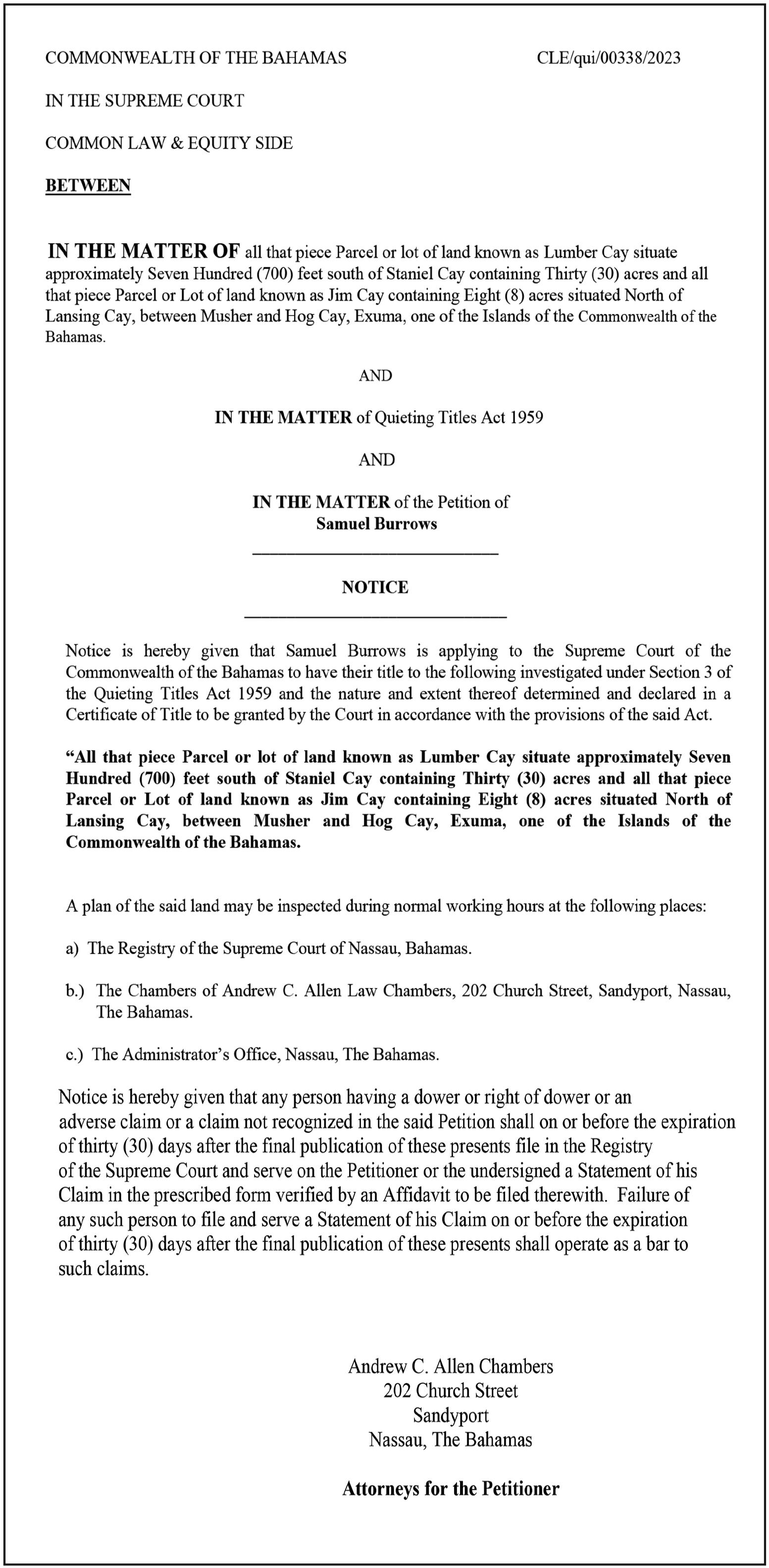

Dealer’s ‘art’ expansion as auto sales jump 60%

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A Bahamian dealer yesterday revealed it will imminently launch its Automotive Art subsidiary in the belief operators cannot survive on vehicle sales alone despite an industry-wide 60 percent increase for the 2023 first-half.

Fred Albury, the Auto Mall chief, told Tribune Business that “if you just depend on vehicle sales to keep you going you’re not going to be around long” as the group prepares for its specialist auto paint and accessories affiliate to begin operations next month following a $250,000 investment at its existing Wulff Road property.

Pointing to the auto industry’s cyclical nature, with dealers “scrapping and fighting to keep our heads above water” in four out of every ten years, he said it was vital that companies expand beyond sales and into value-added services that boost profit margins and customer loyalty.

September seizures for property tax delinquents

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

The Auto Mall chief spoke out after Ben Albury, the Bahamas Motor Dealers Association’s president, told this newspaper that industry-wide sales for the first six months of 2023 had risen by 60 percent compared to the same period last year when 833 vehicles were sold.

Declining to provide the figure for the 2023 first half, he added that sales at his firm, Bahamas Bus and

‘Burden cannot be heavier with corporate income tax’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

CORPORATE income tax must not impose a heavier tax burden on businesses than what already exists, private sector executives are warning, while urging that such proposed reform cannot be viewed in “isolation”.

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, told Tribune Business that the Government’s four proposed corporate income tax reform options must be assessed holistically alongside all other taxes and levies that the Government currently imposes.

With the end-August deadline for feedback on the Davis administration’s so-called ‘green paper’ looming, he added that the hotel and tourism sector had not received a response since it submitted

Chief Justice shows Dorian victims mercy

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE CHIEF Justice has shown mercy to a Freeport couple who lost their home in Hurricane Dorian by not dismissing their battle against a commercial bank and top insurance broker over a Supreme Court order breach.

Sir Ian Winder, in an August 9, 2023, verdict decided after lengthy deliberations not to impose sanctions against Andrew and Sophia Smith even though the violations could have resulted in their “negligence and breach

of contract” claim against both CIBC First Caribbean International Bank (Bahamas) and Insurance Management being dismissed.

TAX officials say they will begin seizing and selling real estate owned by commercial and foreign real property tax delinquents next month, adding:

“We’re dotting all the ‘i’s’ and crossing all the ‘t’s’.”

Shunda Strachan, the Department of Inland Revenue’s acting controller, confirmed that the agency aims to start exercising its ‘power of sale’ in September while adding that it may sell the lien - or charge - secured on delinquent properties rather than go to the extra expense of seizing them.

“The biggest thing relative to real property tax is

an amendment to section 25,” she said. “The Department exercising its powers on the power of sale, we’re still doing that. It’s closer than it was. We should have done it already. But we are dotting all the ‘i’s’ and crossing all our ‘t’s’ and we expect to have our first batch of power of sale properties out within the next month by September.

“But what the amendment now does is it allows the Government to sell the lien on properties. So real property tax really has first charge. If you have outstanding real property taxes on properties, the taxes really represent a first charge on that property.

“The chief valuation officer now has the ability

business@tribunemedia.net MONDAY, AUGUST 14, 2023

SEE PAGE B7

SEE PAGE B9 SEE PAGE B8 SEE PAGE B6 SIR IAN WINDER ROBERT SANDS BEN ALBURY $5.70 $5.75 $5.80 $5.71

EXCESSIVE TAXATION NO SOLUTION FOR CORRUPTION

Corruption, a persistent issue in many countries, can have far-reaching consequences for economies and governance systems.

In the case of The Bahamas, corruption not only erodes public trust but also leads to a cycle where governments resort to taxing citizens more as a solution to reduced productivity and economic activity. However, this flawed approach has its limitations and fails to address the root causes of the problem. In this article, we will delve into why excessive taxation is not the best solution, and explore alternative approaches that can bring about positive change and development.

