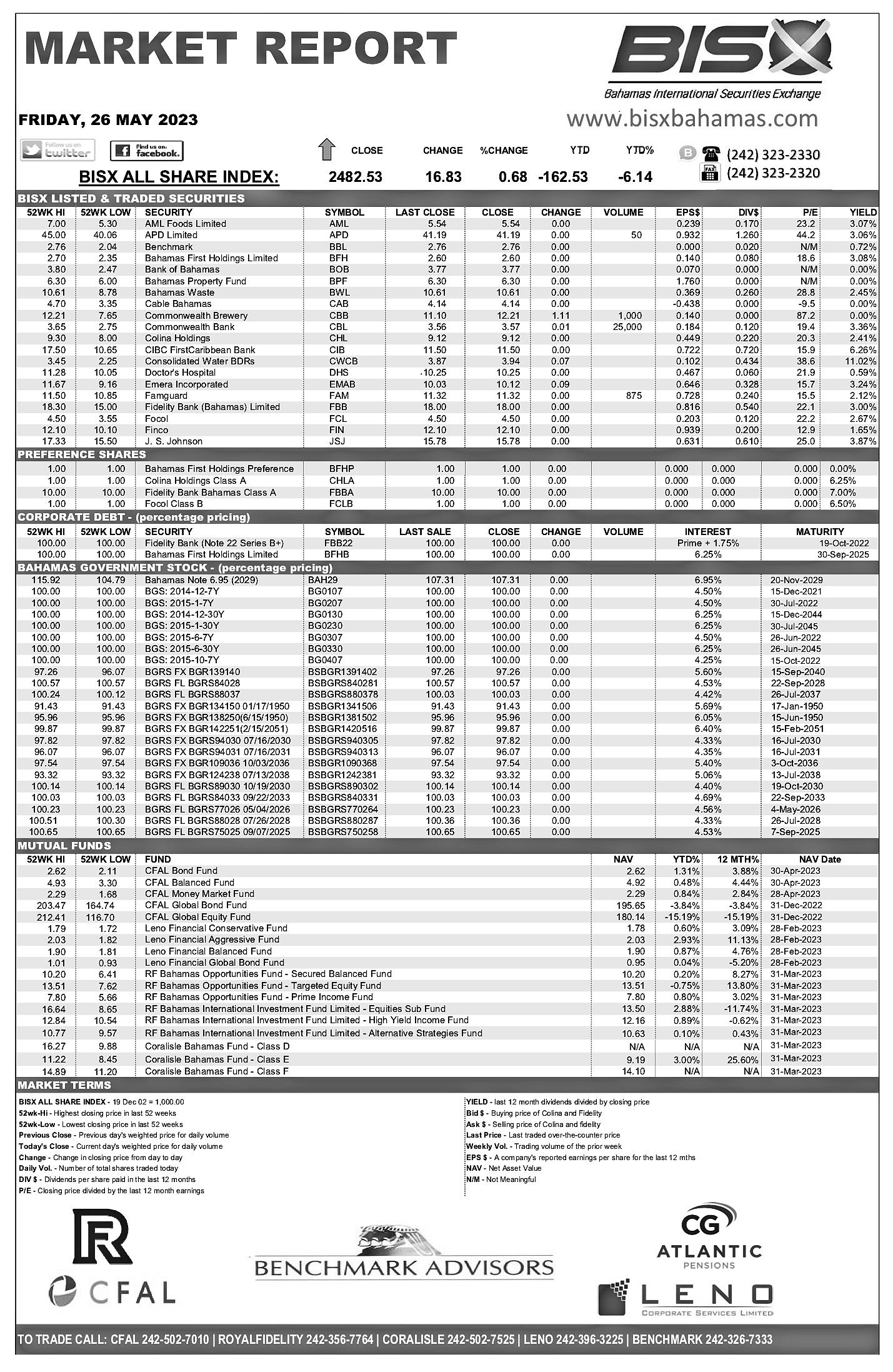

$5.74 $5.74 $5.74 $5.95

Cruise port’s chair eyes ‘missing 10%’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE chair of Nassau Cruise Port’s ultimate parent says he is “90 percent-plus satisfied” with its $322.5m transformation as he waits to see it drive increased visitor spend and more passengers exiting their vessels.

Mehmet Kutman, Global Ports Holding’s chairman, told Tribune Business these promised impacts represent the “missing 10 percent” as he hailed the group’s Nassau investment for establishing it as a major cruise port operator in the Western Hemisphere.

Describing the Bahamian capital as “a true number one”, and the company’s “biggest by far investment wise” to-date, he added that a key objective was to “integrate Bahamians with

• Global Ports chief awaiting visitor spend impac

• ‘90-plus % satisfied’ with $322.5m transformation

• Downtown revival critical as ‘all will die otherwise’

‘Huge lift’: Land free-up for Bay Street’s revival

• Ex-minister: Cut corridor from East St to Dowdeswell

Gas stations: We won’t be ‘paupers’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netPETROLEUM retailers say they refuse to become “paupers” as they intensify demands for a 30 cent per gallon margin increase which they have been seeking to obtain from the Government since April 2022.

The Bahamas Petroleum Retailers Association (BPRA), in a statement issued on behalf of its members, said it has been negotiating an adjustment in the gasoline and diesel margins with the Davis administration for the past 13 months despite the Government’s public stance that it will not agree to such an increase because it would also raise the cost of fuel for motorists and businesses.

However, in contrast to that position, which was reaffirmed by Michael Halkitis, minister of economic affairs, last week, the Association asserted it first agreed to wait for global oil - and, by extension, fuel - prices to drop from their Ukraine invasion peak before any margin changes were implemented.

It then said it was “advised” in November 2022 that the Government had agreed to alter the fixed margin regime to a percentage based on the landed cost of fuel

SEE PAGE B7

Sir Franklyn’s developer in $7.5m battle with MIT chair

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netSIR Franklyn Wilson’s Eleuthera Properties is locked in a legal battle with Massachusetts Institute of Technology’s (MIT) chairman emeritus over the latter’s bid to exit his $7.5m investment in the Bahamian developer.

Justice Deborah Fraser, in a May 26, 2023, ruling granted Robert B Millard’s demand that Eleuthera Properties make “further and better disclosure” of all conveyances, sales agreements and appraisals involving real estate in the Jack’s Bay development dating between 2007 and 2018.

Jack’s Bay recently celebrated the ground-breaking for its $20m, 18-hole golf course by Nicklaus Design to complement the existing nine-hole variety designed by Tiger Woods’ firm, and the valuation of the south Eleuthera development’s lots lies at the heart of the dispute between Mr Millard and Eleuthera Properties.

the port and the cruise passenger” in such a way that the economic impact is felt at the grassroots “Mom and pop” store level.

