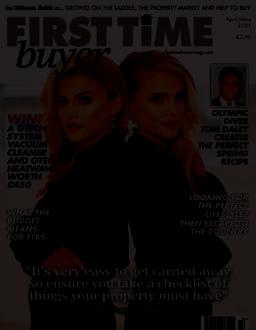

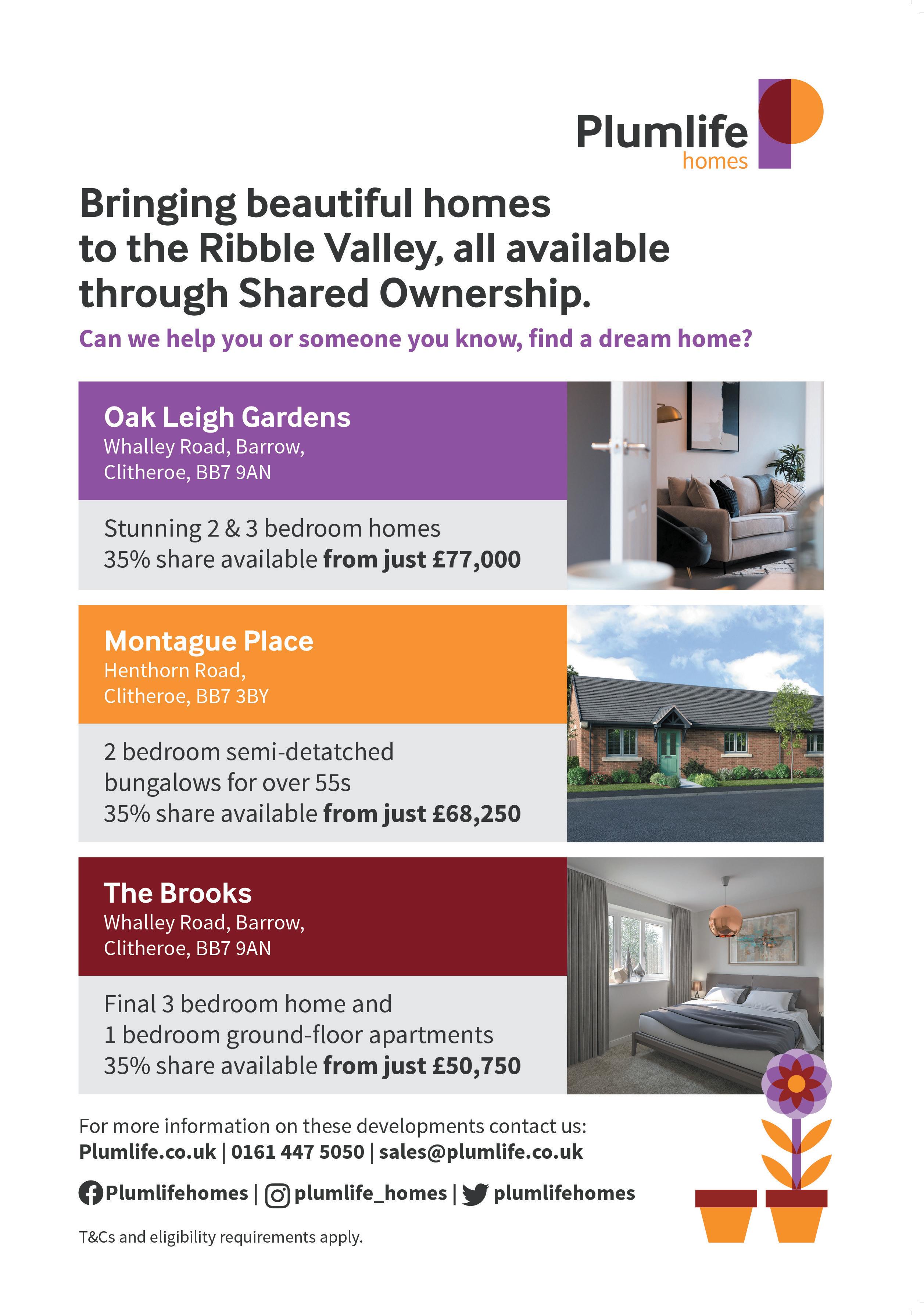

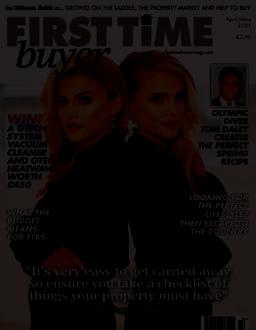

the Ultimate Guide to... GETTING ON THE LADDER, THE PROPERTY MARKET AND HELP TO BUY rsttimebuyermag.com April/May 2023 £3.95 100C ebrating I ues 771758 973014 9 04> FIRST TIMEbuyer 1 th I ue

