Cable ‘accelerates’ fibre due to Elon Musk threat

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

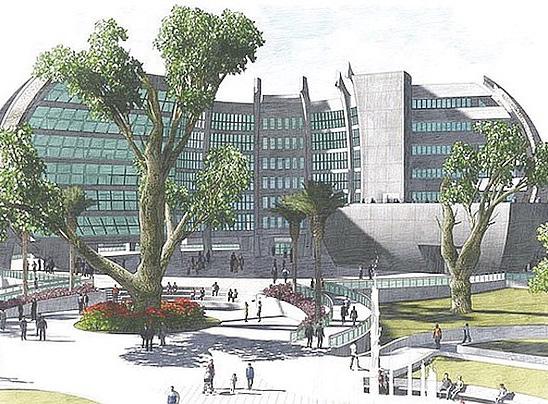

CABLE Bahamas is “accelerating” the roll-out of its fibre-to-the-home network infrastructure in response to the competitive “threat” posed by Elon Musk’s Starlink, its chief executive revealed yesterday.

Franklyn Butler told Tribune Business the BISX-listed communications provider will respond rapidly to safeguard its

market share after Bahamian regulators licensed the Tesla and Twitter magnate’s satellite Internet service provider to operate in this nation exactly three months ago.

Disclosing that its Aliv fibre network now passes 30,000 New Providence homes, he added that the product will “officially be launching” across several communities next week where homeowners will be given the chance to switch from Cable Bahamas’ existing HFC (hybrid fibre coaxial) infrastructure so

they can enjoy a “better experience” with broadband Internet and video TV services.

Acknowledging that the REV and Aliv operator has “had our challenges over the last few years” with customer service issues, Mr Butler also echoed industry regulator, the Utilities Regulation and Competition Authority (URCA), in saying he was “not sure we see a business case for 5G (fifth generation technology) in The Bahamas at the moment”.

While Cable Bahamas and its Aliv mobile affiliate will monitor 5G’s progress and evolution, he added that the group will only invest in technology where it “makes sense” and the returns to shareholders are clear. The Cable chief spoke as the company’s turnaround strategy showed signs of gaining further momentum, with figures for the nine months to end-March 2023 revealing a positive $12.52m bottom line

Central Bank takes $9m hit over abandoned HQ project

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SUPER Value is aiming to reduce egg prices to $1.99 per carton “as quickly as possible” amid hopes its solar roll-out can contain surging energy costs to just a 10-20 percent increase, its president revealed yesterday.

Debra Symonette told Tribune Business the 13-store chain has enjoyed a “big relief” on egg prices, which it was selling on ‘special’ at $5 for two dozen-strong cases of the Hillandale brand this weekend, after farmers replenished their stocks following a devastating outbreak of bird flu.

Disclosing that food prices in general continue to stabilise, with far fewer of the “huge” increases experiences post-pandemic, she nevertheless warned Bahamian consumers that costs “may not go all the way down” to where they were prior to COVID’s outbreak in March 2020.

“We’ve definitely seen a big relief in the price of

eggs,” Ms Symonette told this newspaper. “We’re hoping to take it even further down in the near future. I think farmers have just got over the crisis they were in with the bird flu and shipping costs. When all the birds died that was a major issue, and they’ve managed to replenish the stocks so they have more eggs available now.

“We’re really hoping to get the price down to $1.99 per dozen case. If we can do it for next week, we will. We’re going to do it as soon as possible. We have seen a bit of a decrease in beef and poultry, but otherwise things are remaining pretty much the same. At least we’re not seeing as many huge price increases as we were before. We’ll probably see a little increase here and there, but nothing like what we were seeing before.”

Ms Symonette said a reduction in shipping and freight costs, increased food supplies and an easing of the post-COVID supply chain bottlenecks had all factored into a levelling off

SEE PAGE B4

Payment fraud up eight-fold at $21m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

PAYMENT fraud increased in value almost eight-fold to $21.2m in 2022 with debit cards accounting for four out of every five reported cases, it was revealed yesterday.

The Central Bank, in its 2022 annual report, revealed that while the number of reported incidents fell by 24.2 percent year-over-year there was a significant increase in the sums involved.

“In keeping with the emphasis on consumer

financial protection, the Central Bank also collects data on fraud relative to cheques, debit and credit cards,” the regulator said.

“In 2022, the reported number of such cases reduced by 24.2 percent to 6,319. However, the corresponding value expanded to $21.2m from $2.6m.

“Analysed by type, instances of debit card fraud constituted 80.5 percent of total cases, while the attendant value comprised 71.4 percent of the overall value. Reported credit card fraud comprised 18.9 percent of total cases, and

SEE PAGE B5

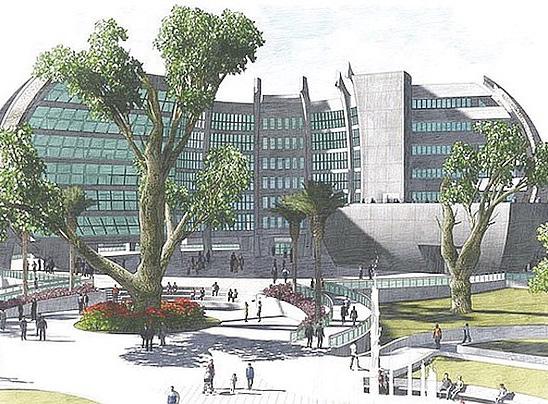

THE Central Bank yesterday revealed it has been forced to write-off almost $9m after the project to construct its new Royal Victoria Gardens headquarters was abandoned, with further impairment charges likely in 2023.

The banking sector regulator, in the financial statements attached to its just-released 2022 annual report, disclosed the extent of the immediate financial hit it has sustained as a result of not proceeding with a development where six years worth of work has effectively gone to waste.

Detailing the impact, note four in the financial statements on property, plant and equipment said:

“The Bank’s ongoing construction of its new premises on the Royal Victoria Gardens (RVG)

site located between East Street and Parliament Street, south of Shirley Street and north of East Hill Street in the city of Nassau, Bahamas, continued throughout the year.

“By resolution in Parliament, the Government of the Bahamas authorised the transfer of property to the Bank at a nominal cost of $10. The site preparation and demolition phase for the project began in 2020 and the architectural designs were completed.

“In March 2023, the Board of Directors approved the termination of the ‘New premises project’ and the transfer of the property ownership back to the Government. As a result, the Bank has recognised an impairment loss associated with this project totalling $8.92m as at yearend [2022]. Additionally, the Bank has estimated

• And warns further writeoffs to come in 2023

• Minnis: My $12m loss estimate ‘conservative’

• Cash, Data facility to break ground by June 30

Central Bank exceeded Govt lending limits at year-end ‘22

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE CENTRAL Bank would have massively exceeded its legal lending limits to the Government had the latter’s accessing of $232.3m in IMF special drawing rights (SDRs) been included in the 2022 year-end calculation.