Expressing hope that Nassau will break the 5m cruise passenger visitor mark in 2024, Mr Kutman said he was also confident in Prime Minister Philip Davis’ pledge to revive Bay Street and wider downtown as neither the city nor the cruise port can succeed without the other flourishing.

“This is 90 percent-plus of my expectation,” the Global Ports chief said during Friday’s official Nassau Cruise Port opening. “However, I keep dreaming, keep envisioning what we can do now. This [Junkanoo] museum is 100 percent; it’s even

SEE PAGE B6

• Nassau must ‘figure out how to create buzz and life’

• Admits ‘fingers crossed’ on wider cruise port impact

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netA FORMER tourism minister yesterday admitted that reviving downtown Nassau is “a huge lift” that would require “cutting” a corridor from East Street through to Dowdeswell Street to free-up land for redevelopment.

Dionisio D’Aguilar, who held the post under the Minnis administration, told Tribune Business that such an undertaking would be fraught with difficulties including land title “complications” and the competing interests of existing property owners and businesses.

However, he argued that Bay Street had to be “pushed south” because there was simply insufficient land between the road and the ocean to develop high-rise residences, retail and other

attractions and amenities that would transform downtown Nassau into a true destination capable of attracting locals and tourists alike well into the evening.

Acknowledging that the city is effectively deserted after 5pm, Mr D’Aguilar added that The Bahamas “has to figure out how to create this buzz and life downtown”. While successive administrations have

Sir Franklyn, chairman of Eleuthera Properties and Jack’s Bay, told Tribune Business he was aware of Justice Fraser’s ruling when contacted yesterday. “We remain confident in our position,” he said. “This is a legal process and we respect the process. We remain confident in our position. I’m aware of the judgment. I’m taking the advice of counsel and we’re going to act on it.”

Confirming that Mr Millard is indeed the MIT Corporation’s chairman, Sir Franklyn added: “This isn’t the first time we’ve had to defend ourselves against him. He’s a wealthy man, but he’s a man, and we’ve had to defend ourselves against him previously.”

Mr Millard’s biography confirms his background as a prominent US citizen. Besides the MIT Corporation involvement, he is also named as a director of Evercore, an international investment bank,

SEE PAGE B4

Union challenges and opportunities

There are several umbrella trade union groups operating in The Bahamas today whose individual union members represent workers across a range of industries. The majority of unions fall under umbrella organisations such as the Bahamas National Alliance Trade Union Congress (BNATUC), National Congress of Trade Unions of The Bahamas (NCTUB) and Commonwealth of The Bahamas Trade Union Congress (BTUC).

While the trade union movement in The Bahamas has faced its share of challenges over the years, it remains an important force for workers’ rights and social justice in the country. According to the Department of Labour, there are currently 29 registered trade unions in the country representing more than 23,000 workers. Given the importance of unions in The Bahamas, this segment will focus on the need to reform policies for generating a sustainable workforce.

A long history Trade unions in The Bahamas have a storied history dating back to the early 20th century. The first union to be established in the country was the Bahamas Public Service Union (BPSU), which was founded in 1948. This union was formed in response to the poor working conditions and low wages faced by civil servants in The Bahamas. The following year, in 1949, the Bahamas Federation of Labour (BFL) was formed. This federation was made up of several smaller unions, including the Bahamas Industrial Union (BIU) and the Hotel and Catering Workers Union.

The BFL became the main umbrella organisation for trade unions in The Bahamas and played an important role in advocating for workers’

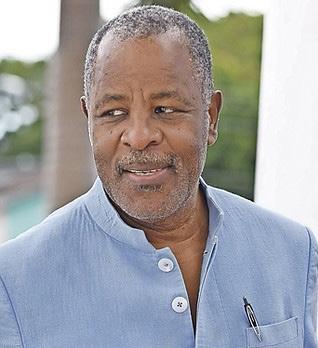

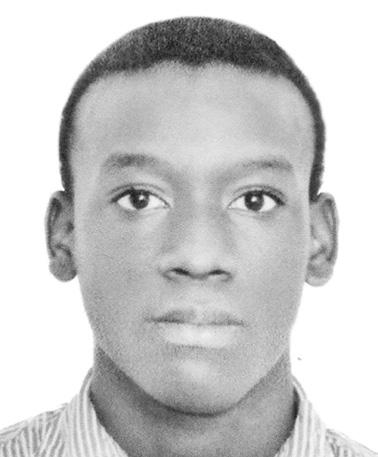

RODERICK A.SIMMS

AN ADVOCATE FOR SUSTAINABLE FAMILY ISLANDS

rights and better working conditions.

In the 1950s and 1960s, the trade union movement in The Bahamas grew rapidly, with several new unions being formed. These included the National Congress of Trade Unions (NCTU) and the Commonwealth Industrial Union.

These unions represented workers in a variety of industries, including tourism and manufacturing, plus the public services. During this period, the trade union movement in The Bahamas was closely linked to the political movements pushing for independence from British rule. The leaders of the trade unions were often also leaders of the independence movement, and the two causes were seen as closely intertwined.

In the 1970s and 1980s, the trade union movement in The Bahamas continued to be a powerful force for change. The BIU played an important role in securing better wages and working conditions for its members. However, the relationship between the Government and the trade unions became increasingly fraught during this period, with several strikes and other industrial actions taking place.

Today, trade unions in The Bahamas face challenges such as declining

membership and limited resources. However, they continue to be an effective force for social and economic justice. They play an important role in promoting workers’ rights and interests, and in advocating for policies that benefit the broader population.

The need to reform

In recent years, trade unions have experienced several challenges that make it difficult for them to effectively represent the interests of workers. According to the International Trade Union Confederation (ITUC) Global Rights Index 2020, it was estimated that union density stood at around 6 percent in The Bahamas.

The union density in The Bahamas is relatively low compared to other Caribbean countries. A low union density generally indicates a weaker labour movement, while a higher density suggests greater worker representation and bargaining power. A low density can make it difficult for unions to negotiate on behalf of workers and to exert political influence.

The Bahamian economy has also faced several challenges in recent years, including the impact of hurricanes, COVID-19 and the closure of several major hotels. These challenges have led to job losses and wage stagnation, making it difficult for unions to negotiate better wages and benefits for workers. While trade unions in The Bahamas have historically had close ties to the Government, there have been tensions between unions and the Government in recent years. This has made it difficult for unions to effectively advocate for workers’ rights and interests. Many trade unions in The Bahamas operate on limited budgets, and have limited staff and

SEE PAGE B5

Engineer says 2023 ‘hottest’ year for construction projects

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.netTHE Bahamas Society of Engineers (BSE) president says 2023 is the “hottest” year for construction-related development that he has seen in a long time as there are “projects all around”.

