Aquapure ‘dam bursts’ over price increases

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN bottled water supplier yesterday said it had been forced to implement its first product-wide price increase for 15 years as “a last resort” with costs having increased “no less than 30 percent” since COVID hit.

Christian Knowles, Aquapure’s senior manager, told Tribune Business the manufacturer had resisted passing greater raw material and other expenses on to consumers for as long as possible but “sometimes the dam bursts and you really have no choice”.

Branding some of the higher increases as “insane”, but typical of the post-pandemic norm most Bahamian companies find themselves operating in, he voiced optimism that Aquapure had “got it right” and struck the necessary balance between not over-burdening consumers while ensuring it earns enough income to survive and remain viable.

Declining to provide specifics on the increases, which will take effect on May 1, Mr Knowles told this newspaper they should be sufficiently “minimal” - ranging from 25 cents on some product lines to 50 cents, with others “not touched” - not to have a major impact on Bahamian families still struggling to make ends meet amid the ongoing cost of living crisis as water is something they cannot go without.

“I’m an optimist. I don’t like to be negative, and I was hoping things

PI entrepreneur hits back over ‘damn lie’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamian entrepreneur seeking to restore Paradise Island’s lighthouse yesterday blasted that it was “a damn lie” for Royal Caribbean to assert his project will have a higher guest density than its own.

result, he argued that concerns Royal Caribbean’s project will “decimate” Paradise Island’s environment “are not necessarily rooted in consistency”.

would come back down to normal pre-COVID but that’s not what’s happening,” Mr Knowles explained. “Freight has come down quite a bit from the craziness where it was at during COVID, but raw material costs are still very high.”

Suggesting that many suppliers have elected to keep prices high because customers have no choice but to pay them, he added: “I can’t do that to the people of The

SEE PAGE B4

$20m developer seeking ‘wasteful’ restrictions end

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN developer yesterday voiced optimism that the planning authorities will eliminate “wasteful” restrictions to allow his proposed $20m project to proceed and create over 100 construction and full-time jobs combined.

Nick Dean, principal of Integrated Building Services (IBS), told Tribune Business he was “fairly confident” that the Town Planning Committee will use its lawful powers to eradicate restrictive covenants - imposed decades ago by Old Fort Bay’s

developer - that “serve no real purpose” and presently block his proposed 30-unit Azumi community.

The residential project, targeted at a three-acre site in western New Providence that lies between Charlotteville and Old Fort Bay, is aiming to create 50 to 75 jobs during the construction phase and a further 30-40 full and part-time posts through operation of amenities such as a clubhouse, pool and wellness centre.

Speaking to this newspaper before Azumi’s upcoming public consultation with the Town Planning Committee, Mr Dean argued that

SEE PAGE B11

Show not spooked by FTX through DARE-ing reforms

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

REFORMS to The Bahamas’ digital assets regulatory regime must send a “strong message” that this nation remains open to innovation and has not been spooked by FTX’s collapse, an industry entrepreneur urged yesterday.

Kevin Hobbs, chief executive and founder of Aventus Ventures, and a blockchain investor for ten years, told Tribune Business that The Bahamas has “a great chance to attract” more digital assets businesses and activity to its shores provided the Digital Assets and Registered

Exchanges (DARE) Bill 2023 takes a risk-based, firm-by-firm approach to supervision.

Acknowledging that FTX’s implosion had disrupted, and blunted, The Bahamas’ ambitions to establish itself as a digital assets business for the wider region and Western Hemisphere, he added that it was vital the reforms provide “clarity” and clear guidelines for what those firms eyeing this jurisdiction can expect should they domicile here.

Mr Hobbs, who has established “a couple” of digital assets companies in The Bahamas because

Toby Smith, the Paradise Island Lighthouse and Beach Club principal, vehemently rejected assertions by Jay Schneider, the cruise giant’s chief product and innovation officer, that his venture was seeking to accommodate some 1,000 visitors per day on a threeacre Crown Land parcel he has been battling to lease.

Mr Schneider, in an interview with Tribune Business said environmental activists are criticising the $110m Royal Beach Club over plans to bring a daily average of 2,750 passengers to its 17-acre western Paradise Island site yet supporting Mr Smith’s project and its greater guest density. As a

However, Mr Smith said his planned maximum capacity - should the project obtain all the necessary approvals to proceed - was half that asserted by Mr Schneider and Royal Caribbean. He pledged that the beach break destination which will accompany the lighthouse tour will be “low impact, sustainable” and a location that will “show the world what Bahamians can do when afforded the opportunity”.

“It’s a damn lie,” he blasted of the suggestion that Paradise Island Lighthouse and Beach Club is targeting up to 1,000 visitors daily. “I have never once proposed 1,000. It’s always been between 200 and a maximum of 500 people per day. Our target, because we are a low

business@tribunemedia.net THURSDAY, APRIL 27, 2023

SEE PAGE B6

SEE PAGE B10

• Water supplier in first acrossboard rise in 15 years • Held-off for three years but expenses jump by 30% • Says increase ‘minimal’; refuses to ‘cut corners’ $5.74 $5.74 $5.78 $5.71

• Smith refutes RCL’s 1,000 guest per day assertion

MINISTER URGES END TO CONSTRUCTION ‘FRONTING’

By FAY SIMMONS

A CABINET minister yesterday lamented the failure to fully implement legislation to regulate the Bahamian construction

industry as he called for an end to ‘fronting’ arrangements that enable foreign ownership in a sector reserved for locals.

Keith Bell, minister of labour and Immigration, told a

Bahamian Contractors Association (BCA) meeting that with the Construction Contractors Act yet to take effect - and the Board responsible for selfregulating the industry still not set up - there was

no private sector body the Government can turn to for advice on whether work permit applications should be approved. He suggested that the four construction industry groups form a body that

Immigration officials can consult prior to issuing labour certificates and work permits. “It goes back to the legislation, introducing the legislation,” Mr Bell said. “In a similar way, before we could bring in somebody in the medical field into the country, before I could grant a work permit we consult with the Medical Association.

“Before we bring someone in in the accounting field, we consult with the accountants to bring them in. And, in much the same way, before we deal with construction we need someone for all of these specialised areas. We need a body that we are able to go to.”

“So I think until we get the legislation to formalise this, and then we can say this is the entity which will be responsible for collaborating with the Ministry of Labour and the Department of Immigration, we are still at this point. If all of the contractor associations are able to work together and form an executive arm of the associations, we can collaborate with those persons before we issue permits or certificates. I’m prepared to work with that.”

Mr Bell said that, when formed, the Construction Contractors Board would be included in negotiations with multi-million dollar foreign direct investment (FDI) projects to ensure local contractors benefit significantly from them. “I sit on the NEC. That is the National Economic Council, and that is the Council which approves all of these developments that you see going on,” he added.

“And each time we sit on that committee, we have to look at the Heads of Agreement. And, more and more, we are questioning what role can specific industries play as we continue to develop these major projects? So, for instance, on the Family Islands there

are several major, multibillion dollar projects that are going on.

