Keep Freeport out of a ‘political cesspool’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

MAJOR figures in last year’s protest march to the Grand Bahama Port Authority (GBPA) have reiterated their opposition to its acquisition by the Government for fear Freeport will be dragged into “a political cesspool”.

Both Rev Frederick McAlpine, the former Pineridge MP, and businessman Darren Cooper, told this newspaper they remain resolutely opposed to a Nassau takeover amid growing suggestions that the Government is supporting Mediterranean Shipping Company (MSC) as a potential contender to purchase the GBPA from the Hayward and St George families.

• Gov’t ‘and its cronies’ opposed as GBPA purchasers

• PM spokesman declines comment on MSC interest

• Port buyer ‘cannot come and just put it on their belt’

The Prime Minister’s spokesperson declined to comment when asked by Tribune Business whether the Government was backing MSC as a potential GBPA purchaser, or seeking financial assistance from the global cargo shipping and cruise giant so it could effect the acquisition itself.

Separately, this newspaper was told that the Davis administration has elected to “keep silent and not

talk about anything” further related to the GBPA, although contacts said negotiations between the two sides remain active as it bids to develop “the way forward” for Freeport and Grand Bahama and “get the best deal for the Bahamian people”.

Mr Cooper, confirming that he, too, has heard talk of MSC’s reputed interest in the GBPA, was joined by Mr McAlpine as both voiced misgivings

over whether the shipping giant - as well as the Government - were the right fit to advance Freeport and make the city a 21st century version of what was originally envisaged under the Hawksbill Creek Agreement.

“I’m hearing the same thing as it relates to MSC,” Mr Cooper said, as he

SEE PAGE B7

Corporate tax plan ‘dead on arrival’ unless wider reform

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government’s corporate income tax consultation will be “dead on arrival” if it does not involve a “holistic” approach to comprehensive Bahamian tax reform, a prominent banker warned yesterday.

Gowon Bowe, who headed the private sector’s Coalition for Responsible Taxation when VAT was introduced in 2015, told Tribune Business he “doesn’t believe there can be introduction of corporate income tax” in The

Bahamas by itself without “wider discussion of tax reform”.

Asserting out that changes to one component of the Bahamian taxation

SEE PAGE B6

Real estate faces greatest corporate tax burden rise

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

REAL estate firms will experience the highest increase in their tax burden for each of the four corporate income tax options that the Government is proposing as replacements for the turnover-based Business Licence fees.

The Government’s longawaited ‘green paper’ on corporate income tax choices, released at the end of last week, reveals that Bahamian realtors are projected to see an increase of between 2.2 percent and 3.7 percent in their tax burden, as a proportion of gross turnover, compared to what they pay now under the

present Business Licence fee.

Recreational activities will see the next highest tax burden increase from switching to a corporate income tax of between 1.5 percent and 2.9 percent, the Government paper adds, followed by financial services and insurance with a rise of between 0.9 percent to 1.5 percent. It states that the increases will be highest among high-margin industries and businesses because, under a corporate income tax, they will taxed in bottom line earnings and profit margins rather than turnover.

Those industries forecast to benefit most from

SEE PAGE B11

Super Value president: ‘Things aren’t flowing’

• Business ease focus before tax reform

• Tax, licence ‘hold ups’ causing delays

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SUPER Value’s president says that, while profit-based taxation “would be favourable” for food retailers, the Government must first prioritise the ease of doing business because “things aren’t flowing like they should”.

Debra Symonette, although welcoming the potential switch from the turnover-based Business Licence fee to a corporate income tax, told Tribune Business the 13-store supermarket chain had recently experienced “hold ups” and delays in getting produce to its stores because it had not received its Tax

Compliance Certificate (TCC).

Stating that there was “nothing they should be holding up on the certificate for”, she explained that its absence had been “really annoying” because a TCC must be presented to Customs when clearing

business@tribunemedia.net MONDAY, MAY 22, 2023

SEE PAGE B8

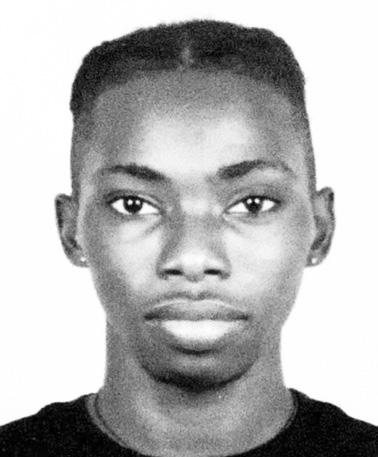

REV FREDERICK MCALPINE

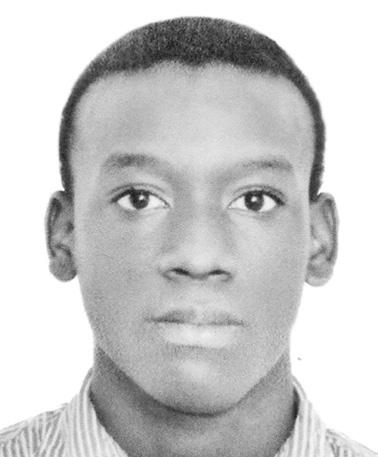

GOWON BOWE

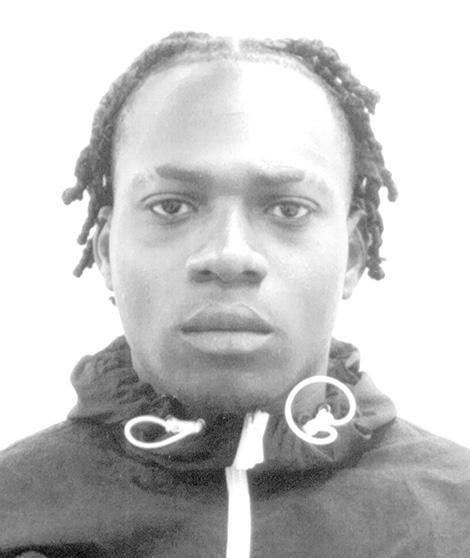

DEBRA SYMONETTE

$5.74 $5.74 $5.74 $5.95

PM unveils lease-to-own Crown Land return plan

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Prime Minister has pledged to launch a leaseto-own initiative involving Crown Land to entice Cat Islanders to return home.

Speaking at the Cat Island Business Outlook conference, Philip Davis KC said the Government would make the land available to Cat Islanders for use by firsttime homeowners and for the construction of second homes and other approved projects,

He added: “With these upgrades and developments underway for Cat Island, it is my hope that Cat Islanders who have left the island will consider returning home. To further encourage Cat Islanders to return we intend to make Crown Land available on a lease-to-own basis for the construction of a second home or put their first home once they decide to remain or other approved developments.

“We have a bank of Crown Land here on the island, and such an initiative is one I have always promoted. Now that the Bahamian people have enabled me to make this happen, I will do so.”

Mr Davis said that although recent census results revealed the Cat Island population has grown since 2010, that of both San Salvador and Rum Cay has decreased. He asserted that improving infrastructure on these islands will attract persons back and increase economic activity.

The Prime Minister said: “The results of the 2022 national census put the Cat Island population at 1,602, an approximately 5.3 percent increase from the 2010 census year. Conversely, the population in San Salvador decreased by just over 12 percent and decreased by just over 9 percent on Rum Cay. Job opportunities and services on New Providence continue to draw Bahamians away from the Family Islands.

“A catalyst for arresting this ‘urban pull’ dynamic familiar to economists and policymakers in many contexts is infrastructure that can improve the quality of life for our Family Islanders, and support and encourage new economic activity.

Adequate infrastructure is essential to facilitating investment, both foreign and domestic, and we are making necessary improvements in this regard.”

The Cat Island, San Salvador and Rum Cay MP said that in addition to the construction of New Bight International Airport and renovations to the Arthur’s Town airport, the island is scheduled to receive 50 miles of paved roads, 90 miles of water installations, rain drainage and a seawall.

He added: “We broke ground in March on our new multi-million dollar state-ofthe art International airport at New Bight and, as I previously indicated, New Bight airport is key to attracting investment, revitalising old industries and incentivising new ones.

“Upgrades to the airport at Arthurs Town will include a $10m runway rehabilitation, a remodelled terminal building, new solar runway lights, an airport beacon, an apron flood lighting system and a police station adjacent to the airport.

“A public-private sector partnership (PPP) will be utilised to carry on 50 miles of road paving, and 90 miles of water installations will be carried out by the Water and Sewerage Corporation which will result in the provision of potable water throughout Cat Island. Public works projects are carried out, and also include road drainage and the installation of a seawall.”

While stating the importance of quality healthcare in attracting long-term investments, the Prime Minister said Inter-American Development Bank (IDB) financing will be used to upgrade Family Island clinics, and the Old Bight and Orange Creek clinic upgrades - which were

suspended in 2017 - will restart.

He said: “In respect to infrastructure, adequate health care infrastructure is also critical for one’s quality of life. And it’s also essential for stable investments. Investment in healthcare infrastructure that ensures Family Island clinics are properly equipped is a priority and we are making steady progress in this regard.

“Upon our election to office, Cabinet approval was sought and granted to reengage the contractors to complete the work on these clinics. Financing through the Inter-American Development Bank will be utilised to carry out much needed healthcare infrastructure upgrades throughout our Family Islands.”

