‘Cooling off’: High-end real estate sales drop 20-25%

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

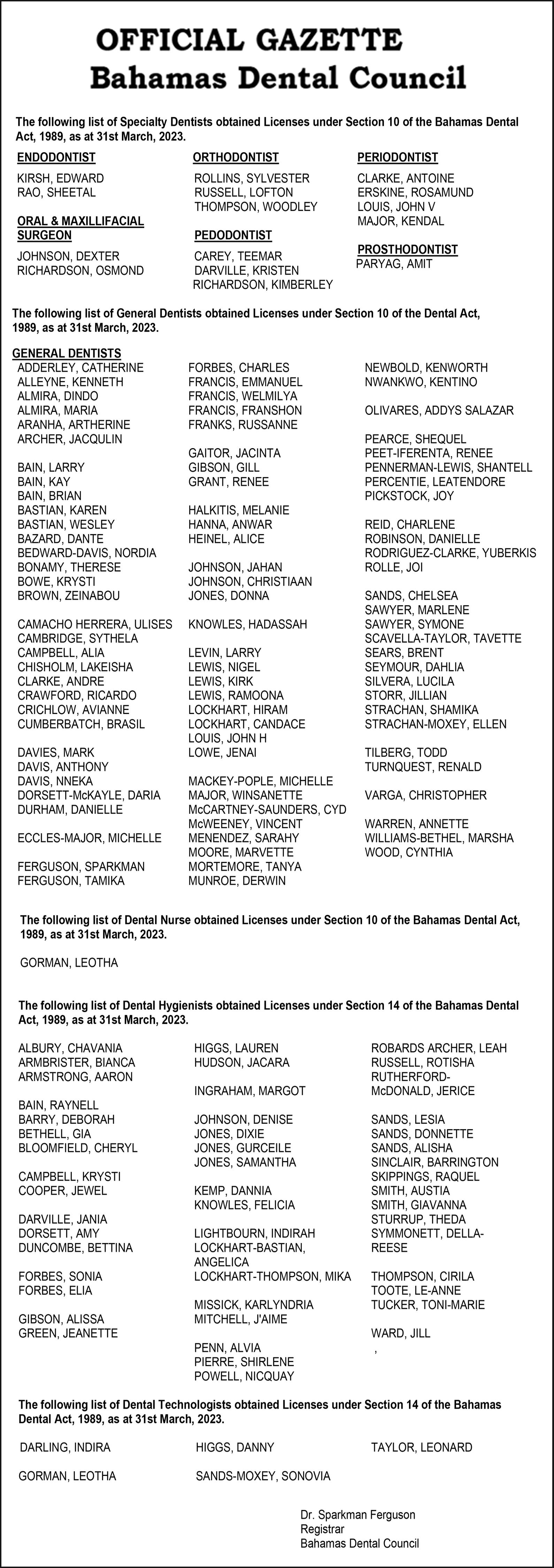

A BAHAMIAN realtor yesterday disclosed that high-end sales volumes “cooled” by 20-25 percent during the 2023 first quarter following a “record-shattering” year for single-family home prices on several islands.

Ryan Knowles, founder and chief executive of MAISON Bahamas, told Tribune Business the market will likely take “a pause” this year following the “crazy, frantic” buying frenzy that was sparked post-COVID. This, he added, will allow available sales inventory to replenish after numerous properties were acquired over the past two years and also permit buyers and sellers to eliminate their “disconnect” over prices.

Speaking as MAISON teamed with Forbes

Global Properties to release an “outlook” for the world’s high-end real estate market, Mr Knowles said while “the spike has come down” - with prices dropping on average by 10-15 percent following the post-pandemic - the market is merely catching its breath and is poised to resume “accelerated growth” yet again in 2024.

In a message to clients in the Forbes Global Properties report, he added that

The Bahamas remained an in-demand destination with 2022 seeing several records for high-end single family home sales. One New Providence-based property fetched $47m, while Elbow Cay in the Abacos saw a $14m sale closing, although neither home or buyer/seller was identified.

“The luxury property market in The Bahamas enjoyed another stellar, and in many ways, historic

year in 2022,” Mr Knowles wrote. “Buying trends continue to demonstrate that luxury home buyers from around the world are particularly attracted to the warm climate, accessibility to other global hotspots, tax-friendliness, high quality of life and variety of luxury property options in The Bahamas as compared to other Caribbean destinations.

SEE PAGE B5

Contractors fear return to Act ‘drawing board’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMIAN Contractors Association’s (BCA) president yesterday said the industry is “absolutely not enthused at all” over signs that the Government may “go back to the drawing board” on legislation to regulate it.

Leonard Sands told Tribune Business the Davis administration simply needs to “lock it down” by resetting the “grandfathering in” period for all contractors under the Construction Contractors Act, plus appoint the Board to

oversee the self-regulating legislation, rather than seemingly moving to reinvent the wheel.

Alfred Sears, minister of works and utilities,

SEE PAGE B10

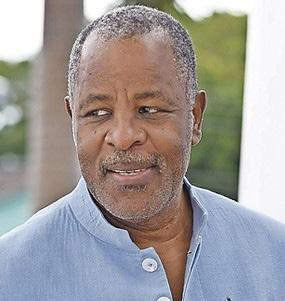

Sir Franklyn hails golf tie-up as ‘world first’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

AN ELEUTHERA-

BASED resort community’s principal developer yesterday hailed its “world first” in being able to offer two golf courses separately designed and branded by some of the sport’s biggest names.

Sir Franklyn Wilson, Jack’s Bay’s chairman, told Tribune Business that it had “never happened before” where a mixeduse resort featured golf courses created by Tiger Woods and Jack Nicklaus plus their respective design companies.

$5.71

GB residents ‘up in arms’ over water hike process

• Gov’t told: ‘Act now’ on regulatory conflict

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government “must act now” and directly intervene to prevent the Grand Bahama Port Authority (GBPA) “regulating itself” over imminent water rate hikes, the Opposition’s finance spokesman charged yesterday. Kwasi Thompson, the east Grand Bahama MP, told Tribune Business his constituents are “up in arms” over the Grand Bahama Utility Company’s proposed increases and view the approval process as “ridiculous”. This is because the GBPA, as the regulator which will make the final decision, enjoys the same ownership as GB Utility - the very entity it is supposed to be providing independent oversight for - via the Hayward and St George families.

Pointing out that the GBPA’s “first legal obligation” is to its owners, and not Grand Bahama’s water consumers, Mr Thompson argued that the rate approval process is “tainted” by the obvious conflict of interest stemming from the common ownership. As a result, he asserted it was “impossible” for any decision to be viewed as fair

Speaking after the $20m, 18-hole course to be created by Nicklaus Design was unveiled at a ceremony featuring Prime Minister Philip Davis KC and several Cabinet ministers, Sir Franklyn asserted that the

SEE PAGE B6

business@tribunemedia.net THURSDAY, APRIL 20, 2023

SEE PAGE B11

RYAN KNOWLES

LEONARD SANDS

KWASI THOMPSON

SIR FRANKLYN WILSON

• 2023 ‘pause year’ after ‘record shattering’ 2022

• $47m New Providence high for single family

• Elbow Cay at $14m; Eleuthera ‘watershed’

$5.67 $5.67 $5.78

PROCRASTINATION

UNHEALTHY FOR EFFICIENCY IN WORKPLACE

Deadlines are key for many workplaces as companies are subject to contractual obligations which require they be met.

Deadlines are vital even though some employees may not take them seriously. While failing to meet, or not committing to, a deadline does not rise to the level of a life and death situation, it can still create unnecessary stress.

Research has found that 26 percent of employees identified themselves as chronic procrastinators, while another study found that workers who consistently procrastinated over projects were less likely to receive promotions. Indeed, this made them more likely to be fired.

Procrastination and Deadlines

It is important to understand the difference between these terms. Some procrastinators contend that they perform better under pressure, and while they may be able to convince themselves of that, research shows it is generally not the case. Instead, they may make a habit of last-minute work to experience the rush of euphoria at seemingly having overcome the odds. Remember the time when you thought you had a week to finish a project that was really due the next day? One of the biggest factors contributing to procrastination when dealing with deadlines is the notion that we have to feel inspired to work on a task at a particular moment. The reality is that if you wait until you are in the right frame of mind to do certain tasks, the task may never be completed.

Procrastination is a voluntary act of postponing a task, even though it is evident that it needs to be done. And a deadline is an externally-imposed date by which something must be done. In other words, deadlines are often set by someone else, whereas procrastination is a decision that we make ourselves. Actually saying “I’ll do it tomorrow” or “It’s not a priority right now” are both examples of procrastination.

Sometimes, regardless of how well-organised and committed you are, chances are that you may find yourself frittering away hours on trivial pursuits - watching

TV, updating your Facebook status or shopping online - when you really should have been spending that time on the project.

Make Deadlines clear and concise

So, how can employers help workers to respect deadlines and avoid procrastination? Ensure that the risk is explained by stating the consequences that may follow. This does not mean being overly critical or punitive; it is simply having a conversation about why the deadline is important.

Ambiguous instructions lead to confusion. For that reason, when setting a deadline, make sure you include all the relevant information needed to communicate clearly, concisely and consistently. Try not to include unnecessary information. Be clear and to the point, and stick to your deadline as much as possible, as this creates stability. Finally, use language that everyone understands by avoiding jargons or complicated terms.

