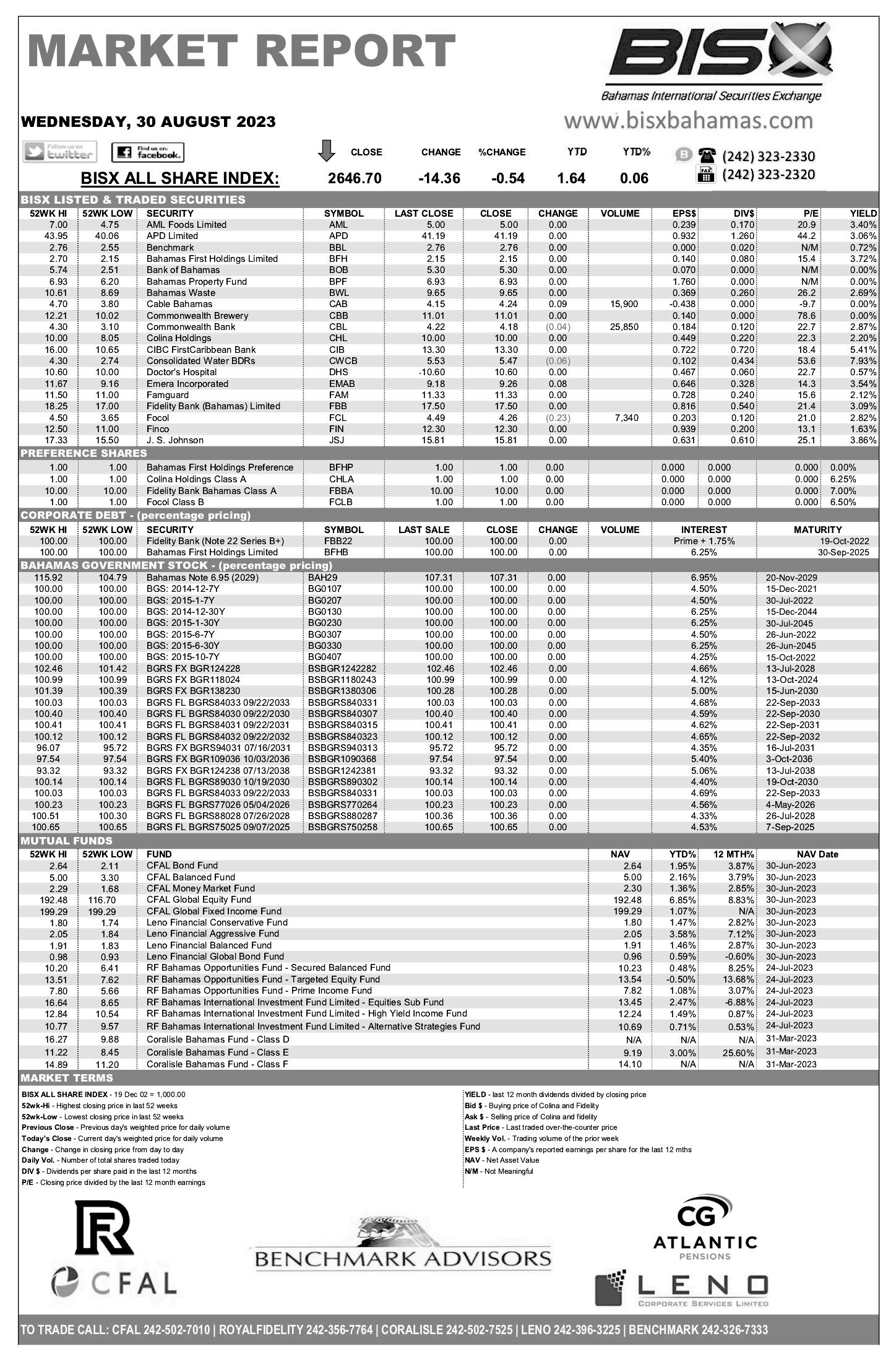

$5.98 $5.98 $5.98 $6.06

$5.98 $5.98 $5.98 $6.06

ATLANTIS has “stabilised” its net cash flow at pre-COVID levels by generating $182.3m for the year to end-March 2023, it was revealed yesterday, as analysts reaffirmed the credit ratings on its $1.2bn debt.

DBRS Morningstar, in its assessment of the Paradise Island mega resort’s post-pandemic rebound, disclosed that average daily room rates (ADR) for the 12 months to endMarch were some 28 percent ahead of those achieved when the debt secured on its assets was last refinanced in 2018.

Revenue per available room (RevPAR), a key indicator of hotel industry performance, matched exactly the $200 generated during that pre-COVID period. And, while Atlantis’ occupancy levels were lagging, the analyst’s report pointed out that the 56.2 percent achieved during the 12 months to end-March 2023 was not a like-for-like comparison

with the 72.2 percent achieved during the same period for 2018 as the Beach Towers has been closed ever since COVID hit. Atlantis representatives could not be contacted for comment before press time last night, but the Morningstar review - a report requested by the resort’s owner, Brookfield Asset Management - affirmed the positive momentum and outlook that the wider Bahamian resort and tourism industry has enjoyed since it emerged from COVID-related lockdowns and other restrictions.

SOME 25,000 Bahamians and 150 small and mediumsized enterprises (SMEs) are projected to benefit from a $30m investment to unlock the country’s ‘blue economy’ potential and enhance coastal protection. An environmental and social impact assessment of the Inter-American Development Bank (IDB) funded initiative, which has been seen by Tribune Business, reveals that it aims to “bolster the safety” of 1.5m hectares in Andros and Abaco through improving storm surge and flooding defences.

This, the report adds, will benefit the populations of both islands as well as an estimated 680,000 annual visitors. And, besides the environmental advantages, the project also aims to benefit 150 Family Island-based SMEs and 12 business clusters through the provision of training and other resources intended to boost their productivity and capacity to participate in The Bahamas’ ocean-based ‘blue’ economy. To accomplish these objectives, there will be a series of investments in infrastructure, tourism and food security-related improvements. These include upgrades to the

SEE PAGE B6

AML Foods has signalled it paid $1.1m to acquire the future site of its Solomon’s Carmichael store and associated shopping centre as it revealed that “smaller footprint locations” will be its future format.

The BISX-listed food retail and franchise group, in its just-released 2023 annual report, did not explicitly tie the land acquisition details in its audited financial statements to the recently-announced 4.23-acre purchase but it

“In April 2023, the company purchased a parcel of land located on Faith Avenue, Nassau, Bahamas

By NEIL HARTNELL and FAY SIMMONS Tribune Business ReportersCONCERNS were voiced yesterday over Abaconians and other Family Island residents incurring extra cost and inconvenience through having to fly to Nassau or Freeport for commercial vehicle driver training.

Amid fears that Abaco’s volunteer fire services would be shut down because none of their members possess the required licence, thereby imperiling residents and businesses, it was alleged that the private company responsible for certifying commercial drivers never returned to the island to provide the necessary training.

One fire service source, speaking on condition of anonymity, told Tribune Business: “We were told at the beginning of the year that all volunteer fire departments in Abaco would receive the commercial driver licence training

at a special training session free of charge.

“The trainers from Nassau never returned to Abaco. At the time we objected to the $700 per driver fee as we are all volunteers and don’t receive any funds from the Government for our service to the communities of Abaco.”

Daphne DegregoryMiaoulis, the Abaco Chamber of Commerce president, also expressed concern to this newspaper over the ability of Family Island residents to access the necessary training and certification course for commercial vehicle drivers.

“I, for one, have a guy who has a trucking company,” she said. “He’s very busy trying to get a loan to buy another vehicle. He still has not been able to get to a commercial vehicle driver’s licence course because the Road Traffic people here are being told that they have to fly to Nassau or Freeport to do the course because there

A BAHAMIAN general insurer yesterday saw its financial strength and creditworthiness reaffirmed by the industry’s major rating agency in the face of “profitability pressures”.

