Deficit’s 75% cut hinges on $400m revenue surge

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

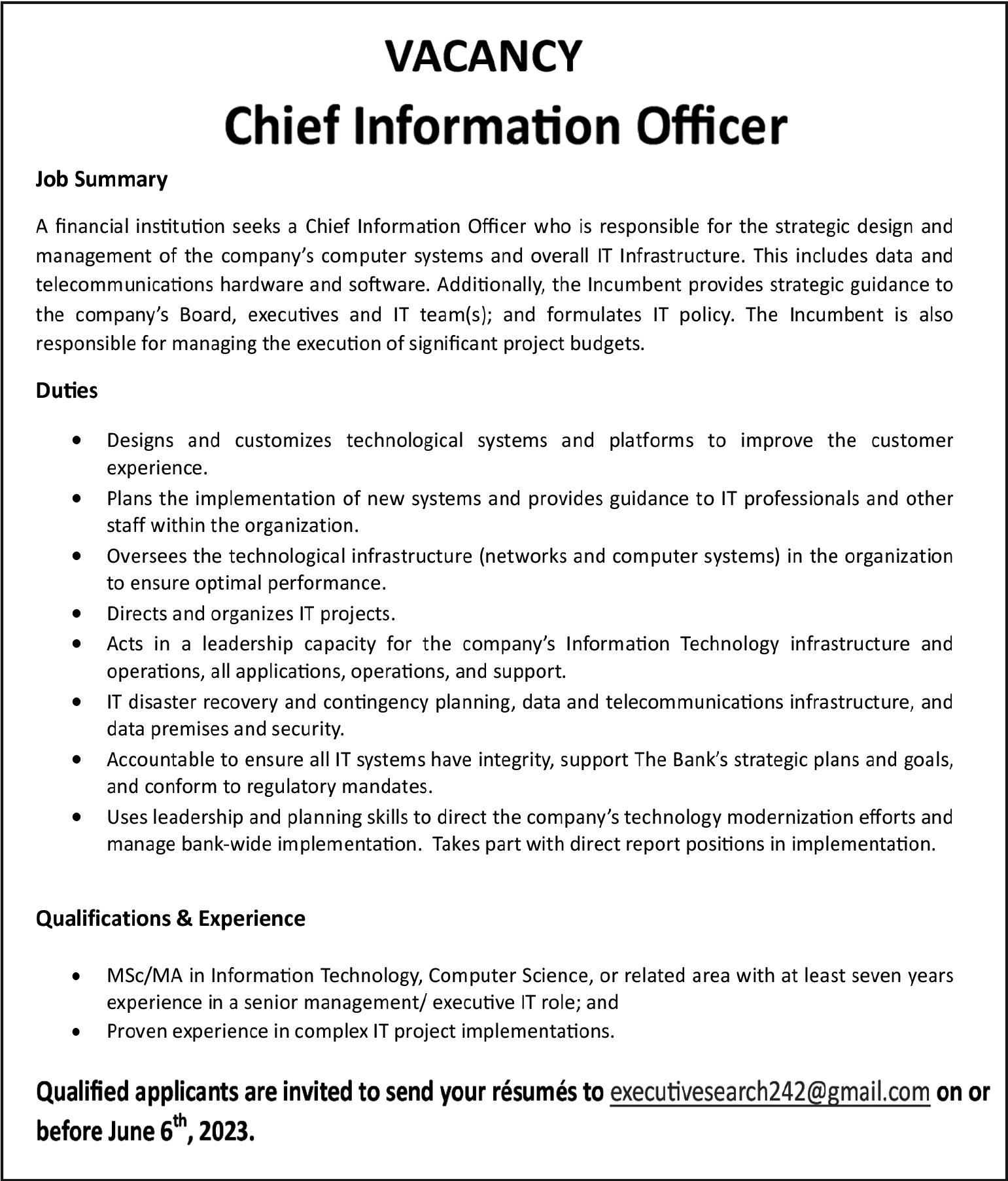

THE Ministry of Finance’s top official yesterday asserted he is “very confident” the Government will increase revenues by $400m year-overyear, and slash its fiscal deficit by 75 percent, in the absence of new and/or increased taxes.

Simon Wilson, the financial secretary, told Tribune Business his optimism surrounding the 2023-2024 fiscal projections comes from current trends with revenues presently surpassing projections and prior year performance by 7 percent and 10 percent, respectively. And, while no headline-grabbing tax measures were announced, legislative changes accompanying the Budget revealed fee adjustments and other tweaks (see articles on Page 1B).

The Davis administration, unveiling its 2023-2024 Budget in the

• Gov’t ‘very confident’: Income 7% above forecast

•

•

House of Assembly, largely stayed true to previous forecasts by projecting that it will cut the GFS deficit by some $389.5m compared to the outturn for the current fiscal year which still has a full month to run.

The numbers show this will be achieved by holding the Government’s recurrent (fixed cost) and capital spending in line with 2022-2023 levels, with a $400m yearover-year revenue increase to $3.316bn driving the

‘Throwing darts’: PM pledges ‘decisive action’ on Freeport

• Places Haywards and St Georges on notice

• Warns that Hawksbill Creek ‘doesn’t work’

• And Port ‘must change’ with reaction mixed

deficit - which measures by how much its spending exceeds income - down to $131.1m for the upcoming fiscal year.

The latter figure, which strips out debt principal redemption to capture the Government’s net new debt or borrowing, is less than $6m more than the $125.3m deficit projected for 2023-2024 in last year’s Budget. The Davis administration is basing its

Gov’t near-tripling cruise departure tax to $145m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government is aiming to near-triple revenues earned from departing cruise passengers to $145m in the 2023-2024 Budget via a series of new and increased fees, it was revealed yesterday.

Revenue estimates for the upcoming fiscal year revealed the Davis administration

is seeking to increase “sea departure taxes” from $50.642m in the current fiscal year via a combination of increases to the existing $18 per passenger departure tax and two new levies.

The Passenger Tax Amendment Bill 2023, tabled in the House of Assembly yesterday to accompany the Budget, reveals that the existing $18 tax is being increased to $23 for “every cruise passenger”

leaving The Bahamas via Nassau and Freeport, and to $25 per head for all those who exit “by sea from a private island not visiting any other port in The Bahamas”.

The revised tax structure, while designed to incentivise the cruise lines to call on Nassau and Freeport, and thus better spread the wealth through their passengers spending with more Bahamian companies and their

VAT filing cut for $5m companies

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Ministry of Finance’s top official yesterday voiced optimism it will “not be a big problem” for Bahamian companies with annual turnovers exceeding $5m to file and pay their VAT returns within 14 days.

Simon Wilson, the financial secretary, speaking after legislation was tabled in the House of Assembly to reduce the filing time available to major firms by one-third, told Tribune Business the move was linked to the Davis administration’s plans to set-up a Large Taxpayer Unit.

The VAT Amendment Bill 2023, which defines

a “large taxpayer” as an entity with annual turnover of $5m or more, stipulates: “A registrant that is a large taxpayer must file with the Comptroller a VAT return in the prescribed form within 14 days after the end of each tax period whether or not tax is payable by the registrant in respect of the period.”

The VAT sum due must also be paid within the same 14-day period, and large taxpayers will be prevented from gaining an extension to the filing timeline is this is passed into law. And the VAT comptroller also has the ability to identify companies as “large taxpayers” in the VAT rules.

SEE PAGE B6

Bahamas is exploring ‘debt for nature’ swap

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government is exploring a “debt-for-nature swap” with the Inter-American Development Bank (IDB) that could result in at portion of its $11.2bn national debt being forgiven, the Prime Minister said yesterday.

Philip Davis KC, unveiling the 2023-2024 Budget in the House of Assembly, said the move was part of wider discussions with the multilateral lender on “two policy-based guarantees” designed to give The

Bahamas access to financing at lower-cost interest rates.

“The Government is presently seeking IDB Board approval for two policy-based guarantee instruments, which will allow access to market financing at even more favourable rates,” Mr Davis said. “These guarantees will support the Government’s debt management operations during the upcoming 2023-2024 fiscal year, which also contemplates a debtfor-nature swap.

“A debt-for-nature swap is an arrangement whereby

employees, imposes departure tax increases of $5 and $7, respectively. They are equivalent to a 27.8 percent and 38.9 percent rise.

In addition, the Bill will also introduce a “tourism environmental levy for every cruise ship passenger arriving or leaving The Bahamas” worth $5 per head. And, finally, for good measure, The Bahamas

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Prime Minister’s decision to put the Grand Bahama Port Authority’s (GBPA) owners on notice that he plans to take “decisive action” to halt Freeport’s two-decade decline yesterday provoked mixed reactions from residents and politicians.

