THURSDAY, OCTOBER 5, 2023

THE BAHAMAS’ first-ever crowd-funding platform plans to bar its largest investor from taking a 22 percent equity stake in the business following the fall-out that triggered its present regulatory woes.

D’Arcy Rahming, ArawakX’s chairman and chief executive, told Tribune Business it is preparing for a legal battle with James Campbell, the former Colina Insurance Company president, after deciding it will not honour the $1.3m “option” that will allow the latter to convert his investment into an ownership interest in the platform.

Asked about the crowd-fund platform’s present relations with Mr Campbell, who sparked the events that have led to it facing a windingup petition when he went to the Securities Commission as a ‘whistleblower’, Mr Rahming replied: “The situation is that he has a legitimate

option to purchase 22 percent of the firm, and he has asked for one share to be recognised and that the rest be held.

“I don’t know what the correct term is, but it was for us to hold the rest of the shares until he is ready with them. Prior to this, our position was that James Campbell has a legitimate right and we are not challenging that at all. Now, we think he’s

not the right person to be given those shares because of the actions he took. We intend to make it a civil matter. It’s not a regulatory matter. It’s a civil matter. We don’t think he’s the right person to be a shareholder.”

Mr Campbell could not be tracked down for comment before press time last night, but any legal battle between himself and ArawakX if and when he chooses to exercise that option could, of course, be rendered moot if the Securities Commission persuades the Supreme Court to order the crowd-funding platform’s winding-up at next week’s October 13 hearing.

SEE

TWO prominent Bahamian businessmen yesterday voiced fears their area’s property values will be undermined if a Bahamian hotel’s planned expansion worsens existing traffic and noise woes, adding: “All our fears have come true.”

Fred Albury, the Auto Mall chief and former Bahamas Motor Dealers Association (BMDA) president, and Peter Bates, The Sign Man’s principal, told Tribune Business in separate interviews that they share similar concerns about the potential

negative fall-out for Tropical Gardens and Gambier Heights if A Stone’s Throw Away’s proposal receives Town Planning Committee approval.

Its decision on the resort’s bid to rezone a property at the junction

SEE PAGE B6

THE FINAL “20 percent” of The Bahamas’ National Development Plan (NDP) is being targeted for completion before year-end, it was revealed yesterday, as the Davis administration moves to give it the full force of statute law.

Felix Stubbs, the former IBM (Bahamas) chief who is a member of the Plan’s steering committee, told Tribune Business that codifying it in law - as was pledged during yesterday’s Speech from the Thronewill ensure the road map, goals and ambitions set out

THE Central Bank has abandoned its original target of eliminating paper cheque use by year-end 2024 because “a compelling fraction” of Bahamians need more time to adjust, its governor affirmed yesterday.

John Rolle, in a brief statement responding to Tribune Business questions, after the banking regulator disclosed the initial timeline has been “deferred” and will now be “reassessed” in 2026, explained that the change had resulted from

feedback provided by the public and businesses.

“We will share more details in our various surveys that provided public feedback soon,” Mr Rolle told this newspaper. “However, there was a compelling fraction of the public who wanted more time to transition away from cheques. The Central Bank and financial institutions will provide more details on what the interim milestones are that are being targeted for progress on payments system developments.”

The Central Bank, in a release on the issue, said the deadline shift resulted

are “not discarded” when administrations change following a general election. “I think it’s extremely important,” he said of the National Development Plan Bill’s unveiling. “As a matter of fact, it was the wish of the steering committee as far back as 2016 to have that done. We had proposed a draft document then for the Government to review as part of the legislation. We took that to the Government again recently, and that’s what they’re using as the basis for the legislation.

“It first of all shows commitment on the Government’s part that they’re

SEE PAGE B7

Business leaders and those charged with the responsibility for hiring workers have an old saying that sums up the proficiencies needed for employment. “Hard skills will get you the interview; soft skills will get you the job.” Both hard and soft skills play an equal role in employment. But, as

companies worldwide continue to shift to machine learning and artificial intelligence (AI), the world of work will look very different in the future. Hard and soft skills will still be necessary for employment, but they will differ from those required today.

So, if you wish to take your career to the next level, you will need to

showcase your development in both skill areas. Hard skills are often applicable to a certain career, whereas soft skills are transferable to any type of job. What is the difference?

Hard skills, also known as technical or tangible skills, are specific abilities that can be quantified, measured and often acquired through formal education, training

programmes or practical experience. These skills are typically job-specific and revolve around a particular set of knowledge or expertise. They can be learned and perfected over time. Nonetheless, soft skills are more difficult to acquire and change. Soft skills lean more to “who” people are than what they know. As such,

they encompass the character traits that decide how well one interacts with others, and are usually are a definite part of an individual’s personality. Moreover, soft skills, often referred to as interpersonal or people skills, are the non-technical personal attributes and qualities that individuals use to navigate social interactions, work effectively in teams and enhance their overall professional and personal relationships.

Unlike hard skills, which are specific to a particular job or industry, soft skills are highly transferable and are valued across various professions and contexts. These skills are essential for building strong workplace relationships, communicating effectively and demonstrating emotional intelligence, all of which contribute to career success and personal growth.

Each generation of workers focuses on building different skills. Moreover, desired skills change over time as those required by workers at the beginning of their career will be much different than the skills required 20 years later.

‘Generation Z’ is more likely to be interested in building their creativity and technology-related skills far more than any other generation.

To date, Millennials and Gen Xers are focused on developing management and leadership skills, as many are becoming new managers or executives. While employees of all generations want to learn, their interests vary. When employers are interviewing

potential employees, they are not just trying to fill an empty seat; they are on the hunt for staff members who fit the company’s culture. Ultimately, hard skills come as a result of education or technical training, while soft skills evolve as a result of life experiences. Both are essential for companies to achieve their goals and objectives, even though soft skills are more important than hard skills. This is because it is easier to teach hard skills, but tougher to train employees in soft skills. Soft skills are increasingly becoming the hard skills of today’s workforce. It is not enough to be highly trained in technical skills without developing the softer, interpersonal and relationship-building skills that help people to communicate and collaborate effectively. Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game. -