A. M. Best, in a statement, upheld RoyalStar Assurance’s financial

strength rating of A (Excellent) and long-term issuer credit rating of ‘a’ (Excellent) while maintaining a ‘stable’ outlook on the

property and casualty underwriter.

The ratings agency said its assessment reflects RoyalStar’s “balance sheet

strength”, which it labelled as “strongest”, along with its “strong operating performance, limited business profile and appropriate enterprise risk management (ERM)”.

These were sufficient to offset the growing pressure being imposed on all Bahamian property and casualty insurers by the reduction in reinsurance capacity, which is driving premium

increases for homeowners and businesses. And, while A. M Best indicated its belief that RoyalStar will continue to maintain its competitiveness against rival underwriters regardless, it reiterated that The Bahamas must escape the European Union’s (EU) tax blacklist to ease these concerns.

“RoyalStar’s balance sheet strength assessment continues to be supported by its strongest riskadjusted capitalisation, as measured by Best’s Capital Adequacy Ratio (BCAR), strategically conservative investment portfolio and comprehensive reinsurance programme,” A. M. Best said in its assessment.

“These strengths are offset partially by Royal Star’s exposure to weatherrelated catastrophic events, given its geographic concentration of business and investments in the Caribbean, and its high reliance on reinsurance to protect surplus from catastrophic events.

“RoyalStar’s strong operating performance continued in 2022 with improved profitability and operating metrics versus 2021,” A. M. Best continued. “RoyalStar’s operating performance has benefited from a lack of catastrophic events since Dorian in 2019. Favourable reinsurance terms also contributed materially as investment and commission incomes derived from business ceded to reinsurers has become a significant portion of revenue.

“Profitability may be pressured over the near term as reinsurance capacity is limited across the Caribbean and insurers, including RoyalStar, are incurring higher costs and lower commissions. However, it is likely that

RoyalStar will continue to maintain its relative performance, as opposed to its Caribbean peers, as all companies in the region are encountering the same challenges.

“Nevertheless, RoyalStar and other Bahamas-domiciled insurance companies remain at risk of losing additional reinsurance capacity if the country cannot remove itself from the European Union (EU) and German lists of noncooperative jurisdictions for tax purposes.”

Turning to RoyalStar’s growth potential, A. M. Best said it views the carrier’s business profile as “limited” It added: “The company provides personal and commercial lines coverages throughout The Bahamas, the Cayman Islands, the Turks and Caicos Islands, the US Virgin Islands, the British Virgin Islands and Anguilla.

“Like many property/casualty insurers operating in the Caribbean, RoyalStar cedes a significant portion of its written premiums to reinsurers under its reinsurance treaties. In addition, earnings remain subject to highly competitive, mature regional markets with limited potential for organic growth. RoyalStar’s plans to actively expand its offerings outside The Bahamas have been on hold due to a lack of reinsurance capacity for new business.

“A. M. Best continues to assess Royal Star’s ERM programme as appropriate given its business risks. Reinsurance terms will be less favourable prospectively, but RoyalStar’s programme remains comprehensive. For 2023, RoyalStar was able to secure sufficient reinsurance coverage despite reduced capacity in the region. The company has established processes in place to mitigate key identified risks and senior management is very active in risk taking decisions.”

A GOVERNMENT

senator yesterday pledged he will “push” to ensure any authority created to manage downtown Nassau has access to the necessary funding.

Senator Randy Rolle, the Ministry of Tourism, Investments and Aviation’s global relations consultant, told Tribune Business the Attorney General’s Office has completed the first draft of legislation designed to create such an authority.

However, he acknowledged that there may be resistance to the potential diversion of tax income to finance such a city manager or even granting it its own

revenue-raising powers. Still, the ministry plans to “push forward” with the Bill, which could potentially be brought to Parliament during the next legislative session.

“It’s going to take me in my capacity to push and say we need to get this done,” Mr Rolle told this newspaper. “I suspect that [the Ministry of] Finance may not necessarily be okay with all the provisions because nobody’s going to want to give up the taxes and other things. That may be in the draft, I suspect, and it may not be an easy sell for everyone, but I’m going to push for it.”

The Downtown Nassau Partnership (DNP), the joint public-private sector entity created to drive improvements on Bay Street and the surrounding

area, lacks both municipal and revenue-raising powers to perform the work of a true municipal authority. “Not taking anything away from the DNP, but they are almost like a

Dear Editor,

As a Bahamian non-profit organisation committed to responsible governance, the Organisation for Responsible Governance (ORG) is writing to express concerns about a notable lack of priority for governance mechanisms to ensure transparency and accountability. ORG finds it imperative to address these issues that directly impact the standard of accountable governance and equitable opportunities for all citizens of The Bahamas.

A most recent example springs from discussions on the lack of clarity on the functionality of the Fiscal Responsibility Council. The Fiscal Responsibility Council was established with a clear mission – to provide independent oversight of the Government’s fiscal planning strategies and ensure transparency and consistency in the budgeting process. The reduction in the frequency of public fiscal reports, mandated to be a cornerstone of transparency and accountability, as per the Public Financial Management Act 2023, has amplified the significance of the Council’s role in providing unbiased input to enhance citizen trust and confidence in our government’s financial position. However, the lack of clarity on the Council’s achievement of its mandate is cause for concern and indicative of a broader trend toward diminishing mechanisms for accountability and transparency in our governance.

A lack of transparency in governance erodes public

trust and dampens citizens’ willingness to engage in governance processes actively. Transparency and accountability are indispensable in inspiring citizens to contribute their time, energy and resources to initiatives that shape our nation’s future. This concern is evident in the unexplained absence of reporting on contracted government bids, a legal obligation under the Procurement Act 2023 and the previous Procurement Act 2021. Establishing a clear, equitable process for awarding government contracts is essential for citizens to perceive their interests as being valued and reflected in governmental decisions. However, despite specific provisions of the Act being implemented, such as a comprehensive website posting available bids, the continuing contravention of the Act by not providing public information and clarity regarding the awarding of bids, awardees and contract conditions significantly hampers transparency and discourages citizen involvement. When citizens are kept uninformed about contracted government bids, public scepticism and mistrust about the Government’s fulfillment of its obligations flourish and become fuel for political rhetoric, all of which limit our nation’s progress and development.

Additionally, the progress of the Freedom of Information Act’s implementation could have been much faster. The 20232024 allocated Budget of only $140,000 for the

necessary tasks to bring the Act into full effect needs to be revised. An estimate of around $1m by the Freedom of Information Act unit suggests a significant disparity, and it remains to be seen how the Government intends to adequately support the unit in responding to requests by the year’s end, as previously promised. These delays and uncertainties hinder the fulfillment of promises made to citizens, further eroding trust.

When the Government fails to meet its stated obligations, citizens are left with limited recourse. A pertinent example is found in the Public Finance Management Act 2023, where references to potential penalties and sanctions for government employees breaching the Act were removed. This unbalanced relationship between citizens and governance tools and mechanisms highlights the critical need for citizen participation, oversight and input.

ORG consistently advocates for standardised and regularised tools that facilitate public consultation and oversight. When citizens know their input is valued, considered and integral to decision-making processes, they see their interests represented and become more participative and more engaged in civic matters. When local businesses feel the system is fair and transparent, they are more willing to risk their time and resources to support the growth of the local economy. We can establish a more robust

part-time thing,” Mr Rolle said.

“Take, for example, this water issue. I have a team working with the Water and Sewerage Corporation (WSC) seven days a week

and sustainable Bahamas by nurturing transparency, accountability and collaboration among government, citizens, civil society and the private sector. Governments and citizens must each meet their responsibilities for The Bahamas to achieve an effective, efficient governance system that reflects the principles of accountability, transparency and equal opportunity. As we move forward, ORG calls on the Bahamian public to urge their elected and appointed representatives to prioritise transparency, accountability and citizen engagement in the upcoming legislative session. Through these actions, a foundation of trust, collaboration and shared responsibility can increase the engagement of citizens and the private sector in propelling The Bahamas toward a brighter future.

