‘Happy to be rid’ of ex-Robin Hood site

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

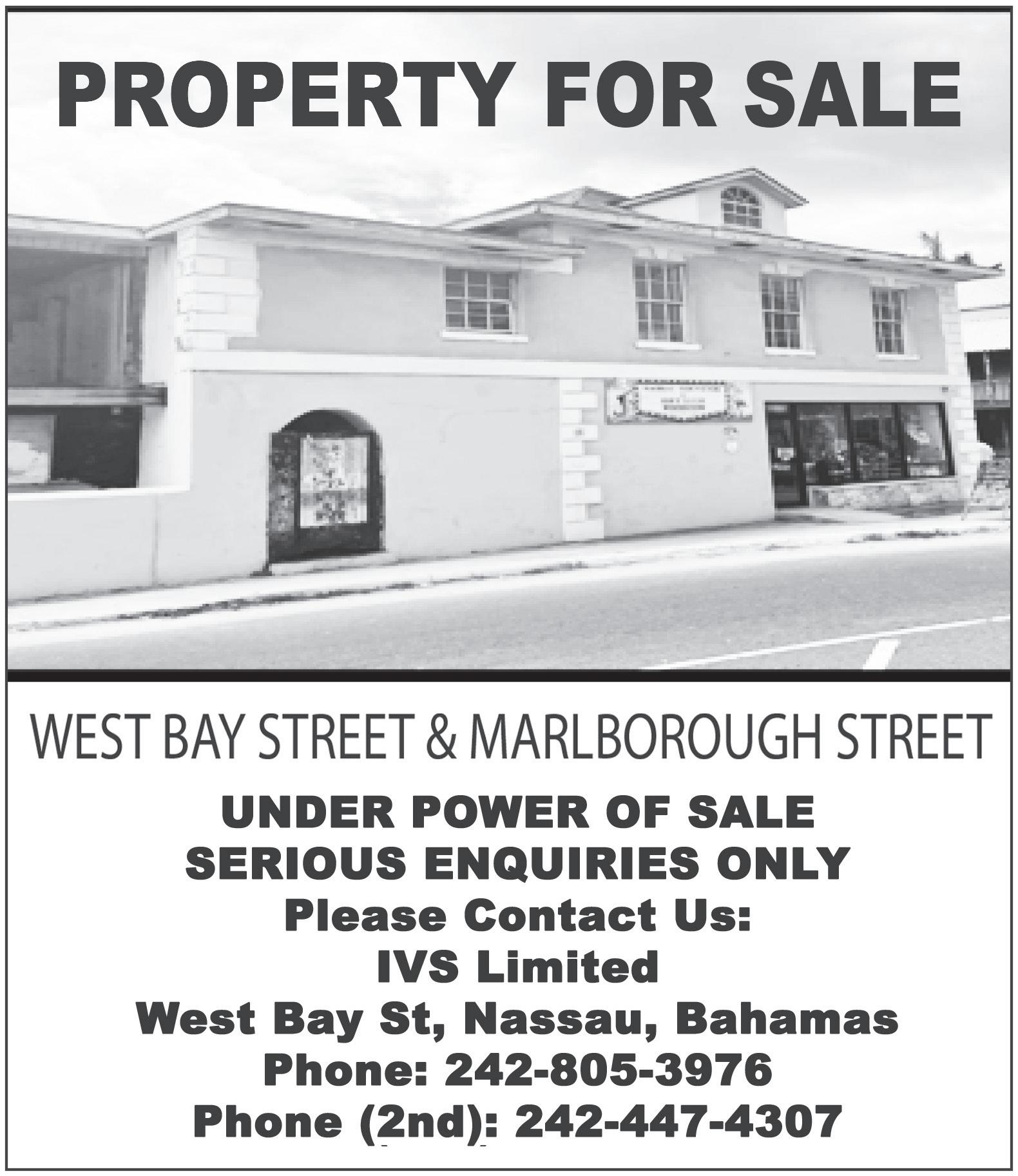

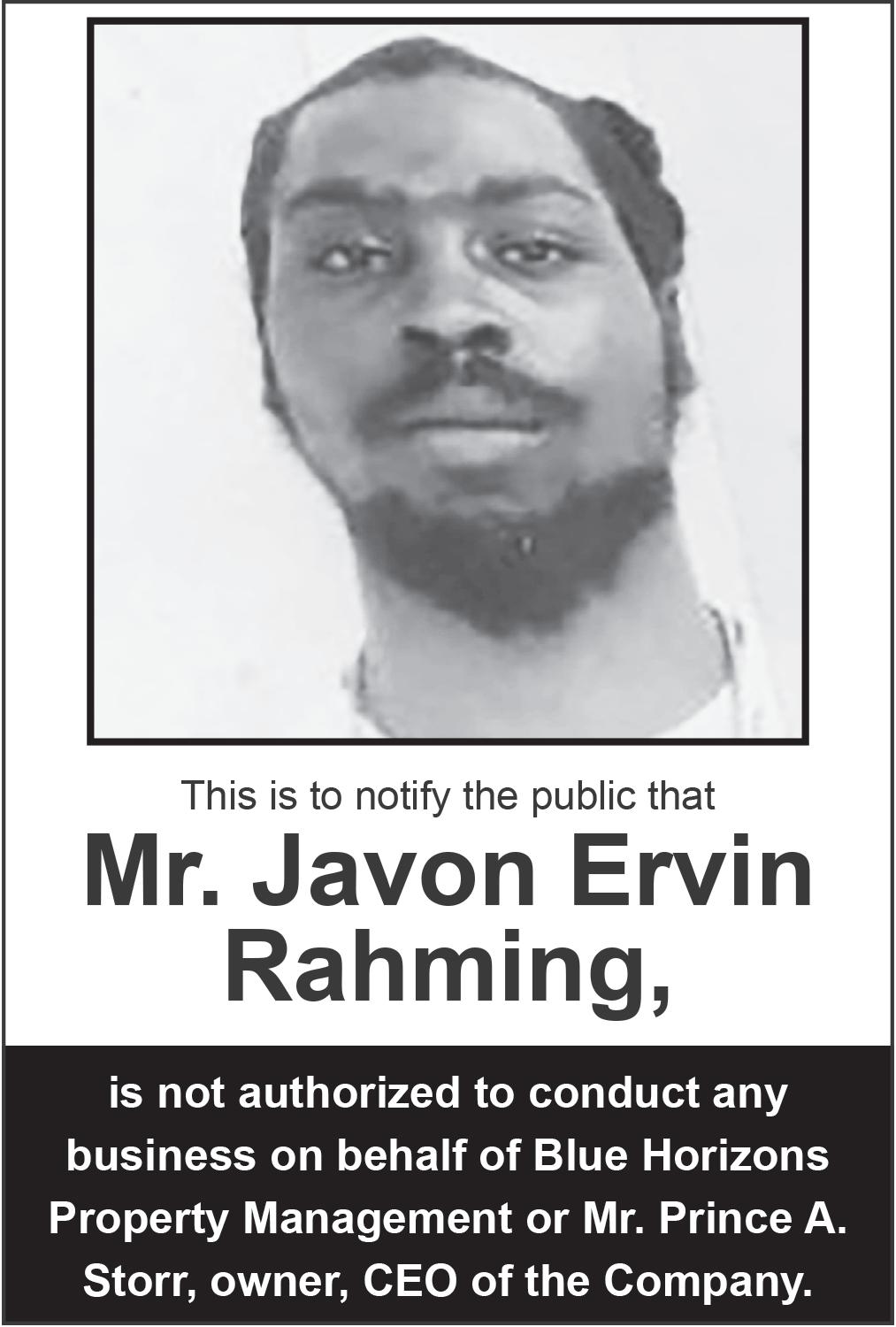

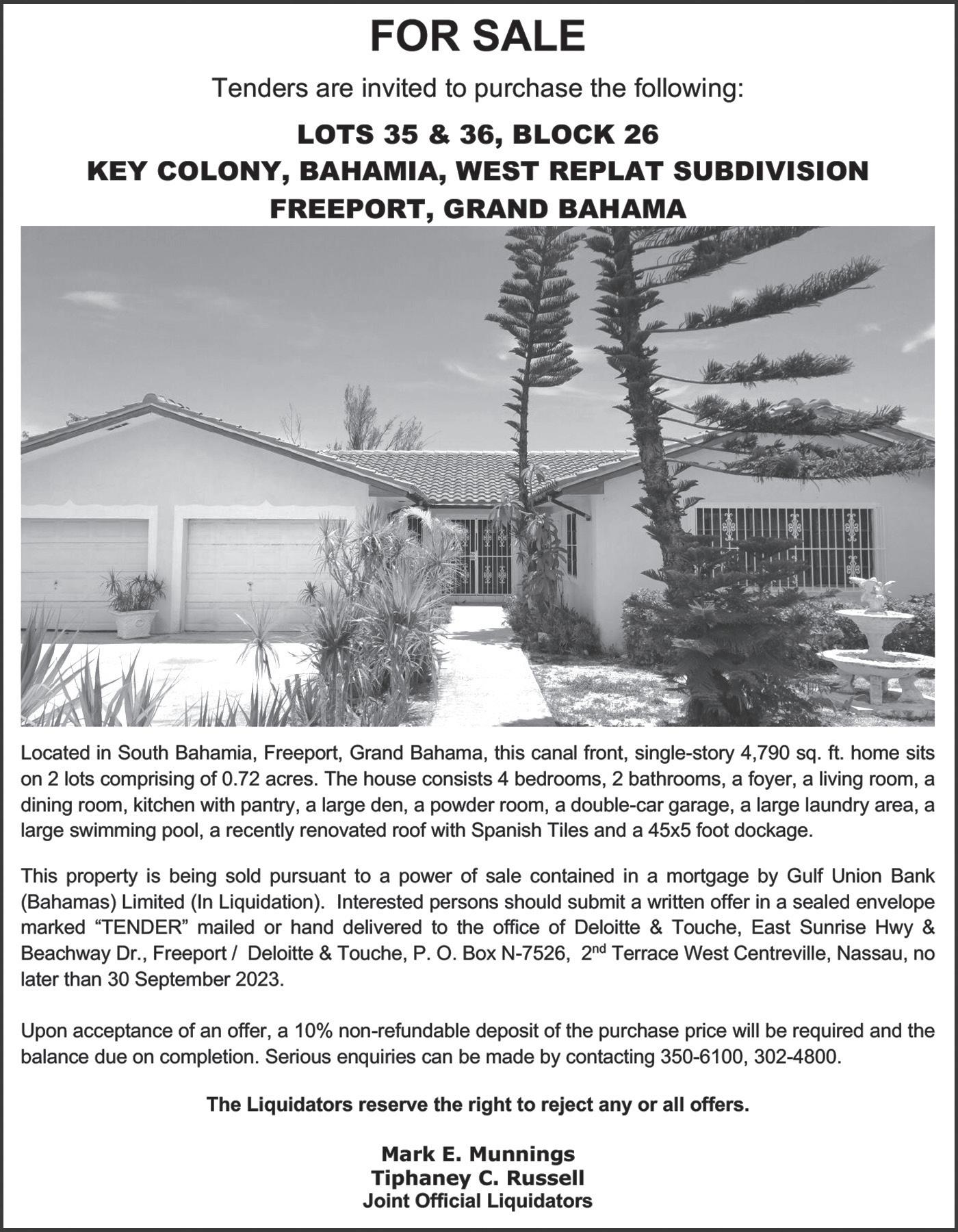

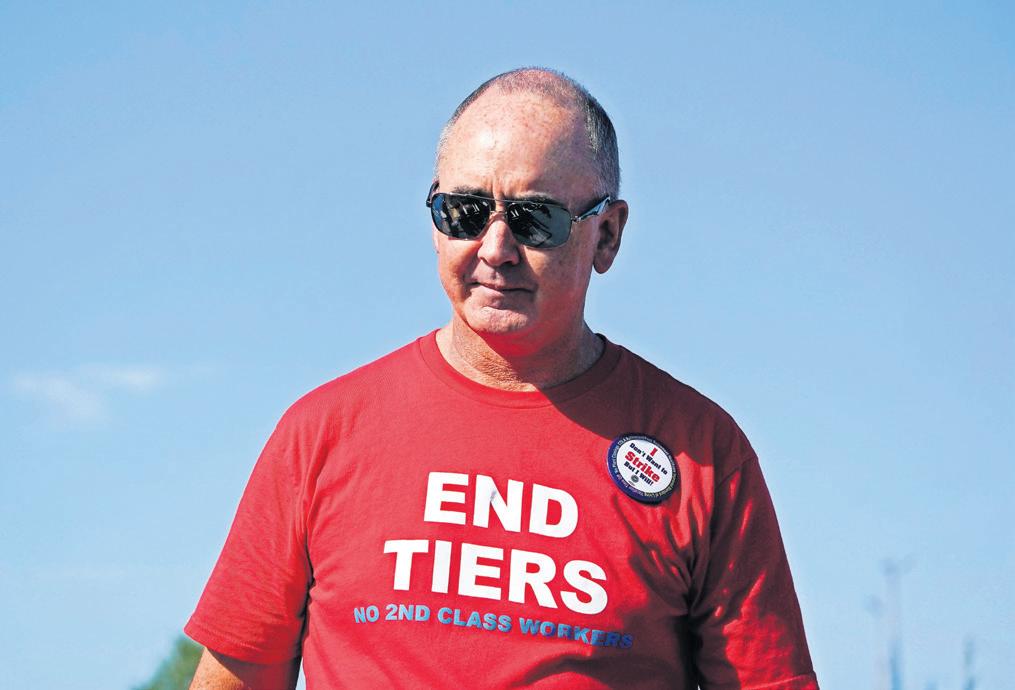

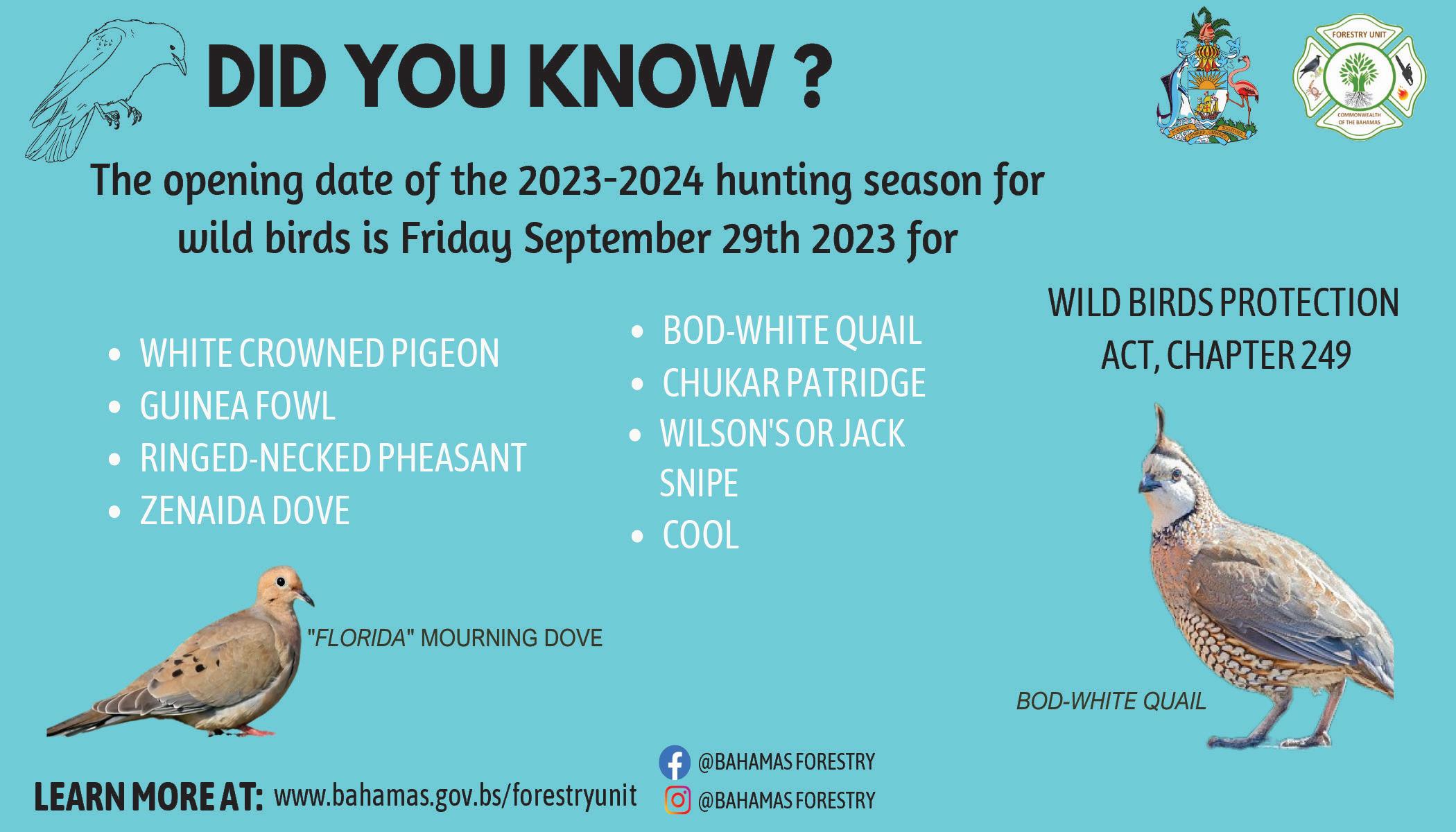

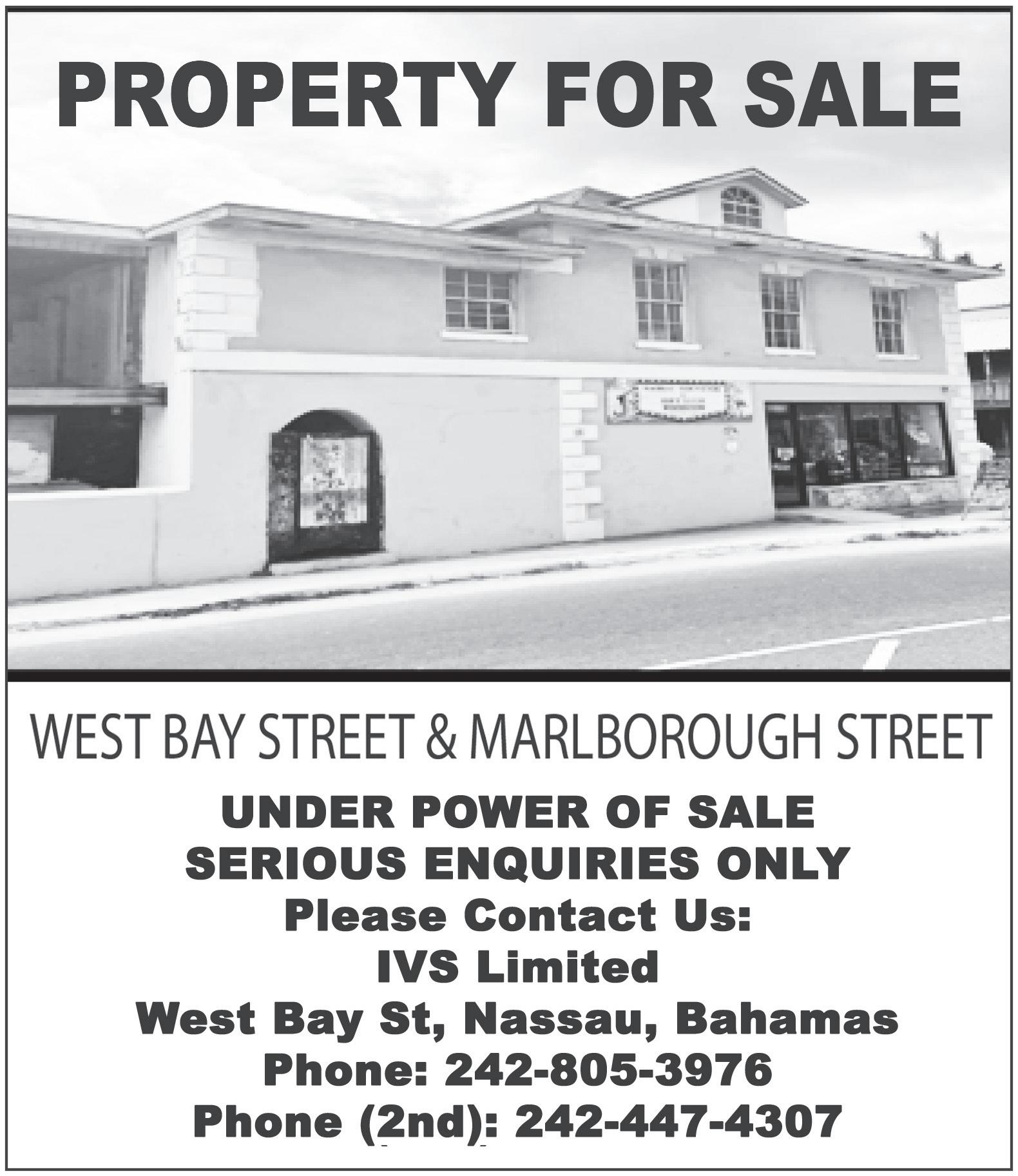

COMPASS Point’s last owner is voicing optimism that the sale of the former Robin Hood store on Prince Charles Drive will close before year-end after the property was plagued by vandalism, vagrants and copper theft.

Leigh Rodney, who closed the western New Providence resort following the 2021 general election, told Tribune Business he had received “a big enough down payment” to convince him that the prospective buyer should be given control of the 45,000 square foot property prior to the

• Last Compass Point owner eyes sale close before end-2023

• Labels buyer a ‘solid person’ and hands building’s control over

• Suffered challenges from vagrants, vandalism and copper theft

deal’s closure.

Declining to identify the purchaser, who he described as “a very solid person”, or the potential sales price, the US investor said he was “delighted to be rid” of a location he took possession of six-eight years ago given the constant security problems encountered.

The site, which was previously home to Pepsi-Cola’s Bahamas manufacturing

‘TREMENDOUS PRESSURE’: FNM FEARS FOR $131M DEFICIT TARGET

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Opposition yesterday voiced fears that the potential $160m VAT under-shoot in the prior fiscal year puts the Government’s 2023-2024 revenue forecast “at risk” and leaves its $131m deficit target under “tremendous pressure”.

