Wendy’s tells Town Planning: No more PI project mistakes

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

WENDY’S is urging the planning authorities to take “great care” to ensure approval for a Paradise Island restaurant, which could create between 75-100 total jobs, is not again derailed by procedural irregularities.

Psomi Holdings, the corporate vehicle seeking to redevelop the

former Scotiabank branch into a combined 175-seat Wendy’s and Marco’s Pizza eatery, called on the Town Planning Committee to make sure “the correct procedures” for holding “a fair public consultation” on its application are followed.

Launching its fresh bid for site plan approval, Psomi Holdings told Keenan Johnson, the Town Planning Committee’s chairman in a July 23, 2023, letter:

“Having regard to the decision

Founder interest ‘four times’ higher than Jack’s Bay goal

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

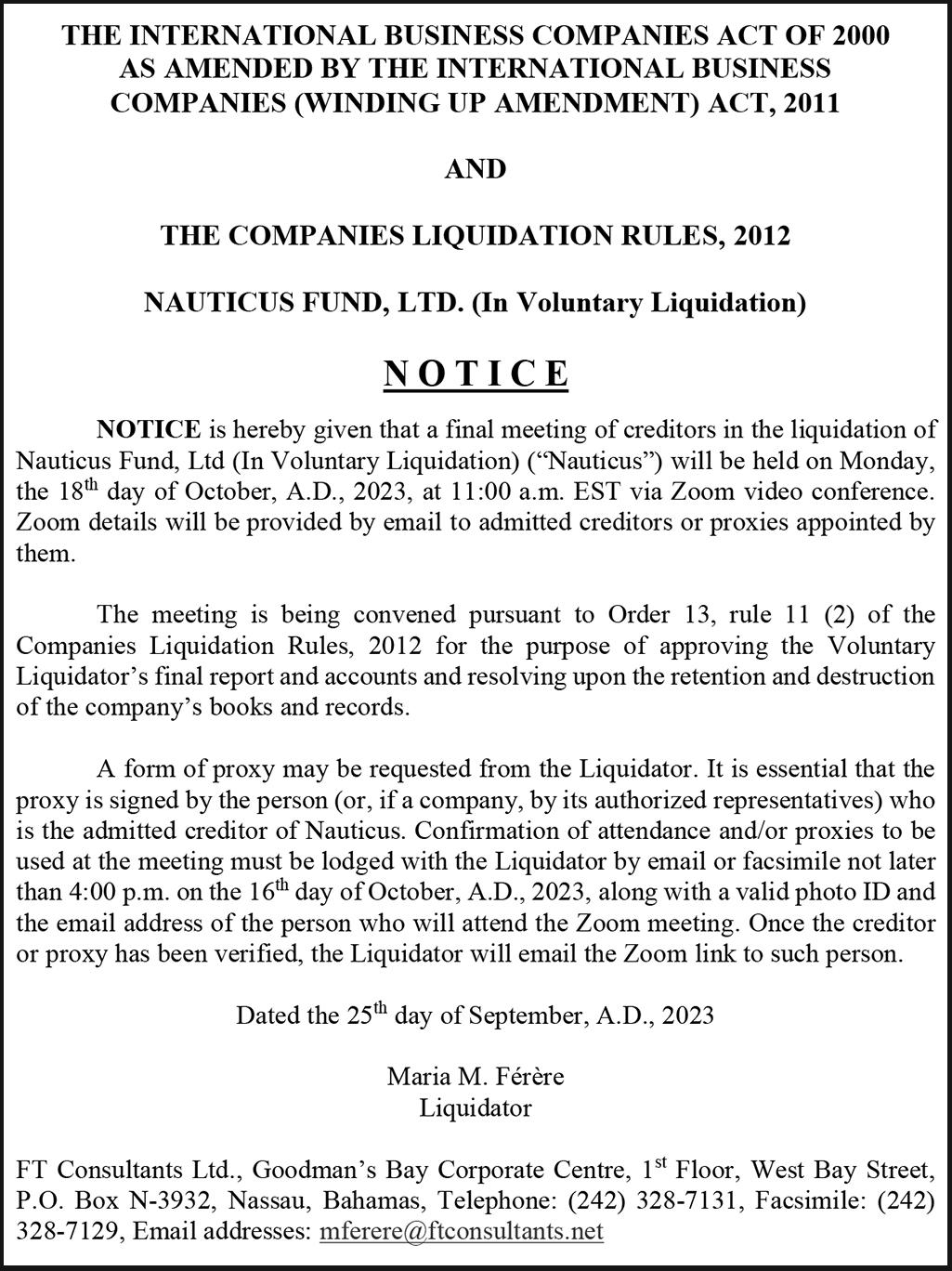

SIR Franklyn Wilson yesterday said the 1,200acre Jack’s Bay project has attracted interest from “four times” the number of founding buyers it is targeting while receiving “a very strong endorsement” from Scotiabank.

The Eleuthera Properties and Jack’s Bay chairman, speaking as the latter unveiled a multi-million dollar debt financing package from the Canadian lender that will enable it to build-out its amenities and provide mortgage funding to its

homeowners, pledged that “big things are happening” with a project he and fellow investors first acquired more than 60 years ago.

He described Jack’s Bay as “pretty unique” given SEE PAGE B2

Opposition alarm on S&P’s three times’ higher deficit

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Opposition’s finance spokesman yesterday voiced alarm over Standard & Poor’s (S&P) prediction that the fiscal deficit for the 2023-2024

Budget year will come in more than three times’ higher than the Government’s forecast at $466m.

Kwasi Thompson, also east Grand Bahama MP, in a statement responding to the credit rating agency’s recent country

analysis on The Bahamas, said his party is “gravely concerned” by the wide divergence between its projections and the Davis administration’s own

deficit target of $131m for the current fiscal year.

The latter figure is equivalent to 0.9 percent of Bahamian gross domestic product (GDP), or economic output, but S&P is forecasting a deficit - which measures by how much the Government’s spending exceeds its income in any fiscal year - of 3.2 percent of GDP.

Suggesting that any improvement in the Government’s fiscal health will be more gradual than the administration anticipate, S&P’s comments also

suggested that austerity measures may be required, via spending cuts, new and/or increased taxes or a combination of both, if higher economic growth fails to materialise and revenue and deficit targets are not hit.

“We expect that fiscal deficits will continue to decline and the pace of nominal debt growth will slow, translating into a gradual reduction of our net debt-to-GDP ratio, although the interest

SEE PAGE B5

Tax authorities push Out Island compliance drive

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE GOVERN-

MENT’S major tax authority is undertaking a Family Island compliance tour to better educate residents and businesses on the need to pay their due tax obligations and how to do so, it was confirmed yesterday.

John Williams, the Department of Inland

Revenue’s (DIR) communications chief, told Tribune Business that officials are currently in Bimini, the third island they have visited after Long Island and Abaco as part of this initiative. He maintained that it is geared towards educating residents on the requirements they must meet for Business Licences, VAT and real property tax rather than an enforcement crackdown that will result

in sanctions, goods seizures and company closures.

He said: “We’re visiting these islands to educate persons on what they need to be doing for Business Licence, real property tax, VAT and everything else that we do at the Department. It’s not a visitation to shut anybody down, or anything of the likes. We just want persons to know what they need to do to become compliant.”

Mr Williams added that the meetings the

of the [appeals] Board setting aside Psomi’s previous approval due to the lack of public consultation, we would respectfully request that great care be taken to ensure that the correct procedures are implemented by the Town Planning Committee in dealing with the application.”

It also called on the planning regulator to make sure “appropriate measures are taken to ensure that the public consultation is fair” after the Subdivision and Development Appeal Board, in a June 14, 2023 verdict, overturned the original goahead for the Paradise Island SEE PAGE B4

RBC’s $22m payment suspicion ‘reasonable’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE COURT of Appeal yesterday ruled it was “reasonable” for Royal Bank of Canada (RBC) to find that $21.957m paid to a Bahamian businessman by a Slovakian he has never met for investment in his sand mining venture was “suspicious”.

The three justices, in a unanimous verdict, dismissed Larry A. Ferguson’s appeal against the Supreme Court’s initial ruling which found that the Canadianowned bank was more than justified in refusing to process and clear a sum that was paid to him via 23 VISA transactions that exceeded the card’s limit each time.

Appeal Justice Indra Charles, in her ruling, said all 23 payments by Boris Plavala, a Slovak citizen, were “force posted” - meaning that the receiving party bypasses the card company’s normal authorisation process by taking the point-of-sale facility that processes such payments

offline. The recipient then processes the transaction via a code obtained from his/her bank.

RBC subsequently flagged the payments to Mr Ferguson and his companies as “suspicious transactions”, and placed a hold on the accounts. VISA also declined to settle the payments, all of which were for $990,000 each time bar one that was for $168,000, because they exceeded the card’s individual transaction limit, while the issuing institution, ZUNO Bank, asserted that all transfers were “fraudulent”.

Ultimately, RBC reversed the payments to Mr Ferguson, who initiated legal action as a result. Noting that he had been an RBC client since October 27, 2010, appeal justice Charles wrote: “On or about October 18, 2016, the appellant handed a letter to the respondent [RBC] alleging that funds in the amount of 350m Euros would be immediately transferred to his accounts.

