Fidelity targets $80m loan delinquents for bankruptcy

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FIDELITY Bank (Bahamas)

will

“aggressively” pursue delinquent borrowers responsible for $80m in collective consumer loan write-offs via personal bankruptcy judgments, asset seizures and taking liens over their wages.

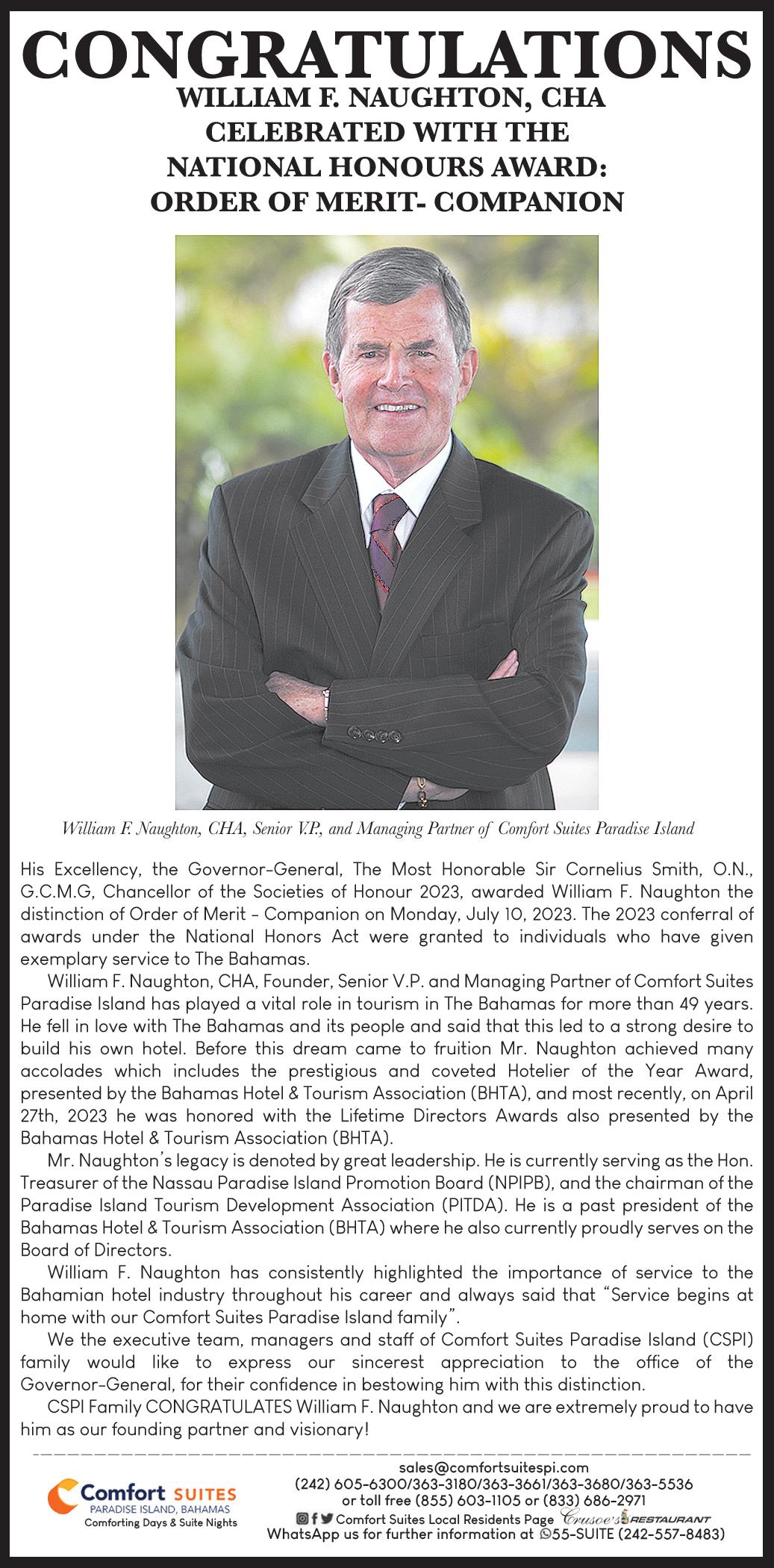

Gowon Bowe, the BISX-listed institution’s chief executive, acknowledged to Tribune Business that these tactics may seem “harsh” and potentially attract criticism but added that the bank will not sit idly by and “allow people to be rewarded for bad behaviour” when they fail to meet their obligations.

Speaking after its annual general meeting (AGM) last week, he said management had “indicated” to shareholders that Fidelity Bank (Bahamas) plans to hire “specialist collection skills” as a means to enforce existing judgments against loan defaulters via the Bahamian court system.

Affirming that success would “have a tremendous impact on the

bottom line”, Mr Bowe told this newspaper that the BISX-listed institution is “fairly confident” it can recover that $80m at a rate of 5-10 percent per year once the initiative hits full speed.

Essentially warning long-standing consumer loan deadbeats that there will be no hiding place, he said:

“We have a significant portfolio of delinquent loans that we have made full provision for, and in the annual results they are essentially written-off. We are now looking, and I

‘Beyond dispute’: But marinas demand proof

indicated this at the AGM, at specialist collection skills for the enforcement of judgments. “Our general collections team is focused on working with borrowers, but when you have borrowers who are not [responding], and the court have given you a judgment that says they owe, we need to start taking the general practice of enforcing that, whether it be through bankruptcy proceedings, the garnishing of wages or seizure of assets.

“We are going to take a very deliberate approach to this portfolio of loans that has been written-off over the years. If persons owed the bank during growth years, the focus was on customers coming in but, if you are in a period of contraction, the

Minnis: BPL chief says we’re right over Wartsila

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

DR HUBERT

Minnis

says Bahamas Power & Light’s (BPL) chief executive has vindicated his administration’s $90m Wartsila investment as he queried whether the utility is increasingly reliant on rental generation once again. The former prime minister said Shevonn Cambridge’s comments at last Thursday’s media briefing by the Prime Minister’s Office not only backed the acquisition of the seven engines but also refuted assertions by Philip Davis KC that “the smell

is rotten” surrounding the deal.

And, having reduced BPL’s rental generation requirements from a peak of 115 to 56 Mega Watts (MW) by the time his administration was voted

SEE PAGE B8

Deltec to ‘vigorously’ fight new FTX lawsuit

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN bank and its chairman yesterday denied fresh allegations that they knowingly aided and abetted the multi-billion dollar FTX fraud prior to the crypto exchange’s November 2022 implosion. Deltec Bank & Trust asserted that neither itself nor its chairman, Jean Chalopin, had any knowledge of wrongdoing by Sam Bankman-Fried and his inner FTX circle as they pledged to “vigorously defend... the unfounded allegations” in the latest

class action lawsuit filed against them by the crypto exchange’s aggrieved investors and clients.

“Deltec Bank and Jean Chalopin had no knowledge of wrongdoing by FTX or its executives until the numerous public revelations in late 2022,” the Bahamian institution said in a statement responding to Tribune Business inquiries. “Deltec Bank and Jean plan to continue to vigorously defend against the unfounded allegations in the complaint and look forward to their forthcoming

SEE PAGE B6

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Ministry of Finance’s top official yesterday asserted it was “beyond dispute” that boating fees due to the Government had not been paid amid demands from the marina industry to “show us the evidence”.

Simon Wilson, the financial secretary, questioned to Tribune Business what the Association of Bahamas Marinas (ABM) and its members “want me to do” as the concerns surrounding the Government-ordered decision to close the SeaZPass online portal showed no signs of abating.

While he described the purported failure to remit yacht charter fees and other boating-related revenues collected by SeaZPass as “indisputable”, an ABM past president called upon the Government to “show us the “proof” that any of these funds were never directly deposited to its

Royal Bank of Canada (RBC) account.

Peter Maury, who confirmed he was called in to a meeting with Mr Wilson and Ministry of Finance officials regarding their SeaZPass concerns, told this newspaper that the Government has yet to provide any evidence to back-up its non-payment assertions despite requests from himself and the Association.