Quentin Knowles told Tribune Business he is struggling to keep pace with the volume of contracts and bids on offer, saying: “Things are looking good. I see projects all around.

I can look at in two perspectives. I’m a consultant engineer and I also am an electrical contractor, so I get a real good understanding of what’s going on and I have to say things are looking really good now. I can’t complain.”

He warned, however, he reiterated previous industry warnings about the negative fall-out for the construction industry if the majority of petroleum retailers stop selling diesel. Sales of that fuel resumed on Wednesday, following a two-day stoppage as part of gas statin operators’ impasse

with the Government over a margin increase, but a consistent, reliable supply of diesel is vital to the construction industry because so much of its equipment runs on it.

“This is extremely inconvenient, because the other day a member of my service crew was complaining to me that they had to go around Nassau looking for diesel for three hours,” Mr Knowles said. “That is not sustainable. There is no way we can go around scrapping for diesel, but there was an official that said a few days ago that there is diesel is on

the island and you just have to look for it.

Mr Knowles was referring to comments made by Michael Halkitis, minister for economic affairs, who referenced the fact that Shell-branded stations, owned and operated by BISX-listed FOCOL Holdings, were continuing to sell the fuel.

“Mr Halkitis’ comments don’t help us in the least,” Mr Knowles added. “That doesn’t help the industry. When you’re running a business, and to have to rely on those comments is no comfort at all. When I have

guys sitting on the back of a truck looking for diesel, who pays for those guys? I hope they get it sorted out soon. It doesn’t affect me all that much, but for the businesses that rely on diesel, they must be hurting.”

With construction “red hot”, Mr Knowles said:

“You see the guys go to work on those backhoes, and on the backs of those vehicles being transported to and from the site.... those vehicles are diesel for the most part. But I guess the gas retailers decided enough was enough and it was time to stand up for

CRUISE PORT LEASES KELLY’S DOCK FOR GROUND TRANSPORT

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.netNASSAU Cruise Port’s (NCP) chief executive says the new taxi call-up system will have a dedicated sales desk and better organisation for visitors seeking transportation following Friday’s opening. Michael Maura said: “What’s happening is you have this oval-looking taxi facility. It’s basically a sales desk, if you can call it that.

What we did was we had a wrap made for the building and it looks like a taxi so that you don’t have to speak English but you know, you walk through that breezeway, you look to your right and there you see this huge decal of a taxi and so you know that’s where I have to go.

Tourists then tell the operators where they would like to go in New Providence which is much different than what existed prior to Nassau Cruise Port’s completion. Taxi cab operators have historically been disorganised with no designated call-up area, sometimes resulting in aggressive behaviour when they are competing for visitors and fares.

To keep Nassau Cruise Port organised and fluid for traffic, operators have had to employ new methods to keep taxis in a facility where drivers feel comfortable

and tourists find it easy to come to. “A tourist would say that they want to go to Cable Beach, or I want to go to Paradise Island, or I want to go someplace else. That group then directs them to the GTA, which is what we call our Ground Transportation Area, and that’s where the taxis are queuing,” Mr Maura said.

Nassau Cruise Port has leased the old Kelly’s Dock for the GTA, which can handle up to 30 taxis and operate as a holding area similar to what exists at the Lynden Pindling International Airport (LPIA). “So it’s more orderly and efficient,” Mr Maura said.

He added that the $8m concession agreement for downtown’s beautification “will be spent no later than 12 months following the completion of construction”, and once Nassau Cruise Port is fully open ] executives will sit with the Downtown Nassau Partnership to determine how best to invest the remaining $7m. Some $1m has already been spent renovating the Ministry of Tourism building at the north end of Rawson Square for conversion into a tourism police station.

Mr Maura said: “Our forecast for 2023 is around 4.2m passengers, and the confirmed bookings that we have for 2024 are over 4.5m visitors arriving and, again, that’s a lot of people. As you move down the piers,

Taxis back cruise port’s new system

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.netTHE NASSAU Cruise Port’s (NCP) new taxi call-up system has been branded as “smooth”, with a union president voicing optimism that it will end hustling and ‘hacking’ for fares by drivers.

Wesley Ferguson, the Bahamas Taxi Cab Union’s president, told Tribune Business the new facilities for taxi drivers were tested and approved by his membership one day before the Nassau Cruise Port’s official opening on Friday.

“We were negotiating with the Nassau Cruise Port for the past two years on the taxi call-up system.

They were very upfront with the taxi union and we have a good working relationship with them,” Mr Ferguson said.

“We have it. We ran the new system on Thursday and it was smooth. Taxi drivers are enjoying their new facilities. They have a negotiated system - where taxi drivers don’t have to be hustling - where they steer the passenger directly from the cruise ship straight to the taxis. There is only one lane where you are going for taxis, so once you get in that lane you automatically know you are going to get a taxi.”

This new system also facilitates cruise passengers wanting to take tours around New Providence, while allowing them to choose their preferred mode of transportation

we would have resurfaced all of the piers completely.

“As you move towards the land, we would have spent about $125m or $130m on upland works.

You would see this phenomenal new arrivals terminal which supports

Bahamas Customs, Bahamas Immigration and the Port Department has got better facilities as well.” There will also be additional security facilities for the Royal Bahamas Police Force and the Defence Force, and for Nassau

Cruise Port itself. As guests walk through they will encounter the equivalent of a TSA (Transportation Security Administration) checkpoint that travellers are familiar with entering New Providence by airplane.

themselves. I have empathy for them because I am in a low margin business myself, and Business Licence fees are a substantial portion of any profits you do make.

“I see a lot of projects, I hear a lot of input. We’re landing projects. We got awarded a contract recently. We are constantly bidding and, as an engineer, we see there’s a lot of interest. People asked us to provide fee proposals for engineering work and, on the construction side, we’re bidding projects. So from my perspective, I think things are going well.”

when they reach the taxi terminals. There are 20 parking spots in the holding area allocated for taxis, and eight for tour busses, along with one spot for handicapped-adapted vehicles. Mr Ferguson added: “It still needs a bit of tweaking, but they are working along with us. For example, on one day we may run 1,500 passengers, but what happens when we run 2,500 passengers-plus? Then that would create different things and more people to be in place, so we have to work on these things.

“No system that you have is going to work seamlessly the first time out. Some things we didn’t encounter on Thursday we may encounter on another day this week.” There are more than 200 taxi drivers dedicated to the cruise port because it is busier than Lynden Pindling International Airport (LPIA) given the volume of cruise

Sir Franklyn’s developer in $7.5m battle with MIT chair

and a member of the Council on Foreign Relations.