Kwasi Thompson, the Free National Movement (FNM) finance spokesman, told Tribune Business that the Davis administration must “adjust their spending” if it finds itself

coming up short on the likely $340m year-overyear increase it will need to meet its 2023-2024 VAT target.

And the east Grand Bahama MP said it was “stunning” that the deficit for the 11 months to endMay 2023 was similar to the prior year comparative. This was despite total revenues to-date exceeding the 2021-2022 full-year amount, leading Mr Thompson to accuse the Davis administration of “squandering the buoyant revenue from a growing economy”.

SEE PAGE EIGHT

URCA ‘MONITORS’ BUT OFFERS NO RELIEF FROM ENERGY HIKES

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

Regulators yesterday sought to reassure Bahamian households and businesses they are “monitoring” Bahamas Power & Light’s (BPL) sky-high bills but made no mention of any immediate relief from “compound billing’s” impact.

The Utilities Regulation and Competition Authority (URCA), in a statement that appeared to have been sparked by the volume of “widespread complaints”

submitted to it, sought to soothe customer fury by disclosing BPL’s assertion that its fuel charge has now “peaked” and bills will be lower moving forward.

However, URCA neglected to mention that it determined late last year that BPL had “made an adequate case” for an up to 163 percent increase in its fuel charge, thus approving the strategy behind the soaring summer bills that households and businesses are now complaining about.

SEE PAGE FOUR

BAHAMAS FIRST BLAMES 50% OF $4.3M LOSS ON NEW RULES

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

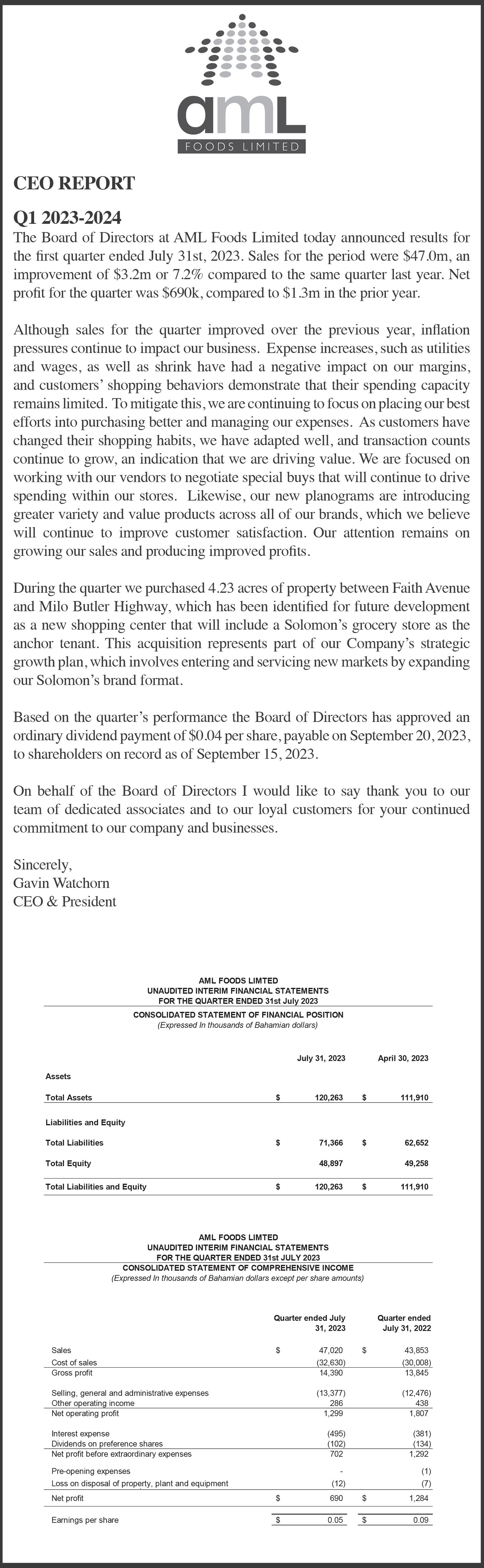

BAHAMAS First’s top executive has blamed more than 50 percent of the group’s $4.3m comprehensive loss for the 2023 first half on a major change to insurance industry accounting standards.

Patrick Ward, the BISXlisted property and casualty insurer’s group president and chief executive, told shareholders that “substantial changes” to the treatment and recognition of insurance contracts under International Financial

facility, was acquired by retail entrepreneur, Sandy Schaefer, as part of his drive to expand the Robin Hood brand to eastern New Providence. Mr Rodney provided the financing, and ultimately took possession of the property after Mr Schaefer exited The Bahamas some six years ago in 2017.

Reporting Standard (IFRS) 17 has had a major impact on the company’s second quarter and results for the six months to end-June.

Using the previous accounting standard, he explained that Bahamas First would have suffered a near $2.1m deterioration year-over-year for the 2023 first-half, falling from a $918,06 profit last year to a $1.168m loss this time around. However, under IFRS 17, a small $29,161 loss during the six months to end-June 2022 has expanded

ARAWAKX SUSPENSION EXTENDED TO MONDAY

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas’ first-ever crowd funding platform yesterday saw its registration suspension extended until September 18 as it pleaded for more time to address Securities Commission concerns over its solvency.

D’Arcy Rahming senior, ArawakX’s chairman and chief executive, told Tribune Business that nothing was resolved in its battle with the Bahamian capital markets regulator during the two sides’ meeting although the platform has been given until tomorrow to provide “substantive answers”

to questions surrounding its financial health.

Pledging that ArawakX will continue to “work in food faith” to satisfy the Securities Commission’s concerns, he said of yesterday’s encounter: “We let our lawyer, Khalil Parker KC, do all the talking. He had presented an earlier document to them saying we needed more time to prepare ourselves properly for the hearing. There was a lot of back and forth with regards to that.

“The meeting ended with the understanding that, by Friday [tomorrow], we will give them substantive answers to some of their

questions with the hope of having another hearing.” Mr Rahming, though, said the Securities Commission did not explicitly commit to another meeting between the two parties, while affirming in response to Tribune Business questions that ArawakX’s registration suspension has been extended for a further five days.

The original 15-day suspension was due to have ended yesterday, coinciding with the hearing, but it is now due to last until this coming Monday. “They extended it to the 18th,” Mr Rahming confirmed.

SEE PAGE SIX SEE PAGE SEVEN

business@tribunemedia.net

THURSDAY, SEPTEMBER 14, 2023

THE FORMER Robin Hood building pictured last night.

Photo: Moise Amisial

SEE PAGE NINE

$6.05 $6.11 $6.12 $6.06

Flowers: Who will profit if changes made on casinos?

By FAY SIMMONS jsimmons@tribunemedia.net

CRAIG Flowers, the FML group of companies chief weighed in on Bahamians being allowed to gamble in casinos and the implementation of standalone casinos on the Family Islands.

Mr Flowers questioned who would profit from these new endeavours and is of the opinion that revenue distribution must be discussed prior to expanding the country’s gaming industry.

He said: “So my point on the matter is that I think that a discussion needs to be had prior to any decisions being made in reference to mini casinos on the Family Islands because it would have to be defined as to who would be the operators, who would be the recipient of the revenue being generated because all of these things are new revenue that can be generated by the industry.

“I think they see the potential of the industry but the challenge is the industry has a tremendous potential to grow but in a regulated environment who and how does this business take

place. Who is going to be the beneficiary of this new growth is the question?”

Dr Daniel Johnson, the Gaming Board’s executive chairman, mentioned the development of standalone casinos on the Family Islands earlier this year and indicated that proposals to make allowances for Freeport, Abaco and Exuma were being considered.

He said: “We also have a very unique opportunity coming, which is our Family Island experience that we’re not wanting it to be as it always was. So, you may see Family Island casinos that will now request that they have a boutique setup, where they would like anyone to be able to game in those areas.”

“The proposal speaks to Freeport, Abaco and Exuma. They may wish to have a casino where anyone above the proper age, and of the right financial status, would be able to attend and participate in that entertainment experience.”

Mr Flowers said that policymakers are not prepared to allow Bahamians to gamble in casinos and noted that there is still a moratorium on new players being allowed into the sector.

He said: “These are all visions that have been offered as an extension to enlarge or to expand the industry. At present, there’s a moratorium that is in place in reference to additional casinos in the Bahamas, be it small large, standalone, miniature, the concern would be whether or not the policymakers have an appetite to expand the industry.

“We can have our wish list, but policymakers aren’t prepared to let Bahamians into casinos just yet. “

He explained that web shop operators are “enjoying the best of what has been offered” to the industry and will be reluctant to push for the government to allow patrons to gamble in casinos. The consumers would have to petition for this allowance rather as they have the ‘control’.

He said: “Operators are enjoying the best of what has been offered and I don’t think that the operators are going to get into any controversy or discussions on behalf of whether or not [Bahamians should gamble in casinos].

“The patrons who play these games should be asked if they are prepared to make any type of noise

in that direction, but the operators won’t be saying anything because the reality is we have no control who has the control is the patron.”

Mr Flowers noted that Bahamians have been calling for a greater portion gaming revenue collected by government to be directed towards social organisations and activities.

He said: “There has been a lot appetite by the public that there should be more of the gaming revenues directed to more social activities and a tremendous amount of associations that needs financial assistance that the gaming platform should be directed more in that direction than the way it is doing now.”

He questioned whether foreigners would be able to establish standalone Family Island casinos and called for a collaborative effort between government, operators and patrons to determine the way forward for the gaming.

He said: “Is it going to be for domestic purposes only, or is it going to be to attract foreign casinos into that area? We would like to know that it is exclusively for Bahamians because if that’s not the case, what is

TOUR OPERATORS: REBOUND DAMPENED BY FEE HIKES

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BAHAMIAN tour and excursion operators were yesterday said to be enjoying a post-COVID bounce back with bookings some 15 percent ahead of 2019 levels.

Adoni Lisgaris, the Bahamas Excursion Operators Association (BEOA) president, told Tribune Business that this year’s bookings are also up 10 percent yearover-year compared to 2022 with business “pretty much steady” throughout the year. “We have been seeing a lot of tourism traffic this year and last year. There

are busier times and slower times, but there is never a closed season. There is slow season,” he added. Chester Cooper, deputy prime minister, last week proclaimed that the traditional slow period for tourism during September and October is now a thing of the past with the industry now enjoying all-year event business. “My sector is more like a higher spending group of people. You have a different clientele and they travel during the off-season. That’s good for other vendors, though, it may not be too good for me, but all in all it’s still steady work and we are able to pay bills, which is good,” Mr Lisgaris said. “Now, we can pretty

much break-even and pay bills.”

The recent increase in first-time and annual boating fees, though, is threatening to put a damper on the post-COVID rebound with some businesses and vessel owners facing a more than 900 percent increase.

“We haven’t had to pay it yet because the commercial licence expires in December, so we haven’t had to pay for it yet. But it’s like we had a good year and we are being punished for it,” Mr Lisgaris added.

“I just don’t understand the increase in fees. Because we are making more money, so that means we are already

paying more VAT because we have a collective increase in sales? They are making more money anyway. So why are they doing that? Out of spite?”

Mr Lisgaris added: “Right now we have a bunch of hackers on the sea, taking fares away from licensed operators. Right

the point?

“These are discussions that needs to be absolutely clear before we go ahead and just open up doors and expanding the industry. Unless we can clearly identify and agree to where the industry is going and not leave it just arbitrarily up to the to the

operators, patrons or to the government.