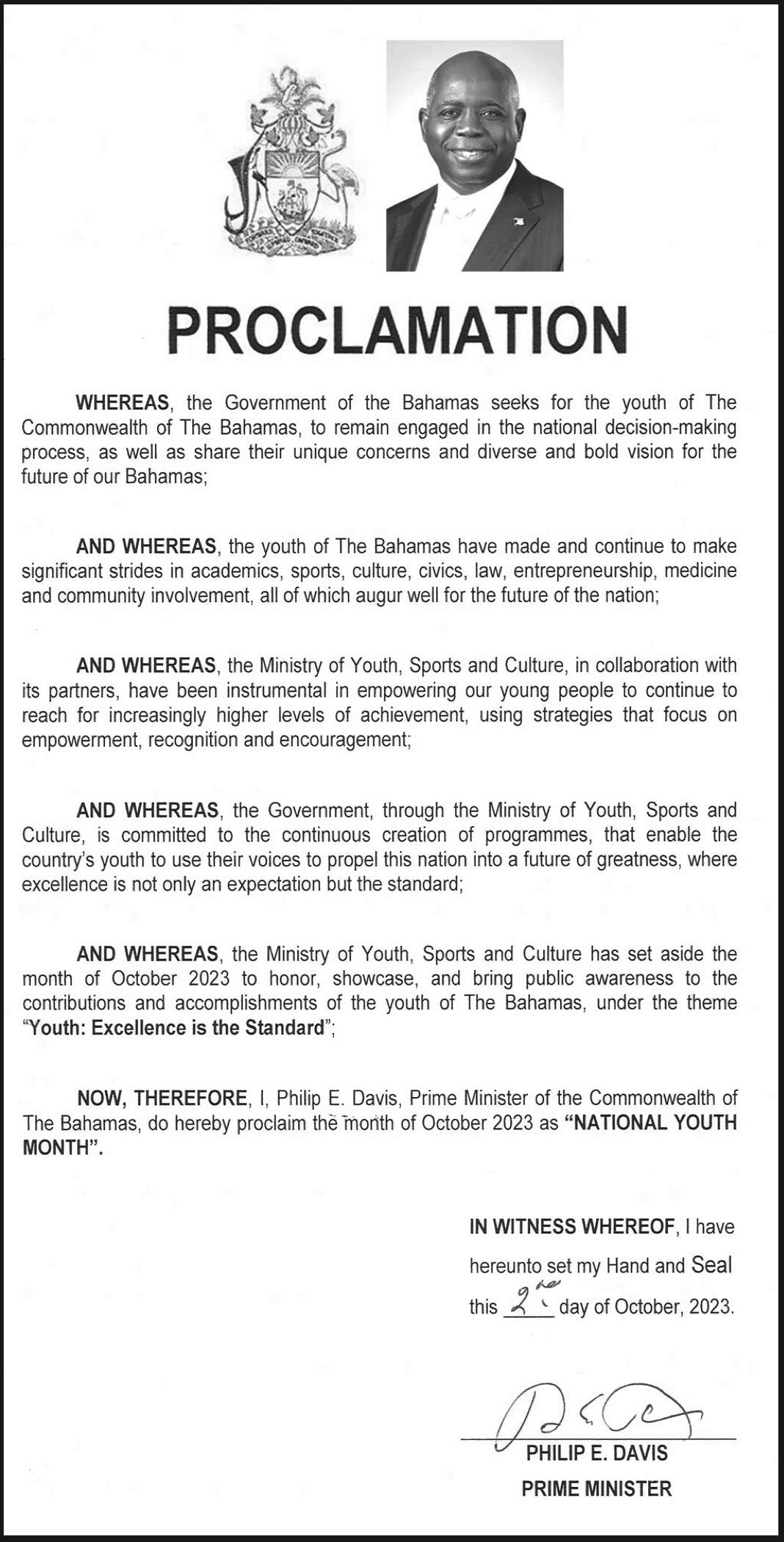

THE GOVERNMENT

pledged to focus on economic security yesterday as one of the three key pillars of national development outlined during the speech from the throne, read by Governor General Cynthia “Mother” Pratt.

The administration said it would table the Bahamas National Development Plan Bill during this parliamentary session as well as an Economic Empowerment Zone legislation to set out “incentives and concessions” for industrial zones.

She said: “[The] government will also introduce a number of Bills to help grow and diversify and our economy. In order to lay the strategic foundation for the future, [the] government will introduce The Bahamas National Development Plan Bill. By putting the National Development Plan on a statutory footing, [the] Government seeks to ensure that the next fifty years of

our national life, will have a firm strategic underpinning and focus.

“[The] government will introduce Economic Empowerment Zone Legislation that will set out a range of incentives and concessions to support specific industries in specific geographic areas.”

The administration also pledged solutions to the high electricity costs by introducing a renewable energy bill and a liquid natural gas bill to provide the regulatory framework necessary to expand these sectors.

She said: “[The] government has already launched programmes to install 100 megawatts of solar energy in Nassau, and new blended power facilities incorporating a minimum of 50% solar generation in sixteen locations throughout the Family Islands.

“The introduction of renewable energy is a fundamental component of our promise to drive down the cost of electricity. [The] government remains especially committed to implementing clean energy in New Providence, by moving to sources

of renewable energy, and becoming less dependent on fossil fuels Building on these efforts, [the] government will therefore introduce the following legislation.

A new Renewable Energy Bill that will provide a legislative and regulatory framework for the expansion of renewable energy generation. A new Liquid Natural Gas Bill that will provide a legislative and regulatory framework for development of LNG generation , which will produce lower carbon emissions than the current system, along with the regulation of bunkering and blending LNG facilities in The Bahamas.”

Other legislation put forward for the new parliamentary session include a bill to protect the intellectual property of artists, legislation to combat cyber crime and promote data protection, a yacht registry and a legal professional amendment bill for the oversight of the sector.

She said: “Intellectual Property Legislation will be introduced to protect the country’s Creative Industries, and empower our

Orange Economy. This legislation will unlock paths to job and wealth creation. [We] will propose legislation to introduce a Yacht Registry.

“A new Legal Profession Amendment Bill will be advanced that will establish a modern approach to the oversight of the legal profession.”

“[The] government will introduce legislation to combat cyber crime. A new Data Protection Act will also be proposed.” Ms Pratt noted that although the unemployment rate has fell to 8.8 percent, lower than pre-pandemic numbers, many people do not have a job and individuals that choose to become entrepreneurs ‘still face too many obstacles. She explained that a unit will be formed to review the notice of vacant process, which verifies if there are any Bahamians suitable and qualified to fill a job vacancy prior to approving foreign labour. She said: “While the country currently enjoys one of the lowest levels of unemployment experienced in a

long time, as yet, not everyone who wants a job, has one. And those who choose to start their own business, and work for themselves, still face too many obstacles.

“A new unit will be formed to review ‘Notice Of Vacancy’ processes, to ensure that Bahamians have a fair opportunity to apply for all available jobs that are created, as our economy grows and diversifies.”

She added that the second phase of National Health Insurance, which includes catastrophic healthcare will be introduced in parliament as well as a bill to regulate the funeral service industry, a downtown management authority to oversee the downtown Nassau ‘revitalization’ and a public service reform bill.

She said: “[The] government prioritises public health, mental health and

wellness initiatives, and is moving aggressively to implement the second phase of National Health Insurance, with the introduction of catastrophic healthcare cover. This will make healthcare more affordable for all Bahamians.”

“Dignity and respect should also come at the end of life, and so My Government will also introduce a Funeral Industry Services Bill to bring about a regulatory framework for the funeral home industry.”

