THURSDAY, JULY 25, 2024

Athol Island goahead one month after ‘cease’ order

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ENVIRONMENTAL

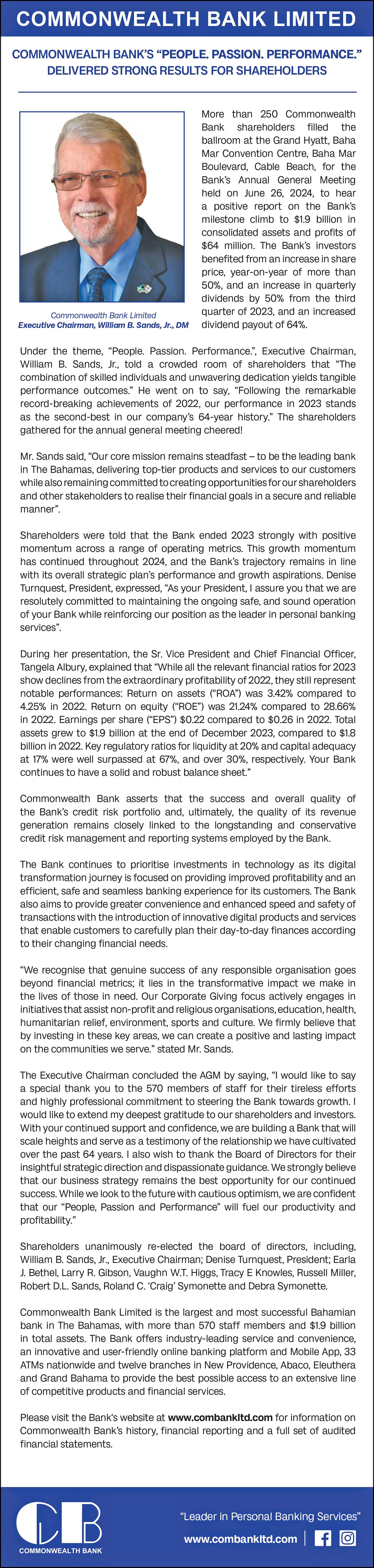

regulators gave the goahead to an Athol Island developer just one month after ordering him to “cease and desist” unauthorised construction activities at the same location. The Department of Environmental Planning and Protection (DEPP) yesterday revealed that despite issuing three such orders to Andrew Hanna - at least one of which remains in effect today - it nevertheless granted a certificate of environmental clearance (CEC) that permitted him to construct a dock on the island off New Providence’s north-east coast.

The Ministry of the Environment and Natural Resources, in a statement issued on DEPP’s behalf, said Andrew Hanna initially applied in January 2024 for a CEC permit to develop a restaurant, rest

‘Decades-long norm’ on fisheries poaching over

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FISHERMEN yesterday hailed “fantastic” progress in combating foreign poachers as they bid to match the “record catches” enjoyed by many last year when crawfish season opens on August 1. Paul Maillis, the National Fisheries Association’s (NFA) secretary, told Tribune Business he was unable to “recall the last time there was a huge Dominican vessel” poaching in Bahamian waters with as he credited the enhanced law enforcement effort with helping to ensure healthy lobster stocks.

“The one thing we can count on is that lobster stocks are very healthy, and the work done to combat out-of-season poaching from the Dominican Republic, in particular, has been fantastic,” he said. “I can’t recall the last time there was a blatant, huge poaching vessel sitting in Bahamian waters catching hundreds of thousands of pounds of Bahamian fisheries product.

“That was the norm for decades. There are still desperate poachers out there, but they have been forced further and further to the outside of our territory, and we are seeing the results with grouper, lobster and

‘Doesn’t offend’: Wendy’s beats Atlantis PI appeal

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

PLANNING authorities yesterday dismissed the appeal by Atlantis and other major resorts seeking to block Wendy’s Paradise Island restaurant by finding it “does not offend” land use restrictions.

The Subdivision and Development Appeal Board, in upholding the Town Planning Committee’s goahead for the fast food chain and its affiliated Marco’s Pizza brand, rejected all the arguments put forward by the mega resort and other hotels including the absence of a traffic impact study and non-existent land use plan for Paradise Island.

Atlantis declined to comment on a verdict which also agreed with the Town Planning Committee’s October 2023 finding that the proposed restaurant is “compatible” with the surrounding area and nearby businesses. It remains to be seen whether the hotel, and others such as Sterling Global, the Hurricane Hole developer, will now challenge the Appeal Board’s finding before the Supreme Court.

None of the other parties to a verdict, which has been obtained by Tribune Business, could be reached for comment before press time.

• Fast food brand clears latest planning hurdle • Board rejects land use plan, traffic study claims • Finds site use ‘compatible’ with nearby areas

Atlantis, Sterling and the Paradise Island Tourism Development Association (PITDA), which represents the likes of the Ocean Club and Comfort Suites, put forward multiple grounds of appeal including alleged procedural and application irregularities. They also claimed “there was a failure to consider or receive traffic studies and/or assessments” on the impact the Wendy’s and Marco’s Pizza restaurants would have, plus the “disregard of lack of a land use

plan, zoning bye-laws or transparent, objective development for the property area”.

Further objections cited by Atlantis and its fellow resorts included “the standard of clientele, traffic congestion, parking demands, obstacles for luxury development... and disregard for the views of [Paradise Island] residents at large”, with the general sentiment that Wendy’s and

SEE PAGE B7

Virtual reality training to become necessity

In recent years, the landscape of employee training and development has been dramatically reshaped by advances in technology. One of the most promising innovations in this field is Virtual Reality (VR), a technology that allows individuals to immerse themselves in simulated environments using headsets and sensory devices. While VR has gained popularity in gaming and entertainment, its application in the workplace for training purposes is beginning to revolutionise how employees learn and grow. Traditional methods of training often rely on classroom settings, manuals and on-the-job shadowing, which can be time-consuming, expensive and sometimes impractical, especially for complex or dangerous tasks. VR, however, offers a solution by providing a safe and controlled environment where employees can practice skills and procedures without real-world consequences.

Imagine a scenario where new surgeons can practice intricate procedures repeatedly in a virtual operating room before ever setting foot in an actual surgical theatre. Or consider an oil rig worker who learns to navigate emergency protocols in a virtual environment, preparing for situations that are rare but potentially catastrophic. VR allows these simulations to be conducted in a realistic yet risk-free setting, enhancing the learning experience and boosting confidence.

Moreover, VR can simulate scenarios that are difficult to replicate in real life. For example, customer service representatives can engage in virtual interactions with irate customers to hone their conflict resolution skills. Retail employees

ROYE II KEITH

can familiarise themselves with new product launches by exploring virtual store layouts and handling merchandise virtually. The benefits extend beyond initial training phases. Continuous development and upskilling are crucial in today’s rapidlyevolving job market. VR enables ongoing training modules that can be updated and adapted swiftly to incorporate new industry standards or company policies. This flexibility ensures employees stay current and competent in their roles without the need for frequent retraining sessions.

Critics may argue that VR is costly to implement and requires specialised equipment. While these concerns are valid, the long-term benefits often outweigh the initial investment. Reduced training time, increased retention of information through experiential learning, and the ability to track and assess employee performance are all compelling reasons for companies to consider integrating VR into their training strategies.

Furthermore, the COVID-19 pandemic underscored the importance of remote and virtual solutions. Many companies had to quickly adapt to remote

work and virtual training environments. VR provides a bridge between physical separation and immersive learning experiences, making it a valuable tool in the post-pandemic era as businesses navigate hybrid work models and distributed teams.