Try not to assume that deadlines will necessarily be useful in every situation, especially since different people perceive and react to deadlines differently. To this end, assess the situation and ask yourself: What do I risk losing if I do not meet this deadline? Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

• NB: Columnist welcomes feedback at deedee21bastian@gmail.com

ABOUT COLUMNIST: Deidre M. Bastian is a professionally-trained graphic designer/brand marketing analyst, author and certified life coach

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PAGE 2, Thursday, April 20, 2023 THE TRIBUNE

DEIDRE BastiaN By

Bahamas-led trading app targets end- a pril launch

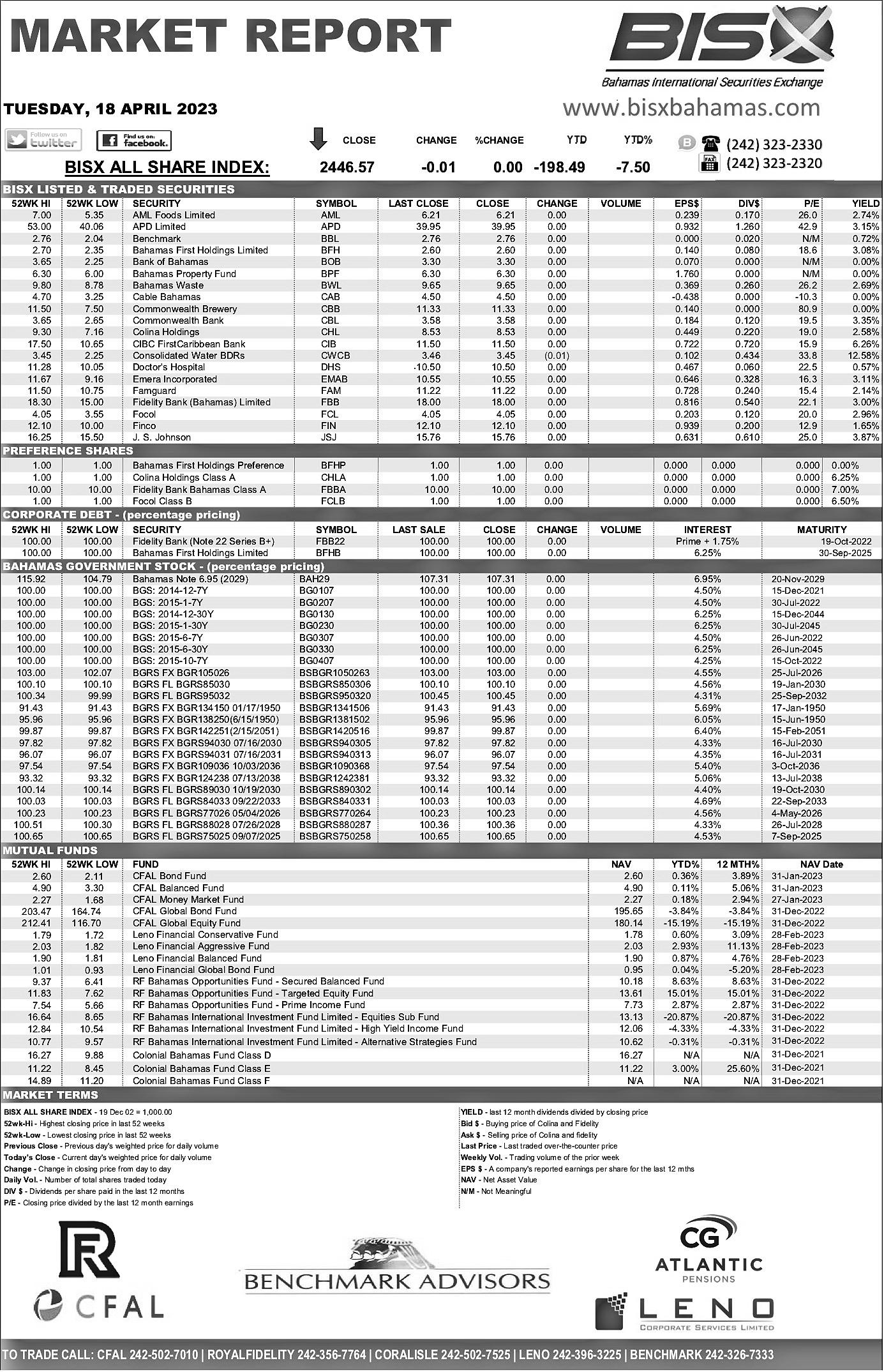

A BAhAmiAn-led trading app yesterday said it will make multiple investment forms more accessible when it launches at endApril 2023.

n’nhyn O’Cof, Prospuh’s president and chief executive, told Tribune Business it has ambitions to expand its trading platform beyond The Bahamas and into the Caribbean. he added that the company’s Board of directors includes Julian Francis, ex-Central Bank governor, as chairman.

“We’re an investment platform,” mr O’Cof said. “We have our licence in the US, and we also have our Securities Commission licence in The Bahamas. We’re a platform that you invest on. You’re allowed to trade in all stocks in the US markets and eTFs (exchange traded funds) in the US markets, and stocks from different countries as well. So stocks in the netherlands, Asia, norway, Sweden, Switzerland etc.

“The big part of it is we wanted to make investing accessible to everybody. So you can buy fractional shares as well on our platform. So you could buy $10 with Google, no matter what Google’s prices are. You could buy technology, or Amazon no matter what Amazon’s prices.

“You can buy full shares. You can buy fractional shares. You can own 0.0001 of a share. And you also own these as well. So you’re not speculating on price.

When you buy these shares, you own them. You can get your stock certificates in your name or give them to your kids or beneficiary.”

mr O’Cof said he was motivated to create the platform after watching generations of workers spend decades working for their employers without acquiring any equity interest in the companies that they toiled for.

he added: “Our goal was to create a platform that

would allow people to build greater wealth. One of the reasons why i was really pushed to do it was i realised that in the generation before us, you had a lot of career workers. nowadays young people aren’t really necessarily career workers, but you have a lot of career workers who have put down 40 years into a company and they never own a piece of that company.

“They work for 40 years and they might get a pension, but they never owned the equity. So we come from a generation of people that never actually had the opportunity to own. Our slogan is putting ownership in the hands of the people; allowing people to be able to own and to be able to create their own investment.”

The Prospuh app is expected to launch at endApril 2023 in The Bahamas before expanding throughout the Caribbean. mr O’Cof said he was interested in developing a CARiCOm stock exchange that can keep pace with today’s evolving technological climate. he added: “We’re launching on April 30. This is very innovative, and it’s the first of its kind in the Caribbean. We’re launching here, but we’re launching in the whole entire Caribbean. my goal over the next year is to actually create a CARiCOm exchange with all the exchanges together. We’d be the first platform that allows people to trade in the way that we do via phone.

“You know, [BiSX] been around for such a long time and hasn’t upgraded. it’s pretty slow. if you look at our cloud platform, users are able to sign up in less than three minutes. You can sign up in two minutes and 30 seconds. You have Ai (artificial intelligence) to integrate it into models in terms of KYC (Know Your Customer) processes.

“if you look at trades, you’re able to book and trade within seconds. You know where technology is today. i would rather create something that i feel comfortable to understand in today’s world of technology for people, and for young people, as well.”

The Prospuh chief said the company has a Board of directors with multiple combined years of financial services industry experience. he added: “We comply with everything. i have a full Board of directors. i also have an advisory board. my chairman of my Board is Julian Francis, who is the former governor of the Central Bank. i also

have the president of the Bahamas Association of Compliance Officers on my Board as well.

“So you have a really good portfolio of guys that really manage me and make sure that i’m complying, and make sure that everything is right. Also we don’t allow margin [trading]... We’re not in crypto at all, or anything. We’re just focused on securities and stocks. We can’t touch your funds. So, you have whatever you have there as what you have. and you are you are in control.

mr O’Cof continued:

“Prospuh is the vehicle that helps you drive your own investing. You turn the key

to decide. The platform facilitates you being able to buy and sell whatever securities that you want to buy and sell outside of our environment.

it’s not just in The Bahamas or launching in the Caribbean, but we’re initially focusing on The Bahamas for us because we’re a team full of Bahamians. But we do have compliance officers, very strict compliance officers. i have all my mitigations in place and i definitely understand the importance of compliance, and to the point where as best as we could with technology, we try to prevent as much

anti-money laundering and all those problems.”

mr O’Cof maintained after the launch that Prospuh will offer free courses and material to educate Bahamians on financial literacy and investments. he said: “i think that a big part of everything is education. And that’s why, once we launch, we offer free education, free financial literacy and investing into education to all Bahamians. We want to get some like free e-books out there. We have the free courses as well. We want to get out there.”

Dependable, Highly Organized, Multi Tasker, Able to Give Attention to Detail.

If you possess these qualities, we invite you to apply for the position of:

CUSTOMER SERVICE CLERK ABACO, BAHAMAS

Job Summary:

We are seeking to recruit proficient, service-oriented Customer Service Clerk (Tellers, Customer Service and Clerical Assistants) to join our team in Abaco, Bahamas, to perform banking transactions and support services for our customers. The position also entails sundry duties and cross training opportunities. This position requires a great attitude, professionalism, an out-going personality, with a high degree of precision and competence.

