Gov’t like ‘the vandal now trying to buy GBPA house’

By NEIL HARTNELL Tribune Business

The Government’s bid to drive change at the Grand Bahama Port Authority (GBPA) was yesterday likened to “the person who did the vandalising now trying to buy the house from its owners for little money”.

Rob Millard, a business strategist who produced a Freeport revival plan for a potential GBPA purchaser more than a decade ago, in an article submitted to

Tribune Business described The Bahamas’ second city as “a house that has been vandalised” due to multiple government measures that have “negated” the Hawksbill Creek Agreement and ensnared the Port area in ever-increasing bureaucracy and red tape.

As a result, and given the Davis administration’s

demands that the GBPA and its owners either fulfill their obligations or seek an exit, he described the current situation as akin to “the person who did the vandalising now trying either to buy the house from its owners for little money (because it is damaged) or pushing those owners to sell it to somebody else while at

the same time preventing them from fixing it”.

Mr Millard’s article (see Page 2B), written in response to calls by Freeport attorney, Terence Gape, for the Hayward and St George families to sell their GBPA ownership and hand control back to the Government so that the city is no longer regarded as a

Sandals expansion awaits ‘overwater’ policy reforms

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SANDALS is proposing to expand its Fowl Cay property through the development of ten “overwater” bungalows in “anticipation” that the Government will finally end the two decade-plus wait for a policy governing such structures.

The Environmental Impact Assessment (EIA) for the proposed expansion of the 50-acre Exuma cay, which has been seen by Tribune Business, states that the locations for the planned overwater bungalows have been selected with the proposed policy in mind and followed a Department of Environmental Planning and Protection (DEPP) visit to the island in December 2022.

The review, by Waypoint Consulting, reveals that Sandals, which also owns and operates resorts on New Providence and mainland Exuma, is planning to more than double guest accommodation on the high-end, secluded retreat for wealthy guests.

“Fowl Cay Resort, aptly named for the island, is owned and operated by

Sandals International. At present, the resort boasts six villas with varying accommodations to support between two and six individuals. The central gathering point on the island is Hillside House which features dining facilities, a bar and lounge amenities,” the EIA stated.

“This EIA pertains to the expansion of existing resort lodging, amenities and back-of-house operations to support additional hotel keys and new offerings such as overwater bungalows. In addition to six new villas and three villas at the water’s edge, Fowl Cay proposes ten overwater bungalows spread over two locations.

“These locations were selected with consideration for The Bahamas’ anticipated overwater structure policy, and following a site visit to Fowl Cay with DEPP in December 2022. The proposed overwater bungalow locations pose no interference with established navigational routes, offer protection from winds, stand perched above a shallow and sandy substrate, and allow adequate spacing to reduce impacts from shading,” the EIA added.

“Construction of overwater bungalows will be similar to installation of

FTX BAHAMAS $9BN CLAIM IS ‘REDUNDANT’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’S US chief yesterday dismissed the $9.15bn claim submitted by his Bahamian counterparts as “invalid” and “redundant” while revealing that the crypto exchange’s local real estate holdings have been valued at up to $214m.

John Ray, who heads the 134 FTX entities in Chapter 11 bankruptcy protection in Delaware, seemingly included the sum demanded by the Bahamian provisional liquidators among the $15bn worth of claims whose validity he is disputing and contesting.

The amount sought by Brian Simms KC, the

Lennox Paton attorney and senior partner, and the PricewaterhouseCoopers (PwC) accounting duo of Kevin Cambridge and Peter Greaves, was the secondlargest claim submitted to Mr Ray’s team behind the Internal Revenue Service’s (IRS) $43.5bn demand.

The latter is “assumed to be subordinated”, according to Mr Ray, with the Bahamian provisional liquidation trio’s $9.15bn amounting to 14 percent of total claims submitted, according to a presentation the FTX US chief gave to creditors and clients of the former crypto exchange.

Tribune Business late last month revealed the

SEE PAGE FIVE

traditional dock pilings while adhering to policies set forth by DEPP and the Ministry of Works...... Land use on the island will not change. The island’s resort offerings will expand to include overwater bungalows and additional amenities. Concurrently, back-ofhouse operations will expand to meet added demand. Tourists and guests will continue to travel to Fowl Cay.”

Tribune Business understands that The Bahamas has been mulling policies and regulations to govern the construction and location of overwater structures for years. This newspaper has seen a draft for ‘national environmental guidelines on overwater structures’ that was prepared by the DEPP’s predecessor, the Bahamas Environment, Science and Technology Commission (BEST), more than a decade ago in 2012 with a subsequent revision made in 2017.

Explaining the rationale for such a policy, the BEST paper said: “In 2012, the developers for Leaf Cay approached the Bahamas Investment Authority (BIA) with a proposal to create second home overwater

SEE PAGE SIX

ATLANTIS VETERAN WINS OVER ‘UNFAIR’ DISMISSAL

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A 32-YEAR Atlantis veteran’s summary dismissal due to a misunderstanding over a drink-related tip was affirmed as “unfair” yesterday by the Court of Appeal, which rejected the mega resort’s challenge to her initial $15,480 damages award.

Sir Michael Barnett, the appeal court president, in a ruling backed by his two fellow judges, found that “no reasonable employer” could conclude that immediate dismissal of Winifred Toote, an employee with 30 years’ standing, was warranted given the circumstances.

Detailing the background to the dispute, the Court of

“separate fiefdom” within

The Bahamas, comes amid fevered speculation that a new multinational consortium is targeting the purchase of either Freeport’s quasi-governmental authority or some of its key assets.

Multiple sources, speaking on condition of anonymity, yesterday told this newspaper that Mediterranean Shipping Company (MSC) and Maersk, the world’s two largest container shipping companies, were partnering

with Italian shipbuilding giant, Fincantieri, to make an approach for the GBPA or its Port Group Ltd affiliate. The latter holds the majority of the two families profit-making assets, such as Freeport Harbour Company and Grand Bahama Development Company.

Several of these contacts suggested that the two shipping companies and their partner were likely to be more interested in acquiring Port Group Ltd’s half-share (50 percent) interest in

CABLE TARGETING ‘MONUMENTAL IMPROVEMENT’ VIA ALIV REFINANCE

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

CABLE Bahamas’ top executive yesterday asserted the group is poised for “monumental improvement” in profits if it can reach agreement with the Government on refinancing Aliv’s debt at lower interest costs.

Franklyn Butler, the BISX-listed communications provider’s chief executive, told Tribune Business that “the key” to its fiscal 2024 performance will be “getting the Government to agree what structure and contribution they want to make” to a mobile operator in which the latter the majority 51.75 percent equity interest.

Arguing that Aliv, which is presently paying preference share investors an interest coupon of 8-8.5 percent, “shouldn’t have to pay such a premium” for its financing, he described reaching consensus with Cable Bahamas’ fellow shareholder as “the number one priority” for the group in its current financial year.

Appeal verdict noted that Ms Toote, who was working as a waitress in Atlantis’ casino bar, was cited for gross misconduct on the morning of May 4, 2019, after a resort guest called Scott Burch alleged that she refused to provide him with a drink.

“Scott Burch stated that Winifred said she works on tips before he received his beverage. Even after the guest asked for the drink, she refused because he did not have any change to tip her. This will not be tolerated,” the Paradise Island resort wrote in its dismissal letter. Mr Burch, though, was never questioned by Atlantis subsidiary, the Island Hotel Company, or

business@tribunemedia.net TUESDAY, SEPTEMBER 12, 2023

nhartnell@tribunemedia.net • STRATEGIST: GOV’T HAS ‘NEGATED’ HAWKSBILL CREEK • FEVERED TALK OF MSC/MAERSK/FINCANTIERI TIE-UP • LICENSEE: GOV’TS ‘FAILED WITH EVERY ENTERPRISE’

Editor

SEE PAGE FOUR SEE PAGE FIVE

$6.11 $6.12

SEE PAGE NINE $6.05

$6.06

A RESPONSE TO THE ‘SAGA OF FREEPORT’

By ROBERT MILLARD robert.millard@ camstrategy.com

I WOULD imagine that most people who have had a serious interest in Freeport’s development over the past two decades would know who I am. I am a business strategist. My clients are mostly large law, consulting, accounting and other professional service firms. I lived in Freeport with my wife and two children from 2006 to 2010.