Justice Fraser’s judgment deals only with a preliminary, interlocutory matter and does not represent a decision on the substantive merits of the case. Noting that Eleuthera Properties owns some 4,600 acres in that island’s south, she revealed that the battle has is roots in Mr Millard’s June 30, 2007, decision to acquire 10,000 shares in the company.

“Subsequently, and after speaking with the chairman of the Sunshine Group of Companies, Sir Franklyn Wilson, Mr. Millard invested an additional $1m into Eleuthera Properties resulting in Mr Millard being transferred an additional 5,000 ordinary shares in Eleuthera Properties,”

Justice Fraser said.

The share purchase agreement stipulated that, if

Mr Millard retained at least 10,000 shares in Eleuthera Properties for at least ten years, he could then sell or part of his investment at a “strike price” equal to 125 percent of the share price. This sale was to be exercised by way of a ‘put option’, which Eleuthera Properties had the option to satisfy via providing “no less than five acres of land” from its south Eleuthera holdings which could be selected by Mr Millard. This land, the agreement said, could include “contiguous sand beachfront” in the Jack’s Bay area. The land’s value was to be determined by an independent appraiser, selected by both Mr Millard and Eleuthera Properties. Once the tenyears were up, Mr Millard gave written notice that he intended to exercise the ‘put option’ and sell all his 17,500 shares in the Bahamian development company.

“Mr Millard claims that the additional 2,500 shares, at $400 per share, were given to him under similar terms to the initial 10,000 ordinary shares. This, Mr Millard claims, was orally agreed between himself and Sir Franklyn,” Justice Fraser wrote in her ruling. “Eleuthera Properties refused to acknowledge the additional 2,500 shares and stated that it would honour the 15,000 ordinary shares issued.

“In anticipation that the strike price of the ‘put option would be satisfied in whole or in part by conveyance of land to Mr Millard, the parties jointly engaged Bahamas Realty for a valuation on certain lots at Jack’s Bay on or about January of 2018.”

The Bahamas Realty report detailed that four lot sales, each worth $1m, occurred at Jack’s Bay between February 2018 and March 2018, while

“three additional transactions were provided for ocean view lots that sold in 2018 with an approximate average sales price of $6,250 per lineal foot. Jack’s Bay beach front lot sales number approximately five in the past six months indicating an absorption rate of approximately 10 units per year”.

“The concluding summary of the report was amended to include an estimate of how many lots would be required to satisfy a sum of $7.5m,” Justice Fraser added. But, while Mr Millard asserted that he selected lots eight-22 as the real estate he desired to satisfy his $7.5m investment, Eleuthera Properties alleges that he “never definitively identified” what he wanted.

This led Mr Millard to initiate legal action in the Supreme Court some five months later in late 2018. “He claims that Eleuthera Properties failed to act in good faith by instructing the independent appraiser to add information to the report without Mr Millard’s knowledge, and Eleuthera Properties inaccurately, fraudulently and/or negligently represented to him that five lots in Jack’s Bay was sold within six months which significantly influenced the report,” Justice Fraser wrote. A discovery dispute then erupted between the

two sides, with Mr Millard demanding “a further and better list of documents” and Eleuthera Properties retorting that this request was “overly broad”. The documents requested included all Eleuthera Properties’ financial statements from 2009-2018, plus all sales documents, conveyances, appraisals and communications involving real estate sales at Jack’s Bay.

Sir Franklyn, in a September 29, 2022, affidavit asserted that Jack’s Bay Development, an affiliate company, owned the land in question and it had not been subdivided between 2009 and 2018. He also confirmed that, in July 2017, Beacon Bahamas and Beacon Land Development, had been contracted to manage Jack’s Bay and handle all marketing and sales. This deal ended in September 2018 and, as a result, Eleuthera Properties had no contact with buyers during this time.

“Sir Franklyn’s affidavit also stated that Eleuthera Properties used best efforts to retrieve from Beacon and Jack’s Bay the remaining documents specified in Mr Millard’s request concerning the sale of the lots in Jack’s Bay over the relevant period,” Justice Fraser recorded. “Sir Franklyn personally contacted Michael Abbott and asked him whether Beacon

had any documents relating to lots at Jack’s Bay.

“Mr Abbott told Sir Franklyn that Beacon was dissolved and that he no longer had any documents or correspondence pertaining to the sales in Jack’s Bay during the period of 2009 to 2018. The documents from Jack’s Bay establish that Lots BF-1 and BF-2 were sold to third parties for the price of $1m gross, which price is also aligned with the appraiser’s valuation of the beachfront lots in Jack’s Bay in 2018.”

While Sir Franklyn asserted that Eleuthera Properties “does not have within its possession, custody or control any other documents relating to the matters in question in the action, Mr Millard’s attorneys pointed out that Jack’s Bay Development was wholly beneficially owned by the same Eleuthera Properties. And Sir Franklyn sat as chairman for both entities.

“Mr Millard’s counsel asserts that Eleuthera Properties produced a valuation chart that refers to agreements and reservations in its discovery without producing the actual agreements and reservations being referred to. He submits that Eleuthera Properties must have these documents in its possession,” Justice Fraser wrote.

“Mr Millard’s counsel asserts that data used to compile the valuation chart produced by Eleuthera Properties during discovery is clearly connected to issues which have been raised by Mr Millard in his pleadings.... Eleuthera Properties counsel submits that it used its best efforts to retrieve from third parties who were directly involved in the sale of land at Jack’s Bay (being Beacon and Jack’s Bay Development Ltd) further documents requested by Mr Millard.

“Its counsel asserts that several documents have been submitted by the two entities and, subsequently Eleuthera Properties filed a supplemental list of documents on September 29, 2022, in its attempt to comply with Mr Millard’s counsel’s request for further documents.”

Justice Fraser, though, found for Mr Millard as he had made “a prima facie” for the real estate-related documents he was seeking. Brian Simms KC, the Lennox Paton senior partner, acted for Mr Millard while Robert Adams KC represented Eleuthera Properties.

A new giant

By CHRIS ILLING CCO Activ Trades Corp

The chip company, Nvidia, is benefiting massively from the boom in artificial intelligence (AI). The boom in AI gives the chip and graphics card manufacturer a boom in orders. The technology heavyweight’s stock rose by almost 30 percent on Thursday last week.

Nvidia trumps Apple’s previous daily record on Wall Street.

With its sales forecast, the graphics card specialist exceeded the average expectations of the analysts by around 50 percent. Nvidia chips and software are well suited for applications based on artificial intelligence. They are now geared even more towards AI applications.

