Realtor has ‘never seen such high rental rates’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas yesterday shrugged off FTX’s implosion through what the attorney general hailed as the “enormous accomplishment” of a perfect score in the fight against financial crime.

Ryan Pinder KC told Tribune Business this nation had achieved a “rare” feat by becoming only the sixth nation ever to achieve full compliance with the Financial Action Task Force’s (FATF) 40 recommendations for combating money laundering and terrorism financing.

The Bahamas’ upgrading to “compliant” on the final two outstanding recommendations, which was confirmed yesterday by the FATF’s Caribbean affiliate, is especially timely given the negative publicity surrounding FTX’s collapse as one of the areas

re-rated involves the regulation of digital assets.

Mr Pinder said the Caribbean Financial Action Task Force’s (CFATF) assessment had vindicated the strength of The Bahamas’ financial services regulatory regime, particularly when it came to digital assets and crypto currency, as well as backing the country’s repeated assertions that supervisory failings did not play a role in FTX’s collapse.

“This is an enormous accomplishment for the

country,” the attorney general said, having targeted a perfect ‘40 out of 40’ compliance with the FATF’s standards earlier this year. To get there, Mr Pinder acknowledged that the effort had spanned several administrations, with the most recent push stemming from the findings presented five years ago in the CFATF’s last “mutual evaluation” of The Bahamas.

Those findings, based on an assessment that was carried out two years prior to that in 2015, identified

multiple deficiencies and weaknesses in the country’s anti-financial crime regime. The results were severe enough to land The Bahamas on the “enhanced monitoring programme” of the parent FATF, but reforms enacted by the Minnis administration ultimately secured the country’s escape.

Mr Pinder and the Davis administration, picking up

‘Unprecedented’: Hotel staff enjoyed slow season boost

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

MANY hotel staff worked “unprecedented” fiveday weeks during the tourism season’s slowest months, a union leader revealed yesterday, as he bids to complete multiple new industrial agreements in early 2023.

Darrin Woods, the Bahamas Hotel, Catering and Allied

Workers Union’s (BHCAWU) president, told Tribune Business that the post-COVID tourism recovery’s momentum meant many employees worked double the two-three day weeks typically endured during September and October to meet the demand.

Forecasting that they will be working up to six-day weeks during the Christmas and New Year period, as occupancies and visitor numbers peak, he

voiced optimism that staff will be able to join their employers in “riding the proverbial wave all the way to Easter” 2023.

At the same time, Mr Woods disclosed to this newspaper that the union hopes to close negotiations on a new industrial agreement with the Bahamas Hotel and Restaurant Employers Association some time in the first four

Ex-AG: Don’t let ‘proper’ FTX collapse probe slide

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A FORMER attorney general yesterday warned The Bahamas against letting a “proper probe” into FTX’s implosion slide because of its perfect score in the financial crime fight and Sam Bankman-Fried’s departure.

John Delaney, now principal at the Delaney Partners law firm, told Tribune Business that simply moving on and treating the crypto currency exchange’s collapse as if it never happened would be “the wrong thing” for the jurisdiction to do as there were likely lessons that have to be learned.

And, while yesterday’s confirmation that The Bahamas is now fully compliant with the 40 global anti-financial crime standards (see other article on Page 1B) may show “there’s no systemic weaknesses in

Investor seeking $2.7bn in South Ocean dispute

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A CONTROVERSIAL

Austrian investor is pledging to seek an extraordinary $2.7bn in damages if his attempted acquisition of New Providence’s 384-acre South Ocean resort is ultimately thwarted.

The claim is the latest astonishing demand by Dr Mirko Kovats, a Lyford Cay homeowner who has permanent resident status in The Bahamas, in his battles to acquire separate Bahamian resort properties. He has already launched Judicial Review litigation against the Government

after it blocked his efforts to acquire Abaco’s Treasure Cay property, claiming a total $3.127bn in damages there.

His South Ocean move, if pursued, would take the combined damages sought by Dr Kovats to some $5.8bn. There is no suggestion he would be awarded anything remotely close to these sums should he prevail in his legal battles, but the latest development provides further evidence of the Austrian investor’s hard-nosed approach to business and litigation.

Dr Kovats’ position was revealed in December 21,

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN realtor says he has “never seen such high rental rates” as now exist in some of western New Providence’s most upscale communities with demand in this segment now suppressing available-for-sale inventory.

John Christie, HG Christie’s president and managing broker, told Tribune Business that high net worth individuals were paying between $10,000-$14,000 per month to rent homes in areas such as Sandyport, while the rates in communities such as Lyford Cay and Old Fort Bay were reaching to $20,000-$30,000 per month.

Given such returns, he explained that residential property owners were increasingly electing to seek tenants rather than buyers for their real estate. The surging rental market is thus keeping the volume of properties for sale relatively low, especially after much available inventory was acquired in the post-COVID boom, with the result that prices are driven higher as buyer demand outstrips supply.

“Inventory is pretty low in places like Lyford Cay and Old Fort Bay,” Mr Christie told this newspaper. “There’s still an inventory in Ocean Club Estates and Albany. Albany still has some inventory in their condos, but it’s still pretty tight. There’s still demand outstripping supply right now. Who knows what

business@tribunemedia.net FRIDAY, DECEMBER 23, 2022

SEE PAGE B7

SEE

SEE PAGE B4

PAGE B5

shrugs off FTX for perfect ‘40 out of 40’

Bahamas

SEE PAGE B5 SEE PAGE B4

DARRIN WOODS

RYAN PINDER KC

JOHN DELANEY

• AG hails ‘enormous accomplishment’ in financial crime fight • Bahamas just sixth nation compliant on all FATF standards • Upgraded on digital assets despite crypto exchange failure • High-end tenants paying up to $30k per month • Further reducing upscale ‘for sale’ properties • Inventory estimated down 30% on ‘normal’

