‘Protect the asset’ focus in $400m UK financing talks

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

CLIMATE resilient projects to protect critical assets such as the redeveloped Grand Bahama International Airport could be included in the up to $400m financing that The Bahamas is negotiating with a UK government agency.

A principal in the Bahamian group that won the bid to redevelop and operate that airport, and a senior UK Export Finance official, revealed to Tribune Business that a “sea defense berm” - which would protect not only the aviation gateway but homes and businesses in Freeport - was among the initiatives being targeted in the financing negotiations.

Both Anthony Myers, Bahamas Hot Mix’s (BHM) chairman, and a lead investor in Aerodrome Ltd, and Jesse McDougall, UK Export Finance’s head for the North American and Caribbean region, confirmed that the size of the potential financing drawdown and its uses were still

• ‘Sea berm’ to secure GB airport, Freeport from storms

10% taxi fare rise to end ‘hustler’ stigma

• Gov’t wants to stop it from adding to $11bn national debt

• Opposition wants guarantee clarity; why not PPP group

North Abaco port’s $60m need as RFP is readied

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A CABINET minister yesterday said the Government is “moving quickly” to put both Abaco’s commercial ports out to bid amid assertions that the northern location needs a $60m upgrade to make it commercially viable.

Jobeth Coleby-Davis, minister of transport and housing, in a messaged reply to Tribune Business inquiries said the Attorney General’s Office is reviewing draft tender documents for bidding processes that will seek qualified groups to redevelop, operate and manage both the Marsh

Harbour and North Abaco ports under a privatepublic partnership (PPP) arrangement.

Pledging that the Government is “committed” to developing both facilities, she added that her ministry

Six design options for GB’s $200m airport

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

GRAND Bahama will be presented with six different design options for its new $200m airport, the winning bidder has revealed, with an announcement on the expected construction start expected “very shortly”.

Anthony Myers, Bahamas Hot Mix’s (BHM) chairman, and a member of the all-Bahamian Aerodrome Ltd group, told Tribune Business that Pascall + Watson, a firm of architects that has a track record in airport design, has been hired to develop several concepts

for a transformed Grand Bahama International Airport.

“We’re expediting it as quickly as possible,” he confirmed. “We have Manchester Airport Group already fully engaged and giving significant input along with the architectural team at Pascall + Watson. They’re the foremost leading airport design firm in the world; they’ve done Dubai airport, done airports all over the world.

“They’ve already introduced concept designs and concept planning. We have six different scenarios we will take to a [planning]

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A TAXI Cab Union’s president yesterday voiced optimism that the imminent 10 percent fare increase will offset the industry’s “over saturation” after it was revealed that new vehicle loan requests jumped sixfold in late 2022.

Wesley Ferguson told Tribune Business that taxi drivers will “no longer be perceived as hustlers” due to a reform package that includes a ‘code of conduct’ all drivers must abide by, and pledged: “You’re going to see great things coming to the taxi industry.”

He spoke out after the Central Bank’s latest bank lending conditions survey, covering the 2022 second half, revealed that loan

• Vehicle loan requests jump 500% SEE

applications to finance the purchase of new taxis and rental cars rose by 500 percent compared to the prior year. This was attributed to the Government lifting the prior moratorium on taxi plates, which sparked demand for new vehicles among recipients.

“Significant advancements were noted for taxis and rented cars, which rose more than four-fold, reflective of the Government’s lifting of the moratorium on taxi plates,” the Central Bank said. “Applications for taxis and rental cars expanded by 500 percent.” However, an expansion of that magnitude represents a six-fold increase.

And a deeper dive showed that this 500 percent increase was based

business@tribunemedia.net MONDAY, MAY 8, 2023

SEE PAGE B6

PAGE B7

PAGE B11

SEE

SEE PAGE B9

JOBETH COLEBY-DAVIS

GRAND BAHAMA INTERNATIONAL AIRPORT AFTER HURRICANE DORIAN.

$5.74 $5.74 $5.78 $5.71

REALTOR: PUT ‘PRICE TAG’ ON OUR WATERS

A PROMINENT realtor is urging The Bahamas to “put a price tag” on the use of its waters by levying fees on vessels of all sizes passing through its territory.

Mario Carey, chairman and founder of Better Homes and Gardens MCR Bahamas, in a statement urged this nation to take advantage of the ever-increasing number of vessels dropping anchor in its harbours and bays at no cost by monetising the value of its waters and other natural resources.

Repeating a call he first made two years ago, he argued that the need for proper fees - and a mechanism to properly calculate and levy them - has become more urgent due to the growing number of craft using Bahamian waters, with charter vessels earning large sums with little benefit to Bahamians.

“Luxury charter yachts are bought and sold by being shown by foreign brokers in Bahamian waters without The Bahamas earning a fee,” said Mr Carey. “A luxury yacht can charge more than $100,000 for a week in Exuma and what does the Bahamian get for that?

“They come in with all foreign crew with no work permits required, and they use our waters. We need to monetise and monitor our waters to protect our coral reefs, our fish, conch and crawfish stock, and our marine life in general.”

Mr Carey said the issue raises both legal and ethical issues, and the policy changes required will be multi-faceted.

“Many yacht owners are responsible,” he added. “They are careful about how they anchor, they contribute to the Exuma Land and Sea Park, so I do not want to denigrate everyone who has ever operated a boat in The Bahamas. But so many more just use our beautiful waters to earn a very handsome living, and it is our fault because we do not have a fee structure for traversing the waters, so that is first.”

Mr Carey pointed to how long it took for The Bahamas to collect fees for use of its air space. He wants to see a similar approach to the country’s waters with all vessels over a minimal size - commercial, cargo, recreational - paying a fee.

The realtor added that he is also troubled by what he calls the ‘ethical implications’ of requiring local industries to abide by work permit requirements while charter boats operating solely in Bahamian waters have no such responsibility.

“How is this good for Bahamians?” he asked.

“We are seeing an historic number of boats from the 30-foot sailboat to the 60-foot catamaran, right up to the luxury charter yacht, just dropping anchor in Nassau Harbour and Montagu Bay as well as in the western part of the harbour.

“Rose Island is lit up like a city at night with all the boats at anchor. Yet with all this heavy boat traffic, we have no regulations, no monitoring. We don’t know who is pumping sewage directly into the water. We don’t know how many fish or conch or crawfish they’re taking. We are giving away our most valuable natural resource – our waters – for free. Why are we doing this?”

Mr Carey said the first requirement should be mooring buoys for any vessel not in a marina. “Keeping vessels safely tied to a mooring buoy will keep them off coral reefs and protect what is left of healthy reefs, which are diminishing before our eyes,” he added. Funds collected from traversing Bahamian waters and using buoy tie-ups, along with a small marina fee per vessel, could pay for equipment and personnel to better monitor the waters, catch and fine anyone who damages coral, takes unjustly from the sea or pumps waste into it,” he added. Repeat offenders, if convicted, should be stopped from entering The Bahamas and their vessels should be seized.

“When there are no regulations regarding anchoring, dumping and flushing, and far too few officers or wardens to enforce fishing regulations, we have the equivalent of a wild, wild west at anchor and in the sea,” Mr Carey said. He added that he has met with dozens of fishermen fed up with foreigners overfishing, and taking grouper, hogfish, snappers and large catch along with conch and crawfish, in many cases selling what they take back in the US.

“We’ve looked at drone monitoring devices, boats, radar, sonar, almost anything that will serve as a tool to get a handle on what is happening in our waters before New Providence and several Family Islands end up like Elizabeth Harbour in Exuma - beautiful to look at but barren; a parking lot for boats,” Mr Carey said frankly.

“If we are the boating capital of the region, if we are the most desired destination, should we not regulate, preserve and benefit from such a prestigious position? It’s within our power. We must act now.”

PAGE 2, Monday, May 8, 2023 THE TRIBUNE

REALTOR Mario Carey has called for the monetising and monitoring of Bahamian waters in the face of record numbers of boats anchoring in harbours and bays, threatening already decaying coral reefs and once-abundant marine life.

‘IMPROVE SERVICE QUALITY BEFORE ROLLING OUT 5G’

By

By

BAHAMIAN businesses and consumers want their communications providers to first focus on improving the quality and reliability of existing services before exploring the introduction of 5G (fifth generation) technology.

