Love Beach is not feeling the Passion

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

LOVE Beach residents have united in opposition to a prominent Bahamian developer’s condominium project amid fears it will “bulldoze” the area’s property values and deter further investor interest.

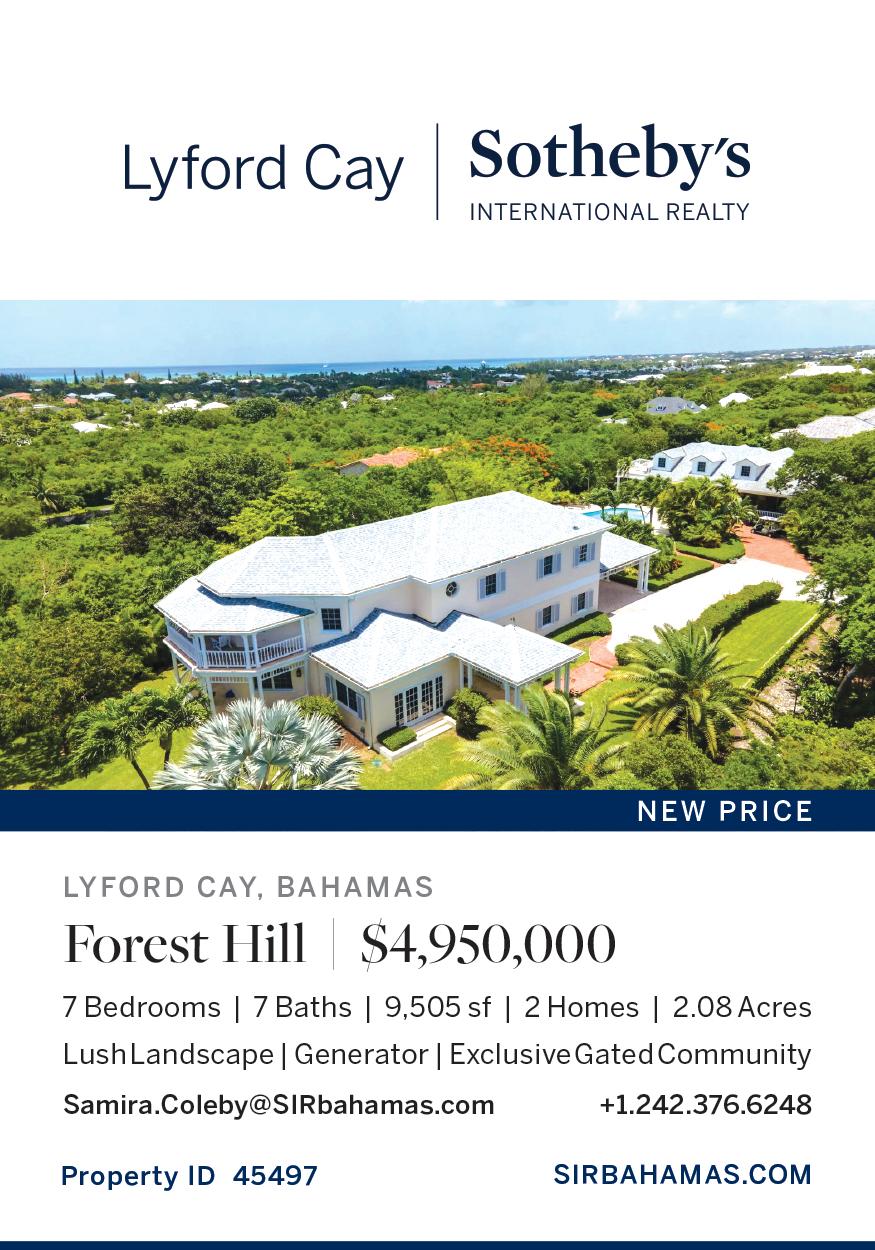

Multiple homeowners, including Sir Baltron Bethel, former senior policy adviser to thenprime minister Perry Christie, are appealing the Town Planning Committee’s decision to give “preliminary approval” to the Passion Point development proposed by Jason Kinsale, the Aristo Development chief behind projects such as Balmoral on Sandford Drive;

ONE Cable Beach, and his current Aqualina high-rise. Besides allegedly violating the area’s “single family zoning” regulations, they are arguing that Passion Point’s two seven-storey condo buildings - which will feature 61 three-bedroom units in

Central Bank warned over Gov’t lending limits breach

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Central Bank was advised it could breach its legal lending limits to the Government through the latter’s use of $232.3m in IMF special drawing rights (SDRs) without reforms to its governing Act.

The Memorandum of Understanding (MoU) between the Government and Central Bank, which facilitated the transaction, shows the alarm was raised by the latter’s external legal advisers to such an extent that the Central Bank Act had to be amended “out of an abundance of caution” over the SDR deal.

The MoU, which was signed by Prime Minister Philip Davis KC in his capacity as minister of finance, and Central Bank governor, John Rolle, on November 29, 2022, makes clear that the transaction was instigated by the Government via the Ministry

of Finance. However, the Central Bank seemingly felt it necessary to obtain a written agreement from the Government that it would amend its governing to ensure the regulator remained in compliance with the law.

“The Ministry has recommended, with the [Central] Bank’s endorsement, a conversion of the 2021 SDR allocation into US dollars to undertake debt management operations to repay external debt, help stabilise The Bahamas’ US dollar bond debt obligations, and to lock in significant savings on the debt, with the cost and replenishment or reconstitution obligations around use of the balances

SEE PAGE B2

total - will completely alter Love Beach’s character for the worse by increasing traffic congestion and raising “huge environmental concerns”.

Peter Whitehead, a Love Beach resident, in a January 17, 2023, missive to the planning authorities

titled: ‘How is seven storeys not illegal’, wrote: “The ares we have out here is a beautiful residential community, one of the nicest in Nassau. “In most of the places I’ve seen around the world, where there are nice residential communities that end up having high valuations, you cannot simply come in and build a building that has nothing to do with the zoning or aesthetics of the area. Think of any area where land values go up, and have enduring value. You can’t simply walk into a single storey or two storey area of residential homes and build seven storeys. It just doesn’t happen.

Former minister: Give Toby ‘some preference’ over PI

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

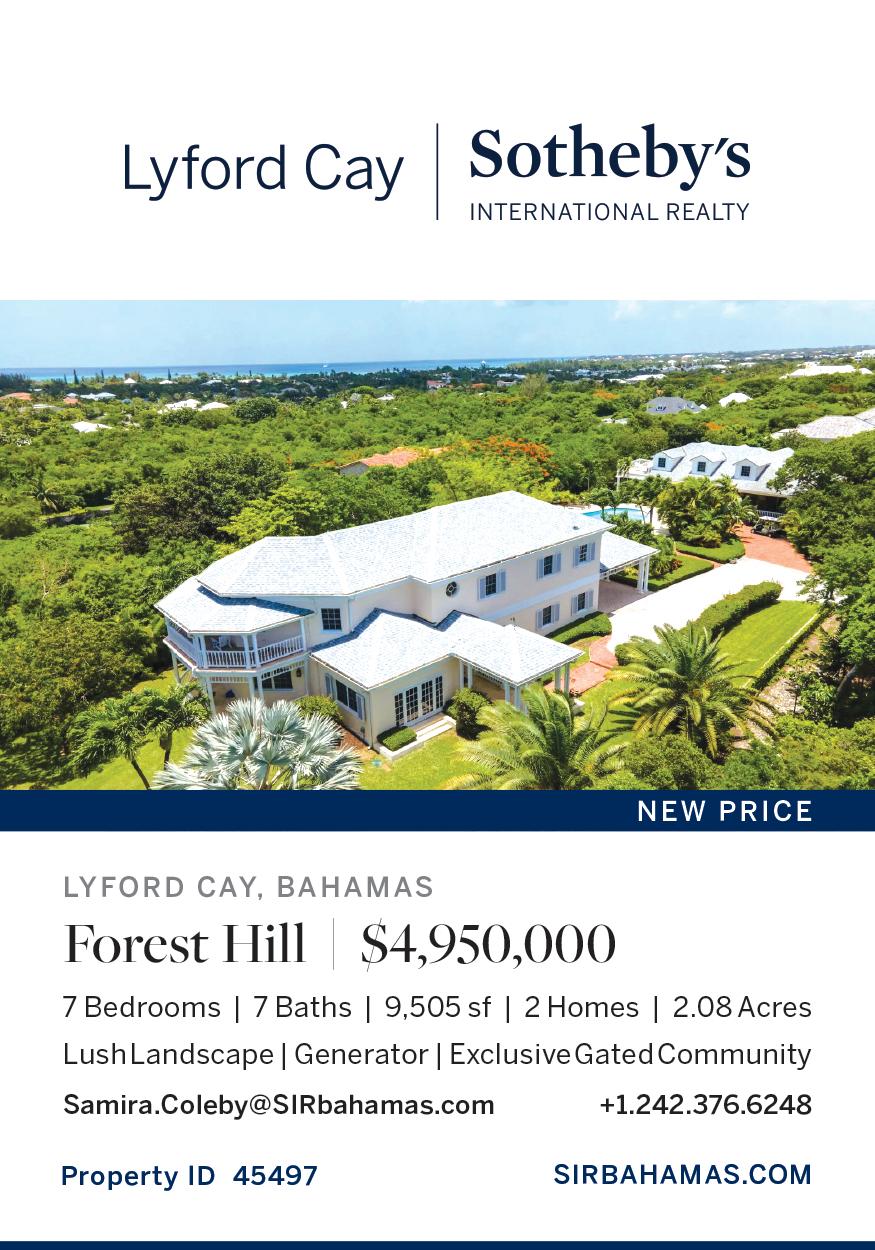

A FORMER Cabinet minister yesterday said the Bahamian entrepreneur battling to restore Paradise Island’s lighthouse should be given “some preference” now that his project can easily “co-exist” with Royal Caribbean’s.