$5.85 $5.86 $5.86 $5.21

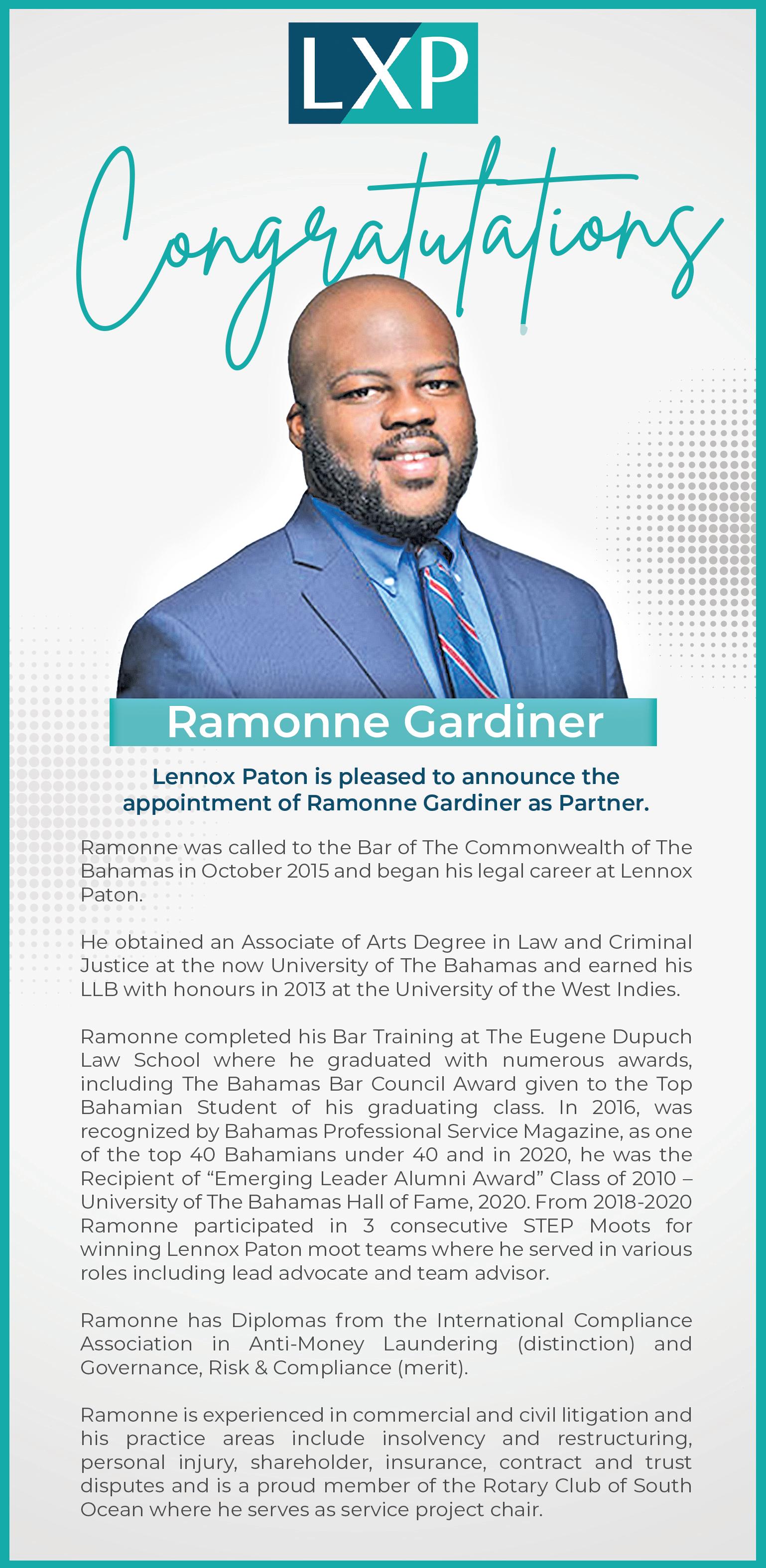

JOHN CHRISTIE

LONG ISLAND CRUISE PORT’S REMOTE LOCATION CHALLENGE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

LONG Island’s Chamber of Commerce president yesterday said the proposed $250m cruise port presents “lots of opportunities” for local businesses once construction begins in earnest.

Cheryl de Goicoechea told Tribune Business that while Calypso Cove’s physical development is only scheduled to begin in 2023, she hopes the economic and jobs impact will revive south Long Island and reverse the area’s decades-long population decline.

“I’m seeing this project calls for a luxury resort and a cruise port,” she said. “This will be great. It will bring opportunities for locals here, and maybe some opportunities for some new people and new businesses.

“Maybe some new businesses can open on the island, and it’ll give other business people here opportunities to base a store at that location. It’ll give construction workers jobs, and it’ll be fantastic. It’ll be a great thing if it happens. It’ll be a great thing and, yes, it is long awaited for the southern end of Long Island.”

The nearest settlement to Calypso Cove is more than an hour’s drive away, and Ms de Goicoechea added:

“I think that if it happens, it’ll be great for Long Islanders because this will be an opportunity for business persons who are interested in setting up a shop or offering some type of kiosk or something for the visitors at the hotel and the cruises that come into the island.

“It’s going to be great for construction workers because it means there’s going to be a lot of construction going on and, all around, it will be great for the south end of Long Island because it’s really needed down there. There’s nothing really down there.”

The only concern with the port’s location is that it is extremely remote, which means transporting visitors to other parts of the island for excursions and other activities - which will help to spread the economic impact - becomes problematic due to the distance involved.

And, with cruise ship passengers typically opting to stay close to their ports, the entire island may not feel the project’s benefits when it is fully operational. “Cruise ship passengers usually only spend a day in one port. So I would imagine that most of their time is going to be spent right at that area there,” Ms de Goicoechea said.

“There may just be some excursions, maybe some fishing trips and boat tours, etc.

But because Long Island is literally a long island, I don’t think that a few hours on the island will allow for them to explore the entire island. They may be able to go to Dean’s Blue Hole, go to Clarence Town, but that’s the extent of it because, by the time they’re done with those tours, they will have to hurry up and get on the bus and head back way south.

“So the southern end of the island, I’m sure they will find some activities for the visitors down there, but I don’t think that we will see them up in the northern parts of the island,” Ms de Goicoechea added.

“It’s not going to be a challenge, it’s just going to be that they’re very limited because they’re only here for a couple of hours. And to drive from that location to Cape Santa Maria or to Columbus Monument will take them about two-anda-half or three hours round trip. They’re not going to have a whole lot of time in any of these locations.

“It takes me, from Salt Pond, to go to Gordon’s an hour and four minutes. That’s one way. So I don’t think they’re going to want to sit on a bus for three hours of their tour unless they just want to see the island. I’m sure they’re going to have the tours for them. There’s lots of tours they can do and stuff.”

PAGE 2, Friday, December 23, 2022 THE TRIBUNE

PRIME Minister Philip Davis addresses the attendees at the groundbreaking of the new cruise port development on Long Island.

Photo:Kemuel Stubbs/BIS

TOURISM NUMBERS UP 11% ON PRE-COVID INTO 2023

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Deputy Prime Minister yesterday said tourism numbers for the next three months through Christmas into early 2023 are “very strong” and 11 percent ahead of 2019’s recordbreaking arrivals year.

Chester Cooper, also minister for tourism, investments and aviation, dismissed fears that a recession or US economic contraction will begin to undermine The Bahamas’ post-COVID tourism rebound. “We decided that we’re not

going to participate in the recession. Over the next three months, the numbers are very strong… It’s in the region of 11 percent ahead of 2019. If you look six months out, it’s also ahead so it’s positive,” he said.

There is also the possibility that “last minute bookings” will take visitor numbers for Christmas/ New Year and much of the 2023 first quarter even higher, and beyond that 11 percent. “If you look six months out, it’s also positive. And as the ADG (acting director-general of tourism) mentioned, we will see additional last-minute bookings,” Mr Cooper said.

“So we expect this number to increase above

Merchants see Xmas hope as recession threat looms

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE BAHAMAS Federation of Retailers (BFR) co-chair yesterday said merchants were enjoying strong Christmas sales but remain concerned about the threat of a US recession in 2023.

