Fund ‘first’ targeting $100m in five years

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A Bahamian investment bank yesterday unveiled ambitions to “make a massive difference” for the economy by growing the country’s ‘first-ever’ private equity fund to $100m within five years.

Michael Anderson, RF Bank & Trust’s president, told Tribune Business its newly-created Strat Equity Fund aims to fill “a huge void in the market” by providing Bahamian businesses with much-needed equity capital to jumpstart the expansion of their enterprises.

Asserting that the fund’s investments into local companies could easily translate into a collective $300m injection into the Bahamian economy, as it makes these firms more attractive to banks and other debt financiers, he disclosed that the Strat Equity Fund is already working on four different acquisition/share purchase opportunities.

Vendors voice cruise port fears despite rent waiver

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunmedia.net

The RF (formerly Royal Fidelity) chief also told this newspaper that “the multiplier effect” of that $300m could be equivalent to 10-15 percent of Bahamian gross domestic product (GDP) “once that money is put to work”, adding

SEE PAGE B7

Food prices to ‘never return to pre-COVID’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Retail Grocers Association’s president yesterday warned Bahamians that food prices will not return to pre-COVID levels and said: “The cost of operations is increasing all over the world.”

Philip Beneby told Tribune Business it was presently impossible to determine what impact Russia’s decision to end the deal that allowed Ukraine to export wheat and related products via the Black Sea will have on world food prices but acknowledged it does create “some concern” for The Bahamas.

“It will have some impact,” he conceded. “I really can’t speak to that at this point. We would have some concerns but, at the end of it all, there’s nothing we can do about it because we are a non-producing country. We only import. We have to hope it doesn’t affect us too badly.”

Russia’s move to abandon that agreement is merely the latest post-COVID headache for the Bahamian food distribution industry and its consumers. Wheat is typically milled into flour, which is then used to make a wide range of products including bread, cereals, crumpets, muffins, noodles, pasta, biscuits, cakes,

SEE PAGE B4

Investor’s $2.2m San Sal hotel claim ‘unenforceable’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A US investor’s $2.239m claim against the family owners of a well-known San Salvador resort has been branded as “unenforceable” by a Supreme Court judge and rejected in its entirety.

Justice Andrew Forbes, in a verdict delivered almost 11 years after the case was first tried, found that the $2m promissory note on which Kenneth Schweitzer based his claim against the Williams family, proprietors of the Riding Rock Resort & Marina ever since it was constructed in

the 1960s, was “invalid” as it failed to meet “the legal meaning and definition” of such an instrument.

The dispute between the parties erupted over a deal, which was never consummated, that would have seen the American acquire a 50 percent ownership interest in the Family Island resort. Mr Schweitzer alleged that the $2m promissory note was intended to “secure the repayment” of all monies he advanced to purchase materials and furnishings for Riding Rock’s renovation.

The Florida resident, a contractor by profession, argued that the April

SEE PAGE B5

NASSAU Cruise Port yesterday said it had waived the first year’s rent for its marketplace tenants to help grow their businesses after several complained about the cost and lease terms they must sign up to.

The Prince George Wharf operator, in a statement, said it has also brokered a deal that will enable those tenants selling “authentically Bahamian products” to meet the $1m minimum

“general liability insurance” coverage at “minimal cost”.

Responding to vendor concerns, it confirmed: “To alleviate the financial burden on its Marketplace tenants, the Nassau Cruise Port is providing one year rent-free to leaseholding tenants. This unprecedented initiative allows these small business owners to focus on their growth and development without the immediate pressure of rent expenses.

“The waiving of rent for a year also allows tenants to

business@tribunemedia.net THURSDAY, JULY 20, 2023

SEE PAGE B6

(L-R): Jim Wilson, RF Bank & Trust’s vice-president of investment banking; Jontra Harvey, regional manager of investment banking; and Michael Anderson, RF Group president.

NASSAU CRUISE PORT

$5.60 $5.63 $5.70 $5.71

BPL HIKES ‘BLOW UP’ ABACO LIVING COSTS

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

ABACO business owners yesterday revealed their electricity costs more than doubled in just one month as Bahamas Power & Light’s (BPL) fuel cost recovery strategy consumes an ever-increasing share of corporate cash flows.

Ruth Saunders, the Abaco Chamber of Commerce vice-president, revealing to Tribune Business that one of her electricity bills ballooned from $281 to $580 in just one month, said: “The last cycle for BPL, there was a lot of talk around town that their bills were high, and we recently got a bill for our home as well as the business.

“The home went up at least 75 percent, and on that your fuel cost is more than the actual bill. What I’ve been noticing with BPL is because the cost of fuel has gone up, the fuel surcharge on the voltage has increased drastically. Our [business] electricity bill is $272 and, out of that, $236 is the fuel charge. But now if you look at the home bill, they went from $281 to $580.81 in a month.”

Ms Saunders owns a print and sign company with her daughter, and said frequent power outages and load shedding - similar to what New Providence has again begun to experience in recent weeks - have put a ‘damper’ on her business as activities cease without electricity to operate the machinery. She added that when BPL’s supply goes out during a large print run, it ruins the image and creates

unnecessary wastage for her company. She said: “We have been experiencing power outages and load sharing, and it really affects and puts a damper on the business - especially our business - because it kind of stops us in our tracks. We really can’t do anything. We can’t even allow customers to come in because our buzzer is on electricity. It puts you at a standstill and it is very disruptive.”

“Don’t let it stop in the middle of a 52-inch by 96-inch print. That print goes in the garbage and we have to restart, and so that’s ink and paper going down the drain. It’s very inconsiderate.”

Ms Saunders explained that increasing BPL bills have forced her to consider if she should pass the increased operational costs

on to consumers or continue to absorb them. She said: “Do you eat the cost of the 10 percent overrun that you have for business? Is it fair to the consumer that we raise the prices just to accommodate the outages and the boo boos we make when they don’t have power, or when you cut us off right in the middle of print and we don’t even get a notification so that we can plan.

“The cost of doing business gets higher because we haven’t yet done an increase because it’s unfair for us to offload it to the customer. And it’s also unfair to us because if our print stops then we have to throw it in the garbage. It’s a BPL problem that comes at our expense or the customer’s expense. So, it’s a fine line.”

Ms Saunders said costs have increased in many

areas on Abaco, especially construction, food and souvenirs. She added that due to Custom duties, the regressive taxation system and overall market conditions, Abaco merchants are often forced to increase prices.

She said: “I think we have just like blown up the market when it came to people doing work for persons and they’ve put a tag on it.”

“Everybody has, you could tell in the food stores; you could tell in the souvenir stores, definitely. You can tell because they’re actually having to pay to bring the stuff in and Customs is going to charge them, so the overall cost they still have to put a mark-up on it. Everything is gone up. It’s blown up, the cost of living in Abaco, because, hey, we live in paradise.”

Bahamas to accelerate seaplane arrival growth

A SENIOR tourism official says The Bahamas is seeking to grow the number of visitors brought to this nation by seaplane to around 40,000 annually.

Dr Kenneth Romer, the Ministry of Tourism’s

director-general and acting aviation director, said accelerating the return of amphibious seaplane airlift is another component in the strategy to expand visitor arrivals post-COVID.

“Amphibious air services is a prominent component of the recently-launched National Aviation Strategic Plan, as we seek to diversify and innovate stopover air arrivals to and within our major islands and cays, to

position The Bahamas as a luxury cachet that cannot be matched by any other destination in our region,” said Dr Romer. Two seaplane operators currently provide services to The Bahamas. Coco Air, which operates from Odyssey Aviation, provides transportation services to Harbour Island, Kamalame Cay, Staniel Cay, the Exuma cays and Bimini using an eight-seat plane.

Dr Romer said it currently transports between 10,000 to 15,000 passengers annually, and tourism officials expect this number to double as demand builds. The other operator, Florida-based Tropic Air, serves Nassau, Bimini and Great Harbour Cay with

eight-seat planes, transporting a similar number of persons to Coco Air.

To mark The Bahamas’ 50th Independence celebrations, a group of travel advisors and media

Ms Saunders said she is doubtful that BPL will transition to using renewables on Abaco because it cares more about making money than ensuring consumers are happy. She added that BPL does not often compensate clients for damages to their appliances and machinery due to power outages.

She added: “They don’t want to move to renewable energy. It’s a money-making scheme right now for most corporations in The Bahamas, and the consumer and business owners suffer for it BPL does not even have a track record if they burn something in the house during their shortages and you put in a claim. Nobody I know has ever gotten anything from BPL, and that’s a shame.”

partners were brought to Paradise Island’s Ocean Club, a Four Seasons resort, for a familiarisation onboard Coco Bahamas’. The plane was operated by Bahamian pilots, Kyle Glenn Fernander and Brandon Fernander.