The Utilities Regulation and Competition Authority (URCA), in launching its public consultation to gauge the level of demand for, and interest in, 5G communications services, said initial feedback from private sector focus groups saw many participants “express concern with respect to the apparent failure” of the Bahamas Telecommunications Company (BTC), Cable Bahamas and Aliv “to deliver high quality, reliable service” to meet their company’s needs.

And, on the consumer front, while “80 percent or above” of 530 survey respondents pronounced themselves happy with the quality of their fixed and mobile services, those voicing dissatisfaction were unhappy about download speeds, Internet reliability and the scope of service

coverage - especially in the Family Islands. URCA, stating that demand for 5G services in The Bahamas is likely to be “limited” at present based on the initial feedback, pledged to focus on improving the availability of communications services - especially Internet connectivity - throughout The Bahamas as well as enhance its regulation and monitoring of service quality.

And BTC and Cable Bahamas/Aliv, in their submissions to the regulator, voiced concerns over whether a Bahamian 5G roll-out is “economically viable” at present given that the limited demand was unlikely to cover “the high capital costs” they will incur through investing in new and upgraded infrastructure.

The cost that Bahamian communications operators would face in introducing the latest communications technologies were not detailed in the URCA consultation. Increased traffic, growth in services and demand for improved affordability and user experience were all cited in its report as key drivers of 5G demand, with Ericsson, the communications equipment supplier, estimating that at

least 50 percent of mobile data will be delivered via this technology by 2028.

With “access to reliable, affordable and high quality Internet connectivity becoming ever more important”, especially in the knowledge-driven economy post-COVID, URCA held nine focus group meetings in late 2022 with 52 representatives from the private sector, key industries and wider society to better understand the level of interest in, and need for, 5G services.

While attendees felt

5G enhancements could be important for key sectors such as tourism, where Nassau Cruise Port is already considering developing a Wi-Fi zone featuring a 5G private network to cater to its annual 4m-plus cruise passengers, most placed more emphasis on improving existing communications service delivery.

“The general view is that the focus for now should be to improve the delivery of current services, both in terms of geographic availability and quality of service/ experience. All participants in the focus groups agreed that priority should be given to extend the availability of reliable Internet

services to remote areas and the Family Islands, as well as ensuring high quality of service across all islands,” URCA said of the feedback.

“Generally, the participants indicated that existing electronic communications services, if optimised, are sufficient for most of their day-to-day operational needs as of now and in the near future. While many participants expressed intrigue into the potential of 5G and mentioned some

speculative use cases, there were no clear or strong use cases emerging for 5G arising from the focus group meetings.

“URCA notes that many participants expressed concern with respect to the apparent failure of the three main operators in The Bahamas to deliver high quality, reliable service to meet the demands of their respective businesses and/ or mandates. Many of the participants also expressed a strong desire

for improved customer service, increased affordability, increased transparency in customer communications, and more resilient service delivery by BTC and Cable Bahamas.”

URCA added of the private sector’s assessment:

“Current (mobile and fixed) Internet connectivity services available are commonly considered sufficient to meet prevailing demand for Internet connectivity in

PICTURED L-R are Hector Oliva, VP Global DesignCALA, Marriott International; Phylicia WoodsHanna,Director of Investments, Bahamas Investment Authority; The Honourable Clay Sweeting, MP for South Eleuthera and Minister of Agriculture and Marine Resources; The Honourable I. Chester Cooper, Deputy Prime Minister and Minister of Tourism, Investments and Aviation; Daniel Zuleta,Project Director, Cotton Bay Holdings Limited; Mauricio Patiño – General Manager, Construcciones Planificadas S.A.; Pablo Blasco – Director Abax Architects.

Cotton Bay developer gives DPM $200m project update

COTTON Bay Holdings executives recently teamed with their partners to give Chester Cooper, deputy prime minister, an update on their $200m RitzCarlton Reserve project in south Eleuthera. The resort developer were joined by representatives from Marriott International and Construcciones Planificadas in their meeting with Mr Cooper, also minister of tourism, investments and aviation, which also discussed the future of tourism in The Bahamas.

The meeting was also attended by Phyllicia Woods-Hanna, the Bahamas Investments Authority’s (BIA) director, and the MP for South Eleuthera, Clay Sweeting, minister of agriculture and marine resources and Family Island Affairs. Some of the challenges facing Eleuthera, including housing, labour and infrastructure capacity, were also discussed. Pictured from L-R are Hector Oliva, vice-president of gobal design, Marriott International;

Phylicia Woods-Hanna, director of Investments, Bahamas Investment Authority; Clay Sweeting, MP for South Eleuthera and minister of agriculture, marine resources and Family Island affairs; Chester Cooper, deputy prime minister and minister of tourism, investments and aviation; Daniel Zuleta, project director, Cotton Bay Holdings; Mauricio Patiño, general manager, Construcciones Planificadas S.A; Pablo Blasco, director, Abax Architects. (photo by Cay Focus Photography)

THE TRIBUNE Monday, May 8, 2023, PAGE 3

Tribune Business Editor nhartnell@tribunemedia.net

NEIL HARTNELL

SEE PAGE B8

Photo:Cay Focus Photography

Bahamas in new Caribbean renewable energy honour

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas has won the Caribbean Renewable Energy Forum (CREF) Industry Award for the third time, with the latest honour for climate resilience in the energy sector due to the the Abaco schools’ solar installation project.

The project was a partnership between the Government, the Rocky Mountain Institute (RMI), Compass Power and Rotary Bahamas Disaster Relief (RBDR). Vaughn Miller, minister of the environment and natural resources, accepted the award at the 15th annual Caribbean Renewable Energy Forum held in Miami, Florida, between April 26-28.

Also in attendance were Phedra

Rahming-Turnquest, the ministry’s permanent secretary, and Dr Rhianna Neely-Murphy, Department of Environmental Planning and Protection (DEPP) director.

Mr Mille said: “Our experience has taught us that we must look at development differently. Climate change has placed the imperative upon us to build with resilience, and we are responding with the assistance of international partners like RMI and local partners like Rotary Bahamas Disaster Relief. We are moving in the right direction.

“The solar installation with battery back-up across these four schools will change the life of the Abaco community. It will open up the imagination of the children. It will improve the quality of life for the residents, and it is

a clear indication to all of what is possible. It provides hope, and for that, we are grateful.”

Dr Neely-Murphy said: “The aftermath of Hurricane Dorian provided us with an opportunity to rebuild smarter and better. The schools also serve as hurricane shelters, and with the solar and battery backup systems they will be able to keep the lights on to continue to service the target communities during power outages and storm events.”

The CREF Industry Awards recognises excellence across clean energy programmes and projects in the Caribbean. Nominees are judged across a series of criteria, including innovative approaches to development, value to investors and customers, and social and environmental impact.

L to R: Keino Cambridge, consultant, Ministry of the Environment and Natural Resources; Gillis Deal, Ministry of the Environment and Natural Resources; Rhianna Neely-Murphy, director, Department of Environmental Planning and Protection (DEPP); Vaughn P. Miller, minister of the environment and natural resources; and Phedra Rahming-Turnquest, permanent secretary, Ministry of the Environment and Natural Resources.

L to R: Christopher Burgess, Rocky Mountain Institute (RMI); Rhianna Neely-Murphy, director, DEPP; Compass Power representative; Vaughn P. Miller, minister of the environment and natural resources; Phedra Rahming-Turnquest, permanent secretary, Ministry of the Environment and Natural Resources; and David Gumbs, RMI

Agriculture minister heading to US for climate change summit

A CABINET minister and his parliamentary secretary are heading to the US capital this week to participate in the threeday Agriculture Innovation Mission (AIM) for Climate Change event. Clay Sweeting, minister of agriculture, marine resources and Family Island

affairs, will be accompanied to Washington DC by Leonardo Lightbourne, MP for North Andros and the Berry Islands. Launched in 2021, AIM For Climate is a global initiative to accelerate and increase investments in climate smart technologies and enhance

existing approaches to improve agricultural productivity, conserve nature and biodiversity, and adapt to build resilience to climate change.

The event provides a platform to create partnerships and share knowledge on innovative solutions in the lead-up to the COP28

climate conference, officials said. AIM’s first ministerial meeting was held during Agriculture week at the World Expo in Dubai in 2022. Some 31 countries and 41 non-governmental partners are signed on to AIM.