The banking regulator’s audited 2022 financial statements, released yesterday to accompany its annual report, reveal it had in any case exceeded

its legal limit for “temporary” loan advances to the Government by some $2.3m as of end-December 2022 although the breach was deemed to create no concern.

However, the Central Bank’s annual financial statements underline the urgency with which its governing Act had to be changed by Parliament recently to exclude the International Monetary Fund (IMF) SDRs from the calculation involving its temporary loan

SEE PAGE B5

business@tribunemedia.net TUESDAY, MAY 16, 2023

• Billionaire’s Starlink satellite Internet new ‘headwind’ • BISX-listed firm’s new network passes 30,000 homes • Chief executive ‘not sure business case’ for 5G yet

SEE PAGE B3

ARTIST rendering of the winning design for what was supposed to be the future building for the Central Bank of The Bahamas.

Super Value’s ‘egg relief’ amid BPL containment

SEE PAGE B4

$5.74 $5.74 $5.74 $5.95

CENTRAL BANK OF THE BAHAMAS

FML CHIEF MAKES CALL FOR RENEWABLES SWITCH

A WEB shop principal yesterday argued that The Bahamas must do more to capitalise on its renewable energy sources as companies brace for up to 163 percent increases in Bahamas Power & Light’s (BPL) fuel charge this summer.

Craig Flowers, the FML Group of Companies chief, said: “I don’t think that BPL can do anything to provide a significant change in the cost of electricity in The Bahamas unless we can go to some alternative means of energy.

“There is a major discussion that needs to be had for us in the Caribbean, particularly with the

amount of sunshine that we have outside the amount of trade winds that we have in the country, that is necessary for us to to go out and seek an alternative means of energy to become the primary source.

“Right now, we are less stuck and we are relying on fossil fuels,” he added. “And I don’t know if that has any sustainable longterm benefits to the country. The Government needs to have a conversation with all the parties to be, and certainly educate the public. We can do more, I say, as a country if we can get the citizens to buy into and to get on board.

“But that’s an educational process that has to be done.

I don’t think that is that difficult because of the rate at which technology is forcing all of us to become more

CRYPTO ISLE PARTNERS WITH COMMISSION OVER DARE

A DIGITAL assets coworking space has teamed with the Securities Commission to host a Town Hall meeting to review the legislative changes to the Digital Assets and Registered Exchanges (DARE) Act.

The meeting, which is being co-organised by Crypto Isle and the Securities Commission, will take place on Thursday, May 18, at 5.30pm at the former’s offices located at One East Bay Street opposite Scotiabank.

The proposed changes to the DARE Act are intended to further strengthen, update and modernise the existing legislation governing digital assets and digital asset businesses in The Bahamas. The town hall meeting will provide an opportunity for attendees to learn more about the DARE regulatory framework and the proposed Bill, and to provide feedback on how those changes may impact the digital assets industry.

“We are excited to partner with the Securities Commission of The Bahamas to host this important town hall meeting,” said Crypto Isle co-founder

Davinia Bain. “The proposed amendments to the DARE Act 2020 will have a significant impact on this vital and important sector, and it’s important that stakeholders are deeply engaged in shaping this industry.”

The Securities Commission released the proposed changes for consultation two weeks ago, and Crypto Isle - after welcoming the important and largely positive reforms indicated by the draft amendments - subsequently released a survey inviting feedback from members of the crypto and blockchain entrepreneurial community. The survey will run until Friday, May 26.

Ms Bain added: “We hope for enthusiastic and constructive engagement with the local and international players in the sector, and are truly excited about the opportunity to engage in meaningful dialogue at this Town Hall meeting.”

The Town Hall meeting is open to the public, and all stakeholders are encouraged to attend. Those who wish to attend can register at linktr.ee/crypto_isle.

cognisant of our surroundings and what’s happening in neighbouring countries. And I think it’s an easy sell, and even more so to the younger population who are going to have the greatest input or concern for this matter.”

Mr Flowers asserted that, given the cost of energy infrastructure, businesses

that may benefit the most from renewable sources cannot afford to have it installed. Thus it is critical for government to lead the charge.

He said: “A consequence [of the high electricity rates] to most of the bigger companies that deal with hundreds of thousands of dollars on a monthly basis for electricity, that cost is astronomical and we have to find alternative means. Individual companies can look at, and probably visualise or have on a wish list that these things take place, but they’re not going to really be effective or sustainable for any long-term period unless government is involved. It’s about educating the public.”

“My company alone, or several of us, will benefit ourselves, but the

population that needs this lower range of energy to be provided is not in a position to afford to pay for the infrastructure. The savings is over a long period of time. It’s a large investment to be considered at any one time, and only governments can really plan a structure whereby the payment for it is done.”

Mr Flowers said the Government’s approach to obtaining the funds necessary to switch to renewable energy sources must be strategic and transparent to ensure the public buys in.

He added: “I think that the Government really needs at this time to look seriously at the way it does business when it comes to initially initialising these new types of ideas in the country. I mean by that if there was going to be an

investment in borrowing funds for renewable energy, and that is, just hypothetically $1bn, then go out and borrow the $1bn but show the public when this $1bn is paid off there are no more payments.

“Government likes to implement taxes. That doesn’t have any closing date and people are annoyed by it. Those types of approaches, you have to be more strategic, you have to be more transparent, and it has to sell to the public that this tax is for the purpose of providing you the infrastructure to give you a lower cost of energy. If that message can be sold by the Government, a lot of these things that we speak of for improving the fundamental things in our country can be had.”