“The three entities need to sit and have a discussion in terms of new or additional revenue that can be generated domestically and do a better job in directing how this revenue is to be dealt with once it is extracted from the public.”

THE TRIBUNE Thursday, September 14, 2023, PAGE 3

SEE PAGE SIX Covid 19 Testing Kits $100.00 per box 25 IN A BOX Contact: (242) 427-7417 FOR SALE

URCA ‘monitors’ but offers no relief from energy hikes

from page one

“As the regulator for the country’s electricity sector, URCA conducted a comprehensive review of BPL’s fuel charge increase proposal. At the conclusion of that review, URCA determined that it is satisfied that BPL has made an adequate case for the rate increases outlined in its press statement dated October 4, 2022,” URCA said in late 2022.

Seeking to soften the blow from its verdict, URCA promised to undertake ongoing monitoring and reviews of BPL’s fuel charge during 2023 to ensure the utility is operating efficiently and levying the correct charges on customers.

“The regulator notes that BPL’s justification for the changes to the fuel charge

is based on conditions that are likely to change,” URCA added. “Therefore, it is URCA’s intent to revisit that matter to ensure that BPL is operating efficiently and charging customers appropriately.

URCA has advised its licensee (BPL) of its intent to review its fuel charge again during the projected glide path fuel charge recovery period, and it will make public notice of the same as necessary.”

URCA did not disclose the full analysis, or review, that it conducted to justify its conclusion that BPL fuel charge hikes of up to 163 percent are warranted. And the timing of its review, and news release, was more than one month after BPL had already begun to implement the phased increases. The regulator’s statement also glossed over the

reason why Bahamians are having to pay such high energy bills this summerthe Davis administration’s decision not to execute the trades that would have purchased extra low-cost fuel for BPL to support its existing hedging strategy. This resulted in BPL increasingly having to pay oil market spot prices for its fuel, thereby exposing it to the fall-out from Russia’s invasion of Ukraine when prices spiked to over $130 per barrel.

These impacts were then magnified, or compounded, by the Government’s decision that BPL should hold its fuel charge at 10.5 cents per kilowatt hour (KWh) for an entire year even though this was insufficient to cover the utility’s costs. Recovering these fuel under-payments is what has forced BPL to hike consumer bills to their current level.

However, URCA’s statement yesterday merely said: “In October 2022, BPL announced an initiative to increase its fuel charge to reflect the rising cost of fuel and to clear some of the outstanding debt it owed on prior fuel purchases. It stated this would be done gradually through the use of a glide path strategy.”

URCA has also failed to address questions of whether the Government, and BPL,

were in violation of the law - in particular the Bahamas Electricity Corporation (Amendment) Regulations 2020 - which were enacted to facilitate the state-owned energy monopoly’s fuel hedging initiative.

These required BPL to pass 100 percent of its fuel costs on to consumers, but the present bills and prior fuel charge under-recover suggest this did not happen between late 2021 and October. Another issue concerned the “over and under account”, which was designed to keep BPL’s fuel hedge in balance. This account was allowed to fluctuate within a 5 percent margin either side, and the suspicion then was that these limits had been breached .Both issues were subject to URCA’s oversight.

The regulator, in its statement yesterday, conceded: “URCA considers electricity a basic necessity that should be affordable and remains concerned about the impact of high electricity bills on BPL’s customers and the economy. Considering the widespread complaints, and in accordance with its commitment to protect consumers, URCA has been monitoring the situation.

“In recent discussions, BPL confirmed that fuel charges have reached their peak and customers can expect lower rates moving forward. The company has confirmed the fuel charge will decline this month for many consumers and will

be reflected in those consumers’ electricity bills next month.”

However, any decline in consumer bills is unlikely to be significant in the nearterm. While it is correct that BPL’s fuel charge peaked at 27.6 cents per kilowatt hour (kWh) over the threemonths between June 1 and August 31, 2023, it will only fall slightly - to 25 cents - between September and November for consumers using more than 800 kWh, before falling further to 18 cents between December 1, 2023, and February 28, 2024.

“In reviewing consumer complaints, URCA has found that consumers have unfortunately experienced the compound billing effects of increased demand during the summer months and the increase in the fuel charge via the glide path strategy,” URCA added yesterday.

“Typically, some people’s consumption of electricity doubles in the summer months due to air conditioning and children being home from school. The doubling of consumption, multiplied by the fuel charge, which is almost three times what it was last summer, means many consumers’ bills are significantly higher.

“BPL’s glide path strategy was designed to slowly increase the fuel charge to a peak this summer and then decrease the fuel charge continuously through the end of February 2024. By March 2024, BPL is expected to have paid off its outstanding fuel debt. This means

that, as of March 2024, bills are expected to only reflect the actual cost of fuel used in supplying consumers,” URCA continued.

“At that point, provided the market price of fuel remains the same, or decreases, the charge for fuel will naturally decrease. Hence, consumers will receive a lower bill for the same amount of consumption.” However, the actual fuel charges incurred between now and March 2024 will also depend on international oil prices, and in the meantime there will be no relief for Bahamian households and businesses.

Several sources have suggested there were good and valid reasons why the September 2021 trades were not executed, namely that the cash-strapped government did not have the necessary $40m funding and cash flow available to finance the deals, especially with a $246m BPL loan coming due for repayment in February 2022 and nothing allocated to cover it.

However, the latest Fiscal Strategy Report revealed the extent of BPL’s financial woes and the need for government support. “The recent disclosure of approximately $150m of payment arrears of Bahamas Power & Light (BPL) represents a significant unbudgeted liability of the Government,” it said. “To ensure continued provision of essential electrical services to the public, the Government has committed to ensuring payment of this liability by the corporation.”

PAGE 4, Thursday, September 14, 2023 THE TRIBUNE

To advertise in The Tribune, contact 502-2394

Bahamas ‘safe harbour’ for financial services

A CABINET minister promoted The Bahamas as a “safe harbour” for financial services and investments during a conference featuring the hemisphere’s leading trust and estate planning executives.

Michael Halkitis, minister of economic affairs, told the Society of Trust and Estate Practitioners (STEP) Latin America conference that innovation, local expertise and a stable democracy provide The Bahamas with its competitive advantage in financial services.

Asserting that this nation may have “the

highest concentration of financial services talent in the world”, based on its population size, he added: “Our financial services industry features a plethora of Bahamian grown talent. You will find Bahamians at every level of the corporate structure – from entry level to managing director.” Mr Halkitis also highlighted the upcoming reforms to the Digital Assets and Registered Exchanges (DARE) Act, which underpins the digital assets regulatory regime, and the roll-out of the recently-passed Commercial Entities (Substance

Reporting) Act 2023 together with the accompanying economic substance reporting portal.

The minister also informed the conference, which was held in Bogota, Colombia, of efforts to establish The Bahamas as an international arbitration centre. “In just a few weeks, we will be making a return to STEP Asia as we move forward with our plans to expand our promotional efforts into the Asian market,” Mr Halkitis said.

“Based on feedback we received in 2022, participants were very interested in The

INSURERS OPEN TO WORK WITH GOV’T OVER COVERAGE POOL

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BAHAMIAN insurers are willing to work with the Government in creating a pool mechanism that would make catastrophe coverage more affordable for homeowners and businesses, its association chief said yesterday.

Julian Rolle, the Bahamas Insurance Association’s (BIA) president, agreed with concerns voiced by Gowon Bowe, Fidelity Bank (Bahamas) chief executive, that reduced capacity and increased premium costs are making it increasingly difficult for new mortgage borrowers to obtain insurance, which is something they require to complete the loan and conclude their property purchases.

“Unfortunately, Mr Bowe is correct in his statement that there is a significant reduction in capacity in in catastrophic

insurance, which basically means that homeowners - while they can get coverage for fire and other types of perils - there is a shortage in coverage available for hurricane damage,” Mr Rolle explained. Bahamian property and casualty underwriters must acquire huge amounts of reinsurance annually because their relatively thin capital bases mean they cannot cover the multibillion dollar assets at risk in this nation, thus making them dependent on global support.

However, the huge losses suffered by the global reinsurance market in recent years from payouts caused by Caribbean hurricanes and other worldwide natural disasters has resulted in both investors and companies withdrawing from this market. This has had the twin effects of both reducing the available supply of catastrophe coverage and increasing the cost for those who require it.

“The BIA and the insurers do try to look for additional capacity. However it is not available in the market at this time,” Mr Rolle said. His comments came after Mr Bowe suggested that the Government work with the insurance companies to create a captive insurer, essentially a means of selfinsurance, that would pool the risk to both reduce costs to consumers and increase coverage availability.

“It would be helpful if there could be an insurance pool, but that requires significant capital,” Mr Rolle said. “An insurance pool where the Government has to facilitate and help - he’s not saying that they should start a pool per se. He said that they should be working with the industry to find a solution for the problem. So my response is the BIA would be happy to have the Government facilitate beginning a pool, and looks forward to working with the Government to do so.”

Bahamas and want to learn more about our products and services. So, just as we’ve done with STEP LatAm, it seems STEP Asia will likely be a permanent addition to our schedule.”

Mr Halkitis voiced confidence in the country’s financial services prospects, adding that “on a fundamental level, The Bahamas is positioned to adapt and thrive”. He expressed optimism that the country will move from “strength to strength”.

Accompanied by Brandace Duncanson, The Bahamas’ director of financial services, the minister

also met with a major law firm during his visit to Colombia to update its members on developments in this nation.

“The response was overwhelming,” Mr Halkitis said. “Attendees welcomed our message and are eager to do business in The Bahamas, which is why it is always critical that we are accompanied by a large private sector delegation. We generated a lot of interest, and we will build on that momentum by pressing ahead with a full slate of promotional efforts to convey our message that we are among the

world’s top destinations for wealth generation and wealth management.”

John Lawrence, chief executive of the Bahamasbased Windermere Group, and immediate past president of the STEP LatAm conference, said the event attracted 420 delegates from 30 countries, including 25 from this nation. “The presentation by minister Halkitis was well-received by the delegates, and affirmed that The Bahamas should be on your short list of jurisdictions for international estate planning,” he added.

THE TRIBUNE Thursday, September 14, 2023, PAGE 5

‘Happy to be rid’ of ex-Robin Hood site

“I have an agreement to sell the property and a substantial down payment,” Mr Rodney said in response to Tribune Business inquiries after this newspaper observed workers dismantling part of the building’s roof structure and performing other work. “I’ve kind of allowed them, even though we have not closed the transaction, to go ahead and do what they want on the property. Beyond that, I’d want to leave it to the person who’s buying it to say what they plan to do with it.”

Asked when the sale was

due to close, Mr Rodney replied: “I would like to think this year. I had problems with vandalism going on, and people living in the building and coming and going, and I’m delighted to have someone come and put a down payment on it. They have given me a big enough down payment where I know they will go through with the deal, so I gave them access to the property.

“They’re kind of responsible for the property now, and have given me a substantial down payment. I’m delighted to be rid of it. I think it’s in good hands now with a very solid person, and whatever they

do I hope they do it very successfully.”

Mr Rodney said he had converted his lien, and loan security, into actual title ownership of the former Robin Hood property, which now counts the second Quality Home Centre among its new neighbours, aided by his attorney, Paul King. “It was moved to my ownership six to eight years ago,” he added. “It is not a lien. The lien was converted to my ownership. Everything was cleared by Paul King so that I can sell it.”