Tara Morley told Tribune Business that, while while the COVID pandemic is finally behind her members this festive season, they are hoping there is “nothing to worry about in 2023 ,and it will be a gangbuster year for all”.

While not all retailers survived the pandemic, and some are still teetering on the brink of closure, she said: “I think, hopefully, those of us that have come out on the other side of COVID can now look forward with having that behind us but, as far as I’m aware, I haven’t heard of anyone that’s looking into closing.

“I think that we have the worst behind us. Touch wood, we don’t know what the potential recession will hold for us. But I think that’s why, as long as everyone can get a good Christmas, then hopefully that’ll help us ride out whatever’s coming our way from 2023.”

Ms Morley added: “We continue to encourage everyone to shop local. It’s important to always try and shop local before you go abroad. I think that people are a little bit nervous for next year because, obviously, there’s some potential for bad news financially,

globally, so that could have an impact for next year.

“So this Christmas will be really important for everybody to get back up to speed with funds to carry them through any potential headwinds of recession that might be coming next year.”

US economists have predicted there is a 70 percent likelihood that the country’s economy will sink into a recession next year, as they slash demand forecasts and trim inflation projections in the wake of massive interest rate hikes by the Federal Reserve. The US central bank last Wednesday raised its benchmark interest rate range to between 4.25 to 4.50 percent, its highest level in 15 years, indicating the fight against inflation is not over despite promising signs recently.

Ms Morley, monitoring these developments in the US, said: “Christmas still looks good, and then we’ll see what 2023 brings.” The Federation last year helped to organise the ShopLocal drive for retailers, encouraging Bahamians to shop at home rather than buy abroad in an attempt to revitalize local businesses that had been driven to the brink of collapse by COVID-19 restrictions.

Speaking about the ShopLocal initiative, Ms Morley said: “I think it was a lot of raising awareness with the Bahamian consumer on how much value there actually is to shop at home with local businesses, and realising that not everything is always cheaper abroad. So I think that with those past two Christmases, people hopefully are understanding the value of shopping locally.

and beyond the 11 percent that we’re now seeing over the next three months.

That’s 11 percent over 2019, which was a record-setting year. We’ve implemented many strategies, this isn’t happening by chance. We have done many marketing and promotional missions.

As you saw, we continue to work with all of the BTO’s (Bahamas Tourism Officed) in all of the countries where we have a presence.”

Latia Duncombe, acting director-general of tourism, added: “Christmas is a special season for everyone. I think this year, with the rebound and recovery, is more important than any other season we’ve seen before. The numbers

are phenomenal. When we look at our numbers compared to 2019, we’re seeing growth in a magnificent way.

“We’re seeing a return of our Junkanoo, our culture, our history, our heritage and, more importantly, our visitors are coming to enjoy our shores. Whether it’s through the airport, whether through the cruise port, the numbers speak for themselves.

“We’ve looked at numbers as recently as yesterday, and they’re still trending in a very positive way. So we’re very excited about what’s happening. We want to encourage our vendors and our locals to capitalise

on the opportunity. We’re back. Tourism is back, and rebounding in a big way, and we want everyone to enjoy and participate.”

Ms Duncombe said there had been a slight shift, or diversification, away from The Bahamas’ traditional reliance on the US eastern seaboard for the bulk of its visitors. “We’ve seen travellers of all ages visit The Bahamas,” she added. “When we look at the interests of the travellers, we’re seeing a more sustainability perspective.

“Visitors want more nature-based and cultural experiences, more authentically Bahamian experiences. When we think about sand, sand and

sea, many countries have that. What they don’t have is the hospitality of our people. And so we’ve seen that the interest is there. We’re seeing a myriad cross-section of visitors that are coming - from the young to the young-at-heart - and they are enjoying the destination.

“We’re seeing an interest from the north-east. When we look at Europe we have daily flights coming in from Europe. What’s great is that Canada is fully open, so we’re seeing some interest from Canada as well. So we’ve returned and we’ve returned in a big way.”

URCA TARGETS REVERSING ‘LIMITED’ RENEWABLES USE

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ELECTRICITY regulators have identified reversing The Bahamas’ “limited success” to-date in adopting renewable energies as a key priority for 2023.

The Utilities Regulation and Competition Authority (URCA), unveiling its 2022 annual plan, said the integration of solar and other renewable forms into The Bahamas’ energy mix - especially in the Family Islands - was critical to the country’s economic competitiveness, energy independence and efforts to combat climate change.

“Renewable energy has been an area of exploration in the electricity sector but with limited success. Developing renewable energy plants in Family Island communities is now viewed as the alternative to traditional fossil fuel plants. Increasing numbers of Bahamians across the archipelago are investing in renewable energy as a supplementary or primary electricity supply. URCA must promote the effective

integration of renewable energy into the country’s energy mix,” it asserted.

To help achieve this, URCA said it is exploring the creation of generation licences for companies operating their own systems that produce one Mega Watt (MW) or more for self-supply only. “Examples would be Atlantis and Baha Mar,” it added. “Work on this project commenced in October 2022, and URCA will issue the consultation document early in 2023.”

URCA then revealed that, together with Bahamas Power & Light (BPL), it is exploiting grant financing provided by the US embassy to work with the National Renewable Energy Laboratory (NREL) to develop grid interconnection requirements for 500 kilowatt to 1 MW renewable systems. This ties into the Small-Scale Renewable Generation (SSRG) and Renewable Energy SelfGeneration (RESG) initiatives that allow residential, commercial and government customers to connect to BPL.

“The focus has been developing technical

specifications for mediumscale renewable energy projects, a follow-through on the RESG framework,” URCA explained. “BPL and URCA are taking advantage of the opportunity to work with the National Renewable Energy Laboratory (NREL), a US-based body, through a grant arranged by the US Embassy in Nassau.

“There is a mutual desire – URCA and NREL – to continue working together on the development of the utility-scale framework. NREL submitted its draft of the proposed 500kw to 1 MW Large Scale Renewable Generation (LSRG) interconnection requirements to URCA and BPL on September 30 for comments. Both URCA and BPL returned their comments. URCA intends to draft a public consultation document once it receives the revised document from NREL.”

URCA said it also plans to develop “guidelines” to prevent anti-competitive behaviour in the energy sector, while efforts to create a framework for measuring BPL’s performance are “in the

inception stage”. The regulator added: “The efficiency audit assesses the financial, operational, and quality of service performance of BPL compared to other relevant utilities in the region and internationally.”

And, with the Government supposed to review and update the National Energy Policy every five years, it first having been introduced in 2013, URCA said it was awaiting “guidance” from the Davis administration on the extent of its involvement in any review.

On the electronic communications side, URCA said work has begun on the public consultation over the introduction of 5G (fifth generation) mobile services into The Bahamas.

“This project has commenced with the surveys of the industry groups/sectors, including tourism, financial education, healthcare and other sectors to ascertain the use cases and demand for 5G service, and develop a public consultation document on 5G,” the regulator added.