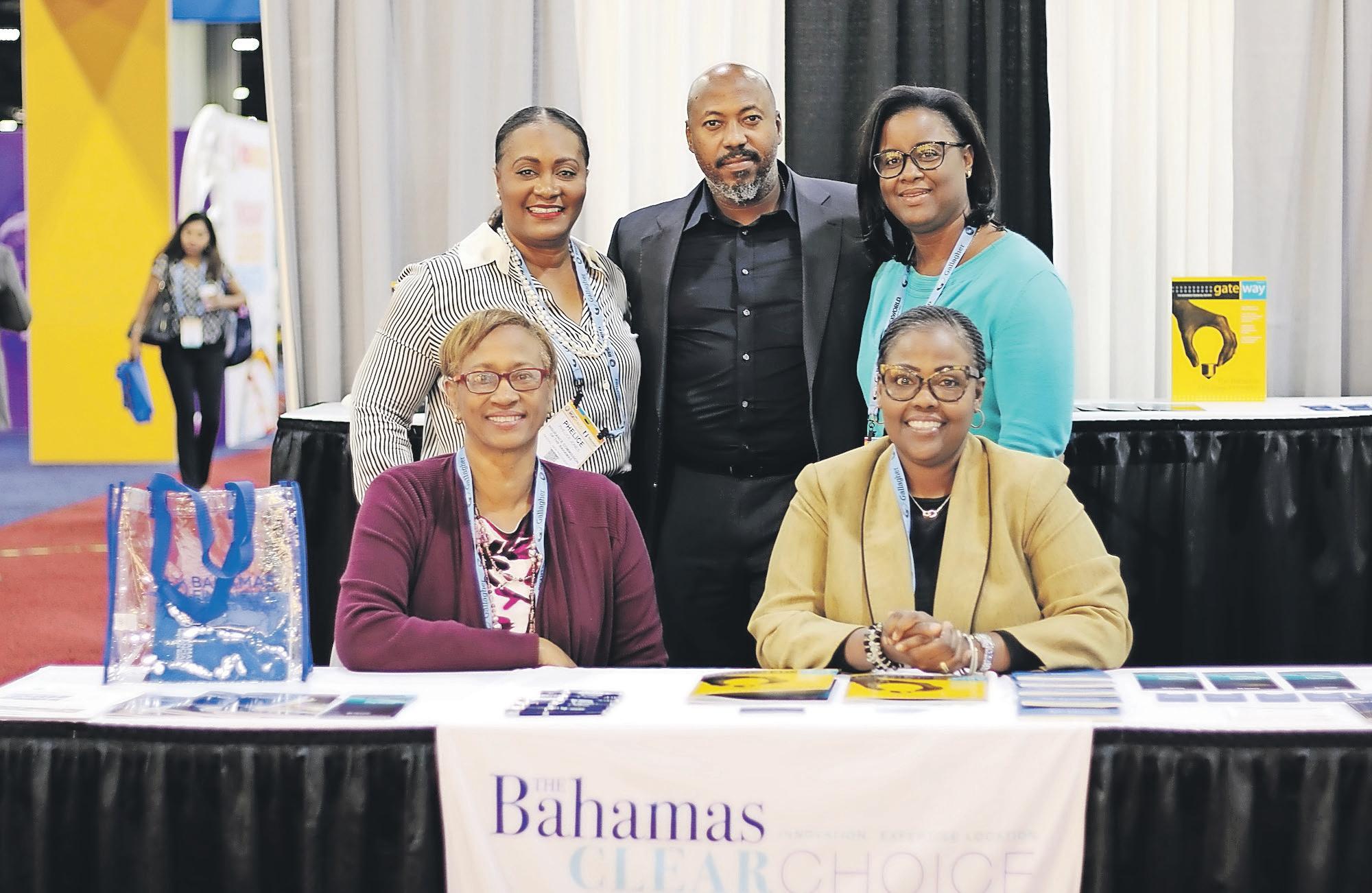

Bahamas delegation attends key risk management summit

THE BAHAMAS Financial Services Board (BFSB) and the Insurance Commission of The Bahamas (ICB) teamed up to give this nation added presence at a major risk management conference.

The two partnered to attend Risk Insurance Management Society’s (RIMS) RISKWORLD 2023, which was held at Georgia World Congress Centre in Atlanta from April 30 to May 2. The four-day event brought together more than 10,000 risk management professionals for an opportunity to educate, learn and connect with clients and other risk professionals.

The Bahamian delegation focused primarily on promoting the captive insurance industry’s growth in The Bahamas. Its members included Dr Tanya McCartney, BFSB chief executive; Rianna Sobiech, BFSB marketing and special projects associate; Michele Fields, insurance superintendent at the Insurance Commission of The Bahamas (ICB); Tiffany Moss, analyst intermediaries and market conduct at the ICB; Phelice Jones, deputy manager of supervision at ICB;

Jermaine Williams, vicepresident and chief risk officer at Commonwealth Bank; Kencil McPhee, external insurance manager at J.S. Johnson & Company; Candice Bain, business development manager/principal representative at The Bahamas Co-operative League/Cooperative Assurance; and Larnest Brown, group procurement manager at Cable Bahamas.

RIMS, founded in 1950, provides a platform for risk management professionals to create a safer, more secure and more sustainable world. RISKWORLD

2023, hosted under the theme of ‘The world of resilience’, is an event that enables attendees to collaborate with other risk professionals and swap strategies.

RISKWORLD

2023 gave risk management

executives insights and tools on how to respond to challenges they face both today and tomorrow, with in-depth education for all career levels. This took place in a marketplace filled with 400-plus exhibitors. The topics featured at this event ranged from career development and claims management to cyber and technology risk.

Cruise ship in first call on GB

FOUR hundred and sixty-eight passengers were on board the Regent Seven Seas Navigator as it made its inaugural voyage to Grand Bahama on Saturday, May 6, where they were met by representatives from the Ministry of Tourism and the Freeport Harbour Company.

During their meeting, commemorative plaques were exchanged. Shown from left are: Roman Laing, marine pilot; Captain Orlando Forbes, port director; Captain Luksa Kristovich, ship’s captain; Nuvolari Chotoosingh, Ministry of Tourism manager for groups and events; and Shawn Thurston, marine pilot.

PAGE 2, Tuesday, May 16, 2023 THE TRIBUNE

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

CRAIG FLOWERS

Photo:Andrew Miller/ BIS

ABACO CHAMBER WARNING ON WORK PERMIT BREACHES

ABACO’S Chamber of Commerce has issued a fact sheet to the island’s employers to address the “huge issue” of work permit and labour law violations.

Daphne DeGregory-Miaoulis, the Chamber’s president, told Tribune Business: “It’s a huge issue… We have just put out a flyer and it’s on our website. And we’re circulating it to all of the real estate agencies, the second home owner chat groups, outlining what the law allows for and what is considered illegal.”

She added that many second homeowners allow persons to work outside the scope of their work permits, while in other cases many expatriate workers are not working on the island where their permits were issued. “A lot of the second homeowners are under the misconception that if somebody has a work permit issued by somebody else, that they are still legal to be

employed,” Mrs DeGregory-Miaoulis said. “If the Immigration Department were to enforce the requirement of housing provided by the work permit holder, then that would cut down a lot because you do have people getting a work permit for somebody out of Nassau who basically are selling them the work permit, and they go to work in other islands. I think that’s an enforcement and policing issue. When work permits are issued, they need to be enforced... what the terms of the work permit are.”

Her comments came after Keith Bell, minister of labour and Immigration, last week affirmed the multiple challenges created by foreign workers working outside the scope of their work permits and/or working for a different employer who did not sponsor the application and pay the fee.

“We need to hear from you as to how we ought to address and deal with these challenges. We’re at a crossroad in this country, and we have to determine how we now move forward with it,”

Mr Bell told the Bahamas Chamber of Commerce and

Employers Confederation (BCCEC) at its breakfast meeting.