The vicious cycle Corruption breeds a culture of inefficiency, mismanagement and reduced productivity within the Government. When funds intended for public welfare are siphoned off for personal gain, the Government faces a shortage of resources to invest in infrastructure, social programmes and public services. Consequently, economic activity suffers, hindering the growth of the private sector and leading to a decline in productivity. For instance, corruption erodes the efficiency and effectiveness of government institutions. When officials engage in corrupt practices such as bribery, the unfair awarding of contracts, embezzlement or nepotism, merit-based

decision-making processes are compromised. Incompetent individuals may be appointed to key positions, impeding the efficient implementation of policies and projects. As a result, the Government fails to deliver essential services to its citizens effectively. Corruption also diverts funds that should have been allocated to vital public investments, including infrastructure development, healthcare, education and social welfare programmes. These resources are instead channelled into the pockets of corrupt officials or used for personal gains. The shortage of resources cripples the Government’s ability to address societal needs and invest in longterm development projects.

As a result, the quality and accessibility of public services declines, negatively impacting the lives of citizens. Finally, a thriving private sector is essential for economic growth and job creation. However, corruption undermines the business environment by distorting fair competition, discouraging both domestic and foreign investments.

When corruption prevails, businesses often face higher costs due to bribes and extortion, and the lack of a level playing field erodes trust in the market. This discourages entrepreneurship, stifles innovation and hampers private sector growth, leading to reduced job opportunities and economic stagnation.

The flawed solution: Taxation

To compensate for reduced economic activity and productivity caused by corruption, governments often resort to increasing taxes on citizens. While taxation is a legitimate tool to finance public goods and services, overreliance on this approach can have adverse effects on the economy and burden citizens. Excessive taxation can deter investment, stifle entrepreneurship and discourage consumption, thereby perpetuating the cycle of reduced productivity and economic growth. These tax increases place an additional burden on both employees and employers, yet fail to address the root causes of the problem.

The consequences of excessive taxation are significant. Increased taxes can dampen consumer spending, leading to reduced economic activity and a decline in productivity. Higher taxes on employers can discourage business expansion and hinder job creation. The additional financial strain on companies limits their ability to invest in new ventures, expand their workforce or offer competitive salaries, which ultimately hampers economic growth and development.

Breaking the Cycle: The Way Forward Addressing corruption and breaking the vicious cycle is a complex and multi-faceted task, but

it is crucial for sustainable development. Our government must undertake comprehensive efforts to combat corruption and implement measures that promote good governance and accountability. Some key steps include:

1. Strengthening Institutions: Enhancing the capacity, independence and transparency of institutions responsible for combating corruption, such as the judiciary and public procurement functions, is vital. These institutions should be adequately funded, staffed with competent personnel and empowered with investigative and prosecutorial authority.

2. Promoting Transparency and Accountability: The Government should adopt robust mechanisms to ensure transparency and accountability in public administration. This includes implementing financial disclosure systems, conducting regular audits, and establishing effective checks and balances. Whistleblower protection laws and mechanisms can encourage individuals to report corruption without fear of retaliation.

3. Enforcing Strict Legal Frameworks: Developing and enforcing comprehensive anti-corruption legislation is essential. The Government should enact laws that criminalise corrupt practices, prescribe

appropriate penalties and establish clear guidelines for ethical conduct in public office. The judicial system must be strengthened to ensure the fair and timely prosecution of corruption cases.

4. Fostering a Culture of Integrity: Promoting ethical behaviour and integrity in both public and private sectors is crucial. This can be achieved through education, awareness campaigns and training programmes that emphasise the importance of ethical conduct, honesty and accountability. Encouraging businesses to adopt transparent practices and promoting corporate social responsibility can also contribute to a culture of integrity.

The National Development Plan

The National Development Plan (NDP) can play a crucial role in addressing corruption and promoting good governance within The Bahamas. The NDP provides a comprehensive road map for the country’s development, outlining strategic goals, priorities and targets. By including specific policies and measures to address corruption, such as establishing transparent procurement processes, strengthening anti-corruption institutions and promoting accountability, the NDP sets the tone for a culture of integrity and ethical conduct within the Government.

Conclusion

In conclusion, corruption poses significant challenges to governments and economies worldwide, and The Bahamas is no exception. This discussion has shed light on how corruption leads to governments resorting to increased taxation as a flawed solution to compensate for reduced economic activity and productivity. By prioritising transparency, accountability and good governance, our government can break free from the vicious cycle created by corruption. Strengthening legal and institutional frameworks, enhancing transparency and public participation, and promoting capacity building and training are vital steps in effectively combating corruption.

Resort ‘hitting all targets’ with 95% of condos sold

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

developer says its condominiums are 95 percent sold with the property “hitting all of its targets” ahead of what is predicted to be a strong 2024.

Randy Hart, the Wynn Group’s vice-president, told Tribune Business: “We’re very confident that our business will be growing over the next year into

2024. We’re going to be rolling out groups, events, weddings and other distribution channels for the hospitality operations. So we expect to grow our

occupancy significantly in 2024. We’re on track. The year’s rolling by and then, of course, we’re now getting ready to launch the second phase of the penthouses.”

That second phase will be built to the east of the existing Goodman’s Bay-based property on West Bay Street, and is scheduled to “start before the end of the year”. The Wynn Group is in the process of “finalising our game plan” for the construction of 35 residential penthouses covering some 12 storeys, Mr Hart added.

Don Adam, Goldwynn’s chief operating officer, said the resort is well ahead of where it was projected to be and is “off to a great start” after officially opening in February this year. All the property’s venues have been “increasing fairly consistently”, especially its restaurant and beach bar that are open for both guests and locals to enjoy.

Mr Adam said that Goldwynn will likely “see the same trends as everyone else” in the industry over the remainder of 2023 with a slowdown for September but “a very strong forecast for November and December”. That leads into the

New Year with bookings into March and Spring Break 2024. “We see 100 percent occupancy days coming very soon,” Mr Adam added.

“We actually hit 100 percent occupancy less than six weeks after we opened in February off of the strength of The Bahamas’ brand in general. Obviously we are doing our own marketing, but the reality is it is kind of like a boulder, and it takes a little while for that to get rolling, and it takes a little while for your active reviews to populate on all the channels, and for your property to really have word of mouth and largely get known as a commodity to the island.

“We’re seeing at large the island is doing very well. Airlifts are increasing and, because everybody is doing very well and there is this ‘share the wealth’ attitude among the hotels, guests are being spread among all the hotels, so everybody’s busy.”

Mr Adam said “revenge tourism” is real and not slowing down any time soon with “all of the properties hitting it out of the park”.

PAGE 2, Monday, August 14, 2023 THE TRIBUNE

SIMMS RODERICK A. AN ADVOCATE FOR SUSTAINABLE FAMILY ISLANDS

THE Goldwynn resort’s

GOLDWYNN RESORT

LARGE TAXPAYERS PROMISED ‘CRÈME DE LA CRÈME’ SERVICE

of period-end, as opposed to the current 21-day deadline, is also being rolled-out in stages.

THE Government’s senior revenue official has pledged that large companies will receive “crème de la crème” service when the Large Taxpayer Unit is launched next month.

Shunda Strachan, the Department of Inland Revenue’s (DIR) acting controller, said an initial 50 firms have already been invited to come under the Unit’s remit in what will be a phased approach. The VAT Act’s

SHUNDA STRACHAN

newly-introduced legal requirement, which mandated companies with an annual turnover in excess of $5m submit their filings and pay the tax within 14 days

Addressing a Friday press conference, Ms Strachan said the initial 50 firms selected for the Large Taxpayer Unit are being notified and informed they will have to submit VAT payments within 14 days of the month’s end.

“We expect to establish a Large Taxpayer Unit by September,” she said.

“The persons who are invited to join the Large Taxpayer Unit will be notified. I know there has been some questions relative to

the amendment that spoke to large taxpayers having to file and pay by the 14th of the month, as opposed to the 21st. Well, that is really intended for those businesses that are going to be invited to be a part of the Large Taxpayer Unit. We expect that there will be at least 50 of the largest businesses and we’re going to notify them.

“So if you haven’t been notified, then you won’t be a part of the unit in the first instance. So everybody who’s considered a large taxpayer will not be invited to the unit first-off. But if you’re invited to join the

Large Taxpayer Unit then you will be expected to file and pay by the 14th of the month, as opposed to 21st of the month,” Ms Strachan continued.

“Of course, they will enjoy other things. They will have the crème de la crème concierge service. So we will treat them as they want to be treated, and give them all of the services that they require. But, of course, on the other side to that is they will be expected to pay us a little bit earlier, the VAT.”