I was then, and have also since been, involved with quite a number of Grand Bahama projects with various organisations, all aimed at restoring and growing

Freeport and advancing the lives of Bahamians.

So, I read Terrance Gape’s document dated 10 September with great interest – but also disbelief.

Freeport is like a house that has been vandalised. The person who did the vandalising is now trying either to buy the house from its owners for little money (because it is damaged) or pushing those owners to sell it to somebody else (again, because it is damaged) while at the same time preventing them from fixing it. From the view of investors, almost every clause in the Hawksbill Creek Agreement (HCA) that

was designed to attract them into the Port area has, over decades, been negated by government measures that duplicate or frustrate responsibilities delegated by the treaty to the Grand Bahama Port Authority (GBPA). The result is unsurprising. Apart from licensee businesses that depend on things outside The Bahamas, such as the Freeport Container Port, the Grand Bahama Shipyard and Buckeye Bahamas (BORCO), it is difficult to find any that operate at anything close to their potential. If Freeport were allowed to function as intended by the Hawksbill Creek

REALTORS HAIL ‘RECORD BREAKING’ SALE ON PI

A BAHAMIAN realtor says it has achieved “a recordbreaking sale” for Paradise Island by finding a buyer for a 20,800 square foot Ocean Club property that was offered at $37.5m.

The La Ceiba property was sold for an undisclosed amount with John Christie, HG Christie’s president and managing broker, and agent Dylan Christie acting as the exclusive agents.

“This was a record-breaking sale as the highest price achieved on Paradise Island, and one of the top single-family home purchases in the country,” said John Christie.

“La Ceiba is a very special property, set on two lots on Cabbage Beach in the Ocean Club Estates. There is simply no other house like it.”

The 2.33-acre property features waterfalls, pools and 300 feet of beachfront. It has ten bedrooms, nine full bathrooms,

and includes an entertainment hub featuring cinemas, game rooms, manicured croquet/bocce ball green, infinity edge pool, lap pool and beach.

The 2,400 square foot main house incorporates recreation spaces, two kitchens, a gym, wine cellar, four-car garage and mechanical rooms. Two tennis courts and a children’s playground are adjacent to the property.

“Our real estate market remains strong, especially with international cash buyers,” Mr Christie added. “We are finding that as high net worth buyers scan the globe for a place to settle, The Bahamas is a shining star, with its tax neutral status, great location, only minutes from south Florida and a number of direct flights from London. The Bahamas is the place to be; not to mention we are a 50-year-old successful thriving real democracy.”

Agreement, Bahamians employed today as waiters and low-skilled workers would instead be entrepreneurs, professionals and expert technicians servicing the needs of a city of at least 250,000 people. Properties that were for sale when I lived in Freeport more than a decade ago would not still be languishing on realtor websites, even at heavily reduced prices, with no prospective buyers in sight. I could go on.

The only way that Freeport will thrive (or even just survive) is for the Government, GBPA, licensees and other key stakeholders to join forces and

TOGETHER develop solutions for the problems that prevent the city from being the most exciting investment destination in the region. Which it could be – of that I am certain. These would include: (a) Transparent and fair systems to approve investment and Immigration for the people that businesses need to compete in global markets; (b) Updated regulations governing the functions, responsibilities and prerogatives of the GBPA and (c) A proper sea wall or dyke along the north shore at least, so the horror of Hurricane Dorian never happens again and the whole city is protected from rising sea levels caused

by global warming. To me, these three are the most important. There are others. Key to all of them is to get rid of the obstacles that prevent the Hawksbill Creek Agreement from working properly. Will narratives EVER shift, though, from who is to blame for Freeport’s travails to what must be done to fix them? Will different stakeholders EVER work together to solve problems rather than taking pot shots at each other to advance what they think are their own best interests? Until that time comes, Freeport’s travails will continue. So I hope that time comes soon.

MINISTER UNVEILS GOVT’S GB ‘INNOVATION’ VISION

A CABINET minister says the Government’s vision for Grand Bahama involves the island becoming a hub for technological innovation as well as a maritime and logistics centre.

Ginger Moxey, minister for Grand Bahama, speaking at the opening of the Level Up entrepreneurial training seminar held at the Grand Lucayan resort on Saturday, said: “As the minister for Grand Bahama, I am also the Cabinet chair for Innovate 242, developed to propel The Bahamas as the centre of innovation for the Caribbean. “Innovate 242 will foster innovation, attract tech entrepreneurs and provide a platform for collaboration on tech-centred solutions for various problems. This hub will be a nucleus for creative minds to converge and revolutionise industries.”

Mrs Moxey said Innovate 242 is based on five pillars, which include the ‘digital nomad’ programmer that allows global technology workers to operate remotely from The Bahamas. There will also be technology campuses on various islands in The Bahamas, such as the ‘we work’ model including villas, hotels, restaurants and entertainment.

Grand Bahama will be specifically designed to accommodate international businesses, and start-up incubators will be located on three islands, namely New Providence, Exuma

and Grand Bahama. The Government also has plans for a Bahamas technology fund, and is committed to seed funding to support entrepreneurs in collaboration with technology hubs from around the world.

“We believe that GB is ideally situated to pilot many of the innovative tech solutions in the area of resiliency and sustainability such as tech tourism, climate change, adaptation, mitigation, renewable energy, environment and master plan development,” Mrs Moxey added.

“We’ve already signed an MOU (memorandum of understanding) with HUB 350 in Ottawa, Canada. We look forward in the next few weeks to signing many more agreements with major international tech hubs. A truly exciting time for The Bahamas.”

Saturday’s seminar, which attracted multiple Grand Bahama small business

Responsible for supervising daily parking lot operation.

Essential Primary Responsibilities:

• Confdent in excel (this is a must).

• Profcient in computer literacy.

owners, was hosted by Access Accelerator, a programme within the Small Business Development Centre (SBDC) now in its fifth year. The programme not only helps potential entrepreneurs incubate, birth and grow their business, but has also provided access to funding for more than 2,000 clients throughout The Bahamas.

Level Up is a quarterly training workshop for those with start-up businesses and small business owners throughout various industries. “For years Access Accelerator has pioneered new and effective ways to help fuel the entrepreneurial sector throughout our country,” said Mrs Moxey. “Its workshop builds on SBDC’s unique purpose and shares a similar mandate with that of my ministry.

“It is my hope that many of you will utilise what you

SEE PAGE FOUR

• Must have own laptop. Must be able to communicate professionally + clearly through email.

• Ability to create work schedules for employees. Previous customer relations training.

• Parking lot operations, including revenue collection and parking ticket procedures.

• Ability to smile, acknowledge, greet and extend a warm welcome to each and every customer.

• Ability to enhance the well being of each customer to ensure a positive, memorable parking experience.

• Ability to provide high levels of customer service and demands the same from all parking lot attendants.

• Ability to maintain high standard of cleanliness of work area, personal appearance, organization, etc. and demand the same from associates. Ability to use Microsof word to create and edit parking lot licenses.

Essential Job Functions: Walk the location to observe the physical condition and appearance of the location, the volume of business and the performance of the attendants.

• Monitor the performance of all employees and provide feedback as appropriate.

• Instruct, train, supervise and evaluate subordinate personnel and also on company procedures and policies.

• Implement and enforce customer service standards.

• Aid in the completion of employee reviews.

• Lead in the auditing of cashier reports and daily summaries.

• Learn Accounting procedures. Provide information to and respond to inquiries from the public.

• Inspect parking lots and ensure the proper correction of problems relating to their physical conditions

• Put in place maintenance contracts on the parking equipment. Assist the Building Manager in reviewing the parking lot operations and oversee the efcient utilization of staf and equipment.

• Responsible for management of parking facility in the absence of the Building Manager.

• Prepare periodic reports regarding parking lot operations and revenues along with Building Manager.

• Perform any other reasonable tasks and duties as assigned by management. Knowledge of trouble shoot parking machines if there is an error.