The Abaco Chamber of Commerce, in its communication, said: “We encourage our fellow Bahamians, permanent residents and second homeowners to understand that persons who employ migrants illegally directly contribute to: Illegal shanty town development/unlawful leasing of land…human trafficking/ exploitation of vulnerable persons…environmental/ public health hazards of unsanitary settlements and and unsafe dwellings.”

Mr Bell last week said that revoking work permits for labour law violations

could lead to significant labour shortages in certain areas such as construction. “Given the substantial number of persons who are working for other people, it’s impossible for the director now to come in and say I’m going to cancel all of these work permits because we could have a significant collapse in certain industries,” he added.

Mrs DeGregory- Miaoulis disagreed with this position, asserting that the majority of offenders - such as persons brought in as farm labourers but who are really skilled construction workers - could be replaced by Bahamians. She said: “No, I don’t agree with that. But I do think that persons who are hiring the illegals, half the time they’re actually being trained and they’re learning their skills on the job. Bahamians would do the same.

“They want Bahamians to come in with skills. They should allow the same opportunities to young Bahamians. And learn a trade on the job the same way the illegals are learning a trade on the job. They didn’t come here with this knowledge or with this

trade experience. They’re developing it actually on the job.”

Mrs DeGregory-Miaoulis suggested that large foreign direct investment projects partner with local educational institutes, such as the Bahamas Technical and Vocational Institute (BTVI), to elevate trade skills throughout The Bahamas. She said: “When these big developments or resorts are coming in, if they know in advance that they’re going to have a labour shortage, one of the things our government should be negotiating for, especially in remote areas…on Family Islands, instead of giving all concessions to the developments, require them to do something for the community.

“If they expand local schools on the relevant islands, and sponsor the trainers to teach at the various schools... maybe finance the employment or use some of their trade men that they’re getting permits for to give courses at the trade school. I mean, we can only grow as much as we provide opportunities

Cable ‘accelerates’ fibre due to Elon Musk threat

‘swing’ to a $7.292m net profit for the period.

“We believe we are following the plan we agreed in the sense that we have got to continue to grow Aliv, and have got to continue to improve customer service across the group and see what we’ve got to do to win more market share,” Mr Butler told this newspaper after Cable Bahamas maintained its 2023 financial year’s consistent quarterly profit trend.

“That’s what we’ve been working towards; making the company profitable, and making net income and not just EBITDA (earnings before interest, taxation, depreciation and amortisation). That has been a focus.

We completed refinancing of our long-term debt in June last year and we’ve been focusing on how to be more efficient from a cost perspective even though there are headwinds on utility costs. That’s something we didn’t necessarily plan for.”

The “utility costs” is a reference to the up to 163 percent increase in Bahamas Power & Light (BPL) fuel charge, compared to October 2022 levels, that the likes of Cable Bahamas and other major electricity users will suffer during peak summer consumption this year. Mr Butler said he did not have figures to hand on the likely increase in Cable Bahamas’ year-overyear electricity costs, but indicated this is one of several challenges the group faces.

“I would say we’re largely on track, but there’s still a lot of headwinds,” he told Tribune Business. “This is a business that is evolving.

We see a threat from Starlink, which was licensed by URCA a couple of months ago. We have to improve our service, be alert to what is happening around the sector from a telecommunications perspective, and listen to our customers and meet their needs.

“We are in a digital transformation that started before the pandemic, and gathered speed through the pandemic, and we have to recognise that customers are serious about having their needs met.” Cable Bahamas, in its feedback to URCA’s proposed 2023 annual plan, said then that “the new and fast developing satellite to mobile industry, which is being pushed globally by new commercialised satellite companies, cannot be ignored”. Its statement proved accurate far quicker than it likely anticipated. For on February 15, 2023, URCA granted a class operating licence and class spectrum licence to Starlink Services Bahamas, which was represented by the Lennox Paton law firm. Starlink is an affiliate of Elon Musk’s SpaceX, which is not only seeking to offer satellite

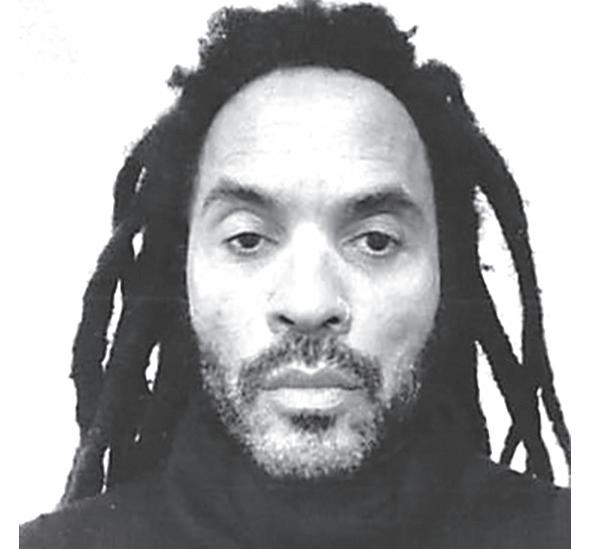

ELON MUSK

Internet services but also mobile services.

Starlink and SpaceX are backed by the considerable financial resources of Mr Musk, the Tesla/Twitter magnate and entrepreneur, who has been ranked by both Forbes and Bloomberg’s Billionaires Index as the world’s second richest man with an estimated net worth between $167bn and $176.2bn. Starlink’s Internet and, potentially, mobile satellite services would also appear to have a market in the Family Islands where Cable Bahamas and BTC’s networks do not extend.

“Starlink has a service people perceive as potentially being more reliable because satellite Internet, particularly in the Family Islands, where we don’t necessarily have fibre, some people believe its more dependable and that’s why we have to accelerate Alive fibre’s roll-out,” Mr Butler conceded to Tribune Business.

“We have 30,000 homes passed with fibre so far on New Providence, and we

will officially be launching above the line in a few communities next week. We’ve been testing so far, using test customers for the most part. We’ll now be allowing customers in areas where we have fibre to sign up for the service and convert from HFC to fibre so they have a better experience.”

Cable Bahamas’ $80m$85m investment in its fibre-to-the-home network is also designed to compete head-on with BTC’s similar infrastructure. Noting that Cable Bahamas will hold an official launch around May 22, Mr Butler added: “It’s definitely gathering some steam. We had some challenges on the equipment side with one of our vendors, but we feel we’ve solved that.

“Aliv fibre is about making sure the customer gets a better service and better experience in keeping with when we launched Aliv a few years ago.” Mr Butler said Cable Bahamas’ fibre build-out on Abaco had gained a headstart post-Dorian, as the

N O T I C E

IN THE ESTATE OF ROBERT RICHARD RUSSELL late of Windsor Estates Subdivision, in the Eastern District of the Island of New Providence one of the Islands of the Commonwealth of the Bahamas, deceased.

