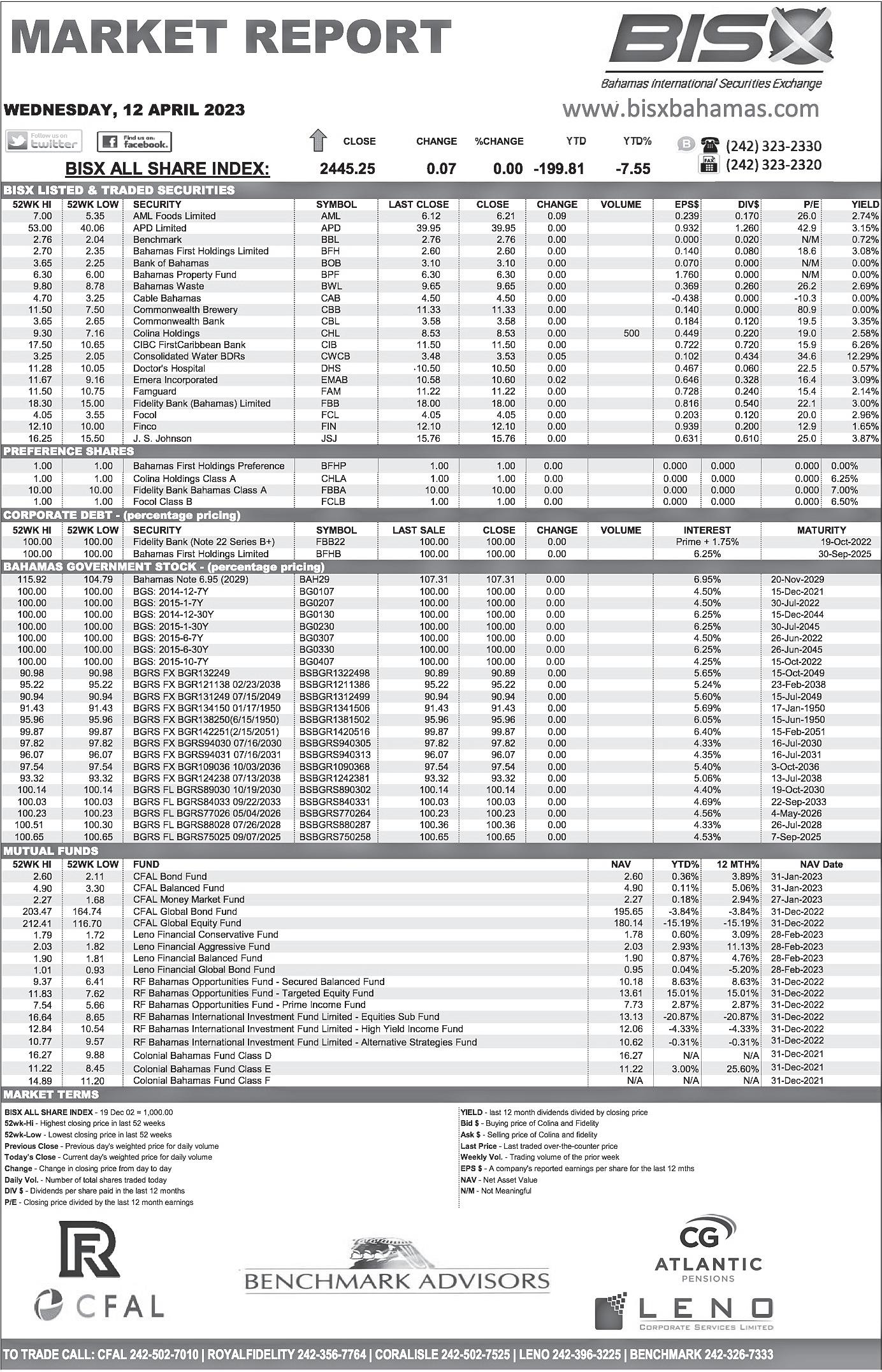

$5.67 $5.67 $5.78 $5.59

Royal Caribbean: 60% of guests won’t visit PI

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTOP Royal Caribbean executives yesterday pledged that “more than 60 percent of our guests” will never visit its Paradise Island project, as they urged: “We can win together or we can lose together.”

• Urging unity, cruise giant says: ‘We can win or lose together’

• Bahamian investor equity raise targeted for 2023 latter half

Tax authority chief labels $875m arrears ‘alarming’

By FAY SIMMONS jsimmons@tribunemedia.netTHE Government’s top tax collector yesterday branded the $875m in combined outstanding VAT, real property tax and Business Licence arrears as “alarming” even though this sum has been slashed from the previous $1bn.

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netROYAL Caribbean executives yesterday said they reduced their Paradise Island Crown Land demands by 43 percent in a bid to “untangle ourselves” from any “conflict” with Bahamian entrepreneur Toby Smith.

Michael Bayley, the cruise giant’s president and chief executive, told Tribune Business he wished Mr Smith well in his bid to restore Paradise Island’s lighthouse but declined to be drawn on whether the

Michael Bayley, the cruise giant’s president and chief executive, told Tribune Business that the Royal Beach Club represents a “win-win” for all parties on the basis that it will enhance the Nassau “brand” and visitor experience, as well as providing increased Bahamian ownership, jobs and entrepreneurial

Royal Caribbean cut Crown Land to avoid Toby ‘conflict’

• Local entrepreneur says he has $7m financing

• 'Reaffirms' intent in 12th year after 4,000 days

two projects can co-exist as neighbours or if Royal Caribbean would go back for the three acres it is relinquishing if the Bahamian’s ongoing court challenge proves unsuccessful.

• $175m investment eyes full approval go-ahead by year-end SEE

His comments came as Mr Smith released a statement “reaffirming” his project in response to the Government’s request that he “reapply” for the necessary approvals. The Davis administration took that stance after the Supreme Court ruled the Paradise Island Lighthouse and Beach Club principal did not possess a valid, binding Crown Land lease for the collective five acres he was seeking on Paradise Island’s western end.

Mr Smith, in a March 22, 2023, letter addressed to the

Ten couriers blocked amid $193m VAT arrears worry

By FAY SIMMONS jsimmons@ tribunemedia.netTEN courier companies recently saw Customs temporarily halt clearance of their clients’ imports, the Government’s top tax official revealed yesterday, as part of a drive to recover $193m in total VAT arrears.

Shunda Strachan, the Department of Inland Revenue’s acting comptroller, said the suspension was imposed to ensure the ten companies settled outstanding VAT payments due to the Government. Nine of the courier firms have made substantial payments on the arrears, which represent monies received from their clients to settle due import

duty and VAT liabilities, and been allowed to resume business.

She said: “There’s lots going on with the couriers. It’s because we’ve noticed a trend where we know business is really heightened for the couriers. They’re collecting more revenue, but we’re not seeing that reflected in what they were remitting. So we did do an exercise where we halted shipments or, you know, we stopped the release of goods until some couriers kind of settled their accounts, especially VAT accounts.

“Some businesses ran on payment plans, which is fine. We are not here to put

SEE PAGE B4

PI investment to be ‘gold environmental standard’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netROYAL Caribbean executives yesterday pledged their Paradise Island project will set “the gold standard” for environmental sustainability, adding that Atlantis and others should feel “comfortable” their concerns will be resolved.

Michael Bayley, the cruise giant’s president and chief executive, told Tribune Business that all questions and criticisms surrounding the Royal Beach Club will be addressed but the project first has to pass

through the Department of Environmental Planning and Protection (DEPP) approvals process before details can be shared with the public.

Promising that the 17-acre development will employ “a very sophisticated waste water management system”, which is one of Atlantis’ major concerns, Mr Bayley and Jay Schneider, Royal Caribbean’s chief product and innovation officer, also said there was no basis to another of the Paradise Island mega resort’s fears that tidal flow around the island and

Shunda Strachan, the Department of Inland Revenue’s acting controller, said the agency is determined that VAT debts will not balloon to reach the $600m in real property tax liabilities that account for the majoritysome 68.6 percent - of the total $875m arrears.