NVIDIA is one of the largest developers of graphics processors and chipsets in the world. Their line of

products range from graphics processors or graphics cards to notebooks, network infrastructure and solutions for self-driving cars. Thus the graphics processors are used for a range of applications such as gaming, digital image processing and Internet and industrial design. The company was founded in 1993 by Jensen Huang, Chris Malachowsky and Curtis Priem. In 1999, the company released the GeForce 265, the world’s first graphics processor. The GeForce 265 could process 10m polygons per second. Now, modern graphics processors process more than

Union challenges and opportunities

FROM PAGE B3

resources. This can make it difficult for unions to provide services and support to their members, particularly in smaller unions. The labour laws in The Bahamas also need reform, particularly in the areas of collective bargaining and dispute resolution. This can make it difficult for unions to negotiate with employers and to resolve disputes in a timely and effective manner.

Despite these challenges, trade unions in The Bahamas continue to play an important role in advocating for workers’ rights and interests.

By adapting to new challenges and opportunities, unions can continue to be a vital force for social and economic justice in the country.

One of the main ways to help improve unions is to strengthen relationships with the Government. Unions need to ensure they are using their political influence in a responsible and effective way. This may require unions to be more strategic in their political engagement and advocacy efforts. To do this, unions will have to bring to the table new ideas and innovative ways of ensuring members are getting value for money. This could include improving benefits, services, and training programmes that meet the needs of workers in a changing economy. Another key step is to develop strategic alliances with other labour and civil society groups. This can help to build a stronger

and more diverse labour movement, and increase the bargaining power of workers. Overall, improving trade unions in The Bahamas requires a combination of structural and cultural changes. By diversifying membership, adapting to new challenges, enhancing transparency and accountability, addressing political influence, improving services to members and developing strategic alliances, trade unions can remain effective in representing the interests of workers and promoting social and economic justice.

Conclusion

seven billion polygons per second. At $12 per share, the company announced its first public offering and has since been listed on NASDAQ. Nvidia then announced sales of around $11bn for the quarter running until the end of July. Analysts had expected an average of around $7.2bn. The group is expanding rapidly, and investors responded enthusiastically. Nvidia’s stock jumped nearly 30 percent during the final two trading days last week and hit a new all-time high of $390. With a year-to-date gain of more than 180 percent, Nvidia shares lead the list of winners in the Nasdaq

While trade unions have made significant progress in advocating for workers’ rights and interests, they face challenges such as declining membership and limited resources. However, the National Development Plan (NDP) offers potential opportunities for improving the performance of trade unions and addressing these challenges. To improve trade unions in The Bahamas, it is important to diversify membership, adapt to new challenges, enhance transparency and accountability, address political influence, improve services to members and develop strategic alliances. By working together, unions, political parties and other stakeholders can create a more just and equitable society for all workers in The Bahamas.

NOTICE

Paladin Trading Ops

Ltd.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas.

Registration Number 208885 B (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 25th day of May, A.D. 2023.

Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Diego Campo Jimenez, whose address is CR. 77 239 45 San Simon CJ Duraznillo CS, Bogota D.C., Columbia. Persons having a Claim against the above-named Company are required on or before the 25th day of June, A.D. 2023 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the benefit of any distribution made before such claim is proved.

Dated this 26th day of May, A.D. 2023.

Diego Campo Jimenez Liquidator

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, SULTANE JEANFRANCIS FENELUS AKA SULTANE FRANCIS of P.O Box C.B 12411 #2 Carroll’s Cove, Nassau, Bahamas, intend to change my name to SULTANE JEAN FRANCOIS If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

100. Since the interim low in October, the stock has tripled. Nvidia’s stock market value rose by almost $210bn on Thursday last week. That’s the largest one-day gain a privately listed company has ever posted. The previous record is held by Apple, which in November 2021 increased its market value by $191bn within one day. They are followed by Amazon ($190bn in February 2022), Microsoft

($150bn in March 2020) and Tesla ($143bn in January 2022).

Most recently, Nvidia’s stock market value was around $940bn. With a valuation of almost $3trn, Apple is still the most valuable private stock exchange company in the world.

On balance, Nvidia ended the quarter with a profit of $2.04bn, up from $1.62bn a year earlier. In recent months, the chatbot ChatGPT and software that

can generate images based on text descriptions have triggered a new AI hype. Many companies want to keep up with such applications, which increase the need for specialised technology in data centres. The savvy investor is keeping an eye on how AI is shaping the investment world.

The US stock market was closed yesterday due to Memorial day in the US.

Cruise port’s chair eyes ‘missing 10%’

110-120 percent” of what was anticipated.

“I want more spirit of Nassau, spirit of The Bahamas, spirit of the Caribbean,” Mr Kutman added.

“When the passengers land, when they walk through, we need more touches like Junkanoo carts. Maybe there could be more food carts there, Junkanoo-type of things. It needs more colour, needs to be more vibrant, it needs integration with downtown Nassau, with Bay Street. It’s a good starting point, let me put it this way.

“It takes time. You cannot do everything immediately. It’s trial and error. The most important thing is the integration of the local tourist,

people of Nassau, with this place. This is not just for cruise passengers to come through, walk through, shop and go. They have to integrate with the locals. That’s the most important thing.

“Our approach, our challenge, is we want to integrate the locals with the port and the cruise passenger.... To me, that’s the most important thing. If the taxi driver is happy, I’m happy. If the shopkeeper says everything is wonderful, everybody is happy. To me, those are the important factors - the people of The Bahamas. The ‘Mom and Pop’ shops are the most relevant.”

The Government’s decision to outsource Prince George Wharf’s transformation, management and

operations to Global Port Holdings, which has a controlling 49 percent equity stake in Nassau Cruise Port, was designed to overhaul the city’s waterfront and elevate the tourist experience by creating a first impression with new attractions and experiences.

It is also intended to act as a catalyst by enticing downtown Nassau business and property owners to elevate their own offerings through investing in a refreshed, revived product that will attract some of the 4.2m and 4.6m visitors expected to arrive at Prince George Wharf in 2023 and 2024, respectively.

Global Ports Holding, in a July 16, 2018, proposal to the Government, pledged

to create a “new waterfront” that would give the Bahamian economy a $16bn boost over a 30-year period. Much of this was based on increased per capita cruise passenger spending, driving this to at least $150 per person, and attracting more persons to disembark their vessels while in port.

Mr Kutman told Tribune Business “that’s the 10 percent” when it came to increased passenger spending and vessel disembarkations. “Remember, I said 90 percent satisfied,” he explained. “Ten percent missing. My job is to ensure the minute that ship arrives, turns the corner by the lighthouse, people are awake and see it. People who are sleeping are woken up.

“It has to be inviting. Already I think the number of people leaving the ship has increased, although I don’t have exact numbers, but that’s the 10 percent. Once they go through there, they have Bay Street and Prince George Wharf.”

Mr Kutman acknowledged that downtown Nassau’s revival, which many hope will be spurred by the cruise port investment, is “a big job” and “cannot happen overnight”.