“And when we look at what it is they are asking for, we know that there are construction industries that can do the work. And what we need now is the expertise from a Contractors Association Board to say that when we look at these Heads of Agreement, this is what we need to incorporate in the Heads of Agreement so that it has the teeth that it needs, and that’s what we can hold the foreign developers and foreign investors to,” Mr Bell continued.

“And when we sit down at the table, if we are able to get the input of the Contractors Association, and are able to put that into Heads of Agreement, that means that even if a percentage of that goes to the association itself, it means that yours can be an entity which can help us - not necessarily just with the construction industry, but with scholarships, building our schools, building our airports, infrastructure upgrade. In that Heads of Agreement, we would have included you. So that’s coming.”

Mr Bell warned contractors that many of their current hiring practices for expatriate employees do not align with Immigration laws. As an example, he said the tendency to advertise jobs at a higher wage rate on the foreign market than in The Bahamas will not be tolerated.

“Over the past months, the Department of Labour has increased the number of investigations and special operations to address undocumented and improperly documented migrants in The Bahamas. Following these actions, it is clear that there are significant challenges within the construction industry as many practices do not align with

PAGE 2, Thursday, April 27, 2023 THE TRIBUNE

jsimmons@tribunemedia.net SEE PAGE B12

CONTRACTORS WARNED ON WORK PERMIT VIOLATIONS

A CABINET minister yesterday hinted the authorities will soon target Bahamian employers who employ illegal migrants as he urged contractors to ensure their work permit holders comply with the law.

Keith Bell, minister of labour and Immigration, reiterated his previous warning for contractors and other employers to “get your house in order” over the hiring of expatriate labour when he spoke at the Bahamian Contractors Association’s (BCA) monthly meeting.

Revealing that the Department of Labour approved Bahamian construction companies to hire 102 expatriates for senior posts, and another 175 in skilled worker positions, over the past 12 months, he implored contractors to ensure these hires adhere to the terms and scope of their work permits.

“Contractors would be aware that they must take responsibility for their construction sites and all of the labour hired on their sites,” Mr Bell said. His comments came two weeks after his House of Assembly address, in which the minister said an Immigration raid on construction sites in an unnamed eastern New Providence gated community revealed that all 56 expatriate workers rounded-up were working outside the conditions specified in their work permits.

Persons brought in to The Bahamas as ‘farm labourers’ were found to be working as skilled construction tradespersons. Such a ruse, Mr Bell said, meant their employers or sponsors were paying a much lower work permit fee than was actually due to the Department of Immigration as ‘farm labourers’ attract a lower levy. He also disclosed that the Immigration Department has found expatriates working for a different employer than the one which sponsored their permit.

Acknowledging that such practices and “loopholes” have often been ignored in the past, Mr Bell said the Government will now begin to fully enforce the law. Noting that he has a “specific mandate to enforce our Immigration laws and policies”, the minister added: “This mandate required that many practices which have been historically ignored be enforced, and the many loopholes which have existed over decades be closed.

“Immigration has not necessarily been enforcing the law with any vigour, quite frankly, against employers and Bahamians who hire illegal immigrants. We have really been going after the illegal immigrants or the irregular migrants. We’ve been putting them before the court for the most part, and repatriating them and putting them on the stop list.

“But we’ve really not been going after the employers and the Bahamians who are doing this. But we’re going to have to get this thing right. And as I warned everybody, the laws have to be enforced. We have to continue to ensure that we protect our laws and that, as Bahamians, we are always on the right side of the law.”

Mr Bell said the Government will continue to grant work permits where firms are not able to find a suitably qualified Bahamian who is available and willing to do the job. He added: “A review of the records of the Department of Labour for the period April 2022

to April 202 confirms that 102 approvals were issued for non-Bahamians to fill vacancies in the construction industry at the senior operational levels.

“Additionally, 175 labour certificates were issued to employ non-Bahamians in non-managerial disciplines including air conditioning technicians, joinery technicians, skilled carpenters and marble tile layers. The Government of The Bahamas recognises that, from time to time, foreign labour is required to supplement local labour in order to complete construction projects.

“Our existing framework recognises this and allows for work permits to be issued on a short or long-term basis where an employer can demonstrate they have not been able to find a suitably-qualified Bahamian national for the job. This has been the policy of successive Bahamian governments, and for this administration it is a red line issue which will not be changed.”

Mr Bell said the Department of Immigration has approved more than 15,00 work permits over the past year, with many granted for farm labourer posts. “The Immigration Department issues in excess of 15,000 work permits per year in this country, the majority of which are for farm labourers,” he added.

“Farm labourers should not be on construction sites. Contractors know that a construction site is not a farm, and a building contractor is not a farmer. Persons who have been issued permits to work on farms, found working on construction sites, are liable for deportation.

“I believe it is important to specifically warn you, as contractors who employ persons on work permits, get your house in order. The law is clear on what is required. If you are unsure, you can call or visit the Department of Immigration or check the website.”

Mr Bell said that besides a valid work permit, expatriates must be employed

at the company that applied and paid for the permit. They can only work within the duties stipulated by the permit.

“Under our laws it is not sufficient to say that the person ‘has a permit’. That is not what the law says. The person must have a valid work permit. The person must be employed for the person named on their work permit, and work being done by the person must be the same work as described

in their permit,” Mr Bell said “It is not sufficient for a worker on a site to produce a permit and say ‘they legal’. Where a person is found working independently, or for another person not named on the permit, the permit may be cancelled. Where persons are found working outside the job they obtained the permit for, the permit may be cancelled. However, in

any event the correct fee must be paid.

“The construction industry is a significant economic driver, job creator and the industry which arguably has significant documented and improperly documented foreign labourers. Contractors would, or should, be aware that all persons in their employment must have legal status in The Bahamas which allows them to work for their employer.”

THE TRIBUNE Thursday, April 27, 2023, PAGE 3

By FAY SIMMONS jsimmons@tribunemedia.net

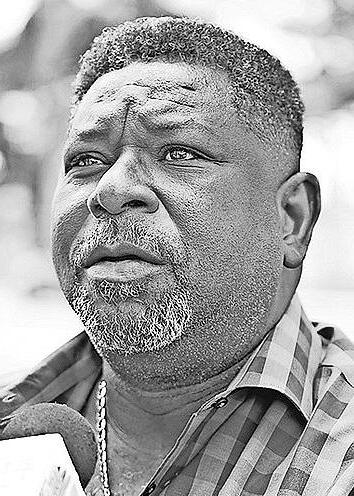

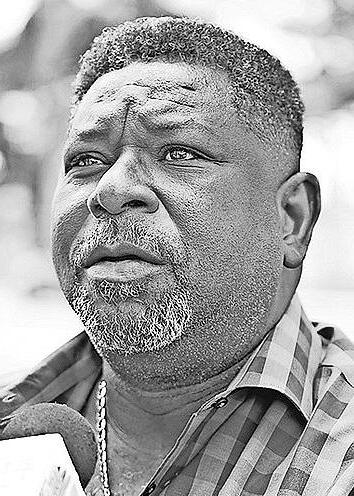

KEITH BELL

AQUAPURE ‘DAM BURSTS’ OVER PRICE INCREASES

Bahamas. Ethically, I cannot do that. We really haven’t raised our prices in ten years maybe. This is the first major price increase that we’ve done since I became part of the company and that’s about 15 years ago.