Detailing the constant challenges experienced in securing the property, Mr Rodney said these

involved vandalism, graffiti and “keeping the property under control” as persons repeatedly broke into the building. Suggesting this was no different from the challenges faced by abandoned and unoccupied buildings throughout the world, he added: “The copper has all been stolen out of the building, the doors were repeatedly broken down. It was not a very good experience.”

The former Compass Point owner told Tribune Business he would pass this newspaper’s contact details on to the potential buyer, but no response has been received and subsequent inquiries have failed to

identify who has acquired the former Robin Hood or their plans for a property that has a colourful past.

A Brooklyn-born entrepreneur, Mr Schaefer brought the Robin Hood format to New Providence in the late 1990s via a discount model that aimed to undercut the prices offered by established Bahamian retailers. The retailer moved from its original location on Soldier Road to larger premises at the Summerwinds Plaza on Tonique Williams Highway, with Mr Schaefer becoming a tenant of ex-Cabinet minister and MP, Leslie Miller.

Robin Hood was sold to the now-defunct BISXlisted company, Freeport Concrete, only for Mr Schaefer to ultimately buy the business back and run it himself once again. The retailer expanded into food, and grew to two stores in late 2010/early 2011 when it opened on Prince Charles Drive in the home of the former Pepsi-Cola bottling plant. At that point, it employed several hundred Bahamians.

However, the business became over-extended, and Mr Schaefer in early 2011 became embroiled in a personal row with then-prime minister, Hubert Ingraham, after he criticised the New Providence Road Improvement Project’s impact on his and other Prince Charlesbased businesses. He was ultimately unable to save Robin Hood’s floundering business despite an increasingly desperate search for new capital and investors.

Mr Schaefer eventually alighted on the late ‘con man’, Hubert Pinder, who used a company supposedly capitalised by $83.345m worth of “precious gem investments” to both buy into Bahamian retailer, Robin Hood, and then solicit investors to pump up to $20m into the venture. Their arrangement broke down in acrimony and threats of litigation.

Mr Schaefer, though, suddenly re-emerged twoand-a-half years after Robin Hood’s 2012 demise with Everything Must Go - a new retail concept that he said would cut operating costs by 60-65 per cent. The format, which used only part of Robin Hood’s former Prince Charles store, was founded on being open just three days a week, thereby enabling him to better control key costslabour and utilities - and minimise inventory shrinkage and theft.

To create the ‘buy now’ impulse, the store, after opening on Thursdays, dropped its prices by 10-15 per cent on Friday and then, on Saturday, dropped throughout the day until inventory was completely clear. However, Everything Must Go held its final liquidation sale in June 2017 less than three years after opening, with Mr Schaefer saying: “I just want to leave this place in peace. I’m done.”

Mr Rodney, too, has experienced the ‘ups and downs’ of doing business in The Bahamas. He closed Compass Point following the September 2021 general election after the former Minnis administration failed to address concerns he raised over the regulatory regime for hotels, particularly the licensing process, viewing it as unnecessarily bureaucratic and costly.

He even had a sign posted outside the former Compass Point resort blaming Dionisio D’Aguilar, former minister of tourism and aviation, for the closure. Mr Rodney subsequently unveiled plans for the property to become “residential”. While he would not rent or sell the resort component, he received proposals to lease the restaurant space. His ultimate goal is to reinvest in the resort site to convert it into residential units.

TOUR OPERATORS: REBOUND DAMPENED BY FEE HIKES

from page three

now, they pay absolutely nothing. The hackers make up as much as the licensed excursion operators. All of the boats have registration numbers on it, or at least they are supposed to. So you can look by the numbers to see if it’s a commercial boat or it’s a private boat.

“You can tell who is doing a charter or not, and some of them have

private numbers on them. The best way I can explain it is that you can tell the difference between a taxi and a regular private vehicle by the licence plate, and you can tell if a private vehicle is charging tourists or whatever, and that is basically what is happening out there. They are just not paying their due taxes. It’s been a good year, but I’m just not too happy with the increase in these taxes and port fees.”

PAGE 6, Thursday, September 14, 2023 THE TRIBUNE

from page one

ARAWAKX SUSPENSION EXTENDED TO MONDAY

“They haven’t given any indication that another hearing will be held postFriday. We don’t want at any point to be seen as not in compliance and not working in good faith. We have been working in good faith.”

ArawakX is understood to fear that the Securities Commission’s ultimate goal is to petition the Supreme Court to place the crowdfunding platform into a judicial-supervised liquidation under its oversight.

The regulator, in a late Tuesday night statement, confirmed that its probe relates to concerns over “the trading platform’s solvency”, although it provided no further details.

Mr Rahming, in exposing ArawakX’s woes publicly, linked its difficulties to a highly-publicised battle for control of the crowd-funding platform with one-time Colina Insurance Company president, James Campbell. Tribune Business disclosed in June how the fight with Mr Campbell, an ‘angel investor’ who provided ArawakX with a portion of its start-up funding, resulted in multiple bank accounts held with BISX-listed Bank of The Bahamas being temporarily frozen. Those accounts were subsequently unfrozen via a May 16, 2023, order by Supreme Court justice, Simone Fitzcharles. However, Mr Rahming blamed the episode for triggering what he branded as a “never-ending” 11-month probe by the Securities Commission into the health of ArawakX’s operations, finances and business model.

He also disclosed that the battle with Mr Campbell began just as ArawakX

submitted a proposal to the Ministry of Finance to develop what was described as a Government Savings Bond product that would be targeted at small Bahamian retail investors to help them build savings and wealth, as well as expand the pool of domestic debt purchasers.

“After a successful crowdfunding raise in 2021, ArawakX was approached by Simon Wilson, [the Ministry of Finance’s] financial secretary, who commissioned ArawakX to create a retail Bahamas Government Savings Bond product that would assist with the financing of the Government,” Mr Rahming wrote in a letter issued to the media.

“The team at ArawakX believes in financial inclusion, and that means getting assets into the hands of everyone. A product like the Bahamas Government Savings Bond, combined with our ability to market and reach the average person with our world-class technology, would create many new owners in the society. That’s what we are about, so we were attracted to designing this product in conjunction with the Ministry of Finance....

“In April 2022, ArawakX received a proposal signed by Simon Wilson and then proceeded to get the necessary approvals from the Securities Commission and Attorney General’s Office as they vet all government contracts.” Mr Rahming attached to his letter a fivepage Bahamas Government Savings Bond “proposal”, which was signed by himself on April 11, 2022, and Mr Wilson some three days later on April 14, 2022.

The proposal seemingly emerged from a meeting between the two sides that discussed “how the Government of The Bahamas

JOB OPPORTUNITY

A mid-sized law frm seeks a Legal Secretary/Assistant for a Partner specializing in real estate and Conveyancing matters.

Requirements/Qualifcations:

• Minimum 3 years’ experience in secretarial roles at a reputable law frm;

• Experience in drafting of legal documents and correspondence related to real estate matters; • Ability to assist with fling, scanning and organization of fles; • Ability to work quickly and effciently; and • Is computer literate and organized.

Resumes should be submitted by email to hrlawresume@gmail.com

Accounts Clerk Needed

e s e e en e n n n nt n f e. Familiar with QuickBooks, Sage or similar accounting . e en e t s t n e . st be b e t t t s . n tes st be b e t t t t n s e e.

Job responsibilities to include: nts b e se e ste nt e n e t n es n en st te ents nt e es nts e e b es nt nt es n es n st te ents st nt ents

3) Bank reconciliations

te t e s n st t s e s eet ss st n t e f e t s s s e e f n ns e n nes eet n st e s e n t s .

e se sen es e n e ette t admin@themallatmarathon.bs b e te be n .

POSITIONS AVAILABLE

Gated Community in the Family Island is seeking applicants for the following positions. Offering a competitive salary and excellent benefts.

-Landscape Manager

-Security Manager

-F&B Manager

-Accountant

Send resumes to jobsintheisland@outlook.

can utilise the ArawakX marketplace platform to develop securities that would allow the Government to more efficiently fund its overall deficit shortfall through wider local community participation”.

The crowd-funding entity suggested that the bonds be issued and traded via its platform, which would adopt the role of facilitator, with the Government filling the role of “market maker” and ensuring liquidity. This would “create a market that is perpetual”, with no fees imposed on small Bahamian investors for opening trading accounts with ArawakX. The proposal also called for the bonds to have “100 percent face value” when pledged as collateral to Bank of The Bahamas.

Promising that implementation would come at no cost to the Government, ArawakX said the plan would enable the Government “to get access to a cheaper source of funding from a broader base, including the unbanked”. The platform also pledged to develop savings plans for specific segments of the population, including children and civil servants.

With ArawakX also acting as clearing house, and registrar and transfer agent, for the proposed savings bond, its proposal added: “ArawakX will create a secondary market

for these securities, thereby allowing for an additional exit strategy for holders of these securities looking for early payouts. ArawakX will create a primary and secondary market that will be accessible 24 hours, inclusive of mobile devices utilising the ArawakX portal.”

Mr Wilson yesterday confirmed that ArawakX’s Government Savings Bond proposal was genuine, but added that it had never advanced beyond this stage. He added that the crowdfunding platform’s product was different from the separate retail savings bond that is presently being developed by the Central Bank of The Bahamas because it targeted less wealthy investors.

“They are on the level,” Mr Wilson told Tribune Business of Mr Rahming’s letter. “That proposal, there was discussion, but it never got beyond that stage. There was nothing binding. It was just to see if it was feasible via crowd funding. The Central Bank is developing a savings bond, but this was a different product from the Central Bank.

“We said we’d look at it and see where it goes. This was a different, low income, perpetual, low-value debt opportunity investment where people could invest $5, $10 in government securities. It was subject to all regulatory approvals and so

forth. It was a proposal, and it never went beyond the proposal stage.”

ArawakX released evidence that it had sought the necessary regulatory approvals. Christina Rolle, the Securities Commission’s executive director, responded to the crowdfunding platform’s request in a June 24, 2022, letter in which she wrote the regulator did not object provided it received the relevant offering documents and the necessary “due diligence” was done after each issue.

“Please be advised that the Commission has no objection to the securities that will be issued in tranches by the Bahamas Government on the ArawakX platform subject to” these conditions, Ms Rolle wrote. “Further, we confirm that Mdollaz Ltd is in no way prohibited, neither by Bahamian securities laws nor by the Commission, from engaging in business with and/or on behalf of the Government of The Bahamas.”

Mr Rahming yesterday said he was unsure of the Government Savings Bond initiative’s status, but argued that the product will “be a big help to the Bahamian people” as they could then bypass broker/dealer fees in opening savings accounts. He added that it would also enable hardpressed families to build-up savings that would “make

a big difference in their lives”.

The ArawakX chief added that the platform had been sent a draft contract, approved by the Attorney General’s Office, but had yet to review the document with its attorney to determine if the terms are acceptable and sign it.

“We got it all the way to a contract with the Attorney General’s Office,” Mr Rahming said. “We got it approved by the Securities Commission, and we got it approved by the Attorney General’s Office.

“We had it sent to us by the Attorney General’s Office. As far as we’re concerned, we have not got any further information. We haven’t received any formal rejection of it, so that’s where it’s at. We got a signed proposal, and draft contract back from the Attorney General’s Office that approved it, with a few terms where we have to decide if we want to sign it or not. Our attorneys were looking at it. I don’t know where we’re at with that. We’ll see.