Duties and Responsibilities:

• Can multi-task while maintaining a high level of accuracy

• Practices good communication skills

• Can assist with sales by making referrals (as per minimum quota)

• Has the ability to cross-sell Fidelity’s products and services

• Possesses excellent work ethics

• Has the ability to stay alert and attentive at all times

• Can work shifts, evenings and weekends (Saturday)

• Is computer literate

Minimum Requirements Quali cations

• High School Diploma or General Education Degree (GED); and one year related experience and/or training; or equivalent combination of education and experience.

• Must have excellent communication skills (verbal and written)

• Ability to manage the administration of multiple tasks at one time

• Who is a resident or lives in Abaco preferred All

THE TRIBUNE Thursday, April 20, 2023, PAGE 3

NO PHONE CALLS

ABSOLUTELY

to:

RESOURCES Re: Customer Service Clerk 51 Frederick Street P.O. Box N-4853

careers@fidelitybahamas.com

PLEASE SUBMIT BEFORE Monday, April 24th, 2023

HUMAN

| Nassau | F: 328.1108

be held in

applications will

strict confidence. Only short listed candidates will be contacted.

PI ‘CANNOT BEAR PRESSURES’ OF ROYAL CARIBBEAN PROJECT

A FORMER Bahamas National Trust (BNT) executive director yesterday voiced concerns that Royal Caribbean’s Paradise Island project “cannot bear the environmental pressures of what is being proposed”.

Eric Carey, who will review the cruise giant’s Environmental Impact Assessment (EIA) on behalf of Atlantis, another critic of its $100m Royal Beach Club proposal, suggested the 17-acre site in the vicinity of Colonial Beach will struggle to cope with the daily average of 2,750 passengers it will host.

“We’re standing on a narrow strip of land that really cannot, it should not and it cannot bear the environmental pressures of what is being proposed. So we want to see how anybody is going to work environmental magic to make that possible and, more importantly, sustainable,” Mr Carey said. “And even if you propose a gold environmental standard, how are you going to make that work on this tiny little narrow strip of the last little piece of Crown land on Paradise Island?

Voicing concern over the volume of visitors that will frequent the site, he added: “Their EIA says they’re

NOTICE

THE BAHAMAS ELECTRICAL CONTRACTORS ASSOCIATION will be holding an IMPORTANT meeting on Monday, 24th April at HOLY CROSS PARISH HALL at 7:00pm.

TOPIC

To discuss the Ministry of Public Works and Transport’s request to change the CEC Code to the new NEC Code.

We invite all Electrical Contractors to attend!

building a facility that can take nearly 8,000 passengers. The deputy prime minister said that they’d negotiated down to 1,000.

Last week, on one of the shows that they were on, they talked about 2,500 to 3,000.

“So they have the capacity to bring lots of people to the small space and, trust me, you go to any of the private islands they put as many people as they can on those islands and there’s no reason to suspect or to believe that if they build it for 8,000 that 8,000 will not come.”

Mr Carey said he and other environmentalists are not against foreign investment, but are concerned with ensuring that developments are site and place appropriate.

He added: “Our country is the beneficiary. We’ve developed our country with foreign direct investment, right. And it has given us a high standard of living. We’ve had some mistakes. I mean, we’ve made some mistakes, and we’ve had some environmental disasters. But generally, I think the Government in the last couple of years have created pretty good environmental legislation, the Environmental Planning and Protection Act, and its associated regulations are very robust.

“They have the ability to effectively review and monitor any development that comes. Look, most of us in this field are not opposed to foreign direct investment. We understand that, you know, we have to live and we have to co-exist. What we don’t want is the type of foreign direct investment that is out of scale and out of place. We need to think of things that are site appropriate… and that whenever it’s placed in a particular area, it does not irreversibly impact the area that you’re putting it”

Mr Carey maintained that the project bypasses downtown Nassau businesses and insisted that visitors should be taking part in Bahamian tours. He went on to state that the responsibility of developing tourism lies with Bahamians and the Ministry of Tourism, and not foreign conglomerates.

He said: “This project proposes a downtown bypass. I mean, that’s what this does. This basically takes thousands of people who otherwise would have

gone on tours… the restaurants at Arawak Cay, the vendors on Junkanoo Beach, etc. The Downtown Nassau Partnership, hopefully, you know, they will eventually get some legs and certainly get east of East Street ready to accept visitors.

“So these people should not be coming here and spending all the money with Royal Caribbean, these thousands of visitors should be taking part in Bahamian tours. I heard the president of Royal Caribbean or one of the executives perhaps speak to the fact that they’re helping to define the tourism product and improve the tourism product. I’m sorry, that’s not their job. That is my deputy prime minister’s job and the people in the Ministry of Tourism, and Ian Ferguson’s job at the Tourism Development Authority to create our tourism product.

“And I believe that as Bahamians we can create more tourism product. Let’s improve our national parks, let’s fix the Botanical Garden, let’s create

more authentic Bahamian experiences and products for the visitors to enjoy. We don’t need to bring them over here for them to have a Bahamian experience because, guess what, they will not have a Bahamian experience at a Royal Caribbean or any other private island facility.”

Mr Carey, along with other members of the environmental community, penned an open letter on April 13 in response to Royal Caribbean pledging to maintain a “gold environment standard”. On the tour, he called for the cruise line to be transparent about its plans for the development.

He said: “That letter basically outlined our demands or requests for full public discourse, transparency. You know, we want to know what’s happening with this development. Businesses have posed questions to the Government and to the developer nearly a year ago, or more than a year ago, and have gotten no responses. We saw the media tour last week, we

saw the hype, we’re going to do this, we’re going to have a gold standard. But, you know, mouth can say anything, I mean, we want to see exactly what is proposed.”

Mr Carey said the coral reefs and coastline could be irreparably damaged from a development of this scale. He added: “Just offshore of the lighthouse is Colonial Reef. It’s a wonderful little reef, very healthy reef, 17 species of coral have been observed. And coral reefs are under stress. Coral doesn’t need help going south, you know, it needs help getting better and so we’re also concerned about that.

“They have talked about altering some little pocket beaches on this side of the of the island on that rocky shore. What does that mean for the natural coastline? Altering the coastline is not a good thing to do. You don’t interfere and alter the coastline without serious, longtime and often irreversible impacts.”

JOB VACANCIES

A public investment company is seeking to fill the following positions:

Financial Analyst:

Responsibilities include conducting qualitative analyses of information affecting investment programs of public or private companies; Analyzing financial information to forecast business, industry, and economic conditions for use in making investment decisions; Interpreting data concerning price, yield, stability, and future trends in investment risks and economic influences pertinent to investments; and gathering information such as industry, regulatory, and economic information.

Minimum Qualifications+ Requirements:

Bachelor’s degree in Accounting, Finance, Economics, Mathematics or Business Administration with 2-5 years’ experience. The successful applicant is also expected to demonstrate experience in trading, abreast of industry updates with good verbal and written communication skills.

Database Specialist:

Responsible for coordinating changes to computer databases, testing, updating, and applying knowledge of database management systems; and implementing security measures to safeguard computer databases.

Minimum Qualifications:

Bachelor’s degree in computer science, management information systems or equivalent with 3-5 years experience.

Qualified candidates should submit Resume/CV with a cover letter via email to rforsythe@allianceinvest.com

Please send your application on or before Tuesday, April 25, 2023.

PAGE 4, Thursday, April 20, 2023 THE TRIBUNE

By FAY SIMMONS jsimmons@tribunemedia.net

ROYAL BEACH CLUB RENDERING

COLONIAL Beach and the Hog Island Lighthouse on the western end of Paradise Island.

Cooling off’: High-end real estate sales drop 20-25%

“The capital of New Providence, which saw a record-setting single-family home sale of $47m, led the way in both demand and activity, establishing itself as one of the most desired warm-weather locales anywhere in the world. Outside of Nassau, familiar hotspots such as Eleuthera and Exuma saw incredible growth in terms of pricing, construction activity and volume of sales.

“Eleuthera, in particular, is in the midst of a watershed moment, with more luxury sales taking place there in 2022 than in any prior year on record. Elbow Cay in Abaco, where picturesque Hope Town is located, also had a very strong year, with a number of celebrity purchases and a record-shattering $14m single-family home trade,” he continued.

“Elsewhere, newlyannounced projects such as Montage Cay by Montage Resorts and The Ocean Club Residences by Four Seasons are setting a new standard for what can be expected in a residential real estate experience. With luxury home buyers willing to pay 25 percent to 35 percent more for a branded residence compared to a non-branded one, we expect this trend to continue in the months and years to come.”

Mr Knowles, speaking subsequently to Tribune Business, said the high-end real estate market consisted of properties valued $1m and upwards. Recalling 2022, he said: “We were coming off the heels of 2021, which was a fantastic year - probably the most active year in the history of maybe our country. Certainly for the luxury market we’ve never had a stronger year than we had in 2021.

“We saw that, globally, coming out of the pandemic there was a lot of urgency for buyers flush with cash to spend to relocate their families and businesses. We saw an unprecedented amount of activity that spilled over into 2022 a little. There was a bit of a cooling off because when so much real estate is sold it takes a lot of supply out of the market which then has to be replenished. We saw a little bit of a cooling off in 2022.”