“You’ve not seen this level of enforcement before, but it is critical now,” she added. “Because as the country moves in a particular direction, and our expenses increase, we need the revenue in order to satisfy those expenses. And so while the Department of Inland Revenue doesn’t deal with expenditure, per se, we do deal with revenue collection. So, probably a couple of months ago, we reported our arrears was over $1bn and we took that very seriously.

“It’s for us to bring those arrears down. So while arrears are continuously added to the bucket, and if there’s an up-and-down kind of action going on, we will be told what those arrears are in the billions. So, bit by bit, we’re trying to get them a bit lower. We’re right now, I’d probably say, at the $875m mark; we’re not at $1bn any more, right. But it’s still alarming that we have that amount of those greater risks out there.

“Real property tax is still leading the way. So we still have more than $600m in arrears for real property tax. But VAT is a new tax. And I don’t know if you remember, but when we implemented that it was said that we won’t allow that to be another real property tax. And so, for us to ensure that we keep on top of things relative to our arrears, we really have

Tax authorities eye $3m from Briland crackdown

By FAY SIMMONS jsimmons@ tribunemedia.netTHE Government is expecting to realise an extra $3m in revenue from the recent crackdown on Harbour Island tax cheats, its top tax official said yesterday.

Shunda Strachan, the Department of Inland Revenue’s acting controller, said: “We did some investigations in Harbour Island. We’re not done. But so far we know that in terms of revenue, it’s probably over $3m for the businesses that we have started to review.

“And I’m saying it like that because the audits are ongoing. The audits are not done for those businesses as yet. We’re still in the midst of gathering data, going through systems, going through revenue reports, receipts, bank statements. So far, we’re probably at the $3m mark. And I don’t know where we’ll end up.”

Ms Strachan said the Department of Inland Revenue is currently auditing nine businesses in Harbour Island and three in mainland Eleuthera, with the tax compliance and enforcement drive set to extend throughout the wider Bahamas.

“For Harbour Island, we’re auditing about nine businesses and then we are still doing preliminary investigations for mainland Eleuthera. But mainland Eleuthera, so far there probably about three businesses. Like I said, we still have a lot to go. We will do more visits. But it’s not just Harbour Island or Eleuthera; it’s throughout the Commonwealth, it’s throughout The Bahamas,” she added.

“It is ongoing and it will not stop. There’s no timeframe, it’s just us staying consistent with what we’re doing across the board. So we don’t have a timeframe to when we’re going to stop because we’re not going to stop. It will be ramped up. That’s what you’re going to notice.

“We will be doing things weekly, bi-weekly. We do have other operations planned. And so it’s going to be a consistent thing. We do know that in order for it to be successful, meaning in order for persons to maintain and keep current with their obligations, we really have to be more active.”

Ms Strachan said the major findings from the Harbour Island investigation were businesses failing to obtain a Business Licence, under-reporting revenue and companies charging clients VAT even though they are not registered or authorised to levy the 10 percent tax.

She said: “We’re noticing businesses not applying for the Business License, not reporting accurate turnover, not registering for VAT even after having gone over the $100,000 threshold. And, even more egregious,

Share

is businesses that are not registered for VAT but are charging VAT. And we saw that when we went to Harbour Island. That was alarming. You can’t have businesses not registered for VAT but charging VAT and not remitting the VAT to the Government.”

Dexter Fernander, the Department of Inland Revenue’s head of operations, added that investigations into Family Island businesses reveal many are operating outside of the scope of their Business Licence.

He said: “We noticed that individuals are having Business Licences, and they are operating with certain things that are outside the scope of their Business Licence. And so what we are currently doing now is just making sure that everyone is in a level playing field - that they’re in accordance with whatever regulator they are under.

“And so as we are into the Family Islands, this now gives us the opportunity to gather material. So we’re asking for businesses to be, first of all, honest and comply with the Business Licence to VAT and even the Real Property Tax Act. There are various Acts. As you sign up as a business, there are some obligations, and we would like them to enforce those that are under the Act.” Ms Strachan revealed that in addition to obtaining warrants, Harbour Island businesses had records and assets seized. She emphasized that the Department of Inland Revenue is not trying to close businesses, but rather ensure that they are operating in a way that is compliant with all tax laws.

She said: “A lot happened because that was really our first seizure where we actually initiated a warrant. We went into businesses, we seized records, and we actually seized some of the assets. We have the ability to search and seize. That’s one of the things that we’re doing now where we are getting warrants. And I think that was all the flurry on Harbour Island that we actually went into businesses; we seized assets.

“And, more importantly for us, we seized records. And that’s critical. Because once we have records then we’re able to properly assess, and so the Department is assessing businesses. So if you aren’t reporting, if you aren’t declaring your turnovers, we are assessing you and we have the right under the law to do that. And, again, on the VAT side, those assets, once seized, can be sold to recover the taxes. And that’s really where we’re headed.

“I think our increased enforcement measures are going to decrease businesses doing the wrong thing. More businesses are now coming forward. They are contacting us. They are saying to us: ‘Listen, I had no Business Licence for five years. Work with me what you could do.’ We are working with them. We are not trying to put businesses out of business. That’s not our goal. We trying to get you on the road to compliance to the right thing.”

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

FOREIGN WORKERS ‘MANIPULATING SYSTEM’; COST GOV’T THOUSANDS

THE Government is losing thousands of dollars in fee income because foreign construction workers and their sponsors “have figured out how to manipulate the system”, the Bahamian Contractors Association (BCA) chief said yesterday.

Leonard Sands told Tribune Business that if the Department of Immigration fully did its job, and cracked down on persons working outside the scope of their work permits, about “60 percent” of the Bahamian construction industry’s workforce would be affected.

He spoke after Keith Bell, minister of labour and Immigration, told the House of Assembly that raids on construction work sites in “a high-end gated community in eastern New Providence” revealed that all of the 56 foreign workers detained were working outside the terms and scope of their work permits.

He added that many were evading due work permit fees by giving incorrect job descriptions, passing themselves off as farm labourers or general labourers to keep payments to the Department of Immigration at $500, when they were really skilled construction workers whose permits should attract annual fees of $4,000-$6,000.

KEITH BELL LEONARD SANDS

Describing such practices as “widespread”, Mr Sands told this newspaper: “What he’s [Mr Bell] making out is exactly what I’ve been saying. Everybody is trying to make me out to be this weird crazy person making stuff up, but that is the reality of what exists which, if they investigate more and dig on it, is that foreign workers have figured out how to manipulate the system.

“What’s been happening is that almost everyone on a work permit is misrepresenting the type of work they’re paying for a permit for. They are alleging they are general labourers or farm labourers when” they are actually skilled workers such as masons, painters, carpenters and dry wall mechanics.

“They are working largely outside the scope of their work permits,” Mr Sands continued. “I’ve said this is the case for many years. It’s nothing new. The

Government is missing out on revenue they should be gaining because the work permit fees for farm labourers or general labourers are generally lower than for a skilled worker.

“It also underscores the comments I made a few weeks ago. There should be a number of persons under investigation where they were hired, and their permit paid for, by employer ‘x’ but they are on another island working for employer ‘y’. If the Ministry of Labour and Immigration did its job, and made sure everyone was working according to the terms of their work permit, it would impact the industry to about 60 percent of the workforce.”

Mr Bell yesterday said it was a breach of Bahamian law for expatriates to work outside the scope of their work permits, and for an employer different to the one that sponsored it and paid the necessary fees. He added that a probe

of one New Providence development revealed that expatriates outnumbered Bahamian construction workers three-to-one.

“Over the past few weeks, the Department [of Immigration] began a special investigation following numerous complaints and information received from the public concerning large numbers of construction workers of foreign nationality working on construction sites in a high end gated community in eastern New Providence,” Mr Bell said.

“Following the conclusion of the investigation, an operation was launched, which revealed that foreign construction workers outnumbered the Bahamian construction workers threeto-one. Madam Speaker, in one swoop, 56 foreign nationals were taken into custody leaving a mere 20 Bahamian workers on site.”

“The findings of the investigations revealed all of the persons had been issued work permits; all of the persons were working outside the scope/terms of their work permits; and a large number of the persons were unlawfully paying dramatically lower work permit fees by giving incorrect job descriptions such as farm labourers when they were highly skilled construction professionals,” the minister added.

“Several persons owed renewal and processing fees for permits. Others were pending processing fee payments for the renewal of

their permits. Persons were classified as farm labourers and handymen when they were highly skilled construction labourers.”

