recovery we are experiencing or increase costs in that area”.

FROM PAGE B3

pictured) won Employee of the Year - Below Wing. In attendance were Dr Kenneth Romer, deputy director general, Ministry of Tourism, Investments and Aviation, and director general of aviation; Obie Roberts, chairman, Nassau Flight Services; Paul Bevans, chairman of the Airport Authority; Ricardo Rolle, general manager of Nassau Flight Services; Dencle Barr, director of security; Lennox Coleby, Nassau Flight Services; and other Nassau Flight Services and government officials.

Jarol Investments Limited is seeking to fill the following position: Assistant Security Manager (Nassau)

Our company has been around gaming for over 30 years and pride ourselves on quality service and customer relationships. We are moving forward in the market and such are looking for hardworking, reliable, people friendly customer services representatives.

• Reinforces company goals and vision to all direct reports and continually implements this strategy into overall communications.

Jarol Investments Limited is seeking to fill the following position:

• Supervises, directly and/or indirectly, all Security/Surveillance team members including: selection, training, work direction, safety, communication, counseling, disciplining, performance evaluations and records.

Handyman (Nassau)

• Oversight and training for emergency response procedures such matters as fires, bomb threats, power outages, and other serious matters or emergencies.

• Directs and monitors the security and safety of customers, employees, facilities, and grounds.

• Reviews security/surveillance investigations concerning all incidents and issues taking place on property and makes necessary reports and notifies the Assistant COO.

• Checks all security/surveillance reports for accuracy and completeness and ensure timeliness.

Cleaning and maintaining property inclusive of cleaning windows, mopping entrance, light weeding & painting, clearing fences, throwing out garbage daily from offices, keeping yard swept and clean & washing all company’s vehicle on Saturdays.

• Ensure compliance with department and Company policies and procedures.

• Create and update weekly department schedule.

• Continually evaluate Team Members for alertness, appearance, and proper performance of duties.

Janitress (Nassau)

• Observes, supervises and instructs shift officers in the performance of their duties.

• Determines personnel requirements and makes assignments at the beginning of each shift.

• Ensure effective onboarding and training for Security/Surveillance

Officers.

Cleaning office daily, mopping, sweeping, wipping doornobs, cleaning bathrooms, dusting desks & keeping kitchen area clean.

• Provide security and protection for customers, team members, property and assets.

• Reacts promptly to disturbances where Security/Surveillance is required.

• Maintain a high level of confidentiality

Performs related duties as assigned by Management.

• Be familiar with all Chances web shops throughout the Bahamas.

• Takes appropriate action, when required, of individuals suspected of illegal activities.

• Perform related duties as assigned by management.

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV

Interested persons should email their resume to careers@chancesgames.com. or visit our Head Office on Prince Charles Drive (across from Restview Funeral Home) between the hours of 9 a.m. to 5 p.m.

ASIAN SHARES MOSTLY HIGHER AFTER MIXED DAY ON WALL STREET

By ELAINE KURTENBACH AP Business WriterSTOCKS were mostly higher in Asia on Tuesday after a mixed session on Wall Street dominated by speculation the Federal Reserve may tap the brakes again on financial markets and the economy by raising interest rates.

Shares rose in Tokyo, Hong Kong, Seoul and Shanghai. U.S. futures edged higher and oil prices also gained.

Monday was the first U.S. trading day after the release of data showing a stronger than expected jobs market in March, which might keep inflation high. That has reinforced expectations the Fed may hike interest rates again at its next meeting.

In Japan, the new central bank governor indicated late Monday that he expects to keep its ultra-low interest

rate policy in place without drastic changes.

Bank of Japan Gov. Kazuo Ueda did say a longterm review of the policy, which is aimed at fostering stronger economic growth by keeping inflation near a target of 2%, might eventually be needed.

“The upshot is that Governor Ueda is not merely making a temporary effort to not rock the policy boat, but is in fact doubling down on the policy course at present,” Mizuho Bank said in a commentary.

It noted that “growing risks of a global downturn alongside monetary policy lags means that the BOJ is acutely aware that any distinct tightening now may be caught wrong-footed by a global downturn.”

In Tokyo, the Nikkei 225 index gained 1.4% to 28,013.86.

South Korea’s Kospi also advanced 1.4%, to 2,546.07. The Bank of Korea left its

policy rate unchanged at 3.5% for a second straight meeting, one of many regional banks that are now slowing or reversing rate increases due to signs of weakness in the global economy.

Hong Kong’s Hang Seng added 0.7% to 20,481.02, while the S&P/ASX 200 climbed 1.3% to 7,314.00.

The Shanghai Composite index lost 0.2% to 3,310.00.

On Monday, the S&P 500 edged 0.1% higher to 4,109.11. Big tech stocks fell more than the rest of the market, which helped pull the Nasdaq composite down less than 0.1%, to 12,084.36. It was down as much as 1.4% earlier in the day. The Dow Jones Industrial Average was steadier, rising 0.3% to 33,586.52.

Higher rates tend to hit tech and other high-growth stocks the hardest, and Apple and Microsoft were the two heaviest drags on the S&P 500. Apple fell

PEOPLE walk near a sign of foreign currency outside a money exchange office at a shopping district in Seoul, South Korea, Tuesday, April 11, 2023. Stocks were mostly higher in Asia on Tuesday after a mixed session on Wall Street dominated by speculation the Federal Reserve may tap the brakes again on financial markets and the economy by raising interest rates.

1.6%, and Microsoft slipped 0.8.%.

Tesla also dipped 0.3% after paring a sharper, early loss. The company cut prices on its entire U.S. model lineup in an apparent attempt to to entice buyers amid rising interest rates, which make auto loans more expensive.

The Fed has raised interest rates at a furious pace over the last year in hopes of undercutting high inflation. Higher rates can do that, but only by bluntly slowing the entire economy in one fell swoop.

That raises the risk of a recession in the future and drags down prices for stocks, bonds and other investments.

The Fed has jacked up rates at every one of its meetings over the past year, forcing them up from near zero at the start of 2022.

On Wednesday, the U.S. government will release its latest monthly update on prices across the economy at the consumer level.

Economists expect it to show inflation slowed last month but remains well above the Fed’s target.

Also this week, earnings reporting season will begin for the biggest U.S. companies. Delta Air Lines, JPMorgan Chase and UnitedHealth Group will be among the first S&P 500 companies to tell investors how much profit they made during the first three months of the year.

Expectations are low, and analysts are forecasting the sharpest drop in earnings per share for S&P 500 companies since the pandemic pummeled the economy in the spring of 2020.

NOTICE is hereby given that RAYMOND THIMOTHEE, of Martin Town, Freeport, Grand Bahama applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 11th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that OMAN ARCHINIEDES COLEBROOK, of P.O Box AP 59223 Basildon Close, Nassau, Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 31st day of March 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that RONY JEAN of Bacardi Road, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 11th day of April, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that EMMANUELLA OLIBRICE of Pinewood Gardens, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of April, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that DRUMAINE ROMARIO WRIGHT of #64 Dumping Ground Corner, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 31st day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that SERGE GUERRIER , of Abaco, Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

Monday, April 10th, 2023