“[The] government will establish in law, a ‘Downtown Management Authority’ to oversee the continued revitalisation of Downtown Nassau. A Public Service Reform Bill will also be introduced to modernize the approach and governance of public servants.

A BAHAMIAN investment bank yesterday acknowledged it was among COVID’s beneficiaries as one of its investment funds grew by more than $100m due to the higher returns it offered Jim Wilson, RF Bank & Trust’s vice-president of corporate finance, speaking during its Investor Week opening, said: “Like the banks, we are sitting on a lot of excess liquidity. The difference is we are paying

a better return than what the banks are doing if you just leave it an inch in your deposit account.”

Recalling what happened when the pandemic first struck in mid-March 2020, Mr Wilson said: “We were actually quite surprised here in The Bahamas because, when we first started thinking strategy and what do we do, we were concerned that there might be a run on our funds. But, quite frankly, we found the opposite.

“We found that because people were stuck at home they had time to sit and look, and see that nothing

was happening with their account. So we had a lot of people moving funds to us. So we actually benefited. We were one of the beneficiaries.”

While RF’s pensions business has remained stable, persistent inflation is still putting pressure on investments. “I think we are going to see inflation for a while,” Mr Wilson added.

“Let’s face it. We import everything and,as much as we have price control on key things and food items, prices are still going up and they are in business. Food stores are still in business, too, they are not

in charity, so they have to make money and be able to be there next year to keep supplying food.

“I think the interest rate hikes in the US, all that does in the end is the companies who are being affected by those high interest rates, they are going to pass that on to their clients and it will just be a continual cycle. So I think for inflation, hopefully we have enough of a cushion here, and we had a lot of revenge tourism in the past year or two as we came out of COVID. Hopefully we will sustain that for a little while.”

Investment in tourismrelated projects remains strong with several properties slated for expansion or a construction start by the 2024 first quarter. “So

I think there are opportunities for Bahamians to get involved to try and offset the effects of that inflation,” Mr Wilson said.

ROYAL Caribbean says some 112 Bahamian job seekers have completed its initial screening process as it makes “solid and steady progress” towards hiring this nation’s citizens at every level of its business.

The cruise line, in a statement issued as it closes a series of job fairs, said it remains committed to energising the communities its ships visit by fostering a diverse workforce of Bahamians at every level of its local operations.

Royal Caribbean added that it is aiming to identify Bahamian talent for its private island destinations and onboard positions. Earlier this year, it opened an office in Nassau on Bay Street, and most recently partnered with the Ministry of Labour to host a series of job fairs in New Providence, Grand Bahama and North and South Andros.

“We are excited to see not only the level of enthusiasm

ROYAL Caribbean International’s Nassau-based recruiter, Tia Ferguson, interviews an applicant at the cruise line’s North Andros job fair on August 10, where 31 applicants received job offer letters. but the qualifications of so many candidates,” said Philip Simon, president of the Royal Beach Club at Paradise Island and

NOTICE is hereby given that MANUCHA SEYMOUR, Nassau Village, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of October 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that MAGDALENE MARCELLA NÉE BELL-ALBURY General Delivery of Lower Bogue, Eleuthera, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 28th day of September 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

general manager of Royal Caribbean International (Bahamas). “We’d like to thank the Department of Labour, which has been an excellent partner in our job fairs in recent months.”

Upon completion of the job fairs, 112 successful applicants have completed the initial screening process. This number is split into 74 in New Providence, 31 in North Andros and seven in South Andros.

More than 15 job categories are available to Bahamians, from lifeguard and beach and kitchen attendant to aquatics guide, electrician, plumber, operations driver and finance specialist. At Perfect Day at CocoCay, Bahamians now serve as managers in almost every aspect of the private island destination that serves up to one million guests per year.

“We appreciate companies like Royal Caribbean providing opportunities to work on cays and return home to Andros,” said Michael Colebrooke, assistant director of labour, Department of Labour. “Encouraging young people to stay in Andros helps the local economy, keeps families intact and strengthens the community.”

NOTICE is hereby given that RAINO RYAN BLACK Emmanuel Drive, Malcom Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 28th day of September 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

ANTI-CORRUPTION legislation such as the ombudsman bill will still be tabled during the new Parliamentary session, according to Attorney General Ryan Pinder - although it was not mentioned during the reading of the Speech from the Throne yesterday. When Parliament prorogued in August, Mr

Pinder said when Parliament returned all bills not passed during the previous session will be tabled again. Yesterday, he maintained “not everything is in the speech from the throne” and that the bills will still be tabled during this session.

In August, Mr Pinder said outstanding anti-corruption legislation will be brought back as “an anti-corruption suite” of legislation. He said: “We have a compendium of anti-corruption legislation. You would have

A BAHAMIAN digital payments provider yesterday said it is rapidly expanding its network of Family Island fast-pay kiosks as requests to partner with it continue to mount. Sean Smith, SunCash’s business development manager, told Tribune Business that community partnerships are essential to this growth. Its fast-pay kiosks are designed to replace the commercial bank branches that have been shuttering, and exiting, the Family Islands over the past decade.

“The growth of our kiosks is going well. It is really tied to our current business model, which has been whatever the customers have been requesting more consistently. We are trying our best to try answer their needs,” he said.

“In the Family Islands we have been getting requests for the past two-and-a-half years to bring some kind of kiosk, or some kind of system, where people can get their money or they can send their money. We’ve been doing our research and a bit of analytics to ensure that we get the best possible solution

for the Family Islands, but it depends on which Family Island or settlement you are in. You might need different solutions.”

Sun Cash is operating a pilot kiosk programme in North Andros, where it has teamed with a local partner who will be responsible for manning the kiosk and ensuring it is kept working for clients. “The word is getting out with regard to the services we are delivering and, as the solution is there, more and more people are coming to the location to be able to utilise the service because what we did is we put a kiosk there,” Mr Smith added.

“We partnered with somebody who has their navel string buried in North Andros, and who wanted to help solve the problem in the community. We may have had different strategies for how we wanted to market the kiosks, but we decided to partner with someone from the community who knows what the people on the island want and can deliver it for them.”

Clients can move funds from their bank accounts to their Sun Cash account after having their Know Your Customer (KYC) profile approved for second-tier status, which allows them to deposit greater sums.

noted the ombudsman bill was left on the table. We look to compound that with a new Public Disclosure Act and an Anti-Whistleblower Act as well as a code of conduct for the public service and bring that all back together as an anti-corruption suite of legislation.”

Governor General

Cynthia “Mother” Pratt read the Speech from the Throne yesterday at the opening of Parliament and said that several bills will be introduced for the financial

Payment recipients can also sign up for a Sun Cash account and are able to withdraw their funds, whether it is money for salaries or to pay vendors for work rendered.

“This is the same when you go to a commercial bank. When you open an account, they ask you what services do you want with the account,” Mr Smith said. “We are rolling out solutions that are going to solve problems that they currently have; not just put something there that may look nice, but put something there that’s going to solve problems that they are having.”