EDITORIAL – 020 3488 7754

Editor-in-Chief SARAH GARRETT sarahg@spmgroup.co.uk

Editor LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Editorial Assistant and Head of Special Events KATIE WRIGHT

Editorial and Special Events Assistant

SOPHIE MUNNERY

Creative Director RYAN BEAL

Sub Editor KAY HILL

Social Media KATIE WRIGHT, SOPHIE MUNNERY

Contributors

BERNARD ARHIN, NICKI CHAPMAN, CHRIS CLARK, DEBBIE CLARK, ABI CULLEY, BILL DHARIWAL, KAY HILL, CECILIA MOURAIN, SOPHIE MUNNERY, LAURA DEAN-OSGOOD, CORALIE PHELAN, LESLEY PRICE, GINETTA VEDRICKAS, KATIE WRIGHT

ADVERTISING

020 3488 7754

Director of Advertising/Exhibition Sales LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Special Events KATIE WRIGHT

– First Time Buyer Home Show

– First Time Buyer Readers’ Awards katie@ rsttimebuyermag.co.uk

Accounts accounts@ultimateguidecompany.com

Managing Director SARAH GARRETT sarahg@spmgroup.co.uk

Public Relations RACHEL COLGAN rachel@building-relations.co.uk

SUBSCRIPTIONS 020 3488 7754

SWITCHBOARD 020 3488 7754

All advertising copy for June/July 2023 must be received before 5 May 2023. Send all copy to: lynda @ firsttimebuyermag.co.uk

Welcome

We are celebrating our 100th issue which is a great milestone for First Time Buyer. As I look back over the years I can see how we have helped so many first timers get a foot on the property ladder and that really is something to applaud. I hope you enjoy our special commemorative cover which is a real trip down memory lane!

We are also bringing you an extra special SO Resi magazine with this issue. It covers everything from how shared ownership works to the latest news from the mortgage market, plus some perfect FTB hotspots around the country and affordable homes in those areas, along with much more.

Our special friend and huge supporter of the magazine Jonnie Irwin is taking a well-earned holiday, so TV and radio presenter Nicki Chapman has shared with us her thoughts on what’s happening in the property market – do take a read!

With Easter just around the corner we enjoyed tasting some delicious eggs to bring you our round-up of what’s in store and which, in our opinion, are the tastiest treats.

I hope you enjoy this issue which is packed with information and help on buying your first home – enjoy!

Until next time, happy house hunting

For me the

Beth Otway, At home with, page14

page 106

The Kent countryside is right on the doorstep and the city centre is so easy to reach.

Casper Willis, House Hunter, page 16

Our monthly outgoing is £100 less than our one bedroom rental.

Rhianne and Sam, Real Life, page 68

I believe there are many opportunities available now for rst time buyers eager to get on the property ladder.

Nicki

Chapman, Nicki’s World, page 9

EDITOR’S LETTER First Time Buyer April/May 2023 3

–

content

publication, either in whole or in part, may not be reproduced, stored in a data retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without prior permission from the publishers. Opinions expressed in First Time Buyer magazine are not necessarily those of the publishers. © The Ultimate Guide Company Ltd 2008-2023. The Ultimate Guide Company Ltd t/a First Time Buyer magazine will take no responsibility for any loss/ claim resulting from a transaction with one of our advertisers/media partners.

The

of this

firsttimebuyeronline @firsttimebuyer

EDITOR’S PICKS…

one incentive to moving home is the thought of all the different houseplants and garden plants I could grow!

I have a huge passion for shared ownership and the springboard it gives people to full homeownership.

Abi Culley, 20 Questions,

FIRST TIMEbuyer 1 th I ue

What’s in…

69

For sale

– the best FTB properties

68

Rhianne and her partner Sam were faced with the all too familiar hurdle of rising house prices and an inaccessible market when it came to taking the first step on the property ladder. A home in the South East was out of reach, but new flexible working arrangements gave them an opportunity to look further afield.

HOMEPAGE

9 Words from Nicki TV presenter and property expert Nicki Chapman gives her views on the housing market.

10 FTB loves…

A round up of our favourite treats for Easter.