Ms Strachan also sought to justify the sharp increase in the occasional licence fee

for public entertainment events to $750, explaining that this will be applied to ticketed for-profit events such as music concerts and not the likes of regattas or cook outs.

Confirming that this fee will have to be paid by the organisers of one-off events, and who do not hold an annual Business Licence, she said: “There is a new fee for occasional Business Licences relative to public entertainment. No, it’s not for cook-outs, it’s not for regattas or homecomings,

FOREIGN VACATION RENTALS FACE RISING TAX COMPLIANCE BURDEN

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

FOREIGN vacation rental owners face an increasing tax compliance burden with the Government handing them the responsibility of ensuring VAT is both levied on the rental income and paid to the Public Treasury.

Department of Inland Revenue (DIR) officials, speaking at a Friday press conference, said foreign owners can either collect the due VAT themselves from their guests or authorise the websites that market their properties - the likes of Airbnb and VRBOto collect the tax on their behalf and remit it to the Government.

Shunda Strachan, the Department of Inland Revenue’s acting controller, also sought to clarify the new rules for residential rentals and short-term vacation rentals depending on whether the property owner is Bahamian of foreign.

Non-Bahamians must now obtain a Business Licence to operate both residential rentals and short-term vacation rentals, and are also required to register for VAT regardless of whether the $100,000

annual turnover threshold is met. However, while Bahamian companies must obtain a Business Licence for residential and shortterm rentals, Bahamian individuals do not, and only those who exceed a $100,000 annual turnover must register for VAT.

Ms Strachan said: “One of the new things in this Act has really highlighted the need for non-Bahamians, or Bahamian companies, to have a Business Licence if they are conducting residential rental. So, if you’re in that arena of renting for residential purposes, you will need a Business Licence if you are nonBahamian or if you are a Bahamian company.

“If you’re a Bahamian individual, and you have properties that you rent for residential purposes, no, you don’t need a Business Licence. The second thing relative to rentals is around short-term vacation rentals. Bahamians in the area, or in the industry of short-term vacation rentals, do not need a Business Licence. But again, if you are a foreigner or a company, and you have a short-term vacation property that you rent, you do need a Business Licence.”

When it came to VAT, Ms Strachan added: “If you are a non-Bahamian you have to register for VAT no matter what your turnover is if you’re in the area of short-term vacation rentals. So, again, if you’re a Bahamian, and you are renting your property for shortterm vacation purposes, you do not need a Business Licence and you don’t need to register for VAT unless you have attained that $100,000 turnover.

“So if you’re doing really well, and your rental properties are generating a turnover of over $100,000 and you’re Bahamian, then yeah, you need to register for VAT. But if you’re a non-Bahamian, you have to register no matter what your threshold is.”

Particia Jackson, the Department of Inland Revenue’s legal head, emphasised that the obligation to ensure VAT is collected, reported and paid lies with the owner of the short-term rental. However, they can authorise the online vacation rental marketplace that promotes their property to levy and collect the tax on their behalf.

She said: “In the case where VAT is required to be paid for vacation home

rentals, the obligation is on both [owner and marketplace]. However, we’re emphasising the obligation primarily in relation to the owner of the property. So, the owner of the property must register for VAT and must report the VAT.

“However, if they have an arrangement whereby the Airbnb or whichever other platform is reporting that amount, then the owner would not be required to pay it but the obligation has primarily been placed on the owner.”

Dexter Fernander, the Department of Inland Revenue’s head of operations, explained that rental platforms are currently collecting VAT related to the listing fee and commission paid to them by property owners. The latest changes will now require the shortterm rental owner to collect VAT on the entire transaction, meaning the rental income, and pay it to the Government themselves or authorise the rental platform to collect it on their behalf.

He said: “The various platforms that are working within the jurisdiction, you would see now that they are paying VAT or there’s

a VAT charge on their commission. It’s not on the entire transaction. What this is enforcing is that the transaction, the rental of that night, is the obligation of the registrant to now remit that VAT that they obtain.

“So, if you’ve seeing on some of the platforms, they will only pay the VAT related to the commission that the platform is giving.

So now on the total rental, it is the responsibility of that registrant to either remit that directly to us through their registration, or they can give that power to their platform operator to remit on their behalf.”

This represents a shift from the former Minnis administration, which intended to collect VAT on rental income via the likes of Airbnb.

Ms Strachan, meanwhile, said there is now an application fee of $25 to reserve a trade name for non-incorporated businesses.

She said: “If you’re going into business, then you need a name; your business has to have a name. Before those fees for nonincorporated businesses were free. You came in, you requested a name from

the Department of Inland Revenue, we reserved the name for you, there was no charge. Now there is a small charge of $25.”

She added that businesses which generate over $250,000 in annual turnover are now required to have an accountant’s verification, while those above $5m must submit audited financial statememts. Businesses that generate less than $250,000 no longer require an accountant certification.

“Again, we will issue guidance notes because the guidance notes will speak to the type of verification that we now require,” Ms Strachan said. “In the past, we just said an accountant’s certification is required for all businesses that generate a turnover of over $100,000.

“Now, we’re saying an accountant’s verification - or verification from an independent accountant registered with BICA - is required if your turnover is over $250,000. And from $250,000 straight on up to just under $5m will require a review. And if it’s over $5m, you will require audited financials.”

THE TRIBUNE Monday, August 14, 2023, PAGE 3

Tribune Business Reporter jsimmons@tribunemedia.net

By FAY SIMMONS

SEE PAGE B10

Farmer expands with fresh produce market

A BAHAMIAN farmer is expanding by launching a fresh produce market that he aims to have ready within the next three months.

Sidney Sinclair, principal of Down to Earth

Adventure Farms, told Tribune Business that the move is both a revenue generator as well as to provide other Bahamian farmers with a location to market their produce.

“I have my own market here now, but my intention is to bring in another ten people that do different things so it would make the market more complete,” he

DIVIDEND NOTICE

TO ALL SHAREHOLDERS

The Board of Directors of Bahamas Waste Limited has declared a Dividend for Ordinary Shares, to all shareholders of record as of August 25, 2023, of $0.16 cents per share

The payment will be made on September 6, 2023, through Bahamas Central Securities Depository Limited, the Registrar & Transfer Agent

Robert V. Lotmore Corporate Secretary

explained. “Within the next three months you will be able to pick up your fresh vegetables and soaps and all of these different things that people like as well.”

Down to Earth has a small market now where it sells fresh produce in addition to preservatives of every kind of native fruit. It also makes fresh juices for sale and has a small bottling operation for both the juices and preservatives. “We also sell fresh cane

juice and use our own cane juice for our juices. We can also make sugar from our canes as well,” Mr Sinclair added. The farm is also branching out into the honey business. “We have already started setting up some bee hives in the back. So within the next couple of months we will be harvesting our own honey,” Mr Sinclair said. Mr Sinclair said he aims to have 500 bee hives

before year-end. Each hive can house up to 80,000 bees, which can make up to three gallons of honey every 60 days. “We are also making hives to sell for other people as well. That’s been going well as we have people from all around the country who we have been selling hives to,” he added.

“We also teach them how to keep the hives, too. Once you have the Queen, the bees do the work themselves. All you have to do

is feed them with syrup or sweet items and they give you fresh honey.”

Down to Earth, based in the Carmichael Road and Cowpen Road area, has developed from selling fresh produce to featuring chickens, ducks, iguanas, crabs, peacocks and a pony that entertains \ students when they come on field trips.

OIL POLLUTION ‘UNFORTUNATE’ SAYS GB CHAMBER CHIEF

By FAY SIMMONS Tribune Business Editor jsimmons@tribunemedia.net

THE GRAND Bahama Chamber of Commerce’s president has branded recent oil pollution impacting the island as “unfortunate” and says “combined efforts” from all stakeholders are needed to protect both the environment and economy.

James Carey told Tribune Business: “It’s an unfortunate thing. Anything like that is environmentally concerning but, you know, we do have the oil bunkering terminal and, you know, that type of thing has happened before. It can happen when we’re dealing with oil.

