Bank shrugs off $2.8m fee rise to ‘beat target by 54%’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

COMMONWEALTH Bank

yesterday revealed its $19.58m first quarter profits “exceeded expectations by 54 percent” despite having to contend with a more than one-third year-overyear increase in licence fees.

Tangela Albury, the BISXlisted lender’s vice-president and chief financial officer, told Tribune Business that its 2023 full-year figures will be impacted by “non-controllable additional

expenses” driven by the reimposition of Business Licence fees on the commercial banking industry.

But, while this will increase Commonwealth Bank’s annual operating costs by some $2.8m, she voiced confidence that the bank will hit both its second quarter and 2023 full-year financial targets after profits for the first three months were aided by signs of renewed growth in its core lending business.

Ms Albury, revealing that loan delinquencies in its key consumer credit segment have now fallen below 5 percent of the

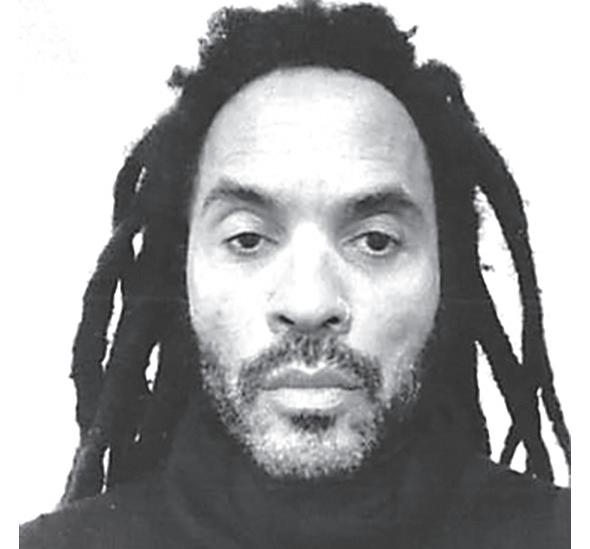

Craig Flowers and FML face winding-up petition

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

FML’s ex-chief operating officer has filed a Supreme Court petition to have the web shop chain wound-up as his five-year legal battle with Craig Flowers escalates into a new phase.

Newspaper advertisements published yesterday disclose that Deyvon Jones’ winding-up petition, which was filed with the Supreme Court on May 10 this year, is due for hearing before Sir Ian Winder, the chief justice, on June 23, 2023.

Mr Jones declined to comment yesterday when contacted by Tribune Business, while Mr Flowers was said to be in meetings all day and was unavailable to speak. As a result, the reasons for the petition’s filings, its prospects of success and whether it will go to a Supreme Court hearing or be settled beforehand could not be ascertained. Mackay and Moxey, attorneys for Mr Jones, referred this newspaper to the Supreme Court registry to obtain any legal documents.

Mr Jones, and Mr Flowers and FML, have been embroiled in a long-running legal battle over the

former’s departure from the web shop chain that has resulted in both Supreme Court and Court of Appeal judgments. Mr Jones obtained a partial success at the Court of Appeal, which ordered FML and his former boss to pay him $120,000 plus interest over a dispute stemming from alleged “irregularities” designed to inflate staff earnings.

The appellate court, by a two-one majority ruling, found that FML’s former chief operating officer should receive the four months’ unpaid salary due to him. With a 6 percent annual interest rate applied to this sum from late March 2018, the total payment due is now close to $170,000,

SEE PAGE B4

Corporate tax ‘driven’ by revenue demands

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT’S corporate income tax proposal is “driven” by the need to increase revenues and could “be a gateway” to further progressive reforms that ultimately include a personal income tax, a governance reformer said yesterday.

Hubert Edwards, the Organisation for Responsible Governance’s (ORG) economic development committee head, told Tribune Business that the Government is

“strategically leveraging” the need for The Bahamas to comply with the G-20/OECD’s 15 percent minimum global corporate tax rate to “inject greater equity” and fairness into the taxation system.

While the first of four options would only levy 15 percent corporate income tax on Bahamas-based entities that are part of multinational groups generating annual turnovers of 750m or more, and are thus caught by the G-20/ OECD initiative, the other three propose different

SEE PAGE B5

total outstanding portfolio, also expressed optimism that Commonwealth Bank will be able to “maintain dividend payments” of $5.9m per quarter throughout 2023 as COVID-19’s devastating financial impact starts to slowly recede into the past.

Speaking after the bank’s 2023 first quarter profits declined by almost 35 percent year-over-year, falling to $19.58m from $30.406m in 2022, she explained that the latter figure was almost entirely driven by the “v-shaped” pandemic rebound which enabled it to recover or write-back some

$17.403m in loan loss provisions during the early part of last year alone.

Loan loss provision recoveries dropped by 72.5 percent yearover-year, declining to a more regular $4.817m, which meant Commonwealth Bank had to rely more on interest income and fees from its core lending business to drive growth. These helped push 2023 first quarter profits to a level some $5.5m higher than the $14.1m historical average achieved over the past five years.

SEE PAGE B2

PI Wendy’s: Bank restriction expired almost 50 years ago

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE ONLY firm restriction governing how the disputed ex-Scotiabank location on Paradise Island can be used expired almost 50 years ago in 1975, Tribune Business can reveal. The so-called “restrictive covenants”, which have been obtained by this newspaper, show the site acquired by the Wendy’s and Marco’s Pizza franchise owner was limited to use as a bank branch and related offices for only a five-year period dating from the original conveyance of the property. The conveyance is dated November 9, 1970, which means the restriction expired more than 47 years ago at the end of 1975.

The revelations shed new light on the battle initiated by Atlantis and its fellow Paradise Island resorts and developers to bar Aetos Holdings, the Wendy’s and Marco’s Pizza owner, from converting the former Scotiabank branch - which it has

• Commonwealth eyeing ‘all areas for growth’

• Consumer loan delinquency cut below 5%

• Business Licence return drives 38% fee rise

• ‘Nothing to prevent restaurant operating there’

• Hotel objectors had chance to buy themselves

• Atlantis: Approval ‘unlawful’ - no public meeting

“restrictive covenants” governing how the location is to be used do not appear to provide an iron-clad case by themselves for that decision to be overturned.

acquired and now owns - into a restaurant destination featuring both brands.

The mega resort has teamed with the Ocean Club and Comfort Suites, as well as Hurricane Hole’s developer, Sterling Global, in a bid to overturn the permission granted by the Town Planning Committee for Aetos Holdings to “change the use” of that location from a bank to fast-food restaurants. However, the

One well-placed source, speaking with knowledge of the covenants, told this newspaper: “There’s nothing there to prevent a restaurant from operating there. The only restriction placed with regard to use of the property was in that 1970 conveyance when, for the first five years, it had to be a bank branch.”