“I know the product will be a big help to the Bahamian people, as they will be able to have individual savings accounts without going through the broker/dealers. It will make it possible for a mother with two children to set aside $25 per week, and that makes a big difference to some people’s lives.”

THE TRIBUNE Thursday, September 14, 2023, PAGE 7

from page one

‘TREMENDOUS PRESSURE’: FNM

FEARS FOR $131M DEFICIT TARGET

The Government’s fiscal summary for May 2023, released on Tuesday, shows that total revenues and total tax revenues stood at 91.4 percent and 90.7 percent, respectively, of their fullyear targets with just one month left in the 2022-2023 fiscal year. Total revenues

for the 11 months to endMay were $244.5m below their full-year goal, standing at $2.613bn compared to $2.857bn, while total tax revenues at almost $2.3bn needed to bridge a $237.3m gap during June to reach $2.537bn. Based on June 2022’s performance, when total revenues and total tax

revenues were $221.3m and $187.8m, respectively, if that was matched this year it would leave both indicators moderately short of Budget forecasts by $23.2m and $50m. However, if June 2022’s intake of $85.2m is repeated, VAT revenues for the full-year will come in at $1.247bn - a figure $164m below the $1.411bn target.

The significance of the VAT performance is that, despite this under-shoot, the VAT revenue projection is increasing by almost $180m year-over-year compared to last year’s forecast to $1.591bn for the current 2023-2024 fiscal period. And, when compared to the likely outturn, this represents a $340m year-over-year increase, thus raising questions as to how the Government will hit this hiked target.

Zeroing in on this issue, Mr Thompson told this newspaper: “We are raising this as a concern. The May report makes it clear, I believe, that they are going to find it very difficult to meet their VAT projections. If they are not able to meet their VAT projections [for 2022-2023], that places this year’s VAT projections at risk. We again call on the Government to adjust their lavish spending, adjust their unnecessary spending, in order to compensate.

“They have spent far more than last year. We again urge the Government to take note that if they have to adjust the VAT numbers they will also have to adjust spending.” However, Michael Halkitis, minister of economic affairs, previously pointed out that when inflation is factored in the projected $11.8m year-over-year increase in recurrent spending to just over $3bn for the 2023-2024 fiscal year actually represents a decrease.

The Government will thus argue that it is containing spending, holding it relatively constant, and will also likely assert that some of the increase since 2018-2019 is due to postCOVID inflation. However, Mr Thompson reiterated in a statement: “It is painfully clear that the VAT projections for last year

will almost certainly not materialise.

“The Government has also projected a significant increase in VAT receipts for this 2023-2024 fiscal year, and the failure to meet the VAT target from the last fiscal year will likely put the current year’s revenue targets at risk. This will place tremendous pressure on the Government’s ambitious deficit target of some $131m for the current fiscal year.

“We again call on the Government to immediately begin to revise its current spending plan and to cut down on unnecessary and wasteful spending so as to ensure the country stays on its documented medium-term plan for fiscal consolidation.”

Simon Wilson, the Ministry of Finance’s financial secretary, previously told Tribune Business that the Government was on track to “come in very close” to both its revenue and revised $520.6m full-year deficit target for the nowclosed 2022-2023 fiscal year.

However, administrations typically incur substantial deficits in June, as ministries, agencies and departments rush to present bills for payment that the Ministry of Finance never knew existed before the fiscal year closes at that month’s end. The Government incurred a $318.7m deficit for June 2022, and a repeat performance this year would take the 12-month deficit for 20222023 to $640m - above both the revised $520.6m target and the initial $575.4m.

“The Opposition restates its grave concerns on the trajectory of the fiscal position as the final numbers for 2022-2023 become clear,” Mr Thompson added. “The May 2023 year-to-date deficit of $321.4m is not far off from the over $300m

deficit recorded for the previous corresponding period, although revenues for the same period are up over $225m.

“If the Budget deficit for the month of June 2023 ends up close to that of June 2022, then the Government is likely to miss both its budgeted and revised fiscal deficit target despite having record revenues. It is stunning that with higher revenues the Government is still poised to run a deficit of well in excess of half a billion dollars. From a fiscal standpoint, the Davis administration is squandering the buoyant revenue position from a growing economy.”

Mr Thompson, former minister of state for finance in the Minnis administration, subsequently affirmed to Tribune Business: “The last two months, May and June, are critical months, and if we go based on what took place last year the Government is at a very critical stage as to whether it will meet last year’s [20222023] deficit target and, if it does not, whether it will have to make changes to this year’s projections as well. The Government should definitely be making adjustments to spending.”

Mr Wilson said the Davis administration remains “well-positioned” to hit the revised 2022-2023 full-year deficit target of $520.6m, which was almost $200m away with one month left in the period. “We are still doing the final bits of clean up, but I think we’re well positioned,” he added, while acknowledging the toll June can inflict. “We can’t rest on our laurels. June is its own beast. You can fool yourself and say you will be OK, but it takes only one thing in June to blow everything up,” the financial secretary said.

PAGE 8, Thursday, September 14, 2023 THE TRIBUNE

from page one

BAHAMAS FIRST BLAMES 50% OF $4.3M LOSS ON NEW RULES

to a $4.29m comprehensive loss - equal to 12 cents per share - this time around.

“For the six months ended June 30, 2023, we are reporting a total comprehensive loss of $4.3m in the consolidated statement of comprehensive income in comparison to a $29,000 loss in the prior year. The increased loss is attributed to the impact of discounting and risk adjustments,” Mr Ward wrote.

“Total comprehensive loss/income using the former standard shows a deterioration of $2.1m for current year to-date versus prior period. The material changes pertain to the investment result and operating expenses, as well as increased reinsurance costs. However, the deterioration increases dramatically to $4.3m under IFRS 17, indicating that $2.2m is attributed to the changes in measurement under the new standard.”

Despite the $4.3m loss, Bahamas First paid out a collective $1.5m to shareholders via a four cents per share dividend. “Our capital base remains strong, and this fact was emphasised in July 2023 with A M Best’s affirmation of our A- (Excellent) rating with a stable outlook,”

Mr Ward reassured, while asserting that progress has been made in addressing woes that resulted in regulators threatening to bar its Cayman affiliate from writing new life and health insurance business.

“Year-to-date [through] the 2023 second quarter, other expenses were $7.2m or $0.6m higher than the prior period. The increased expenses were driven by increased salaries, professional fees and travel, the majority of which related to the remediation efforts that are underway within the health segment of our business in Cayman,” Mr Ward revealed.

“We have seen improvements in some of the key problem areas connected with claims processing, and we now have better insight on what is required to bring resolution to the system issues. The remediation work will continue in discrete phases, with an initial focus on bringing stability to the operating environment.”

The BISX-listed property and casualty underwriter previously disclosed that its Board had appointed a committee of its non-executive directors to investigate the matter “and the governance related thereto”.

Bahamas First confirmed

to this newspaper in early May 2023 that its Cayman First subsidiary was noncompliant with that territory’s health insurance regulations due to a claims processing “backlog” that had resulted from the implementation of a new system in the 2022 third quarter, but the investigation’s launch suggests the issues have lasted longer - and are more deep-rootedthan previously thought.

“As a result of problems with the implementation of the new processing system, Cayman First failed to comply with regulatory reporting deadlines with respect to claims processing, payment and client invoicing,” Bahamas First told shareholders. “These problems, which have proved both difficult and, as a result, slow to resolve, are ongoing.

“They have led to the Cayman Health Insurance Commission (CHIC) indicating to Cayman First on March 30, 2023, that what occurred breached the conditions of its Approved Insurer Certificate for health insurance business issued by the CHIC, that it was considering enforcement action and may be minded to make regulatory orders which would prevent new health insurance for Cayman

residents being underwritten by [Cayman First].” Bahamas First and its affiliate responded by providing the Cayman regulator with a plan to resolve the issues, and hired an international consultant and added extra staff to address the matter.

Meanwhile, addressing other aspects of the company’s results, Mr Ward said: “For the year-to-date, gross written premium increased by 11.8 percent against the same period in the prior year, as we experienced growth in premiums across the property and casualty major lines of business.

“This growth was generated by the combination of rate increases and organic expansion. However, under the new accounting standard,

insurance revenue decreased by 0.3 percent from the prior year, primarily as a result of new seasonal adjustments, which resulted in a larger deferral in revenue recognition to later in the year.”

As for expenses, he added:

“During the 2023 second quarter, under the new standard, we are reporting insurance service expenses of $44.8m, an 11.1 percent increase over the prior year’s total of $40.3m. While still elevated, we have seen stabilising of loss ratios on the health line of business and the Cayman motor business.

“Under the new accounting standard, service expenses are reported gross of reinsurance recoveries and growth in the business will result in higher amounts

of insurance service expense if loss ratios are stable. In addition, there has been a significant adverse discounting impact as reported under the new methodology of determining claim liabilities.”

Mr Ward described the 2023 first half as “uneventful” when it came to investment and other income, which totalled $0.8m for the period. This contrasted with the 2022 first half when Bahamas First “reported combined investment and other income, and other comprehensive income, of $1.2m, driven by net realised and unrealised gains on the Commonwealth Bank equity holdings of $1.7m and an unrealised loss on the bond portfolio of $1.3m”.

Career Opportunities

Business Banking Officer - Grand Turk Branch

Salary - $52,725 - $68,242

The Manager, Business Banking is responsible for managing a portfolio of up to 100 business banking customers by meeting their total personal and business banking needs (clients typically defined as having commercial credit needs up to USD$250,000). The portfolio primarily contains business banking customers whose business needs are increasingly complex and referral of customers to this level of manager is triggered by the business needs, not by the complexity of the personal needs.

About You

• Time spent in a sales capacity, preferably previous personal and business banking experience

• 2-3 years’ experience dealing with and servicing small business clients

• Working knowledge of the small business banking industry and the needs of small business clients, current events, business affairs, trends in the marketplace, and the environment in which business is transacted locally.

• Business Banking Accreditation desired or in process of completing.

• Good selling, influencing and negotiating skills.

About Our Offer

You will have a challenging, diverse experience with opportunities for professional growth. Our compensation and reward package is attractively structured and performance bonuses are offered

To apply for this and any other positions, kindly visit https://www.cibcfcib.com/about-us/careers. Applications with detailed resumes should be submitted no later than 15 September, 2023. CIBC FirstCaribbean thanks all applicants for their interest, however only those under consideration will be contacted.

THE TRIBUNE Thursday, September 14, 2023, PAGE 9

from page one

The CIBC logo is a trademark of Canadian Imperial Bank of Commerce, used by FirstCaribbean International Bank under license LINKEDIN cibc-firstcaribbean-international-bank

CIBC FirstCaribbean is a relationship bank offering a full range of market leading financial services through our Corporate and Investment Banking, Retail and Business Banking and Wealth Management segments through its leading digital banking network and locations across the region. CIBC FirstCaribbean is one of the largest regionally listed financial services institutions in the English and Dutch-speaking Caribbean.