NOTICE is hereby given in pursuant to the provisions of Section 218 of The Companies Act, 1992 that Eighty-five (85%) of the total shareholding of the Members of the abovenamed Company by Resolution passed on the 25th day of November, A.D., 2022 that the Company be wound up voluntarily and that the Liquidator be Jean Hénon of 15 bis, route de la Halte des Gauthiers, 17100 Saintes, France with an address at c/o Clement T. Maynard and Company, G. K. Symonette Building, Shirley Street, P. O. Box N-7525, Nassau, The Bahamas.

ALL persons having claims against the abovenamed Company are requested to submit particulars of such claims and proof thereof in writing to the Liquidator, Jean Hénon, c/o Clement T. Maynard and Company, G. K. Symonette Building, Shirley Street, P. O. Box N-7525, Nassau, The Bahamas no later than the 15th day of December, A.D., 2022.

Hénon Liquidator for the above-named Company

THE TRIBUNE Friday, December 23, 2022, PAGE 3

CALL 502-2394 TO ADVERTISE TODAY! SEE PAGE B7

NOTICE SEAFARI

(BAHAMAS) LIMITED (Voluntary Liquidation)

Jean

Bahamas shrugs off FTX for perfect ‘40 out of 40’

where their predecessors left off, pushed for full compliance with FATF standards upon being elected to office in September 2021. “The Bahamas is the second jurisdiction in the Caribbean region, and sixth in the FATF global network, to achieve the status of ‘40 for 40’ compliant and largely compliant ratings in the technical compliance with the FATF’s 40 recommendations,” the attorney general added.

“Achieving this rare rating demonstrates that we are a country that can lead in the satisfaction of international best practices while being innovative in our financial services industry. To be recognised as one of the very few in the world to accomplish ‘40 for 40’ for the FATF recommendations is laudable, and will be a platform that our financial services industry can stand on and demonstrate our excellence.

“It should provide a significant boost to the industry and the reputation of the jurisdiction. Clients worldwide can have confidence that we are a jurisdiction that is compliant at the highest levels.”

The CFATF’s upgrades, which were discussed during the body’s late November-early December meeting, come as FTX’s embattled founder, Sam Bankman-Fried, was on

Wednesday extradited to the US to face multiple financial crime charges, including fraud and money laundering.

The crypto currency exchange’s early November 2022 collapse, which may have resulted in losses of up to $8bn for clients and investors, shone an increasingly unfavourable spotlight on this jurisdiction’s regulatory structure and ability to supervise the digital assets industry.

The Bahamas was made a scapegoat for FTX’s failure, with John Ray, head of the 134 group entities in Chapter 11 bankruptcy protection, going to the extent of alleging collusion between the Government, Securities Commission, local joint provisional liquidators and Mr Bankman-Fried over the removal of assets from the crypto exchange.

Such accusations have been vehemently denied, and the Securities Commission subsequently disclosed the Supreme Court order authorising it to remove and secure some $300m in digital assets to protect them from being stolen via a hack. Mr Pinder yesterday argued that the upgrading of The Bahamas’ digital assets regime from ‘partially compliant’ to ‘compliant’ vindicates both its strength and representations that regulation played no part in FTX’s failure.

“Achieving a ‘compliant’ rating on recommendation 15, [which] addresses anti-money laundering protections for the virtual assets service providers, demonstrates what the country and the regulator (Securities Commission) have been saying all along in the digital asset space,” the attorney general told Tribune Business

“We believe in our regulation, and we as a jurisdiction are capable of keeping pace in regulation in an industry globally that evolves practically by the day. The Bahamas is one of the few, if not the only, country in the world to achieve a ‘compliant’ rating on this recommendation.

“This achievement speaks to the Commission’s, as well as The Bahamas’ commitment, to maintaining the highest standards of international best practices as promoted by standard-setting bodies.” The Securities Commission was the first to react to FTX’s collapse, placing it in Supreme Court-supervised provisional liquidation using the authority granted by the Digital Assets and Registered Exchanges (DARE) Act prior to Chapter 11 bankruptcy protection in the US.

The CFATF’s December 22, 2022, assessment, released yesterday, confirmed that The Bahamas has been deemed

‘compliant’ with antifinancial crime regulation of both digital assets and non-profit groups. “Overall, The Bahamas has made significant progress in addressing the technical compliance deficiencies identified..... and no deficiencies remain. The Bahamas has been re-rated compliant on recommendation eight and recommendation 15,” the CFATF said.

“The Bahamas has 40 recommendations rated ‘compliant’ or ‘largely compliant’. While the CFATF move is positive for The Bahamas, particularly in its timing, there will be observers both in this nation and abroad who are likely to be sceptical at the digital assets upgrade and feel regulatory/supervisory failings failed to prevent FTX’s collapse.

For the report made clear the re-rating was based on “technical” compliance with the benchmarks set by the FATF, the global standardsetter in the fight against money laundering and counter-terror financing, rather than “effectiveness” of implementation.

The Bahamas was previously rated as ‘partially compliant’ on digital assets regulation because it lacked mechanisms and procedures to identify the financial crime risks presented by the sector, and there was no risk-based approach for assessing

these factors. Guidelines to help digital asset services providers detect and report suspicious transactions were also lacking.

“There was a gap regarding originator information and beneficiary information on virtual asset transfers being available on request to appropriate authorities. Deficiencies regarding international co-operation were not demonstrated as addressed,” the CFATF report added.

Analysing The Bahamas’ progress to-date, the report added: “Section 41 of the DARE Act provides the provisions for co-operating and providing assistance to overseas regulatory authorities and, to-date, The Bahamas has provided assistance in regard to one of its registered digital assets services providers.” It is unclear if this was FTX, although that is highly likely.

The Bahamas was also found to have completed its risk assessment of the digital assets sector, which was published on May 25, 2022, with the digital assets industry now also covered by the Financial Transactions Reporting Act and Proceeds of Crime Act regimes. The industry was assigned “a low-risk rating”, which may raise eyebrows in FTX’s wake.

“The addition of the new section 39 (3) of the DARE Act places a responsibility

Investor seeking $2.7bn in South Ocean dispute

FROM PAGE B1

2022, legal filings in the south Florida federal court.

He is attempting to obtain legal discovery from Southern Cross, the real estate and property development firm owned by world-renowned golfer, Greg Norman, which acted as an agent for South Ocean’s Canadian pension fund owner in their talks over his proposed acquisition.

The Austrian investor’s position is that he had a

legally binding sales agreement with the Canadian Commercial Workers Industry Pension Plan (CCWIPP) to acquire the still-shuttered southwestern New Providence resort in 2014, but the latter then committed a breach of contract by refusing to honour and conclude the agreement. CCWIPP and its Propco affiliate then sought to sell South Ocean to Albany’s investors, but that deal has now been held up by Dr Kovats litigation.

“Dr Kovats is an international real estate investor, permanently residing in the Bahamas since 1995,” his legal filings asserted. “The South Ocean property is located on New Providence, and consists of 384 acres of land and 3,000 feet of beach access. It is adjacent to an ultra-luxury development known as Albany, and Dr Kovats’ redevelopment plan includes sales of lots, condominiums, a resort hotel, a marina, and a casino.