While concerns over inflation and Russia’s invasion of Ukraine had a modest dampening effect, Mr Knowles added: “2022 was still a very strong year, almost as good as 2021.

What we’re seeing now as we come past 2022 and past the pandemic is we’re starting to see it normalise; that normalising of activity. Buyers are being a lot more prudent.

“I don’t want to say it’s fallen off, but the spike has come back down. Buyers are taking a little bit longer to make decisions, and while sellers were getting amazing prices for their homes two years ago they are not getting numbers to the extent they could then. They stick their foot in the ground and are not going to budge. But buyers are saying: ‘Do I need that third or fourth home? Maybe I do, but I’m not going to pay more than that’.

“They were willing to do it two years ago, but any more. That’s what’s caused the cool down. At $5m and above, people are thinking longer and harder about it: ‘Will I get great value for my money?’. That’s been a shift we’ve noticed over the last 18 months, whereas before they needed it, had got to get it, got to have it and were willing to pay a premium,” he added.

“Now, it’s a ‘wait and see’ approach. If it’s a good deal it’s always snapped up, but the pace has slowed down.” Asked about the impact on 2023 real estate volumes for the year-todate, Mr Knowles replied: “I would say it’s probably slowed down 20-25 percent for the first quarter of 2023

compared to the first quarter of 2022.

“Having said that, certain segments are doing incredibly well. The $1m-$5m market is still highly active, and we’re still seeing in certain areas a great deal of price appreciation. Places like Sandyport, values are going up even though the overall market has cooled to a degree. There are pockets where there is a lot of demand, and not a lot of inventory, and that’s causing prices to increase. It’s an interesting market and we’ll see where it goes in the next six months.

“At the higher end we’re starting to see sellers make peace with the fact they will not get the price they wanted, so we are starting to see some price reductions, which is healthy... We were seeing properties selling two times’ in one year, and people doubling their money, increasing by 50 percent, 60 percent and 70 percent. That’s just not sustainable.”

Explaining the factors that have driven the recent “cooling off”, Mr Knowles said: “It’s not because buyers aren’t around. I would argue that there are the same amount of buyers. We have tons of buyers looking, but we don’t have the same amount of inventory and there’s this disconnect. Buyers feel the market should be here, and sellers feel the market should be where it was 18 months ago.

“It’s causing a little bit of stagnation as you see expectations come back into line and become more realistic from the seller’s standpoint. The buyer, for the most part, decides if a deal is going to get done. If all the buyers feel the prices are too high there won’t be any activity.”

Asked about the impact on high-end real estate prices, the MAISON Bahamas chief said: “It’s mixed. It depends on the area and depends on the product. It’s not a straight line.

If I had to average it out, we’ve not seen a decline in prices; we’ve seen a decline in price growth. We might have seen a 10 percent drop in average prices, maybe 15 percent in some cases, but it’s not been much since 2021.

“I believe that as we come closer to 2024 sellers will come to terms with where the market is and start to price properties

appropriately, and that will cause a lot more deal flow than what we see now. There was all this crazy, frantic activity, with people buying left, right and centre,

and they are now taking a pause. 2023 will be a bit of a pause year, and then we will see what I believe will be accelerated growth starting in 2024.”

THE TRIBUNE Thursday, April 20, 2023, PAGE 5

page B1

from

Sir Franklyn hails golf tie-up as ‘world first’

taken seven deposits for Jack’s Bay’s ‘founders’ real estate programme in just five days.

“In answer to your question, in my humble view this is a major, major initiative. Very substantial. Very substantial. That is the theme of the conversation,” he said of the partnership with Nicklaus Design and its wider group of companies for both the golf course and real estate branding/naming rights.

“These are the best in the business. It’s never happened before where you have a golf course with Tiger Woods and one with Jack Nicklaus. Where is that anywhere in the world? Look at the people who are with us. IMI Worldwide Properties. You go through the list and see the investors that have joined with us as partners in the financing component. It’s huge.

“IMI, in five days, they got seven new deposits for founders. They are the best in the business. This is for the whole country. This is not Jack’s Bay. By definition, this is the whole country. This has never happened before. It was a wonderful day for the country. In my humble view this is a major, major, major opportunity for the country. It has never happened before.”

Jack’s Bay, in a statement, said the new course - which is to be completed by 2025 - will be the first Nicklaus Heritage course in the world. The deal will also see Jack’s Bay secure Nicklaus real estate branding rights as a Nicklaus Community, which it described as “a distinction afforded to only a very select collection of developments around the world and the very first in the Caribbean”. The Nicklaus Heritage course will co-exist

alongside the existing 10-hole playground designed by Tiger Woods and TGR Design, which was completed in March 2020. “Completion of the Nicklaus Heritage championship course is scheduled for 2025, making Jack’s Bay the first property in the world to feature an 18-hole golf course by Nicklaus Design coupled with a Tiger Woods and TGR Design,” Jack’s Bay added.

Jack’s Bay’s founders programme will include 24 beachfront and ocean view homesites ranging in price from $1m to $3m. Other amenities planned for the 1,200-acre Jack’s Bay include a beach club, spa village, fitness and wellness programme, and family-friendly sports pavilion complex. Among the amenities already in place are beaches, tennis, a marina and multiple dining venues.

Howard Milstein, executive chairman of the Nicklaus Companies, said: “The principals of Jack’s Bay Resort Development have a remarkable vision to make their community the destination of choice for the most discerning golfer in The Bahamas and throughout the Caribbean. From my very first meeting, I committed all of our Nicklaus, IMI and 8AM Golf assets to ensure the greatest golf experience imaginable.

“With the history of the island, stunning ocean views for golf and real estate, and access to world-class fishing and other amenities, Jack’s Bay rivals any destination in The Bahamas. Nicklaus Design is proud to have been selected to create a world-class golf course on this property.”

Chad Goetz, senior design associate at Nicklaus Design, who will lead the Jack’s Bay project, added: “It’s going to be spectacular.

A number of holes stretch directly along the ocean and even the land off the ocean has remarkable topography, featuring a rolling terrain of elevation changes, lakes, deep water ‘blue holes’ to the ocean, and caves. What Mother Nature has provided us is rare, and we plan to preserve the natural integrity and enhance the beauty of the island.”

Not to be left out, Tiger Woods said: “Jack’s Bay is destined to become the next great family destination and draw people from all over the world to Eleuthera. The future is bright for Jack’s Bay.” Jack’s Bay has a large number of Bahamian shareholders in its immediate holding company, Eleuthera Properties.

While Sir Franklyn’s Sunshine Holdings group is the largest shareholder, its other investors include the likes of Colina, BAF Financial, the John Bull Group of Companies and Royal Bank

of Canada (RBC). Besides the corporate investors, the Anglican Church has been “gifted” shares in Eleuthera Properties Ltd, while the estates of the late John Morley and Billy Lowe were also among the shareholders. Eleuthera links to the investors are through the estates of the late Albert Sands and Whitfield Kemp. Another Eleuthera shareholder is businessman Lawrence Griffin from Governor’s Harbour, while Sir Orville Turnquest, the former governor-general, and his family - long-time investment and business partners of Sir Franklynare also invested. Tommy Turnquest, Sir Orville’s son and the former MP and Cabinet minister, is Jack’s Bay’s deputy chairman and chief executive.

Persons

PAGE 6, Thursday, April 20, 2023 THE TRIBUNE

from page B1 • Reconciliation Officer • Mortgage Officer (Nassau and Freeport) • Information Technology Network Security Specialist • Collateral Officer

who may be interested are asked to forward a copy of their resumes and academic qualifications to

resume@tswccul.org We are seeking to fill the following Job Vacancies

Major leagues, broadcasters pledge responsible betting ads

By WAYNE PARRY Associated Press

MOST of the nation's major professional sports leagues, plus the media companies Fox and NBCUniversal are creating an alliance to ensure that sports betting advertising is done responsibly and does not target minors.

The Coalition for Responsible Sports Betting Advertising was created Wednesday, consisting of the National Football League; Major League Baseball; the men's and women's leagues of the National Basketball Association; the National Hockey League; NASCAR, Major League Soccer, Fox and NBCUniversal.

They described the group as a voluntary alliance to control how sports betting advertising, which is everpresent on the airwaves, in print and online, is presented to consumers.

It includes a recommendation that "excessive" advertising be avoided.

Formation of the group follows a move last month by the commercial casino industry through its national trade association, the American Gaming Association, to adopt a new responsible sports betting marketing code. Both efforts recognize the proliferation of sports betting advertising in the five years since the U.S. Supreme Court cleared the way for any state to offer legal sports wagering. They also have a clear, if unstated goal: to regulate their own advertising before the government might step in and do it for them. One New York congressman has introduced legislation that would ban all online and digital sports betting advertising, and others have called for government-imposed regulation of sports betting ads.

"As the legalization of sports betting spreads nationwide, we feel it is critical to establish guardrails around how sports betting should be advertised to consumers across the

United States," the group said in a joint statement. "Each member of the coalition feels a responsibility to ensure sports betting advertising is not only targeted to an appropriate audience, but also that the message is thoughtfully crafted and carefully delivered."