He also argued that the Government had yet to share the results of a

business@tribunemedia.net MONDAY, JULY 31, 2023

SEE PAGE B9

SEE PAGE B7 GOWON BOWE SIMON WILSON

DR HUBERT MINNIS $5.70 $5.75 $5.80 $5.71

DEVOLVED GOVERNANCE A FAMILY ISLANDS NECESSITY

Decentralisation is not just an option but a crucial need for The Bahamas given its estimated 30 inhabited islands. The current centralised governance model poses limitations and hampers the nation’s ability to effectively address the diverse challenges and opportunities presented by its unique geography. By pushing for decentralisation, The Bahamas can unlock immense potential and pave the way for inclusive development.

The need for Decentralisations

The economic potential of The Bahamas can be fully realised through decentralisation. The tourism industry, a major driver of the national economy, can benefit greatly from island-specific strategies. Each island possesses distinct cultural heritage, natural beauty and unique attractions. By granting local authorities the autonomy to develop and implement tourism initiatives, The Bahamas can tap into the individual strengths of each island, attracting diverse segments of tourists and diversifying the product offerings. This decentralised approach can spur economic growth,

create job opportunities and drive sustainable development throughout the archipelago.

While local government has existed since 1996, its full potential has not been fully exploited, particularly in catering to the specific tourism needs of each island. To address this, it is crucial to establish a dedicated arm focused on tourism and the preservation of each island’s unique culture. This specialised entity can work towards formulating island-specific tourism strategies, promoting local attractions and

ensuring the preservation of cultural heritage. By prioritising these aspects, The Bahamas can effectively leverage its diverse cultural assets and natural beauty to drive tourism and economic growth, while maintaining the authenticity of each island’s culture.

Furthermore, decentralisation ensures the preservation and celebration of The Bahamas’ rich cultural diversity. Each inhabited island carries its own historical significance, traditions and cultural heritage.

Centralised governance often overlooks the importance of local customs and identities. However, by empowering local authorities, decentralisation enables island-specific initiatives to protect and promote cultural heritage. This not only preserves the unique identities of each island but also contributes to the collective national identity of The Bahamas, fostering a sense of pride and unity among its people.

Why Decentralisation works

1. Empowering Local Communities: Decentralisation bestows power and autonomy upon the residents of each island, providing a platform for active

participation in decisionmaking processes. Local representatives possess an intimate understanding of the unique challenges and aspirations of their respective islands, enabling them to craft tailored and effective policies that meet the specific needs of their communities.

2. Efficient Resource Allocation: With decisionmaking authority vested at the island level, decentralisation enables efficient resource allocation. Local administrators are better equipped to prioritise investments and public services based on the distinct requirements and priorities of each community. This targeted approach can foster significant improvements in infrastructure, healthcare, education and other essential services across the various islands of The Bahamas.

3. Fuelling Economic Growth and Tourism: Renowned for its tourism industry, The Bahamas stands to gain from decentralisation. By embracing island-specific tourism strategies, local governments can tap into their in-depth knowledge of cultural heritage and natural resources to attract visitors, create job opportunities and drive sustainable economic growth. Each island’s unique identity can be celebrated, contributing to the overall national identity while

preserving local traditions and historical sites.

4. Safeguarding Cultural Diversity: The Bahamas boasts a rich tapestry of cultural diversity across its inhabited islands. Decentralisation acts as a bulwark, protecting and promoting this diversity by enabling local decision-making on cultural initiatives. Local authorities can champion the preservation of unique traditions, festivals and historical landmarks, ensuring that each island’s heritage remains intact and contributes to the collective identity of The Bahamas.

Navigating the challenges of Decentralisation

1. Overcoming Administrative Hurdles: Implementing decentralised governance requires establishing robust administrative structures and processes at the island level. Building capacity, training personnel and ensuring effective co-ordination between the central government and local authorities pose initial challenges. Adequate resources and support must be provided to empower islands with the tools needed to overcome these obstacles.

2. Addressing Financial Implications: Decentralisation necessitates a redistribution of fiscal resources among the islands. To mitigate

potential disparities, smaller islands with limited revenue streams may require financial assistance to support governance and public service delivery. Striking a balance between financial autonomy and equitable resource distribution is vital to foster sustainable development and reduce inequalities.

3. Fostering Co-ordination and Cooperation: Successful decentralisation hinges on seamless co-ordination and co-operation between the central government and island administrations. Harmonising decision-making, aligningpoliciesandenforcing national laws while respecting local autonomy can be intricate endeavours. Developing robust mechanisms for collaboration and information sharing is crucial to ensure effective implementation of decentralisation.

4. Promoting Equitable Development: Decentralisation, if not carefully managed, can inadvertently amplify inequalities between islands. Islands with greater resources and economic opportunities may advance more rapidly, exacerbating regional imbalances. The Bahamas must establish safeguards to address such disparities, promoting equitable growth and

SEE PAGE B4

PRIVACY POLICIES AND NOTICES BOTH BOOST DATA PROTECTION

Data protection is of the utmost importance in today’s data-driven world. As technology advances and businesses collect more data than ever before, it is increasingly important to understand the difference between data privacy policies and privacy notices in order to protect individual rights and to maintain compliance with regulatory requirements.

Most data privacy laws now require websites to incorporate various information and transparency requirements into their privacy notices and policies. But is a privacy policy not the same as a privacy notice? Otherwise, how do privacy policies and privacy notices differ? The purpose of this article is to explore their contrasts in more detail albeit briefly.

Privacy Policy

The purpose of a privacy policy is to give employees at data controllers or processors, who may handle or make decisions regarding the personal data of users, instructions about how to collect, use, store and destroy data in a compliant and correct manner, as well as about any specific rights the data subjects (users) may have. As part of a privacy policy, a company may also develop mechanisms for enforcing its privacy posture and establishing a system of checks and balances (including penalties) to ensure compliance.

Privacy Notice

In a privacy notice, a company informs customers, regulators and stakeholders about how it uses personal information collected from data subjects. The topics covered are the types of data

to whom they apply. On the other hand, a privacy notice explains to data subjects and other external stakeholders how the company commits to processing personal data securely and legally.

BY

DEREK SMITH

processed, the lawful basis for processing, the transfer of data to third parties, and the time that data will be stored. Furthermore, it outlines users’ rights regarding their data and provides contact information for the company’s privacy teams, thus fulfilling transparency obligations.

Fundamental differences

Core Audience: The privacy policy is intended for internal employees with access to, or who manage, data. Detailed information on how to handle personal information will be provided to employees in the privacy policy. A privacy policy should be developed and updated according to the latest applicable privacy regulations. Conversely, external users, customers and regulators are the intended audience for the privacy notice. A privacy notice provides more details and explanations about data, rights of users and data sharing policies.

A privacy notice is typically based on a privacy policy.

Scope: Privacy policies specify the type of personal data and the stakeholders

Keep components: Privacy policies must have defined internal procedures, methods and standards for data collections, data processing, data retention, data security, data subject rights and compliance. Conversely, the key components of a privacy notice include transparency, accessibility, consent, dates regarding updates to the notice, and specifics regarding data practices.

In conclusion, even though data privacy policies and privacy notices serve different purposes, both are vital in maintaining data and regulatory compliance. In order to create a trusted and secure environment for all stakeholders, companies must craft clear, conciseand transparent documents that respect individuals’ rights and protect their personal data.

Smith Jr

Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the assistant vice-president, compliance and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle and Turks & Caicos.

PAGE 2, Monday, July 31, 2023 THE TRIBUNE

SIMMS RODERICK A. AN ADVOCATE FOR SUSTAINABLE FAMILY ISLANDS

GOV’T SET TO MAKE VAT-FREE INITIATIVE ‘MORE MEANINGFUL’

THE Ministry of Finance’s top official yesterday revealed the Government is seeking to “tweak” this year’s Back to School ‘VAT-free holiday’ to provide merchants and consumers with “more meaningful benefits”.

Simon Wilson, the financial secretary, confirmed to Tribune Business that the Davis administration will provide tax relief on the local purchase of school supplies, books and clothing for a similar period to last year’s initiative, which ran from August 22 to September 11, 2022.