Sun Cash is presently doing its “due diligence” on other Family Islands to find suitable partners for its fast-pay kiosks. “The same thing we did in Andros with our two partners in North Andros and Central Andros, it’s just a matter of our vetting process to be able to get the right partners on this island,” Mr Smith added.

“Once we pass the vetting process, they will be in a position to service their community the same way in Andros because they are our franchise partners. We’re prepared to roll our kiosks out. We are prepared to roll all of them out. But if we drop a kiosk in every island, that means we will end up running it and we don’t want that. So we just want the completion of the due diligence of the partner so we can find whoever is best, and hopefully that will happen soon.”

sector, including a securities industry bill and a new Digital Assets Registered Exchanges (DARE) bill for the regulation of digital assets. She said: “[The] government remains committed to development and innovation in the Financial Services industry. It is committed to compliance with international best practice, while being innovative in new product and service development.

“A new Securities Industry Bill will be presented that will ensure that our financial services industry and its regulation, maintain the highest level of regulatory integrity. A new Digital Assets Registered Exchanges Bill will also be advanced, which will ensure that our country continues to lead from the front in the digital assets industry.”

She also said the Family Island Airport Renaissance project unit will be formed to “accelerate” the

redevelopment’ of Family Island airports and that a local government bill will be introduced to “enhance” the responsibilities and operations of Family Islands.

She said: “[The] government will implement the Family Island Airport Renaissance Project to accelerate the redevelopment of airports throughout The Bahamas.

of West Bay Street and Tropical Gardens Road as commercial, so A Stone’s Throw Away can develop a cafe, grocery story and florist shop, is expected any day now, but the two business principals agreed that the concerns of residents and homeowners stem from the Government’s decision more than two decades ago to permit the hotel’s construction in a residential neighbourhood without adequate parking.

Oneil Khosa, A Stone’s Throw Away’s proprietor, told this newspaper on Wednesday that many of the residents’ concerns about loud music and noise being generated by his property were “not factual”. And he said numerous complaints appeared to be based on “emotion”, or related to issues not relevant to the present application, such as the resort’s construction in the late 1990s well before he acquired the property five to six years ago.

Mr Bates, in reply, yesterday agreed “it is” emotional given that his concerns and those of others stem from “a 20 year-old argument” that A Stone’s Throw Away “should never have been permitted” as a hotel in a residential area - especially without staff and guest parking. Voicing surprise that the commercial rezoning application is even being entertained, he blasted: “At some point Town Planning has to plan the town.”

The Sign Man principal and his wife, in a letter

sent to the Town Planning Committee yesterday following Monday’s public hearing, wrote: “He’s [Mr Khosa] right about emotions because all our fears have come true. A 20 yearold issue that we complained about has now reared its head again with another proposition.

“The opening of a café, flower shop and grocery store will only exasperate the situation. This will add further traffic congestion and danger to both commercial and pedestrian traffic at a major juncture at West Bay Street and Tropical Gardens as vehicles will be parking on both sides of the streets.

“Parking along West Bay by patrons of Traveler’s Rest, the conch shack corner at Gambier Village and across the road from Sapodilla are all examples of what will happen in our neighbourhood. The parking Mr Khosa showed us at the meeting will not satisfy the needs and that major junction will become a hazard, as it’s a blind corner.”

Mr Bates told Tribune Business that he feared approving the rezoning, and that property’s subsequent commercial redevelopment, will slash property values in the area if increased traffic congestion and noise pollution result. “The neighbourhood has been plagued for 20 years by having the road blocked with taxis, food delivery trucks,” he added.

“We have had issues with traffic for 20 years because of this hotel being given the right to build against residential objections. I’m getting fed up. As Bahamians, we’re being told to accommodate this type of behaviour for a sense of progress. There has to be a development plan. Traffic and loud noise are the two major issues with the hotel.”

Mr Khosa previously told this newspaper he felt many of the residents’ concerns have been “blown out of proportion” and exaggerated, and denied that his resort played loud

music to the nuisance of its neighbours as this would undermine its $500 per night business model and market position as the “quaintest” property in Nassau.

Mr Bates, though, was far from convinced. “My two biggest concerns are his zero parking for his guests, staff and patrons and, if he opens this thing up, with that comes the criminal elements. We have enough crime as it is. When is the Government going to stop this nonsense? When is the Government going to listen to citizens of The Bahamas?”, he added.

“At some point Town Planning has to plan the town. We’re very surprised that Town Planning seems to be taking him seriously. They should have shut him down. He has no business in that area. If he goes commercial, someone else will come along, buy vacant land, put up a high rise, gas station and devalue the neighbourhood. I have no time for this. I don’t trust the Government; any government. We really need to have a voice. It’s just become a very unhappy place to be a resident here.”

When it was pointed out that Mr Khosa said A Stone’s Throw Away had hosted just seven events or functions last year, Mr Bates replied: “I don’t care. I don’t care if it’s one a year. He’s in the middle of a residential area. He needs to shut it down at 10pm at night.”

Mr Albury, meanwhile, joked: “If it gets rezoned I will have to go to the Department of Inland Revenue and ask for a refund of property tax because the value of my property has gone down.

“What he should do take that property, create parking for his resort, and if he wants to do something with those properties he can turn them into villas and can rent them out as they will be right on the water. That will alleviate a lot of the parking issues and put him back in the good books of the residents of the neighbourhood.”

The Auto Mall chief said it was only once or twice a month, when A Stone’s Throw Away hosted functions, that traffic/parking woes and noise became a major problem. He revealed that he has to place stones along his property’s boundaries to prevent persons parking there, damaging his home and blocking him in.

Mr Albury, outlining his concerns to Tribune Business, wrote in an e-mail: “The issue I have with the rezoning is that it opens up the property to creating more traffic congestion at a very dangerous intersection, and creates a safety issue as that intersection is already a dangerous one to navigate.

“In addition, the resort has created a nightmare with traffic and noise on weekends as its being used for wedding receptions, birthday parties, company parties and more. How they were ever granted a resort license in the first instance without providing parking for staff and guests amazes me........

“In addition, Gambier Heights is about to become a gated community, which will have the effect of causing delivery trucks and clients attending Stones Throw to either reverse out on to Tropical Gardens Drive on top of the hill or turn around, which is very tight to do in a big truck. Presently, they drive into Gambier Heights and turn around there, causing traffic congestion in our quaint community and also a safety hazard to kids playing in the area,” Mr Albury continued.

“While I sympathise with the owner of the business, he should have done his due diligence regarding the parking issue around his property. While he does not live there, we do and have to contend with noise and overflow of parking. My recommendation to him is to utilise the property in front of his resort to create parking for his resort, and not attempt to put more businesses that will impact the parking issue further and create safety issues for the residents of the area”

FROM PAGE B1

serious about going forward with the plan. Second, it makes it more difficult for the Plan to be discarded when administrations change. What we’re hoping to do is reconvene most of the members from the steering committee of a few years ago, add some new faces and continue the work done six years ago.”