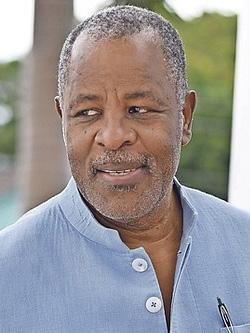

‘Anyone who wants diesel able to buy it’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FOCOL Holdings chairman yesterday voiced optimism that “anyone who wants to buy diesel on this island can get it” even though “the majority” of petroleum retailers were said to have stopped sales of this fuel.

Sir Franklyn Wilson, whose BISX-listed wholesaler operates under the Shell brand, acknowledged to Tribune Business that all parties in the petroleum industry were “no doubt disappointed that things have not been resolved faster” when it came to addressing the industry’s issues - particularly its price-controlled fixed margins - with the Government.

Speaking after numerous dealers, in an act that appeared to be spontaneous rather than pre-planned, stopped selling diesel in a longthreatened first step to take action if their

demands were not met, he argued that there was no supply shortage and all those needing this fuel for their vehicles can get it.

“The fact of the matter is that I am satisfied anyone who wants to buy diesel on thus island can get it,” Sir Franklyn told this newspaper. “No one who wants to buy diesel cannot find it on this island. Anyone who wants to buy diesel on this island, I am satisfied they can get it.”

SEE PAGE B5

business@tribunemedia.net TUESDAY, MAY 23, 2023

CRAIG FLOWERS

SIR FRANKLYN WILSON

TANGELA ALBURY

SEE

WENDY’S

PAGE B4

$5.74 $5.74 $5.74 $5.95

THE EY accounting firm has announced that LaNishka FarringtonMcSweeney, its regional anti-money laundering solutions leader, has returned to The Bahamas to support its growth in this nation.

The regional leader for The Bahamas, Bermuda, British Virgin Islands and Cayman Islands in this area, she also served as EY’s chief MLRO (money laundering reporting officer).

Ms FarringtonMcSweeney, who has transferred from EY Cayman where she served as a partner for five years, has more than 22 years of financial services experience as an auditor, advisor and industry consultant.

A certified anti-money laundering specialist

CRIME HEAD BACK IN BAHAMAS

(CAMS), she has extensive experience in assessing compliance by financial institutions with local antimoney laundering (AML) laws.

Ms FarringtonMcSweeney has designed, and helped to implement, numerous programmes for assessing clients’ anti-money laundering policies and procedures in both banking and fund administration. She has led regional anti-money laundering engagements in Latin America, the Caribbean and North America, conducting due diligence file reviews and gap analysis of local laws and regulations versus other jurisdictions. Ms Farrington-McSweeney has also led anti-money laundering training for

clients, and has provided advice to regulators on proposed changes to laws and regulations.

Initiative to ‘accelerate’ capital access finishes

A CLOSING ceremony for Accelerate Bahamas, an initiative designed to strengthen capital access for Bahamian micro, small and medium-sized (MSME) businesses, was held last week.

The effort, a partnership between the Inter-American Development Bank Lab (IDB) and the Access Accelerator Small Business Development Centre (SBDC), gave additional support to the guaranteed loan programme assisting MSME.s

Samantha Rolle, the SBDC’s executive director, said that since its launch in 2020 the initiative has achieved its two-fold objectives. These were to build the capacity of Bahamian MSMEs to scale through digital transformation, innovation, adoption and access to finance, while improving the entrepreneurial and innovation ecosystem for Bahamian MSMEs through mentorship, entrepreneurial training and other advisory services offered by the SBDC.

Phyllice Bethel, the SBDC’s deputy executive director, said the relationship between the IDB and SBDC will continue through the latter’s credit enhancement facility and guaranteed loan programme. She said: “This means that the IDB will continue to sponsor business plans, business statement compilations and energy audits.

“As it relates to funding, in four months this year we are close to surpassing the quantity and dollar value of loans approved through

the guaranteed loan programme over 12 months last year. So our partnership continues and will evolve as we continue to drive a resilient and robust economy together.”

Daniela Carrera Marquis, the IDB’s Bahamas country representative, said the lab is the IDB group’s innovation arm and is the leading source of development finance and expertise for improving lives in Latin America and the Caribbean. The lab promotes earlystage entrepreneurial innovations, focusing on two development priorities in the region.These are benefiting poor and vulnerable populations, and activating new drivers of sustainable growth.

EY region of The Bahamas, Bermuda, British Virgin Islands and Cayman Islands, said: “We are delighted to have LaNishka rejoin our growing team in The Bahamas.

“The firm places high value on developing local talent, and LaNishka’s presence on the ground will also enable her to mentor and support our junior Bahamian staff. With her extensive knowledge of anti-money laundering and regulatory matters, she will be a sought-after advisor among clients seeking to build robust anti-money laundering programs to minimize the risk of reputational and financial damage caused by financial crime or regulatory sanctions.”

Ms FarringtonMcSweeney said: “I look

forward to continuing to help our clients navigate the complex and evolving regulatory landscape, and to identify and implement appropriate frameworks, procedures and technologies to meet their compliance needs in an efficient and effective manner.

“It’s a pleasure to come home to join the thriving business in The Bahamas, and I look forward to working closely with the EY Bahamas team on the ground, coaching our Bahamian staff to fully develop their careers.”

Ms FarringtonMcSweeney is a member of the Bahamas Institute of Chartered Accountants and the Cayman Islands Institute of Professional Accountants.

BANK SHRUGS OFF $2.8M FEE RISE TO ‘BEAT TARGET BY 54%’

FROM PAGE B1

“The first quarter results exceeded expectations for the period by approximately 54 percent,” Ms Albury said.

“The bank continues to have a strong liquidity position to be a major participant in the expansion of local credit. Given that the market for qualified borrowers has improved in 2023, all of the bank’s business segments are targeted for growth.

“We are cautiously optimistic that the lending market can significantly expand beyond pre-Dorian and pre-COVID-19 levels.

Accordingly, we are encouraged when we attract those customers in segments of the economy that have a proven track record for low delinquency, even in challenging business environments.”

Ms Albury said Commonwealth Bank’s ambitions to convert depositors into borrowers remains “a work in progress” as it works to “determine the appropriate type of product-service mix that will be most effective, including tailoring our existing products and exploring value-added services which are favourable to making us their complete banker of choice”.

Commonwealth Bank’s interest income jumped by almost $2m during the 2023 first quarter, growing by 6.3 percent to $33.488m from $31.513m during the same period in 2022. Net interest income rose by 7.1 percent, growing to $29.224m from $27.274m in a sign of some lending growth, while fees and other income were up 59.8 percent at $6.039m compared to $3.778m in the prior year.