Dionisio D’Aguilar, minister of tourism and aviation in the Minnis administration, told Tribune Business there was now “sufficient real estate” for both Toby Smith’s Paradise Island Lighthouse and Beach Club venture and the cruise giant’s destination to proceed given that the latter has cut its Crown Land demands.

Village Road companies slam ‘haphazard’ damage repairs

By NEIL HARTNELL and YOURI KEMP

Tribune Business Reporters

By NEIL HARTNELL and YOURI KEMP

Tribune Business Reporters

VILLAGE Road businesses yesterday blasted the Government’s efforts to repair business premises, residences and driveways/ parking lots damaged by the area’s 15-month roadworks as “haphazard” and lacking “structure”.

Michael Fields, president and chief executive of Four Walls Squash and Social Club, who also heads the Village Road Business Collective, in an open letter to Alfred Sears KC, minister of works and utilities, said it was “impossible to reconcile” the latter’s suggestions that promised repairs are now underway with the on-ground reality.

Voicing surprise at the minister’s assertions,

especially given the Village Road business community’s alleged lack of communication with the Ministry of Works and Utilities, he also urged the Government to get the traffic lights at the Shirley Street junction operational following “another” threecar accident last week. “Is the Government going to wait for someone to be severely injured or killed?” Mr Fields asked.

He wrote in his letter: “It is difficult to understand why the Ministry of Works refuses to engage in an open and transparent dialogue with the business community, and why our discussions with the Ministry of Finance seem to be an excuse for avoiding answering any questions or providing any official updates on a project that is

EX-PM demands Central Bank HQ deal explanation

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A FORMER prime minister yesterday demanded an explanation for why the Central Bank’s proposed new headquarters building at Royal Victoria Gardens in downtown Nassau was “terminated’.

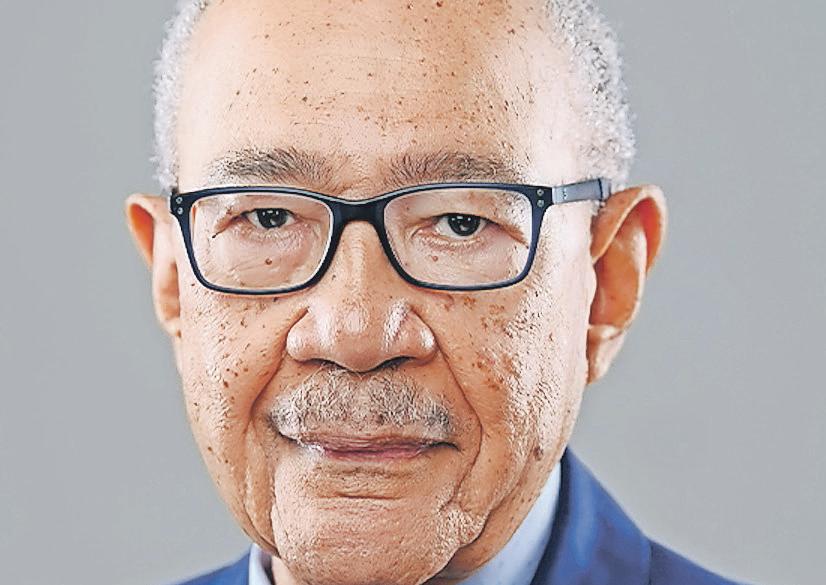

Dr Hubert Minnis, speaking in the House of

Assembly on the Central Bank of The Bahamas Act amendments, questioned whether a Cabinet decision was behind the move given that Parliament had already approved the land transfer from the Government to the financial services industry regulator.

Noting that the project had started under the last Christie administration, and carried on through his own, he suggested that

millions of dollars - up to $12m - could be wasted if the project does not proceed. “Parliament approved the transfer of Crown Land to the Central Bank. Why was the decision made not to go ahead with this major project? Was this a Cabinet decision,” Dr Minnis asked.

“The cancellation of the new headquarters at that

SEE PAGE B6

Disclosing that this was a solution he had pushed when in office, he argued that Mr Smith should receive some reward for 12 years’ “in the trenches” through being awarded all the necessary approvals to proceed with plans

to restore Paradise Island’s lighthouse and develop his own ‘beach break’ destination for guests.

Voicing optimism that any “bad blood” between Mr Smith and Royal Caribbean over their Crown Land fight will “heal over time”, Mr D’Aguilar told this newspaper: “I was supportive of both of them. It’s good that they could both co-exist, and it seems as if Royal Caribbean, which initially asked for seven Crown Land acres, has reduced their requirements down to four.

“That leaves a position for Toby’s project to move forward if they can both coexist, and it seems a happy medium has now been reached.... There may be bad blood between them, but there’s sufficient real estate for both projects to co-exist, and I’m sure the bad blood will heal over time and they will happily co-exist next to each other.