Cynthia Pratt, the governor-general, reading the Speech from the Throne, which sets out the headline or broad-brush themes of the Government’s legislative agenda for the upcoming session of Parliament, said: “My government will also introduce a number of Bills to help grow and diversify and our economy.

“In order to lay the strategic foundation for the future, my government will introduce The Bahamas National Development Plan Bill. By putting the National Development Plan on a statutory footing, my government seeks to ensure that the next 50 years of our national life will have a firm strategic underpinning and focus.”

Mr Stubbs yesterday told Tribune Business that he and the steering committee are hoping to complete the remaining work required to finalise the National Development Plan before year-end. “We’re about 80 percent complete, and I think there’s about 20 percent more to complete,” he explained. “Our best estimate is that we will have it complete by the end of the year.

“The work started in 2014, and the draft Plan is in its fourth iteration. We need to finalise that draft, and then turn it over to a new organisation. The draft Bill is expected to create a body that will manage the Plan going forward. We always thought it was important to codify this.

“We’re just delighted that the Government has taken this recommendation and proceeded with that. It’s going to do a lot in terms of ensuring the Plan lives a long life. The thing we have asked the Government to do is as soon as Parliament is back is to convene a session so that we can speak to all parliamentarians about the Plan in a nonpartisan forum,” Mr Stubbs continued.

“We’re looking forward to it. We have the team convened. We haven’t had any meetings yet. We were waiting for the Government to make its announcement. We were waiting for the Speech from the Throne. We know the Bill is presently being drafted, so the Steering Committee will begin to meet and do its work knowing the legislation will come to Parliament very soon.”

Meanwhile, the Speech from the Throne pledged to “do what many previous administrations have promised” but failed to deliver on - land reform. “One long-standing issue that our government will address in the upcoming legislative session is the security of property ownership,” the governor general said. “My government will do what many previous administrations have promised: It will enact appropriate legislation to deal with land registration and the adjudication of disputes.”

The Governor General also said the environmental regulatory regime, which has attracted multiple bureaucracy and red tape concerns from investors, will be eased for small Bahamian-owned projects. “My government will amend the Environmental Planning and Protection Act to provide for a more streamlined application of the environmental laws to Bahamian-owned small developments,” she said.

“Regulations will also be introduced under the Environmental Planning and Protection Act to allow for spot-fines to be administered for violations of the Act that result in environmental damage..... Every Bahamian’s quality of life should be enhanced by legislation which will be put forward to ensure public access and right of way to beaches, by requiring at least one public access to every beach.

“Dignity and respect should also come at the end of life, and so my government will also introduce a Funeral Industry Services Bill to bring about a regulatory framework for the funeral home industry.” Practitioners have long complained about the lack of regulation, and its enforcement, in this industry.

Meanwhile, the Speech from the Throne argued

In the Estate of WILBERT SOLOMON DEAL late of the Settlement of Palmetto Point in the Island of Eleuthera one of the Islands of the Commonwealth of Te Bahamas, deceased.

NOTICE IS HEREBY GIVEN that all persons having any claim against the above named Estate are required on or before the 3rd day of November, 2023 to send their names and addresses and particulars of their debts or claims to the undersigned and if so required by notice in writing from the undersigned to come in and prove such debts and claims or in default thereof they will be excluded from the benefts of any distributions made before such debts are proved AND all persons indebted to the said Estate are asked to pay their respective debts to the undersigned.

HAILSHAMS LEGAL ASSOCIATES

Counsel and Attorneys at Law

RENALDO HOUSE 10 Queen’s Highway Palmetto Point, Eleuthera, Bahamas

P. O. Box SS 5062, Nassau, Bahamas

Attorneys for the Administratrix of the above Estate Tel: 242-332-0470

email: hailshams@1stcounsel.com

that some of the postCOVID economic recovery has been muted by external factors such as higher oil prices, global supply chain shocks and the war in Ukraine. “The result is that things are still far too tough for far too many people, especially the poor amongst us,” the Governor-General said.

“We remain determined to do what we can to make things better. Mindful of the estimated two thousand verses in Scripture that deal with issues of the poor, and committed to the ideals underpinning the genesis of its political foundation, my Government retains a strong focus on helping to alleviate the misery of poverty.

“Our commitment is unwavering. Though it may be difficult, and though it may take some time, ‘we shall not fail or falter, we shall not weaken or tire’ as we seek to ‘wipe every tear from every eye’.” One of the themes was a focus on reducing the cost of living, with the focus placed on energy sector reform and enhanced consumer protection.

“Survey results from 2020 confirm what we all know: That The Bahamas remains one of the top 10 most expensive countries in the world,” the Governor General said. “The high cost of living is a major cause of financial stress and psychological distress in the country.

“In a number of sectors, poorer people pay disproportionately higher costs than the wealthier sections of society. My government does not wish to overburden any section of the community, but we do seek to make our economy fairer. In order to provide a better framework for businesses and consumers, my government will introduce the following measures.”

These include a Registrar General Bill to re-organise the operations of the Registrar General’s Office and “ease the burden of doing business in The Bahamas”. This is already underway via the upgraded online company registry portal, plus an online civil platform “to provide efficient and transparent services to Bahamians”.

The Securities Commission of The Bahamas, a statutory agency responsible for the oversight, supervision and regulation of the securities and capital markets, investment funds, fnancial and corporate service provides and digital assets and exchanges, invites applications from qualifed individuals for the following position:

We seek to hire a full-time Human Resource (HR) Manager to provide executive level leadership and guidance to the organization’s HR operations. The HR manager is responsible for setting, enforcing and evaluating legally compliant human resource policies, procedures and best practices, and identifying and implementing long-range strategic talent management goals. Compensation packages are competitive with the fnancial services industry and other regulatory bodies.