“In these ministerial meetings, we are expected

to discuss challenges and solutions, and to find ways to integrate climate smart technologies that many young farmers are eager to adapt,” Mr Sweeting said.

“In order for us to develop a progressive agricultural sector, we must continue to hold discussions with stakeholders and international

partners to ensure that we incorporate the best and most resilient technologies that the world has to offer.” While in Washington DC, Mr Sweeting will also hold a courtesy call with The Bahamas ambassador to the US, Wendall Jones.

PAGE 4, Monday, May 8, 2023 THE TRIBUNE

Debt for nature

By CHRIS ILLING CCO @ ActivTrades Corp

Prime Minister Philip Davis KC was in the UK last week and spoke at the Caribbean Council reception in London, where he said once more that about 40 percent of the county’s $11bn-plus national debt was the result of post-hurricane repairs and restoration efforts. He stated further that climate change is the greatest threat that The Bahamas is facing. But this battle against climate change is a costly endeavour, and the country must be innovative in creating new sources of income and reducing the crippling debt it is faced with.

One way to create new income is the development of a market for blue carbon credits and monetising the natural carbon sinks, such as mangroves and seagrass

beds. Another way to reduce the ever-growing burden, instead of increasing earnings, is to reduce the national debt. An example of how to do it was made public last week when the troubled bank, Credit Suisse, bought back Ecuadorian government bonds on a large scale. Behind the $1.6bn deal is what is arguably the largest debt for nature swap (DNS) to-date.

The idea behind the DNS mechanism - published for the first time in the New York Times in 1984 by the vice-president of the World Wildlife Fund (WWF), Thomas Lovejoy - seemed to be a win-win solution: On the one hand,

it promised to reduce the mountain of debt threatening to suffocate many nations. On the other hand, it sought to improve a country’s environmental status. The first wave of DNS, which began in Bolivia in 1987, was a mechanism in which an intermediary organisation, usually an international non-governmental organisation (NGO) with environmental and social objectives, bought up the foreign debt of a highly indebted country at a significantly reduced value in relation to its nominal value. In a second step, negotiations were started with the debtor government, in which that

Sales chief targets $90m listings during first month

ARISTO Development’s

former sales and marketing chief is targeting $90m worth of real estate listings in his first month at a boutique firm targeting the high-end market.

Matthew Marco, who worked with Aristo developer, Jason Kinsale, on projects such as ONE Cable Beach and Aqualina, is joining BOND. “BOND is more than a real estate brokerage,” he said. “It is a property advisory firm, and my plan is not only to build a platform catering to the needs and whims of the high net worth individual, but to cater to them in a similar fashion to that of a family office.

“When you are in the privileged position of guiding purchases or sales of those who have homes and investment property around

the world, you cannot rest on your laurels. To maintain relationships and trust, you have to keep up with trends, market events, political stability issues and currencies around the globe.”

Mr Marco continued: “I am inspired daily by many of my clients, who are extremely successful entrepreneurs, professional athletes and industry leaders. The dual common themes I see in all of them is, first, never being satisfied with where they are, always wanting to do something greater, and secondly, surrounding themselves with exceptional people and being open to their advice, counsel and wisdom.”

He added that the real estate industry has not kept pace with many other industries when it comes to

marketing, customer service, technology and data, which has created a pathway to introduce more .com alternatives and online solutions, including auctions and quick turnarounds. With the focus on listing a property and getting it sold, instead of a full life-cycle look at the client and their long and short-term goals, Mr Marco said real estate agents and brokers are

government declared its willingness to invest in social and environmental projects using local currency. From 1990 onwards, several bilateral DNS appeared, in which creditor and debtor governments in direct contact without the private intermediary role of an NGO negotiated conditional debt forgiveness against social and environmental programmes.

Now, Credit Suisse has bought back Ecuadorian government bonds with a face value of $1.6 bn. This was announced by Ecuadorian bankers on Thursday last week. The notes were

selling themselves short and failing to secure the client’s trust for ongoing transactional business for decades in the future.

“The single sale approach is a thing of the past for the high net worth individual who does not just buy or sell every few years,” said Mr Marco. “They transact with extraordinary frequency, and they rely on the broker they trust regardless of where the potential investment is - New York, Paris, London, Switzerland, The Bahamas. I see my role as part-agent, part real estate portfolio manager, and part lifestyle concierge.”

trading deep in distress on the secondary market, which allowed the bank to pay the original investors less than par. The buyback will free up cash that Ecuador will invest in preserving the Galapagos Islands, one of the world’s most valuable ecosystems. The bonds had fallen sharply in value due to Ecuador’s political difficulties, and Credit Suisse - itself in the process of being acquired by UBS in a forced rescue - saw the opportunity. Credit Suisse states that Thursday’s buyback saw just over $1bn in face value of Ecuador’s 2035 bonds repurchased at 38.5

cents on the dollar, $202m of a 2030 note bought at 53.25 cents and $420m of a 2040 bond bought at 35.5 cents. The buyback lowers Ecuador’s debt service costs from $16.5bn to approximately $14.9bn, which is a 10 percent reduction on the debt stock.

Climate change is real, and the vicious circle of environmental destruction is turning faster and faster. The COVID pandemic, rising prices for energy and grain, and supply bottlenecks in exports are driving up the foreign debt of many developing countries. If this trend is to be stopped, politics must break out of the prevailing financial logic. Creditors should forgive developing countries at least part of their external debt in return for leaving resources in the ground and protecting more of nature. Keep on raising your voice, Prime Minister.

THE TRIBUNE Monday, May 8, 2023, PAGE 5

DEBT FOR NATURE

MATTHEW Marco has joined BOND Bahamas, a boutique real estate firm aiming to play a broader and more critical role in high net worth clients’ property investment portfolios.

10% TAXI FARE RISE TO END ‘HUSTLER’ STIGMA

on a small base, with just 18 loan applications for new vehicles and taxis made to commercial banks during the six months to end-December 2022. And of those 18, just six were approved, making for a relatively low approval rate of just one-third or 33 percent.

However, Mr Ferguson said the increased demand for vehicles had been sparked by the need to accommodate more passengers and visitors following tourism’s postCOVID rebound. That sector’s “aggressive” revival, he added, together with the impending 10 percent increase to all fare rates should help counter the disruption caused by the influx of new taxi drivers - all competing for the same business - following the moratorium’s end.

“The market is dictating that you get a bigger car,” the union president said of the increase in loan applications. “Prior to the lifting of the moratorium,

the majority of taxi drivers had five to seven-seat cars. Then the cruise port re-opened and arrivals rebounded in such an aggressive way there’s a greater need for vehicles to carry 12-15 persons.

“The taxi drivers are opting to take a chance, because the economy looks really vibrant, and are choosing to purchase bigger cars. A lot of them are flush with cash, so they don’t need to go to their banks. The taxi economy is pretty lucrative. They do the fare increase, which was just announced last week, and it’s going to give them an even bigger boost financially.

“You’re going to see great things come out of the taxi industry. We’re about to roll-out a new code of conduct that will bolster the reputation of taxi drivers and make them realise they’re entrepreneurs and not just hustlers like they’re presented to be.”

Mr Ferguson confirmed that the fare increase, which still needs to be implemented through publication

in the Government’s official gazzette, is “10 percent on all existing rates”. While this is lower than the 25-30 percent he had initially pushed for, as a means to offset higher fuel prices and the increased cost of living, the union chief added that the revised structure will also include “clear” rates for transporting baggage and animals.

“The fare increase was one of our demands on the minister and the Government; to level the playing field and mitigate the shortfall with the over-saturation of the industry,” Mr Ferguson added. “The increase in fares will mitigate the shortfall as a result of that.

“I would think that, with the new fare increase, that will level the playing field with the over-saturation and, with the robust tourist arrivals at the port and airport, we should still be able to take home a good week’s pay.” However, the union president said Jobeth Coleby-Davis, minister of transport and housing, had yet to provide

“a comprehensive report” on the number of taxi plates in existence - including those issued since the moratorium was lifted.

Mr Ferguson yesterday estimated that just shy of 700 new plates have been issued since the prohibition was lifted by the Davis administration, saying the number had increased from 1,135 to 1,818 although he provided no evidence to support these figures. “Plates are still being issued systematically every day in this country,” he added. “I think there may also have been a backlog of those who were left behind.”