Mr Davis revealed that in addition to receiving new vehicles and ambulances for medical staff, fibre optics will be installed to digitise healthcare records throughout The Bahamas. He added that an extension to the Arthurs Town Comprehensive School is also on the agenda for Cat Island.

“These upgrades include the construction of a new clinic in Stephenson, the purchase of vehicles for medical, nursing, allied healthcare and support services, and the purchase of ambulances for deployment in Family Islands, including Cat Island and San Salvador ,is on the way as well,” he said.

“Additional upgrades include the installation of fibre optic connections to clinics throughout The Bahamas, the procurement of digital technology for electronic health records and procurement of new medical equipment including ultrasound, electrocardiogram and portable X ray machines, laboratory and dental equipment and defibrillators.”

“A four-classroom extension to the Arthurs Town Comprehensive School will also be constructed to accommodate additional students.”

PAGE 2, Monday, May 22, 2023 THE TRIBUNE

REINVESTING 50% OF CORPORATE TAX NO GDP GROWTH PANACEA

a 0.3 percent GDP shrinkage to 0.1 percent.

REINVESTING 50 percent of the revenues generated by a corporate income tax would lessen - but not eliminate - the negative economic impact of each of the four proposed implementation options, the Government is forecasting.

Its long-awaited ‘green paper’ on corporate income tax reform, released at the end of last week, found that the gross domestic product (GDP) contraction caused by its replacement of the present Business Licence fee system could be reduced by up to one-third or almost half under one of the options being considered if the Government pumped tax revenues back into the economy via infrastructure spending or public services.

Under the ‘green paper’s second option, which would introduce a 15 percent rate for all Bahamian corporate entities part of multinational groups with over 750m euros in annual turnover, and also levy a 10 percent corporate income tax on all other businesses, reinvesting 50 percent of revenues generated by this taxation would cut the negative economic impact from

As for the third option, which would exempt or carve-out small businesses earning less than a $500,000 annual turnover to leave them still paying the existing Business Licence fee, levy 15 percent corporate income tax on multinational group members above 750m euro turnovers and all other companies generating more than $500,000 pay a 12 percent rate, the GDP shrinkage falls from 0.9 percent to 0.5 percent.

Under the final option, which would impose the 15 percent corporate income tax rate on all businesses with a turnover greater than $500,000 per annum, and a 10 percent on small and medium-sized enterprises earning less than that, the contraction in economic growth is projected to fall from 1.7 percent to 1.2 percent if 50 percent of revenues are reinvested. The latter scenario is projected to increase the Government’s income by 96 percent to $274m compared to the $140m Business Licence revenues from 2019. Under the 10 percent corporate income tax option for all businesses regardless of turnover, government revenues were projected to rise by 36 percent to $191m.

Bahamas in $800,000 farm deal with China

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Government has signed an $800,000 agreement with the People’s Republic of China to help support Bahamian farmers through the provision of greenhouses.

Clay Sweeting, minister for agriculture, marine

resources and Family Island affairs, said at the contract signing that the two-year partnership will see Beijing provide technical expertise to help construct multiple greenhouses on an acre of land at the Gladstone Road Agricultural Centre. Work is expected to begin next month.

A technical manual will be produced for vegetable planting, complete with

And, under the choice where SMEs still pay Business Licence fees, they were forecast to expand by 62 percent to $226m.

“Investment into Bahamian projects such as infrastructure or healthcare provision could mitigate some of the negative economic impacts via creation of jobs or by improving productivity. However, the size of these impacts depends on the actual projects chosen by the Government,” the ‘green paper’ said.

“For example, expenditure on infrastructure may have greater long-term impacts in terms of transport or logistics, whereas expenditure on healthcare could improve long-term health of the population and thus the productivity of the workforce.” It added that there were several factors which might limit the economic impact not captured by the data.

“First, the global tax landscape may mitigate the estimated adverse impacts. Around 140 countries are signatory to the OECD Pillar Two initiative. This could close the gap between tax systems globally and thus marginalise the role of tax factors in investment decision making, at least for large multinational groups,”

six test reports on variety selection. The Chinese will assist with the construction of three steel frame vegetable greenhouses, as well as hold two training demonstrations for vegetable planting for both local and commercial farming.

Dai Qingli. China’s ambassador to The Bahamas, said the total value of the technical assistance project is $800,000. The benefits will be spread throughout the Family Islands in addition to the focus on greenhouse construction and technical manuals being produced in New Providence.

Ambassador Qingli said China was ready and willing to assist Bahamian farmers with increasing

the Government’s ‘green paper’ said.

“This is particularly relevant for foreign direct investment, and thus the impacts on GDP may be more moderate as investors are less likely to relocate to jurisdictions with lower effective tax rates as the gap between respective systems appears to be closing. Second, against this backdrop, non-tax factors should become the main driver to attract investment from overseas.

“The Bahamas benefits from high levels of human capital, political stability and an internationally recognised financial system, which will be important considerations in investment decisions. IMF research cites the strength of legal and economic institutions as a reason many international financial service entities hold assets and lending operations in The Bahamas. Even when tax factors are considered, under all policy options, The Bahamas will remain a relatively low-tax jurisdiction on the global scale.”

However, the Government admitted that introducing a corporate income tax will likely increase the country’s already high costs of doing business. “The imposition

their seedling variety and quality of production. Beijing wants to set up similar technical partnerships throughout the region, and already has a working relationship with Barbados.

Mr Sweeting said it is imperative that The Bahamas reduce its food import bill. He said that if the country takes “one step at a time”, lowering the 12 percent import bill on greens through the new greenhouses and technical assistance would be “something to be proud about”.

of a new corporate income regime in The Bahamas is likely to increase the overall cost of doing business in The Bahamas,” it conceded.

“In addition to the change in the tax burden, there may be increased administrative costs which will vary according to business size and complexity. For entities operating in The Bahamas that fall in scope of Pillar Two, this burden will likely exist even if The Bahamas does not impose corporate income tax where jurisdictions of the associated ultimate parent companies require top-up taxes.”

Then there is the uncertainty over whether, and how, businesses in Freeport’s free trade zone

will be impacted by the introduction of corporate income tax. “Businesses under the Hawksbill Creek Agreement in Freeport are exempt from paying the Business Licence fee, alongside the elimination of property taxes and import duties,” the Government’s ‘green paper’ said. “For these free trade zones, appropriate Bahamian legal advice would be required to determine whether the application of corporate income tax would be legally possible, though any application of corporate income tax would likely erode the competitive advantage afforded to this area.”

THE TRIBUNE Monday, May 22, 2023, PAGE 3

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

CLUB MED: OVER 75% OF WORKFORCE RETURNS

CLUB Med’s general manager yesterday revealed that more than 75 percent of the resort’s staff have returned to work at the property despite its near three-year shutdown due to COVID-19.

Adeline Vitry, the Columbus Isle hotel’s general manager, told the Cat Island Business Outlook conference that since its late October 2022 re-opening the resort has been

generating occupancy levels of between 80 to 95 percent. She revealed that high guest volumes have been achieved despite ongoing renovations and upgrades, which typically see around eight rooms taken out of its 230-strong inventory at a time, because Club Med had prioritised re-opening before remodelling. Had it not done so, Ms Vitry hinted there was a real possibility that Columbus Isle would “maybe not have re-opened”.

As it is, the property is now employing 250 persons directly and indirectly, she added, with the parents

of up to 80 percent of San Salvador’s schoolchildren working at Club Med. Ms Vitry said it can accommodate up to 500 guests at any one time, and is receiving three charter flights per flights per week - one from each of Miami, France and Canada.

“We are now re-open and super-happy that 75 percent of our previous employee came back,” she said. “Since the re-opening, we’ve been at between 80 to 95 percent capacity occupancy. We will have a full resort for July and August because we will have a lot of friends and family.

“We wanted to re-open without any time to refurbish and rebuild because if we did not re-open at this time we would maybe not have re-opened at all.”

Ms Vitry said Club Med is renovating its rooms “step by step” to avoid impacting the guest experience and inconveniencing staff.

Club Med, she added, spends around $17m per year on local purchases including food and beverage, taxes, utilities and staff payroll. And it also spends more than $15m to have its charters fly into San Salvador.

Prime Minister Philip Davis KC, who is MP for Cat Island, Rum Cay and San Salvador, said at the time of October’s re-opening that the Government had sought to match the $5m invested by Club Med put $5m in the resort’s reopening by spending $3.5m to upgrade infrastructure such as public health clinics, water resources, the airport and electricity supply.

“The impact of the reopening of Club Med to the economy of San Salvador cannot be overstated,” said Mr Davis. “It will see those who left for work in Nassau and other places return

to continue to build their home. We expect to see at least 350 jobs generated on the island as a result of this. And it represents opportunities for other Bahamians.

“One of the reasons the property remained closed for so long is because the infrastructure had been neglected over the course of several years. My administration made a commitment to ensure that would not remain an obstacle to the continued growth of San Salvador. It’s a commitment that we meant to keep.”

Visitor ‘leads’ jump 40% for Family Islands duo

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A SENIOR tourism official says The Bahamas’ digital marketing efforts have generated a 40 percent increase in visitor “leads” for Cat Island and San Salvador hotels this fiscal year.

Latia Duncombe, the Ministry of Tourism,

Investments & Aviation’s director-general, told the Cat Island Business Outlook conference that the profile of visitors to The Bahamas is changing and they now want more of what Family Islands destinations have to offer. The ministry’s bahamas. com website generated more than 300m forms of measured engagement last year, and reported a 40

percent increase for Cat Island and San Salvador.