As a result, Mr Bell demanded of contractors and other employers with expatriates on work permits to “get your house in order’. He said: “The law is clear on what is required. If you are unsure, you can call or visit the Department of Immigration. The Immigration laws must and will be enforced.

“The law will be enforced equally and throughout The Bahamas. Island to island. East to west. In front of the gate, back of the gate - one country - one law for everyone. Immigration will target the owner, the occupier, the hirer, the employer and the worker. Be warned.”

These trends are not confined to the construction industry. Mr Bell said: “Investigations in Abaco have shown that a significant number of persons are working outside the scope of their permits. The employers are in New Providence or some other island, and the permit holders are working outside New Providence independent of their employer.

“Additionally, they are also working outside the scope of the grant in that many who were classified as ‘handymen’ were found engaged working in other classified fields of employment of skilled labour.

Madam Speaker, from January 1, 2023, to March 31,

GB water supplier: 40% protected from price rise

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netGRAND Bahama's water supplier yesterday pledged that 40 percent of its customer base will not see any price hikes from an adjusted tariff structure due to take effect on May 1 if approved by regulators.

Grand Bahama Utility Company, in a statement, said a further 47 percent of clients - who consume between 2,001 and 10,000 gallons monthly - will only see an $8 per month tariff increase as the company bids to recover some

of its $15m Hurricane Dorian losses and finance future capital works and maintenance. Its projections thus suggest that 87 percent of customers will either experience no tariff rise or a relatively minimal one of $8 per month. Those consuming between 10,001 and 20,000 gallons per month will see their bills rise by around $20.73, representing 8 percent of the customer base, while users of more than 20,000 gallons - chiefly hotels and Freeport's large industrial companies - will see their tariffs jump by $125.74 per month.

Philcher Grant-Adderley, GB Utility's chief operating officer, said in a statement:

“There is no denying that Dorian had a long-lasting impact, not only on our infrastructure but, most critically, on our freshwater lens. Our biggest wellfield, W6, was inundated with over 20 feet of seawater for three days and the consequences to the fresh water supply were devastating. In total, GB Utility has suffered over $15m in losses as a result of Hurricane Dorian recovery efforts.

"We added 75 new wells and were able to restore potability to 70 percent

of the island by July 2020. After comprehensive hydrological and geotechnical surveys with local teams, the international scientific community and NGOs, it was determined that the rate of recovery of the W6 aquifer would most likely not return to potable standard in this generation.

"We made the decision to invest in a $5m, three million gallon per day mobile reverse osmosis system that enabled us to return full potability to the Island in December 2021.” Mrs Grant-Adderley added said the reverse osmosis system has added $2.5m to the

utility’s annual operating costs from its commissioning in 2021.

That, coupled with the approximately $2m in uninsurable losses associated with Hurricane Dorian, including over $500,000 in costs to operate the free water depots for residents and 25 percent discounts given to residents for water usage, has taken a significant financial toll on GB Utility.

“It is never a decision that a company takes lightly when discussing possible rate adjustments for customers”, said Mrs Grant-Adderley. “We

Vacation rental listing ‘not so we can tax you’

By FAY SIMMONS jsimmons@tribunemedia.netTHE Government’s revenue chief yesterday said some 7,500 vacation rental owners have registered with the Department of Inland Revenue but insisted this is “not so we can tax you”.

Shunda Strachan, the Department of Inland Revenue’s acting controller, said: “The short-term vacation rental platform that we have launched - and

we’re asking anybody in the short-term vacation industry to register on that platform - it’s not so we can tax you. That’s not the goal right now.

“I don’t want to be deemed disingenuous, but the goal of the platform right now is to gather information. You may have a short-term vacation unit on to your house, or you may have a duplex. I don’t think that those will be taxed. Now it’s a difference if you

have a complex with ten two-bedroom units that you rent out for $3,000-$4,000 a week. Truly, we need to regulate that industry.”

Ms Strachan said the registration drive was necessary for the industry to be properly regulated. She added: “I don’t know if you’re noticing online social media, where we’ve seen the advertisement for Airbnb in a palatial location, beachfront. And, when you look at it, I won’t

call the name of where it is. But no Bahamian would stay there because of the area that it’s in. “And they have pictures. They have used pictures or photos, right. That’s false advertisement of some other place. And when the tourists, unsuspecting, get there, it is like, what is this? So we do need to regulate the industry. It’s not regulated right now.”

She added: “And government really needs to know

2023, some 81 persons were found on Abaco using work permits issued for employers in New Providence.

“These persons were removed from Abaco and, in each case, the permit is liable for revocation. To date, 65 of the 81 persons have been charged and convicted.... Another significant challenge we have found is Bahamian employers are failing to renew permits on a timely basis,” Mr Bell continued.

“This is a vexing issue for the Department. Let me at the outset say that whilst I understand that persons can face delays obtaining the accompanying documents to have a permit renewed, if a person is here without a valid permit and without having a renewal application before the Department of Immigration, they will be arrested and deported.

“Madam Speaker, over the past three months, Operation Restore has resulted in over $90,000 being collected in back fees for processing and document fees from Bahamian employers of various persons being taken into custody. Immigration fees must be paid... Work permits are obtained by employers, and it is the employer’s responsibility to pay the Government its fees. Any employer found owing Immigration will be required to pay all fees owing and may face prosecution.”

know that it is not an easy message to deliver or to hear. That is why, despite the incredible financial loss to the utility, we have absorbed these additional costs and deferred this rate adjustment application for as long as we could.

"However, to continue to do so would not only be irresponsible but makes it impossible for us to make the additional capital investments we need to restore island pressure and maintain potability."

She added that as part of the rate adjustment, GB Utility has budgeted more than $6.5m for capital improvement plans. This includes construction of an

SEE PAGE B7

what it needs to do to really kind of help that industry out. We want to encourage Bahamians to go into that industry, right? It’s an easy thing to do. If you have an extra property, it’s more lucrative for you to rent that as a short term vacation property as opposed to long term.

“It’s also doing something that’s driving up the rentals on the family islands, but all of this is information that we need to gather in order

to know what we need to put in place in order to make the industry safe, number one, and just make sure that everything is there that needs to be put in place – the roads, the clinics. Right again, a bunch of Airbnbs on some of these islands, and you have no clinic, no nurse even on the island. So, we really need to plan and that’s really the

SEE PAGE B7

Ten couriers blocked amid $193m VAT arrears worry

to use the powers of enforcement,” Ms Strachan continued.

“VAT is a very hard tax because, really, you would have collected already. It’s not a tax that the business pays; it’s a tax that the business collects on behalf of the Government to remit to the Government. So if you’re collecting VAT, and you’re not paying that VAT over, then it amounts to really stealing - misappropriating the Government’s

revenue. And so we are now taking a very hard line on businesses that have collected and not paid over the VAT to the Government.”

Ms Strachan said the issues that the Department of Inland Revenue encounters most frequently are companies operating without a Business Licence, firms not declaring that they have reached the $100,000 VAT registration threshold, and businesses that do not keep adequate records. She added: “What we’re noticing is that we have

more and more businesses that have no Business Licence. So you have businesses engaged in generating turnovers, and they’re not reporting or they’re not applying for the Business Licence. So that was one concern that we noticed, especially in the Family Island. “We’re concerned because we have businesses operating, but they really don’t have valid Business Licences. The second thing was, or is, that we’re noticing is a whole lot of

businesses that we know have reached the $100,000 VAT threshold but they’re not registered for that, and that’s alarming to us.”

“We saw on the Family Islands where businesses had no Business Licence. But yet, when we go in, they tell us they have no records. So, again, the law mandates that if you are in business you are obligated to keep records. That’s an obligation. And the fine for not keeping records is great, you know. There’s a

massive fine, and it’s actually an offence.” Ms Strachan said that, as a result, the Department of Inland Revenue has no choice but to use its enforcement tools and crack down on bill duckers and tax cheats. She added: “We went through a season of inviting persons and businesses in recommending that they go on payment plans for real property tax. We did a whole lot of amnesties. And we did a lot of incentives.