As with any technology, successful implementation of VR in training and development requires careful planning and consideration. It is essential to assess the specific needs of the workforce, provide adequate support and training for both employees and trainers, and continuously evaluate the effectiveness of VR applications.

Virtual Reality represents a paradigm shift in how we approach employee training and development. By offering immersive, interactive and adaptive learning experiences, VR has the potential to not only enhance skill acquisition but also to transform corporate performance and employee engagement. As we look to the future, embracing VR in training will likely become not just a competitive advantage but a necessity for forwardthinking businesses aiming to thrive in an increasingly digital world.

• NB: About Keith Roye II

Keith Roye II is the chief operations officer of Plato Alpha Design, a bespoke software development company that specialises in business efficiency and profitability. Throughout his career in software development, Mr Roye has served as chief software engineer for companies in The Bahamas and the US. His work has led or assisted companies in generating millions of dollars in passive revenue, while saving millions through custom software design.

Union chief: Minister’s Pike meeting ‘flies in worker faces’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE head of the Bahamas Power & Light (BPL) line staff union yesterday asserted that the arrival of workers and equipment from a US contractor “flies in the face of the workers”.

Kyle Wilson, the Bahamas Electrical Workers Union’s (BEWU) president, said he did not like “the optics” as JoBeth ColebyDavis, minister of energy and transport, inspected bucket trucks brought in by Pike Corporation. The US firm has been tasked with upgrading and managing BPL’s transmission and distribution network through its Bahamian management company, Island Grid Solutions.

A statement released by the Ministry of Transport and Energy confirmed that Pike and Island Grid representatives are “currently on the ground” assisting BPL with upgrading its infrastructure and improving the “resilience” of the electricity grid.

“Representatives from Island Grid are currently on the ground, fulfilling their commitment to assist BPL with outstanding distribution work to strengthen infrastructure and support the grid’s resilience during storms” said the statement.

“Their presence underscores their commitment to being proactive partners in fortifying our energy infrastructure. We remain committed to transparent communication and to working collaboratively with all stakeholders to achieve the best outcomes for the Bahamian people and the dedicated workforce at BPL.”

Mr Wilson, though, said:

“The optics of it, I don’t like. It flies in the face of the workers. You come to work to BPL and you see a big truck that says Pike on the side and you see another image, minister working and walking along, say she inspecting the Pike trucks. I never seen anyone come and inspect the BPL trucks, if we have any trucks. So the optics of it… my phone was overloaded by employees.”

He added that workers are “angry” about the minister’s inspection and are more concerned about their jobs and benefits than political affiliation. “People care about their future no

matter what affiliation or political affiliation they have; they care about their job,” Mr Wilson said. “No matter who is the Government, we have to go to work the next day. If I have to go to the hospital tomorrow, no matter who the Government is, I know that I have a good medical insurance. No matter who the Government is, when I retire, I want my pension.

“The workers are angry and the optics of what was shown was poor, and I think someone in PR supposed to say ‘Hey, Minister stay out that picture’. I don’t think she should have been directly in the picture, promoting a third-party entity over BPL. That’s just how it looks. It looks like you flying in the face of the workers, that’s the optics it’s given off, and I don’t think someone’s given sound advice in that capacity.”

Mr Wilson argued that the Davis administration is playing a “dangerous game” by “disrespecting” the union and called for the Government to provide answers to BPL employees.

He said: “I don’t think you want to challenge a union that has its hand on the pulse of something as important as energy. I find this to be a dangerous game they are playing. We dealing with energy. Everything is affected by energy.

“So, I think greater respect needs to be shown to the union not to cause us to have to show or to run up and down the street carrying on bad and embarrassing our country and acting silly because we in a civil country. Why can’t we just sit down and work these issues out?”

Union ‘ready for action’ over reforms to BPL

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A UNION leader yesterday asserted that Bahamas Power & Light (BPL) staff are “p***** off and ready for action” amid uncertainty over how they fit into the Government’s energy reform plans.

Kyle Wilson, the Bahamas Electrical Workers Union’s (BEWU) president, said employees are “frustrated, angry” over a perceived lack of “transparency” regarding the Davis administration’s plans for BPL’s existing workforce and whether all the benefits and rights contained in their existing industrial agreements will be honoured.

He accused the Davis administration of intentionally keeping BPL staff and the public “in the dark” on the terms of the agreements struck to outsource New Providence’s baseload energy generation and control of the island’s energy grid to the private sector.

“There appears to an intentional effort to keep the Bahamas Electricity Workers Union and Bahamian people in the dark as this BPL deal progresses,” Mr Wilson asserted. “No one in authority is directly addressing the labour issues concerning this deal that will have a major impact on BPL and its operations.

“A deal that will split the operations of the company, and place transmission and distribution assets along with unabated management rights into a third-party hand. This deal appears top secret and classified, and

little to no information of the details is known to the union.”

Mr Wilson said he has written to the minister of energy and transport, JoBeth Coleby-Davis, requesting answers to concerns raised by staff but has received no response. And he accused BPL management of showing a “great level of disrespect” to workers by excluding the union and refusing to inform staff exactly how the reforms could impact their careers.

He said: “When the minister responsible for energy

was asked if she could elaborate on the future of the workers at BPL, as it relates to the deals with Bahamas Grid Company and Island Grid, she empathically said no. How is that fair to the workers and the Bahamian people with regards to public assets? Especially by an administration that claims to be union-friendly or for unions.

“The authorities with oversight of BPL and their partners are showing a great level of disrespect in how they are dealing with this matter concerning the

workers and their future. The deal appears rushed and the union seems to be intentionally shut out despite their direct articulation to share with stakeholders how they intend to direct the labour force in a recent document concerning investment into this deal.”

New Providence’s electricity grid is being transferred to the control of Bahamas Grid Company, an entity that will be 60 percent majority-owned by private investors. Island Grid, the entity that will manage Bahamas Grid Company, is headed by Eric Pike, whose Pike Electrical will be supplying the manpower, equipment and resources to overhaul the grid. Pike trucks and staff are already arriving in The Bahamas.

Bahamas Grid Company is presently raising $100m via the private placement of a bond issue, with the proceeds set to finance some $120m in “foundational”

Career Opportunity

I.T. Service Desk Administrator

Since its inception in 1997, RF Bank & Trust (Bahamas) Limited has been committed to helping clients create and manage wealth. We are your local private bank connecting Bahamians with the best in local and international investments.

The I.T. Service Desk Administrator provides help desk support to the bank through I.T. Service Desk tasks, along with maintaining in-house computer software systems and network connections to ensure high availability and security of the supported business applications of the RF Group.

Key Responsibilities:

Provides I.T. assistance to internal clients with personal computer hardware, software, and specialized mainframe technology.

• Create required reports in response to business user needs.

• Participate in negotiations with vendors, outsourcers, and contractors to secure software products and services.

• Help develop, document, and maintain policies, procedures and associated training plans for system administration and appropriate use.

Liaise with customers resolving, and/or initiating the resolution of problems and computer operation concerns.

Key Qualifications & Experience:

Bachelor’s degree in computer science, Information Technology or related certifications/designations

• Minimum of 3 years demonstrated experience in a similar role

• Certifications in Microsoft desktop technologies and IT security principles preferred Working technical knowledge of network, PC, and platform operating systems, including Microsoft Windows. Application support experience with SQL-based applications. Strong knowledge of local area network (LAN) administration. Strong customer service, analytical and problem-solving skills Demonstrated verbal and written communication skills

• Keen attention to detail

Please apply online at:

https://www.rfgroup.com/careers Deadline to Apply is Friday, 2nd August 2024

Athol Island go-ahead one month after ‘cease’ order

area and dock on an island that sits at the heart of a Marine Protected Area (MPA), well-known for its fish and marine life, and is also a site of historical significance given its past as a quarantine station.