SEE PAGE B3

Department of Inland Revenue is holding with Family Island communities to address their queries, gather feedback and resolve outstanding tax matters is generating a positive response. He said: “We’ve held Town Hall meetings, either one or multiple meetings, depending on the island and the reach, to hear from persons in the community; what issues they’re having

SEE PAGE B2

business@tribunemedia.net TUESDAY, SEPTEMBER 26, 2023

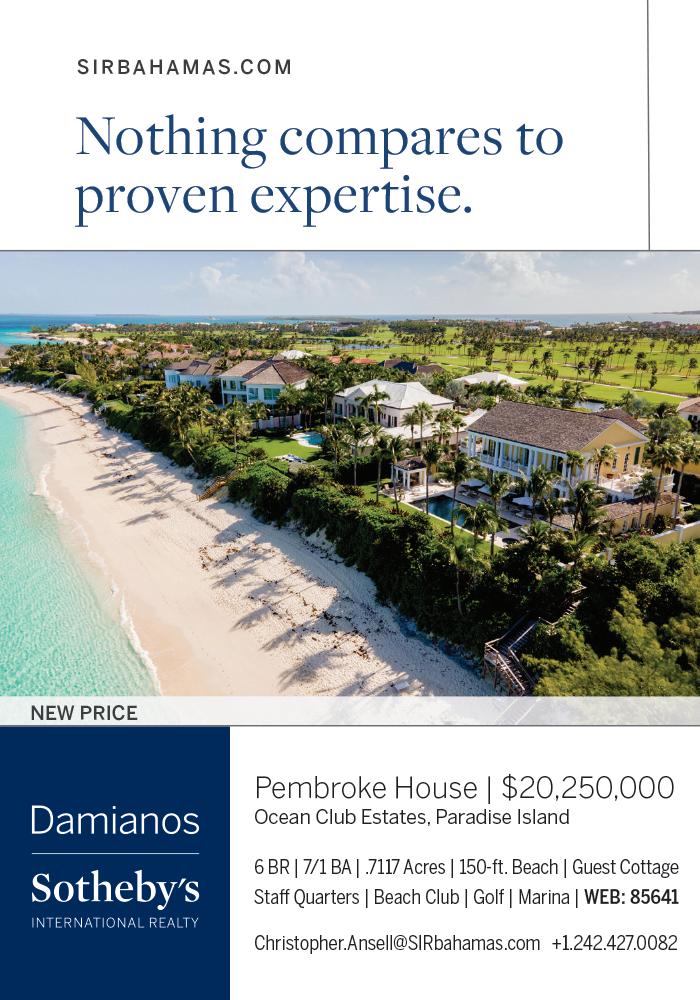

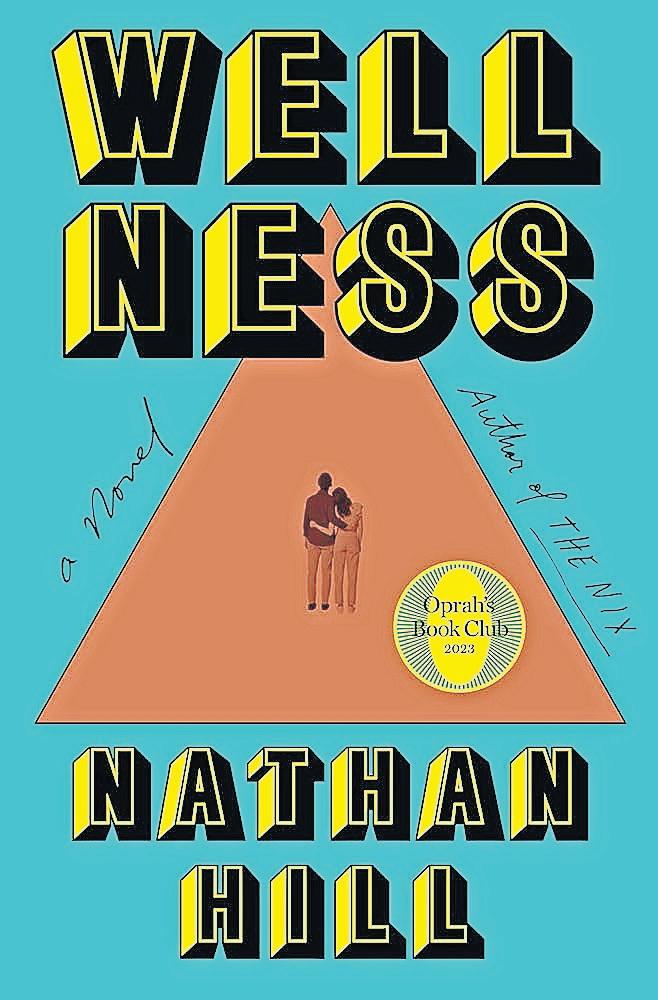

WEDNY’S PARADISE ISLAND RENDERING

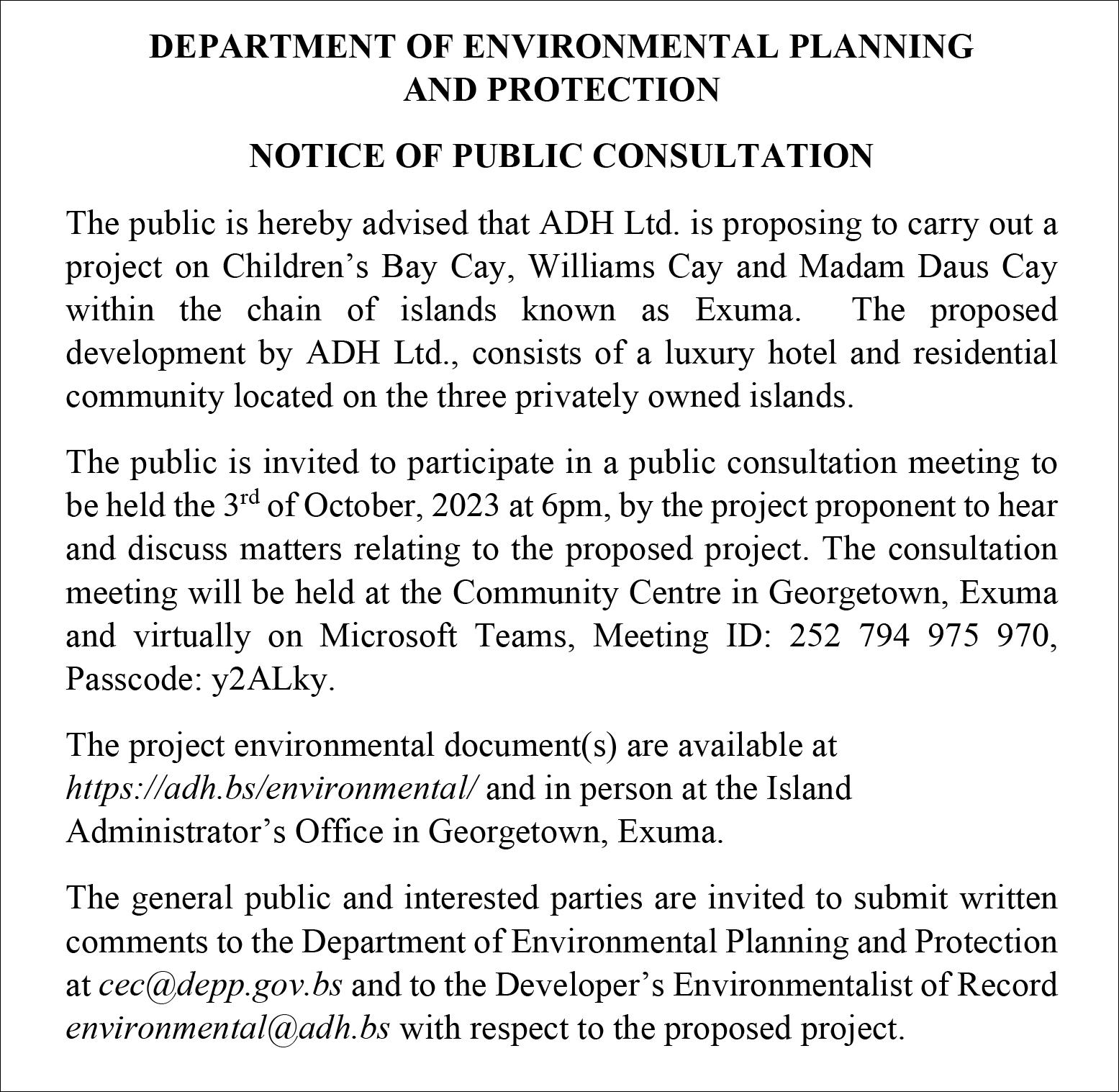

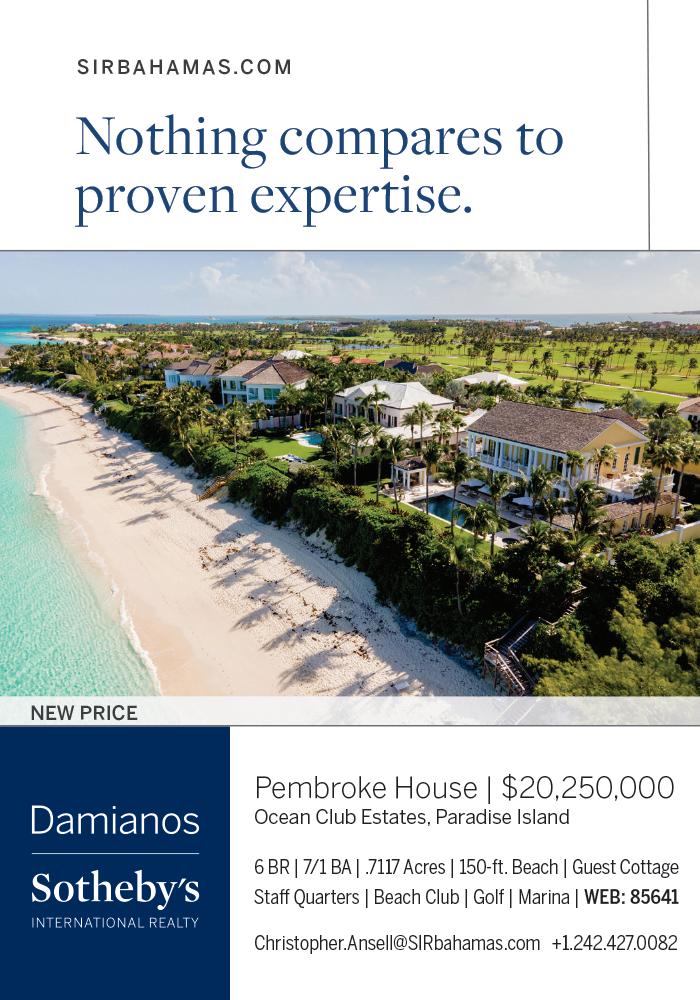

L to R: Alicia Rolle, senior credit solutions officer at Scotiabank; Velma Miller, senior client relationship officer at Scotiabank; Greg Stuart, head of corporate and commercial banking at Scotiabank (Bahamas); Tommy Turnquest, chief executive of Jack’s Bay; Robi Das, portfolio manager and strategy advisor to Sir Franklyn Wilson; and Sir Franklyn Wilson, chairman of Eleuthera Properties.

HURRICANE SEASON IS HERE. ARE YOU PREPARED? (BAHAMAS) LIMITED. INSURANCE BROKERS & AGENTS INSURANCE MANAGEMENT $6.10 $6.11 $6.15

KWASI THOMPSON

$6.17

THE BAHAMAS will this week sign agreements with Qatar to strengthen this nation’s aviation sector by improving Bahamasair’s operations and enhancing training opportunities as part of a wider West Asia trade mission.