David Schwartz, a gambling historian at the University of Nevada Las Vegas, said the prosects for government control of sports betting ads are uncertain.

"I can see how it would be in the leagues' and operators' best interests to avoid formal federal oversight," he said. "Advertising is an area that touches not just customers, but the public at large. As such, it may have more visibility than even the actual business of taking bets. It is understandable that those involved want to get out in front of this."

Speaking Wednesday at a gambling industry forum in Atlantic City, West Virginia state Delegate Shawn Fluharty said there is definitely concern among state

lawmakers over the frequency of sports betting advertising. "If you're talking to any people out there, they're probably a little tired of seeing Jamie Foxx on TV," he said, referring to the actor's widely broadcast ads for BetMGM's sportsbook. He said the coalition is a good idea that also shows that the leagues recognize there is cause for concern about the possibility of

government intervention regarding sports betting advertising. The group has several core principles, including that sports betting should be marketed only to adults of legal betting age; that the ads should not promote irresponsible or excessive gambling; they should be in good taste and not be misleading; and that publishers of sports betting advertising should have strong internal

reviews and should take seriously complaints from consumers about such advertising.

Kenny Gersh, executive vice president of media and business development for Major League Baseball, called the group "another important step for our industry as legal sports betting continues to grow."

Sports betting is currently legal in 33 U.S. states, plus Washington D.C.

THE TRIBUNE Thursday, April 20, 2023, PAGE 7

earlier this week said the registrar of contractors was consulting with industry stakeholders on the “grandfathering in” period, but the BCA president argued that this was unnecessary because two relatively simple steps remain to give the Act - which was passed in 2016 - full enforcement effect.

He told this newspaper that further dragging out the process does “a disservice to the community” as it leaves Bahamian consumers exposed to abuse and shoddy workmanship by

FEAR RETURN TO ACT ‘DRAWING BOARD’

rogue contractors, while the industry itself is unable to compete with foreign rivals for “hundreds of millions” in construction contracts because developers have no knowledge of their competencies in the absence of a licensing and registration system.

“To be very honest, we’re not enthused at all,” Mr Sands said over Mr Sears’ remarks that the Government is taking the necessary steps to bring the Act into effect. “This administration came to office in September 2021 and we’re now approaching the end of April 2023.

“Where the last administration left off was the appointment of the Construction Contractors Board and they had also allowed the period to be grandfathered in under the Act to expire simply because they had not appointed the Board to which all contractors must make applications to. It’s been gathering dust.

“There are no substantial changes to the legislation that are needed; only two things remain. It needs to be revised to change the date for the enforcement and the ‘grandfathering in’ period to be reset, and give it 24 months for everyone to make application under the Act, and the appointment of the Board.”

The initial “grandfathering” period expired two years after the Act was

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

passed in 2016, which would have been 2018 when the former Minnis administration was in office. This period was designed to give all contractors wishing to practice sufficient time to apply to the Board to be registered and licensed according to their abilities and size of job they are capable of doing. Without that period, only contractors with the necessary tertiary (college/ university) qualifications and/or industry experience as stipulated by the Act’s Schedule Ten are eligible to be licensed. “In 18 months nothing has been done. Are we encouraged? We are absolutely not enthused by it,” Mr Sands said.

“We’ve met with the minister, worked with his team and had numerous but I will say this on the record: There seems to be a total misunderstanding from their [the Government’s] perspective of what needs to happen. It seems like they went back to the drawing board.

“They’re talking about widespread consultation all over again and restarting the process. There’s no need for it. Take the legislation, revise the date for the ‘grandfathering in’ period and take it to Parliament. We’re tried of talking. We’re in our 50th year of independence and been at this for 40 years,” he continued.

“When are we going to stop talking? When are we going to protect the industry? When do we make this profession a proud one? We’re bringing the players to the table. Lock it

down. That’s my message. Anything short of that is foolishness. The previous minister [Desmond Bannister] spent five years doing nothing. I advise the present minister not to do the same. History reflects terribly on persons who do nothing.”

Mr Sands said the failure to enforce the legislation was depriving legitimate, bona fide Bahamian contractors with the necessary skills and ability of the chance to compete for contracts from the “hundreds of millions of dollars” in foreign direct investment (FDI) projects targeting this nation.

And he suggested that the present FDI pipeline represents “only a fraction of what wants to come here” if The Bahamas had a construction industry that was properly regulated. With livelihoods and businesses suffering as a result, the BCA chief argued: “It’s only a snippet of what wants to be invested here. They refuse to do it in an unregulated environment. I challenge anyone to tell me I’m lying.

“Let’s knock The Bahamas open and celebrate billions of dollars in investment rather than $1bn or $2bn. We’re in our 50th year of independence. Let’s build something. The third largest part of our economy has been held at a standstill for the last 50 years. Let’s break it open.”

Giving a personal example of why the construction industry is so desperate for proper regulation, Mr Sands told this newspaper: “I had a young man call

me yesterday saying he was interested in getting a contractor’s licence. I paused. He said: ‘What do I do Mr Sands?’ I’d like to tell him what to do under the Act, but the Act is not enforceable because there’s no Construction Contractors Board for him to make a licence application to.

“I said to go to the Business Licence office, take a couple of references and make the necessary payment of a few hundred dollars. That’s all he needs to do. I don’t know if he knows the difference between a hammer and a nail and that’s the scary thing. Can you imagine your doctor having no licence or experience and being allowed to open you up?”

Mr Sands said this served to highlight the near-total absence of protection that Bahamian consumers enjoy from rogue contractors, fraud and shoddy workmanship. He added that the BCA was often being asked to provide expert witness testimony in court actions where consumers were suing contractors for deficient work, failing to perform at all or taking money far in excess of the value delivered.

Noting that the Association has also been working with the Consumer Protection Agency, he said: “We’re doing the job out there to help but there’s so much rampant abuse. That’s why the Act was created, but to leave it unfinished is a disservice to the community. They only need to fix the date and change The Bahamas for the better.”

PAGE 10, Thursday, April 20, 2023 THE TRIBUNE

FROM PAGE B1

CONTRACTORS

GB residents ‘up in arms’ over water hike process

FROM PAGE B1

and impartial, and urged the Davis administration to intervene and work with the GBPA to develop an independent review mechanism or body to handle GB Utility’s rate increase application.

Ginger Moxey, minister for Grand Bahama, responded to Mr Thompson’s concerns during yesterday’s House of Assembly sitting by asserting that “our administration is on top of it”. She added, though, that Mr Thompson, who was her predecessor as minister of state for Grand Bahama, would be aware of the difficulties facing any government intervention because Freeport’s founding treaty gives the GBPA the power to regulate all utilities within the Port area.

Noting that the east Grand Bahama MP “would have gone through all this we are going through now with the GBPA”, Mrs Moxey said: “You understand the Hawksbill Creek Agreement and how it works. I can assure you this government from day one has been addressing these issues with the Grand Bahama Port Authority.... Our administration is on top of it.”

She also referred to a Supreme Court action involving Grand Bahama Power Company, which is fighting a legal battle challenging the Utilities Regulation and Competition Authority’s (URCA) efforts to assert regulatory authority over itself and other Freeport utilities.

However, Mr Thompson argued that this was separate and distinct from the GB Utility matter as URCA does not yet have national regulatory authority for water.

And he argued that the Davis administration, and Ministry for Grand Bahama, “must go further” than the latter’s statement last week in which it said the GBPA and GB Utility had not allowed sufficient time for public consultation given that a decision on the rate increase was due by May 1. It also demanded that the two entities provide “a business case that makes sense” to justify the water tariff hikes and the size of increase.

“I’m calling on the Government to intervene. It cannot just let it die,” Mr Thompson told Tribune Business. “What we did is continue to call upon the Government to act. They must reach out to the Port Authority, sit down with the Port Authority and come up with a mechanism that the people of Grand Bahama are satisfied with... I don’t believe the people of Grand Bahama will be satisfied until they see a result where there is an independent body that will review the matter.

“At present it’s an unfair situation where we have the Port Authority regulating itself, and I don’t believe anyone would agree that is an acceptable position given the maturity Grand Bahama has achieved. It’s

incumbent on the Government to act, it’s incumbent they sit with the Port Authority and come up with a mechanism people will be satisfied with.”

With the May 1 decision date looming just 11 days away, Mr Thompson continued: “I think the Government must act, and they must act now. A decision is going to be made, we have been told, very shortly, and so the Government must act before a decision is made.

“I will not have confidence in the Government’s ability to act until I see a tangible, real result that shows there’s an independent person reviewing this. Just saying you understand and appreciate the situation, and that you have called on the Port Authority to do certain things, is not enough. What we are hoping for is to be able to see tangible results with an independent body that is going to regulate the situation.”

Asked how Grand Bahama residents view the situation, Mr Thompson replied: “The people in my constituency are up in arms. They are very upset. They are very dissatisfied with the process as it stands. Some people are calling it ridiculous that a company can regulate itself and those involved don’t see anything wrong with it.

“I’m someone who pays for water, and I believe it’s an unsustainable position. My view is shared by many constituents that I have spoken to who feel the same way. And there are many businesses and other residents who share the same view. Something has to happen. It really requires that the Government act, and that the Government act now.”