Present to mark the occasion were regulators from the Bahamas Civil Aviation Authority and law enforcement officers, along with tourism, aviation and hospitality executives.

“As we promote the islands of The Bahamas as an extended-stay, multi-destination travel experience, seaplanes afford visitors ease of access to more destination offerings throughout our picturesque archipelago, while delivering the best way to lower the total cost of air transportation per mile flown”, added Dr Romer.

PAGE 2, Thursday, July 20, 2023 THE TRIBUNE

DR. KENNETH ROMER

AUTHENTIC BAHAMIAN GOODS SALES STRUGGLE

conducive to be able to sell that product.

VENDORS at the Nassau Cruise Port have been having difficulty in promoting and selling authentically Bahamian products, it was asserted during a press conference held by the Trade Union Congress (TUC) yesterday.

Yvette Prince, president of the Festival Place Association, said vendors are reporting low sales and experiencing difficulties exclusively selling authentically Bahamian products at the Nassau Cruise Port.

Ms Prince said authentic merchandise is expensive to purchase and produce and many cruise passengers are not willing to pay for authentic items. She added that because vendors are outdoors tourists are often put off by the high prices. She said: “It’s hard because authentically Bahamian products are expensive to make and also to buy. And so to make an authentically Bahamian product and to sell it in that environment is not

“If you are in a store, like the port store, for instance, with air conditioning, everything people expect to pay more, but out in those little, I call them tool sheds, they’re not going to pay that kind of money for them. We don’t have the proper environment to be able to sell those things properly.

“And so to support other Bahamian artists, the costs of buying products is expensive, those tourists are not willing. I’m not saying they won’t buy any of it, they will buy some of the small items, they’re less expensive, but they’re not willing to pay the money that it would cost to sell the items for and so the tourists are always looking, but they go elsewhere.”

Ms Prince said tourists are often looking for inexpensive items and the Nassau Cruise Port had initially promised to make a logo to promote the goods. She said: “Some items will be sold, small items, but tourists are basically looking for inexpensive items and handmade Bahamian items are not cheap.

They encouraged us to make as many Bahamianmade products as possible and we were committed to them. And they said that they would create a logo to promote that product as an authentically Bahamian product. So that is the premise in which we agree to.”

Thelma Miller, a vendor at the cruise port, became emotional as she explained the challenges she has faced in sourcing materials to make authentic straw products, that often do not sell. She noted there have been days that she has made only $5 in sales as she can no longer sell other items to compensate for times when sales of straw goods are low. She said: “My concern right now is we sell Bahamian products. I sell straw work, it is beautiful but its not available because of the straw. A lot of the ladies who used to 20 years ago supply me with the straw have retired or died. And so when we were in Rawson Square, we used to sell other things to offset, so we were able to make moneys from the cheap items. But now they telling us we can’t

sell it anymore so I don’t know how we are going to survive, because right now I made $5… $5 can not help me.”

Ms Prince added that the long hours she invested in authentically Bahamian products, low sales and harsh working conditions have disheartened her and “taken the joy” out of her career. She said: “They don’t want me to sell T-shirts after 20 years, but the other stores are being allowed to sell it and some of them are foreigners. You know, like for instance if you go on the port store… they said that it would be authentically Bahamian and there’s nothing authentically Bahamian in those stores, but they want us to be the slaves and be up all night making items to make crumbs while the other store owners make 1000s of dollars every day, and it’s not fair and that’s why we’re here.

“It is not fair. I mean, you go inside the port store, and they have air condition, but you have Bahamian people staying up all night making things and until morning and then you come here

and make $116. You know, it’s not fair.

“It’s just hard. Everything is hard, you know, takes the joy out of going in to work. I love tourism, but it takes the joy of going to the point it feels like you’re going to a plantation and people would be offended that you’re actually saying that but, you know, that’s how I feel.”

The Nassau Cruise Port released a statement yesterday, saying they are committed to supporting local artisans and entrepreneurs and creating a ‘culturally enriched’ experience for visitors.

“The Authentically Bahamian Programme is a testament to Nassau Cruise Port’s commitment to supporting local entrepreneurs, artisans, and businesses while elevating the cruise port experience to new heights. By championing Bahamian authenticity, Nassau Cruise Port strives to create a more immersive and culturally enriched experience for cruise passengers visiting Nassau.” The statement went on to note that the port has been in discussion with

tenants for the past three years and that tenants were aware that merchandise is required to be authentically Bahamian.

“Majority of the tenants within the Port Marketplace at Nassau Cruise Port are legacy tenants from the former Festival Place. In 2003, the Ministry of Tourism sought to create an authentic market featuring Bahamian artisans. The requirement that the majority of products offered for sale needed to be authentic was fundamental to the original lease with Ministry of Tourism.

“Over the years, product lines became less and less authentic, and more massproduced. Three years ago, Nassau Cruise Port began comprehensive engagement with each of its legacy tenants and Nassau Cruise Port executives held oneon-one meetings with each individual tenant to understand their businesses and to discover the impetus of their business becoming selected as a vendor at Festival Place, some of which have been operating in the port space since 2003.”

Musicians hit at ‘second class citizens’ treatment

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

BAHAMIAN musicians

yesterday argued that they remain unemployed while foreign entertainers are permitted by the Government to work at major New Providence resorts.

Fred Munnings, of the United Artists Bahamas Union, sought to sound the alarm over such practices by asserting that its members and other musicians made several attempts to meet with Ministry of Labour officials on the matter only to be told that Sandals is

permitted to bring in foreign entertainers under its Heads of Agreement.

He said: “We have had several meetings with the Ministry of Labour, Robert Farquharson (director of labour) and representatives of the United Artists Bahamas Union. To date, we have no resolution. We have met with representatives of RIU, who have foreign dancers, displacing Bahamian dancers. We have made several attempts to meet with Sandals. They have refused to meet with us.

“The Ministry of Labour has told us that Sandals is entitled to bring in the

foreign dancers because it’s a part of their Heads of Agreement, which is a bunch of foolishness in my opinion, because if there are Bahamians who are qualified, as they are, to provide this entertainment in this country - to give the visitors a Bahamian experience - I see no reason why foreign entertainers should be allowed into this country.”

Mr Munnings added that labour officials are aware of the “discomfort” artists feel over the situation. He said Obie Ferguson, the Trades Union Congress (TUC) president and prominent labour attorney, will be

representing the union in seeking a resolution to this issue.

He said: “We expressed this to the minister himself [Keith Bell], and to the director of labour, and we’ve expressed discomfort with what’s happening at RIU and other resorts in this country but, to-date, no satisfaction. Sandals outright refused to meet with any union in this country. That is an abomination. And it will stop.

“We said this to the minister. Mr Ferguson has represented our position to the highest authority in this country. And, trust me, Sandals will meet and treat

with the union representatives in this country. They don’t run this country. This is the Bahamas. You for me, I for you. That’s our motto.”

Mr Munnings also criticised labour officials for allowing foreign entertainers to perform at resorts as parts of special events or

SEE PAGE B4

THE TRIBUNE Thursday, July 20, 2023, PAGE 3

By FAY SIMMONS Tribune Business Writer jsimmons@tribunmedia.net

19 Testing Kits $100.00 per box 25 IN A BOX Contact: (242) 427-7417 FOR SALE

Covid

Food prices to ‘never return to pre-COVID’

pastries, cereal bars, sweet and savoury snack foods, crackers, crisp-breads, sauces and confectionery items.

Any wheat/flour supply shortages and price increases will raise the cost of these items and, combined, Russia and Ukraine together are responsible for almost one-seventh of the world’s wheat supply based on 2017 data. Between the two, they produced 112.1m tons of wheat that year, but recent estimates have pegged their global contribution as high as 25 percent.

Mr Beneby, meanwhile, warned that there was

little sign that food price increases are tapering off with local factors - especially Bahamas Power & Light’s (BPL) soaring electricity costs - combining with global market conditions to exert further upward pressure on costs. “It hasn’t eased. Prices have increased, while some have stayed at that [postCOVID] level. They are at post-COVID levels,” he told Tribune Business “They never went back to pre-COVID levels. I don’t think we’ll ever see preCOVID prices. The cost of everything is increasing. The cost of operations is increasing all over the world.”

Asked about the fallout from BPL’s heightened electricity costs, Mr Beneby added: “It will have an impact on food costs. The stores can only absorb those costs for so long but eventually they will have to pass them on. Every business has their own level that they can withstand; “Some businesses have been really griping because electricity costs have increased by as much as 25 percent-plus. Definitely, at some point, that is going to have to be passed on. We just have to brace ourselves for it because it’s not going to stop coming. It’s coming from all sides. What else can we do? There’s nothing we can do about that.

The cost of operations is increasing.”