Mrs Duncombe also praised the success of content stories that have showcased eight islands so far.

She added: “There are thousands of digital images and island-specific campaigns, targeted marketing initiatives with direct potential to send all of the global community to our site where our visitors can explore

detailed island overviews and plan their ideal getaway.

“We’ve generated more than 300m forms of measured engagement with our multi-digital platforms throughout last year in addition to generating brand awareness for each island. We send leads to our stakeholder websites and booking engines. This fiscal year, we recorded more than 5,000 leads for Cat Island to the individual hotels and 3,000 for San Salvador - a 40 percent increase from the previous year.

“Our biggest success however, was the impact we saw from the content stories released. Through captivating storytelling, we produced and present micro stories that delve into aspects of Bahamian culture, must visit attractions and renowned landmarks,” Mrs Duncombe continued.

“I’m pleased to report that our efforts have already captured the essence of eight islands, including the beautiful Cat Island…In fact, the Ministry of Tourism, Investments and Aviation received several marketing awards and generated a 156 percent increase in hotel leads as a result of the story ‘Sweet Cat Island’.”

Ms Duncombe said the people-to-people programme, which allows visitors to stay with locals and experience their daily routines, has been successful on Cat Island. She added: “Cat Island, quiet and unassuming but rich in treasure, offers an immersive cultural experience to the people-to-people programme where guests are hosted by residents and intimately involved in their way of life.”

The director-general said that in preparation for The Bahamas’ 50th independence celebrations, the ministry’s website and social media platforms have been updated with the associated logo. She added that the Ministry of Tourism,

Investments and Aviation has hosted ten media trips with journalists from the US, the UK and Europe that have generated more than 2.65bn media impressions.

Mrs Duncombe said: “Moreover, as we are in celebration mode or golden jubilee of independence, we’re utilising branding integration to include the 50th logo on our website and all of our social media platforms. We want to reach out to consumers and provide them with every opportunity to join us by partaking in our year-long independence activities on all of our islands, including Cat Island.

“Our PR coverage includes group and individual journalists, and influencer press trips that allow first-hand experiences of what the islands of The Bahamas offer. In 2022, there were 10 press trips with various visiting journalists from the US, UK and Europe. We garnered 2.65bn media impressions, 309 stories between features in international and digital papers, the Wall Street Journal, Washington Post, USA Today just to name a few.”

Mrs Duncombe said the Ministry of Tourism, Investments and Aviation will now use artificial intelligence (AI) to improve marketing results and capitalise on consumer behaviours. She added: “As we move forward in the digital space, the Ministry of Tourism advertising initiatives will now utilise artificial intelligence or AI.

“We’re focusing on the optimal use of AI to capitalise on consumer behaviours. Our intent is to improve our marketing initiatives and increase our results by taking advantage of AI powered by Google..... The Ministry of Tourism, Investments and Aviation is steering The Bahamas forward through strategic brand positioning. The ministry’s primary objective is to showcase The Bahamas

and its unique make-up as a multi-island destination in the Caribbean.

“The visitor profile has changed and our visitors want more. More of what our family of islands has to offer, and the more that they seek is in Cat Island, Rum Cay and San Salvador. As we’ve seen in a number of our global sales missions, we are executing our aggressive and strategic marketing plan as we continue to promote our destination, highlighting the distinct characteristics of each island.”

Mrs Duncombe added of the ministry’s strategy: “Our three-pronged plan consists of increasing brand visibility, while simultaneously educating prospective guests on our multi-island offerings, promoting The Bahamas to consumers in the market for a warmer weather destination vacation and driving demand to our website, bahamas.com, producing leads for business listings.

“At the Ministry of Tourism, we capitalise on our positionality and create awareness for each island. This is achieved through our cohesive, multi-platform messaging across digital markets. Whether it’s TV, billboards, banner ads and print ads, our global brand messaging includes content covering our culture, things to do on any and all of our 16 island destinations, our people attractions and landmarks.”

PAGE 4, Monday, May 22, 2023 THE TRIBUNE

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

LATIA DUNCOMBE

Little juice left

By CHRIS ILLING

Corp

Global stocks of orange juice have shrunk significantly, and raw material costs are rising. Consumers must be prepared for price increases for their most popular drink. According to experts, orange juice is currently scarcer than it has been for a long time. Consumers worldwide will therefore have to prepare for price increases in the coming months.

The industry is suffering from poor harvests in numerous regions plus falling stocks of orange juice concentrate in Brazil, the most important supplier

country. Orange juice concentrate is currently several times more expensive than usual on the commodity futures exchange in the US. Orange juice futurescontracts to buy and sell orange juice – have almost doubled to $2.60 per pound over the last year, up from $1.40 a year ago, leading to price surges in stores.

This season, the US agriculture department predicts the state will produce 16m 90-pound boxes of oranges,

a 61 percent drop compared with last season when the state produced 41m boxes. It is a worrying decrease but nothing compared with the fall from its peak in the 1990s, when the state was producing 200m boxes a year. Orange juice concentrate prices are at record levels. And there is currently nothing to buy, as the markets have been swept empty.

