$5.75 $5.63 $5.80 $5.71

Super Value in halt over ‘reached the limit’ orders

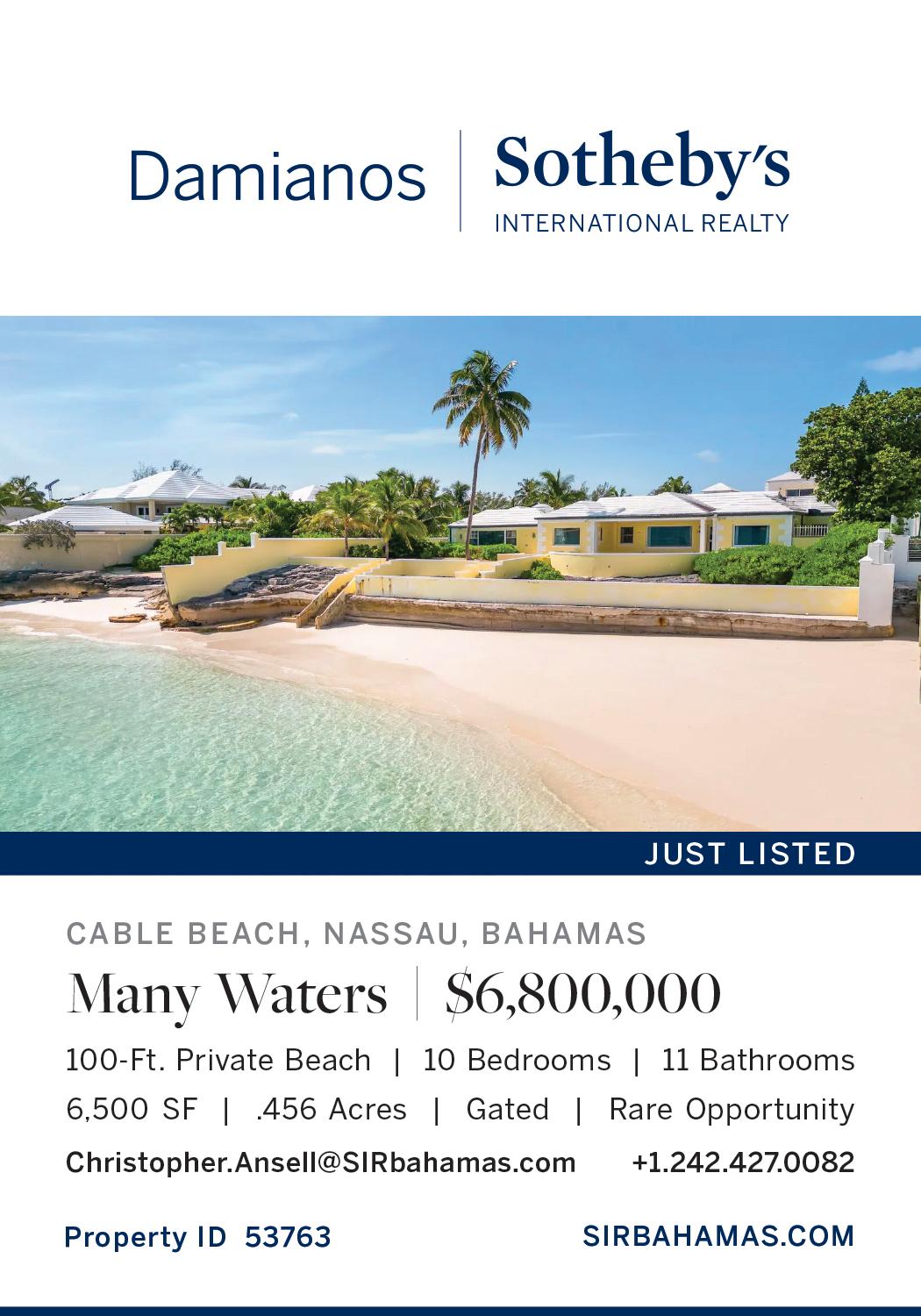

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netSUPER Value will stop buying products whose prices have “reached the limits” of Bahamian affordability, its owner disclosed yesterday, while revealing that soaring energy bills have “siphoned off 5 percent of our sales”.

Rupert Roberts told Tribune Business that suppliers must

realise “there’s only so much the public are prepared to pay” as he revealed that the 13-store supermarket chain had stopped purchasing one-gallon bottles of Hellmann’s mayonnaise because consumers had stopped buying it because of the price.

Keenly aware of the impact escalating food prices, and the ongoing cost of living crisis, are having on Bahamian families, he added that Super Value’s buyers can no longer raise prices “without my consent or joint

agreement” given the extent of post-COVID hikes.

Mr Roberts also said Bahamas Power & Light’s (BPL) soaring electricity rates, which are projected to peak this summer as the utility seeks to reclaim at least $90m in previously under-recovered fuel costs, are taking an ever-increasing bite of consumer incomes and spending power as shown by a recent dip in Super Value’s sales which he attributed to rising energy prices.

Cruise port ‘not unreasonable’ over tenant expansion plans

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

NASSAU Cruise Port will “not unreasonably withhold” permission for any of its Marketplace tenants to expand their business by opening another outlet in a New Providence resort, its top executive has pledged.

Michael Maura, addressing concerns that a clause in the vendors’ lease agreement with Nassau Cruise Port is tantamount to a

‘restraint of free trade’, told Tribune Business in a recent interview that the Prince George Wharf operator only wants “to understand” what a vendor’s expansion plan may be so that it does not detract from the overall effort to downtown Nassau’s waterfront. He spoke out after concerns were voiced over a lease clause that stipulates marketplace tenants cannot open a “competing retail shop” at any other New Providence

or Paradise Island resort without the cruise port’s permission.

“The tenant agrees that, during the term of this lease agreement, it shall not own or operate, whether on its own, or in partnership, or other form of association with another, any competing retail shop in any other resort on Paradise Island or New Providence without prior written consent of the landlord, save and except those currently so owned and/or operated

Away from BPL, international developments are threatening to further increase food costs for already hard-pressed Bahamian consumers. With Russia once again refusing to permit Ukrainian grain exports through the latter’s Black Sea ports, India late last week sparked fears of a global rice shortage by banning exports of its largest export category, non-basmati rice.