“We tried our best [to hold off]. We went through the whole SKU (stockkeeping unit) line to reassess everything. We did an accounting exercise to see what the impacts were, and put a lot of time and effort into making sure we did the absolute necessary amount as well. It’s really not something you do every day. We wanted to get it right, and hopefully we did without putting too much on the customer while helping us a little bit.”

Aquapure’s three-year effort to hold back the tide, caused by a multitude of

cost increases happening at the same time, highlights the pressures many Bahamian manufacturers and other companies are under as their expense base continues to expand post-COVID.

The bottled water supplier, in a message to its customers, said: “It is with sincere regret that we must announce that we will be implementing a small price increase on all of our products. Although many of our suppliers have already raised the price of their services to us, over the last three years we have resisted raising our prices in an effort to minimise the burden on you, our valued customers.

“As a manufacturer’s costs increase, there comes a point when they have only two choices in order to stay viable - cut corners, or increase prices to cover the additional expenses. Rest

assured, we value our quality and your trust far too much to even think about cutting corners. Hence we have no choice but to implement this small price increase.”

Mr Knowles said Aquapure was able to mitigate some of its cost pressures through being a verticallyintegrated manufacturer that produces its own bottles. However, it can do little about volatile raw materials prices determined by global commodities markets, with resin and paper costs especially vulnerable.

He added that the company’s “hedge” against such volatility is its relationship with multiple suppliers of the same materials, which it uses as “leverage” in negotiations to obtain the best possible price. And, while freight rates have “come down quite significantly from the several hundred percent” they increased

by during COVID and the subsequent supply chain disruption, Aquapure has piggybacked off its large suppliers who are able to obtain better shipping rates than it could itself.

“There’s some things we can do but it’s unfortunate,” Mr Knowles said. “There’s a position in economics when the market has absorbed the price changes without any other actions. If people for a prolonged period of time pay the increased costs it’s business to keep prices where they are. I think we’re seeing a lot of that now. People have adapted to the new economy and are reacting to the new rules.

“Certainly we’ve never done a price increase like this since I’ve been involved here. We might have increased our fivegallon rates once in 10-15 years and that’s not a big deal.” Asked how much

Aquapure’s costs have risen over the past three years, Mr Knowles replied: “I would say, straight across the board, our costs have increased no less than 30 percent and probably a bit more on average. At the high end, it’s been insane.

“You can only kick the can down the road for so long. You can decide when it comes, but it’s a last resort. This was our last resort. We didn’t take this lightly and want to make sure people can afford something like water. We’ve made the decision and have to stick with it at this point.

I’m hoping we got it right. I’d hate to have to come back to it.”

Aquapure has also seen its fixed costs rise since 2023’s start as Bahamas Power & Light’s (BPL) rolling series of fuel charge hikes kick-in to recover some $90m in unpaid fuel bills owed to Shell. Mr Knowles said the company’s labour expenses have also increased due to the 24 percent minimum wage rise that took effect on January 1, 2023, as it employs “a lot

of manual labour” at that pay scale.

“Those things went up. We have to figure out ways to do things a little more efficiently and save money where we can, which will come from efficiencies in the plant, negotiating harder on raw materials,” Mr Knowles said. “That’s the way of the world right now. It has affected our cash flow quite a bit and we can see that. Our two highest costs are human capital and utilities, and both have gone up. We have to adapt to the times and we’re in a good position to do that.”

Noting that Aquapure, like The Bahamas itself, is celebrating its 50th birthday this year, he added: “If we did the same things we did 50 years ago it would not make sense. That’s a testament to us having been around for 50 years. We have to adapt to change and the times. Hopefully the new normal settles and forces people to be more efficient and less wasteful; less wasteful with time and money.”

PAGE 4, Thursday, April 27, 2023 THE TRIBUNE

FROM PAGE B1

PORT AUTHORITY ‘GAME IN TOWN’ FOR FREEPORT

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Grand Bahama Port Authority (GBPA) remains “the game in town” for all investors seeking to do business in Freeport, the island’s Chamber of Commerce president said yesterday.

James Carey, speaking to the continued uncertainty over whether the Government might force the Hayward and St George families to sell, or even buy Freeport’s quasi-governmental authority itself, argued that investors are likely to be swayed either way by what happens with the GBPA’s ownership.

“The GBPA is the game in town. It is the persons they go to. They are the pivotal point and I don’t think that persons who are not familiar with the set up in Grand Bahama will have an opinion either way because they just don’t know how it operates,” the Grand Bahama Chamber of Commerce president said.

Speaking about his and the Grand Bahama Chamber’s recent attendance

at a major cruise industry conference, SeaTrade Cruise Global (STCG), where they teamed with the GBPA, Mr Carey said the event was an “opportunity” for Grand Bahama to showcase what it has to offer.

“There was an opportunity to speak with a number of persons who showed some interest in what we have to offer and, hopefully, it will result in some visitors. Some persons who may seek to do business there. So it was really promoting Freeport and our island,” he added.

The “best outcome” from such conferences is that they enable Grand Bahama businesses to meet potential investors, as well as organise and facilitate faceto-face meetings and future visits to the island.

Mr Carey said he remains optimistic that investors will scope out Freeport and be “enticed” by what they see, sparking more interest in the island. “I hope they look at the possibilities and, if nothing else, look at Grand Bahama as a vacation spot. That all adds to what we’re trying to do,” he said.

The GB Chamber is about to conduct a survey of the island’s business

WATER CORP AGREES

$3M INDUSTRIAL DEAL

climate now there is a “bit more activity” postCOVID amid hopes this will pave the way for more economic development.

“There is nothing else happening on the island,” Mr Carey added. “We are just waiting on the sale of the Grand Lucayan, and still waiting on the big announcement on the airport. But the other projects that have been published over the last couple of months, we’re still waiting on them to kick in and make a difference.”

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Government has signed a $3m industrial agreement with the trade union representing the Water & Sewerage Corporation’s line staff that includes four set salary increases over the next three years.

Dwayne Woods, the Bahamas Utilities Services and Allied Workers Union (BUSAWU) president, said the first salary increase for his members at the Water and Sewerage Corporation

(WSC) will be a double increment made retroactive and payable on July 1, 2022, for people employed as at July 1, 2020. There will be a single increment added to their salary on July 1 this year, and a third increment payable on July 1, 2024. “We had to give in order to receive,” Mr Woods said. “A person having their hands balled up can’t possibly receive anything. So by all means the union would have given up one or two things to make the burden a little easier on management to be able to afford such a contract.

DWAYNE WOODS

DWAYNE WOODS

“One thing we would have given up right away was that, based on our insurance premium that the WSC would pay for our employees, new employees coming in as of February 2023 would have to contribute to 30 percent of their insurance premium. That

SEE PAGE B7

THE TRIBUNE Thursday, April 27, 2023, PAGE 5

LOCATION : HUMES BAY, GOVERNORS HARBOUR, ELEUTHERA. OCEANVIEW 100 X 70 / 80 X 70 SERIOUS ENQUIRES ONLY PH# 1(242) 525-2056 PROPERTY FOR SALE

PI entrepreneur hits back over ‘damn lie’

impact, sustainable operation is not mass tourism but where Bahamians will be put first. In due course, we will be providing more details as to how we shall be putting Bahamians first.”