The BISX-listed lender also enjoyed some loan portfolio expansion, as the book grew by more than $11.5m to reach $797.724m at endMarch 2023 compared to the 2022 close. Customer deposits also increased by a slightly higher margin of just under $18.5m, rising from $1.513bn to $1.532bn.

“We have been able to improve delinquency percentages in our non-performing loan book, as well as overall improvement in loan contractual delinquency percentages,” Ms Albury said. “Delinquency in our core business, consumer lending, is now below 5 percent, and the bank is operating within budgetary expectations for 2023.

“We believe that there are further opportunities for a decline in delinquency, which are attached to simultaneously achieving growth in loan receivables while continuing to focus attention on controlling delinquency levels.... The continued rebound of the Bahamian economy has improved the level of qualified borrowers over the prior year.

“Accordingly, the bank is focused on the opportunity to drive organic business growth through a posture of safely expanding credit to both new and existing customers, and past customers recovering from the economic challenges of the last three years. In addition, we continue to price our products and services effectively on both sides of the balance sheet. We are still

experiencing some reversals of impairment allowances. However, it is a milder contribution to the bank’s profitability year-on-year.” Expenses, though, have come under pressure with general and administrative costs (G&A) up year-overyear by more than $2.5m, having risen by 14.9 percent to $20.278m during the 2023 first quarter as opposed to $17.642m during the prior year period.

“2023 will be impacted by some non-controllable additional expenses which did not affect the prior period results, such as the reintroduction of Business Licence fees which increases the bank’s operating costs in 2023 by approximately $2.8m. This represents an approximately 38 percent increase in licence fees paid by the bank over the prior year,” Ms Albury told Tribune Business.

“The bank is committed to improving its infrastructure, which requires investment in people and overall organisational development. In addition, increases in utility costs year-on-year and business maintenance costs reflect inflationary elements that are now showing some permanence as part of the bank’s operational costs. However, these increased costs, which are reflected in the 2023 financial results, have been budgeted and the bank is operating within budgetary targets.”

Detailing Commonwealth Bank’s positive outlook on the remainder of 2023, Ms Albury said: “We are very confident that we can maintain dividend payments through the rest of 2023. We are approaching the hurricane season, and this creates a level of uncertainty that we cannot predict.

“Otherwise, we expect to be positioned to pay the usual two cents per share per quarter, which approximates $5.9m quarterly. We were also pleased to pay an extraordinary dividend during the first quarter of 2023 such that our total return to shareholders in the form of dividends was $11.7m compared to $2.9m during the same first quarter of the prior year.

“We anticipate achieving our budgetary targets for the second quarter and the full 2023 financial year. The first quarter results have certainly exceeded the past five-year historical average profitability for the same period,” she added. “The bank’s historic net profit of $76m in 2022 benefited from the V-shaped recovery of the economy.

“However, as the economy is now stabilising and lending conditions normalising, the first quarter financial results are certainly encouraging. We expect that our profitability will be in step with the historic financial results that are just before the impacts of Hurricane Dorian and COVID-19.”

PAGE 2, Tuesday, May 23, 2023 THE TRIBUNE

Michele Thompson, EY Bahamas country managing partner and regional assurance leader for the

EY ANTI-FINANCIAL

LANISHKA FARRINGTON-MCSWEENEY, EY’s anti-money laundering leader, is returning to The Bahamas.

A CLOSING ceremony for Accelerate Bahamas, a strategic partnership between the Inter-American Development Bank (IDB) and the Access Accelerator Small Business Development Centre (SBDC), was held on May 18. The SBDC’s executive director, Samantha Rolle, and deputy executive director, Phyllice Bethel, both gave remarks.

Photo:Patrice Johnson/BIS

ARBRITRATION ‘KEY TOOL’ FOR ECONOMIC BENEFIT

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

ARBITRATION is an “important tool” that will improve The Bahamas’ competitiveness, ease of doing business and slash the time and money incurred by companies in pursuing expensive court litigation, a Cabinet minister asserted yesterday.

Michael Halkitis, minister of economic affairs, leading the Senate’s debate on the Arbitration Amendment Bill 2023, said the legislation represented an improvement on The Bahamas’ existing framework for alternative dispute resolution (ADR).

Explaining how arbitration works, he said: “The primary role of an arbitral tribunal is to apply the relevant law and decide on the

dispute by administering an arbitral award. In principle, arbitral awards are final and binding decisions of the arbitral tribunal.

“They can only be challenged before a national court under exceptional, and in limited, circumstances; that is,on the grounds of serious irregularity. Arbitral awards can be enforced in most countries worldwide by virtue of the Convention on the Recognition and Enforcement of Foreign Arbitral Awards, better known as the New York Convention.

“The use of ADR is important for several reasons: Firstly, national court systems cannot handle the overwhelming number of disputes that arise. We know that in The Bahamas it can take several years for a matter to move through the court system, and we know that most times

MICHAEL HALKITIS

people want their matters to be quickly resolved. ADR is considered to be faster, more efficient and cost-effective for the involved parties.

“Secondly, when disputes are heard expeditiously with certainty and accuracy, that directly and positively impacts the ease of doing business – something that

this Davis administration is committed to improving,” Mr Halkitis added.

“Thirdly, ADR is considered to be the preferred dispute resolution mechanism in the global business community. The days of running to court for major disputes, worth millions of dollarsc are long gone. Increasingly, multinational

enterprises and even Governments are utilising ADR, particularly arbitration and mediation, to resolve disputes efficiently and privately in the name of quickly getting back to business.”

Mr Halkitis thus argued that ADR is an “important tool for economic development” for the Bahamian economy, and especially tourism, financial services and foreign direct investment (FDI) - the key drivers. He added: “Based on our experience, we know that FDI is essential for the growth and stability of a state’s economy.

“We know that FDI directly increases consumer spending, and that The Bahamas successfully achieving an international reputation as a leading international centre for international arbitration etc can result in increased

FDI flows. We know this because we have witnessed the economic benefit of international arbitration in other jurisdictions.

“For instance, the combined value of international arbitrations which take place in London, a leading arbitration seat, in any given year has been recorded at $40bn to $50bn, significantly contributing to the income of legal and dispute resolution service providers as well as the wider service economy in London.”

The Bill will provide for the inclusion of expanded provisions that support the arbitration of trust disputes, ensure there is a penalty for improper disclosure of confidential information, and restrict the appeal of an arbitration award.

Taxi president: Cruise port call-ups will end ‘hustling’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE BAHAMAS Taxi Cab Union’s (BTCU) president yesterday voiced optimism that the new callup protocols at the Nassau Cruise Port (NCP) will eliminate hustling by drivers for fares.