12 Living

With spring just around the

corner, find some inspiration on how you can give your home a facelift using some pretty pastel and floral accessories.

14 At home with… Beth Otway

Beth Otway is a horticulturist and garden writer with a passionate interest in plant conservation. She has a passion for houseplants and her Surrey home is full of plants! She talks to Lynda Clark about her first home, her love of allotments, favourite gardening tools, and admiration for Martin Lewis.

16 House Hunter

We try to find a home for Casper Willis and Allesandra Dellano, who are searching for a one or two bedroom property in Kent or south east London.

18 Developer’s doctor Michelle Chidgey, Head of Sales and Marketing at OX Place, answers your property question.

FEATURED

20 The View: Charlie Lamdin

Charlie Lamdin is the founder of bestagent.co.uk, the home moving website, and presents the Moving Home with Charlie broadcasts on YouTube. Charlie tells Lynda Clark about his interesting career, his love of planes and has some excellent advice for first time buyers

24 Singles are doing it for themselves!

A new survey from leading property portal Share to Buy has made the surprising revelation that the majority

of prospective shared ownership buyers are actually planning to purchase their new home alone. Debbie Clark looks at the findings

30 Rent Happy!

London Living Rent could be the answer to help you eventually take that step on the property ladder. We highlight what Network Homes has to offer.

34 Rent today, own tomorrow – London Living Rent with L&Q

London Living Rent could help you to save money each month to put towards your first home deposit.

CONTENTS 4 First Time Buyer April/May 2023 APRIL/MAY 2023 / ISSUE 100 / FIRSTTIMEBUYERMAG.CO.UK

24

CHARLIE LAMDIN, PAGE 20 20

75 Competition

Seven lucky winners will win a £50 bundle of Harris indoor and outdoor tools.

REGULARS

32 Hotspot

We look at Hainault as a place to live.

86 Finance

Kay Hill looks at the different insurances you might need when becoming a homeowner, to ensure you protect your home and finances.

88 Market

Leasehold versus freehold; what first time buyers need to know. Ginetta Vedrickas explores what is involved.

90 Agony Agent

All your property questions answered by our panel of experts.

93 Buyer’s Guide

Check out FTB’s Buyer’s Guide, which walks you through the property buying process.