Philip Davis KC used the platform provided by the 2023-2024 Budget address to assert that Freeport’s founding treaty, the Hawksbill Creek Agreement, “does not work” and that the GBPA’s governance model “must change” if the city is to “realise the promise, growth and prosperity” it aspires to.

While not setting out specific details on the “decisive action” his government plans to take, the Prime Minister suggested these could be revealed during the Budget debate over the next month. His comments drew a mixed response, with one Freeport entrepreneur suggesting he and the Government should “stop throwing darts” at the GBPA and instead meet with its owners and management to map out the city’s revival.

Michael Pintard, the Free National Movement (FNM) leader, and who as Marco City’s MP is one of three Opposition parliamentarians on Grand Bahama, yesterday told Tribune

business@tribunemedia.net THURSDAY, JUNE 1, 2023

SEE PAGE B7

SEE PAGE B5

Opposition: Projections ‘hugely, hugely optimistic’

No new/increased taxes, but plenty subtle tweaks

PAGE B6

B9

SEE

SEE PAGE

PHILIP DAVIS KC

SIMON WILSON KWASI THOMPSON

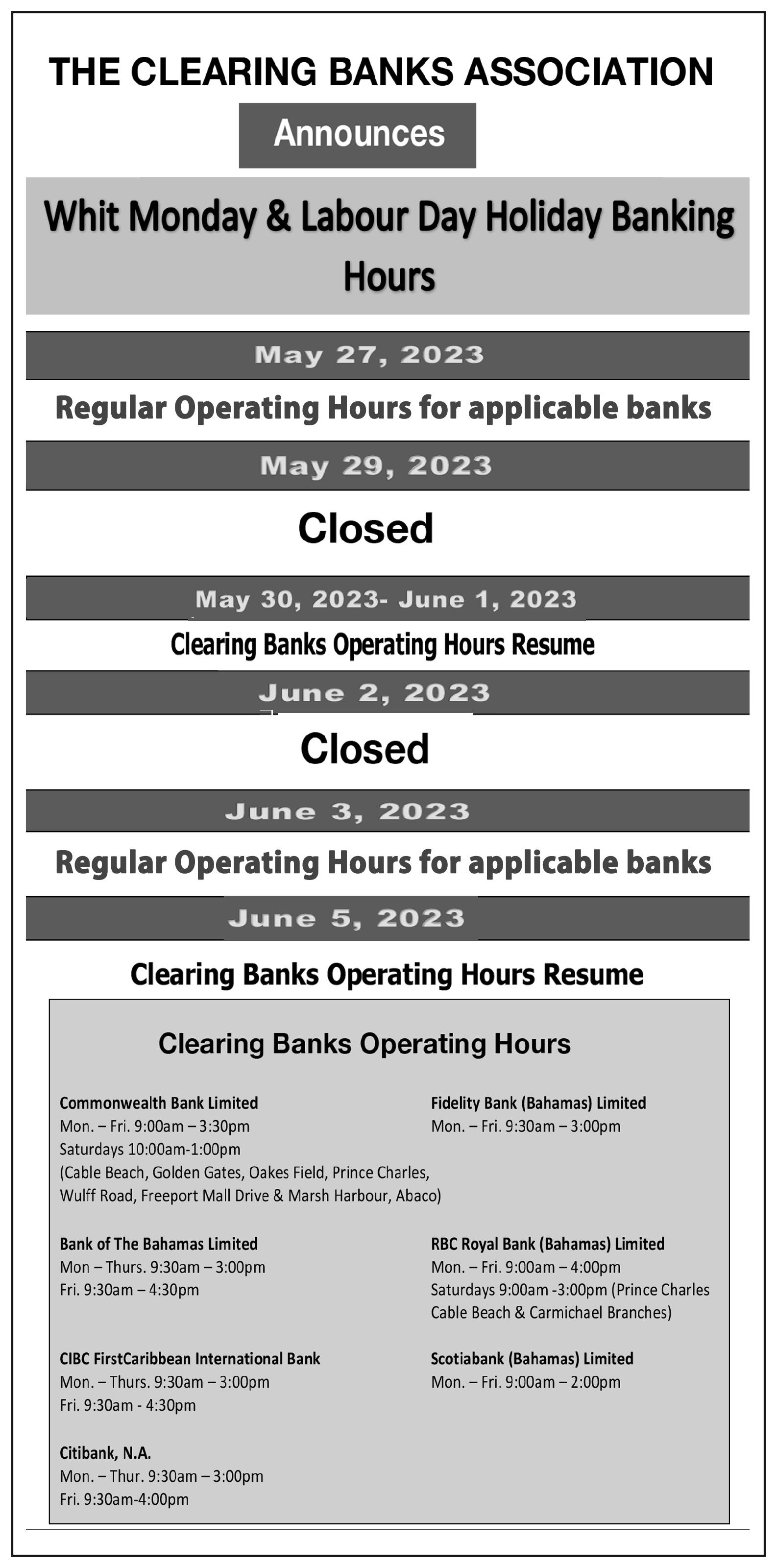

$5.74 $5.85 $5.74 $5.95

In recent years, environmental, social and governance (ESG) factors have become increasingly important for financial institutions. The ESG approach goes beyond traditional financial metrics, instead focusing on sustainability, responsible investment and ethical practices. This article aims to explore two negative, and two positive, aspects of ESG and how it can impact financial institutions.

Increased Regulatory Scrutiny: Regulatory scrutiny is one of the adverse effects of ESG on financial institutions. As sustainability and responsible investing gain traction, regulators are increasing their efforts to ensure compliance with ESG guidelines.

As a result, institutions in the financial sector may be subject to additional reporting requirements, disclosure obligations and potential fines for non-compliance. This increased regulatory burden can strain resources

Derek Smith By

for systems, processes and talent to meet compliance standards. According to the 2023 KPMG chief ethics and compliance officer survey, the top compliance challenge is new regulatory requirements, as

confirmed by 43 percent of respondents.

Reputational and Brand Risk: In the absence of ESG considerations, financial institutions run the risk of harming their reputation and brand. A company’s sustainability and ethical practices are becoming increasingly important to consumers, investors and other stakeholders in today’s socially conscious environment.

Failure to integrate ESG principles into business operations may result in companies suffering reputational damage, a loss of customer confidence, and a loss of value for their brands. In addition, an institution’s bottom line may be impacted by negative publicity related to environmental controversies, labour practices or governance issues.

Improved Risk Management: Financial institutions can enhance their risk management practices by embracing ESG principles.

Climate change, natural disasters and social unrest can be identified and mitigated by considering environmental and social factors.

Robust risk management frameworks encompassing ESG considerations help institutions build resilience, ensure business continuity and protect stakeholders’ interests. As a result, financial institutions can enhance their long-term viability and minimise potential financial losses by managing ESGrelated risks proactively.

Access to Sustainable Investment Opportunities: Access to sustainable investment opportunities is another positive impact ESG can have for financial institutions. The demand for ESG-focused investment products and strategies is rapidly growing.

By integrating ESG factors into their investment decision-making processes, financial institutions can tap into this expanding market and attract socially

INSTITUTIONS

responsible investors.

ESG-focused investment options can diversify revenue streams, attract new clients and enhance the institution’s competitive advantage. Additionally, investing in companies with strong ESG performance can generate attractive returns and long-term value for investors.

In short, ESG factors significantly impact financial institutions, influencing their strategies, operations and relationships with stakeholders. Even though increased regulatory scrutiny and reputational risks pose challenges, embracing ESG principles can be beneficial in many ways.

The incorporation of ESG factors into the business practices of financial institutions can enhance their risk management capabilities, provide them with access to sustainable investment opportunities and enable them to build longterm resilience. Moreover, aligning financial goals with

Embrace competition rather than fighting it

Competition is inevitable in the business world. It is not a necessary evil but, rather, an important part of the commercial ecosystem. Competition can be an effective tool for growing and improving your business. The presence of competition means that customers have the option to choose either your business or a rival. When there is competition, you must quickly understand that customers are using your business not because you are the only one out there but because you appealed to them most. Why is this? It is because your service or product may stand out more than the

competitors. In short, it is not that you are so different - it is that, despite being so similar to other businesses, you have a distinct quality that sets you apart.

Competition can enhance a company’s online presence

Do you know that the more competitors you have, the more power your ranking holds? By increasing your online presence, you can rank higher than your competitors in search engine results pages.