Wesley Ferguson told Tribune Business the union was “very receptive” to the new structure that is being put in place, comparing it to the call-up system at the Lynden Pindling International Airport (LPIA). “They are contemplating an electronic system as their end goal so they can cancel you out if you are misbehaving,” he added.

“I think taxi drivers are excited to go to the port to

see how the new system will work. We are trying vigorously to cancel out that kind of negativity that is attached to taxi drivers and the way they have performed on the dock. So we are basically trying to get rid of that kind of action, and that kind of hustling, and try to get them to work as professionals.”

Taxi drivers at Prince George Wharf have operated differently to those

stationed at LPIA. The former, prior to the Nassau Cruise Port’s $322.5m redevelopment, was not organised like LPIA and lacked a call-up system. There were also concerns over security, along with reports of physical altercations between drivers competing for passengers and fares.

Mr Ferguson said he believes Nassau Cruise Port will help put an end to these practices through a more organised system. “We are going to have to tweak it as we go because we know not everybody is going to fall in line, but once there are some disciplinary measures levied against them if they step out of line, then they will get it quick, fast and in a hurry,” he added.

Silver Airways adds two routes to Family Islands

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A US airline has added two non-stop routes to the Family Islands from Orlando this past weekend.

The Ministry of Tourism, Investments and Aviation, in a statement, said: “Silver Airways, a major provider of routes between The Bahamas and Florida, is expanding its service with the introduction of two new non-stop flights. On Saturday, 20 May, 2023, the airline launched a direct service from Orlando, Florida, to both North Eleuthera International Airport and Leonard Thompson International Airport in Abaco.

“Tourism officials, John Pinder, parliamentary secretary, and Dr Kenneth Romer, deputy director-general and director of aviation, were present at Abaco’s major airport to welcome Silver Airways guests.

“The Orlando to Marsh Harbour flight, with connecting service to North Eleuthera, will be available once a week exclusively on Saturdays. This new addition complements Silver Airways’ existing flights from Fort Lauderdale and Tampa to the Abacos. Notably, after a break in service due to the pandemic, on 7 January. 2023, the airline resumed its nonstop service from Tampa to the Abacos, signalling its

commitment to The Bahamas,” the ministry added.

Mr Pinder said: ‘Silver Airways has recognised the increasing demand for travel to Abaco, and has subsequently added a new Orlando-Abaco route to their schedule. This route will present a significant opportunity for both leisure and business travellers.

“Orlando is an important hub with over 50m passengers a year from over 100 destinations. The Abaco market is back, and our partners acknowledge the opportunities to expand their businesses. I welcome a continued, prosperous partnership.”

The Ministry of Tourism said Silver Airways is offering a special one-way

fare, starting as low as $89, for travellers who book their flights by May 31 for travel to either destination between May 20 and August 12, 2023.

Dr Romer said: “The Bahamas continues to improve its overall market positioning as the regional leader in foreign air and sea arrivals. One of our key organisational priorities is to significantly increase

year-over-year stopover airlift beyond the 2019 historic pre-pandemic levels throughout all the islands of The Bahamas.

“This inaugural Silver Airways Orlando to Abaco service is even more significant, as it demonstrates our resolve to supporting this island after the dual devastations of Hurricane Dorian and the COVID-19 pandemic.

“Abaco’s airlift recovery has now remarkably surpassed 70 percent of pre-pandemic levels, and through our commitment to increasing airlift while simultaneously improving the state of airport infrastructure, we expect to further position Abaco on its aggressive pathway to full recovery.”

THE TRIBUNE Tuesday, May 23, 2023, PAGE 3

NASSAU CRUISE PORT

WESLEY FERGUSON

PI Wendy’s: Bank restriction expired almost 50 years ago

The November 9, 1970, conveyance’s restrictions stipulate: “No trade manufacture or business other than the development of a bank branch and professional offices relating to the business of banking shall be carried out on the said hereditaments for a period of five years from the date hereof.”

That, based on the documents seen by this newspaper, appears to be the only ‘hard’ or immovable restriction that would have caused the Wendy’s and Marco’s significant problems - and it does not now exist. Other restrictions set out in the 1970 conveyance relate to the height of the building; a prohibition on digging a well; how much of the site is to be covered by buildings; the setback from the boundary lines; and dedication of 15 percent of the location to landscaping.

These restrictions were updated in a subsequent 1984 document. Besides the well prohibition, these also retained the requirement for the owner to obtain the vendor’s permission to erect a “billboard hoarding or other advertising device”, while they are also forbidden from doing anything which “may be or will become an annoyance or nuisance to the owners and occupiers or any adjoining or neighbouring lot”.

The 1984 document was signed by the late George Myers in his capacity as

president of Paradise Island Ltd. Tribune Business was told that the successor to that corporate entity is one of Atlantis’ numerous subsidiaries, and thus the mega resort would have possessed both the restrictive covenants and related conveyances - and been aware of the restrictions - when Scotiabank placed its former branch on the market for sale.

While the “annoyance or nuisance” restrictive covenant is subjective, it was cited by Atlantis and its subsidiaries in arguments to the Subdivision and Development Appeal Board as to why the original Town Planning Committee “change of use” approval should be overturned.

“The property on which [Aetos Holdings and its affiliates] wishes to install a Marco’s Pizza and Wendy’s restaurant contains a restrictive covenant against doing anything which may be, or become, an annoyance or nuisance to the owners or occupiers of any adjoining or neighbouring lot,” Atlantis argued.

“A change of use which results in increased vehicular and pedestrian traffic congestion, increased noise, unpleasant odours and visible waste would be a clear annoyance or nuisance not only to neighbours on the adjoining lot but also to the entire Paradise Island community.”

The mega resort also highlighted the restrictions

pertaining to maximum building size, the minimum setbacks and parcels of land to be reserved for walkways and landscaping, arguing that Aetos Holdings had failed to submit detailed plans and architectural renderings as to how these elements would be preserved and complied with.

Aetos Holdings, though, is understood to be arguing that the concerns about increased traffic volumes, congestion and parking shortages are overblown. With few persons likely to drive over Paradise Island bridge from mainland New Providence to visit Wendy’s or Marco’s Pizza, its target customer base for those outlets will be the thousands of hotel and other workers, plus tourists, located within walking distance.

The former Scotiabank branch occupies a key strategic location at the junction of Harbour Drive and Paradise Beach Drive. Tribune Business was told that copies of the site’s restrictive covenants were provided to all interested purchasers, who were all advised to do their research and consult their respective attorneys to ensure the planned use complied before making an offer.