Debra Symonette, Super Value’s president, concurred that the postCOVID surge in food prices over the past three years has yet to “come to a complete halt” and warned Bahamian shoppers that “we cannot truly relax yet”.

Acknowledging that Russia’s actions over Ukraine’s grain and wheat exports is nothing positive for The Bahamas, she told Tribune Business: “Once it’s anything affecting something like grain that does play a role in a lot of the products that we sell it’s highly likely that it would have an effect on the prices. We still have to wait and see how much of an effect it would have.

“We import from different parts of the world, so if it affects any of our suppliers it also affects us.”

Tribune Business understands that among the commodities that have experienced recent price increases are soup, rice, detergent, paper products and sugar.

“We’ve seen somewhat of a tapering off,” Ms

Symonette added on food prices generally. “There are still some products that are increasing. It hasn’t come to a complete halt. We cannot truly relax yet. We’re still seeing these increases. We did see a bit of a slowing down but now we’re seeing somewhat of an increase in certain items.

“We did see an increase in sugar. We don’t have much of a shipping problem right now, but other factors have come into play; weather, labour, anything that affects our manufacturers and suppliers.” Ms Symonette agreed that BPL’s soaring energy costs will “play a role” in increased food prices, but said the 13-store Super Value supermarket chain is racing to complete the installation of solar energy at all its sites to “mitigate some of the increase”.

“We’re well on the way; maybe 80 percent or so complete,” she added. “The stores are at like 80-85 percent, and there’s just a few more to go. We’re hoping they’ll be done shortly.. by next month for sure. It’s just starting to kick in and

MUSICIANS HIT AT ‘SECOND CLASS CITIZENS’ TREATMENT

FROM PAGE B3

conventions without including Bahamian sound or light engineers. He added that a recent group imported “millions and millions” of dollars of equipment that could have been locally sourced.

He added: “Now, with respect to entertainment generally in this country, we have all kinds of foreign entertainment being brought into this country under the disguise of coming in as a part of a convention, or a special event, or whatever thing of some sort and they end up performing.

“We have protested. We have brought this to the attention of the Ministry of Labour. Nothing is being done. About three weeks ago, a company came into this country with millions and millions of dollars of sound and light equipment that we know can be provided locally.

“We brought it to the attention of the Ministry of Labour and Immigration; nothing happened. This foolishness will stop in this country. There are too many Bahamians qualified, highly qualified, that are being denied their rightful place in this country. “

Mr Munnings said Bahamian artists are treated as “second class” citizens in a country whose tourism

industry was built on the success of live band night clubs.

He added: “There were more than 40 nightclubs operating successfully in New Providence alone. And it was because of some of the proprietors of those nightclubs that the fledgling PLP party was able to get to the point where they were because they financed their rallies etc. But now we’re being treated like second class citizens in our own country. That will stop.”

Mr Farquharson declined to respond to the union’s allegations. However, he did reveal that labour officials are working with the union to ensure that when there is a qualified Bahamian available to take on a vacancy, no work permit or labour certificates will be issued. He added that it is an ‘ongoing situation’ with the hospitality sector.

He said: “I’m not going to comment on an ongoing situation. We know what it says; that the Department of Labour in conjunction with our industry partners, which includes that organisation, is working to ensure that section 86 of the Industrial Relations Act is followed. Whenever there is a qualified Bahamian, no work permit or labour certificate will be issued. And we are working in partnership with them. It’s an

probably in a month or so we can start to see the real effect.

“We have seen quite an increase percentage wise, probably around 40 percent. Of course, if the electricity bill goes higher that will take away from the bottom line but if we’re able to use the solar to offset the rising cost the effect shouldn’t be that bad. We’re really trying not to pass any increase on to the customers. We’re doing our best to keep the prices steady or give them a little breather whenever we can. We’re trying our best.”

Ms Symonette said Super Value was hoping for up to a 50 percent reduction in its energy costs once its roof-top solar solution was implemented companywide, although the actual savings will only be quantified once this is completed. She added that the food store chain is “doing our best to control all those costs we can” through obtaining deals from suppliers and seeking out new product sources.

ongoing situation with the hospitality sector.”

Mr Bell addressed the issue of resorts requesting permission for foreign entertainers in May at the Bahamas Chamber of Commerce and Employers Confederation’s (BCCEC) breakfast in May.

He said that although the entertainment in resorts should be reserved for Bahamians, many hotels have requested with justification why they should be permitted to employ foreign entertainers. He added that he has met with, and told, unions that they must address issues within their organisations before being a part of the consultation process.

He said: “There’s certain areas in the music industry that you will preserve strictly for Bahamians, but a number of the hotels, for example, are bringing them in. They bring in dancers, they bring in the artisans, they bring in everybody, or they are trying to bring them in. And they have written the justifications as to why these people are needed.

“The musicians and entertainers unions, I told them quite frankly, the two of them, that we are prepared to consult with you but you have got to get yourself together first. How can I be consulting with you before I issue these things or look at these things, and I know there’s a lot of issues and challenges and concerns within your organisations.”

PAGE 4, Thursday, July 20, 2023 THE TRIBUNE

FROM PAGE

B1

Executive says MyGateway programme ‘20 years late’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

AN EXECUTIVE in the information and communications technology field has said the roll-out of the MyGateway programme “is not a game changer” for the country - and is 20 years late.

Philip Darville, owner/ operator of SolveIt Bahamas, told Tribune Business that while the programme is

a positive step forward, it is decades late.

Mr Darville said: “Where are we now, post introduction of all of the new initiatives? I think we are still fairly stagnant in the ease of doing business.”

He said MyGateway needs to be properly capitalised in order to address the glaring deficiencies in the country’s digitisation gap in order to improve the ease of doing business ranking.

An option to improve the MyGateway is to privatise its efforts or at least allow

other stakeholders to control how it is rolled out, he said. “I think we need to focus on getting the best from it long term and that isn’t always through the global bidding processes. I think we have to develop our own industries per se, but I think being able to do certain basic things is good, but these small things won’t have an impact on the ease of doing business,” Mr Darville said. He added: “It is not a game changer. You can put in for your police record or your birth certificate now,

but that should have been done 20 years ago. If investors want to come to this country the digital portal that is needed should be almost like a red carpet. And that is not what the MyGateway was probably intended to do, but it’s not the digital portal we have seen in other countries.”

In other developed countries, the digital portal not only has provisions for basic government documents, but also has portals for getting business related approvals fast tracked and monitored. “We don’t have

INVESTOR’S $2.2M SAN SAL HOTEL CLAIM ‘UNENFORCEABLE’

FROM PAGE B1

1, 2007, promissory note required the Williams family and their company, Carter Enterprises, to repay the principal and interest by January 31, 2008, with a default occurring if the full sum was not paid within 30 days of the latter date.

Mr Schweitzer argued that the Williams’ family defaulted after he had obtained Customs duty and other tax breaks, worth $1.611m, on $2.044m worth of materials imported to renovate Riding Rock. “He further alleges that he agreed to assist the defendant with financing the purchase of the goods which it intended to import into The Bahamas for the purposes of renovating the said Riding Rock Inn and Marina in exchange for executing the promissory note,” Justice Forbes noted.

“The plaintiff further alleges that in pursuance of this agreement the plaintiff spent a total of $1.455m for the Riding Rock project and the said sum was acknowledged by Kevin Williams, one of the defendant’s duly authorised representatives on July 7, 2007.”

The alleged failure to pay saw Mr Schweitzer initiate legal action on September 4, 2012, although the case ultimately only made it to trial in late June and early July 2022 - almost ten years later. The Williams family, though, rejected the American’s $2.239m demand and asserted that he - not themselves - was responsible for a breach of contract by not paying the sum required under the promissory note.

They alleged that Mr Schweitzer was supposed to acquire a 50 percent stake in their resort by paying a $2m purchase price, but the deal was never concluded because this sum was never received.

And, while admitting to the promissory note’s execution, the Williams family denied that it was designed “to create a legal obligation” to the American but, rather, was intended to help him secure “Chinese” financing for the $2m purchase.

The Riding Rock owners also alleged that, in 2006, they entered into an

“independent collateral oral agreement” with Mr Schweitzer that they would share the cost of resort improvements if he acquired a 50 percent stake. And, while admitting that he did acquire some of the materials, denied that their value exceeded $400,000.

Mr Schweitzer, who denied seeking “Chinese” financing, said Kevin Williams informed him that the family “needed financial help to fix the problems with the marina” when he spent a month’s fishing at Riding Rock in summer 2004 and 2005. He responded that he would be interested in investing $2m in the property in return for a 50 percent equity stake in all the marina properties and businesses on the 25-acre tract.

“By August 2006, he had committed to spending a total of $3m on the resort with a breakdown for $2m in respect of the shares and $1m for the repairs,”Justice Forbes said of the US investor’s evidence. “That he was purchasing the resort ‘as is’ and he agreed that at the end of it the Williams family would have their 50 percent share remaining, a renovated resort and $1m cash in hand.”