Insurance cuts ‘false economy’ despite 26year high premiums

as listed” in an annex to the agreement, the lease document said. Those exceptions and the annex were not enclosed.

Yvette Prince, president of the Nassau Cruise Port Tenant Association, which includes Marketplace vendors, voiced strident objections to this clause.

“One of the things that they want us to sign on the lease says if we signed the lease, if we have an existing business, they want to know where it is. And if we want to have another business, we have to get permission from them. There was no way that I would put my signature on something like that,” she said last week.

SEE PAGE B3

Contractors chief: No to permit double standards

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE BAHAMIAN Contractors Association’s (BCA) president yesterday called for “greater transparency and management” in the work permit process amid the ongoing controversy over “irregularities” involving Chinese construction workers.

LEONARD SANDS

Leonard Sands told Tribune Business it was vital that the Immigration laws are applied evenly, and that there are no double standards where the rules are different for certain developers and contractors, after it emerged that only three of the 65 Chinese workers found at the British Colonial could produce identity documents when asked by officials.

Speaking after it was revealed that Immigration officers were instructed to “stand down” less than one hour after they began an enforcement operation to determine whether the Chinese were in The Bahamas legally, and had the necessary work permits, the BCA chief said the revelations

SEE PAGE B4

Fidelity chief’s ten-point plan to $50m profitability

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netFIDELITY Bank (Bahamas) president has set out what he describes as a ten-point plan to seizing market share and more than doubling annual profits to $50m by its 50th anniversary.

Gregory Bethel, writing in the BISX-listed

institution’s just-released 2022 annual report, said the bank has identified its “priorities” as greater automation for account opening, loan applications and deposit administration as well as total digitisation so that customers can interact with it via virtual platforms.

Besides upgrading the existing digital platform, which includes automated

teller machines (ATMs), online and mobile banking applications and its website, Mr Bethel said opening offices in Exuma and Eleuthera is another core focus. Employee share ownership, as a means to attract and retain the best staff, is also an element in the plan.

Finally, Mr Bethel said Fidelity Bank (Bahamas) is exploring the launch

of corporate and private banking units, as well as the introduction of a client relationship management (CRM) tool “to enhance the ability of the bank to ‘mine’ and ‘harvest’ customer data and facilitate targeted marketing”.

Mr Bethel added: “Digital banking, credit cards, business loans, merchant

SEE PAGE B2

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netBAHAMIAN homeowners and businesses have been warned that cutting, or dropping, property catastrophe coverage will be “a false economy” in the face of 26-year record-high insurance costs.

Tom Duff, who is retiring as Insurance Company of The Bahamas (ICB) general manager after 26 years in the post, warned clients in the company’s just-released 2022 annual report that while they may save premium dollars they run a huge risk of becoming

“financially crippled” if their property assets are devastated by a Hurricane Dorian-style storm.

Acknowledging that the affordability of insurance is becoming an increasing concern, with reinsurance costs at their highest-ever level during ICB’s existence, Mr Duff wrote: “The cost of catastrophe reinsurance has risen quite dramatically for 2023 and, as a result, customers will be faced with an unwelcome increase in their renewal premiums.

“Although some may be tempted to cancel or reduce cover, doing so may

SEE PAGE B5

ARTIFICIAL INTELLIGENCE IS ‘GREAT BENEFIT’ DESPITE RISK OF ABUSE

By YOURI KEMPBAHAMIAN technology executives yesterday hailed the evolution of Artificial Intelligence (AI) as “a great benefit for society” even though there is a risk of abuse by bad actors.

Scott MacKenzie, Cloud Carib’s chief executive, told Tribune Business that AI - in common with any technology - can be harmful to society despite the advantages it potentially offers.

“AI can do a great benefit for society. I see technology as a tool, and if it is widely used then it’s a

benefit to society, but if bad actors use it, it’s a detriment to society,” he added. The world is a “long way” from AI replacing human beings in the workplace, and its full impact on society and the economy may not be seen for another 10 years at least. Describing the transition to AI, Mr MacKenzie said: “There’s a time in the future called the singularity, and the singularity is when a computer is smarter than a human. Then the second that occurs, that one computer will then be smarter than all of humankind within a very short period of time, which is then called super intelligence.”

The “path between artificial intelligence to artificial general intelligence” is when jobs will be impacted, and before AI can become fully sentient. “People predicted that nuclear bombs would blow up the whole world and we’d all be dead now. I grew up in the 1970s where we all had to duck under the table and things like that. But I think AI is like anything. Providing people act in good faith towards each other, I think it’ll be a great benefit,” Mr MacKenzie said.

AI-related fears are not that different to the concerns raised over the Internet’s evolution more than 30 years ago, when

there were numerous reviews and predictions that it could negatively impact society. “AI will probably be the same type of thing in that some harm will get created. But, hopefully, there’s enough good people out there that will make sure that it’s shaped society in a positive way,” Mr MacKenzie added.

Philip Darville, owner/ operator of SolveIt Bahamas, said any new technology should be “used as a supplement” and not to replace humans, particularly in academia. “What schools should do is implement it in their standard protocols or learning methodology,” he added.

“So let’s look at how human elements are compared to automated elements, and be able to use the differential as a teaching method to that. If the AI is the clean-up content, then why can’t the human element do just as good?

I don’t think they should look at it as discouraging that people are going to use it to write full essays for them. But I think it should be used as a way to improve the way humans write in general.”

Tools such as AI are a “positive” thing, Mr Darville said, because the formal method is for educators to ask students to write essays without performing

the task for them. AI can add value because it can help students form essays before they ultimately have to conduct the final edit.

“AI is important to aid in academics and should not be looked at as an evil thing that’s going to help people how to cheat,” he added.

“It’s not just about academics. It’s about businesses, too, because AI is really where the shift is going to make the most impact in utilising AIbased processes to maybe replace the human-based element from an entry level perspective. So CSRs can all become a web-based component.”

Retailer doubles summer internship to 20 students

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN retailer

yesterday disclosed it is doubling its summer intern programme to 20 persons amid the economy's strong post-COVID rebound.