Sincerely, The Organization for Responsible Governance (ORG).

and I want this done. We’ve identified some potential opportunities, but if nobody is pushing it and following up with phone calls then it gets lost in everything else.”

Garbage collection is also a key concern for downtown Nassau. Mr Rolle, in a statement yesterday, warned downtown merchants and property owners of their responsibilities to keep their premises and the surrounding area clean.

“It is imperative to acknowledge that irresponsible waste disposal practices can precipitate the proliferation and habitation of rodents, insect pests and other vermin. Beyond the evident environmental degradation, this poses a direct threat to the health and safety of the public,” the statement said.

“In light of this pressing concern, we would like to draw your attention to the Environmental Health

SEE PAGE B6

AN ABACO poultry farm yesterday said its $45,000 hatchery will be completed by the end of September 2023.

Lance Pinder, Abaco Big Bird Poultry’s operations manager, told Tribune Business that if this investment produces the yield of birds that he anticipates then further expansion could be initiated by December this year.

“We bought a small hatchery set up as an initial phase to putting a hatchery here at the farm, which should help with the problem of getting chicks because then we can get our own eggs right here,” he added.

Supply shortages continue to challenge Abaco Big Bird as its ability to secure layer eggs

from regular suppliers is still strained due to “shipping challenges and the rise of inflation on everything”.

“I hope by the end of September or the first part of October we will have this hatchery set up,” Mr Pinder added. “We have all of the parts now; we just have to set everything up. I just have to install it and make sure everything is running well. It may not be for all of our chicks, but if it goes well then maybe by December we will expand it.”

Abaco Big Bird currently has an estimated 15,000 chickens, but is having difficulty meeting the country’s total demand. The hatchery, it hopes, has the potential to increase its inventory by 25 percent over the next six months.

“This hatchery is very important because it is what really held us back for the last two years because,

SEE PAGE B6

for $1.1m,” the audited financials declared. AML Foods did not disclose the land acquisition costs, or the likely total investment that will be made in constructing the shopping centre and new store, when it late last week unveiled the purchase of real estate located between Faith Avenue and Sir Milo Butler Highway.

Meanwhile, the group confirmed it is shifting away from the larger ‘big box’ retail formats it was initially known for, with Solomon’s SuperCentre and Cost Right, towards its smaller neighbourhood-type store strategy given that such outlets better enable it to control costs.

“The success of our Exuma Markets location has solidified that running smaller footprint locations, with less overhead, will be the future of our organisation’s food distribution division,” AML Foods said.

“Not 12 months after the opening of our Solomon’s Downtown Freeport location under the new footprint, we have already secured the site for our highly anticipated entrance into the south-western area of New Providence. Our

opening date is not yet confirmed but we remain committed to serving customers in the area.

“Additionally, in May 2023, we closed on the sale to acquire the building that currently houses our Solomon’s SuperCentre store. Plans for construction are in progress and the building will be the future home for our existing Cost Right Nassau store and as well as a new Solomon’s neighbourhood store. The building purchase and relocation is expected to aid in the reduction of high and increasing rental costs.”

Meanwhile, AML Foods said around half of its existing stores have been converted to new ‘planograms’ - upgraded product displays and visual merchandising - which has already helped to boost sales. It is also invested in technology that has reduced buying/order errors, and promised that it will soon launch its e-commerce division.

“Just over 50 percent of our stores have been reset to our new planograms, and we have already begun to see improved sales results in these locations. The use of planograms is expected to improve [the] customer

shopping experience through improved variety and stock levels,” the BISX-listed food retail and franchise group said.

“Our implementation of Electronic Data Interface (EDI) commenced, and key suppliers who provided over one one-third of our purchased inventory during the year are now using EDI. This has resulted in enhanced quality of data, a reduction in human error and improved ordering cycle speeds. We will continue to invest in EDI where possible.

“The culmination of our efforts of the past few years to launch our e-commerce division is near. We expect to launch e-commerce in Exuma Markets within the upcoming months and rollout the platform to other locations shortly after. Our plan is to reach existing customers through online shopping but also customers on islands where we do not have a store presence.”

Gavin Watchorn, AML Foods’ president and chief executive, admitted to shareholders that high inflation had taken a bite out of the group’s earnings during the year to end-April 2023 and that

its financial performance for the period had failed to meet expectations.

“This past year, our performance did not meet our expectations, as due to the highest inflation rate in generations, customers’ shopping habits were affected by changes to the types and quantities of products that they bought. Consequently, this is having a short-term impact on our performance,” he acknowledged.

“Each week, we process approximately 75,000 transactions throughout our 19 locations over three islands. We appreciate that our stores are an important part of our customers lives, and we aim to strengthen that relationship through providing great experiences, that will make us the first choice for our customers’ primary shop – whether that is for groceries or a quick service meal.

“This focus on improving our customers’ shopping experience is driving much of our short-term objectives – equipment upgrades and store resets in our Fresh Market brands to the much larger project of a complete remodel of our Solomon’s Nassau store and

the relocation of Cost Right Nassau,” Mr Watchorn continued.

“The purchase of the property formerly leased by Solomon’s Nassau provides us with greater strategic certainty for that business, as well as Cost Right Nassau, and will result in significant expense savings over the long-term. We expect to complete the remodels and resets in our existing stores within the next 24 months, and we will then shift our focus back to expansion.

“The opening of our Solomon’s Downtown Freeport store has filled a void in the Grand Bahama market and has also allowed us to create a smaller store format that we can replicate in other locations. There are several areas that we have identified as targets for our long-term growth plans and, as part of this strategic planning, we recently purchased a property on Faith Avenue, near the intersection with Carmichael Road in New Providence.

“Our plans are to convert this property into a shopping centre with a Solomon’s neighbourhood store as the anchor tenant.”

Turning to the future, Mr Watchorn said AML Foods’ objective remains to

increase total group turnover to $250m by 2030 - a 35 percent or $65m increase from the near-$185m generated during the prior financial year.

“Looking ahead, I foresee continued change for our industry and our company, especially given the uncertainty in the local and global markets. I am encouraging our team to embrace these changes and to focus on the challenge of meeting the evolving needs of our customers, while delivering upon the expectations of our shareholders,” the AML chief added.

“Our outlook on the success of our business remains unchanged, and we will continue to invest in technology and our people as we work to grow our company to $250m in revenues by 2030. To continue growing our company and improving shareholder value, we will remain committed to managing through the current industry conditions while, at the same time, pursuing opportunities to expand our retail footprint, integrate our supply chain network and provide complementary services to our customers.”

By PAUL WISEMAN AP Economics WriterTHE U.S. economy

expanded at a 2.1% annual

pace from April through June, showing continued resilience in the face of higher borrowing costs for consumers and businesses,

the government said Wednesday in a downgrade from its initial estimate.

The government had previously estimated that

the economy expanded at a 2.4% annual rate last quarter.

The Commerce Department's second estimate of growth last quarter marked a slight acceleration from a 2% annual growth rate from January through March. Though the economy has been slowed by the Federal Reserve's strenuous drive to tame inflation with interest rate hikes, it has managed to keep expanding, with employers still hiring and consumers still spending.

Wednesday's report on the nation's gross domestic product — the total output of goods and services — showed that growth last quarter was driven by upticks in consumer spending, business investment and outlays by state and local governments. A measure of consumer prices in the report also showed inflation cooling, which could ease the pressure on the Fed to further raise interest rates.

"Lower growth and weaker increases in prices are good news for the Federal Reserve,'' said Eugenio Aleman, chief economist at Raymond James. Consumer spending, which accounts for about

70% of the U.S. economy, rose at a 1.7% annual pace in the April-June quarter — a decent gain, though down from 4.2% in the first three months of 2023. Excluding housing, business investment rose at a strong 6.1% annual rate last quarter. Investment in housing, hurt by higher mortgage rates, fell in the second quarter.