By April 17, 2007, Mr Schweitzer said that while the $2m payment for his 50 percent ownership stake remained outstanding, he had funded some $1.5m worth of improvements to Riding Rock and wanted the

Responsibilities

promissory note as security for his outlay.

However, Michelle Williams, who together with her four brothers Kevin, Carlos, Jamal and Jayson owns Riding Rock Resort & Marina, alleged that in early 2007 Mr Schweitzer admitted “he was having difficulty raising” the $2m and needed documents to prove to a lender that he had a deal to acquire a 50 percent share.

The promissory note, prepared by the family’s attorney, Bryan Glinton, the Glinton, Sweeting & O’Brien partner, “was prepared solely for the purpose of assisting the plaintiff in his attempt to raise the funds to enable him to purchase the 50 percent interest in the resort”. And Ms Williams alleged that “the cover note from Mr Glinton partially explains” it was not designed to create a legal obligation for the family to pay Mr Schweitzer money.

Kevin Williams, the resort’s managing director, in his evidence said that - at the time - the family had “decided to sell the resort due to the recession and 9/11 and had difficulties with people coming to the island”. However, Justice Forbes said the main issues to be determined were whether the promissory note was legally binding and enforceable, and if the Williams family had defaulted on their obligation to repay.

He found Mr Schweitzer and his witnesses “to be

• Handle cash transactions with customers using cash registers;

• Scan goods and collect payments;

• Issue receipts, refunds, change or tickets;

• Pleasantly deal with customers to ensure satisfaction.

Requirements

• Must have a clean police record; and

• Two references.

wholly unreliable”, and said the US investor “seems to be somewhat confused as to the nature of his agreement. It would appear that the plaintiff either did not appreciate the nature of the agreement that was being proposed or has simply chosen to appear to be ignorant, and the court finds this unlikely given

that red carpet effect yet.”

Mr Darville also said: “If we are currently ranked at 94 in the World Bank’s ease of doing business then we need to find our way to get into the 30s and then how do we continue to get it down into the 10s.”

The MyGateway should be able to “make an impact”, on the way we do business in the country and over the last ten years of the country’s digitisation efforts, more is needed than the MyGateway roll-out.

Mr Darville added: “If you speak to the average

the multiple businesses the plaintiff indicated he was a part of”.

Noting that the promissory note “is an unconditional promise to repay”, Justice Forbes noted that the document signed by the two sides violated this by containing 11 terms and conditions.

“Therefore, the court finds that the promissory note dated April 17, 2007, is invalid as it fails to meet the requirements of a bill of

business person and not even foreigners, you would know that things are inexplicably challenged in terms of how quick things are resolved like the responsiveness, the communication efforts, the whole thing from start to finish and the entire satisfaction process of it all. I think that in itself, we don’t need a government agency to tell us about the ease of doing business. We already know everything is challenged right now.”

exchange and is therefore unenforceable,” he added.

This meant Mr Schweitzer’s pleaded case “has to fall away”, Justice Forbes added, finding that while there was an “oral agreement” over the repairs and renovations it was unclear as to what the terms were and bother parties were disputing them.

THE TRIBUNE Thursday, July 20, 2023, PAGE 5

CASHIER: Send resume’ to Johneberhardt@hbsmarine.com

Harbourside Marine is seeking a FULL TIME

Vendors voice cruise port fears despite rent waiver

adjust their authentic products and non-Bahamian product offerings to be better aligned with demand. The rent waiver gives the tenants an opportunity to refine their products and promote their unique artistic offerings. In addition, tenants were only required to pay a security deposit, not first and last month’s rent.

“Nassau Cruise Port [has also] brokered a deal to provide liability insurance coverage for each tenant at Nassau Cruise Port for a minimal cost, saving time, money and effort and ultimately benefiting all of the tenants.” Tenants also received an up to $20,000 grant to fit out their spaces. Its response came after Nassau Cruise Port Tenant Association members yesterday voiced complaints about the

working conditions and lease agreements. Yvette Prince, president of the Association, asserted that working conditions are harsh as their stalls lack ventilation and proper overhead protection from the elements. She added that appeals to Nassau Cruise Port to construct a canopy to avoid workers and products getting wet in the rain have been denied. She said: “It’s been so many issues. We’ve just been there two months. When it rains, we’re getting wet. Our products are getting wet. There’s also flooding there. You know, if you’re not mopping your floor, the water goes straight to the back and it wetting up your products. “For a new port, the design is really poor. We don’t have no windows; it’s only ten by ten. There’s a little storage area in the back, there’s no windows in there. There’s no

ventilation. It’s just totally hot. There was a little ministorm out there and a tenant got soaked and her products got soaked, and we asked if they could put up a canopy. They said it’ll never happen. They’re not willing to work with us to make things better.”

Ms Prince alleged that Nassau Cruise Port, which is 49 percent owned and controlled by Global Ports Holding, has not fulfilled its promises but some vendors have signed their lease agreements out of “fear of victimisation’ while others have outright refused to sign.

She said: “I have been in communications with Mr Maura (Nassau Cruise Port’s chief executive) from the very beginning, from conception, and they promised us a lot of stuff and they did nothing that they promise. I cannot think of one thing

that they promised that they did.

“Management up there has so much division. People have signed leases that they don’t agree with, but they did it out of fear of victimisation. There are things on the lease that should not be there. And so we decided we’re not going to sign it. I mean, because leases are legally binding documents.”

A copy of the vendor lease agreements, seen by Tribune Business, confirms that the first year is rent-free. It stipulates: “The first year of the term shall be rent free. The rent payable hereunder for the second year of the term shall be $1,000.

“As from the third year of the term until the termination of this lease agreement, the fixed rent shall be adjusted on a yearly basis to reflect any aggregate increase in the annual Consumer Price Index (CPI) as

published by the Bahamas Department of Statistics over the preceding year.” A common area charge of $3,000 per year, or $250 per month, is also applied to help cover the Nassau Cruise Port’s marketing and maintenance costs - the equivalent of $1,250 per month.

Ms Prince said tenants are opposed to terms in the lease such as the $1m general liability insurance coverage and having to gain Nassau Cruise Port’s permission to open another business at a New Providence resort.

She said: “One of the things that they want us to sign on the lease says if we signed the lease, if we have an existing business, they want to know where it is. And if we want to have another business, we have to get permission from them. There was no way that I would put my signature on something like that.

“They want everybody to get $1m worth of insurance, and we sign them as the beneficiary. If something happens to our products and our environment, we have to be responsible for it. That don’t make sense to me. Everything that they promised us they did nothing because they said they would get a group insurance and we would all pay a portion of it every month.”

The lease agreement seen by Tribune Business confirms that marketplace tenants cannot open a “competing retail shop” at any other New Providence or Paradise Island resort without the cruise port’s permission.

“The tenant agrees that, during the term of this lease agreement, it shall not own or operate, whether on its own, or in partnership, or other form of association with another, any competing retail shop in any other resort on Paradise Island or New Providence without prior written consent of the landlord, save and except those currently so owned and/or operated as listed” in an annex to the agreement, the lease document said. Those exceptions were not noted.

As for insurance, the lease stipulates: “The tenant shall procure, maintain and renew, at minimum, such general liability insurance, and at such limits of cover, from such reputable insurance as the landlord shall reasonably require and accept with a coverage level of at least $1m.

“In addition, the Tenant shall maintain builder’s insurance, fire insurance, liability and such other insurance as are reasonable and responsible in connection with fitting out and operating the leased premises with coverages for, among others, sprinkler leakage, waste water and water flooding with a coverage level of at least $1m.

“The tenant shall also take-out Contractors All Risk insurance with regards to the fit-up of the space and equal the value of the planned fit-out. The tenant shall name the landlord, its shareholders, affiliates and subsidiaries as additional insureds on such policies of insurance, and such insurance shall be primary and noncontributory with respect to the landlord.”

JOB OPPORTUNITY

Busy Optometry offce in New Providence looking for full time Optometrist. Must have Doctorate of Optometry degree from an accredited college of Optometry or trained at a college of Optometry from the UK. Must be licensed to practice in country of training. Must be profcient in OCT and Humphrey’s Visual Field.

opticalopportunity36@gmail.com

Employment Opportunity Accounts Clerk/Admin Assistant

The ideal candidate will have:

• Experience in accounts payable

• Experience using Quickbooks

• The ability to work well in a team

• The willingness to undertake any task assigned to them

• Provide accounting and clerical support to the accounting department

• Type accurately, prepare and maintain accounting documents and records

• Prepare bank deposits, general ledger postings and statements

• Reconcile accounts in a timely manner

• Daily enter key data of fnancial transactions in database

• Provide assistance and support to company personnel

• Research, track and restore accounting or documentation problems and discrepancies

• Inform management and compile reports/ summaries on activity areas

• Function in accordance with established standards, procedures, and applicable laws

• Constantly update job knowledge

Interested persons should send their resume’s and a cover letter to

PAGE 6, Thursday, July 20, 2023 THE TRIBUNE

FROM PAGE B1

hr353360@gmail.com

end of day July 31, 2023

by

Fund ‘first’ targeting $100m in five years

that the Strat Equity Fundif all targets and objectives are realised - could impact the economy at every level from job creation to greater returns for the investment bank’s clients.