Stock market today

WALL STREET CHURNS TO A MIXED FINISH AFTER HIGHLY ANTICIPATED INFLATION DATA

WALL Street churned to a mixed finish on Wednesday after a highly anticipated report showed inflation accelerated across the country last month, but not by much more than expected. The S&P 500 edged up by 5.54 points, or 0.1%, to 4,467.44 after flipping between small gains and losses a few times through the day. The Dow Jones Industrial Average dropped 70.46 points, or 0.2%, to 34,575.53, and the Nasdaq composite rose 39.97, or 0.3%, to 13,813.59.

The modest moves followed a shaky immediate reaction to the inflation report across financial markets, where bond yields and stock prices swung back and forth several times. The report said US consumers paid prices last month that were 3.7% higher than a year earlier, up from July’s inflation rate of 3.2%.

That’s discouraging for shoppers paying higher prices, but much of the acceleration was because of higher fuel costs, which can swing very sharply and quickly. Ignoring those, underlying inflation trends still look to be pointing toward continued moderation, economists said. Inflation has been generally cooling since peaking above 9% last year.

The inflation report was so highly anticipated because it will help steer what the Federal Reserve does next on interest rates. The Fed has already hiked its main rate to the highest level in more than two decades, which hurts prices for stocks and other investments, and the hope on Wall Street is that inflation has cooled enough for it to be done.

Wednesday’s data likely keeps the Fed on track to keep rates steady at its meeting next week, said Gargi Chaudhuri, head of iShares Investment Strategy, Americas. It could also mean trends continue in such a way that the Fed does not hike rates any more during this cycle.

But she also said expectations among traders on Wall Street for cuts to interest rates next year may be too aggressive. Such cuts can act like steroids for stocks and other investments, but inflation is still above the Fed’s target of 2%.

“If anything, higher headline inflation is proof that the Fed will need to keep rates higher for longer and that heavy rate cuts next year are mispriced,” Chaudhuri said.

Even though economists are willing to ignore fuel costs when looking at inflation to find the underlying trends, households and

companies don’t get the same luxury.

Stocks of airlines were some of the biggest losers in the S&P 500 after a couple warned of the hit to profits they’re taking because of higher costs.

American Airlines cut its forecast for profits during the summer because fuel costs are running higher than it expected. It also had to pay about $230 million in retroactive pay to pilots after they ratified a new labor contract. Its stock fell 5.7%.

Spirit Airlines said it’s also paying higher fuel costs this summer than expected, roughly $3.06 per gallon instead of the $2.80 it had earlier forecast. It’s also been seeing steep discounting to fares during the last few weeks. That pushed it to cut its forecast for revenue during the third quarter, and its stock fell 6.3%.

Other airlines also sank, including declines of 3.8% for United Airlines and 2.8% for Delta Air Lines.

On the winning end of Wall Street were highgrowth stocks that could be big beneficiaries if the Fed is indeed done hiking interest rates. High rates hurt all kinds of investments, but they often most hurt technology companies and others promising big growth far out in the future.

Amazon climbed 2.6% and was one of the strongest forces pushing upward on the S&P 500. Microsoft gained 1.3%, and Nvidia rose 1.4%.

Moderna rallied 3.2% after it reported encouraging results from a trial of a flu vaccine.

In the bond market, the yield on the 10-year Treasury edged down to 4.26% from 4.27% late Tuesday. It had swung as high as 4.34% immediately after the inflation report.

The two-year Treasury yield, which moves more on expectations for Fed action, slipped to 4.99% from 5.02% late Tuesday. It also leaped earlier and was as high as 5.07% a minute after the inflation report’s release, as traders digested the numbers.

PAGE 12, Thursday, September 14, 2023 THE TRIBUNE

HBCU COALITION

RECEIVES $124M GIFT FROM NON-PROFIT FUNDER BLUE MERIDIAN PARTNERS

NEW YORK

Associated Press

THE HBCU Transformation Project, a coalition of 40 historically Black colleges and universities, on Wednesday announced a $124m gift from philanthropic funders Blue Meridian Partners to increase enrollment, graduation rates and employment rates for the schools’ graduates.

Michael Lomax, president and CEO of UNCF, which is acting as an intermediary overseeing the funding, called the donation a vote of confidence in the coalition, which includes public and private schools.

“This very significantly scaled grant from them signals to the philanthropic community that this is a really good investment to make,” he said of the Blue Meridian gift.

The donation will expand the work of the project, which has already received $75 million from Blue Meridian since 2020. The project’s early results on improving enrollment and other core operations were strong, said Jim Shelton, president and chief investment and impact officer of Blue Meridian Partners.

“It made it relatively straightforward to say, ‘Clearly, we’re just beginning this work. Institutions have been underinvested and need more investment, and we believe that we can play a catalytic role in bringing resources to the table,’” Shelton said, adding that they were actively seeking additional support from other funders to expand to more schools. The project has also received $17.6 million in funding from the Bill & Melinda Gates Foundation, $4.5 million from JP Morgan Chase and $1 million Capital One, according to UNCF.

Blue Meridian first provided funds to support HBCUs at the start of the pandemic to help cover their operating costs when the schools had to close.

“One of the things that we were concerned about was whether or not HBCUs were going to survive because we knew that HBCUs didn’t have large endowments, didn’t have the resources that could sustain them,” said Harry Williams, president and CEO of the Thurgood Marshall College Fund (TMCF).

Along with UNCF, TMCF and Partnership for Education Advancement jointly oversee the project’s grant, though most funds will go directly to the participating schools. The three intermediaries also received direct funding from Blue Meridian to

HIRING

Director of Security & Surveillance - Oversee the security and surveillance functions of the hotel and casino, inclusive of the investigation of alleged violations of laws, policies, and regulations in support of government agencies, corporate governance, and administrative and prosecutorial action.

Executive Pastry Chef - Direct the planning, preparation, production, and control of pastry kitchen operations, inclusive of restaurants and bars, room service, banquets, and catering. Develop creative menu items and maintain product quality, while ensuring guest service levels are delivered.

improve their capacity to support the schools.

South Carolina State University used some of the first round of funding to buy a customer relationship management platform to integrate their applications for enrollment and financial aid, which the school’s president, Alexander Conyers, said had previously been “very manual.”

“We had computer systems, but the different systems weren’t talking to each other,” he said.

The new platform allowed the school to text and email applicants and to identify and contact people who had started applications but hadn’t completed them. As a result, the number of entering freshman grew from 371 in 2019 to 1,200 this year.

“This flexible funding has really allowed us to probably move five to seven years faster than the pace we were on,” said Conyers, who also used project funding to update the school’s website in part to make it appear higher in search results.

By sharing some of these new services and vendors, the schools are helping keep costs down, Lomax said.

Because of decades of underfunding and systemic bias in state funding for public HBCUs, it has been hard for schools to build out and sustain their basic infrastructure, said Marybeth Gasman, a university distinguished professor at Rutgers University.

“It’s long overdue,” Gasman said of the project and the new funding. “Sharing services is a great idea for financially under resourced institutions — frankly most colleges and universities benefit from sharing services.”

The HBCU Transformation Project needs to meet goals for increasing enrollment and graduation rates, as well as metrics around employment for graduates, in order to continue to receive the funds. Shelton said Blue Meridian would prefer the schools set ambitious goals and miss them rather than have them think too small.

The gift mixes both flexibility and accountability, he said, with the three intermediaries and participating schools having broad leeway to determine how to use the funds, as long as they present a business case that explains what the funding would achieve.

In legislation passed after the pandemic, HBCUs have received almost $6 billion in funding and support from federal agencies, including the canceling of $1.6 billion in debt held by the Department of Education, according to the White House.

Executive Steward - Direct the planning, preparation, and control of stewarding operation across multiple food and beverage outlets, including banquets. Responsible for inventory control and equipment inspection.

Executive Sushi Chef - Direct the planning, preparation, production, and control of sushi kitchen operations, inclusive of restaurants and bars, room service, banquets, and catering. Develop creative menu items and maintain product quality, while ensuring guest service levels are delivered.

Mechanic II - Perform diagnostic work, overhaul, adjust, repair, and maintain resort vehicles and equipment while under general supervision. Complete metal fabrication and repairs as needed.

Sushi Chef - Prepare sushi, sashimi, sushi rolls, and other food items. Strong knowledge of Japanese seafood, products, and terminology, and advanced knife skills are required.

Fully furnished housing, meals, Wi-Fi, on-property transportation, and laundry facilities are provided.

To apply, submit your resume to careers@rwbimini.com by September 14, 2023. Please indicate your position of interest in the subject heading of your email. To be considered, applicants must possess a valid Bahamian passport and be willing to relocate to Bimini.

THE TRIBUNE Thursday, September 14, 2023, PAGE 13

NOTICE is hereby given that ROBERSON FENE , of Plantol Street off East Street, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 14th day of September 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

HIRING

General Manager

• 10+ years in the role of a General Manager of a hotel/casino resort

• Master’s or Bachelor’s Degree in Hotel, Restaurant, and Resort Management required

• Extensive knowledge of all aspects of hotel/resort operations including, but not limited to, rooms, food and beverage, activities, maintenance, security, and warehouse

• Champion of driving exceptional guest service, with a proven track record of delivering 4 or 5-star service consistently

• Ability to deliver incremental pro tability gains through cost controls, including labor allocation across functional departments

• Demonstrate superior leadership abilities and a thorough understanding of all aspects of gaming and non-gaming operations

• Ability to think strategically, plan and develop detailed operational plans and drive execution

• trong nancial, marketing, and analytic skills in order to provide input to a corporate support of ce

Fully furnished housing, meals, Wi-Fi, on-property transportation, and laundry facilities are provided.

To apply, submit your resume to careers@rwbimini.com by September 14, 2023. Please indicate your position of interest in the subject heading of your email. To be considered, applicants must possess a valid Bahamian passport and be willing to relocate to Bimini.

LEAVING GOOGLE’S SEARCH ENGINE ISN’T EASY TO DO

WASHINGTON Associated Press

THE US Justice Department pressed ahead with its antitrust case against Google on Wednesday, questioning a former employee of the search engine giant about deals he helped negotiate with phone companies in the 2000s.

Chris Barton, who worked for Google from 2004 to 2011, testified that he made it a priority to negotiate for Google to be the default search engine on mobile devices. In exchange, phone service providers or manufacturers were offered a share of revenue generated when users clicked on ads.

In the biggest antitrust case in a quarter century, the government is arguing that Google has rigged the market in its favor by locking in its search engine as the one users see first on their devices, shutting out competition and smothering innovation.

Google counters that it dominates the internet search market because its product is better than the competition. Even when it holds the default spot on smartphones and other devices, it argues, users can switch to rival search engines with a couple of clicks.

That’s not so easy, according to Antonio Rangel, a behavioral economist from the California Institute of Technology who testified for the government. He said Google defaults discourage users from switching to rival search engines. And consumers, he said, are

often reluctant to change behaviors that have become ingrained.

Rangel also disputed Google’s contention that switching to a different search engine is easy. He said he acquired an Android 12 phone and studied the process required to replace the Google search engine with Bing; it took ten steps. “That is considerable choice friction,’’ he said.

He also offered an example of the power of defaults. In Germany, where people must actively decide whether to agree to be organ donors, only 12% do so. In neighboring Austria, where donating organs is the default option, the figure is 99%.

Barton, however, testified that Google wasn’t the only search engine seeking default status with phone companies.

In a 2011 email exchange, Google executives noted that AT&T chose Yahoo and Verizon went with Microsoft’s Bing as its search engine.