Build loyalty Customers do know what they want and, as a result, the more a customer chooses your product over a competitor’s, the more likely it is they will continue

with you. If a competitor’s prices drop, or your business has a slip-up, loyal customers will still stay with your services not because you asked them to but because they wanted to. Do not be afraid to embrace competition

Although it can be scary, embracing competition in business may be one of the best moves you can make, as it is through them that you can gain new ideas and perspectives, learn how to stand out, and progressively grow your business. Competition is good and can help to keep you on your toes, and become much more motivated to do better.

As a final point, there is much to learn from your competitors. Remember, if you are having difficulty in any particular area of marketing, find competitors who are doing it well and gain knowledge from them. Your goal is not to copy them, but adopting certain practices into your own plan is smart. Make it your business to use your competitors as a catalyst for change, and watch your business succeed. Until we

sustainability and responsible practices will allow financial institutions to position themselves for success in an evolving business landscape where stakeholders increasingly value ESG considerations.

• NB: About Derek Smith Jr Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the assistant vice-president, compliance and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

• NB: Columnist welcomes feedback at deedee21bastian@gmail.com

About columnist: Deidre M. Bastian is a professionally-trained graphic designer/brand marketing analyst, author and certified life coach

BAHAMIANS ‘ON NOTICE’ OVER CREDIT DELINQUENCY

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A CENTRAL Bank official has placed Bahamians “on notice” that they will no longer be able to “conceal” existing loan facilities or debt delinquencies when applying to lenders for new credit.

Karranda Smith, lead supervisor in its bank supervision department, said The Bahamas’ first-ever credit bureau will ultimately make lending institutions aware of all outstanding debts owed by potential borrowers - including those they fail to voluntarily disclose or reveal.

Addressing the Bahamas Institute of Financial Services (BIFS) seminars, Ms Smith said: “In any event, and in time, the credit bureau will ensure that lending institutions are apprised of all the debt obligations of a potential borrower via the credit report, despite any of the efforts of the borrower to conceal this information.

“So, you’re put on notice. The credit information providers would be the banks, the credit unions, the money transmission businesses, hire purchase companies, utility companies and insurance companies.” Ms Smith explained that the data collected from these entities is used to generate a credit report, which can be accessed by a consumer, credit information provider (CIP) or a permitted party.

A free credit report is available to all Bahamians over 18, while a fee of $13 is charged for a credit score. Ms Smith said: “The

information gathered is transformed into a factual and usable credit report, and sold to lenders and consumers alike. The credit reports are then used by credit monitors and other approved users to assess an individual’s or a company’s creditworthiness for loans, mortgages and a variety of other uses within the purview of the Credit Reporting Act 2018.

“A consumer can access a credit report, a CIP can access a credit report, a user with the consent of the data subject can access the credit report. So, every Bahamian over the age of 18 is entitled to receive a free copy of your credit report each calendar year. Their free report, however, does not include a credit score. If you want your credit score included in the credit report, you have to pay a fee of $13.”

Ms Smith said a number of institutions are either actively participating with the credit bureau, with more expected to join to provide a comprehensive credit reporting system.

She added: “The initiative is currently ongoing with, as at February 28, 2023, 24 institutions actively participating in the initiative; 26 institutions with signed contracts; 11 institutions in the testing phase; 15 institutions submitting live data or during the production phase; 11 institutions pulling credit reports; and one institution in the testing phase for actually pulling the credit reports or accessing credit reports.

“It is expected that the utility companies, the

SEE PAGE B3

PAGE 2, Thursday, June 1, 2023 THE TRIBUNE

HOW

AFFECTING FINANCIAL

SOCIAL RESPONSIBILITY IS

DEIDRE BaStiaN By

NEW HEALTHCARE FACILITIES ANNOUNCED BY THE PM

PRIME Minister Philip Davis announced yesterday new healthcare facilities for New Providence and Grand Bahama.

While premiering the Davis administration’s 2023/2024 budget, the Prime Minister stated a new health facility will be constructed on Grand Bahama, a new hospital will be constructed on New Providence and that Family Island clinic infrastructure

will be improved. Mr Davis also announced a new organ transplant programme which he maintains will become a ‘life-saving benefit’ for Bahamians. He said: “Continuing our efforts from our last budget to promote better health and greater wellness among the Bahamian people, in this budget we are providing funding to continue the development of a new health facility in Grand Bahama, to build a new hospital in New Providence, as well as continuing to improve the infrastructure for Family Island Clinics.”

“In relation to healthcare, in a first for The Bahamas, we will be supporting the creation of the first ever ‘National Organs Transplant Programme’ in The Bahamas. I trust that this will become a life-saving benefit to many, who depend on such generous donations for their very survival.”

Mr Davis also announced that the National Health Insurance (NHI) will be consolidated with the Prescription Drug Plan in an attempt to make healthcare more affordable. He added that uniformed officers will maintain health insurance

coverage and subsidized dependent coverage will be available for new recruits. He said: “To make healthcare more affordable, we will consolidate National Health Insurance and the Prescription Drug Plan into an overall health policy. The provision of health insurance is costly, but the Government realises that this is a necessary benefit for many employees. And so the Government is aggressively taking steps to protect this benefit for as many employees as possible.”

“I wish to make clear that members of the uniformed

MORE FUNDS FOR BAMSI AND FARMERS MARKETS

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

PRIME Minister Philip Davis announced the government will maintain capital expenditure in agriculture.

While presenting the Davis administration’s 2023/2024 budget, the Prime Minister stated that the government will continue to invest in agriculture by increasing funding to BAMSI and other farmers markets and assisting land development for farmers.

H said “The Government has implemented various programs to strengthen food security over the medium term. For example we have introduced the ‘Golden Yolk Egg Programme’ which facilitated the purchase of chickens for domestic egg harvesting on a larger scale. Going forward we will continue to increase food security and maintain capital expenditure in agriculture.”

“We have set aside funding for the expansion of BAMSI and other Farmers

Markets in New Providence, and to support the supply of equipment to assist farmers in land development.”

Mr Davis also announced several new agriculture initiates such as an agriculture cadet programme, a fishing pot programme and a hydroponic programme for primary school students.

He said: “We will fund a number of initiatives to directly increase local agriculture and fishing. We will use Green House Investments for local produce cultivation.”

“We will implement a new Agriculture Administration Cadet Programme.”

“The Fishing Pot Programme trains fishermen how to make and use pots as a means of fishing. We will promote the Citrus Tropical Orchard development in Andros, Cat Island, and Eleuthera. And we will promote the ‘Hydroponic Program and Rise Bed’ initiatives in primary schools to teach children a more efficient means of growing produce.”

Minister of Agriculture

Clay Sweeting stated that he was pleased with the budget

allocation for agriculture and that the Golden Yolk egg product programme is a staple project for the ministry and the Davis administration.

He said: “We have a good budget allocation for agriculture this year so we’re looking forward to utilise that and we’ll build upon that this upcoming budget.”

“I'm excited, I think it's a staple project for the ministry of agriculture and even more so for the administration and we look forward to a successful upcoming budget.”

The Prime Minister also noted the growth in several Family Islands such as Andros, Exuma, Cat Island, San Salvador and Rum Cay through tourism and real estate.

He said “In 2022, the combined GDP of Cat Island, San Salvador, and Rum Cay experienced a remarkable growth of 39 percent compared to the previous year. Although these islands only make up a small fraction of the Bahamas' economy, accounting for 0.4 percent of the total, their growth is still noteworthy, and

supports the Government’s very aggressive and successful effort to reopen Club Med in San Salvador.”

“In 2022, Exuma also played a crucial role in boosting the overall GDP of The Bahamas, contributing 2.1 percent to the country's economic growth. Exuma experienced a significant growth of 33 percent in its GDP compared to the previous year, which was largely attributed to the increase in tourist arrivals. The tourism industry played a pivotal role in Exuma's economic progress, allowing the island to surpass its prepandemic levels and achieve significant growth.”

“From 2015 to 2022, the island of Andros consistently accounted for 1.0 percent of the Bahamas' total GDP. However, in 2022, the island's GDP reached its highest level in an eight-year period. Andros experienced a significant economic growth of 6.2 percent in 2022, with real estate activities being the primary contributor.”

"Bimini and the Berry Islands contributed to 1.4 percent to The Bahamas’

BAHAMIANS ‘ON NOTICE’ OVER CREDIT DELINQUENCY

FROM PAGE B2

insurance companies that provide credit and that are not yet contributing data to the credit bureau, and other hire purchase companies.... it’s expected that they will participate in the credit bureau initiative in due course. And this will, of course, result in a more fulsome and more comprehensive credit reporting system. Information on how you’re paying your bills will be contributed to the credit bureau and will form a part of the credit reports”

Ms Smith said credit information providers must ensure data is recent and accurate, and that credit reports can be used for employment screening, tenancy arrangements and obtaining or signing as a guarantor on loans.