Unaware of any existing private equity funds operating in the Bahamian dollar space, Mr Anderson said the Strat Equity Fund is targeting investments in ten-20 local companies that typically range in size between $5m to $10m.

“We think between $50m to $100m is reasonable in terms of the total assets under management for this fund,” he told Tribune Business. “I’m sure it may get higher than that, but as I sit here today I think a reasonable target in the next three to five years is to get up to that $100m.

“We believe that if we put $100m in equity into this market it’s a huge multiplier effect for the economy. I think if you look at a typical transaction, the banks are willing to put up 60-70 percent of bank loans against equity. If you inject $100m in equity, you get businesses able to take on another $200m in debt, so you will have $300m in combined debt and equity financing because banks are now willing to lend in this space.

“A $300m investment in this economy could make a big impact in terms of overall growth...... Turn that over multiple times with inventory, and it really has a huge multiplier effect putting equity in at the bottom. It’s really about the economy ultimately. The investors benefit by the investment hopefully becoming successful, but they also get a chance to buy into these larger, more profitable companies when they go public,” Mr Anderson added.

“Putting $300m into a $13bn economy, the multiplier effect of that $300m could easily be a 10-15 percent impact on the GDP of the country once that money gets put to work.”

While the likes of private equity and venture capital

firms abound in larger, more developed countries, they have been conspicuous by their absence in The Bahamas.

Private equity funds work differently from how traditional mutual and investment funds have operated in the domestic Bahamian capital markets. While the latter acquire shares in companies, these tend to be firms that are publicly traded and listed on the Bahamas International Securities Exchange (BISX), with positions often held for the long-term.

In contrast, private equity funds acquire shareholdings in private companies with the goal of turning these firms around, generating returns for their investors by making them more profitable and efficient before recovering the initial principal outlay by seeking an exit route for their investment.

This is often done by taking the firm public via an initial public offering (IPO), and the Strat Equity Fund will typically seek an exit after five to seven years.

Mr Anderson revealed that RF Bank & Trust had been working on the Strat Equity Fund, and the private equity concept in general, “for about 18 months” prior to its licensing by the Securities Commission being concluded in late 2022. He added that it was initially developed in response to the perceived urgent capital needs of many Bahamian businesses as they emerged from the devastation of COVID-19 lockdowns and other restrictions.

“The concept of the fund has been around for many years,” the RF chief confirmed. “The opportunity that COVID created, there was always expectation that as people came out of COVID there would be a need to rescue businesses, some would close down and people would want to sell out of their interests.

“The idea was there would be a significant change coming out of COVID, and there would be a need for people to build their businesses back

or take over businesses that they might be competing with. We’re putting back in equity to grow the economy. This is to help businesses who might not be generating the right amount of cash flow but, if given an equity injection, can come through this period and get into a cash flow generating position.”

Equity capital is often the hardest financing source for companies to locate and obtain. Acknowledging that all markets, including The Bahamas, suffer from shortages, Mr Anderson told Tribune Business: “Equity is the lifeblood of companies. It’s not just this market where it’s needed. It’s an essential component of businesses, and one of the biggest shortages.

“If we can find a significant source of equity it will have a significant impact on the economy. There’s a huge requirement for equity, and if we can make equity available for companies here it will make a massive difference to their growth and this economy’s growth. It will fill a huge void in the market for equity.”

Mr Anderson disclosed that the Strat Equity Fund has already closed its first private equity deal, buying into a Bahamian business, although he declined to name the company involved or provide further details.

“We currently have four projects we are working on,” he added, while conceding that the fund’s role and purpose will have to win acceptance among the private sector to become successful.

Given the number of family-owned businesses in The Bahamas, a number of whom will be grappling with succession issues, and there should be fertile ground upon which a private equity fund can grow. However, Mr Anderson added: “People are reluctant to take on equity partners because they fear they will lose control or do not want to share with others.

“They instead go to the bank to borrow money.... It has to overcome this reluctance to partner. If we

can find the right partners we can grow the business beyond most people’s expectations.” The RF president said the Strat Equity Fund’s goal is to identify businesses (and industries) with strong growth and expansion potential, and either acquire them or partner with their existing owners/investors to “scale up” if they can agree on the company’s future direction.

“It will be huge over time,” Mr Anderson said of the fund’s potential. “It takes a while for people to adjust to the fact they’re going to have a partner, and particularly an institutional partner. It’s unusual to have an institutional equity partner in your business, and people have to get their heads around what makes sense.

“We think as an institution we not only bring knowledge of how businesses work, but access to a broader range of financing options - bank loans, mezzanine financing. It has all the opportunities of broadening beyond the initial equity injection. This opportunity to partner with an institution like RF should be attractive to the market once they get their head around partnering. I think in time it will grow.”

Mr Anderson said the Strat Equity Fund is not a provider of start-up financing for new entrepreneurs, or micro, small and medium-sized enterprises (MSMEs), instead targeting established enterprises that are already operating but require more equity capital to get to the next level through expansion that creates extra jobs.

“The biggest problem we are having is people looking for equity are looking for $1m-$2m, and the minimum amount we are looking for is $5m equity participation and interest in the business,” he explained. “We’re

ending up with too many small people looking for equity. For us it has to be a certain size to make sense.

“We are receiving a lot of interest from small businesses but, from our side, we have to be disciplined with where we take our capital. We’re looking for more established businesses that have a business case that looks promising, where we understand the potential, and they are looking for $5m and above. At the moment, we think above $5m-$10m is a good area and makes sense. There’s a number of areas and businesses of size to put $5m of equity into.”

Mr Anderson said the Strat Equity Fund’s role is to act as “intermediary” between investors seeking higher rates of return and companies in need of equity capital. “The investors we are looking to come in and participate in the Strat Equity Fund are looking for returns in excess of 15-20 percent,” he told Tribune Business. “If investing in equity that will generally be the rate depending on the risk.”

The RF president also explained that the fund will be structured as a

segregated accounts company (SAC) with each investment held in a separate “cell” from the others. This, he added, will allow investors to select the firms they want their capital injected into, with the minimum investment set at $50,000.

The Strat Equity Fund will invest in a diversified range of industries, including technology, healthcare, consumer goods and hospitality, with selected firms needing to meet its corporate governance standards. “There is a clear need for additional equity capital in The Bahamas market to help fund and build younger companies,” said Jim Wilson, RF’s vicepresident of investment banking.

“The Strat Equity Fund will identify and provide equity capital to viable businesses and help them scale in a sustainable way. The fund will act as a catalyst to take early-stage businesses that don’t yet have the track record to get listed to a position where they can transition from private to public ownership via an IPO”.

THE TRIBUNE Thursday, July 20, 2023, PAGE 7

FROM PAGE B1

SOUTH AFRICA SAYS PUTIN WILL SKIP A JOHANNESBURG SUMMIT NEXT MONTH BECAUSE OF HIS ICC ARREST WARRANT

By GERALD IMRAY Associated Press

VLADIMIR Putin has agreed not to attend an economic summit in Johannesburg next month that will include China’s premier and other world leaders because of an arrest warrant by the International Criminal Court for the Russian president, South African authorities said Wednesday.

Russia and summit host South Africa reached a “mutual agreement” that Putin would not attend the Aug. 22-24 gathering, which brings together a bloc of developing economies known as BRICS, though he was initially invited, the office of South African President Cyril Ramaphosa said.

The development could be viewed as embarrassing for Putin, who is now expected to be the only leader of a country in the bloc not to attend.

Kremlin spokesman Dmitry Peskov said Wednesday that Putin “has decided to take part” in the summit via video link, without confirming if he had intended to attend the summit.

It ended months of speculation over whether Putin would travel to South Africa, which is a signatory to the Rome treaty that formed the International Criminal Court and therefore has the obligation to arrest the Russian leader if he sets foot on South African territory.

South Africa had given strong hints that it would not arrest Putin if he attended but had also been lobbying for him not to come to avoid the problem.

South Africa said as recently as last week that the Russian leader had been determined to attend, perhaps as a way to challenge

“I must highlight, for the sake of transparency, that South Africa has obvious problems with executing a request to arrest and surrender President Putin.”

President Cyril Ramaphosa

the ICC warrant, which Moscow has dismissed.