However, he added: “I think this prime minister has his mind set. I really believe

he’s going to get it done.... We try to help, but the Government is taking action. Downtown Nassau can really be the centre of everything in the Caribbean. It has so much; the Bahamian people have so much. We need to revitalise downtown for sure, otherwise the port will die. Without downtown, the port will die as well.”

Pointing to the shared dependency that Nassau Cruise Port and downtown Nassau enjoy, Mr Kutman said the Bahamian capital will “always be number one in my heart” when it comes to Global Port Holdings’ multiple port investments because of his family’s more than three-decade connection to this nation via cruises and visits.

While Nassau Cruise Port represents the group’s largest single investment to-date, he added that it will soon be exceeded by the $500m it intends to spend on similar cruise facilities in Puerto Rico. Together, Nassau and Antigua represent Global Ports Holding’s expansion into the Caribbean and Western Hemisphere after it began to look beyond Europe after achieving dominance on that continent.

“Nassau is a true number one,” Mr Kutman told Tribune Business. “Traffic wise by far, revenue wise

probably again number one, EBITDA, number one. This is the biggest by far investment wise, but we will soon start in Puerto Rico, which will be bigger. That will be $500m.

“Antigua was the first one in the Caribbean, and people were surprised that we had crossed the ocean because we had become too big in Europe. Antigua was a surprise, and then Nassau came and everybody started taking us seriously....... Antigua was the key to open the door. Nassau was the door. We turned the key, and Nassau was the door. We opened the door. Then, of course, there is Puerto Rico, St Lucia and lots of other ports coming one by one.”

Mr Kutman said Nassau Cruise Port will play a “complementary” role to the cruise lines’ private islands, especially on the short-haul four to five-night cruises, while its amphitheatre will bring hotel guests as well as persons “from Lyford Cay and Old Fort Bay” back to downtown Nassau through the variety of music and entertainment options it provides.

Graeme Davis, Baha Mar’s president, said the projected increase in cruise passenger numbers creates more potential day pass customers for its $200m Baha Bay water park as well as the opportunity to convert these guests into higher-paying stopover visitors who stay at one of its hotels.

JOB OPPORTUNITY

Law firm is immediately seeking a detail oriented, hands-on individual to fill the post of an Accountants Receivable Clerk (Collections).

The qualified candidate must have 3 years of experience. A Bachelor`s degree (Accounting or Finance) would be preferable

Responsibilities include, but not limited to:

➢ Maintain accounts receivable ledger

➢ Reconcile accounts receivable ledger to ensure that all payments are accounted for and properly posted

➢ Generate reports detailing accounts receivable status

➢ Drafts correspondence for standard past-due accounts and collections, identifies delinquent accounts by reviewing files, and contacts delinquent account holders to request payment.

➢ Respond to and resolve clients’ billing issues and questions

➢ Perform other related duties as assigned

The candidate must work well independently, take initiative, be a team player, and have excellent written and verbal communication skills.

Salary commensurate with experience and qualifications

Attractive benefits

Only applicants with the above criteria need apply Reply in confidence to: arclerkvacancy@gmail.

Gas stations: We won’t be ‘paupers’

but, yet again, nothing was implemented. Finally, the Association said it received another proposal, involving adjustments to the fuel margins, from Simon Wilson, the Ministry of Finance’s financial secretary, in early April and agreed to it “with a few minor amendments”.

The petroleum dealers, though, allege that nothing further has been heard from the Government and, with no margin increase forthcoming, was forced to take action to get the Davis administration’s “attention” last week by suspending all diesel fuel sales for a week.

Mr Halkitis did not respond to Tribune Business’ message seeking comment last night on the difference between the Government’s public stance on fuel margins, and its approach to negotiations with the gas station operators in private as identified by the Association. However, one possible explanation is that the Government still believes fuel prices are presently too high to implement an increase at this time.

Vasco Bastian, the Bahamas Petroleum Dealers Association’s (BPDA) vicepresident, confirmed to Tribune Business that he and other gas station operators are requesting a 30 cent increase in gasoline margins so that they “do not starve in this industry”. Based on the current 54 cents per gallon, that would take the margin to 84 cents, representing a 55.6 percent increase.

Other petroleum dealers contacted by Tribune Business, who decided to remain anonymous, said they are at the point of laying-off staff in the next few weeks without a margin increase. Mr Bastian added that an Association survey found some 84 percent of motorists would have no difficulty with a 30 cent increase.

Speaking yesterday, he said there has been “no movement” from the Government but himself and Raymond Jones, the Association’s president, will “try and reach out” to Mr Halkitis this week in another bid to resolve this matter and

see if the Government has “a change of heart”. Asserting that the Association does “not want to go down the road of getting into a back and forth with the Government”, Mr Bastian said: “It’s going to get dire. These are some really bad times for the industry itself. We are mindful of the challenges globally, but continue to remind the public we are open 24 hours a day, seven days a week to provide an essential commodity to the Bahamian people but we are losing.

The Association’s vicepresident said that, if the Government does not want to give a margin increase, it should simply get out of the way and lift the price-controlled structure. This would allow dealers to set their own gasoline prices where they could be profitable, and allow the industry to truly compete, with motorists heading to those stations which were run more efficiently and have the cheapest fuel.

“If the Government doesn’t want to give us a margin increase, eliminate the margin issue and let us compete among ourselves to be profitable,” Mr Bastian argued. “If the Government doesn’t want to increase the margin, eliminate the margin and let us compete among ourselves so we can earn a living. You set your own price, and if it’s too high people won’t buy from you.”

He also suggested that, if no margin increase is forthcoming soon, dealers will have to examine and conduct an “in-depth study” on whether to follow other countries by going to motorist self-service and therefore reduce staffing numbers and costs.

“We cannot really afford to continue to starve in this industry,” Mr Bastian said. “Let’s be fair to us. We are investors in this economy. We do so much to keep this economy afloat. This is a vital part of the economy that serves the public.”

The Association, in its statement, said the root cause of its members’ difficulties are that the margins they earn per gallon of gasoline are simply insufficient

to cover ever-increasing operating costs that have soared post-COVID amid the cost of living crisis.

“Every single business owner and every consumer has seen and endured the effects of inflation (rising costs), and the average business owner can adjust his pricing to reflect increased cost of merchandise. Petroleum retailers cannot adjust the margin in diesel or gasoline, which are set by the Bahamas government,” it said. These stand at 54 cents per gallon for gasoline, and 34 cents per gallon for retail. By contrast, the Government earns a fixed $1.16 per gallon on all fuel sales plus 10 percent VAT, but the Association was quick to acknowledge it is not asking that this be reduced or that a portion be redistributed to its members.

And, confirming that the Government had provided gas station operators with $6m in rebates last year, it added: “We presented the case to the Government that retailers have to pay for all operating costs from these

margins and, at that time in 2022, we are already in the red.