She said: “So CIPS are responsible for ensuring that they contribute accurate information to the credit bureau. They have to ensure that all of the data subject information submitted is up to date. They need to ensure that they’re using the credit reports for permissible purposes. And one of the purposes that users use or r•eports for is for pre-employment checks, for example.”

“And if you’re a landlord, you would want to use that report whenever someone is entering into a tenancy agreement or lease agreement, or when someone is renewing a tenancy agreement. And of course, the banks would use that information when they’re considering applications for credit or persons who want to serve as guarantor on the

applications that are made for credit.”

Ms Smith also explained that credit information providers are responsible for correcting information and notifying denial of credit due to the credit report within five working days. She said: “The CIPS are also responsible for securing information obtained from the credit bureau, and for instructing the credit bureau within five working days upon discovery to delete inaccurate information and replace it with accurate information.

“They’re also responsible for notifying the data subject of the denial of credit, where the credit is denied based on the negative information that’s contained within the credit report. And they’re responsible for informing within

ESTATE OF DUSTON CECIL BABB

TAKE NOTICE that anyone having a claim against the Estate of DUSTON CECIL BABB late of Golf Course Boulevard, Sea Breeze Estates, New Providence Bahamas, who died on the 25th day of March, 2020, may submit such claim in writing to the law firm of MAILLIS & MAILLIS, Chambers, Fort Nassau House, Marlborough Street, Nassau, Bahamas, tel: (242) 3224292/3, fax: (242) 323-2334 ON OR BEFORE the 31st August, A.D., 2023.

ESTATE OF ERNIE WILLIS PINDER

TAKE NOTICE that anyone having a claim against the Estate of ERNIE WILLIS PINDER late of 19th Street, Spanish Wells, St. George’s Cay, Bahamas, who died on the 2nd day of November, 2022, may submit such claim in writing to the law firm of MAILLIS & MAILLIS, Chambers, Fort Nassau House, Marlborough Street, Nassau, Bahamas, tel: (242) 322-4292/3, fax: (242) 323-2334 ON OR BEFORE the 31st August, A.D., 2023.

Gated Community on the Family Island seeks a Landscape Manager and a Landscape Supervisor

with at least 3 years’ experience.

Please send resume to jobsintheisland@outlook.com

the same five days, informing the data subject of the name and address of the creditor that provided the information.

“In terms of disputes, there is a dispute process in which the credit bureau is permitted 15 days after receiving a notice of dispute from the data subject to conduct an investigation and to take remedial action relative to the accuracy of the data subject’s

branches of our services will continue to benefit from insurance coverage, and new members will still be eligible for subsidised dependent coverage.”

Dr Michael Darville, Health and Wellness Minister, stated he was content with the budget’s allocations for health and noted several new items such as the organ transplant program and a capital budget He said: “With the budget, I’m satisfied with what’s happening for health. We are so pleased that there’s some new line items in here, one is transplant surgery, the other

total GDP. Despite the downturn in 2020, with the GDP dropping to almost one-third of its usual level, these islands have consistently maintained a strong economic performance from 2015 to 2022.”

Leon Lundy, Member of Parliament for Mangrove Cay, Central and South Andros said Andros was beginning to ‘boom’ and that the budget was financially stable. He added that local small and medium sized enterprises have been benefiting from programs launched by the ministry of tourism.

“Whenever you're doing anything for the Family Islands, I can tell you that people really appreciate it. And even more so its a financially stable budget. So

one you will see training, another line item that I also have is capital budget.”

Former Prime Minister, Dr Hubert Minnis questioned whether Grand Bahama was receiving a hospital, as previously promised, or a clinic.

He said “The Minister of Health said he was building a hospital in Grand Bahama, Brave Davis when he spoke said they were building a health facility in Grand Bahama and a hospital in New Providence, they conflicted, so they are building a clinic.. because he would’ve specifically said if it was a hospital.”

definitely, we're more prudent with the finances and we're catching up.”

“For Andros, the growth of Andros already that he announced in the budget it was more in real estate. So definitely, I understand Andros is beginning to boom, we're pushing them in the right direction, and we're giving them some more opportunities.”

“Right now we have a cluster program going on with tourism, and that's beginning to help it where each business helps out the other where when you have someone come down the motels and hotels and lodges now are spreading it around and using it more as an experience rather than just a specific thing they come to the island for.”

NOTICE

IN THE ESTATE of DENIEL ALEX RECKLEY, late of the Southern District of the Island of New Providence, one of the Islands of The Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 1st day of June A.D., 2023, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Administrators shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO., Attorneys for the Administrators Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

THE TRIBUNE Thursday, June 1, 2023, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

“What does decisive action mean?”

By YOURI KEMP Tribune Business

THE Grand Bahama Chamber of Commerce's president yesterday said he wants more information on what the Prime Minister means on “decisive action” on the Grand Bahama Port Authority (GBPA).

James Carey told Tribune Business that it is hard to make any comments on Prime Minister Philip Davis’s remarks on the government’s intention to take “decisive action", on the way the GBPA’s governance model has transformed over the years because the remarks didn’t go into any great detail.

Philip Davis, KC, during his budget communication,

said: “Grand Bahama contributes 12 percent of the overall GDP of The Bahamas, yet its economy declined by 9 percent compared to the previous year.

“There was a silver lining as the tourism sector witnessed a slight increase in 2022, which was evident in the growth of the accommodation and food service industries.

“Unfortunately, the statistics show a prolonged decline in the Grand Bahamian economy. The evidence confirms the view of my Government that the Hawksbill Creek economic model, which was meant to attract foreign direct investment, does not work.

“Furthermore, in our view, the governance model of the Grand Bahama Port Authority must change, in

order to realise the promise, growth and prosperity which we all desire.

“Additionally, The Government of The Bahamas has serious concerns regarding the compliance of the GBPA and its related companies with the terms and conditions of the Hawksbill Creek Act, and its subsequent amendments.

“Previous administrations have made efforts to tackle the situation, but the issue is clearly systemic and fundamental.

“We believe the time has come for decisive action. In due course, we will make a separate, detailed announcement.”

Mr Carey however, in response to the Prime Minister’s remarks, noted, “Do you think that the billion dollars worth of investment

projects in the pipeline would cause the Prime Minister to pause on what he is going to do? If I were investing I would want to know what’s happening too.”

Mr Carey also said: “The GBPA has done stuff over the past several years and I’m not defending the GBPA, but in the last two decades, we've had hurricanes, we've had a pandemic and the whole leadership structure at the GBPA, which was a different breed of people, has changed.”

The government has stepped in to nationalise the Grand Bahama International Airport (GBIA) in 2019 from the GBPA and its partner Hutchinson Port Holdings. The government said at the time that the

Pintard differs with PM on GBPA

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Prime Minister and Leader of the Opposition share very different views on the future of the Grand Bahama Port Authority (GBPA) and how its engagement with

the community on Grand Bahama should continue.

Prime Minister Philip Davis said in his budget communication yesterday the governance model of the GBPA “must change". The government has “serious concerns regarding the compliance of the GBPA and its related companies with the terms and conditions of the Hawksbill

Creek Act (HCA), and its subsequent amendments". Without going into details on what breaches of the HCA have been made, he added that “decisive action,” will be taken and further announcements on this will be forthcoming.

Michael Pintard, Leader of the Opposition, in the Opposition’s response to the budget communication,

said the Prime Minister’s comments on the future of the GBPA and that whatever decisions are being made in that regard should not be a “private matter".

Mr Pintard added: “The persons who reside there ought to have a principal place at the table in weighing in on this because certainly, we understand the HCA a lot better than a

Pintard criticises ease of doing business

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE LEADER of the Opposition said the government has not improved the ease of doing business and said it is “quite the opposite".

Michael Pintard said the Prime Minister’s Budget communication is not business friendly and has gone

“quite the opposite” on improving the ease of doing business.

Citing the recent waves of enforcement measures on the insurance industry, firstly the proposed changes on the implementation of Value Added Tax (VAT) on health insurance and also the initiative for insurance companies to consider a mandate for them to invest 50 percent of their portfolio in government securities, both

initiatives Mr Pintard called “incredible", and asked the government to provide a rationale for it.

Mr Pintard also said:

“We also saw in the case of pharmaceuticals and food store owners where the government that does not have discipline and how it spends our money, is seeking to determine and dictate how private industry spends theirs.

“Under my administration, we intend to work collaboratively with private sector in the best interest of Bahamians, but we believe smaller government, we also believe that the money is best suited in consumers pockets and business pockets as opposed in the hands of government.