Speaking earlier in the House of Assembly, Mr Thompson argued that the GBPA - a unique entity with quasi-governmental powers - is “not accountable to the people of Grand Bahama” but, instead, to its profit-driven shareholders, the Hayward and St George families. As a result, its “first legal obligation” is to its owners and not the interests of Grand Bahama water consumers who, in its regulatory capacity, it is supposed to protect.

GB Utility is owned via Port Group Ltd, the GBPA affiliate that is also controlled by the same two families. “The GBPA, in a statement, committed to a fair and transparent process, which will be impossible when a decision is made by the GBPA where the shareholders are the same as GB Utility,” the east Grand Bahama MP told the House of Assembly. “The process will not be fair and transparent if left to themselves. The Government has made a statement, but must go further. Do not allow the GBPA to simply say this is the way we are going. Their response was: This is the way it is, we regulate ourselves. We cannot allow that to be their response. We cannot

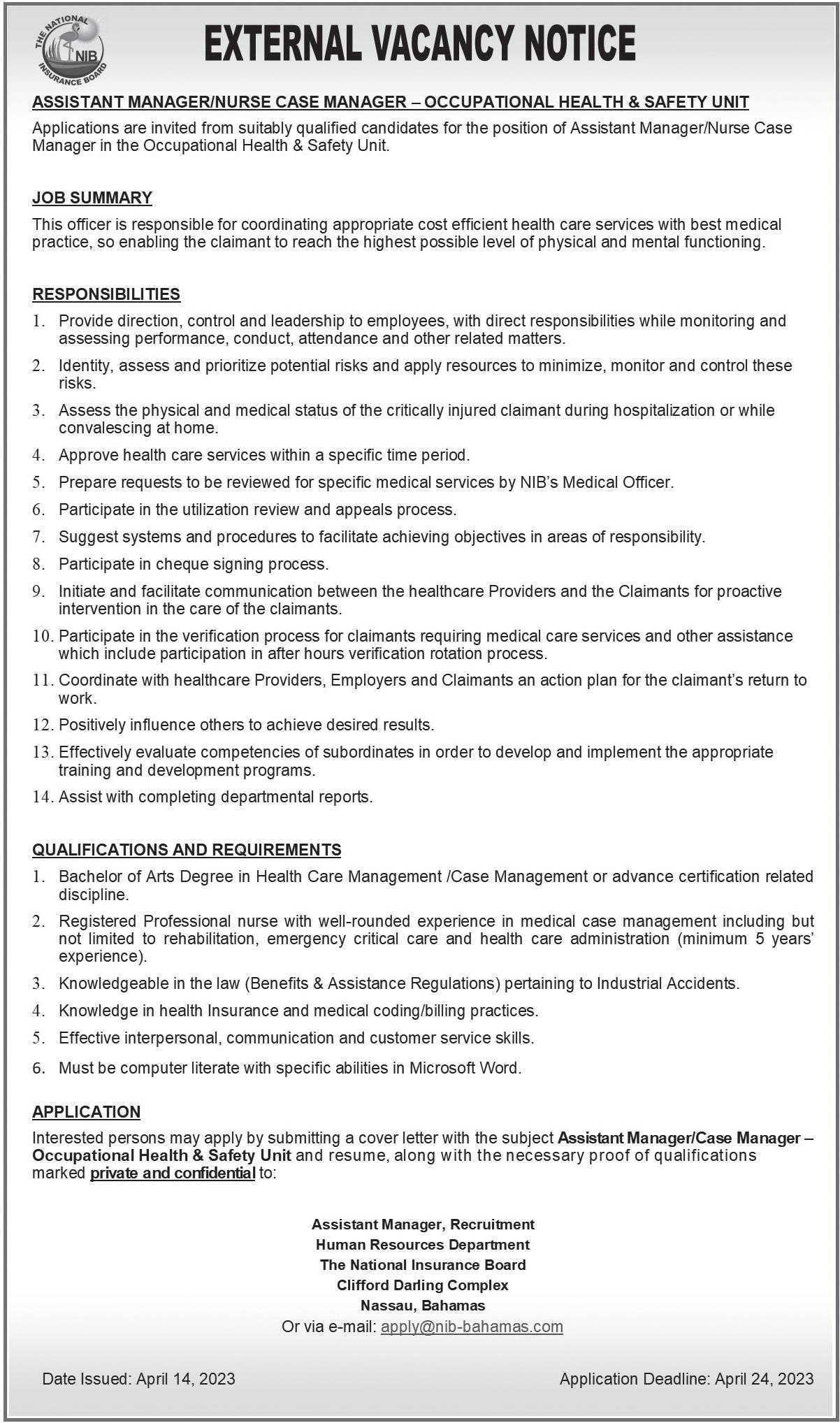

ABANDONED OIL, GAS WELLS GET PLUGGED IN NEW MEXICO

By SUSAN MONTOYA BRYAN

Associated Press

MORE than 200 inactive oil and natural gas wells in New Mexico have been plugged as land managers have tried to crack down on producers as part of an accountability and enforcement program in one of the top producing states in the U.S., officials said Wednesday.

The State Land Office estimates it has saved taxpayers at least $20 million in cleanup costs over the past few years by having the industry pick up the tab.

The Land Office’s efforts are separate from work elsewhere that’s being funded by the federal government.

Congress in 2021 committed

$4.7 billion in infrastructure spending to plug and reclaim orphaned wells and associated sites. The Bureau of Land Management awarded its first contracts last summer for

be satisfied that is their response.”

Pledging the Opposition’s help if needed, Mr Thompson said GB Utility’s rate increase proposal came against the backdrop of many consumers having appliances ruined through the provision of “salty water” following the wellfields’ inundation by Hurricane Dorian’s storm surge. While the water provider has pointed out that it gave consumers a 25 percent discount on their bills as compensation, the MP also argued that the extent of the water rate increase needs to be better justified. “We all lived in Grand Bahama, and suffered having to bathe and cook with salty water,” Mr Thompson said. “They made the case they decreased the rate, but

we had to suffer with salty water that we were paying for.”

Calling on GB Utility to expand its infrastructure and provision of water to more Grand Bahama communities, and thus generate more revenues, he added: “Who is looking at the rates we are paying in Grand Bahama for water? Is this a fair rate compared to what others are paying in New Providence and the rest of the Caribbean?

“We would be able to say, based on what the rate is in Nassau, and in Barbados, Jamaica and Florida, and the rest of the Caribbean, that this is a fair rate. Others have reminded me the water rate was onethird of what it is today. That is what was presented to me. The rate is significantly lower than it

is today. Who’s justifying that? Who’s reviewing the situation? The independent body should be looking at this and reviewing the entire situation.”

GB Utility, in justifying its application for a water rate increase, said 40 percent of its customer base - the lowest volume users - will see no hike at all, while another 47 percent will suffer an average $8 per month rise. It said: “GB Utility deferred the rate case for two years, at a significant financial burden and cost to the utility.

“To defer any longer will result in higher cost accumulation and consequently rates, and jeopardises the utility’s ability to maintain and produce potable water and remain functional. It will also impact the ability to storm harden and make

JOB OPPORTUNITY

the utility resilient against future storm events and jeopardises the ability to recover after major storms like Hurricane Dorian.

“GB Utility also experienced $3m in Hurricane Dorian-related infrastructure storm damage. In addition, there was approximately $2m in uninsurable losses associated with Hurricane Dorian including over $500,000 in costs to operate the free water depots for residents and 25 percent discounts given to residents for water usage.

“These costs were at a financial loss to the utility and will not be recouped in rates. The 25 percent discount and free water depots were in place from 2019 to December 2022 at a financial cost to GB Utility.”

VACANCY – REAL ESTATE ASSOCIATE (ABACO OFFICE)

Higgs & Johnson, a full-service corporate and commercial law firm serving clients around the globe, is seeking a qualified Real Estate Associate for our expanding Marsh Harbour, Abaco location. Candidates must possess:

• Minimum three (3) years’ experience

• Specialization in the area of real property and commercial law.

• Demonstrated ability to work independently

• Possess thorough working knowledge and technical competence in the areas mentioned

• Willing to relocate to Abaco

Qualified candidates interested in this exciting and rewarding opportunity, should forward their resumeto fmullings@higgsjohnson.com by Monday, April 24, 2023. Only qualified, short-listed applicants will be scheduled to interview

work in Utah and California, while New Mexico and other states were awarded multimillion-dollar grants.

In New Mexico, the State Land Office says its work has resulted in a nearly 20% decrease in the number of abandoned wells on state trust lands, property that was allocated to New Mexico by the federal government more than a century ago so it could be used to raise revenues for public schools, hospitals, colleges and other public institutions.

Several inactive wells dated to the 1980s, including one that hadn’t produced anything since 1982. Another well that went on the inactive list in 2020 had been drilled in 1925. Land

Commissioner Stephanie Garcia Richard said the idea is to keep the state — and ultimately taxpayers — from having to pay for any messes that companies create on state trust lands.

THE TRIBUNE Thursday, April 20, 2023, PAGE 11

AS US SPORTS BETS BOOM, INTERNET GAMBLING IS SLOW TO EXPAND

By WAYNE PARRY Associated Press

WHILE two-thirds of the country now offers legal sports betting, only six states offer online casino gambling, confounding industry hopes that the rapid growth of sports betting would also bring internet casino wagering along with it.