However, he argued that the financial benefits from the initiative as presently structured are “more symbolic than real” because many school supplies

- including clothing and computer equipmentalready enjoy duty-free exemptions year-round.

As for the VAT, Mr Wilson said the Ministry of Finance had seen fewer businesses apply for the exemption because it was viewed as “administratively burdensome” and did not spark a significant increase in sales as shoppers are able to buy Back to School supplies on a year-round basis. The precise nature of the “tweaks” and “more meaningful benefits” was not disclosed.

He spoke out after Kwasi Thompson, the Opposition’s finance spokesman, again sought to slam the “late again” Davis administration for failing to thus far confirm if the Back to School ‘VAT-free holiday’ would be held this year and between what dates. He argued that the potential savings would be especially

GOVERNANCE REFORMERS CALL FOR MORE TRANSPARENCY FOCUS

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

GOVERNANCE

reformers yesterday urged the Government to improve The Bahamas’ anti-corruption standing by prioritising and speeding-up reforms to promote transparency after it was accused of “stalling” on several measures.

The Organisation for Responsible Governance (ORG), responding to assertions in the US State Department’s recent investment climate statement on The Bahamas, said:

“We take this opportunity to reiterate our call to the Government of The Bahamas to prioritise and expedite necessary reforms, emphasising enhancing the ease of doing business, streamlining bureaucratic

processes and ensuring transparency in all public proceedings.

“We also underscore the importance of digital transformation, which is critical to a resilient, sustainable and inclusive economy.” ORG said that although The Bahamas is attractive to investors, issues such as lack of transparency and iyts digital infrastructure continue to cause concern.

It added: “We concur with the assessment that The Bahamas boasts a robust service-based economy, attractive geographical location, stable political system and commendable infrastructure, making our nation an attractive destination for global investment. We celebrate these strengths while recognising the need for

SEE PAGE B4

KWASI THOMPSON

valuable for vulnerable lower and middle income Bahamian families who have been hit hard by postCOVID inflation and the cost of living crisis.

Describing the tax breaks as “so critically needed for many struggling Bahamian families”, the former minister of state for finance said:

“As began by the FNM several years ago, this VAT

holiday would eliminate the VAT for purchases of Back to School supplies, uniforms and footwear for a period of time.

“We recall vividly that, last year, we in the Opposition had to call upon the Government to do the right thing for the Bahamian people. And the Davis administration ended up doing a VAT holiday at the last minute with a very constrained timeframe and with much confusion among merchants and consumers.

“Bahamian families have been ravaged by the effects of global inflation over the last two years..... The Government’s commitment to Bahamian families must be more than just gimmicky and meaningful action. And implementing the VAT holiday will save Bahamian families at a time when it is critically needed.” Mr Thompson thus called on the Government to confirm

if a Back to School ‘VATfree holiday’ will be held this year.

Responding in the affirmative, Mr Wilson explained why the initiative is “symbolic more than real” when it comes to providing merchants and shoppers with real benefits. “Hopefully this year we will be able to tweak it a little bit to get some real benefits in and make it a bit mote meaningful,” he added.

“The clothing providers, the retailers, are already getting duty-free clothing in year-round. Most school supplies are duty-free, and computer equipment is duty-free. There is a wide spread of goods for Back to School that is already duty-free. And, when you move to VAT, the benefits are not as much as people think they are for business people.

“As we encourage more businesses to apply for

the programme, every year we see less apply as they see it as an administratively burdensome and doesn’t translate into a significant increase in sales,” Mr Wilson continued. “Back to School sales can happen any time, any how. When we try and convince them to be involved in the programme, they say: ‘You know what? It doesn’t change my bottom line enough to take on the administrative burden’.”

The Back to School ‘VAT-free holiday’ was introduced by the former Minnis administration during the COVID-19 pandemic as a means to to encourage Bahamians to purchase school supplies, books and clothing locally, thereby keeping money circulating in the country’s economy and boosting revenues for businesses.

‘RACISM AND ELITISM’ HIT CLIMATE CHANGE EFFORTS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN scientist is denouncing what she branded as “racism”, “bias” and “elitism” that are impacting the battle against climate change - especially when it comes to the provision of financing to mitigate its impacts.

Marjahn Finlayson, a director and educator at ClimateEdu Bahamas, and an advocate in the climate change fight, told a panel discussion during Baha Mar’s Sustainability Week that there is a “level of Global North elitism” in the climate change arena.

She explained that scientists and researchers from larger, developed countries believe their counterparts from the developing world are not up to standard when it

comes to the true dynamics of climate change and the associated discussion on conservation.

“A black woman in this space always has to come to some white man or some wonderful white woman, and normally they are wonderful white women, and ask them for assistance in this one thing,” Ms Finlayson said.

“Like, it’s so frustrating, because now I have to tell you: ‘OK, yes, it’s all of your ancestors’ fault and I need reparations for this. I need capacity built’. And, you know, [Barbadian] prime minister Mia Motley is doing the thing, getting the financing, and that’s very important and we could talk a little bit more about that later.

“But just to come back to the point that there is this huge bias in the climate sector. It is enormous, it is huge. And we’ve got to call

the thing a thing. There is racism, there is a level of global North elitism.”

Tarran Simms, assistant director of conservation and sustainability programmes at Baha Mar, argued that “colourism” also affects the environmental field as well. He said: “In the environmental field, colourism is something that we fight against every day. Another side gig that I do, I work with foundations, and I’ve been to foundation

meetings and they have the saviour complex. Scientists, when they come into small island nations and developing countries, it’s like: ‘We know is right for you’. Instead of building areas of conservation, the funders send their parachutes in science in, and tell us we know what’s right for you, so why aren’t you doing this for yourself?”

THE TRIBUNE Monday, July 31, 2023, PAGE 3

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SEE PAGE B5

SECURITY OFFICER POSITIONS Seeking To Find JOB OPPORUNITY Info@tacticalinvestigators.com | (242) 394-3082 send resumes to

CENTRAL BANK: ‘STAY ALERT’ ON CREDIT CARD FRAUD RISE

THE Central Bank is urging Bahamians “to stay alert” due to an increase in credit card fraud incidents.

The banking regulator, in a written response to Tribune Business queries, said: “Anecdotally we have reason to believe that fraudulent attempts are increasing. However, financial institutions have been taking more aggressive steps to educate their customers and protect them against fraud.

“Members of the public need to say alert, monitor the transactions passing through their accounts, be very secretive about the

security details attached to their accounts, and use the established direct channels to communicate with their financial services providers when they suspect that they are either targets or victims of fraud. Likewise, individuals should be swift to alert both the police and Financial Intelligence Unit whenever they sense suspicious activity.”

CIBC FirstCaribbean, responding via e-mail to Tribune Business questions on the Central Bank’s warning, said it has a “very robust fraud monitoring team which is constantly engaged in ensuring our credit card clients are able to conduct transactions safely and securely.

“Fraud attempts are a fact of life in our digital world,”

Devolved governance a Family Islands necessity

FROM PAGE B2

development across the archipelago.

The National Development Plan

Utilising the National Development Plan (NDP) presents an opportunity to achieve decentralisation in The Bahamas. By incorporating a robust policy framework within the NDP, decentralisation can be emphasized as a core principle. This framework should articulate the objectives, strategies and mechanisms necessary to devolve power and decision-making authority to individual islands. Legislative and institutional reforms are crucial elements in supporting decentralisation efforts, and the NDP can outline specific actions, such as enacting legislation to establish the legal framework for decentralisation and establishing dedicated

institutions at the island level to facilitate local governance. Furthermore, enhancing the capacity of local authorities and island administrations is essential for the success of decentralisation. Through the NDP, strategies can be outlined to provide comprehensive training and support programmes for local government officials, equipping them with the requisite skills and knowledge to effectively carry out their responsibilities. Additionally, addressing the financial implications of decentralisation is critical. The NDP can propose equitable mechanisms for allocating financial resources among the islands, ensuring that smaller islands with limited revenue streams receive adequate support for governance and public service delivery.

Conclusion

it added. “However, our clients can rest assured that we are well-positioned to detect and manage such occurrences when they happen and minimise the impact on them. We remind our clients that they should make use of the facility in our mobile banking app that allows them to keep their cards frozen when not in use, as this gives them an added layer of protection against fraud.”