“The government signal that its intention to make adjustment in this budget by reducing the amount of funding available to state owned enterprises. We are going to go through the figures. The initial glance does

GBIA was allowed to fall into disrepair over the last several years and after Hurricane Dorian hit the island, the owners were stalling to make the repairs necessary to turn it into a viable, world-class airport.

That notwithstanding, Mr Carey believes in the GBPA and is “concerned” that the Prime Minister’s remarks may be misinterpreted as nationalisation of a private asset. He also said: “The times have changed and I've said on several occasions that I believe that the HCA should be reviewed, reconfirmed or tweaked as necessary because times have changed.

“I can't imagine the government will step out and do anything radical as far as the government is

number of the bureaucrats in New Providence.

Further warning that Grand Bahamians should be careful of any possible “land grab,” by the Davis administration, “We want to guard against the lack of understanding by this administration on how fragile the economy of Grand Bahama is.”

Investors are watchful over comments made by the government on the GBPA because it may come across as the government seeking to “nationalise”

not show any substantial or transformative adjustment in this regard.”

The Prime Minister in his budget communication also signalled that he does not intend to raise taxes, but also said he would increase revenue. Whether or not businesses should be concerned for a change in the government’s approach towards increasing taxes, Mr Pintard said: “I don't know about whether or not he's going to change his mind. That's in the realm of possibility. But I think it's more so the pressure that they intend to exert on businesses. Businesses should expect that that is likely to continue.

concerned because it sends the wrong message out that the government can be heavy handed and just step in and regardless of the agreements that are in effect, make changes.

“I don't think the government's going to do that. But it would be interesting to know all of what it is that they're thinking of the terms of development.” Noting that it it could appear to be a veiled threat, Mr Carey continued, “You know, Grand Bahama is more than Freeport. The GBPA is responsible for Freeport so we may have to ask what has government itself done with regard to West Grand Bahama and East Grand Bahama at the same time as well.”

the GBPA. “So the government has to be very careful in terms of how they talk about Grand Bahama and so what we want to say, really to persons who are in Grand Bahama, we intend to fight for the residents to be at the table so that this government does not unilaterally-even with the owners- make some decision about the future of the Port Authority. We ought to have a say in where it goes,” Mr Pintard said.

“This government has been very disrespectful to businesses, it doesn't see the need to consult adequately in advance and it obviously is sometimes not informed by the appropriate studies to justify some of the decisions that they're making.” Further adding that all of these decisions on the insurance, pharmaceutical and food retail industry “reeking of desperation", Mr Pintard also noted that with regard to the Prime Minister’s comments on producing a primary balance surplus of $175.6m at the end of March, 2023 that he has to see the figures in order to believe that.

PAGE 4, Thursday, June 1, 2023 THE TRIBUNE

ykemp@tribunemedia.net

Reporter

Bahamas is exploring ‘debt for nature’ swap

a developing nation can have a portion of foreign debt forgiven, typically in exchange for committing to specific conservation measures.... A key component of the Government’s fiscal strategy is to use access to the Caribbean Development Bank and IDB financing to lower our overall funding cost by leveraging the institutions’ AAA credit rating.

“Reduced borrowing costs and improved debt tenor are tools which should improve the overall debt profile of the nation.”

Mr Davis said the Government’s borrowing strategy focus remains to secure the majority of its financing needs in the domestic Bahamian dollar market rather than with international capital markets because global interest rate hikes have raised this nation’s costs.

“The Bahamas’ borrowing costs had begun to experience a downward trend in the previous quarter, but the cost of borrowing rose at the end of March 2023,” the Prime Minister added. “At the end of the third quarter, the total average cost of borrowing for current

outstanding debt had risen to an interest rate of 5.55 percent.

“This is notably higher than the previous year’s rate of 4.93 percent at the end of March 2022. This increase in borrowing costs is primarily attributable to the higher costs associated with external loan facilities. More specifically, the average interest rate for external financing has risen by 1.99 basis points, resulting in a rate of 5.55 percent as of March 2023 compared to the preceding year’s 3.56 percent.”

Mr Davis contrasted this with the Bahamian dollar debt market, adding: “The cost of borrowing in the domestic market has been declining over the past quarters. The average interest cost for domestic loans subsided by 27 basis points to 4.62 percent at end of March 2023, from 4.89 percent in the previous year. And the average interest cost for domestic bonds subsided by three basis points to 4.63 percent at the end of March 2023 from 4.66 percent in the previous year.

“These statistics affirm the Government’s latest medium-term debt strategy,

which aims to shift its borrowing away from costly external commercial debt. Such debt has seen a sharp increase over the past five years, including recent interest rate hikes.

This strategic move will enable the Government to once again rely predominantly on the domestic market to meet its financing requirements.”

To aid this initiative, Mr Davis confirmed that an International Monetary Fund (IMF) team had visited The Bahamas earlier this year to assess the domestic capital markets.

“In our view, The Bahamas has the potential to expand the domestic government securities market and reduce its dependence on external borrowing. This shift towards higher domestic financing could provide a more sustainable and stable source of funding for the country’s needs,” he added.

“In order to assist with the development of the Government securities market in The Bahamas, a team from the International Monetary Fund conducted a technical assistance mission in March 2023. During their visit, they evaluated

FEDERAL RESERVE LIKELY TO SKIP INTEREST RATE HIKE AT NEXT MEETING IN JUNE, OFFICIALS SIGNAL

By CHRISTOPHER RUGABER

AP Economics Writer

Leading Federal Reserve officials are sending out stronger signals that they will forego an interest rate increase at the central bank's next meeting in June, though they indicate hikes could resume later this year.

"Skipping a rate hike at a coming meeting would allow (Fed policymakers) to see more data before making decisions" about whether to further increase rates, said Fed Governor Philip Jefferson in a speech Wednesday. Philadelphia Fed President Patrick Harker made similar comments Wednesday.

Jefferson has been nominated by President Joe Biden to be the Fed's vice chair, though he has yet to be confirmed by the Senate. But his nomination places him close to the center of Fed policymaking.

Including Jefferson, three top Fed officials have been united in support of the idea of skipping a rate hike

in June, despite a slew of tough talk from other Fed policymakers and a disappointing inflation report last week.

On May 19, Fed Chair Jerome Powell hinted that he also supported pausing rate hikes at the June meeting, to give the Fed time to evaluate the economic impact of its previous rate increases.

And John Williams, president of the Federal Reserve Bank of New York, another key member of the Fed's leadership, has also indicated he would prefer to hold off from lifting rates at the June meeting.

"All the pieces of a skip are here and told more forcefully than in past weeks," Tim Duy, chief U.S. economist at SGH Macro Advisors, said. The Fed has implemented 10 straight rate hikes over the past 14 months, pushing its benchmark interest rate to about 5.1%, the highest in 16 years. The rate increases have made mortgages, auto loans, credit card borrowing, and business loans

more expensive. Fed officials hope that higher rates will slow spending, cool the economy, and bring down inflation.

Tough talk on inflation from other Fed officials continued this week. Loretta Mester, president of the Cleveland Fed, expressed support for another hike in June during an interview published Wednesday in the Financial Times.

"I don't really see a compelling reason to pause — meaning wait until you get more evidence to decide what to do," she said. "I would see more of a compelling case for bringing (rates) up."

And last Friday, a report showed that U.S inflation picked up to 4.4% in April, compared with a year ago, up from 4.2% in March, according to the Fed's preferred inflation measure. That is far above the Fed's target of 2%. Excluding the volatile food and energy categories, core prices rose 4.7% from a year ago, also higher than the previous month.

the current state of the country’s sovereign debt market and provided suggestions for improvement.

“These recommendations were focused on three main areas: The primary market, cash management and investor relations management. The IMF team suggested implementing a more structured approach to these areas in order to facilitate growth and success in the local currency government bond market.”

Mr Davis said The Bahamas now needs to build on the Bahamas Government Securities Depository’s (BGSD) roll-out in January 2023, which allows the direct and automated settlement of trades in

government debt. “Looking ahead, the BGSD will roll-out competitive bidding for primary market Bahamas Registered Stock issuances early in the fiscal year, thereby allowing the market to price Government bond issues,” he added.

“This initiative will enhance price transparency, allow for the development of a true domestic yield curve, while at the same time strengthening the local bond market... In terms of policy reform, a significant step forward will be to promote and encourage an increase in the level of government securities held by regulated and unregulated businesses.

“Therefore, in this Budget, the Government is removing any tax on the interest income that a business would otherwise incur by holding any type of government securities. In addition, there will be the formulation of a master repurchase agreement for government securities,” the Prime Minister continued.

“This initiative will add agility to the local bond market and bolster Central Bank monetary policy operations. In the long-term, the Government will seek to implement buy-backs and switches to standardise and increase the depth of securities trading across the secondary market.”