Martha Wallace, owner/ operator of Janaees Uniform Centre, told Tribune Business this is the first

time the company has taken on such a large number of interns. “We have done this summer programme for years, and a friend of mine said that we need to start letting the public know exactly what we’re doing because a lot of people don’t know what we’re doing for the community," she said.

“We have 20 students now in our summer programme, and it has

nothing to do with the Government’s summer programme. It’s only to do with Janaees Uniform Centre. We are teaching the interns work ethic and how to save their money, teaching them how to give customer service. We also teach them about punctuality and things of that nature.”

The Janaees summer intern programme has been a company staple for more than a decade, with one

break during the COVID19 pandemic, but was restarted in 2022 and has this year been expanded to its largest ever. “This is a very, very costly venture. Last year, we had a challenge whereby the pandemic was not fully over and we had a line outside because we can only allow a certain quantity of persons in at a time," Ms Wallace said.

Fidelity chief’s ten-point plan to $50m profitability

FROM PAGE B1

acquiring services and electronic banking, along with a new professional client programme that will comprise a VIP loan product and expansion of credit to the private sector are the foundations for priorities nine and ten.”

The latter refers to launching the corporate and private banking units, and he said: “The bank has an opportunity to take market share from other financial institutions during the next

five years. In other words, this is the path to annual net income of $50m by the 50th anniversary of the bank.”

Mr Bethel, though, told Fidelity Bank (Bahamas) shareholders that the institution has seen a decline in revenues from traditional loan and credit facilities as Bahamians continue to struggle with the postCOVID cost of living crisis along with the Government. And he warned that tax increases may have to be considered to dig The Bahamas out of its fiscal crisis by

maintaining the confidence of lenders and investors.

“The Government of The Bahamas, faced with substantial increases in expenditure and national debt, must now place greater emphasis on keeping its finances in line with prudential norms, or risk undermining the confidence of the lenders and investors which buy the debt securities issued by the Government of The Bahamas, and effectively fund its operations and activities,” Mr Bethel warned.

“Greater national debt levels are no longer appropriate now that the cost of servicing the national debt is more significant in the national Budget. External national debt is even more costly, as interest rates have been raised in the US and Europe in an effort to combat the widespread threat of inflation.

“Although unpopular, tax increases and/or tax collection efficiency are better alternatives than losing the trust of lenders and investors, not to mention credit

“Even though we put up the tent and we would have offered water, we still had some customers who were not so pleased because they had to wait on a line. So, therefore, I said I will also increase the amount of students that we would bring on this year.”

Customer traffic is heavy at Janaees in the back to school run-up, with lines snaking around its property even during

rating downgrades by the international rating agencies,” he added. “Bahamian residents commonly report or opine that their financial health has deteriorated. In the face of elevated inflation, most persons are impacted by a higher cost of living with no proportionate increase in income and little, if any, savings.

“Many persons are saying ‘I am barely surviving’ or ‘I am finding it difficult to meet my obligations’. Therefore, against the backdrop of all the issues previously mentioned, the bank has seen a reduction in the rate of growth in its

the non-pandemic years. The intern period will last until August 25, with the students involved rotated periodically. "A lot of children are in need, and while they are in need to help their parents we would also want them to be saving their funds. Because we don’t pay cash, we want you to have a bank account so you can start your savings early,” Ms Wallace said.

traditional banking products, especially loans and other credit facilities.

“The Bank has sought to offset this experience by offering new value -dded service offerings, including credit cards and merchant acquiring services, to businesses and individuals. Additionally, the bank has invested significant sums in information systems and personnel for these new lines of business and sources of revenue, and expects the full and consistent return on its investment in the next two to three years.”

PINTARD: BPL 'WEIGHS DOWN' BUSINESSES

By FAY SIMMONS Tribune Business Writer jsimmons@tribunemedia.netTHE OPPOSITION'S leader yesterday charged that Bahamas Power and Light (BPL) is in "crisis" and "weighing down" businesses

Michael Pintard, also the Marco City MP, told the House of Assembly that the state-owned utility is "saddling" Bahamian businesses with high electricity bills and questioned whether the Davis administration has the capability to resolve the problem Speaking during the debate on the Inter-Parliamentary Union (IPU) resolution, he said: “As we look at the IPU objective of addressing the issue of climate change, one cannot help but think about how important utility companies are…and in The Bahamas, we have one that is in crisis.

“We have one that is under-resourced. We have one that's presided over by a minister that's lost the moral authority to continue to preside over its affairs. We have one that is saddling Bahamian residents and businesses with exceptionally high costs of electricity.”

Mr Pintard said it was vital that The Bahamas liaise with other countries to help resolve BPL's financial issues after its previously-proposed $535m rate reduction bond (RRB) refinancing has now been shelved for the foreseeable future.

He said: “In the course of our participation in the IPU, it is important for us to talk with other jurisdictions to see how they are dealing with retiring legacy debt that BPL has, raising some $535m or thereabout.

“As we join the IPU, we join with you in having conversations with our

colleagues around the world to find out how they are coping with this albatross that is around the necks of Bahamian businesses and residents, and these costs that are weighing us down.”

The Opposition leader said that in addition to addressing BPL’s legacy debt, the utility must also tackle the infrastructure woes that have caused frequent power outages.

Mr Pintard again criticised the Davis administration for not preparing a strategic plan to lower to cost of electricity as it had promised to do within its first 100 days. He said: “Alas, we are trapped with a government that promised that within the first 100 days it would pay attention and review all systems at the utility company, and come up with a strategic plan on how to lower electricity. We have gone in the opposite direction and businesses are being weighed down.”

Air traffic optimistic on industrial deal signing

By FAY SIMMONS Tribune Business Writer jsimmons@tribunemedia.netBAHAMIAN air traffic controllers say they will be signing an industrial agreement shortly after major issues in the contract negotiations were resolved.

Hinsey McKenzie, the Bahamas Air Traffic Controllers Union’s president, said: “As you’re aware, we were dealing with our industrial agreement for the past year. It was only supposed to take one month.

It’s now more than 13 months; 14 months later.

“The issue was financial.

It dragged on and on and on until up to April of this year when we met with the Prime Minister. We expect to sign soon. Hopefully they

will get out of the meeting and call me and say: ‘Well, we agreed, so come in and get paperwork done.”