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, is leading the delegation of tourism and other government officials that left The Bahamas on Saturday to head to the Middle eastern gulf state.

The Ministry of Tourism, Investments and Aviation, in a statement, said the visit aimed to build on

previous efforts to forge partnerships with several Middle Eastern countries while strengthening that region’s ties to The Bahamas and the Caribbean.

Ginger Moxey, minister for Grand Bahama; Zane

Lightbourne, minister of state for the environment; and Senator Barry Griffin are accompanying Mr Cooper.

During the Qatar visit, the deputy prime minister will sign a Memorandum of Understanding (MoU) with Qatar on behalf of The Bahamas. This will formalise agreements in principle surrounding the development of aviation and other related services.

Mr Cooper will also meet with the head of Qatar Airways to discuss multiple aviation opportunities for both countries, as well as prepare for a site visit to Bahamasair’s domestic

WITH QATAR

operations by the airline’s technical teams next month. Tourism officials will continue talks with Qatar Tourism on driving visitors to The Bahamas and multidestination Caribbean tourism.

Sheikh Mohammed bin Abdulrahman bin Jassim

Al Thani, prime minister of Qatar, will also have a private audience with Mr Cooper to discuss alliances between the two countries. The Bahamian delegation will also meet with officials from the Qatar Fund for Development and the Qatar Investment Authority.

Talks will focus on investments in The Bahamas and

the possible framework for a Caribbean Investment Fund project, which would provide funding for infrastructure, science and technology, energy, airports and aviation, business incubation and entrepreneurship, tourism and agriculture and fisheries.

Discussions will also focus on grant funding for environmental protection, sustainable development goals, support for business development for women and youth, disaster reconstruction, urban development and national development planning.

The ministry’s statement said Mrs Moxey, Mr Lightbourne and Senator Griffin will meet with officials and private investors to discuss investment opportunities in Grand Bahama, technology, innovation and sustainable environmental initiatives.

Dr Kenneth Romer, The Bahamas’ director of aviation, will also meet with executives of Qatar Aeronautical Academy to exchange knowledge and best practices on aviation strategies that could further develop the planned Bahamas Aeronautical Academy and aviation industry. The delegation leaves Qatar later today.

Founder interest ‘four times’ higher than Jack’s Bay goal

FROM PAGE B1

that it now has two of the three Canadian-owned, Bahamas-based commercial banks involved as investors, with Royal Bank of Canada’s (RBC) equity ownership complementing Scotiabank’s debt position.

Disclosing that the project, billed as a private club community, is attracting “tremendous interest” from potential investors and real estate buyers, Sir Franklyn added that has generated demand far in excess of the 24 ‘“founders” it was originally seeking to attract.

With IMI Worldwide Properties, which first marketed Ocean Club Estates to global purchasers once it was developed, now hired to do the same for Jack’s Bay, he said the sales drive will be further boosted by the Scotiabank partnership that will result in the bank providing mortgage financing to home buyers.

Voicing optimism that Jack’s Bay will become a model, or trailblazer, for other Family Island hotel and resort projects that have traditionally struggled to attract bank financing, Sir Franklyn said he and his fellow investors “had to stay the course” and stick with the “vision” for the property even if it required incredible patience to show Bahamians the benefits of investing in the country’s largest industry.

“This is a very significant development,” Sir Franklyn told Tribune Business of Scotiabank’s debt financing provision. “Jack’s Bay is now in an incredible position where the Royal Bank of Canada is an investor with actual ordinary

shares; an equity investor.

Scotiabank is in in a very complementary way.

“We have two of the three big Canadian banks involved in Jack’s Bay in ways that are pretty unique. That [Scotiabank’s partnership] is a very, very strong endorsement. Let’s just say we are very pleased it happened at a significant time because there are a lot of other things happening that we’ll be announcing to the public in short order.”

Sir Franklyn, also the Sunshine Holdings and Arawak Homes chairman, added that the profile feature on Jack’s Bay’s in one of Golf magazine’s summer editions was “generating tremendous interest” in the development from prospective international buyers. This, he said, easily exceeds the 24 so-called “founders” the project was hoping to entice to purchase one of its beachfront and ocean view homesites ranging in price from $1m to nearly $3m.

“It’s very, very strong interest,” he told this newspaper. “We have dozens of persons who have paid deposits to become founders in the programme. We referenced not more than two dozen. We have at least four times’ that, the number of people who would have interest in this. They have paid deposits for a reservation. The fact of the matter is we are only looking for about two dozen. We have four times’ that with potential founders. Potential.”

Revealing IMI Worldwide Properties’ involvement in Jack’s Bay’s real estate marketing and sales efforts, Sir Franklyn added: “The method these people have is they’re going

through a process where people can go online, look at the legal documents, do what due diligence they have to do and be told on a given day that they have to close. That is the significance of that part of the announcement about financing home buyers.”

Besides mortgage financing for real estate buyers, the Scotiabank financing package also includes a development loan. This will fund Jack’s Bay first phase development, which will include the Atlantic Club; a sports pavilion; upgrades to the current beach club known as the Pink House; a 7,000 square foot spa village; ready-to-build lots on Founders Row; and 12 Atlantic Club cottages.

This phase is expected to be complete in late 2024, according to a Jack’s Bay statement. Other amenities planned for Jacks’ Bay include a beach club, fitness and wellness programme and 18-hole Nicklaus Heritage course with a new clubhouse and comfort stations scheduled for completion in early 2025.

Sir Franklyn declined to provide details on the total value and size of the Scotiabank financing package, referring this newspaper to the bank, but added: “It’s a lot of money.” Confirming that it was “no doubt” in the millions of dollars, he said: “The first figure is not one.”

Apart from Jack’s Bay, Sir Franklyn voiced optimism that the partnership with Scotiabank will also pave the way for other Family Island resort and hotel developments to secure their own bank financing. “It is significant

for Jack’s Bay, but it is even more significant for Family Island development,” he told Tribune Business. “The fact of the matter is getting banks to invest in Family Island projects has been a struggle for people with such vision.

“We hope that this will become very relevant for other investors, Bahamian and non-Bahamian, who are seeking to do things in the Family Islands. Do you think Baha Mar would exist if Atlantis was not successful? That’s my point. The fact that once Jack’s Bay is successful, we pray that our success will help to fuel the success of others throughout the Family Islands. That’s our prayer.”

Sir Franklyn said the involvement of former FNM Cabinet minister and MP, Tommy Turnquest, as Jack’s Bay’s chief executive “demonstrates for all to see this is nothing to so with partisan kind of stuff. It’s to do with country; that’s part of the narrative of what’s unfolding”.

Asked whether Jack’s Bay could inspire more Bahamians, who have traditionally been reluctant to invest in the resort and hotel sector, to do so, Sir Franklyn replied: “That’s what it’s all about. That’s why the patience, that’s why we had to take it. That’s why we had to stay with it. The lessons for the country are too many and too varied. We had to do this. We had to stay the course. “We closed on the purchase of the asset on January 30, 1987. Investors don’t generally go to 36 years, 37 years to stay with the vision. That’s not normal.” Sir Franklyn, in

a statement unveiling the financing partnership, said: “We are thrilled to partner with Scotiabank on this integral phase of Jack’s Bay. Their confidence in our capital structure is an honorable endorsement and a nod to the firm’s strong track record.

“Further, we were able to collaborate with the team at Scotiabank on a facility that met the conditions of a traditional senior loan but also provided a degree of customisation to allow us to execute our original business plan. This is a significant milestone for an Out Island development, and we are proud that Scotiabank chose to endorse Jack’s Bay as a beacon Bahamian project.”

Jack’s Bay also announced it has received a recent investment by Eric Pike, chairman of Pike Corporation and equity partner in the Jack’s Bay project. It added that there is no existing debt or encumbrances on the property.

“By structuring a tailored financing solution and extending our local knowledge and expertise throughout the course of the transaction, we were happy to have played a role in making the project a reality. Scotiabank’s unique positioning in The Bahamas allows us to support our clients in a variety of ways on projects of all sizes,” said Gregory Stuart, head of corporate and commercial banking at Scotiabank.

“We do this by providing end-to-end financial and operating solutions, thereby allowing them to capitalise on lucrative opportunities with ease. Jack’s Bay is an invaluable and timely

Tax authorities push Out Island compliance drive

FROM PAGE B1

burden will remain high.

The expanding economy is supporting government revenues, which increased almost 12 percent in the most recent fiscal year,” the credit rating agency added.

“While some of the pandemic-related programmes are ending, the interest burden, combined with other spending rigidities, including state-owned

enterprise (SOE) outlays, continues to weigh on expenditures. We expect the deficit to reach to 4.6 percent of GDP in fiscal year 2022-2023, and to further fall to 3.2 percent in fiscal year 2023-2024.” Mr Thompson, former minister of state for finance in the Minnis administration, said yesterday: “The Opposition is gravely concerned with the projection by S&P that the

Government will have larger than forecasted deficits for the last fiscal year and this one.

“Based on the GDP estimates in the Government’s Budget document, that would translate into a deficit of over $600m last year [2022-2023] and over $500m this year. This year the deficit is to drop to $131m. It is stunning to see these projections of massive fiscal deficits at a time

of record revenues. The PLP continues to squander the economic recovery with its total abandonment of proper fiscal management.”

Tribune Business calculations suggest Mr Thompson’s figures may be slightly out. For example, based on the GDP numbers and percentages contained in the 2023-2024 Budget, the 3.2 percent of GDP deficit forecast by S&P would be equivalent to $465.78m. However, the 4.6 percent of GDP forecast for the recently-closed 2022-2023 year would be some $630.2m - almost $110m higher than the Government’s own $520.6m projection.

Any miss of the 2023-2024 deficit target by the magnitude suggested by S&P, which would be equal to $334m based on the rating agency’s and the Government’s respective forecasts, could undermine The Bahamas’ fiscal credibility and investor/market confidence

in its public finances at home and abroad. It would also place the Government’s ambition of achieving a fiscal surplus by the 20242025 fiscal year in peril.

S&P, meanwhile, also warned that the Government will likely struggle to meet its debt reduction targets “without material new revenues, significant cost-cutting or well above average economic growth”.

