Insurers: Don’t sleep on EU blacklisting ‘breathing room’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bank of The Bahamas bail-out vehicle must now employ “lots of muscle” to recover its remaining “toxic” loan collateral valued at $142m, its chairman revealed yesterday.

James Gomez, Bahamas Resolve’s chairman, told Tribune Business it has largely recovered the “low hanging fruit” among delinquent Bank of The Bahamas commercial loans that it received via two transfers in 2014 and 2018.

Disclosing that some $40m has been recovered to-date, on assets appraised at a collective $63m, he said Bahamas Resolve is now focusing on the “more toxic” credit in its portfolio where success will be “key” to minimising the potential

financial “burden” for both the Government and Bahamian taxpayers.

Mr Gomez, acknowledging that the bail-out vehicle’s work will take some years to finish, told this newspaper that the work-out of five loans worth a collective $100m will be key to remaining recoveries. While he declined to identify the borrowers involved, one of the five is almost certainly the Summerwinds Plaza on Tonique Williams Highway that was pledged as

IDB brands price controls ‘poorly targeted subsidy’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government’s price controls are a poorlytargeted mechanism to counter soaring 16 percent food inflation as they benefit the rich as much as low income and vulnerable families, a multilateral lender is arguing.

The Inter-American Development Bank (IDBO), in its latest quarterly Caribbean economic bulletin, indicated that social assistance to offset the cost of living crisis could be better focused on poor families through the use of conditional cash transfer (CCT) initiatives that build on existing initiatives such as food stamps.

It also backed the Retail Grocers Association (RGA) in warning that price controls will disproportionately impact small and medium-sized food stores that lack the breadth of product range and economies of scale - in comparison to larger competitors - to absorb selling

more items at a loss, or below cost.

“A price control, at least in terms of behaviour if adequately enforced, is a de facto combined turnover tax and income redistribution policy (a cash transfer from business to consumers),” the IDB wrote. “Revenues for specific products that would have accrued to specific businesses, and possibly to the Government in the form of an increased VAT, would now be transferred to all Bahamians.

“Additionally, despite the updates, the price controls do not differentiate using size or profitability. Therefore, this policy is likely to impact small and mediumsized enterprises negatively and disproportionately because they are more likely to have neither the volume of sales nor the economies of scale to absorb the per unit loss of revenue. In addition, they will have to use these same diminished margins to cover increasing electricity bills and labour costs.”

collateral by former PLP cabinet minister, Leslie Miller, and upon which more than $30m is alleged to be owed.

That loan is currently the subject of a court battle, but Mr Gomez voiced optimism that Bahamas Resolve’s recovery efforts are proving effective even though the outstanding debt still owed is worth $204m - a sum he said “contemplates write-offs”. Should the full $142m value assigned to remaining loan security be

realised, this will only be equivalent to 69.6 percent of that debt, thus leaving a potential $62m shortfall.

Some 391 commercial and residential properties are among the assets left on Bahamas Resolve’s books, the chairman confirmed, with almost one-third of these accounted for by a 131lot residential subdivision. Mr Gomez, though, said progress had been made in bringing the company’s financials up-to-date with audited statements covering all years through 2020 now completed.

“Things are moving along as anticipated,” Mr Gomez told Tribune Business. “The real issue is that during the first couple of years it’s good to deal with the low-hanging fruit. Now we are getting into the real toxic stuff and that, of course, provides the challenge. These are

CCA: We’ll ‘be laughed at by world’ if Baha Mar not open

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

TOP executives at Baha Mar’s main contractor voiced fears they would “be laughed at by the world” if the mega resort’s target 2015 opening was missed while admitting to multiple “shortcomings and deficiencies” in its construction.

E-mail exchanges between Ning Yuan, China Construction America’s (CCA) president, and Guocai Chen, its general manager, revealed that the Chinese state-owned contractor was - exactly two months

from Baha Mar’s agreed March 27, 2015, completion - privately praying for a miracle this target would be achieved.

The never-before-seen correspondence, filed in the New York State Supreme Court at the weekend in the $2.25bn fraud and breach of contract battle between CCA and Baha Mar’s original developer, Sarkis Izmirlian, reveals CCA’s concern that all construction work had to be completed within 19 days if the project was to stand a chance of passing code inspections by the

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas must not fall asleep after it gained “two years’ breathing room” to escape the European Union’s (EU) tax blacklist and preserve up to 40 percent of its hurricane reinsurance capacity, insurers are warning.

While the immediate threat has been eliminated, Bahamian property and casualty underwriters are urging the Government to promptly enact the necessary reforms to secure this nation’s exit from the EU listing and thus preserve their ability to continue writing present levels of coverage.

Should the 27-nation bloc’s ‘blacklisting’ remain

in place, it could still bar German reinsurers from underwriting multi-billion dollar risks in The Bahamas as of end-2024 despite that country’s parliament eliminating the more immediate threat of a 15 percent withholding tax being imposed on all claims payouts to this nation.

Anton Saunders, RoyalStar Assurance’s managing director, told Tribune Business that the German legal amendments passed last Friday should give The Bahamas sufficient time to satisfy the EU given that this has removed the possibility of a 15.82 percent withholding tax rate being levied on claims payouts from January 1, 2023.

‘Unenviable balancing act’ confronting The Bahamas

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas “faces an unenviable balancing act between food security and fiscal discipline”, the Inter-American Development Bank (IDB) warned yesterday, with global financial developments proving “particularly concerning”.

The multilateral lender, in its latest Caribbean quarterly economic bulletin, said the combination of US interest rate hikes as well as forecasts of a global

recession were especially unfavourable for The Bahamas’ ability to access the international capital markets for foreign currency bonds and other debt.

Pointing out that such financing has become more costly, with investors likely to shy away from emerging markets due to the higher returns available on US investments as well as recession fears, the IDB said: “With the likelihood of a global recession increasing, appetite for emerging

business@tribunemedia.net WEDNESDAY, DECEMBER 21, 2022

SEE PAGE B4 SEE PAGE B3

SEE

PAGE B4

‘Lots of muscle’ required for $142m toxic BOB pile

SEE PAGE B2 • Bail-out vehicle recovers $40m ‘low hanging fruit’ • Resolve focusing on ‘key’ five loans worth $100m • Chair says bad loan ‘outstanding debt’ is $204m • Threat to 40% of reinsurance capacity remains • Despite Germany eliminating withholding tax • Danger to ‘viability’ of Bahamas underwriters $5.85 $5.86 $5.97 $5.21

SEE PAGE B2

MORE MIDDLE CLASS FAMILIES SEEKING OUT FOOD ASSISTANCE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

AN INCREASING

number of middle income families are seeking food assistance as Bahamians continue to struggle with the post-COVID cost of living crisis, it was confirmed yesterday.

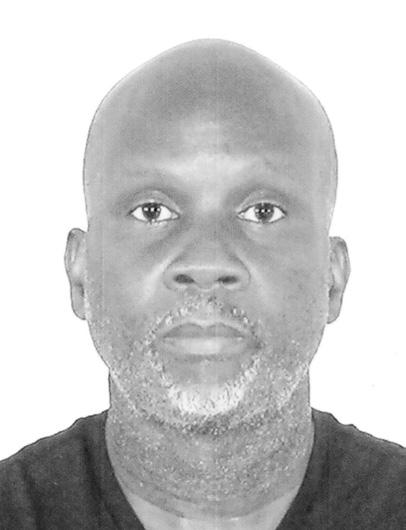

Felix Stubbs, the Bahamas Feeding Network’s chairman, said there has been a noticeable increase in the number of “middle

income” families seeking help from the group and other non-profit charities providing food aid. While lower income families still account for the majority of persons seeking help, even employed and middle income persons are finding it increasingly difficult to meet food expenses amid soaring inflation.