“They certainly have the real estate now, and the

business@tribunemedia.net TUESDAY, APRIL 25, 2023

PAGE B5

SEE

JASON KINSALE

SIR BALTRON BETHEL

PAGE B4 SEE PAGE B3

DR HUBERT MINNIS

SEE

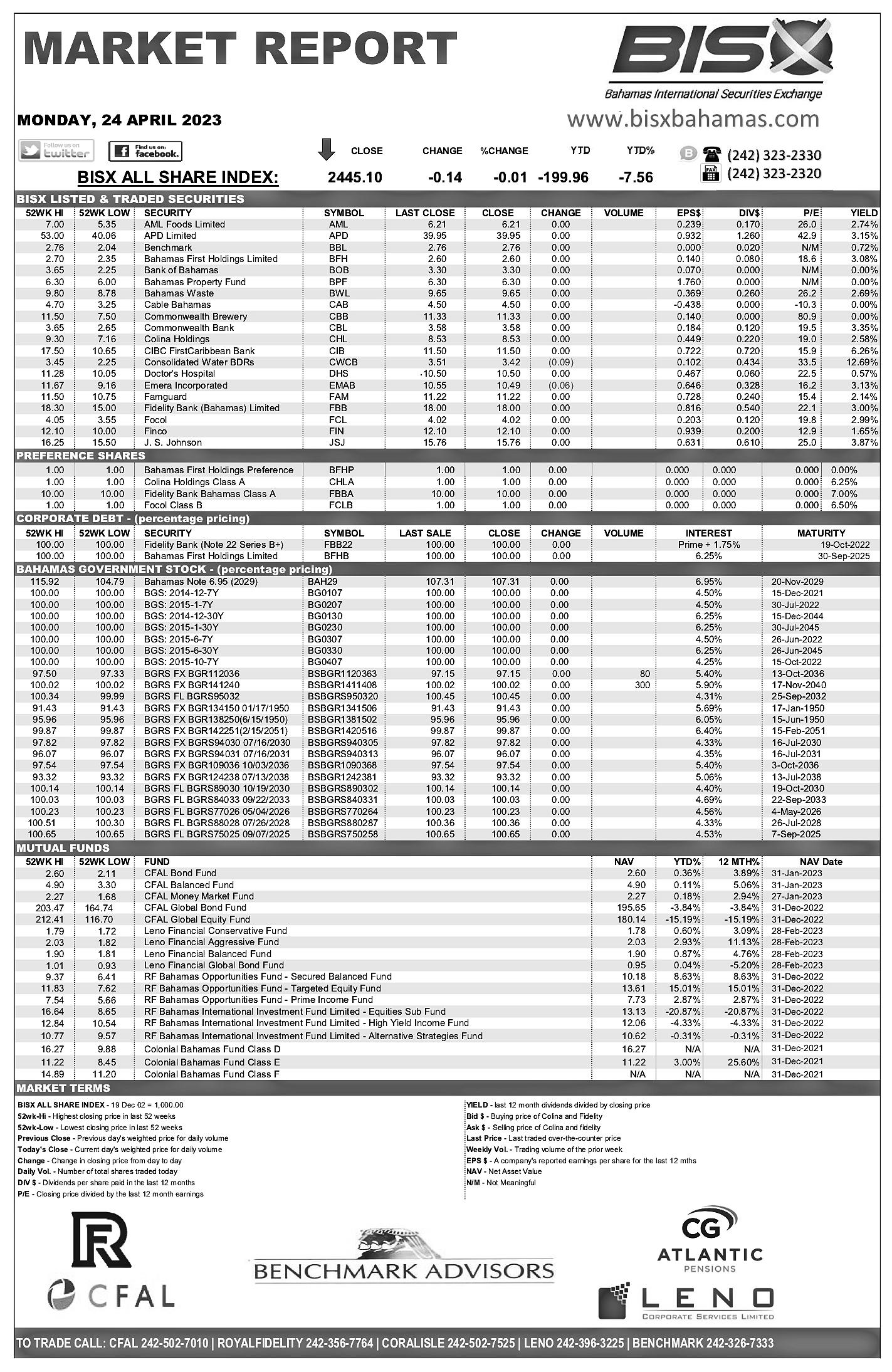

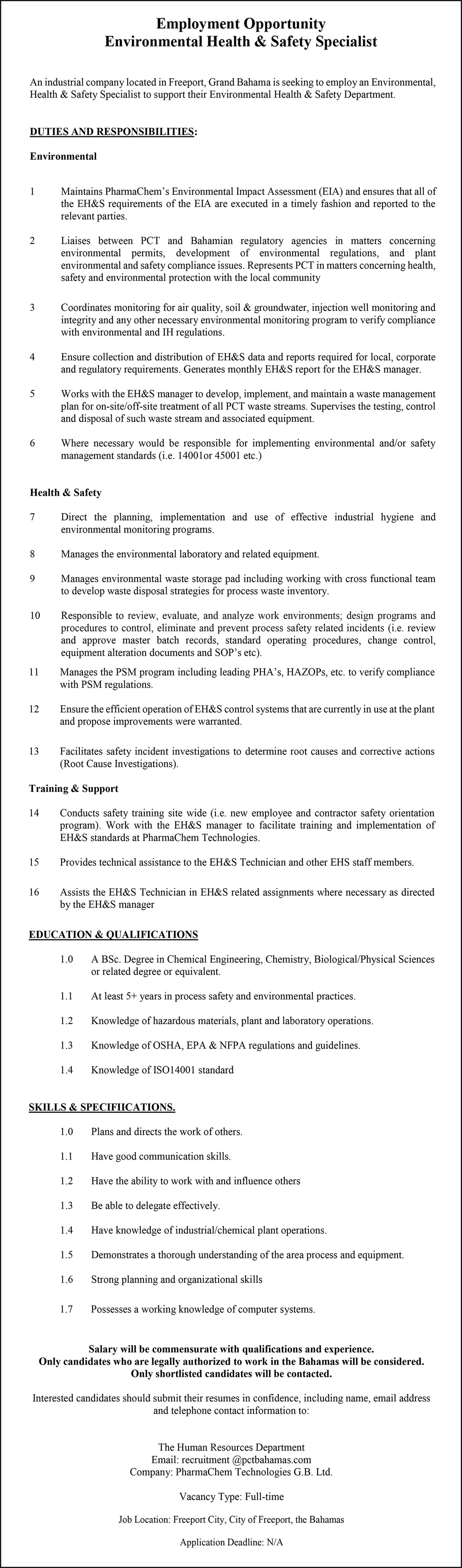

$5.74 $5.74 $5.78 $5.71

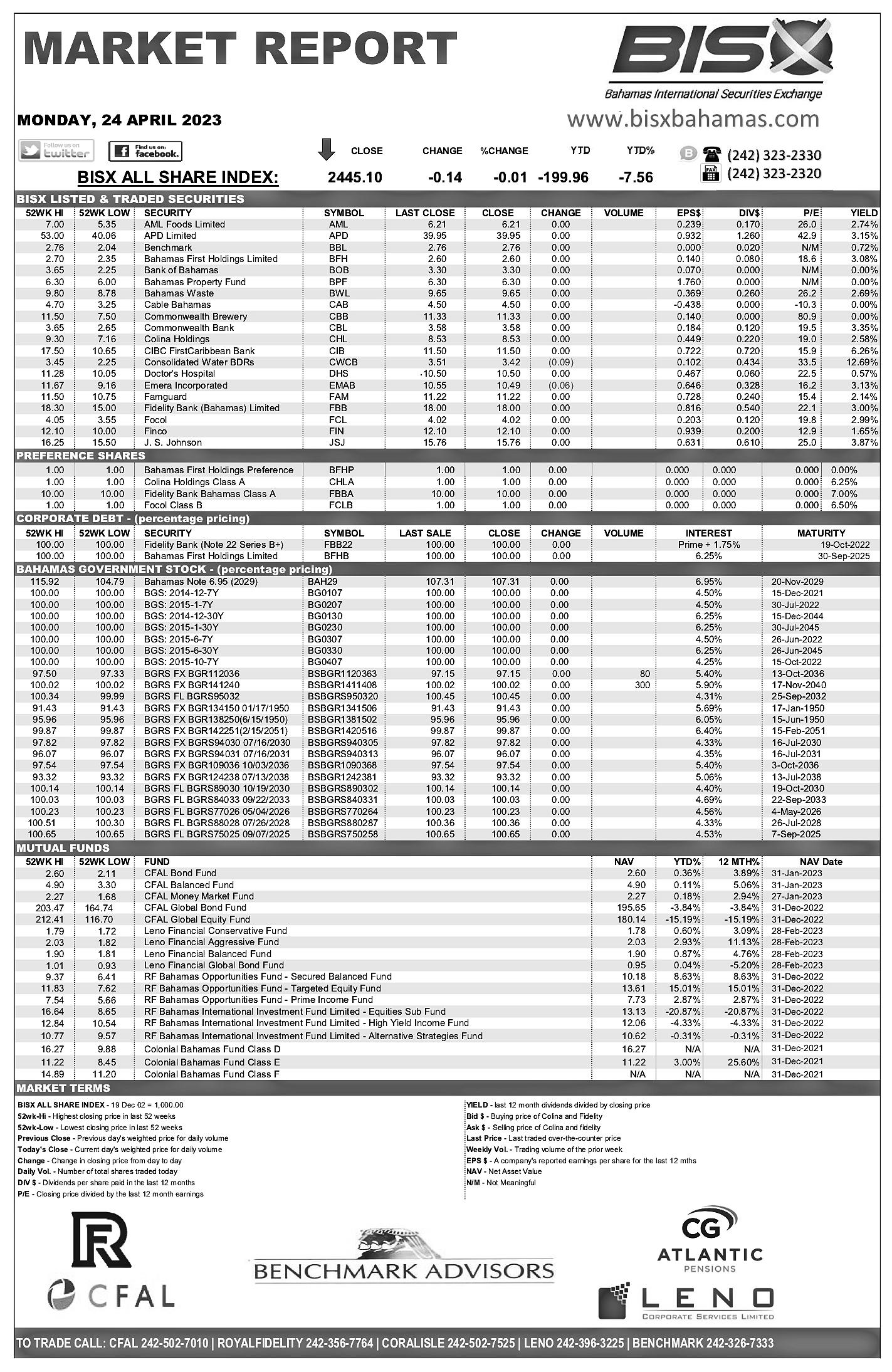

FORMER Cabinet minister Dionisio D’Aguilar at Lighthouse Point, Paradise Island.

ACTIVISTS FEAR ‘TOTAL DECIMATION’ OF PI SITE BY ROYAL CARIBBEAN

BAHAMIAN environmental activists yesterday reiterated fears that Royal Caribbean’s $100m beach club project will cause “total decimation” of western Paradise Island despite assurances to the contrary. The activists, in a joint statement responding to the cruise giant’s multiple environmental stewardship pledges, argued that the Royal Beach Club’s 17-acre site “cannot survive intact” with a daily average visitor count of some 2,750.

“We continue to believe that the site cannot survive intact and faces full transformation, and total decimation, of its physical assets,” the group alleged. “The precedent for grossly exceeding a small area’s carrying capacity is as per the permanent and irreversible impact Royal Caribbean had on the Bahamian island Little Stirrup Cay, whose Bahamian name couldn’t even survive the undue pressure to transform to Coco Cay.” They also recalled the concerns voiced by Joe

Darville, Save the Bays chairman, who argued that the location, which includes four acres of Crown Land, “is ill-suited and incapable of absorbing the impact of the estimated 3,000 visitors that Royal Caribbean plans to descend on the site daily”.

The group, which includes ex-Bahamas National Trust (BNT) chief, Eric Carey; Save the Bays chief, Joe Darville; reEarth president, Sam Duncombe; EarthCare’s Gail Woon; Rashema Ingraham, executive director, Waterkeepers; and Casuarina McKinney, executive director, Bahamas Reef Environment Educational Foundation (BREEF), hit out after Royal Caribbean pledged that its $110m Paradise Island project will contribute “zero” waste to the New Providence landfill.

The cruise giant added that its development will also employ “100 percent renewable energy by 2030”, and said the environmental plans for its Royal Beach Club are built on what it described as “six focuses” - zero waste-tolandfill, renewable energy,

wastewater treatment, protecting and enhancing the surrounding habitats, and environmental monitoring.

However, the activists retorted: “While we appreciate Royal Caribbean’s commitments, what the company announced yesterday was insufficient to deter us from our request for information. We still do not have any real, meaningful details on Royal Caribbean’s environmental plans, or answers to the numerous questions we’ve posed. This remains a significant problem for us.

“Royal Caribbean needs to respond to our previously stated requests for online public access to all documents related to the beach project submitted to the Government by Royal Caribbean, inclusive of the cultural and environmental impact assessments and management plans.”

They also renewed calls for “responses and mitigation plans related to the beach project submitted to the Government by Royal Caribbean”, and “open inperson and online town halls at which members of the public will be permitted

ample time to express their views, and a commitment to making transcripts available online”.

All Royal Caribbean responses “to numerous unanswered questions shared by The Bahamas’ business and environmental communities, regarding the impact of its proposed project” need to be supplied in writing, and an environmental review timetable, “including a schedule of town hall meetings and public comment period”, supplied no later than April 30.

However, in promising that the Royal Beach Club will contribute no extra waste to the New Providence landfill, the cruise line said: “The beach club will be free of single-use plastics and offer compostable service ware at food and beverage venues.

“In addition, it will be equipped with biodigesters to reduce food and other organic waste, and process cooking oil into biodiesel for energy production. The cruise line will also develop partnerships with local Bahamian companies focused on recycling and

CENTRAL BANK WARNED OVER GOV’T LENDING LIMITS BREACH

FROM PAGE B1

assumed by the Government,” the MoU said.

“The proposed purpose aligns with the intended uses for which the IMF allocated the special drawing rights.” The SDRs have already been fully drawn down and converted to cash by the Davis administration, although the precise purpose for which the funds were used has not been disclosed. Such a transaction was not contemplated in the Government’s previouslyreleased annual borrowing plan for the 2022-2023 fiscal year. The Prime Minister, addressing the House of Assembly yesterday during

the debate on the Central Bank Act changes sparked by the IMF SDR deal and MoU, vehemently denied Opposition charges that the transaction represented a loan to the Government.

However, the MoU itself details concerns that the deal created a liability now due from the Government to the Central Bank that could place the latter outside its legal lending limits and violate the law.

“Based on the advice of external legal counsel, the [Central] Bank is of the view that using the 2021 SDR allocation for the purpose would create a liability from the Government to the Bank notwithstanding

section 4(6) of the Act, and a position could be taken that the Government would have exceeded the authorised borrowing limits set forth in section 21 of the Central Bank of The Bahamas Act 2020,” the MoU stipulates.

“Out of an abundance of caution, the [Central] Bank has requested, and the Government has agreed, to table an amendment to the Central Bank Act on the terms more specifically set forth below.” The reforms were supposed to have been “debated and gazzetted” no later than the mid-year Budget debate, which has long passed and was supposed to have taken

place on February 22, 2023, more than two months agomeaning the Government is late again.

The MoU’s contents were seized on by Kwasi Thompson, the Opposition’s finance spokesman, during his contribution to the Central Bank Act debate. Pointing out that the IMF requires countries to use the SDRs in accordance with their laws, he said: “The MoU is very telling. The Government received advice from the Central Bank’s external lawyers that this transaction was unlawful.