Pointing to the Environmental Impact Assessment (EIA) for the Royal Beach Club, Mr Smith said it showed that the only

“inconsistent” party was Royal Caribbean. For while the EIA’s section 4.2 said the facility was being built for 8,719 guests, the “maximum capacity” was set at 3,750 - 3,500 guests and 250 workers. Mr Schneider said the daily average, spread across 365 days per year, will be between 2,500 and 2,750 visitors.

“Royal Caribbean initially presented the

proposed Beach Club for a capacity of 3,500 passengers. In the fine print of their EIA point 4.2, they are building it to a capacity of 8,719 passengers. Royal Caribbean’s [Michael] Bayley then claimed this year they are building it to only 1,000 passengers, and now last week saying 2,500 to 3,000 and presenting an average of 2,750. So if Jay Schneider is looking for

inconsistency, he need not look beyond him and his boss,” Mr Smith added.

“I have affirmed my position to the Davis administration, and look forward to an approval. It will be for the benefit of all Bahamians, and now that we have rolled out Royal Caribbean from encroaching on our location we are confident that the Prime Minister and his Cabinet will follow through on the previous administration’s Cabinet conclusion so we can show the world what Bahamians can do when afforded the opportunity.”

Royal Caribbean has reduced the Crown Land requirements for its Paradise Island project by 43 percent, reducing its needs from the original seven acres to just four. This is part of a strategy to extricate the cruise line from conflict with Mr Smith, as both sides were competing to lease the same two-acre parcel for their respective projects after it was seemingly ‘double dealt’ to each of them by the former Minnis administration.

This, in theory, has created a pathway for both projects to proceed and co-exist side-by-side as neighbours - if they can obtain all the necessary approvals. For while Royal Caribbean still needs to obtain the Certificate of Environmental Clearance (CEC) and construction permits, Mr Smith has been told by the Davis

CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

administration to reapply for his permits. That came after the Supreme Court, via chief justice Sir Ian Winder, ruled that Mr Smith did not have a valid and binding Crown Land lease for the two separate parcels that comprise his five acres. However, the Bahamian entrepreneur yesterday challenged whether the Government and Royal Caribbean should have been negotiating a reduction of the latter’s Crown Land footprint when at least part of the land involved was the subject of his Supreme Court battle.

“Royal Caribbean, in their statement, confirmed they have been negotiating with this new administration since they took office on land that was in litigation,” Mr Smith added. “We will be seeking the court’s assistance for clarity as to possible contempt of court for negotiating land in litigation. This land has been in litigation since before Minnis was voted out.”

Calling on Royal Caribbean to publicly confirm whether the disputed twoacre parcel is still included in its present Crown Land lease for Paradise Island, the Bahamian entrepreneur also queried whether that document will have to be revised or a new one drawn up to reflect the fact that the cruise line’s demands have been reduced from seven acres to four.

“We believe that the Government of The Bahamas is in a great position to allow Paradise Island Lighthouse and Beach Club to get on with it. We are a country of beaches, and we don’t need royalty distracting us from

COMMONWEALTH OF THE BAHAMAS 2022/PRO/npr/00927 PROBATE DIVISION

NOTICE

how a Bahamian beach club should be run,” Mr Smith added.

“Every single environmental group in The Bahamas have provided written support for the Paradise Island Lighthouse and Beach Club project because we have gone about it in the right way and involved the environmentalists since inception. My letters go back as far as 2015.

“The environmentalists being up in arms about Royal Caribbean is because they are coming into our country as if they are royalty in attempting to divide and conquer Bahamians for the chance to export millions of dollars out of The Bahamas for the benefit of foreign shareholders, not Bahamians.”

Royal Caribbean, though, has for the Royal Beach Club negotiated a PPP, or public-private partnership (PPP) model, which has been hailed as a firstof-its-kind for the tourism industry. This will see the Government exchange the four Crown Land acres that Royal Caribbean requires for an equity stake in the project.

Bahamian investors will also be able to buy into the development via an investment fund and, together with the Government, the two will collectively own a 49 percent stake in the venture. There will also be greater participation by Bahamian entrepreneurs, who will own and operate the amenities at the Royal Beach Club, plus increased job opportunities.

IN THE ESTATE OF LINDA LOUISE MARSHALL, a.k.a LINDA L. MCPHEE of Emerald Ridge Subdivision, in the Eastern District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas

Notice is hereby given that all persons having any claim or demand against the above estate are required to send the same duly certified in writing to the undersigned on or before the 29th day of May A.D., 2023 after which date the Executor will proceed to distribute the assets after having regard only to claims of which they shall then have had notice.

And Notice is hereby also given that all persons indebted to the said estate are requested to make full settlement on or before the date hereinbefore mentioned.

BOWLEG MCKENZIE ASSOCIATES

CHAMBERS

Attorneys for the Administrator #67 RowClem House Marathon Road. Marathon Estates, Nassau, The Bahamas

PAGE 6, Thursday, April 27, 2023 THE TRIBUNE

FROM PAGE B1

‘DIFFICULT TO COMPETE WITH FREE’ ON CUSTOMS SOFTWARE SOLUTION

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN software developer yesterday said it is “difficult to compete with free” after the Customs Department provided small brokers with a similar product that can integrate with its electronic goods clearance system at no cost.

Clyde Symonette, Information Specialists Ltd’s (ISL) managing director, told Tribune Business that his Single Window Management (SWIM) software is “superior” to any rival and was offered to Bahamian Customs brokers prior to the Government-imposed mandate that they digitally connect to its Electronic Single Window (ESW), or Click2Clear, system.

Mr Symonette said: “We have developed a package

that, given the set of circumstances that were being enforced, we had a solution to the problem that arose. We had that solution before the problem arose and we still have that solution.”

Customs, though, is now providing the necessary software solution for free to small brokers who Asked if this had cost him business opportunities, Mr Symonette replied: “That was never our concern. That was always a Ministry of Finance initiative, and was never our initiative. It doesn’t matter to me. The integration system that they had given out, they said that they would produce a free version, and that’s what they said they would do and that has nothing to do with me.

“We continue to get customers coming in, but it has tapered off a bit. But no matter how good the system is, nothing is better

Water Corp agrees $3m industrial deal

FROM PAGE B5

order to sustain itself going forward.”

NOTICE

In the Estate of CALEB EUGENE PEDICAN late of the Settlement of Bluff in the Island of Eleuthera one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE IS HEREBY GIVEN that all persons having any claim against the above named Estate are required on or before the 12th day of May, 2023 to send their names and addresses and particulars of their debts or claims to the undersigned and if so required by notice in writing from the undersigned to come in and prove such debts and claims or in default thereof they will be excluded from the benefits of any distributions made before such debts are proved AND all persons indebted to the said Estate are asked to pay their respective debts to the undersigned.