Royal Bank of Canada (RBC) Bahamas, in an e-mail statement, added that it is “committed to advising clients on how to maintain security in their banking activities. It must be emphasised that an RBC credit card should always be treated as cash, keeping it out of reach of

In conclusion, decentralisation is not only a beneficial choice but a necessity for The Bahamas. With its multiple inhabited islands, embracing decentralisation offers an opportunity to address unique challenges and unlock the immense potential of each community. By devolving power and decision-making authority to the individual islands, The Bahamas can empower local communities, optimise resource allocation, stimulate economic growth and preserve its rich cultural diversity. Through the National Development Plan (NDP) or other strategic frameworks, the Government can outline clear objectives, enact legislative reforms and promote capacity building to support decentralisation efforts. By embarking on this path, The Bahamas can foster inclusive development, ensure local participation and create a more resilient and prosperous future for all its inhabitants across the archipelago.

unauthorised individuals,” the bank added. “Upon receiving a card, it should be promptly signed using an ordinary ballpoint pen in the designated ‘Authorised Signature’ space, found on the reverse side.

“RBC credit cards offer CHIP and PIN technology for added protection. Smaller value transactions can be completed securely by tapping your card where available, otherwise you may be required to enter your PIN when the card is inserted.”

RBC continued: “RBC strongly advises against lending your card to anyone, including close friends or family. We warn against responding to unsolicited calls or e-mails requesting confidential information.

FROM PAGE B3

continued commitment to upholding these standards. “However, we also recognise the challenges that have been brought to light. Issues such as bureaucratic red tape, lack of transparency and the need to overhaul our digital infrastructure are of utmost concern. These areas have long been a part of our advocacy for better governance and an improved business climate.”

The US investment climate statement asserted that the roll-out of anticorruption measures such as campaign finance reform, plus legislation that would create bodies such as an Integrity Commission and an Ombudsman, are being delayed.

It reiterated prior concerns that laws and regulations to combat graft have been “inconsistently

Your banking details are personal and must remain secure. This extends to ensuring the proper disposal of all banking correspondence, including transaction slips.

“We urge cardholders to exercise constant vigilance with their transactions, checking receipts against monthly statements, and swiftly reporting discrepancies. When using your card at Point-of-Sale terminals (POS), ensure the machine in use is genuine and always maintain the card in your presence.

“Share your information sparingly,” RBC warned. “This means not disclosing your credit card details over the phone unless you initiated the call. It’s highly recommended that shopping

applied”, and “more robust enforcement” is needed to prevent conflicts of interest in the bidding on and awarding of government contracts. It also noted there were no sanctions or penalties imposed on MPs, senators and public officials who failed to meet the 2022 deadline for filing their annual financial disclosures. ORG said it “appreciates” the US assessment, adding that it can be used as a “road map” to guide The Bahamas towards a more favourable business environment.

It added: “ORG appreciates the thorough review and comprehensive perspective offered on the investment landscape of our nation. The report highlights our strengths and the areas that demand improvement, providing a road map that can guide our efforts toward creating a more

be done on Internet sites that offer secure ordering, which can be recognised by ‘https’ web addresses or associated security icons such as padlocks or keys in your browser window. Be wary of merchant sites that require you to store your credit card credentials and only store on reputable sites.

“If you anticipate any changes in your personal information, please notify the card centre ahead of time. Swift reporting of lost or stolen cards is essential. Lastly, we advise avoiding public wi-fi networks when carrying out online shopping, bill payments or sharing any financial information. Always prioritise secure networks with requisite login procedures to ensure safety.”

favourable and conducive business environment.

“ORG is committed to working with the Government, business communities, civil society and our international partners to address these issues. Continued dialogue, reforms and proactive policies will foster a climate that encourages local entrepreneurship and foreign investment, accelerating our nation’s economic recovery and paving the way for sustainable growth.”

JR. ACCOUNTANT/BOOKKEEPER NEEDED

Primary Responsibilities

• Prepare payroll and vendor payments on a weekly basis

• Manage all accounting transactions

• Prepare monthly, quarterly, and annual reports

• Reconcile bank and credit card accounts weekly

• Manage balance sheets and pro t loss statements

• Comply with nancial policies and regulations

• Compute and prepare Value Added Tax returns

• Assist and other tasks as deemed necessary

Requirements and skills

• Minimum of (3) years’ Work experience as a bookkeeper

• Hands-on experience with QuickBooks and MS Excel

• Experience with general ledger functions

• Strong attention to detail and good analytical skills

• Minimum of AAs in Accounting, Finance, or relevant degree Please

PAGE 4, Monday, July 31, 2023 THE TRIBUNE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

reformers call for

transparency focus TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

Governance

more

send resume to: newcareer591@gmail.com Deadline to apply: July 31st, 2023

a well-established

to a

JOB OPPORTUNITY

For

accounting frm. Successful candidate will be assigned

portfolio of clients, primarily in the restaurant industry.

Prepare for soft landing

By CHRIS ILLING

In view of the slowdown in inflation, US consumers increased their consumption significantly in June. The US Commerce Department said last Friday that consumers increased their spending by 0.5 percent from the previous month. Economists had expected growth of just 0.4 percent, down from a revised 0.2 percent in May. Private consumption is a cornerstone of the US economy, which continued to grow robustly in the spring, also thanks to consumer spending.

In order to curb inflation, the Federal Reserve has further tightened the monetary policy reins and raised its key interest rate to a new range of 5.25 to 5.50 percent. Despite falling to 3 percent, inflation was still

well above the Fed’s target of 2 percent. One measure of inflation that policymakers are keeping a close eye on is consumers’ personal spending. This so-called PCE core index fell surprisingly sharply in June to an annual inflation rate of 4.1 percent, down from 4.6 percent in May. Experts had only expected a decline to 4.2 percent. This does not include volatile food and energy costs. The US economy grew much faster than expected in the 2023 second quarter. Durable goods orders and weekly labour market data also surprised on the upside.

‘Racism and elitism’ hit climate change efforts

FROM PAGE B3

This, Mr Simms said, only gets worse when it is time for negotiations on climate change and the environment. Smaller nations that are most affected by climate change, and the actions of the larger, developed

Share your news

countries “lack the capacity” to negotiate with them.

“All of us are good the first week, and then they start hitting the text (with), ‘I don’t like this word’. ‘I don’t like human rights’. ‘I don’t like this word’, and the text is so dumbed down and you’re so tired at the

The data is seen as an important factor that the US Federal Reserve will consider when making its next interest rate decision in September. Federal Reserve chairman, Jerome Powell, has left the door open for another hike while not ruling out a pause. The US central bank wants to base its decision on incoming data.

Upbeat economic data surprises, and strong corporate balance sheets, drove Wall Street higher during the final trading day last week. The S&P 500 was up by over 1.1 percent, and the NASDAY up by almost 2 percent. The

end of the day that you just agree and everybody celebrates at the end like oh, we won, but when you read the text it is not substantive. Nor will it do anything to help you as a small island developing state,” he said.

“So we lack capacity, and also the global north lacks the economic will to actually fight the right fight - and the just fight - to ensure that small island nations are able to persevere for future generations.”

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

biggest winner this week was META. The Facebook company’s second quarter revenue grew by 11 percent year-over-year to $32bn, while earnings increased by 21 percent to $2.98 per share. That was better than anticipated. The share price rose by almost 10 percent.

Across the Atlantic, the European Central Bank (ECB) also raised its key

interest rate on Thursday for the ninth time in a row to its highest level since 2000 in a bid to contain inflation in the monetary union. However, the monetary watchdogs did not want to commit to their further course after the summer break. The ECB’s head, Christine Lagarde, said: “I can assure you that we will not lower it; that’s a definite no.

There is a possibility of a rate hike or a pause.” Just like the Federal Reserve, the ECB wants the inflation rate back to its target of two percent.

The prospect of an end to interest rate hikes boosted the European indices on Friday. The leading German index, DAX, rose to a new record high despite weak economic data.