THE TRIBUNE Thursday, June 1, 2023, PAGE 5

FROM PAGE B1

Gov’t near-tripling cruise departure tax to $145m

is also applying a $2 per head “tourism enhancement levy for every passenger arriving in or leaving The Bahamas”.

Combined, these two new levies will add a further $7 in taxes and fees for departing cruise passengers. Depending on whether they exit via Nassau or Freeport, or one of The Bahamas’ private islands, this will take the per capita fees and taxes paid to $30 and $32, respectively, representing 67 percent and 77.8 percent jumps.

Many Bahamians, especially the environmental advocates, will be delighted that the Government is seeking to extract greater revenues from a cruise industry to whom The Bahamas’ waters and

private islands have become increasingly valuable in the post-COVID environment.

The 186 percent, or $94m, year-over-year jump in sea departure taxes is the critical driver behind the projected rise in international trade and transactions taxes to $708.545m in 2023-2024. The departure taxes paid by higher-spending stopover, or air arrivals, by contrast are only forecast to rise by some $6m to $54m because the per capita tax is being held at $28 in the Bill.

However, one source familiar with the cruise industry, speaking on condition of anonymity, told Tribune Business: “The cruise lines are going to have a kitten but anyway. When it comes to the industry, they say they need a

year to adjust and roll it out effectively because they have already sold tickets for July 2024.”

Reflecting this, the Tourism Enhancement Levy will not come into effect until January 1, 2024, although the environmental levy and increase to the existing fees will take effect from July 1 this year, according to the Bill. “The Bill seeks to introduce a Tourism Enhancement Levy on passengers arriving [in] and leaving The Bahamas to be deposited to the Tourism Development Fund,” the legislation stipulates. That Fund will be established under the Tourism Development Corporation of The Bahamas Act 2023, which was also tabled in the House of Assembly yesterday for its first reading. The

Passenger Tax Amendment Bill, meanwhile, states that its reforms are also designed to “introduce a tourism environmental levy and revise existing fees and taxes on departing cruise passengers.”

However, this newspaper’s cruise source, referring to the deputy prime minister, and minister of tourism, investments and aviation, said: “Chester don’t play. The cruise companies are going to go ballistic. Wow. They’re taking the departure tax from $18 to $23 for those leaving from Nassau and Freeport, and from $18 to $25 if they leave from a private island.

“Then you have this $5 environmental levy that takes you to $30 for the private island, and $28 for Nassau and Freeport, plus

VAT filing cut for $5m companies

FROM PAGE B1

“Clause 11 of the Bill amends section 47 of the principal Act to require large taxpayers to file returns and pay VAT within 14 days after the end of

their tax period and to prevent large taxpayers from requesting an extension of time to file a VAT return,” the Bill’s “objects and reasons” state.

All VAT registrants, who must have an annual

turnover exceeding $100,000, presently file their returns and tax payments within 21 days of the period end regardless of whether they are monthly or quarterly filers. Now, monthly filers with an

annual turnover exceeding $5m will see the time they have to submit accurate returns and payments cut by one-third.

Mr Wilson, though, said there was nothing unusual about the move and it was in line with established practices worldwide. “In most countries in the world, large taxpayers file and pay weekly,” he said. “Some file and pay bi-weekly, some file and pay within three to four days. These are the most sophisticated taxpayers, so we don’t see it as creating a big problem.”

Asked whether the goal was to improve the Government’s cash flow by reducing the time to file and pay to 14 days, Mr Wilson conceded: “One eye was on doing that. Really, we think the idea is we can provide superior service to large taxpayers. These services will be enhanced even more with this unit. We do already provide special services to large taxpayers.’

The financial secretary confirmed that the reduced

the $2 enhancement levy.”

Prime Minister Philip Davis yesterday said the Budget contained no new and/or increased taxes, but the Passenger Tax Amendment Bill showed there were still significant adjustments to critical fees.

Kwasi Thompson, the Opposition’s finance spokesman, picked up on this theme, telling Tribune Business: “The Government says no new taxes. However, we see a significant increase in communications levies, a new hotel condominium tax, increase in transportation fees, concession application fees, harbour dues, tourism environment taxes. These all must be explained by the Government.” He also argued that the $54.8m forecast reduction

VAT return filing timeline was directly linked to the Government’s creation of the Large Taxpayer Unit, which was confirmed by the Prime Minister yesterday. Mr Wilson said it should be created by this summer.

“Really the focus is to provide better services to our larger taxpayers. That’s the idea. I think it’s ready,” he added.

“We will establish a Large Taxpayer Unit to improve compliance and revenue collection from the 100 or so businesses that account for $1.7bn in taxes,” Mr Davis said yesterday. “We will implement a national revenue targeting centre that uses technology to identify anomalies in revenue reporting among taxpayers, which will lead to more efficient audits.

“And we will improve revenue collection in the Family Islands by increasing staffing levels in revenue collection agencies. In other measures, we will introduce and implement an updated fee schedule for the registration of pleasure crafts to address chronic revenue underperformance in the marine sector.

in the 2022-2023 deficit, as compared to the last projection, paled against the $300m year-over-year revenue rise that the Government is now forecast to enjoy. Suggesting that this is a sign the Davis administration is having difficulty controlling its spending, Mr Thompson said: “The problem with the Government is their rate of expenditure and the type of expenditure. “You have added $50m to the public service. This most likely a yearly add. It is also completely unacceptable that, according to their own numbers, an increase of more than $250m [sic; $300m] only equates to a possible $50m reduction in the deficit. Even the reduction by $50m is unbelievable.”

“We want our stateowned enterprises (SOEs) to succeed, and we are determined to improve transparency, efficiency and profitability in the way they operate. We have decreased the budget allocation for SOEs from the previous Budget,” he added.

“We will also issue clear expenditure guidelines to SOEs to ensure transparency and financial responsibility in the conduct of their businesses to ensure that it confirms with the national fiscal objectives. We will also implement a plan to increase revenue by collecting dividends from state-owned enterprises.”

The Government is aiming to slash taxpayer subsidies to SOEs by some $47m, or 7.5 percent, in the upcoming 2023-2024 fiscal year by cutting their allocations from a collective $492.24m in 2022-2023 to $455.229m in 2023-2024. The major reductions involve an $18m slash to subventions for the Water & Sewerage Corporation, and $10m cuts at the Public Hospitals Authority (PHA) and Airport Authority.

PAGE 6, Thursday, June 1, 2023 THE TRIBUNE

FROM PAGE B1

‘THROWING DARTS’: PM PLEDGES ‘DECISIVE ACTION’ ON FREEPORT

Business he was opposed to the Davis administration either acquiring the GBPA itself or doing this and then “flipping” Freeport’s quasigovernmental authority to a private company of its choosing.

While acknowledging that Freeport’s status quo is untenable, he added that the “veiled, vague” statements by Mr Davis “send entirely the wrong message” to the city’s residents and businesses, as well as creating “a sense of uncertainty” among potential investors.

However, a prominent Freeport resident, speaking on condition of anonymity, while agreeing that the Government must be careful not to be perceived as acting in a “dictatorial” manner, said it was time for the GBPA’s owner, the Hayward and St George families, to exit given that they were failing to live up to their development obligations and shown themselves unwilling to halt the city’s slide.

Using Grand Bahama’s contracting economy as his launch pad, Mr Davis told the House of Assembly: “Grand Bahama contributes 12 percent of the overall GDP of The Bahamas, yet its economy declined by 9 percent compared to the previous year. There was a silver lining as the tourism sector witnessed a slight increase in 2022, which was evident in the growth of the accommodation and food service industries.

“Unfortunately, the statistics show a prolonged decline in the Grand Bahamian economy. The

evidence confirms the view of my government that the Hawksbill Creek Agreement economic model, which was meant to attract foreign direct investment, does not work.

“Furthermore, in our view, the governance model of the Grand Bahama Port Authority must change. The Hawksbill Creek Agreement does not work, the Port Authority must change, in order to realise the promise, growth and prosperity which we all desire,” the Prime Minister continued.

“Additionally, The Government of The Bahamas has serious concerns regarding the compliance of the GBPA and its related companies with the terms and conditions of the Hawksbill Creek Act [Agreement] and its subsequent amendments.

“Previous administrations have made efforts to tackle the situation, but the issue is clearly systemic and fundamental. We believe the time has come for decisive action. In due course, we will make a separate, detailed announcement. That may be during the course of the debate.”

Tribune Business revealed earlier this year that the Government has been examining whether change at the GBPA is best achieved through either a private buyer acquiring the Hayward and St George families’ ownership interests, the Government doing itself or the regulatory and quasi-governmental powers being devolved back to Nassau.