NOTICE is hereby given that all persons having any claim or demand against the above Estate are required to send the same duly certified in writing to the Undersigned on or before 20 June 2023, after which date the Executrixes will proceed to distribute the assets having regard only to the claims of which they shall then have had notice.

AND NOTICE is hereby also given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

BAYCOURT CHAMBERS

Attorneys for the Executrixes Chambers

company rebuilt its network there using the technology.

Once the New Providence roll-out is completed, Cable Bahamas will then likely look at Eleuthera “first” before moving on to Grand Bahama, although this schedule could change depending on where major hurricanes strike The Bahamas. The BISX-listed communications provider is aiming to finish its work on New Providence by June 2025.

Turning to URCA’s recently launched consultation on 5G, Mr Butler said Cable Bahamas will focus on improving the existing communications services it offers first as a “priority” in accordance with the regulator’s wishes. “We continue to look at what could make sense, but I’m not sure if we see a business case for 5G in The Bahamas at the moment,” he told Tribune Business.

“While we certainly have a plan, our hope is to leverage the assets we have and make sure we’re responsible in our investment process. We want to focus on providing shareholder returns as opposed to choosing technology that doesn’t provide a return to the shareholder.

“This industry never stops, and you can never get complacent. Circumstances change all the time, technology changes all the time. We have competitors chomping at the bit to gain our customers. We continue to be vigilant to improve service and give customers a better experience. We know we’ve had our challenges over the last few

years, but are taking them head on and treating them as seriously and intently as we can. We hope our customers see the results.”

Cable Bahamas’ $7.292m profit for the nine months to end-March 2023, as opposed to the prior year period’s $5.23m loss, was driven largely by a near$10m increase in its top-line revenue. Mr Butler said the 6 percent growth, from $161.759m to $171.383m, was driven largely by its government and B2B (business to business) segments

for local young people to get the training.

“Whatever is most feasible but, in some way, get the financial support and commitment with these developments that are going to need the employment. Get them to help provide scholarships for students even in particular trades where they see that they’re going to need that kind of labour force in the future.”

The Abaco Chamber president backed plans for a National Apprenticeship Programme and maintained that training and education will help quell crime and other social ills.

She said: “We’ve got to get our young people trained and educated and off the streets, and that will help to cut down on crime. Because our kids are born criminals. They’re idle. They don’t have things that will provide them a future, you know, work. So we need to get them trained, and we need to give them a sense of responsibility and a sense of value that keeps them off of the street and out of the gangs.”

plus the Aliv mobile operator.

The same trend was seen for the third quarter, covering the three months to end-March, with revenues increasing by 6.7 percent year-over-year from $54.376m to $58.007m. Net profits more than doubled, rising 117 percent from $1.462m to $3.095m.

“As long as we have no external shocks such as hurricanes, which change things, we anticipate that we have set the foundation to continue to improve net income and results,” Mr Butler said.

IN THE ESTATE of DANIEL ALEX RECKLEY , late of the Southern District of the Island of New Providence, one of the Islands of The Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 1st day of June A.D., 2023, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Administrators shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO., Attorneys for the Administrators Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

THE TRIBUNE Tuesday, May 16, 2023, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net DAPHNE DEGREGORY-MIAOULIS

FROM PAGE B1

P.O. Box SS-6836 Cumberland House 15 Cumberland & Duke Streets New Providence, The Bahamas.

NOTICE

CENTRAL BANK TAKES $9M HIT OVER ABANDONED HQ PROJECT

that additional termination fees will be recognised subsequent to year-end.”

The Central Bank added that it “will explore alternative arrangements to meet its long-term accommodation needs”, but the annual report’s disclosures - that, in effect, $9m of the regulator’s money has been wasted with further financial hits to come - will raise further questions as to why the project was abruptly abandoned and likely spark calls for greater explanation from both it and the Government.

John Rolle, the Central Bank’s governor, has not responded to Tribune Business questions on the issue and has remained tightlipped. No explanation is provided in the annual report, while for the Government, Michael Halkitis, minister of economic affairs, said it had suggested “the optics” of the project may not be the best so soon after COVID-19 and that

other priorities should take precedence. However, given the extent of the financial exposure already incurred, questions are likely to be raised as to why the project did not proceed given that the Central Bank was already so deeply invested. And the funding source was the Central Bank, and not Bahamian taxpayers via the Government, meaning the former was taking all the risk. It thus appears likely the Royal Victoria Gardens project was aborted at the Government’s request for reasons that are not yet clear.

Dr Hubert Minnis, the former prime minister, yesterday reiterated his criticism of the Government’s “ill-advised and poor decision” not to proceed and argued that his previous estimate that the Central Bank stands to lose a total $12m was “conservative”.

“The Central Bank had already invested money. It was their money, not the Government’s money, that

was already allocated and budgeted for,” he blasted.

“That [the headquarters] was part of a plan for regeneration and redevelopment of the downtown area.

“They will lose more than $12m. I gave them a conservative figure. It will be more than $12m that the Central Bank will lose, and all because of the Government’s poor and ill-advised decision. That’s the Central Bank’s money. The money

has already been allocated. As a result of that poor and ill-advised decision, the Central Bank is poised to lose - I said $12m, but that’s a conservative figure. They’re poised to lose a lot more than that.”

Dr Minnis reiterated his belief that the present Central Bank building on Frederick Street should be converted to museum. Among the artifacts it should display, he argued, are the gifts that successive prime ministers receive when they travel abroad on business for The Bahamas.

Describing these as “gifts of state”, the former prime minister said that when he was voted out in September 2021 he had nowhere to put them so left them at the Prime Minister’s Office.

“You would have heard the cruise lines complain that there is nothing to do,” Dr Minnis said. “The present Central Bank was supposed to be turned into a museum. When prime ministers travel abroad they are given gifts for the

state, and there is nowhere to put them or leave them. The question is: What happens to gifts for the state? We could have allocated a space in there for gifts to be viewed by visitors and Bahamians.”

The Central Bank, in previously announcing the end of its Royal Victoria Gardens headquarters project, detailed the amount of time that had been invested. “In 2017, the Government agreed to transfer the Royal Victoria Gardens to the Central Bank for development of its new headquarters building,” it said.

“The transfer was approved by Parliament in 2019 and executed in 2022. In 2018, the Central Bank hosted a competition and selected a conceptual building design from Architecton Design Studios. The firm was subsequently contracted to provide the architectural services for the project.”

Elsewhere, the Central Bank said it plans to break

ground on its new Cash and Data Centre, which is to be located in southwest New Providence on Frank Watson Boulevard, before June 30 this year. “During 2020, the Bank completed the purchase of land which will be the future location for the Bank’s Cash and Data Centre,” the financial statements said.