“It is my belief that the Central Bank would not proceed with the transaction unless this amendment was proceeded with.” The MoU agreed that the Central Bank Act could be reformed such that it came into effect retroactively to cover the Government’s previous SDR conversion, which it has now done with the amendments that passed the House of Assembly yesterday taking effect from December 1, 2022.

“The Bahamian people have yet to receive a satisfactory answer from this government on why it decided to circumvent the law and access the country’s external reserves in the SDRs held by the Central Bank. These SDRs reside on the balance sheet of the Central Bank as detailed in the bank’s most

innovative waste reduction programmes.

“Royal Caribbean is committed to a net-zero carbon footprint for the Royal Beach Club by 2030,” it added of its renewable goals. “The project will incorporate smart design considerations during construction, including natural shade, low flow filters and more. The line will also invest in renewable green energy production – solar, wind and hydro –both onsite and through innovative, new partnerships throughout New Providence.”

Royal Caribbean, in an effort to mitigate environmental fears, is also promising no dredging or overwater cabanas. “Royal Caribbean will conserve the ocean environment, including coral, and will not dredge the area in and around Paradise Island,” the cruise line added.

“In addition, the cruise line will not build overwater cabanas on the property, and it has no marine development plans for the northern shore where abundant coral is present. It also plans to minimise

recent audited financial statements. They are not, and have never been, the property of the central government for reasons that are well known and well understood....

“Clearly, the Government was caught red- handed and is now bringing the legislation in an attempt to wipe the slate clean from their breaking the law. The fact that you are bringing this now and making it retroactive to December is only proof of your breach in the law.”

The MoU makes the Government responsible for servicing all obligations due to the IMF on the SDRs, including interest payments, “without a financial burden to the Central Bank”. The SDRs have to be “reconstituted”, or repaid, no later than when the US dollar liabilities they have financed mature. No date was given, but the MoU remains in effect until January 4, 2038.

Mr Davis, while reiterating that the SDRs are not a loan, sought to justify the transaction on the basis that The Bahamas’ postCOVID economic needs have altered from propping up the foreign currency reserves to “rebuilding and strengthening our fiscal position”.

He added: “Of course, it is not free money. The interest rate associated with the Special Drawing Rights is 0.05 percent, far below market rates. We have discretion as an IMF member state to utilise

the impact on marine life through monitoring and adjusting the location of the limited structures, such as the floating pier, in place during construction on the southern shore of the island.

“The Beach Club will have a dedicated and best-in-class wastewater treatment plant that will process 100 percent of the wastewater generated onsite. More than 95 percent of the treated wastewater is intended for beneficial reuse, and the remaining byproduct will be composted for landscaping and vegetation.”

Noting that the western end of Paradise Island “has fallen into disrepair, with several former residential properties neglected or abandoned”, Royal Caribbean added: “The company will restore this area by adding native plants and vegetation, removing invasive, non-native species of plants and only constructing buildings on previously altered property or that contain significant invasive or non-native species of plants.”

these assets for our national benefit. Today, this amendment ensures that our laws align with our national priorities and needs as a government.....

“Initially, our primary need was to maintain our levels of foreign reserves. It was in August 2021 that the Central Bank of The Bahamas gained access to the Special Drawing Rights valued at $247.5m held as international reserves. The funds served their immediate purpose. But, over time, as this administration oversaw the nation’s economic recovery, our needs as a government changed.

“You see, Madam Speaker, when tourism is at an all-time high and the economy is recovering at a record pace, money is coming into the country and foreign reserves can be maintained in a way that was not possible during the pandemic. This is why the role of the Special Drawing Rights in boosting our foreign reserves was so critical when the economy was locked down,” Mr Davis added.

“Now that the economic situation has changed, our needs have changed. The Bill before us today allows us to adapt the use of these resources to reflect our evolving national priorities. In this instance, we are specifically addressing foreign currency debts.... Ultimately, it simply makes sense to use the resources on hand to service foreign debt obligations rather than to incur additional debt.”

PAGE 2, Tuesday, April 25, 2023 THE TRIBUNE

By FAY SIMMONS jsimmons@tribunemedia.net

Village Road companies slam ‘haphazard’ damage repairs

now seven months delayed and 15 months in, with no end in sight.

“It is impossible to reconcile your comments that remedial work to driveways and parking lots with damage ‘is taking place now’ with what we are seeing on the ground. We see fractured projects popping up from time to time in different places. For example, a few temporary striping marks were placed in one area, but have since washed away.

“We see work randomly starting and stopping. As an example, for about three days last month, we noticed demolition work on a small portion of the sidewalk on the southern end, but that work stopped about two weeks ago. Later, we heard jackhammering on the northern end. There appears to be no structure, consistency or clear work plan. The project is haphazard and disorganised. There is no timeline, and we have no clue what the scope of the remaining work entails.”

Highlighting concerns about a lack of structure and planning, Mr Fields told Mr Sears: “In one instance, an entire parking lot was repaved. In other instances, no work was done - not even to tie-in the newly paved road. Parking lots/driveways have been left dug up, cracked and damaged.

“And in other instances, as one business stated, the work was completed at a sub-par standard. ‘I only wish they would get with it, as my entrance and curbs are a disaster!! The asphalt [poured to tie in] my driveway is higher than before and was not graded properly, so it is extremely difficult to get out the entrance without going further into the road right into oncoming traffic!’

“We also want to stress the importance of getting the traffic lights

operational. There was yet another three-car accident last week at the Shirley Street/Village Road junction. Is the Government going to wait for someone to be severely injured or killed before they get the traffic lights working?”

In a final plea to Mr Sears, Mr Fields added: “Minister Sears, we cannot emphasise the damage this 15-month project has caused to businesses in the area and how disappointing the Ministry of Works’ refusal to communicate and engage has been for the community. We implore you to turn things around, and are inviting the Ministry of Works to commit to the following.”

He called on the minister to ‘“walk the Village Road strip alongside businesses to personally survey the damages and status of the work that remains”, plus meet with the Village Road Business Collective to listen to its concerns and those of individual members.

Mr Fields also urged that the Government publicly disclose the remaining work and its scope, plus a project plan, and release the timeline and completion schedule. The Davis administration also needs to “assign a business liaison to provide ongoing updates as needed, and facilitate enhanced communication between the Ministry of Works and the business community”.

“We hope to hear from you in a timely manner, and that you accept our invitation to meet and survey Village Road personally. We remain hopeful for your availability this week,” he added.

Mr Sears, though, last week said repairs have begun to Village Road driveways and parking lots in the aftermath of the road improvement project, with new sidewalks also now being installed.

He said: “Those residents whose driveways, as well as businesses whose parking

lots were damaged, remediation is taking place as well as the sidewalk. The initial plan was to rehabilitate the sidewalk [but], as I consulted with the stakeholders, we decided to scrap that and design new sidewalks to go with a new road and that design has been completed.”

Village Road businesses have been vocal about the lack of response by the Ministry of Works to their cries for it to repair damage done to private property during the roadworks initiative. Along with the new sidewalks, new signage and striping closer to the roundabout with Bernard Road is also underway.

Mr Sears acknowledged more must be done for Village Road businesses, and that the Ministry of Finance is working closely with their representatives.

“Businesses have also complained about the impact, and they are engaged in negotiation with the Ministry of Finance in terms of some form of compensation or stimulation,” he added.

The cost of the new sidewalks is still being negotiated with the contractor because “these were beyond the initial scope of work”. Mr Sears said the Ministry of Works is now focused on other upgrades throughout New Providence.

“The road project is going forward,” he added. “As you know there’s a lot of road to cover, and also we’re moving into the rainy season. So in addition to repaving, in addition to patching, there’s also the issue of drainage and we’re also giving very focused attention to issues of flood mitigation.

“We’ve bought additional equipment such as pumps and valves so that in the wells, where you have

over a period of time water coming up with high tide, these valves will stop the water coming up and just ensure that the drainage of the water that’s ponding on the road or on the sidewalk goes down.

“We’re also re-drilling wells which have been covered with debris so that they can be more effective, and we are drilling additional wells in communities

where there is a history of ponding water. So the road is combined with the mitigation and that work is continuing.”

The Ministry of Works is also preparing a publicprivate partnership (PPP) for a “massive” road rehabilitation programme in Eleuthera, and actively looking for financing to construct the Glass Window Bridge’s replacement.

As for concerns over the Grand Bahama Utility Company’s proposed water rates increase, Mr Sears said: “The matter is being reviewed by the Minister for Grand Bahama and she will report to the Cabinet, at which time it will be considered. But as you know the Grand Bahama Port Authority is the regulator.”

THE TRIBUNE Tuesday, April 25, 2023, PAGE 3

PAGE B1 CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

FROM

Government is assessing what to do with the portion of beach no longer needed by Royal Caribbean. Toby certainly has done his time in the trenches trying to secure it, so I would like to believe he has some preference.”

The Davis administration, though, has requested that Mr Smith “reapply” for the necessary government permits and approvals so that his project can proceed.

It took that stance after the Supreme Court ruled the Paradise Island Lighthouse and Beach Club principal did not possess a valid, binding Crown Land lease for the collective five acres he was seeking on Paradise Island’s western end.

That five acres was split into two parcels, one for three acres and the other involving two acres. The latter was also sought by Royal Caribbean for its project, drawing it into conflict with Mr Smith, amid assertions that the former Minnis administration had effectively ‘double dealt’ the same Crown Land to two separate, different investment ventures.

Royal Caribbean executives recently said

they reduced their Paradise Island Crown Land demands by 43 percent in a bid to “untangle ourselves” from any “conflict” with Mr Smith who, while now appealing the Supreme Court’s verdict to the Court of Appeal, has also reaffirmed to the Government his commitment to proceed after obtaining “proof of financing” in excess of $7m.