76 First home, first meal

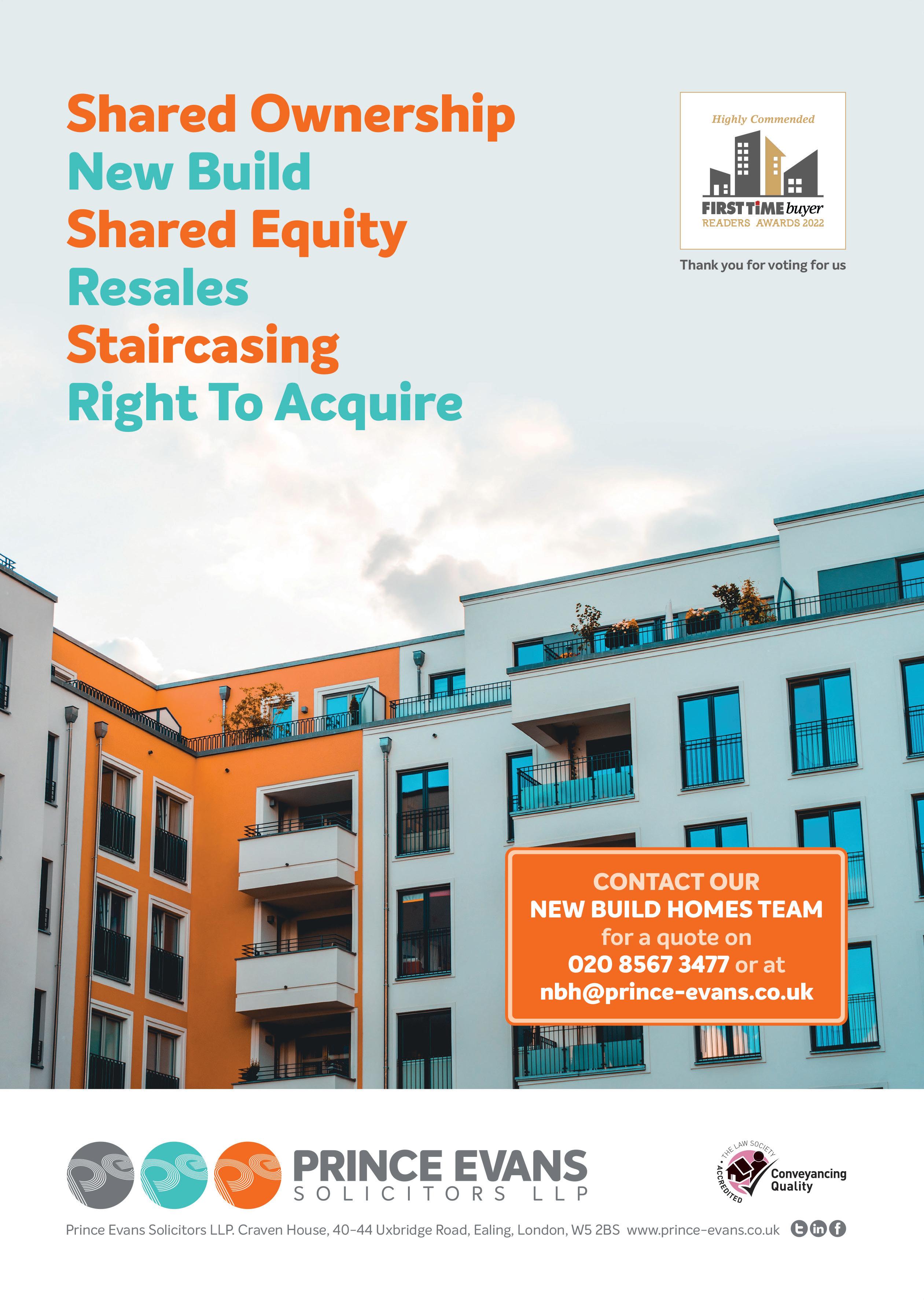

Celebrate Easter with these lovely mini striped no-bake cheesecakes from Lakeland.

82 Staircasing – is now the time to buy more shares?

Bill Dhariwal, Director and Solicitor, and Bernard Arhin, Staircasing and Resale Conveyancing Executive at Lawcomm Solicitors review the new rules on staircasing and whether now might be a good time for shared ownership property owners to consider buying additional shares in their property.

84 Lifetime ISA Special

Cecilia Mourain, Managing Director at Moneybox gives the lowdown on Lifetime ISAs

98 Shared ownership – the new & improved product

Coralie Phelan, Partner and Head of New Build Homes at Prince Evans Solicitors LLP, looks at what the changes to the shared ownership Lease in April 2021 means for first time buyers, and the advantages of the scheme.

100 Directory

Where and how to contact your Help to Buy Agents or providers.

106 20 Questions

We ask 20 quick-fire questions to Abi Culley, Operations Director at LSL Land & New Homes, The PX Hub and The SO Hub, who is in the spotlight this month.

CONTENTS First Time Buyer April/May 2023 5

Charlie Lamdin

VIEW AS MANY PROPERTIES AS YOU CAN AS IT’S THE ONLY WAY TO KNOW WHAT’S REALLY HAPPENING IN THE AREA YOU WANT TO LIVE

78

You’re a good egg!

FTB checks out the best Easter eggs for all the family.

Mailbox

ENERGY PERFORMANCE CERTIFICATE

I have seen the term EPC a lot in my hunt for my first home. What does this mean and is it important?

Issy Yorke

FTB says: EPC is an abbreviation for an Energy Performance Certificate and this gives your home a rating to show how energy efficient it is. When somebody is selling a property, they must make sure that the EPC is available for potential buyers to see. It is something you will want to make sure you look at, as it could influence your decision on buying a property as less energy-efficient homes are going to cost you more in the long term. An EPC also gives a list of recommended energy-saving home improvements tailored to a particular property to help boost its rating. Again, this is worth looking at as small changes could make a big impact.

This month’s star letter prize wins this versatile roasting tin from Lakeland worth over £25. Ideal to use for your special Easter lunch, it has an enamel finish and handy lid, which ensures that your tasty joint will stay succulent and your oven clean and sparkling! lakeland.co.uk

GREEN MORTGAGES

I am very keen to buy my first home and I have been looking into all the various mortgages that are available. What is a green mortgage and are they worth looking into?