“Dr Kovats reached an agreement with the pension fund to buy the South Ocean property, using a corporate vehicle called the Bahamas Island Consortium to do so. The pension fund reneged on this deal, so Dr Kovats filed suit for breach of contract and has already overcome an initial motion to dismiss in The Bahamas.

“Dr Kovats seeks to enforce his agreement with the pension fund or, in the alternative, in excess of $2.7bn in damages (which is informed, in part, by a CBRE market analysis prepared for the sale of the South Ocean property).... The case is now proceeding to the case management stage, where the parties

exchange evidentiary presentations in advance of trial.”

That CBRE document, which has been seen by Tribune Business, is at least a decade old because it refers to projected land sales at Albany in 2013. Its value, therefore, for determining damages seems dubious. “Unfortunately, the South Ocean property litigation is now bleeding into Dr Kovats’ other property disputes in The Bahamas,” the latest legal filings allege.

“For example, Dr Kovats has agreed to purchase a property from a private seller known as Treasure Cay, but the Government of The Bahamas refuses to provide a perfunctory ‘letter of no objection’ necessary to purchase this property.

“The Government has raised explicitly with Dr Kovats his attempts to purchase the South Ocean property even though it is not involved in that purchases. All of this has led Dr Kovats to believe that his different attempts to purchase and develop property in The Bahamas have been subject to undue influence by the Government.”

The concern here for The Bahamas is that prime tracts of real estate, extremely valuable for driving future resort development, investment and job creation, face being potentially tied-up for years in expensive, timeconsuming court fights.

Several sources have suggested that litigation is frequently employed as a hardball negotiating tactic by Dr Kovats as a means to an end in securing his desired outcome.

The Canadian pension fund, which took over South Ocean after Ron Kelly defaulted on his loan repayments, has been seeking to exit its last remaining Bahamas resort investment for almost two decades.

Viewing the 2014 deal with Dr Kovats as having fallen through, CCWIPP subsequently agreed to sell the property to the adjacent Albany developers, who include Lyford Cay-based billionaire Joe Lewis, golfers Ernie Els and Tiger Woods, and singer Justin Timberlake.

The Austrian’s legal action, though, has halted Albany’s purchase and forced the high-end southwestern New Providence

on the Securities Commission to implement systems to identify persons not registered under..... the Act,” the CFATF report added. “As such, the Securities Commission has developed and implemented an internal policy framework for identifying persons carrying on, or attempting to carry on, activities under the DARE without the requisite registration...

The prohibition of natural or legal persons carrying out digital asset service provider activities without the requisite licence/registration is captured legislatively in various parts of the DARE Act. The amendment to the DARE Act... provides the proportionate and dissuasive sanctions to be applied – up to $100,000 for each contravention. There is also a general penalty provision under section 44 of the DARE Act of $500,000 or imprisonment of up to five years or both.”

The CFATF said it was also satisfied that the Securities Commission has “the authority to conduct inspections, compel production of information and impose a range of disciplinary and financial sanctions”. It added: “The Bahamas applies proportionate and dissuasive administrative and criminal sanctions for persons carrying on digital asset activities without the requisite licence.”

residential community to put redevelopment plans for its South Ocean neighbour on ice. This newspaper, though, was told that Albany and its principals have not walked away from the deal, and are instead watching and waiting to see how the legal battle between Dr Kovats and the pension fund plays out.

“Albany has agreed to sit back and wait and hang in there,” one source, speaking on condition of anonymity, told Tribune Business previously. “They’re confident [CCWIPP] will win this action and get rid of them.”

Dr Kovats has also attracted controversy in Austria throughout his business and investing career, despite building his publicly-listed industrial group, A-Tec Industries, into a conglomerate that once featured over 70 companies and more than 10,000 employees, with turnover pegged at more than one billion euros.

Numerous companies he was involved with early in his business career became insolvent, and Dr Kovats has faced numerous civil lawsuits during his business career, being criminally indicted twice. He was sentenced to six months’ probation in 2000 by the Vienna High Court over the bankruptcy of a nightclub he had invested in. Dr Kovats was also charged over another nightclub insolvency in 2007, although he was never convicted.

NOTICE

SEAFLEET LIMITED (Voluntary Liquidation)

NOTICE is hereby given in pursuant to the provisions of Section 218 of The Companies Act, 1992 that Eighty (80%) of the total shareholding of the Members of the abovenamed Company by Resolution passed on the 25th day of November, A.D., 2022 that the Company be wound up voluntarily and that the Liquidator be Jean Hénon of 15 bis,route de la Halte des Gauthiers, 17100 Saintes, France with an address at c/o Clement T. Maynard and Company, G. K. Symonette Building, Shirley Street, P. O. Box N-7525, Nassau, The Bahamas.

ALL persons having claims against the abovenamed Company are requested to submit particulars of such claims and proof thereof in writing to the Liquidator, Jean Hénon, c/o Clement T. Maynard and Company, G. K. Symonette Building, Shirley Street, P. O. Box N-7525, Nassau, The Bahamas no later than the 15th day of December, A.D., 2022.

Hénon Liquidator for the above-named Company

N

(a) DTC INVESTMENTS LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 21st December, 2022 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Leeward Nominees Limited, Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, British Virgin Islands VG1110.

Dated this 23rd day of December, A. D. 2022

N

Tribune Business’s own research also found that Dr Kovats and a fellow executive were fined by Austrian regulators in 2012 for providing misleading information to the capital markets, thus harming investors. Following a two-year period of turbulence that began in 2011, A-Tec moved to restart business activities in 2013, after undergoing a reorganisation.

(a) AFY LTD. is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 21st December, 2022 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas

Dated this 23rd day of December, 2022

PAGE 4, Friday, December 23, 2022 THE TRIBUNE

PAGE B1

FROM

SOUTH OCEAN

Jean

O T I C E IS HEREBY GIVEN as follows:

Leeward

N O T

C E DTC INVESTMENTS LIMITED

Nominees Limited Liquidator

I

O T I C E IS HEREBY GIVEN as follows:

Bukit Merah Limited Liquidator N O T I C E AFY LTD.

‘Unprecedented’: Hotel staff enjoyed slow season boost

months of the year. That body represents Atlantis and other properties such as the Lyford Cay Club.

The BHCAWU’s last industrial agreement with the Association expired in around 2013-2014, although employers have treated its terms and conditions as still being in effect after the union failed to submit its proposal for a new deal and kickstart negotiations within the time stipulated. This means its members have not experienced any improvement in salaries, benefits and working conditions via an industrial deal for at least eight-nine years despite soaring inflation.

Mr Woods, meanwhile, said he has set a similar schedule for completing separate industrial agreements with individual

employers such as Restaurants Bahamas (KFC), Best Western, Graycliff and Harbourside as the union bids to at least partially offset the cost of living crisis for its members.

“There’s a night restaurant where they’ve reduced the days but, for the most part, all the other hotel areas have in our view surpassed [pre-COVID staffing levels] because they’re working six days,” the union chief told Tribune Business of current hotel employment levels.

“Based on the projections, it appears that we’re going to be very busy over the next couple of days.