According to the latest market report from the US

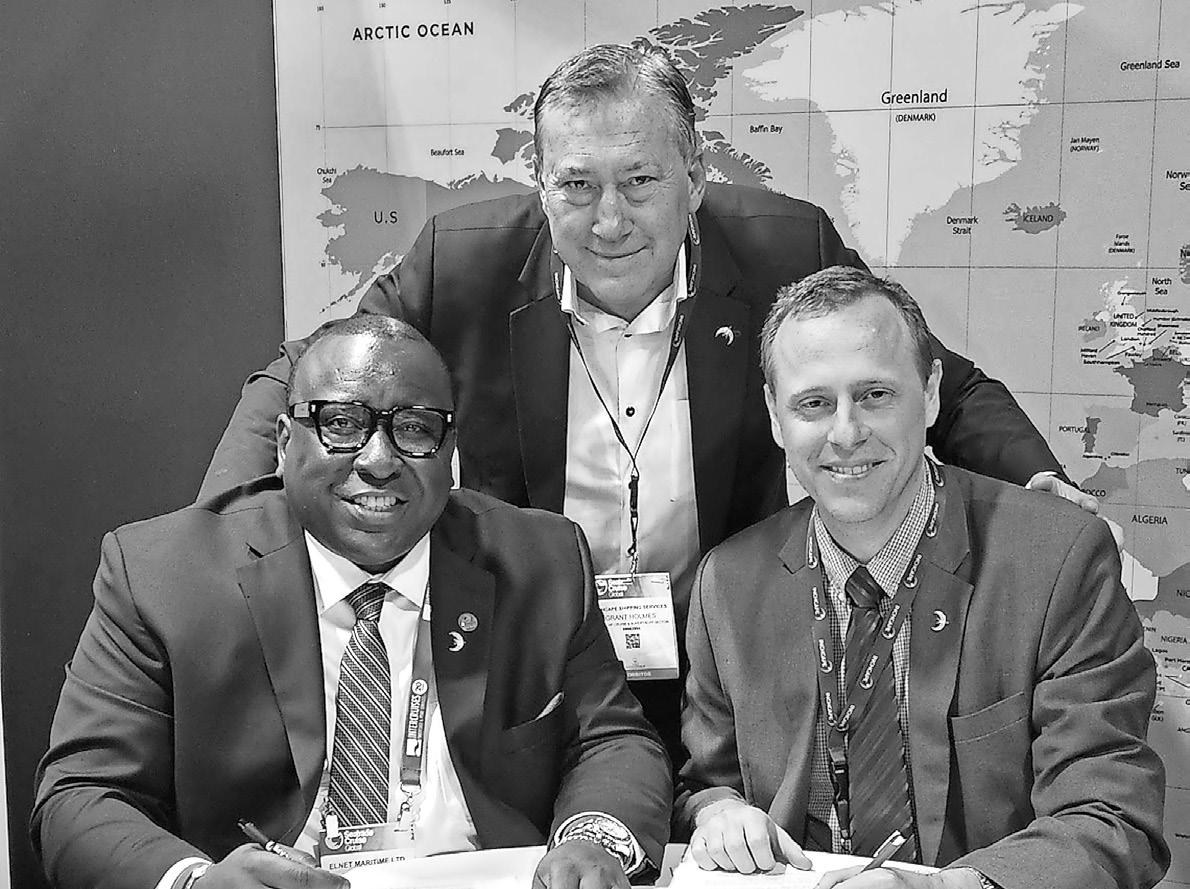

Bahamian company becomes global provider’s cruise agent

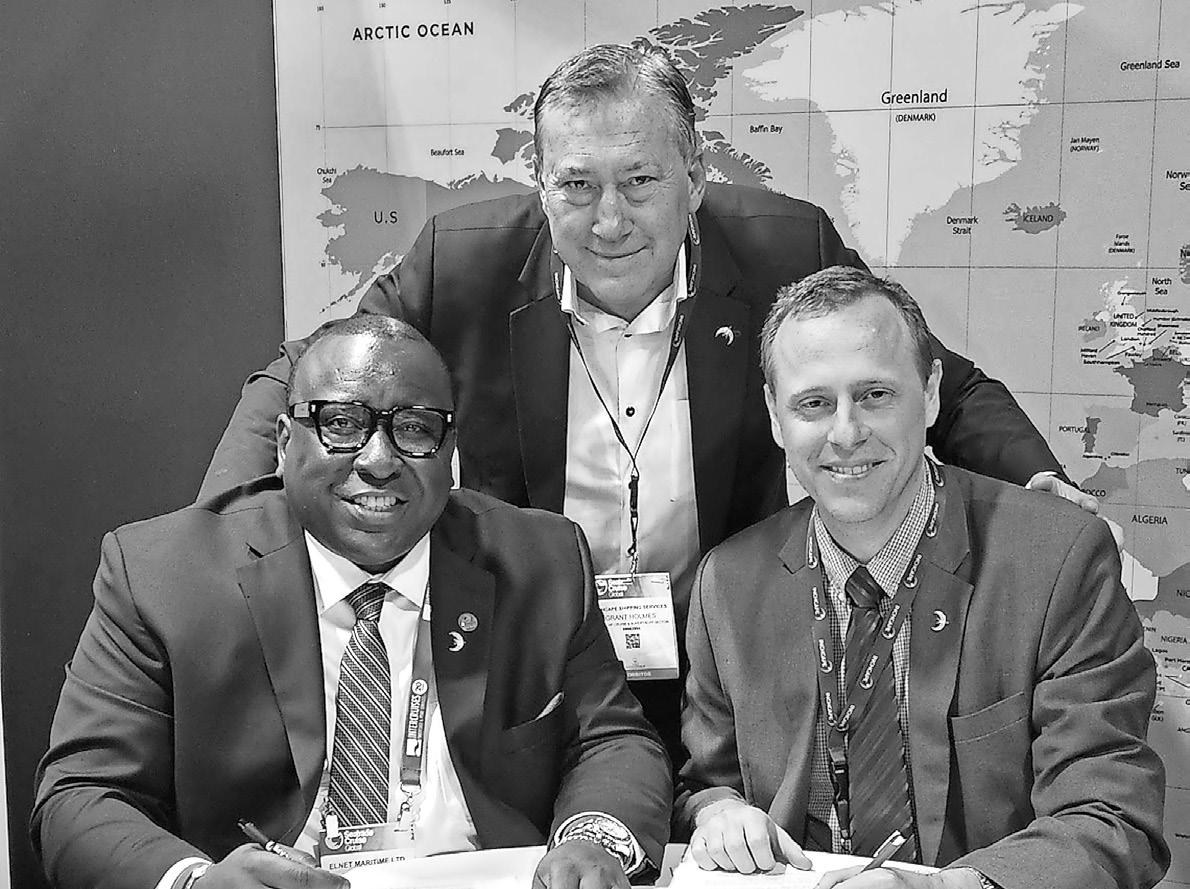

A BAHAMIAN company has become a major global shipping agency’s local partner in the provision of port services to the cruise industry.

ElNet Maritime has become Inchcape Shipping Services’ exclusive partner for full port agency, husbandry and related activities dedicated to cruise services in The Bahamas.

Ellie Hepburn, ElNet Maritime’s president and chief executive, signed the agreement at Seatrade Cruise Global while meeting with Inchcape Shipping Services’ John Willemsen, its area general manager for the Central American Region, and Grant Holmes, global vice-president for the cruise and superyacht sector.

Mr Holmes said: “We are proud to collaborate with ElNet Maritime for all cruise and superyacht sector activities. Our evaluation and research portrays that ElNet Maritime is the best-in-class shipping agent in The Bahamas, offering

the greatest future potential, and we look forward to a fruitful partnership whereby we will be in a position to add value to our portfolio of cruise line and superyacht customers.”

Founded in 1847, Inchcape Shipping Services has a global network of over 245 offices across 60 countries and a workforce of more than 3,100. Its customer base includes owners,

charterers and ship managers in the oil and gas, cruise, container and bulk commodity sectors and naval, government and intergovernmental organisations.

Founded in 2008, Elnet Maritime serves oil and gas, cruise and super yacht vessels providing port agency services, husbandry, logistics, offshore bunkering and lightering and related marine activities.

ORANGES

Department of Agriculture, global orange production in the 2022-2023 marketing year is likely to be 5 percent below the previous year’s level. The slumps in the US, where production is likely to fall to its lowest level in more than 56 years, are particularly severe. The main reasons for this are the spread of a plant disease

- the so-called citrus greening - as well as the effects of hurricanes on harvest volumes. But also in Brazil, the largest producer of oranges, and in Europe, bad weather had a negative impact on harvest volumes.

According to estimates by the US Department of Agriculture, global orange juice production is likely to

fall by 7 percent. The stocks of orange juice concentrates in Brazil, from where 90 percent of European Union (EU) imports originate, are lower than ever before. With a per capita consumption of 7.4 gallons of fruit juice and fruit nectar annually, consumers in Germany are world champions when it comes to fruit juice consumption. Their favourite in recent years has always been orange juice. In 2021, Americans consumed roughly 4.8 gallons of juice per year, and 2.2 gallons of it was orange juice. The price increases have been capped by a drop in demand, especially after the pandemic, causing consumers to look at other options such as apple juice, non-fruit beverages and flavoured water. The savvy investor has to consider a broad spectrum of influences on the price of our beloved orange juice.

ELLIE HEPBURN, president and chief executive of ElNet Maritime, signs the agreement at Seatrade Cruise Global while meeting with Inchcape Shipping Services’ John Willemsen, area general manager for the Central American region, and Grant Holmes, global vice-president for the cruise and super yacht sector.

THE TRIBUNE Monday, May 22, 2023, PAGE 5

CCO @ ActivTrades

Share

news The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 3221986 and share your story. ESSENTIAL FUNCTIONS Drive Heavy Duty Vehicle to deliver Propane Gas to Commercial/Residential Customers Competent in Vehicle Maintenance MINIMUM QUALIFICATIONS

High School Degree Good Communication with others/ customers

Be able to work with others effectively

Must be hard-working-friendly and Customer Service Oriented Honest, Energetic and Trustworthy. DRIVERS LICENCE A MUST Salary based on Experience Please email Resume to caribbeangasbahamas@gmail.com TRUCK DRIVER/ MECHANIC JOB OPPORTUNITY

your

•

•

•

Corporate tax plan ‘dead on arrival’ unless wider reform

system will inevitably cause consequences for other components, the Fidelity Bank (Bahamas) chief executive pointed to the possibility of corporate income tax evasion by business owners who elect to pay themselves salaries as opposed to taking shareholder dividends from a company’s profits. Without a personal income tax other other measures to catch this, such avoidance could become increasingly widespread.

The International Monetary Fund (IMF) had previously suggested The Bahamas combat such practices by introducing a personal income tax for high net worth individuals, so that corporate chieftains taking profits as salaries

rather than dividends will still be caught in the tax net. This was tacitly admitted by the Government’s ‘green paper’ itself, which said: “Since no form of personal income tax exists in The Bahamas, there is a potential risk for some owner-managed businesses to minimise their corporate income tax liability by opting for increased salaries (which are not taxed and would potentially be a deductible expense for corporate income tax purposes) rather than receiving distributions from the post-corporate income tax earnings of the business.

“To circumvent this risk, there are certain antiavoidance features a tax system can apply to combat non-commercial salaries to owners.” These antiavoidance measures were not disclosed, as Mr Bowe

yesterday urged Bahamians, businesses and the Government to view the ‘green paper’ “as the beginning of the journey as opposed to a fait accompli and coming to the finish line”.

Urging that the document on “corporate income strategies for The Bahamas” be the start of wider tax reform discussions, when asked by Tribune Business if such a levy can be introduced without reforms elsewhere, he replied: “I don’t think you can. “I think there are components of tax reform, and those can be started and you can have discussions around them, but in terms of any changes in the tax system as it currently stands at present, I don’t believe there can be the introduction of corporate income tax without holistic discussion around tax reform

and looking at the entire system,” Mr Bowe added.

“When you look at what we consider to be bespoke parts of the system, you can fall victim to believing everything else remains equal.

A tax system is a complex system, so just changing one component from a consumption base or turnover base to an income base is going to have other consequences so we need to look at it in a completely holistic manner.”

While there was a tendency to focus on “low hanging fruit”, the Fidelity Bank (Bahamas) chief said that often-times while “the tree limb may look a bit low those fruits are hard to detach.” Calling for tax reform discussion, and consultation, to go beyond corporate income tax, he argued: “While I certainly welcome discussions on any income tax, be it corporate or personal, I would caution the Government not to be naive or ignorant such that it only focuses on one tax reform component.

“If this is the springboard into a wider discussion and analysis, it’s welcome. If it’s a bespoke initiative, it’s dead on arrival.” One consequence of a “bespoke initiative”, he added, was the possible evasion/avoidance by business owners substituting salaries for profits and dividends.

“If the sole focus is on corporate taxation, there is an elevated risk and shareholders and owners become more creative about the declaration of profits of the business very personal emoluments,” Mr Bowe explained. “From that perspective, it can’t be a tax system that’s ready unless there’s a closing of loopholes allowing businesses to change the way businesses report in order to circumvent the tax structure.”

While it was possible to combat such schemes with multiple laws and regulations, he added that this not only compromised taxation simplicity but also undermined a “principles-based system” that is the type widely soon as most palatable by taxpayers and easy to implement.