The rating agency, in a report that made no change to this nation’s creditworthiness, said the debt blow-out produced by Hurricane Dorian and the COVID pandemic means the Government’s “previous fiscal consolidation plans” are insufficient to achieve its fiscal goals unless economic growth is strong enough to avoid the imposition of further austerity measures.

“We believe the country’s record of slow progress in reforming public finances and key economic sectors has weakened its financial

addition to the real estate inventory that is available in The Bahamas.”

Among the amenities already in place are existing food and beverage outlets, a 10-hole golf course designed by Tiger Woods and TGR Design, 18 partially completed residential and mixed-use buildings and a 22,000-square foot partially completed activity centre with a pool and direct beach access.

Jack’s Bay has a large number of Bahamian shareholders in its immediate holding company, Eleuthera Properties. While Sir Franklyn’s Sunshine Holdings group is the largest shareholder, its other investors include the likes of Colina, BAF Financial, the John Bull Group of Companies and Royal Bank of Canada (RBC). Besides the corporate investors, the Anglican Church has been “gifted” shares in Eleuthera Properties Ltd, while the estates of the late John Morley and Billy Lowe were also among the shareholders. Eleuthera links to the investors are through the estates of the late Albert Sands and Whitfield Kemp. Another Eleuthera shareholder is businessman Lawrence Griffin from Governor’s Harbour, while Sir Orville Turnquest, the former governor-general, and his family - long-time investment and business partners of Sir Franklynare also invested. Another investor is former minister of tourism and aviation, Dionisio D’Aguilar.

profile over the long-term and hurt its economic performance,” S&P said of The Bahamas. “The Bahamas has faced two large negative shocks (Hurricane Dorian in 2019 and the pandemic in 2020), resulting in a significant rise in government debt and testing the Government’s resolve to put the nation’s finances on a sustainable path.

“The rapid increase in debt in recent years means the Government’s previous fiscal consolidation plans will likely be insufficient to meet its debt targets without material new revenues, significant cost cutting or economic growth well above historical averages. Furthermore, the country remains vulnerable to environmental risks.”

Joining Moody’s and the Inter-American Development Bank (IDB) in warning that The Bahamas faces “elevated” external financing risks, with the Government requiring $2.1bn during the present 2023-2024 fiscal year to refinance maturing debt, S&P nevertheless hinted it was optimistic that it will source the necessary funding to cover the $300m foreign currency bond coming due for repayment in January 2024.

However, it then warned that “material spending cuts will be more difficult to implement if they become necessary”, pointing to the “drain” imposed by subsidies to loss-making state-owned enterprises (SOEs) which consume 15 percent of the Government’s total annual expenditure.

PAGE 2, Tuesday, September 26, 2023 THE TRIBUNE

Share your news BAHAMAS TO SIGN AVIATION

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

AGREEMENTS

CHESTER COOPER

MINISTER SOUNDS ALERT OVER ‘FAKE’ LOAN FLYER

A CABINET minister yesterday said he had asked the authorities to probe a “fake flyer” that was using his image without permission in a bid to entice Bahamians to seek loans.

Senator Michael Halkitis, minister of economic affairs, in a statement

sought to warn the public not to be duped by this and added that he has asked the Financial Intelligence Unit (FIU) to investigate the matter.

He said: “It has come to my attention that a flyer with my image attached is circulating on social media purporting to show me thanking one Renay Sands of Loan Express for approving a loan to me.

“This flyer is being used to solicit individuals to apply for loans. This flyer is fake. The public is warned to avoid this fraud. This matter has been referred to the Financial Intelligence Unit for investigation with a view to prosecution of the perpetrators.” Efforts to track down the person and entity named, Renay Sands and Loan Express, proved unsuccessful prior to press time. Efforts to reach

Mr Halkitis also proved fruitless.

Last month, the Financial Intelligence Unit (FIU) warned financial institutions and the general public to be on alert for an increasing number of fraudulent activities. The FIU said that it has seen an increase in suspicious transaction reports (STRs) filed by financial institutions, with victims being contacted by fraudsters impersonating

RBC’S $22M PAYMENT SUSPICION ‘REASONABLE’

FROM PAGE B1

“On or about October 20, 2016, the sum of $20.958m was credited to his Coastal Winds account arising from a VISA credit card transaction and $990,000 was also credited to the account of Store Away by the same method.” Coastal Winds was a vacation rental business operated by Mr Ferguson, while Store Away was another entity in which he was a shareholder.

“The funds were facilitated by 23 force-posted transactions from the VISA card of Boris Plavala, whom the appellant had never met but who had agreed to provide him with the funds without him having to repay Mr Plavala,” appeal justice Charles added. “A force-posted transaction occurs where a merchant processes a credit card or a debit card offline by use of a code obtained from the merchant’s bank. This enables the merchant to bypass the normal authorisation process.

“Twenty-one of these transactions were in the amount of $990,000 each and the 22nd was in the amount of $168,000. A separate transaction was also made to the Store Away account for $990,000.” This unusual activity, and the sums involved, alerted RBC executives.

“The transactions in both accounts were flagged by RBC Financial (Caribbean) Ltd’s Fraud Monitoring Unit in Trinidad & Tobago, which monitors merchant accounts operated within all RBC Caribbean jurisdictions for suspicious activity. As a result, a hold was placed on the accounts. On or about 20 October 2016, the appellant attempted to access the accounts and was advised of the hold,” appeal justice Charles added.

“In addition to the accounts being flagged for suspicious activity, VISA also declined to settle the transactions on the basis that the amounts of the

transactions exceeded the card’s limit for individual transactions. Further, the respondent was later contacted by the credit card issuer ZUNO bank and informed that the transactions in question were fraudulent.”

Mr Ferguson, though, argued that because the funds had been posted to his accounts they had “passed RBC’s investigatory ‘firewall’ confirming the legitimacy of the transmissions and, therefore, the respondent was obligated to immediately pay the funds to him upon request”.

However, RBC’s stance “is that it never received the funds from VISA to settle the transactions which it advanced to the appellant’s accounts. Consequently, the funds which were advanced to the accounts were reversed”. Unable to reconcile their differences, Mr Ferguson initiated legal action on November 8, 2016, but his arguments were dismissed by Justice Diane Stewart at the Supreme Court level.

Central to Mr Ferguson’s appeal was his assertion that, once the funds were credited to his accounts, “he had an automatic right” to them and RBC did not have the ability to reverse the transactions even though VISA had refused to settle the payments.

“Returning to the pivotal issue, the gravamen of the appellant’s case is that once the funds were credited to his accounts, he had a contractual right to the funds upon his demand and the respondent did not have the ability to debit the accounts. Further, it matters not whether VISA did not honour the transactions,” appeal justice Charles wrote.

“As the respondent [RBC] properly submits, there was clear evidence at the trial, which the judge accepted, that the nature of the transactions being offline transactions meant that such transactions by-passed the standard

approval process and were ‘force-posted’.

“In other words, they were approved by the person seeking to post the transactions and not by VISA. This process required a subsequent verification from VISA which did not occur. Therefore, the judge was correct to categorise these transactions as ‘attempts’ and not ‘approved’ as the only entity that could have approved them was VISA and it did not.”

The Court of Appeal found that Mr Ferguson, who was represented by attorneys Keod Smith and Carlton Martin, has “missed the point” because no funds were ever deposited in his accounts. Instead, RBC had made an advance to him but VISA subsequently never settled the card payments.

“The absurdity of the appellant’s argument that once the funds were credited to the accounts, the respondent did not have the ability to debit the accounts regardless of whether VISA honoured or did not honour the transactions, was underscored during oral submissions,” appeal justice Charles wrote.

This saw a lengthy exchange between Sir Michael Barnett, Court of Appeal president, and Mr Smith over whether a financial institution can debit a cheque posted to a customer’s account if it bounces because there are insufficient funds to clear it.

“We agree... that the respondent bank has an unquestioned duty to prevent the use of funds deposited to the account of a customer where it is aware that that customer has no legitimate claim to those funds,” appeal justice Charles wrote.

“In the instant case, the funds in question, being an advance, were in fact the respondent’s own funds but even if that were not the case, the respondent, being aware of a report of suspicious transactions and potential fraud was under

an obligation to take steps to prevent harm to third parties.”

Mr Ferguson also sought to appeal on the grounds that the Supreme Court erred in finding Mr Plavala had to be called as a witness given that “the funds were sent from ZUNO bank by Mr Plavala as an investment in his sand mining business.

“The Judge found that Mr Plavala was not called as a witness to support his contention that he had in fact sent the funds as a non-obligatory investment. She further found that the

representatives of reputable financial institutions.

The FIU explained that customers of commercial banks were receiving calls or e-mails from individuals posing as bank representatives requesting account and personal information for “verification purposes”.

It said: “The Financial Intelligence Unit (FIU) of The Bahamas hereby advises financial institutions and the public at large

Central Bank confirmed by letter that Mr Plavala had not obtained any approval to invest in The Bahamas nor did the appellant obtain approval to borrow in a foreign currency,” appeal justice Charles added.

“What the judge said... is that it would have been beneficial to the appellant’s case for him to set out any agreements between him and Mr Plavala since no Central Bank approval had been obtained by Mr Plavala, a non-Bahamian, to invest in The Bahamas.

Later on, the judge stated that all of those omissions supported the finding of the respondent that the transactions were suspicious, which

of incidences of fraudulent activities that are adversely affecting account holders of various commercial banks in the jurisdiction. The FIU has noticed an increase in suspicious transaction reports (STRs) where commercial banks have reported instances of account holders reporting unauthorised online transfers to persons unrelated or unknown to them.”

SEE PAGE B5

she accepted as reasonable. We do, too......

“It is the appellant who alleges that Mr Plavala, whom he had never met, transmitted millions of dollars to him. There was no approval from Central Bank for a non-Bahamian to do so. The judge was concerned that there was no evidence that Mr Plavala and the appellant were engaged in any ongoing business relationship. She accepted that the scenario could objectively have been viewed as suspicious....” The Court of Appeal dismissed Mr Ferguson’s claim for “not having advanced any cogent or rational grounds of appeal”.

THE TRIBUNE Tuesday, September 26, 2023, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

TELLS TOWN PLANNING: NO MORE PI PROJECT MISTAKES

restaurant project on the basis that the Town Planning Committee did not carry out adequate public consultation in accordance with the Planning and Subdivisions Act.