Supervisory Responsibilities:

• Development of recruitment, retention and talent management strategies

• Development and evaluation of performance review criteria

• Recommendation on compensation packages for approval by the Board of the Commission

• Overseeing the daily workfow of the HR Department

• Administration of disciplinary process and termination of employees, when necessary

Duties/Responsibilities:

• Collaborate with executive leadership to defne the organization’s long-term mission and goals, and identify ways to support this mission through talent management

• Review and draft policies, procedures, and practices, and amend/update where necessary

• Oversee all aspects of the organization’s recruitment and hiring process

• Lead in the development and implementation of the annual training plan

• Ensure payments and benefts to staff are processed in a correct and timely manner

• Create and review programs and initiatives aimed at improving employees’ quality of work-life and morale

• Oversee employee development initiatives and coaching to assist employees in growing in their current roles or advancing to new ones within the organization

• Oversee the performance management and bonus system

• Plan and conduct employee engagement surveys at least annually and ensure actions are taken to improve results

• Oversee employee relations and address issues such as harassment, discrimination, intimidation, exploitation, and workplace health and safety

• Oversee the development and implementation of staff wellness (i.e. CPR, health monitors etc.), including mentoring and counselling

• Lead in the development and implementation of the organization’s succession plan

• Develop programs to foster a culture of teamwork, employee empowerment and commitment to organizational goals

• Ensure grievance and disciplinary procedures are handled fairly and consistently

• Participate in professional development and networking conferences and events

• Keep current with trends, best practice, regulatory changes and technologies in HR with the aim of adoption where they would lend to improvements and effciencies in HR services

Knowledge/Skills:

• Excellent oral and written communication skills

• Well organized with the ability to work in a fast paced environment

• Knowledge of laws, regulations, and best practices in employment law, HR and talent management

• Experience with the development of HR policies, processes and procedures

• Mediation training

• Profciency in Microsoft Offce Suite (Word, Excel, PowerPoint, etc.)

Qualifcations/Experience:

• Master’s degree in HR management, psychology or related area with a minimum of 10 years’ experience as an HR Manager

• Bachelor’s degree in HR management, psychology or related area with a minimum of 15 years’ experience as an HR Manager

• Senior level SHRM and/or HRCI certifcations

Contact Information:

Senior Manager, Human Resource Department Securities Commission of The Bahamas Tel: (242) 397-4100

E-mail: hrm@scb.gov.bs

Deadline for applications: Friday 20 October 2023

from a “consensus” among members of the Steering Committee appointed to oversee the transition away from cheques that more time is needed to ready and educate Bahamians. The delay will also give Bahamian commercial banks and other financial providers more time to better roll-out the digital payments infrastructure that will replace cheques as a means of settling transactions.

“After extensive stakeholder consultation, the Central Bank of The Bahamas has agreed with commercial banks and other stakeholders on a reassessment of priorities regarding use of cheques in The Bahamas, while accelerating modernisation of the digital payments infrastructure,” the regulator’s statement said.

“Based on wide stakeholder feedback obtained by the Steering Committee, consensus has emerged to adjust the medium-term strategic mandate for use of cheques. Specifically, the timeline to effect the policy for use of cheques will be deferred from the original

target date of December 2024. “A reassessment of progress in the payments system, and the policy for use of cheques, will be made in 2026. In the interim, milestones are being identified to strengthen universal access to enhanced efficiency in payments across all deposit taking institutions and payment services providers, including use of the Sand Dollar [Central Bank-backed digital Bahamian dollar].”

Some $4.3bn worth of cheque payments were processed in 2022, although the volume of such transactions fell by almost 12 percent. “Cheque usage remained low, except for large value transactions. In particular, the number of processed cheques declined by an annualised 11.9 percent to 1.1m, albeit the corresponding value rose by 1.1 percent to $4.3bn,” the Central Bank said in its 2022 annual report.

Gowon Bowe, Fidelity Bank (Bahamas) chief executive, yesterday confirmed to Tribune Business that the commercial banks and other industries represented on the Steering Committee were in favour of the 2024 year-end “deferral” to make sure “we are not putting the

cart before the horse” and moving faster than Bahamians are ready to go in eliminating cheque use.

Noting that the Steering Committee had already obtained feedback from consumers and businesses, following its February 2023 appointment, Mr Bowe said it had sought to determine the country’s “readiness” for cheque elimination and “if it was something nationally that was gaining sufficient consensus.

“What the Central Bank and Steering Committee ultimately decided is that 2024 was too short a period of time, and more analysis was necessary,” the Fidelity Bank (Bahamas) chief added. “It highlighted the need to put the infrastructure in place for alternatives and the cost.”

Besides implementing a digital payments network that Bahamians and businesses have confidence in, especially when it comes to reliability and the speed/ finality at which transactions are concluded, Mr Bowe said they also needed reassurance that cheque alternatives will not be more expensive prior to their elimination.

Pointing out that cheque usage is not free, given that such payments attract Stamp

IN THE ESTATE OF JOHN ERNEST PRATT late of 111 IIer Avenue in the Town of Essex in the Province of Ontario in the Dominion of Canada, deceased.

NOTICE is hereby given that all persons having any claim or demand against the above Estate are required to send the same duly certifed in writing to the Undersigned on or before the 20th day of November, A.D. 2023, after which date the Co-Executors will proceed to distribute the assets having regard only to the claims to which they shall then have had notice.

AND NOTICE is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

MERIDIAN LAW CHAMBERS

Attorneys for the Co-Executors Chambers, P.O. Box N-168, East Bay Shopping Center, East Bay Street, Nassau, Bahamas.

Duty, along with printing and monthly maintenance costs, he added: “Wire transfers need to be comparably priced to say to persons watching their costs that it makes sense for them to move away from cheques to the digital platform.

“What’s intended is that, from an analysis perspective, we are not putting the cart before the horse, for want of a better expression, if the alternatives are not reliable, cost comparable and consumers are well-educated. We have to get that right. The focus is to get that right, and then come back with an actual cheque policy....

“The best way to describe it is let’s make sure the facilities are in place to provide a viable alternative so as people move to reduced use and elimination they don’t feel oppressed by not having solutions that work.” The Fidelity Bank (Bahamas) chief executive added that it was also vital to ensure commerce is not disrupted, and that no person or group is disadvantaged, by the move to reduce cheque usage as a means of payment and, ultimately, eliminate it.

“I’m one that stands by cheques really being an extinct instrument,” Mr Bowe told Tribune Business, “and that we should be using digital platforms because it’s certainly faster. Clearance time for cheques can be anywhere up to two days, whereas to clear through the ACH (Automated Clearing House) can happen the same day and certainly within 24 hours.

“The fraud level is much lower with digital payments because you are putting in your PIN, identification number, whereas with a cheque you’re susceptible to someone copying the signature, stealing the images.

Ultimately, the cost of pro-

cessing and clearing cheques is very labour intensive. With automation you get money faster and there is less risk of fraud.

“As long as the infrastructure supports it, and with the right education, people will naturally migrate across from using old paper forms of commerce.” The Central Bank’s move was yesterday welcomed by private sector representatives who had previously voiced scepticism about the need to eliminate cheque use, instead arguing that The Bahamas simply needed to follow the US lead and digitise this payment form.

Ethric Bowe, an engineer with multiple business interests including Advanced Technical Enterprises, an insurance agency/brokerage and a family farm, told Tribune Business “there was no purpose” to the year-end 2024 elimination target and the Central Bank should drop the idea “period”.

“That’s a good decision,” he added. “All they need to do is digitise the cheques. The same information you have on the cheque is the same information that you have on the debit and credit card. It doesn’t make sense.” eChecks have been a feature of the US financial system for several years, and Mr Bowe previously added: “Instead of moving away from cheques, they’re getting deeper into them. I think it’s [their elimination in The Bahamas] a bad plan.”