Mr Bowe spoke out as the opposition Free National Movement (FNM), in a statement, blasted the Government’s corporate income tax ‘green paper’ as “halfbaked” and said it “cannot

fathom” how the Davis administration could be proposing four reform options that all lack any positive impact on economic growth, jobs and foreign and domestic investment.

Describing this as “a non-starter”, Opposition leader Michael Pintard said: “This paper puts forward four proposals, all of which according to the paper will have a negative effect on economic growth, foreign and domestic investment, and unemployment.

“The Opposition cannot fathom how the Government would find it appropriate to enter into any set of tax reform measures that will have a negative effect on every single key metric related to economic performance. The Bahamian people cannot accept a proposal that does not support sustained economic growth and better employment opportunities.

“The only sensible approach for the Government is to consider a fuller fiscal reform plan that looks broadly at our tax system, our public sector expenditure and the bureaucracy and red tape that often stifles entrepreneurship and business opportunity. The country needs a green paper on fiscal reform, not just corporate income tax.”

This would be the first such income-based levy in the country’s history, and is intended to ensure The Bahamas complies and fulfills its obligations as one of 140 countries that have signed on to the G-20/ Organisation for Economic Co-Operation and Development (OECD) drive for a minimum 15 percent global corporate tax. In the first instance, this applies only to corporate groups and their subsidiaries that have a minimum annual turnover in excess of 750m euros.

The Government’s ‘green paper’, which is dated May 17, 2023, sets out the first option as merely introducing a 15 percent corporate income tax for all Bahamasbased entities that fall into that 750m-plus turnover category. While that would have zero impact on the country’s economic growth and unemployment rate, the paper estimates it would cause foreign direct investment (FDI) and domestic investment to contract by 0.3 percent and 0.1 percent, respectively.

The second and third options, described as “more nuanced” because of the better balance they strike between tax revenue and economic impact, are those the Government indicates it is giving more serious consideration to. The second, labelled as “a soft introduction”, would introduce the same 15 percent rate for all those caught in the G-20/OECD net and also levy a 10 percent corporate income tax on all other businesses “to maintain regional tax competitiveness”.

This option, the ‘green paper’ adds, would have minor negative impacts on GDP, foreign and domestic investment, and unemployment. The latter would rise by 0.1 percent, while GDP growth would contract by 0.3 percent and foreign and domestic investment fall by 1.5 percent and 0.3 percent, respectively.

The third option, branded as “simplicity driven”, would exempt or carve-out small businesses earning less than a $500,000 annual turnover to leave them still paying the existing Business Licence fee. Bahamas-based entities in groups that meet the G-20/OECD threshold would pay a 15 percent corporate income tax, and all other companies generating more than $500,000 would pay a 12 percent rate.

The third option, though, would result in greater negative economic impacts although generating more revenue for the Government. Under this scenario, the ‘green paper’ said GDP growth was estimated to contract by 0.9 percent with unemployment increasing by 0.5 percent. Foreign and domestic investment will fall by sums equivalent to 5.1 percent and 1 percent, respectively.

The final option, which will generate the greatest revenue increase for the Government but also inflict the harshest economic impact, is to simply impose the 15 percent corporate income tax rate on all businesses with a turnover greater than $500,000 per annum and a 10 percent on small and medium-sized enterprises earning less than that.

This would result in an economic contraction of 1.7 percent, or around $200m, the ‘green paper’ projected, with the unemployment rate rising by 0.9 percent. FDI would fall by 10.2 percent, and its domestic investment counterpart by 2 percent. However, government revenues under this scenario are forecast to rise by 96 percent compared to the $140m collected from Business Licence fees in 2019.

PAGE 6, Monday, May 22, 2023 THE TRIBUNE

FROM PAGE B1

Keep Freeport out of a ‘political cesspool’

called for both the Government and GBPA to disclose the identities of any confirmed bidders for the latter.

“I am opposed to both parties…..

“I’m not in favour of the Government for many reasons. One reason is that the Government has not managed what they have now, and for us to put the GBPA in the hands of the Government of The Bahamas, it will only end up in another political cesspool or political game. We could be victimised depending on which government is in power.

“I do believe there are qualified persons out there that can purchase the GBPA, and who have real funding and vision. We don’t want someone who buys it and just puts it on their belt. We want someone to come in with a vision, immediate intent and be able to take Grand Bahama where it needs to go. Grand Bahama is welldeveloped; we just need more investment to happen on the island,” Mr Cooper added.

“There are some persons out there that can purchase the GBPA and take it where it needs to go. I would like for the Government or Port Authority to disclose to the people who may have expressed an interest in the GBPA so we would know it is not just MSC. I would like for them to be upfront with the people and transparent, and let us know who may have bid on and expressed interest in the GBPA.”

Mr McAlpine, acknowledging that he also continues to hear the talk swirling around the GBPA, told this newspaper: “I’m not sure MSC would be my first choice. I am also opposed to the Government being involved with the purchase of the GBPA. That’s always been my stance. I am also opposed to any cronies of the Government purchasing the GBPA.

“If you want to see how the Government will run the GBPA, look at how it operates the eastern and western parts of the island of Grand Bahama, and that will tell you exactly how the Government would run Freeport. I agree there needs to be an infusion of new vision or new private investors, or a crosssection of Bahamians might be interested in partnering with international investors.

“That would mean persons with a strong personal reputation and character in business, and finances, and who are acquainted with international investors and have a rapport with international investors. If a group like that wants to do something, we would welcome that. But if it’s the

Government, and its cronies, we’re not interested.”

Well-placed contacts, speaking on condition of anonymity, revealed that to-date there has been no official approach from MSC to either of the GBPA’s shareholding families with regard to a formal offer to acquire Freeport’s quasigovernmental authority. And several voiced doubts that the shipping giant would be interested despite possessing the necessary financial means via the billions of dollars in cash sitting on its balance sheet.

While the drumbeat about MSC’s interest has grown louder in recent weeks and months, one contact said: “There’s been no approach from MSC. It’s been rumoured for more than a year.” However, they conceded that “there’s something going on” and added that there seemed to be “a lot of shenanigans” occurring in the background as it relates to the Government’s relations with the GBPA and its present owners.

MSC already has extensive Bahamas interests, and especially in Grand Bahama. It has long been Hutchison Whampoa’s partner in, and a prime user of, the Freeport Container Port for container storage and breakdown, and has recently teamed with Royal Caribbean and ITM Group on the $80m project to transform Freeport Harbour via the addition of new cruise ship berths and an enhanced tourist experience. It has also transformed Ocean Cay, the man-made island off Bimini that was formerly used for aragonite and sand mining, into its private island cruise destination. “Government has been trying to get MSC into the picture for years,” one source, speaking on condition of anonymity, said of the GBPA. They added, though, that the shipping giant is more likely to be interested in the harbour than acquiring a quasi-governmental authority.

However, other permutations could involve MSC providing the necessary financing for the Government to itself acquire the GBPA, or for the shipping giant to do it and then hand all quasigovernmental and regulatory powers back to Nassau. One advantage of involving MSC is its existing relationship with Hutchison Whampoa, which could be invaluable given that the latter is 50/50 partners with the Haywards and St Georges in vital assets such as the Grand Bahama Development Company and Freeport Harbour Company.

Mr McAlpine, meanwhile, said any potential GBPA purchaser must be “vetted properly” as The Bahamas must avoid “finding ourselves

the same quagmire” as that involving Hutchison Whampoa and its lack of proactive investment/development in Grand Bahama.

“Whoever’s considering purchasing, we need to make sure they have a vested interest in Grand Bahama and want to see the advancement of Grand Bahama,” he told Tribune Business. “Their internal profits cannot be the bottom line for Grand Bahama. They have to have a vested interest in developing Grand Bahama, and invest in the interests of the people of Grand Bahama.

“That is what we have been lacking for the last 20 years or so. Everybody is just interested in their balance sheet and profits, but the people of Grand Bahama are going to hell.... We’re at a crossroads because people have become very much frustrated at the lack of vision displayed by the Port Authority. They’ve done some things to prop themselves up, but to have investments that are touching the lives of the Bahamian people has been difficult and a failure for the past 20 years.

“There are many Grand Bahamians that have left this island and would love to come back home if there was something tangible to come back to. Unemployment is very high in Grand Bahama, and we’re not seeing the Port Authority do the things they should be doing to maintain the roads.” However, for all these faults, Mr McAlpine reiterated his vehement opposition to the Government taking over Freeport’s management.

“I don’t want the Government taking over my water or electricity. They cannot do it in Nassau properly, so how are they going to do it here?” he argued. “We are at a crossroads, and I really think that in order for us to progress there needs to be an infusion of a new set of shareholders and directors who have interest in this island and must be committed to help.

“When I look at MSC, that’s fine, good and dandy but who in that group is going to represent Grand Bahama and Bahamians? I want someone connected to the island. I don’t want another international company coming in and it’s business as usual and bottom line profits, or somewhere to relax because it’s a tax haven for them.

“We’re at that juncture, and any decision now must be for the benefit of the people. We know it has to be balanced, but it has to be profitable for the people of Grand Bahama and profitable for investors seeking to buy the Port. The players have to be right, and we have to determine the right moves for the benefit of the people of Grand Bahama.”

Mr Cooper, too, agreed that any GBPA purchaser “needs to be community orientated” and work with the people of Grand Bahama as well as bringing the necessary capital and investment contacts. He voiced particular concern that investment activity continues to bypass Freeport in favour of other Bahamian islands despite the tax breaks and other advantages the city can offer via the Hawksbill Creek Agreement.