The original ‘change of use’ application for the former Scotiabank site by Aetos Holdings, the Wendy’s and Marco’s Pizza Bahamian franchisee, was heard in March 2022 when COVID restrictions were still governing the staging of public meetings. The Appeal Board determined this hearing did not meet the Act’s requirements for public consultation, thus overruling the original decision and requiring Aetos Holdings to restart the planning approval process all over again.

Tribune Business understands that, if successful in obtaining planning permission, the Paradise Island restaurant project will create between 75 to 100 construction and full-time jobs. Aetos Holdings could also invest up to $3m in the site’s redevelopment, including all the necessary restaurant equipment to outfit the location.

Revealing some of its plans online, Aetos

Holdings said: “The proposed plan for the old Scotiabank building features two of our modern state-of-the-art restaurants fit for the community in one unique space. This retrofit will utilise the same two-storey building which the bank previously occupied, but with a few design updates on the interior and exterior.

“It is important to note that there is no Wendy’s drive-through included in this proposal, as there will only be walk-up service to cater to our guests for Wendy’s, and Marco’s Pizza will offer both walkup and delivery services within the area. Therefore, this proposal will not create additional traffic in the community for neighbouring residents, tourists [and] business, or to motorists. It also gives us an opportunity to cater to Paradise Island residents, tourists and guests. “There is adequate space for parking, with 19 spots on the property, and directly across from our property is the paid parking lot. It is also conveniently located across the street from Marina Village and next to Dunkin’ Donuts. The building will feature large floor to ceiling hurricane impact

doors and windows to allow natural light to come into the dining room on both levels,” Aetos Holdings continued.

“On the inside ground floor there is seating capacity for 56 guests, plus an additional 44 seats on the covered outdoor seating area on this level. Additionally, on the second level there is indoor seating for 40 guests plus an additional 32 seats on the covered outside dining area. This gives combined seating of up to 172 persons on both levels.

“This will give our guests the opportunity to enjoy their food in a new, modern dining space that both Bahamians and tourists deserve.” Chris Tsavoussis, who with his brother, Terry, is the principal and owner of Aetos Holdings, was yesterday said to be travelling back to The Bahamas and could not be reached for comment. However, the food franchise group said it is “confident that we will be able to offer an upscale quick service restaurant experience” on Paradise Island.

Meanwhile, new documents filed with the Town Planning Committee confirm previous Tribune Business revelations that there are no so-called

restrictive covenants that prohibit Aetos Holdings from developing the site into a restaurant destination for its pizza and hamburger brands.

Jamie Liddell, a Lennox Paton attorney, in an October 26, 2021, legal opinion for Psomi Holdings and Chris Tsavoussis, concluded that last remaining restrictions on what the former Scotiabank branch site can be used for expired almost 48 years ago. He agreed with this newspaper’s analysis that the location, at the intersection of Harbour Drive and Paradise Beach Drive, was limited to use as a bank branch and related offices for only a five-year period dating from the original conveyance of the property. The conveyance is dated November 9, 1970, which means the restriction expired just before the end of 1975.

“This restriction expired on November 9, 1975. As such, use of the site is no longer restricted to the business of banking,” Mr Liddell wrote. “There are no other restrictions encumbering the site that would prevent or inhibit the operation of a restaurant thereon.”

However, Aetos Holdings is likely to still encounter

the same formidable opposition as its original Paradise Island plans faced. Atlantis had teamed with fellow Paradise Island hotels, the Ocean Club and Comfort Suites, plus Hurricane Hole’s developer, Sterling Global Financial, and the Paradise Island Tourism Development Association to oppose its plans on the basis that converting the bank into fast-food restaurants would create “a potential obstacle for planned luxury resort and residential development”.

The mega resort added that such projects are planned by itself, Four Seasons (the Ocean Club) and Hurricane Hole’s developer, and allowing the presence of Wendy’s and Marco’s Pizza will cause “incongruence with the idyllic setting of Paradise Island” and “erosion of the natural, scenic and aesthetic environment”.

Vaughn Roberts, Atlantis’ senior vice-president of government affairs and special projects, could not be reached for comment by Tribune Business before press time as night but it is unlikely that the mega resort’s stance on the Wendy’s and Marco’s Pizza project - or that of its fellow Paradise Island resorts and developers - will have changed significantly since

TO ADVERTISE TODAY IN THE TRIBUNE CALL @

they successfully appealed the original approval.

The Subdivision and Development Appeal Board, in reversing the Town Planning Committee’s initial decision, said:

“Having concluded that for such approval to stand there must be an application in accordance with the Planning and Subdivisions Act and public consultation as aforesaid, and same not having taken place, the appeal is allowed and the decision is therefore set aside.....

“[It] does not appear that an adequate opportunity was afforded to all parties to receive materials and make representations before a decision was made by the Town Planning Committee and this is fortified by the lack of documentation contained in the record of appeal provided.”

However, this newspaper was previously informed that Atlantis and some of the others seeking to now bar Aetos Holdings have little cause for complaint. Atlantis, which was said to have been approached first by Scotiabank as a potential purchaser, did not act despite possessing - and knowing of - the restrictions on that location.

Well-placed contacts, speaking on condition of anonymity, also disclosed that Sterling Global, the Hurricane Hole developer and another objector, actually did make an offer to acquire the former bank branch but it did not come close to meeting Scotiabank’s valuation. That valuation is said to have been close to $3m.

NOTICE

NEW MOON LTD.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas registered in the Register of Companies under the Registration Number 203573 B.

(In Voluntary Liquidation)

Notice is hereby given that the liquidation and the winding up of the Company is complete and the Company has been struck off the Register of Companies maintained by the Registrar General on the 8th day of September 2023.

Dated this 26th day of September A.D. 2023

RICARDO PALMARI LIQUIDATOR

NOTICE R17&BELO LTD.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas registered in the Register of Companies under the Registration Number 204260 B.

(In Voluntary Liquidation)

Notice is hereby given that the liquidation and the winding up of the Company is complete and the Company has been struck off the Register of Companies maintained by the Registrar General on the 8th day of September 2023.

Dated this 26th day of September A.D. 2023

PAGE 4, Tuesday, September 26, 2023 THE TRIBUNE

WENDY’S

FROM PAGE B1

502-2394

Ramon Rabelo De Souza LIQUIDATOR

OPPOSITION ALARM ON S&P’S

THREE TIMES’ HIGHER DEFICIT

FROM PAGE B1

burden will remain high.

The expanding economy is supporting government revenues, which increased almost 12 percent in the most recent fiscal year,” the credit rating agency added.

“While some of the pandemic-related programmes are ending, the interest burden, combined with other spending rigidities, including state-owned enterprise (SOE) outlays, continues to weigh on expenditures. We expect the deficit to reach to 4.6 percent of GDP in fiscal year 2022-2023, and to further fall to 3.2 percent in fiscal year 2023-2024.”

Mr Thompson, former minister of state for finance in the Minnis administration, said yesterday: “The Opposition is gravely concerned with the projection by S&P that the Government will have larger than forecasted deficits for the last fiscal year and this one.

“Based on the GDP estimates in the Government’s Budget document, that would translate into a deficit of over $600m last year [2022-2023] and over $500m this year. This year the deficit is to drop to $131m. It is stunning to see these projections of massive fiscal deficits at a time of record revenues. The PLP continues to squander the economic recovery with its total abandonment of proper fiscal management.”

Tribune Business calculations suggest Mr

Thompson’s figures may be slightly out. For example, based on the GDP numbers and percentages contained in the 2023-2024 Budget, the 3.2 percent of GDP deficit forecast by S&P would be equivalent to $465.78m. However, the 4.6 percent of GDP forecast for the recently-closed 2022-2023 year would be some $630.2m - almost $110m higher than the Government’s own $520.6m projection.

Any miss of the 20232024 deficit target by the magnitude suggested by S&P, which would be equal to $334m based on the rating agency’s and the Government’s respective forecasts, could undermine The Bahamas’ fiscal credibility and investor/market confidence in its public finances at home and abroad. It would also place the Government’s ambition of achieving a fiscal surplus by the 2024-2025 fiscal year in peril. S&P, meanwhile, also warned that the Government will likely struggle to meet its debt reduction targets “without material new revenues, significant cost-cutting or well above average economic growth”.

The rating agency, in a report that made no change to this nation’s creditworthiness, said the debt blow-out produced by Hurricane Dorian and the COVID pandemic means the Government’s “previous fiscal consolidation plans” are insufficient

Legal Notice

FIRWOOD HOLDINGS LTD.

NOTICE IS HEREBY GIVEN as follows:

(a) Firwood Holdings Ltd. is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 25th day of September 2023 when its Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said Company is Delco Investments Limited of Deltec Bank & Trust Limited, Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas.

Dated this 26th day of September A.D. 2023

NOTICE

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the International Business Companies Act 2000 the dissolution of BLUESHORES INVESTMENTS LTD. has been completed and the company has been struck from the Register on the 17th day of August 2023.

Delco Investments Limited Liquidator

to achieve its fiscal goals unless economic growth is strong enough to avoid the imposition of further austerity measures.

“We believe the country’s record of slow progress in reforming public finances and key economic sectors has weakened its financial profile over the long-term and hurt its economic performance,” S&P said of The Bahamas. “The Bahamas has faced two large negative shocks (Hurricane Dorian in 2019 and the pandemic in 2020), resulting in a significant rise in government debt and testing the Government’s resolve to put the nation’s finances on a sustainable path.

“The rapid increase in debt in recent years means the Government’s previous fiscal consolidation plans will likely be insufficient to meet its debt targets without material new revenues,

significant cost cutting or economic growth well above historical averages. Furthermore, the country remains vulnerable to environmental risks.”

Joining Moody’s and the Inter-American Development Bank (IDB) in warning that The Bahamas faces “elevated” external financing risks, with the Government requiring $2.1bn during the present 2023-2024 fiscal year to refinance maturing debt, S&P nevertheless hinted it was optimistic that it will source the necessary funding to cover the $300m foreign currency bond coming due for repayment in January 2024.

However, it then warned that “material spending cuts will be more difficult to implement if they become necessary”, pointing to the “drain” imposed by subsidies to loss-making state-owned enterprises (SOEs) which consume 15 percent of the Government’s total annual expenditure.

COMMONWEALTH OF THE BAHAMAS IN THE SUPREME COURT

Probate Side

In the Estate of Manuel Lopez late of #47 Bamboo Cay, Bahama Terrace Yacht and Country Club, Freeport, Grand Bahama, The Bahamas.