“I can’t give you an exact number of how many middle income families are looking for food assistance, but I can tell you the percentage is on the increase. So there are people that are

‘LOTS OF MUSCLE’ REQUIRED

FROM

very significant assets, and you have to work out the best deal possible for Bahamas Resolve and the Government.

“The whole tranche of loans that were sent over to Resolve were toxic, but some were more toxic than others. We have five loans that total about $100m that are a significant part of the facility that was transferred. The key thing is how best we can recover on those. It’s going to be critical to us meeting our obligations to Bank of The Bahamas....

“If we are able to negotiate some sort of settlement arrangement for those five major loans, I think we’ll be close to completion. There’s lots of muscle needed to take us to the finish line. The recovery itself, for the Government and to lessen the burden on the taxpayer, is going to be connected to how we are able to recover on those large loans.”

Realising those loan assets is likely to be complex, and also involve fights

before the Supreme Court. However, the Bahamas Resolve chair said that in some cases it was able to leverage the fact that borrowers have also pledged their residential homes as security for the commercial credit advanced by Bank of The Bahamas.

“We are now in the process of trying to follow up on those larger sources, and working out agreements with homeowners,” Mr Gomez said, estimating that there were about 20-25 such loans where homes were also serving as loan security. He added that “ten so far have come forward” to work out payment plans given that they are at risk of losing their family homes.

Mr Gomez said several residential properties were subject to the Homeowners Protection Act, which provides extra security for delinquent mortgage borrowers in danger of losing their homes by inserting the courts into the process. This, in turn, makes it harder for lenders to secure assets pledged as collateral for credit, and he added: “That is a process we are trying to navigate now.

“People are approaching Resolve, understanding

working, and even though they make an income it’s still not sufficient to cover the expenses when you have utilities and rent and school fees and that kind of stuff,” Mr Stubbs said.

“They don’t have enough to feed their families and so they come looking for support.” Middle income families are not crowding out those on lower incomes, Mr Stubbs said, but they are becoming a “higher percentage” of those seeking assistance. “There’s still a significant number of lower income people who don’t

have jobs who really need food, so what you’re seeing is that there is a greater number, but the lower income is still a higher percentage,” he added.

The Bahamas Feeding Network has been in existence for 13 years, and has developed a wide network of operations. “We have 104 feeding programmes that we support. So we use our reach to get more food and funding, and then we support any number of feeding programmes,” Mr Stubbs said.

$142M TOXIC BOB PILE

the seriousness of it. It goes to the foundation of one’s security. Some of them have come forward to make arrangements. In the meantime, based on the Government’s strategy, the Government is not interested in kicking people out of their homes and putting them on the streets but, at the same time, it wants action and that Resolve continues to service the bond interest payments to Bank of The Bahamas.”

To fill the hole created by the toxic loans transfer to Bahamas Resolve, two promissory notes were injected into the bank’s balance sheet, worth $100m and $167m, respectively, in 2014 and 2018. The first has since been converted into cash, but the latter - and larger - bond’s maturity was this summer extended by three years to August 31, 2025, with a 4 percent fixed interest rate coupon mandating quarterly interest payments.

Bank of The Bahamas’ balance sheet ascribed a $170.171m value to the last promissory note, meaning that the annual interest bill attached will be around $6.8m. This sum is supposed to be paid by Bahamas Resolve from selling assets

upon which the toxic loans are secured, but if it fails to generate a sufficient sum then the Government - via the Bahamian taxpayerhas to step in and make the payment.

Mr Gomez said the promissory note’s extension will result in Bahamas Resolve having to pay “a bit more” in annual interest to Bank of The Bahamas, confirming that the now-higher 4 percent interest rate will push the annual interest bill “closer to $7m”.

He added that the previous “low hanging fruit” recovery of $40m, on assets appraised at $63m for a 63.5 percent realisation rate, had largely enabled Bahamas Resolve to meet those payments and thus protect taxpayers from additional exposure. However, the Bahamas Resolve chief conceded that the more difficult loan recoveries ahead - combined with the higher interest payments - will make this “a bit of a challenge” moving forward.

“We have been able to cover it. Government hasn’t stepped in since a couple of years ago,” Mr Gomez told Tribune Business of the interest paid to Bank of The Bahamas. “We’ve been trying to treat it as a

CCA: We’ll

FROM PAGE B1

commercial enterprise as best we can where we try to recover the assets and meet our expenses. Other than that the taxpayers have to bear the burden. To the extent we can minimise the burden on taxpayers, the Board will do its best to make sure that happens.”

He added that changes made to Bahamas Resolve’s Articles of Association under his predecessor as chairman, James Smith, had given the bail-out vehicle more flexibility in how it deals with distressed commercial assets by enabling it to appoint receivers for income-generating properties so that it earns rental revenues and other earnings that can satisfy the outstanding debt. This provides an alternative to simply seizing the real estate and looking for a buyer.

“We have been able to put a lot of pressure on people who otherwise would have just turned their backs and not even looked at Bahamas Resolve,” Mr Gomez said. “We’re pretty happy with the response. People know we are there. We have three officers in the main office constantly reaching out to the debtors. They are responding.

The Bahamas Food Network is providing an average 100,000 meals a month. “This is the highest we’ve seen it with middle income families, and it is not just with this programme, because I’m involved in another programme as well and I see it there as well. So it is a major concern, particularly with single mothers with kids. They are having a particularly difficult time now in this country at the moment,” Mr Stubbs said.

“Some of the debtors have been very good. They consistently come in monthly or make wire transfers to Bahamas Resolve accounts. We have some people who have settled their debts.” He added that Bahamas Resolve was also working with the Department of Inland Revenue, Bahamas Power & Light (BPL) and the Water & Sewerage Corporation to ensure all taxes and outstanding bills were paid when distressed loan collateral was sold.

As for its financial statements, Mr Gomez said audited accounts have been completed for the years from 2014 up to and including 2020. “Even though we’re lagging behind slightly, we’re in a better position than when I came in as chairman in 2017,” he revealed. “At that time there were no audited financial statements.

“We have 2021 that is outstanding, so hopefully by mid-year 2023 we will be current with 2021 and 2022. We have already submitted to central government the statements for 2014 to 2018. I have 2019 and 2020 on my desk now. I just need to complete my review of what the auditors have submitted and we will be sending those in.”

laughed at by

if Baha Mar not open

Ministry of Works and be able to receive paying guests.

The e-mail exchanges, which took place on January 27, 2015, as Mr Izmirlian and his team sought to race Baha Mar’s construction to completion, saw CCA executives concede that “every minute and every second counts”. A paper, which Mr Yuan said had been prepared for Mr Chen ahead of a meeting later that day, called on CCA to request multiple additional workers from its affiliates and other Chinese contractors.

To achieve the February 15, 2015, target for construction completion, and enable Baha Mar to obtain the crucial temporary certificate of occupancy (TCO) that would allow the resort to pass all Ministry of Works inspections, the document recommended that vacation leave be suspended and all workers work until 10pm every day in an effort to finish the project on time - an effort that ultimately proved futile.

CCA executives, though, fretted at the impact this would have on worker morale and productivity as it coincided with the Chinese New Year celebrations. They even suggested that such onerous working conditions could cause “trouble” among the Chinese workforce.

Mr Yuan, in his e-mail to Mr Chen ahead of an “all-party meeting” to discuss Baha Mar’s progress, or lack of it, appeared to concede that meeting the March 27, 2015, opening - which had been agreed with Mr Izmirlian and Baha Mar’s financier, the China Export-Import Bank, just two months previously in mid-November 2014 - was a near-impossibility.

“When I went back for the meeting, I had talked with several companies separately, and my impression was that everyone was daunted by the difficulties and was counting on a

stroke of luck, knowing that if there were no additional workers it was impossible to catchup with the progress of work,” he wrote, “yet being worried that workers might snake trouble or there might be enforced idleness due to poor organisation of work during the Chinese New Year holiday.