“In 2020, the accumulated costs were transferred to land and work in progress in the amount of $2.211m and $268,708, respectively, upon conveyance of the land title. The Bank anticipated that the initial phase of construction would commence near the end of 2021. However, this was rescheduled for late 2022.

“As at December 31, 2022, the Bank has outstanding contractual commitments on the Cash and Data Centre Project in the amount of $11,720 (2021: $396,549). The Bank anticipates ground-breaking prior to June 30, 2023, with completion within 24 months.”

Super Value’s ‘egg relief’ amid BPL containment

FROM PAGE B1

food prices, although data from the Bahamas National Statistical Institute showed that inflation remains prevalent as food and nonalcoholic drink costs were up 9 percent year-over-year for February 2023.

And the Super Value president added of the outlook: “They [prices] may not go all the way down. Consumers will see a decrease in some products, like with the eggs, beef and poultry. Hopefully other products will follow suit, but it all depends on the markets.

“Things are hopeful. We’re seeing the decrease in eggs. Consumers can just remain hopeful other prices will do the same and come down to a reasonable level that they can afford. I wouldn’t want to put a timeline on it. We’re hoping that it will be very shortly, but some things we can’t predict.”

Ms Symonette said the installation of roof-top solar panels across all Super

Value’s stores is now 50-60 percent complete, having previously revealed that it has slashed $400,000 off its annual energy bill through employing renewables at its warehouse alone. The supermarket chain is hoping the roll-out has come just in time to mitigate the up to 163 percent increase in Bahamas Power & Light’s (BPL) fuel charge that will coincide with peak summer consumption.

“The solar is definitely helping us,” she said. “The bills we have seen are increase after increase. We’re watching the rate, and seeing it go up bit by bit. It’s a relief to have that solar in place to mitigate the increase, and I would say the roll-out is 50-60 percent complete.”

Revealing that Super Value expects the chainwide installation to be finished in two to three months if all goes to plan, Ms Symonette said of the BPL fuel charge: “I know when they announced it we were looking at up to a 60 percent increase in electricity. We’re hoping that the 60 percent increase will be cut down to maybe 10-20 percent - maybe even to where we offset them. Summer is coming when we use electricity the most, and that’s when these rates will be swinging up and up.

Other Bahamian food retailers yesterday confirmed that the large post-COVID spikes in food prices have “tapered off” and “stabilised” over the past four months.

Allan Butler, managing director of Milo B Butler & Sons, told Tribune Business there “has not been that sharp increase in food prices” since the start of 2023 with inflationary pressures having “tapered off” to produce smaller rises.

“I don’t think we will ever see the pre-pandemic prices again. To be quite frank, I think those days are gone because of the fact that there are a lot of costs that have been incurred, and that we are incurring now, that we didn’t even have pre-pandemic that also affects the prices,” he added.

Cereals and snack prices have increased, while meat

costs have also gone up across-the-board. Produce is currently experiencing a steady increase due to the seasonality of fruits and vegetables, but this is “expected”.

Mr Butler added: “Produce prices change every week based upon different situations and weather changes and so on. This is somewhat acceptable, but the other items that tend to not change as much, however, you have seen a general increase in prices in those areas.

“You have also seen an increase in the price of grains straight across the board. So that means things like your oatmeal, your cream of wheat, your farina and all of those things with grain effects, you will see a general increase in the price of flour. We have also seen an increase in the price of rice. We have also seen an increase in the price of tomato paste. Those type of items have all seen increases where the base product has been affected.”

The major food price spikes seen after COVID began have eased, and Mr Butler is no longer seeing those “sporadic increases” that the food distribution industry incurred during the pandemic. “Even during COVID-19 we had to deal with heavy spikes due to shipping shortages and so on, and we still have those shortages but nowhere near where they used to be,” he added.

Bronson Beneby, general manager of Courtesy Supermarket, said prices are “pretty much stable” despite several items increasing. “Some items in the produce section are increasing, but they are seasonal items and, with their time, the prices normally increase such as lettuce and limes and stuff like that,” he added.

“Eggs right now are pretty much going back to normal. There are one or two items but there is no drastic increase. Meat items right now are pretty much stable. Breadbasket items are pretty much stable. There is no major increase and nothing much to be alarmed about.”

PAGE 4, Tuesday, May 16, 2023 THE TRIBUNE

FROM PAGE B1

DR HUBERT MINNIS

CENTRAL BANK EXCEEDED GOVT LENDING LIMITS AT YEAR-END ‘22

advances to the Government. For, if they had been included, the regulator would have exceeded its legal lending limits by some $234.6m as at year-end 2022.

Prior to the passage into law of the recent Central Bank of The Bahamas Act amendments, the banking regulator’s legal lending limit on loan advances to the Government were supposed to be capped at 30 percent of either the average or “estimated ordinary” revenue of the latterwhichever is less. However, before the amendments were passed, at year-end 2022 these advances stood slightly in excess of the target at 30.12 percent of government revenues.

“The Bank may provide temporary loans to the Government where the amount of the loans which may be outstanding at any one time, taken together with the Treasury bills or securities issued or guaranteed by the Government or a public corporation, shall not exceed in aggregate 30 percent of the average ordinary revenue of the

Government or 30 percent of the estimated ordinary revenue of the Government - whichever is less,” the Central Bank’s financials state.

“The loan should mature within 91 days, and the interest rate on the loan is based on market-related interest rates. At the yearend date, advances to the Government were 30.12 percent (2021: 28.89 percent) of the lesser of such revenues, which exceeds the Bank’s temporary loan limits to the Government by 0.12 percent or $2.3m. This was significantly impacted by the facilitation of secondary market redemptions during the year. Per the Act, there are no resulting concerns for exceeding the limit.”

However, the financial statements’ note 11, dealing with advances to the Government by the Central Bank, reveals just why the latter’s governing Act had to be amended. “Prior to the amendment to the Central Bank Act’s section 17A, the SDR loan would have been included in the calculation of the temporary loan limits,” they confirm.

“The amendment to the Central Bank Act’s section 17A excludes the SDR loan from the temporary loan limit calculations and, as a result, removes the SDR loan balance from this assessment.” The Central Bank’s financials also describe the $232.3m SDR transaction as a “loan” - a description that the Government, and Prime Minister Philip Davis KC, have furiously rejected.

Labelled “SDR loan to the Government”, note 17 reveals that the interest rates attached to the transaction fluctuate between 0.05 percent and 2.92 percent. The facility is also due to be repaid “in full or in part by December 31, 2023”. The notes said: “The SDRs are convertible into US dollars and, at year-end, the loan totalled $232.661m.

“The loan bears variable interest rates, which fluctuate on a monthly basis, ranging from 0.05 percent to 2.92 percent, and is anticipated to be repaid in full or part by 31 December, 2023. The interest shall be repaid at such frequency and on such dates as may be set by

the IMF, which is normally on a quarterly basis. “The Memorandum of Understanding (MOU) further stipulates all obligations related to the SDRs including all costs, charges and payment of interest will be the responsibility of the Government without a financial burden to the Bank.”