ROYAL CARIBBEAN CUT CROWN LAND TO AVOID TOBY ‘CONFLICT’

Prime Minister, said he had “brought proof of financing” in excess of $7m with additional investors seeking to get into a project requiring just a $3m outlay. Calling on the Government to honour the original lease that was drafted under the former Minnis administration, he added: “Our Bahamian enterprise is overdue for success.”

Royal Caribbean and Mr Smith have been in competition seeking to lease the same two-acre Crown Land parcel for their respective projects after it was

effectively ‘double dealt’ to them by the former Minnis administration. Mr Bayley yesterday confirmed that Royal Caribbean reduced its Crown Land needs from seven to four acres, relinquishing the parcel it was contesting with Mr Smith, so the Royal Beach Club can proceed and avoid any potential legal battles.

“We knew it was locked up in an endless back and forth, and there was conflict over the Crown Land,” he told Tribune Business. “In conversations with the Government, it was agreed to remove the three acres; take those out of the equation

and uncomplicate the entire project.

“It will still be a stunning success. Would it be more of a stunning success with the extra acres? Yes, it would, but it’s a great project and we will move ahead having untangled ourselves from the conflict..... We’re super happy with the 17 acres (13 acres acquired from private owners). Our guests will love it, and we think it will enhance the total product offering.”

Asked whether Royal Caribbean would go back for the same three acres if Mr Smith loses his legal battle, and his project does not proceed, Mr Bayley replied: “Let’s see. Time heels everything. I don’t know how it will work out.” Given that the cruise line has reduced its Crown Land footprint, it is unclear whether a new lease will have to be drafted given that the original involves seven acres rather than the current four.

Then, asked if Royal Caribbean could co-exist with Mr Smith’s own beach break activity and lighthouse restoration project, Mr Bayley said: “I wish Toby good luck in his endeavours.” However, Jay Schneider, Royal Caribbean’s chief product and innovation officer, backed the need to restore the Paradise Island

lighthouse given that its present rundown state provides a poor impression for millions of cruise passengers entering Nassau Harbour annually.

“I’d love to see him succeed if he improves the tourism product, and that includes the lighthouse, which is in desperate need of restoration. The first impression that visitors get is a lighthouse in disrepair, so we’d love to see that improve.”

Mr Smith, in a statement yesterday confirming that Paradise Island Lighthouse and Beach Club has reaffirmed its application for government approval, said he was now in his 12th year of seeking the necessary permits in an effort that has spanned four administrations.

“In our recent meeting on March 2, 2023, you instructed me to ‘reapply’ for the Paradise Island Lighthouse and Beach Club project,” Mr Smith wrote in his March 22 letter to Philip Davis KC. “I write to you to reaffirm Paradise Island Lighthouse and Beach Club’s all-Bahamian project on Paradise Island.

“As you are aware, we originally applied on April 12, 2012, and to this day continue to remain steadfast in bringing this project to fruition. It started out as a $2m project and is committed to invest $3m. We are ready to commence. We have brought proof of financing for our commitment to you in excess of the $3m the project calls for to the tune of more than $7m.

“We also have additional investment dollars on the sidelines seeking to invest in this bright investment opportunity. We seek to restore the Paradise ‘Hog’ Island lighthouse back to its former 1817 glory. While Paradise Island Lighthouse and Beach Club shall

provide the financing for this significant undertaking, we have also received an overwhelming financial interest from others for the purpose of restoring the lighthouse with us.” Calling on the Government to honour the lease that is the subject of his ongoing legal battles, Mr Smith added: “Our Bahamian enterprise is overdue for success and we have endured four administrations of government. Your administration of government could, at any time, mitigate the need for court action by letting our project flourish. We are asking this of you today.” The Bahamian entrepreneur asserted that the lighthouse restoration and beach break activity will create 80 Bahamian jobs while, as a locally-owned business, its revenues and profits will remain circulating in the local economy and be spent with “cottage industries, micro, small, medium and large businesses and wholesale suppliers’.

Promising a low impact, environmentally sustainable project, Mr Smith wrote: “We seek to be able to offer greater beach access for Bahamians. We have been deprived over the decades from beach access and amenities available to Bahamians, and we will drastically change this immediately.

“We believe that a Bahamian project is long overdue for opening. Bahamians feel sidelined and made to feel as second-class citizens, and I believe are tired of ‘stand aside and look’. We therefore conclude by reiterating our affirmation to receive everything necessary to move our all-Bahamian project forward, with your support, and without any further delay.”

In a further letter to Mr Davis on March 29, 2023,

“We offered a lot of incentives to persons just to kind of regularise and to satisfy their tax obligations. That is now ended; we’re not in that season any more. We’re in the season of enforcement. And the Department of Inland Revenue has a whole lot of powers in its bucket that it can utilise. It’s really because of the arrears that we’re seeing, and they’re building. And so the Department has an obligation to collect the Government’s revenue.”

Mr Smith pledged that a restored Paradise Island lighthouse will be a “‘shining’ example of Bahamian pride, a healthy first impression for new visitors and a symbol of salvation and hope for all. As you are aware, our Beach Club will be the best of the best in The Bahamas”.

Mr Smith, in his e-mailed statement yesterday, said: “April 12, 2023, marks the start of our 12th year in bringing about this restoration and sustainable development for the benefit of all Bahamians and our guests. This is how hard a Bahamian company has to fight to fully restore the oldest lighthouse in our country, free of charge, and create a venue for Bahamians to have beach access and use of our Crown Land with modern amenities.

“We recognise that there is not a foreign component to our project, and we should not be penalised nor disadvantaged for this. We see foreign promises flying in a dime a dozen, and Bahamians have been sidelined and pushed aside. The playing field needs to be level. When did Royal Caribbean apply for Bahamian Crown Land; what lease are they referring to when they claim to have a Bahamian Crown Land lease?

“The Government of The Bahamas has the unique opportunity to demonstrate to the Bahamian public that we should be able to participate and to have a hand at the wheel in steering our own destiny. More than 4,000 days and here we are affirming our commitment that we have expressed since April 12, 2012,” Mr Smith added

“The Government of The Bahamas already decided to offer Paradise Island Lighthouse and Beach Club a lease for Bahamian Crown Land. There is an agreement for a lease and the Government could, at any time, decide to honour this agreement and let Bahamians get to work.”

The American Embassy in Nassau is accepting applications for the following position:

Human Resources Specialist

Open to: All Interested Applicants / All Sources

Duties:

Incumbent is the technical advisor and principal assistant to the Human Resources Officer (HRO) in all areas of Human Resources Management for Mission Nassau. Under the general supervision of the HRO, the incumbent is directly responsible for the full perfonnance of a wide range of HR functions at post for Department of State employees and employees of other Agencies (CBP, USCG, DOD, ICE, ATF, FBI/LEGATT) as well as Locally Employed Staff. Oversees management of recruitment, salary and benefits, HR infonnation systems, training, check-in and check-out processing, awards, policy fonnulation, the American employee program, and employee relations issues. The incumbent supervises the HR Office and HR Assistants.

Interested candidates are required to possess the following skills and qualifications:

• Education: Bachelor's degree in Human Resources, Psychology or Business Administration is required.

• Experience: Five years of progressively responsible experience in the field of Human Resources (HR) with proven experience covering compensation and benefits, employee relations, recruitment, performance management, and social security laws and benefits. Application must illustrate a thorough knowledge of Bahamian local labor laws and prevailing practices. One year of supervisory experience is required. Experience must have been gained in a global organization with 150 or more employees.

Language: English level - Fluent, Reading/Writing/Speaking.

The complete Vacancy Announcement and Application fonns are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs Applications will not be accepted at the Security Gate of the Embassy, by Mail, E-mail or other means of delivery. Opening Period: Monday March 27, 2023 - Friday April 14, 2023. Due to the high volume of applications, unsuccessful candidates will not be contacted.

Tax authority chief labels $875m arrears ‘alarming’

to use the powers of enforcement,” Ms Strachan continued.

“VAT is a very hard tax because, really, you would have collected already. It’s not a tax that the business pays; it’s a tax that the business collects on behalf of the Government to remit to the Government. So if you’re collecting VAT, and you’re not paying that VAT over, then it amounts to really stealing - misappropriating the Government’s revenue. And so we are now taking a very hard line on businesses that have collected and not paid over the VAT to the Government.”