Still, the Bahamas Taxi Cab Union president asserted that the industry’s prospects were looking much improved. The fare increase for drivers is one aspect of a reform package, also including the ‘code of conduct’ and display of rate schedules for passengers, that is designed to improve behaviour, overall standards and end constant complaints about tourists and locals being over-charged.

“It’s a two-sided coin, twofold effort,” Mr Ferguson said of the reforms. “It was already a complaint that taxi fares were too high. There were a lot of complaints from industry stakeholders about taxis over-charging and not having a dependable taxi rate. It was a grey area, and the rate schedule has not been updated since 2016.

“What it does now is it gives the Ministry of Transport and the Road Traffic Department, the controller, some boundaries to say what the new rate is and, if you charge more than that, it gives them the ability to say you’re in contravention. It gives the Road Traffic Department a grip on the over-charging. They have a definitive rate they can go by.

“The hotels can publish the rates and have them on display to get rid of the overcharging. It’s a win-win for everyone because the industry, the airport, Baha Mar and Atlantis have always had issues with taxi drivers over-charging, but with the

new rates they can publish them on display and get rid of the over-charging. It gives the authorities a grip to say we gave you a fare increase, you are over-charging and so there will be disciplinary measures levied against you.”

Mr Ferguson said the 10 percent fare increase is “not Nassau centric” and will be rolled-out across all Bahamian islands. “The future of the taxi industry looks good,” he added. “The rhetoric between myself and the minister has ended. We decided to bury the hatchet and work together in partnership to make sure taxi drivers taxi drivers take care of the tourism industry.”

Asked when the fare increase was likely to take effect, the union chief said Mrs Coleby-Davis had forecast it would be implemented before this summer. “We’re looking at between mid-June and mid-July,” Mr Ferguson said, adding that this will give all sides time to “fine tune, pick out all the pins and needles in the old rates, and come up with something suitable for tourists and the public who also catch taxis”.

PAGE 6, Monday, May 8, 2023 THE TRIBUNE

FROM PAGE B1

North Abaco port’s $60m need as RFP is readied

is continuing to plot the way forward and said: “Greater details will be shared with the people of Abaco in short order.

“Specifically, I can confirm that my ministry is in active communication with the Office of the Attorney General. They are reviewing draft Requests for Proposal (RFP) for both ports, and we are moving for a quick resolution and to have final drafts available for public review. As the minister of transport and housing, I understand the importance of the ports to the economic growth of Abaco. I will have much more to say in a few weeks.”

Mrs Coleby-Davis spoke as the North Abaco Pastors Association, an alliance of pastors from the area between Treasure Cay and Crown Haven, served notice of their intent to today launch a petition requesting that the Government ensure the $41m North Abaco port is fully opened and operational.

Captain Scott Bootle, a member of the North Abaco Port Company that approached the former Minnis administration about taking over the location via a PPP arrangement, yesterday told this newspaper that the Bahamian people have received little to no return on their $41m investment in a facility that was constructed by China Harbour Engineering Company (CHEC) and turned over to the Government in 2018.

While it was subsequently employed for the distribution of Hurricane Dorian relief, it is still today not used for commercial shipping purposes and has only a few Customs officers based there to deal with private shipments. Confirming that the North Abaco facility is handling “just minor cargo, nothing to boast about”, Captain Bootle said: “If you’ve spent $41m you have to make it work because you’re paying back

the Chinese every penny of that investment.

“The Bahamian people have to get a return on their investment. It has a lot of potential, especially after you dredge it. We have dredging companies we’re in contact with to do that exercise. We’re looking to go down to 35 feet. Right now were at 16 feet in the basin at high tide. Abaco needs a serious deep water port. You cannot grow the Abaco economy with a port that has 16 feet of water. That’s not good when you want to grow your third largest economy.”

Captain Bootle argued that dredging the North Abaco port to 35 feet depth would open up the facility to use by commercial shipping, including large 3,000 ton vessels. This, in turn, would open up the possibilities for the Cooper’s Town location to become a transshipment, break bulk and logistics facility for cargo bound for the US, Canada and other regions.

While this would mean competing directly with Freeport, which already enjoys tax incentive and other cost advantages via the Hawksbill Creek Agreement, Captain Bootle said Abaconians and Bahamian taxpayers can ill-afford to simply let a $41m port infrastructure asset deteriorate and whittle away through lack of use and maintenance.

Suggesting that some 1,200 square feet of additional dock space can be created, he added that bunkering, warehousing and boat/yacht storage were other markets that the Cooper’s Town port can potentially target. “It has 22,533 square feet of warehouse now,” Captain Bootle said. “You can built out another 150,000 square feet of warehouse. We just have to put enough time in and get it working.

“One of the potential uses we’re looking at is bunkering. Some of the major companies looked at it and want to do bunkering. BP looked at it, Sun Oil came

in and looked at it..... I think for right now we’re looking at a $60m investment to dredge the port and refit it the way it has to be done. Then we expect to bring quite a bit of material out the ground when we dredge, and we can distribute that.

“We can get the port in North Abaco dredged and kill two birds with one stone. We can give Abaco its deep water port, and the dredged material can be taken to Grand Bahama and raise the airport up to stop the flooding. It makes sense. The Ministry of Works looked at it and said it makes sense. We’re just waiting for the RFP to come out right now.”

The Government has been promising to seek a PPP arrangement for the Marsh Harbour port, which has never fully recovered or been rebuilt from Hurricane Dorian’s devastation, since the Minnis administration was in office in 2021.

Mrs Coleby-Davis and her ministry, shortly after the Davis administration was elected to office on September 16, 2021, issued an expression of interest (EOI) seeking to gain an understanding of the appetite financiers, developers and port managers have for taking over and reconstructing/operating the Marsh Harbour port.

Dion Bethell, president and chief financial officer of BISX-listed Arawak Port Development Company (APD), confirmed to Tribune Business that the Nassau Container Port operator had responded to the EOI indicating its desire to become involved and bid on the Marsh Harbour port if the opportunity arose. However, no reply was received from the Government. Under a PPP model, private capital would be responsible for financing the Marsh Harbour port’s transformation and upgrade. The facility would likely remain in the Government’s ownership, but be leased to a private sector operator for a long-term period,

with the fees and charges levied on areas such as container throughput and storage helping to repay the earlier reconstruction financing while also generating an investment return for the manager and its shareholders.

The Government could also opt to take an equity ownership interest in the port operator itself, as it has done with APD. Mrs

Coleby-Davis, addressing the September 2022 Abaco Business Outlook conference, agreed that “very little action” has been taken to rebuild Marsh Harbour’s commercial shipping port - the main freight gateway into the island - in the three years since the facility was destroyed by Hurricane Dorian.

However, she said then that “more information will

be shared with Abaconians in short order” on plans to develop a replacement via a public-private partnership (PPP). “I wish to advise efforts to rebuild an efficient and secure port system are underway,” she promised. “A PPP was sought to create the performance dynamics of a modern port and develop quality infrastructure for every dollar invested.”

JOB OPPORTUNITY

LAW FIRM IS HIRING!

COME JOIN OUR TEAM!

A reputable Law Firm is seeking to employ a Legal Secretary who is experienced in Real Estate Conveyancing and Corporate Law Practices. A knowledge of Litigation Practice would also be helpful.

The successful candidate must necessarily possess the following aptitudes and capabilities:

1. Be able to take dictation accurately and swiftly through the use of shorthand and/or the ability to quickly take precise and plenary notes;

2. Be proficient in the use of Microsoft Word, keyboarding, Excel, PowerPoint, and other commonly utilized computer programs;

3. Possess outstanding time-management and typing skills;

4. Be able to work independently after being given directions;

5. Be proficient in English;

6. Have the ability to multitask and be comfortable dealing with a diverse pool of people;

7. Must love serving people and must be characteristically diligent and hardworking; and

8. Knowledge of basic bookkeeping is an advantage. Compensation shall be competitive.

Interested persons should send their resumes to the following email address: lawfirmhiresbahamas@gmail.com

THE TRIBUNE Monday, May 8, 2023, PAGE 7

FROM PAGE B1

SERVICE QUALITY BEFORE ROLLING OUT 5G’

The Bahamas if provided to an adequate quality of service and customer care standard......