The Central Bank was advised it could breach its legal lending limits to the Government through the latter’s use of $232.3m in IMF special drawing rights (SDRs) without reforms to its governing Act. The MoU between the Government and Central Bank, which facilitated the transaction, shows the alarm was raised by the latter’s external legal advisers to such an extent that the Central Bank Act had to be amended “out of an abundance of caution” over the SDR deal.

The MoU, which was signed by Prime Minister Philip Davis KC in his capacity as minister of finance, and Central Bank governor, John Rolle, on November 29, 2022, makes clear that the transaction was instigated by the

Government via the Min-

istry of Finance. However, the Central Bank seemingly felt it necessary to obtain a written agreement from the Government that it would amend its governing to ensure the regulator remained in compliance with the law.

“The Ministry has recommended, with the [Central] Bank’s endorsement, a conversion of the 2021 SDR allocation into US dollars to undertake debt management operations to repay external debt, help stabilise The Bahamas’ US dollar bond debt obligations, and to lock in significant savings on the debt, with the cost and replenishment or reconstitution obligations around use of the balances assumed by the Government,” the MoU said.

“The proposed purpose aligns with the intended uses for which the IMF allocated the special drawing rights.” The SDRs have already been fully drawn down and converted to cash by the Davis administration, although the precise purpose for which the funds were used has not been disclosed. Such a transaction

Payment fraud up eight-fold at $21m

FROM PAGE B1

some 6 percent of the associated value. As cheque usage continued to decline, the instances of this type of fraud represented just 0.6 percent of total cases against 22.6 percent of overall value.”

Elsewhere, some 61 percent of foreign exchange outflows in 2022 via the Investment Currency Market (ICM) went towards the acquisition of the Bahamian government’s external bonds after the 5 percent investment premium was waived for several months by the Central Bank.

“Outflow activity via the ICM totalled $272.7m during 2022, a significant share representing purchases of Bahamas Government external bonds, which traded for a period at a substantive discount on the international markets. From October 6,

2022, through end-2022, the Bank granted a temporary waiver of the ICM premium on investments in The Bahamas Government’s external bonds,” the regulator added.

“Of the $227.4m approved for transactions, approximately $166.9m was used through year-end. A number of approvals were allowed to be carried over to January 2023.” Of the $35m allocated on an annual basis to Bahamian broker/dealers for Bahamas Depository Receipt (BDR) investments in foreign stocks and securities, some $21.6m was used in 2022 by two of the five eligible firms.

When it came to dormant bank accounts, the Central Bank revealed: “As at December 31, 2022, the Bank maintained custody of 41,878 dormant facilities with balances totalling $89m denominated in six

NOTICE is hereby given that LEONARD ALBERT KRAVITZ 10960 Wilshire Blvd. 5th Floor, Los Angeles, CA 90024, USA applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that SAINTILMA SAINTIL , Hope Town, Abaco, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

currencies. Balances in US dollars and Bahamian dollars combined accounted for a dominant 91.4 percent of the total, while the Canadian dollar, Swiss franc, Euro and British pound accounted for the remaining 8.6 percent.

“In accordance with the Act, as at December 31, 2022, an estimated $1.9m in dormant funds was due for remittance to the Government against the applicable ten-year custodial period expiration.” As for digital transactions, the Central Bank said growth was “highlighted by greater overall use of credit cards, debit cards and automated cash dispensing services, with reliance on credit finance transactions.

“These shifts also captured the uplift in spending from the depressed levels estimated during the pandemic,” it added. “For card-based payments, the volume of debit card transactions increased by 18.2 percent to 20.8m with the value expanded by 16.6 percent to $2.3bn.

“In 2022, the number of credit cards issued or renewed by commercial banks expanded by 4.9 percent to 95,049, and the associated value of debt owed also rose by 2 percent to $221.2m. The volume of purchases and other transactions using credit, most of which were repaid within the same period, rebounded by 27.5 percent to $1.2 billion. This was still below

pre-pandemic levels, given shifts towards debit cards.

“Disaggregated by access amount, the number of cards with a credit limit under $5,000 grew by 6.2 percent to 62,961, while the outstanding balance decreased by 5.9 percent to $70m. Meanwhile, the number of cards issued with a credit limit between $5,000-$10,000 increased by 4.4 percent to 19,443, and the corresponding value by 7.1 percent to $64.7m,” the Central Bank continued.

“However, the number of accounts extending credit with limits in excess of $10,000 declined by 0.7 percent while the value grew by 5.5 percent to $86.5m. As for automated banking services, the number of

was not contemplated in the Government’s previouslyreleased annual borrowing plan for the 2022-2023 fiscal year.

“Based on the advice of external legal counsel, the [Central] Bank is of the view that using the 2021 SDR allocation for the purpose would create a liability from the Government to the Bank notwithstanding section 4(6) of the Act, and a position could be taken that the Government would have exceeded the authorised borrowing limits set forth in section 21 of the Central Bank of The Bahamas Act 2020,” the MoU stipulates.

“Out of an abundance of caution, the [Central] Bank has requested, and the Government has agreed, to table an amendment to the Central Bank Act on the terms more specifically set forth below.” The reforms were supposed to have been “debated and gazzetted” no later than the mid-year Budget debate, which has long passed and was supposed to have taken place on February 22, 2023, meaning the Government was late again.

ATMs slightly reduced to

385. However, the volume of cash denominated transactions conducted through these devices grew by 9.6 percent to 8.9m and associated value rose by 11.9 percent to $2.1bn.

“Cheque usage remained low except for large value transactions. In particular, the number of processed cheques declined by an annualised 11.9 percent to 1.1m, albeit the corresponding value rose by 1.1 percent to $4.3bn.”

NOTICE is hereby given that SELINA LARAIN WALTERS of Sandilands Village, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

THE TRIBUNE Tuesday, May 16, 2023, PAGE 5

FROM PAGE B1

NOTICE

NOTICE

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

NOTICE

WALL STREET RISES AHEAD OF UPDATES ON U.S. SHOPPERS

By STAN CHOE AP Business Writer

WALL Street ticked

higher Monday ahead of reports that will show how much a slowing economy is hurting what's prevented a recession so far: solid spending by U.S. households.

The S&P 500 rose 12.20, or 0.3%, to 4,136.28, the latest tick higher in what's been a listless weekslong run for the market. The Dow Jones Industrial Average added 47.98, or 0.1%, to 33,348.60, and the Nasdaq composite climbed 80.47, or 0.7%, to 12,365.21.