The Prime Minister, in a prepared statement earlier this year, said: “Grand Bahama over the many

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

MAPLE FALLS TRADING CORP. (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, MAPLE FALLS TRADING CORP. is in dissolution.

The dissolution of the said Company commenced on May 26, 2023 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas. The sole liquidator of the said Company is Kim D Thompson of Equity Trust House, Caves Village, West Bay Street, P O Box N 10697, Nassau, Bahamas.

Kim D Thompson Sole Liquidator

years has failed to live up to its true promise and potential. And we are are in discussions with the Port Authority for the purposes of identifying a path towards putting Grand Bahama on the right track to enable it to fulfill its full potential and promise.”

The GBPA owners, in a 2016 Memorandum of Understanding (MoU) signed with the Christie administration, committed to masterplan the development of their landholdings and seek a buyer for their interests within specified timelines. However, none of these conditions appear to have been fulfilled.

Reaction to the Prime Minister’s comments was varied. Some suggested it was largely “noise”, and the fact he revealed no details indicates either the Government does not have a defined plan or strategy, or that not all elements are in place. Darren Cooper, a Freeport businessman who was among the leaders of a protest march to the GBPA’s headquarters last year, yesterday said it was better for the Government, the GBPA and its owners to talk than engage in confrontation.

Describing the Prime Minister’s comments, and decision to go public, as “very interesting”, Mr Cooper added: “I’m not sure what the impact will be, but I really hope the Prime Minister summons the GBPA to a round table discussion than talk to them through the media. He’s the Prime Minister, and has the authority to lay out the cards as to what he expects from them and what his plans are moving forward

for the Port Authority and Grand Bahama.

“The Prime Minister is only speaking to this company through the media. I hope they get round the table and have a meaningful discussion on the way forward for Grand Bahama. The behaviour of the Prime Minister; that there is a plan and he is not prepared to speak to them, and is just throwing darts in the public domain, it doesn’t come back with a clear message and that he’s justified in what he’s doing.

“There may be a breakdown in communication between the Government and the Port Authority, and I hope the nation’s chief sees the need to get all parties around the table.” Mr Pintard, meanwhile, said the Opposition “are not supportive of the Government of The Bahamas” acquiring the GBPA, should it be seeking to do so, again accusing the Davis administration of lack of transparency and accountability.

While agreeing that “the status quo cannot be maintained as is”, as Freeport’s infrastructure is “slowly falling into disrepair”, he argued that the better solution was to “let the market, and negotiations and discussions, drive this process” of seeking new ownership and investment partners for the GBPA.

“This veiled, vague statement by the Prime Minister sends entirely the wrong message to people living on the island of Grand Bahama,” Mr Pintard argued. “I’m confident there’s more than a handful of people wary of the possibility of the Government

being in charge of not just the regulatory functions but the assets presently resident in the Port Group of Companies. “It creates an environment of uncertainty. If you are contemplating a deal, you are likely to pause everything.... The Government should also not be a go-between to acquire and flip the GBPA to any private investor. That’s a very real concern, and a bad role for a sovereign government to be playing, particularly when there can be multiple buyers and suitors for the GBPA.”

However, one supporter of the Government’s plans for a change of GBPA ownership, added: “It’s the best thing. We need to be part of The Bahamas. It’s untenable. The rest of The Bahamas is booming from an investment point of view and we’ve got nothing.”

While Ian Rolle, the GBPA’s president, has repeatedly touted $1bn worth of investments, the Freeport resident branded this as “pure baloney” and said none are connected to the GBPA. “They have mismanaged this economy terribly for the past 20 years,” the source added. “A lot of investors wanted to come here, but they didn’t let them come because they didn’t want the competition.

“I understand he’s [the Prime Minister] given them a written notice before now, and whatever it is is going to happen. I think the Government is just going to take it over and get rid of the families and let them go. This could all get very ugly if not handled right. Investors could lose confidence if

they feel the Government is being dictatorial, but as far as I’m concerned change is good.”

The GBPA, while described by some as a ‘regulatory shell’, still possesses considerable powers that include business licensing, building code and environmental enforcement, city management, and the power to levy fees and service charges together with the operation of a free trade zone that offers multiple forms of tax relief to investors.

However, its incomeearning assets have been transferred to Port Group Ltd. These include the 50 percent equity stakes in Grand Bahama Development Company (DevCO) and the Freeport Harbour Company, likely to be the two families’ most valuable assets, together with interests in multiple other companies such as Freeport Commercial & Industrial, another major landowner. Should the Government seek to take over the GBPA’s regulatory powers, one source said it would amount to an “abrogation” of the Hawksbill Creek Agreement and raise multiple legal issues that would have to be addressed. Among these, they added, would be the provision that requires four-fifths (80 percent) of licensees to approve the devolution of quasi-governmental authority to a local government-type entity.

THE TRIBUNE Thursday, June 1, 2023, PAGE 7

FROM PAGE B1 CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

CEOS GOT SMALLER RAISES. IT WOULD STILL TAKE A TYPICAL WORKER TWO LIFETIMES TO MAKE THEIR ANNUAL PAY

By ALEXANDRA OLSON AP Business Writer

AFTER ballooning for years, CEO pay growth is finally slowing. The typical compensation package for chief executives who run S&P 500 companies rose just 0.9% last year, to a median of $14.8 million, according to data analyzed for The Associated Press by Equilar. That means half the CEOs in the survey made more and half made less. It was the smallest increase since 2015.

Still, that's unlikely to quell mounting criticism that CEO pay has become excessively high and the imbalance between company bosses and rankand-file workers too wide.

Discontent over that gap has helped fuel labor unrest, and even some institutional investors have pushed back against a few of the most eye-popping packages.

The smaller increase came after CEO pay soared 17% in 2021, when boards rewarded top executives handsomely for steering their companies through the pandemic-induced recession.

Many of the compensation packages were approved early in 2022 but even a small raise might seem lavish in retrospect against the backdrop of a year in which stock markets tanked to their worst performance since 2008, inflation erased wage gains, fears of a recession grew, and tech giants began laying off workers.

"I'm not surprised that after two record years in a

row, pay hikes cooled somewhat," said Sarah Anderson, who directs the Global Economy Project at the progressive Institute for Policy Studies. "What we shouldn't lose sight of is that CEO pay is still off the charts by historical measures." She said even a small hike last year was "outrageous."

In contrast to recent years, CEO pay gains were lower than the 5.1% increase in wages and benefits netted by private-sector workers through 2022.

Still, worker pay failed to keep up with inflation, which was sitting at 6.4% at the end of last year. And the pay disparity between CEOs and rank-and-file workers, which has been widening for years, narrowed only slightly.

The median pay for workers at companies included in the AP survey was $77,178, up 1.3% from $76,160 the

previous year. That means it would take that worker 186 years to make what a CEO making the median pay earned just last year. At the same group of companies in 2021, it would have taken 190 years.

The timing of some of the biggest pay packages struck a discordant note against the backdrop of difficult times for their industries.

Alphabet's CEO, Sundar Pichai, ranked No. 1 in the AP's pay survey this year with a package valued at nearly $226 million. The vast majority of his compensation came from a grant of restricted stock, valued at $218 million, and which Google grants its CEO every three years.

The leader of Google won't reap most of the benefits of the stocks awards right away and how much he realizes ultimately depends on how Alphabet's stock

performs. Alphabet noted in its annual proxy filing that, compared with Pichai's 2019 stock awards, a greater proportion of the latest batch will only vest if the company reaches goals for shareholder return.

Even so, Pichai received a total compensation package 15 times higher than this year's median CEO pay just before Google laid off tens of thousands of workers. The company's total shareholder returns fell 39% last year.

Stephen McMurtry, a Google software engineer and member of the Alphabet Workers Union-CWA, said he was not impressed when Pichai told employees shortly after the layoffs that executives would take significant bonus cuts in 2023 because "bonuses are a small part of executives' primarily stock-based compensation." Pichai didn't receive a bonus in 2022.

"The clear disparity between executive rewards and our jobless former coworkers erodes trust and further underscores the need for transparency," McMurtry said in a statement e-mailed to AP.

Like many companies, Alphabet's equity portion of executive compensation is designed to reflect results over several years. Since Pichai started as CEO in 2015, Alphabet's stock has nearly quadrupled, and the company has become the third most valuable on Wall Street.

Alphabet declined to comment beyond its proxy statement.

Nearly 130 CEOs in the AP's survey saw pay cuts last year. Among them was UPS CEO Carol Tomé, who received a total compensation package valued

at nearly $19 million, most of it in stock awards. That's down 31% from $27.6 million in 2021. UPS said Tome's compensation was lower because she didn't exceed performance targets by as much in 2022 as she did in 2021.