Mr McKenzie attributed the delay in finalising the industrial agreement to executives not agreeing to extend the salary scale. He added that the union had settled the issue of salary and allowance amounts earlier in the negotiations, but hit a stalemate when discussing the scale.

He said: “We were dealing with percentage. The Prime Minister said no, let’s deal with increments. We agreed with him; we went with increments. But the problem is the chairman and her [directors] did not want to extend the scale. That was a problem with the industry agreement; that’s why we’re still

waiting. But late yesterday, they have agreed to extend the scale.

“The scale was the problem. So because people were at the top of the scale, they would only get a lump sum instead of getting an additional increase with their increment. That’s why we told them we couldn’t accept it. We have accepted the salary, we accepted the allowance, but the only thing that was the problem was extension of the scale.”

Mr McKenzie said the union signed the last industrial agreement even though it did not extend the salary scale, but could not allow a new deal to proceed without amending the terms accordingly. He added that with the anticipated increase in air traffic over the coming months,

Lynden Pindling International Airport (LPIA) would be in “trouble” if negotiations were not successfully completed.

“We could not accept. They come back again, wanting to give us the same thing, which was foolishness. No salary increase because they want to keep you on top of scale,” Mr McKenzie said. “We seem to be pretty much in the driver’s seat for now. But if it was not done, you can expect some trouble at that airport. Reason being, the deputy prime minister is saying at least nine new airlines coming in, nine.

“So if you having more airlines come here, and that ain’t even the executive jets which comes in here for the winter....... So they know what’s coming, believe me,

they know what’s coming. I expect my contract to be signed without any problems coming forward so no further ado about that.”

Nadia Vanderpool, president of the Union of Public Officers, which represents line staff at the National Insurance Board (NIB), said both management and the Board appear reluctant to resolve numerous issues it has raised. She added that a meeting is scheduled to further discussions with executives, and is hopeful some matters will be resolved.

Ms Vanderpool said: “We, too, are experiencing issues with our executive management with them not seeking to resolve many of our grievances and issues within our membership body. And it’s the simplest

CRUISE PORT ‘NOT UNREASONABLE’ OVER TENANT EXPANSION PLANS

FROM PAGE B1

Mr Maura, though, said Nassau Cruise Port was investing heavily in promoting the Marketplace tenants’ business to visitors and positioning them at “the front door” of the 4.2m cruise passenger arrivals it expects to accommodate in 2023. It is also providing the first year rent-free, had brokered a deal for all to secure general liability insurance at “minimal cost”, and had invested heavily in ensuring all tenants offer authentically Bahamian products to tourists.

Indicating that the cruise port did not want this effort disturbed through a Marketplace Tenant opening a similar, or competing, outlet in a New Providence hotel that offers the same products, thereby drawing stopover tourists away from visiting downtown Nassau, Mr Maura said: “The requirement, as outlined in the lease, is that a tenant that is operating at the port that wishes to open up the same store in another location simply has to come to us as landlord and make as request.

“The company will not unreasonably object. That’s the way it works. The question is the ‘why’. From our perspective, specific to the

Marketplace tenant group, we are providing assistance to help those folks get established and develop, enhance and improve their individual brands. We’re doing that by positioning them so close to the front door of 4.2m cruise passengers for 2023 and 4.6m for 2024.

“We’re helping them out with Small Business Development Centre (SBDC) grants up to $20,000 to fitout their spaces. We are undertaking promotional campaigns to highlight that operators in that space are offering authentic Bahamian products, and promoting that to cruise passengers and people coming into that space,” Mr Maura continued.

“The first year, they are operating rent free. The

second year is reasonable, and we feel that we’re doing a lot to promote their brand. A big part of the overall project is to improve the destination of downtown. What we want, and our hope is, that people come downtown to go and see the tenants as opposed to going a hotel some place to see that tenant.”

The Nassau Cruise Port chief emphasised that the Prince George Wharf operator, which is 51 percent Bahamian owned by a combination of the investors in the Bahamas Investment Fund and the Yes Foundation, will not stand in the way of Marketplace tenants seeking to grow and expand by increasing their number of locations.

“We obviously support and applaud the entrepreneurial spirit of all Bahamians, and don’t have any intention of being unreasonable in terms of someone trying to grow and expand their business,” he told Tribune Business.

“We’d like to understand, so that what we don’t do is

harm the collective effort to revitalise the downtown waterfront.

“We have no intention of being unreasonable to someone’s desire and passion, and them investing in their business to grow and develop their business. You’re getting into business looking to get a return on your hard work, creativity and ingenuity. That’s to be applauded and supported. We’d like to understand what the plan is and, per the lease, permission will not be unreasonably withheld.”

The Nassau Cruise Port, in its previous response to other Marketplace Tenant concerns, said: “To alleviate the financial burden on its Marketplace tenants, the Nassau Cruise Port is providing one year rent-free to leaseholding tenants. This unprecedented initiative allows these small business owners to focus on their growth and development without the immediate pressure of rent expenses.

“The waiving of rent for a year also allows tenants to adjust their

authentic products and nonBahamian product offerings to be better aligned with demand. The rent waiver gives the tenants an opportunity to refine their products and promote their unique artistic offerings. In addition, tenants were only required to pay a security deposit, not first and last month’s rent.

“Nassau Cruise Port [has also] brokered a deal to provide liability insurance coverage for each tenant at Nassau Cruise Port for a minimal cost, saving time, money and effort and ultimately benefiting all of the tenants.”

of issues. We’re not understanding exactly what it is; why we can get these issues resolved.”

“We have a meeting schedules and we are very hopeful, anticipating that after this meeting we will get the matters that are now presently on the table resollved. Because we have another list to go we have to do it in phases. That’s how many grievances we have…we can do it all at one time.”

Busy

Optometry offce in New Providence looking for full time Optometrist. Must have Doctorate of Optometry degree from an accredited college of Optometry or trained at a college of Optometry from the UK. Must be licensed to practice in country of training. Must be profcient in OCT and Humphrey’s Visual Field.

Contractors chief: No to permit double standards

and ensuing controversy were “no surprise” for the industry given similar situations that have occurred previously.