HAILSHAMS LEGAL ASSOCIATES

Counsel and Attorneys at Law

RENALDO HOUSE 10 Queen’s Highway Palmetto Point, Eleuthera, Bahamas

P. O. Box SS 5062, Nassau, Bahamas

Attorneys for the Administrator of the above Estate Tel: 242-332-0470

email: hailshams@1stcounsel.com

than free. No matter how much time it saves you, the genuine logic is, not only in The Bahamas but across the world, nothing isn’t free. So it’s difficult compete with free.”

Mr Woods added: “Previously, in our last contract, we would have given up a few sick days and accrued vacation days that we would benefit from going forward after retirement. So we gave up accrued vacation. That was an eating sore of the WSC as far as it being a

burden. Now we look forward to maybe going from here, but the costs even spoke to the WSC.”

The new industrial agreement signed yesterday expires on June 30, 2025. The last such BUSWAU contract expired in 2018.

Alfred Sears, minister for works and utilities, said that, notwithstanding the increments for WSC

employees, the Government is not considering any increase in water tariff rates to cover the extra costs. “I know the WSC is currently finalising a business plan, which will be provided to us and considered by the Cabinet. But I can say definitively at this point that no decision with respect to tariffs increases has been made,” Mr Sears said.

THE TRIBUNE Thursday, April 27, 2023, PAGE 7

Show not spooked by FTX through DARE-ing reforms

of “the strides” made with the existing DARE Act, told this newspaper he was personally aware of six Canadian digital assets players who had started the process of obtaining approval to operate in this nation but had placed this on hold because they were “a little bit shaken and scared” as to what the regulatory reforms might bring.

But, while not having studied the newly-released DARE Bill 2023 Bill in detail, he backed the Securities Commission’s moves to increase the reserves

requirement for digital assets exchanges and ban algorithmic stable coins such as Terra Luna given the problems that were exposed by 2022’s so-called ‘crypto winter’.

“It’s extremely important that they update it and kind of move with the global trends but not be too restrictive because if they’re too restrictive they’re going to lose the potential business looking to domicile and wanting to come to The Bahamas,” Mr Hobbs said. “They had a bad experience with FTX, but you don’t want to be too restrictive with other

crypto companies because of that.”

While the DARE Act reforms need to protect investors, clients and operators, he added that this has to be balanced with not penalising innovative companies because of what occurred with FTX.

“You want to look at businesses individually,” Mr Hobbs said, calling on The Bahamas to avoid the enforcement-led approach preferred by the US.

“As long as The Bahamas doesn’t go the way the US is going, and takes a more individual approach to regulation, a more innovative

approach to regulation, I think The Bahamas has a great chance to attract a lot of companies,” he told Tribune Business.

“Right now a lot of companies want to come to The Bahamas but they’re a little bit shaken and scared by the new regulations. I hope they do not regulate by enforcement. Hopefully they’ll take an open-handed approach that does not stifle innovation. I just know of those six [companies] because I’m familiar with them personally.

“They’ve started the process but kind of put it on hold until they get some clarity on is it going to be worthwhile. Are companies that are going to come here going to get clear guidelines on what they can and cannot do to run their business? That’s the biggest thing in crypto. People need clear guidelines; they can do this, they can’t do that.”

Mr Hobbs said banning algorithmic stable coins such as Terra Luna was the correct move given the fragility of the digital assets business, as he branded the product “too dangerous” and “a house of cards”. He added of the Securities Commission: “I like the approach they’re taking with it so far as long as they still have an approach where they look at each individual business, assess the potential and potential risk that has for The Bahamas.

“I think they can still come out with a real strong message that can attract talent to The Bahamas. I have numerous potential investors waiting to see what is going on before they invest in The Bahamas. As long as it’s not a warning message: ‘Don’t come here to try that’. The Bahamas had really good results in 2021 and early 2022. Unfortunately FTX started unravelling that for a bit.

“But people are not moving away from The Bahamas. They still are

waiting to see what The Bahamas is going to do, what the message is going to be and, if the message is clear and positive, they will start the process all over again.”

The Securities Commission, in outlining the major reforms contained in the DARE Bill 2023, listed the operation of digital assets exchanges as one area that will be strengthened, and referred to “lessons learned” from last year’s socalled ‘crypto winter’, but studiously avoided any link to FTX.

Nevertheless, given the fast-paced evolution of the digital assets industry, the Securities Commission has constantly acknowledged that the DARE Act 2020 - the centrepiece of its regulatory regime - must be upgraded. It is hoping that Parliament will pass the Bill into law by the end of the 2023 second quarter, which is just two months away at end-June.

“In light of lessons learned during the so called ‘crypto winter’ of 2022, the Commission identified aspects of the DARE Act that require further consideration,” it told industry stakeholders.

“In April 2022, the Commission began consolidating its ongoing review of DARE for the purposes of addressing any legislative gaps, ambiguities and procedural concerns within the legislation.” The international law firm, Hogan Lovells, was hired to draft the new Bill, and the Securities Commission promised: “The DARE Bill 2023 will establish new regulatory frameworks to ensure the Bahamian legislative regime is current, proactive and compliant with international standards and best practices.

“The DARE Bill 2023 encompasses a comprehensive range of digital asset activities and establishes appropriate protection mechanisms for the registration and ongoing

supervision of operators that align with prevailing international standards.

“The new DARE Bill represents an even greater focus on consumer and investor protection, robust risk management as well as market development and innovation. Furthermore, the DARE Bill 2023 explicitly addresses staking services in the context of international standards, making it among the first legislation of its kind.” Stablecoins will be regulated for the first time, with the issuance of algorithmic stablecoins prohibited.

“The amendments provide a clear definition for stablecoins, provide for the registration of existing stablecoins, specify acceptable forms of reserve assets and establish new requirements for custody and management, segregation, reporting and redemption of reserve assets,” the regulator added.

As for the issuance of digital assets, the Securities Commission added: “The DARE Act requires that issuers of digital assets in or from within The Bahamas must comply with several obligations aimed at protecting investors, primarily as related to initial token offerings.

“These include fit and proper requirements for the issuer, the requirement to prepare an offering memorandum unless an exemption applies, continuing disclosure obligations and purchasers’ rights to rescission or damages and withdrawal.

“Under the DARE Bill 2023, a voluntary registration regime will be established for persons who issue digital assets from outside of The Bahamas to persons outside of The Bahamas or otherwise not in the scope of the issuer requirements under the DARE Bill 2023. The Commission will keep a register of initial token offerings containing specified information.”

PAGE 10, Thursday, April 27, 2023 THE TRIBUNE

FROM PAGE B1

developer seeking ‘wasteful’ restrictions end

the present restrictive covenants imposed on land his parents bought last century are simply “not sustainable” given the growing shortage of available land and affordable housing on New Providence.

The covenants, imposed by Old Fort Bay Company Ltd in selling the three-acre parcel to his father in 1998, presently limit development to two private residential dwellings of “no more than 3,000 square feet each”.

A qualified engineer with some 30 years’ experience of working on major investment projects such as Baha Mar, Mr Dean is urging the Town Planning Committee to use its authority under the Planning and Subdivision Act’s section 25 and eliminate these obstacles.