“The participants expressed a strong desire for better service delivery nationwide, particularly in the Family Islands where network coverage gaps remain, and the need for (reliable and fast) connectivity is urgent. There is a relatively high degree of dissatisfaction with the current service level, in terms of reliability, quality of service, customer support or care and thus value for money.

“In this context, some participants claimed that the cost of Internet, especially for businesses, is too high in The Bahamas. This may, in part, be related to many of the participants purchasing connectivity from both BTC and Cable Bahamas as redundancy in the event of a loss of service.”

Besides tourism, where 5G services may be needed

to meet the demand from US visitors, other potential ‘early adopters’ were identified as security companies (artificial intelligence devices, cameras and CCTC); financial services (online payments); logistics (high speed delivery over mobile networks); and education.

“The industry groups raised questions around the affordability of 5G services if deployed in The Bahamas. In particular, given the expected investment needs, there was a concern that 5G services, if implemented, may be cost prohibitive to end users/businesses in The Bahamas,” URCA added. These concerns were shared by BTC, Cable Bahamas and Aliv. The latter two acknowledged that 5G would require a large investment by all carriers, while BTC said the technology will likely be required in the medium-term to enable more mobile Internet capacity.

5G’s deployment, BTC said, will require operators to share facilities and also a reduction/elimination of import taxes to lower the cost of communications equipment. It also argued that carriers will have to increase capacity to foster greater spectrum needs, called for a reduction of communications licence fees, and warned against the introduction of a third mobile operator on the basis this would make it impossible for existing providers to earn a return on 5G investments.

As for consumers, URCA said of its 530-strong survey: “The majority of the survey respondents did not feel that their existing mobile or fixed Internet services constrain them. Fixed and mobile users are overall (80 percent or above) satisfied with their current download speed, the reliability of the service and the network coverage. These results do not vary significantly across mobile and

fixed services, although dif-

ferent issues are reported by respondents. “Dissatisfied survey respondents mainly reside in the Family Islands or in New Providence. For those end users that are dissatisfied, the key issues stated were the download speed, Internet reliability and coverage. In particular, some mobile data users in the sample complained about the lack of service coverage (not receiving any mobile data service) in the Family Islands.

“In relation to both fixed and mobile Internet services, a number of survey respondents complained about the low-speed of their Internet services and they also reported frequent drops of service and intermittent/ high-latency internet for example during streaming. The survey results also show that consumers in the Family Islands are not satisfied with their services, which may be linked to coverage issues persisting since the passing

of Hurricane Dorian in 2019.”

Summing up its findings to-date, URCA said any 5G investments by Bahamian communications providers over the next three to five years will likely be centre on supporting existing data needs with larger capacity and more cost-efficient delivery.

“5G investments related to enabling new use cases may take a considerably longer time to emerge and roll-out in The Bahamas due to the magnitude of investments,” URCA cautioned.

“At this stage and in the short-term, the demand for 5G is expected to be limited in The Bahamas and, if anything, it would be circumscribed to specific and prospective use cases in certain industries....

“Given the feedback received to-date, URCA’s focus going forward will be on monitoring developments and requests from such targeted demand amongst industry groups. For specific sectors that will require high-speed connectivity in the form of 5G (tourism,

national security and logistics), URCA’s priority will be enabling and facilitating these use cases.”

Given the demand for improved reliability and coverage, URCA said it plans to review its universal services regulatory framework and the incentives available to incentivise the roll-out of communications infrastructure to remote Family Islands.

“URCA sees a need to address the issues relating to the availability of Internet services throughout all islands of The Bahamas. This will require targeting prevailing coverage gaps, and ensuring a minimum level of connectivity at affordable prices also in the more remote islands,” the regulator added.

“A key component of this will be URCA’s upcoming review of the current universal service regulatory framework and to establish whether operators have incentives to invest in networks in more remote areas.”

PAGE 8, Monday, May 8, 2023 THE TRIBUNE

‘IMPROVE

FROM PAGE B3

THE ASSET’ FOCUS IN $400M UK FINANCING TALKS

l being worked out with the Davis administration. The Prime Minister indicated at the weekend that a portion of the funding may also be used for the overhaul of 14 Family Island airports.

However, revelations of the UK Export Finance negotiations, and Philip Davis KC’s confirmation that he misspoke in relation to them, yesterday triggered Opposition calls for the Government to explain whether it - rather than Mr Myers, Aerodrome Ltd and the private sector group - was borrowing the funds or otherwise guaranteeing the financing given the fiscal implications and potential impact for the already-$11bn national debt.

Mr Davis, responding to questions at a Caribbean Council meeting in London last week, ahead of King Charles’ coronation, gave the impression that the $400m would be devoted entirely to Grand Bahama International Airport’s redevelopment. This seemed to imply that the price tag had doubled from the original $200m, with the investment set to match that of Lynden Pindling International Airport in Nassau, and raised questions over why the Government - and not the PPP consortium - was seemingly raising the financing for the project.

Mr Davis later clarified that Grand Bahama International Airport’s price tag remains at $200m as previously announced, with the remaining $200m potentially targeted at 14 Family Island airports - such as North Eleuthera and Exumawhose redevelopment has been estimated at $263m.

This was subsequently confirmed by Mr Myers, who was among the group accompanying the Prime Minister on his UK visit. “We’re still in negotiations with that in terms of the final sum,” he told Tribune Business of the talks with UK Export Finance. “The original sum was $270m, and it could be as high as $400m...... It could be higher than that, it could be lower than that. He [Mr Davis] was picking a number he was comfortable with. It will probably be that number.

“It relates to the different goals the Prime Minister wants to achieve in Grand Bahama, and that scope still needs to be defined.

The highest priority is the airport.” Mr Myers said the financing could also cover a sea defence berm “to stop wave and water intrusion from hurricanes”, and thus protect a redeveloped Grand Bahama International Airport from the storm surge and flooding that devastated it during Hurricane Dorian as well as prior storms.

Ms McDougall said the climate resilient financing was “a separate cost envelope” from the airport, and added: “You have to ensure the airport is not battered by the next storm.” Mr Myers, describing climate change resilience as a “huge priority”, added: “There is no point making a huge investment in the international airport and not protecting that asset. That will not only protect the asset, but homes and businesses of people living in Freeport. It has a dual purpose.”

However, Kwasi Thompson, the Opposition’s finance spokesman, last night demanded that the Government provide greater clarity and details around the Grand Bahama International Airport financing. While stating that the Free National Movement (FNM) backs moving ahead with the project, he said little was known about “the arrangement, obligations and responsibilities of the Government” in relation to the potential UK Export Finance facility.

Pointing to the PPP unveiled in March with Mr Myers and his Aerodrome Ltd partners, the former state minster of finance questioned why the Government - and not the private consortium - appeared to be arranging and negotiating the funding. “What is the Government involvement in the financing for the Grand Bahama airport project?”

Mr Thompson asked. “Is it borrowing the funds? Is it guaranteeing the borrowing in any way?

“It is astonishing that the public has not been advised of the financing terms for this Grand Bahama airport project, or what this ‘new’ $1bn in funding is for. What commitments or guarantees has the Davis administration given for these monies. Why has there been no specific communications around this $1bn facility, and why was there no mention of this facility in the annual Debt

Management Strategy or the Fiscal Strategy Report.”

Chester Cooper, deputy prime minister, in announcing the Aerodrome Ltd PPP deal for Grand Bahama International Airport in mid-March, gave the impression that work would begin almost immediately via the “demolition of the old international terminal and storage building.... at the end of this month, or by the first week of April”. However, Tribune Business sources have repeatedly said they have subsequently seen no major works begin.

UK Export Finance was confirmed as the financier at the time by Mr Cooper, although nothing was mentioned about the terms, conditions or the Government’s potential involvement in obtaining funding. Whispers were growing last week that the airport deal had run into difficulties because UK Export Finance wanted some kind of guarantee from the Bahamian government, which the latter was reluctant to give because the debt would appear on its balance sheet and add to the national debt.

Mr Myers told Tribune Business he was unaware of such concerns, saying: “I don’t know anything about that. The Government is very much aligned in making this happen and moving forward very quickly.” However, Mr Davis, in clarifying his statements on the $400m, confirmed that the Government was seeking to structure the potential $400m drawdown from UK Export Finance in such a way as to keep it from adding to the $11bn-plus national debt.