THE TRIBUNE Monday, July 31, 2023, PAGE 5

CCA @ Activ Trades Corp

Deltec to ‘vigorously’ fight new FTX lawsuit

motions to dismiss this case.”

Deltec and Mr Chalopin have been named as defendants in an action filed last Wednesday in the eastern Washington state federal court by Connor O’Keefe, a former FTX client representing the ‘class action’ group. Mr O’Keefe, who lent his name to another FTX class action lawsuit that also named Deltec and Mr Chalopin as defendants, that one in the southern Florida federal court, has gone to eastern Washington likely because that is where Moonstone Bank is located.

This institution, one of the smallest banks in the US, was acquired by Mr Chalopin in his personal capacity. Some $50m, deposited in the name of Bahamas-based

FTX Digital Markets, was seized from Moonstone accounts by the US Justice Department.

“Though FTX customers could not see that Sam Bankman-Fried was misappropriating their deposits on vice, vanity and speculative personal investments, defendants had full view,” the lawsuit alleged of Deltec and Mr Chalopin.

“Through diligence on FTX and close ties with Sam Bankman-Fried, defendants learned that FTX was operated as Sam BankmanFried’s personal piggy bank; that as quickly as FTX customer funds flowed into FTX, they flowed back out to other entities Sam Bankman-Fried separately owned or controlled, and that FTX lacked the most basic internal controls, such that the enterprise was in fact a house of cards.

“But defendants did not care. They, too, had money to make in the scheme, and their interests aligned with Sam Bankman-Fried’s... Defendants provided a suite of non-routine, highrisk banking services to FTX when traditional financial institutions would not, including accepting and/or transferring class members funds into accounts that defendants knew were held by entities that Sam Bankman-Fried separately owned; developing proprietary blockchain software and other infrastructure necessary to Sam Bankman-Fried’s looting of class members funds, and helping to fence class member funds across the US border.” Mr O’Keefe and his fellow plaintiffs alleged that Deltec “provided one-of-a-kind digital asset

banking services to FTX and, upon information and belief, served as a primary vehicle through which Sam Bankman-Fried routed class member funds offshore beyond the reach of US regulators and law enforcement”.

“By way of his close ties with Sam BankmanFried, Mr Chalopin sought funding from FTX for his other bank, defendant Moonstone. Janvier Chalopin, Moonstone’s chief digital officer and Mr Chalopin’s son, reports that they ‘pitched [Alameda Research] the whole road map’ to invest in Moonstone, which he claimed would fill ‘the massive gap in banking in the US for digital assets businesses’,” the lawsuit alleged.

“The Chalopins succeeded. In January 2022, Alameda invested $11.5m

in Moonstone—nearly double the bank’s net worth at the time. Moonstone was not always flush with such large inflows of capital. Until recently, Moonstone was the 26th smallest of 4,800 banks in the US with a single branch in Farmington, Washington, a town of only 150 residents.

“In 2010, the bank’s president bragged that it did not offer credit cards and held more deposits than loans outstanding. That changed in 2020, when Mr Chalopin purchased Moonstone, purportedly to support the ‘underserved cannabis industry’, and now serves as its chairman and chief executive.”

The lawsuit added:

“Upon Alameda’s investment in Moonstone, Moonstone promptly applied, and was approved, to become a member of

the Federal Reserve. With that, FTX gained access to a third point of entry to the US banking system, and FTX promptly took advantage of these services, depositing $50m in class member funds across two accounts.

“At the time of the fraud’s collapse, FTX was Moonstone’s largest customer, and Moonstone, for its part, benefited tremendously from this quid pro quo. With FTX’s accounts, Moonstone’s deposits jumped to $71m in the third quarter of 2020, a 600 percent increase from Moonstone’s historical average. In pursuit of continued growth and unprecedented profits, Moonstone, at the direction of Mr Chalopin, gladly took action in furtherance of Sam Bankman-Fried’s fraud.”

INDIA CUTS RICE EXPORTS, TRIGGERING PANIC-BUYING OF FOOD STAPLE BY SOME INDIAN EXPATS IN THE US

By BOBBY CAINA CALVAN Associated Press

CHATTER on one of

Prabha Rao's WhatsApp groups exploded last week when India announced that it was severely curtailing some rice exports to the rest of the world, triggering worry among the Indian diaspora in the United States that access to a food staple from home might soon be cut off.

As in any crisis situation

— think bottled water and toilet paper— some rushed to supermarkets to stock up, stacking carts with bags and bags of rice. In some

places, lines formed outside some stores as panic buying ensued.

But Rao, who lives near Syracuse, New York, was reassured when the proprietor of her Indian market sent out an email to customers to let them know there was no need to worry: There was an ample supply of rice.

At least for now.

An earlier than expected El Niño brought drier, warmer weather in some parts of Asia and is expected to harm rice production. But in some parts of India, where the monsoon season was especially brutal, flooding destroyed

some crops, adding to production woes and rising prices.

Hoping to stave off inflationary pressures on a diet staple, the Indian government earlier this month imposed export bans on non-Basmati white rice varieties, prompting hoarding in some parts of the world.

The move was taken "to ensure adequate availability" and "to allay the rise in prices in the domestic market," India's Ministry of Consumer Affairs, Food & Public Distribution announced July 20. Over the past year, prices have increased by more than

11%, and by 3% over the past month, the government said.

Non-Basmati white rice constitutes about a fourth of the rice exported by India.

"On WhatsApp, I got a lot of messages saying that rice was not going to be available. I think there was a lot of confusion in the beginning because, as you know, rice is very important for us," Rao said. "When we first heard the news, there was just mild confusion and people started panic buying because they thought that it may not be available," she said.

There are scores of different varieties of rice, with people having their preference depending on taste and texture. India's export ban does not apply to Basmati rice, a long-grain variety that is more aromatic.

The ban applies to shortgrain rice that is starchier and has a relatively neutral flavor — which Rao says is preferable in some dishes or favored in specific regions of India, especially in southern areas of the country.

At Little India, a grocery store in New York City's Curry Hill neighborhood in Manhattan, there was no shortage of Basmati rice and other varieties.

That wasn't the case at other Indian groceries. On its Facebook page, India Bazaar, an Indian grocery chain in the Dallas-Fort Worth area, told customers not to panic. "We are working hard to meet all our shoppers' demands," the post said. Customers cleared shelves and waited in long lines to stockpile bags of rice, reported NBC Dallas affiliate KXAS. "They really wanted to purchase ten, 12, 15 bags," India Bazaar's president, Anand Pabari, told the station. "It was a really crazy situation."

RELATIONSHIP MANAGER FOR EXTERNAL ASSET MANAGER DESK (“EAM”)

A Swiss Bank is looking for an experienced Relationship Manager who is fuent in Spanish and French, travels for client visits, a pro-active, enthusiastic and highly motivated professional to fll the subject position.

• The Relationship Manager’s primary responsibilities are to increase the bank’s client base, develop partnerships with new and existing EAMs, and manage an existing book of clients.

• The candidate must have an existing client book. In addition, the senior position requires developing incremental business – specifcally in the LATAM region – with ensuring top level service and strict adherence to the Bank’s policies & procedures and current jurisdictional regulatory and legislative framework.

• The candidate should be a qualifed professional having at minimum a Bachelor’s Degree in Business Administration or relevant area of study.

• Candidate should possess experience at a senior level position for at least 5 years.

Selected candidate shall be offered benefts commensurate with their qualifcations and experience.

PAGE 6, Monday, July 31, 2023 THE TRIBUNE

FROM PAGE B1

Interested candidates should submit a CV to contact@bankgonet.com by August 4, 2023

Fidelity targets $80m loan delinquents for bankruptcy

focus is on recovering loans from those who have failed to meet their obligations.”

With Bahamian commercial banks still struggling to find suitably qualified borrowers for new lending opportunities, many institutions are now grappling with flat or contracting loan books. With little prospect of strong growth in their core business line for the foreseeable future, some are turning to alternative income streams such as fees and commissions plus placing emphasis on recovering loan loss provisions and delinquent credit.

“The general society is going to see a more aggressive approach from Fidelity,” Mr Bowe affirmed. “It may garner some criticism from some as they see it as being harsh.”