“There is no need to blame whichever company any more now, as the entire situation and honour are at stake. There is no way but to fight.” While Mr Yuan’s e-mail represented something of a CCA rallying cry intended to boost morale, it provides firm evidence that CCA knew it had virtually no chance of meeting its November 2014 completion commitment to Mr Izmirlian and Baha Mar.

The attached paper, headlined: ‘At the time of a decisive battle, make sure to go all out’, added that Baha Mar had “arrived at a decisive phase for winning the victory where every minute and every second count”.

It continued: “In the 19 days from today to February 15, it will be decided whether the project we have been working on so hard for nearly four years can be completed as scheduled, whether China State Construction Engineering Corporation (CSCEC) will end up as a winner and be praised in the industry or become a loser and be laughed at by the world.”

CSCEC is CCA’s parent company, and the document added: “This has become an issue that has gone beyond that of a simple financial interest. Why is February 15 said to be the bottom line after which the back door will be shut forever? That’s because everyone knows that March 27 is the date when the project is to be open to business to the general public.

“In order to achieve this goal, we must complete all the work in the scope of planned business operations in all aspects by February 15 as well as apply

to the local government department in The Bahamas (Ministry of Works) for acceptance inspection and the permit for residential occupation (TCO).

“In other words, our work must be basically completed by February 15 instead of being able to linger on till March 27. This point must be clarified, and time and tide wait for no man.” CCA thus apparently recognised the urgency required, and that a monumental effort was needed to meet Baha Mar’s opening target - especially given the self-admitted defects in its construction work.

“Looking at the convention centre we have just handed over for completion acceptance inspection, it can be seen that our work still has quite a few shortcomings and deficiencies which refrained us from smoothly passing the acceptance inspection by the local government department,” the CCA paper admitted.

“These issues must be fully resolved before the acceptance inspection of the main building starts on February 15. At present, there is still a lot of remaining work on the main building that has not been completed. In order to make sure that the set progress goal be fulfilled within the coming 19 days, all subcontractors as well as-the general contractor’s collaborative units must carry out the following tasks to the letter.”

These included the end to “selfish departmentalism” and a focus on the greater picture. “Although it is extremely challenging to complete all of our construction tasks by February,15, we still believe that as long as everyone can put aside their own individual interests, stay united and consistent, go all out for the fight, make every possible effort, leave nothing to regret, miracle will be achieved through our hands,” the CCA document added.

PAGE 2, Wednesday, December 21, 2022 THE TRIBUNE

FELIX STUBBS

FOR

PAGE B1

‘be

world’

CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

Pirate ship needs getaway to survive

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN excursion provider yesterday said he needs a dedicated destination for his guests in order to exploit the 4.5m cruise tourists forecast to visit Nassau in 2024 or he is “done”.

Tony Knowles, chief executive of Pirate’s Revenge, operator of the pirate-themed ship, the Blackbeard’s Revenge, told

Tribune Business that securing a island-style getaway that customers can enjoy is critical to ensuring his excursion dream survives.

“I need an island to carry those people to. It’s for a treasure hunt, a Black Sail-type village and pavilion serving food and entertainment on an island along with shows, etc,” he explained. “I need that. I really, really need that. If not, I’m done. I’m screwed. I’ll have to take my pirate ship somewhere else and that’s sad.”

The Blackbeard’s Revenge set sail in September 2019 with ambitions to expand and develop its own destination off New Providence similar to Rose Island and Pearl Island. Without such a location, Mr Knowles fears the excursion provider will miss out on the post-COVID ‘revenge tourism’ that has driven the industry’s recovery.

“I was on Long Island for the for the groundbreaking of the Calypso Cove development, and someone told me that the cruise passengers are coming, but if we

are going to keep them and do a repeat we must have things for these people to do,” he said. “The reality is we really don’t. My fear is that they come and we don’t satisfy them. They leave and we don’t get them back in a generation. We have to have things for these people to do.”

Recalling pre-COVID tourism numbers, Mr Knowles said 2019 was a record year for Bahamian tourism that “maxed out” at 7.2m total visitors. “In 2022 we will be surpassing that number, and in 2023

they’re projecting in excess of 4m cruise passengers and close to 1.6m stay-overs.

In 2024, they’re expecting close to 4.5m cruise passengers (for Nassau alone),” Mr Knowles said.

“But where are these people going to go, and what are they going to do? How are we going to take care of them, and how are they going to satisfy them?

We can’t just have a cruise ship and people not wanting to come off the ship to do anything. They all can’t be going to Atlantis and the Blue Lagoon.

“We are doing a bit of business, but the cruise ships now are just sputtering. Carnival Cruise Line is bringing new business but they can’t sell it. I need that destination because there really is only Royal Caribbean and Norwegian Cruise Line and Disney that supports us like that. I restarted operations, and we have a mutiny show and we do various different tours. We’re also doing night charters, too, but it’s slow; it’s really slow. This is a killer. It’s killing me.”

‘Unenviable balancing act’ confronting The Bahamas

market assets will decrease and the cost of financing debt will also increase as investors favor safe assets such as US Treasury bonds.

“This development is particularly concerning, as reconstruction costs following any severe tropical storm will likely be funded using progressively scarce and expensive debt.

Moreover, the Bahamian government’s financing needs remain elevated, and in the medium-term external debt service will rise given already acquired commitments. Fiscal space for The Bahamas’ will continue to be constrained in the short to medium-term.”

The Davis administration, though, has repeatedly said it plans to avoid the international capital markets for its debt and deficit financing needs in the 2022-2023 fiscal year. It instead plans to rely on

domestic investors, as well as multilateral lenders such as the IDB, for its funding. And, in the meantime, the value and yields on its listed international bonds have improved markedly since August, recovering to close to face value or par while the yields have near halved/ Nevertheless, the IDB added: “The Bahamas is expected to have a robust economic recovery as tourism activity progressively returns to pre-pandemic levels. However, broad macroeconomic challenges, driven primarily by external shocks, will continue to present risks in the short to medium-term.

“The Government faces an unenviable balancing act to ensure that its pursuit of food security does not jeopardise its need for fiscal discipline. The Government’s tight fiscal space – both high debt and persistent fiscal deficits – will

constrain its policy options and thus underscore the need for targeted and consensus-driven responses to mitigate the inflationary impact, particularly for the most vulnerable.”

Noting that tourism arrivals for the 2022 halfyear were equivalent to 81 percent of numbers achieved during the same pre-COVID period of 2019, the IDB added: “For Bahamians, particularly the most vulnerable, the most pressing issue is likely the increasing cost of living, as reflected by food inflation......

“As of August 2022, headline inflation was 6.4 percent year-over-year, while food and transport prices grew by 14.3 percent and 23.8 percent, respectively, over the same period.” And the multilateral lender warned this impact was likely to be worsened by Bahamas Power & Light’s (BPL)

fuel charge hikes, which will peak at a 76 percent increased compared to September 2022 for low energy consumers next summer.

“Taken together, these increases in food, transportation and electricity prices will disproportionately impact the most vulnerable given the weight of such items in their consumption basket,” the IDB warned. Turning to the imposition of price controls on food retailers, it added that those in New Providence and Grand Bahama will see their margins capped at 25 percent and 30 percent, respectively, for dry goods and perishables.

Their Family Island counterparts are to receive an additional 5 percentage point mark-up for both categories, although the industry has not yet implemented the changes. “Perishables, as their name suggests, have a limited

shelf life and thus cannot be stored for long periods. Therefore, sold perishables also must cover the cost of unsold produce in addition to other operating costs such as refrigeration and labour,” the IDB said.

“At least 17 goods (44 percent of the 38 proposed product categories) can be categorised as perishable and, for a few items, their estimated spoilage rates are high enough that the required mark-up is approximately the same as the maximum mark-up allowed in the original proposal (25 percent).