“We’re trying do it in a way that would not immediately increase our debt, and so we’re entering this partnership with the UK Development Bank,” the Prime Minister added. “For all intents and purposes, the bank has indicated to us that they would have $1bn available to us for infrastructural development.

“We have to identify those projects to be able to decide what we would draw down. The fact that it’s available doesn’t mean we will use it all. It has to be a project that they could embrace, and that they feel has what they call an internal rate of return that will benefit the country and its people.”

Ms McDougall explained that UK Export Finance

has a Bahamas “country envelope” worth £750m, or $950m, which is the total available financing that can be allocated to infrastructure projects in this nation where there is “UK content” - meaning that British companies are involved.

In the case of Grand Bahama International

Airport, Bahamas Hot Mix

(BHM) is “the exporter of record” through its UK office. Ms McDougall, though, explained that the total $950m represents “a global allocation” that is not necessarily drawn down quickly, or all at once, by the borrower. This often occurs over a period of time,

“years and years”, before it is used up and, in the case of The Bahamas, it is presently seeking just $400m or less than 50 percent of the total available.

UK Export Finance, which serves as the British government’s credit agency, is also selective in what it funds, choosing only “qualifying projects” once due diligence is satisfactorily completed.

THE TRIBUNE Monday, May 8, 2023, PAGE 9

FROM PAGE B1

‘PROTECT

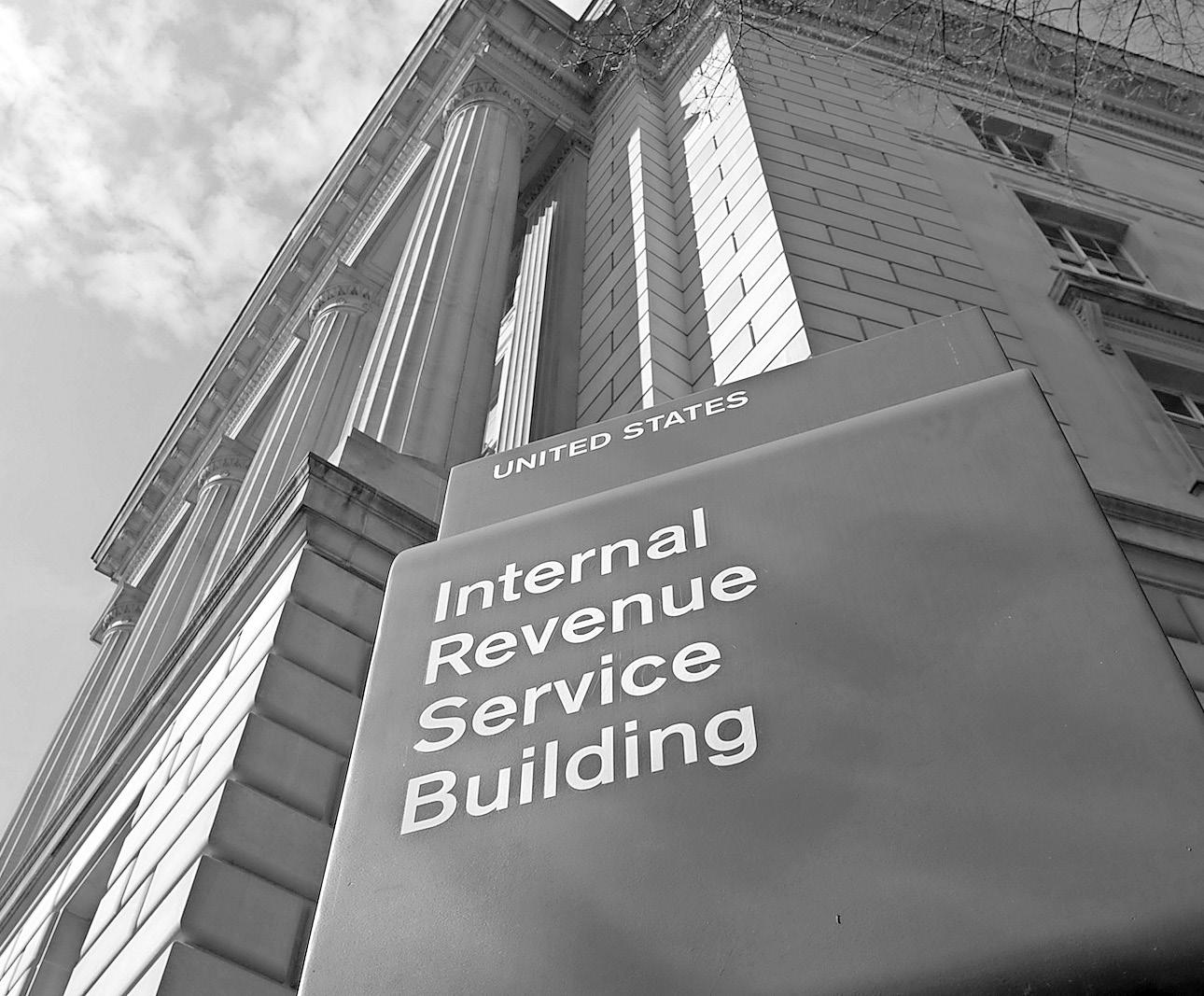

THE EXTERIOR of the Internal Revenue Service (IRS) building in Washington, on March 22, 2013. That big infusion of cash that Congress approved last year to shape up the beleaguered IRS is having an unexpected side benefit. The funding increase has helped the agency to catch up on processing new and backlogged tax returns. And that, in turn, has allowed federal beancounters to give policymakers a more precise picture of when the Treasury could run out of money — the so-called X-date.

FASTER IRS OFFERING BETTER PICTURE ON LOOMING DEBT ‘X-DATE’

By FATIMA HUSSEIN Associated Press

THAT big infusion of cash that Congress approved last year to shape up the beleaguered IRS is having an unexpected side benefit.

The funding increase has helped the agency to catch up on processing new and backlogged tax returns. And that, in turn, has allowed federal bean-counters to give policymakers a more precise picture of when the Treasury could run out of money — the so-called X-date — if the government isn’t able to take on more debt.

The nation is stepping uncomfortably close to an unprecedented default that could have catastrophic effects on the global economy because it is bumping up against its legal limit for borrowing. Congress and the White House have been unable to agree on a plan to lift or suspend the borrowing limit. The debt covers the gap between revenues collected by the government and the programs, projects and services it provides.

In the meantime, the Treasury is using “extraordinary measures” to keep the U.S. from running out of cash. The X-date arrives when Treasury has exhausted those accounting workarounds.

Nina Olson, a former head of the Office of the Taxpayer Advocate, said the latest X-date calculation, provided through IRS data, offers a contrast to how underfunded the agency was in previous years.

During the pandemic, the IRS was so backlogged that it was still processing 2020 returns at the start of 2022.

“They have a better picture of what receipts will be,” Olson said. IRS and Treasury spokespeople declined to comment.

Treasury Secretary Janet Yellen informed Congress this week that the U.S. could default on its debt as early as June 1, if

lawmakers do not raise or suspend the nation’s borrowing authority. That same day, the Congressional Budget Office reported that it, too, was able to zero in on a more accurate X-date because the IRS is “processing tax returns more rapidly than it did last year.”

Tax and policy experts say the up-to-date IRS data is invaluable to understanding the nation’s financial position as the debate over whether to raise the debt ceiling drags on.

“That, in combination with less-than-expected receipts through April, means that the Treasury’s extraordinary measures will be exhausted sooner than we previously projected,” CBO Director Phil Swagel said in his report. The X-date is typically not a specific date — it’s a time range. That’s because it reflects not just the money coming into the government, but the cash that goes out. Even if the government has a better sense of tax revenues, it could have to reimburse a state government, pay a contractor or face expenses that make the X-date a moving target.

Natasha Sarin, a Yale Law School professor who previously worked as a counselor for Yellen on IRS issues, said the latest tax data reveals the “tremendous uncertainty that exists in determining the precise X-date.”

The CBO, Moody’s Analytics and the private Bipartisan Policy Center all try to calculate the time frame for potential default using data on government cash flows and changes in debt. But even their leaders say that no one knows exactly when the X-date could arrive.

That depends on the billions of dollars flowing in and out of federal coffers all the time.

Mark Zandi, chief economist of Moody’s Analytics, said Thursday at a Senate Budget Committee hearing that he estimates the X-date to fall around June 8.