“Subsequently, the Government acknowledged that retailers were in dire situation and, as a result, in June 2022 the Government agreed to provide a temporary support for a few months..... Please tell us how a temporary assistance for a few months addresses a systemic issue of costs exceeding gross profit.”

The Association, while pushing for a change from a fixed margin structure to a percentage-based one predicated on the landed cost of fuel, said it agreed to hold-off on its request for a 39 cent per gallon rise until global oil prices dropped. They duly fell by $2 per gallon between July and September 2022, but no change was forthcoming even though the Association said it was advised in November 2022 that the Government had agreed to switch to a percentagebased margin.

However, gas stations were hit with a wave of cost increases early in the

New Year. The 24 percent, or $50 per week, rise in the minimum wage impacted virtually all gas station staff, along with security contractors, while insurance costs jumped 15 percent. Retail store sales remain below pre-COVID levels, the Association added, while the cost to purchase those products has soared.

“Gas stations are mainly cash businesses,” the Association added. “Banks charge fees of 1 percent or more on cash deposits. So, some retailers are paying $3,000 to $5,000 per month depending on which banks they use. So, since the beginning of the year, the additional rising costs as noted have only made the situation worse.”

Following the Association’s March 13 meeting with the Prime Minister, at which he pledged a resolution in a week-and-a-half, the group and its members were then presented with “a proposal to change the fuel margins” by Mr Wilson and the Ministry of Finance which they accepted after suggesting several modifications.

“Since that time, we have not heard from the Government despite many requests to inquire as to the implementation of their proposal to the retailers. Petroleum retailers are highly disappointed that we had to resort to stopping diesel sales just to get the Government’s attention,” the Association said.

“We don’t want to harm the economy of The Bahamas, and especially our customers. However, we have been calling on the Government to grant the margin increase which they propose, and what they acknowledge is badly needed by retailers, so that we - investors, business owners, employers, citizens of the Bahamas are afforded the ability to earn a profit.....

“History has shown that governments will leave the same margin in place for up to 40 years regardless of the financial condition of retailers who will lose their investment and become paupers. We feel this is unfair and will do our best for petroleum retailers to ensure this does not continue.”

‘Huge lift’: Land free-up for Bay Street’s revival

“pecked” at the problem, improving sidewalks and street lighting, he suggested the Government “lacks the bandwidth in-house” to do what is required regardless of whether it is a PLP or FNM administration holding office. While Nassau Cruise Port’s $322.5m transformation is being viewed as a catalyst for stimulating downtown Nassau’s revival, the former minister conceded: “It’s really fingers-crossed that this brand new facility will cause the owners of properties and businesses on Bay Street to coral together and see how, as a collective, they can impact the experience on Bay Street.

“Everyone agrees that it’s somewhat underwhelming and something needs to be done to create a destination

for downtown. I’ve always argued that the downtowns that are successful create a destination people go to in the day and during the night. But we all know that Bay Street at 5pm just becomes a wasteland.”

Mr D’Aguilar said that, while many European city centres are pedestrianised with cafes and other outdoor amenities, it was difficult to do the same with Bay Street because it is “heavily trafficked and such a critical artery and thoroughfare” for motorists. He instead suggested focusing on Woodes Rogers Walk as such a destination, which will require collaboration between the property owners, businesses in that area and the Government.

“The difficulty with Bay Street is there’s many different owners, all with different agendas,” the

former tourism minister added. “They’ve all got different goals; some want to rent, some don’t have the cash, some don’t want to fix up. They’re at different levels of wealth. It’s hard to coral those owners on to the same path.”

Mr D’Aguilar said successful shopping destinations in The Bahamas, pointing to Atlantis’ Marina Village as an example, typically had one owner that was able to develop a destination concept. Downtown Nassau, he added, has been attempting to do similar for decades - but without success so far - through the creation of a Business Improvement District (BID) that would serve as a single entity to manage the city “That requires a huge lift that, to-date, we haven’t been able to do,”

Mr D’Aguilar told Tribune Business. “Substantial capital is required to make it happen. The Government fixes the lights, paves the sidewalks, but only pecks at the problem. It doesn’t solve the problem. The properties east of East Street require enormous capital. And all those buildings are oriented towards the street. We need to reorientate those buildings to look at the ocean.”

Many observers have long argued that downtown Nassau needs to become a ‘living city’, with Bahamian professionals attracted back to live and work in the area.

Mr D’Aguilar suggested that land must be freed-up between Bay Street and Dowdeswell Street, east of East Street, to facilitate this, together with retail stores that face on to the ocean and harbour boardwalk.

UAE announces groundbreaking mission to asteroid belt, seeking clues to life's origins

By NICK EL HAJJAssociated Press

DUBAI, United Arab

Emirates (AP) — The United Arab Emirates unveiled plans Monday to send a spaceship to explore the solar system's main asteroid belt, the latest space project by the oil-rich nation after it launched the successful Hope spacecraft to Mars in 2020.

Dubbed the Emirates Mission to the Asteroid Belt, the project aims to develop a spacecraft in the coming years

and then launch it in 2028 to study various asteroids.

"This mission is a follow up and a follow on the Mars mission, where it was the first mission to Mars from the region," said Mohsen Al Awadhi, program director of the Emirates Mission to the Asteroid Belt. "We're creating the same thing with this mission. That is, the first mission ever to explore these seven asteroids in specific and the first of its kind when it's looked at from the grand tour aspect."

The UAE became the first Arab country and the second country ever to successfully enter Mars' orbit on its first try when its Hope probe reached the red planet in February 2021. The craft's goals include providing the first complete picture of the Martian atmosphere and its layers and helping answer key questions about the planet's climate and composition.

If successful, the newly announced spacecraft will soar at speeds reaching 33,000 kilometers (20,500

miles) per hour on a sevenyear journey to explore six asteroids. It will culminate in the deployment of a landing craft onto a seventh, rare "red" asteroid that scientists say may hold insight into the building blocks of life on Earth.

Organic compounds like water are crucial constituents of life and have been found on some asteroids, potentially delivered through collisions with other organic-rich bodies or via the creation of complex organic molecules in space. Investigating the origins of

To create “sufficient land”, he suggested a new corridor will have to be “cut” between East Street, starting north of HG Christie’s office, through Elizabeth Avenue to Dowdeswell Street. “You’d push Bay Street south to create the necessary real estate to build high rise apartments because the real estate between Bay Street and the ocean is not deep enough,” he argued.

Pointing out that Baha Mar had done similar in re-routing West Bay Street to free land for its multibillion development, Mr D’Aguilar added: “There’s multiple owners and probably very complicated title. It takes something extraordinary to make that happen. It really takes someone who is visionary, and we need someone in government who has the leadership

these compounds, along with the possible presence of water on red asteroids, could shed light on the origin of Earth's water, thereby offering valuable insights into the genesis of life on our planet.