DAYS: Wednesday – Sunday | HOURS: 10am – 6pm

Starting Salary Range $20,800.00 - $24,000.00 per annum

PAGE 2, Tuesday, September 12, 2023 THE TRIBUNE

MINISTER of Grand Bahama Ginger Moxey greeting seminar participants.

Photo: Andrew Miller/BIS

Email your resume & cover letter to:

JOB OPPORTUNITY

bahamasparkingsupervisor@gmail.com

Parking Lot Supervisor

New taxi plates placed ‘on hold’

THE Government’s decision to place new applications for taxi, livery and self-drive plates “on hold” was yesterday hailed by a union president for bringing order to a situation that was “never going to end”.

Wesley Ferguson, the Bahamas Taxicab Union’s (BTCU) president, backed the Road Traffic Department’s (RTD) move after it warned that franchise plates for New Providence are now “fully subscribed”. Explaining that the decision is partly to “avoid over-saturation” in the public transport sector, with too many drivers chasing too few customers, the Department added that the halt to new issuance will also enable it to assess

existing plates. This, it added, will enable it to identify dormant or inactive plates plus target “the unlawful and unfair practice of franchise leasing”. This involves franchise holders renting plates out to drivers, with the latter often paying a significant proportion of their earnings to the owners, thereby significantly reducing their take home pay.

Lanecia Darville, the Road Traffic Authority chair, wrote in a notice that a key element in efforts to modernise public transportation “is to create opportunities for small business ownership in the tourism and hospitality industry, the success of which is largely dependent on the discontinuation of the unlawful and unfair practice of franchise leasing”.

Noting that the

Department has already begun to tackle this through issuing plates directly to drivers who “for decades operated under unlawful ‘lease arrangements’”, Ms Darville added: “The Road Traffic Department wishes to advise members of the public that the number of available franchises (taxi, livery, self-drive and other public service plates have been fully subscribed for New Providence.

“New franchises may be granted when plates are surrendered or franchises revoked. New applications will be placed on hold to enable the Road Traffic Department to complete an assessment of all franchise plates. As a part of this assessment, the Board reserves the right to require franchise holders to show cause why licence plates should not be surrendered

to the Department of Road Traffic immediately.”

Calling for all inactive and dormant plates to be surrendered, in compliance with the Road Traffic Act, Ms Darville continued: “The decision to place new applications on hold is to allow for the full completion of the assessment process and to avoid oversaturation in the public transportation industry.”

New applications will only be processed as plates become available, and franchise holders will have 90 days to comply with these requirements or otherwise be forced to re-apply. Mr Ferguson, though, told Tribune Business that the taxi industry is already over-saturated and many drivers take home little to no money on consecutive days.

“Everybody who is out of

the industry, and everybody who thinks they should get one, will be continuously agitating and continuously applying. That was never going to end. They should have put in a moratorium months ago,” Mr Ferguson argued.

“We were crying foul for a while now that there were too many taxi plates on the road. It is now September and taxi drivers are feeling the brunt of the saturation because sometimes there are no jobs. In previous times you could have gotten one or two jobs, but in most days some drivers are getting none.”

Mr Ferguson previously accused the Road Traffic Department of causing this problem by issuing more than 500 plates over the past two years, compared to the 200 requested by the union. “The chickens now

have come home to roost,” he said.

“It’s too late to make a big deal about it because what is done is done, and we just have to now work around it and see how much tourists we can get in here so everyone can have something to take home until the season opens again. We just have to weather the storm until then.”

Mr Ferguson said drivers are waiting for their 10 percent fare increase to be formally introduced by the Ministry of Transport “within the next couple of weeks”. He added: “Right now we had our cake and now we have to set the plate down. The 10 percent is nothing much, but it is just to reinstate the respect for the BTCU because we felt that we were done an injustice with the saturation of the taxi plates.”

BAHAMAS JOINS TRIBUNAL CASE OVER CLIMATE CHANGE

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Bahamas has joined with other small island states from the Caribbean and the Pacific to launch a landmark case before the International Tribunal of the Law of the Sea (ITLOS) to seek protection of the world’s oceans against climate change and rising temperatures.

The countries are requesting that the ILOTS determine if carbon dioxide emissions absorbed by the oceans can be considered pollutions and what obligations countries that are large carbon emitters have in its prevention.

A request for advisory opinion submitted to ILOTS by the commission of small island states requested that the UN

maritime court determine the obligations for state parties under the United Nations Convention of Law of the Sea (UNCLOS) “to prevent, reduce and control pollution of the marine environment in relation to the deleterious effects that result or are likely to result from climate change, including through ocean warming and sea level rise, and ocean acidification, which are caused by anthropogenic greenhouse gas emissions into the atmosphere?”

The effort also seeks to protect the marine environment.

ILOTS agreed to a full hearing of the case with the first session held yesterday in Hamburg, Germany.

Eric Carey, former executive director of the Bahamas National Trust said when the UN determined many maritime laws

climate change did not exist and that the laws should be amended to include these important developments.

He said: “Some of these things go back centuries, when they were dividing up the oceans between, two or three countries, and they were only thinking about access to resources. As time went on the discussion started to get more complicated, they have to start thinking about things also protecting the oceans.

“And that’s really important because the language that would have gone into the convention back in the 80s, people didn’t really think about greenhouse emissions. I mean, it wasn’t a thing. Climate change wasn’t a thing.”

He said the effects of climate change have ‘profound and significant impacts’ on small island states and these

BAHAMAS TO EXPLOIT 34% GROWTH IN GEORGIA TOURISTS

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE deputy prime minister is aiming to exploit the 34 percent year-overyear growth in visitors from Georgia to promote The Bahamas as a tourism and film destination during his ministry’s upcoming Atlanta promotional mission.

Chester Cooper, also minister of tourism, investments and aviation, said: “The Georgia market is up maybe 34 percent ahead of last year. So it’s growing. We want to really harness the partnerships that we’ve been building in this Atlanta area and Georgia, generally, and a part of this mission will be to renew all of those acquaintances.

“We will meet with travel agents and specialists, we will meet with companies that might be interested in doing events and conventions. We are looking to see how we can build more of a connection with the film and television industry.”

Mr Cooper said the ministry is developing a Memorandum of Understanding (MoU) with the Atlanta Film Authority to promote The Bahamas as a venue for filming movies and TV shows. It is working with the former mayor of Atlanta, Kasim Reed, to establish connections and forge new opportunities for Bahamian creative artists.

He said: “We’ve been working very closely with the Atlanta Film Authority, and we are going to be working to develop a Memorandum of Understanding so that they can encourage their partners to work in The Bahamas, whether it’s just doing a beach scene or whether it is doing an entire episode.

“We had occasion already to work with a group out of Atlanta to produce one of their shows. This is going to be an opportunity for us to continue in this space. We’re working very closely with former mayor Kasim Reed, who has built the Atlanta film industry when he was the mayor, and this has grown really exponentially.

“We’re going to draw on

his contacts, draw on his experiences, and see what opportunities we might create for the creative industries and the creative individuals in this space in The Bahamas.”

Mr Cooper said he is “very positive” about The Bahamas’ prospects in the film industry. On a previous visit, he and his team toured Tyler Perry’s studios and encountered a young Bahamian employee who is learning the industry and training others.

He added: “When we were there last time, we visited the Tyler Perry studios. We met a Bahamian there, a young man by the name of Monroe, who was working there. This was refreshing to see.

“He is learning the industry and he is training others, and really it’s an eye opener for many possibilities that exist for Bahamians in Atlanta but, more importantly, for persons interested in this business in The Bahamas. We’re very positive about the prospects of what we have been seeing overall in this space.”

Mr Cooper said Atlanta is the last US stop on the ‘Bringing The Bahamas to you’ tour. “We’re going to Atlant. This is our 10th or 11th city in our US tour. These missions have been really important to really get the word out that we’re open for business. We are creating new partnerships. This is going to be the last major mission we’re doing in the US market,” he added.

“We are going to do other promotions. We’re going to do other launches, but we have made these big and grand, and they have been an opportunity to showcase our art, our culture, our music, our food our libations. We have infused into all of them a cultural component, mainly Junkanoo, or one of our other cultural artists.