While conceding that the Association cannot complain when all proper laws and procedures are followed in the granting of construction work permits, Mr Sands nevertheless warned the Davis administration and its successors that by “continuing to export” building work they are effectively denying Bahamian contractors and skilled tradesmen the chance to “earn a living” in their own country.

He revealed that, just prior to talking to Tribune Business, he had been speaking to a husbandand-wife team who own a heavy equipment and engineering company who had complained about a lack of work for the past two years because they were having

to constantly compete with machinery bring brought into The Bahamas that they can provide.

“What is required is that there has to be an appreciation that an individual has the right to work in his own country, and if we continue to export the opportunities, we are saying that we don’t care about the ability of our citizens to earn an income,” Mr Sands told this newspaper. “That’s the larger underlying concern.

“A minute before you called I was on the phone with a contractor and his wife who spent their entire savings putting together a company in the heavy equipment and engineering field. They were complaining they have not had work for the last two years. They go up and down, trying to rent the heavy equipment that they own, but are faced with the same equipment being brought into the country.

“They have to pay to maintain it, keep it working, and it’s not being rented out. They’re asking: How do we get work? This is one company calling, and another one calling and another one calling. They’re all saying the same thing. They cannot get a job. The equipment is going to seize up, become rotten and they will have to lay-off staff.

“They’re legitimate contractors, members of the Association, pay taxes, keep up with VAT but every day money is going out and not coming in. It’s unfair. Our hope is that, if all things are equal, the cream rises to the top and we’ll be able to work and make a living.”

Keturah Ferguson, the Immigration director, in a January 18, 2023, letter to Cecilia Strachan, the Ministry of Labour and Immigration’s permanent secretary, wrote that her department’s enforcement

team received directives from their minister, Keith Bell, to discontinue the British Colonial Hilton operation some 59 minutes after it had begun. Mr Bell “indicated that this request” came from Chester Cooper, who was then serving as acting prime minister. If accurate, the memorandum indicates that China Construction America (CCA), the British Colonial’s owner, and which likely brought in the Chinese workers to work on the resort’s renovation, reached out almost immediately to members of the Davis Cabinet to have Immigration called off - something that appears to have happened with remarkable speed.

This was despite Ms Ferguson describing the 65 Chinese nationals as a potential “security breach” because Immigration was unclear as to who the 62 were, and how they arrived in The Bahamas. Mr Sands yesterday voiced concern

over whether the law governing work permits and any infractions, and accompanying policies, were being evenly applied to all developers and employers with expatriate labour.

“I would hope the law is consistent and, if not, something will be done about it because everybody should be subject to the same criteria whether in the Act, policy or Heads of Agreement. It should be consistent,” he argued.

“I cannot speak in this instance [the British Colonial] as to whether or not it has been followed. That’s for someone else to determine. I hope it was followed because everyone else has to comply with the same guidelines.

“We have developers, some doing developments, in our Association doing developments and, if they have work permit holders, they are asked to keep them current and make sure their permits do not

lapse. It would help if every developer is held to the same standard. It would be unfair to others who have to make sure their work permits don’t expire.”

Describing the British Colonial situation as “very, very concerning”, Mr Sands declined to pass judgment after the Prime Minister’s Office last night released a statement saying it would investigate the situation and address any concerns. “It just underscores the lack of transparency and management of the granting of permits,” he told Tribune Business.

“It’s how we manage it. We can understand it [the issuance of work permits] has to happen. It will not change. The question is how we manage it and monitor it to make sure the law is being followed. That’s as much as we can ask. Once the law is followed all we can do is cry about loss of opportunity but that’s as far as we can go with it.”

Super Value in halt over ‘reached the limit’ orders

FROM PAGE B1

The southern Asian nation accounts for 40 percent of global rice exports, and its action - in a bid to calm its own domestic prices - has spared rice panic-buying by some Indian-Americans while more than tripling the cost of a 20-pound bag from $16 to almost $50 in some stores. Vietnam, the world’s third largest rice exporter, has this week seen its own prices hit their highest level in more than a decade due to India’s actions and the imminent cut-back in global supplies.

Both grain and rice are critical food staples worldwide and for most, if not all, Bahamian families so it is likely just a matter of time before these globallevel impacts are felt at home given this nation still imports all it consumes.

Philip Beneby, the Retail Grocers Association, yesterday suggested that “if you want it, rice will soon become oil” if India’s export ban proves longlasting and extends to other rice categories.

“We’ve had a price increase in rice, but we’re not aware of any scarcity and I hope - that being one of our staples - it never becomes scarce,” Mr Roberts told Tribune Business as he revealed that Super Value is halting product orders where Bahamian shoppers “refuse to pay” the prices being charged.

“I think that manufacturers have to realise that prices are high, and people are prepared to pay only so much,” he added. “They’ll realise it when their sales go to zero. Prices can only go so high and the public will refuse to pay.” Mr Roberts cited as an example onegallon bottles of Hellmann’s Mayonnaise. “It went so high that the public stopped buying it, and we stopped buying it,” he explained.

“We got shot of a shipment by selling it at half-price. Hellmann’s must know they have to

find cheaper ingredientscheaper oil, cheaper eggs. We’re noticing it in our sales. The price goes up, and sales go down. We’ve seen it with other items, too, and have started a policy where we’re not necessarily marking on a percentage.

“We put dollars on when an item goes over $8. We don’t collect a percentage any more. We put a dollar mark-up on it because the public are not otherwise prepared to pay and we want the item to keep selling, especially if we have the warehouse loaded with it,” Mr Roberts continued.

“It’s got so bad now that we’ve got an agreement where [the buyers] cannot raise any prices without my consent or joint agreement. Instead of raising prices, we may decide not to order in some cases. We sell-off what we have at cost, and we said with the mayonnaise we would sell at half-price to get rid of it and never order it again.

“Manufacturers realise they have to come up with something better and have to cut their costs somewhere. There’s a limit that all consumers are prepared to pay, and we will decide what to do based on what the manufacturers decide to do. If they raise prices, we’re not going to buy it. There’s no point if the public have reached the point of resistance.

You’ve reached the limits of the consumer, and have reached the bottom of their pocket books.”

Mr Roberts said that within the past ten days four major food producing groups, including Procter & Gamble, Kelloggs and General Milk, have all increased their prices. He added that his latest inquiries with major US-based food producers, undertaken some two months ago, saw predictions that food costs will continue to increase until early 2024.