The American economy — the world's largest — has proved surprisingly durable in the midst of the Fed's aggressive campaign to stamp out a resurgence of inflation, which last year hit a four-decade high. Since March of last year, the Fed has raised its benchmark rate 11 times, making borrowing for everything from cars to homes to business expansions much more expensive and prompting widespread predictions of a coming recession.

Since peaking at 9.1% in June 2022, year-over-year inflation has fallen more or less steadily. Last month, it came in at 3.2% — a significant improvement though still above the Fed's 2% inflation target. Excluding volatile food and energy costs, so-called core inflation in July matched the smallest monthly rise in nearly two years.

One measure of prices in the GDP report — the personal consumption expenditures index — rose at a 2.5% annual rate last quarter, down from a 4.1% pace in the January-March quarter and the smallest increase since the end of 2020.

Since the Fed began raising rates, the economy has been bolstered by a consistently healthy job market. Employers have added a robust average of 258,000 jobs a month this year, though that average has slowed over the past three months to 218,000.

On Tuesday, a report from the government added to evidence that the job market is gradually weakening: It showed that employers posted far fewer job openings in July and that the number of people who quit their jobs tumbled for a second straight month. (When fewer people quit their jobs, it typically suggests that they aren't as confident in finding a new one.)

Still, job openings remain well above their pre-pandemic levels. The nation's unemployment rate, at 3.5%, is still barely above a half-decade low. And when the government issues the August jobs report on Friday, economists polled by the data firm FactSet think it will show that while hiring slowed, employers still added 170,000 jobs.

are not enough people signing up in Abaco.

“What they want you to do is go online and register for the course, and then they will give a session in Abaco once they have enough people to make it worth their while. Otherwise you have to fly to Freeport.” Mrs DegregoryMiaoulis, though, said she understood that the fees associated with the training and certification are slightly lower than those given by the fire service source.

For a ‘Class A’ commercial driver’s licence, she said the fee was $535 plus VAT, while for ‘Class B’ and ‘Class C’ licences they are $425 and $395 plus the 10 percent levy, respectively. The Abaco Chamber chief, though, said she had been unsuccessful in confirming those fees while adding that applicants will also have to cover their air fare and accommodation costs if they have to fly to another island.

With Royal Bahamas

Police Force officers now warning drivers lacking the correct licence that they will be fined if caught operating commercial vehicles, such as heavy construction machinery, utility and delivery trucks, oil and sewage tankers, yesterday’s developments shone a spotlight on the Government’s decision to outsource the required training and certification to a private company that appears to have an exclusive monopoly in this area.

Motor Vehicle Training Services (MTVS) is the entity responsible for approving commercial vehicle drivers to obtain their licence from the Road Traffic Department. The

significance of its engagement, which occurred more than a year ago, was not apparent at the time, although it appears to have been awarded the contract without any competitive bidding or tender process.

Online research by Tribune Business reveals that MTVS made its first posting on October 21, 2021, just one month after the Davis administration won the general election with a reveal of its corporate logo and contact details. Then, on December 6 that year, it urged persons to “roll into the New Year with your new commercial drivers’ licence”.

Its first weekly schedule for “training and certification” classes was posted on social media on January 11, 2022, with all this taking place prior to a government press release and photo revealing that the company had signed a Memorandum of Understanding (MoU) with the Road Traffic Department to provide these services

to commercial vehicle drivers. Jobeth Coleby-Davis, minister of transport and housing, was pictured although no private media were there.

A statement released by the Government at the time described the MoU as “transformative”, and said:

“The objective of the MoU is to assist with strengthening the knowledge and skills of current and potential drivers of commercial vehicles, heavy duty vehicles, and heavy duty equipment operators.

“The MOU is also to assist with ensuring that the proper inspection of these vehicles are carried out, in an effort to place the industry on par with international standards and best practices.”

The 2021 and early 2022 postings by MTVS also took place before the Road Traffic Act was amended to make commercial vehicle drivers licences mandatory by law. MTVS’ subsequent social media postings contain glowing testimony from

drivers who have passed, vouching for the quality of the theoretical and practical training, and one on June 1 this year suggests the company will next year take over all commercial vehicle inspections from Road Traffic.

“Annual inspections on all commercial vehicles in 2024 by MTVS,” the post states, although there has been no confirmation of this by the Government. Martiniqua Davis, MTVS operations manager, could not be reached for comment despite numerous Tribune Business attempts yesterday, but several sources questioned why a private company should be providing a service that the Government is mandated to offer.

“It’s not the way government works,” one argued.

“Why, all of a sudden, do you have to go to a private company to pre-qualify for a government service?”

Another added: “With a regular driver’s licence, you take the test and either pass or fail. Why is the commercial driver’s licence not the same? Take the test, and either pass or fail. Some of these guys have been driving for 30 or 40 years. They know their stuff.”

The Government, though, will likely retort that commercial vehicles, given their size and potentially greater safety hazard they pose, require drivers with specialist skills that are properly trained and certified. And, given the nature of these skills, they require a specialist firm such as MTVS to qualify the drivers and make sure they have what it takes.

Linda Moxey, acting Road Traffic controller, could not be contacted for comment.

However, research by Tribune Business reporters and photographers shows that MTVS’ 30 Claridge Road address is the same building as the Marathon constituency headquarters for Lisa Rahming, the minister of state for social services. The two, though, have separate entrances and appear to use separate offices.

Meanwhile, David Lockhart, chief superintendent in charge of the police’s Road Traffic division, explained that persons wishing to obtain a commercial driver’s licence must attend four hours of in-class training and two hours of practical training before applying for a licence.

He said: “The process is that you have to attend inclass training for four hours and then a practical training for two hours. And if you succeed and you’re given a certificate, once you’ve given the certificate, then you have to go to traffic and apply for your commercial licence that you can get for one year or three years.”

The Ministry of Transport and Housing, in a statement last night, said: “According to section 35A of the Road Traffic Act, a commercial driver’s licence is required to operate heavy duty vehicles, heavy goods vehicles, heavy equipment and placarded hazardous material vehicles when travelling on the road network.

“Specifically, a commercial driver’s licence is required to operate a single vehicle or a combination of a vehicle and a trailer if the total gross vehicle weight rating is more than 10,000 pounds.” A fine of $250 can be imposed on persons found driving these vehicles without a valid licence.

Bahamas Agricultural and Industrial Corporation’s (BAIC) Bartard Campus and Marine Field Station at Stafford Creek, both of which are based in North Andros, plus the restoration of eight docks on that same island and Abaco.

The project is also targeting the construction of two visitor centres, both 3,500 square feet in size, in north and south Andros, plus the launch of a grant programme to equip small and medium-sized Bahamian businesses with the financing required for expansion.

With ocean covering 95 percent of The Bahamas’ territory or exclusive economic zone (EEZ), the report compiled on behalf of the Ministry of Economic Affairs asserted that this nation has “significant opportunities” that remain untapped when it comes to its ‘blue economy’.

However, it warned that the Family Islands, in particular, face major difficulties in capitalising on this potential due to their lower population density and increased costs of doing business when compared to Nassau. “Contributing an estimated 21.5 percent to the GDP and up to 50 percent when indirect impacts are considered, this economic sector encompasses various aspects, from harvesting of living and non-living resources to tourism, trade and indirect

contributions,” the report said.

“Although most of the population is concentrated in New Providence and Grand Bahama, the Family Islands (comprising 700 islands and 2,000 cays) harbour a rich marine biodiversity supporting tourism and fishing industries, along with providing natural coastal defences.

“Despite these advantages, the low population density of the Family Islands, coupled with the vast marine space and climate change vulnerability, presents unique challenges and opportunities for sustainable development.

Although The Bahamas has a higher percentage of innovative firms than most Caribbean countries, it lags behind in green innovative firms. However, it does excel in women-owned innovative firms compared to the regional average,” the assessment said.

“Blue economy firms on the Family Islands encounter increased costs and risks due to geographical conditions, lack of public goods and the need for enhanced digital and technical capacities. However, these islands, particularly Andros, offer potential for the expansion of agricultural products, marine resources and associated value chains.”