“They’ve gone across extremely well. We believe that it’s a part of the reason for much of the phenomenal success that we’re seeing in terms of tourist arrivals, and we are now going to move to other markets. We’re looking at London. This is something that

countries should advocate for their protection. He said: “UN law of the sea speaks not only to how you manage and divide the marine resources from the point of view of maximum economies, but it also talks about how countries are obligated to protect the environment.

“So now, our countries that are advancing this position to this tribunal are making the case that this new phenom, you know, greenhouse gas emissions and climate change. These are having significant and profound impacts on our

way of life and should be considered.”

Mr Carey said although the ITLOS decision is not legally binding, it can be used by the government to advocate for funds that can be put towards environmental and disaster relief and protection. He added that the case is a “powerful advocacy” as legislation must be updated to include current realities.

He said: “The decision isn’t legally binding, its not a legal position, but it is an it’s an international expert’s opinion, and our countries can use that experts opinion

during negations at COP or when they are negotiating for more private financing for environment protection, disaster relief and protection and carbon credits. So, while not a legal judgment, is still a very powerful leveraging tool that our countries could use it our advocacy “And as society progresses and things change, they have to update the legislation. So what our countries are arguing for is that the new realities be included. I think it’s intriguing and it has a lot of merit. I think it’s a very powerful advocacy and I hope it succeeds.”

we’re looking to do, maybe in November around the time of the World Travel Market.”

Visitors can book twice weekly flights to Nassau, and Saturday service to Exuma, on Delta Airlines.

Beginning on November 5, the carrier will increase service to Nassau, Exuma, Abaco and Eleuthera, ahead of the holiday season.

Mr Cooper said the connections between Atlanta and The Bahamas are “profound” with regular, direct flights on Frontier Airlines and Delta and increased airlift underway.

He added: “Atlanta is an important market for us, as is the entirety of Georgia. It’s rich in culture, and the connections are profound between Atlanta and The Bahamas. We have direct flights. Delta is increasing their airlift, so this is an overall generally good market for us.” By

THE TRIBUNE Tuesday, September 12, 2023, PAGE 3

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

CABLE TARGETING ‘MONUMENTAL IMPROVEMENT’ VIA ALIV REFINANCE

And, speaking after Cable Bahamas incurred a $16.008m fourth quarter loss that wiped out profits generated during the first nine months of the year to end-June 2023, Mr Butler disclosed that among “certain one-off costs” incurred during that period was a sum set aside to pay tax liabilities associated with a VAT dispute with the Department of Inland Revenue (DIR).

Declining to provide details, given that attorneys are dealing with the tax authorities on Cable Bahamas’ behalf to resolve the dispute, he nevertheless pointed out that the company’s ordinary shareholders had enjoyed a near-$5m profit for the 12 months to end-June despite the overall $8.716m net loss.

The latter was incurred because accounting rules require that Cable Bahamas consolidate the Government’s Aliv losses

of $13.649m into the group’s overall results, which produced the net comprehensive loss of $8.716m - itself a 22.6 percent decline on the prior year’s $11.256m worth of ‘red ink’.

Acknowledging that accounting write-downs, namely depreciation and amortisation, relating to the value of Aliv’s mobile network continue to impact Cable Bahamas’ results, Mr Butler explained that refinancing its affiliate’s debt will produce immediate returns for shareholders by helping to lower the near-$20m collective dividends paid on the group’s total preference share debt in the year to end-June 2023.

“Amortisation and depreciation are obviously very significant,” Mr Butler told this newspaper, “as well as interest payments as it relates to some of the debt in Aliv, which ought to be refinanced at some point. We’re trying to work through that with the shareholders of Aliv. Once we do

that, it will change things significantly. “I’m unable to give any real, broad details. We are working with the shareholders to see what would be possible. Once there is clarity on that, certainly around the annual general meeting (AGM) time, we will give clarity around what that refinancing should look like. We’re trying to get the Government to agree on what structure and contribution they want to make to the company.”

The Government holds a 51.75 percent majority stake in Aliv, with Cable Bahamas owning the 48.25 percent balance and enjoying both Board and management control. Mr Butler gave no indication of how much Aliv debt will likely be refinanced, but added: “We’re paying 8 percent to 8.5 percent on Aliv debt. Based on the business performance, we believe we should not have to pay such a premium on our debt associated with Aliv at this time.

“The key is going to be: Can we get the Government to restructure the Aliv balance sheet? That will be the first thing; the number one priority this year. The Alive fibre roll-out to improve the quality and dependability of the fixed network, and continuing to grow Aliv mobile.

“Those are our core areas going into 2024. If we can do that, we think we will end the year fairly positive. That’s what out focus is. The good news is it’s the Government, but only the Government. If we can get the Government to agree, that has a monumental impact on our business.”

Cable Bahamas saw its net comprehensive loss for the three months to end-June 2023 more than double compared to the prior year, rising by 166 percent to $16.008m as opposed to $6.026m. “We had certain one-off costs,” Mr Butler explained. “We had an accrual of tax liabilities and stuff that needed to be cleaned up with the VAT

Department. We accounted for it. “We don’t believe it’s due. It’s in dispute with the Department of Inland Revenue. We’ll see where it ends up. I don’t want to say too much at this stage. We have some lawyers dealing with it.” The sum involved, and what it relates to, were not disclosed.

Cable Bahamas fared better on its 2023 operating performance, which saw operating income increase by almost $7m year-over-year, growing by 52 percent from $13.406m in 2022 to $20.383m for the 12 months to end-June. This was driven by revenue growth outpacing that of expenses, with the top-line rising by 5.7 percent year-over-year from $217.981m to $230.419m. Operating expenses, by contrast, rose by less than $5m year-over-year to $147.288m while depreciation and amortisation were also relatively flat, expanding by just over $1m to $62.748m. “We continue to grow revenue,” Mr Butler said. “We want to continue to find opportunities to grow and, of course, focus on service quality. That is continuing to make sure we invest in the mobile network, and making sure we continue to invest in Aliv fibre services.”

Turning to the latter, which is Cable Bahamas’ fibre-to-the-home infrastructure, he added:

“We’ve had some challenges but we are back on track. We are at 23,000, maybe 25,000, homes passed right now. We’ll be going into those areas, connecting customers. We believe that by the end of this financial year we will have all of New Providence done.”

And, while the Cable Bahamas group posted a net comprehensive loss for the year to end-June, Mr Butler said he was encouraged by the near$5m profit that accrued to ordinary shareholders.

“We believe that, even though it may seem like $5m is a small profit, we believe we are well-positioned if we restructure the Aliv debt for a significant improvement in our net income from a group perspective.

“Internet is holding its own and continues to grow slowly, but it’s growing. Mobile is where we have most of our growth. On TV we continue to see some challenges with people cutting back on service, but that was still ahead of budget even for last year. The biggest challenge is the margin we’re paying for signal fees.”

MINISTER UNVEILS GOVT’S GB ‘INNOVATION’ VISION

from page two

will learn here today to propel your vision, your ideas and your businesses to another level. To the organisers and moderator, I applaud you all for providing this creative opportunity for entrepreneurs throughout the entire island of Grand Bahama to attain valuable information.”

She also spoke about her ministry’s Collab Unit, which was created to partner with non-profits, businesses, other government agencies and the community in meeting the basic needs of residents and for the growth and development of Grand Bahama .

“Through Collab,” she explained, “Beautiful Grand Bahama was formed. It employs over 350 individuals who are now able to provide for themselves, put food on their tables and support small businesses such as yours. I hope you

see the correlation. Our collaborations are intended to put our people in a better position, in order to spur economic growth from the ground up. We help our brothers and sisters and they in turn help you. This is what true collaboration is all about.

“Collab will also address some of the legacy issues that have been facing Grand Bahama for a long time. For instance, we would like to see the road that was closed open back up, we want the Bazaar situation dealt with, we want the Princess property dealt with, we want the ghetto area fixed up.

“We want these things dealt with and we’ve been working real hard over the past 24 months to make it happen. So, I’m very excited about the future. The future for our beautiful Grand Bahama is bright. But let’s do it together, as we collab.