“Fortunately, they reacted very quickly, and hopefully the whole problem is essentially mitigated. I know the environmental people from Nassau were in town to check those out, but I’ve not seen a report on what their disposition is about what transpired.”

Following a spill of an estimated five to ten barrels of oil at the Buckeye Bahamas (former BORCO) oil storage terminal, which went into the sea, pollution from another, different source - widely suspected to be a ship - contaminated

SPECIAL EDUCATION NEEDS TEACHER

This is a rare and exciting opportunity to join an outstanding and ambitious founding team at Inspired’s new premium school in Nassau, The Bahamas.

We are looking for a SEN teacher and leader who brings a dedication to supporting the thriving of each student, a forward-thinking attitude and outstanding experience of best practice across the sector.

You will be able to demonstrate experience in coordinating and delivering outstanding SEN provision in an academically ambitious environment, and in working collaboratively with a team of dedicated educators to design and implement personalised learning plans and inclusivity strategies.

The successful candidate will be providing one on one or small group support to students with SEN, whilst also building the foundations for a thriving department which will grow with the school. As such, the ideal candidate would have a strong background in Special Education, with a proven track record in coordinating and delivering SEN provision in an academically ambitious environment.

A willingness to participate fully in the co-curricular life of the School is expected. King’s College School, The Bahamas, offers a vibrant learning community, already renowned for its high academic standards, and committed to inclusion and the holistic development of every student. The school will offer the highest quality modern facilities in a new purpose-built state-of-the-art facility on an expansive 10-acre campus, ensuring learn in the modern day.

Facilities include football pitches, tennis and Padel courts, as well as dance, drama, and art studios. There will also be state-of-the-art science labs, a multi-purpose hall, a 25m competition swimming pool, an adventure park playground, and plenty of green spaces and shaded areas for students to enjoy.

Job Description

The SENCO is line-managed directly by the Founding Principal and is directly responsible for ensuring that pupils who are registered as having, or show symptoms of, possible across all year groups. The role holder will deliver one-on-one or small group support initially, whilst also establishing a thriving SEN department which will grow with the school. Some of the responsibilities or the role will be:

• To support individuals and small groups of students.

• To work alongside the class teachers to help to identify pupils who may have Special Educational Needs through the use of initial in-house diagnostic tests and refer children to an Educational Psychologist for diagnostic testing whenever necessary.

• To work collaboratively with colleagues to ensure all SEN pupils’ needs are met fully at all times, also by creating, preparing and implementing Individual

• To ensure the details of all ILPs are recorded on iSams and updated regularly and are shared appropriately with class teachers.

• To arrange and attend meetings with parents and teachers.

• To advise the teaching staff on the support for SEN pupils through targeted SEN matters and by participating in the drawing of the school development plan.

When joining King’s College School you will join the family of the awardwinning Inspired Education Group, the leading global group of premium schools, with over 80 schools operating in 23 countries. We offer a competitive salary and benefts and access to best practice and career pathways with some of the very best schools worldwide. To apply please send a CV and letter of motivation to admin@kingscollegeschool.bs

multiple Grand Bahama beaches just days later.

Mr Carey, meanwhile, said tourism and the oil industry can co-exist on Grand Bahama, but there is a need for more frequent inspections to ensure firms are following safety procedures and mitigating potential accident risks.

He added that a joint effort between the Grand Bahama Port Authority (GBPA), the Government, local businesses and residents is needed to ensure the environment is protected and the tourism industry revitalised.

“There is certainly room for tourism and industry I believe,” Mr Carey said. “However, authorities need to have more prominence and effective policing, and to ensure that certain things don’t happen. And, equally with hotels, there should be more frequent inspections in other types of

businesses, but particularly with industry.

“I think the authorities need a stronger presence and a more frequent inspection, and it’s not just the environmental concerns - it is also the safety concerns of the individuals who are employed in the industry and depending on the type of industry, that community as a whole.

“Because there are a number of industries that affect other businesses and, in some cases, residential areas. So I certainly will invite a more prominent presence in terms of the authorities and checking industry to ensure they’re in compliance with legal requirements,” Mr Carey continued.

“We need the combined efforts of all of the players - the Grand Bahama Port Authority, the Government, businesses and the community as a whole to

pay attention to environmental concerns, and also make the efforts in terms of tourism in particular.”

James Rolle, Dolly Madison’s general manager, said oil spills have an environmental cost that goes beyond the initial clean-up. He said legislative changes should be made to ensure the Government does not have to be burdened with those long-term costs.

“I think there has to be consideration at the legislative level in order to, number one, protect from the effects of these spills on the island,” Mr Rolle said. “Someone has to bear the costs of any environmental detriment that happens as a result of these spills.

“And so, I think legislation is a way to protect and secure the responsibility, especially financially, because government can’t bear the price of rectifying these accidents. It has to be borne by the entities or the companies that are actually involved in these accidents.”

Mr Rolle said companies must be prepared to deal with accidents efficiently and quickly, as the ability to contain oil pollution will directly affect the tourism

Responsibilities:

• Creates and delivers high-quality content that prepares students for

PAGE 4, Monday, August 14, 2023 THE TRIBUNE

YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By

PAGE B6

SEE

• • Requirements: • • • • • • • • • • • coordination • • • • Job Summary: JOB OPPORTUNITY

August 28th, 2023 Email: Hrcareer242@gmail.com

Deadline

The impending impact of AI on financial markets

By RICARDO EVANGELISTA

In a world where technology continues to evolve at an unprecedented pace, recent advances in Artificial Intelligence (AI) are poised to reshape the landscape of financial markets. These leaps in AI technology have the potential to revolutionise trading strategies, risk assessment and customer experiences, ushering in a new era of efficiency and innovation. These advances in AI have the potential to impact the stock markets, with some segments poised to benefit more directly, due to their inherent characteristics and the way AI technologies can be leveraged. Here are seven stock market sectors that may benefit significantly from AI advancements in the medium-to-long term.

The technology sector itself is a natural beneficiary of AI advancements. Tech companies are often at the forefront of developing and implementing AI solutions. AI can enhance product development, optimise supply chains and improve customer experiences.

Companies in this sector, which effectively integrate AI, can enjoy competitive advantages and potentially experience substantial growth.

Financial services is a broad definition, encompassing banks, insurance companies, brokers and other financial institutions. AI can revolutionise various aspects of financial services, including fraud detection, credit scoring, algorithmic trading and customer service through chatbots and virtual assistants. By leveraging AI to analyse vast amounts of data, financial services firms can make more informed decisions and offer more tailored products and services.

Although healthcare may not be traditionally considered a stock market sector, it is worth mentioning due

to its increasing importance. AI has the potential to revolutionise medical diagnosis, drug discovery and patient care. Companies at the intersection of technology and healthcare, often termed “healthtech”, can experience significant growth as AI-driven innovations gain traction.

Retail and e-commerce companies can benefit from AI’s ability to analyse consumer behaviour and preferences. AI-powered recommendation systems, supply chain optimisation and personalised marketing campaigns can drive customer engagement and boost sales. Companies that effectively use AI to enhance customer experiences may see their stock prices rise.

The energy and utilities sector can leverage AI for predictive maintenance, optimising energy distribution and improving efficiency in power generation. AI can help companies in this sector make datadriven decisions that reduce costs and minimise down time, potentially leading to improved financial performance.

Manufacturing companies can benefit from

AI-driven automation, which can optimise production processes, reduce waste and enhance product quality. Companies that embrace AI to streamline operations may experience increased profitability and stock price growth.

Businesses in the consumer goods and services sector can benefit from AI-driven insights into customer preferences and trends. By analysing data from social media, online reviews and other sources, firms can tailor their products and marketing strategies to align with consumer demands.

In conclusion, it is important to note that the benefits of AI are not limited to specific sectors. Many companies across different industries can gain from AI’s potential to enhance decision-making, streamline operations and create innovative products and services. However, sectors that are more data intensive, have complex supply chains or rely heavily on customer engagement are often better positioned to extract substantial benefits from AI advancements.

JOB OPPORTUNITY

Restaurant Manager

Responsible for ensuring the attainment of targeted revenues and and providing appealing restaurant service; managing staff and ensuring the smooth operation of the restaurant.

Essential Duties

• Maintain operations by enforcing company’s policies, standard operating procedures; implement production, productivity, quality, patron- service standards; determine and implement system improvements.

• Maintain patron satisfaction by monitoring, evaluating, and auditing food, beverage, and service.

• Ensure that all food and products are consistently prepared and served according to the restaurant’s recipes, portioning, cooking, and serving standards.

• Maintain a safe, secure, and healthy facility environment by establishing, following, enforcing sanitation standards and procedures; complying with health and legal regulations; maintaining security systems.

• Develop employees by providing ongoing feedback, establishing performance expectations and by conducting performance reviews.

•

• Prepare schedules and ensure that the restaurant is staffed for all shifts.

•

• Work with C. E.O/C.O. O and Head cook to plan and price menu items.

• Control food cost and usage by following proper requisition of products from storage areas, product storage procedures, standard recipes, and waste control procedures.

• Oversee and ensure that restaurant policies on employee performance appraisals are followed and completed on a timely basis.

• Conduct training for all personnel in conjunction with H.R and Sr. Manager or Regional Manager.

• PHYSICAL

REQUIREMENTS

• Flexible and long hours sometimes required.

• Ability to stand during entire shift.

QUALIFICATIONS

Bachelors Degree in Business/ Hospitality or a related feld from an accredited college/university with at least 3 years of proven supervisory/management experience. Please forward your resumes to hr@sapodillabahamas.com

Application deadline 18th August, 2023.

We thank all applicants for their interest, however only shortlisted applicants will be contacted for an interview.

THE TRIBUNE Monday, August 14, 2023, PAGE 5

DEALER’S ‘ART’ EXPANSION AS AUTO SALES JUMP 60%

Truck, would be “through the roof” if suppliers could sort out their postCOVID supply chain woes and provide the correct amount of inventory to meet local demand.

Ben Albury also said that if current industry “trends continue”, total sector sales might surpass 2022’s full-year figure by the third quarter’s close at end-September.

Fred Albury, though, suggested that this spike might be “temporary” given that individual dealers will have benefited from a number of government fleet deals that boosted overall industry sales during the six months to end-June 2023. He pointed, as an example, to the “100-plus” truck and vehicle re-equipping of the Royal Bahamas Police Force that occurred several months ago.

“In this industry, you get ten years,” the Auto Mall chief told Tribune Business “Out of that ten years, you get through three relatively good years, two to three so-so years, and the other years you are scrapping and fighting to keep your head above water. It’s a cycle. You have to know when to

hold and when to fold out there.

“The other thing I’m trying to do is have these add-ons to the sales to increase our profit margins. We’re expanding operations to take on more of those areas such as paint and body work. We’re about to launch a paint supply company called Automotive Art, which is very specialised auto paint and accessories. We’ve closed a portion of the property on Wulff Road, changed out the shelving, put in inventory, so it’s about a $250,000 investment.

“We’re doing that from our Wulff Road location and will hopefully launch that in the next 30 days. We’ve had our first shipment of materials, the equipment is in, and we’re hoping by the middle of next month to be up and operating out there. People are going to need tyres, people are going to need batteries, people are going to need wheel alignments, they’re going to have dinks to their cars here and there, so we’ve started looking at the add-ons.”

Fred Albury said Automotive Art’s launch will add a further five jobs to the group’s workforce, with

a further one-two posts in bodywork and repair. “We’re also looking for qualified technicians,” he added. “Trained technicians in The Bahamas are in very short supply. We have people who can to the brakes, do oil changes, but can they do computer diagnosis?

“We might have to import the talent that’s needed, especially as vehicles shift from internal combustion engines to plug-in hybrids and electric. We’ve found that with the BMW brand. It’s difficult. Fortunately, there’s a few Bahamian we have been working with and they’re doing a great job.”

Meanwhile, Ben Albury told Tribune Business the industry’s 60 percent firsthalf sales increase “seems unreal” even though it built on the 40 percent rise recorded for the 2023 first quarter. “Last year was way behind that,”he added of the 2022 first-half comparatives. “We’re up drastically. That’s a substantial increase. That’s very, very encouraging. Hopefully it’s a sign of things to come.

“If that trend continues, hopefully we should see an improvement over last year.

If we continue this way, by the end of the third quarter we will be around what we did for the entire year for last year. Some dealers are up more than others. That, too, depends on market activity and also inventory. I know that if I am able to get what I am ordering my sales would be up by an even higher amount. I’m still having challenges with vehicles and parts.”

The Bahamas Bus and Truck general manager said that while Japanese manufacturers had caught up and eliminated the postCOVID backlog, their US counterparts were still enduring supply chain challenges. “It just goes to show you can’t stop the world for a month,” Ben Albury added. “I would have figured by now all of that would be caught up, but there’s still some challenges there....

“From my perspective, with the availability, if I were able to get what I was ordering my sales would be through the roof. I’m just praying that improves. My suppliers are seeing it as well. In our monthly meetings, they see pretty much what they’ve sent me is gone not long after they’ve sent it. I keep getting promises as to when it will level off, but have given up counting on those promises.”

Ben Albury said the ability of suppliers to match his vehicle orders had improved “slightly” in recent months, but added: “They’ve cancelled all of my Wrangler orders for the remainder of the year and that’s one of my top sellers. The Jeep Renegade, if we order 20-30 at a time, we might get three to four or seven to eight. It’s levelling off. It’s a slight improvement, but not greatly aligned with where we need to be.”

However, Fred Albury, while agreeing that 2023 first half half sales were robust, forecast a slight easing during the final six months of the year. And, in a nod to the vehicle availability woes still plaguing many dealers, he added:

“Whoever has inventory is king of the hill.”

“Sales have been strong for the first half, I think all around,” he added. “The supply chain is still having an effect so it depends on who has inventory. It’s very similar to what happened last year. I think in the second half of this year we might see things balance out a bit more. Supply is starting to pick up and demand is starting to taper off a bit.

“Some brands have managed to be up because they had some government fleet deals, but that might

probably not be happening in the second half of the year.... The Government has been on to me about the supply of certain vehicles; I don’t want to say which department, but I could not get them as Toyota could not provide them, so they went to Ford. Whoever has inventory is king of the hill.

“The market is also price sensitive when it comes to new vehicles,” Fred Albury continued. “We’ve seen Suzuki sales significantly increase, and Hyundai as well. People are shopping around that $30,000 price line. The BMW sales are still strong out there, and Toyota is doing well but they have had some supply issues.

“I think, all in all, this year will be on a par with last year. The fleet deals have helped some brands in the first half of the year and the second quarter, but those won’t be repeated so things will balance out in the second half of the year.

“From a business point of view I’d rather have a strong flow of inventory coming in and not discount for fleet deals. You want to squeeze every dollar out of a sale and not discount. On fleet deals you’re expected to discount because of the volume of vehicles being bought.”

Oil pollution ‘unfortunate’ says GB Chamber chief

FROM PAGE B4

product on Grand Bahama. He added that businesses on the island are experiencing a “stable” summer but that is “contingent” on the wider economy. He added: “The thing is, when we talk about the strength of legislation, it speaks to legislation that regulates how these companies who are involved in this type of production

or business, how they are prepared and how they’ve structured themselves in order to be able to deal with these things - and act on these things - right away in the most efficient manner. I think that’s one way of reducing the risk of such an accident.

“From the tourism side, we have to look at the effectiveness of our ability to contain these accidents to the point where it does

not really affect the tourism product. And for us, the tourism product in this particular case is going to be those persons who are beaching and water sports and that kind of stuff.

“You know, everything is contingent or hinges on what’s happening around us, the economy and all of that. But, for the most part, business is stable. And we don’t anticipate things getting any worse.”

PAGE 6, Monday, August 14, 2023 THE TRIBUNE

FROM PAGE B1

SEPTEMBER SEIZURES FOR PROPERTY TAX DELINQUENTS

to sell the liens. So, we can sell the tax lien to a buyer, someone who wants to buy that lien. And I think that is going to be one of the things that persons need to pay attention to. And we can only do it on foreign-owned properties and commercial properties.”

Ms Strachan also revealed that more than 250 bank accounts held by companies were garnished for non-payment of VAT between April and June 2023. She added that the commercial banks have also incorporated the collection of real property tax into mortgage payments by their borrower clients.

“Generally speaking, we would have garnished more than 250 accounts, let’s say from the month of April to June. But that’s something we consistently do, because it wasn’t like a one-time thing. But it’s something that we’re going to be doing consistently as the need arises,” she said.

“By and large, with the exception of one that I can think of, all of the commercial banks, they have stepped up to the plate. They’ve made the necessary changes to their system. They are including the real property tax in the mortgage process. And that is really helping us to be able to keep the real property tax arrears low in that arena.

“So if you have a mortgage property, then we don’t expect that those properties will have real property tax arrears going forward. The banks again, they stepped up to the plate. They put processes in place. We meet on a regular basis to iron out any concerns that we have. And that process has been flowing quite smoothly.”

Ms Strachan added that the Department of Inland Revenue will not “shy away” from garnishing

wages, funds, property or other real estate that is owned by a tax delinquent - but held by another party - to ensure that they see a reduction in arrears.

She said: “So again, the penalties will be stiff. But also we will not shy away from doing things like garnishing. The Real Property Tax Act also now allows us to even garnish for real property tax arrears. Again, that’s something that we didn’t do in the past. We were able to garnish funds. But now we can even garnish property.

“So, for example, if you have arrears for real property tax, we will seek to garnish wages, but we may also seek to garnish property or property that is held by somebody else for you that is owned by you. So, again, we will be doing a lot of things really to step up our enforcement activities. And it’s really to reduce the arrears. “

Ms Strachan said the tax authority is making “good progress” with collecting outstanding VAT, Business Licence and real property tax arrears. She said the Department of Inland Revenue almost made its $1.3bn target last year and will “step it up” this year to ensure its $1.6bn goal is met.

She said: “Relative to the collection of arrears, we’re making good progress. We’re happy to say that last year, our budget or the forecasted revenue for Inland Revenue was $1.3bn. And we just made that or were just a little shy of it. We made a little over $1.2bn and a lot of that is attributed to the collection of arrears.

“We’d like to step it up this year. We don’t have a choice, because there are really no new fees, no new taxes, for us to collect. So what will be critical for the Department in making its $1.6bn forecast this year is

really collecting on those arrears.

“We do have extra things like the selling of liens, power of sale. There’s some things we’re going to be doing that we didn’t do before. And it is simply because we really have to, yet again, step it up even more with the collection of the arrears. We did well last year, but there’s still room for us to improve this year.”

Ms Strachan said VAT collection has been “steady” but businesses are still failing to report or file due returns.

“We are concerned with the amount of arrears that we’re seeing; simply nonfiling and non-reporting,” she said. “So while collection has been steady, there is a lot of room for us to increase our collections. Because we need to really strengthen and do more enforcement activities to deal with persons that are not filing and not paying their VAT.”

The Department of Inland Revenue audit section has expanded, and is conducting more audits. “Enforcement activities continue and we’re going to be stepping those enforcement activities up,” Ms Strachan said. “Our audit section has expanded, and we are conducting more audits and, from those audits we are discovering that a lot of businesses aren’t paying what they should be paying.

“Again, persons want to avoid those large fines. They can do so simply by filing correctly, paying on time. We are seeing businesses that are operating, but not filing their VAT returns, and that’s a concern.”

CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

Project Manager

This is a rare and exciting opportunity to join an outstanding and ambitious team at Inspired who has already proven to be incredibly successful and is now moving into its second year. We are looking for an exceptional Project Manager, who brings outstanding experience, high standards and a solution focused approach.

Job Summary: As an Inspired Project Manager, you will manage the construction and Capex-related matters for our projects in the Bahamas. This role requires a leader with a track record of delivering local construction projects within budget and on time. The successful candidate will be expected to manage a team of professionals and subcontractors to ensure the highest quality of workmanship is delivered to international standards of excellence.

Responsibilities:

• Develop and execute a comprehensive project plan that includes project timelines, budget, resources, and deliverables.

• Oversee the project team, including architects, engineers, contractors, and subcontractors, to ensure project milestones are met.

Manage the tendering process.

• Work closely with the quantity surveyors and our internal Commercial Manager to control project costs, including contractor variations to ensure the project is delivered within budget. Manage the construction schedule, ensuring that all work is completed on time

• Ensure compliance with all building regulations, including health and safety requirements.

• Develop and Manage project risk register and develop contingency plans to minimise any potential issues.

• on project progress and addressing any concerns.

• Foster a collaborative work environment, promoting teamwork and communication among project stakeholders.

• Ensure all project documentation is complete and up-to-date, including contracts, change orders, and project reports. Manage Value Engineering processes and ensure that the design and other schedules are met to avoid delays.

• Manage the full critical path for project delivery and retain ownership of stage gates.

• Establish best practice reporting and systems of working; dashboards, weekly reports, monthly reports – tracking progress etc.

Requirements:

• Essential: experience managing projects in the Bahamas with major contractors Bachelor’s degree in construction or project management, engineering, or management or minimum of 10 years of experience in project management in the construction industry.

• Experience managing large-scale construction projects, preferably some in the education sector. Strong leadership and communication skills, with the ability to motivate and inspire team members.

• Demonstrated ability to manage project budgets and schedules, ensuring projects are delivered on time and within budget.

• Thorough knowledge of construction best practices, build sequence, and regulations. Ability to work collaboratively with various stakeholders, including clients, architects, engineers, contractors, and subcontractors.

• experience working with project management software like MS Project, ASTA or Primavera.

When joining King’s College School, The Bahamas, you will join the family of the award-winning Inspired Education Group, the leading global group of premium schools, with over 80 schools operating in 23 countries.

some of the very best schools worldwide.

To apply please send a CV and letter of motivation to admin@kingscollegeschool.bs

THE TRIBUNE Monday, August 14, 2023, PAGE 7

FROM PAGE B1

CHIEF JUSTICE SHOWS DORIAN VICTIMS MERCY

The couple, whose Devonshire subdivision home was deemed “a total loss” after it “sustained significant damage” from Category

Five Dorian in September 2019, are alleging that the BISX-listed lender failed to pay the necessary property insurance premiums on their behalf and/or notify them of this. As a result, insurance coverage was purportedly cancelled without their knowledge and they cannot make a claim for funds to rebuild or construct a new home.

The couple are represented by Beryn Duncanson, an attorney from the Turks & Caicos Islands, who has filed at least two similar claims against CIBC FirstCaribbean International Bank (Bahamas) and Insurance Management. However, the two corporate entities and their attorneys last year took the position that the Smiths’ claim “stood dismissed” because they had failed to comply with the Supreme Court’s case management instructions

These were issued in the form of an ‘Unless Order’,

which means that an action can be struck out or dismissed if the instructions - and specific dates by which they must happen - are not complied with. Mr Duncanson, in a July 25, 2022, e-mail to Viola Major, Insurance Management’s attorney, accused the broker of using “the merest of excuse to attempt to shut out our poor clients from justice” and pledged that would take “delight in that particular flight”.

After Ms Major informed him that he and his clients were in breach of the ‘Unless Order’, and that their claim “stands dismissed”, Mr Duncanson retorted: “It is unfortunate that your clients are so eager to use the merest of excuse to attempt to shut out our poor clients from justice in finally having their day in court.

“Should you wish to waste costs from your clients’ doubtlessly bottomless bank account on a special application to dismiss for alleged ‘lateness in receiving the actual stamped/filed copy, or not having a document headed ‘Expert’s Report’ in an affidavit, that is your prerogative. Just know that we

HVAC and Plumbing

Maintenance Laborers

are prepared for and shall delight in that particular fight. Bring it.”

Mr Duncanson asserted similar arguments when he appeared before the Chief Justice, arguing that “a dangerous precedent has built up whereby opposing counsel can simply assert slight non-compliance with an Unless Order and thereby derail and progress towards trial until the other side obtains relief from sanctions..... This is a tactic used by deep-pocketed corporate defendants, and the Civil Procedure Rules were intended to discourage it”.

Nevertheless, while finding that Mr Duncanson’s clients were in breach of the Unless Order, Sir Ian declined to punish them or dismiss the case and granted their motion for relief from any Supreme Court sanctions to allow the dispute to proceed towards trial.