This newspaper was also informed that Atlantis and some of the others seeking to now bar Aetos Holdings have little cause for complaint. Atlantis, which was said to have been approached first by Scotiabank as a potential

purchaser, did not act despite possessing - and knowing of - the restrictions on that location.

Well-placed contacts, speaking on condition of anonymity, also disclosed that Sterling Global, the Hurricane Hole developer and another objector, actually did make an offer to acquire the former bank branch but it did not come close to meeting Scotiabank’s valuation.

“Each of those people now complaining about it had an opportunity to purchase that property, and revise the restrictions, but now they’re telling Wendy’s and Marco’s that they cannot do ‘x’, ‘y’ and ‘z’,” one source said. “To me, it reeks of bully in the playground. You can’t come in after the fact and bully your way through it. To me, if you’re going to block it, you should have bought it, changed the restrictive covenants and put it back on the market. There was a lot of interest in it.”

Atlantis has denied that its stance is motivated by concerns about the competition that Wendy’s and Marco’s Pizza may pose, but several persons have pointed to the recent arrival of Shake Shack, the burger eatery, among the resort’s restaurant options.

“It’s OK for Atlantis to open up this restaurant, and have no objections from people around them, but not Wendy’s,” one asked. “It’s OK for Dunkin’ Donuts to open up a restaurant across

the street from Atlantis and get permission to expand to double the size?”

Atlantis, in its appeal submissions, argued that allowing Aetos Holdings to go ahead will will create “a potential obstacle for planned luxury resort and residential development” on Paradise Island. It added that such projects are planned by itself, Four Seasons (the Ocean Club) and Sterling Global, Hurricane Hole’s developer.

However, in supplemental arguments, it sought to attack the Town Planning Committee’s decision on procedural matters by arguing that it was “unlawful” on the basis that no public consultation had been held. Arguing that their had been non-compliance with “the record of appeal”, as several documents required by law had not been provided, Atlantis said “change of use” applications are not mentioned in the Planning and Subdivisions Act 2010.

Regardless, the mega resort argued that “in any event, no matter what type of application for development is made”, a public hearing was mandatory before the Town Planning Committee reached its decision.”It is now apparent that no public hearings were held,” Atlantis said. “The meeting held by the Town Planning Committee on March 15, 2022, was not a public hearing.

“Whilst it is appreciated that [the Atlantis subsidiaries] were notified of and

CRAIG FLOWERS AND FML FACE WINDING-UP PETITION

FROM PAGE B1

but the Court of Appeal rejected the bulk of a claim by Mr Jones that totalled more than $1m for breach of contract and constructive dismissal.

Appeal justice Stella

Crane-Scott, writing the majority verdict, noted that Mr Jones brought eight of the former Fantasy web shop locations with him when he joined FML Group of Companies as its chief operating officer in 2015. He was to initially be paid an annual $180,000 salary, or $15,000 per month, “plus 20 percent of net revenue generated over a pre-determined amount of $1.5m per month”.

This contract, which was to last for two years, was modified in December 2015 to double Mr Jones’ salary to $360,000 per year, or $30,000 per month, together with the same 20 percent share of net generated revenue growth (NGR) above $1.8m. Further contract revisions followed, until FML entered a November 1, 2017, management agreement with an entity called Blue Star Holdings that would see the latter operate/manage its 19 “Express” web shops.

Blue Star’s principals included Mr Jones, plus two other employees, Cindy Williams and Jamaal Stubbs.

“In early February 2018, FML became aware of what

appeared to be suspicious customer activity at certain store locations managed under the appellant’s [Mr Jones] portfolio,” the Court of Appeal noted.

The scheme purportedly involved deposits made in the morning being withdrawn that very same evening in a bid to unduly inflate compensation. The performance-based compensation agreement struck with Mr Flowers and FML meant that the higher the daily amount/volume of customer deposits at those “express stores”, the greater Mr Jones’ share of daily profits.

“The activity involved what FML claimed was unusually high deposit/ withdrawal activity with no clear gaming purpose. FML’s internal investigations continued and, by mid-February 2018, the matter was escalated to the level of the Board of Directors. On February 16, 2018, Craig Flowers met the appellant and his team and informed of them the situation,” the Court of Appeal verdict said.

“The appellant refuted any knowledge or suspicion of inappropriate activity. Cindy Williams left the meeting and Jamaal Stubbs made no comment. On or about February 19, 2018, the appellant advised the Board of Directors that

N O T I C E

IN THE ESTATE OF ROBERT RICHARD

RUSSELL late of Windsor Estates Subdivision, in the Eastern District of the Island of New Providence one of the Islands of the Commonwealth of the Bahamas, deceased.

NOTICE is hereby given that all persons having any claim or demand against the above Estate are required to send the same duly certified in writing to the Undersigned on or before 20 June 2023, after which date the Executrixes will proceed to distribute the assets having regard only to the claims of which they shall then have had notice.

AND NOTICE is hereby also given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

BAYCOURT CHAMBERS

Attorneys for the Executrixes Chambers P.O. Box SS-6836

Jamaal Stubbs had admitted to orchestration of a scheme to manipulate the accounting system in order to boost performance numbers for his team. The following day, the appellant informed the Board of Directors of Jamaal Stubbs’ resignation.”

However, some three to four days later, Mr Jones’ socalled ‘performance-based incentive agreement’ was terminated on the grounds of “gross negligence”. Mr Flowers’ son, Jason, in a February 23, 2018, letter told Mr Jones: “It has come to my attention that there has been a falsification of the accounting system operating under the 1Click Platform, which handles the day-today operation.

“Further that, based on this falsification, percentages have been manipulated to benefit FLM Express. Furthermore, your company has admitted to and acknowledged that this has occurred.” A further meeting was held between FML and Mr Jones, but the former received legal advice on February 27, 2018, that he had “not returned to work and had abandoned his job, and that due to the infractions he should be summarily dismissed of he returned to work”.

This triggered the legal dispute between the two sides. Mr Jones alleged that he was unable to perform his job from February 23, 2018, because he was “locked out” of the web shop’s computer system while FML had also “started an unsubstantiated rumour” that he “was engaged in fraudulent activity”.

He claimed damages that included $720,000, or two years’ salary; some $120,000 in unpaid wages between September 2017 and February 2018; and other sums that included accrued vacation and three months’ termination notice. The total amounted to more than $1m.

FML, though, countered with a defence that asserted Mr Jones’ computer access was only restricted “in order to facilitate an investigation of irregularities involving the operation of the ‘express stores’”. The probe “disclosed unauthorised behaviour and internal fraud taking place..... that would benefit [Mr Jones] under the new compensation arrangement”.

The web shop chain added that apart from the restricted computer access, Mr Jones was never barred from coming to the office, but instead he “never returned to his workplace after the investigation started” and therefore “abandoned his job” without notice to FML.