“Getting new investors or an investor in at the Port Authority is definitely warranted,” he added. “We as Grand Bahamians cannot understand why there’s so many desired investment developments in other parts of The Bahamas but they’re not looking at Freeport,” he added. “I think a new investor will be able to bring some new ideas. New blood is key, and new vision is key.”

Both Mr Cooper and Mr McAlpine suggested that one candidate potentially capable of doing what Freeport requires is Rupert Hayward, grandson of Sir Jack. The latter suggested he possesses “the spirit of Edward St George, and a rapport with the locals”, while Mr Cooper said he was “interested in seeing the island take off”.

Mr Hayward previously told Tribune Business he ha submitted “a new partnership” proposal that “can attract billions of dollars in investment [and] create thousands of jobs” for Freeport and the wider Grand Bahama to the Davis administration. He did not mention any names, but he has been heavily involved with the multi-party deal to develop a Six Senses resort at the 30-acre Barbary Beach site previously owned by Marriott.

That agreement features Weller Development, which is spearheading the largest US urban regeneration in Baltimore via the 235-acre Port Covington site, and Pegasus Capital Advisors, the $10.6bn private equity group focused on investing in sustainable projects and the only such group accredited as a fund manager by the Green Climate Fund.

Multiple Freeport-based sources have previously suggested this partnership could lead to bigger things beyond Six Senses, and there have been indications that Mr Hayward was working on a proposal with these entities to potentially buy-out the St George interest in the GBPA.

The Government has been examining whether change at the GBPA is best achieved through either a private buyer acquiring the Hayward and St George families’ ownership interests, the Government doing itself or the regulatory and quasigovernmental powers being devolved back to Nassau.

The Prime Minister, in a prepared statement earlier this year, said: “Grand Bahama over the many years has failed to live up to its true promise and potential.

And we are are in discussions with the Port Authority for the purposes of identifying a path towards putting Grand Bahama on the right track to enable it to fulfill its full potential and promise.”

The GBPA owners, in a 2016 Memorandum of Understanding (MoU) signed with the Christie administration, committed to masterplan the development of their landholdings and seek a buyer for their interests within specified timelines. However, none of these conditions appear to have been fulfilled.

The GBPA, while described by some as a ‘regulatory shell’, still possesses considerable powers that include business

licensing, building code and environmental enforcement, city management, and the power to levy fees and service charges together with the operation of a free trade zone that offers multiple forms of tax relief to investors.

However, its incomeearning assets have been transferred to Port Group Ltd. These include the 50 percent equity stakes in Grand Bahama Development Company (DevCO) and the Freeport Harbour Company, likely to be the two families’ most valuable assets, together with interests in multiple other companies such as Freeport Commercial & Industrial, another major landowner.

Should the Government seek to take over the GBPA’s regulatory powers, one source said it would amount to an “abrogation” of the Hawksbill Creek Agreement and raise multiple legal issues that would have to be addressed. Among these, they added, would be the provision that requires four-fifths (80 percent) of licensees to approve the devolution of quasi-governmental authority to a local government-type entity.

THE TRIBUNE Monday, May 22, 2023, PAGE 7

FROM PAGE B1

Super Value president: ‘Things aren’t flowing’

imported shipments off the dock. The inability to produce one had caused complications for several months, hampering goods clearance until Super Value was finally issued with a temporary TCC. And Ms Symonette said the supermarket chain has experienced similar issues with its Business Licence renewal. While the necessary fee has been paid, and issuance approved, she disclosed that Super Value has yet to receive the actual licence for wall display

from the Department of Inland Revenue. Bahamian retailers and wholesalers, according to the Government’s justreleased ‘green paper’ on “corporate income tax strategies for The Bahamas, will be among the industries set to gain most from the proposed switch away from the current turnoverbased Business Licence fee. However, Ms Symonette suggested there are more immediate priorities for the Government to resolve that will get commerce and economic growth moving faster.

NOTICE is hereby given that

FREDERICK JOACHIN, Ida Street, Robinson Road, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

“The only other thing we have a problem with is getting the Business Licence even when we pay and submit the application on time,” she told this newspaper. “We still don’t get the licence. Up to now, we’ve been approved, but haven’t gotten the actual paperwork. If they [the authorities and police] come in and see we don’t have it on the wall, they question us as to whether we’ve paid and why we’ve not got it on the wall; that type of stuff. It’s not our fault; they just haven’t issued it.”

Similar frustration exists over Super Value’s TCC, which is required by itself and all other Bahamasbased companies as proof they are fully compliant with all due tax liabilities to the Public Treasury and National Insurance Board (NIB). Failure to produce or obtain once can impede doing business with the Government, including the receipt of payments due from the latter, as well as the ability to clear imported goods shipments through Customs.

“The other thing we’re having an issue with is the TCC,” Ms Symonette told Tribune Business. “Just like how long they have taken to

issue the Business Licence, they have taken long to issue the Tax Compliance Certificate. There are a lot of things that depend on that certificate.

“Government agencies require you to have that certificate in order for them to pay you, and in order for you to get your goods off the dock, yet there’s a big hold up in getting the actual certificate. Things aren’t flowing like they should be. They’re having some issues that they need to straighten out. It’s just a matter of getting these things straight and getting the actual certificate. It’s nothing they should be holding up on the certificate for.

“We’ve been issued a temporary one [TCC], but before that we had been waiting several months. That was a problem. We’ve only had the temporary one for a month or two. Both of them are very important because both of them hinder you getting your business done in a timely fashion if you don’t have them,” Ms Symonette continued.

“We really shouldn’t be held up because of that. It’s really annoying as you go to pick your stuff up off the dock and, because you don’t have this certificate [TCC], you can’t get the stuff to put in your

stores that customers want to buy. We need things to flow smoothly because we have to have produce in the stores on time for customers to buy, and we need shipments off the dock before others come in.

“It’s also vexing to the customer to go in and be asking: ‘Where’s the stuff?’. They’re not going to be happy with us saying the stuff is on the dock. Ease of doing business... they need to get on with that.”

Still, Ms Symonette said she supported the proposal to switch the basis of direct Bahamian corporate taxation away from the turnover-based Business Licence fee to net earnings and profit margins.

“I think that would be pretty good because right now you could be earning a whole lot but profits are not that much,” the Super Value president explained. “It could be a bit unfair. If they switch to a profitbased tax that would be favourable. I think most in the industry would be in favour of that.

“If your turnover is high, and you have a lot of expenses and they tax you on that turnover, it would be a bit unfair because your profits may not be that great. They’re just looking at turnover and thinking you’re making a lot of money when there’s a lot coming out of that turnover. It’s a substantial amount.”

Many in the Bahamian private sector have long favoured reforming the existing Business Licence fee regime, which is based on turnover rather than corporate profits. It is viewed as a distortionary tax that disproportionately

penalises high turnover/ low margin businesses, such as food stores and gas stations, while favouring high margin/low turnover entities such as services firms

It also causes further complications for companies who sell a significant volume of price-controlled goods, and often leads to companies paying more in Business Licence fees than they earn in annual profits while others are effectively taxed into a loss.

The Government’s ‘green paper’ acknowledged these concerns as it noted the higher margins enjoyed by some industries that paid the same Business Licence fees, based on turnover, as their lower margin counterparts. Real estate and recreational activities, both enjoying earnings margins of close to 40 percent based on EBITDA (earnings before interest, taxation, depreciation and amortisation), were shown as paying Business Licence fees equal to 1 percent of turnover.

The latter percentage was equal to wholesalers and retailers who, while also paying almost 1 percent of their turnover in Business Licence fees, earn an EBITDA margin of just 5 percent.

“For example, the wholesale and retail trade sector and recreational activities sector each pay 0.9 percent of turnover, on average, to the Business Licence fee. However, businesses in the wholesale and retail trade sector are estimated to have a lower profit margin than businesses operating in the recreational activity sector (6 percent compared to 40 percent),” the ‘green paper’ said.

PAGE 8, Monday, May 22, 2023 THE TRIBUNE

FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

NOTICE

BIDEN AIMS TO REASSURE WORLD ON US DEBT STANDOFF AS HE CONSULTS WITH INDO-PACIFIC LEADERS

By JOSH BOAK AND ZEKE MILLER Associated Press

PRESIDENT Joe Biden tried to reassure world leaders on Saturday that the United States would not default as he consulted with the heads of Australia, Japan and India in a meeting of the so-called Quad partnership that had been hastily rescheduled because of the debt limit standoff back in Washington.

Hoping to avert an outcome that would rattle the

NOTICE

NOTICE is hereby given that ALEXANDER LUCAS MCPIKEZIMA , East Bay View Drive, Paradise Island, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

global economy and prove to be a boon to Beijing, Biden opened his third day in Japan at the annual Group of Seven meeting of the world’s most powerful democracies with a briefing from his staff on the latest fits and starts in talks over how to raise the federal debt limit.

The president also squeezed in meetings aimed at challenging China’s buildout across the Indo-Pacific. The Quad members originally had planned to meet in Sydney next week, but got together instead on the sidelines of the G7 so Biden could return to Washington earlier on Sunday in hopes of finalizing a deal to increase the U.S. borrowing limit before the government runs out of cash to pay its bills.

Biden said he felt there was headway in the talks with GOP lawmakers.