Leila James

FTB says: A green mortgage is a new, profitable incentivebased mortgage that encourages homeowners to consider the environmental impact of their home. With the UK now making big moves towards its net zero goal, now could be a good time to benefit from such a scheme. To put it simply, a lender will

offer preferential rates to potential buyers who can prove that the property they are wanting to buy meets certain environmental standards. In the majority of cases, this will result in cheaper interest rates or cash back incentives to buy energy efficient properties. A lender could even increase the loan amount, which could be very beneficial. To be eligible, a property cannot have an EPC rating below an A or B. With not many people currently taking advantage of such schemes, now is definitely the time to get involved if the property you are looking at meets the criteria needed.

WRITE TO US!

Please send us your questions, comments and suggestions concerning property, or the articles in First Time Buyer magazine.

lynda@firsttimebuyermag.co.uk

RENT A ROOM SCHEME

I have just bought my first flat in London but I am worried that my mortgage payments are going to increase to a point where I’m going to struggle to afford them as I am on a variable rate. Is there anything I can do to gain more income through my own home?

Eloise Stewart

FTB says: A scheme that is becoming ever more popular is the Rent a Room Scheme that can generate some more money that can be put towards your mortgage payments. This is a Government initiative that lets you earn up to £7,500 per year tax free for letting out furnished accommodation within your own home. If you were to use the entire allowance, you could bring in an extra £625 a month. Obviously, the downside to this is that you will be sharing your home with someone else, but if you have a friend or perhaps a sibling that is in need of somewhere to live then this set-up could work very nicely to solve your mortgage money worries. Just keep in mind that you will need your mortgage lender’s permission in advance to do this.

BUYING WITH A PARTNER

My partner and I are looking at buying a property together. Could you outline the pros and cons of this so that we can see if this is the best decision for us.

Jessica Crossman

FTB says: It is common for couples to jump into buying a property together without talking about what the implications are if they were to break up. Putting two salaries together is an attractive idea as it means that you can borrow more money and look at more expensive properties. You really need to sit down and have a proper discussion about it though. If you can both afford

to put in 50-50 and you’re happy with that then everything is equal regardless of what happens. Commonly, though, this isn’t the case, with one party putting in more than the other. In this case, a “tenants in common” agreement is better suited as you can work out what proportion of the property you both own based on what you put in, so it is fair if anything happens down the line. A solicitor can draw up the documents.

VISIT OUR WEBSITE

For everything you need to know about buying for the first time, go to firsttimebuyermag.com

LETTERS First Time Buyer April/May 2023 7

WORLD

I have lost count of the headlines I have read about first time buyers struggling to buy their own home in recent months –and being priced out of the market. Anyone thinking about buying for the first time will undoubtedly be feeling the pressure – and maybe, not surprisingly, they might have even given up their dream of homeownership.

While it is true that the overheated market has been challenging –especially in terms of the availability of affordable mortgages – the reality is that now actually might be a good time for buyers. Let me explain…

Despite widely negative market depictions, I believe there are actually many opportunities available now for first time buyers eager to get on the property ladder. While the media portrayed a worrying and unstable property market following September’s mini-Budget, there are several emerging incentives which could provide aspiring home owners with some timely reassurance.

With drops in mortgage rates and average house prices, and an increase in incentives and schemes such as shared ownership, homebuying is still very much a feasible option for many1. Currently, average fixed mortgage rates are down to 5.6% from their August high, and lower rates are expected to remain relatively steady compared with the recent financial upheavals.

And why is buying still a good option? Well, one figure that continues to rise is the cost of rent. Zoopla reported that the average UK rent rose by 12.1% over the past year alone2. With an ongoing housing crisis within the rental market, flats are more expensive as well as harder to come by. Not a problem if you are managing to benefit from the hotel of mum and dad, but for those stuck in rental –this is not good news.

There is a range of products which can help you get on the ladder. The Lifetime ISA is an inflation busting account which can top up

your deposit by 25%. That’s the same bonus achieved by a Help to Buy ISA, however the Lifetime ISA can also be used for retirement savings. So, worry not if you missed the chance to open a Help to Buy ISA, there is still an opportunity to have your deposit topped up.

For those struggling to grow a reasonable deposit, shared ownership may allow you to take a first step on to the housing ladder and is a useful option if you can’t afford an entire deposit and mortgage repayments.

Even more good news for first time buyers, it seems the market has shifted away from favouring sellers in recent months. I’ve noticed the number of properties on the market growing, whereas demand has subsided, with price drops becoming more common giving prospective buyers the edge in many negotiations.

Even with these positive signs, I realise homebuying can still be a daunting concept. To combat some of the stress, I’d always suggest first time buyers make use of free, professional advice which will be available to them through the likes of mortgage lenders. So, rest assured, in an industry that has been painted almost as the first time buyer’s enemy, there are truthfully people there to help guide you through.