Turning to tourism, the report said: “Sustainable infrastructure-supporting tourism activities need to be strengthened, particularly on islands like Andros and

Abaco, where nature-based tourism is the primary focus. There is a need for the establishment of visitor centres, clear signage for attractions, birding towers and infrastructure to ensure safe exploration of Blue Holes.

“Tourist operators have identified the need for more tourist guides for fishing, nature, birding and diving. Many dock facilities in Andros and Abaco need repair, which is both a safety and an economic issue. Modern, safe, green dock facilities are needed to support connectivity by water between Andros and Abaco and the rest of the nation, and to spur overall economic development.....

“The programme aims to address the challenge of fostering economic development while leveraging and preserving the natural assets and fragile ecosystems of the Family Islands. This will involve an integrated set of interventions to enhance local firms’ productivity and human capital availability while ensuring the sustainable use of land and marine resources.”

Breaking down how the $30m will be spent, the project report revealed that more than half - some $17.36m - will go towards “promoting business growth” through enabling small and medium-sized Bahamian companies to embrace technology and other innovations while also driving the expansion of tourism-related firms.

Fresh water, waste water and waste management, and logistics, as well as “value chains” and business clusters in industries such as agriculture, mariculture and sponging will be targeted with just over $9m in grant funding, while the balance of the $17.36m will be directed into “green and climate resilient infrastructure for tourism” including the restoration of docks and other assets.

As to the remainder of the financing, some $12.64m, this will be allocated for “agriculture and marine research, including climate change considerations”, plus the promotion of sustainability in oceanbased industries that includes upgrading the management of The Bahamas’ Marine Protected Areas (MPA) network. With the $30m investment set to be executed over a five-year period, the assessment report forecast: “The proposed advantages and beneficiaries of this scheme primarily include MSMEs across the Family Islands, who are expected to see capacity growth due to technical aid and potential for heightened productivity via participation in value chains, clusters and public resources like infrastructure and training.

“It is estimated that 150 SMEs and 12 firm groupings will profit. Inhabitants of the Family Islands, especially Andros and Abaco (roughly 25,000 locals and 680,000 annual visitors), are

set to gain from improved coastal protection, which would also bolster the safety of 1.5m hectares of coastal land.

“The expected results are increased growth in Bahamian firms in the blue economy and tourism business that will benefit from investments in infrastructure, an increase in research and absorption of the industry in agriculture and marine research, and (promotion of sustainable economic activity in the strengthened MPAs. Public institutions such as BAMSI and the Bahamas National Trust will also benefit with institutional strengthening activities.”

Going into specifics, the report said BAMSI is set to enjoy building upgrades focused on the Marine Field Station at Stafford Creek and the Bartard Campus. The latter will have solar installed as a back-up power source, while the outdoor classrooms for animal science and aquaponics will also be enhanced. The Marine Field Station will also enjoy improvements to its six classrooms, “In the current scenario, the programme plans to fund up to approximately $2.5m towards the rehabilitation and improvement of at least eight selected existing public and government docks in Andros and Abaco, which were damaged in the wake of Hurricane Dorian,” the report added.

“Works will include demolishing, piling replacement, concrete slabbing and structure, steel structure reinforcements, construction (and relocation) of new timber dock structure, minor dredging and debris disposal.” While only Abaco’s docks were damaged in Hurricane Dorian, the three targeted for upgrades on that island are the Treasure Cay ferry dock, The Crossing dock and White Sound, Elbow Cay. The five attracting attention on Andros are in Red Bay, the fisherman’s and main public docks in Lowe Sound, Nicholls Town and Conch Sound. “Andros’ economic development is largely driven by tourism,” the report added. “This sector, incorporating nature-based activities such as recreational fishing, diving and guided visits to natural attractions like blue holes, significantly contributes to the island’s annual income.

“Within the scope of this programme, funding will be allocated towards the development of light tourist facilities such as visitor centres, informational signage and trail maintenance in the island. This includes the establishment of two new visitor centres, each spanning approximately 3,500 square feet. In addition, the programme also encompasses investment in minor scale visitor infrastructure associated with blue holes and bird-watching areas.”

FROM PAGE B3

despite all of the other problems, if you can’t have chicks to raise then you have no product to sell,” Mr Pinder explained.

“When we get the hatchery up and running we can hatch pretty much everything from chicken eggs to quail eggs. This is just one more part of the supply chain being inside of the country rather than outside of the country.

“This hatchery will cost us about $45,000 for the entire investment - from the parts to installing it. I hope to have multiple sets of chicks to come off of it by December if it’s going well. We will buy more equipment and expand it; that’s what we’re looking at doing. This should help us to get our supply under control and maybe cut down some of the costs a little bit barring nothing else coming along to eat it up.”

FROM PAGE B3

Service Act, Chapter 232, which delineates essential regulations to ensure a clean and healthy environment. The Environmental Health Service Act, particularly Parts III and V, underscores the prohibition of unsanitary conditions, nuisances and the fostering of vermin on premises.

“Specifically, Section 9 mandates that individuals refrain from allowing or creating conditions conducive to the breeding or harbouring of rodents, insect pests, termites or other vermin.” Mr Rolle’s statement added that non-compliance “raises alarming apprehensions with regards to environmental conservation and public health standards”.

He then proceeded to provide guidance to downtown merchants on their responsibility for proper garbage storage and the schedule for daily pickup. “Section 20.1 outlines penalties for contravening

the Act, encompassing fines and potential imprisonment for non-compliance. These punitive measures will be enforced,” Mr Rolle warned.

“In the event that you require guidance or clarification on appropriate waste management protocols or local regulations, we encourage you to liaise with the Department of Environmental Health. This department holds responsibility for the inspection process and has the authority to grant or deny final approval for Business Licences issued by the Inland Revenue.

“Your attention to this matter is not only appreciated but essential in fostering a cleaner and healthier environment for the entire community.” Mr Rolle subsequently told this newspaper: “Essentially, if there is no one leading the charge, there is no real direction. Then people are just going to do what they want.”

Maintaining, or confirming, its existing creditworthiness ratings on the various classes of commercial mortgage-backed securities issued to Atlantis debt holders, Morningstar said:

“The collateral reported a net cash flow of $182.3m for the trailing 12-month period ended March 31, 2023, surpassing the yearend 2022 net cash flow of $133.8m, year-end 2021 net cash flow of $24.4m, and in line with the issuer’s net cash flow of $181.3m.”

That latter figure would have been generated in the pre-COVID era at the time of the last debt refinancing in 2018, which means that Atlantis’ annual cash flow has now rebounded in line with the peaks achieved before the pandemic. The $182.3m achieved for the year to end-March 2023 represents a 36.2 percent year-over-year increase, with the $24.4m generated during the period when the tourism shutdown, including lockdowns and border closures, was at its height.”

Drawing on data provided by STR, the entity that monitors the worldwide lodging industry, Morningstar said of Atlantis: “According to the most recent STR report, the combined occupancy, average daily rate (ADR) and revenue per available room (RevPAR) for the trailing 12-month period ended March 31, 2023, were 56.2 percent, $355 and $200, respectively, up from 35.5 percent, $277 and $99 for year-end 2021.

“In comparison, the occupancy, ADR, and RevPAR were 72.2 percent, $277 and $200 at issuance, respectively.” However, it conceded that there were mitigating factors behind the occupancy decline, including the now-completed renovations to all

rooms at the Royal Towers, while also acknowledging that Atlantis and BREF One, the Brookfield-controlled investment fund that owns the Paradise Island mega resort, invested $52m in capital upgrades to the property in 2022.

“While occupancy at the property remains low, as noted at the time of the last rating action, the collateral has been undergoing significant upgrades and renovations, including the complete redevelopment of the Beach Towers and upgrades to all guest rooms and suites in the Royal Towers,” the rating agency said.