Partanna Presents: Building a Sustainable Future for The Bahamas

Climate technology company Partanna Bahamas is preparing to launch its frst home built using its carbon negative building materials.

Partanna’s concrete removes carbon dioxide from the atmosphere and gets stronger when exposed to seawater, making it an ideal solution for communities in The Bahamas exposed to the effects of climate change.

On Friday 15th September it will showcase its frst home and share more about its plans to power carbon negative housing in The Bahamas.

Join us at our Open Town Hall Meeting in Nassau.

Date: Friday 15th September

Time: 2pm

Location: Courtyard by Marriott Nassau Downtown | Junkanoo Beach Blue Marlin Ballroom

Why Attend?

• Learn more: Hear about Partanna’s innovative technology that produces carbon-negative concrete that are resilient to the challenges of climate change.

• Share your feedback: Your voice matters! We want to hear your thoughts on our new home and plans to deliver carbon-negative housing in The Bahamas.

Be a part of history and contribute to a sustainable future for The Bahamas. Don’t miss this opportunity to shape the course of our nation’s progress. Together, we can build a brighter, greener tomorrow.

For more information, visit our website: www.partanna.com or contact us at info@partanna.com

PAGE 4, Tuesday, September 12, 2023 THE TRIBUNE

from page one

GOV’T LIKE ‘THE VANDAL NOW TRYING TO BUY GBPA HOUSE’

Freeport Harbour Company given the nature of their businesses. One even suggested that Fincantieri, which mulled a potential offer to acquire the Grand Bahama Shipyard almost two decades ago, may be interested in developing a new ship building facility in Grand Bahama.

“I’ve heard that left, right and centre,” one contact said of such a joint venture.

“My personal opinion on that is I pray to God it is true. You have the two biggest cargo shippers in the world, and Fincantieri outside of China is the biggest ship builder in the world. It jives with MSC expanding their cruise fleet here. Everybody is making noise about this, but if this is the case are we going to settle for the status quo or are we not.”

However, one wellplaced GBPA source, speaking on condition of anonymity, yesterday cautioned that any bid for the GBPA, or assets held by its Port Group Ltd affiliate, has multiple obstacles and distance to overcome. “The Government doesn’t own the assets, and the families have not been approached, so I wouldn’t take it too seriously,” they advised.

Efforts to obtain comment from the Government prior to press time last night proved unsuccessful. Prime Minister Philip Davis KC and his administration have yet to disclose the strategy, or road map, through which they will achieve the GBPA and Hawksbill Creek Agreement transformation they are seeking, but one route would involve finding private investors with the capital, vision and expertise to both acquire the GBPA,

Port Group and take Freeport forward. The three companies mentioned would fit that criteria. MSC brings an added advantage given its existing worldwide commercial relationship with Hutchison Whampoa, which holds the other half-share in Freeport Harbour Company and Grand Bahama Development Company, along with management control. While private investors acquire Port Group Ltd’s assets, the Government could then be free to take over the GBPA’s quasi-governmental and regulatory functions.

Meanwhile, GBPA executives last week revealed to some of their 3,000-strong business licensees that they are negotiating with the Government over the extension of Freeport’s real property tax, capital gains and income tax-related exemptions.

Kirk Antoni, the Cafferata & Company attorney and partner, who is a prominent member of the 25-30 strong licensee body that previously issued a public letter to both the Prime Minister and GBPA owners over their impasse, yesterday told Tribune Business that continued uncertainty over the status of Freeport’s investment incentives regime is “a big concern” for all the city’s businesses. The Grand Bahama (Port Area) Investment Incentives Act 2016 mandated that all GBPA licenseesbesides the Port Authority itself and Hutchison Whampoa - apply to Nassau for the renewal of real property tax, capital gains and income tax-related exemptions. The Act has never been implemented but the Minnis administration, which promised to repeal it, never did, thereby creating concern as to whether - and

FTX BAHAMAS $9BN CLAIM IS ‘REDUNDANT’

from page one

extent of the Bahamian provisional liquidators’ claim against the FTX entities currently in Chapter 11 bankruptcy protection. Besides seeking to “clawback” more than $7.7bn in transfers made from FTX Digital Markets, the crypto exchange’s local subsidiary, the trio are also asserting a further $1.4bn is due to the Bahamian liquidation estate. They are demanding $1.117bn in “indemnification” based on the articles of incorporation for FTX Trading, the Chapter 11 parent, which purportedly require it to compensate “agents” such as the Bahamian subsidiary for any loss and damages.

Recovery of the $256mplus that financed FTX’s high-end residential real estate and office purchases is also included in the $9.15bn total, along with $47.628m worth of “intercompany” claims against other FTX entities and $16.226m to cover “corporate expenses”. Most of FTX Digital Markets’ “inter-company” claim, some $45.948m, is against Alameda Research, the private trading vehicle of embattled FTX founder Sam Bankman-Fried, which played a central role in the collapse.

Mr Ray, in previously responding to the Bahamian provisional liquidators’ recovery bid, asserted that the claims are “far-fetched” and based on a “fiction” because the international exchange platform, together with its millions of customers and billions in assets, was never transferred to FTX Digital Markets, and this nation’s jurisdiction, before the crypto exchange imploded in early November 2022.

The Bahamian provisional liquidation trio holds the exact opposite position, and this is at the centre of their jurisdictional battle for control of FTX’s fatewhich customers and assets belong to which estate, FTX Digital Markets and The Bahamas, or Mr Ray’s Chapter 11 entities. Once

for how long - these incentives will continue.

Referring to the licensee group’s meeting with GBPA executives last Wednesday, Mr Antoni said: “They did advise they are in discussions with the Government on extending the tax concessions and they’re speaking to the Ministry of Grand Bahama and Ginger Moxey, minister for Grand Bahama....

“That’s absolutely the big concern. It’s just the level of uncertainty right now as to whether the Government will decide to impose Business Licence fees on top of the Port Authority fees we now pay, whether we will pay property taxes on top of the service charges we now pay, and if they will take further steps on capital gains tax and corporate income tax. That’s the level of uncertainty we’re facing

right now and are trying to get some response on.”

Fred Mitchell, minister of foreign affairs, who has been the most outspoken Cabinet minister in support of Mr Davis’ GBPA pressure strategy, last week warned the Port’s licensees not to become involved in the fight. He suggested they were also in danger of being ‘used’ by the GBPA and its two shareholding families to strengthen their position - something Mr Antoni vehemently denied yesterday.

Pointing out that two members of the licensee group had responded to Mr Mitchell’s accusations already, he asserted: “We are not being used. We hold no booking for the Government or the Port Authority. We are on the side of the Hawksbill Creek Agreement, and that’s the only

thing we’re interested in right now. “Quite frankly, personally I’m not in favour of the Government taking over Freeport, unlike Terry Gape. They’ve been a failure at every enterprise they’ve had since Independence, and they change every five years. How’s that going to work with the GBPA?

They’ve failed at everything. Look at the Hotel Corporation, Bahamasair and the Water & Sewerage Corporation. It’s all been failures; government-run failures.

“The bureaucracy right now is just stifling us commercially and we’re not moving forward. Every day there’s a new form to fill out. What I want to see is a world-class management company come into Freeport and take over the city. That’s in the best interests

of Freeport. Find someone to come in, buy some or all the ownership of the families, and grow the economy.”

Mr Antoni said last week’s meeting between the GBPA and licensees “went very well”, with executives both “guarded” and “candid” in their responses. “At least they met with us and answered our questions,” he added. “They gave us two hours of their time. They shied away from some of the questions, and others they answered very directly.

“They kind of gave us a potential view of their masterplan for Freeport. We’re continuing on. We’re going to try and educate the licensees tonight [last night] on the Hawksbill Creek Agreement, and keep them engaged and informed, and try and nudge both parties

that is worked out, both will then have to determine which assets belonged to the crypto exchange, and which are client assets, so that the process of returning funds to the latter can begin.

Mr Ray, meanwhile, yesterday informed creditors and clients that FTX acquired some 38 Bahamian properties, which presently have a $222m “book value” and have been valued or appraised at a collective $199m. “FTX Bahamas properties [were] appraised by the FTX Digital Markets joint provisional liquidators, via PwC, at a range of $185m to $214m,” the FTX US chief reported.