Mr D’Aguilar said yesterday of Mr Smith: “The Government is now saying he needs to reapply and start all over. I don’t know if they gave him the expectation they were supportive and, once there was a resolution Royal Caribbean to reduce their needs, that would immediately translate into finalising his project. It seems that’s his view, but is not the view of the Government, which has said to reapply.

“That was always my position; that they could always co-exist. When I was in office I requested that Royal Caribbean reduce their ask. ‘Why do you not take five acres, and Toby take five acres?’ They wanted seven. I said: ‘Jesus, you’re going to have this big battle over seven acres. We should be able to accommodate both projects.”

The former tourism minister said that, based on Royal Caribbean’s public comments, it appeared as if the cruise giant was now taking the approach that ‘if Toby wants to go for it, go for it’. He added, though, that he is also backing the cruise giant’s $110m Royal Beach Club investment on the basis that it “anchors” or locks the cruise line into consistently calling on Nassau given that it will have a vested financial interest in the destination.

The Davis administration has sought to build upon, and enhance, the deal left by its predecessor through what is being billed as a “first-of-its-kind” public-private partnership (PPP) model with Royal Caribbean. The Government will convert the four Crown Land acres into an equity stake in the project and, collectively with Bahamian investors, will hold a 49 percent interest in the Royal Beach Club. Entrepreneurial and employment opportunities for locals have also been boosted.

“We’re beginning to understand, for the very first time, that the cruise companies need us as much as we need them,” Mr D’Aguilar told Tribune

Business. “It’s not such a one-sided relationship any more, and we’re finally beginning to understand the power of our geography.

“If you’re doing three or four-night cruises out of the busiest cruise ports in the world, Miami, Fort Lauderdale and Canaveral, The Bahamas is almost certainly going to have to be part of the itinerary and gives us a certain leverage that St Lucia doesn’t have. When you have that leverage, you can extract a better deal.”

Pointing to Nassau Cruise Port’s $132m bond offering memorandum, which stated that the ever-increasing number of passengers going on short three and four-day cruises was to The Bahamas’ advantage, Mr D’Aguilar added that the Prince George Wharf operator is forecasting it will handle 4.1m-4.2m passengers in 2023 and up to 4.5m-4.6m in 2024.

With this growth, he argued that there will be sufficient passenger volumes to satisfy Bay Street merchants and all cruisereliant businesses despite the Royal Beach Club’s addition in 2025. “You cannot allow your attractions and offerings to remain static,” the former

NOTICE

TRIER INVESTMENT LIMITED

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas.

Registration Number 206405 B (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 17th day of April, A.D. 2023. Articles of Dissolution have been duly registered by the Registrar. Te Liquidator is Gerson Luis Muller, whose address is RUA ENGENHEIRO OLAVO NUNES 100 AP 00601 PORTO ALEGRE – RS, BRAZIL. Persons having a Claim against the above-named Company are required on or before the 16th day of May, A.D. 2023 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the beneft of any distribution made before such claim is proved. Dated this 17th day of April, A.D. 2023.

Gerson Luis Muller Liquidator

tourism minister told this newspaper. “You have more people coming, and if you want them to come off the vessel you have to offer them more and interesting excursions, and things to do.

“At what point do you say, ‘yes, we’re going to allow one more project’.

I’m of the view that there’s enough passengers coming to go around all the businesses, and we have to keep expanding and offering more interesting things.

Bahamians are going to be part-owners of these excursions. Yes, it’s going to be empowering Bahamians.”

Disclosing that he supports the Royal Beach Club for that very reason, Mr D’Aguilar added: “Most importantly, it anchors Royal Caribbean to the port of Nassau. When they are deciding their cruise itineraries, if they have a financial interest in an excursion in a particular port, they are more minded to include it in their itineraries than locations where they don’t have an interest. This ties them to the port of Nassau. Not that we have a problem attracting people.”

Royal Caribbean has pledged to increase the number of passengers it brings to Nassau by 150 percent come 2027, growing the total from one million per annum in 2019 to 2.5m by that year. It has also said that more than 60 percent of this number will not set foot at the Royal Beach Club.

Mr D’Aguilar, though, agreed that Royal Caribbean’s Paradise Island development will stand or fall based on its ability to address all potential environmental issues. He declined to voice an opinion on this, asserting that the issues were best addressed by the Department of Environmental Planning and Protection (DEPP) and specialists in the field.

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, JUSTIN WELLS Johnson Terrance, New Providence, Nassau, Bahamas, intend to change my name to JUSTIN KNOWLES If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, PAOLA ALICE ALVINO CHRISTIE Old Fort Bay, Western District, New Providence, P. O. Box N-8164, Nassau, Bahamas, intend to change my name to PAOLA ALICE CHRISTIE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

EMJR Global Holdings Ltd.

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, EMJR Global Holdings Ltd. is in dissolution as of April 20th, 2023

International Liquidator Services Ltd. situated at 3rd Floor Withfeld Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator.

L I Q U I D A T O R

NOTICE

NOTICE is hereby given that EVA BEAUGRIS, of Key West Street, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that PRINCESS SHELITA BELLEVUE, of Mount Royal Avenue, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

PAGE 4, Tuesday, April 25, 2023 THE TRIBUNE

MINISTER:

TOBY

PI FROM PAGE B1

FORMER

GIVE

‘SOME PREFERENCE’ OVER

Love Beach is not feeling the Passion

“The end effect is that you scare investors away from building nice houses. If you are just going to randomly bulldoze their value by putting towers up next to them, they will see you do that once and then simply not invest because they do not trust that you will protect the integrity of the space they are trying to create.”

The Town Planning Committee, according to documents seen by Tribune Business, gave Passion Point preliminary approval to proceed subject to certain conditions. These include obtaining approval for the project’s height from the Civil Aviation Authority, given its proximity to Lynden Pindling International Airport (LPIA) and planes taking-off and landing, plus a satisfactory traffic impact assessment and meeting the requirements of the Ministry of Works’ civil design section.

Mr Whitehead, though, contrasted Town Planning’s Passion Point stance with Ministry of Works action that once stopped a neighbour building a 10-foot retaining wall, and a further six-foot property wall on top of that, just yards from his property. “This man

[was] building a skyscraper in my face,” he wrote. “But, unfortunately, that is exactly what these plans for Passion Point are...

“We have to start using sense again. They [Passion Point] should be forced to build in Cable Beach till that is built out before they change the nature of smaller communities. The Bahamas is in high demand. We can demand people build nice things and they will. But if we allow them to abuse us, and destroy our environment, they will do that, too.

“If this is somehow legal, that zoning doesn’t stop something as ridiculous as this, then zoning laws seem meaningless and we live in a free-for-all. And, long-term, that is not smart planning. People have to trust that it is worth investing in nice homes and that they will not have totally inappropriate structures built into areas. Otherwise, they won’t invest, and in the long-term the island will lose because of it.”

The Town Planning Committee’s January 31, 2023, preliminary approval is now being appealed by Love Beach residents to the Subdivision and Development Appeal Board. Sir Baltron’s name appears on the appeal, and Tribune

Independent auditors’ report

To the Shareholder of Santander Bank & Trust Ltd.

Report on the audit of the financial information

Our opinion

Business sources yesterday confirmed the matter has yet to be heard, although they could not provide a date. Mr Kinsale did not respond to this newspaper’s phone calls or messages seeking comment before press time yesterday.

Passion Point is targeted at a 3.82-acre site immediately to the east of ‘Garden of Eden’ on West Bay Street. It will lie to the north of Old Fort Bay in lots six and seven of Love Estates subdivision, and is close to where the road makes a second turn major turn eastwards towards Cable Beach.

“Please note that there is a significant drop in elevation from the road to the beach of approximately 20 feet,” Mr Kinsale said in a November 23, 2022, letter to Charles Zonicle, the Department of Physical Planning’s director. “It will enable the building to appear as if it is a five-storey building from the road when driving by.”

Mr Whitehead, though, was far from alone in his concerns. Anja Allen, a Garden of Eden resident, branded Passion Point “a monstrosity” in a January 18, 2023, e-mail. “Developments of this height are rare on New Providence and,

up until now, kept to high density tourist areas such as Cable Beach and Paradise Island,” she asserted to the planning authorities.

“In a nutshell, this quiet residential area will be completely ruined if two seven-storey buildings are allowed to be erected.” Ms Allen added that she has “huge environmental concerns with regards to what the construction will do”, citing the “dire” flooding that currently occurs on the site where one of the two condominium towers will be located.

Questioning where that water will go once the tower is built, she added: “The property is currently home to a vast selection of mature trees which must be respected and built around.” Susan HaslauerSchauff, vice-president of Bahamas Motor Sports Association, and who oversees its EduKarting educational initiative, added that persons had invested in Love Beach on “the clear understanding” that it was reserved and zoned for single family residential use only.

Another Garden of Eden property owner, together with her husband, she questioned why Passion Point was even being considered

for approval. Mrs HaslauerSchauff, alleging that the design appeared to include no coastal flood protection, also challenged the “geological implications” for adjacent properties from Passion Point offering residents underground parking, which she said was “very questionable in the coastal area.

Meanwhile, Janine Carey, a Love Beach Colony resident, wrote that she had already noticed the area start to shift from one that is community-based to a neighbourhood focused only on “economical return”. “We have seen more apartment buildings going up, more trees being cut down, more natural environment being destroyed and the increase of Airbnb rentals, where you have new guests every four days, prohibiting you from creating community,” she wrote.

“With the development of Passion Point, we will lose even more of our Bahamian community living that is still present in our Out Islands but seems to be becoming more and more scarce in Nassau. The seven-storey building will turn the area into condo gated community living - who is ‘in’, and who is

Santander Bank & Trust Ltd.

‘out’. Natural environment will be negatively affected, coastal shoreline altered, more congested, less traffic, less native trees, birds and insects. The list goes on and on.”

Ms Carey then continued:

“Can we not stay Bahamian and let the lifestyle of the Out Islands shine and guide us here in Nassau? We need to create communities that are environmentally, economically and socially balanced. We need to stop only focusing on economic returns. It is destructive and only short-term.