The scheme to inflate deposits was reported to the Gaming Board, with FML alleging that - at the time - it had already incurred $50,000 in legal and accounting costs for doing so and these were continuing to mount. These claims, though, were vehemently denied by Mr Jones who alleged that Fantasy’s eight outlets increased FML’s footprint by onethird, taking it from 16 to 24 stores.

He also claimed that the same-day deposit and withdrawal of monies at FML’s express stores “was a feature

allowed to attend the meeting, that notification and attendance were not sufficient” to qualify as a public hearing. No notice of such a hearing, and/or informing the public it was being held, were included in the record of appeal.

“As a result, it is now submitted that the absence of any public notice, and therefore of any public hearing, is a further reason why the Appeal Board ought to overturn the decision of the Town Planning Committee,” Atlantis said. “Providing an opportunity for public input is a mandatory step that the Town Planning Committee must take before making a decision in any application for development. “The importance of holding a public hearing cannot be underestimated. The public ought to have an opportunity to be notified and consulted regarding any development within their community. This was not done in the instant case... Accordingly it is submitted that the Town Planning Committee’s decision in the instant case to grant preliminary support of application was unlawful.”

Atlantis added that the failure to include any plans, reports or other documents from Aetos Holdings in the appeal record “is another indicator” that the information provided by the latter was “woefully inadequate” and that Town Planning should not have given its approval.

‘changed orally’ as FML had claimed in its defence,” Appeal justice Crane-Scott found.

I had asked several times to be addressed, as based on the compliance rules under the Gaming Board this is not permitted”. Then-justice Keith Thompson, in the initial Supreme Court verdict, found for Mr Flowers and FML and ruled that Mr Jones was never terminated but simply did not return to work.

However, the Court of Appeal was critical of former justice Thompson, finding that he “failed to take proper advantage of having heard and seen the witnesses and, quite simply, failed to show a correct understanding of the issues he had to decide against the background of the pleadings and the material available, the evidence led and the inherent probabilities”. Appeal justice Milton Evans said he had failed to “properly analyse the evidence”.

He and Justice CraneScott ruled that Mr Jones had established “a prima facie case” for breach of contract dating from May 15, 2017, where FML had agreed to pay him a $30,000 monthly salary and 4 percent share of net generated revenue “on new products only”.

They found that the burden of proof had thus shifted to FML to prove this salary and terms had been altered orally. “While Craig Flowers’ testimony was that FML had agreed to compensate the appellant ‘based on’ the Blue Star agreement, his evidence fell far short of providing any details as to precisely how (and when) the relevant compensation Agreement had been

“Most importantly, Craig Flowers gave no evidence whatsoever as to what was the new ‘varied’ salary or compensation which FML and the appellant had (as it claimed) verbally agreed that the appellant was to pay himself out of the income from the Express Stores after 1 November 2017.

“What is even more astounding is that apart from merely stating that the appellant had in fact been compensated from November 2017 based on the Blue Star compensation agreement, and that the appellant could in effect ‘keep as compensation the lion’s share of the profits generated after paying the expenses of those stores’, FML produced no evidence or accounting whatsoever to support these crucial assertions of fact.”

As a result, she found Mr Jones’ employment contract had been breached and he was entitled to receive four months’ unpaid salary at $30,000 per month or $120,000 in total. Appeal court president, Sir Michael Barnett, dissented from the majority by finding that the ex-FML chief operating officer’s compensation terms were varied by the Blue Star agreement.

However, he found that Mr Jones was constructively dismissed because he was locked out of FML’s computer system, and would also have allowed the claim for wrongful dismissal or breach of employment agreement for the same reason.

PAGE 4, Tuesday, May 23, 2023 THE TRIBUNE

FROM PAGE B1

Cumberland House 15 Cumberland & Duke Streets New Providence, The Bahamas.

‘Anyone who wants diesel able to buy it’

Revealing that he had “been getting e-mails all day”, and seen Internet and digital postings voicing fears that gas stations will close and are going on strike - claims that could not be verified or corroborated up to press time last night -

Sir Franklyn acknowledged that talks between the industry and the Government have dragged on for months without resolution.

“All I can say is I have no doubt that wholesalers and retailers are disappointed things have not been resolved faster, but what action they are taking I don’t know,” he added. “I heard stations were going to close tomorrow [today] and be on strike, but I don’t know if that’s true or not.”

Raymond Jones, the Bahamas Petroleum Retailers Association’s president, could not be reached for comment before press time last night. However, he confirmed earlier to The Tribune that a large number of gas stations had stopped selling diesel as they literally “run out of fuel” over ongoing negotiations with the Government to obtain a per gallon margin that would enable them to cover their costs and earn a profit.

“I am told that petroleum retailers were not selling diesel today,” Mr Jones said. “This is a result of the high cost of diesel and a margin that barely gives them any profit. The cost to operate fuel stations in the current environment has escalated to the point where most retailers are barely breaking even.

“Retailers operate against a fixed margin that is not flexible against rising operating costs other than the Government making a change with the fuel margin. We have requested consideration to amend the fuel margin for more than a year but have now ‘ran out of fuel’ on this’..... I have gotten reports that the majority of fuel stations were not selling diesel today.”

Mr Jones said petroleum dealers may now look to cut operating hours as they seek to reduce costs to a point where they can break even or earn a profit - actions that would impact both the motoring public and business community, as well as the incomes and work hours of gas station employees.

Petroleum literally fuels the Bahamian economy, and any decision to stop selling a particular type of

fuel will have negative consequences for businesses - especially those in the transportation field or those that, in yesterday’s case, operate diesel vehicle fleets.

Reports on yesterday’s impact were mixed, with Wesley Ferguson, the Bahamas Taxi Cab Union’s president, saying he was unaware of the situation. However, some jitney drivers were said to have been unable to fill up with diesel as normal, which limited their operations.

Vasco Bastian, the Bahamas Petroleum Retailers Association’s vice-president, who was not at work and unaware of yesterday’s unfolding events, told Tribune Business at the weekend that gas station operators are “hanging by a thread” and were hoping that the Government will announce a margin increase in the upcoming 2022-2023 Budget due to be presented in the House of Assembly next Wednesday.

“We are hanging by a thread. We are hanging by a thread,” he said. “We met with the Government a month ago and haven’t heard from them subsequently. They gave us some suggestions. We looked at it, we tweaked it and are

just waiting for them to get back to us.

“Hopefully it comes before July 1. Whatever adjustments need to be done, hopefully it comes before July 1. We’re just hoping and praying for the best. The Budget has to be presented, and hopefully we’re somewhere in there. Hopefully there’s some type of relief in there for us. We pray and persevere through. Whatever they come out with at this point, we’re willing to sit down and consider. Desperate times, desperate times. This is the worst I have ever seen it.”