However, he reminded potential critics that Fidelity Bank (Bahamas) has a fiduciary duty to both its depositors and shareholders to both protect their capital and recover all funds due and owing.

“The bank is going to turn its attention to enforcing, not penalising, the obligations on persons who it has secured legal judgments in relation to,” he told Tribune Business. “We are certainly take the most proactive approach in terms of enforcement even if that means, which is a rare occurrence in The Bahamas, putting people into bankruptcy proceedings under Bahamian bankruptcy law.”

Asked about the collective size of the delinquent credit portfolio that Fidelity Bank (Bahamas) is targeting, Mr Bowe said: “This has been built up over a decade to near $80m. Even collecting 10 percent of

it over several years... If we recover at $8m a year. We know in the beginning stages it will not be that successful, but will be more from the perspective of starting the collection effort.

“We will have to devise a strategy that will allow us to be most efficient and cost effective. We’re not going to spend $10,000 to collect $12,000. We’re hoping to spend $1m to collect $5m. We have to make sure the ratio is like that, and that whatever we put into the collection effort is appropriate.

“We have a near-$400m loan portfolio currently, and when you look at the loans written off since the better part of 2012 and 2013, which was when we saw an uptick in the economy, that’s not unusual - writing off between $7m to $10m per year,” he continued.

“Last year we recovered $1.5m, and this year we’re already at $2m for the halfyear period. We are quite encouraged that, without specialist collection efforts, by doing that we are fairly confident of a 5-10 percent recovery once we are up and fully running. We will certainly make life more difficult for those who fail to borrow responsibly, even if we do not collect in cash. We are not going to allow people to be rewarded for bad behaviour.

“If we’re successful, we’ll see the results. As we discussed with the shareholders, nothing ventured, nothing gained. This is, in effect, a secondary loan portfolio that has different characteristics but currently has a value of zero, so any recovery will add to the bottom line.”

Mr Bowe said the $28m did not include delinquent

mortgage credit because this is secured on the underlying real estate assets that provided collateral for the loan. “It’s about getting sales,” he added of the difficulties in realising mortgage collateral. “We had a great increase in the last year. It may not sound like a lot, between one and two sales per month, but compared to years past that’s like night and day.”

The Fidelity Bank (Bahamas) said shareholders were last week given guidance as to the 2023 first-half performance with the second-quarter and six-month figures now in the process of being finalised. “We spoke to what we are seeing in the first half of the year,” he added.

“We are finalising the sixmonth results, and we did share that the loan contraction in the industry, which for 2022 was over $130m, with some $90m in consumer loans, is abating but still present in the first half of the year. We’ve been able to maintain interest income and grow revenues, but we have seen an increase in loan loss provisions and that put a damper on profits for the first six months.”

Fidelity Bank (Bahamas), in its just-released 2022 annual report, said the more than $127m collective decline in outstanding mortgage and consumer loans during 2022 shows “quality new credit” and borrowers will be tough to find despite the economy’s rebound.

The BISX-listed bank added that it is aiming to increase non-interest earnings from 10.64 percent to 20 percent of total income in a bid to counter the decline in traditional loan-related income sources that Bahamian commercial

banks have relied upon to drive profitability and growth.

“Statistics from the Central Bank of The Bahamas report that consumer loans and mortgage loans outstanding with commercial banks as of December 31, 2022, decreased by $89m and $38.1m compared with December 31, 2021, which demonstrates that the availability of quality new credit is limited even as the economy of The Bahamas experiences its rebound,” Fidelity Bank (Bahamas) warned shareholders.

“Since the peak of the global pandemic, when furloughs and unemployment, particularly in the tourism sector, led to significant increases in the number of loans and advances to customers that fell into delinquency, the yeoman’s effort by the bank during the past two years led to the rehabilitation of a significant number of such delinquent loans.

“However, certain such loans remain as of year-end

and, when combined with the contraction in the primary interest earning assets of the Bank, loans and advances to customers, particularly in the consumer loan portfolio that yields higher interest margins, resulted in a decreased interest income,” bank management added.

“This was offset by the decrease in interest expense

as a result of the maturity and redemption of debt securities and other interest rate adjustments. Overall, net interest income for the current year decreased by $328,434 demonstrating that the bank, despite pressures from contraction in its primary line of business, is maximising yield from its interest earning assets.”

NOTICE

NOTICE is hereby given that RAFAEL ANTONIO GOMEZ SIMO of High Vista, #2 Orange Grove Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 24th day of July 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

INVESTMENT OPPORTUNITY

EARN HEALTHY RETURNS WITHIN PROFITABLE MARKET AND SUCCESFUL GLOBAL INDUSTRY:

A lucrative and secure business opportunity exist in a worldwide market with healthy and sustainable returns within a dual income project (including Airbnb in prestigious area).

Seriously interested persons should send their name and private contact number in confdence via email to pdgbizguru@gmail.com to initiate a brief but direct overview of low risk and income potentials.

THE TRIBUNE Monday, July 31, 2023, PAGE 7

FROM PAGE B1

CALL 502-2394 TO ADVERTISE TODAY!

Minnis: BPL chief says we’re right over Wartsila

out of office, he alleged that this had risen once again to the point where the stateowned utility monopoly is presently leasing 113 MW from a combination of Aggreko and Sun Oil.

Calling on the Government to disclose how much BPL is paying per kilowatt hour (KWh) for this rental generation, Dr Minnis

told this newspaper he has “absolutely no concern” over promises by the Prime Minister and Alfred Sears KC, minister of works and utilities, to disclose documents and a “forensic analysis” that they implied will reflect poorly on his administration’s management of the power provider.

Mr Cambridge could not be contacted for comment on Dr Minnis’ assertions

regarding BPL’s rental generation capacity demands and the associated costs, despite voice and text messages being sent. However, the former prime minister said his administration secured a contract with Wartsila that required the latter to pay compensation to the Government if it failed to meet set power production thresholds and costs.

Disclosing that the engine manufacturer had to pay $2m in 2021 after it failed to meet production targets, Dr Minnis said: “We were very happy with the Wartsila engines. You must remember that Wartsila is number one in the medium speed engines in the world, and has 90 percent of the market share in the Caribbean. The question you have to ask is: If Wartsila is

so bad, why is Sun Oil using four Wartsila engines at BPL’s Blue Hills plant? “As part of our contract with Wartsila we had a pre-production guarantee which meant they had to produce a certain amount of power at a certain cost. If that was not achieved, they had to pay. In 2021, they did not achieve the production they said they were going to do, so they had to pay liquidated compensatory fees of about $2m.”

Mr Davis, in a House of Assembly exchange with Dr Minnis last week, suggested that despite being billed as “tri-fuel” - meaning they could run on either liquefied natural gas (LNG), heavy fuel oil (HFO) or light fuel oil (diesel) - the seven Wartsila engines, representing 132 MW of generation capacity, were incapable of using all three.

However, well-placed Tribune Business sources, speaking on condition of anonymity, said the seven engines were specifically configured to burn HFOwhich is cheaper than diesel - simply because LNG as a fuel source would not be available for some years until the proposed Shell North America regasification terminal at Clifton Pier was constructed and became operational.

They added that, once LNG became available, BPL had a schedule mapped out to modify the engines so that they would be capable of using the third fuel sources. Another contact, meanwhile, revealed that once the Wartsila engines were installed there were issues with the “purity” of the fuel that was supplied by BPL.

The engines were managed and operated by Wartsila, and this newspaper was told: “The problem they had was the quality of fuel coming into ‘Station A’. BPL was responsible for the fuel supply and providing it to the station, which Wartsila managed. One of the problems they had early on was the purity of the fuel. They had to invest $3-$4m in a new fuel purifier because the existing purifier was not to the level Wartsila required.

“The Wartsila guys pointed out the fuel was not clean enough, so they had to do a lot more maintenance to clean those engines up. The fuel purity did not meet the manufacturer’s standard, and they had to do more maintenance because of the impure fuel. A couple of times those engines shut

down because the fuel was not pure enough.”