NOTICE is hereby given that all persons having any claim or demand against the above Estate are required to send the same duly certifed in writing to the undersigned on or before October 31, 2023 after which date the Personal Representative will proceed to distribute the assets having regard only to the claims of which they shall have had notice; AND NOTICE is hereby given that all persons indebted to the said estate are requested to make full settlement on or before the date hereinbefore mentioned.

Gouthro & Co. Attorneys for the Executor The Mall Drive, East Freeport, Grand Bahama The Bahamas

Minister sounds alert over ‘fake’ loan flyer

FROM PAGE B3

The advisory also warned that persons may become involved in receiving fraudulent funds through bogus online employment recruiters that convince them the funds have been transferred for legitimate purposes. These individuals then send a portion of the sum received to the fraudsters and unknowingly participate in the schemes. Others catch on to the illicit schemes and willingly participate.

Wayne Munroe, minister of national security, acknowledged the rise in fraudulent transactions as The Bahamas makes a push to become digitised while speaking at the Computer Incident Response Team stakeholder conference. He noted that as technology becomes more accessible participants are more vulnerable to persons with malicious intentions. This threat extends to financial institutions, the general public and government agencies.

He said: “The Davis administration’s blueprint for change noted that we’re committed to advancing The Bahamas as a digital society. We fully understand that we are in an era of technology, regardless of some of us still relying on paper. Our citizens, civil agencies, private sector, government agency and safety and security defences are all utilising more and more digital platforms.

“The ultimate goal is to accelerate digitisation, thereby increasing productivity. Simultaneously, as the cyber landscape becomes more accessible it is also becoming increasingly connected and increasingly more complex. Hence the number of cyber threats, and attacks on both personal and commercial levels, are on the increase. With the continuous advancement and evolution of technologies, vulnerabilities also are on the rise both for individuals and state actors.”

Baird

One Limited Liquidator

· Ms. Butler Vernelle (242)

424-1288

THE TRIBUNE Tuesday, September 26, 2023, PAGE 5

Delco Investments Limited Liquidator NOTICE

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the International Business Companies Act 2000 the dissolution of ORACLE SECURITIES LTD. has been completed and the company has been struck from the Register on the 17th day of August 2023.

NOTICE ORACLE SECURITIES LTD.

BLUESHORES INVESTMENTS LTD.

· Mrs. Major Dorothy (242) 443-5448 · Mr. Delancy George (242) 553-3534

Paging all owners benefciaries of the Sea Sun Manor Condo ssociation oom meeting is planned for eptember 2 th at 00 pm our attendance is necessary Please contact one of the members noted below for further information

URGENT

SEA SUN MANOR UNIT OWNERS

NOTICE!

Across 1 Come back under a new cover (7)

5 A number possibly tour round a royal house (5)

8 Suspicious affair the comedian is involved in? (5,8)

9 They may be used to make a stool (5)

10 Pan, you sound unusually silent (7)

11 Reluctant as ever perhaps (6)

12 Firemen use it though it may ruin the hose (6)

15 Revolutionary air followed by early motorists (3,4)

17 River heron that’s wild (5)

19 The fish in a tin is bad but might come good (2,2,3,6)

20 Drags children around English capital (5)

21 For the record a woman has to call back (7)

YESTERDA

L R O N O F C R

Sudoku is a number-placing puzzle based on a 9x9 grid with several given numbers. The object is to place the numbers 1 to 9 in the empty squares so the each row, each column and each 3x3 box contains the same number only once. The difficulty level of the Sudoku increases from Monday to Sunday

Best described as a number crossword, the task in Kakuro is to fill all of the empty squares, using numbers 1 to 9, so the sum of each horizontal block equals the number to its left, and the sum of each vertical block equals the number on its top. No number may be used in the same block more than once. The difficulty level of the Conceptis Kakuro increases from Monday to Sunday.

Down

1 Source of pointless strife in a shipyard? (5)

2 With which one suffers a lack of balance (4,9)

3 Sly Sue’s destroyed Joyce’s character (7)

4 Obtain support with a beating? (4,2)

5 String can break in wet (5)

6 Wearing a gun? (7,2,4)

7 The governor takes in saint and criminal (7)

11 A flying start for the hitchhiker? (7)

13 Transport essential to some divers (7)

14 Is of one mind about grease (6)

16 Flower produced in great numbers in America (5)

18 Moral principle held by the thick-skinned (5)

PAGE 6, Tuesday, September 26, 2023 THE TRIBUNE Yesterday’s Kakuro Answer JUDGE PARKER CARPE DIEM BLONDIE MARVIN TIGER HAGAR THE HORRIBLE CALVIN & HOBBES DENNIS THE MENACE CRYPTIC PUZZLE EASY PUZZLE 1234567 8 910 11 12 13 14 15 16 17 18 19 20 21 Yesterday’s Sudoku Answer

Across 1 To swindle (7) 5 Underlying (5) 8 In miniature (2,1,5,5) 9 Exalted (5) 10 Strain (7) 11 Obtrusively bright (6) 12 Envelop in bandages (6) 15 Hairwashing preparation (7) 17 Maladroit (5) 19 Where life’s hectic and exciting (2,3,4,4) 20 Frivolous (5) 21 State opinion boldly (5,2) Down 1 Die by immersion in liquid (5) 2 Dumbfounded (13) 3 Haphazard (7) 4 Water down (6) 5 Shaggy-haired wild ox (5) 6 Attack treacherously (4,2,3,4) 7 Purify (7) 11 Effusive (7) 13 Pare by repeated slicing (7) 14 Marsh (6) 16 Godliness (5) 18 Business alliance (3-2)

Yesterday’s Cryptic Solution Yesterday’s Easy Solution Across: 1 Hedge, 8 Chop chop, 9 Jelly, 10 After all, 11 Smear, 12 Ass, 16 Orated, 17 Taught, 18 Dry, 23 Cramp, 24 Concerto, 25 Genoa, 26 Windfall, 27 Osaka. Down: 2 Evermore, 3 Gallants, 4 Shifts, 5 Spies, 6 Cheap, 7 Spill, 12 Add, 13 Sty, 14 Quarters, 15 Shamrock, 19 Rattle, 20 Scowl, 21 Inane, 22 Reefs. Across: 1 Maine, 8 To be sure, 9 Kitty, 10 Go too far, 11 Swoop, 12 Jam, 16 Armada, 17 Orient, 18 Rob, 23 Visit, 24 In a jiffy, 25 Route, 26 Cut no ice, 27 Offer. Down: 2 As it were, 3 Not to say, 4 Bogota, 5 Genoa, 6 Huffy, 7 Ferry, 12 Jar, 13 Mob, 14 Hit it off, 15 On tiptoe, 19 Office, 20 Ditch, 21 Waltz, 22 Bigot. 4 Daily Express Tuesday, June 13, 2023 DX1ST CRUSADER PRIZE CROSSWORD THE ALPHABEATER CAN you crack the Alphabeater? Each grid number represents a letter – or black square. As in Alphapuzzle, every letter of the alphabet is used. But you have to complete the grid too! Use the given letters and black squares below the grid to start. The grid is ‘rotationally symmetrical’ – in other words, it looks the same if you turn the page upside down. Solution tomorrow Extra letter clues 0907 181 2560 (Deduct three minutes each extra clue letter Full solution 0907 181 2558 *Calls cost 80p per minute your telephone company’s network access charge. ● Alternatively, for six Extra Letter clues to your mobile, text DXBEAT to 64343. Texts cost £1 plus your usual operator rate TARGET T 36 minutes Puzzles FIND where the fleet of ships shown is hidden in the grid. The numbers to the right of and below the grid indicate how many of the squares in that row are filled in with ships or parts of ships. The ships do not touch each other, even diagonally. Some squares have been filled in to start you off. Solution tomorrow A 1 B C D E F G H I J 2345678910 222222212 2 4 0 3 1 3 0 4 1 2 3 1 x Battleship 4 x Submarine 3 x Destroyer 2 x Cruiser

HOW many words of four letters or more can you make from the letters shown here? In making a word, each letter may be used once only. Each must contain the centre letter and there must be at least one nine-letter word. No plurals. Verb forms ending in S permitted. TODAY’S TARGET Good 10; very good 15; excellent 19 (or more). Solution tomorrow ● The Target uses words in the main body of Chambers 21st Century Dictionary (1999 edition) Call 0907 181 2585 for today’s Target solution *Calls cost 80p per minute plus your telephone company’s network access charge. TARGET BATTLESHIPS 1 2 3 4 5 9 10 11 12 15 16 18 19 20 21 22 23 24 26 3 4 4 2 3 4 1 2 2 1 2 4 3 3 1 1 Place the tiles the grid so four different numbers and different shapes appear in each and column. Solution tomorrow KEIJO 2 3 4 5 6 7 8 9 10 11 12 ■ 13 ■ 21 22 23 24 ■ 25 H 26 27 28 29 F 30 31 32 33 14 15 16 17 18 34 35 36 37 Y 38 A B C D E F G H I J K L M N O P Q R S T U V W X Y Z 18 24 9 3 38 3 10 15 22 35 13 1 28 4 1 19 9 6 18 32 20 11 31 21 25 9 4 13 12 26 28 26 34 39 33 23 30 18 22 31 32 20 35 31 14 20 21 16 33 27 8 37 14 40 39 19 38 17 10 5 12 27 11 29 40 23 10 35 1 4 25 31 8 29 22 26 12 18 8 31 31 21 25 5 16 28 26 9 18 4 17 37 5 7 10 31 39 2 9 37 22 23 28 25 13 8 22 3 1 12 5 32 5 10 23 38 8 6 20 3 20 38 35 31 18 35 8 20 39 31 19 39 11 35 37 31 13 36 40 20 22 11 17 24 31 4 17 34 31 36 33 18 8 1 5 20 ACROSS 1 Pleased to be Gordonstoun’s head boy (4) 3 Like fur – embracing trouble and vulnerable to attack (10) 9 Ceremony sounds correct (4) 10 Feverish condition of oarsman after qualifier (10) 11 Space to sing meant heartless delight (11) 15 Laugh at terrible movie about journalist returning domestic footage (4,5) 17 Motorist wasted second to become an athlete (5) 18 Boy with a right to a navigation aid (5) 19 Also manage to pursue share and depart quickly (3,3,3) 20 Fool laid item out and got taken in (11) 24 Plotters find us retiring unexpectedly (10) 25 Pen and four keys (4) 26 Ladylike pose is a team burden (10) 27 The responsibility we bear (4) DOWN 1 Water supplier – awful danger to stockings (6,4) 2 Fondness for something on an email (10) 4 Reportedly posted perfume (5) 5 The tom sat around – no more (2,3,4) 6 Along the north/south axis, until a tidal change (11) 7 Cheer up lad for the audience (4) 8 Weapon used to acquire record points (4) 12 Opponents raved about small sign (11) 13 Work too hard concerning tune (10) 14 Gardener is upsetting regiment (10) 16 Hard scoundrel back to reject daughter, the dog (9) 21 Rum drunk by a student, painting (5) 22 Delights in cheap living quarters (4) 23 Breeder is hard-working? No promises (4)