The Central Bank in its statement, said the Steering Committee’s mandate involves deciding the “appropriate policy for use of cheques in The Bahamas and the development of strategies to efficiently achieve the policy determined, including an effective public education campaign.

“This work is advancing steadily, focusing on initiatives to improve the

ease of banking and extend the reach of digital payments alternatives. It is also addressing the format of deeper engagement with the business community around the cost-benefit analysis of domestic payment instruments, while adequately capturing and responding to concerns related to payments,” it added.

“The initiative to modernise payments systems remains focused on outcomes that improve financial inclusion, and provides all users with safe, secure and legitimate access to the digital alternatives. In addition to improving the infrastructure for, and access to, digital payments, the Central Bank will continue to work alongside the Steering Committee to formulate and execute a targeted public education and awareness campaign.

“The Central Bank will also consider amendments to its regulations to increase transparency and facilitate greater enforcement of consumer protection standards in services related to issuance and processing of cheques.”

The Steering Committee is co-chaired by Mr Rolle and the Clearing Banks Association (CBA) chair. Its membership includes the Ministry of Finance, members of the CBA, the Bahamas Cooperative Union League, the Bahamas Insurance Association and the Bahamas Chamber of Commerce and Employers Confederation (BCCEC).

The Business Matters working group, established under the Steering Committee, also includes representatives from the Bahamas Real Estate Association (BREA), the Bahamas Institute of Chartered Accountants (BICA), Civil Society Bahamas, the Bahamas Bar Association and the Office of the Financial Services Ombudsman.

“[The] government will implement a new Local Government Bill that will enhance the operations and responsibilities of local government throughout our family of islands.”

The administration also pledged to implement an online registry portal to assist the registrar general in the registration process and to introduce a registrar general office bill to reorganise the department. She said: “A new Registrar General Bill to re-organise the operations of the Registrar General’s Office. This will help to

ease the burden of doing business in The Bahamas. My government will launch a new online company registry portal which will help to make the process of registration more efficient. My Government will also launch a new online civil platform, to provide efficient and transparent services to Bahamians.”

She noted that the high cost of living in the Bahamas causes ‘financial stress and psychological distress” and pledged that consumer protection leglislation will be introduced. The second phase of the National Health Insurance which

covers catastrophic healthcare will be introduced in the upcoming Parliament session as well a cannabis and hemp legislation. She added that legislation that ensures public access to all beaches will also be tabled.

She said: “The high cost of living is a major cause of financial stress and psychological distress in the country. In a number of sectors, poorer people pay disproportionately higher costs than the wealthier sections of society. My Government is also mindful of the need to provide for greater protection of consumers, and will therefore

introduce consumer protection legislation.

“[The] government prioritises public health, mental health and wellness initiatives, and is moving aggressively to implement the second phase of National Health Insurance, with the introduction of catastrophic healthcare cover. This will make healthcare more affordable for all Bahamians.

“New opportunities will be created by legislation regulating cannabis and hemp. Several rounds of

public consultations have already been completed, and my government notes the widespread enthusiasm amongst the public for this new health and economic sector.

“Every Bahamian’s quality of life should be enhanced by legislation which will be put forward to ensure public access and right of way to beaches, by requiring at least one public access to every beach.”

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 3221986 and share your story.

Should the regulator succeed, and ArawakX be placed into provisional liquidation, Mr Campbell could potentially be among the biggest losers as equity investors typically reside at the bottom of the creditors’ queue. The former Colina chief had provided MDollaz, which traded as ArawakX, with nearly $1.6m in total financing. This was broken down into the $1.3m “option” which, if exercised, would give him a 22 percent equity stake in the platform plus a further loan for $279,000.

Based on the $1.9m raised from outside investors, as noted in ArawakX’s draft financial statements for the year to end-July 2022, Mr Campbell’s $1.3m option accounted for 68.4 percentor more than two-thirds - of the new equity capital that the platform was hoping to obtain Securities Commission approval for.

Mr Rahming, in a September 27, 2023, affidavit responding to the Securities Commission’s petition, alleged that Mr Campbell had issued no demands that he be repaid the $1.3m.

Meanwhile, ArawakX’s attorney, Khalil Parker KC, in a September 12, 2023, letter responding to the regulator’s decision to suspend his client’s licence for 15 days, denied that it

increased its share capital to dilute Mr Campbell’s influence.

“For the avoidance of doubt, the increase of ArawakX’s share capital was a reasonable and necessary step to afford any third party the option to participate in ArawakX at the scale asserted by PJ Enterprises,” Mr Parker said of Mr Campbell’s company. “Therefore, the increase of ArawakX’s capital was intended to facilitate increased participation in ArawakX and would, in any event, have been a necessary first step to PJ Enterprises’ desire to participate in ArawakX.”

Christina Rolle, the Securities Commission’s executive director, in an August 30, 2023, letter to Mr Rahming had suggested the change in the crowd-funding platform’s capital structure from what was originally set out in its Memorandum and Articles of Association was designed to “diminish the potential authority” and influence of Mr Campbell and PJ Enterprises.

ArawakX’s initial capital was $5,000, divided into 5,000 shares with a par value of $1 each, but Ms Rolle said the Companies Registry revealed this was subsequently changed to $100,000 divided into 10m shares each with a par value of one cent. This change,

NOTICE is hereby given that EMIDLEY JEAN CHARLES, P.O Box 1901 Exuma, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 28th day of September 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

she added, was done without the knowledge or approval of the Securities Commission.

“The Commission notes that the act of changing the capital structure appears to have been done to accomplish at least two things,” Ms Rolle wrote. “Firstly, the diminution of the potential authority or influence of lenders to the company and, of particular note, is the impact of the share structure in relation to the primary lender, PJ Enterprises.”

Having refuted this, Mr Parker then accused Mr Campbell of “setting out to gravely injure” ArawakX by both his complaints to the Securities Commission and his intervention with Bank of The Bahamas. The latter resulted in the crowd-funding platform’s operational and fiduciary accounts being blocked, or frozen, for just over six months between early November 2022 and mid-May 2023.

“ArawakX does not intend to issue any shares to Mr Campbell or his proxy in the circumstances,” Mr Parker added, backing Mr Rahming’s assertions to Tribune Business. “Mr Campbell has such rights as may be available to him at law, and ArawakX will defend any such litigation vigorously....

“It must be noted that ArawakX has received

neither a claim nor a demand for funds from Mr Campbell to the date hereof. ArawakX’s relationship with Mr Campbell remains a private matter, which the Commission appears determined to conflate into a regulatory issue.”

Hillary Deveaux, one of Ms Rolle’s predecessors as Securities Commission executive director, was on Mdollaz/ArawakX’s Board but he resigned on December 9, 2022, to join Mr Campbell and Felix Stubbs, the former IBM Bahamas chief, as a whistleblower when they met with the regulator on October 11, 2022, to voice concerns about the platform’s operations and corporate governance structure.