Tomé is trying to stave off a potentially crippling strike by unionized workers, who feel they saw little of the company's windfall in profits, which nearly tripled during the pandemic as consumer reliance on deliveries grew.

"I don't feel bad for her that she got a decrease," said Jimi Hadley, UPS package driver in Roswell, Georgia, and Teamsters shop steward. "Nineteen million? Most workers will never make that in their entire life."

Tomé's pay was 364 times higher than $52,144 median pay for UPS workers, although the company notes that the average pay for fulltime drivers is $95,000. UPS says its executive pay is "at the midpoint when compared to other companies of similar size and global scale."

Some boards put the brakes on CEO compensation following pushback from institutional investors, who get the chance to vote in "Say On Pay" tallies at annual shareholder meetings, although such votes are only advisory and don't compel boards to make changes.

Homebuilder Lennar, for example, capped the annual cash bonuses for its

co-CEOs, Rick Beckwitt and Jonathan Jaffe, at $6 million each in response to complaints from investors about their $16.6 million bonuses in 2021. Just 63% of Lennar's investors voted to approve the pay packages at last year's shareholder meeting, compared to 84% in 2021.

Beckwitt and Jaffe saw their total compensation fall 11% and 12% in 2022, respectively, to $30.4 million and $30 million.

Higher up the pay scale, Apple CEO Tim Cook was no. 3 in the AP survey with a compensation package valued at $99.4 million, nearly identical to what Apple gave him in 2021. But Cook has requested a 40% pay cut for 2023, in response to the vote at last year's annual meeting, where just 64% of shareholders approved of Cook's pay package, compared to 94% the previous year.

Such shareholder pushback remains rare, however. The vast majority of companies included in AP's survey received more than 90% support for their executive compensation programs in 2022.

The AP's and Equilar's compensation study included pay data for 343 CEOs at S&P 500 companies who have served at least two fiscal years at their companies, which filed proxy statements between Jan. 1 and April 30. Some well-paid CEOs are not included because they don't fit the criteria, such as Amazon's Andy Jassy and Microsoft's Satya Nadella.

PAGE 8, Thursday, June 1, 2023 THE TRIBUNE

APPLE CEO Tim Cook smiles at an Apple event in Cupertino, Calif., on Sept. 7, 2022. After ballooning for years, CEO pay growth is finally slowing. Cook, who was number three in the AP CEO pay survey, requested a 40% pay cut in 2023 after shareholders questioned the size and structure of his $99.4 million compensation package in 2022.

Photo:Jeff Chiu/AP

Deficit’s 75% cut hinges on $400m revenue surge

revenue, and entire fiscal performance, on economic growth and tax compliance/ enforcement measures driving increased income in the absence of new and/or increased levies.

“I think we’re very confident,” Mr Wilson told this newspaper of the Government’s revenue and deficit forecasts. “We think they’re achievable. That’s why we put it there. We look at this year’s trends, and we are trending 7 percent above projections and 10 percent above the previous year. We know there are some areas where we fall short. We have to work hard, stick to the plan, and should be OK.”

The Budget’s 2023-2024 fiscal projections, which forecast revenues will jump from $2.909bn in 2022-2023 to $3.316bn next year, are also broadly in line with the current Fiscal Strategy Report. Comparing the two indicates that the Government is more than $70m ahead of the Fiscal Strategy Report’s projections when it comes to revenues, as it had forecast total income of $3.243m for 2023-2024.

However, the Davis administration has backed away from forecasts that it will achieve a fiscal surplus exceeding a quarter of a billion dollars in the 20242025 fiscal year. While still predicting it will reach the rarity of a surplus, meaning the Government’s revenues exceed its spending, it has cut the size of this surplus to $109.2m. This represents a 61 percent cut to the $278.8m forecast in last year’s Budget, and a 62 percent fall against the Fiscal Strategy Report’s $287.3m. Kwasi Thompson, the Opposition’s finance spokesman, yesterday told Tribune Business he viewed the Government’s fiscal projections as “hugely, hugely optimistic” given that the Bahamian economy’s growth rate will likely slow after regaining the output that was lost due to COVID-19 “I think those projections are hugely, hugely optimistic. I think the rate of growth this year, I don’t believe it’s going to be the same next year. I think those revenue projections are hugely optimistic as a result,” he argued. “The

latest Central Bank report said that while tourism continues to grow, the rate of growth is decreasing, and that is a very, very significant point we need to take into account with regard to our projections. I think they’re hugely optimistic.”

Hubert Edwards, the Organisation for Responsible Governance’s (ORG) economic development committee head, yesterday said it was possible the Government could hit its $400m revenue increase target. “Given the outlay they have just announced I don’t want to go out on a limb and say it’s not realistic,” he added.

“I think there are some elements they have in mind, not increasing taxes but incorporating areas that, up to now, have not been taxed or have only attracted fees. Clearly, the universe of sources has expanded. Obviously the numbers are better than what was originally projected, and if they hold true they would have set the trend for a significant rebalancing and move into securing a surplus.

“One caveat to that is if this increase is from recurring revenue or supported by the collection of outstanding tax arrears. If it’s from recurring revenues it means it’s sustainable, but if not there’s a question of how it will materialise the following year.”

Prime Minister Philip Davis KC, in unveiling the 2023-2024 Budget, asserted that the Government will achieve its revenue ambitions without resorting to new and/or increased taxes. “A key focus will be to generate more revenue for the public purse without raising taxes. This means no increase in the VAT rate, and no increase in Customs duties, Excise duty, tax rates and real property tax rates,” he said.

“We will instead increase revenue collection by improving tax compliance and enforcement. This is based on the simple principle of fairness. Most people pay their taxes. Why should some people be allowed not to? If people are experiencing hardship, or if there are other extenuating circumstances, we invite people to come and talk with us. We can usually come to some form of agreement.

NOTICE

NOTICE is hereby given that SAMMY GIBSON DORCELY Sunrise Road, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that JOHNNY PETERSON, Sommerville Drive Freeport, Grand Bahama applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of May 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

“It is noteworthy that, when pressed to do so, a significant number of people readily pay off their arrears. This suggests that they weren’t unable to pay their taxes; they simply didn’t do so.”

The two major drivers of the Government’s revenue increase are VAT and taxes on international trade and transactions, which combined are forecast to generate an extra $270mplus in the upcoming 2023-2024 fiscal year. VAT collections are forecast to rise by almost $180m, growing by 12.7 percent from $1.412bn to $1.591bn, while international trade and transactions taxes are forecast to grow by $92m to $708.546m.

Meanwhile, Mr Wilson said he was “pretty confident” the Government slash the 2022-2023 fiscal deficit by $54.8m, or near10 percent, compared to the last projection of $575.4m. “Unless something drastic happens to the revenue we should finish this year at over $100m above target,” he told Tribune Business.

“March was a very strong month. We have to wait and see on April’s numbers. June last year wasn’t as strong as we wanted it to be, so we have to keep our fingers crossed for June.” However, Mr Wilson added that there had been no sign of any easing in revenue trends heading into the last month of the fiscal year, which closes on June 30, 2023.

The Government’s Budget numbers predict that 2022-2023 revenues will come in some $107.8m above forecast, finishing the year at $2.909bn as opposed to $2.801bn, and thus setting it up to further cut the deficit next fiscal year on the path to achieving a fiscal surplus in 2024-2025.

Mr Davis yesterday confirmed that his administration is expecting to run a $300m-plus deficit in the final quarter of the 2022-2023 fiscal year, as the amount of ‘red ink’ after the first nine months stood at $216.2m. Successive administrations typically

incur large deficits in June, especially, as this is when multiple agencies, ministries and departments present bills for payment prior to the fiscal year end that the Ministry of Finance was unaware of.

Turning to the full-year outlook, the Prime Minister added: “Analysis of the trends of the first three quarters of this fiscal year, and the years prior, suggest that the Government is potentially set to exceed the $2.85bn target set forth in the February 2023 mid-year supplementary Budget. I am confident the revenue outturn at the end of the fiscal year 2022-2023 will near $2.9bn.

“Public spending has remained on track, and is well within the budgeted amount. For this reason I am confident that

expenditure at end of the fiscal year 2022-2023 will almost reach the target of $3.1bn set in the supplementary Budget. The primary balance will therefore record a surplus of $68.4m at the end of the fiscal year, a $54.8m

increase from the $13.6m surplus projected in the supplementary Budget.

“Likewise, the overall deficit is expected to improve to $520.6m, down from the $575.4m outlined in the supplementary Budget.”

Share your news