“These capital projects, which are scheduled to be completed in 2024, have likely resulted in rooms being temporarily closed, contributing to the decline in occupancy.

According to the servicer’s latest update, the Beach Towers have remained vacant since closing during the COVID-19pandemic, and while the property was originally scheduled to reopen as Somewhere Else in 2024, the borrower has stated that design plans and the scope of the renovation work are still being discussed.

“Other minor capital projects involving dining, operations, the marine water park and supply chain management, among others, were recently completed according to the December 2022 capital expenditure report provided by the servicer, which outlined that the borrower had spent approximately $52m in 2022 on major and minor capital projects, and $76m since 2019.”

Vaughn Roberts, the Paradise Island resort’s senior vice-president of government affairs and special projects, previously

told Tribune Business that Atlantis is “going through value engineering” in a bid to ensure construction costs for the redevelopment of its Beach Towers property stay within budget following the post-COVID surge in material prices, labour and other related costs.

The 400-room Beach Towers is awaiting redevelopment into Somewhere Else by Grammy Awardwinning musician and producer, Pharrell Williams, and his business partner David Grutman, and Mr Roberts said: “We’re still working through it, working through the design and working through the budget.

“The numbers came in a bit higher on the construction side, so we’re going

through a value engineering to find savings. That means tweaking the design and so forth. We’re trying to figure out how to make it work within the budget. From where we sit now, it’s probably a 2024 construction start project. We always thought it was a two-year kind of build-out.

“It’s well over $100m. We don’t know where it will end up, but it’s 425 rooms and it’s a complete renovation of the hotel. It’s the oldest hotel, so we have to do a lot of work with it. Elevators, the rood, building systems. All the main building systems have to be replaced.”

Morningstar, meanwhile, yesterday assigned a 112.6 percent loan-tovalue ratio to the debt that

is secured on Atlantis’ real estate and other physical assets. “Whole loan proceeds of $1.2bn, along with $650m in mezzanine debt spread across three loans, refinanced existing debt, returned $148.9m of sponsor equity and covered closing costs,” it added, nothing that one component of the debt has been extended for a fourth time to July 2024.

“The rating confirmations follow improvements in performance for the underlying collateral, Atlantis, driven by the return of tourism in The Bahamas. This is evidenced by reported net cash flow (NCF) which, as of the most recent financial statements, has stabilised to issuance levels,” Morningstar said.

“The loan is secured by the Atlantis resort, a 2,917-key beachfront resort comprising of four (the Beach, the Coral, the Royal and the Cove) hotel towers on Paradise Island in the Bahamas, and the fee interest in amenities including 40 restaurants and bars, a 60,000 square foot casino, the 141-acre Aquaventure water park, 73,391 square feet of retail space and spa facilities, and 500,000 square feet of meeting and group space.

“The resort also includes a luxury tower with an additional 495 rooms owned by third parties as condo-hotel units and 392 timeshare rooms at the Harborside Resort, neither of which are part of the collateral.”

IN a first-of-its kind auction for the Gulf of Mexico, a company bid $5.6 million Tuesday to lease federal waters off the Louisiana coast for wind energy generation. It was a modest start for wind energy in the Gulf, which lags the Northeast in offshore wind power development. Only one of three available tracts received bids. And only two companies bid. The winning bidder was RWE Offshore US.

The Biden administration said the tract covers more than 102,000 acres (41,200 hectares) with the potential for generation of 1.24 gigawatts, enough wind power to supply 435,000 homes.

Analysts cited a variety of factors behind the current, relatively low interest in the lease sale, including inflation and challenges specific to the area such as lower wind speeds and the need for designs that consider hurricane threats.

Washington-based research group Clearview Energy Partners said in a Tuesday analysis that Gulf states' governments

lack the needed offshore wind targets or mandates for renewable energy that could encourage more wind development. Clearview's report also said wind energy is likely to play a key role in development of clean hydrogen production. The Biden administration has yet to implement a planned tax credit for hydrogen

THREE wind turbines stand in the water off Block Island, R.I, the nation’s first offshore wind farm, Aug. 15, 2016. In a first-of-its kind auction for the Gulf of Mexico, a company bid $5.6 million Tuesday, Aug. 29, 2023 to lease federal waters off the Louisiana coast for wind energy generation.

— another possible drag on immediate interest in Gulf wind leases, the report said. "Offshore wind developers have to pick and choose where to deploy their resources and time and energy. It is not surprising that they are more interested in locations like the Northeast where power prices are higher and offshore wind is better positioned to compete," Becky Diffen, a partner specializing in renewable energy financing at the Norton Rose Fulbright law firm in Houston.

Other factors bode well for eventual wind development in the Gulf. "While RWE may be the only company to have won a bid for federal waters in the Gulf, there are a few companies interested in pursuing offshore wind in Louisiana state waters," Clearview said. "We note Louisiana lawmakers enacted a law last year that expanded the

size of allowable offshore wind leases in state water." In a region where offshore oil and gas production remain a major economic driver, industries are embracing wind energy as well. For instance, Louisiana shipbuilding giant Edison Chouest Offshore is assembling a 260-foot-long (80-meter) vessel to serve as floating quarters for offshore wind technicians and their tools to be used to run wind farms in the Northeast.

"Today's auction results show the important role state public policy plays in offshore wind market development," said Liz Burdock, president and CEO of the Business Network for Offshore Wind, an organization formed to aid the development of offshore wind. "Gulf expertise in offshore construction is unparalleled, and their innovative solutions will continue to drive the U.S. and global offshore wind industry forward."

“Offshore wind developers have to pick and choose where to deploy their resources and time and energy. It is not surprising that they are more interested in locations like the Northeast where power prices are higher and offshore wind is better positioned to compete.”

Becky Di fen

TESLA is allowing some drivers to use its Autopilot driver-assist system for extended periods without making them put their hands on the steering wheel, a development that has drawn concern from U.S. safety regulators.

The National Highway Traffic Safety Administration has ordered Tesla to tell the agency how many vehicles have received a software update making that possible and it’s seeking more information on what the electric vehicle maker’s plans are for wider distribution.

“NHTSA is concerned that this feature was introduced to consumer vehicles, and now that the existence of this feature is known to the public, more drivers may attempt to activate it,” John Donaldson, the agency’s acting chief counsel, wrote in a July 26 letter to Tesla that was posted on the agency’s website. “The resulting relaxation of controls designed to ensure that the driver remain engaged in the dynamic driving task could lead to greater driver inattention and failure of the driver to properly supervise Autopilot.”

A message was left early Wednesday seeking comment from Tesla. “If you haven’t tried Tesla Autopilot, you don’t know how awesome it is,” Musk wrote Wednesday on X, formerly Twitter.

The government has been investigating Autopilot for crashing into

emergency vehicles parked on freeways, as well as hitting motorcycles and crossing tractor-trailers. It opened a formal probe in 2021 and since 2016 has sent investigators to 35 Tesla crashes that may involve partially automated driving systems. At least 17 people have died.

Tesla says Autopilot and a more sophisticated “Full Self-Driving” system cannot drive themselves and that drivers must be ready to intervene at all times. Autopilot generally can keep a car in its lane and a distance away from objects in front of it.

The special order tells Tesla to describe differences in the software update that reduces or eliminates instances where Autopilot tells drivers to apply pressure on the steering wheel, “including the amount of time that Autopilot is allowed to operate without prompting torque, and any warnings or chimes that are presented to the driver.”

The letter to Tesla Senior Legal Director Dinna Eskin orders the Austin, Texas, company to say why it installed the software update and how it justifies which consumers got it. It also seeks reports of crashes and near misses involving vehicles with the software update. “Your response should include any plans to enable the subject software in consumer vehicles within the next calendar year,” Donaldson wrote in the letter. A Tesla officer has to respond to the letter under

oath by Aug. 25 or the agency will refer the matter to the Justice Department, which can seek a maximum penalty of more than $131 million.

Tesla’s system of monitoring drivers has been criticized by safety advocates and the National Transportation Safety Board for letting drivers check out when Autopilot is operating.