These include 15 properties, valued at a combined $151m according to book worth, in the high-end Albany development in south-west New Providence. A further six properties, estimated to be worth a combined $25m, are based at western New Providence’s Veridian Corporate Centre, while seven units at Goldwynn and five at One Cable Beach were appraised at a total $7m and $5m, respectively. Another five properties, worth $34m, are also on FTX’s books.

Mr Ray also revealed that negotiations between his team and the Bahamian provisional liquidators will take place this Friday as both sides bid to end their long-running conflict and work out how they can best co-operate in the interests of clients and creditors. The talks, though, will take place without appointed arbitrator, retired judge Judith Fitzgerald, being present. She will be briefed on the outcome this coming Monday.

Both sides are then due to exchange proposals on September 22 and 29, respectively, with “inperson mediation” before justice Fitzgerald taking place from October 2-3 in New York if required.

To advertise in The Tribune, contact 502-2394

THE TRIBUNE Tuesday, September 12, 2023, PAGE 5

from page one

Sandals expansion awaits ‘overwater’ policy reforms

structures. As the initial proposal targeted the second home market, only recently have the proposals been geared toward the tourism market.

“Since 2014, the BEST Commission through The BIA has received numerous applications for the construction and operation of overwater structures - specifically, overwater cabanas and villas. These structures have been proposed to be located in coastal areas such as the offshore cays. Proponents have repeatedly expressed the desire for developments of this nature to appeal to the high end, high income tourist simultaneously offering the exclusivity of an overwater villa/cabana.

“In response to these proposals, the BEST

Commission has summarily not recommended approval or consideration of these proposed overwater structures due to concerns with addressing issues of waste (solid and liquid) generation and disposal; construction in sensitive areas leading to destruction of habitat and sedimentation; potential hazards to navigation; potential hazards to marine life; impacts to the aesthetic value of the coastline; access/ removal of the seafront and seabed to the general public; potential for expanding the property greater than the actual size; safety; placement of structures in public beaches; the placement of permanent structures (concrete) in areas vulnerable to natural disasters; and endorsing developments without any due consideration to effects of climate change.” However, acknowledging

NOTICE

NOTICE is hereby given that

MICK ROMAIN ARCHER of P.O. Box N1213 Stapleton Gardens, Auster Lane, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that ORILIO SAINT FLEUR of East Street South, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 12th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

the need to balance eco-

nomic and environmental interests, the paper added: “The BEST Commission has recognised that the tourism industry is a pillar of The Bahamian economy and the ability to offer the exclusivity of an overwater structure may be an asset to certain developments.

“However, the BEST Commission also recognises that developments of this nature should be conducted in a prudent and regulated manner, and has embarked on the development of guidelines for the construction and operation of overwater structures.

“These guidelines are intended to assist the BEST Commission, other permitting agencies and the proponents in determining where, how and what type of structure can be allowed throughout the country.

They are also expected to reflect and be consistent with the existing regulations and legislations of relevant government agencies; best practices and standards for the activity; consideration of communities, while still being economically viable for the proponent.”

One source familiar with the overwater regulation situation, and speaking on condition of anonymity, told this newspaper: “Still no decision despite 27 years of promises. I’m told that there is draft legislation, but there doesn’t seem to be the political will to undertake it.

“We’re missing a large segment of the tourism market. And if you look at the number of over-water structures that have already been built without permitting, there’s quite a number out there. Look at Harbour Island. The street that faces the harbour, there

NOTICE

NOTICE is hereby given that PLACIDE LOREUS of Flamingo Gardens, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that

CAVIN ALBERT NEITA of P. O. Box SS-6067, West Winds Estates, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 12th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

must be a dozen of those conch

shacks over the water. Potter’s Cay used to have a few.

“Those overwater structures have been approved for Royal Caribbean at Coco Cay, built over the water on the stipulation they are nonhabitable. If we’ve gone that far, then the next step must be to get legislation drafted and make them habitable. It’s not for everywhere, but there are certainly a lot of locations in The Bahamas where it could work. Fowl Cay is definitely one place.”

Tribune Business research also located on the Internet a June 2012 paper by Bahamian environmental engineering firm, Islands by Design, that was submitted to BEST in June 2012 advising on environmental considerations for overwater bungalows.

“Perhaps the best indication of impacts stemming from overwater bungalows is to draw on a case study of the Maldives. The Maldives is a nation of islands with over 1,100 small low lying islands congregated in 26 atolls in the Indian Ocean, not dissimilar

to The Bahamas with over 700 islands and cays spread across 100,000 square miles of the Atlantic Ocean,” the report said.

“The Maldivan government established a policy of resort islands; islands that cater only to foreign tourists to guarantee complete privacy with comprehensive facilities for accommodation, food, recreation and leisure. Regulations state that the built environment should utilise no more than 20 percent of the total land area where water bungalows are allowed only to enhance the appeal of the resort and not as an alternative to lack of space on the island.

“It further requires that for every room built on the lagoon equivalent spaces should be left aside on the island..... While it is not likely that The Bahamas will embrace resort island development with such vigor, the Maldives reinforces the importance of overwater bungalow placement and utility planning with operational management.”

NOTICE

NOTICE is hereby given that

NOELZINA ST FLEUR of East Street South, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 12th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that SERGE VALENTINO CAREY JR, of P.O Box N1983, Palm Beach Street, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 12th day of September 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that AMRIK MATHEW BOODOO, of #3 Pine Street, Pinewood Gardens, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that JOHNSON MOISE, of P.O. Box N10326 #36 Twynam Heights, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that ONIECIA SHANTEL SHERWOOD, of Soldier Road, Windsors Place, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