Dr Minnis, meanwhile, said BPL’s reliance on rental generation seemed to be increasing. Having inherited 80 MW of leased generation when his administration took office, he acknowledged this peaked at 115 MW while the Wartsila engines were being installed in ‘Station A’. However, once they came online, BPL’s rental generation need dropped to 56 MW by the time of the September 2021 general election.

Of that 56 MW, some 40 MW was provided by Aggreko and the balance by Sun Oil, a subsidiary of BISX-listed FOCOL Holdings. However, Dr Minnis asserted this has now increased to 113 MW, with Sun Oil supplying 73 MW and Aggreko the minority. He also questioned how much BPL was paying for this power, adding that Wartsila had received two cents per KWh compared to the six cents that BPL’s own generation assets required. “I and my government were very pleased with how we managed BPL, and the results were reflected even during the pandemic with air conditioning running 24/7 at people’s homes. The power bill was lower then than it was today,” Dr Minnis added.

The former prime minister added that Mr Cambridge’s remarks last week, when the current BPL chief said he would likely have made the same decisions as his predecessors regarding the Wartsila deal and the engines’ installation, had vindicated his administration’s actions.

Mr Cambridge, while acknowledging that Station A’s construction was rushed, with the cooling and fuel systems less than optimal, and fewer redundancies installed to counter emergencies, said the haste was understandable given the constant load shedding experienced by New Providence at the time and the loss of BPL’s two most efficient engines in the 2018 fire.

“I would like to think that under the circumstances, those were the best decisions to make,” he said. “I will say, given what we were going through or what the country was going through then, in terms of right after the fire and the four, eighthour rolling blackouts, I cannot be critical of the decisions because I probably would have agreed with the decision.”

PAGE 8, Monday, July 31, 2023 THE TRIBUNE

FROM PAGE B1

‘Beyond dispute’: But marinas demand proof

Deloitte & Touche audit of the online portal. However, Mr Wilson yesterday said that was not the accounting firm’s remit, and that it had been retained to conduct a wider assessment of government tax and revenue collections from multiple different “channels”. As a result, the ABM had no right to receive a copy of Deloitte’s findings.

“I’ve said it before: We had a meeting with Peter Maury, who represented the ABM. We provided him with non-public information and we said this is why we have to do this,” Mr Wilson reiterated of the SeaZPass portal’s closure. “Come on, man. What do they want me to do?

“It is indisputable that money was collected and not paid to the Government. That is beyond dispute. We said to the marinas: ‘We have no problem with the portal. We have a problem with this particular vendor’, and left it at that. I don’t know why they keep going on about this because we met with them and provided detailed non-public information.”

The ‘vendor’ in question is Omni Financial Services, which acted as SeaZPass’s payments facilitator and collector, ensuring those funds were remitted to the Government. Tribune Business previously revealed that the online portal was closed over a dispute as to whether Omni had remitted the full fee sums due to the Public Treasury. Omni asserted that all sums due and owing had been paid in response to Ministry of Finance allegations that some $5m remained outstanding, vehemently denying the latter claims. Mr Wilson, though, yesterday indicated that the dispute still has yet to be resolved. Several sources, though, have questioned why, if the Government had concerns, it simply did not require that the digital payments provider be changed and allow SeaZ Pass to continue with a new provider. Mr Wilson indicated he had said as much to the ABM, but Mr Maury told this newspaper on Friday that the industry body never got a response from the Government when it asked

MORE TRADER JOE’S RECALLS?

THIS SOUP MAY CONTAIN BUGS AND FALAFEL MAY HAVE ROCKS, GROCER SAYS

NEW YORK

Associated Press

TRADER Joe's is recalling a broccoli cheddar soup that may contain insects and cooked falafel that may contain rocks, about one week after the grocery chain recalled two cookie products over similar concerns.

The soup recall impacts Trader Joe's Unexpected Broccoli Cheddar Soup with "Use By" dates ranging from July 18 to Sept. 15, according to a Thursday announcement from the company. On Friday, the grocer announced that Trader Joe's Fully Cooked Falafel sold in 35 states and Washington, D.C., was also under recall.

On July 21, Trader Joe's announced that it was recalling Trader Joe's Almond Windmill Cookies and Trader Joe's Dark Chocolate Chunk and Almond Cookies with "sell by" dates ranging from Oct. 17 to Oct. 21. Like the falafel, the cookies may also contain rocks, the company said.

When asked for further information about how the insects and rocks may have gotten into these products, a Trader Joe's spokesperson said that "there was an issue in the manufacturing processes in the facilities."

Suppliers alerted Trader Joe's of the possible foreign material for each recall, the company said.

"We pulled the product from our shelves as soon as we were made aware of the issue. Once we understood the issue we notified our customers," the spokesperson said in a statement sent to The Associated Press Saturday.

All of the recalled cookies, soup and falafel have been removed from sale or destroyed, Trader Joe's said in its announcements. But the Monrovia, Californiabased company is still urging consumers to check their kitchens for the products.

Trader Joe's says customers who have the recalled products should throw them away or return them to any store for a full refund. Lot codes and further details about the products under recall, as well as customer service contact information, can be found on the company's website.

Trader Joe's did not specify how many products were impacted with each recall or identify suppliers. But one Food and Drug Administration notice cited by NBC News says that the Unexpected Broccoli Cheddar Soup recall impacts around 10,889 cases sold in seven states. Winter Gardens Quality Foods, Inc. is identified as the recalling firm, per the notice. No formal releases about the three recalls were published on the FDA's Recalls, Market Withdrawals, & Safety Alerts page as of Saturday. The Associated Press reached out to the FDA and Winter Gardens Quality Foods for information on Saturday.

"We have a close relationship with our vendors and they alerted us of these issues. We don't hesitate or wait for regulatory agencies to tell us what to do," the Trader Joe's spokesperson said. "We will never leave to chance the safety of the products we offer."

JOB OPPORTUNITY

Busy Optometry offce in New Providence looking for full time Optometrist. Must have Doctorate of Optometry degree from an accredited college of Optometry or trained at a college of Optometry from the UK. Must be licensed to practice in country of training. Must be profcient in OCT and Humphrey’s Visual Field.

if replacing Omni would resolve all issues.

“I’m the one who they told they were going to cancel the SeaZPass portal,” the former ABM president told this newspaper. “I asked: ‘On what basis?’ They said because there had been non-payment, and I said: ‘Show me the evidence’. They gave us no evidence.”

Mr Maury said that during SeaZPass’s 16 months in operation, every Friday the ministries of finance, tourism and transport, as well as the Port Department, were provided with reports and reconciliation statements showing how much had been collected, how much had been paid into the Government’s RBC account.

“We have evidence of every wire sent. Every Friday the Government was given an accounting of what was paid,” he asserted. “I was the one who sat in the meetings, and they gave us no evidence. They said they were going to do an audit,

and Deloitte & Touche contacted me. If the Government is so sure of it’s position, show us the report and what the findings are.

“Show us the proof. We can show where $4.3m was paid to the Government. Show us where it wasn’t paid. We have the evidence of where the wires were sent to the Government. You either cannot reconcile your bank statements or the money was not paid. Show us where it was not paid. If you cannot show us that it means you cannot reconcile your own bank statements.”

However, Mr Wilson said the Government was under no obligation to share Deloitte & Touche’s findings with the ABM because it had not been tasked with a specific focus on the SeaZPass online portal and monies collected through it.

“Deloitte’s audit was for a different purpose,” he told Tribune Business

“We have to make a decision in terms of how we collect our revenue. We engaged Deloitte to assist

with that. This has nothing to do with them [the ABM].

It looks at this broader question of the collection of government revenues from various different channels.”

The SeaZPass controversy erupted again last week after the issue was raised at the Bahamas Hotel and Tourism Association’s (BHTA) Board of Directors meeting. Marques Williams, the current ABM president, told the same meeting that attorneys have been retained over the Government-enforced closure of the online portal that the Association spearheaded to allow client vessels to pay their yacht charter fees and other relevant fees.

Mr Williams said the ABM was “at a standstill”, and “kind of in limbo”, over the SeaZPass portal’s fate after it was recently revealed that the Government had awarded a $3.355m contract to DigieSoft Technologies to develop exactly the same solution even though the

Association’s had been provided at no expense to the Bahamian taxpayer.