The endeavor is a significant milestone for the burgeoning UAE Space Agency, established in 2014, as it follows up on its success in sending the Amal, or "Hope," probe to Mars. The new journey would span a distance over ten times greater than the Mars mission.

The explorer is named MBR after Dubai's ruler Sheikh Mohammed bin Rashid Al Maktoum, who also serves as the vice president and prime minister of the hereditarily ruled

bandwidth to make that happen and coral it all together.”

Recalling his recent visit to Cartagena, the port city in Colombia, Mr D’Aguilar said that while it, too, has its share of abandoned and dilapidated buildings, there were multiple boutique stores and restaurants with “a vibe that extends into the night” - unlike Nassau. “We have to figure out how we’re going to create this buzz and life downtown,” he told Tribune Business. “This is a fulltime job for someone in government with a mandate to make it happen. I personally don’t think the Government, irrespective of whoever it is, has the bandwidth in house to deal with this. You have to go out and acquire that talent and vision to make it happen. But it’s a huge lift.”

UAE. It will first make its way toward Venus, where the planet's gravitational pull will slingshot it back past the Earth and then Mars.

The craft will eventually reach the asteroid belt, flying as close as 150 kilometers (93 miles) to the celestial boulders and covering a total distance of 5 billion kilometers (around 3 billion miles).

In October 2034, the craft is expected to make its final thrust to the seventh and last asteroid, named Justitia, before deploying a lander over a year later. Justitia, believed to be one of only two known red asteroids, is thought to potentially have a surface laden with organic substances.

Markets mostly higher after Biden-McCarthy deal on US debt

By ELAINE KURTENBACH AP Business WriterWORLD shares were mostly higher Monday after President Joe Biden and House Speaker Kevin McCarthy reached a final agreement on a deal to raise the U.S. national debt ceiling, though the measure requires approval by Congress.

Paris, Frankfurt, Tokyo, Sydney and Shanghai advanced while Hong Kong fell. Markets in London and Seoul were closed for a holiday and U.S. markets will be closed Monday for Memorial Day.

The agreement on the U.S. debt eased what had been a potentially huge threat to markets worldwide. Biden and McCarthy worked over the weekend to try to ensure enough support in Congress to pass the measure before a June 5 deadline and avert a disruptive federal default.

"Markets are so far reacting cautiously. Buoyed, but cautious," Clifford Bennett, chief economist at ACY Securities, said in a commentary.

"This agreement merely rolls the issue to potentially more politically friendly times post the Presidential election in two years. Nothing is certain in this regard, and it is possible resolution will be even more difficult then, than it has been on this occasion," Bennett said. Germany's DAX rose 0.2% to 16,010.98 and the CAC40 in Paris edged 0.1% higher. The futures for the Dow Jones Industrial Average

and the S&P 500 were 0.3% higher. In Asian trading, Tokyo's Nikkei 225 index jumped about 2% early on but closed 1% higher, at 31,233.54. The S&P/ASX 200 in Sydney jumped 0.9% to 7,217.40. The Shanghai Composite index added 0.3% to 3,221.45. In Hong Kong, the Hang Seng slipped 1% to 18,551.11. Taiwan's benchmark gained 0.8% while India's added 0.5%. Investors have another busy week of U.S. economic updates ahead, including data on consumer confidence and employment. On Friday, technology stocks powered solid gains for Wall Street. Chipmaker Marvell Technology surged a record-setting 32.4% after the chipmaker said it expects AI revenue in fiscal 2024 to at least double from the prior year. On Thursday, fellow chipmaker Nvidia soared when it forecast huge upcoming sales related to AI. The S&P 500 rose 1.3% and the Dow industrials gained 1%. The tech-heavy Nasdaq notched the biggest gains, surging 2.2%. The index rose 2.5% for the week. The revolutionary AI field has become a hot issue. Critics warn that it is a potential bubble, but supporters supporters say it could be the latest revolution to reshape the global economy. The nation's financial watchdog, the Consumer Finance Protection Bureau, said it's working to ensure that companies follow the law when they're using AI.

Wall Street and the broader economy already had a full roster of concerns before the threat of the U.S. defaulting on its debt became sharply highlighted on the list.

A key measure of inflation that is closely watched by the Federal Reserve ticked higher than economists expected in April.

The persistent pressure from inflation complicates the Fed's fight against high prices. The central bank has been aggressively raising interest rates since 2022, but recently signaled it will likely forgo a rate hike when it meets in mid-June. The latest government report on inflation is raising concerns about the Fed's next move.

The latest inflation data also highlighted the continued resilience of consumer spending, which has been a key bulwark, along with the strong jobs market, against a recession. The economy grew at a sluggish 1.3% annual rate from January through March and it is projected to accelerate to a 2% pace in the current AprilJune quarter.

The impact from inflation and worries about a recession on the horizon have been hitting corporate profits and forecasts. The latest round of company earnings is nearing a close with the profits for companies in the S&P 500 contracting about 2%.

In other trading Monday, U.S. benchmark crude oil added 14 cents to $72.81 per barrel in electronic trading on the New York Mercantile Exchange. It picked up 84 cents to $72.67 per barrel on Friday.

EXXONMOBIL ABU DHABI (UNCONVENTIONAL) LIMITED

Creditors having debts or claims against the above-named Company are required to send particulars thereof to the undersigned c/o P.O. Box N-624, Nassau, Bahamas on or before 20th day of June, A.D., 2023. In default thereof they will be excluded from the benefit of any distribution made by the Liquidator.

Dated the 30th day of May, A.D., 2023.

Daniel A. Bates Liquidator 22777 Springwoods Village Parkway Spring, Texas 77389 U.S.A

LEGAL NOTICE

N O T I C E

EXXONMOBIL ABU DHABI (UNCONVENTIONAL) LIMITED

N O T I C E IS HEREBY GIVEN as follows:

(a) EXXONMOBIL ABU DHABI (UNCONVENTIONAL) LIMITED is in dissolution under the provisions of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 24th day of May 2023 when its Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said Company is Daniel A. Bates, of 22777 Springwoods Village Parkway, Spring, Texas 77389, U.S.A.

Dated the 30th day of May, 2023

HARRY B. SANDS, LOBOSKY MANAGEMENT CO. LTD.

Registered Agent for the above-named Company

NOTICE

NOTICE is hereby given that ABDUL RAUF ABDUL RAZAK of Prince Charles Drive, New Providence, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 23rd day of May, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that FEDNER JOACHIN, Ida Street, Robinson Road, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that FREDERICK JOACHIN, Ida Street, Robinson Road, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.