PAGE 6, Tuesday, September 12, 2023 THE TRIBUNE

from page one

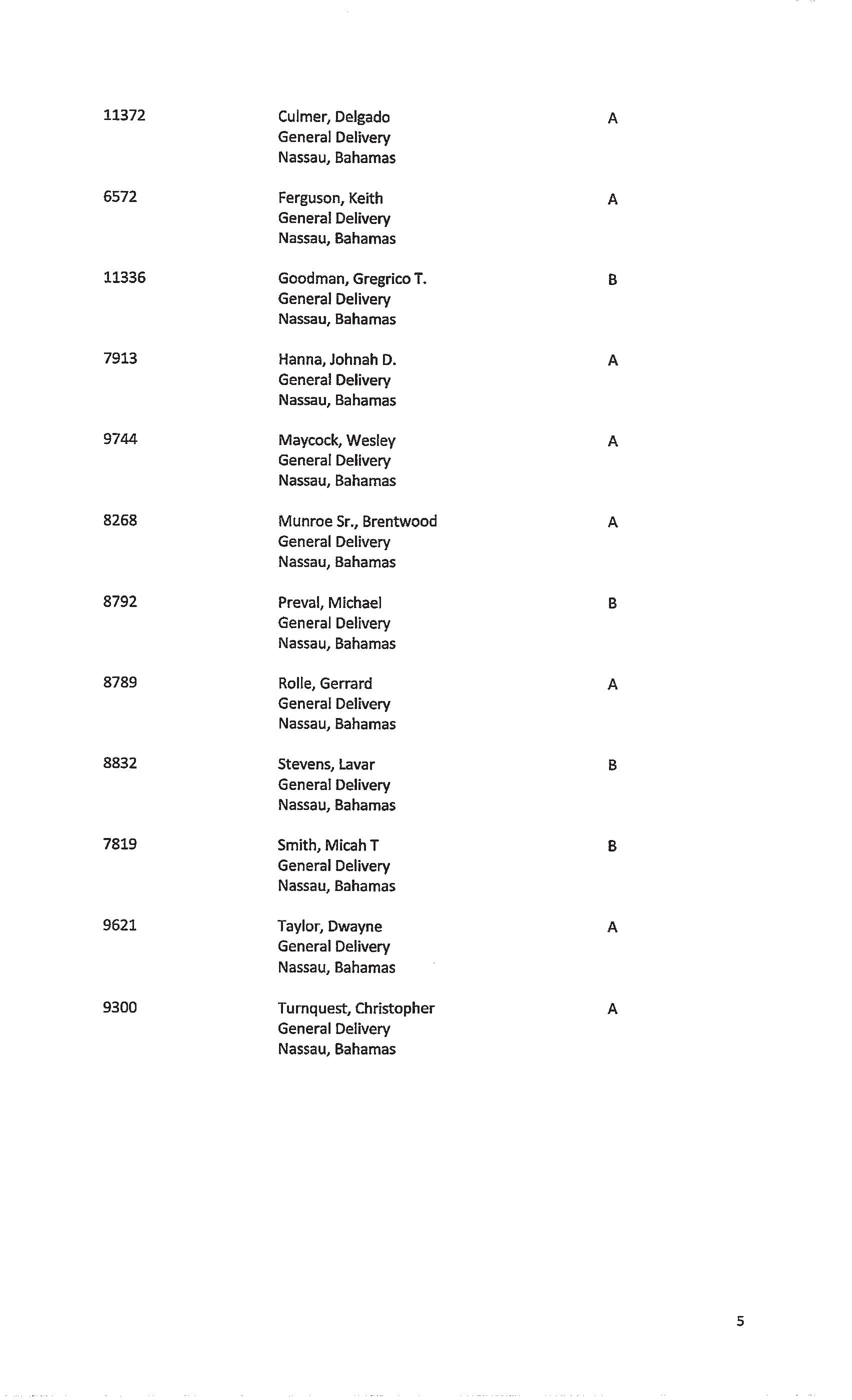

MONDAY, 11 SEPTEMBER 2023 CLOSE CHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2674.700.260.0129.641.12 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$ P/E YIELD 7.004.75 AML Foods Limited AML 5.00 5.000.00 0.2390.170 20.93.40% 43.9540.06 APD Limited APD 41.19 41.190.00 0.9321.260 44.23.06% 2.762.55Benchmark BBL 2.76 2.760.00 0.0000.020 N/M0.72% 2.702.15Bahamas First Holdings Limited BFH 2.15 2.150.00 0.1400.080 15.43.72% 5.742.51Bank of Bahamas BOB 5.30 5.300.00 0.0700.000 N/M0.00% 7.006.30Bahamas Property Fund BPF 7.00 7.000.00 1.7600.000 N/M0.00% 10.618.69Bahamas Waste BWL 9.65 9.650.00 0.3690.260 26.22.69% 4.703.80Cable Bahamas CAB 4.24 4.240.00 -0.4380.000 -9.7 0.00% 12.2110.20Commonwealth Brewery CBB 11.01 11.010.00 3000.1400.000 78.60.00% 4.303.10Commonwealth Bank CBL 4.28 4.280.00 0.1840.120 23.32.80% 10.008.50Colina Holdings CHL 10.00 10.000.00 0.4490.220 22.32.20% 16.0010.65CIBC FirstCaribbean Bank CIB 13.30 13.300.00 0.7220.720 18.45.41% 4.302.74Consolidated Water BDRs CWCB 5.88 6.060.18 0.1020.434 59.47.16% 10.6010.00Doctor's Hospital DHS 10.60 10.600.00 0.4670.060 22.70.57% 11.679.16Emera Incorporated EMAB 8.98 9.080.10 0.6460.328 14.13.61% 3.833.67Famguard FAM 3.78 3.780.00 0.7280.240 5.26.35% 18.2517.00Fidelity Bank (Bahamas) Limited FBB 17.75 17.750.00 0.8160.540 21.83.04% 4.503.65Focol FCL 4.49 4.490.00 0.2030.120 22.12.67% 12.7211.00Finco FIN 12.30 12.300.00 0.9390.200 13.11.63% 17.3315.50J. S. Johnson JSJ 15.81 15.810.00 0.6310.610 25.13.86% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.000 0.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.000 0.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.000 0.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.000 0.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.66100.24BGRS FL BGRS86028 BSBGRS860289 100.24100.240.00 94.9494.94BGRS FX BGR118037 10/13/2037BSBGR1180375 100.00100.000.00 92.6392.63BGRS FX BGR124238 07/13/2038BSBGR1242381 93.3293.320.00 89.4289.42BGRS FX BGR129249 04/15/2049BSBGR1292493 89.4289.420.00 90.6090.60BGRS FX BGR132249 10/15/2049BSBGR1322498 90.8990.890.00 96.6196.61BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 98.8098.80BGRS FX BGR142251 BSBGR1420516 99.8799.870.00 100.78100.78BGRS FL BGRS81035 07/26/2035BSBGRS810359 100.78100.780.00 100.81100.81BGRS FL BGRS81037 07/26/2037BSBGRS810375 100.81100.810.00 97.3497.34BGRS FX BGR112036 10/13/2036BSBGR1120363 97.1597.150.00 100.14100.14BGRS FL BGRS89030 10/19/2030BSBGRS890302 100.14100.140.00 100.03100.03BGRS FL BGRS84033 09/22/2033BSBGRS840331 100.03100.030.00 100.23100.23BGRS FL BGRS77026 05/04/2026BSBGRS770264 100.23100.230.00 100.51100.30BGRS FL BGRS88028 07/26/2028BSBGRS880287 100.36100.360.00 100.65100.65BGRS FL BGRS75025 09/07/2025BSBGRS750258 100.65100.650.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.642.11 2.641.95%3.87% 5.003.30 5.002.16%3.79% 2.291.68 2.301.36%2.85% 192.48116.70 192.486.85%8.83% 199.29199.29 CFAL Global Fixed Income Fund 199.291.07%N/A 30-Jun-2023 1.801.74 1.801.47%2.82% 2.051.84 2.053.58%7.12% 1.911.83 1.911.46%2.87% 0.980.93 0.960.59%-0.60% 10.206.41 10.230.48%8.25% 13.517.62 13.54-0.50%13.68% 7.805.66 7.821.08%3.07% 16.648.65 13.452.47%-6.88% 12.8410.54 12.241.49%0.87% 10.779.57 10.690.71%0.53% 16.279.88 N/AN/AN/A 11.228.45 9.193.00%25.60% 14.8911.20 14.10N/A N/A MARKET TERMS BISX ALL SHARE INDEX 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi Highest closing price in last 52 weeks Bid $ Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 6.25% 30-Sep-2025 6.25% 4.50% 6.25% 4.25% NAV Date 4.33% 4.53% 4.38% 4.56% 5.06% 5.60% 4.69% 5.40% 13-Oct-2037 5.22% 19-Oct-2030 6.40% 4.88% 4.40% FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund 13-Jul-2038 4.87% 15-Jun-2040 22-Sep-2033 5.55% 5.65% 15-Apr-2049 15-Oct-2049 15-Feb-2051 26-Jul-2035 26-Jul-2037 13-Oct-2036 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 30-Jun-2023 7-Sep-2025 27-Aug-2028 26-Jul-2028 4-May-2026 31-Mar-2023 24-Jul-2023 24-Jul-2023 30-Jun-2023 24-Jul-2023 24-Jul-2023 24-Jul-2023 24-Jul-2023 30-Jun-2023 30-Jun-2023 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2023 31-Mar-2023 MATURITY 19-Oct-2022 20-Nov-2029 30-Jun-2023 30-Jun-2023 6.95% 4.50% 30-Jun-2023 30-Jun-2023 4.50% 6.25% Coralisle Bahamas Fund - Class D Coralisle Bahamas Fund - Class E Coralisle Bahamas Fund - Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320

www.bisxbahamas.com

NOTICE

ATLANTIS VETERAN WINS OVER ‘UNFAIR’ DISMISSAL

from page one

asked to respond to Ms Toote’s version of events. Sir Ian Winder, the chief justice, who gave the original verdict in Ms Toote’s favour, wrote in his judgment: “A guest identified as Scott Burch asked her if the drinks were complimentary. She responded in the affirmative and added that the servers work on tips. Mr Burch ordered a rum and coke. Ms Toote got the drink from the bar and returned to Mr Burch, who was sitting at the slot machines. The drink was on the tray which Ms Toote had in her hand.