These figures are based on US supermarket chains, which likely have more reliable cold storage supply chains, and thus may underestimate figures for their Bahamian counterparts, especially in the Family Islands. Occasional load shedding, especially during tropical storms, is an added

risk that increases spoilage rates for Bahamian grocers and supermarkets,” the IDB continued.

“Under the original proposal, when other operating costs are included, it is possible that several items may become unprofitable, especially for small and medium- enterprises operating in the Family Islands, where transportation and refrigeration costs are higher. Nevertheless, the current updated proposal makes important distinctions between perishables and dry goods, as well as between the different market dynamics that exist across the islands of The Bahamas.”

THE TRIBUNE Wednesday, December 21, 2022, PAGE 3

FROM PAGE B1 ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

IDB brands price controls ‘poorly targeted subsidy’

The IDB argued that only the 24 percent or $50 per week minimum wage increase, which is set to take effect on New Year’s Day and raise legal floor to $260, was targeted specifically at low income or vulnerable Bahamians. All other measures unveiled by the Government to combat the cost of living crisis and inflation, such as import tariff cuts and raising the VAT exemption on electricity bills from $300 to $400, benefit rich and poor alike.

“Furthermore, like price controls, the VAT exemption for electricity bills – and, even more so, the import tariff reductions and exemptions – would result in government revenues transferred to Bahamians, including those who are least affected by inflation,” the IDB said.

“Hence, except for the minimum wage, the remaining policies outlined are effectively untargeted subsidies for everyone - both the rich and the poor. That said, as a short-term temporary measure, the price controls have the advantage of not imposing any direct expenditure costs on the budget.”

Given that segments in Bahamian society who do not need such assistance also stand to benefit from the Government’s policies, the IDB suggested an alternative. “Unlike price controls, which are blunt policy tools, a more targeted response – such as a conditional or unconditional cash transfer – could build on existing programmes such as emergency food assistance that provides food stamps to qualifying families,” it argued.

“Beneficiaries of this policy would be Bahamians who earn less than a predefined income threshold – low enough to ensure that only the most vulnerable qualify, but high enough that it does not distort incentives for those earning close to the minimum wage.

“Beyond targeting food insecurity, well-designed and innovative cash transfers could have other beneficial secondary effects. For example, instead of food stamps, the Government could transfer Sand Dollars to restricted digital wallets, which would have the secondary effect of increasing the use of digital currency and fostering financial inclusion for the unbanked and underbanked.”

The IDB thus added its voice to the controversy circling the Government’s imposition of fresh pricecontrolled margins on

the food distribution and pharmaceutical industries, which it has billed as lasting for just six and three months, respectively, in a bid to ease the cost of living crisis sparked by soaring inflation. The move ran into opposition from both sectors, although the Davis administration was able to agree a compromise with the pharmacies.

The multilateral lender said there was numerous evidence, including from Jamaica and Brazil, as well as statements from the likes of the World Bank, UN Food and Agricultural Organisation and World Food Programme, which showed such conditional cash transfer initiatives “are more effective – both in cost and impact – than untargeted food and energy subsidies”.

Such programmes were first discussed, as a means of directing increased

INSURERS: DON’T SLEEP ON EU BLACKLISTING ‘BREATHING ROOM’

FROM PAGE B1

However, he added that the German legislature has yet to change another legal clause “which says come January 1, 2025, if the country is still on the blacklist then the German reinsurers can’t use expenses, which are commissions or claims, as a tax refund on their bills or returns from whatever companies.

“That means if we are still on the blacklist at the end of 2024, we’ll be subject to that law,” Mr Saunders explained. “We have until December 31, 2024, to get

off this blacklist. They [the reinsurers] will not be able to do business if they are unable to get a refund on their taxes.

“We have two years’ breathing space, 2023 and 2024, to get off this blacklist. The German reinsurers provide 30-40 percent of the market, and it will be very hard in this environment to replace them. We need to get off this blacklist as quickly as possible.

“We have two years’ breathing room from an insurance standpoint to make sure that is dealt with. If we’re still on that

NOTICE Black Birch Company Limited

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the International Business Companies Act 2000 the dissolution of Black Birch Company Limited has been completed and the company has been struck from the Register on the 4th day of November 2022.

Baird One Limited Liquidator

NOTICE

Eastern Diversified Company Limited

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the International Business Companies Act 2000 the dissolution of Eastern Diversified Company Limited has been completed and the company has been struck from the Register on the 1st day of December 2022.

Baird One Limited Liquidator

NOTICE AZALEA COMPANY LIMITED

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the International Business Companies Act 2000 the dissolution of Azalea Company Limited has been completed and the company has been struck from the Register on the 29th day of November 2022.

Baird One Limited Liquidator

blacklist, and they can’t take their credits from commissions and claims, they will not be able to do business with us.”

Patrick Ward, Bahamas First’s president and chief executive, who told Tribune Business he thought The Bahamas has only one year to escape the EU’s blacklist, believing the German law will kick-in from New Year’s Day 2024, warned that the loss of such reinsurance capacity threatened the “viability” of local underwriters’ business models as well as their capacity to insure risk in an

era of more powerful and frequent storms.

Confirming that the German withholding tax threat has been eliminated, he said: “With the passage of that we believe the issue around the possibility of a withholding tax on claims payments and a few other issues have been resolved. But if The Bahamas remains on the blacklist in 2024, there are some other provisions that will kick-in that are onerous and will make it virtually untenable for German reinsurers to do business with Bahamian companies.”

NOTICE SAPROPIN LTD.

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the International Business Companies Act 2000 the dissolution of SAPROPIN LTD. has been completed and the company has been struck from the Register on the 1st day of December 2022.

DELCO INVESTMENTS LIMITED Liquidator

NOTICE Best Way Company Limited

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the International Business Companies Act 2000 the dissolution of Best Way Company Limited has been completed and the company has been struck from the Register on the 13th day of October 2022.

Baird One Limited Liquidator

Legal Notice NOTICE

NOVA BAY COMPANY LIMITED

NOTICE IS HEREBY GIVEN as follows:

(a) Nova Bay Company Limited is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 20th day of December 2022.

(c) The Liquidator of the said Company is Baird One Limited of Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas.

Dated this 21st day of December A.D. 2022

Baird One Limited Liquidator

financial and social services

assistance, to low income Bahamians when VAT was first introduced in 2015.

Obie Wilchcombe, minister of social services and urban development, has repeatedly said the RISE conditional cash transfer initiative is just months away from relaunch only for such deadlines to be missed.

The IDB yesterday pegged annual food price inflation in The Bahamas at 16.1 percent, the second highest in a five-strong Caribbean sample that also included Jamaica, Barbados and Trinidad & Tobago.

Only Suriname had a higher rate of food price rises, with The Bahamas’ food inflation outpacing the country’s overall annual inflation rate of 6.5 percent.

The Bahamas’ trade deficit in agriculture and energy products was also shown to have risen year-over-year,

Pointing out that this would impact all Bahamian industries and companies that do business with German firms, not just insurers, Mr Ward added: “The key now is to get off the EU blacklist. It’s very important otherwise 2024 could be a very daunting year.... That’s the potential unless there are some mitigating factors, but at this point that doesn’t appear to be the case.

“The important thing is to get off this blacklist otherwise it could be a real problem. We’re operating in an environment where reinsurance capacity is extremely tight, so there will not be a lot of options for replacing them. We could lose the ability to write a substantial amount of business that we currently write in terms of having it supported by reinsurance.

“That could mean there are other decisions that are going to hinge on that. Do you have a viable business model in the absence of that kind of capacity or support?” Property insurance, including catastrophe protection against storms, and motor coverage would be among the main business lines impacted from a loss of German reinsurance.