“The developers of Passion Point need to go back to the drawing board and create a plan to work with the natural environment, enrich the community and stay within the island lifestyle that we all promote to the world and cherish. It is my hope that you [Town Planning] can protect this existence for us all. If we do not act now then the entire western coastline will be turned into a condo, multi-level, concrete gated monstrosity, devoid of character, heart and warmth, uniqueness and the absolute beauty of island living.”

Both Dr Robert Ramsingh and Cathy Ramsingh-Pierre, and Robert Smith, warned that Passion Point would “disrupt a long-standing residential community” while echoing many of the concerns raised by their fellow residents.

(Incorporated under the laws of the Commonwealth of The Bahamas)

Statement of Financial Position

As at December 31, 2022

(Expressed in thousands of Euros, except for share amounts)

In our opinion, the financial information of Santander Bank & Trust Ltd (the Bank) as at December 31, 2022, is prepared, in all material respects, in accordance with the basis of preparation as set out in Note 1 to the financial information.

What we have audited

The Bank’s financial information comprises:

● the statement of financial position of the Bank as at December 31, 2022.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditors’ responsibilities for the audit of the financial information section of our report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Independence

We are independent of the Bank in accordance with International Code of Ethics for Professional Accountants (including International Independence Standards) issued by the International Ethics Standards Board for Accountants (IESBA Code). We have fulfilled our other ethical responsibilities in accordance with the IESBA Code.

Emphasis of Matter - Basis of preparation

We draw attention to Note 1 to the financial information, which describes the basis of preparation. The financial information is prepared to comply with the requirements of the Bank’s regulator. As a result, the financial information may not be suitable for another purpose.

The financial information does not comprise a full set of financial statements prepared in accordance with International Financial Reporting Standards. Our opinion is not modified in respect of this matter.

Responsibilities of management and those charged with governance for the financial information

Management is responsible for the preparation of the financial information in accordance with the basis of preparation as set out in Note 1 to the financial information and for such internal control as management determines is necessary to enable the preparation of financial information that is free from material misstatement, whether due to fraud or error.

In preparing the financial information, management is responsible for assessing the Bank’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Bank or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Bank’s financial reporting process.

Auditors’ responsibilities for the audit of the financial information

Our objectives are to obtain reasonable assurance about whether the financial information as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered mater ial if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial information.

As part of an audit in accordance with ISAs, we exercise professional judgment and m aintain professional scepticism throughout the audit. We also:

2 Bayside Executive Park, West Bay Street & Blake Road, P.O. Box N -3910, Nassau, Bahamas

302 5350, www.pwc.com/bs

● Identify and assess the risks of material misstatement of the financial information, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain aud it evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

● Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opini on on the effectiveness of the Bank’s internal control.

● Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

● Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Bank’s abil ity to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the financial information or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Bank to cease to continue as a going concern.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Other Matters

The Bank has prepared a separate set of financial statements for the year ended December 31, 2022 in accordance with International Financial Reporting Standards, on which we issued a separate auditors’ report to the Shareholder of Santander Bank & Trust Ltd. dated April 21, 2023. This report, including the opinion, has been prepared for and only for the Shareholder, in accordance with the terms of our engagement letter and for no other purpose. We do not, in giving this opinion, accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save where expressly agreed by our prior consent in writing.

These financial statements were approved by the Board of Directors on April 17, 2023 and are signed on its behalf by:

31, 2022

1. Basis of preparation

The accompanying financial information is an extract from Santander Bank & Trust Ltd.’s financial statements as at December 31, 2022 and for the year then ended, which have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board and is used to submit to The Central Bank of The Bahamas.

The auditors’ report included herewith should be read in conjunction with the full set of financial statements, which can be obtained at Santander Bank & Trust Ltd.’s office located at Caves Corporate Centre, Building A 1st Floor, West Bay Street and Blake Road, Nassau, Bahamas.

THE TRIBUNE Tuesday, April 25, 2023, PAGE 5

FROM PAGE B1 PricewaterhouseCoopers,

T:

1 242

1

+

302 5300, F: +

242

Chartered Accountants Nassau, Bahamas April 21, 2023

2022 2021 € € ASSETS Cash and due from banks Demand - Group 1,277 74,753 - Others 207 262 1,484 75,015 Time - Others 48 45 - Group 79,299Total cash and due from banks 80,831 75,060 Mortgage securitization bonds 16 58 Foreign currency forward contracts 111,076 107,484 Loans 228,670 375 Investment in Group entities - 4,635 Intangible assets 27 48 Other assets and receivables 392 230 Right-of-use asset 155 164 Total Assets 421,167 188,054 LIABILITIES Due to Group entities Demand deposits 970 3,044 Time 41,032 117,970 Foreign currency forward contracts 1,429 2,286 Other liabilities 393 351 Total Liabilities 43,824 123,651 EQUITY Share capital Authorized, issued

paid: 10,000 ordinary shares of €75.79 each 758 758 Additional Contributed Capital 310,000Reserve for foreign currency translation (10,004 ) (10,004 ) Retained earnings 76,589 73,649 Total Equity 377,343 64,403 Total Liabilities and Equity 421,167 188,054

and fully

Director Director

December

Note to the Financial Information

Independent auditors’ report

To

EX-PM DEMANDS CENTRAL BANK HQ DEAL EXPLANATION

site is very disturbing and begs many questions that need to be answered. As we noted, in office we were giving consideration to using the old Central Bank complex as a potential temporary museum space for the enjoyment of Bahamians and visitors.”

The Central Bank announced earlier this month that it had “terminated” plans to construct its new headquarters building on the Royal Victoria Gardens site, and is now in the process of transferring the property’s ownership back to the Government.

No explanation was given for why the new Central Bank project, which has been planned since 2017, has been abandoned although Tribune Business sources suggested months ago that the Government was expressing the view that it should not proceed. The development was designed to be an “iconic structure” and a “one-ofa-kind building” that was to play a central role in the overall revival of downtown Nassau.

“The Central Bank of The Bahamas wishes to advise the public that it has terminated its project to construct a new headquarters building on the Royal Victoria Gardens site in downtown Nassau,” the Central Bank said. “Accordingly, the Central Bank has started the process to transfer

ownership of the property back to the Government so that alternative use can be made of the site.

“In 2017, the Government agreed to transfer the Royal Victoria Gardens to the Central Bank for development of its new headquarters building. The transfer was approved by Parliament in 2019 and executed in 2022. In 2018, the Central Bank hosted a competition and selected a conceptual building design from Architecton Design Studios. The firm was subsequently contracted to provide the architectural services for the project. The Central Bank will explore alternative arrangements to meet its long-term accommodations needs.”

Dr Minnis, meanwhile, slammed the Government over changes to the Central Bank Act Bill that have been made retroactive to December 1, 2022, to facilitate its use of the International Monetary Fund’s (IMF) $232.3m Special Drawing Rights (SDRs).

“The Central Bank Amendment Bill seeks to make provision for the insertion immediately after section 17 of a new section, 17A, to empower the minister to access, utilise or convert special drawing rights allocated by the International Monetary Fund for the purpose of reducing its foreign currency debt obligations and to manage its foreign currency debt operations.

“When made law, section two of this amendment takes effect from December 1, 2022. It is the responsibility of the minister of finance to ensure that proper rules and procedures are followed when it comes to oversight of the people’s money. If the rules were not followed properly, and now the administration has to pass a law to justify its behaviour, the minister of finance bears the blame for what occurred.”

Referring to the Davis administration’s preliminary approval of Royal Caribbean’s Paradise Island project, he argued that it was in “disarray” over whether the development has been given the full go-ahead or not. He pointed to one report where the Prime Minister referred to the Royal Caribbean deal as a “draft,” while the deputy prime minister said the Government had approved the project. Dr Minnis also argued that his successor changed his story by after saying a ground breaking for the project was to happen “almost immediately”, only to be followed by Glenys Hanna Martin, minister for education, saying the Royal Caribbean deal should not be approved. He added: “The Cabinet is in utter disarray and confusion. So, within a matter of weeks the minister of finance didn’t know the deficit numbers and blamed his mistake on someone else. Two Bills were pulled at the last minute; there is open dissension on a Cabinet matter; and now there is confusion about the state of a proposed investment.”