“We have pretty much come through the slower period with higher occupancies and expanded work levels. August, September and October, you’d usually be working two to three days. With the exception

I told you about, those other areas were working five days minimum, which is unprecedented for that time of the year. If we’re able to ride the proverbial wave through 2023 we believe that should take us all the way to Easter.

“We understand there’s an expected uptick in tourist arrivals next year, and we hope that translates into heads in bed in the hospitality industry, not Airbnb, so our people can benefit.”

Mr Woods said higher occupancies, and greater guest numbers, translated into higher tipped or gratuity income for housekeepers, room attendants and persons working in service areas such as the restaurants.

While the increased working hours, and incomeearning opportunities, will not compensate for what was lost during COVID, the

union chief added: “This was much needed. You can never make up for lost time, but this kind of compensates for it rather than making up for it.....

“I believe our people are more appreciative now, particularly with what we went through with COVID and post-COVID, so there’s a realisation we need to take care of those guests coming in so that we woo them and get repeat customers coming back and also get some referrals, so that they carry us through the hot patches.”

As for the union’s industrial agreement talks on multiple fronts, Mr Woods revealed of talks with the Association: “We’re relatively close I believe. We had a meeting last week Thursday with the membership to kind of bring them up to speed with where we are. There’s only one major

item [left]. That, of course, is the wages. We hope to get back together [with the employers] in the New Year and wrap-up in the first quarter of next year to be honest.”

When it came to the separate negotiations with individual employers, he added: “Those are moving on at the same pace as the other agreement. They’re all pretty much in the same stage; it’s just the salaries and financial items that are left. For the most part, we believe we’ll be able to bring those on and complete them in the first quarter or first four months of the year God willing, barring any unforeseen delays.

“Once we get through them we’ll be able to let our hair down a bit. Once we’re able to get those industrial agreements completed and registered, they’re binding on the parties and with

the amendment to the law in 2017 what it does now is that they form part of their individual contracts of employment.”

Mr Woods said improved salaries and working terms will help hotel workers partially offset the impact of soaring inflation, which is now being worsened by the rolling quarterly increases in Bahamas Power & Light’s (BPL) fuel charge.

“While salaries and pay are up by the amount of days they are working, you have to take into consideration things are inflated because of what is going on around the world,” he added.

“They want be able to match it, but can at least cope and get the things they need and ensure their children have a good time in the festive season. I believe it’s going to be good and important for them in the next couple of days.”

the industry writ large”, he argued that The Bahamas has a duty to itself and “the financial services arena” to conduct a comprehensive investigation into all aspects of FTX’s multi-billion dollar failure.

Mr Delaney, telling this newspaper there had been no “immediate reaction” to the crypto exchange’s collapse in terms of loss of business, especially in the “established” Bahamian financial services industry, said the country’s upgrading by the Caribbean Financial Action Task Force (CFATF) to ‘compliant’ on digital

assets regulation will bolster its “credibility” in the face of recent international attacks.

“This assessment by the CFATF will go a long way in showing there’s no systemic weaknesses in the industry writ large,” the former attorney general said. “Having said that, I think there is undoubtedly a need to have a proper inquiry and analysis of everything that touched the FTX collapse simply because of the scale of its presence here, and The Bahamas being the its place of domicile.

“It’s important to equip ourselves properly with that regulatory role, and

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, NICOLE JOHNSON A.K.A NICOLA JOHNSON of Hatchet Bay, Eleuthera, Bahamas, intend to change my name to LATOYA YVONNE NICOLE JOHNSON If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

duty to the jurisdiction and financial services arena, to show we are responsible and doing a full, proper inquiry as to what transpired and whether it makes apparent any weakness in our system and regulatory framework, and determine what needs to change if anything going forward. We must determine lessons from this. The wrong thing will be if we divide time, let it go past, and continue as if it never were.”

The Wednesday evening extradition of Mr Bankman-Fried to New York, where he now faces multiple fraud and money laundering charges in a federal court, means the focus

of FTX-related attention has shifted away from The Bahamas to some degree. Little has been heard of both the Securities Commission and Royal Bahamas Police Force investigations that were triggered in early November amid whistleblower revelations that FTX had been misusing customer funds.

The temptation may now be to leave the investigation to US authorities, and regulators such as the Securities & Exchange Commission (SEC) and Commodities and Futures Trading Commission (CFTC), although the joint provisional liquidators will continue their work

and inquiries as part of fulfilling the Supreme Court mandate to trace, seize and protect assets for the benefit of creditors of the local subsidiary, FTX Digital Markets.

“While in some sense it bears no direct connection or nexus, it’s a great Christmas present with the timing,” Mr Delaney said of The Bahamas’ upgrade by the CFATF. “It’s happened at a time when The Bahamas is under not so good scrutiny about its dealings relating to FTX.

“I think it is good by way of credibility. When something that is sensational happens, and I’m not suggesting that FTX is merely sensational, but when something of that nature happens it’s very easy for persons on the outside looking at The Bahamas not to have the full perspective..

cap and we should wear it proudly, especially against the backdrop of FTX developments”.

He said: “Obviously with FTX and Sam BankmanFried we’ve have lost a bit of wind from our sails regardless of how you want to look at it. News like this is positive. When you look across many, many jurisdictions, and jurisdictions considered well-regulated, in many instances they are nowhere near ‘40 out of 40’ where they are regarded as ‘compliant’ or ‘largely compliant’, so The Bahamas stands out in that regard.

NOTICE is hereby given that in accordance with Section 138(4) of The International Business Companies Act, 2000, BUZIR COMPANY SA is in dissolution.

The date of commencement of the dissolution was the 21st day of December A.D., 2022.

Mr. Michael C. Miller, P.O. Box EE-17971, Nassau, Bahamas is the liquidator of Buzir Company SA.

INTERNATIONAL BUSINESS COMPANIES ACT, 2000 BUZIR COMPANY SA In Voluntary Liquidation Michael C. Miller Liquidator

www.bisxbahamas.com

(242)323-2330 (242) 323-2320

0.9321.26042.93.15%

1.7600.000N/M0.00%

0.3690.26026.42.67%

-0.4380.000-10.3 0.00%

0.1400.00073.20.00%

0.4490.22019.02.58%

0.6460.32814.53.50%

0.7280.24015.42.14%

0.8160.54022.22.98%

0.2030.12019.63.02%

“The Bahamas has, for the past 22 years, been on the road to ensuring our anti-money laundering and counter terror financing regimes are world class.

It’s been an arduous journey that The Bahamas has undertaken over successive administrations, and the whole financial services industry, civil servants and technical people have worked hard to ensure we are well regulated in the domestic and international space,” he continued.

“It’s so easy for one sensational thing to come up and damage the effort. It’s good we have the timing of this [CFATF report] at this particular time and, hopefully, it can get enough attention from persons that they have a more balanced approach in terms of looking at The Bahamas as a jurisdiction for financial services. It will help shore up confidence.”