“She did not immediately give the drink to Mr Burch. She could have done so. Ms Toote said to Mr Burch: “Sir, your drink is here.” He responded by saying “what is it” and then felt his pocket with his hands for money. Mr Burch said that he did not have any change and Ms Toote responded by saying that she could assist him by getting change from the ‘bill breaker or the cashier’s cage’. At that time Mr Burch became annoyed. “At about 30 seconds into the exchange between Ms Toote and Mr Burch he began gesticulating with his hands. It would have been difficult at that point, and going forward, to serve the drink without the risk of it being knocked over by the hand movements of Mr Burch. He told Ms Toote to take the drink away “...if I had to beg for a tip’. He went on to say that ‘....he would have given ... [Ms Toote] a tip, but if he had to beg for the drink just take it away’.

“Ms Toote walked behind Mr. Burch and discarded the drink into a nearby garbage

container. Mr. Burch, who was still sitting at the slot machines, did not see Ms Toote discard the drink as he had his back to her at that time. Ms Toote then walked pass Mr Burch and made a gesture with her hand. After walking a few steps she turned around and walked in the opposite direction passing Mr Burch again before leaving the area.”

Sir Ian, in finding for Ms Toote, described the incident as “an unfortunate case of a situation escalating to an unpleasant outcome”. He concluded:

“In my view this was not a case where Ms Toote belligerently or pugnaciously refused to give Mr Burch a complimentary drink until she was given a tip and argued with him about the matter...

“Ms Toote was wrong in not serving the drink immediately upon approaching Mr Burch. However, beyond that, I did not accept that two of the aggravating factors had occurred – the taunting of Mr Burch and the unprofessional and rude conduct of Ms Toote - and the third one – throwing the drink in the garbage – was inconsequential as there was no evidence that Mr Burch had seen it and he had not mentioned it in his complaint.

“Having looked at the case in the round, and bearing in mind all the circumstances of this case as outlined above, including my holding that the investigation by the company was not reasonable and fair, I decided that based on the substantial merits of the case the dismissal of Ms Toote was unfair.”

Sir Michael agreed with Sir Ian, finding: “In my judgment, the critical

question is whether the appellant, as a reasonable employer, on the evidence that it had could come to the determination that Ms Toote refused to give or denied Mr Burch the drink because he did not give her a tip. That was the basis of the summary dismissal.

“In my judgment, there is an important distinction between ‘refusing to give the customer a drink’ and waiting with the drink on the tray when the customer is searching for money to give a tip. It was the customer who told her to take the drink away, not her refusing to give him the drink.”

And he added: “Whilst Ms Toote’s behaviour may well have resulted in some disciplinary action (Ms Toote admitted that she was wrong), in my judgment no reasonable employer could have come to the conclusion that summary dismissal of an employee of over 30 years was a reasonable response to that incident. Not every infraction by an employee warrants summary dismissal.... “Dismissal for an isolated incident of misconduct will rarely be fair, although in some circumstances the incident will be sufficiently serious to justify dismissal for a first offence. This is particularly so where the misconduct involves an act of dishonesty or demonstrates a complete disregard for the interest of the employer or fellow employees.

“Generally, dismissal for misconduct will only be a reasonable sanction if the employee had committed earlier acts of misconduct and has been warned that further incidents may lead to dismissal. There is no evidence of that in this case.”

In the Estate of ROSCOE JOHN DARVILLE a.k.a. ROSCOE DARVILLE, late of #18 Sapodilla Street, Johnson Road Estates Subdivision in the Eastern District of the Island of New Providence, one of the Islands of the Commonwealth of the Bahamas, deceased.

Notice is hereby given that all persons having any claim or demand against the above Estate are required to send their names, addresses and the particulars of their debts or claims duly certifed in writing to the undersigned on or before the 4th day of October A.D., 2023 after which date the Executor will proceed to distribute the assets having regard only to the proved debts or claims of which notice have been given.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

MICHELLE Y. CAMPBELL & CO.

Chambers #55 Mackey Street Nassau, Bahamas

Attorney for the Executor of the Estate Roscoe John Darville a.k.a. Roscoe Darville

Tuesday, September 12, 2023, PAGE 9

NOTICE

Rising Big Tech stocks help claw back losses

By STAN CHOE AP Business Writer

A RALLY for Big Tech stocks on Monday helped Wall Street claw back about half its loss from last week.

The S&P 500 rose 29.97, or 0.7%, to 4,487.46, coming off its first losing week in the last three. The Dow Jones Industrial Average gained 87.13 points, or 0.3%, to 34,663.72, and the Nasdaq composite climbed 156.37, or 1.1%, to 13,917.89.

Like last week, some big technology-oriented stocks led the way. Tesla jumped 10.1%, Amazon climbed 3.5% and Meta Platforms rose 3.2%. Tech stocks were at the head of the line leading the market lower last week as yields climbed. Higher yields hurt all kinds of stocks, but high-growth stocks tend to be among the hardest hit. Yields rose last

week after reports showed the US economy remains stronger than expected, which could be adding more fuel to pressures keeping inflation high.

This upcoming week will offer a huge data point for the Federal Reserve, which is weighing whether to keep raising interest rates in its effort to get inflation back to 2%. On Wednesday, the US government will offer the latest monthly update on prices consumers are paying across the economy, and the forecast is they were 3.6% higher in August than a year earlier.

The Fed has already hiked its main interest rate to the highest level in more than two decades, and it has said it will make upcoming moves based on how inflation and other parts of the economy perform. Inflation has come down from last year’s peak above 9%, but economists warn the last bit

of improvement to get to the Fed’s target could be the most difficult to achieve.

With Fed officials no longer giving speeches ahead of their meeting next week on interest rates, “the data will do all of the talking this week,” economists at Deutsche Bank said in a report. Those economists say a report on Thursday about inflation at the wholesale level will be nearly as important as the data on inflation at the consumer level. High growth for wages in the health care industry could be pushing upward on inflation there, they say.

A separate report on Thursday will also show how much US households spent at retailers last month. Strong spending there recently has helped the economy avoid a longpredicted recession. But it also could encourage companies to keep trying

to raise prices, pushing upward on inflation.

Yields held relatively steady on Monday, with the 10-year Treasury yield up to 4.28% from 4.26% late Friday. The two-year Treasury yield, which moves more closely with expectations for the Fed, rose to 5.00% after drifting through the day, up slightly from 4.99% late Friday.

Most traders expect the Federal Reserve to leave rates where they are at its meeting next week, according to data from CME Group. But many are bracing for another possible hike by the end of this year, while paring expectations for cuts to rates next year.

On Wall Street, Charter Communications rose 3.2% after it announced a deal with The Walt Disney Co. to restore access to ESPN and other channels to its Spectrum video customers. Disney rose 1.2%. Apple rose 0.7% ahead

of a Tuesday event where it’s expected to release its latest iPhone model. How Apple performs has great consequence for the market because it’s the most valuable stock on Wall Street. That means its movements pack more weight on the S&P 500 and other indexes than any other stock.

Qualcomm rose 3.9% after it announced a deal to supply 5G equipment for Apple in its phone launches in 2024 through 2026.

Aerospace company RTX slumped 7.9% after it said a previously announced issue with its Pratt & Whitney aircraft engines could mean a hit of $3 billion to $3.5 billion over the next several years to its operating profit before taxes. It said it will remove up to 700 engines for shop visits in the next few years.

Hostess Brands jumped 19.1% after J.M. Smucker

said it will buy the maker of Twinkies and HoHos in a cash-and-stock deal valued at $5.6 billion, including $900 million of net debt.

JM Smucker, whose brands run from Folgers to Smucker’s, slumped 7%.

Shares of Chinese e-commerce giant Alibaba that trade in the United States fell 1.5% after it said its former CEO, Daniel Zhang, would step down as head of its cloud-computing unit.

The company has been restructuring after setbacks from regulatory crackdowns on the technology and financial sectors.

In stock markets abroad, Japan’s Nikkei 225 fell 0.4% after Bank of Japan Gov. Kazuo Ueda reportedly hinted at possibly allowing interest rates to rise.

Stock indexes were mixed across the rest of Asia and higher in Europe.

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows.

PAGE 10, Tuesday, September 12, 2023 THE TRIBUNE