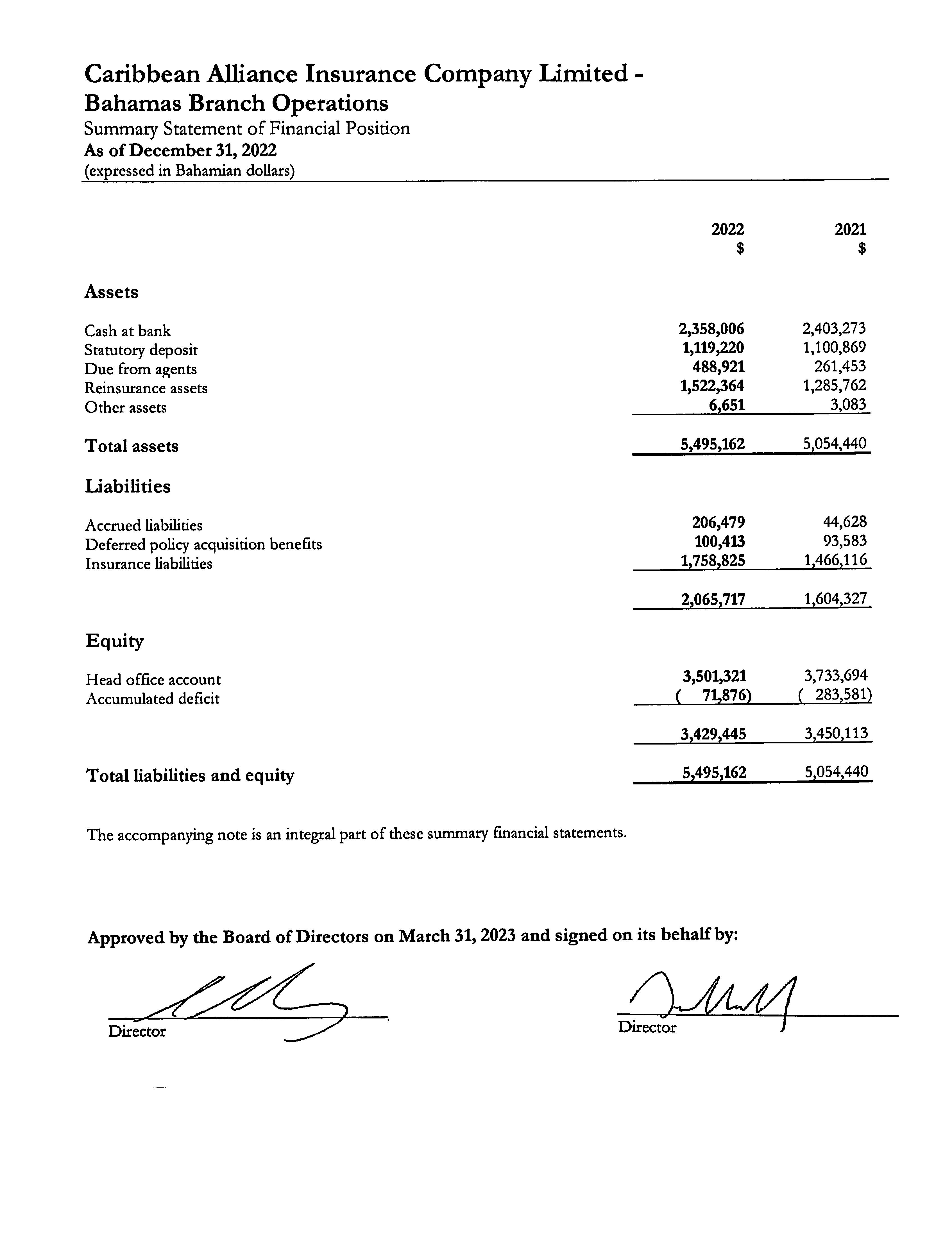

Santander Investment Bank Limited (Incorporated under the laws of the Commonwealth of The Bahamas)

Santander Investment Bank Limited (Incorporated under the laws of the Commonwealth of The Bahamas)

Statement of Financial Position

As at December 31, 2022 (Expressed in thousands of Euros)

Code of Ethics for Professional Accountants (including International Independence Standards) issued by the International Ethics Standards Board for Accountants (IESBA Code). We have fulfilled our other ethical responsibilities in accordance with the IESBA Code.

Emphasis of Matter - Basis of preparation

We draw attention to Note 1 to the financial information, which describes the basis of preparation. The financial information is prepared to comply with the requirements of the Bank’s regulator. As a result, the financial information may not be suitable for another purpose.

The financial information does not comprise a full set of financial statements prepared in accordance with International Financial Reporting Standards. Our opinion is not modified in respect of this matter.

Responsibilities of management and those charged with governance for the financial information Management is responsible for the preparation of the financial information in accordance with the basis of preparation as set out in Note 1 to the financial information and for such internal control as management determines is necessary to enable the preparation of financial information that is free from material misstatement, whether due to fraud or error.

In preparing the financial information, management is responsible for assessing the Bank’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Bank or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Bank’s financial reporting process.

Auditors’ responsibilities for the audit of the financial information

Our objectives are to obtain reasonable assurance about whether the financial information as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial information.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional scepticism throughout the audit. We also:

PricewaterhouseCoopers, 2 Bayside Executive Park, West Bay Street & Blake Road, P.O. Box N-3910, Nassau, Bahamas T: + 1 242 302 5300, F: + 1 242 302 5350, www.pwc.com/bs,

These financial statements were approved by the Board of Directors on April 17, 2023 and are signed on its behalf by:

● Identify and assess the risks of material misstatement of the financial information, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain aud it evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

● Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opini on on the effectiveness of the Bank’s internal control.

● Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

Conclude on the appropriateness of management’s us e of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Bank’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the financial information or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evi dence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Bank to cease to continue as a going concern.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Other Matters

The Bank has prepared a separate set of financial statements for the year ended December 31, 2022 in accordance with International Financial Reporting Standards, on which we issued a separate auditors’ report to the Shareholder of Santander Investment Bank Limited dated April 21, 2023.

This report, including the opinion, has been prepared for and only for the Shareholder, in accordance with the terms of our engagement letter and for no other purpose. We do not, in giving this opinion, accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save where expressly agreed by our prior consent in writing.

These financial statements were approved by the Board of Directors on April 17, 2023 and are signed on its behalf by:

Note to the Financial Information December 31, 2022

Note to the Financial Information

December 31, 2022

1. Basis of preparation

1. Basis of preparation

The accompanying financial information is an extract from Santander Investment Bank Limited’s financial statements as at December 31, 2022 and for the year then ended, which have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board and is used to submit to The Central Bank of The Bahamas.

The accompanying financial information is an extract from Santander Investment Bank Limited’s financial statements as at December 31, 2022 and for the year then ended, which have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board and is used to submit to The Central Bank of The Bahamas.

The auditors’ report included herewith should be read in conjunction with the full set of financial statements, which can be obtained at Santander Investment Bank Limited’s office located at Caves Corporate Centre, Building A 1st Floor, West Bay Street and Blake Road, Nassau,

The auditors’ report included herewith should be read in conjunction with the full set of financial statements, which can be obtained at Santander Investment Bank Limited’s office located at Caves Corporate Centre, Building A 1st Floor, West Bay Street and Blake Road, Nassau, Bahamas

PAGE 6, Tuesday, April 25, 2023 THE TRIBUNE

PAGE B1

FROM

the Shareholder of Santander Investment Bank Limited Report on the audit of the financial information

opinion In our opinion, the financial information of Santander Investment Bank Limited (the Bank) as at December 31, 2022, is prepared, in all material respects, in

Note 1 to the financial information.

we have audited The Bank’s financial information comprises: ● the statement of financial position of the Bank as at December 31, 2022.

for opinion

Our

accordance with the basis of preparation as set out in

What

Basis

financial

We are independent of the Bank in accordance with International

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditors’ responsibilities for the audit of the

information section of our report. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Independence

Accountants Nassau, Bahamas April 21, 2023

Chartered

Financial Position

at December 31, 2022 (Expressed in thousands of Euros) 2022 2021 € € ASSETS Cash and due from banks Demand – Group 940 2,524 Time – Group 41,029 117,958 Total cash and due from banks 41,969 120,482 Loans – Group - 375,616 Prepaid expenses 50 33 Intangible assets - 1 Investment in group entities 430,320 98,333 Right-of-use asset 155 164 Other assets 272 133 Total Assets 472,766 594,762 LIABILITIES Due to group entities - demand deposits - 2,100 Accrued expenses 450 398 Total Liabilities 450 2,498 EQUITY Share capital Authorized, issued and fully paid: 10,000 ordinary shares of €757.92 each 7,579 7,579 Additional contributed capital 303,105 613,105 Other reserves 185,471Reserve for foreign currency translation (2,141) (2,141) Accumulated deficit (21,698) (26,279) Total Equity 472,316 592,264 Total Liabilities and Equity 472,766 594,762

Statement of

As

Bahamas

2022 2021 € € ASSETS Cash and due from banks Demand – Group 940 2,524 Time – Group 41,029 117,958 Total cash and due from banks 41,969 120,482 Loans – Group - 375,616 Prepaid expenses 50 33 Intangible assets - 1 Investment in group entities 430,320 98,333 Right-of-use asset 155 164 Other assets 272 133 Total Assets 472,766 594,762 LIABILITIES Due to group entities - demand deposits - 2,100 Accrued expenses 450 398 Total Liabilities 450 2,498 EQUITY Share capital Authorized, issued and

paid: 10,000 ordinary shares of €757.92 each 7,579 7,579 Additional contributed capital 303,105 613,105 Other reserves 185,471Reserve for foreign currency translation (2,141) (2,141) Accumulated deficit (21,698) (26,279) Total Equity 472,316 592,264 Total Liabilities and Equity 472,766 594,762