However, upon undertaking a site visit to Athol Island, DEPP officials found construction of the restaurant and rest area was already underway. And, despite issuing the first “cease and desist” order to Mr Hanna to halt such activities, the environmental regulator granted him the requested CEC - for the dock only - on February 16, 2024, on the understanding that any other development would face further review.

Adrian White, the St Anne’s MP who first raised the alarm over questionable development activities on Athol Island, yesterday voiced surprise to Tribune Business that the DEPP would proceed to grant the CEC applicationalbeit restricted to the dock - when it had found Mr Hanna engaging in unauthorised construction activities that lacked the necessary approvals.

He added that “while the light is red” at present, in terms of the restaurant and rest area activities being halted, it will likely “eventually turn green” and the developer will “end up in the clear” and be able to proceed with the project despite the prior violations.

Describing this as “unacceptable” to the Bahamian people, the Opposition MP argued that “if developers misuse our patrimony once” they should not be given the chance to “abuse it again”

but instead required to correct any damage caused and withdraw.

He spoke out after the Ministry of the Environment and Marine Resources revealed DEPP had issued no less than three “cease and desist” orders to Mr Hanna’s Athol Island project in just over six months, including one that was imposed on the same day - Wednesday, July 17 - that Mr White again raised the issue in the House of Assembly.

The Department of Environmental Planning and Protection received an application for a certificate of environmental clearance (CEC) from a Mr Andrew Hanna in January 2024 to install a wooden dock, a rest area and a restaurant on Athol Island,” the ministry said in its statement yesterday.

“A site visit was conducted of the area. At the time of the site visit, the construction of the proposed rest area and restaurant was in progress. A cease and desist order for all activities onsite was issued.” However, just weeks later DEPP granted the CEC for the dock only.

“After further review, a CEC was issued in February 2024 for the construction of a wooden dock. It was always understood that any other activity would require further environmental review,” the ministry added. It made clear that the CEC permit was not an approval for construction activities, and that Mr Hanna needed to seek the relevant building approvals from the Ministry of Works and its agencies.

Yet DEPP’s January 2024 site visit also revealed

a seawall was under construction, with the ministry stating: “It is unclear as to whether the appropriate building permits were obtained for the construction of the seawall.”

Construction permits, it added, could only be obtained once the CEC is issued.

Two more cease and desist orders were subsequently issued to Mr Hanna after further concerns were raised over Athol Island development.

“In April 2024, the Department conducted a site visit in response to reports that the construction of the rest areas and a restaurant were underway on the property,”

DEPP said.

“Accordingly, a cease and desist order was issued to Mr Hanna. Upon investigation, there were signs of oxidised limestone and wood, indicating that the disturbance was not new or active. The cease and desist has since been lifted.” Then, the concerns raised by Mr White led to another being imposed.

“The matter was raised again in the House of Assembly on July 17, 2024. Out of an abundance of caution, a cease and desist was issued until the Department was able to conduct a comprehensive review of the entire site and meet with the environmental consultant of record,” the Ministry of the Environment and Natural Resources said.

“Officers of the DEPP conducted a site visit on that day to determine if any activities outside of those for which clearance was issued were being conducted. It was determined that the site was predominantly unchanged since

the April 2024 visit. The cease and desist remains in place.”

Mr White, summing up what the release meant, told Tribune Business: “Despite a developer being in breach they went ahead and gave a CEC in February for the dock. The concerns are clear and they are continuing....

“What seems to be happening is while the light is red, the expectation is it will eventually turn green for this developer despite the violations on this project todate. All this is attempting to do is for the developers to stop and correct themselves and, once they do that, they will end up in the clear in a marine habitat which is the complaint by the Bahamian people.”

Mr White, who previously alleged that “the relative of a high-ranking MP” is among those involved in Athol Island development activities, said he was “thankful” to the Ministry of the Environment and Natural Resources, DEPP and the latter’s director, Dr Rhianna Neely-Murphy, for laying out the sequence of events as they occurred.

He added, though, that there had been “accusations of egregious breaches of environmental laws”, and said: “Overall, the

picture being painted for the people is unacceptable and, while they know the red light is the only light seen, the public can already anticipate the green light will be given to this developer for the dock, rest area and restaurant, all of which should be removed.”

Suggesting that “a free for all” had been occurring on Athol Island, with various groups treating it as “untouched land like Christopher Columbus claimed”, Mr White questioned why DEPP had not required any dock to face similar restrictions to those in the Exuma Cays Land and Sea Park where they can only extend out ten feet from the cay’s edge.

The St Anne’s MP also argued that all developments found to have acted “contrary to the laws of the Commonwealth of The Bahamas”, and in breach of environmental and other laws and regulations, should be required to “cease, desist and not permitted to proceed” even after corrective action is taken.

“If you have been wrong once with our Bahamian patrimony, we will not put it at risk for you to be wrong again,” Mr White told Tribune Business. “I’m thankful the [DEPP] director and her team have gone out

there since I raised it in the House.

“I would like her team to follow through on the suggestions of myself and right-thinking Bahamians that if a developer misuses our Bahamian patrimony once they should be given the opportunity to correct it and not risk it being abused. They should correct it, their lease be rescinded, whether it’s a parcel of land or seabed.

“Whichever developer it is should make the change and no longer have the rights given them by the Government. Acting in accordance with the law is not an option. It is the law. If you act outside the law there are consequences, and that’s the appropriate consequence for anyone in The Bahamas carrying on under an act first, ask later policy. That’s not a policy I would ever support as a minister.”

Athol Island lies 0.75 miles east of Paradise Island, and was once eyed by former Atlantis owner, Kerzner International, as a potential golf course location. That proposal was subsequently dropped, as it is a site of historical significance and sits at the heart of a Marine Protected Area (MPA).

Career Opportunity

We Are Growing and Have an Exciting New Opportunity For You! If you possess the qualities below, we invite you to apply for the position of: PENSION SERVICES REPRESENTATIVE

Since its inception in 1997, RF Bank & Trust (Bahamas) Limited has been committed to helping clients create and manage wealth. We are your local private bank connecting Bahamians with the best in local and international investments.

The role of the Pension Services Representative supports the day-to-day implementation and administration of the RF Bank & Trust Limited’s Pension Plans.

Key Responsibilities:

• Provide excellent client and pension administrative services to jurisdictional clients.

• Acts as a primary liaison for Employee Pension benefit, vested participants, beneficiaries’ queries and administration, pension payments and pension document administration.

Client Pension Plan enrollment

• Analyze, research and calculate routine individual employee pension benefits for, terminations, retirements, disability, beneficiaries and death.

• Provide accurate and complete plan, fund and investment details to clients

Assist with the audit and reconciliation of monthly pension payments; calculate, reconcile and prepare monthly payments as required.