Hubert Edwards, head of the Organisation for Responsible Governance’s (ORG) economic development committee, told Tribune Business that the CFATF’s assessment that The Bahamas is in full compliance with global anti-financial crime standards is “a real feather in our

“The Bahamas is in an enviable position. The fact the report speaks to crypto assets is also a good thing despite the fact we’ve had a little bit of a stumble with FTX. There are certainly some things we have to go back to the drawing board on as it relates to the regulatory framework for digital assets. We would have learned some important lessons, and there’s more to come to the extent we fully understand how to manage these risks.

“But to look past that at this point in time, without any adjustments, and not suggest there’s anything negative around our regulatory framework for digital assets is significant. It’s a vindication, in many ways, of the work that The Bahamas has done, it’s a vindication of the framework put in place. I wouldn’t say, though, that this is a guarantee nothing else has to be done as these issues are constantly evolving,” Mr Edwards continued.

“Yes, we have been troubled a bit on the digital assets side, but clearly it’s not going to be fatal. This demonstrates to the outside world that our commitment to the underlying regulatory framework is strong. Next year we will still have to confront the fall-out, or ongoing fall-out, from FTX but this is a good thing.”

0.0000.0000.0007.00%

29-Jul-2023 15-Jan-2039 15-Oct-2049 17-Jan-2040 15-Jun-2030

NOTICE

NOTICE is hereby given that ALIDIEU BRAZELA of Lower Bogue, Eleuthera,

is applying to

and Citizenship, for

The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 23rd day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

THE TRIBUNE Friday, December 23, 2022, PAGE 5

FROM PAGE B1

EX-AG: DON’T LET ‘PROPER’ FTX COLLAPSE PROBE SLIDE FROM PAGE B1 THURSDAY, 22 DECEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2645.080.900.03416.8418.71 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00

53.0040.03 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL

2.462.31Bahamas First Holdings Limited BFH

of Bahamas BOB

Property Fund BPF

Holdings CHL

FirstCaribbean Bank CIB

Water BDRs CWCB

Hospital DHS

Incorporated EMAB

FAM

18.3014.50Fidelity Bank (Bahamas) Limited FBB

FCL

11.509.85Finco FIN

16.2515.50J. S. Johnson JSJ

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP

1000.001000.00 Cable Bahamas Series 6 CAB6

1000.001000.00 Cable Bahamas Series 9 CAB9

1.001.00Colina Holdings Class A CHLA 1.00

10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307

100.00100.00BGS: 2015-6-30Y BG0330

100.00100.00BGS: 2015-10-7Y BG0407

102.07102.07BGRS FX BGR105026 BSBGR1050263

500 102.73100.97BGRS FX BGR141230 BSBGR1412307

1400

FX BGR142231 BSBGR1420318

1200 100.71100.01BGRS FL BGRS70023 BSBGRS700238

700 91.9191.91BGRS FX BGR127139 BSBGR1271398

92.6792.67BGRS FX BGR131239 BSBGR1312390

90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.582.11 2.583.48%3.87% 4.883.30

2.261.68

205.22164.74

N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 30-Nov-2022 30-Nov-2022 6.95% 4.50% 30-Sep-2022 31-Oct-2022 4.50% 6.25% 31-Dec-2021 30-Nov-2022 30-Nov-2022 31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 31-Oct-2022 31-Oct-2022 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 25-Nov-2022 22-Sep-2033 25-Jul-2026 26-Jul-2037 26-Jul-2035 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 5.00% 5.35% 6.25% 30-Sep-2025 30-Sep-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.55% 4.81% 5.40% 5.14% 5.60%

4.53% 5.00%

5.65% 5.35%

0.2390.17029.12.45%

2.76 2.760.00 0.0000.020N/M0.72%

2.46 2.460.00 0.1400.08017.63.25% 2.852.25Bank

2.61 2.610.00 0.0700.000N/M0.00% 6.306.00Bahamas

6.30 6.300.00

9.808.78Bahamas Waste BWL 9.75 9.750.00

4.502.82Cable Bahamas CAB 4.50 4.500.00

10.657.50Commonwealth Brewery CBB 10.25 10.250.00

3.652.54Commonwealth Bank CBL 3.58 3.600.02 2,0000.1840.12019.63.33% 8.547.00Colina

8.53 8.530.00

17.5012.00CIBC

15.99 15.990.00 0.7220.72022.14.50% 3.251.99Consolidated

3.00 3.000.00 0.1020.43429.414.47% 11.2810.05Doctor's

10.50 10.500.00 3000.4670.06022.50.57% 11.679.16Emera

9.38 9.380.00

11.5010.06Famguard

11.22 11.220.00

18.10 18.100.00

4.003.50Focol

3.98 3.980.00

11.00 11.000.00 0.9390.20011.71.82%

15.75 15.750.00 0.6310.61025.03.87%

1.00 1.000.00 0.0000.0000.0000.00%

1000.001000.000.00 0.0000.0000.0000.00%

1000.001000.000.00 0.0000.0000.0000.00%

1.000.00 0.0000.0000.0006.25%

1.000.00 0.0000.0000.0006.50%

100.00100.000.00

100.00100.000.00

100.00100.000.00

102.07102.070.00

102.68102.730.05

103.16103.16BGRS

103.16103.160.00

100.71100.710.00

100.00100.000.00

92.5592.550.00

4.884.49%5.32%

2.262.74%3.02%

190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A

17-Nov-2030 15-Feb-2031 15-Jul-2039 15-Jun-2040

NOTICE

The Bahamas

the Minister responsible for Nationality

registration/ naturalization as a citizen of

is hereby given that NANCY JOSEPH of Central Pines, Abaco, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 23rd day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

US STOCKS SLIDE AS ECONOMIC DATA STOKES RATE HIKE WORRIES

By DAMIAN J. TROISE, STAN CHOE AND ALEX VEIGA AP Business Writers

STOCKS closed broadly lower on Wall Street Thursday as stronger-thanexpected reports on the U.S. economy stoked worries about interest rates staying high.

The S&P 500 fell 1.4% after having been down as much as 2.9% earlier in the day. The pullback brings Wall Street’s main measure of health back to a loss of nearly 20% for the year. The Dow Jones Industrial Average fell 1% and the Nasdaq closed 2.2% lower.

The selling was broad, with all 11 industry sectors in the S&P 500 ending up in the red. Technology stocks were the biggest drag on the benchmark index. Chipmaker Nvidia slumped 7%.

Usually, good data on the economy would be positive for markets, particularly when worries are high

about a possible recession looming. But Thursday’s reports suggested the Federal Reserve may indeed follow through on its pledge to keep hiking interest rates and to hold them at a high level for a while in order to get inflation under control.

The Fed is particularly worried about a still-strong job market giving more oxygen to inflation, which has come down a bit in recent months but remains close to its highest level in decades. One report on Thursday indicated employers laid off fewer workers last week than expected, while a separate report showed that the broad U.S. economy grew more strongly during the summer than forecast.

The reports forced a reminder of a longstanding mantra on Wall Street: Don’t fight the Fed. When it’s raising interest rates, the Fed is intentionally slowing the economy and increasing the risks of a

potential recession. Higher rates also drag down on prices for stocks and other investments.