fully

Director Director

Caribbean

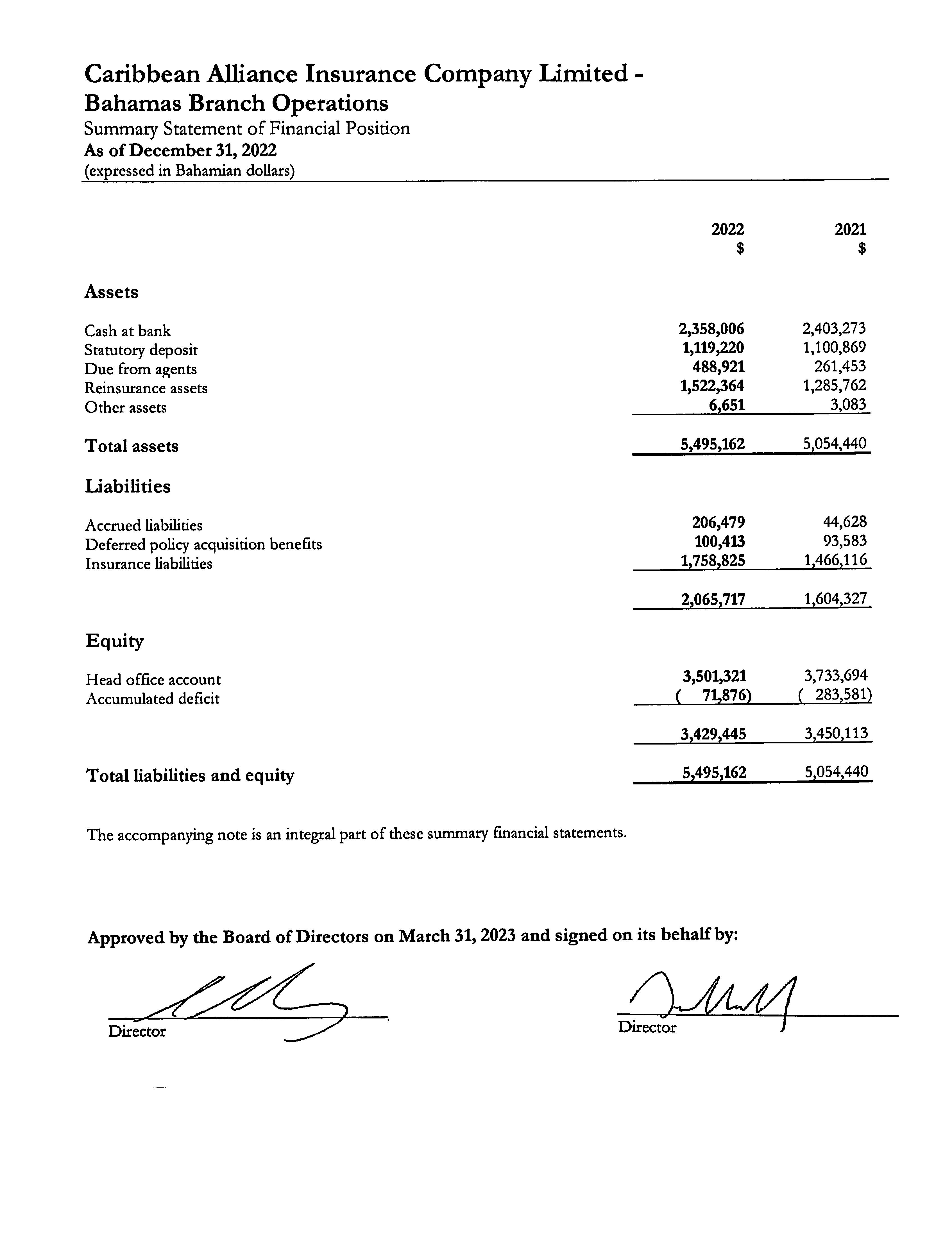

The accompanying note is an integral part of these summary financial statements

Caribbean Alliance Insurance Company Limited

Bahamas Operations

Notes to Summary Financial Statements

December 31, 2022

(expressed in Bahamian dollars)

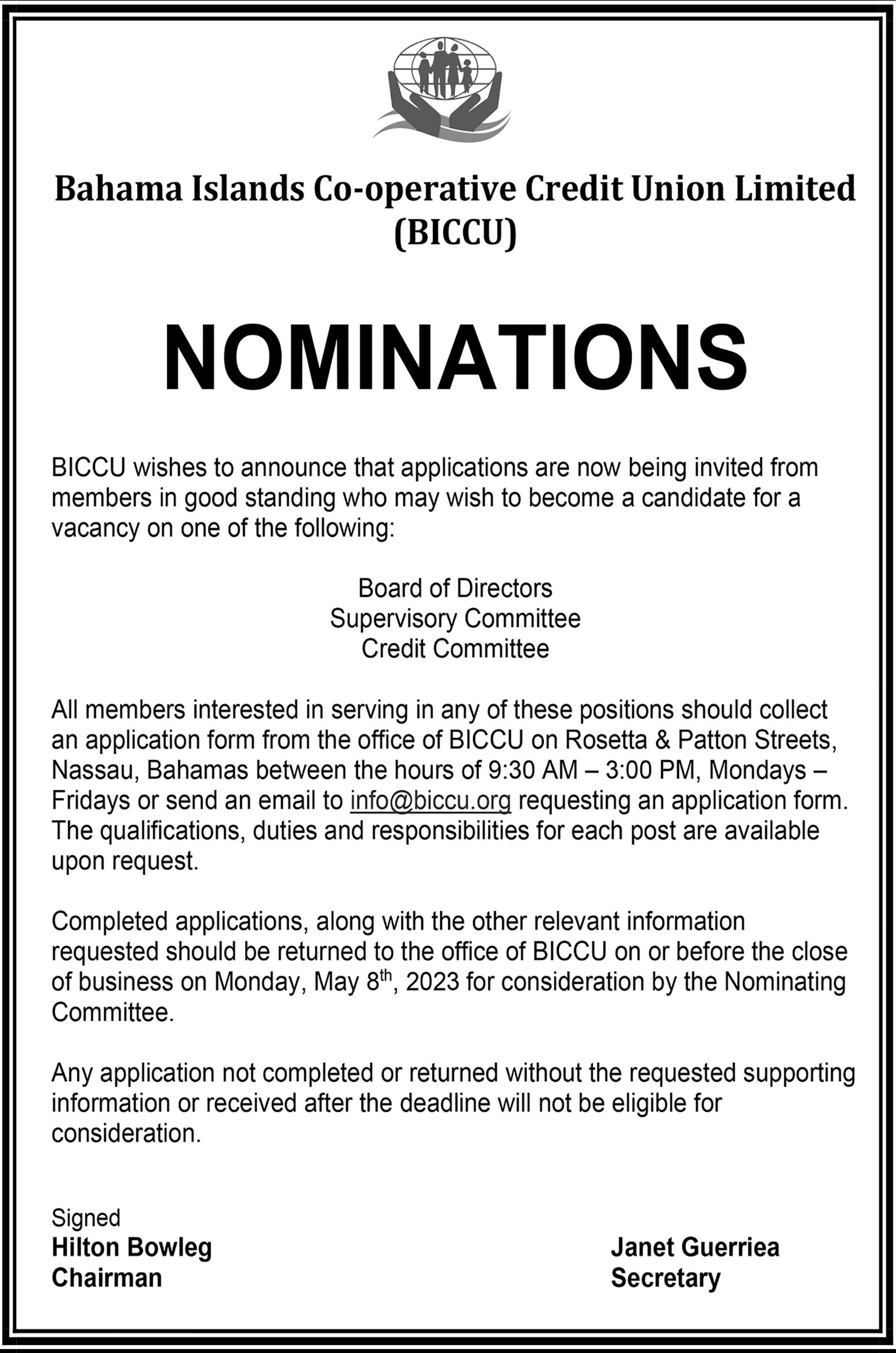

1 General information and nature of operations

Caribbean Alliance Insurance Company Limited was incorporated on August 10, 1988, under the laws of Antigua and Barbuda and commenced business on January 1, 1989. The registered office is located on the corner of Newgate and Cross Streets, St. John’s, Antigua, West Indies.

On August 28, 2014, the Company was registered as a foreign company in the Commonwealth of The Bahamas. The Insurance Commission of The Bahamas granted the Company its insurance license on December 14, 2014 and business in the territory commenced during the second quarter of 2015.

The principal activity of Caribbean Alliance Insurance Company Limited (“the Company) is the carrying on of general insurance business.

Basis of preparation

These summary financial statements are derived from the audited financial statements of Caribbean Alliance Insurance Company Limited – Bahamas Branch Operations for the year ended December 31, 2022

PAGE 10, Tuesday, April 25, 2023 THE TRIBUNE Caribbean Alliance Insurance Company LimitedBahamas Branch Operations Summary Statement of Comprehensive Income For the year ended December 31, 2022 (expressed in Bahamian dollars) 2022 $ 2021 $ Premium income Insurance premium revenue 3,553,495 2,900,647 Insurance premium ceded to reinsurers (3,312,040) (2,730,995) Net insurance premiums revenue 241,455 169,652 Change in unearned premiums ( 57,490) ( 114,166) Net premium income 183,965 55,486 Insurance benefits and claims Insurance claims and loss adjustment expenses ( 167,128) 257,927 Insurance claims and loss adjustment expenses recovered 149,722 ( 286,195) from reinsurers Change in IBNR Provision ( 2,946) Net insurance benefits and claims ( 20,352) ( 28,268) Acquisition income (expense) Commissions on reinsurance premiums ceded 736,909 818,011 Commission expense for the acquisition of insurance contracts ( 532 649) ( 426,595) Net acquisition income for insurance contracts 204,260 391,416 Gross underwriting income 367 873 418,634 General and administrative expenses ( 174 519) ( 171,569) Net underwriting income 193,354 247,065 Finance income Interest income 18,351 5,212 Total comprehensive income for the year 211,705 252,277 The accompanying note is an integral part of these summary financial statements Caribbean Alliance Insurance Company LimitedBahamas Branch Operations Summary Statement of Changes in Equity For the year ended December 31, 2022 (expressed in Bahamian dollars) Head office account $ Accumulated deficit $ Total $ Balance as of December 31, 2020, (restated) 3,053,559 (535,858) 2,517,701 Net advances from Head Office 680,135 680,135 Total comprehensive income for the year 252,277 252,277 Balance as of December 31, 2021 3,733,694 (283,581) 3,450,113 Net advances from Head Office ( 232,373) ( 232,373) Total comprehensive income for the year 211,705 211,705 Balance as of December 31, 2022 3,501,321 ( 71,876) 3,429,445

accompanying note is an integral part of these summary financial statements

The

Alliance Insurance

Bahamas Branch Operations Summary Statement of Cash Flows For the year ended December 31, 2022 (expressed in Bahamian dollars) 2022 $ 2021 $ Cash flows from operating activities Net underwriting income 193,354 247,065 Adjustment for non-cash item: Interest received on statutory deposit 2,864 11,213 Operating income before changes in operating assets and liabilities 196,218 258,278 Changes in operating assets and liabilities: Increase in other assets and receivables ( 3,568) Increase in statutory deposit ( 2,864) ( 11,257) Increase in due from agents ( 227,468) ( 90,218) Increase in reinsurance assets ( 236,602) ( 192,800) Increase in accrued liabilities 161,851 14,918 Increase in deferred policy acquisition benefits 6,830 45,901 Increase in insurance liabilities 292,709 235,588 Net cash from operating activities 187,106 260,410 Cash flows (used in) from financing activities Advances from head office ( 232,373) 680,135 Net (decrease)/increase in cash at bank ( 45,267) 940,545 Cash at bank, beginning of the year 2,403,273 1,462,728 Cash at bank, end of the year 2,358,006 2,403,273

Company Limited -

Share

news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

your

By NEIL HARTNELL and YOURI KEMP

Tribune Business Reporters

By NEIL HARTNELL and YOURI KEMP

Tribune Business Reporters