Moscow has showcased the BRICS alliance as an alternative to the West’s global dominance, but this year’s meeting has proved awkward for Putin following the ICC’s move in March to indict him for war crimes relating to the abduction of children from Ukraine.

Although Moscow dismissed the warrant, Putin has not traveled to a country that is a signatory to the ICC treaty since his indictment. Analysts have said that the public debate about whether the Russian leader would or would not travel to South Africa was in itself an unwelcome development for the Kremlin.

The South African government has strong political ties with Russia, but Putin’s attendance would have exposed it to possible diplomatic and legal repercussions.

South Africa’s main opposition party recently took the government to court in an attempt to compel it to arrest Putin should he travel to the country. The ICC treaty has also become part of South African domestic law, meaning the government could be taken to court in South Africa if it failed to honor its commitment to the international court.

Ramaphosa spoke with Putin by telephone this weekend and held more “consultations” with BRICS officials on Tuesday, Ramapohosa’s office said in a statement. Russian

Foreign Minister Sergey Lavrov would attend the BRICS summit in person to represent Russia, Ramaphosa’s office said.

Meanwhile, the leaders of all the other BRICS nations, including China’s Xi Jinping, would attend the summit, Ramaphosa’s office said.

Wednesday’s announcement comes a day after a court document was made public in which Ramaphosa said that any attempt by South Africa to arrest Putin would be viewed as a “declaration of war” by Russia. The affidavit made by Ramaphosa was part of the government’s response to the court challenge brought by the country’s main opposition party to compel it to arrest Putin.

“I must highlight, for the sake of transparency, that South Africa has obvious problems with executing a request to arrest and surrender President Putin,” Ramaphosa said in the affidavit. “Russia has made it clear that arresting its sitting president would be a declaration of war.”

However, Kremlin spokesman Peskov denied that.

“No one has indicated anything to anyone,” Peskov said. “In this world, it is absolutely clear to everyone what an attempt to encroach on the head of the Russian state means. So there is no need to explain anything to anyone here.”

PAGE 8, Thursday, July 20, 2023 THE TRIBUNE

RUSSIAN President Vladimir Putin attends a cabinet meeting via video conference, at the Kremlin in Moscow, Russia, Wednesday, July 19, 2023.