High-growth technology stocks have taken some of the year’s worst hits because they’re seen as some of the most vulnerable to rising rates. A discouraging profit report from chipmaker Micron Technology cast even more of a pall on the industry Thursday.

Micron fell 3.4% after it gave a weaker forecast for upcoming earnings than analysts expected as it faces softening demand.

Electric vehicle maker Tesla has also felt big pain from rising interest rates, though it’s also dealing with issues specific to itself and its CEO, Elon Musk. It tumbled 8.9%, bringing its loss for the year to around 64%. It’s taking the rare step of offering discounts on its two top-selling models through year’s end, an indication demand is slowing.

Realtor has ‘never seen such high rental rates’

FROM PAGE B1

will happen in the New Year, but it’s still pretty much status quo.

“There’s still more people coming in, especially people looking for rentals. People are getting very high rental prices, and that’s keeping prices high. That’s what’s keeping inventory low as well; persons renting rather than selling. I’ve never seen such high rental rates as people are getting now.

“People are paying $10,000, $12,000, $13,000, $14,000 a month in places like Sandyport. Places like Lyford Cay and Old Fort Bay, people are paying $20,000-$30,000 a month. The bigger houses, it’s $30,000.” Mr Christie said The Bahamas was increasingly attracting high net worth tenants, wanting to rent upscale properties for a year or two, for purposes such as pre-US immigration or to test whether they want to put down more permanent roots in this nation.

This, though, is also helping to reduce the amount of high-end property available for sale. The 35 condos and other real estate acquired by failed crypto currency exchange, FTX, for a collective $256m will take time to come on the market given that it will tied-up in the platform’s respective liquidation and bankruptcy proceedings.

“Usually there’s something to buy, and right now there’s very little,” Mr Christie said. “If you go to Lyford Cay there’s hardly anything; very little to buy. There’s one or two homes, but usually there would be 10-15 houses on the market at a time. Now there’s one or two.

“The houses that are on the market, people have been going at them, but for whatever reason they are priced above what people are willing to pay. The owners say this is what they want, and if people don’t pay then they’re not selling. It keeps the prices high. It’s pushed up a lot in the last two years.”

Mr Christie estimated that prices in high-end communities such as Lyford Cay have increased by “at least 75 percent” over that period, and the combination of low inventory and high demand will ensure no decline in the immediate future. “There will be less turnover because there are less properties to sell, but prices will remain high,” he added.

Peter Dupuch, ERA Dupuch’s founder and president, told Tribune Business he had encountered the same problems as Mr Christie. “We’re running out of inventory,” he said. “We were showing at Lyford Cay on Monday, and didn’t have a whole lot of homes. Sometimes you go in there and see eight to ten homes in that price bracket, and now there are only four or five. The inventory is getting low, and we need more homes.

URCA TARGETS REVERSING ‘LIMITED’ RENEWABLES USE

FROM PAGE B3

“This consultation aims to assess the use cases/ demand for 5G services, identify any potential bottleneck/impediments (including commercial constraints and economies of scale and scope) in the provision of 5G services by way of responses from stakeholders and interested parties, gain an understanding of the demand for use cases of 5G services and identify any supply constraints supported by empirical analysis.”

URCA said it expects to provide recommendations to the Government by yearend on whether there is sufficient market capacity for a third mobile operator in The Bahamas, and also plans to review existing consumer protection regulations to make sure they stay “fit for purpose”.

And, with the Electronic Communications Sector Policy set to expire in March 2023, URCA has to formulate and present a revised draft for its replacement - covering the next three years - to the Government.

“The acceleration of digital transformation has changed the world but integrating the world’s population into this new technological age is a journey,” the regulator added.

“Though advanced in the major population centres, for SIDS (small island developing states) like The Bahamas, the journey remains a significant struggle that demands a unified, systematic and well-structured approach. The challenge is particularly true regarding accessibility and affordability in many of our Family Islands.”

“I think it’s been lower since last year. I feel like it’s down a good amount. I feel like there’s only 65-70 percent of the inventory we normally have. It’s in my head that it’s down by at least 30 percent. Supply and demand takes over what’s left, and prices go up. If there’s not a lot left, prices go up.”

Real estate’s importance to the post-COVID economy was recently highlighted by Shunda Strachan, the Department of Inland Revenue’s (DIR) acting controller, who said it had helped fill the void in the Government’s income created by tourism’s pandemic shutdown. She disclosed that almost 31 percent of VAT revenues collected by her agency between July 1 last year and end-May 2022, or some $220m of $712m, originated from property deals.

This translates into more than $2bn in real estate sales being brought forward for stamping and the payment of taxes during the first 11 months of the 20212022 fiscal year.

Damianos Sotheby’s International Realty earlier this year revealed property sales for the 2022 second quarter increased by 34 percent compared to the year’s first quarter. And the sales value of properties sold soared by 73 percent quarter-over-quarter.

Meanwhile, the average sales and list prices for properties handled by the realtor, which specialises in the high-end luxury market, jumped by 30 percent and 8 percent, respectively, for the June quarter compared to the first three months of 2022.

Worries are rising broadly about corporate profits across industries, which are contending with the weight of higher interest rates, still-high inflation and rising costs rise due to payroll and other expenses. A drop-off in corporate profits in 2023 could knock out another support for stocks, after profits strengthened through much of 2022.

Used-auto retailer CarMax dropped 3.7% after it reported much weaker profit for its latest quarter than analysts expected.

The market’s slide eased toward the end of the day, leaving major indexes to finish off the day’s lows. The S&P 500 dropped 56.05 points to 3,822.39. The

Dow, which had been down 803 points, finished down 348.99 points at 33,027.49. The tech-heavy Nasdaq fell 233.25 points to close at 10,476.12.

Small-company stocks also fell. The Russell 2000 index dropped 22.85 points, or 1.3%, to 1,754.09.

Trading has been topsyturvy across Wall Street recently as reports paint a mixed portrait of the economy.

The housing industry and other areas of the economy whose fortunes are closely tied to low interest rates have already shown sharp downturns. But consumer confidence has strengthened recently, offering hope for the biggest and most important part of the economy: consumer spending.

Inflation has been moderating since peaking in the summer, which at times has raised hopes on Wall Street that the Fed may back off its tough talk on interest rates. But Fed officials continue to hammer the message that they’ll hike rates further in 2023 and

don’t

before 2024.

The Fed has already hiked its key overnight rate up to its highest level in 15 years, after it began the year at a record low of roughly zero. That has a growing number of economists and investors are predicting a recession will hit the U.S. economy in 2023.

And the Fed is just one of many central banks around the world hiking rates at an explosive clip. Even the Bank of Japan, which has been a holdout in keeping interest rates super-low this year, this week made moves that would allow some rates to rise a bit.

The yield on the twoyear U.S. Treasury, which tends to track expectations for Fed action, rose to 4.26% from 4.22% late Wednesday.

The 10-year yield, which helps dictate rates for mortgages and other economy-setting loans, rose to 3.68% from 3.67% a day earlier.

THE TRIBUNE Friday, December 23, 2022, PAGE 7

a

to

envision

cut

rates

PETER DUPUCH