The Government, though, has reiterated several times that it will not approve anything that will immediately increase gasoline and diesel prices at the pump - such as a margin increase for both retailersbecause it does not want to further burden Bahamian families and businesses given the ongoing cost of living crisis. Hence the sticking point with retailers’ calls for a margin increase.

Data from the Bahamas National Statistical Institute, published yesterday, showed diesel prices were up 12 percent, and gasoline declined 8 percent, for the 12 months to end-March

2023 compared to the same period that ended in March 2022. However, compared to February 2023, gasoline prices decreased by 9 percent while diesel prices declined 2 percent for March.

Wholesale margins are 33 cents and 18 cents per gallon of gas and diesel, respectively, and for retailers, the equivalent is 54 cents and 34 cents for gas and diesel, respectively.

The last margin increase enjoyed by gas station operators occurred in 2011, some 12 years ago, under the last Ingraham administration, and operating costs and inflationary pressures have increased substantially then. That took gasoline margins from 44 cents per gallon to 54 cents, where it has remained ever since, while diesel stands at 34 cents per gallon.

Gas station operators have been seeking a margin increase equal to 7 percent of the landed cost of fuel as their equivalent of a livable wage, viewing this as critical to their survival given that existing price-controlled fixed margins simply cannot be adjusted to cover a multitude of ever-increasing costs.

Listing the ever-rising costs that fixed gasoline and

Corporate tax ‘driven’ by revenue demands

FROM PAGE B1

treatments for other firms.

These range from corporate income tax rates of between 10 percent and 12 percent, plus an option for small businesses earning under $500,000 to still pay Business Licence fees.

Describing the Government’s argument for the introduction of corporate income tax as “very impressive”, Mr Edwards said the move was largely being pushed by the need to increase tax revenues as the Davis administration seeks to hit a 25 percent revenueto-GDP target by 2025-2026, and a Budget surplus a year earlier. Revenues, according to the latest Fiscal Strategy Report, are projected to grow by $1.3bn-$1.4bn over a four-year period.

“We must appreciate that this is largely a domestic matter driven by the need to increase the revenue space of the country. The contemplation of a wider implementation of corporate income tax (CIT) is strategically leveraging the need to comply with the OECD,” Mr Edwards told this newspaper.

“Without doubt this presents a significant window of opportunity to inject greater equity and fairness in the taxation regime while seeking to achieve revenue

HUBERT EDWARDS

goals. Looked at differently, if the Government was to ultimately fail in implementing a corporate income tax beyond its proposed first option, it will still be forced to eventually raise taxes under the existing regressive regime. “The ‘green paper effectively identifies and underlines revenue needs, which have been discussed and projected over the last year, and crystallised in the 2022 Fiscal Strategy Report. On the domestic side of the equation it is imperative to raise additional revenue.”

Mr Edwards acknowledged that corporate income tax’s potential arrival goes against The Bahamas’ longstanding business model as a ‘no’ or ‘low tax’ jurisdiction, and conceded that it “will represent a wrinkle

in the fabric of its existing value proposition”.

However, he added:

“Such a conclusion requires balance. To reiterate, a very clear case has been made [that] there is a need for new or additional taxes. Corporate income tax is, however, not sales tax and fees and will present certain complexities, administratively and regulatory, which calls for very careful implementation so as not to damage the country’s attractiveness.

“There must be careful thought given to legislation and tax regulation. At the heart of any taxation system there must be equity and efficiency. Regulatory burden should be avoided, but government through their advisors would have already been fully aware that corporate income tax in the hands of experienced tax planners can be vicious, and the certainty created by the current system can’t be guaranteed.

“The need for a robust approach to enforcement must be anticipated, and the requisite steps taken to ensure a comprehensive but balanced system is in place to facilitate this,” Mr Edwards added. “One of the main challenges faced by government is the need for its policy choice to be revenue positive....

“The likely impact is that this will cause a major cultural shift for the domestic sector and taxation going forward will look markedly different. The country, too, could be seen much differently as a strategic location. It is, however, too early to draw a hard conclusion in that regard. It is likely that over the course of the consultation period a greater sense of what the potential impact might be will emerge.”

Arguing that corporate income tax must be seen as part of wider tax reform, Mr Edwards said: “In all likelihood this implementation would be a gateway change for a later adoption of a more progressive taxation system to include income tax at some level. Government should therefore appreciate the vagaries of income tax regimes, and make changes to government and governance which will facilitate its effectiveness and efficiency.

“The ‘green paper’ encapsulates the intent to take more from the economy and, consequently, the

country must be shown and assured how the takings will be more effectively managed vis-à-vis historical performance and track record. There are lingering reforms which must necessarily precede or be implemented alongside any corporate income tax.

“Fiscal responsibility must take on a more

diesel margins must absorb, the Association’s Mr Jones previously pointed to the 2-3 percent “commission” or fees charged on every debit and credit card payment. On a $6 gallon of gasoline, the 3 percent charge amounts to 18 cents or one-third of the 54 cent margin, although this might be slightly less depending on the issuing bank. With The Bahamas still largely a cash-based economy, he added that some gas station operators are being charged between $4,000 to $10,000 a month to deposit cash. With banks unwilling to accept such deposits over the counter, the industry is now incurring fees for doing this via the night deposit box. And, with many of the petroleum industry’s 1,000plus employees earning the minimum wage, Mr Jones said their has increased by 24 percent or $50 per week due to the increase. While not opposed to the rise, he added that this has increased payroll costs for gas stations while also raising associated National Insurance Board (NIB) contributions. Insurance costs have also risen by 15 percent.

heightened sense of awareness. The Government must review and rethink its current approach to concessions with a view of synchronising disparate negotiated allowances under the corporate income tax system. As part of the way forward, taxation must be seen and used as a more potent fiscal tool designed to drive development across the archipelago.”

THE TRIBUNE Tuesday, May 23, 2023, PAGE 5

FROM PAGE B1

Stocks are mixed as Wall Street waits to hear on Washington

By STAN CHOE

AP Business Writer

STOCKS drifted to a mixed finish Monday, as Wall Street waited for the results of a pivotal meeting meant to avoid a potentially disastrous default on the U.S. government’s debt.

The S&P 500 was at a virtual standstill after flipping between small gains and losses through the day. It edged up by 0.65, or less than 0.1%, to 4,192.63.

The Dow Jones Industrial Average fell 140.05 points, or 0.4%, to 33,286.58, and the Nasdaq composite rose 62.88, or 0.5%, to 12,720.78.