Mr Ward said three German reinsurersMunich Re, Hanover Re and R & V Re - account for around 30 percent of the Bahamian reinsurance market. The loss of such partners would leave a huge void for local underwriters to fill, and likely mean they cannot take on as much

expanding from 8.5 percent in 2021 to 9 percent of gross domestic product (GDP) this year. “It is important to note that food prices have been rising faster than overall inflation,” the IDB added. “This is to be expected, given the rise in international prices of food as a driving force for overall inflation.

“However, the increase is important from a social perspective. The overall price index is based on a typical consumption basket for consumers, but the consumption basket of lower-income families is often more heavily weighted towards food. If food inflation is higher than overall inflation, then these lower-income households will suffer a larger cost of living effect than the average household.”

risk - and cover as many property and vehicle assets - at a time when Hurricane Dorian inflicted $3.4bn in loss and damages in September 2019.

Already-expensive insurance coverage, especially that which protects against hurricanes, would only increase further due to the cutback in reinsurance supply. In turn, this would push premium prices beyond the reach of more Bahamian businesses and households, making insurance increasingly unaffordable in a climate where the threat posed by Dorianstyle storms is growing.

Bahamian property and casualty underwriters must acquire huge amounts of reinsurance annually because their relatively thin capital bases mean they cannot cover the multi-billion dollar assets at risk in this nation. And global reinsurance market has already been recently been pulling back from the Caribbean due to hurricane-related losses.

With all this in play, Mr Ward said the Government needed to fulfill its pledge to enact the necessary reforms that will ensure The Bahamas exits the EU blacklist as rapidly as possible. Turning to the new year, he added: “Unfortunately we’re not going to be starting out from an optimum position, but at least we’ve done away with the imminent threat for 2023. We need to focus on doing as much as we can in the early part of the year” to address the blacklisting.

NOTICE Top Service Company Limited

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the InternationalBusiness Companies Act 2000 the dissolution of Top Service Company Limited has been completed and the company has been struck from the Register on the 4th day of November 2022.

Baird One Limited Liquidator

NOTICE

Aurora Blue Investment Limited

NOTICE IS HEREBY GIVEN that pursuant to section 138 (8) of the International Business Companies Act 2000 the dissolution of Aurora Blue Investment Limited has been completed and the company has been struck from the Register on the13th day of October 2022.

Baird One Limited Liquidator

PAGE 4, Wednesday, December 21, 2022 THE TRIBUNE

PAGE B1

FROM

RULE DELAY MAKES BIG EV TAX CREDIT POSSIBLE EARLY NEXT YEAR

By HOPE YEN AND TOM KRISHER Associated Press

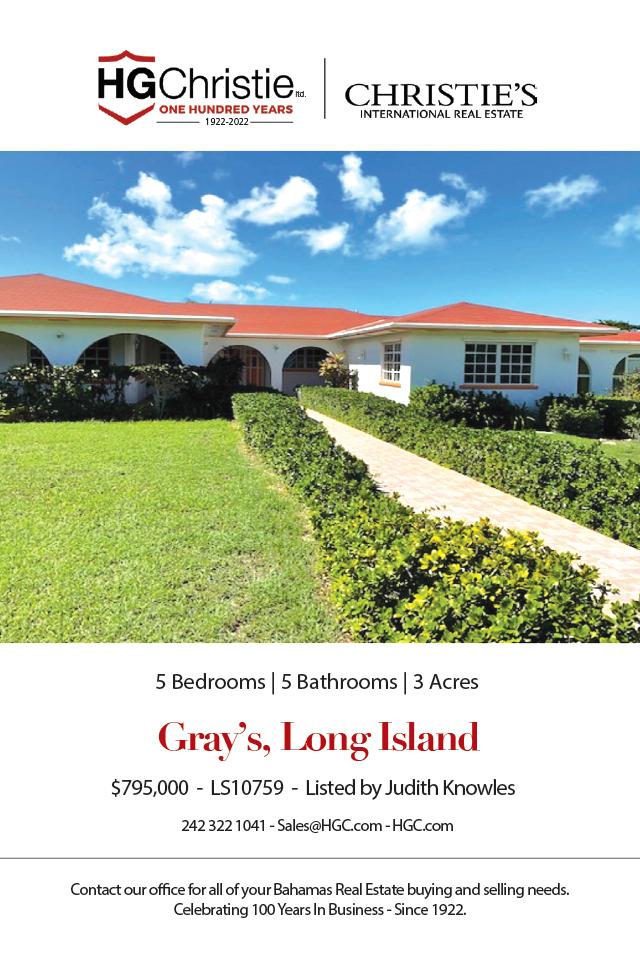

PEOPLE who want to buy an electric vehicle could get a bigger-than-expected tax credit come Jan. 1 because of a delay by the Treasury Department in drawing up rules for the tax breaks.

The department said late Monday it won’t finish the rules that govern where battery minerals and parts have to be sourced until sometime in March.

As a result, it appears that buyers of EVs assembled in North America with batteries made in the U.S., Canada or Mexico will be eligible for a full $7,500 tax credit under the Inflation Reduction Act. The act calls for the batteries’ minerals and parts to also come from North America in order to get the full tax

break, but that provision has been temporarily put on hold.

The auto industry is watching the situation closely, but it could cause a rush to dealers because most, if not all EVs aren’t expected to qualify for the full credit when the rules are all in place.

Experts say most automakers won’t be able to comply with requirements that the battery components come from North America. For instance, General Motors already has said that it expects its EVs to get only half the tax credit, or $3,750, until at least 2025.

So people who buy early next year before the rules are announced could pocket an extra $3,750.

“I imagine there will be a rush,” on EV dealers to get the extra savings, said Sam Abuelsamid, principal

e-mobility analyst with Guidehouse Research.

In the meantime, Treasury said it will release information by year’s end on the “anticipated direction” of the rules to help automakers identify eligible EVs, the department said in a statement. But the rules won’t be effective until March.

Other requirements, like new caps on a buyer’s income and price of the EV, will still take effect Jan. 1.

“It should allow some consumers to get an EV a little bit cheaper than they might have otherwise,” said Chris Harto, a senior policy analyst on transportation and energy for Consumer Reports magazine.

With a base price of $26,595 including shipping, General Motors’ Chevrolet Bolt hatchback is among the lowest-cost EVs on sale in the U.S. today. A $7,500

tax credit would knock the price down to just over $19,000 — less than the average price of a used vehicle in the U.S. That could bring buyers off the sidelines.

GM says it’s watching developments with the tax credit rules. “We feel well-positioned, but we’re still waiting on guidance for vehicle eligibility,”

AMAZON TO MAKE BIG BUSINESS CHANGES IN EU SETTLEMENT

By KELVIN CHAN AND HALELUYA HADERO AP Business Writers

AMAZON will make major changes to its business practices to end competition probes in Europe by giving customers more visible choices when buying products and, for Prime members, more delivery options, European Union regulators said Tuesday.

The EU's executive Commission accepted the legally binding commitments from Amazon to resolve two antitrust investigations, allowing the company to avoid a legal battle with the E.U.'s top antitrust watchdog that could potentially have ended with fines worth up to 10% of annual worldwide revenue.

The agreement marks another advance by EU authorities as they clamp down on the power of Big Tech companies, and comes just a day after the Commission accused Facebook parent Meta of distorting competition in the classified ads business. The 27-member bloc has

hit Google with billions in fines, opened investigations into Apple and is set to enact sweeping regulations by 2024 aimed at preventing so-called digital gatekeepers from dominating online markets.

"Today's decision sets the rules that Amazon will need to play by in the future instead of Amazon determining these rules for all players on its platform," the EU's competition commissioner Margrethe Vestager said at a news briefing in Brussels. "With these new rules, competing independent retailers, carriers and European customers, well, they will have more opportunities and more choice."

The agreement only applies to Amazon's business practices in Europe and will last for seven years, though some portions of the deal will end in five years. Amazon will have to make the changes by June.