Photo:Alexander Kazakov/AP

CLIMATE GLIMPSE: Here’s what you need to see and know today

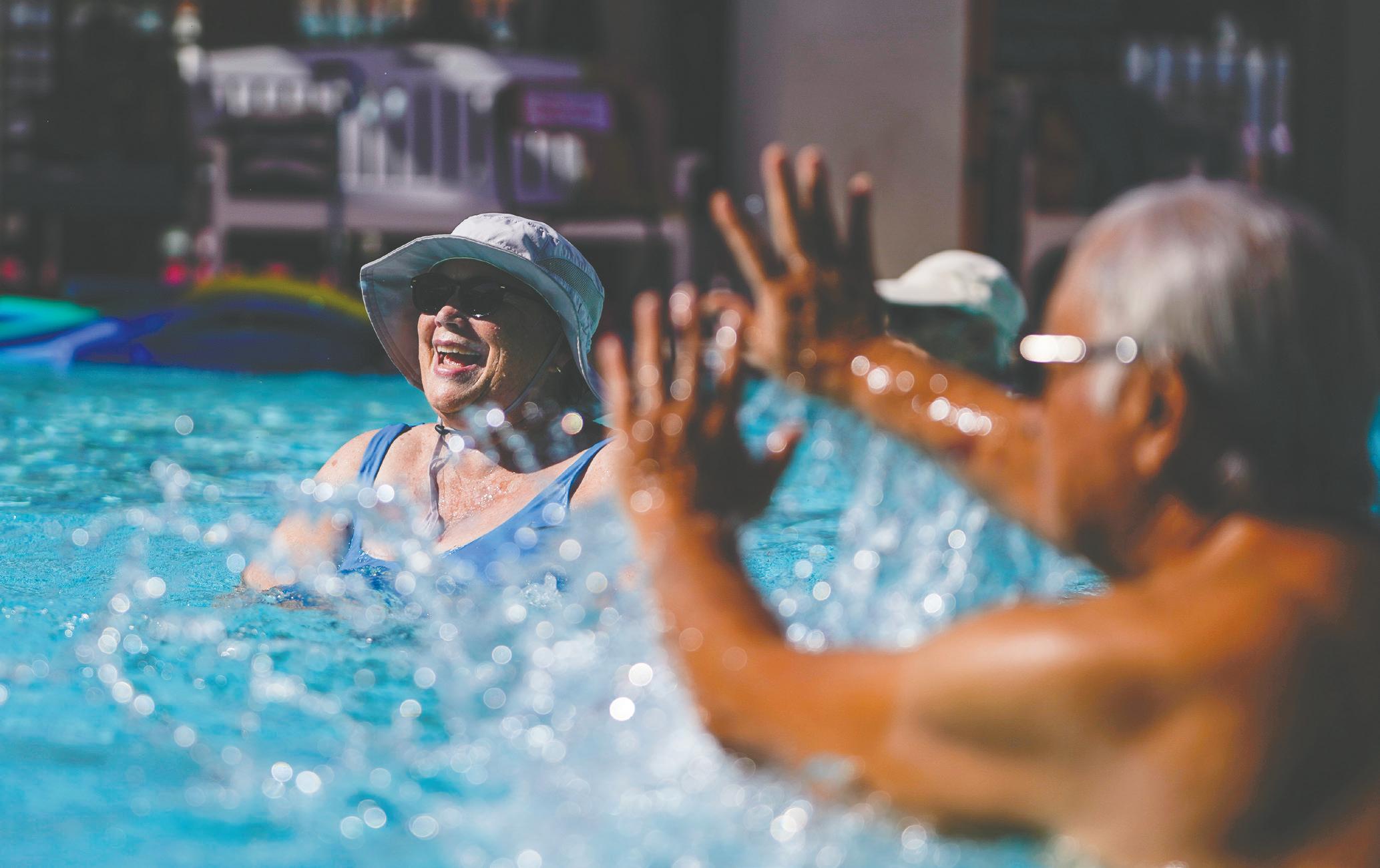

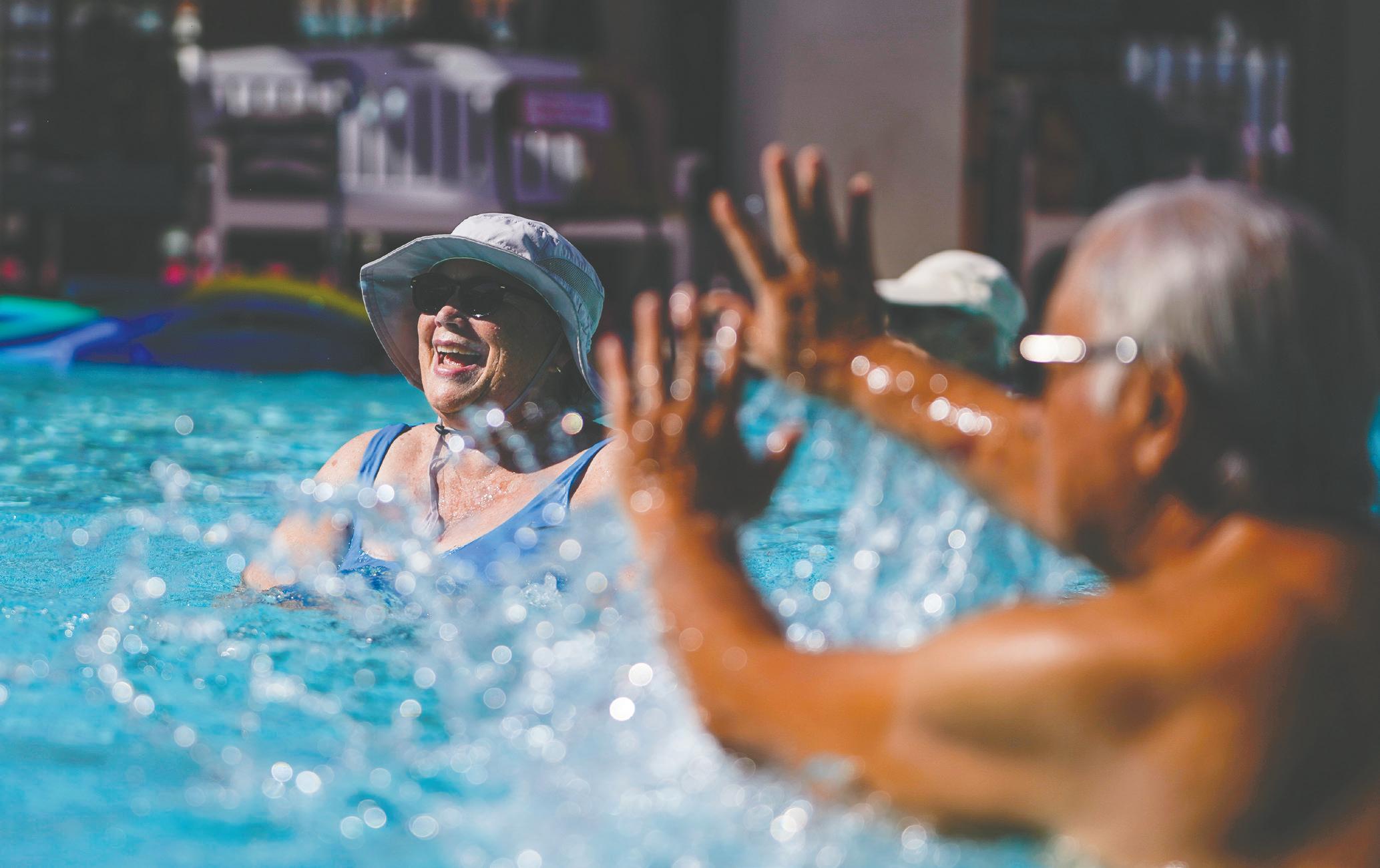

AS INTENSE heat batters much of the planet, people cool off however they can. In Pasadena, California, where Wednesday’s high was “only” in the mid-90s, seniors found relief — and some fun — in a morning swim class in this image made by Associated Press photographer Ryan Sun.

Elsewhere, things were more serious. As southern Europe bakes under a heat wave, firefighters in Greece continued battle Wednesday with wildfires near Athens that have prompted days of evacuations. Aircraft and crews from other countries were heading to join the fight. Heat in southern Greece was expected to grow worse later this week, approaching 44 Celsius (111 Fahrenheit).

Here’s what’s happening related to extreme weather and the climate right now:

• In Texas, crushing heat is raising concern for families with loved ones in state prisons that lack air conditioning. One woman blames her son’s death on excessive

Audit Services

� Purpose

heat.

• As destructive floods hammer different parts of

the globe, scientists say they have something in common: Climate change that has

storms forming in a warmer atmosphere with the result that extreme rainfall is

more frequent now. And they say additional warming will make it worse.

�e�uest for Tender� Internal Audit Services

The Bahamas Development Bank (“the Bank”) is seeking to appoint an independent service provider (“the service provider”) to design and execute an internal audit function on behalf of the Bank. The service provider �ill create a plan for, design and execute an internal audit program for the Bank.

The Bank invites eligible vendors to submit competitive �uotes for the provision of these services. �ailure to provide a �uote that meets the minimum specifications re�uired may lead to dis�ualification of a bidder from selection.

• The world’s two biggest climate polluters, China and the United States, met in Beijing to talk about climate change. China’s vice president told US climate envoy John Kerry that the country is willing to work with Washington to stem global warming, but needs the US to respect its views on a range of issues.

• Nigeria is looking at a food security crisis driven by conflict and climate change. Russia’s war with Ukraine imperils shipments of wheat to the West African nation, and a vicious heat-and-rain cycle worsened by climate change is decimating yields for Nigeria’s own farmers.

• As Canada’s summer of wildfires stretches on, Indigenous communities are among those hardesthit — far more likely to be evacuated than their share of the population suggests. • India, one of the most populous and climatevulnerable countries, is thinking and talking a lot about transitioning to cleaner energy.

by key personnel i.e. Partners, Directors, etc., and other team members, the proposed schedule for submission of progress reports, and follo� up timelines.

�eferences of �omparable �ngagements A list of references of similar or comparable engagements should be provided �ith the proposal. At least three (�) references should be provided and each reference must be clients retained for a minimum of t�e lve (��) months. A summary of the pro�ect and client names and contacts should be provided to enable the Bank to contact references if re�uired.

Applicants must declare any areas that may constitute conflict of interest related to this proposal

� Scope of �ork

The independent service provider �ill design, implement, and execute the internal audit function for the Bank. The service provider �ill meet �ith the Audit �ommittee and �xecutive �anagement to discuss the structure and intended design of the internal audit frame�ork The service provider �ill be responsible for designing the ne� frame�ork and developing an Internal Audit Policies and procedures to support it The service provider �ill also be responsible for development and execution of an integrated annual audit program for the function.

The service provider �ill provide a proposed plan of action to achieve the ob�ectives of the internal audit function. Internal Audit �unction Design and Implementation Services and deliverables expected include�

�. �eet �ith Audit �ommittee and �xecutive �anagement to determine suitable structure for internal audit unit function of the Bank

�. Development of the Internal Audit �harter.

�. Set ob�ectives and performance measurements for the internal audit function.

�. �evie� and advise on the �uality of the existing internal control frame�ork, including best practice reporting relationships.

�. �onduct an �nterprise �isk Assessment for the Bank

Development Bank (“the Bank”) is seeking to appoint an independent service provider (“the provider”) to design and execute an internal audit function on behalf of the Bank. The service create a plan for, design and execute an internal audit program for the Bank.

�. Development of risk assessment and audit methodology for the organi�ation, including identification of audit universe.

�. Develop an internal audit �ork program to cover all departments �ithin the Bank.

� Background

The primary purpose of the Bahamas Development Bank is to assist in the economic development of The Bahamas by providing financial and technical assistance in areas including Agriculture, �isheries, Tourism, Industry, �ousing and Business Development �or more information see� ���.bdb.gov.bs

�. �valuation, ac�uisition, and maintenance of audit tools and technology.

� Subcontractors

eligible vendors to submit competitive �uotes for the provision of these services. �ailure �uote that meets the minimum specifications re�uired may lead to dis�ualification of a bidder

� Terms and �onditions

�here a firm or company intends to submit a proposal, the re�uirements, and terms, including all instructions, re�uirements, and specifications, provided in this ��P should be revie�ed in their entirety

The Bank shall incur no liability in the case of failure of a proposing firm or company to understand the contents of the ��P. It is the service provider’s duty to properly understand and examine the ��P and re�uest any clarification or make any reasonable in�uiry and satisfy itself as to the completeness and sufficiency of its response.

If a proposer intends to subcontract some of the �ork to another company or individual for any reason, the Proposer must identify the �ork items that they intend on subcontracting, to �hom, and the experience and �ualifications of the organi�ation or individual. The Bank reserves the right to approve all subcontractors.

� Schedule of �ork and �xpected Deliverables

The Proposer should present a preliminary �ork plan outlining key tasks, schedules and anticipated start and completion dates for each deliverable �ithin the scope of �ork re�uested.

� �eporting and �ommunication

purpose of the Bahamas Development Bank is to assist in the economic development of The providing financial and technical assistance in areas including Agriculture, �isheries, Tourism, �ousing and Business Development �or more information see� ���.bdb.gov.bs

The Bank and its officials, officers, employees and advisors are not liable or responsible in any �ay for any costs, expenses, losses, damages or liabilities incurred in the preparation of a proposal in response to this ��P. This includes but is not limited to costs associated �ith preparing the submission of its proposals, costs associated �ith the undertaking of any due diligence, and any other costs associated �ith this ��P process �esponses to this ��P and any ackno�ledgement of receipt of proposal shall not constitute an obligation on the part of the Bank to a�ard a contract for any services or combination of services. �ailure of the Bank to select a contractor by �ay of this ��P shall not result in any claim �hatsoever against the Bank

�onditions

The Bank reserves the right, in its sole and absolute discretion, to re�ect any or all proposals in part or in full, �ithout assigning any reason. The Bank may, at any time, vary the ��P process or abandon the ��P process �ithout assigning any reason thereof and �ithout notice.

The Proposer �ill report directly to the Audit �ommittee, functionally, and to the �anaging Director, for administrative purposes. It is expected that the selected team �ill submit periodic progress reports �ith recommendations on mutually agreed upon dates throughout the engagement period. The Bank may re�uest additional reports over the course of the contract period.

�� Pricing Structure and �ees

Proposers should provide a separate financial proposal outlining all proposed fees and the proposed pricing structure to complete the �ork effort. The financial proposal should be itemi�ed by expected engagement deliverables and should be inclusive of any ongoing costs. The contracted rate and any necessary scope changes �ill be revie�ed by the Bank annually. The annual contracted fee �ill be paid on a �uarterly basis. �� �valuation �riteria

company intends to submit a proposal, the re�uirements, and terms, including all re�uirements, and specifications, provided in this ��P should be revie�ed i n their entirety incur no liability in the case of failure of a proposing firm or company to understand the ��P. It is the service provider’s duty to properly understand and examine the ��P and clarification or make any reasonable in�uiry and satisfy itself as to the completeness and response.

The Bank �ill consider the follo�ing factors in the evaluation and selection of proposals.