Some of the sharper moves came from companies announcing takeovers of rivals, including a 9.1% drop for energy company Oneok after it said it's buying Magellan Midstream Partners. Magellan jumped 13%. But the larger market was relatively quiet as several concerns continue to drag on Wall Street.

Chief among them is the fear of a recession hitting later this year, in large part because of high interest rates meant to knock down inflation. But concerns are also rising about cracks in the U.S. banking system and the U.S. government's inching toward a possible default on its debt as soon as June 1, which economists warn could be catastrophic.

So far, a resilient job market has helped U.S. households keep up their spending despite all the pressures. That in turn has offered a powerful pillar to prop up the economy. On Tuesday, the government will show how much sales at retailers across the country grew last month.

Several big retailers will also show how much profit they made individually during the first three months of the year, including Home Depot on Tuesday, Target on Wednesday and Walmart on Thursday.

They're among the few companies left who have yet to report their results for the start of the year. The

majority of companies in the S&P 500 have topped expectations so far, though the bar was set particularly low for them coming in.

S&P 500 companies are still on track to report a drop of 2.5% in earnings per share from a year earlier. That would be the second straight quarter they've seen profit drop, according to FactSet.

"These are backwardlooking numbers, so it's something we take with some value, but we're more interested in what they're saying going forward," said Megan Horneman, chief investment officer at Verdence Capital Advisors.

For that, Horneman said she's been hearing many CEOs talk about pressures on profitability and worries about a weakening economy. "We still think a recession is likely at some point this year," she said, pointing to the latest discouraging report about manufacturing on Monday. A survey of manufacturers in New York state plunged by much more than economists expected.

"It was pretty dismal, to say the least," Horneman said.

As earnings reports slide out of the spotlight, the U.S. government's debt-ceiling negotiations are shoving in. The federal government is risking its first-ever default if Congress doesn't raise the credit limit set for federal borrowing.

Most of Wall Street expects Democrats and Republicans to come to a deal, simply because the alternative would be so disastrous for both sides. U.S. Treasurys form the bedrock of the global financial system because they're seen as the safest possible investment on the planet.

But one worry is that politicians may not feel much urgency to reach an agreement until financial markets shake sharply to convince them of the importance.

"A debt default may not be the most likely scenario, but any prolonged debate

or unexpected development has the potential to trigger higher volatility," said Chris Larkin, managing director, trading and investing, at E-Trade from Morgan Stanley.

In the bond market, Treasury yields rose after briefly dipping during the morning.

The yield on the 10-year Treasury climbed to 3.49%, up from 3.46% late Friday. It helps set rates for mortgages and other loans. The two-year Treasury yield, which more closely tracks expectations for the Fed, held steady at 3.99%.

High interest rates have meant particular pain for some smaller- and midsized banks. Customers are leaving to park their deposits in money-market funds and other options paying higher yields. High rates are meanwhile knocking down the value of investments that banks made when rates were lower.

The pressures have already caused three highprofile bank failures since March, and Wall Street has been on the hunt for other potential weak links.

Several recovered a bit Monday after dropping sharply last week. PacWest Bancorp jumped 17.6% after losing 21% last week, for example.

In markets abroad, Japan's Nikkei 225 gained 0.8% and is near its highest level since the early 1990s. It's climbed on strong corporate earnings reports and signs that inflationary pressures might be easing.

Over the weekend, finance ministers of the Group of Seven advanced economies wrapped up a meeting in Japan with a call for vigilance given many uncertainties for the global economy.

However, they also said financial systems have shown resilience despite recent failures of several banks in the U.S. and Europe. No mention was made of the urgency of resolving the debt ceiling standoff between President Joe Biden and Republicans.

Warren Buffett's company recommits to Bank of America stock while dumping other banks

By JOSH FUNK AP Business Writer

INVESTOR Warren

Buffett recommitted to his favorite bank stock, Bank of America, during the first quarter while dumping two other banks as part of a number of moves in Berkshire Hathaway's stock portfolio.

Berkshire provided a quarterly update on its U.S. holdings Monday in a filing with the Securities and Exchange Commission. Many investors follow the company's moves closely because of Buffett's remarkably successful investing record over the decades.

Berkshire slightly increased its 179.4 million share stake in Bank of America stock while eliminating long-time stakes in US Bancorp and the Bank of New York Mellon. Buffett has eliminated a

number of bank investments in recent years, but he continues to back Bank of America.

Berkshire also picked up nearly 10 million shares of Capital One stock.

The quarterly filings don't identify which investments Buffett made and which ones were done by one of Berkshire's two other investment managers, but Buffett generally handles all of Berkshire's biggest investments worth $1 billion or more. Buffett doesn't regularly comment on these stock filings.

Berkshire continued to reduce its Activision Blizzard stake in the quarter down to 49.4 million shares from 52.7 million at the start of the year. Buffett has said he bought that stock as a way to bet that Microsoft's acquisition of the video game maker will ultimately go through. That deal is in doubt after British regulators rejected it and U.S. regulators sued to block it although the European Union did endorse Microsoft's purchase Monday.

Berkshire also cut its General Motors investment

down to 40 million shares from the previous quarter's 50 million.

Monday's report doesn't include the biggest investment move Berkshire has made over the past year to sell more than half of its stake in Chinese electric carmaker BYD. Those sales, which have generated several billion dollars for Berkshire, are reported separately on the Hong Kong stock exchange. At the last update on that investment, Berkshire held about 108 million BYD shares worth roughly $3.3 billion.

Until last August, Berkshire held 225 million shares that it bought in 2008 for $232 million. The value of that BYD investment had ballooned to more than $9.5 billion last summer before Buffett began selling.

One of the biggest other moves Berkshire made in the quarter was selling some 35 million Chevron shares to leave it with 132.4 million shares of the oil producer, but Berkshire had already disclosed that move in its quarterly earnings report.

PUBLIC NOTICE

INTENT TO CHANGE

NAME BY DEED POLL

The Public is hereby advised that I, DEANDRA N. WOODSIDE of GT 2253 #5 Flamingo Garden, New Providence, Bahamas, Parent of IZIS D’KELL THOMAS A minor intend to change my child’s name to IZIS D’KELL WOODSIDE If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

PUBLIC NOTICE

INTENT TO CHANGE

NAME BY DEED POLL

The Public is hereby advised that I, OLIVIA THERESA EVANS and BRIAN BERNARDO EVANS of Millers Heights, Carmichael Road, New Providence, Bahamas, Parent of ANNALICIA JAMIMA MOTT A minor intend to change my child’s name to ANNALICIA JAMIMA EVANS If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

PAGE 6, Tuesday, May 16, 2023 THE TRIBUNE

TRADERS work on the floor at the New York Stock Exchange in New York, Wednesday, May 3, 2023. Stocks are drifting ahead of what Wall Street hopes will be the last hike to interest rates for a long time.

Photo:Seth Wenig/AP