With all these emerging and longstanding incentives, which promise to

benefit the house buyer, it seems there is still hope even within a market plagued by worrying headlines and disbelievers. With the buyers’ market already experiencing some positive trends, 2023 could perhaps be the year to reinstate optimism among even more aspiring homeowners.

1propertyreporter.co.uk/five-things-to-give-aspiring-first-time-buyers-hope-rightnow.html

2thisismoney.co.uk/money/mortgageshome/article-11745083/Houseprices-2023-bring-down.html

OPINION First Time Buyer April/May 2023 9

TV and radio presenter and property expert Nicki Chapman gives her thoughts and views on first time buyers and the housing market

Hop into spring! The Easter bunny is on his way! If you are looking for the perfect Easter treat, decoration, gift or craft, then here at FTB we have a few ideas

Yes, you candy!

Personalised smash cup, £19.99, gettingpersonal.co.uk

The perfect alternative to an Easter egg or birthday cake! Nothing satis es a sweet tooth in the same way as this pink strawberry smash cup!

Ears to a great Easter

National Trust milk chocolate bunny shapes, £4.75, shop.nationaltrust.org.uk

A perfect sweet treat for all the family to enjoy.

Let’s get ready to crumble

Don’t worry, be hoppy Easter rabbit wreath, £8, hobbycraft.co.uk

Easter egg hunt tin, £48, biscuiteers.com

Gift this sweet display of Easter biscuits that comes with a fabulous tin which can be kept and used for years to come.

Brighten up your seasonal style with this Easter rabbit wreath. Created in the shape of a bunny, the pretty wreath features stunning oral details, with colourful egg ourishes.

FTB LOVES 10 First Time Buyer April/May 2023

Easter craft eggspert!

Easter bumper craft jar, £6, hobbycraft.co.uk

Create unique Easter bonnets, egg hunt decorations and seasonal cards with the contents of this fantastic box of crafts!

Ear-resistible

Bunny mug, £4.99, tkmaxx.co.uk

Chick me out!

Chick mug, £7, johnlewis.com

Enjoy a nice warm cup of tea or hot chocolate in these seasonal themed mugs!

FTB LOVES First Time Buyer April/May 2023 11

SIMPLY SPRING

As we begin to look forward to spending as much time outdoors as we do in our homes, add a touch of spring and summer vibes to your space this season. Enjoy those longer evenings and the warmer sunny afternoons with florals, pastels, and the thoughts of the impending summer… we can’t wait!

Homepage LIVING 12 First Time Buyer April/May 2023

Green vase, £12; jug, £6; crochet throw, £12; Riverside glass vase, £10; woven wood basket £15; woven seagrass mirror, £30; cottage print throw,£20; leaf cushion,£8; green cord cushion, £7; reactive glaze battery light, £9; green check throw £20; embroidered cushion, £10, George Home

, ,

Sheep cushion, £12.50, Matalan

Bundle of faux owers, £19.99, Homesense

Pastel mugs, £16, Next

Candle holder, £5.99, TK Maxx

Carrot napkin rings, set of 4, £12, John Lewis & Partners

Bee wall art, set of 3, £14, George Home

Candle holder, £4.99, Homesense

Female

Raf a placemats, pack of 2,

» George Home direct.asda.com » Habitat habitat.co.uk » Homesense homesense.com

» John Lewis & Partners johnlewis.com » Matalan matalan.co.uk

» Next next.co.uk » Primark primark.com » Talking Tables talkingtables.co.uk

» TK Maxx tkmaxx.com » Wilko wilko.com

Bedding

Homepage LIVING First Time Buyer April/May 2023 13

Cake stand, £10, Wilko

Bee cushion, £9, George Home

Rose cushion, £14.99, TK Maxx

Bobble vase, £26, Next

form ornamental vase, £9; round ornamental vase, £3; tin candle, £2, Primark

set, from £10; velvet cushion, £7, Primark

£21, Talking Tables

Bee wine glass, set of 4, £12, George Home

Cushion, £16, Habitat

At home with: Beth Otway

FTB: Tell us about your first step on the property ladder?

BO: My first property was a two bedroom, semi-detached cottage in Godalming in Surrey. I devoted a lot of love and energy to this property and created a beautiful secret garden. I had hoped to live there for a long time, but we ended up moving on after just two years. Some years later we were considering moving back to Godalming; the first house that popped up on Rightmove was our first home, which over the years had risen out of our price range.