Speaking Wednesday at the East Coast Gaming Congress in Atlantic City, industry executives and legislators from gambling states offered various explanations for why internet gambling has yet to expand beyond a handful of eastern states.

Internet gambling is legal in New Jersey, Connecticut, Delaware, Michigan, Pennsylvania and West Virginia; Nevada offers online poker but not casino games.

By contrast, 33 states plus Washington, D.C. offer legal sports betting.

"It's a mystery to me why we have 30 or so states that have sports wagering, and only six that allow I-gaming," said Lloyd Levenson, an attorney who represents many Atlantic City casino companies. "You have to scratch your head as to why."

Shawn Fluharty, the minority whip of the Werst Virginia House of Delegates, said the disparity is surprising because internet gambling brings in much more money than sports betting does. He said in his state, it takes three months of sports betting revenue to match a single month of online casino revenue.

Some in the gambling industry, as well as in state houses around the country, continue to fear that authorizing internet gambling will cannibalize revenue that would otherwise go to brick-and-mortar casinos — even though the experience of states like New Jersey has shown that not to be the case.

Internet gambling brought in $1.6 billion in New Jersey in 2022, up more than 21% from a year earlier. Atlantic City's nine casinos won nearly $2.8 billion from in-person gamblers, an increase of 9% from the previous year.

Indiana state Sen. Jon Ford said his state tried

unsuccessfully to pass internet gambling this year, an effort that was at least partly undone by an analytical report from legislative researchers that worried that online gambling would eat into revenue from brick and mortar casinos to an unacceptable extent.

"I question the validity of that report," he said, adding he plans to try again next year to get the bill passed.

Howard Glaser, global head of government affairs with Light & Wonder, the gambling equipment manufacturer, said efforts to expand internet gambling are "dead in every state this year."

"Where we run into a problem is there is a realization that this is about revenue — who gets a piece of the pie?" he said.

Glaser said many casino companies are reluctant to give a perceived foothold to companies "that they view as an existential threat. There's a fight for dominance within the casino industry about who gets growth."

Fluharty said about 65% of the country is governed by Republican-controlled state legislatures, a group he said is less likely to favor gambling at all, let along expanding it.

But he and others said that with federal pandemicrelated aid coming to a close, states will once again be looking for money to avoid raising taxes. That should give internet gambling another look in many places, they said.

Panelists agreed that New York and Indiana are among the states most likely to add internet gambling in the next two years. Fluharty also said states that recently adopted sports betting might also be likely to add internet gambling, including Ohio.

"There's been a push in New York; this just wasn't the year to get it done," said Jordan Bender, a senior equity research analyst with JMP Securities. "That's a market we estimate can get to $3 billion, That's a massive, massive number."

Duane Bouligny, a managing director with Wells Fargo Bank, said Texas remains a longshot possibility.

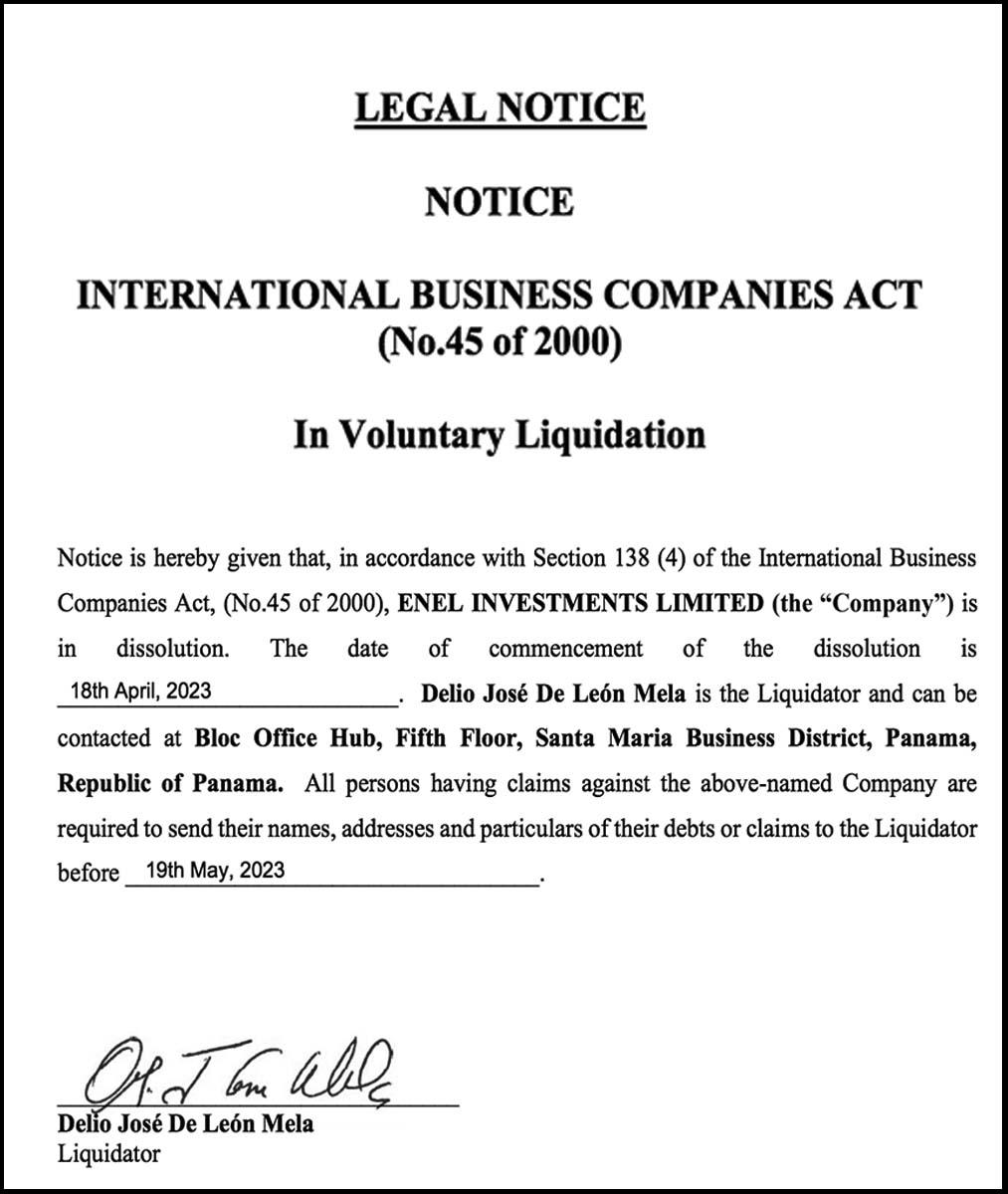

Notice

FANATO LTD.

(In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 13th day of April 2023. Articles of Dissolution have been duly registered. The liquidator is AMICORP BAHAMAS LIMITED, of Nassau, Bahamas

Dated this 19th day of April 2023

Amicorp Bahamas Management Limited

PAGE 12, Thursday, April 20, 2023 THE TRIBUNE

SLOT machines are controlled by gamblers over the internet at the Hard Rock casino on Feb. 10, 2020, in Atlantic City, N.J. Panelists at a casino industry conference in Atlantic City on Wednesday, April 19, 2023, said there are several reasons why internet gambling has not spread beyond the six states where it is now authorized, but expects the online market to grow in coming years.

Photo:Wayne Parry/AP

LIQUIDATOR

PRICE CUTS CAUSE TESLA 1Q INCOME, PROFIT MARGINS TO FALL

By TOM KRISHER AP Auto Writer

TESLA'S first-quarter net income tumbled 24% from a year ago as multiple price cuts across its model lineup reduced the amount of money generated per vehicle even as sales rose.

The Austin, Texas, electric car and solar panel company said Wednesday it made $2.51 billion from January through March, down from $3.32 billion a year ago. Revenue rose 24% to $23.33 billion, but the company's operating profit margin fell.

Tesla made an adjusted 85 cents per share in the first quarter, matching analyst estimates, according to FactSet. Analysts had expected profits to fall because of the price cuts.

CEO Elon Musk hinted that price cuts may not be over. He told analysts that Tesla evaluates them daily and wants to keep producing the maximum number of vehicles possible to increase its world-leading electric vehicle market share.

"Orders are in excess of production," he said when asked what happened to orders since recent price cuts were announced.

Early in the quarter Tesla reduced U.S. prices on many of its models, then did it a second time early in March. The company slashed U.S. prices two more times in April, including overnight Wednesday, in an effort to boost demand.

It trimmed them in Europe as well.

The net income drop came even though Tesla's sales last quarter rose 36% to a record 422,875 vehicles worldwide. That's largely because the average sale price per vehicle fell just over $5,000 from the first quarter of 2022 due to the price cuts. Analysts estimated that the average Tesla sold for $46,850 last quarter, down from $52,100 a year earlier. The company produced nearly 18,000 more vehicles than it sold during the quarter, indicating softening demand.

Tesla's first-quarter operating margin fell from 19.2% in the first quarter of last year to 11.4% this quarter.

Musk said Tesla wants to sell more vehicles at lower prices so it later can take in revenue from software, service and its $15,000 "Full Self-Driving" system that

will turn cars into robotaxis and increase their value.