"We are pleased that we have addressed the European Commission's concerns and resolved these matters," Amazon said in a prepared

NOTICE

ROSEBUD ADVISORY LTD. In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, ROSEBUD ADVISORY LTD. is in dissolution as of December 19.2022

Lighthouse Corporate Services Ltd., office situated at Old Fort, Building 2, Suite A, Lyford Cay, Nassau, Bahamas is the Liquidator. L I Q U I D A T

O R

statement, adding that it still disagrees with some of the Commission's preliminary conclusions.

Amazon had offered concessions in July to resolve the two investigations. It improved those initial proposals after the

commission tested them out and received feedback from consumer groups, delivery companies, book publishers and academics.

The Seattle-based company promised to give products from rival sellers equal visibility in the "buy

LEGAL NOTICE

YUMA INVESTMENT HOLDINGS LTD. (In Voluntary Liquidation)

Notice is hereby given in pursuance of Section 138 of The International Business Companies Act, 2000 (as amended) that the Directors of the above-named company by Resolution passed on the 1st day of December 2022 resolved that the company be wound up voluntarily forthwith and that the Liquidator is Mr. Bennet R. Atkinson of Ronald Atkinson & Co., Chartered Accountants, Marron House, Virginia and Augusta Streets, P.O. Box N-8326, Nassau, Bahamas.

All persons having claims against the above-named company are requested to submit particulars of such claims and proofs thereof in writing to the Liquidator, Mr. Bennet R. Atkinson, Marron House, Virginia and Augusta Streets, P.O. Box N-8326, Nassau, Bahamas, not later than the 23rd day of January 2023, after which date the books will be closed and the assets of the company distributed.

Dated the 21st day of December 2022.

Bennet R. Atkinson Liquidator

NOTICE

PALMADEL ADVISORY LTD. In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, PALMADEL ADVISORY LTD. is in dissolution as of December 19.2022

Lighthouse Corporate Services Ltd., office situated at Old Fort, Building 2, Suite A, Lyford Cay, Nassau, Bahamas is the Liquidator. L I Q U I D

A T O R

spokeswoman Jeannine Ginivan said Tuesday.

Automakers have criticized the battery sourcing and assembly requirements as complex, hard to trace and unrealistic in the short term, with no EV model sold in the U.S. likely able to qualify right away for the full $7,500 tax credit. Beginning next year, the new law requires batteries to be made in the U.S., Canada

box," a premium piece of website real estate that leads to higher sales.

European customers will get a second buy box underneath the first one for the same product, but with a different price or delivery offer.

"As Amazon cannot populate both Buy Boxes with its own retail offers, this will give more visibility

or Mexico, with 40% of battery minerals coming from North America.

It’s part of a U.S. effort to reduce reliance on batteries now predominantly made in China and move supply chains to the U.S. Fifty percent of the battery parts have to come from the U.S. or a country with which it has a free trade agreement. Those percentages rise annually.

to independent sellers," Vestager said. Regulators will monitor how the second box performs.

John E. Lopatka, an antitrust scholar and law professor at Penn State University, said the terms of the deal represent a significant change for Amazon's business and could become a precedent for U.S. antitrust regulators.

N O T I C E

Pursuant to the provisions of Section 138 (4) of the International Business Companies Act, 2000, (AsAmended) NOTICE is hereby given that, AZIMUT HOLDINGS LIMITED. is in dissolution and that the date of commencement of the dissolution is the 08th day of December A. D. 2022.

CROWE BAHAMAS LIQUIDATOR

Harbour Bay Plaza, Shirley Street, Suite 587 P.O. Box AP-59223 Nassau, The Bahamas

NOTICE is hereby given pursuant to Section 204 (1)(b) of the BVI Business Companies Act, 2004 that Queensgarden Investments Ltd. is in voluntary liquidation. The voluntary liquidation commenced on 15th December 2022 and Jacqueline Elsener of c/o HBM Kerdos AG, Jenatschstrasse 1, 8001 Zurich, Switzerland been appointed as the Sole Liquidator.

Dated this 16th day of December 2022 Sgd. Jacqueline Elsener

Voluntary Liquidator

SCHEYVILLE

REAL ESTATE INC.

Company No. 606455

(In Voluntary Liquidation)

NOTICE is hereby given pursuant to Section 204 (1)(b) of the BVI Business Companies Act, 2004 that SCHEYVILLE REAL ESTATE INC. is in voluntary liquidation. The voluntary liquidation commenced on 16th December 2022 and Robert G. Rohner of Bahnhofstrasse 17, 7323 Wangs, Switzerland been appointed as the Sole Liquidator.

Dated this 20th day of December 2022 Sgd. Robert G. Rohner Voluntary Liquidator

N

(a) JIREH HOLDING LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 20th December, 2022 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas

Dated this 21st day of December, 2022

Bukit Merah Limited Liquidator

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, OLEANDER Advisory Ltd. is in dissolution as of December 19.2022

Lighthouse Corporate Services Ltd., office situated at Old Fort, Building 2, Suite A, Lyford Cay, Nassau, Bahamas is the Liquidator.

THE TRIBUNE Wednesday, December 21, 2022, PAGE 5

AN ELECTRIC vehicle is plugged into a charger in Los Angeles, on Aug. 25, 2022. People who want to buy an electric vehicle could get a bigger-than-expected tax credit come Jan. 1, 2023, because of a delay by the Treasury Department in drawing up rules for the tax breaks. Photo:Jae C. Hong/AP

Queensgarden Investments Ltd. Company No. 1854421 (In Voluntary Liquidation)

O T I C E IS HEREBY GIVEN as follows:

N O T I C E

HOLDING LIMITED

JIREH

L I Q U I D A T O R

Advisory Ltd. In Voluntary Liquidation NOTICE

OLEANDER

RULE DELAY MAKES BIG EV TAX CREDIT POSSIBLE EARLY NEXT YEAR

By HOPE YEN AND TOM KRISHER Associated Press

PEOPLE who want to buy an electric vehicle could get a bigger-than-expected tax credit come Jan. 1 because of a delay by the Treasury Department in drawing up rules for the tax breaks.

The department said late Monday it won’t finish the rules that govern where battery minerals and parts have to be sourced until sometime in March.

As a result, it appears that buyers of EVs assembled in North America with batteries made in the U.S., Canada or Mexico will be eligible for a full $7,500 tax credit under the Inflation

Reduction Act. The act calls for the batteries’ minerals and parts to also come from North America in order to get the full tax break, but that provision has been temporarily put on hold.

The auto industry is watching the situation closely, but it could cause a rush to dealers because most, if not all EVs aren’t

expected to qualify for the full credit when the rules are all in place.

Experts say most automakers won’t be able to comply with requirements that the battery components come from North America. For instance, General Motors already has said that it expects its EVs to get only half the tax

credit, or $3,750, until at least 2025.

So people who buy early next year before the rules are announced could pocket an extra $3,750.

“I imagine there will be a rush,” on EV dealers to get the extra savings, said Sam Abuelsamid, principal e-mobility analyst with Guidehouse Research.

In the meantime, Treasury said it will release information by year’s end on the “anticipated direction” of the rules to help automakers identify eligible EVs, the department said in a statement. But the rules won’t be effective until March.

Other requirements, like new caps on a buyer’s income and price of the EV, will still take effect Jan. 1.

“It should allow some consumers to get an EV a little bit cheaper than they might have otherwise,” said Chris Harto, a senior policy analyst on transportation and energy for Consumer Reports magazine.

With a base price of $26,595 including shipping, General Motors’ Chevrolet Bolt hatchback is among the lowest-cost EVs on sale in the U.S. today. A $7,500 tax credit would knock the price down to just over $19,000 — less than the average price of a used vehicle in the U.S. That could bring buyers off the sidelines.

GM says it’s watching developments with the tax credit rules. “We feel wellpositioned, but we’re still waiting on guidance for vehicle eligibility,” spokeswoman Jeannine Ginivan said Tuesday.