The proposal, he added, saw SeaZPass developed at no cost to the Government or taxpayer, and with all revenues deposited to the Government’s account. The developer was to receive a 2 percent commission to recover its costs, which was to be shared with the ABM, and Omni 1.5 percent to cover operational expenses. The ABM was to use its share of the 2 percent to help maintain navigation aids.

The ABM and Omni were said to have yet to receive a commission payment from the Government prior to the online portal’s shutdown, and Mr Williams said there had been no response to inquiries as to how the Davis administration plans to move forward. He said the closure meant boaters and yachters lack a convenient mechanism to pay due fees to the Government.

THE TRIBUNE Monday, July 31, 2023, PAGE 9

PAGE B1

FROM

opticalopportunity36@gmail.com

CUSTOMERS WANT INSTANT GRATIFICATION. WORKERS SAY IT’S PUSHING THEM TO THE BRINK

By ALEXANDRA OLSON AP Business Writer

SIX straight days of 12-hour driving. Single digit paychecks. The complaints come from workers in vastly different industries: UPS delivery drivers and Hollywood actors and writers.

But they point to an underlying factor driving a surge of labor unrest: The cost to workers whose jobs have changed drastically as companies scramble to meet customer expectations for speed and convenience in industries transformed by technology.

The COVID-19 pandemic accelerated those changes, pushing retailers to shift online and intensifying the streaming competition among entertainment companies. Now, from the picket lines, workers are trying to give consumers a behind-thescenes look at what it takes to produce a show that can be binged any time or get dog food delivered to their doorstep with a phone swipe.

Overworked and underpaid employees is an enduring complaint across industries — from delivery drivers to Starbucks baristas and airline pilots — where surges in consumer demand have collided with persistent labor shortages. Workers are pushing back against forced overtime, punishing schedules or company reliance on lowerpaid, part-time or contract forces.

At issue for Hollywood screenwriters and actors staging their first simultaneous strikes in 40 years is the way streaming has upended entertainment economics, slashing pay and forcing showrunners to produce content faster with smaller teams.

"This seems to happen to many places when the tech companies come in. Who are we crushing? It doesn't matter," said Danielle Sanchez-Witzel, a screenwriter and showrunner on the negotiating team for the Writers Guild of America, whose members have been on strike since May. Earlier this month, the Screen Actors Guild–American Federation of Television and Radio Artists joined the writers' union on the picket line.

Actors and writers have long relied on residuals, or long-term payments, for reruns and other airings of films and televisions shows. But reruns aren't a thing on streaming services, where series and films simply land and stay with no easy way, such as box office returns or ratings, to determine their popularity.

Consequently, whatever residuals streaming companies do pay often amount to a pittance, and screenwriters have been sharing tales of receiving single digit checks.

Adam Shapiro, an actor known for the Netflix hit "Never Have I Ever," said many actors were initially content to accept lower pay for the plethora of roles that streaming suddenly offered. But the need for a more sustainable compensation model gained urgency when it became clear streaming is not a sideshow, but rather the future of the business, he said.

"Over the past 10 years, we realized: 'Oh, that's now how Hollywood works. Everything is streaming,'" Shapiro said during a recent union event.

Shapiro, who has been acting for 25 years, said he agreed to a contract offering 20% of his normal rate for "Never Have I Ever" because it seemed like "a great opportunity, and it's going to be all over the world. And it was. It really was. Unfortunately, we're all starting to realize that if we keep doing this we're not going to be able to pay our bills."

Then there's the rising use of "mini rooms," in which a handful of writers are hired to work only during pre-production, sometimes for a series that may take a year to be greenlit, or never get picked up at all.

Sanchez-Witzel, co-creator of the recently released Netflix series "Survival of the Thickest," said television shows traditionally hire robust writing teams for the duration of production. But Netflix refused to allow her to keep her team of five writers past pre-production, forcing round-the-clock work on rewrites with just one other writer.

"It's not sustainable and I'll never do that again," she said.

THE TRIBUNE Monday, July 31, 2023, PAGE 11

Wall Street returns to rallying following reports on profits and inflation

By STAN CHOE AP Business Writer

WALL Street’s rally got back on track Friday following more encouraging profit reports and the latest signal that inflation is loosening its chokehold on the economy. The S&P 500 rose 1% to its highest close in more than 15 months. The Dow Jones Industrial Average climbed 176 points, or 0.5% after breaking a 13-day winning streak the day before. The Nasdaq composite jumped 1.9% as Big Tech stocks led the market.

Stocks have been rising recently on hopes high inflation is cooling enough to get the Federal Reserve to stop hiking interest rates. That in turn could allow the economy to continue growing and avoid a longpredicted recession. The S&P 500 closed out its third straight winning week and its ninth in the last 11.

A report on Friday bolstered those hopes, saying

the inflation measure the Fed prefers to use slowed last month by a touch more than expected. Perhaps just as importantly, data also showed that total compensation for workers rose less than expected during the spring. While that’s discouraging for workers looking for bigger raises, investors see it adding less upward pressure on inflation.

The hope among traders is that the slowdown in inflation means the Federal Reserve’s hike to interest rates on Wednesday will be the final one of this cycle.

The federal funds rate has leaped to a level between 5.25% and 5.50%, up from virtually zero early last year. High interest rates work to lower inflation by slowing the entire economy and hurting prices for stocks and other investments.

Critics, though, say the stock market’s rally may have gone too far, too fast.

The full effects of the Fed’s rate hikes have yet to make their way fully through the

system. Other parts of the economy could still crack under the pressure, like the three U.S. bank failures this spring that shook confidence. Plus, inflation remains above the Fed’s target level, and the central bank could have to keep

the brakes on the economy a while to get it down to target.

“Don’t underestimate central bank commitment to 2% inflation,” Bank of America economists wrote in a BofA Global Research report.

Still, hopes for a halt to rate hikes helped technology stocks and others seen as big beneficiaries from easier rates to rally and lead the market Friday.

Microsoft, Apple and Amazon each rose at least 1.4% and were the three

THE WEATHER REPORT

FED chairman Jerome Powell’s news conference is displayed on the floor at the New York Stock Exchange in New York, Wednesday, July 26, 2023. Stocks are mixed after the Federal Reserve followed through on Wall Street’s expectations and raised its benchmark interest rate to its highest level in more than two decades.

Seth Wenig/AP

strongest forces pushing upward on the S&P 500. Companies also continued to deliver stronger profits for the spring than analysts expected. Roughly halfway through the earnings season, more companies than usual are topping profit forecasts, according to FactSet. Intel rose 6.6% after reporting a profit for the latest quarter, when analysts were expecting a loss. Food giant Mondelez International climbed 3.7% after reporting stronger results for the spring than expected.

THE TRIBUNE Monday, July 31, 2023, PAGE 13

STOCK MARKET TODAY

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 75° F/24° C High: 91° F/33° C TAMPA Low: 81° F/27° C High: 92° F/33° C WEST PALM BEACH Low: 77° F/25° C High: 91° F/33° C FT. LAUDERDALE Low: 79° F/26° C High: 92° F/33° C KEY WEST Low: 83° F/28° C High: 92° F/33° C Low: 79° F/26° C High: 91° F/33° C ABACO Low: 84° F/29° C High: 89° F/32° C ELEUTHERA Low: 83° F/28° C High: 89° F/32° C RAGGED ISLAND Low: 83° F/28° C High: 88° F/31° C GREAT EXUMA Low: 83° F/28° C High: 88° F/31° C CAT ISLAND Low: 80° F/27° C High: 89° F/32° C SAN SALVADOR Low: 81° F/27° C High: 90° F/32° C CROOKED ISLAND / ACKLINS Low: 82° F/28° C High: 88° F/31° C LONG ISLAND Low: 82° F/28° C High: 89° F/32° C MAYAGUANA Low: 81° F/27° C High: 90° F/32° C GREAT INAGUA Low: 82° F/28° C High: 90° F/32° C ANDROS Low: 82° F/28° C High: 90° F/32° C Low: 80° F/27° C High: 90° F/32° C FREEPORT NASSAU Low: 79° F/26° C High: 93° F/34° C MIAMI

Photo: