‘Full steam ahead’ for Royal Caribbean on PI

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ROYAL Caribbean’s Bahamas chief has hailed as “a critical milestone” the environmental goahead for its Paradise Island beach club “that could benefit hundreds of businesses and tens of thousands of Bahamians”.

Philip Simon, the Royal Beach Club’s president and general manager for the cruise line’s Bahamas operations, told Tribune Business there “has never been any confusion” as to how important approval of its Environmental Impact Assessment (EIA) and related issues were to the $100m project’s ability to move forward.

He spoke after Dr Rhianna Nelly-Murphy, the Department of Environmental Planning and

Protection’s (DEPP) director, affirmed in an August 15 letter to Jason Mayes, Royal Caribbean’s senior investments manager for private destinations, that the cruise line has “substantively addressed the environmental concerns” surrounding the western Paradise Island project and can move forward with submission of its Environmental Management Plan (EMP).

“The department is satisfied that Royal Caribbean

International has substantively addressed the environmental concerns associated with the development of the Royal Beach Club at Paradise Island,” Dr Neely-Murphy wrote. “The DEPP is also satisfied that Royal Caribbean has demonstrated a high degree of of representation throughout the public consultation process and ensured that all key players were involved.

“In our review of the processes undertaken,

VAT to undershoot full-year $1.4bn goal

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

in correlation with the final report, Royal Caribbean provided access to information, transparency, confidentiality of information and dedicated resources to achieve the goal of facilitating the public consultation requirements as ascribed by law.”

SEE PAGE B3

PI entrepreneur: ‘Could I have swift approval too?’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMIAN entrepreneur seeking to restore Paradise Island’s lighthouse yesterday voiced hope the Government will now approve his project - now in its 12th year of asking - with the same “swiftness” it has afforded Royal Caribbean.

Toby Smith, the Paradise Island Lighthouse and Beach Club principal who was previously battling the cruise line for the same two Crown Land acres, told Tribune Business that the go-head granted to Royal

Caribbean “is not a recipe for success for the revitalisation” of Bay Street given the extra competition that the 17-acre Royal Beach Club will provide.

SEE PAGE B4

Royal Caribbean: Can’t blame us for Bay St ‘decline’ reports

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ROYAL Caribbean says Bay Street merchants have reported “a decline” in business volumes amid assertions it has “not sufficiently analysed” the economic impact from its $100m Paradise Island beach club project.

The cruise line disclosed the revelations about reduced business for downtown Nassau retailers and others in responding to a question raised by Eric Carey, the former Bahamas National Trust (BNT) executive director, during the public consultation on the Environmental Impact Assessment (EIA)

for its Royal Beach Club investment.

Mr Carey, who was hired by Atlantis to assess the EIA on its behalf, suggested that Bahamians should “be able to review a professional third-party analysis of the economic impact your project will have on your neighbours already struggling to operate their businesses and earn their livings across the harbour from your beach club”. Clearly referring to downtown Nassau, he queried if such a study will be included in the yet-to-be released Environmental Management Plan (EMP).

“We will continue to work with the Government of The Bahamas,

SEE PAGE B6

THE Ministry of Finance’s top official yesterday conceded that VAT revenues were likely to under-shoot their 20222023 target but voiced confidence that tougher enforcement will keep them on track in the current fiscal year.

Simon Wilson, the financial secretary, told Tribune Business that the Government’s tax and revenue agencies are targeting the Family Islands, marine industry, tourism and services sector with more stringent compliance measures to ensure VAT hits its $1.591bn target for the 2023-2024 fiscal year.

That goal, though, could be tough to reach given that VAT collections are on pace to fall short of their 2022-2023 full-year target.

The Government’s monthly fiscal snapshot for April 2023, released last week, reveals that VAT revenues for the first ten months of the fiscal year at $1.063bn

business@tribunemedia.net MONDAY, AUGUST 21, 2023

SEE PAGE B7

PHILIP SIMON

TOBY SMITH

SIMON WILSON

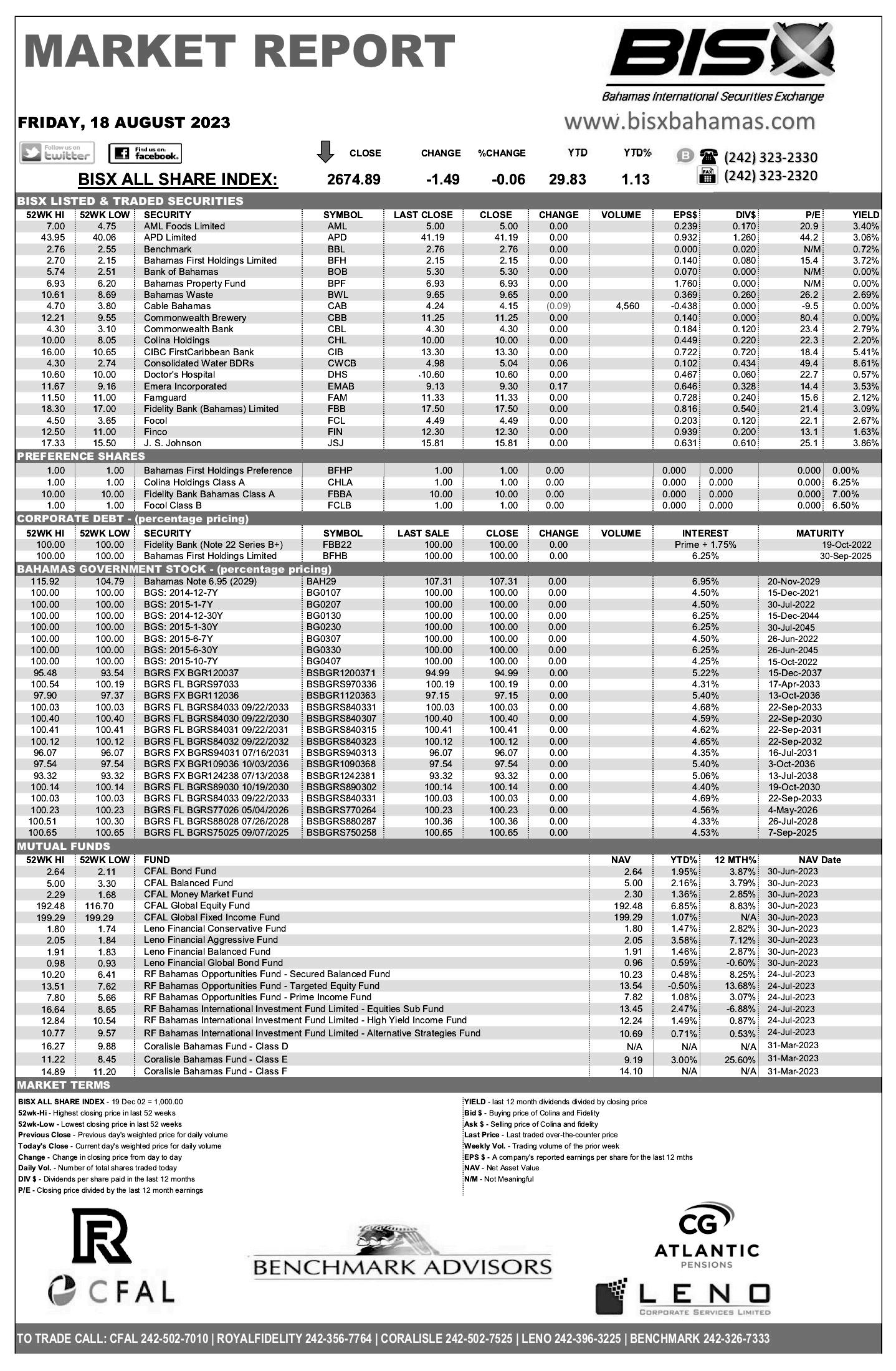

$5.70 $5.75 $5.81 $5.94

ECONOMIC GROWTH CRITICAL FOR BAHAMIANS TO PROSPER

As citizens of The Bahamas, we frequently ponder the intricate workings of our economy, questioning its sources of income and its influence on our daily existence. Since achieving independence, the economy has evolved into a multi-faceted entity encompassing both diversification and expansion. However, despite implementing additional revenues, taxes and procedures, the Bahamian economy has seemingly experienced minimal transformation and growth. In this article, we will uncover the relationship between microeconomic (micro) and macroeconomic (macro) trends, and the crucial role of education in driving job demand and fostering economic diversification.

Unveiling the Economic Foundations

For years, The Bahamas has thrived on two primary pillars - tourism and financial services. Tourism, with its alluring attractions and vibrant culture, has attracted tourists from far and wide, contributing significantly to the national coffers. On the other hand, the country’s reputation as a international financial

and business hub has made financial services an equally lucrative sector.

However, to truly understand our economy, we must venture beyond these two pillars and explore the delicate dance between micro and macro trends. At the micro level, individual decisions made by consumers, businesses and workers shape the local economic landscape. The spending habits of residents, the success of small businesses and the dynamics of the labour

market all play a crucial role in molding the economy from its roots.

On the other hand, macro trends pertain to the broader economic picture, encompassing national and global factors that impact the country’s financial health. Factors such as international trade, exchange rates, fiscal and monetary policies, and global economic conditions all fall within the purview of macroeconomic trends.

These larger forces can greatly influence the economic direction of The Bahamas, sometimes even more so than micro-level decisions.

Crucially, micro and macro trends are not isolated from each other but, rather, are interconnected. The success of local businesses (a micro factor) can contribute to the overall economic growth of the nation (a macro outcome). Similarly, global economic fluctuations (macro factors) can affect the purchasing power and job opportunities available to individuals (micro impact). Acknowledging this interdependence allows us to gain a comprehensive understanding of our economic landscape.

Growth Matters

Economic growth is a vital driver of improved living standards, and it positively impacts individuals and communities in various ways. As economies expand, businesses generate more revenue, leading to higher wages and salaries for workers, and resulting in increased income levels. This higher income allows individuals to afford better quality goods and services, contributing to an enhanced standard of living. Moreover, economic growth often goes hand in hand with job creation, reducing unemployment rates and providing more job opportunities for the workforce. Reduced poverty, access to better education, improved healthcare services and advances in technology are among the many other benefits that economic growth brings, uplifting living standards and fostering a brighter future for all.

Economic growth enables governments to invest in public services, such as healthcare, education and infrastructure, thus enhancing the quality of life for citizens. Increased funding for education and scholarship programmes opens up more opportunities

for higher education, empowering individuals with better job prospects and upward workforce mobility. Additionally, economic growth fosters technological advances, leading to the development of new products and services that improve convenience, efficiency and overall well-being. As societies experience sustained economic growth, the benefits extend to the entire population, creating a more prosperous and resilient environment for individuals to thrive.

Embracing Individual Agency

While policymakers and government play a crucial role in creating an enabling environment for economic growth, it is essential to recognise that building a diverse economy is not solely their responsibility. Each citizen plays a vital part in shaping the economic trajectory of The Bahamas. By supporting local businesses and entrepreneurs, we stimulate economic growth from the grassroots level. Choosing to buy local products and services fosters an environment where small businesses can thrive,

Petroleum retailers continue Gov’t talks

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BAHAMIAN petroleum retailers are pledging to pass any reduction in oil prices on to motorists as they continue “private” discussions with the Government over their calls for a margin increase.

Vasco Bastian, the Bahamas Petroleum Retailers Association’s (BPDA) vice-president, told Tribune Business that gasoline prices being well below last summer’s high of $7.39 per gallon is a “good indication” of motorists being able to travel at ease with lower pump prices. “Wherever oil prices land, we will certainly pass those savings

on to the consumer,” he added.

Diesel prices have been rising compared to gasoline. “Diesel, because there is so much heavy stuff and equipment moving around the world, and logistics going up along with those big cargo vessels doing more around this time of year, the product is seeing an increase in demand,” Mr Bastian said.

He also confirmed that talks between the industry and the Government to address the former’s woes are ongoing. “We have been meeting privately with the Government on our concerns for the industry and I have to say things are looking positive for us,” Mr Bastian said.

“The Government has been very accommodating to us, and we are hopeful

that a resolution to this impasse will come shortly. Our president has been having some impromptu meetings with the Government and I am hopeful that he is getting the job done.”

Raymond Jones, the Bahamas Petroleum Retailers Association (BPRA) president, previously told this newspaper that gas station operators are seeking a margin increase equal to 7 percent of the landed cost of fuel as their equivalent of a livable wage.

He added then that such an adjustment was critical “to allow us to survive as retailers” given that existing price-controlled fixed margins simply cannot cover a multitude of everincreasing costs. Believing that “the Bahamian public will be OK to absorb a few cents more” on the per gallon cost of gasoline, he provided several insights into the increasing hardship faced by many gas station operators due to an inflexible business model that has left many unable to break even.

Mr Jones said turnoverbased Business Licence fees have almost doubled yearover-year due to last year’s spike in global oil prices following Russia’s invasion of Ukraine, which saw gas prices peak at around $7.20 per gallon during the 2022 first half. Noting that his fee has increased to almost $25,000, he estimated that “99 percent” of the Association’s members would be unable to make payment this year and would be seeking to agree payment plans.

Mr Jones said he had informed the Prime Minister then of how one gas station operator was using his pension money to cover operating costs and maintain staffing levels due to insufficient margins.

The last margin increase enjoyed by gas station operators occurred in 2011, some 12 years ago, under the last Ingraham administration, and operating costs and inflationary pressures have increased substantially then. That took gasoline margins from 44 cents per

creating a ripple effect throughout the economy.

Likewise, the task of fostering an educated and adaptable workforce extends beyond the Government’s purview. Embracing a culture of lifelong learning, and recognising education as a cornerstone of personal development, empowers individuals to cultivate their skills continuously. Citizens must take charge of their own learning journeys, actively seeking opportunities to upskill and re-skill themselves in response to evolving economic demands.

By embracing individual agency and actively participating in shaping our economic landscape, we can collectively drive The Bahamas towards progress, sustainability and prosperity. Beyond relying solely on government intervention, our collective efforts will pave the way for a vibrant and resilient economy, benefiting us all. The role of the central bank

As Bahamians, we hold the collective power to shape our economic

gallon to 54 cents, where it has remained ever since, while diesel stands at 34 cents per gallon.

Mr Jones contrasted the industry’s inflexible, pricecontrolled fixed margins with the food distribution sector. While much of the latter’s produce is price controlled, retailers and wholesalers have percentage-based - rather than fixed - margins and markups that allow them to apply for cost increases as the landed costs change.

Listing the ever-rising costs that fixed gasoline and diesel margins must absorb, Mr Jones pointed to the 2-3 percent “commission” or fees charged on every debit and credit card payment. On a $6 gallon of gasoline, the 3 percent charge amounts to 18 cents or one-third of the 54 cent margin, although this might be slightly less depending on the issuing bank.

With The Bahamas still largely a cash-based economy, he added that some gas station operators are being charged between $4,000 to $10,000 a month to deposit cash. With banks unwilling to accept such deposits over the counter, the industry is now incurring fees for doing this via the night deposit box.

And, with many of the petroleum industry’s 1,000plus employees earning the minimum wage, Mr Jones said their has increased by 24 percent or $50 per week due to the increase. While not opposed to the rise, he added that this has increased payroll costs for gas stations while also raising associated National Insurance Board (NIB) contributions.

To maintain the “spread” between minimum wage employees and others, gas stations have been forced to raise pay for cashiers as an example. Security costs have also increased, as third-party contractors pass the minimum wage’s impact on to gas stations and their other clients.

PAGE 2, Monday, August 21, 2023 THE TRIBUNE

SIMMS RODERICK A. AN ADVOCATE FOR SUSTAINABLE FAMILY ISLANDS

B12

SEE PAGE

‘Full steam ahead’ for Royal Caribbean on PI

Branding Royal Caribbean’s report on the EIA public consultation as “thorough”, and containing “the necessary responses” to all questions that were raised, Dr Neely-Murphy said the DEPP “now closes” the consultation process. She added that the Government’s environmental watchdog “offers no objection” to the terms of reference, outlining the EMP’s scope, and that it now awaits this document’s submission by Royal Caribbean.

Mr Simon confirmed that the DEPP’s approval “takes us to the next step” of submitting the EMP and, following the agency’s review and hoped-for approval, a Certificate of Environmental Clearance (CEC) to confirm the Royal Beach Club has satisfactorily addressed all issues relating to this topic.

He acknowledged, though, that the CEC “does not negate” the need for Royal Caribbean to obtain the necessary permits and approvals from other government agencies given that it confirmed in its 169-page public consultation report that it has “not received approval from Town Planning” yet.

Still, Mr Simon told Tribune Business that while the environmental process “has taken a little longer than expected” the cruise line’s ultimate goal of having its 17-acre Royal Beach Club open by summer 2025 remains on schedule. He voiced optimism that Royal Caribbean will be in position to start construction on Paradise Island, beginning with site preparation and the demolition of existing structures, in the first or second quarter next year.

As for the Royal Beach Club’s economic impact, the cruise line’s Bahamas chief said its ambition to increase the number of passengers it brings to Nassau by 150 percent compared to pre-COVID levels - from one million per year to 2.5m by 2027 - will “no doubt”

generate sufficient customers to ensure all businesses - as well as the Paradise Island destination - benefit.

“By 2027, we expect between 900,000 and one million guests will visit the Royal Beach Club each year. As a result, we would expect an annualised maximum daily capacity of [around] 2,750 guests per day. This translates to 171 guests per acre (assuming one acre is removed for back of house needs),” the cruise line said in a response to questions submitted as part of the EIA consultation.

That means 40 percent of the 2.5m passengers it plans to bring to Nassau in 2027 will go its its Paradise Island destination. Asserting that “everyone should benefit as that pie continues to grow”, Mr Simon explained that his reference to “hundreds of businesses and tens of thousands of Bahamians” benefiting from the Royal Beach Club alluded not only to spin-off opportunities involving the supply of goods and services but the opportunity for locals and the Government to collectively own a 49 percent equity stake in the project. Besides the environmental aspects, he confirmed that Royal Caribbean has already initiated the process to value the four Crown Land acres that will be included in the overall 17-acre site. This valuation will be used to monetise the Government’s contribution in the project and determine the size of the equity stake it will hold via the National Investment Fund, the country’s sovereign wealth fund. Once the value of the Government’s equity stake is determined, the balance of the collective 49 percent Bahamian interest in the Royal Beach Club that will be held by private investors can be calculated. That will then set the stage for the equity capital raise from Bahamian investors, with Mr Simon confirming that Royal Caribbean is still aiming for this offering to take place before year-end.

“That’s an ongoing process,” he affirmed of the Crown Land valuation.

“We have had evaluators and surveyors working on that. We hope to complete that process in full very shortly and present that to the Government. We are very satisfied with the work done thus far.”

Mr Simon declined to be drawn on a timeline for completing the valuation, but added: “We understand how important that is to the economic model,” he added. “We have to ensure that we do things the right way, and that we’re not unduly taking our time doing that. We’re trying to that as expeditiously and efficiently as possible given the timelines are expected to potentially have the Beach Club open and operational by summer 2025.

“We are going to push as hard as we can, full steam ahead, to meet our goals and objectives.” Asked about how far efforts to structure the Bahamian capital raise have progressed, Mr Simon added: “We’re still aiming and pushing, and committed to keeping this timeline towards the end of the year. We are having rigorous conversations with potential stakeholders and partners in that regard.”

The Royal Beach Club’s local equity raise will be structured similar to that of the Nassau Cruise Port. In the latter, Bahamian investors acquired shares in an investment fund, the

Bahamas Investment Fund, which hold the collective 49 percent equity interest in the Nassau Cruise Port on their behalf. This will likely be the model employed for the Royal Caribbean project.

Mr Simon described this equity model, where The Bahamas and Bahamians hold a collective 49 percent ownership interest in a tourism development alongside a major investor, as “just representing such a unique and tremendous opportunity”. He added: “If we get it right, it has the potential to be a wonderful model.”

Royal Caribbean, in answers submitted to questions posed as part of the EIA public consultation, confirmed: “Bahamians will have the opportunity to own equity in up to 49 percent of the Royal Beach Club at Paradise Island joint venture.

“That equity is made up of two parts: Equity that will be granted to the Bahamas National Investment Fund for the fair market value of the four acres of Crown land, and individual Bahamians will be invited to own equity through an investment fund that will be created for Bahamian investors.”

It added: “As an illustrative example, if the valuation of the Crown land is determined to be worth 9 percent of the value of the joint venture, then 40 percent of the total value of the joint venture’s equity will

be made available to individual investors. The profits generated by the joint venture will be distributed to all equity partners (including the Bahamas National Investment Fund) based on their proportional share of equity in the total joint venture. “As an illustrative example, if the Bahamas National Investment Fund owns 9 percent equity in the joint venture (in exchange for four acres of Crown land) it would receive 9 percent of the total profit available for distribution.”

The DEPP’s decision that Royal Caribbean has “substantively addressed” these concerns brings the investment opportunity for Bahamians one step closer to fruition. “It’s a critical milestone,” Mr Simon told Tribune Business of the DEPP go-ahead. “It’s been any number of months and, for some, even longer than that. This entire process, which again is a very important process for the company and the country, and of course it has gotten a lot of attention.....

“Royal Caribbean has been committed to this from the very beginning. There’s never been any confusion as to how important the environment and environmental protection is, and obviously the plans and policies relating to marine life and land use. This is a very important and critical milestone. It takes us to the next step, which is completion of the EMP and Certificate of Environmental Clearance approval.”

Mr Simon added: “Everything is moving ahead. Looking at the timelines, we are on schedule right now. The environmental process has taken a little longer than expected, but it has not impacted the overall timeline we have set for the project thus far.

“We’re almost at the beginning of where we can move into phase one, which involves the site preparation, demolition of existing structures and getting construction drawings so we can send our requests for

proposals (RFPs). Hopefully we can commence construction in the first quarter or second quarter of next year.”

Asserting that Royal Caribbean plans to grow the cruise passenger market, rather than seize it all for itself, with only 40 percent of the 2.5m it brings to Nassau in 2027 visiting its Paradise Island destination, Mr Simon said: “The company has committed quite a lot of of its resources to the Bahamian market.

“Through the Royal Beach Club at Paradise Island, just a limited number of persons will experience that on an annual basis. The number of passengers coming to The Bahamas from the company will increase. We have ships that are on screen, bigger vessels, that will bring a greater number of visitors to our shores and there will be the need to have as many options as possible within the destination and other areas of Nassau and The Bahamas for them to experience.

“If we are all as stakeholders building a better product, offering more attractions and delivering greater service to our guests, as that pie continues to grow everyone should benefit from the oval.” Mr Simon said the ultimate goal is to create a “win-win-win” where Royal Caribbean, The Bahamas, its people and businesses, and the Government all benefit.

“It just represents such a unique and tremendous opportunity,” he added. “The potential benefit to out country.... that was the deciding factor for me, a model that could benefit hundreds of businesses and tens of thousands of Bahamians through the spin-offs and equity.”

THE TRIBUNE Monday, August 21, 2023, PAGE 3

PAGE B1

FROM

ROYAL CARIBBEAN ON PI RENDERING

PI entrepreneur: ‘Could I have swift approval too?’

Speaking after the Department of Environmental Planning and Protection (DEPP) affirmed that the cruise line has “substantively addressed the environmental concerns” surrounding its western Paradise Island project, and brought the public consultation phase to an end, he also questioned how Royal Caribbean can proceed given its admission that it is still awaiting a revised Crown Land lease.

The cruise line modified its initial requirements for seven Crown Land acres on Paradise Island’s western tip, dropping this to four, so as to exclude the land also sought by Mr Smith and end all conflict with him. However, the latter yesterday queried why Royal Caribbean was seemingly negotiating land that remains caught up in his ongoing legal battle with the Government over claims

Paradise Island Lighthouse and Beach Club had a valid

DIVIDEND NOTICE

TO ALL SHAREHOLDERS

The Board of Directors of Bahamas Waste Limited has declared a Dividend for Ordinary Shares, to all shareholders of record as of August 25, 2023, of $0.16 cents per share

The payment will be made on September 6, 2023, through Bahamas Central Securities Depository Limited, the Registrar & Transfer Agent

Robert V. Lotmore Corporate Secretary

and binding lease for those three acres.

Mr Smith’s claim is now before the Court of Appeal, following a Supreme Court reversal, but Royal Caribbean admitted in an answer to one of the questions he posed during the EIA public consultation that it does not possess a revised Crown Land lease for the four-acre parcel - as opposed to the original seven - that will be incorporated into the Royal Beach Club. Nor does the cruise line yet possess any Town Planning Committee approvals.

Replying to what it deemed “the most relevant” queries among the 167 submitted by Mr Smith, Royal Caribbean wrote: “Royal Caribbean was granted a Crown Land lease on May 25, 2021, by the Government of The Bahamas for seven acres of Crown land from the western boundary of our private property.

“Given, at the time, the unresolved legal status of the purported lease held by Mr Smith, Royal Caribbean proposed to the Government that it amend its lease to exclude the three acres under dispute. In January 2023, the National Economic Council (NEC) of The Bahamas granted Royal Caribbean’s new proposal and began to discuss the terms of the amended lease and other associated legal documents.

“Despite the recent court ruling that found that Mr Smith did not have a valid lease, Royal Caribbean has submitted its terms for the amended lease to exclude the disputed property. At present, that amendment has not been completed. Lastly, no, we have not received approval from Town Planning.”

Mr Smith, who said he was “surprised” to learn of the environmental approvals through Royal Caribbean rather than the Government, told this newspaper: “Given the fact Royal Caribbean conceded they don’t have a concluded

lease, why is Royal Caribbean negotiating a lease that is not finalised while proceeding through the approval process?

“Why is Royal Caribbean uttering a lease involving land that is before the courts and respecting the legal process? Once I’ve had an opportunity to review the responses from Royal Caribbean I’ll be in a better position to speak more specifically. It’s extremely frustrating, them moving on to the next step.

“Paradise Island Lighthouse and Beach Club is in its 12th year of bringing an all-Bahamian project to market. It has the written support of every major environmental group, and I hope the swiftness upon which the Government is approving Royal Caribbean is applied to our project.”

The Davis administration, though, has requested that Mr Smith “reapply” for the necessary government permits and approvals so that his project can proceed.

It took that stance after the Supreme Court ruled the Paradise Island Lighthouse and Beach Club principal did not possess a valid, binding Crown Land lease for the collective five acres he was seeking on Paradise Island’s western end.

Mr Smith, meanwhile, argued that Royal Caribbean’s beach club proceeding does not bode well for the present drive to revive Bay Street and downtown Nassau given the increased competition it will pose after it launches operations in late summer 2025.

“Bahamians are trying to revitalise Bay Street, and Royal Caribbean plans to compete against Bay Street. I don’t believe that will be a recipe for success for the revitalisation,” he told Tribune Business. “Bahamians have it tough enough as it is without having foreign-owned competition immediately across from Bay Street.”

However, Philip Simon, Royal Caribbean’s

Bahamas country chief, in today’s paper argues that the cruise line will expand the market for all and not seize it all for itself via the Royal Beach Club. He added that plans to increase the number of passengers it brings to Nassau by 150 percent by 2027, taking this to 2.5m compared to preCOVID’s one million, will grow the pie for all cruisereliant businesses. Of that 2.5m, only 40 percent will go to Paradise Island (see Page1B).

Environmentalists and others who have voiced concerns about the Royal Caribbean project and its impact were quieter yesterday. Vaughn Roberts, Atlantis senior vice-president of government affairs and special projects, could not be contacted for comment although the mega resort previously raised queries about the environmental impact and other issues raised by the cruise line’s plans.

Eric Carey, the former Bahamas National Trust (BNT) executive director who was hired by Atlantis to review its EIA, told this newspaper he was “still meeting with the client to formulate a response” and unable to comment yet. Other environmental activists spoken to by this newspaper said they were unaware that the DEPP had given Royal Caribbean its approval, which was issued last week Tuesday, August 15.

The Royal Beach Club now moves on to the submission of its Environmental Management Plan (EMP) and, if there are no issues, will likely receive its Certificate of Environmental Clearance (CEC) and be free to proceed where this topic is concerned although it will also have to satisfy Town Planning Committee requirements.

However, given that it has been found to have “substantively addressed the environmental concerns”, Royal Caribbean’s Paradise

Island ambitions have likely overcome their last remaining major hurdle. The Davis administration’s NEC approval earlier this year was conditioned, or predicated, on it satisfying all environmental issues and it now appears to have done just that, paving the way for full and final approvals.

Mr Smith, though, challenged whether Bahamians had been given sufficient time to assess the environmental issues raised by the Royal Beach Club given that multiple key documents were only released publicly just days before the June 8, 2023, public consultation.

“Given that the Bahamian people have only been given approximately an hour at a public forum to air their concerns on something as substantial as a Crown Land lease for a minimum 150 years, I don’t think they’ve given the Bahamian people a fair chance with consultation,” he added.

“Royal Caribbean only released data quietly a few days before the public consultation meeting. They didn’t allow anybody to be able to review, digest and address questions or concerns.”

Similar concerns were raised by Mr Carey at both the public consultation meeting and in a letter he wrote on July 5, 2023. “As I expressed that evening, I was disappointed that the public was given so little time to review your supplemental EIA materials,” he wrote.

“And as I’ve shared with you directly since that meeting, the poor resolution quality of the report made it very difficult to properly review. The more recent studies you cite in the supplemental information are welcome and important to understanding both the potential impact of your project and what level of mitigation is required to reduce the chances of catastrophic environmental harm.”

PAGE 4, Monday, August 21, 2023 THE TRIBUNE

FROM PAGE B1

A weak dragon

By CHRIS ILLING CCO @ ActivTrades Corp

By CHRIS ILLING CCO @ ActivTrades Corp

China’s real estate giants are faltering. Evergrande has filed for bankruptcy protection and competitor Country Garden is on the verge of insolvency. To prevent panic, Beijing could intervene with billions of dollars in aid.

Since the late 1990s, China’s real estate sector had enjoyed a years-long, cheap money-driven, boom. Developers got into debt like there was no tomorrow but, by 2018 at the latest, the market was in danger of overheating, which slowly became clear to those responsible in Beijing. The debt levels of many companies in the industry had reached record levels when the authorities significantly tightened the criteria for lending in 2020 with the aim of stopping over-indebtedness.

Many real estate firms in China are now struggling financially, including financial conglomerate, Zhongzhi. The company is considered one of the biggest players in the $2.9trn shadow finance market.

Zhongrong International Trust, in which Zhongzhi holds a 33 percent interest, is suffering from the real estate crisis and had missed the deadlines for payments on dozens of investment products since the end of July.

Property developer Evergrande is the largest of many distressed real estate groups, and has now accumulated debts equivalent to $320bn. On August 17, Evergrande filed for

Royal Caribbean plans Beach Club workshop

ROYAL Caribbean International will host an August 29 workshop for potential vendors, artisans and suppliers seeking to provide goods and services to its Paradise Island-based Royal Beach Club.

The two-hour morning event will be the first in a series designed to bring the best of Bahamian food, music, culture and provisions to the $100m beach destination expected to open in late 2025 at the western end of Paradise Island. The project, six years in planning and permitting, will create what has been called a “transformative structure” in the tourism industry – owned and operated by Bahamians and featuring all-Bahamian entertainment, food,

attractions, exhibits, art, crafts and goods.

“Although the opening of the Royal Beach Club is more than a year away, and we are continuing with the ongoing review process as legislated, we are committed to opening a dialogue with individuals and businesses to develop an immersive Bahamian experience for our guests ” said Royal Beach Club’s president, Philip Simon. “By going in early, it also gives us a chance to see if there are businesses that would be well-suited but may need time to scale up.”

Royal Caribbean said the 17-acre development will provide economic opportunities and a boost to Bahamian businesses, small and large, as well as

bankruptcy in the US. The company sought protection under Chapter 15 of America’s bankruptcy code, which shields foreign firms undergoing restructuring from being sued by creditors.

A week ago, another Chinese developer, Country Garden, was unable to make two interest payments due on loans. The company has a period of 30 days to do so, otherwise bankruptcy threatens in September. At the end of 2022, Country Garden had put its debt around $160bn. The number is likely to have increased since then. Country Garden loses billions of dollars every quarter.

JP Morgan analysts warned of “a vicious circle

a venue for artists, artisans and musicians.

This first workshop is specifically geared towards food and beverage, retail and artisans. Follow-up sessions will be dedicated to different categories of services and supplies. In addition, the cruise line is conducting planning charrettes to curate experiences with an authentic Bahamian feel.

“The Royal Beach Club may be the largest single opportunity ever presented for Bahamians from every walk of life, and every type of business, to play a role in, and benefit, from a major tourism experience,” said Mr Simon, who is also general manager of Royal Caribbean’s Bahamas business.

“We will need to fill everything from front-ofhouse services like food and beverage to the behindthe-scenes operations - from trucking goods from a warehouse to a staging space, insurance, fire protection, security. We have to identify who ferries goods,

in real estate financing” after China’s largest home builder missed its bond payments. This could exacerbate liquidity stress for developers and their nonbank creditors.

The nervousness about China’s real estate sector can be felt not only in China, but also on the stock

as well as guests and staff, back and forth to the island which is only accessible by boat.

“There are probably hundreds of needs and services to be supplied that must

exchanges in Europe and the US.

Investors are taking note of the latest purchase from money guru Warren Buffet and his investment company, Berkshire Hathaway.

The company has secured shares in three US home builders for a total of approximately $800m in the

be filled - from providing fuel for the ferries to mass laundry services, including towels for up to 2,750 guests daily.” Interested individuals or businesses can register for the workshop

second quarter this year. For many home builders in the US, building a house themselves is currently the better alternative than buying in a difficult market with high interest rates. Let us see if Buffet has the correct instinct once more.

by going to RoyalBeachClubatParadiseIsland.com. The venue will be provided to those who register. Space is limited.

THE TRIBUNE Monday, August 21, 2023, PAGE 5

Royal Caribbean: Can’t blame us for Bay St ‘decline’ reports

the Downtown Revitalisation Committee and the Tourism Development Corporation (TDC) to support the continued efforts to revitalise downtown Nassau,” Royal Caribbean wrote in response.

“We’ve received comments from downtown businesses wanting to understand the impact our development may have and our commitment to significantly grow tourism beyond the Beach Club’s capacity, as some businesses report they have been seeing a decline in their current business.

“If, in fact, there is a decline, there are other socio-economic drivers contributing to that decline and impacting their businessesas the Beach Club isn’t open yet - that need to be objectively evaluated outside of our development. Any assessment would require support from the Government and would hopefully influence future developments and initiatives that

could potentially benefit downtown businesses.”

Royal Caribbean did not identify the businesses making such assertions, when they were made or quantify how big the “decline” is. Any recent fall-off, though, would be concerning given the much-touted impact of the $322.5m investment in upgrading Nassau Cruise Port, which is already said to be facilitating increased passenger numbers through the addition of an extra berth and ability to accommodate several of the world’s largest cruise vessels at any one time.

The cruise line, meanwhile, rolled out the exact same answer when Mr Carey tried again, this time asking whether it would agree to commission “a professional third-party analysis” of the economic impact on downtown Nassau businesses as a result of the Royal Beach Club beginning operations in summer 2025.

The former BNT chief also reiterated his concerns

in a letter written subsequently on July 5, 2023, a week after the public consultation. “After a thorough review of your original and supplemental EIA, I still have serious concerns.

I fear that even with the technology, monitoring and expense you are proposing, this fragile strip of Paradise Island does not have the capacity to support and survive the intensity of use you envision,” Mr Carey told Royal Caribbean.

“Missing from your EIA is any discussion of the anticipated effects of climate change on the site you wish to alter so dramatically. And you have not sufficiently analysed or addressed the economic impact of the daily diversion of 3,000 arriving passengers from Nassau’s restaurants, businesses and cultural attractions........

“It would also be helpful for Bahamians to be able to review a professional third-party analysis of the economic impact your project will have on your neighbours already

struggling to operate their businesses and earn their livings across the harbour from your Beach Club,” he added.

“This was not included in your EIA, but can we expect to see such study in your EMP? Given the stakes of your proposal, no review would be adequate without an assessment of the economic projections you have offered without independent support or evidence.”

Royal Caribbean, in response to a question by Azaleta Ishmael-Newry, confirmed the Royal Beach Club’s planned capacity. It said: “By 2027, we expect between 900,000 and one million guests will visit the Royal Beach Club each year. As a result, we would expect an annualised maximum daily capacity of 2,750 guests per day. This translates to 171 guests per acre (assuming one acre is removed for back of house needs).”

The cruise line also disclosed details on its plans for a ferry service

to transport cruise passengers and Beach Club staff between the Paradise Island and the Nassau Cruise Port, and what the layout of its $100m project will ultimately look like.

“The proposed 17-acre beach club would include: two beaches, three to four pools and water experiences, five food venues, seven bar experiences, two guest arrival piers (on the southern shore), two new provisioning piers/ramps (on the southern shore), seven to eight back of house facilities, two artisan/ retail pavilions (each pavilion may house multiple vendors) and multiple other small buildings (a towel station, concierge booth, first aid station),” Royal Caribbean said.

“The site plan for the Beach Club has been submitted to and reviewed by the DEPP and is posted on our website. While the site plan has largely remained the same, some limited modifications have been made [such as] adjusting the location of the guest

arrival piers based on the coral reports.”

Turning to the water taxi operation, Royal Caribbean added: “We expect to need between four to six passenger vessels for guests and between two to three vessels for employees, provisioning and/or specialised transport. Depending on the configuration a single vessel may be able to perform multiple functions.

“The final specifications (number of vessels, size, configuration, power, trip schedule) will be determined in conjunction with our Bahamian partner. Given the harbour is already a high traffic boating corridor and main shipping channel, the incremental addition of six to nine vessels will likely have little impact. Our construction and operating Environmental Management Plans (EMP) will address strategies to follow to minimise the potential impact of vessels that will access the site.”

PAGE 6, Monday, August 21, 2023 THE TRIBUNE

PAGE B1

FROM

VAT TO UNDER-SHOOT FULL-YEAR $1.4BN GOAL

were equivalent to just 75.3 percent of their $1.412bn full-year target.

With just two months of the 2022-2023 fiscal year left, that near-25 percent or $350m gap appears to be to steep to bridge. The 2022 comparative period shows that VAT collections for May and June stood at $94.5m and $85.2m, respectively, representing a collective $179.7m. A repeat performance would take full-year VAT revenues to just over $1.242bn for the 2022-2023 full-year, some $170m short of target.

Several sources yesterday highlighted the likely shortfall, given that VAT was projected to account for almost 50 percent or half the Government’s $2.857bn total revenues in 2022-2023.

They noted that, despite this under-shoot, the VAT revenue projection is increasing by almost $180m year-overyear to $1.591bn for the current 2023-2024 fiscal year, thus raising questions as to how the Government will hit this hiked target. The 2023-2024 fiscal year is shaping up as critical for The Bahamas given that achieving the forecast $131.2m fiscal deficit is key to placing the Government

on track to deliver the projected Budget surplus, where total revenue or income exceeds spending, the following year. Hitting these targets is also vital to retaining, and sustaining, investor and capital markets confidence both in The Bahamas and abroad.

Mr Wilson, while conceding that VAT revenues will likely miss their 2022-2023 full year target, yesterday pointed out that revenue performance in other areas had “compensated” for this and the Government was still on a path to achieve both its total revenue and revised $520.6m deficit for the 12 months to end-June 2023. And, while acknowledging the 2023-2024 deficit target is “ambitious”, nothing has emerged to-date to show it is not achievable.

He added that the tax authorities’ compliance and enforcement efforts place the higher 2023-2024 VAT target within reach. “I will say yes,” Mr Wilson replied, when asked by this newspaper if VAT revenues will miss their 2022-2023 target, “but we compensate for that with overall performance of total taxation.” Total revenues and total tax revenue, at $2.356bn and $2.079bn, respectively, stood at 82.4 percent and 81.9 percent of

full-year target, and appear much more in reach.

Breaking VAT down into three components, namely the 10 percent levy on goods, services and real estate transactions, Mr Wilson said the latter was by far the most difficult to forecast due to uncertainty over whether deals would be completed and when they will be presented for stamping and payment of due taxes.

“The timing of the transaction we cannot control,” he explained. “We can see the approvals from the Bahamas Investment Authority (BIA) [for foreign purchases] and so forth but the timing of the transaction, and when they’re brought forward for stamping, we cannot control and that impacts VAT forecasting more than anything else.

“They may not happen at all, and they may have approval but do not close in the time you think they’re going to close. Especially with bigger transactions, higher value transactions, it may drag on for six months or even a year.”

Explaining why he remains optimistic that the Department of Inland Revenue (DIR) will hit its 2023-2023 targets, Mr Wilson said: “We have a four-pronged VAT strategy

this year.” This, though, does not involve VAT levied on domestic goods sales, the financial secretary saying “we have no challenges with that” due to the electronic ability to track every sale or resale of a product.

“Where we have a challenge is VAT on services, especially in the tourism sector,” he added, pointing particularly to the marine and maritime sectors, where much attention has been focused on collecting due VAT on foreign yacht charters and other elements.

“We have a challenge with the Family Islands when we look at the amount of activity,” Mr Wilson disclosed. “When we look, those are areas where we think we can make up these numbers. VAT on services, the Family Islands and tourism. We feel we can get a lot more from compliance, better enforcement and better education of the taxpayer.

“We’ve seen significant improvement early on. Everybody heard about what happened in Harbour Island previously. Those taxpayers who were non-compliant are becoming compliant. We have more work to do on Harbour Island. We’ve done some work in Bimini, we’re doing some work in Abaco and doing some work in

Long Island. Those are areas where there is significant under-reporting of VAT for whatever reason.

“We have to find them so we have to work every day, every week. We are actively monitoring, making some adjustments every week. We have to be on it, inspecting, doing things, following up and so forth. Most people want to comply. Once you educate them on what should be paid, they pay it. That’s the good thing.”

April saw the Government record its fourth consecutive small monthly surplus, with revenues exceeding spending by some $4.3m. This followed surpluses of $3.1m, $18.6m and $6.3m in January, February and March respectively, with the combined $30m-plus helping to control the deficit ahead of the end-June surge when multiple ministries, departments and agencies present bills for payment that the Ministry of Finance previously knew nothing about.

Describing the first four months of the calendar year as traditionally the richest for government revenue, given that it coincides with the peak winter tourism season, Business Licence fee payments, the bulk of real property tax payments and commercial vehicle licensing

month, Mr Wilson said “that was the plan” to generate fiscal surpluses throughout that period.

“It was good that we stuck to the plan and it’s a good base going forward,” he added. “There’s more work to be done. We’ve seen good momentum in real property tax, we’ve seen good momentum on Business Licence fees. We have the hotel condo tax that will have its first full year, so we will see what happens. We have our Family Island strategy, we’re doing four islands and will go back, and we have our marine sector strategy that’s ongoing.”

While unable to provide figures, Mr Wilson said the Government finished 20222023 “close” to its full-year deficit target of $520.6m. At end-April, ten months into that fiscal period, it stood at $246m or 47.3 percentless than half - the revised $520.6m target.

Looking forward to this year’s $131m deficit goal, he added: “The target for this fiscal year, the deficit target, is an ambitious target... but there’s nothing we’ve seen to say it’s not achievable. It’s certainly ambitious but we have to work towards it. If we get through the hurricane season OK, avoid any natural disasters, there’s nothing unforeseen in expenditure and we manage state-owned enterprises (SOEs) and really focus hard on revenue, it all becomes achievable.”

THE TRIBUNE Monday, August 21, 2023, PAGE 7

PAGE B1

FROM

RBC says relocated Prince Charles branch opens today

ROYAL Bank of Canada’s (RBC) new Prince Charles at One East Plaza branch is now open.

ROYAL Bank of Canada (RBC) has confirmed its relocated Prince Charles branch will open today at One East Plaza. The Canadian-owned commercial bank, in a statement, said the move reflects its continued investment in redesigning and enhancing its physical presence in The Bahamas and the improved delivery of products and services to clients.

“We are thrilled to unveil our brand-new location at One East Plaza. With the move, we will effectively continue to revolutionise our service delivery to align with our clients’ shifting needs,” said LaSonya Missick, RBC’s managing director and vice-president of personal banking and RBC FINCO.

“This relocation reinforces RBC’s commitment to the economic and financial growth of The Bahamas, and our unwavering commitment to delivering exceptional client experiences. The Bahamas market is an important part of RBC’s overall strategy as we continue to focus our efforts where we see potential and invest in innovation for sustainable growth.”

Prince Charles at One East Plaza will retain the same services and solutions as the former branch location, including two ATMs and non-stop depository service, while integrating digital and mobile capabilities. The integration of digital offerings aims to provided improved flexibility and

convenience for a better customer experience. Besides the services available, the new branch will feature a dedicated private banking office. This office will cater to the specialised needs of private banking clientele, offering personalised and confidential advisory services.

Royal Bank said Prince Charles at One East is its latest investment in physical infrastructure over the past three years. Within that time, the bank has fully renovated the Freeport branch and begun operations in its new Marsh Harbour branch after both sustained significant damage during Hurricane Dorian. RBC also relocated its Carmichael branch to a new digitally-enabled location at Southwest Plaza.

PAGE 8, Monday, August 21, 2023 THE TRIBUNE

STARBUCKS TOLD TO PAY $2.7 MILLION IN LOST WAGES TO MANAGER FIRED AFTER ARREST OF 2 BLACK MEN

CAMDEN, N.J.

Associated Press

A JUDGE has ordered Starbucks to pay an additional $2.7 million in lost wages and tax damages to a former regional manager who was earlier awarded more than $25 million after alleging she and other white employees were unfairly punished following the highprofile arrests of two Black men at a store in 2018.

In June, Shannon Phillips won $600,000 in compensatory damages and $25 million in punitive damages after a jury in New Jersey found that race was a determinative factor in Phillips' firing, in violation of federal and state anti-discrimination laws. The Philadelphia Inquirer reports that U.S. district judge Wednesday ordered Starbucks to pay Phillips another $2.73 million in past and future lost

earnings and benefits as well as compensation for tax disadvantages due to the lump sum, according to court documents. The company opposed paying any amount, saying Philipps had not proven she couldn't have earned the same or more in the future. In April 2018, a Philadelphia store manager called police on two Black men who were sitting in the coffee shop without ordering anything. Rashon

Nelson and Donte Robinson were later released without charges. Phillips, then regional manager of operations in Philadelphia, southern New Jersey, and elsewhere, was not involved with arrests. However, she said she was ordered to put a white manager who also wasn't involved on administrative leave for reasons she knew were false, according to her lawsuit.

Phillips, 52, said she was fired less than a month later after objecting to the manager being placed on leave amid the uproar, according to her lawsuit. The company's rationale for suspending the district manager, who was not responsible for the store where the arrests took place, was an allegation that Black store managers were being paid less than white managers, according to the lawsuit. Phillips said that argument made no sense since district managers had no input on employee salaries.

The lawsuit alleged Starbucks was instead taking steps to "punish white employees" who worked in

the area "in an effort to convince the community that it had properly responded to the incident." Starbucks lawyers had alleged that Phillips was fired because the company needed stronger leadership in the aftermath of the arrests.

Starbucks is seeking a new trial, arguing that jurors were allowed to remain despite having expressed negative opinions about the company, that incorrect information in witness testimony "poisoned the well," and that Phillips should not have been awarded "double damages" on both the state and federal allegations, the Inquirer reported.

THE TRIBUNE Monday, August 21, 2023, PAGE 9

GM’S CRUISE AUTONOMOUS VEHICLE UNIT AGREES TO CUT FLEET IN HALF AFTER 2 CRASHES IN SAN FRANCISCO

Associated Press

GENERAL Motors' Cruise autonomous vehicle unit has agreed to cut its fleet of San Francisco robotaxis in half as authorities investigate two recent crashes in the city. The state Department of Motor Vehicles asked for the reduction after a Cruise vehicle without a human driver collided with an unspecified emergency vehicle on Thursday.

"The DMV is investigating recent concerning incidents involving Cruise vehicles in San Francisco," the DMV said Saturday in a statement to The Associated Press. "Cruise has agreed to a 50% reduction and will have no more than 50 driverless vehicles in operation during the day and 150 driverless vehicles in operation at night."

The development comes just over a week after California regulators allowed Cruise and Google spinoff

NOTICE

NOTICE is hereby given that KARVA KEVIN JEROME FORBES of Bain Town, Meadows, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 14th day of August 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

Mountain Invest SA (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, Mountain Invest SA is in dissolution.

The dissolution of the said Company commenced on August 16, 2023 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas.

The sole liquidator of the said Company is Kim D Thompson of Equity Trust House, Caves Village, West Bay Street, P O Box N 10697, Nassau, Bahamas.

Kim D Thompson Sole Liquidator

Kim D Thompson Sole Liquidator

Waymo to operate autonomous robotaxis throughout San Francisco at all hours, despite safety worries spurred by recurring problems with unexpected stops and other erratic behavior.

The decision Aug. 10 by the Public Utilities Commission made San Francisco the first major U.S. city with two fleets of driverless vehicles competing for passengers.

On Thursday around 10 p.m., the Cruise vehicle had a green light, entered

an intersection, and was hit by the emergency vehicle responding to a call, the San Francisco Chronicle reported, based on tweets from Cruise. The robotaxi was carrying a passenger, who was taken by ambulance to a hospital with injuries that were not severe, Cruise told the newspaper. Also Thursday night, a Cruise car without a passenger collided with another vehicle in San Francisco, the newspaper reported.

NOTICE

NOTICE is hereby given that JOHNSON LOUIS of George Town, Exuma, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

The San Francisco Fire Department did not immediately respond to a request for comment from the newspaper. The robotaxi almost immediately identified the emergency response vehicle as it came into view, Greg Dietrerich, Cruise's general manager in San Francisco, said in a statement on the company website.

At the intersection, visibility is occluded by buildings, and it's not possible to see objects around a corner until they are very close to the intersection, Dietrerich's statement said.

The Cruise autonomous vehicle detected the siren as

soon it was distinguishable from background noise, he wrote.

"The AV's ability to successfully chart the emergency vehicle's path was complicated by the fact that the emergency vehicle was in the oncoming lane of traffic, which it had moved into to bypass the red light," Dietrerich wrote.

The Cruise vehicle identified the risk of a crash and braked, reducing its speed, but couldn't avoid the collision, he wrote. Cruise vehicles have driven more than 3 million autonomous miles in the city and have interacted with emergency vehicles more than 168,000 times in the first seven months of this year alone, the statement said. "We realize that we'll always encounter challenging situations, which is why continuous improvement is central to our work."

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, RODIA KEVONIA MARY STRACHAN of Buttonwood Avenue, Pinewood Gardens, New Providence, Bahamas intend to change my name to RODIA KEVONIA MARY SAUNDERS If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O. Box N-742, Nassau, The Bahamas no later than Thirty (30) days after the date of publication of this notice.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, KARINA LIDIA MATEO MARIN of the Eastern District of the Island of New Providence, Bahamas one of the Islands of the Commonwealth of The Bahamas intend to change my name to KARINA LIDIA MALONE. If there are any objections to this change of name by Deed Poll, you may rite such o ectio s to the Chief Passport Offcer, P.O. Box N-742, Nassau, The Bahamas no later than Thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that LEONIE MARCIA BLAIR of P. O. Box N-9249, #7 Wimpole Street, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that WILMIDE JOSEPH, of Weybridge Road, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of July, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

COMMONWEALTH OF THE BAHAMAS 2007 IN THE SUPREME COURT CLE/QUI-1385

COMMON LAW & EQUITY DIVISION IN THE MATTER OF THE QUIETING TITLES ACT 1959 AND

IN THE MATTER OF ALL THAT parcel or lot of land being known as lot Number Sixteen (16) Block Number Nineteen (19) Centreville District, as shown on the Master Plan in the Department of Lands And Surveys in the Island of New Providence AND

IN THE MATTER OF THE Petition of JULIETTE L. RAMSEY

NOTICE JULIETTE L. RAMSEY the Petitioner claim to be the owner in fee simple in possession of the parcel of land and free from encumbrances. The Petitioner has made application to the Supreme Court of the Commonwealth of The Bahamas Section 3 of the Quieting Act, 1959 to have their Title to the said land investigated and declared in a Certifcate of Title to be granted by the Court in accordance with the provisions of the act.

Copies of the fle plan may be inspected during normal hours at:

1. The Registry of the Supreme Court; and

2. The Chambers of Ramsey And Associates, Rames Building, 23 Plantol, Nassau, Bahamas

Notice is hereby given that any person or persons having a right of dower or any adverse claim not recognized in the Petition shall within thirty (30) days after the publication of the notice herein fled in the registry of the Supreme Court in the City of Nassau aforesaid and serve on the Petitioner or the undersigned a statement of such claim in the prescribed Form, verifed by an affdavit to be fled therewith. Failure of any such person to fle and serve a statement a such claim within thirty days (30) herein will operate as a bar to such claim.

Dated this 1st day of August A. D. 2023 Dulwich Law Chambers Farrington Road, Nassau, Bahamas

PAGE 10, Monday, August 21, 2023 THE TRIBUNE

ECONOMIC GROWTH CRITICAL FOR BAHAMIANS TO PROSPER

destiny, and individual agency is a crucial aspect in this endeavour. At the same time, the Central Bank of The Bahamas, the nation’s monetary authority, also plays a critical role in ensuring economic stability and fostering an environment conducive to wealth generation. Through its implementation of monetary policies to regulate the money supply and influence interest rates, the Central Bank exercises control over various economic factors. These measures impact borrowing costs, consumer spending and investment, thereby influencing the overall economic activity and wealth generation in the country.

By maintaining price stability and supporting economic growth, the Central Bank’s actions create an atmosphere of financial security and prosperity.

Stable prices and controlled inflation rates provide a solid foundation for businesses and individuals to plan their investments and spending effectively.

This fosters an environment where entrepreneurs can take calculated risks, knowing that economic

conditions are favourable for their ventures to thrive.

Moreover, the Central Bank’s role in managing interest rates influences borrowing costs for businesses and consumers alike. Lower interest rates incentivise borrowing and investment, driving economic activity and generating employment opportunities. As businesses expand and create more jobs, individuals gain access to better employment prospects, contributing to their personal wealth generation.

However, for the Central Bank’s efforts to yield the maximum benefit, individual agency comes into play. Each Bahamian can make a difference by making informed financial decisions and taking advantage of the opportunities created by the Central Bank’s policies. Responsible borrowing, prudent financial planning and wise investment choices can enhance personal wealth accumulation and contribute to the overall economic growth of the nation.

Education: The key to unlocking potential

In the pursuit of economic prosperity, education emerges as a potent catalyst, supported by a wealth

of research evidence.

Countries with higher educational attainment tend to experience higher labour productivity levels, which positively impacts overall economic performance.

According to a report by the World Bank, a one-year increase in the average level of schooling in a country can lead to an increase in its annual per capita GDP growth rate by about 0.37 percentage points. Moreover, education not only enhances productivity but also fosters adaptability in the face of changing economic landscapes. Studies published in the Journal of Labor Economics indicate that higher education levels are associated with greater flexibility, making individuals more likely to switch occupations and industries as needed, and thus contributing to their employability in dynamic job markets.

The long-term economic benefits of education are also undeniable. Individuals with higher levels of education tend to earn higher wages over their lifetime, leading to increased tax revenue for governments and reduced reliance on social welfare programmes, according to reports by the National Centre for Education Statistics (NCES).

In essence, the dynamic relationship between education and the economy cannot be understated. By investing in education and equipping individuals with the necessary skills, societies foster a culture of self-reliance, adaptability and resilience, as supported by an array of research findings. This collective effort contributes to economic growth, job creation, industry expansion and, ultimately, a brighter future for all.

The National Development Plan

Tying all these aspects together, the National Development Plan (NDP) serves as a strategic road map to capitalise on education’s transformative power and maximise individual agency in shaping the economic trajectory of The Bahamas. By incorporating evidence-based policies and initiatives inspired by research findings, the NDP can create an environment that cultivates economic progress and wealth generation.

The NDP can prioritise education and workforce development, investing in programmes that enhance skills training, technical education and continuous

learning opportunities. By equipping citizens with the necessary skills and adaptability, the NDP can bolster the nation’s workforce, making it more competitive and responsive to economic changes and industry demands.

By integrating education, individual agency and the Central Bank’s role into the NDP, The Bahamas can foster a culture of self-reliance and resilience, driving economic diversification and progress. As citizens actively participate in shaping the economic landscape, supported by the NDP’s initiatives, the nation can navigate challenges and embrace opportunities for sustained economic growth, financial security and prosperity for all.

Conclusion

In conclusion, our exploration of the Bahamian economy and the factors that influence its growth and prosperity has revealed a dynamic interplay of micro and macro trends, the transformative power of education and the critical role of individual agency and the Central Bank. Education has emerged as a potent catalyst, empowering a well-educated workforce that meets the demands of a

THE WEATHER REPORT

diverse and evolving economy. Research evidence highlights the positive correlation between education levels and economic growth, productivity, adaptability, job demand and entrepreneurship.

However, economic progress is not solely the responsibility of the Government. Each citizen plays a vital part in shaping the economic trajectory of The Bahamas. Supporting local businesses, making informed financial decisions and actively participating in the economy through individual agency are key aspects of contributing to wealth generation and industry growth. By capitalising on our collective potential, we can navigate challenges and embrace opportunities, ensuring a thriving and resilient economy that benefits present and future generations alike.

PAGE 12, Monday, August 21, 2023 THE TRIBUNE

FROM PAGE B2 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 75° F/24° C High: 95° F/35° C TAMPA Low: 77° F/25° C High: 97° F/36° C WEST PALM BEACH Low: 81° F/27° C High: 91° F/33° C FT. LAUDERDALE Low: 82° F/28° C High: 90° F/32° C KEY WEST Low: 83° F/28° C High: 91° F/33° C Low: 79° F/26° C High: 90° F/32° C ABACO Low: 83° F/28° C High: 88° F/31° C ELEUTHERA Low: 82° F/28° C High: 88° F/31° C RAGGED ISLAND Low: 82° F/28° C High: 87° F/31° C GREAT EXUMA Low: 81° F/27° C High: 87° F/31° C CAT ISLAND Low: 79° F/26° C High: 89° F/32° C SAN SALVADOR Low: 80° F/27° C High: 89° F/32° C CROOKED ISLAND / ACKLINS Low: 81° F/27° C High: 87° F/31° C LONG ISLAND Low: 81° F/27° C High: 88° F/31° C MAYAGUANA Low: 81° F/27° C High: 89° F/32° C GREAT INAGUA Low: 82° F/28° C High: 90° F/32° C ANDROS Low: 81° F/27° C High: 89° F/32° C Low: 78° F/26° C High: 91° F/33° C FREEPORT NASSAU Low: 81° F/27° C High: 90° F/32° C MIAMI

5-DAY FORECAST Breezy; a morning t-storm in spots High: 90° AccuWeather RealFeel 101° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Partly cloudy with a shower late Low: 79° AccuWeather RealFeel 88° F Sunshine and breezy with a shower High: 90° AccuWeather RealFeel Low: 78° 102°-82° F Some sun with a t-storm in the area High: 89° AccuWeather RealFeel Low: 78° 104°-86° F Mostly sunny with a stray t-storm High: 90° AccuWeather RealFeel Low: 78° 104°-85° F A t-storm in spots in the afternoon High: 90° AccuWeather RealFeel 104°-86° F Low: 78° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY ALMANAC High 90° F/32° C Low 81° F/27° C Normal high 89° F/32° C Normal low 76° F/24° C Last year’s high 94° F/34° C Last year’s low 81° F/27° C As of 2 p.m. yesterday 0.36” Year to date 40.29” Normal year to date 23.08” Statistics are for Nassau through 2 p.m. yesterday Temperature Precipitation SUN AND MOON TIDES FOR NASSAU First Aug. 24 Full Aug. 30 Last Sep. 6 New Sep. 14 Sunrise 6:46 a.m. Sunset 7:40 p.m. Moonrise 11:05 a.m. Moonset 10:42 p.m. Today Tuesday Wednesday Thursday High Ht.(ft.) Low Ht.(ft.) 11:42 a.m. 2.9 5:31 a.m. 0.7 11:51 p.m. 2.7 5:56 p.m. 1.0 12:25 p.m. 2.9 6:07 a.m. 0.8 6:44 p.m. 1.1 12:34 a.m. 2.6 6:48 a.m. 0.8 1:14 p.m. 3.0 7:38 p.m. 1.2 1:23 a.m. 2.5 7:37 a.m. 0.8 2:11 p.m. 3.0 8:41 p.m. 1.3 Friday Saturday Sunday 2:23 a.m. 2.4 8:35 a.m. 0.8 3:14 p.m. 3.1 9:48 p.m. 1.2 3:29 a.m. 2.4 9:40 a.m. 0.7 4:19 p.m. 3.2 10:54 p.m. 1.0 4:37 a.m. 2.6 10:47 a.m. 0.5 5:22 p.m. 3.4 11:55 p.m. 0.8 MARINE FORECAST WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 12-25 Knots 4-8 Feet 5 Miles 85° F Tuesday: NE at 10-20 Knots 4-7 Feet 10 Miles 85° F ANDROS Today: E at 12-25 Knots 1-2 Feet 10 Miles 86° F Tuesday: ENE at 12-25 Knots 1-2 Feet 10 Miles 86° F CAT ISLAND Today: ENE at 12-25 Knots 3-6 Feet 10 Miles 85° F Tuesday: ENE at 12-25 Knots 3-6 Feet 4 Miles 85° F CROOKED ISLAND Today: ENE at 12-25 Knots 3-6 Feet 10 Miles 84° F Tuesday: ENE at 12-25 Knots 3-6 Feet 10 Miles 84° F ELEUTHERA Today: E at 12-25 Knots 4-7 Feet 6 Miles 85° F Tuesday: ENE at 12-25 Knots 4-7 Feet 5 Miles 85° F FREEPORT Today: E at 12-25 Knots 2-4 Feet 10 Miles 85° F Tuesday: NE at 10-20 Knots 1-3 Feet 10 Miles 85° F GREAT EXUMA Today: E at 12-25 Knots 1-2 Feet 10 Miles 85° F Tuesday: ENE at 12-25 Knots 1-2 Feet 10 Miles 85° F GREAT INAGUA Today: NE at 12-25 Knots 3-5 Feet 10 Miles 84° F Tuesday: ENE at 12-25 Knots 3-5 Feet 10 Miles 84° F LONG ISLAND Today: ENE at 12-25 Knots 3-5 Feet 10 Miles 85° F Tuesday: ENE at 12-25 Knots 2-4 Feet 7 Miles 85° F MAYAGUANA Today: ENE at 12-25 Knots 4-8 Feet 10 Miles 84° F Tuesday: ENE at 12-25 Knots 4-7 Feet 7 Miles 84° F NASSAU Today: E at 12-25 Knots 1-3 Feet 10 Miles 85° F Tuesday: ENE at 12-25 Knots 1-3 Feet 10 Miles 85° F RAGGED ISLAND Today: NE at 12-25 Knots 3-6 Feet 6 Miles 85° F Tuesday: ENE at 12-25 Knots 3-5 Feet 7 Miles 85° F SAN SALVADOR Today: E at 12-25 Knots 1-3 Feet 10 Miles 85° F Tuesday: ENE at 12-25 Knots 1-3 Feet 10 Miles 85° F UV INDEX TODAY The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2023 H H TRACKING MAP Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 10-20 knots N S W E 12-25 knots N S W E 12-25 knots N S W E 12-25 knots N S W E 12-25 knots N S W E 12-25 knots N S W E 12-25 knots N S W E 12-25 knots

By CHRIS ILLING CCO @ ActivTrades Corp

By CHRIS ILLING CCO @ ActivTrades Corp

Kim D Thompson Sole Liquidator

Kim D Thompson Sole Liquidator