Should this plea be successful, Mr Dean said he plans to give Bahamians an opportunity to finance and invest in Azumi via a private placement offering that will take place once all necessary permits and approvals are obtained. Forecasting that construction will take between 24 and 30 months to complete, he predicted that work will likely start in “the second half of next year” to allow for all design, planning and engineering work to be concluded.

“They serve no purpose now,” the Bahamian engineer said of Old Fort Bay’s restrictions. “The market is completely different from what it was 30-40 years ago. The development of two family homes on a threeacre plot is not sustainable. We need to provide more sustainable housing opportunities for people as land shortages will be a real thing in the next 15 to 20 years for New Providence.

“I’m thinking about my daughter. I have a five yearold toddler and don’t know where she’s going to live. It’s going to be a challenge. Finding affordable houses, especially first homes, is very difficult. It’s got to be a healthy mix of multi-family, and single residential options. Not everyone will

be able to buy single family homes. You’ve got to have multi-family.”

Mr Dean, in making his case for the elimination of the restrictive covenants, argued to the Town Planning Committee that communities such as Azumi “should be encouraged, not stifled by outdated restrictions which do not serve the common good. This is especially poignant in the case of communities developed by Bahamians where most of the proceeds will remain in circulation in the Bahamian economy”.

He added of the restrictions: “In addition to being an inefficient and wasteful use of the three-acre property, this is inconsistent with the use of the adjacent developed properties. There are multiple townhome and condominium developments in the immediate vicinity beginning from as close as 600 feet north of the subject property along West Bay Street. “Given the limited availability of developable land and housing opportunities in the area, the restriction only serves to retard the progress of economic development but it severely limits opportunities for other affected property owners by putting them at an unfair disadvantage compared to owners of similar properties in the adjacent communities.

“The restrictive clause on the original conveyance is outdated and in direct contravention with the current Planning and Subdivision Act... This application represents an appeal, in accordance with the Act, for the removal of the current restriction which unfairly restricts the use of the subject property and other affected neighbouring properties.”

Mr Dean also informed Town Planning that the 3.017-acre site, which is presently undeveloped land, will be transformed into a high-end community that complements “the value and calibre” of Charlotteville and Old Fort Bay plus other western New Providence projects.

“Azumi will be a low-density, high-end, multi-family condominium community consisting of approximately 30 units, resulting in a 10-unit per acre density,” he added. “This ten-unit per acre density will result in less than 40 persons per acre, which is well below the 50 person per acre maximum allowable density..

“The residential units will be condos, town homes or a mixture of both. The size of the units will range from 1,600 to 2,000 square feet. The design aesthetic will be Bahamian contemporary with an emphasis on creative landscape architecture to encourage healthy

CALL 502-2394 TO ADVERTISE TODAY!

outdoor lifestyles and community interaction.”

Planned as a gated community, with 24-hour security, a community clubhouse, sports courts and electric vehicle charging station, Town Planning was also informed that there will be two parking spaces per unit together with guest parking. “Passive park space will, at a minimum, meet the 5 percent green space requirement,” Mr Dean wrote.

“The Azumi property is fully owned by Bahamians and will be designed and built by Bahamian companies, thereby ensuring that funds generated remain in circulation in the local economy... During the planning phase, Bahamian contractors will be engaged to construct the site and building aspects of the community.

“It is anticipated that 50 to 75 persons will be employed during the construction of the community. Approximately 30 to 40 persons will be partially or fully employed during the operational phase in areas including property management, Property Owners

Association (POA) maintenance, concierge services, housekeeping, maintenance etc.

“Bahamian service providers will be engaged once the community is operational to provide services such as landscaping, solid waste management and cleaning etc. Given the current economic climate, Azumi and other similar communities which will contribute positively to the local economy should be encouraged.”

Mr Dean, who will be ‘hands on’ and “spearhead” the project, managing a team of Bahamian architects, engineers and other professionals, told Tribune Business: “It’s going to be a $15m-$20m investment. I want to use as much Bahamian input as possible. With a project of this size and complexity, it can be primarily Bahamian on the design side and construction.

“What I also want to do is create investment opportunities for Bahamians. We don’t have many options to invest and turn money over. I want to get Bahamians involved at the earliest

COMMONWEALTH OF THE BAHAMAS 2022/PRO/npr/00820

PROBATE DIVISION

NOTICE

level... I want Bahamian investors, Bahamian professionals and Bahamians taking care of the project.”

Mr Dean said he will work with a “development adviser” to develop Azumi’s economic feasibility plan and structure the capital raise from Bahamian investors, which will be in “the first tier”. He was unable to say what the target raise will be, but added that the remaining “balance” would come from conventional sources such as institutional investors and banks.

Revealing that his family had always planned to develop the three-acre site, and “things just kind of lined” up now from both a financial and engineering/construction expertise perspective, Mr Dean said: “I’m not too ambitious. I don’t want to do anything to large with many moving parts. I want something simple, and am keeping it very low rise, two-storey, simple, clean and serene. It will be a very low density, very low impact and very low energy type of development.”

IN THE ESTATE OF NEVILLE WINSTON GLINTON of Cottonwood Street, Pinewood Gardens, in the Southern District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas

Notice is hereby given that all persons having any claim or demand against the above estate are required to send the same duly certified in writing to the undersigned on or before the 29th day of May A.D., 2023 after which date the Executor will proceed to distribute the assets after having regard only to claims of which they shall then have had notice.

And Notice is hereby also given that all persons indebted to the said estate are requested to make full settlement on or before the date hereinbefore mentioned.

BOWLEG MCKENZIE ASSOCIATES

CHAMBERS

Attorneys for the Administrator #67 RowClem House Marathon Road. Marathon Estates, Nassau, The Bahamas

THE TRIBUNE Thursday, April 27, 2023, PAGE 11

$20m

FROM PAGE B1

MINISTER URGES END TO CONSTRUCTION ‘FRONTING’

FROM PAGE B2

Immigration laws and policies,” Mr Bell said.

“We have increased our review of permits from employers to ensure that the requests are genuine, and reflect genuine efforts to firstly recruit Bahamians on terms which are reflective of our market realities.

Interestingly, we have found several examples where persons have advertised

positions at one salary locally only to hire nonBahamians at a significantly higher salary than the one advertised. Schemes such as this do not conform with the regulations and will not be permitted.”

Mr Bell also warned contractors to avoid so-called fronting arrangements, where they provide the ‘public face’ for businesses that are really owned by foreigners. He called on them to ensure their subcontractors also adhere to Immigration laws and guidelines.

He said: “Contractors would be aware that this sector is reserved for Bahamians. Yet we have

numerous reports of fronting operations where employees are really owners, and have arrangements with Bahamian citizens to submit accurate documents to facilitate approvals.

“This is where contractors must speak up. The system cannot function if we allow persons to corrupt the system by making illegal fronting arrangements. Equally, tourists should not be managing construction firms or projects. If they have no permit they should not be working here.

“It is not acceptable to hire a sub-contractor and fail to determine if your sub-contractor is operating

in compliance with laws.