The stock market is near its highest level since August, but it’s been mostly remaining within a tight range for weeks as several big worries weigh. The biggest near-term risk is the possibility of a U.S. default, something that could occur as soon as June 1.

That’s when Washington could run out of cash to pay its bills, unless Congress allows it to borrow

more. Because Treasurys are seen as the safest investment on Earth, economists and investors say a default would likely trigger a recession for the economy and deep pain for financial markets.

President Joe Biden and House Speaker Kevin McCarthy were set to meet after U.S. stock markets closed to discuss the debt limit. Talks so far have been start-and-stop, with stocks rallying in the middle of last week on hopes that a deal may be progressing, only to falter Friday when negotiations hit a roadblock.

Another worry that’s hung over the market is the strength of the U.S. banking system, which has begun to crack under the weight of much higher interest rates. Three high-profile U.S. failures have shaken confidence since March, and investors have been looking for the next possible weak link.

Much scrutiny has been on PacWest Bancorp. Its stock jumped 19.5% after

it agreed to sell a portfolio of real-estate construction loans with about $2.6 billion in principal still outstanding to Kennedy Wilson.

PacWest is one of the smaller and mid-sized regional banks that Wall Street highlighted in its hunt for the next possible bank to suffer a drop in confidence. Other banks collapsed after depositors pulled their cash all at once to create debilitating runs. PacWest’s stock is still down 70.2% for the year so far.

Elsewhere on Wall Street, Micron Technology dropped 2.8% as tensions heighten between China and the United States.

China’s government said on Sunday Micron’s products have unspecified “serious network security risks” that could affect national security. It told users of sensitive computer equipment to stop buying Micron products.

Meta Platforms rose 1.1% after shaking off news that European regulators hit it with a record $1.3

billion privacy fine. Meta called the decision flawed and unjustified. It said it would appeal. Meta has been on a tear this year, more than doubling in 2023 already. Other Big Tech companies have also had powerful leaps, much stronger than the rest of the market.

But that split in performance is worrying some market watchers. It’s left the index extremely top heavy, meaning its performance is more dependent on a couple handfuls of stocks than it’s been in decades.

Much of the excitement has been around artificial intelligence, but that hasn’t been enough to turn around some of Wall Street’s more pessimistic voices.

“While we believe AI is for real and will likely lead to some great efficiencies that help to fight inflation, it’s unlikely to prevent the deep earnings recession we forecast for this year,” Michael Wilson and other

China's Sinopec signs agreement to enter retail fuel market in crisis-hit Sri Lanka

By BHARATHA MALLAWARACHI

Associated Press

CHINESE petroleum giant Sinopec signed an agreement with Sri Lanka

on Monday to enter the South Asian island country's retail fuel market as it struggles to resolve a worsening energy crisis amid an unprecedented economic upheaval.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, KELSON PIERRE of Freeport, Grand Bahama, intend to change my name to ZADOK MUSGROVE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

The contract agreement would enable Sinopec to import, store, distribute and sell petroleum products in Sri Lanka, which has had a fuel shortage for more than a year.

The move comes as Beijing looks to consolidate investments in Sri Lanka's ports and energy sector amid growing security concerns raised by the island nation's immediate neighbor, India,

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, QUINTIN HOLLIS FORBES of P.O Box SS-5230 Fox Hill Road, Nassau, Bahamas, intend to change my name to QUINTIN HOLLIS JOHNSON If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

strategists at Morgan Stanley wrote in a report.

S&P 500 companies are in the midst of reporting a second straight quarter of profit drops from yearago levels. The question is how much worse they will get because the economy is slowing under the weight of much higher interest rates meant to get inflation under control.

On the more optimistic side is Savita Subramanian, equity strategist at Bank of America. She raised her target for where the S&P 500 will end the year to 4,300 from 4,000. That’s not far from its current level, but she also said in a BofA Global Research report that stocks outside the behemoths at the top will likely be behind most of the gains.

She pointed to improved efficiencies at companies, which should help earnings become more stable, while acknowledging all the risks that could keep keep stocks in a long-term down

which considers Sri Lanka to be its strategic backyard.

Sri Lanka, which is facing a foreign exchange crisis, hopes the deal will help to resolve its energy crisis.

The agreement signed Monday in the Sri Lankan capital, Colombo, was made to "ensure uninterrupted fuel suppliers to consumers," the president's office said in a news release.

Under the pact, Sinopec will be granted a 20-year license to operate 150 fuel stations currently operated by Sri Lanka's state-run Ceylon Petroleum Corporation, and to invest in 50 new fuel stations and in the country's energy sector, the nation's Power and Energy Ministry said in a statement.

Sinopec can start operations within 45 days of license issuance and "this development brings hope for a more stable and reliable fuel supply, boosting the country's energy sector and providing assurance to consumers," the president's office said.

When the economic crisis hit Sri Lanka last year, the

market, or what’s called a “bear market”.

“For the bear case, talk to the person next to you,” she said, who can bring up everything from worries about the Federal Reserve making a mistake on interest-rate policy to the debt ceiling.

In the bond market, the 10-year Treasury yield rose to 3.71% from 3.68% late Friday. It helps set rates for mortgages and other important loans. The two-year yield, which moves more on expectations for the Fed, rose to 4.32% from 4.28%.

Hopes are high that the Fed will start taking it easier on interest rates by leaving them steady at its next meeting in June. That would be the first time it hasn’t hiked rates at a meeting in more than a year.

In stock markets abroad, Japan’s Nikkei 225 rose 0.9% to continue a big run over the last couple weeks. The Hang Seng in Hong Kong rose 1.2%, while stock indexes were mixed across Europe.

government couldn't find foreign currency to import fuel, triggering a severe shortage that lasted for more than two months and forcing people to endure long lines at fuel stations. Sri Lankans are still allotted limited amounts of fuel that is distributed according to a QR code system.

In an effort to resolve the crisis, Sri Lanka opened its retail fuel market to foreign petroleum companies, asking them to use their own funds to purchase fuel, without depending on Sri Lankan banks for foreign exchange. The government has given approval to two other foreign companies — Australia's United Petroleum and U.S. company RM Parks in collaboration with Shell — to enter its fuel market.

An Indian oil company already operates in Sri Lanka. But, India is concerned over the growing influence of China in Sri Lanka, which sits along one of the world's busiest shipping routes.

NOTICE

NOTICE is hereby given that LEONARD ALBERT KRAVITZ , 10960 Wilshire Blvd. 5th Floor, Los Angeles, CA 90024, USA applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that ABDUL RAUF ABDUL RAZAK of Prince Charles Drive, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 23rd day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that SAINTILMA SAINTIL , Hope Town, Abaco, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

PAGE 6, Tuesday, May 23, 2023 THE TRIBUNE

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net