The two Unless Order terms that the Smiths were alleged to have breached were that they needed to file and serve the “list of documents”, or evidence they intended to rely upon, by June 10, 2022, while the report by their “expert”

witnesses had to be filed and served by July 22 last year. The Order also stipulated that failure to comply with these conditions would result in their claim being struck out and dismissed.

Mr Duncanson, on his clients’ behalf, sent an “unfiled” list of documents to attorneys for CIBC FirstCaribbean and Insurance Management on June 10, 2022. And, on July 22, 2022, he sent them “an unfiled draft affidavit” that was supposed to be sworn by Brian Hanna as the Smiths’ “expert witness”. Neither submission met the requirement that they be filed by that date, leading Insurance Management’s attorney to argue that the action should be dismissed. This prompted Mr Duncanson’s filing of a motion requesting that no sanctions be imposed on the Smiths. However, Sir Ian found there was “no room for reasonable debate” that they had not complied with the Unless Order, even though the couple’s attorney argued that CIBC FirstCaribbean and Insurance Management’s objections were “over form and not substance, and it is a ‘new day’ with ‘new rules’” via the Civil Procedures Rules.

They also argued that it was in “the public interest for this case to be resolved as expeditiously as possible”, and urged that the Supreme Court not pursue procedural justice by ‘throwing out the baby with the bath water’.

CIBC FirstCaribbean, though, argued that the order breaches were “serious and significant” because they inhibited trial preparations, and they questioned the Smiths’ claim of “financial hardship” as they had been able to finance the action.

Similar arguments were made by Insurance Management’s attorneys. Sir Ian agreed that the noncompliance was “serious and significant”, as it had forced the Supreme Court to vacate two trial dates, impacted other court users and “unnecessarily wasted time and expense”.

He also found that the couple had not justified or explained their non-compliance, even though it was alleged that the Smiths had “simply struggled under continued severe financial hardship because of the defendants’ own negligence, a dilapidated and mostly destroyed, uninhabitable house, with continuing outside rental accommodation rental expense also whilst

bank mortgage payments still continued/continue’.

Sir Ian, though, said that while the non-compliance was not willful or deliberate, there was “no excuse for what transpired” as they “adopted an excessively casual and lackadaisical approach” to the case. He hinted that some of the fault lay with Mr Duncanson.

However, in the “final analysis”, the Chief Justice decided not to impose sanctions or drive the Smiths’ “from the seat of judgment” by dismissing the case. Noting that the proceedings were at an early stage, he added that neither CIBC FirstCaribbean or Insurance Management had argued they would be “prejudiced” by allowing the matter to continue to trial.

Tribune Business records show that Mr Duncanson, who seemingly set up Bahamas Claims Assistants Company in Hurricane Dorian’s wake, also initiated four claims against J S Johnson & Company Ltd/ Island Heritage Insurance Company, and Star General Insurance Agents and Brokers/Royal Star Assurance and Safeguard Insurance Brokers over disputed claims payouts.

NASSAU AIRPORT DEVELOPMENT COMPANY NOTICE OF VACANCIES

Maintenance and Engineering Department

Electrician Level III

services in the shortest possible time with minimal impact to operations for the overall success of the ADB & BHS Team/NAD.

The Maintenance Laborers are responsible for performing a range of duties including, but not limited to assisting with HVAC and Plumbing system Electrical, Facilities and Structures repairs, inspections, and check of equipment. The job is also responsible for the installation, removal, painting and cleaning of HVAC and Plumbing system components throughout the Terminals to maintain a high level of standard.

Facilities and Structures

Maintenance Laborers –

Facilities and Structures

The Maintenance Laborers are responsible for performing a range of duties including, but not limited to assisting painting, drywall, masonry, and door repairs throughout the Terminals to maintain a high level of standard.

Electrical Power Systems & Fleet Supervisor, Maintenance Response Team

The Supervisor, Maintenance Response Team primary responsibility is the supervision of the Electrical maintenance team and multi-disciplinary maintenance team including performance of inspection and execution of repairs of critical Terminals system and airside infrastructure. The job requires exceptional knowledge and skills to troubleshoot, repair and maintenance of three phase electrical and industrial systems.

Electrician Level I

The Electrician Level I is responsible for providing support to the Electrical Team in the day-to-day operational functions at LPIA. The job also performs daily checks, repairs, and preventative maintenance of all electrical systems throughout the Terminals and on the airfeld to maintain a high level of standard.

Manager, Airfeld Maintenance & Environmental Affairs

This position is responsible for monitoring all airfeld maintenance works in compliance with local and international regulations necessary for the safe, secure aircraft operations at the Lynden Pindling International Airport (LPIA). Additionally, this position is also responsible for environmental sustainability through the implementation of policies and programs in line with applicable regulations and industry standards.

The Electrician Level III is responsible for providing support to the Electrical Team in the day-to-day operational functions at LPIA. The job also performs three phase electrical installation and troubleshooting of motors, control circuits and perform preventative maintenance of electrical system throughout the Terminals and on the airfeld to maintain a high level of standard.

Maintenance Laborer Level I

The Maintenance Laborer is responsible for performing a range of duties including, but not limited to assisting with Electrical, HVAC, Plumbing system and Facilities and Structures installation, maintenance, repairs, inspection check and removal of Electrical equipment at LPIA. The job is also responsible for painting and cleaning rooms and system components throughout the Terminals and on the airfeld to maintain a high level of standard.

Information Technology & Electronics Automation Engineer

The Automation Engineer responsibility includes assisting with the upkeep of the IT infrastructure at LPIA, performing maintenance on a range of instrumentation and controls equipment. HVAC maintenance, MS network troubleshooting and repairs, VFD maintenance and troubleshooting, repairs of computer equipment and network systems throughout the airport campus.

Apron Drive Bridges (ADB) & Baggage Handling Services (BHS)

Supervisor Preventative Maintenance Team

The Supervisor Preventative Maintenance Team has responsibility for the daily activity for Preventative Maintenance of the BHS & ADB systems and equipment at LPIA. This will include the supervision of all assigned ADB & BHS Team to ensure that all the agreed key performance standards between NAD and its stakeholders are maintained. Supervisory skills must be demonstrated to provide leadership for the ADB & BHS Team, liaise between local/external contractors to resolve technical issues and to position the team to resolve any disruption to the ADB & BHS

Cleaning Technicians

This position is responsible for the ongoing cleaning and maintenance of the terminal facilities to world class standards.

The Revenue Collection Clerk

Supervisor, ADB & BHS

ADB & BHS Supervisor is responsible for the BHS & ADB Team operations at LPIA. This will include all daily activity Operational/Maintenance and supervision of the ADB & BHS Team to ensure that all the agreed performance specs between NAD and stakeholders are maintained. Contribute to the success of the ADB & BHS Team/NAD. Supervisory skills must be demonstrated to provide leadership, liaise between local/external contractors to resolve technical issues and to position the team to resolve any disruption to services in the shortest time possible with the least impact to operations for the overall success of the ADB & BHS Team/NAD.

Work Coordinator

This position is responsible for coordinating all work requests to ensure the accurate and timely creation, dissemination and documentation of work orders submitted and gather critical data for the BHS Team to ensure an effcient, safe operation for the department. The coordinator will provide another layer to the Supervisor/BHS Admin in organizing critical manpower resources and checking the performance of BHS & ADB Team members through the computerized maintenance management system. The coordinator will offer another position of leadership on the BHS & ADM Team that will assist in focusing the team along with the supervisor and senior personnel.

BHS Technician Level I

The BHS Technician Level I is responsible for providing support to the BHS & ADB Team with the day-to-day operational functions at LPIA. The job details performing daily checks and assists with the preventative maintenance (PM & DMs) on all BHS/ ADB/ BIWIS/GPU Systems.

BHS Technician Level II

The BHS Technician Level II is responsible for providing support to the BHS & ADB team in the day-to-day operational functions at LPIA. The job also performs daily checks and assists with the PMs on all systems (BHS/ADB/GPU/BIWIS), and any other duties that contribute to the success of the ADB

Operations Department Finance Department

Lead, to ensure that they provide Extraordinary Customer Service, while effciently and effectively assisting the traveling public.

contractual and reporting relationships with fnancial institutions, government entities and airlines as well as other duties of strategic and fnancial importance to the Airport’s operation.