Additional changes to the laws and regulations may be required to ensure that this loophole is closed.”

Mr Bell also addressed the need for employers to adhere to guidelines on understudies for specialised and skilled positions. He said that, in many cases, persons nominated to understudy a foreign worker are unaware they were identified as such to Immigration officials. He said: “What we’ve also been doing is to ensure that while we approve those [permits] that an understudy is identified. And at all levels, what is so amazing to us is that in a significant majority of the cases, and not just in the construction industry, the person who’s supposed to be the understudy does not know that they are understudying somebody.”

PAGE 12, Thursday, April 27, 2023 THE TRIBUNE

BOEING LOSES $425M IN 1Q BUT PLANS PRODUCTION BOOST FOR MAX

By DAVID KOENIG AP Airlines Writer

BOEING lost $425 million in the first quarter — more than Wall Street expected — but said Wednesday that it plans to boost production of its bestselling plane, the 737 Max, later this year.

Revenue rose 28% from a year earlier, as airlines scooped up new jets to meet rising travel demand, and the company stood by its forecast of producing $3 billion to $5 billion in cash flow this year.

Shares of Boeing rose nearly 5% before settling to close up less than 1%.

CEO David Calhoun called it a "solid first quarter."

"We continue to make real progress, steady progress, in our recovery," he said on a call with analysts.

"Challenges remain, there's more to do, but overall we feel good about the operational and financial outlook."

Boeing's passenger jets have been plagued by production problems, and the quarterly loss was

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

due largely to the cost of reworking planes to fix production flaws. It also took a write-down for a military tanker.

Calhoun said again that Boeing will delay deliveries of some planes that airlines were expecting for the busy summer travel season. The delays are due to unapproved fittings that a contractor, Spirit AeroSystems, installed where the tail meets the fuselage on most 737 Max jets built since 2019.

"It's a gnarly defect,"

Calhoun said when an analyst asked why it took four years to discover the flaw. The CEO said a sealant applied over fuselage joints hid the cracks.

Analysts expressed some skepticism about Boeing's outlook while problems persist in its supply chain.

Seth Seifman of JPMorgan wondered whether Boeing can increase 737 production given issues at Spirit.

"You can only go as fast as they can go, and ... I don't

think anybody has had a more challenging three or four years than Spirit, other than maybe you guys," Seifman told executives.

Calhoun replied that Boeing is confident Spirit can meet a faster schedule.

Officials said it would take a matter of days to fix planes that are not yet assembled but longer for about 225 Max jets that were finished and are now sitting in Boeing's inventory.

Executives didn't put a precise number on how many 737 deliveries will be delayed beyond the peak summer travel season. Calhoun said last week that 9,000 seats would be missing from airline schedules this summer, which works out to about 50 Max jets.

Despite the setback, Boeing still hopes to hit its goal of delivering 400 to 450 Max jets this year. It delivered 111 in the first quarter.

Boeing said it still expects to increase Max production. The company was building

31 a month at the start of this year and plans to raise that to 38 a month later this year and 50 a month by 2025 or 2026.

Boeing repeated earlier assurances that the fuselage issue on the Max does not affect safety and that airlines can keep using planes that are already carrying passengers.

The company also plans to step up production of the larger, two-aisle 787, which it calls the Dreamliner, from three to five a month.

Deliveries of 787s have been paused several times in the last two years for

various quality and paperwork issues. The Arlington, Virginia, company said the loss in core operations worked out to $1.27 per share. Analysts expected the company to lose $1.07 per share, according to a FactSet survey.

The company lost money in its airliner and defense units, although less than a year ago. The defense side was dragged down by a $245 million charge to fix the KC-46A refueling tanker. Boeing's services business was profitable.

Revenue climbed to $17.92 billion, beating

analysts' forecast of $17.52 billion. Boeing shareholders are on the hook for a $414 million loss in the first quarter, with another $11 million loss attributed to a noncontrolling interest. Boeing lost $5 billion last year.

"It's been a tough slog for the company, but the trends appear to be getting better," said Jeff Windau, an analyst for Edward Jones. "We know there is demand (for planes), there is a solid order book. We should be seeing better performance from them in the second half of the year."

THE TRIBUNE Thursday, April 27, 2023, PAGE 13

THE LOGO for Boeing appears on a screen above a trading post on the floor of the New York Stock Exchange, July 13, 2021. Boeing reports earnings on Wednesday, April 26, 2023.

Photo:Richard Drew/AP

The Public is hereby advised that I, ERROL RAPHAEL ALEXANDER of Shady Hollow Lane. Hawkins Hill, Nassau, Bahamas, intend to change my name to ERROL RAPHAEL STRACHAN. If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that DAVIN JAMES CEPHORD HARVEY, of P.O Box EE S5557 Elizabeth Estates,New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of April 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

LEGAL NOTICE

YUMA INVESTMENT HOLDINGS

LTD.

(In Voluntary Liquidation)

Notice is hereby given in pursuance of Section 138(8) of The International Business Companies Act, 2000 (as amended), the Dissolution of the above-named company has been completed, a Certificate of Dissolution has been issued and the above-named company has therefore been struck off the Register. The date of the completion of the dissolution was the 16th day of February 2023.

Bennet R. Atkinson Liquidator

PAGE 14, Thursday, April 27, 2023 THE TRIBUNE

INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE

By STAN CHOE AP Business Writer

WALL Street fell again

Wednesday, though a rally for Microsoft and some other Big Tech stocks helped to limit the losses.

The S&P 500 dropped 15.64 points, or 0.4%, to 4,055.99. The Dow Jones Industrial Average fell 228.96, or 0.7%, to 33,301.87, while the Nasdaq composite led the market with a gain of 55.19, or 0.5%, to 11,854.35.

Wall Street was coming off its worst day in a month, hurt by concerns about the strength of U.S. banks. The spotlight has been harshest on First Republic Bank, which lost another 29.8% after nearly halving the day before. That's when it gave details about how many customers bolted amid last month's turmoil in the industry.

The worry is that it and other smaller and midsized banks could suffer debilitating runs of deposits from customers, similar to the ones that caused last month's failures of Silicon Valley Bank and Signature Bank. Even without more shutdowns, the industry's struggles could cause a pullback in lending by banks that saps the economy.

PacWest Bancorp., another bank that's been in investors' spotlight, rose 7.5% after reporting stronger results than expected and saying that its deposits have grown since late March. That may offer optimism that First Republic's struggles could be specific to itself, rather than a symptom of deeper issues with the system.

Also dropping sharply Wednesday was Enphase Energy, which fell 25.7% despite reporting stronger profit and revenue for the latest quarter than forecast. Analysts pointed to its revenue forecast for the

current quarter, which fell short of some expectations.

The majority of companies have been topping expectations so far this reporting season, but the low bar set for them has many investors paying more attention to what CEOs say about upcoming trends than results for the past three months.

Activision Blizzard, meanwhile, tumbled 11.4% after U.K. regulators blocked its takeover by Microsoft on concerns it would hurt competition in the cloud gaming market.

BIG TECH BLOOMS

While the majority of stocks fell, gains for Microsoft and other Big Tech companies prevented a sharper slide for the market.