Despite the name, the cars cannot drive themselves, and Tesla warns drivers that they have to be ready to intervene at all times.

"The trend is very clearly toward full self-driving," Musk said. "And I hesitate to say this, but I think we'll do it this year."

In 2019, Musk promised a fleet of autonomous robotaxis by 2020, and he said early last year that the cars would be autonomous in 2022. Since 2021, Tesla has been using owners to beta test "Full Self-Driving" on public roads.

But Tesla's partially automated driving systems are coming under increasing scrutiny from U.S. safety regulators. The National Highway Traffic Safety Administration has sent investigative teams to more than 30 crashes since 2016 in which Teslas suspected of operating on Autopilot or "Full Self-Driving" have struck pedestrians, motorcyclists, semi trailers and parked emergency vehicles. At least 14 people were killed in the crashes.

In addition, NHTSA in February pressured Tesla into recalling nearly 363,000

ESTATE OF EUGENE ARNAUD PYFROM

TAKE NOTICE that anyone having a claim against the Estate of EUGENE

ARNAUD PYFROM late of Dicks Point, Nassau, The Bahamas, who died on the 18th day of February 2022, may submit such claim in writing to the law firm of MAILLIS & MAILLIS, Chambers, Fort Nassau House, Marlborough Street, Nassau, Bahamas, tel: (242) 322-4292/3, fax: (242) 323-2334, Attention: Alexander P. Maillis II, ON OR BEFORE the 1st June, A.D., 2023.

vehicles with "Full SelfDriving" software because the system can break traffic laws. The agency said in documents that the system can make unsafe actions such as traveling straight through an intersection from a turn-only lane or going through a yellow traffic light without proper caution. The problems were

to be fixed with an online software update.

The Justice Department also has asked Tesla for documents about "Full SelfDriving" and Autopilot.

In its earnings release, Tesla said it's aiming to leverage its position as a cost leader as other automakers try to handle electric vehicle costs.

"Although we implemented price reductions on many vehicle models across regions in the first quarter, our operating margins reduced at a manageable rate," the company said.

The company said it expects to reduce costs on its vehicles with improved production efficiency at its new factories and with lower shipping costs.

THE TRIBUNE Thursday, April 20, 2023, PAGE 13

NOTICE is hereby given that DAVIN JAMES CEPHORD HARVEY, of P.O Box EE S5557 Elizabeth Estates,New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

POSITONS WANTED

ESTABLISHED RESTAURANT

seeking

• Head Chef

• Line Cook

Mediterranean cuisine experience is a plus.

• Bar back

• Bussers

Must be great team player, work well under pressure, possess top tier customer service and professionalism.

Salary compensates of qualifications and/or experience.

Serious inquiries only. Send resume with photo to nassauemployment@gmail.com

We Are NoW HiriNg!

Established restaurant require the services of a Utility Worker and 3 Pizza Chefs to work 40 hours shift per week at a designated restaurant

Interested persons please send resume to cvk@sbarrobahamas.com

PAGE 14, Thursday, April 20, 2023 THE TRIBUNE

NOTICE

STOCK MARKET TODAY: WALL STREET IS MIXED AS CALM CONTINUES

By STAN CHOE AP Business Writer

WALL Street barely

budged again on Wednesday following another set of mixed earnings reports from big U.S. companies.

The S&P 500 inched down by 0.35 points, or less than 0.1%, to 4,154.42.

The Dow Jones Industrial Average slipped 79.62, or 0.2%, to 33,897.01, and the Nasdaq composite edged up by 3.81 points, or less than 0.1%, to 12,157.23.

Tesla weighed heavily on the market after the electric-vehicle company cut prices for its two top-selling models, its fourth price cut in the U.S. this year. That could be a signal Tesla is trying to spur sales amid shifting U.S. tax credits for electric vehicles. Tesla fell 2% before releasing its latest earnings report after trading closed.

Netflix slumped 3.2% after reporting weaker revenue for the latest quarter than analysts expected, though its profit topped forecasts.

Elevance Health dropped 5.3% despite reporting stronger profit and revenue than expected. The health insurer gave a forecast for earnings this year that fell short of some analysts’ expectations.

So far, most companies have been beating profit forecasts to clear a bar that was set particularly low. Analysts came into this reporting season forecasting the sharpest drop S&P 500 earnings since the pandemic torpedoed the global economy in 2020. Profits are under pressure because inflation is high, interest rates are much higher than

a year ago and portions of the economy are slowing.

“That’s part of the reason why the market has been kind of directionless” recently, said Megan Horneman, chief investment officer at Verdence Capital Advisors. “We got mixed earnings, but not as bad as people expected.”

Intuitive Surgical leaped

10.9% for one of the biggest gains in the S&P 500 after delivering stronger profit and revenue for the latest quarter than expected.

Abbott Laboratories rose

7.8%, Nasdaq Inc. gained

3.1% and United Airlines flew 7.5% higher after they also topped Wall Street’s expectations for profits.

Particular focus has been on the health of banks after higher interest rates helped lead to the second- and third-largest U.S. bank failures in history last month.

The industry’s behemoths have largely reported better results than expected, with several saying they benefited from the industry’s turmoil as customers moved deposits to them and away from smaller banks that seemed at greater risk.

The fear was how much pain smaller, regional banks would show in their quarterly reports, including how many of their customers fled.

Western Alliance Bancorp., a Phoenix-based bank whose stock plunged nearly 64% over a five-day stretch last month, surged after it said deposits stabilized after an initial drop and have been rising in recent weeks. Its stock jumped 24.1%.

It helped lead the majority of financial stocks higher.

Synchrony Financial rose 1.8% after reporting better

revenue than expected but weaker profit. Morgan Stanley rose 0.7% after topping forecasts for both profit and revenue.

In the bond market, yields climbed after a report showed U.K. inflation remained above 10% for a seventh straight month.

Central banks around the world have been raising rates at a furious pace for more than a year, and the wide expectation is for the Federal Reserve to raise short-term U.S. rates again at its meeting next month. High rates can stifle inflation, but only by slowing the entire economy, raising the risk of a recession and hurting prices for investments.

The yield on the 10-year Treasury rose to 3.59% from 3.58% late Tuesday.

The two-year Treasury yield, which more closely tracks expectations for the Fed, rose to 4.25% from 4.20%.

Another fear for markets is that smaller and midsized banks could pull back on their lending amid all the industry’s struggles, which would clamp the brakes even tighter on the economy. The Federal Reserve said Wednesday that several of its 12 regional districts have noticed banks tightening lending standards recently.

“When I look at economic growth, there’s so many components of economic growth that are screaming we’re either in a recession or heading that way,” Horneman said.

She has been preparing for more turbulence in the stock market on expectations interest rates will stay high through the end of the year, despite forecasts by many traders that the Fed will cut rates.

MICROSOFT AGREES TO BUY $50M FOXCONN PARCEL IN WISCONSIN

By TODD RICHMOND Associated Press

MICROSOFT has agreed to buy a $50 million parcel of land in southeastern Wisconsin meant for Foxconn after the world's largest electronics manufacturer failed to fulfill grandiose promises to build a massive facility that would employ thousands of workers.

Microsoft plans to build a $1 billion data center on the 315-acre (127-hectare) parcel in Mount Pleasant, a village of about 27,000 people in Racine County, about 30 miles (50 kilometers) south of Milwaukee. It's unclear how many people the center might employ. Paul Englis, Microsoft's director of global community research and engagement, told the Racine County Board of Supervisors on Tuesday that such centers typically employ 300 to 400 people.

The village already is home to a Foxconn Technology Group manufacturing facility. The Taiwan-based company is best known for making Apple iPhones. The company announced plans in 2017 to build a $10 billion facility in Mount Pleasant that would employ 13,000 people.

Wisconsin's governor at the time, Republican Scott Walker, and then-President Donald Trump praised the decision, with Trump boasting the plant would be the "eighth wonder of the world."

The state agreed to provide Foxconn with nearly $3 billion in tax breaks. The

company never delivered on its promises and Democratic Gov. Tony Evers scaled back the tax breaks to $80 million contingent on the number of jobs created and investments. The company qualified for just $8.6 million in tax credits last year after creating 768 eligible jobs and making a $77.4 million capital investment by the end of 2021.

According to a fact sheet describing the Microsoft project compiled by southeastern Wisconsin economic development groups, the parcel of land is part of a tax-increment financing district that includes the Foxconn campus. Property taxes collected in such districts can be used to subsidize development.

Foxconn spent $60 million to help Mount Pleasant officials buy the property to create the district, said Mia Tripi, a spokesperson for the village and Racine County.

Foxconn would receive the proceeds from the land sale to Microsoft as partial reimbursement of what Foxconn spent to acquire land for the district in 2017, according to the fact sheet. Microsoft would be eligible to recoup 42% of property taxes paid on new construction, up to $5 million annually.

Microsoft must begin the first phase of construction by July 2026 and begin the second phase by July 2033. The tech sector has been contracting after pandemicera expansions brought on a boom in demand for workplace software.

THE TRIBUNE Thursday, April 20, 2023, PAGE 17

TRADERS work on the floor at the New York Stock Exchange in New York, Monday, April 17, 2023.

Photo:Seth Wenig/AP

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net