“The first meetings weren’t all that progressive, the second ones were, the third one was,” he said before a meeting with

Australian Prime Minister Anthony Albanese. “And then, what happens is the carriers go back to the principals and say, ‘This is what we’re thinking about.’ And then people put down new claims. I still believe we’ll be able to avoid a default and we’ll get something decent done.”

In a sign of a renewed bargaining session in Washington, food was brought to the negotiating room at the U.S. Capitol on Saturday morning, only to be carted away hours later. No meeting was likely Saturday, according to a person familiar with the state of the talks who was not authorized to publicly discuss the situation and spoke on condition of anonymity.

The shortened trip has reinforced a fundamental tension shaping Biden’s presidency: As he has worked to signal to the world that the U.S. is reclaiming the mantle of global leadership, at key moments, domestic dramas keep getting in the way.

NOTICE

IN THE ESTATE of DENIEL ALEX RECKLEY, late of the Southern District of the Island of New Providence, one of the Islands of The Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 1st day of June A.D., 2023, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Administrators shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO., Attorneys for the Administrators Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

NOTICE

NOTICE is hereby given that MARK CLAUDELL LAFRANCE of Cowpen Road, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that FEDNER JOACHIN Ida Street, Robinson Road, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that MAKINSON GULES, Eleuthera Governors Harbour, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

THE TRIBUNE Monday, May 22, 2023, PAGE 9

NOTICE

REAL ESTATE FACES

ditching the current Business Licence fee are low margin sectors such as retail/wholesale and construction. The former, which is traditionally high volume, especially in food distribution, would see their tax burden under corporate income tax decline by between 0.3 percent and 0.5 percent as a percentage of gross turnover, while construction firms could see either a 0.1 percent decline or 0.3 percent increase depending on the option.

“Although the tax burden across the economy is at least as high as under the current Business Licence fee for each option, it is estimated that tax revenues from the wholesale and retail trade would be reduced across all options,” the Government’s ‘green paper’ said. “This reflects the relatively high effective tax rate paid by this sector now compared to other sectors, which are estimated to face an increase in their tax burden across most options. This is particularly the case for the financial services (excluding insurance activities) and real estate sectors.”

David Morley, Morley Realty’s president, yesterday questioned why the Government was leaning towards imposing corporate income tax on domestic firms and entities that are not part of multinational groups earning over 750m euros per annum. The latter is the threshold above which the G-20 and Organisation for Economic Co-Operation and Development’s (OECD) minimum 15 percent global corporate tax would apply.

“If that’s what they’re putting focus on, why don’t they restrict it to those multinational groups and leave local businesses alone?” he asked. “The whole issue for those external agencies is those multinational groups. I think the Government is using this as an additional money grab from businesses. It’s another one of these big game changers, and if it’s not done properly it could cripple a lot of real estate companies.”

Others were more welcoming. Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, yesterday said the hospitality industry in principle favours corporate taxation levied on profits,

and the bottom line, rather than revenue and turnover.

Disclosing that the tourism industry had been part of the private sector committee advising the Government, he added: “Now that a position paper has been put out, the Hotel Association and member hotels are reviewing the document to determine what impact and level of support we intend to give.

In general, the Association does believe a tax on profits is better than on budgeted income, revenue income and turnover etc.

“This is something that has only just been received by the general population, and is currently being reviewed in detail before we are able to make any further detailed comments on the matter.” When measured by annual turnover, the Government’s ‘green paper’ forecast that the highest tax burden increase across all four options proposed will fall on companies generating between $1m to $6m per year.

Their tax burden, as a percentage of gross turnover, will rise by between 0.6 percent to 1.5 percent depending on the option taken. Only if the Government decides to restrict the

corporate income tax to a 15 percent levy on those businesses caught by the OECD/G-20 initiative will there by no change.

Companies generating between $400,000 and $1m will also experience an increase of between 0.5 percent and 1.3 percent according to which choice The Bahamas makes. Firms earning between $50,000 and $400,000 will face the highest potential tax burden rise, of 1.7 percent of gross turnover, but only if The Bahamas goes for option four which would see them facing a 10 percent corporate income tax as opposed to the present Business Licence fee.

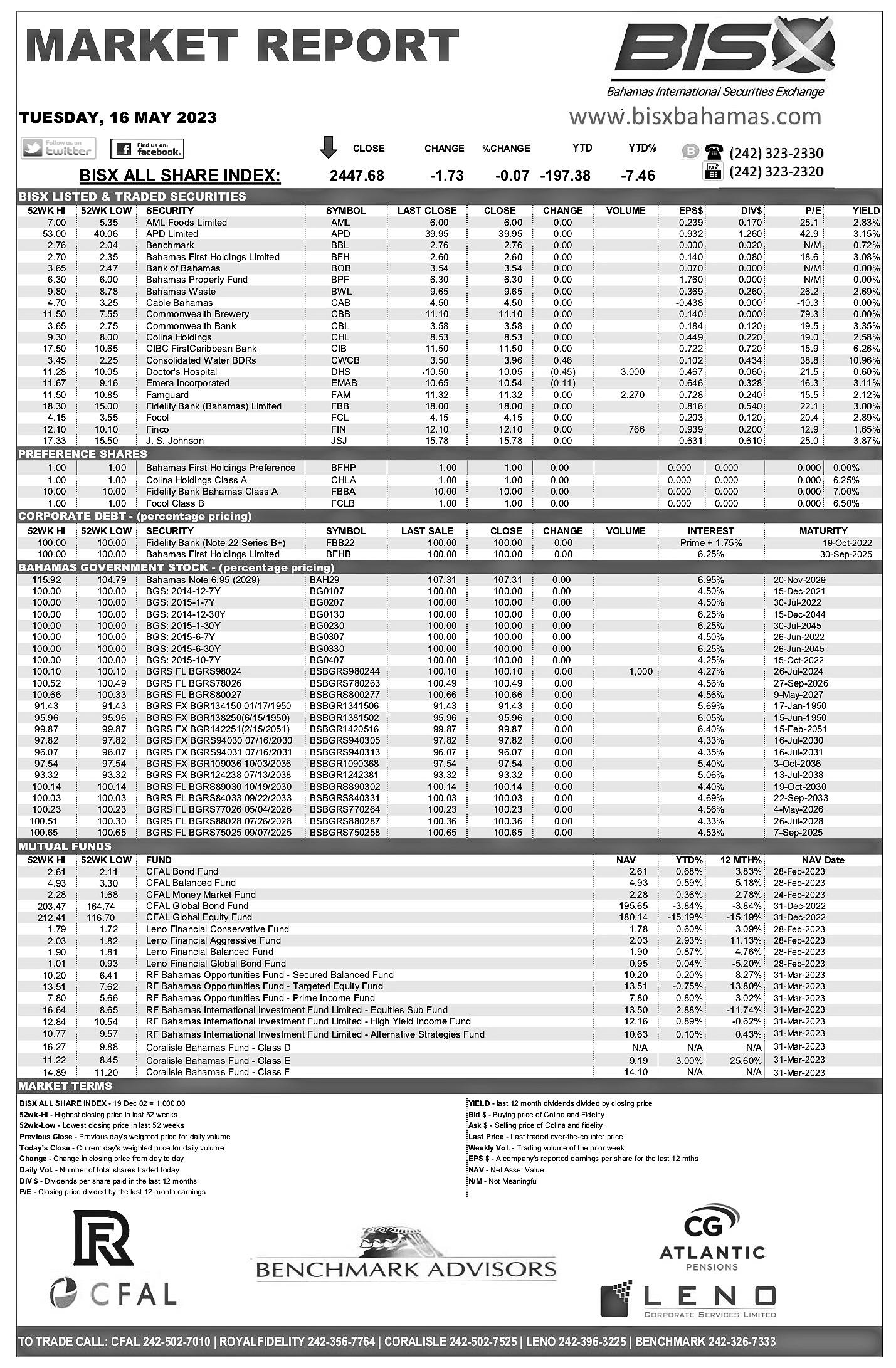

Larger companies, such as major resorts and BISXlisted firms which earn over $6m in annual turnover, will suffer a lower tax burden increase than those in the $400,000 to $1m and $1m to $6m brackets. Depending on the option taken, the increase would be between 0.2 percent and 0.7 percent.

“Across the options, the tax burden for very large businesses (turnover greater than $6m) is estimated to increase,” the Government’s ‘green paper’ said. “For businesses earning less than $400,000, the

tax burden is estimated to increase only under options two and four where corporate income tax is levied on all businesses and thus there is a change from the existing Business Licence fee system.

“Comparatively, under option three, the corporate income tax applies only to larger firms (earning more than $400,000) and the existing Business Licence

THE WEATHER REPORT

fee system remains for smaller firms. It is recognised, however, that options two and four imply the introduction of corporate income tax even for small businesses. The viability of this is an important topic of this consultation, and business costs associated with implementation will be considered in detail in the design phase.”