Microsoft rose 7.2% after reporting stronger profit for the first three months of the year than analysts expected. It carries a huge weight on the S&P 500 because it's the second-largest stock in the index.

Tech stocks have broadly been some of the year's best performers so far as they've laid off workers and made other cost cuts to improve their profitability. Hopes for a coming pause from the Federal Reserve on its barrage of hikes to interest rates have also helped them in particular.

Google's parent company, Alphabet, also turned a bigger profit than expected. But its stock slipped 0.2% after drifting between gains and losses through the day. It reported its first back-to-back drops in advertising revenue from a year earlier since it became a publicly traded company in 2004.

More Big Tech companies are scheduled to follow with their own reports soon. Facebook's parent company, Meta Platforms, rose 0.9% ahead of its report. It jumped in afterhours

trading after it said it earned more than expected.

WHY CHIPOTLE IS

HIGHER Chipotle Mexican Grill rose 12.9% for the biggest gain in the S&P 500 after reporting stronger profit than expected. It was one of a few companies that raised hopes consumer spending could remain resilient despite a slowing economy. That's key because it makes up the bulk of the U.S. economy. Stocks have been mostly listless in recent weeks, as Wall Street struggles with several questions. With few answers imminent, Mark Haefele, UBS Global Wealth Management's chief investment officer, expects stocks to stay stuck in a range.

Not only are investors worried about the possibility of a recession this year, he said stocks also look relatively expensive. That means "the scope for upside appears limited, in our view," he said.

Scott Wren, senior global market strategist at Wells Fargo Investment Institute, sees the S&P 500 largely remaining within a range of 3,700 to 4,200 this year. It's within the top half of that range, and he said he's not looking to "chase this equity rally."

THE FED AND RATES

All banks are contending with much higher interest rates, which have flown higher over the past year to tighten the screws on the economy and financial markets.

The Federal Reserve has hiked its key overnight interest rate to its highest level since 2007. It's trying to rein in high inflation, but its main tool to do so is a notoriously blunt one. High rates slow the entire economy and hurt prices for investments.

Stock market today: First Republic falls more, tech rallies Facebook parent Meta posts solid 1Q results, stock soars

By BARBARA ORTUTAY AP Technology Writer

FACEBOOK parent company Meta's first-quarter results surpassed Wall Street's modest expectations on both profit and revenue, sending its stock soaring in after-hours trading.

Meta reported that the monthly user base of its flagship platform — Facebook — inched close to 3 billion, and its revenue guidance for the current quarter was also above analyst estimates.

"Our AI work is driving good results across our apps and business," CEO Mark Zuckerberg said in a statement. "We're also becoming more efficient so we can build better products faster and put ourselves in a stronger position to deliver our long term vision."

Meta Platforms Inc. said Wednesday it earned $5.71

billion, or $2.20 per share, in the January-March period.

That's down 19% from $7.47 billion, or $2.72 per share, a year earlier. Results in the latest quarter were weighed down by restructuring charges.

Revenue climbed 3% to $28.65 billion from $27.91 billion.

Analysts, on average, were expecting earnings of $2.02 per share on revenue of $27.67 billion, according to a poll by FactSet.

Meta said it has "substantially completed" layoffs it first announced in 2022. It announced a second round of layoffs in March.

For the current quarter, Meta said it expects revenue in the range of $29.5 billion to $32 billion, above analysts' expectations of $29.45 billion. "In this economic environment — and after the disaster that was 2022 — 3%

year-over-year revenue growth is an accomplishment," said Debra Aho Williamson, an analyst with Insider Intelligence. "Meta's strong guidance for Q2 revenue is another indicator that the company may be starting to come out of the woods."

But, she added, Meta still has a lot of work to do — including finish the rebuilding of its ad targeting capabilities "after the Apple privacy debacle," make a strong case to advertisers for "why they should invest in Reels instead of TikTok, and keep restless creators in the fold."

Apple made privacy changes to its phones that make it harder for companies like Meta to track people for advertising purposes, which hurt the company's revenue — which mostly comes from ads on Facebook and Instagram.

THE TRIBUNE Thursday, April 27, 2023, PAGE 15

A PEDESTRIAN passes by the Hong Kong Stock Exchange electronic screen in Hong Kong, Wednesday, April 26, 2023. Asian shares are trading mostly lower, as worries about the health of global economies grew after a tumble on Wall Street despite some better-than-expected earnings reports.

Photo:Louise Delmotte/AP

Twitter relaxes pot ad rules to lure in more advertisers

By BARBARA ORTUTAY AP Technology Writer

TWITTER under its 420-friendly owner Elon Musk earlier this year became the first major social media company to allow cannabis advertisements. Now, the platform is relaxing those rules in an attempt to lure in more advertisers from U.S. states where marijuana is legal.

“Going forward, certified advertisers may feature packaged cannabis products in ad creative,” Twitter said in a post on its website. Previously, cannabis advertisers could not show any products in their ads, nor could they actually promote their sale.

“They may also continue responsibly linking to their owned and operated web pages and e-commerce experiences for CBD, THC, and cannabis-related products and services,” Twitter said. The billionaire Tesla CEO has been forced to make huge cost cuts and scramble to find more sources of revenue to justify his $44 billion purchase of Twitter. The platform also removed a ban on political advertisements in January.

Still, companies interested in advertising cannabis products on Twitter must comply with a long list of rules. They must be licensed and pre-authorized by Twitter, only target jurisdictions where they are licensed and refrain from targeting anyone under 21, among other policies.

Facebook parent Meta, Google and other major

tech companies all prohibit cannabis ads. Google does allow ads for FDAapproved CBD products and topical, hemp-derived CBD products with THC content of 0.3% or less in California, Colorado, and Puerto Rico, but not for marijuana even in states where it is legal.

Musk became widely associated with marijuana usage in 2018 when he tweeted that he was mulling a buyout of Tesla for $420 per share – a price that was widely assumed to be tied to a specific time in the afternoon of April 20 when cannabis users annually celebrate the drug by partaking in it. Shortly after that August 2018 tweet, Musk smoked a marijuana joint on a podcast with Joe Rogan. In a trial centered on whether Musk’s buyout tweet had misled Tesla investors, Musk testified the price of his offer wasn’t meant to be a marijuana reference while acknowledging why people might think it was.

“There is some, I think, karma around 420. I should question whether that is good or bad karma at this point,” Musk said on the witness stand.

The origins of the term “420” generally, were long murky. Some claimed it referred to a police code for marijuana possession or that it arose from a Bob Dylan song. But a consensus has emerged that it started with a group of California high school students in the 1970s.

BUDTENDER Taylor Altshule holds Cherry Pie marijuana at a California Street Cannabis Company location in San Francisco, Monday, March 20, 2023. Twitter under its 420-friendly owner Elon Musk earlier this year became the first major social media company to allow cannabis advertisements. Now, the platform is relaxing those rules in an attempt to lure in more advertisers from U.S. states where marijuana is legal.

THE TRIBUNE Thursday, April 27, 2023, PAGE 17

Photo:Jeff Chiu/AP

DWAYNE WOODS

DWAYNE WOODS