�. �ompleteness of Proposal�

The information provided by the Bank in connection �ith this ��P is for the sole purpose of this solicitation and is to be considered confidential. Any information learned by a Proposer in connection �ith this solicitation �ill not be revealed by such service provider or used for any purpose other than the preparation of their proposal.

This ��P shall be governed by the la�s of The Bahamas. Any legal action or proceedings arising out of or in connection �ith such terms and procedures shall be sub�ect to the exclusive �urisdiction of the courts of The �ommon�ealth of The Bahamas.

�. Appropriateness of Approach to �ngagement and�or �ethodology�

�. �uality and Depth of �esponse�

�. �ualifications and �xperience of �ey Personnel�

�. �uality of �eferences and Demonstrated �elevant �xperience in the Provision of Internal Audit Services�

�. �eputation of the �irm or �ompany�

�. �uality of Preliminary �ork Plan and Schedule� and

�. Pricing and �ee structure.

The Bank, in its sole discretion, may modify the re�uirements, terms, and conditions for this ��P

� �ontract Term

The initial contract period �ill be for t�o (�) years. The Bank reserves the right to extend the contract for �uality management, including updates, enhancements, and maintenance services.

� �onditions� information for applicants

These instructions are provided for general information for the preparation of the proposal. Proposals should be concise and contain the sections described belo� Proposals that fail to adhere to or comply �ith the prescribed format may be excluded from the evaluation process. The proposal should be submitted in �nglish and must include the follo�ing�

Proposal �etter All proposals must be submitted �ith a duly signed proposal letter, �hich should include the signatures of the individual or individuals authori�ed to legally bind the firm or company (“the authori�ed person”).

Business Profile The proposal must include an overvie� of the firm�company i.e. Business profile.

The profile must include�

o Type of Business (i.e. �ompany, Partnership, etc.)

o Date of incorporation�formation�

o

The Bank reserves the right to evaluate the proposals either by itself and�or in coordination �ith and�or by engaging any external consultants.

�� �ontract A�ard

officials, officers, employees and advisors are not liable or responsible in any �ay for any losses, damages or liabilities incurred in the preparation of a pr oposal in response to this includes but is not limited to costs associated �ith preparing the submission of its proposals, costs the undertaking of any due diligence, and any other costs associated �ith this ��P process ��P and any ackno�ledgement of receipt of proposal shall not constitute an obligati on the Bank to a�ard a contract for any services or combination of services. �ailure of the Bank contractor by �ay of this ��P shall not result in any claim � hatsoever against the Bank

The Bank reserves the right to make no a�ard, make a partial a�ard, make multiple a�ards, or to a�ard in aggregate or by line item in scope of services as determined by the Bank to be in its best interest, sub�ect to determination that the price proposal is fair, reasonable, and provides the best value to the Bank given the re�uirements of the pro�ect.

Appointment as a successful contractor shall be sub�ect to the parties agreeing to mutually acceptable contractual terms and conditions. In the event of the parties failing to reach such agreement, the Bank reserves the right to appoint an alternative service provider.

�� �ontract �ompletion �riteria

�here a contract results from this ��P, such contract �ill be considered complete �hen the Bank has approved and accepted all assigned contract deliverables.

�� Insurance �overage

The selected contractor is to provide professional liability insurance covering the services described in the contract.

�� Deadline The due date for submission of the tender is ��th �uly, ���� �ate submissions �ill be returned unopened to the sender.

Please send all tenders clearly marked “Internal Audit Service Proposal” to

THE TRIBUNE Thursday, July 20, 2023, PAGE 9

�e�uest for Tender� Internal Audit Services �uly ��th ���� Sub�ect� Internal Audit Services

of �ork The proposing firm

company should respond to all re�uirements outlined in the re�uested scope of �ork in a comprehensive and clear manner. This should include any information or supplemental material that may clearly outline ho� the scope of �ork �ill be approached and ho� the team �ill address all re�uirements specified. Proposed Schedule of �ork The proposal should include a schedule of �ork �ith proposed timelines for the specified �ork period of one year. The schedule should include �ork to be done by key personnel i.e. Partners, Directors, etc., and other team members, the proposed schedule for submission of

�eferences of �omparable �ngagements A list

references

similar

engagements should

provided �ith the proposal. At least three (�) references should be provided and each reference must be clients retained for a minimum of t�e lve (��) months. A summary of the pro�ect and client names and contacts should be provided to enable the Bank to contact references if

Address of registered office� o �ame of key contact person and address for communication (i.e. phone contact and email)� o Business Status� and o The name and position of key personnel (Partners�Directors����) and team members along �ith an attachment of their �ualifications, including professional licenses or certifications (i.e. �urriculum �itae) An �xecutive Summary of the proposal should also be provided for ease of reference. Scope

or

progress reports, and follo� up timelines.

of

of

or comparable

be

�mail�

Person� Submit

at BDB’s

address.

careers�bdb.gov.bs

by hand in the tenders’ box

reception, add

complaints

tenders

refer

�omplaints section on the BD B �ebsite.

�or any

regarding the

please

to the

STATE DEPARTMENT SANCTIONS 2 FORMER SALVADORAN LEADERS, DOZENS OF OFFICIALS IN CENTRAL AMERICA

MEXICO CITY

Associated Press

THE State Department announced Wednesday it was imposing sanctions on two former Salvadoran presidents and dozens of other officials and judges in Central America.

The report said that those sanctioned “have

knowingly engaged in actions that undermine democratic processes or institutions, significant corruption or obstruction of investigations” into corruption in El Salvador, Guatemala, Honduras and Nicaragua.

The extensive list, which also includes heads of banks, judges and

high ranking officials, underscores the depth of corruption across the region.

Chief among the names on the list was Mauricio Funes, president of El Salvador between 2009 and 2014 who was recently sentenced to prison for 14 years for negotiating with the gangs and six years for

tax evasion. Funes’ successor, former president Salvador Sánchez Cerén, was also sanctioned for “significant corruption by laundering money” while he held the position as vice president.

Corruption has been a hot button issue in Central America for years, fueling distrust in institutions and regularly cited as one of the root causes of migration to the United States, something President Joe Biden has sought to stem.

It has become a key talking point in Guatemala’s

current tumultuous election cycle as the political establishment attempts to quash competition, and it frequents the discourse of populist El Salvador President Nayib Bukele, who has adopted the catchphrase “there’s enough money when no one steals it.”

Despite accusations by the Biden administration that Bukele also negotiated with gangs, and civil society raising alarms that the millennial leader has been taking steps that eat away at the country’s democracy, Bukele’s name was not on

the list of those sanctioned. Funes, the ex-president of El Salvador, raged against the sanctions on Twitter, saying sanctioning El Salvador’s two previous leaders from the same party that Bukele once broke with “is a clear backing by the US for Bukele’s election.” He called US criticisms of Bukele’s plan to seek re-election “lukewarm” despite the move being a clear violation of their country’s constitution. He suggested that it was “convenient” for the US for Bukele to continue in office.

PAGE 10, Thursday, July 20, 2023 THE TRIBUNE

EL Salvador’s President Mauricio Funes stands in the National Assembly before speaking to commemorate the anniversary of his third year in office in San Salvador, El Salvador, June 1, 2012. The State Department announced Wednesday, July 19, 2023, it was imposing sanctions on two former Salvadoran presidents including Funes, and dozens of other officials and judges in Central America.

Photo: Luis Romero/File

TORNADO DAMAGES PFIZER PLANT IN NORTH CAROLINA

RALEIGH, North Carolina

Associated Press

A TORNADO heavily damaged a major Pfizer pharmaceutical plant in North Carolina on Wednesday, while torrential rain flooded communities in Kentucky and an area from California to South Florida endured more scorching heat.

Pfizer confirmed that the large manufacturing complex was damaged by a twister that touched down shortly after midday near Rocky Mount, but said in an email that it had no reports of serious injuries.

A later company statement said all employees were safely evacuated and accounted for.

Parts of roofs were ripped open atop its massive buildings. The Pfizer plant stores large quantities of medicine that were tossed about, said Nash County Sheriff Keith Stone. “I’ve got reports of 50,000 pallets of medicine that are strewn across the facility and damaged through the rain and the wind,” Stone said. The plant produces anesthesia and other drugs as well as nearly 25% of all sterile injectable medications used in U.S. hospitals, Pfizer said on its website. Erin Fox, senior pharmacy director at University of Utah Health, said the damage “will likely lead to long-term shortages while Pfizer works to either move production to other sites or rebuilds.”

The National Weather Service said in a tweet that the damage was consistent with an EF3 tornado with wind speeds up to 150 mph (240 kph).

The Edgecombe County Sheriff’s Office, where part of Rocky Mount is located, said on Facebook that they had reports of three people injured in the tornado, and that two of them had lifethreatening injuries.