“That’s very disappointing, but that’s what the manufacturers and economists are saying and, of course, it’s proven to be true up until now. We’ve constantly had increases, never a decrease. Never, never,” the Super Value chief said, describing Russia’s refusal to permit Ukrainian grain exports through the Black Sea as “serious”.

Revealing that food scarcity, rather than cost, was his greatest concern, Mr Roberts said Russia’s actions would force African and Middle Eastern countries to look to North America - the US and Canada - as supply alternatives. This is where The Bahamas sources its grain and wheats from, and such a scenario would “put pressure” on the prices and supplies offered by this country’s suppliers.

Besides the external factors, Mr Roberts said

Super Value is now being impacted by local forces. “I noticed this week that BPL took some of our sales, and BPL will continue to take some of our sales all through the summer,” he told Tribune Business. “I don’t know where it’s going to go, but I can say it is siphoning off 5 percent of our sales already.

“We’re keeping up with last year, and that’s because we’re fighting to keep up. Last week was the first week we noticed the break. It was clearly indicated by the Sunday morning shoppers when we started to get negative sales. We said there’s something wrong.”

To offset these pressures, Mr Roberts advised Bahamians to switch from more expensive recognised brands to private labels that offer similar quality. “We’re going through the markets

and buying the best. Vegetables and canned meat from Brazil will shortly hit the shelves, and consumers will find they are cheaper than the US market,” he added.

“Every day that’s all we concentrate on. That’s why we’re in business; to solve problems. That’s where your reward comes from - as a problem solver. You get the best rewards. But it’s probably going to be a long, hot summer. I hope it doesn’t get any hotter.”

Mr Beneby, meanwhile, noted that while rice is price-controlled The Bahamas will likely not escape the fall-out from India’s actions. “Without a doubt we will be affected by it. That’s all I can say right now,” he told Tribune Business. “How much and when, I cannot say. There’s nothing we can do. Rice is a

staple for most families and the restaurants. It is what it is.

“Wherever the other 60 percent of rice is exported from, I guess the wholesalers and importers would have to try and see if they can source it from elsewhere at a better price. The other countries, though, are going to raise their prices because India has stopped exporting. That’s what normally happens. If you want it, rice will soon be like oil. We are importers. Whatever increases are placed around the world, we will no doubt import in an increase here.”

These developments will likely be seized on by the Government as further justification for efforts to improve Bahamian food security and grow more products at home.

Elon Musk reveals new 'X' logo to replace Twitter's blue bird

By KELVIN CHAN AND BARBARA ORTUTAY AP Business WritersGoodbye, Twitter. Hello, X.

Elon Musk has unveiled a new "X" logo to replace Twitter's famous blue bird as he follows through with a major rebranding of the social media platform he bought for $44 billion last year.

The X started appearing at the top of the desktop version of Twitter on Monday, but the bird was still dominant across the smartphone app. At Twitter's headquarters in San Francisco, meanwhile, workers were seen removing the iconic bird and logo Monday until police showed up and stopped them because they didn't have the proper permits and didn't tape off the sidewalk to keep pedestrians safe if anything fell.

As of early afternoon, the "er" at the end of Twitter remained visible.

The haphazard erasure of both the physical and virtual remnants of Twitter's past were in many ways typical of the chaotic way Musk has run the company since his reluctant purchase.

"It's the end of an era, and a clear signal that the Twitter of the past 17 years is gone and not

coming back," said Jasmine Enberg, an analyst with Insider Intelligence. "But the writing was on the wall: Musk has been vocal about transforming Twitter into platform X from the start, and Twitter was already a shell of its former self."

It's yet another change that Musk has made since acquiring Twitter that has alienated users and turned off advertisers, leaving the microblogging site vulnerable to new threats, including

rival Meta's new text-based app Threads that directly targets Twitter users. Musk had asked fans for logo ideas and chose one, which he described as minimalist Art Deco, saying it "certainly will be refined." He replaced his own Twitter icon with a white X on a black background and posted a picture of the design projected on Twitter's San Francisco headquarters.

"And soon we shall bid adieu to the twitter brand and, gradually, all the birds," Musk tweeted Sunday. The X.com web domain now redirects users to Twitter.com, Musk said.

"I can't say I'm surprised, but I think it's a very selfish decision," said Hannah Thoreson of Baltimore, Maryland, who's used Twitter since 2009 for work and personal posts.

"There are so many small businesses and so many nonprofits and so many government agencies and things like that all around the world that have relied on Twitter for many years to push their message and reach people," she said.

"And they all have the Twitter icon on everything from their website to their business cards."

Changing all this costs time and money, she added, not to mention the confusion that comes with a previously unknown brand name.

"I mean, do you want to get rid of the Coca-Cola brand if you're Coca-Cola?

Why would you do that?" said Thoreson, who now primarily uses Mastodon.

Musk, CEO of Tesla, has long been fascinated with the letter X and had already renamed Twitter's corporate name to X Corp. after he bought it in October. In response to questions about what tweets would be called when the rebranding is done, Musk said they would be called Xs.

The billionaire is also CEO of rocket company Space Exploration Technologies Corp., commonly known as SpaceX. And he started an artificial intelligence company this month called xAI to compete with ChatGPT. In 1999, he

INSURANCE CUTS ‘FALSE ECONOMY’ DESPITE 26-YEAR HIGH PREMIUMS

FROM PAGE B1

prove to be a false economy as uninsured losses from a major storm can be financially crippling......

The recent phenomenon of the ‘super storm’ is unfortunately a reality that the region can no longer deny. Scientists are predicting that, because of global warming, the region will likely experience an increase in the frequency of these destructive storms.

“This probability represents a major threat to the well-being of The Bahamas and the population at large.

It is therefore vitally important that homeowners and businesses take every measure they can to mitigate their risk of incurring serious financial loss from a major hurricane. I encourage all of our policyholders to consider the vulnerabilities of their individual properties and take steps to make them more secure against the risk of hurricane and any other perils.”