FTB: How did you get into gardening?

BO: I’ve always been a gardener and I’ve always been fascinated by plants. As a child I spent all my time in the garden studying plants, flowers and butterflies, sowing seeds and taking cuttings. I love helping people and sharing my knowledge. When I was younger I would give my friends, neighbours and acquaintances advice on how to help their plants and so often they would ask me to write it down for them.

Beth Otway is a horticulturist and garden writer with a passionate interest in plant conservation, and holds the National Collection of Miniature Phalaenopsis Species and the National Collection of Miniature Aerangis and Angraecum Species. She has a passion for houseplants; her Surrey home is jam-packed full of plants! Beth talks to Lynda Clark about her first home, her love of allotments, favourite gardening tools and admiration for Martin Lewis

Photos © pumpkinbeth.com

I used to organise and write all the press releases for Godalming in Bloom. A couple of the local publications that received my press releases asked me if I would write a regular column for them. I’ve been a freelance garden writer for over 10 years and I’ve been writing my gardening blog, pumpkinbeth.com for nine years.

FTB: What advice do you have for first time buyers?

BO: Location really is key. A bathroom or kitchen can be impressive and captivating, but something similar can be recreated in every home, on every street. Eventually

kitchens and bathrooms become dilapidated and need replacing – whereas the view from the lounge window and the beauty of the local countryside, or the distance from the train station and journey time to a particular town or city is unique to the dwelling and is more important to evaluate and consider when buying a property.

None of us knows what the future holds, so one of life’s true luxuries is an emergency fund. This is something I’d recommend first time buyers save for. Ideally an emergency fund will cover six months’ worth of mortgage payments, bills, and essential expenditure.

Homepage LIVING 14 First Time Buyer April/May 2023

“NONE OF US KNOWS WHAT THE FUTURE HOLDS, SO ONE OF LIFE’S TRUE LUXURIES IS AN EMERGENCY FUND. THIS IS SOMETHING I’D RECOMMEND FIRST TIME BUYERS SAVE FOR”

I have hundreds of ideas of how to save money in the garden, but for ideas on reducing household expenditure I take my inspiration from Money Saving Expert, Martin Lewis – who shares fantastic ideas and offers for saving money on all aspects of life, from tips for making smart purchases to reducing household bills and travel costs.

Moving home is an expensive, time consuming and stressful activity; it’s not something I would rush into doing again! Try to visualise different scenarios (positive and negative) for your future and consider the options and limitations that any potential home could offer when your circumstances change.

For me, the one incentive to moving home is the thought of all the different houseplants and garden plants I could grow! I love trialling plants and discovering the best houseplants for shaded conditions as well as for bright, sunny rooms. The option of a new houseplant or orchid trial is a tempting prospect!

FTB: If you are a keen gardener but you can’t afford a home with outside space, is there anything you can do?

BO: There are plus sides and drawbacks to everything in life and however big or small your budget, no property is perfect. If you want a garden but you can’t afford

to purchase a house or flat with a garden, consider purchasing a property near an allotment site or a local community garden. Having said that, in some areas there are waiting lists for allotments – so add your name to the list as soon as your offer is accepted. Another way to speed up your allotment application is to offer to take on a full or half-sized plot or volunteer to help an existing plot holder with their allotment.

Getting an allotment is a great thing to do! If you’re thinking of joining a gym, why not consider taking on an allotment instead? You could grow your own healthy food while taking exercise, making new friends, and socialising! I have so many happy memories of times spent at the various allotments I’ve tended in Scotland and Surrey. I’ve made some superb friends at my allotments and cultivated a vast range of edible plants and cut flowers. I’d recommend allotments to everyone; they can be life-enriching spaces!

Our lives are busy. Work and household tasks drain a lot of our time and energy. Naturally it’s easy to put off doing things. When you haven’t visited your allotment for a couple of weeks or more it can be quite a shock to see how much the weeds have grown. When you recall how hard you worked at your previous visit, seeing the plot look the same or worse than when you started can be very demoralising. Try to avoid this by aiming to visit your allotment at least once a week and ideally more often.

Some allotment holders prefer to have set days of the week to visit their allotment –perhaps one or more evenings after work in the spring and summer months, as well as a Saturday or Sunday.