THE TRIBUNE Monday, May 22, 2023, PAGE 11

GREATEST CORPORATE

FROM PAGE B1 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 70° F/21° C High: 86° F/30° C TAMPA Low: 73° F/23° C High: 88° F/31° C WEST PALM BEACH Low: 75° F/24° C High: 88° F/31° C FT. LAUDERDALE Low: 76° F/24° C High: 87° F/31° C KEY WEST Low: 79° F/26° C High: 87° F/31° C Low: 75° F/24° C High: 86° F/29° C ABACO Low: 76° F/24° C High: 82° F/28° C ELEUTHERA Low: 76° F/24° C High: 82° F/28° C RAGGED ISLAND Low: 78° F/26° C High: 84° F/29° C GREAT EXUMA Low: 77° F/25° C High: 84° F/29° C CAT ISLAND Low: 76° F/24° C High: 85° F/29° C SAN SALVADOR Low: 76° F/24° C High: 84° F/29° C CROOKED ISLAND / ACKLINS Low: 76° F/24° C High: 83° F/28° C LONG ISLAND Low: 77° F/25° C High: 84° F/29° C MAYAGUANA Low: 77° F/25° C High: 86° F/30° C GREAT INAGUA Low: 76° F/24° C High: 85° F/29° C ANDROS Low: 75° F/24° C High: 85° F/29° C Low: 71° F/22° C High: 85° F/29° C FREEPORT NASSAU Low: 75° F/24° C High: 89° F/32° C MIAMI

TAX BURDEN RISE

5-Day Forecast Nice with times of clouds and sun High: 86° AccuWeather RealFeel 95° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Mainly clear Low: 75° AccuWeather RealFeel 79° F Partly sunny and pleasant High: 85° AccuWeather RealFeel Low: 75° 99°-79° F Mostly cloudy, a cou ple of t‑storms High: 85° AccuWeather RealFeel Low: 74° 93°-77° F Sun and some clouds High: 86° AccuWeather RealFeel Low: 74° 96°-76° F Morning t‑storms; mainly cloudy High: 87° AccuWeather RealFeel 101°-77° F Low: 74° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 83° F/28° C Low 77° F/25° C Normal high 85° F/29° C Normal low 72° F/22° C Last year’s high 88° F/31° C Last year’s low 79° F/26° C As of 2 p.m. yesterday 0.00” Year to date 14.38” Normal year to date 7.71” Statistics are for Nassau through 2 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau First May 27 Full Jun. 3 Last Jun. 10 New Jun. 18 Sunrise 6:23 a.m. Sunset 7:51 p.m. Moonrise 8:35 a.m. Moonset 10:59 p.m. Today Tuesday Wednesday Thursday High Ht.(ft.) Low Ht.(ft.) 10:27 a.m. 2.1 4:41 a.m. 0.0 10:52 p.m. 2.9 4:26 p.m. 0.0 11:11 a.m. 2.1 5:25 a.m. 0.2 11:35 p.m. 2.7 5:09 p.m. 0.2 11:58 a.m. 2.0 6:11 a.m. 0.3 ‑‑‑‑‑ ‑‑‑‑‑ 5:55 p.m. 0.4 12:21 a.m. 2.6 6:58 a.m. 0.5 12:48 p.m. 2.0 6:45 p.m. 0.6 Friday Saturday Sunday 1:09 a.m. 2.5 7:46 a.m. 0.6 1:42 p.m. 2.0 7:40 p.m. 0.8 1:59 a.m. 2.4 8:34 a.m. 0.6 2:38 p.m. 2.0 8:39 p.m. 0.8 2:51 a.m. 2.3 9:22 a.m. 0.5 3:32 p.m. 2.2 9:39 p.m. 0.8 marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 6 12 Knots 3 5 Feet 10 Miles 81° F Tuesday: NNE at 3 6 Knots 3 6 Feet 10 Miles 80° F ANDROS Today: NE at 3 6 Knots 0 1 Feet 10 Miles 85° F Tuesday: SSE at 4 8 Knots 0 1 Feet 10 Miles 86° F CAT ISLAND Today: NNW at 7 14 Knots 3 6 Feet 10 Miles 79° F Tuesday: NW at 4 8 Knots 3 5 Feet 10 Miles 79° F CROOKED ISLAND Today: NNW at 6 12 Knots 2 4 Feet 6 Miles 82° F Tuesday: NW at 3 6 Knots 2 4 Feet 10 Miles 82° F ELEUTHERA Today: N at 6 12 Knots 3 5 Feet 10 Miles 80° F Tuesday: NNW at 3 6 Knots 3 5 Feet 10 Miles 80° F FREEPORT Today: NE at 6 12 Knots 1 2 Feet 7 Miles 83° F Tuesday: SE at 3 6 Knots 1 2 Feet 10 Miles 84° F GREAT EXUMA Today: N at 4 8 Knots 0 1 Feet 10 Miles 82° F Tuesday: NE at 3 6 Knots 0 1 Feet 10 Miles 82° F GREAT INAGUA Today: NW at 4 8 Knots 1 3 Feet 8 Miles 83° F Tuesday: NW at 3 6 Knots 1 2 Feet 10 Miles 83° F LONG ISLAND Today: N at 6 12 Knots 1 3 Feet 10 Miles 81° F Tuesday: NNE at 3 6 Knots 1 3 Feet 10 Miles 81° F MAYAGUANA Today: WNW at 7 14 Knots 4 7 Feet 8 Miles 81° F Tuesday: WNW at 4 8 Knots 3 6 Feet 8 Miles 81° F NASSAU Today: NNE at 4 8 Knots 0 1 Feet 10 Miles 81° F Tuesday: E at 3 6 Knots 0 1 Feet 10 Miles 81° F RAGGED ISLAND Today: NE at 4 8 Knots 1 2 Feet 10 Miles 82° F Tuesday: ENE at 3 6 Knots 1 2 Feet 10 Miles 83° F SAN SALVADOR Today: N at 6 12 Knots 1 2 Feet 10 Miles 80° F Tuesday: NNW at 3 6 Knots 1 2 Feet 10 Miles 80° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2023 L L tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S E W 3 6 knots N S W E 6 12 knots N S W E 6 12 knots N S E W 6 12 knots N S E W 4 8 knots N S E W 4 8 knots N S W E 4 8 knots N S W E 3 6 knots

Biden, McCarthy to speak on debt limit; talks stalled as Republicans seek deep spending cuts

By ZEKE MILLER AND JOSH BOAK Associated Press

PRESIDENT Joe Biden planned on Sunday to speak directly with House Speaker Kevin McCarthy, hoping to salvage talks to raise the debt limit that have stalled in recent days while he was abroad at the Group of Seven summit.

GOP lawmakers are holding tight to demands for sharp spending cuts, rejecting the alternatives proposed by the White House for reducing deficits. Biden and world leaders at the gathering for industrial nations in Japan had been closely tracking the negotiations, looking for signs of a compromise that would ensure the federal government can keep paying its bills and avoid a potentially catastrophic default.

Biden has tried to project optimism even as the talks back in Washington were rocky. Republicans are rejecting a White House plan that would impose less strict cuts while also increasing revenues. The two sides are up against a deadline as soon as June 1 to raise its borrowing limit, now at $31 trillion.

“We’re going to get a chance to talk later today,” Biden said of McCarthy, R-Calif., while the president met with the leaders of Japan and South Korea at the G7 in Hiroshima, Japan.

But McCarthy may need bipartisan support; it’s possible he’ll need as many as 100 House Democratic votes to pass an agreement, based on likely GOP defections and past votes, according to a person familiar with the talks. The person was not authorized to provide details about the proposal and spoke to The Associated Press on condition of anonymity.

In the latest round, McCarthy’s team called for deep cuts to non-defense spending, while insisting on increased funding for the military. Education, health care, Meals on Wheels and other programs would likely bear the burden, according to the person.

The GOP wants work requirements on Medicaid, though the administration has countered that millions of people could lose coverage. The Republican side also introduced new cuts to food aid by restricting states’ ability to wave work requirements in places with high joblessness, an idea that when floated by the Trump administration was estimated to cause 700,000 people to lose their food benefits.

The GOP lawmakers are also seeking cuts to IRS funding and asking the White House to accept provisions from their proposed immigration overhaul.

The White House has countered by keeping defense and nondefense spending flat next year, which would save $90 billion in fiscal 2024 and $1 trillion over 10 years.

Republicans have also rejected White House

proposals to raise revenues in order to further lower deficits. Among the proposals the GOP objects to are policies that would enable Medicare to pay less for prescription drugs and the closing of a dozen tax loopholes. Republicans have refused to roll back the Trump-era tax breaks on corporations and wealthy households as Biden’s own budget has proposed.

With talks frozen on Saturday as each side accused the other of being unreasonable, Biden was frequently briefed on the status of negotiations and directed his team to set up the call with McCarthy.

The decision to set up a call came after another start-stop day with no outward signs of progress.

Food was brought to the negotiating room at the Capitol on Saturday morning, only to be carted away hours later, and no meeting was expected. Talks, though, could resume on Sunday after the two leaders’ conversation.

“The Speaker’s team put on the table an offer that was a big step back and contained a set of extreme partisan demands that could never pass both Houses of Congress,” press secretary Karine Jean-Pierre said in a statement late Saturday.

“Let’s be clear: The president’s team is ready to meet any time,” said Jean-Pierre, adding that Republican leadership is beholden to its extreme wing in threatening default.

McCarthy tweeted that it was the White House that was “moving backward in negotiations.”

He said “the socialist wing” of the Democratic party appears to be in control, “especially with President Biden out of the country.”

Republican Rep. Dusty Johnson, who has worked closely with McCarthy to shape the GOP proposal told The Associated Press late Saturday that there were no meetings scheduled Sunday. Republicans are trying to grab the president’s attention rather than negotiators.