Key Qualifications & Experience:

• Bachelor’s degree in Business Administration, Finance or Accounting

• Minimum of Two (2) years of related work experience

• Series 7 Certification an asset

• Strong interpersonal, analytical, and problem-solving skills

Excellent interpersonal and communication skills (verbal & written)

• Proficient in Microsoft Office Suite and the aptitude to learn new software

• Confidential and Professional

Ability to work in a self-motivated environment with little supervision

Please apply online at:

https://www.rfgroup.com/careers

Deadline to Apply is Friday, 2nd August 2024

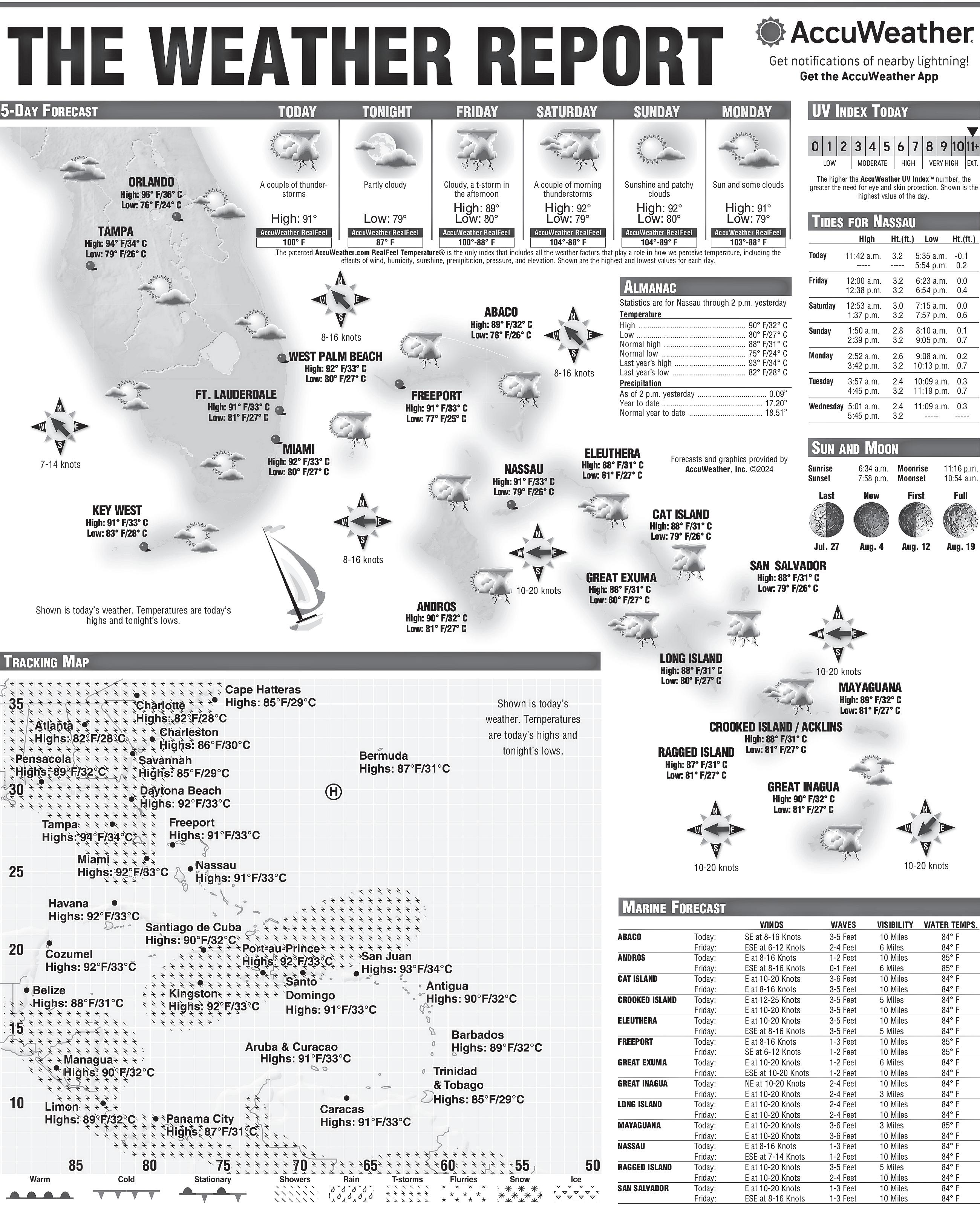

ANNUAL INFLATION RATE HITS THREE-YEAR LOW

BAHAMIAN infla-

tion rates hit a three-year low in May 2024 following a second consecutive monthly decrease in overall prices, data released yesterday discloses.

The Bahamas National Statistical Institute (BNSI), in unveiling May’s consumer price index (CPI), revealed that the trailing 12-month inflation rate had dropped to 0.4 percentthe lowest level achieved since the spike in global and domestic prices sparked by the COVID-19 pandemic.

The annual increase for the year to May 2024 was lower than both the 1.7 percent rises seen for the 12 months to February and April, respectively, and March’s 2.8 percent jump.

And, on a month-to-month basis, the Statistical Institute reported that May’s inflation rate fell by 0.9 percent compared to April 2024.

The May decrease in overall prices follows the 0.4 percent month-to-month fall recorded for April compared to March 2024. When

set alongside the three-year low in the trailing 12-month inflation rate, the two consecutive monthly declines provide further evidence that pricing pressures are easing although many hardpressed consumers and businesses may not yet be feeling the impact.

“The monthly inflation rate in The Bahamas, which represents the overall change in price for 2024, decreased by 0.9 percent when compared to April 2024. This decrease is reflected in the overall price

of items purchased by the average consumer during this period. This May 2024 decrease followed a 0.5 percent decrease between the months of March 2024 and April 2024,” the Statistical Institute said.

“On a month-to-month basis, the major decreases by group included clothing and footwear, 4.2 percent; health, 4.1 percent; housing, water, electricity, gas and other fuels, 3.1 percent; and alcoholic beverages, 0.5 percent. Meanwhile, the major group of

transportation recorded a moderate increase of 3.6 percent compared to April 2024.”

As for the trailing 12-month rate, the Statistical Institute added: “For May 2024, the CPI rose 0.4 percent over the same period last year. The major categories that contributed to this increase [were] education, 4.3 percent; food and non-alcoholic beverages, 3.7 percent; along with miscellaneous goods and services, 2.9 percent.

“Meanwhile,clothing and footwear recorded a decrease of 6.3 percent when compared to this same period last year. For the month of May 2024, gasoline prices recorded an increase of 1.9 percent while diesel decreased by 1.3 percent when compared to last month. Meanwhile, when compared to this time last year, gasoline prices increased by 1.9 percent while diesel prices decreased by 3.6 percent.”

Pike trucks arrive to overhaul BPL’s grid

JOBETH ColebyDavis, minister of energy and transport, inspected Pike Corporation bucket trucks on Tuesday. Pike Corporation, through its Bahamas-based management company, Island Grid Solutions, has a mandate to upgrade and manage Bahamas Power & Light’s (BPL) transmission and distribution network. Pictured in the group photo, front row, from left: JoBeth Coleby-Davis, minister of energy and transport; Josh Eller, Island Grid; Kevin Mortimer, controller of Road Traffic in Grand Bahama; and Matt Arthurs and Joseph Shaffer, Island Grid. Second row: Ministry of Energy and Transport support staff and energy consultants.

Photos:

Anthon Thompson/BIS

Career Opportunity

We Are Growing and Have an Exciting New Opportunity For You! If you possess the qualities below, we invite you to apply for the position of:

SECURITIES ANALYST

Since its inception in 1997, RF Group has been committed to helping clients create and manage wealth. We are your local private bank connecting Bahamians with the best in local and international investments.

The Securities Analyst role conducts detailed research and analysis of securities, including stocks, bonds, and other investment instruments of the RF Group. The Securities Analyst provides insightful recommendations to support the investment strategies and decision-making processes of our clients.