Automakers have criticized the battery sourcing and assembly requirements as complex, hard to trace and unrealistic in the short term, with no EV model sold in the U.S. likely able to qualify right away for the full $7,500 tax credit. Beginning next year, the new law requires batteries to be made in the U.S., Canada or Mexico, with 40% of battery minerals coming from North America.

It’s part of a U.S. effort to reduce reliance on batteries now predominantly made in China and move supply chains to the U.S. Fifty percent of the battery parts have to come from the U.S. or a country with which it has a free trade agreement. Those percentages rise annually.

More broadly, U.S. allies including South Korea, the European Union and other countries are also upset that the new law will disqualify their foreign-made EVs unless or until they can open new U.S. plants, which could take several years.

The new law continues to require that EVs be assembled in North America, which took effect when President Joe Biden signed the measure in August. Still taking effect on Jan. 1 are new caps that EV sedans must cost $55,000 or less, or under $80,000 for pickup trucks, SUVs and vans. A car buyer must have income of $150,000 or less if single, or $300,000 if filing jointly.

Abuelsamid said it’s not clear whether someone could order an EV before the rules take effect and still get the full credit.

NOTICE

9.310.05 0.6460.32814.43.52%

11.220.00 0.7280.24015.42.14%

NOTICE

PAGE 6, Wednesday, December 21, 2022 THE TRIBUNE

NOTICENOTICE is hereby given that WILLIAM KAJOKAYA of P.O Box SP 60178 High Vista, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

is hereby given that ELVIS CHARLES of Pinedale, Eight Mile Rock, Freeport, Grand Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE TUESDAY, 20 DECEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2644.180.080.00415.9418.67 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00

53.0040.03 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL 2.76

2.462.31Bahamas First Holdings Limited BFH 2.46

2.852.25Bank of Bahamas BOB 2.61

6.306.00Bahamas Property Fund BPF 6.30

Waste BWL

Bahamas CAB

Brewery CBB

Bank CBL

Holdings CHL

FirstCaribbean Bank CIB

Water BDRs CWCB

Hospital DHS

11.679.16Emera Incorporated EMAB 9.26

11.5010.06Famguard FAM 11.22

18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.10

4.003.50Focol FCL

11.509.85Finco FIN 11.38

16.2515.50J. S. Johnson JSJ 15.75

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP

1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00

1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00

1.001.00Colina Holdings Class A CHLA 1.00 1.000.00

10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00 1.000.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 97.5197.51BGRS FX BGR106036 BSBGR1060361 97.4997.490.00 97.5097.50BGRS FX BGR107036 BSBGR1070360 96.6996.690.00 94.9994.99BGRS FX BGR120037 BSBGR1200371 94.9994.990.00 91.9891.98BGRS FX BGR125238 BSBGR1252380 100.00100.000.00 91.9191.91BGRS FX BGR127139 BSBGR1271398 100.00100.000.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.582.11 2.583.48%3.87% 4.883.30 4.884.49%5.32% 2.261.68 2.262.74%3.02% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81%

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.22% 5.14% 5.60% 26-Aug-2036 15-Dec-2037 15-Jul-2039 15-Jun-2040 5.00% 5.00% 15-Oct-2038 15-Jan-2039 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% 5.40% 6.25% 30-Sep-2025 30-Sep-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 5.40% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 25-Nov-2022 22-Sep-2033 4-Aug-2036 26-Jul-2037 31-Mar-2021 30-Nov-2022 30-Nov-2022 31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 31-Oct-2022 31-Oct-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 30-Nov-2022 30-Nov-2022 6.95% 4.50% 30-Sep-2022 31-Oct-2022 4.50% 6.25% 4.81% 26-Jul-2035 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com NOTICE is hereby given that JEANCILIA PIERRE of P.O Box Kennedy Subdivision Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas. NOTICE

is hereby given that STEVE HESRON GLASGOW of P.O Box N4505 Commonwealth Drive, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

0.2390.17029.12.45%

0.9321.26042.93.15%

2.760.00 0.0000.020N/M0.72%

2.460.00 0.1400.08017.63.25%

2.610.00 0.0700.000N/M0.00%

6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas

9.75 9.750.00 0.3690.26026.42.67% 4.452.82Cable

4.20 4.450.25 5,000-0.4380.000-10.2 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth

3.58 3.580.0035,0000.1840.12019.53.35% 8.547.00Colina

8.53 8.530.00 0.4490.22019.02.58% 17.5012.00CIBC

15.99 15.990.00 0.7220.72022.14.50% 3.251.99Consolidated

3.05 3.070.02 0.1020.43430.114.14% 11.2810.05Doctor's

10.50 10.500.00 0.4670.06022.50.57%

18.100.00 0.8160.54022.22.98%

3.98 3.980.00 0.2030.12019.63.02%

11.00 (0.38) 6,5000.9390.20011.71.82%

15.750.00 0.6310.61025.03.87%

1.00 1.000.00 0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0006.25%

0.0000.0000.0007.00%

0.0000.0000.0006.50%

7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

By STAN CHOE, DAMIAN J. TROISE AND ALEX VEIGA AP Business Writers

STOCKS closed modestly higher on Wall Street, while bond markets around the world felt pain Tuesday after a surprise move from Japan’s central bank cranked up the pressure on an already slowing global economy.

The S&P 500 rose 0.1% after flipping between small losses and gains in the early going. The Dow Jones Industrial Average rose 0.3% and the Nasdaq composite barely budged after closing less than 0.1% higher. Small company stocks outdid the broader market, lifting the Russell 2000 index 0.5% higher.

The muted gains were enough to end a four-day losing streak for the major indexes.

The biggest action was in the bond market, where yields pushed higher after Japan, one of the world’s last bastions of super-low and economy-aiding interest rates, made moves that

could allow rates to climb more than otherwise.

The Bank of Japan said Tuesday it still wants the yield on 10-year Japanese government bonds to remain at roughly zero, but it also said it would allow the yield to move up to 0.50% instead of the 0.25% cap it had held previously. What made Tokyo’s unexpected move a particular jolt was how much resistance it’s shown so far in joining the global campaign to hike rates in order to undercut high inflation.

“BoJ’s surprise move allowed it to take a small step away from the extreme dovish side of the monetary policy spectrum, where it had stood alone all year among major central banks,” wrote Jennifer Lee of BMO Economics in a note to clients. “It is not joining the rate-hikers out there, but it is now a tad closer.”

Higher yields make borrowing more expensive, which slows the economy while also pushing down on prices for stocks and other investments. Other central banks around the world,

particularly in the United States and Europe, have been raising rates at such an explosive clip that a growing number of economists and investors see a recession hitting in 2023. Both the Federal Reserve and European Central Bank have pledged to keep raising rates into next year to be sure the job is done on getting inflation under control.

Aftershocks from the Bank of Japan’s move on Tuesday rippled through bond and currency markets around the world.

In the U.S., the yield on the 10-year Treasury rose to 3.68% from 3.59% late Monday. That yield helps set rates for mortgages and other economy-setting loans, which has already meant particular pain for the U.S. housing market.

A report on Tuesday showed U.S. homebuilders broke ground on fewer homes for a third straight month in November. The number of building permits, meanwhile, fell to its lowest level since June 2020 when the pandemic froze the economy.

The two-year U.S. Treasury yield, which tends to more closely track expectations for action from the Federal Reserve, was more reserved. It held steady at 4.26%.

In the foreign exchange market, Tokyo’s surprise move sent the value of the Japanese yen climbing against the U.S. dollar, which gave back some of its huge gains over the past year. The dollar fell to 131.50 Japanese yen, down 4% from a day earlier.

The Nikkei 225 index of Japanese stocks also fell 2.5%.

Stocks worldwide have been under pressure the entire year on worries about high inflation, higher interest rates and a weakening economy.