Ms Strachan said the issues that the Department of Inland Revenue encounters most frequently are companies operating without a Business Licence, firms not declaring that they

have reached the $100,000 VAT registration threshold, and businesses that do not keep adequate records.

She added: “What we’re noticing is that we have more and more businesses that have no Business Licence. So you have businesses engaged in generating turnovers, and they’re not reporting or they’re not applying for the Business Licence. So that was one concern that we noticed, especially in the Family Island.

“We’re concerned because we have businesses operating, but they really don’t have valid Business Licences. The second thing was, or is, that we’re noticing is a whole lot of businesses that we know have reached the $100,000 VAT threshold but they’re not registered for that, and that’s alarming to us.”

“We saw on the Family Islands where businesses had no Business Licence. But yet, when we go in, they tell us they have no records. So, again, the law mandates that if you are in business you are obligated to keep records. That’s an obligation. And the fine for not keeping records is great, you know. There’s a massive fine, and it’s actually an offence.”

Ms Strachan said that, as a result, the Department of Inland Revenue has no choice but to use its enforcement tools and crack down on bill duckers and tax cheats. She added: “We went through a season of inviting persons and businesses in recommending that they go on payment plans for real property tax. We did a whole lot of amnesties. And we did a lot of incentives.

PI investment to be ‘gold environmental standard’

FROM PAGE B1

New Providence’s northern shore.

They told this newspaper that “no structures”, such as piers, docks and cabanas, will be constructed on the water to cause such interruption. Mr Bayley, meanwhile, said “there may be things big resorts can learn” from the technology that Royal Caribbean has introduced on its ships to deal with waste management, recycling and developing a more environmentally sustainable footprint.

Revealing that the cruise giant expects to be “pretty close to completion” on design work, and obtaining the necessary environmental approvals and other permits by year-end 2022, so it can begin Royal Beach Club construction early in the New Year, Mr Bayley said “nothing surprises me any more” when asked of he was taken aback by Atlantis voicing its concerns so publicly.

“One thing I will say about the environmental concerns is that we’ve been on an environmental journey for many decades at Royal Caribbean,” he explained. “We have some very advanced technology as it relates to waste management. Once we’ve gone through the process with the DEPP - we want to be respectful and mindful of that process - but once we’ve gone through that process we will share everything we plan for the environmental management space.

“It’s fair to say we think it will be the gold standard, and we encourage and invite other businesses to follow that lead.” Pointing to Royal Caribbean’s newly-opened terminal in Galveston, Texas, which is the first to be powered by solar energy, Mr Bayley added: “We’re completing a $20m investment in a waste management system at Coco Cay that allows us to process all the waste through a three-step process and use that as fertilizer....

“Where we are in terms of our focus on environmental technology and management, we believe, is a very good place. I would also say that if cities, towns and villages operate at the

same level as an Oasis class ship, people will be very proud and employees will be very proud in how we manage the environment. There may be things big resorts can learn from this technology.”

Asked about the concerns voiced by Atlantis and environmental activists over how the Royal Beach Club’s solid and waste water will be handled, especially as the site has no road access, Mr Bayley replied: “They’re entitled to ask the question. We’re going to have a very sophisticated waste water management system.

“I think, as time will tell, they should feel comfortable we’ve addressed those questions but we need to go through the process with the DEPP before we start sharing this information. There are no structures on the water. There are no overwater cabanas. There’s nothing like that planned.

“Everybody’s entitled to voice their concerns and raise the question. We have no issue with that. We just believe we need to go through the process and will share all the relevant information when the timing is right.... We think by the end of the year we should be pretty close to completion with all different elements of the process including design. By the end of the year we will have that complete and will start construction in early 2024.”

Mr Bayley confirmed that Royal Caribbean had met with Audrey Oswell, Atlantis’ president and managing director, and Vaughn Roberts, the resort’s senior vice-president of government affairs and special projects, earlier this year to show them the Royal Beach Club’s plans and visit the proposed site on western Paradise Island’s Colonial Beach area.

The two sides exchanged views, and the cruise giant promised to address the resort’s concerns and “come back to them”. Asked if he was surprised that Atlantis had gone public when that process was still ongoing, Mr Bayley replied: “We do projects all over the world and operate all over the world, so nothing surprises me any more.”

Royal Caribbean’s executives spoke out as Bahamian environmental

“We offered a lot of incentives to persons just to kind of regularise and to satisfy their tax obligations. That is now ended; we’re not in that season

any more. We’re in the season of enforcement. And the Department of Inland Revenue has a whole lot of powers in its bucket that it can utilise.

It’s really because of the arrears that we’re seeing, and they’re building. And so the Department has an obligation to collect the Government’s revenue.”

activists yesterday hit out at what they branded as “a lack of transparency” surrounding the Royal Beach Club’s public consultation and approvals process. Those signing a public letter included ex-Bahamas National Trust (BNT) chief, Eric Carey; Save the Bays chief, Joe Darville; reEarth president, Sam Duncombe; EarthCare’s Gail Woon; Rashema Ingraham, executive director, Waterkeepers; and Casuarina McKinney, executive director, Bahamas Reef Environment Educational Foundation (BREEF).

They demanded “a thorough, transparent review of the environmental, economic and cultural impacts of Royal Caribbean’s proposed beach project on Paradise Island”, and said: “To-date there has been a lack of transparency, with little or no opportunity for public input or dialogue. Critical questions posed to Royal Caribbean and government agencies have gone unanswered.

“Our concerns include, but are not limited to, the threats of the proposed development on the fragile coastline of Paradise Island, the pollution of our waters, the safety and traffic in our harbour, the negative economic impact of having thousands of cruise line passengers bypass our capital’s downtown, and the future and unforeseen consequences of selling out our natural resources and heritage to a foreign entity with no real/substantive return for the Bahamian people.”

The group called for “responses and mitigation plans related to the beach project submitted to the government by Royal Caribbean”, plus “Royal Caribbean written responses to numerous unanswered questions shared by The Bahamas’ business and environmental communities regarding the impact of its proposed project”.

Embassy of the United States

Vacancy Announcement

Th e American Embassy in Nassau is accepting applications for the following position:

Commercial Specialist

Open to:

All Interested Applicants / All Sources

Duties:

As a member of the U.S. Embassy's dynamic Political-Economic Section, the Commercial Specialist (CS) leads on all aspects of work related to Embassy Nassau's efforts as a Commerce Department Partner Post, including the planning, coordination, and implementation of multiple complex commercial services. The CS provides support for business matchmaking programs such as the Gold Key Service and International Partner Search and conducts market research to fulfill trade infonuation requests from U.S. exporters and host country importers. The CS leads on the promotion of trade missions, local trade exhibits, and other export promotion activities, including coordinating the participation of a combined Embassy Nassau/Government ofBahamas delegation and up to 30 bilateral meetings between U.S. finns, local companies, and ministry representatives directly following a trade mission.

Interested candidates are required to possess the following skills and qualifications:

• Education: Bachelor's Degree in Business Management, Economics, Marketing, Finance, International Trade or related major is required.

• Experience: Al least five years of progressively responsible experience in business or govenunent in the fields of marketing, trade promotion, economics, international trade, business development or sales is required.

• Language: English level - Fluent, Reading/Writing/Speaking.

The complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

Applications will not be accepted at the Security Gate of the Embassy, by Mail, E-mail or other means of delivery. Opening Period: Monday March 27, 2023 - Fridav April 14, 2023.

Due to the high volume of applications, unsuccessful candidates will not be contacted.

opportunities through a first-of-its-kind tourism model.

Besides the Government converting the four Crown Land acres it is contributing into an equity stake in the Royal Beach Club, Bahamians will also be able to acquire an ownership interest by buying into an investment fund that will hold shares in the project. That equity raise will take place during the 2023 second half, once the Government’s Crown Land has been valued, and between the two they will hold a combined 49 percent stake in the Paradise Island development.