“I faced a challenge because mobile carriers became fixed on revenue share percentage,’’ Barton said Wednesday. To counter the competition, he tried to persuade potential partners that Google’s high-quality searches would generate more clicks — and therefore more advertising revenue — even if the carriers were paid a nominally lower percentage.

Google has emerged as the dominant player in internet searches, accounting for about 90 percent of the market. The Justice Department filed its antitrust lawsuit against the company nearly three years ago during the Trump administration, alleging Google has used its internet search dominance to gain an unfair advantage against competitors.

The trial, which began Tuesday, is expected to last ten weeks.

US District Judge Amit Mehta likely won’t issue a ruling until early next year. If he decides Google broke the law, another trial will decide what steps should be taken to rein in the Mountain View, California-based company.

Top executives at Google and its corporate parent Alphabet Inc., as well as those from other powerful technology companies are expected to testify. Among them is likely to be Alphabet CEO Sundar Pichai, who succeeded Google cofounder Larry Page four years ago. Court documents also suggest that Eddy Cue, a high ranking Apple executive, might be called to the stand.

On Wednesday, the Justice Department also questioned Google chief economist Hal Varian for a second day about the way the company uses the massive amounts of data generated by user clicks to improve future searches and entrench its advantage over rivals.

PAGE 14, Thursday, September 14, 2023 THE TRIBUNE

NOTICE

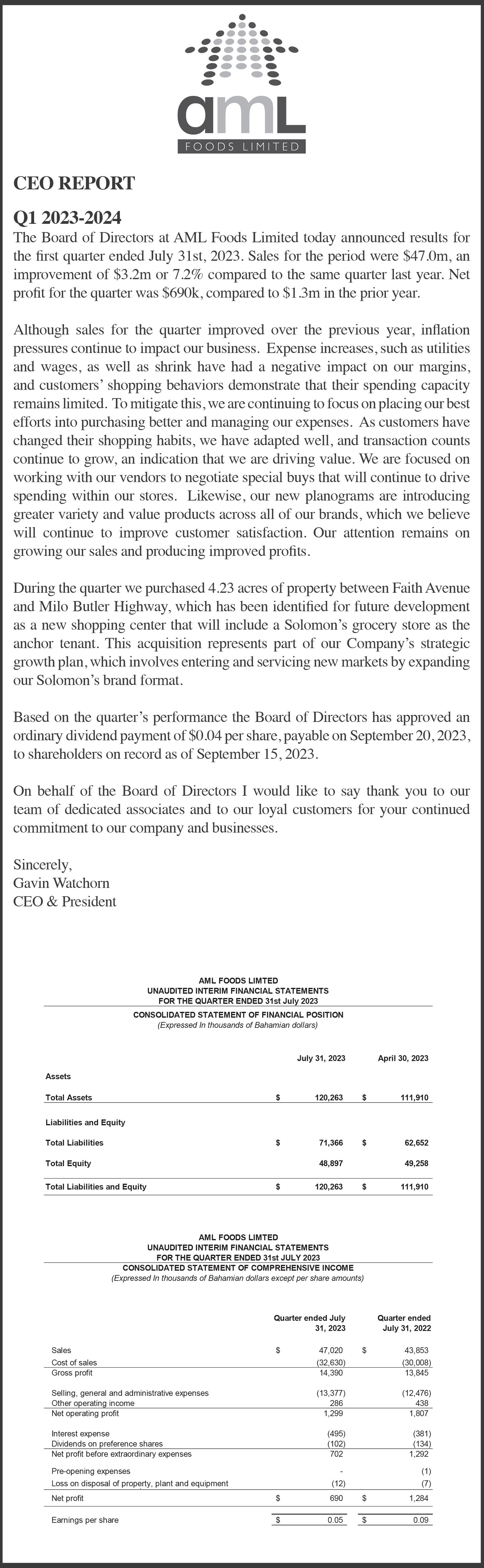

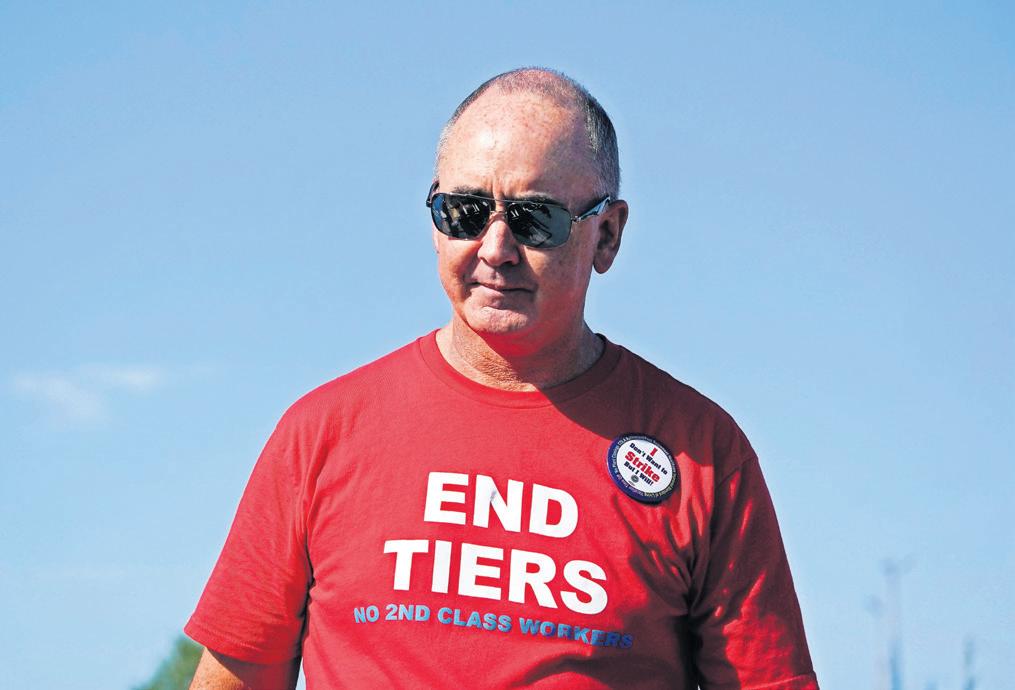

UNION CHIEF SAYS OFFERS FROM DETROIT INADEQUATE

DETROIT

Associated Press

WITH just over 24 hours left before a strike deadline, United Auto Workers President Shawn Fain says offers from the companies aren’t enough and the union is getting ready to strike.

In an online address to members yesterday, Fain said General Motors, Ford and Stellantis have raised their initial wage offers, but have rejected some of the union’s other demands.

“We do not yet have offers on the table that reflect the sacrifices and contributions our members have made to these companies,” he said. “To win we’re likely going to have to take action. We are preparing to strike these companies in a way they’ve never seen before.”

The union is threatening to strike after contracts with companies that haven’t reached an agreement by 11.59pm on Thursday. It would be the first time in

N

the union’s 80-plus-year history that it struck all three companies at the same time.

Talks continued Wednesday with the companies, but it appeared that both sides are still far apart.

Automakers contend that they need to make huge investments to develop and build electric vehicles, while still building and engineering internal combustion

O T I C E

EXXONMOBIL EXPLORATION AND PRODUCTION ROMANIA (CALIFAR) LIMITED

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certificate of Dissolution issued by The Registrar General on the 29th day of August, 2023.

Dated the 14th day of September A.D., 2023

D. A. Bates Liquidator of EXXONMOBIL EXPLORATION AND PRODUCTION ROMANIA (CALIFAR) LIMITED

N O T I C E

EXXONMOBIL EXPLORATION AND PRODUCTION ROMANIA (NARD) LIMITED

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certificate of Dissolution issued by The Registrar General on the 29th day of August, 2023.

Dated the 14th day of September A.D., 2023

D. A. Bates Liquidator of EXXONMOBIL EXPLORATION AND PRODUCTION ROMANIA (NARD) LIMITED

N O T I C E

ESSO EXPLORATION AND PRODUCTION CONGO (MER TRES PROFUNDE SUD) LIMITED

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certificate of Dissolution issued by The Registrar General on the 28th day of August, 2023.

Dated the 14th day of September A.D., 2023

D. A. Bates

Liquidator of ESSO EXPLORATION AND PRODUCTION CONGO (MER TRES PROFUNE SUD) LIMITED

Thursday night and will be announced at 10pm. He said the targeted strikes will keep the companies guessing. “We will not strike all of our facilities at once” on Thursday, he said.

SHAMYLOVE NOEL , of Plantol Street off East Street, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 14th day of September 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

vehicles. They say an expensive labor agreement could saddle them with costs, forcing them to raise prices higher than non-union foreign competitors.

Fain said the final decision on which plants to strike won’t be made until

Initially they’ll strike at a limited number of plants, but that will grow if there’s no movement in contract talks. It’s still possible that all 146,000 UAW members could walk out, he said. The goal is to reach a fair agreement, he said, “but if the companies continue to bargain in bad faith or continue to stall or continue to give us insulting offers, then our strike is going to continue to grow,” Fain said.

The union will not extend contracts, so those who stay at work will do so with an expired agreement. Fain said he understands sentiment behind an all-out

strike, which is still possible. But he said the targeted-strike strategy is more flexible and effective. If there’s no deal by the end of Thursday, union officials will not bargain on Friday and instead will join workers on picket lines.

The UAW started out demanding 40% raises over the life of a fouryear contract, or 46% when compounded annually. Initial offers from the companies fell far short of those figures. The UAW later lowered its demand to around 36%. In addition to general wage increases, the union is seeking restoration of cost-of-living pay raises, an end to varying tiers of wages for factory jobs, a 32-hour week with 40 hours of pay, the restoration of traditional defined-benefit pensions for new hires who now receive only

401(k)-style retirement plans, pension increases for retirees and other items.

On Wednesday, Fain said the companies upped their wage offers, but he still called them inadequate. Ford offered 20% over 4 ½ years, while GM was at 18% for four years and Stellantis was at 17.5%. The raises barely make up for what he described as minimal raises of the past.

All three companies’ offers on cost-of-living adjustments were deficient, he said, providing little or no protection against inflation, or annual lump sums that may workers won’t get.

The companies rejected pay raises for retirees who haven’t receive one in over a decade, Fain said, and they’re seeking concessions in annual profit-sharing checks, which often are more than $10,000.

THE TRIBUNE Thursday, September 14, 2023, PAGE 15

NOTICE is hereby given that

NOTICE

UNITED Auto Workers President Shawn Fain walks in the Labor Day parade in Detroit on Monday. Photo: Paul Sancya/AP

DELTA AIR LINES TO RESTRICT ACCESS TO SKY CLUB LOUNGES

By KEN SWEET AP Business Writer

DELTA Air Lines pas-

sengers who have long enjoyed access to free meals, alcohol and a quiet place to relax before their flight are in for some major cutbacks in coming years.

The Atlanta-based airline said it plans to cap the number of entries to its Sky Clubs starting February 1, 2025 for holders of the American Express Platinum Card as well as the Delta Reserve American Express Card. Those holding the Platinum Card will be allowed six visits

per year, while the Delta Reserve Card holders will get ten annual visits.

Those who book a basic economy ticket will no longer be allowed in the lounge starting January 1, 2024, regardless if they carry a Platinum Card or any other premium credit card.

The news originally was leaked on a Portugueselanguage website and was confirmed by a Delta spokesman.