U

WORDSEARCH TARGET THE ALPHAPUZZL Across: Suspect, Expiate, Emblazon, Barrow, Born, Quantity, Arena, Horde, Diluted. Down: Subvert, Belch Shrub, Partner, Entrails, Tremor, Putrid, Sips, Cracker, Inept, Stern, ERADICATE aced acid acre acrid acted arcade arced cadet cadre carat card cardie care cared caret cart carte carted cater catered cedar cede cedi cere ceria cert cider cite cited crate crated create created cred credit creed cried dace deceit dice direct edict ERADICATE erect erica iced race raced react reacted recite recited redact rice riced terce tierce trace traced trice QUICK CROSSWORD Across: 7 Rocket, 8 Riddle, 10 Interim, 11 Tacit, 12 Aged, 13 Meant, 17 Aloud, 18 Dawn, 22 Music, 23 Urgency, 24 Leader, 25 Reason. Down: 1 Arrival, 2 Scatter, 3 Merry, 4 Distant, 5 Edict, 6 Petty, 9 Impetuous, 14 Slacken, 15 Earnest, 16 Undying, 19 Small, 20 Essay, 21 Agree. B H U S P B R E E A B K O E R E A I H L C J B I T R Y Y A V C S S S R L D C P M T P Q V A U K N R R N N P L A S E A I E W D A G E Y T Y Y Q I L T S D T W N C Z B U R L E S Q U K I C T S S Z E D M I G K B J L T H E R E D S H W B I L L Y E L WORDSEARCH R Y C F N S Z P P L K O O N T Z V N O T X U Y A G Y M S Y V E L R P O B I S Y O F Q A X R R R Y G U T D X O R O Z E D H A H W A F Y C N A L L N H R Q O I W N A L O Y O R L L E C V E H H L C O V H H V D H T I M S H G I H N S Z A K F J J L M E N O S S R A L D T R P U W N H A W K I B G R I S H A M C D inside squares on the grid. Write blank squares in the direction indicated Solution Find all the terms listed below Solution tomorrow BROWN ● CHILD ● CLANCY DOUGHTY ● ELLROY ● FLYNN GRISHAM ● HARRIS ● HAWKINS HIGHSMITH ● KOONTZ ● PATTERSON ● RENDELL ● SLAUGHTER THRILLER

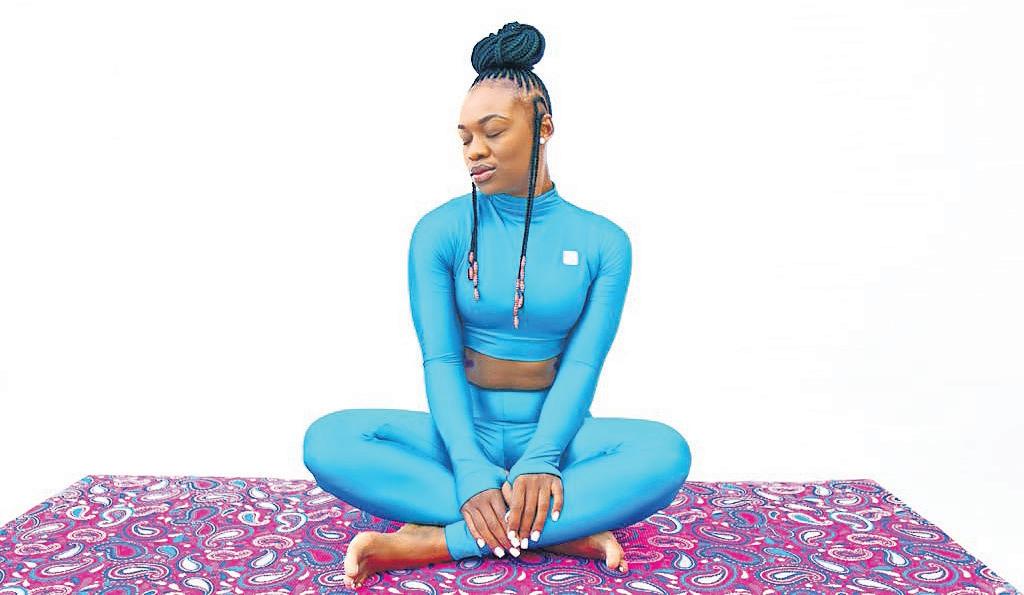

Strike a pose of better living

By ALESHA CADET Tribune Features Writer acadet@tribunemedia.net

FOR yoga instructor and wellness enthusiast

Whitney B Fowler, living life on her own terms is very important. In her case that means enjoying the simple things like a good healthy meal, natural skincare products and self-care activities that bring her joy.

She believes her fellow Bahamians can also find their own inner peace and improve their health by making a few simple changes to their lifestyles.

Whitney wants to do her part in assisting others achieve this goal through her yoga classes and products from her business venture called The Wellness Brands.

“Whether I’m reading a book that will help me with my personal growth, chilling in a peaceful environment, meditating or hanging out with loved ones, my health and wellness journey was inspired by wanting to choose an alternative lifestyle to the one that I was living at the time. I wasn’t a reckless, crazy child, but society made me feel that way,” she told Tribune Health.

“I decided to seek healthy activities that would be an outlet for times when I needed to wind down. I found yoga and meditation very effective. I believe up to this day, yoga and meditation has been such a blessing in my life and will continue to put me in places that I can’t imagine.”

When it comes to health and wellness, Whitney said she feels the Bahamas is evolving.

Growing up, she said they were often fed plates full of starches: macaroni, potato salads with peas and

rice. There were barely any vegetables.

But now, a growing number of Bahamians have seen the light and have started changing their eating habits. There are now even several vegan restaurants to be found in the country.

“We are farming (thanks to BAMSI) and eating a well-balanced diet. There is room for growth, but I am proud of where we came from. We now have a Ministry of Health and Wellness, and their mission is to reduce illness, disabilities and death due to lifestyle related diseases, and I’m all for that,” she said.

“Something as simple as educating the public on portion sizes and daily nutrition intake will reduce these lifestyle illness diseases that many Bahamians suffer from. And I love that the fitness industry is overpopulated because we are at the top in diabetes and heart attacks (in the world) and the cure for these diseases is mostly lifestyle changes.”

Whitney completed her Vinyasa yoga and Yin yoga teacher training in 2019.

Vinyasa – which is also called “flow” yoga – is a term used to describe continuous or dynamic movements between yoga poses.

The strength-building and often sweaty Vinyasa classes are great for a full body workout, but Whitney’s true love is Yin yoga, because she said it forces her to focus completely inward while finding openness through stillness.

“Yoga is vast and the benefits are never-ending. Yoga deals with the mind and body, and it can get as deep as the soul. There are many mental and physical health benefits of yoga.

Incorporating yoga into your routine may help enhance health, increase strength and flexibilities and reduce symptoms of stress, depression and anxiety. Finding the time to practice yoga a few times per week may be enough to make noticeable difference when it comes to significantly increasing physical and mental health,” said

Whitney. Besides getting the body and the mind fit, Whitney said yoga teaches ethical guidelines; the way people should interact with themselves, different breathing techniques, how to let go of the unnecessary baggage holding them down, literally and figuratively, and how to become focused and mindful of the present. She personally loves the meditation and selfrealisation aspects of the ancient practice. When it comes to poses, Whitney said some of the most popular ones are the stretches that strengthen the body, for example the Utthita Parsvakonasana and Trikonasana.

She said the Supta Matsyendrasana (supine spinal twist) and the Ardha Matsyendrasana (sitting half spinal

twist) are poses that can aid in digestion, increase blood circulation, strengthen and lengthen muscles that protect the spin, improve posture and spinal alignment, and calm the nervous system.

Whitney has always been inspired in her pursuits by her parents, Barbara and Whitmore Fowler.

“My dad, during his disabilities…I’ve watched him every day literally fight for a better life for himself and his family, no matter the pain that his disability placed on him. He got up every morning, did his morning routines and went out in the world to pursue what he loved. My mom is the happiest woman I know; always, well most of the time, in a joyful mood. She too pursues a career that she loves. That inspires me to also purse my passion, which is wellness,” she said.

Because of her love of health and wellness, Whitney has started a business called The Wellness Brands in an effort to promote healthy habits on a daily basis. She believes it is important to not only survive, but thrive in life.

“Whether that’s through a yoga class, practicing a self-care task or being concise with the different products we use on our

skin,” she said. Through The Wellness Brands, she sells plantbased beauty products such as body butters and other skincare alternatives that are rich in antioxidants.

Addressing women in particular, she said they should be aware of the different phases in their cycles and the different hormones their bodies produce during each phase so that they can be better able to answer their body’s needs.

Whitney hopes to encourage people to be more physically active and allow minds to rest.

To this end, she offers weekly group yoga classes on Saturdays at 7.45am and 9.30am on Goodman’s Bay Beach.

As for her personal healthrelated goals, she said: “A few of my wellness goals for the remainder of the year include to be disciplined with my well-balance meals; (adding) a majority of fruits and vegetables and only eating when I’m hungry, not because I am bored; to exercise daily – my favourites are speed walking, body weight training and yoga. It feels so good when I’m able to exercise and move my body freely and naturally. Mobility is a privilege that I am grateful to have.”

HOW TO MANAGE YOUR DIABETES IN EXTREME SUMMER HEAT

WE often look forward to a change of seasons and warmer temperatures. But if you have diabetes, you may be especially sensitive to the hot weather of summer. Extreme heat can affect your blood sugar control.

If you use insulin or your blood sugars aren’t effectively controlled, you could be at higher risk during the summer months. Worsening blood sugar control is often the main concern, and depending on your level of activity, developing low blood sugars may also be a concern.

If you’ve had complications from diabetes that have damaged the nerves to sweat glands, you may be unable to sweat properly.