POSTITION WANTED

SEEKING PRIMARY CARE PHYSICIAN

Montague Medical Clinic is seeking to employ full-time and part-time Primary Care Physicians, to work at our New Providence facilities.

Candidates with postgraduate qualifications in Public Health are also encouraged to submit their resume for special consideration.

Please forward all inquiries /resumes along with contact information to montaguemed69@gmail.com

PAGE 10, Monday, May 8, 2023 THE TRIBUNE

Photo:Susan Walsh/AP

Six design options for GB’s $200m airport

charrette with the Government of The Bahamas for the people of Grand Bahama to look at. They’ll have a variety of very innovative designs based on Bahamian architectural typography.”

Mr Myers, together with CFAL president, Anthony Ferguson, is a member of the Bahamian investor group that will spearhead what has been billed as a complete overhaul of Grand Bahama International Airport. They are joined in Aerodrome Ltd by two fellow Bahamians - Anthony Farrington, an engineer; and Greg Stuart, a businessman.

Asked when a groundbreaking will occur, and construction begin on the new airport, Mr Myers replied: “I certainly don’t want to pre-empt what the Prime Minister will say, but it’s very soon. Look out for an announcement very shortly.”

Chester Cooper, deputy prime minister and also minister of tourism, investments and aviation, in confirming the airport deal in mid-March had suggest that work would begin in earnest in April via the “demolition of the old international terminal and storage building”. He added that Aerodrome Ltd and its partners aim to ultimately transform Grand Bahama International Airport into an international “air cargo hub” for the Caribbean and Latin America.

Describing the air cargo plans as “a very big part of the overall design”, Mr Myers said this and the enhanced passenger facilities will be “simultaneously developed together”. He added that the consortium’s vision, with Manchester Airport Group as the operating partner, was to develop “a climate resilient international hub with major linkages globally.

“You’ll see direct flights from London and various other cities in the UK,” he added. “You’ll see a significant increase in air traffic, and see a significant increase in jobs and revenue for Grand Bahama.” Aerodrome Ltd has also hired an accounting firm to assess its project’s likely economic impact and present this data to the Government.

Acknowledging the airport’s importance to facilitating other multimillion dollar projects on Grand Bahama, Mr Myers said: “It is a key. There’s huge investments going on right now between the Weller Group, Carnival, the Grand Bahama Shipyard and expansion of the cruise ship berths. There’s five to six significant projects equal in importance to the airport. It’s a fantastic

opportunity for Grand Bahama and it definitely needs that gateway to support these projects.”

Jesse McDougall, North America and Caribbean head for UK Export Finance, the UK government arm being eyed as the major financier for the Grand Bahama International Airport overhaul, explained that its funding will also support participation by Bahamian companies and employees as well as their British counterparts.

Taking a $100m infrastructure project as an example, she added that UK Export Finance could “scale up” to provide up to $85m of the necessary funding even if British participation was just $20m.

Describing The Bahamas as “a core focus” and “one of my priority locations”, Ms McDougall added: “I came back from The Bahamas last week, meeting with a lot of the ministries there. There’s a great infrastructure need there and in the Caribbean, and an appetite to get things done.”

Mr Cooper, in unveiling the airport deal, said acknowledged that upgrading the facility, which was left in a state of disrepair following the devastation inflicted by Hurricane Dorian in September 2019, is “a key factor” in facilitating both Grand Bahama’s economic rebound and the Grand Lucayan’s sale.

He added that the Government signed the agreement with Aerodrome Ltd, and its partners, in February 2023 for the airport’s redevelopment via a public-private partnership (PPP) that will see the consortium design, build, finance, upgrade and maintain a new main aviation gateway for Grand Bahama.

The consortium’s role, Mr Cooper said, will be to “generate [aviation and passenger] traffic, and to grow revenues and further enhance Grand Bahama International Airport”. He added: “Their mission is to transform Grand Bahama International Airport into a carbon neutral, climate resilient, commercially viable world-class airport.

“Subject to final design, this is expected to be an investment of $200m in that range, and this investment will begin its preliminary work this quarter, this month; March. The airport will consist of two phases which are expected to generate 1,200 construction jobs consistently over the next five years.

“Ninety percent of these jobs will be reserved for Bahamians, and work permits will only be granted where Bahamians cannot be found in accordance with our Immigration laws

and policies. During the construction of phase one of the new Grand Bahama International Airport, which we expect to be completed no later than the first quarter of 2025, 300 construction jobs will be created along with 50 engineering, management and accounting jobs.”

While Aerodrome, the Bahamian investor group,

will lead the project’s financing and management under a contract with Airport Authority-owned Freeport Airport Development Company, BHM will serve as the design and construction partner.

Manchester Airport Group will manage the airport and develop a fee structure, including passenger user and management

fees, to ultimately finance the overhaul while repaying UK Export Finance and other lenders and ensuring the Bahamian group get a return on their investment.

Any net profits produced by the airport will go into the Government’s planned Airport Infrastructure Development Fund.

Although Mr Cooper did not say it, this structure

implies that Grand Bahama International Airport will be operated under the same model as Lynden Pindling International Airport (LPIA), where the Government - via the Airport Authority - retains ownership of the real estate but leases the facility to the consortium long-term, which is likely to be for 30 years.

THE TRIBUNE Monday, May 8, 2023, PAGE 11

FROM PAGE B1 NOTICE is hereby given that BERLINE JOACHIM, Collins Avenue, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 8th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas. NOTICE

Over-the-counter

birth control pill faces FDA questions

By MATTHEW PERRONE AP Health Writer

U.S. health regulators are weighing the first-ever request to make a birth control pill available without a prescription. But in an initial review posted Friday, the Food and Drug Administration raised numerous concerns about drugmaker Perrigo’s application to sell its decades-old pill over the counter.

The FDA cited problems with the reliability of some of the company’s data on the drug, Opill, and questioned whether women with certain other medical conditions would correctly opt out of taking it. The agency also noted signs that study participants had trouble understanding the labeling instructions.

Advisers to the FDA meet next week to review drugmaker Perrigo’s application. The two-day public meeting is one of the last steps before a final FDA decision.

If the agency grants the company’s request, Opill would become the first contraceptive pill to be moved out from behind the pharmacy counter onto store shelves or online.

Friday’s FDA review suggests regulators have serious reservations about broad access to the drug, including whether younger teenagers will be able to correctly follow the labeling directions.

At the end of the meeting, the FDA panel will vote on whether the benefits of making the pill more widely available outweigh the potential risks. The panel vote is not binding and the FDA is expected to make its final decision this summer.

Perrigo executives say Opill could be an important new option for the estimated 15 million U.S. women — or one-fifth of those who are child-bearing age — who currently use no birth control or less effective methods, such as condoms.

“We have no doubt that our data clearly shows that women of all ages can safely use Opill in the over-the-counter setting,” Frederique Welgryn, the company’s global vice president for women’s health, said this week.

The company’s application has no relation to the ongoing lawsuits over the abortion pill mifepristone, which is not a contraceptive. Research for over-the-counter sales of the pill began nearly a decade ago.

Hormone-based pills, like Opill, have long been the most common form of birth control in the U.S., used by tens of millions of women since the 1960s.

Opill was first approved in the U.S. 50 years ago.

Perrigo acquired rights to the drug last year with its buyout of Paris-based HRA Pharma, which bought the pill from Pfizer in 2014. It’s not currently marketed in the U.S. but is sold without a prescription in the U.K.

FDA’s decision won’t apply to other birth control pills, only Opill, although advocates hope that an approval decision might push other pill makers to seek over-the-counter sales. Birth control pills are available without a prescription across much of South America, Asia and Africa.

Many common medications have made the over-the-counter switch, including drugs for pain relief, heartburn and allergies. Generally, drugmakers must show that consumers can accurately understand and follow the labeling instructions to safely and effectively use the drug. Non-prescription medicines are usually cheaper, but generally not covered by insurance. Forcing insurers to cover over-the-counter birth control would require a regulatory change by the Department of Health and Human Services.

Perrigo’s main study tracked nearly 900 U.S. women taking its pill without professional supervision for up to six months. The group included women of different ages, races, educational and cultural backgrounds.

Women were paid to track and record their use of the pill, including whether they followed instructions to take it during the same 3-hour window each day. That consistency is key to the drug’s ability to block pregnancy. But after Perrigo wrapped up its study, the FDA identified a problem: nearly 30% of women erroneously reported taking more pills than they were actually supplied.