“Markets continue to play the back-and-forth between inflation and concerns about Fed policy and growth,” said Zachary Hill, head of portfolio management at Horizon Investments. Investors have been trying to push markets higher every time it seems that inflation is easing and

every time they “run into the simple fact that the Fed needs to tighten financial conditions to slow down the economy,” Hill said.

In Shanghai, stocks lost 1.1% after the World Bank cut its forecast for China’s economic growth this year to 2.7% from its June outlook of 4.3%. The bank cited repeated shutdowns of major cities to fight COVID-19 outbreaks. China now is relaxing some of its anti-COVID restrictions, but worries are rising that resulting breakouts of the virus could mean their own hits to the world’s second-largest economy.

European markets ended mixed.

On Wall Street, the Bank of Japan’s move had less of an impact on stocks.

“It was a surprise, a very unexpected move, but on its own it’s probably not enough to really be a riskoff event for markets,” said Ross Mayfield, investment strategist at Baird.

The S&P 500 rose 3.96 points to 3,821.62. The Dow added 92.20 points to 32,849.74. The Nasdaq rose 1.08 points to 10,547.11. The Russell 2000 picked up 9.44 points to 1,748.02.

Energy sector stocks led the S&P 500’s gains as the price of U.S. oil settled 1.2% higher. Halliburton climbed 3.8%, and Schlumberger rose 3.9%.

Communications, technology and banks also rose.

5:34 a.m. 3.2 12:03 p.m. ‑0.2 5:48 p.m. 2.4 11:55 p.m. ‑0.7 6:25 a.m. 3.3 12:56 p.m. 0.4 6:41 p.m. 2.4

7:16 a.m. 3.5 12:47 a.m. ‑0.8

7:34 p.m. 2.5 1:48 p.m. ‑0.5 8:08 a.m. 3.5 1:40 a.m. ‑0.9 8:28 p.m. 2.5 2:40 p.m. ‑0.6

9:01 a.m. 3.5 2:34 a.m. ‑0.8

Sunday Monday Tuesday

9:24 p.m. 2.6 3:33 p.m. ‑0.6

9:54 a.m. 3.4 3:30 a.m. ‑0.7 10:22 p.m. 2.6 4:26 p.m. ‑0.5 10:49 a.m. 3.2 4:28 a.m. ‑0.5 11:22 p.m. 2.6 5:20 p.m. ‑0.4

PAGE 8, Wednesday, December 21, 2022 THE TRIBUNE

STOCKS RISE, BOND YIELDS JUMP AFTER JAPAN SURPRISES MARKETS

A TRADER stands outside the New York Stock Exchange, Friday, Sept. 23, 2022, in New York.

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 61° F/16° C High: 73° F/23° C TAMPA Low: 64° F/18° C High: 72° F/22° C WEST PALM BEACH Low: 69° F/21° C High: 79° F/26° C FT. LAUDERDALE Low: 70° F/21° C High: 80° F/27° C KEY WEST Low: 71° F/22° C High: 79° F/26° C Low: 70° F/21° C High: 83° F/28° C ABACO Low: 67° F/19° C High: 78° F/26° C ELEUTHERA Low: 70° F/21° C High: 81° F/27° C RAGGED ISLAND Low: 73° F/23° C High: 82° F/28° C GREAT EXUMA Low: 73° F/23° C High: 82° F/28° C CAT ISLAND Low: 71° F/22° C High: 83° F/28° C SAN SALVADOR Low: 72° F/22° C High: 83° F/28° C CROOKED ISLAND / ACKLINS Low: 72° F/22° C High: 82° F/28° C LONG ISLAND Low: 72° F/22° C High: 83° F/28° C MAYAGUANA Low: 72° F/22° C High: 83° F/28° C GREAT INAGUA Low: 72° F/22° C High: 83° F/28° C ANDROS Low: 70° F/21° C High: 81° F/27° C Low: 67° F/19° C High: 78° F/26° C FREEPORT NASSAU Low: 71° F/22° C High: 81° F/27° C MIAMI THE WEATHER REPORT 5-Day Forecast A couple of morning showers High: 83° AccuWeather RealFeel 89° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Partly cloudy Low: 70° AccuWeather RealFeel 71° F Partly sunny and pleasant High: 84° AccuWeather RealFeel Low: 70° 89°-71° F Partly sunny; t‑storms at night High: 81° AccuWeather RealFeel Low: 70° 86°-67° F Cloudy, breezy and not as warm High: 74° AccuWeather RealFeel Low: 64° 71°-62° F Breezy with a thick cloud cover High: 70° AccuWeather RealFeel 66°-59° F Low: 62° TODAY TONIGHT THURSDAY FRIDAY SATURDAY SUNDAY almanac High 79° F/26° C Low 73° F/23° C Normal high 79° F/26° C Normal low 67° F/19° C Last year’s high 84° F/29° C Last year’s low 68° F/20° C As of 1 p.m. yesterday 0.01” Year to date 56.11” Normal year to date 39.20” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau New Dec. 23 First Dec. 29 Full Jan. 6 Last Jan. 14 Sunrise 6:50 a.m. Sunset 5:25 p.m. Moonrise 4:51 a.m. Moonset 3:44 p.m. Today Thursday Friday Saturday High Ht.(ft.) Low Ht.(ft.)

Photo:Mary Altaffer/AP

marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 12 25 Knots 6 10 Feet 5 Miles 77° F Thursday: SSE at 10 20 Knots 4 8 Feet 10 Miles 77° F ANDROS Today: NW at 7 14 Knots 1 2 Feet 7 Miles 76° F Thursday: S at 4 8 Knots 0 1 Feet 10 Miles 77° F CAT ISLAND Today: SW at 8 16 Knots 4 7 Feet 7 Miles 80° F Thursday: SE at 7 14 Knots 4 7 Feet 8 Miles 80° F CROOKED ISLAND Today: SSE at 7 14 Knots 3 5 Feet 10 Miles 80° F Thursday: ESE at 6 12 Knots 3 5 Feet 10 Miles 81° F ELEUTHERA Today: SW at 8 16 Knots 4 7 Feet 7 Miles 79° F Thursday: SSE at 8 16 Knots 4 7 Feet 7 Miles 79° F FREEPORT Today: NE at 8 16 Knots 2 4 Feet 10 Miles 76° F Thursday: SSE at 4 8 Knots 1 3 Feet 10 Miles 76° F GREAT EXUMA Today: SW at 7 14 Knots 1 2 Feet 8 Miles 80° F Thursday: SSE at 6 12 Knots 0 1 Feet 10 Miles 79° F GREAT INAGUA Today: SE at 6 12 Knots 2 4 Feet 10 Miles 81° F Thursday: E at 6 12 Knots 1 3 Feet 10 Miles 81° F LONG ISLAND Today: S at 6 12 Knots 2 4 Feet 10 Miles 82° F Thursday: SE at 6 12 Knots 1 3 Feet 10 Miles 82° F MAYAGUANA Today: SSE at 8 16 Knots 4 8 Feet 9 Miles 80° F Thursday: ESE at 6 12 Knots 4 8 Feet 10 Miles 80° F NASSAU Today: WSW at 8 16 Knots 1 2 Feet 7 Miles 79° F Thursday: SSE at 8 16 Knots 1 2 Feet 10 Miles 79° F RAGGED ISLAND Today: SE at 4 8 Knots 1 3 Feet 10 Miles 81° F Thursday: ESE at 7 14 Knots 1 2 Feet 10 Miles 81° F SAN SALVADOR Today: SW at 8 16 Knots 1 3 Feet 7 Miles 80° F Thursday: SSE at 7 14 Knots 1 3 Feet 10 Miles 80° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 L tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 8 16 knots N S W E 12 25 knots N S W E 10 20 knots N S E W 8 16 knots N S E W 7 14 knots N S E W 6 12 knots N S E W 4 8 knots N S E W 7 14 knots | Go to AccuWeather.com