This can become serious as outdoor temperatures rise, leading to heat exhaustion and heat stroke.

Extreme temperatures can also damage your medications and testing equipment, says Dr. Marwan Hamaty, endocrinologist at Cleveland Clinic, Ohio. “I always remind my patients to take precautions to protect themselves and their supplies during both winter and summer.”

He says it’s important to get a handle on your blood sugar control before you engage in summer fun. “If your blood sugars are mostly higher than 250 mg/dl, I recommend improving your blood sugar control before engaging in heavy physical

activity — regardless of the climate and the temperature, as recommended by the American Diabetes Association.”

Dr Hamaty also advises that the extreme heat of summer affects blood sugar levels. How the heat affects your levels depends on what you’ve eaten, whether you’re well-hydrated and your activity level.

If the heat and your activity make you sweat a lot, you may become dehydrated, leading to a rise in glucose levels. “If you become dehydrated, your blood glucose levels will rise. This can lead to frequent urination, which then leads to further dehydration and even higher blood sugar levels — a kind of vicious cycle,” he says.

Things can become even worse if the treatment includes insulin: “Dehydration reduces blood supply to your skin and, therefore, the ability of your body to absorb the insulin you’ve

injected is reduced,” he says.

Most types of insulin can tolerate temperatures up to 93-95 degrees Fahrenheit. Exposing your supply to anything higher than this will make the medication quickly break down. Be careful and pay attention to any insulin you’re carrying with you in the heat. While it’s fine to store insulin and glucagon in the refrigerator, hot temperatures (as well as freezing temperatures) will cause the medications to degrade, making them ineffective and unusable. High temperatures can have a negative effect on other medications and diabetes management supplies too. Don’t forget about the weather’s effect on things like test strips and monitoring devices. When the mercury begins to rise, these items can change in their effectiveness. Physical activity usually causes blood sugar levels to decrease, reducing your need for insulin. The

sudden addition of exercise may put you at an increased risk for low blood sugars.

Therefore, if you’re active in extreme heat, know that you’re at high risk for both low and high blood sugars. This means you should take extra precautions and monitor your sugar levels before exercising.

“I advise my patients to maintain warm skin and adjust insulin dosage prior to engaging in physical activity because insulin adjustment could vary significantly,” says Dr. Hamaty. “But don’t allow the heat to keep you indoors. It’s OK to participate in outdoor activities and enjoy all types of weather as long as you take a few precautions.”

Dr Hamaty also suggests seeking input from your doctor regardless of the temperature before adding physical activity to your routine.

Follow these tips to help manage your diabetes while enjoying the outdoors:

1. Drink plenty of water. Staying hydrated is important for everyone during physical activity, and it’s especially critical if you have diabetes.

2. Avoid becoming dehydrated. Carry small bottles of water or low-calorie electrolyte-replenishing sports drinks in a backpack or on a belt while you’re hiking or playing sports.

3. Adjust your insulin as needed. Ask your provider or diabetes educator how you should adjust your insulin

(and sometimes eating extra carbohydrates) before exercising. Typically, your first few doctor’s visits focus on urgent issues, such as getting diabetes under control. Ask about how to adjust your insulin so you can prepare to be physically active.

4. Test your blood sugar levels frequently. Since hot temperatures can cause blood sugar levels to fluctuate, it’s a good idea to test more often. That way, you can take appropriate and immediate action to keep your levels stable. You should continue frequent monitoring for several hours after you’re done with your workout or other activity. That’s because the effects of activities on blood sugars usually last for a longer period of time.

5. Keep items to treat low blood sugar with you. This includes glucose tabs or glucose gel. If you’re at high risk for very low blood sugar (if you have frequent low blood sugar or had very low blood sugar previously), you should also have a glucagon kit available.

6. Take some snacks with you. Some snacks can serve as a meal replacement while others help prevent low blood sugar. Discuss possible options with your dietitian.

7. Protect your medication and supplies. Take proactive steps to protect your insulin, glucagon kit and other supplies before you head outdoors, regardless of the temperature.

Consider a car cooler that plugs into a 12-volt car adapter to keep your supplies at the proper temperature. This will keep the temperature stable for some time. If you’re going away from your car for an extended period, you’ll need to take your supplies along with you. If you are on insulin pump, be sure to protect your insulin pump from high temperatures. Depending on the situation and how long your activity will be, you might simply need to monitor your glucose more often. In certain circumstances (if it’s extremely hot or you’re out for an extended amount of time) consider using a long-acting insulin temporarily along with meal insulin injection instead of an insulin pump.

8. Avoid sunburn. You can get sunburned while skiing on the slopes or while hiking in the summer. Sunburn stresses your body and can raise blood sugar levels. Use a broad-spectrum sunscreen and wear protective eye gear.

9. Finally, limit how much time you spend outside in extreme temperatures. “While I advise staying active during the peak winter or summer months, I also tell my patients to try to take advantage of outdoors activities when temperatures aren’t too extreme,” says Dr Hamaty. By taking a few precautions, you can enjoy an active, healthy lifestyle in most any weather.

PAGE 8, Tuesday, September 26, 2023 THE TRIBUNE BODY AND MIND

Bahamian yoga instructor offers classes and products to help people be healthier and find inner peace

Digital rectal exam in 2023 - where do we stand?

PROSTATE cancer is the most diagnosed cancer in the Bahamas, even eclipsing the high local incidence of breast cancer.

The Bahamas has the 14th highest per capita incidence of prostate cancer in the world. Prostate cancer represented 22.9 percent of all cancers diagnosed in both sexes for all ages in the Bahamas in 2020. Prostate cancer represented 46.6 percent of all cancers diagnosed in men in the Bahamas in 2020.

The cancer incidence is rising in the Caribbean and expected to cause significant adverse implications for the health of the people in the region, according to an article in the Lancet by Associate Professor L Glasgow from St George’s University.

Professor Glasgow in her eloquently written review discusses the various pertinent aspects to cancer control and management in the Caribbean region.

Tailored and sustainable cancer programmes

The world is stepping up the fight against cancer: Europe is now gearing towards screening for prostate cancer.

A screening test is a medical test or procedure performed on a large group of individuals to identify those who may have a certain disease or condition, or who may be at risk of developing it in the future. The purpose of a screening test is to detect the presence of a disease or condition at an early stage when it is more treatable, and to prevent the disease from progressing and causing serious complications. The benefits of such a move are enormous- including early pick up of disease, potential cure of a lethal cancer and overall economic gains on multiple levels, individual to regional.

As per Professor Glasgow, financial limitations together with entrenched socio-cultural barriers

significantly exacerbate cancer risks. It is a sad sight, seeing the huge number of men with advanced prostate cancer at the Princess Margaret hospital, living with an incurable form of the disease that has almost 100 percent cure rate if caught early. For us to be able to one day see this dramatic shift in the presentation of our patients, we must tailor our programs to the needs of the population and environment.

Digital rectal exam (DRE)

Most Bahamian men and residents have a very negative connotation between prostate cancer screening and the dreaded digital rectal exam. Tens of thousands of men in the Bahamas refuse to seek prostate cancer screening because they want to avoid the violating finger exam that they assume is automatically necessary.

This is similar in an article published by Nipher Malika and team in the American Journal of Men’s Health, there were several themes identified that functioned as a barrier in the screening

for prostate cancer amongst African immigrant men in the United States.

This included the fact that gender and cultural identity strongly influenced African health beliefs and some men would opt out of a DRE, as they saw it be a threat to their manhood.

The digital rectal exam is a test that examines the lower rectum, anus and prostate in men and people assigned male at birth. The test checks the prostate gland for unusual lumps or swelling or lumps in the rectum that can indicate prostate cancer in men. However, this method is highly subjective, lacks repeatability and results depend on the skills and experience of the medical examiner.

Time to ditch the DRE?

The 2021 American Urological Association guidelines for prostate cancer screening recommend PSA blood test screening and does NOT recommend the digital rectal exam (DRE) as a primary prostate cancer screening tool. The AUA

PODCAST OPENS UP ON ISSUES OF MENTAL HEALTH

By JEFFARAH GIBSON Tribune Features Writer jgibson@tribunemedia.net

A NEW podcast getting set to air in a matter of months aims to place continued attention on mental health awareness.

The podcast titled “Mindful Expressions Podcast” will air in January and hosted by educator Jasmine Collins.

The focus of the podcast is Mental Health - the definition, the diagnosis, the support available, financial assistance and the arts available for healing in the areas of writing, poetry, dance, theatre, and music, activities such as sports, karate, yoga etc.

The podcast will also focus on mentorship with men, women and teens who are interested in sharing

guidelines state that the DRE has no proven benefit as a primary prostate cancer screening test and offered as a secondary test if a patient has an elevated PSA.

At the just concluded annual scientific meeting for the European Association of Urology in Milan, the results of PROBASE trial were shared with the Urology community.

The PROBASE trial is a German multi-centre prostate cancer screening trial conducted between 2014 and 2019, recruiting up to 46,495 men over the age of 45 years.

Half of the group had a DRE and a delayed PSA at the age of 50. About 6,000 men had a DRE and only 57 of them had suspicious findings requiring a biopsy. Of these only three patients were diagnosed with cancer. The DRE strategy therefore has many false negatives which means that this strategy misses a lot of cancers. Of those that DRE deemed to be suspicious the detection rate of cancer was similarly low indicating inferior performance. The inferior performance of the

DRE in this setting can be explained by the fact that this is screening a population who have yet to manifest the features of cancer. So, in the setting of the screening for prostate cancer as the primary test- the DRE does not fare well.

The pinnacle of diagnosing prostate cancer is performing a biopsy which is an invasive test with a small potential of life-threatening complications. There is also the need to avoid diagnosing cancer that may not need treatment, however this increases healthcare and patient costs, has a psychosocial impact in the lives of many such patients and therefore identifying the correct patient to offer a biopsy can be crucial.

J Andersson et al in their study of 5,543 men found that the DRE provided valuable information in patients with raised PSA and could help doctors in making an informed decision on whether to recommend a biopsy. Therefore, in its appropriate use the test still has a significant use but is not a test that all men will undergo on the initial visit to their health providers.

Will Rogers phenomenon

This phenomenon named after the American humourist and social commentator Will Rogers, credited with making a comment that exemplifies the phenomenon. He said, “When the Okies left Oklahoma and moved to California, they raised the average intelligence level in both states.”