The FDA said Friday these cases of “improbable dosing” call into question the company’s results. Perrigo will present a reanalysis of the data that excludes the participants who overreported. The company says the results showed the study still achieved its goal of demonstrating that most women used the pill correctly.

Women reported taking the pill on a daily basis 92% of the time during the study, the company says.

The company says its data show there would be about two pregnancies for every 100 women who take its pill for a year. But the FDA called this figure “an imprecise estimate” because the study was significantly smaller than those typically used to evaluate contraceptive effectiveness.

The most popular birth control pills today contain a combination of synthetic hormone progestin, which helps block pregnancy, plus estrogen.

Access Medical Clinic

Nassau is seeking a

Pharmacist to join our team! As a leading provider of pharmaceutical services in the area, we are committed to delivering the highest level of care to our patients.

The ideal candidate must have a Doctor of Pharmacy degree and a current license to practice in The Bahamas. Additionally, the candidate must be able to work independently and have strong communication skills to interact with both patients and healthcare professionals.

We are offering a sign-on bonus for the successful candidate to join our team, and we provide a competitive salary and benefits package, including health insurance, and paid time off.

If you are a motivated and dedicated pharmacist looking for an exciting opportunity to advance your career, Access Pharmacy is the place for you. To apply, please send your resume and cover letter to accessmedicalbahamas@gmail.com. We look forward to hearing from you soon!

PAGE 12, Monday, May 8, 2023 THE TRIBUNE

JOB OPPORTUNITY

CALL 502-2394 TO ADVERTISE TODAY!

Apple-juiced rally closes bruising week

By STAN CHOE AP Business Writer

APPLE was at the head of a widespread rally on Wall Street Friday after the market's most influential company reported a better profit than expected. Stocks of beaten-down banks also leapt to recover a smidgen of their sharp losses from a brutal week.

The S&P 500 jumped 1.8%, though it still turned in a modest loss for the week that was its worst in nearly two months. The Dow Jones Industrial Average climbed 546 points, or 1.7%, while the Nasdaq composite rallied 2.2%.

Treasury yields jumped in the bond market after a report showed hiring accelerated across the economy by much more than expected last month.

The U.S. government's jobs report also showed workers won bigger pay raises in April than expected.

While that's good news, particularly when many economists fear a recession may arrive this year, the data also raises worries inflation may stay high and push the Federal Reserve to keep interest rates higher.

That in turn would keep the pressure up on an already slowing economy.

The data did little to narrow the extremely wide range of possibilities for the economy that investors are forecasting for the economy, from a painful recession to a soft landing, said Bill Northey, senior investment director at U.S. Bank Wealth Management.

"Today's jobs report likely gave both the bulls and the bears something to anchor around," he said.

High interest rates have already caused cracks in the U.S. banking system, and fears about what may be next to fall have rocked the industry. This week began with regulators seizing First Republic Bank, which became the third large U.S. bank failure to hit since March.

Investors have been hunting for the next possible weak link in the system and driving down stock prices for those seen at risk of a sudden exodus by customers. That's even as banks protested that they were seeing deposit levels stabilize or strengthen. Several of the hardest hit recovered some of their steep losses Friday, adding to the ebullient mood.

PacWest Bancorp. soared 81.7%, though it still lost 43.3% for the week. Western Alliance Bancorp. jumped 49.2% to trim its loss for the week to 26.8%.

The worry is falling stock prices for banks could create a vicious cycle that causes customers to lose faith and pull their deposits, which then raises more fear for the system.

Apple didn't rise as much as those banks Friday, but its moves pack a more potent punch. Apple is the most valuable stock on Wall Street, which gives its moves outsized weight on the S&P 500 and other indexes.

Its 4.7% gain made it the biggest force by far lifting S&P 500. The iPhone

maker reported a drop in earnings and revenue, but the results nevertheless topped analysts' muted expectations.

The story has been similar across the broader market for results during the first three months of the year. Analysts came into this earnings reporting season with low expectations given high interest rates and a slowing economy, but the majority of companies have done better than feared.

Live Nation Entertainment jumped 15% after reporting a more modest loss than analysts expected, while Cigna Group rose 7% after topping forecasts for profit and revenue.

On the losing end was Lyft, which slumped 19.3% after it gave a weaker financial forecast for the current quarter than Wall Street expected. It's a contrast to competitor Uber, which rose solidly for the week following its earnings report.

In the bond market, yields leaped immediately after the jobs report as traders bet on it pushing the Fed to keep rates high for longer than earlier expected.

The Fed on Wednesday said that it wasn't sure of its next move after raising its benchmark rate to a range of 5% to 5.25%, up from virtually zero early last year. It's been raising rates at the fastest pace in decades to drive down inflation, but that works by slowing the economy and hurting investment prices.

Many traders expect the Fed to hold rates steady at its next meeting in June, which would be the first time that's happened in more than a year. After that is where expectations diverge.

The Fed has been insistent that it sees inflation coming down slowly, which would mean rates would stay high for a while, if not rise further if inflation were to reaccelerate. Many traders, meanwhile, see the economy weakening so much that the Fed will have to cut rates later this year.

Adding to the uncertainty is what comes out of the U.S. banking industry's turmoil. If it causes banks to pull back on their lending, that could act like rate increases that further smother the economy.

Friday's jobs report offered encouraging and discouraging news, depending on one's outlook.

The strong hiring numbers reaffirm that the job market is remaining resilient. It's propping up the rest of the economy, which has already begun to slow under the weight of much higher interest rates.

But more concerning to pessimists was the 4.4% rise in wages for workers from a year earlier. The fear is toostrong wage increases could push companies to raise prices for their own goods and make other moves that create a vicious cycle that keeps inflation high. That in turn could pressure the Fed to keep rates higher for longer, which could cause more things to break beyond First Republic.

NOTICE

In the Estate of CALEB EUGENE PEDICAN late of the Settlement of Bluff in the Island of Eleuthera one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE IS HEREBY GIVEN that all persons having any claim against the above named Estate are required on or before the 12th day of May, 2023 to send their names and addresses and particulars of their debts or claims to the undersigned and if so required by notice in writing from the undersigned to come in and prove such debts and claims or in default thereof they will be excluded from the benefits of any distributions made before such debts are proved AND all persons indebted to the said Estate are asked to pay their respective debts to the undersigned.

HAILSHAMS LEGAL ASSOCIATES

Counsel and Attorneys at Law

RENALDO HOUSE 10 Queen’s Highway Palmetto Point, Eleuthera, Bahamas

P. O. Box SS 5062, Nassau, Bahamas

Attorneys for the Administrator of the above Estate Tel: 242-332-0470

hailshams@1stcounsel.com

THE TRIBUNE Monday, May 8, 2023, PAGE 13

email:

The Public is hereby advised that I, BENIESHA OLIVIA CECILE RUSSELL of #17 St. Lucia Road, Nassau, Bahamas intend to change my name to OLIVIA MARCIA CECILE BAIN. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, New Providence, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

MGP Invest S.A. (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, MGP Invest S.A. is in dissolution.

The dissolution of the said Company commenced on May 3, 2023 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas.

The sole liquidator of the said Company is Kim D Thompson of Equity Trust House, Caves Village, West Bay Street, P O Box N 10697, Nassau, Bahamas.

Kim D Thompson Sole Liquidator

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

MGP Invest S.A. (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, MGP Invest S.A. is in dissolution. The dissolution of the said Company commenced on May 3, 2023 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas.

The sole liquidator of the said Company is Kim D Thompson of Equity Trust House, Caves Village, West Bay Street, P O Box N 10697, Nassau, Bahamas.

Kim D Thompson Sole Liquidator

PAGE 14, Monday, May 8, 2023 THE TRIBUNE

INTENT TO CHANGE NAME BY DEED POLL

PUBLIC NOTICE

Career Opportunity CAD TECHNICIAN

• Must have - 5 years experience using CAD

• Ideally - 2 years experience working for an architecture firm

• Be able to produce full architectural drawings (internal floor plans,

elevations, site plans)

• Create high-quality detailed technical drawings and plans based on designs

supplied by architects and designers and make modifications to existing

drawings

• Use a variety of CAD software programmes to create designs in 2D and

3D models

• Liaise with architects, engineers and designers to understand their design