Disclosing that Royal Caribbean’s total investment in the Royal Beach Club, between construction

costs and the acquisition of 13 acres of privately-owned land on western Paradise Island, is likely to total $175m when full build-out is complete, Mr Bayley told this newspaper that the cruise line is hoping to complete the environmental approvals process and obtain all necessary permits to proceed by year-end 2023. This will enable construction to begin in early 2024, with the Royal Beach Club’s opening targeted for June/July 2025. Jay Schneider, Royal Caribbean’s chief product and innovation officer, yesterday told Tribune Business that the project will likely create “hundreds” of Bahamian jobs - “far in excess” of the 200 originally referenced by Mr Bayley - via the local

entrepreneurs that will provide its retail, food and beverage, entertainment, water sports, security and other functions.

Disclosing that the Royal Beach Club will cater to 2,750 guests “on average per day”, Mr Schneider also clarified previous remarks by Chester Cooper, deputy prime minister, saying that the latter’s reference to the project accommodating no more than 5 percent of cruise passengers was not based solely on Royal Caribbean’s visitors but the total brought to Nassau by all cruise lines. Pointing out that Royal Caribbean is poised to “grow capacity to Nassau far in excess of what could go to the Royal Beach Club”, with its passenger volumes set to increase by

150 percent compared to pre-pandemic levels come 2027, Mr Schneider asserted that the Paradise Island will accommodate a minorityrather than a majority - of its guests.

“When we started this project we were bringing one million to Nassau per year,” he explained. “By the time we hit 2027, we will be at 2.5m. Less than 40 percent of our guests on an annual basis will be able to visit the Royal Beach Club. That means 60 percent of our guests, at a growth rate of 1.5m over that period, will be able to visit other attractions.

“You’ll have more than one million passengers a year looking to have other things to do, like Blue Lagoon, Stuart Cove, Baha Mar..... More than 60

percent of our guests will never have the opportunity to visit. We need a lot of really great attractions for them.”

Mr Bayley said the Royal Beach Club should be viewed as just one element among many that is badly required to enhance the Nassau tourism product with fresh attractions, tours and experiences - especially given that a significant number of cruise passengers have visited the city before.

“Our customer data shows our number one destination is Coco Cay [Royal Caribbean’s private island in the Berry Islands] from a pure experiential destination perspective, and it rings every bell,” the cruise chief explained. “They go to Nassau next day, and it ranks in the bottom 10 percent/

“We’ve all got to work together as a team to improve the product. There’s a lot of groups that are interested in that. We’ve talked to a lot of resorts, and everybody is on the same page on how to deliver a world-class product all around. It’s the totality that makes people purchase the product.”

Those weaknesses were acknowledged by Nassau Cruise Port in its just-released $134m bond refinancing offering document, which said:

“Unfortunately, the previous port infrastructure limits further growth and, coupled with an underwhelming passenger experience, Nassau’s image as a favoured cruise destination has been negatively impacted.”

Addressing fears from Bay Street merchants and other tourism stakeholders that the Royal Beach Club will suck cruise passengers, and their spending power, away from Bahamian-owned businesses, Mr Bayley said: “I’d say that’s just inaccurate. It’s just not factually correct.

“We need to start working together as a collective team to improve the overall experience for our customers and tourists we’re bringing to the destination, and we need to start thinking win-win. How do we create experiences that make Nassau a desired destination for tourists? It’s not going to happen with a negative narrative; it will happen by positively working together. We can win together, and we can lose if we can’t work together.”

Mr Bayley promised that the Royal Beach Club, if it proceeds, will have a “pretty significant” economic impact for Nassau and, by extension, the wider Bahamas. “First of all, we’ve already invested around $70m in this project so far,” he revealed. “By the time we’ve built the project it will be close to $175m worth of investment.

“The vast majority of that investment is going back into the Bahamian economy, not only for construction but landscaping and utility services that will be required by Royal Beach Club.” Mr Bayley pledged that all workers employed at Royal Beach Club will be Bahamian, saying “200 fulltime jobs will be coming almost immediately as soon as the Beach Club opens”, while all goods and services required will be sourced by local vendors.

“I think the economic impact of the Royal Beach Club will be significant in the grand scheme of things,” the Royal Caribbean chief reiterated. “It’s really again a win-win.” Mr Schneider, who confirmed that “hundreds” will likely be hired once full-time operations begin, explained that the 49 percent Bahamian equity stake in the project will be split between the Government and local investors.

“Bahamians will be able to buy equity in the Beach Club,” Mr Schneider said. “We’re going to partner with a local financial management company who will develop a Royal Beach Club equity fund and

Bahamians will be able to participate directly in that equity fund. The goal is up to 49 percent of the Beach Club could be owned by Bahamians - the equity from the land, and the remainder from Bahamian investors.”

The pricing and amount of capital raised, as well as the terms and conditions of any equity offering, have yet to be determined. Much will depend on the value assigned to the Government’s four Crown Land acres, as this will determine how much capital must be contributed by Bahamian investors.

“We have to go through the land valuation, which we’re doing now with the Government, and that will determine the raise,” Mr Schneider explained. “The land valuation will be done in the first half of this year. The goal is the equity fund, it’s raise will be between July and December this year. We can’t do that raise until we look at the land valuation.”

He added that the investment firm which will structure the fund, and manage any equity raise, has yet to be selected. However, the concept appears similar to the Nassau Cruise Port offering, in which Bahamians bought shares in the Bahamas Investment Fund, a vehicle that holds a collective 49 percent interest in the cruise port.

Both Mr Bayley and Mr Schneider credited Mr Cooper, the deputy prime minister and minister of tourism, investments and aviation, for developing the so-called public-private partnership (PPP) model for the Royal Beach Club. Mr Bayley said the project has been six years in the making, with Royal Caribbean having started to first acquire land on western Paradise Island in the Colonial Beach area in 2017.

“I think we spend a huge amount of time trying to understand how we make our customers happy, and how we design and innovate with product and ships,” Mr Bayley told Tribune Business: “Certainly, when we thought about opportunities in Nassau, a kind of laid-back, easy-breezy Bahamian beach club came to mind. We started the journey to acquire the land over several years.”

The acquisition of what he referred to as “derelict land” back in 2017, with Royal Caribbean assembling 13 privately-owned acres and then seeking to lease additional Crown Land from the Government. While COVID-19 had intervened, the cruise line ultimately picked up where it had left off, and views the Royal Beach Club as “another element” that adds to the options for visitors to Nassau alongside the likes of Baha Mar and Margaritaville.

“We think we have an exciting addition to Nassau’s product, to Nassau’s brand,” Mr Bayley said. “Nassau compared to many destinations, and is like a destination and brand.... There’s a good opportunity to work together as a team to continue the journey of reimagining and reinventing experiences in Nassau. We just want to be part of that dialogue.

“What we see for the Beach Club is that it’s truly a win-win project. It’s the first PPP in tourism model. It’s a win for the Bahamian people. It allows access to the Bahamian people to participate in the venture. It takes Crown Land and puts it in a profitable business that will provide a return for the sovereign wealth fund for years to come. It allows for revenue streams to go into a national fund.

“We think this model is going to be very successful, and we’re having discussions in other destinations around the world and in the Caribbean about using the same model.” Mr Bayley said that despite giving up 49 percent ownership Royal Caribbean views its Paradise Island project as still viable from an economic and investment return standpoint.

Vacation rental listing ‘not so we can tax you’

purpose of the portal right now.”

Dexter Fernander, head of operations, Department of Inland Revenue, indicated that some short-term rental owners are operating outside of the scope of their licenses and should be regulated.

“Some have voluntarily registered as a business but, currently how the Value Added Tax says, if it’s 45 days short term that’s considered short term rental, there is no business license,” he said. “What we’re seeing is a trend and that they are going beyond the scope of just short-term rental. We’re seeing individuals are renting cars. So

you have private plates, no SD, nothing controlled by road traffic. What happens to a tourists, they meet the key underneath the mattress at the airport, and they have someone who’s doing private chef for them, they have pleasure vessels.

So we’re seeing that this spill off going into different areas that need to be regulated. So that is of a concern.”

Mr Fernander also defended the registration platform as a means to ensure the safety of visitors and the country’s reputation.

“If we’re to look at the industry, on many days, we see the tourists come in the taxi with their bags, where cancellations happen, who

they coming to see they don’t know,” he said. “They see a picture of someone who says that they are the property manager, the property manager doesn’t even live in The Bahamas, the phone contact number is a WhatsApp number and in the United States that’s organised. They have easy digital access into the building by code. So, there’s no interaction and most of the times the transaction happens before they come here.”