After investigating three crashes involving Autopilot, the NTSB recommended in 2017 that Tesla and five other automakers limit where the partially automated systems can be used to limited-access divided highways, and to bolster

their systems that monitor drivers. All of the automakers but Tesla responded. In 2021 NTSB Chairwoman Jennifer Homendy wrote a letter to Tesla CEO Elon Musk calling on him to act on the recommendations. The NTSB said Musk never responded.

The NTSB investigates crashes but has no regulatory authority. It can only make recommendations to automakers or other federal agencies such as NHTSA. Most other automakers use an infrared camera to make sure a driver is paying attention. Some Teslas lately have been equipped with cameras that watch drivers.

Jake Fisher, who heads auto testing for Consumer Reports, said Tesla may have activated the cameras to monitor drivers, and that may be the reason for relaxing the steering wheel notifications.

But during its last test of Autopilot in 2022, the cameras didn’t do anything, and older Teslas aren’t equipped with the cameras, Fisher said. However, the cameras did monitor drivers when using “Full Self-Driving,” Fisher said.

Cameras, he said, are better at ensuring that drivers pay attention than steering wheel monitors.

Tesla owners refer to alerts about hands on the steering wheel as “nags.”

When Autopilot was first introduced in 2015, it warned drivers to pay attention if it didn’t feel torque on the steering wheel for about three minutes, Fisher said. Later that was reduced to 30 seconds, but it changes between software updates, he said. “It always seems to be jumping around,” he said. Consumer Reports also has found that it’s easy to bypass Tesla’s steering wheel monitoring system. Earlier this month NHTSA sent investigators to a crash in Virginia in which a Tesla apparently on Autopilot ran underneath a tractor-trailer, killing the driver.

THE AMERICAN Airlines logo is seen atop the American Airlines Center in Dallas, Texas, Dec. 19, 2017. On Wednesday, Aug. 30, 2023, flight attendants at American Airlines voted overwhelmingly to authorize union leaders to call for a strike, a move intended to put more pressure on the carrier

raises.

Associated Press

FLIGHT attendants at American Airlines voted overwhelmingly to authorize union leaders to call for a strike, a move designed to put pressure on the carrier during negotiations over pay raises.

The Association of Professional Flight Attendants said Wednesday that more than 99% of members who voted recently favored giving the union power to call a strike. The union backed up the vote with picketing at several airports.

Union President Julie Hedrick said the vote tells company management that flight attendants, who have not received raises since 2019, are "fired up." American executives, she said, "ignore this strike vote at their peril."

American said, "We're proud of the progress we've made in negotiations with the APFA, and we look forward to reaching an agreement that provides our flight attendants with real and meaningful value.

We understand that a strike authorization vote is one of the important ways flight attendants express their desire to get a deal done."

The vote does not mean that a strike is imminent or even likely. Federal law makes it difficult for airline unions to conduct legal strikes — they need a decision from federal mediators that further negotiations would be pointless, which rarely happens. The president and Congress can also get involved to delay or block a strike.

Earlier this month, American's pilots ratified a contract that will raise average pay more than 40% over four years. Flight attendants are not expected to reap that kind of increase, as they have less leverage than pilots, who are in short supply.

Other airline unions are also pushing for new contracts. Pilots at Southwest Airlines and flight attendants at United Airlines plan to picket at airports Thursday.

THE Biden administration proposed a new rule Wednesday that would make 3.6 million more U.S. workers eligible for overtime pay, the most generous such increase in decades.

The rule revives an Obama-era effort that faced pushback from business leaders and Republicans and was ultimately scuttled in court. Business groups Labor advocates and liberal lawmakers have pushed the Biden administration to take the fight back up, arguing that overtime protections have been sharply eroded over the decades by wage stagnation and inflation.

The proposed regulation, unveiled by the Department of Labor, would require employers to pay overtime to salaried workers who are in executive, administrative and professional roles but make less than $1,059 a week, or $55,068 a year for full-time employees. That salary threshold is up from $35,568 level that has been in place since 2019 when the Trump administration raised it from $23,660, in a more modest increase than President Barack Obama's earlier proposal.

The rule, which is subject to a public commentary period and wouldn't take effect for months, would have the biggest impact on retail, food, hospitality, manufacturing and other industries where many

managerial employees meet the new threshold.

"I've heard from workers again and again about working long hours, for no extra pay, all while earning low salaries that don't come anywhere close to compensating them for their sacrifices," acting Secretary of Labor Julie Su said in a statement.

Under the Fair Labor Standards Act, almost all U.S. hourly workers are entitled to overtime pay after 40 hours a week, at no less than time-and-half their regular rates. But salaried workers who perform executive, administrative or professional roles are exempt from that requirement unless they earn below a certain level.

The left-leaning Economic Policy Institute has estimated that about 15% of full-time salaried workers are entitled to overtime pay under the Trump-era policy. The new rule would almost double that to nearly 30%, according to Labor Department figures.

That's still fewer than the more than 60% of salaried workers who were entitled to overtime pay in the 1970s, according to the institute. The overtime rule has been sporadically updated over the past decades, with the Trump increase being the first since 2004. The Labor Department's new rule attempts to change that pattern by adopting automatic increases to the salary threshold every three years.

Business leaders quickly criticized the new rule, saying it would add to labor challenges and saddle companies with new costs as they grapple with higher interest rates, inflation and economic uncertainty.

"The DOL's proposed rule would inject new regulatory burdens and compliance costs to an industry already reeling from workforce shortages and an onslaught of other unbalanced regulations,"

said Chris Netram, managing vice president of the National Association of Manufacturers.

David French, senior vice president of government relations of the National Retail Federation, said the automatic increases proposed in the rule ties the hands of future administration and exceeds the authority of the Labor Department. The rule is less generous than the Obama-era

regulation, which would have lifted the threshold to more than $47,000. It also falls short of the demands of some liberal lawmakers and unions for an even higher salary threshold than the proposed $55,068. But labor advocates praised the rule as positive step. "It's decades overdue, and it's a really important step," said Economic Policy Institute President Heidi Shierholz, who was the chief economist at the Labor Department when the Obama administration tried to enact its overtime rule.

AFL-CIO President Liz Shuler called the measure a "victory for the working people." She said employers that don't want to pay overtime "instead could take the high road and hire additional staff or promote workers from part-time to full-time status."

The new rule would extend overtime eligibility to some 300,000 more manufacturing workers and a similar number of retail workers. Some 180,000 hospitality and leisure workers and 600,000 health and social service workers would also be newly covered.

Under the rule, 27% of salaried workers would be entitled to overtime pay because they make less than the threshold, according to the Labor Department. A smaller number of workers would become newly eligible because of a change to a rule that excludes the highest paid salaried workers from overtime benefits even if they don't perform administrative, professional or executive duties. The Labor Department proposed raising that salary threshold from $107,432 to $143,988.

In its proposal, the Labor Department said it tried to find a balance that would address one of the concerns raised in legal challenges to the Obama-era policy: that the threshold was so high that it sidelined the socalled "duties" test, which determines whether salaried workers are entitled to overtime pay based on the work they perform.

JULIE SU, Acting Labor Secretary, speaks during an impromptu appearance at the “Democracy for the People” tour, a race and democracy summit sponsored by the Congressional Black Caucus, Wednesday, July 28, 2023, in Houston. Biden administration proposed a new rule Tuesday, Aug. 29, 2023 that would make 3.6 million more U.S. workers eligible for overtime pay, reviving an Obama-era policy effort that was ultimately scuttled in court. “I’ve heard from workers again and again about working long hours, for no extra pay, all while earning low salaries that don’t come anywhere close to compensating them for their sacrifices,” Acting Secretary of Labor Julie Su said in a statement.Photo:Michael Wyke/AP

COMMERCE Secre-

tary Gina Raimondo on Wednesday said she warned Chinese leaders that U.S. businesses might stop investing in their country without prompt action to address complaints about worsening conditions due to raids on firms, unexplained fines and unpredictable official behavior.