“Mr Campbell, in particular, who is a silent investor in the company and invested roughly $1.2m, expressed deep concerns about the direction and operations of the company,” the Securities Commission’s winding-up petition alleged.

The former Colina chief asserted “that since operations began the company had been cash strapped, and that roughly $1.5m received from investors had been spent as only one out of the six crowdfund offerings that was listed on the platform had met its minimum ask”.

It was also claimed that ArawakX staff “had

NOTICE is hereby given that LOUNISE JEAN of P. O. Box N-3331, Anthol Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of October, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

not been paid for several months”, while $40,000 “was moved from the fiduciary account to the operating account” - suggesting that client/investor monies were used to finance the platform’s operating expenses. When this was brought to Mr Rahming senior’s

attention, he allegedly described this as “an error”.

Mr Campbell also alleged that senior ArawakX executives were travelling and spending lavishly to promote the business, which he argued was not wise given the company’s financial position.

The Public is hereby advised that I, JOANNA SANTALIA of Carew Street off Mount Royal, New Providence, Bahamas intend to change my name to JOANNA CHARITE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE is hereby given that KATRINA PIERRE PAUL of George Town, Exuma, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 28th day of September, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE IS HEREBY GIVEN that an Extraordinary General Meeting of the Shareholders of SUNSHINE FARMS, LIMITED is hereby called to be held at the Registered Offce of the Company, Ocean Centre, Montagu Foreshore, East Bay Street in the City of Nassau on the 7th day of November, 2023 at 10:00 o’clock in the forenoon. The object and purpose of said meeting is to have laid before the Shareholders of the Company the accounts of the Liquidator, Jonell Rolle, showing the manner in which the winding up of the Company has been conducted and also to hear any explanation that may be given by said Liquidator.

Dated the 2nd day of October, 2023.

Jonell Rolle LIQUIDATOR of SUNSHINE FARMS, LIMITED

Palm Cay is hiring Carpenters

RESPONSIBILITIES:

• Unit Layouts and ensuring quality control.

• Installing cabinets, doors, frames, trims, counter tops, machines, hand tools, or power tools.

• Installing joists, trimmers, hangers, collars, staircases, balustrades.

• Following established safety rules and regulations and maintaining a safe and clean environment.

• Installing vanities

• Liaise with HVAC, plumbing and electrical teams

• Liaise with Management and Design Teams

REQUIREMENTS:

•

• sites

•

•

• as the ability to follow all on site safety procedures and protocols

Please submit your resume to HR@PALMCAY.COM

Deadline is Friday, October 6th, 2023

WORKERS in California will soon receive a minimum of five days of paid sick leave annually, instead of three, under a new law Gov. Gavin Newsom signed Wednesday.

The law, which takes effect in January, also increases the amount of sick leave workers can carry over into the following year. Newsom said it demonstrates that prioritizing the health and well-being of workers "is of the utmost importance for California's future."

"Too many folks are still having to choose between skipping a day's pay and taking care of themselves or their family members when they get sick," Newsom said in a statement announcing his action.

It was one of more than a dozen bills the Democratic governor signed Wednesday. He has until mid-October to act on all the legislation sent to him this year. He can sign, veto or let bills become law without his signature.

Beyond preventing workers from choosing between taking a day off or getting paid, proponents of the sick day legislation argue it will help curb the spread of diseases and make sure employees can be productive at work. But the California Chamber of Commerce, which represents businesses across the state, said it will be burdensome for small businesses.

"Far too many small employers simply cannot absorb this new cost, especially when viewed in context of all of California's other leaves and paid benefits, and they will have to reduce jobs, cut wages, or raise consumer prices to deal with this mandate," Jennifer Barrera, the group's president, said in a statement.

The law was among several major labor initiatives in the Legislature this year, including proposals to raise the wages of health care workers and allow legislative staffers to unionize. Newsom already signed a law to raise the minimum wage for fast food workers to $20 an hour.

But he vetoed a bill Saturday that would have given unemployment benefits to striking workers, saying the fund the state would use is approaching nearly $20 billion in debt.

The United Food and Commercial Workers Western States Council, which supported the sick day legislation, said the law will help prevent the spread of deadly diseases.

"Five paid sick days is a step in the right direction and workers will be less

likely forced to risk their livelihoods to do the right thing and stay home when they're sick because of this bill," Andrea Zinder, president of the group's Local 324 chapter, said in a statement.

Newsom also signed a law Wednesday to ban local government from manually counting ballots in most cases, a direct response to a rural Northern California county's plan to stop using machines to count votes.

Shasta County's board of supervisors, controlled by a conservative majority, voted earlier this year to end its contract with Dominion Voting Systems, a company that has been subject to unfounded allegations of fraud pushed by former Republican President Donald Trump and his allies. County leaders said there was a loss of public confidence in the company's machines.

At the time, local leaders did not have a plan for how the county would conduct future elections for its 111,000 registered voters. The county had been preparing to count ballots by hand for its next election on Nov. 7, 2023, to fill seats on the school board and fire district board and decide the fate of two ballot measures.

The new law, which takes effect immediately, halts Shasta County officials' plans. The only exceptions under the law are for regularly scheduled elections with fewer than 1,000 eligible registered voters and special elections where there are fewer than 5,000 eligible voters.

Assemblymember Gail Pellerin, a Democrat from Santa Cruz who authored the law and is a former local elections official, said the law creates necessary guardrails around elections. The law also requires local government use state-certified voting machines.

The legislation "ensures that no California voter will be disenfranchised by the actions and decisions of illinformed political actors," she said in a statement.

The legislation has divided the rural county.

Shasta County Clerk Cathy Darling Allen, a Democrat, called the law a "commonsense protection for all California voters."

Despite the county getting rid of its Dominion voting machines, local leaders gave her permission to purchase equipment needed to comply with federal laws for voters with disabilities. The system that was purchased, made by Hart InterCivic, includes scanners capable of tabulating votes electronically.

The equipment will be used to tabulate votes in upcoming elections, Darling Allen said.

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, ANISKIA KASSANDRA RIGBY of Breadfruit Street, Pinewood Gardens, New Providence, Bahamas intend to change my name to ANISHKA KASSANDRA RIGBY

If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O. Box N-742, Nassau, The Bahamas no later than Thirty (30) days after the date of publication of this notice.

Incorporated under the International Business Companies Act, 1990 of the Commonwealth of The Bahamas.

Registration Number 78,592 B

(In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 25th day of September, 2023.

Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Stanislas le Carpentier, c/o Saffery Champness (Suisse) S.A. Rue de la Confédération 5, 1204 Geneva, Switzerland. Persons having a Claim against the above-named Company are required on or before the 20th day of November, 2023 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the beneft of any distribution made before such claim is proved.

Dated this 5th day of October, 2023

Stanislas le Carpentier Liquidator