He added “So, we are here as the regulators to make sure if we are seeing this trend, what do we do? What do we do to protect our image? Remember was a situation in Trinidad where a short-term rental

GB water supplier: 40% protected from price rise

FROM PAGE B3

additional 1.5m gallon a day mobile reverse osmosis system, which will increase potable water capacity.

It will also further improve water quality, and address the lower pressure being experienced by residents because of the diminished freshwater lens. Olethea Gardiner-Miller, GB Utility’s wellfield officer, said: “Customers control their consumption and that’s one of the most important takeaways from the utility.

“Our rate proposal addresses key components and consumer behaviours we want to encourage. The first being to encourage environmentally-conscious customers, hence no rate increase for the lower usage customers, about 40 percent of our base. The second being that Hurricane Dorian has significantly damaged our freshwater lens and we must learn the new normal of consuming

less or we run the risk of destroying what’s left of the aquifer for us and future generations.”

The Grand Bahama Port Authority (GBPA), GB Utility’s regulator, said in a statement: “In keeping with its regulatory governance, GBPA must ensure efficient, cost-effective and reliable operations of the water utility. As the island’s water utility provider, GB Utility shall work under an agreed set of standards of service framework agreement to ensure it acts in the best interests of customers.

“GBPA will provide access to the rate adjustment proposal and a feedback mechanism for customers on our website. As regulator, the GBPA will ensure a fair and transparent review process while it balances the potential impact to customer bills with the need to have a healthy utility that meets its obligations to provide customers with the highest quality product and service.

“GBPA will thoroughly review the application in detail and provide a decision to GB Utility no later than May 1, 2023. We understand fully the importance of ensuring that this island has access to a consistent and quality supply of potable water that meets World Health Organisation (WHO) guidelines,” it continued.

“We are cognisant of the critical role of water in our everyday life and future development. We act in accordance with best practices and industry standards to balance the needs of our customers, protect our natural resources and ensure we have a sustainable and storm resilient utility.”

was raped, and they had to start governing rules down to Trinidad as relate to it. So, before we reach that, we prevent it, we want to see who are the people out there in the market working on it, and what can we do?”

Ms Strachan also reiterated that foreign short-term vacation rental owners must obtain a business license and be registered for VAT, even of they do not meet the $100,000 VAT threshold. She said “Foreigners in the industry need business licenses and have to be registered for that. So, if you’re non-Bahamian, and you’re in the short-term vacation rental market, you have to be registered for VAT,

even if your turnover is not $100,000. And you need a business license. Now, we expect that, again, during amendment time, that everybody will need a business license, but there will probably not be a fee. I don’t

know if there’ll be a fee for Bahamians in the in the market for short term vacation rental. But it would be good to get a license because then the bank can fund you and all that kind of good stuff.”

Buffett says people shouldn’t worry about Berkshire, banks

By JOSH FUNK AP Business WriterBILLIONAIRE Warren

Buffett assured investors

Wednesday that Berkshire Hathaway will be fine when he's no longer around to lead the conglomerate.

Buffett said that after Vice Chairman Greg Abel takes over, Berkshire will still follow the same model of allowing its subsidiaries to largely run themselves while

looking for other companies to buy with the substantial cash reserves it keeps on hand at all times.

"The problem for our board of directors is the day I'm not around and Greg's running it, I am not giving him some envelope that tells him what to do next," Buffett said.

Buffett said Berkshire is "so damn lucky" to have Abel ready to take over as CEO. The 92-year-old says

he has no plans to retire, but Abel has been designated as the successor ever since Buffett's partner Charlie Munger let it slip at the 2021 annual meeting.

Abel already oversees all of Berkshire's non-insurance businesses.

Buffett and Abel appeared together Wednesday on CNBC from Tokyo where they are checking on several companies Berkshire has invested in, and to

promote the conglomerate Buffett leads.

Wednesday's appearance was the first extended television interview Buffett has done since before the pandemic. He used to regularly appear on the cable business news network to answer questions for three hours at a time, several times a year.

Buffett and Abel fielded a variety of questions Wednesday, including regarding the recent bank failures and

whether railroads, including Berkshire's BNSF railroad, need to improve safety in the wake of several recent high-profile derailments.

Buffett said more banks will fail over time because some managers will continue to do "dumb things" to boost short-term profits, but most people shouldn't worry because their money is protected by the Federal Deposit Insurance Corp., which is paid for by the banks — not the federal government.

"We're not over bank failures, but depositors haven't had a crisis," Buffett said. "Banks go bust, but depositors aren't going to be hurt."

Berkshire sold off most of its bank investments in recent years — except for a major Bank of America stake — because of Buffett's concerns.

"I don't like it when people get too focused on the earnings number and forget what in my view is

basic banking principles," he said. There has been an intense focus on improving railroad safety in the wake of the fiery Feb. 3 Norfolk Southern derailment outside East Palestine, Ohio, that prompted evacuations and lingering health concerns after hazardous chemicals were released.

Buffett said Norfolk Southern "handled it terribly" and was "tone deaf" in their initial response to that derailment. He pointed out that after a recent BNSF derailment, CEO Katie Farmer was on a plane right away to respond to the crash. Norfolk Southern's CEO Alan Shaw has repeatedly promised to make things right in East Palestine, but he was slow to meet with residents after the derailment and the railroad missed one of the initial community meetings to answer residents' questions.

WARREN BUFFETT, Chairman and CEO of Berkshire Hathaway, speaks during a game of bridge following the annual Berkshire Hathaway shareholders meeting on May 5, 2019, in Omaha, Neb. Buffett assured investors Wednesday, April 12, 2023, that Berkshire Hathaway will be fine when he’s no longer around to lead the conglomerate because Vice Chairman Greg Abel will do a great job and the conglomerate’s basic model won’t change.

Legal Notice

NOTICE

GIBBONS INC.

NOTICE IS HEREBY GIVEN as follows:

(a) Gibbons Inc. is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 12th day of April 2023.

(c) The Liquidator of the said Company is Delco Investments Limited of Deltec Bank & Trust Limited, Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas.

Dated this 13th day of April A.D., 2023

Delco Investments Limited Liquidator

Legal Notice NOTICE

SHERRY WORLDWIDE INVESTMENTS CORPORATION

NOTICE IS HEREBY GIVEN as follows:

(a) Sherry Worldwide Investments Corporation is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 12th day of April 2023.

(c) The Liquidator of the said Company is Delco Investments Limited of Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas.

Dated this 13th day of April A.D., 2023

Delco Investments Limited Liquidator

Legal Notice NOTICE

LAUREL CORPORATION

NOTICE IS HEREBY GIVEN as follows:

(a) Laurel Corporation is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 12th day of April 2023.

(c) The Liquidator of the said Company is Delco Investments Limited of Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas.

Dated this 13th day of April A.D., 2023 Delco Investments Limited Liquidator

ZELENSKYY CALLS FOR CONFISCATING RUSSIAN CENTRAL BANK FUNDS

By FATIMA HUSSEINAssociated Press

IN AN appeal to the heads of the IMF and World Bank, Ukraine's president on Wednesday renewed his call to confiscate Russian Central Bank assets held around the world and use them to help rebuild Ukraine. "To charge the aggressor with compensation for damages," Ukrainian President Volodymyr Zelenskyy said by video link. "Russia must feel the full price of its aggression."

The U.S. announced at the start of Russia's

invasion that America and its allies had blocked access to more than $600 billion that Russia held outside its borders. The U.S and its allies continue to impose rounds of targeted sanctions against companies and the wealthy elite with ties to Russian President Vladimir Putin.

"It must be clearly stated that the assets of the Russian Central Bank will be confiscated. It will be a peacemaking act on a global scale," Zelenskyy said. He was patched in for a session with Ukrainian Prime Minister Denys Shmyhal, U.S. Treasury

Secretary Janet Yellen, World Bank President David Malpass and International Monetary Fund Managing Director Kristalina Georgieva, held during the IMF and World Bank spring meetings to discuss Ukraine's ongoing funding needs.

A joint assessment released in March by Ukraine's government, the World Bank and European Commission estimates Ukraine's long-term recovery needs will total at least $411 billion. In March, Ukraine and the International Monetary Fund agreed on a $15.6 billion

loan package aimed at shoring up the government's severely strained finances.