Mr Duff’s assessment was backed by Bruce Fernie, ICB’s chairman, who conceded that the major global reinsurers that The Bahamas heavily relies on to underwrite risks in this nation have either drastically increased their prices, cut capacity or withdrawn from the Caribbean altogether after suffering multi-billion dollar losses from previous hurricanes while anticipating further losses from more powerful, and frequent, storms in the future.

“Against this backdrop, ICB approached its most recent reinsurance treaty renewal season anticipating that reinsurers’ terms would likely harden somewhat for 2023,” Mr Fernie wrote.

“Unfortunately, the reinsurance market hardened to an extent not seen in the company’s 26-year history. Catastrophe reinsurance capacity reduced substantially over 2022 with many reinsurers electing to reduce their exposure to catastrophe risk.

“Some reinsurers completely withdrew from writing catastrophe exposed business. Despite this, ICB was successful in renewing all our property reinsurance treaties, although at a significantly increased cost. Exacerbating the situation is that there is a growing demand for catastrophe insurance cover throughout The Bahamas with many new building projects underway and many more at the planning stage.

“Given the shortage of windstorm capacity available to the market in 2023, I would appeal to all our customers who insure their properties against hurricane loss not to delay renewing their policies when they fall due... The Bahamian insurance industry will certainly be challenged in the year ahead as we trade through this period of extraordinary level of increase in the cost of property catastrophe reinsurance. Homeowners and businesses will be faced with

property rates that are as high as they have ever been.”

Bahamian property and casualty insurers have no choice but to purchase significant amounts of reinsurance on an annual basis because their relatively thin capital bases mean they cannot underwrite all risks in this nation. As a result, premium prices paid by local homeowners and businesses are dictated by the reinsurance market. Those with mortgages, though, are mandated by the loan contract to insure or their lenders take out coverage on their behalf.

ICB, which is the carrier through which BISX-listed J S Johnson places much of its property and casualty insurance, was able to beat profit targets and expectations for 2022 largely due to the absence of any major hurricanes striking The Bahamas for the fourth consecutive year.

“[ICB] was able to produce a trading profit of $4.175m for the 2022 year. This represents an improvement of 10.13 percent over 2021 and a return on equity of 10.5 percent. This betterthan-expected result was in large part due to the absence of any major hurricane losses during the year. Profit was also enhanced by ordinary claims costs being substantially lighter than normal across all the main classes,” Mr Fernie wrote.

“ICB’s strong performance in 2022 must be viewed within the context of a growing risk of catastrophic weather losses to

The Bahamas and the wider region. The Inter-American Development Bank (IDB) in recently unveiling a $160m loan to finance this nation’s disaster risk management governance was quoted in its policy paper as saying that ‘more frequent and intense storms have cost The Bahamas, its economy and people some $6.7bn in the two decades leading up to 2022’. The document also reinforces The Bahamas extreme vulnerability to hurricanes and the fact that this vulnerability is likely to be further exacerbated by climate change.”

Mr Duff added: “Our gross written premiums (net of fronting arrangements) grew by 7.16 percent to just under $60m. This was significantly better than expected and all our main classes contributed to this growth. Our underwriting profit was almost identical to 2021 at around $3.5m.

“At claims level, net incurred claims costs (after reinsurance) increased by 16.93 percent over the prior yea. However, 2021 claims losses were unusually low due, in part, to reduced activity as the country slowly emerged from the COVID pandemic. Finally, the

founded a startup called X.com, an online financial services company now known as PayPal.

Additionally, he calls one of his sons, whose mother is singer Grimes, "X." The child's actual name is a collection of letters and symbols.

Musk's Twitter purchase and rebranding are part of his strategy to create what he's dubbed an " everything app " similar to China's WeChat, which combines video chats, messaging, streaming and payments. Musk has made a number of drastic changes since taking over Twitter, including a shift to focusing on paid subscriptions, but he doesn't always follow through on his attentiongrabbing new policy pronouncements.

Linda Yaccarino, the longtime NBC Universal executive Musk tapped to be Twitter CEO in May, posted the new logo and weighed in on the change, writing on Twitter that X would be "the future state of unlimited interactivity — centered in audio, video, messaging, payments/banking — creating a global marketplace for ideas, goods, services, and opportunities." But ad industry analysts were less certain about X's prospects.

company’s bottom line was boosted by the recording of $816,952 in unrealised gains.

“Based on the above, ICB was able to produce a better-than-expected total net trading profit of $4.175m for the 12 months of 2022, an increase of 10 percent over 2021. It is important that ICB is able to produce healthy levels of profit during hurricane-free years so that we are able to build up our balance sheet in readiness for the next major event loss. It is also vital that we are able to return profit to our reinsurers following major event losses like Hurricane Dorian. That particular hurricane cost our reinsurers some $220m.”

Applicants should be organized, self-driven, innovative, diligent, a team player and have the ability to work with minimum supervision.

Successful applicants will be eligible to participate in the company’s medical insurance plan and proft-sharing scheme. Salary will commensurate with experience.

Interested applicants should deliver their curriculum vitas to carolyn.adderley@halsburylawchambers.com

Wall Street rises ahead of what’s hoped to be the last Fed rate hike for a while

By STAN CHOE AP Business WriterWALL Street ticked higher Monday to start a week full of updates on where interest rates and profits for some of the stock market’s most influential companies are heading.

The S&P 500 rose 18.30, or 0.4%, to 4,554.64, coming off its eighth winning week in the last 10. The Dow Jones Industrial Average gained 183.55, or 0.5%, at 35,411.24, and the Nasdaq composite added 26.06, or 0.2%, to 14,058.87.

Becton, Dickinson jumped 5.7% for the largest gain in the S&P 500 after it said its updated Alaris infusion system will return to full commercial operations following earlier recalls. It received a clearance from the U.S. Food and Drug Administration for the system, which delivers medications and other products to patients.

Chevron rallied 2% after it gave an early look at its results for the spring, reporting a stronger profit than analysts expected.

Roughly 30% of companies in the S&P 500 are scheduled to tell investors this week how much they earned from April through June. Key among them are three Big Tech behemoths that have grown so large that their stock movements

often dictate where the S&P 500 goes.

Alphabet, Meta Platforms and Microsoft will all report their results this week, and they’re three of the seven stocks that accounted for the majority of the S&P 500’s gain in the first half of the year. Each of the three has soared at least 37% for this year so far, and they’ll need to deliver strong numbers to justify their big rallies.