Raimondo's comments add to pressure on Chinese leader Xi Jinping's government, which is trying to revive investor interest and reverse an economic slump. Business groups say confidence among foreign companies is at an all-time low. Official figures show foreign investment plunged in the latest quarter.

Raimondo visited Beijing as part of U.S. efforts to restore relations that plummeted to their lowest level in decades due to disputes about technology, security, Taiwan and other issues. She called her meetings with China's No. 2 leader, Premier Li Qiang, and other officials "very productive" but said she "didn't pull any punches" in conveying business complaints.

Raimondo said CEOs ahead of her trip told her they face increased pressure from Beijing's expansion of an anti-spying law this year, raids on some firms, tighter controls on data and lack of information about rule changes.

"My point was U.S. business needs to see some action taken to address these issues. Otherwise, they will deem it as just too risky and, as I said, uninvestable," Raimondo told reporters at a Boeing Co. joint venture in Shanghai's eastern district of Pudong.

Foreign direct investment in China fell 89% from a year earlier in the three months ending in June, according to official data. Most investment is believed to be brought into the country by Chinese companies disguised as foreign money to get tax breaks and other incentives, but business groups have warned foreign companies are withholding new spending until their status is clearer.

"Patience is wearing thin," Raimondo said. She said conditions for companies that have complained for years about technology theft and official favoritism toward Chinese competitors are "becoming in some ways even tougher."

Economic growth slid to 0.8% compared with the previous quarter in the three months ending in June from the January-March period's 2.2%. That is equal to an annual rate of 3.2%, which would be among China's weakest in decades.

Despite that, Li, the premier, has expressed confidence the economy can hit the ruling party's annual growth target of "about 5%."

Raimondo said she welcomed moves such as the ruling party's announcement of a 24-point plan to improve conditions for entrepreneurs. She said the party secretary for Shanghai, Chen Jining, told her Wednesday the city was considering creating a hotline to receive business complaints.

"We have to see the situation on the ground match the rhetoric," Raimondo said.

Raimondo's visit produced the most substantial results of a series of trips to Beijing over the past three months by U.S. officials including Secretary of State Antony Blinken in June and

(Incorporated under the International Business Companies Act No. 45 of 2000)

TAKE NOTICE that the International Business Company, RUXLEY LIMITED incorporated on 23rd August, 2012 has registered its Articles of Dissolution with the Registrar General’s Department effective 28th August, 2023.

The name and address of the Liquidator is:

G W & Partners LP West Bay Street Nassau, Bahamas

Treasury Secretary Janet Yellen last month.

The two governments announced Monday they would form two groups to reduce trade tension by sharing information about U.S. export controls on technology that irritate

Beijing and discuss other commercial disputes. They also agreed to have officials meet to discuss protection of trade secrets and to hold a "travel and tourism summit."

Beijing broke off dialogue with Washington

over military, climate and other issues in August 2020 in retaliation for a visit to Taiwan by then-House Speaker Nancy Pelosi. The ruling party claims the selfruled island democracy as part of its territory and

objects to foreign official contacts.

Relations already were strained by a tariff war launched by then-President Donald Trump over complaints including that Beijing steals or pressures companies to hand over technology.

Li appealed to Raimondo on Tuesday for "concrete actions" by Washington to improve relations, a reference to Chinese pressure for changes in U.S. policy on Taiwan, technology and other issues.

JAPAN'S Prime Minister Fumio Kishida and three Cabinet ministers ate Fukushima fish sashimi at a lunch meeting Wednesday, in an apparent effort to show that fish is safe following the

release of treated radioactive wastewater from the Fukushima Daiichi nuclear power plant that began last week.

Kishida and the three ministers had sashimi of flounder, octopus and sea bass, caught off the Fukushima coast after the water

release, along with vegetables, fruits and a bowl of rice that were harvested in the prefecture, Economy and Industry Minister Yasutoshi Nishimura, who was at the meeting, told reporters. The release of the treated wastewater into the ocean, which began Thursday and

is expected to continue for decades, has been strongly opposed by fishing groups and by neighboring countries. China immediately banned all imports of Japanese seafood in response.

In South Korea, thousands of people joined rallies over

the weekend to condemn the discharge. All seawater and fish sampling data since the release have been way below set safety limits. The lunch showed Kishida's "strong commitment to take the leadership in tackling reputational damage while standing by the feelings of the fisheries community in Fukushima," Nishimura said. "It is important to show safety based on scientific evidence and resolutely disseminate (the information) in and outside of Japan."

Nishimura visited a Fukushima supermarket chain Monday to sample fish, and Kishida is set to visit Tokyo's Toyosu fish market Thursday also to promote Fukushima fish.

In South Korea, President Yoon Suk Yeol also ate fish for lunch. According to Yonhap news agency, the Presidential Office cafeteria this week was serving Korean fish, whose demands have fallen due to concern about the impact of the release of the wastewater from the Fukushima plant.

Japan's Foreign Ministry issued a travel advisory on Sunday urging Japanese citizens to use extra caution in China, citing an escalation of harassments and violent protests over the discharge of the wastewater.

Chief Cabinet Secretary Hirokazu Matsuno said that stone throwers had targeted Japan's embassy, consulates and schools in China.

"It is extremely regrettable, and we are concerned," Matsuno said.

He also hinted at a possibility of taking the case to the World Trade Organization. He said that Japan has in the past raised issues under the WTO framework concerning China's trade restrictions without scientific bases, and that "Japan will consider various options while continuing to work within the WTO framework to decide necessary steps."

Officials and reports say thousands of crank calls from China have targeted Fukushima government offices and the nuclear plant's operator. Many of the callers shouted in Chinese, and some yelled "stupid" and other swear words, Japan's NHK public television said.

In Tokyo, a sign at a Japanese-style bar warning "the Chinese" that it's only serving food from Fukushima caught the attention of a Chinese V-tuber, who called police complaining about the "nationality discrimination" against the Chinese by singling them out. The owner changed the sign but refused to talk.

Treated radioactive wastewater has accumulated since the March 2011 meltdown at the nuclear plant caused by a massive earthquake and tsunami. It totals 1.34 million tons and is stored in about 1,000 tanks.

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, LESLIE GEORGE FRENCH of Sutton Stree, New Providence, Bahamas intend to change my name to LESLIE ABDULLAH IBN FRENCH If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE is hereby given that MARCELLINE YIMMY, of Nassau Street, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 31st day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, RUBYANN

MARIKA ASTASHA DUNCOMBE of Amherstia Avenue, New Providence, Bahamas intend to change my name to RUBYANN MARIKA ASTASHA TAYLOR . If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O. Box N-742, Nassau, The Bahamas no later than Thirty (30) days after the date of publication of this notice.

NOTICE is hereby given that STEVEN DELIUS of Marathon, Ninacrest, Nassau, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 31st day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that HAMLER MICHEL , of Marsh Harbour, Abaco, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 31st day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that MARIO EXANTUS, of General Delivery, Cooper Town, Abaco, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that ROMAINE BLAKE of Roberts Boulevard, Coral Heights West, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that HAMLER MICHEL , of Marsh Harbour, Abaco, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 31st day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that DOTHLYN BLAKE of Smith’s Bay, Cat Island, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of August, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

STOCKS ended modestly higher Wednesday, extending Wall Street’s recent winning streak to its fourth day in a row and chipping away more of the market’s losses this month.

After a choppy day of trading, the S&P 500 closed 0.4% higher. The benchmark index remains down 1.6% for August, with one trading day left in the month. The Dow Jones Industrial Average edged up 0.1%, while the Nasdaq composite added 0.5%.

Technology stocks led the market’s gains. Apple rose 1.9% and Palo Alto Networks rose 1.7%. HP was on the losing end with a 6.6% slump after cutting its profit forecast for the year.

Wall Street’s focus this week remains a broad mix of data that investors hope will paint a clearer picture of where the economy