Since the war began in February 2022, the United States has given Ukraine more than $100 billion in military and civilian support, which includes some money for reconstruction. Other countries also have provided Ukraine with substantial support.

At the roundtable, Yellen said "the United States will do what it takes to support Ukraine, for as long as it takes." She said "our historic multilateral sanctions coalition is restricting Russia's access to the

technology and equipment it needs to supply its military."

Zelenskyy argued that liquidating Russia's funds held around the world, including those of sanctioned oligarchs, would send a message to "potential aggressors" wherever they may be.

The idea is gaining traction. Former Biden administration official Daleep Singh told the Senate Banking Committee on Feb. 28 that forfeiting Russia's billions in assets held by the U.S. is "something we ought to pursue."

And Charles Michel,

president of the European Council, has called for using Russia's Central Bank funds to "rebuild what it has destroyed."

The U.S. announced last week that Treasury officials Liz Rosenberg and Brian Nelson — specialists in sanctions and terrorist financing — will travel to Europe this month to meet with leaders of financial institutions in Switzerland, Italy and Germany. They plan to share intelligence on potential sanctions evaders and to warn of the potential penalties for failure to comply with international sanctions.

PUBLIC NOTICE

The Public is hereby advised that I, JESSICA DUMERVIL of Freeport, Grand Bahama, intend to change my name to JESSICA JONES If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

FRANZETTA FERGUSON NOTICE

PLEASE CONTACT THE OFFICE OF MITRE COURT AT THE ADDRESS AND CONTACTS PROVIDED BELOW MITRE COURT Chambers Suite 227, 2nd Floor, Island Lane Building Olde Towne, Sandyport West Bay Street Nassau, The Bahamas Telephone: 327-4150

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, FLOYD PRATT also known as FLOYD OSCAR WALKES of Eleuthera Island Shores, Gregory Town in the Central District of the Island of Eleuthera one of the Islands of the Commonwealth of the Bahamas intend to change my name to FLOYD OSCAR WALKES. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport O cer, P. O. Box N-742, Nassau, Bahamas no later than Thirty (30) days after the date of the publication of this notice.

NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000

Njord Finance Inc.

(IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, Njord Finance Inc. is in dissolution.

The dissolution of the said Company commenced on April 6, 2023 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas.

The Sole Liquidator of the said Company is L. Michael Dean of Equity Trust House, Caves Village, West Bay Street, P O Box N 10697, Nassau, Bahamas.

L. Michael Dean Sole Liquidator

BEHAVIOR THERAPIST NEEDED

Behavior Therapist to Teach Individuals with special needs how to talk, play, make friends and function independently while helping reduce any inappropriate behaviors.

MINIMUM REQUIREMENTS

Currently enrolled in college/university with 2 years of collage coursework completed in psychology related field.

Please send Resumes To mcandela@seahorseinstitute.org

BANK TURMOIL LED FED OFFICIALS TO FORECAST FEWER RATE HIKES

By CHRISTOPHER RUGABER AP Economics WriterTURMOIL in the banking system after two major banks collapsed led many Federal Reserve officials to envision fewer rate increases this year out of concern that banks will reduce their lending and weaken the economy.

The heightened uncertainty surrounding the banking sector also helped Fed officials coalesce around their decision to raise their benchmark rate by just a quarter-point, rather than a half-point, at their meeting March 21-22, according to the meeting minutes.

The Fed also revealed Wednesday that its staff economists have forecast that a pullback in bank lending will cause a “mild recession” starting later this year. That is a shift from their previous estimates, which had predicted that the economy would eke out positive growth this year.

If the impact of the banking turmoil ends up being less than economists’ forecasts, a recession might be avoided, the minutes suggested.

Overall, the minutes showed that the banking troubles have injected significant uncertainty into the Fed’s decision-making and reversed an emerging trend to keep raising rates aggressively to quell inflation. At their meeting last month, Fed officials projected that they will raise their benchmark short-term rate — which affects many consumer and business loans — just once more this year, in May.

Fed officials who spoke this week have also emphasized the importance of monitoring bank lending. There are already reports of small companies struggling to obtain loans, though it’s not yet clear how widespread the impact will be.

Before the collapse of Silicon Valley Bank, many Fed officials had said they expected to forecast more than one additional hike this year because economic and inflation data showed that they still had more to do to control the pace of price increases. But according to the minutes of last month’s meeting, Fed officials agreed that the collapse of the two large banks “would likely lead to some weakening of credit conditions,” as banks sought to preserve capital by curtailing lending to consumers and businesses.

Several officials said they had considered supporting leaving rates unchanged at last month’s meeting. But they added that actions by the Fed, the Treasury Department and the Federal Deposit Insurance Corp. to protect depositors had “helped calm conditions” in banking and reduced the risks to the economy in the short run.

Some other officials said they had favored a half-point hike last month because hiring, consumer spending, and inflation data still pointed to a hot economy. But given the uncertainty resulting from the banking troubles, they “judged it prudent” to implement a smaller quarter-point increase.

Also Wednesday, the government’s latest inflation

data showed that price increases are slowing but remain far above the Fed’s 2% inflation target, making another quarter-point rise in its benchmark rate highly likely at its meeting next month.

Consumer prices were up 5% in March compared with year ago, much less than the 6% year-over-year increase in February. But excluding volatile food and energy costs, core inflation ticked higher — from 5.5% to 5.6%. Economists consider core prices a better read on underlying inflation.

Fed officials who have spoken this week have suggested that they will need to raise their key short-term rate for a 10th time in May. Economists outside the Fed increasingly expect the Fed to pause its rate hikes after that.

Mary Daly, president of the Federal Reserve Bank of San Francisco, said Wednesday that the March inflation report was “good news” but that price increases are “still elevated.”

“The strength of the economy and the elevated readings on inflation,” Daly said, “suggest that there is more work to do.”

Yet she also suggested that the Fed’s forthcoming rate decisions will hinge, in part, on how severely banks restrain lending.

“How much does that put the brakes on the economy so that we don’t have to tighten more?” Daly asked. “We don’t know the answer, but it’s one of the things we’ll focus on.”

The San Francisco Fed was the principal federal regulator for Santa Clara, California-based Silicon Valley Bank, whose collapse a month ago ignited financial turmoil in the United States and Europe. Daly declined to comment on the issue.

Tom Barkin, head of the Federal Reserve Bank of Richmond, said on CNBC that the March inflation report showed that core inflation was still too high.

“There’s still more to do, I think, to get core inflation back down to where we’d like it to be,” he said.

Austan Goolsbee, who became president of the Chicago Fed early this year, sounded a more cautious note this week. Goolsbee noted that stress in the banking system can weaken the economy and could mean that the Fed might not have to raise rates as much as it otherwise would.

“I think we need to be cautious,” he said. “We should gather further data and be careful about raising rates too aggressively until we see how much work the headwinds are doing for us in getting down inflation.”

Goolsbee did not say explicitly whether he supported another rate increase. Goolsbee, Daly and Barkin are among the Fed’s 18 policymakers, although only Goolsbee currently has a vote on rate decisions. The Fed’s regional presidents vote on a rotating basis.

STOCKS DIP AFTER INFLATION DATA, FED ECONOMISTS’ WARNING

By STAN CHOE AP Business Writer

STOCKS dipped to close an up-and-down Wednesday on Wall Street following the latest update on inflation and the latest warning of a possible recession. The S&P 500 fell 16.99, or 0.4%, to 4,091.95 after drifting between small gains and losses through the day. The Dow Jones Industrial Average slipped 38.29, or 0.1%, to 33,646.50, and the Nasdaq composite lost 102.54, or 0.9%, to 11,929.34.

The main focus for more than a year on Wall Street has been high inflation and how much painful medicine the Federal Reserve will have to dole out to contain it. Wednesday’s update on inflation was a mixed one, showing prices at the consumer level were 5% higher last month than a year earlier.

That’s still well above the Federal Reserve’s comfort level, and some underlying trends within the data were also concerning. That weighed on financial markets. But on the upside for investors, the overall inflation number was still better than the 5.2% that economists expected. It also marked a continued slowdown from inflation’s peak last summer.