The market’s top stocks have become so big and their movements so influential over the market that Nasdaq rebalanced its Nasdaq 100 index before trading began Monday, to lessen the impact some stocks have on the overall index.

Perhaps even more important than how profits at the Big Tech titans go is what the Federal Reserve will say Wednesday at its latest meeting on interest rates.

The wide expectation is that the Fed will raise its federal funds rate again, to its highest level since 2001, as it fights to bring inflation down. But the hope among traders is that will be the final increase of this cycle because inflation has been cooling since last summer.

High rates undercut inflation by slowing the entire economy in a blunt move, as well as by hurting prices for stocks and other

investments. That caused many investors to brace for a recession, but the economy has so far remained resilient due largely to a remarkably solid job market.

A report on Monday suggested the U.S. services industry is continuing to grow, but at a slower pace than economists expected.

On the upside for the economy, the preliminary report from S&P Global also

suggested U.S. manufacturing isn’t doing as badly as feared. Overall, growth in business activity during July appears to be at its slowest in five months. Stocks have rallied hard this year, and the S&P 500 is up 18.6% on hopes the economy can continue to grow as inflation cools enough to get the Fed to not only stop hiking rates but to begin cutting them next year. Such a nottoo-hot and not-too-cold

By CHRISTOPHER RUGABER AP Economics WriterWHEN Chair Jerome Powell and other Federal Reserve officials gather this week for their latest

decision on interest rates, they will do so on the cusp of achieving an elusive “soft landing” — the feat of curbing inflation without causing a deep recession. After the Fed began aggressively raising

borrowing costs early last year, most economists predicted it would send the economy crashing as consumers cut spending and businesses slashed jobs and expansion plans.

Yet even though the Fed is poised to raise its key rate on Wednesday for the 11th time since March 2022, to its highest point in 22 years, no one is panicking. Economists and financial traders have grown more

outcome would mean the Fed pulls off a tricky “soft landing” for the economy.

“A lot would need to go right for such an outcome, in our view,” strategists at BlackRock Investment Institute wrote in a report. Rate hikes take a notoriously long time to take full effect across the economy, and they can cause unanticipated parts of it to break.

The BlackRock strategists also warn profits may be under pressure in the

optimistic that what some call “immaculate disinflation” — a steady easing of inflation pressures without an economic downturn — can be achieved. Most economists think this week’s hike in the Fed’s benchmark rate, to about 5.3%, will be the last, though they caution that that rate, which affects many consumer and business loans, will likely stay at a peak until well into 2024.

“I would have been not super-optimistic about a soft landing a few months ago,” said Jeremy Stein, a Harvard University economist who served on the Fed’s Board of Governors from 2012 through 2014. “Now, I think the odds are clearly going up.”

Economists at Goldman Sachs, who have sketched a more optimistic outlook than most others, have downgraded the likelihood of recession to just 20%, from 35% earlier this year.

Even economists at Deutsche Bank, among the first large banks to forecast a recession, have been encouraged by the economy’s direction, though they still expect a downturn later this year.

“We have greater resiliency within the economy than I would have anticipated at this point in time, given the extent of rate increases we’ve gotten,” said Matthew Luzzetti, Deutsche Bank’s chief U.S. economist.

Luzzetti points to durable consumer spending as a key driver of economic growth.

Many Americans still have extra savings stemming from the pandemic, when the government distributed several stimulus checks and people saved by spending less on travel, restaurant meals and entertainment.

Hiring has remained healthy, with employers having added 209,000 jobs in June and the

second half of the year as increased wages for workers eat into profit margins.

The big run for stocks in the S&P 500 this year also leaves them looking expensive compared with history, even outside the big seven stocks that have driven most of the gains, according to Doug Ramsey, chief investment officer of The Leuthold Group.

He calls this “another chance to buy high” after the market’s rebound from the 2020 COVID crash. Public Storage, which runs self-storage facilities, rose 1.3% after it said it would buy Simply Self Storage for $2.2 billion from Blackstone Real Estate Income Trust.

In the bond market, the yield on the 10-year Treasury rose to 3.87% from 3.84% late Friday. It helps set rates for mortgages and other important loans.

In markets abroad, European stocks were mixed after data suggested manufacturing and services industries across the continent are weaker than expected. The European Central Bank will meet on interest rates Thursday.

In Asia, indexes were also mixed. Stocks sank 2.1% in Hong Kong and 0.1% in Shanghai, but they were stronger in Tokyo and Seoul.

unemployment rate declining to 3.6%. That’s near the lowest rate in a half-century and about where it was when the Fed began raising rates 16 months ago — a sign of economic resilience that almost no one had foreseen.

At the same time, inflation has steadily declined. In June, prices rose just 3% from a year earlier, down from a peak of 9.1% in June 2022 though still above the Fed’s 2% target.

Even more encouragingly, measures of underlying inflation have dropped. “Core” prices, which exclude volatile food and energy costs, rose just 0.2% from May to June, the slowest monthly rise in nearly two years. Compared with a year ago, core inflation was still a relatively high 4.8%, though down sharply from 5.3% in May.

Some economists warn that a recession cannot yet be ruled out. The Fed’s rate hikes, they note, have made the cost of buying a home, financing a car purchase or expanding a business much more burdensome.

And with inflation still not fully contained, Fed officials have yet to sound the all-clear. One day after the government reported unexpectedly mild inflation, Christopher Waller, a key member of the Fed’s board, said he needed to see further evidence of smaller price increases before he would be sure inflation is slowing. Until then, Waller said, two more quarterpoint rate hikes would likely be “necessary to keep inflation moving toward our target.”

Waller expressed concern that the Fed might be “head-faked” by temporary slowdowns in inflation, only for prices to resurge again, which previously occurred in mid-2021 and the fall of 2020.

Key question as Federal Reserve meets: Can the central bank pull off a difficult ‘soft landing’?FEDERAL Reserve Chair Jerome Powell speaks after a Federal Open Market Committee meeting, June 14, 2023, at the Federal Reserve Board Building in Washington. The Federal Reserve wraps up its two-day policy meeting on Wednesday, July, 26, 2023. Photo:Jacquelyn Martin/AP