Key Responsibilities:

Conduct research and analysis of securities, including qualitative and quantitative assessment

Monitor and evaluate market trends, economic conditions, and industry developments to inform investment decisions

• Prepare detailed financial models, forecasts, and valuations for various securities

• Provide investment recommendations and reports to portfolio managers and clients

• Collaborate with the investment team to develop and implement effective investment strategies

Assist in the preparation of client presentations and investment proposals

Key Qualifications & Experience:

Bachelors Degree Finance, Economics, Accounting or related field

CFA Charter holder

• Series 7 qualification or equivalent an asset

• Minimum 3-5 years’ experience in securities analysis or related field

• Strong analytical and quantitative skills, with proficiency in financial modeling and data analysis

Ability to manage multiple priorities/excellent organizational skills

Strong interpersonal, problem solving and customer service skills

Excellent written and verbal communication skills, with the ability to present complex information clearly

• Proficient in financial software and tools (i.e. Bloomberg, Reuters, Microsoft Excel)

• Proficient in Microsoft Office Applications

• Ability to work independently and as a part of a team in a fast-paced environment Strong work ethic, integrity and professional demeanor

Please apply online at: https://www.rfgroup.com/careers

Deadline to Apply is Friday, 9th August 2024

‘DECADES-LONG NORM’ ON FISHERIES POACHING OVER

other species.” Mr Maillis said the drastic reduction in foreign poaching in Bahamian waters was just one of the reasons Bahamian fishermen are viewing the upcoming crawfish season with optimism.

Asserting that 2024 will be “looking good” if catches match 2023’s, he conceded that last year saw many fishermen receive one of the lowest per pound prices in recent times, but added that the increased volumes had helped to at least partially offset the financial impact.

The NFA secretary said the recent grouper season, which ran from December 1 to February 28, had provided further encouragement as it had proven “record breaking” for some fishermen, while fuel costs seemed to have “stabilised” in comparison to the immediate post-COVID years.

He revealed, though, that the NFA and wider fisheries industry remain concerned over the regulations that

will accompany the alreadypassed Fisheries Act and are now being finalised. Mr Maillis disclosed that there are “some concerning provisions that we hope don’t make the final cut” as he cautioned against imposing too much bureaucracy and red tape on the sector.

“We have to ensure that commercial fisheries can maintain, that we don’t over-bureaucratise the industry, and do sensible regulation,” he explained. “We have new fisheries regulations coming up for the new Fisheries Act and are in consultations with the minister, Jomo Campbell.

“There are some concerning provisions in the regulations that we hope don’t make it to the final cut because they will have a very drastic and negative impact on commercial fishermen and Bahamian fishermen in general.”

Mr Maillis declined to be drawn on the details of the fishermen’s concerns, saying: “I don’t want to get too far into the weeds.

We’ve been raising our concerns in private with the minister and the Department of Marine Resources. There are certain fishing seasons that are of particular concern. We are optimistic that we can come to a positive result on this.”

As for the upcoming crawfish season, which starts in just under a week’s time, Mr Maillis said: “I think there’s a lot of optimism in terms of the lobster stock. Last year there were a number of fishermen who hit record highs. It did not necessarily have to compensate for the low price, as they would have caught that much anyway, but it helped offset lower yields.

“The price wasn’t much higher than $10 per pound, and in some instances for a lot of the season it was $8-$9 per pound. When the catches are really good you can make up for some of the loss with volume.” Mr Maillis said it was impossible to predict the prices that fishermen will get in the upcoming crawfish season,

but acknowledged that 2023 yields were among the lowest seen for some years.

“Hopefully it’s going to be a better price this year, that’s all I can say,” he told this newspaper. “The price has fluctuated over the many decades. It was one of the lowest prices in recent years for sure. I can say that with confidence. In recent years it was one of the lowest.”

Pointing out that the likes of Honduras, Belize and Cuba all compete with The Bahamas on spiny lobster exports, Mr Maillis said the rock lobster produced by the likes of Australia and South Africa has also “come back roaring” postCOVID and increased global supply has impacted the prices achieved by all.

He added that local prices also depend on timing, and when Bahamian fishermen bring their catch to market. If they come back to shore all at once, and flood the crawfish market with product, prices are automatically pushed downwards because of the increased supply.

However, Mr Maillis asserted: “Overall, I believe

it’s going to be a good season for the vast majority of lobster fishermen. If the lobster catch is anything as good as last year then we’re looking good. It was a great season last year. If it’s that good or close to that good we’d call it a successful year. We don’t have an indication of the price yet, but I think the catch will be a really good catch this year... “It was a fantastic grouper season this year by all reports. For some fishermen it was record-breaking. I know that in Coral Harbour a lot of grouper trappers had their best year ever. It was really encouraging to hear that and hopefully that helps fishermen for lobster season. It was a really good year for a lot of people.”

Mr Maillis said the main concern, especially for fishermen who specialise in traps as opposed to diving, is whether their traps have been speared and moved before they can get to them. He explained: “The only thing affecting an individual commercial fisherman’s prospects for the year is whether the traps have

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

been speared beforehand and moved. That plays a huge role.

“If a local Bahamian fishes a condo, according to the law it’s not illegal at this point in time. But, if you are doing that for a living, you are really hurting the person who sets the condo out. It makes it hard for them to stay in business.

“For some folks, lobster condos are all they do, and if condos are not profitable then they’ve travelled a long way for nothing or for less. That is not profitable. It plays a role in how a lot of fishermen view their season. There are areas where traps are going to be substantially exploited by the people who set them, and a lot of areas where they have been speared by others.

Mr Maillis said lobster condos fall victim to poachers, visiting tourists and Bahamian fishermen. He added that spearing most commonly takes place around the islands of Bimini, Abaco and Grand Bahama.

‘DOESN’T OFFEND’: WENDY’S BEATS ATLANTIS PI APPEAL

Marco’s Pizza would devalue Paradise Island’s image and status as a highend tourism destination.

Describing the appeal as “round two”, given that it had previously sent Wendy’s application for site plan approval back to the Town Planning Committee for further consideration due to lack of consultation and failure to comply with the process set out in the Planning and Subdivision Act, the Appeals Board said no such criticism could be levied this time.

While voicing concern over the “lack of participation” in the appeal proceedings by the Department of Physical Planning, given that it was named as the first respondent, the Appeals Board knocked down the Paradise Island resort industry’s arguments one by one.

“While objections were made based on the lack of a traffic study, the same is not a mandatory requirement under the terms of the Planning and Subdivision Act

and or Planning and Subdivision Regulations and, therefore, despite protest, the Board sees no reason on the basis of the intended use of the property that the lack of one should amount to the setting aside of the decision,” the Appeals Board said.

“This point may have been more materially considered if the report which was said to have been commissioned by an appellant was provided to the Board. However, absent more, the failure to consider same does not in the Board’s view rise to the level of vitiating the approval.”

As for PITDA’s argument that the lack of a land use plan and zoning bye-laws for Paradise Island resulted in the Town Planning Committee acting unlawfully, and in violation of the Planning and Subdivisions Act 2011 when granting site plan approval, the Appeals Board said it was guided by the legal expression that “the law does not compel the impossible”.

On the land use plan, it added: “Such a plan cannot

be regarded as one does not exist, while it is extremely preferable that one is promulgated post haste.”

In other words, the Government and its relevant ministries and agenciesespecially the Ministry of Works - need to take note.