Manager, Revenue

This position is responsible for the collection of all of NAD’s parking and ground transportation revenue. This will include both paid lots, domestic and international, along with the AVI system and Ground Transportation Fees. The Revenue Collection Clerk will work closely with the Car Park

of Finance

Director

This position is primarily responsible for managing fnancial forecasts and projections, evaluating investment and fnancing arrangements, corporate cash management, and managing

This position is responsible for the proper accounting of the Company’s revenues including billing, receivables, credit and collection, compilation of the annual revenue budget and maintenance of the Accounts Receivable ledger.

PAGE 8, Monday, August 14, 2023 THE TRIBUNE

FROM PAGE B1 APPLY TO: Att: Human Resources Department Email: People@nas.bs Phone: 702-1000

its recommendations “a few months ago”.

Mr Sands told this newspaper of the industry’s response to the corporate income tax proposal: “It had its genesis in that we cannot look at that in isolation, but have to look at a number of other taxes that exist, such as Customs duties and Business Licence fees, trying to determine what is an acceptable and unacceptable level of taxation.

“We have to appreciate what level they are looking at, and what will happen if there are reductions in duties and Business Licence fees. Until we can get an appreciation of that, the thinking on all those things in aggregate, it’s very difficult at this time to make an overall recommendation.”

The options detailed in the Government’s ‘green paper’ would eliminate the Business Licence fee for most, if not all, companies operating in the domestic economy should a corporate income tax be ultimately adopted by The Bahamas. Simon Wilson, the Ministry of Finance’s financial secretary, recently estimated that implementation of a corporate income tax economy-wide is some four years away if this nation elects to go that route.

“We continue to be open to collaboration and consultation on this particular matter,” Mr Sands said. “I don’t think the industry is dismissive of it, but we have to have appreciation for all these other taxes that we’re paying. I think we still have to look at it, and assess what we’re paying today versus what is levied with a corporate income tax and we will be paying tomorrow.

“The impact will be determined, by and large, by at what level, and what will be the percentage

cannot be heavier with corporate income tax’

rate, versus the taxes we’re paying now. If we’re paying ‘x’ today and we’re expected to pay three-four times ‘x’ tomorrow that would not be an acceptable approach. We have to look at the recommendations, and what will be reduced elsewhere, to see what the net proposed impact will be on the sector.”

Rupert Roberts, Super Value’s owner, told Tribune Business that “the devil’s in the detail” with regard to the corporate income tax proposal. Echoing Mr Sands, he added that the Government must avoid increasing the private sector’s total tax burden beyond what exists today, and added that any reforms cannot result in a further increase to the cost of living.

“I think we realise it’s all coming. We know everybody suggests it’s the way of the future,” Mr Roberts added. “It seems to me that it will be replacing the Business Licence fee. We cannot have both as that would be over-taxing. I hope it’s not going to be too harsh and I hope it doesn’t increase the cost of living. But we can hardly say that until we know what it is.

“It’s always going to be the devil’s in the detail. We have to see where we are, and if you are better or worse off. It’s hard to comment until we know all of the facts, and you apply it to your particular business and see if you will be better off or worse off, and pay more taxes or less taxes. I hope it’s nothing that contributes to the increased cost of living.”

A corporate income tax will be the first such income-based levy in the country’s history, apart from the National Insurance Board’s (NIB) payrollbased contributions, and is intended to ensure The Bahamas complies and fulfills its obligations as one

of 140 countries that have signed on to the G-20/ Organisation for Economic Co-Operation and Development (OECD) drive for a minimum 15 percent global corporate tax.

In the first instance, this initiative applies only to corporate groups and their subsidiaries that have a minimum annual turnover in excess of 750m euros. The Government’s ‘green paper’, which is dated May 17, 2023, sets out the first option as merely introducing a 15 percent corporate income tax for all Bahamas-based entities that fall into that 750mplus turnover category, while maintaining the Business Licence status quo for all entities which are not affected. While that would have zero impact on the country’s economic growth and unemployment rate, the paper estimates it would cause foreign direct investment (FDI) and domestic investment to contract by 0.3 percent and 0.1 percent, respectively. The Government may implement this in the near term as a shortterm measure to ensure compliance with the G-20/ OECD, depending on the initiative’s progress, while leaving much of the rest of the economy untouched.

The second and third options, described as “more nuanced” because of the better balance they strike between tax revenue and economic impact, are those the Government indicates it is giving more serious consideration to. The second, labelled as “a soft introduction”, would introduce the same 15 percent rate for all those caught in the G-20/OECD net and also levy a 10 percent corporate income tax on all other businesses “to maintain regional tax competitiveness”.

This option, the ‘green paper’ adds, would have

minor negative impacts on GDP, foreign and domestic investment, and unemployment. The latter would rise by 0.1 percent, while GDP growth would contract by 0.3 percent and foreign and domestic investment fall by 1.5 percent and 0.3 percent, respectively.

The third option, branded as “simplicity driven”, would exempt or carve-out small businesses earning less than a $500,000 annual turnover to leave them still paying the existing Business Licence fee. Bahamas-based entities in groups that meet the G-20/ OECD threshold would pay a 15 percent corporate income tax, and all other companies generating more than $500,000 would pay a 12 percent rate. The third option, though, would result in greater negative economic impacts although generating more revenue for the Government. Under this scenario, the ‘green paper’ said GDP growth was estimated to contract by 0.9 percent with unemployment increasing by 0.5 percent. Foreign and domestic investment will fall by sums equivalent to 5.1 percent and 1 percent, respectively.

The final option, which will generate the greatest revenue increase for the Government but also inflict the harshest economic impact, is to simply impose the 15 percent corporate income tax rate on all businesses with a turnover greater than $500,000 per annum and a 10 percent on small and medium-sized enterprises earning less than that. This would result in an economic contraction of 1.7 percent, or around $200m,

the ‘green paper’ projected, with the unemployment rate rising by 0.9 percent. FDI would fall by 10.2 percent, and its domestic investment counterpart by 2 percent. However, government revenues under this scenario are forecast to rise by 96 percent compared to the $140m collected from Business Licence fees in 2019 (see other article on Page 24B).

The more favoured options, according to the ‘green paper’, would see

government revenues rise by 36 percent and 62 percent from implementing the second and third scenarios, respectively, compared to those same 2019 Business Licence revenues. Just levying 15 percent corporate income tax on those groups targeted by the G-20/ OECD, though, would only produce a 4 percent revenue rise from business community taxation.

THE TRIBUNE Monday, August 14, 2023, PAGE 9

FROM PAGE B1

‘Burden

LARGE TAXPAYERS PROMISED ‘CRÈME DE LA CRÈME’ SERVICE

or any kind of civil type of entertainment.

“But if you are a promoter, and you don’t have

an annual license, and you’re having a public entertainment event, if you are bringing in somebody from the States to perform and you’re selling

tickets… that’s the catch… You’re selling tickets, it’s at a public place on public premises, you’re inviting an entertainer, whether it be Bahamian or foreigner,

selling tickets, and you’re going to put up this nice stage and have lighting.

“You’re spending money because you expect that you will generate a pretty sizable turnover, then your occasional license fee is $750…For those events, if a promoter does not have an annual Business Licence, then they will really need to get an occasional license and pay the $750.”

Moving to real property tax, Ms Strachan reiterated that non-Bahamians are now required to show proof that they are current with their payments prior to obtaining a building permit. She added that this was designed to catch the many foreign property owners who do not remain current with real property tax payments for vacant lots, as they will now be unable to build without bringing their taxes up-to-date.

Ms Strachan said: “Another thing relative to real property tax will now be that foreigners will require proof of payment if they are building. So if you go in, if you’re a non-Bahamian, and you’re going in

to get a permit to build a home or to build whatever it is you’re building, you have to show proof that your real property taxes are up to date.

“And that’s really because we see a lot of cases where foreigners own vacant land. But the real property tax is not being kept current. And so now the Act requires them to show proof that real property tax has been settled before they are granted a building permit.”