The Wendy’s and Marco’s Pizza restaurant will be located at Paradise Island’s former Scotiabank branch location at the junction of Harbour Drive and Paradise Beach Drive. Turning to the site itself, the Appeals Board confirmed that restrictive covenants determining what it could be used for have long expired.

“Having reviewed the restrictive covenants in the title documents of the proposed site, the intended use of the proposed site for the restaurants does not, in the Board’s view, offend the existing restrictive covenants,” it said.

“Moreover, and in any event, having regard to the surrounding fast food businesses and the indication that there will be no drive-through services, this

use does not seem incompatible once the conditions imposed by the approval are met. Those conditions relate to the erection of signs, billboards and advertising devices at the site.

The only modification made by the Appeals Board was to clarify that the Town Planning Committee has granted preliminary, as opposed to final, site plan approval as the law requires the former to be issued first before the latter can be granted. Wendy’s still has to obtain final site plan approval.

The verdict leaves Wendy’s clear to proceed with its Paradise Island plans unless a further legal challenge is mounted. The former Scotiabank branch occupies a key spot at the junction of Harbour Drive and Paradise Beach Drive.

Drivers coming on to Paradise Island reach it before they get to Atlantis,

Hurricane Hole and any of the other resorts, while persons exiting via the offbridge also have to pass it. It is also within walking distance for both the thousands of staff and tourists at Paradise Island’s hotels, giving any fast food operator a lucrative and large market to tap into.

The respective homeowners associations for Ocean Club Estates and Ocean Club Residences and Marina, which collectively purport to represent more than 200 property owners, had also voiced their opposition to the Wendy’s/Marco’s Pizza dual restaurant on the basis that the project does not fit with Paradise Island’s upscale image and will adversely impact their property values.

A letter, signed by Paolo Garzaroli as Ocean Club Estates president, and Mark Newman as Ocean

Club Residences chair, said:

“We represent more than 200 homeowners and condo owners on Paradise Island, which is the vast majority of the people who have made their homes on Paradise Island and who are directly impacted by the pending decision of the Town Planning Committee.

“Our members strongly object to the proposed change in use of this property to make it fast food restaurants.” The October 12, 2023, letter, addressed to Charles Zonicle, director of physical planning, cited fears that the Wendy’s/Marco’s Pizza location will drive increased traffic, congestion and “loitering” compared to Scotiabank. “This will create nuisance and possibly hardship for members of the community,” they wrote.

Career Opportunity

We Are Growing and Have an Exciting New Opportunity For You! If you possess the qualities below, we invite you to apply for the position of:

ADMINISTRATIVE ASSISTANT, INVESTMENTS

Since its inception in 1997, RF Group has been committed to helping clients create and manage wealth. We are your local private bank connecting Bahamians with the best in local and international investments.

The Administrative Assistant, Investments is an integral member of the Investments unit. This role supports the Investments department in the day-to-day administration of its activities.

Key Responsibilities:

Perform general administrative and clerical duties while providing administrative support to individuals/the department, and assisting internal/external clients

• Prepare requests for funds and payment, prepare reports for management, minutes and other ancillary documents

• Data entry into spreadsheets and/or databases

• Perform other duties including file recording and maintenance, mail distribution, answering telephones, write memos, as directed.

Key Qualifications & Experience:

• Bachelor’s degree in Business Administration or equivalent Minimum 4 years related experience Excellent administrative and communication skills (verbal and written)

• Proficient in Microsoft Office Suite programs

• Ability to work independently as well as with a team

• Ability to multi-task Ability to draft minutes and perform administrative duties Strong leadership abilities

Please apply online at: https://www.rfgroup.com/careers

Deadline to Apply is Friday, 9th August 2024

Union ‘ready for action’ over reforms to BPL

upgrades to the New Providence grid by the 2025 third quarter. The bond offering document details the implications for BPL staff, with expatriate workers set to take the lead on the

upgrades until Bahamians can be up-skilled.

“BPL will continue to maintain customer relationships and billing, as well as its owned power generation assets,” the bond offer states. “Bahamas Grid Company’s plan is to hire new Bahamian staff and

upskill BPL staff as the core workforce to maintain the upgraded grid.

“Because this cannot happen overnight due to the additional training that will be required, Bahamas Grid Company’s workforce plan is to stage employee growth as follows. Bahamas

Grid will post for local job opportunities outlined with the skills needed and what Bahamas Grid training will be available to bridge the gap between current training and skills needed.

“Bahamas Grid will hire the New Providence transmission and distribution employees at BPL for a period of one year, after which they will have the opportunity to remain with Bahamas Grid or return to BPL. As a benefit to BPL to lower its operating

cost model, Bahamas Grid Company can release these job listings first to all BPL employees,” it added.

“The goal in this phase is to hire a core group of local employees that will be trained first. Bahamas Grid Company will bring in US-based contractors with storm hardened grid experience to work efficiently on energised lines and get the foundational upgrades implemented.

“During this period, the locally hired workforce will

shadow and learn from the contractors, in addition to participating in cooperative programmes to learn energised work skills in the US. Once the foundational upgrades are complete and the steady-state maintenance workload is clearer, Bahamas Grid Company will continue to hire and train local staff while bringing in offshore contractors on an as-needed basis for specific projects.”

Career Opportunity

We Are Growing and Have an Exciting New Opportunity For You! If you possess the qualities below, we invite you to apply for the position of:

I.T. Services Supervisor

Since its inception in 1997, RF Bank & Trust (Bahamas) Limited has been committed to helping clients create and manage wealth. We are your local private bank connecting Bahamians with the best in local and international investments.

The I.T. Services Supervisor role ensures the streamlined operation of the IT Service Desk in alignment with the business objectives of the RF Group. This role plans, coordinates, directs, and designs IT-related activities of the bank including applications support, training, administration and IT quality improvement initiatives.

Key Responsibilities:

Lead I.T. service operational and strategic initiatives, fostering innovation ideas, planning projects, and organizing and negotiating the allocation of IT Service Desk resources.

• Manage financial aspects of the IT Service Desk, including purchasing, budgeting, and budget review

• Negotiate and administer vendor, outsourcing, and consultant contracts and service agreements

• Oversee end-user services, including service desk and technical support services while ensuring service level agreements are met Perform asset management for IT hardware, software, and equipment and end user systems

Key Qualifications & Experience:

Bachelor’s degree in Computer Science, or Information Technology

Minimum of 5 years demonstrated experience in a similar role

• Certifications in Microsoft desktop technologies and/or ITIL preferred

• Strong technical knowledge of network, and PC operating systems, including MS Windows

• In depth knowledge of GDPR and data protection principles

Strong understanding of project management principles

Supervisory skills

Strong interpersonal and customer service skills

Strong analytical and problem-solving skills

Demonstrated verbal and written communication skills

Keen attention to detail

Please apply online at:

https://www.rfgroup.com/careers Deadline to Apply is Friday, 2nd August 2024

Union chief: Minister’s Pike meeting ‘flies in worker faces’

Mr Wilson said BPL employees are especially concerned about how their health insurance and pensions will be affected.

“People have genuine fears concerning the lack of information and transparency in this deal, especially with the mention of transferring or the secondment of labour to a third-party entity, which we believe is a round about way to separate employees from BPL to Pike without compensation,” he added.

“That just can’t happen as easily as they think or believe. How will this affect accounts, supply chain, transportation and fleet services, consumer services, communications, call centre, capital contributions, overhead and underground services, tree trimming, planning, stores and supply chain... all the various departments? This is people’s lives and jobs we are talking about. You have no right to shun or ignore Bahamian people and workers as you roll out the red carpet to foreigners.”

Mr Wilson said the deal appears to “lack both respect and structure” relating to labour and “flies directly in the face” of the Memorandum of Understanding that the Trade Union Congress signed with the PLP in August 2021 prior to the general election.

He likened the deal to “giving your house away, then asking for a job to clean the yard” and questioned how many of the 200 positions that will be

made available in Bahamas Grid Company will be held by foreigners and the pay structure and benefits they will enjoy.

Mr Wilson said: “I stand to be corrected but we are giving away 60 percent control and management of our transmission and distribution assets to a foreign company, then allowing them to raise over $100m from the Bahamian people who will have no say in the company. Then, after a certain amount of years, giving them their money back, but if it goes belly up there’s a risk of losing that investment?

“They claim 200 jobs will be created but how many will be Bahamian versus foreigners? As stated in their investment document they intend to bring in a significant amount of foreign labour. What will be their benefits and wages when compared to ours?”

The Ministry of Energy and Transport, in a statement, reiterated the Davis administration’s “ironclad commitment” to protect the jobs and benefits of BPL employees and honour the terms of the industrial agreement. They maintained that meetings were held with both the employees and managers unions of BPL advising them of the changes and plans for “blended working relationships, including opportunities for training and development”.

“From the outset, the Prime Minister and Minister Coleby-Davis emphasised that our reforms include an ironclad commitment

to protect the job security of BPL union workers: All industrial agreements will continue to be honoured, and all commitments made to workers, including pension benefits, will be met,” said the statement.

“BPL workers know well the inefficiencies and risks of continuing to operate an ageing and deteriorating energy grid, and will benefit from the modernisation and upgrades not just as workers, but as consumers of energy in their own homes.

“And, of course, the fact that there is finally a plan to address the utility’s fiscal woes should be a source of relief for BPL’s workers and their representatives. BPL is carrying a legacy debt of $500m. Without change and reform, BPL could not meet pension obligations in the future. We are not aware of any other proposals that purport to address this urgent unfunded obligation,” it added.

“We have conducted meetings with both BPL unions, initially advising them of the upcoming changes and subsequently elaborating on plans for blended working relationships, including opportunities for training and development. We will continue to create opportunities to share information and listen to any concerns, including in an upcoming comprehensive meeting with BPL staff to provide further clarity and address outstanding questions.”

NOTICE

NOTICE is hereby given that D’JACKENS WOLF AUGUSTE of P.O.Box CR-55814, East Street North, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of July, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that ROBERT URIEL ROPER of P.O. Box N4235 West Winds, Nassau The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of July, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that STANLEY VICTORof Blue Hill Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of July, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that ROBERT ALEXANDER WALKER KEITH of P.O. Box CR54633 40/n Montgomery Avenue Millary Heights Nassau, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of July, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that AMBROSE AGHAHOWA OBASEKI of #5 Miller Close off Market , Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of July, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that OLITA ALMAZI of Hanna Hill Eight Mile Rock Grand Bahama, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of July, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NEBRASKA GOVERNOR ISSUES A PROCLAMATION FOR A SPECIAL SESSION TO ADDRESS PROPERTY TAXES

By MARGERY A. BECK

Associated Press

NEBRASKA

Gov. Jim Pillen issued a longawaited proclamation on Wednesday calling a special legislative session to address the state's soaring property taxes, ruffling some lawmakers' feathers by giving them just a day's notice.

Pillen warned lawmakers on the last day of the regular legislative session in April that he would convene a special session sometime in the summer after lawmakers failed to pass a bill to significantly lower property taxes. Last month, he sent a letter to Speaker of the Legislature John Arch saying he planned to call lawmakers back on July 25. Property taxes have skyrocketed across the country as U.S. home prices have jumped more than 50% in the past five years, leading a bevy of states to pass or propose measures to rein them in. Nebraska has seen revenue from property taxes rise by nearly $2 billion over the past decade, far outpacing the amount in revenue collected from income and sales taxes.

Pillen's proclamation calls for slew of appropriations and tax changes, including subjecting everything from cigarettes, candy, soda, hemp products and gambling to new taxes. It also calls for a hard cap on what cities and other local governments can collect in property taxes.

Just as significant is what's not included in the proclamation: Pillen didn't direct lawmakers to consider a winner-take-all system of awarding electoral votes ahead of this year's hotly-contested presidential election.

Nebraska and Maine are the only states that split their electoral votes.

In Nebraska, the three electoral votes tied to the state's three congressional districts go to whichever candidate wins the popular vote in that district. Republicans who dominate state government in the conservative state have long sought to join the 48 other states that award all of their electoral votes to whichever candidate wins statewide, but have been unable to get such a bill passed in the Legislature.

Pillen said this year that he would include a winner-take-all proposal in a special session proclamation if the measure had the 33 votes needed to overcome a filibuster. He could still call another special session to consider a winner-take-all proposal if he thinks it has enough support to pass.

Pillen's 11th-hour call for a special session to deal with property taxes drew testy responses from some lawmakers, who have to interrupt summer plans, find day care for children and put their full-time jobs on hold to head back to the Capitol. Even some of Pillen's fellow Republicans joined in the criticism.

State Sen. Julie Slama, a Republican in the single-chamber, officially nonpartisan Legislature, slammed Pillen in a social media post as "an entitled millionaire." She also dismissed his plan to shift a proposed 50% decrease in property taxes to a wideranging expansion of goods and services subject to the state's 5.5% sales tax.

Pillen "thinks the Legislature will pass the largest tax increase on working Nebraskans in state history because he snapped his fingers and ordered us to dance," Slama posted on X.

State Sen. Justin Wayne, a Democrat from Omaha, called on fellow lawmakers to immediately adjourn

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, TROY ANDREW PINDER of Union Village, in the Eastern District of New Providence, one of the Islands of the Commonwealth of The Bahamas, intend to change my name to TROY ANDREW DOUGLAS. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas, no later than thirty (30) days after the date of publication of this notice.

PUBLIC NOTICE

The Public is hereby advised that I, LAVETTE RENEE ROLLEFERGUSON AND GODWIN BRENDINO FERGUSON of Fire Trail Road East Tall Pines P.O. Box SS 19992, Nassau, Bahamas, Parents of FAITH PATRICE RICHAE ROLLE A minor intend to change my child’s name to FAITH PATRICE RICHAE FERGUSON If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL

NOTICE

NOTICE is hereby given that MARIA ESTHER ROPER of P.O. Box N4235 West Winds, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of July, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that SELONDIEU SAINT-LOUIS of Claridge Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of July, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

the session Thursday and demand a week's notice from Pillen before reconvening. Barring that, the Legislature should at least recess on Thursday until Aug. 1, Wayne said in a Tuesday letter to his fellow 48 senators.

Under Nebraska rules, governors can call a special session but must issue a proclamation that outlines specifically what issues the Legislature will address during it. There is no deadline by which governors must issue a proclamation before calling lawmakers back for a special session, but legislators have typically gotten that call a week or more ahead of time.

Wayne called the lack of a proclamation from Pillen with only hours before the planned special session "blatant disrespect."

Prosecutors file Boeing’s plea deal to resolve felony fraud charge tied to 737 Max crashes

By DAVID KOENIG AP Airlines Writer

THE Justice Department submitted an agreement with Boeing on Wednesday in which the aerospace giant will plead guilty to a fraud charge for misleading U.S. regulators who approved the 737 Max jetliner before two of the planes crashed, killing 346 people.

The detailed plea agreement was filed in federal district court in Texas. The American company and the Justice Department reached a deal on the guilty plea and the agreement's broad terms earlier this month.

The finalized version states Boeing admitted that through its employees, it made an agreement "by dishonest means" to defraud the Federal Aviation Administration group that evaluated the 737 Max. Because of Boeing's

deception, the FAA had "incomplete and inaccurate information" about the plane's flight-control software and how much training pilots would need for it, the plea agreement says.

U.S. District Judge Reed O'Connor can accept the agreement and the sentence worked out between Boeing and prosecutors, or he could reject it, which likely would lead to new negotiations between the company and the Justice Department.

The deal calls for the appointment of an independent compliance monitor, three years of probation and a $243.6 million fine. It also requires Boeing to invest at least $455 million "in its compliance, quality, and safety programs."

Boeing issued a statement saying the company "will continue to work

transparently with our regulators as we take significant actions across Boeing to further strengthen" those programs.

Boeing was accused of misleading the Federal Aviation Administration about aspects of the Max before the agency certified the plane for flight. Boeing did not tell airlines and pilots about the new software system, called MCAS, that could turn the plane's nose down without input from pilots if a sensor detected that the plane might go into an aerodynamic stall. Max planes crashed in 2018 in Indonesia and 2019 in Ethiopia after a faulty reading from the sensor pushed the nose down and pilots were unable to regain control. After the second crash, Max jets were grounded worldwide until the company redesigned MCAS to make it less powerful.

STOCK MARKET TODAY

A wipeout on Wall Street sends the S&P 500 down by 2.3% as Big Tech skids

By STAN CHOE and ALEX VEIGA AP Business Writers

A WIPEOUT on Wednesday sent U.S. stock indexes to their worst losses since 2022 after profit reports from Tesla and Alphabet helped suck momentum from Wall Street's frenzy around artificial-intelligence technology.

The S&P 500 tumbled 2.3% for its fifth drop in the last six days. The Dow Jones Industrial Average dropped 504 points, or 1.2%, and the Nasdaq composite skidded 3.6%.

The profit reports from Tesla and Alphabet weren't disasters, but they raised questions among investors about which other market heavyweights' springtime results could fall short of expectations, said Sam Stovall, chief investment strategist at CFRA.

"How many disappointments are we likely to see?

Maybe let's sell first and ask questions later."

Tesla was one of the heaviest weights on the market and tumbled 12.3% after reporting a 45% drop in profit for the spring, and its earnings fell short of analysts' forecasts.

Tesla has become one of Wall Street's most valuable companies not just because of its electric vehicles but also because of its AI initiatives, such as a robotaxi. That's a tough business to assign a value to, according to UBS analysts led by Joseph Spak, and the "challenge is that the time frame, and probability of success is not clear."

At Alphabet, meanwhile, investors' patience with the company's big AI investments may also be running thinner.

Alphabet dropped 5% even though it delivered better profit and revenue for the latest quarter than expected. Analysts pointed to some pockets of weakness underneath the surface, including weaker growth in advertising revenue for YouTube than expected. They also said increased AI investments and other spending could crimp how much cash it generates.

The larger challenge for Alphabet may have simply been how much its stock has already rallied, nearly 50% in the 12 months through Tuesday, on expectations for continual growth.

Profit expectations are high for U.S. companies broadly, but particularly so for the small group of stocks known as the " Magnificent Seven." Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla need to keep delivering powerful growth after being responsible for the majority of the S&P 500's run to records this year, when many other stocks struggled under the weight of high interest rates. Critics are also calling these superstar stocks too expensive following their rocket rides higher.

The hope on Wall Street is that if momentum does flag for the Magnificent Seven, more stocks outside them can rise to support the market. Conditions may be improving at the right time. Hopes for imminent cuts to interest rates have helped

smaller stocks in particular to flip the market's leaderboard and jump in recent weeks.

The Russell 2000 index of smaller stocks had leaped at least 1% in seven of the last 10 days, though its momentum also slammed into a wall. It dropped 2.1% Wednesday.

Smaller stocks had been jumping as Treasury yields eased on expectations that inflation is slowing enough for the Federal Reserve to begin lowering its main interest rate in September.

Treasury yields were mixed Wednesday after preliminary data suggested U.S. business activity is back to shrinking in manufacturing, though continuing to grow in services industries.

The overall data suggested a "Goldilocks" scenario, where the economy is not so hot that it puts upward pressure on inflation but not so cold that it veers into a recession. But Chris Williamson, chief business economist at S&P Global Market Intelligence, said some potentially concerning signals were also lying beneath the surface, including heightened uncertainty around November's elections.

The yield on the 10-year Treasury rose to 4.28% from 4.25% late Tuesday.

AT&T was a bright spot for the stock market, rising 5.2% after its profit for the latest quarter matched analysts' expectations. Mattel jumped 9.8% after topping expectations for profit, aided by growth for its Fisher-Price and Hot Wheels lines.

The problem for Wall Street is that even if more stocks were to rise, they'll need to do so by more than Big Tech stocks are falling because of how much influence that small group carries.

Nvidia, for example, fell 6.8%. That wasn't as steep as Tesla's drop, but it was still the single heaviest weight on the S&P 500 because its total market value tops Tesla's. A 1% move for Nvidia packs more punch on the index than a 1% move for any company other than Microsoft or Apple.

Outside of Big Tech, Lamb Weston lost 28.2% for the worst loss in the S&P 500 after the supplier of French fries and other frozen potato products reported weaker profit for the latest quarter than expected. The company said fewer diners visited restaurants during the spring than it expected. It also warned challenges could continue into its upcoming fiscal year because of softer demand due to "menu price inflation."

All told, the S&P 500 fell 128.61 points to 5,427.13. The Dow dropped 504.22 to 39,853.87, and the Nasdaq slid 654.94 to 17,342.41. In stock markets abroad, indexes slumped across Europe and Asia.

France's CAC 40 index fell 1.1% as shares of luxury giant LVMH dropped 4.7% in

Stubborn warranty costs push down Ford's 2Q net profits, causing stock plunge in after-hours trading

By TOM KRISHER AP Auto Writer

IN October of 2020, Ford's then-new CEO Jim Farley said the company was working to cut warranty costs after glitch-prone small-car transmissions hit the automaker's bottom line.

we need to quickly accelerate," he said at the time.

Chief Financial Officer

John Lawler told reporters Wednesday that Ford is making progress on quality.

Nearly four years later, warranty costs are still vexing the nation's secondlargest automaker and lopping billions off of its profits.

Ford Motor Co. reported Wednesday that its secondquarter net income fell 4.7% from a year ago as its combustion-engine unit posted a pretax loss due to rising warranty and recall costs. The profit drop and lingering quality problems knocked net income to $1.83 billion from April through June, compared with $1.92 billion a year ago. It caused Ford to badly miss Wall Street estimates for adjusted earnings per share, touching off a stock plunge in after-hours trading.

Last quarter, the company said warranty and recall costs totaled $2.3 billion, $800 million more than the first quarter and $700 million more than a year ago.

At its investor day event nearly four years ago, Farley said Ford had made progress on quality of new vehicles as well as initial quality after vehicles were sold. "However we are not satisfied at all with our quality performance, including our recalls and customer satisfaction efforts, which

The second-quarter costs were attributed to older vehicles from the 2021 model year and earlier. Farley told analysts that improvements are showing up in internal data, and in research by J.D. Power, which found that Ford rose 14 places in this year's initial quality survey, from 23rd to ninth.