When taking on an over-grown allotment, you might choose to spend your first visit clearing anything the previous custodian left on site. Then start at one side of the plot and begin clearing any plants you don’t want. Before you leave, sow at least one row of seeds, if you can. The types of seeds you can sow will vary depending on the time of year, as well as how sunny the site is, and what the soil is like.

At your next visit, start right at the beginning – at the area you weeded and cleared. Use a hoe to skim over the soil on your weed-free patch, taking care to keep your distance as you hoe around rows of seeds or seedlings. A hoe is my favourite tool. Hoeing the ground each week will help prevent weeds germinating. Next, water your seedlings if necessary and continue clearing. Before you leave, sow a row or two of seeds if you can. Repeat the cycle of maintaining your weed-free area at each allotment visit before you make a start on clearing new ground and remember to sow seeds before you leave.

For ideas of which seeds you could sow this month and tips on growing a wide range of orchids and houseplants, visit Beth’s website pumpkinbeth.com

Homepage LIVING First Time Buyer April/May 2023 15

“IF YOU WANT A GARDEN BUT YOU CAN’T AFFORD TO PURCHASE A HOUSE OR FLAT WITH A GARDEN, CONSIDER PURCHASING A PROPERTY NEAR AN ALLOTMENT SITE OR A LOCAL COMMUNITY GARDEN”

The HOUSE HUNTER

This month FTB goes on the hunt with Casper Willis and Allesandra Dellano, who are looking for a one or two bedroom home in south east London or Kent

What we found…

THE LONDON HOTSPOT THE LAID-BACK LIFE Sydenham Groves Sydenham, south east London

Southmere Thamesmead, south east London

Maximum budget £280,000

Requirements A one or two bedroom home in Kent or south east London – near the Kent borders. Good travel links, outdoor space and parking would be ideal

What they wanted…

Casper and I want to buy our rst home together after several years of renting in a shared house. We live in Bromley at the moment, which borders London and Kent. We’re interested in nding something within the area that’s more local to us but would be happy to move further into Kent, too. We’re both from Sevenoaks originally so have many connections in that area and in south east London. We need at least one bedroom, though two bedrooms would be a huge bonus, along with some outdoor space, such as a balcony or shared gardens. It’s really important that we can travel easily by train into central London. Casper and I both work from home, but he is often travelling to client meetings, so it would be great to have good transport links for that. We have a budget of around £280,000.

This new collection of one and two bedroom apartments has proven hugely popular since its release last year. With the high street and a choice of three rail and Overground stations within walking distance, this is a great spot for enjoying the local area and easily getting around and into central London. The properties are thoughtfully designed, with bright open-plan living areas that lead to outdoor space. There is on-site parking as well as playing space for families. A great opportunity to buy in an increasingly popular part of London.

peabodysales.co.uk

Residents will get a taste of laidback life at Southmere, which is alongside a lake. With a range of on-site amenities and good commuting links, everything you could need is on the doorstep. The site will eventually be home to more than 500 properties, including one, two and three bedroom shared ownership apartments. Inside, the properties have been thoughtfully designed, with open-plan living areas that open to generously sized balconies and terraces. Nearby Abbey Wood will soon bene t from Crossrail services.

peabodysales.co.uk

What they thought…

Sydenham is quite close to where we live now and we know it well. It’s a good area with lots to do nearby − we love the cafes and pubs in Forest Hill and Crystal Palace. The apartments look beautiful with tasteful styling, good layouts and lots of space. We particularly love how the development is set in a quiet cul-de-sac, but is also so close to the high street. I think you’d get a good balance here of quiet retreat combined with plenty of life, which is just perfect when you’re working from home a lot.”

What a stunning location this is − with some really great facilities on site, too! We love the idea of having new shops and restaurants nearby, and a brand new gym would be a welcome neighbour! The homes here are stylish and well designed, with plenty of natural light which is great for home working. It’s well positioned in terms of getting to work and family, and the whole area near Abbey Wood is being regenerated, so we’re really looking forward to seeing what happens here.”

16 First Time Buyer April/May 2023 Homepage FIRST RUNG

Name Casper Willis, 32, and Allesandra Dellano, 32 Occupation Account manager, graphic designer

PROFILE

*Based on a 30% share of the full market value of £457,500

*Based on a 30% share of the full market value of £405,000

FROM £137,250* FROM £121,500*

THE WATERSIDE VISTAS THE BEST-OF-BOTH

Rochester Riverside Rochester, Kent

Ashmere Ebbs eet, Kent

First choice!

FROM

THE PERFECT BLEND

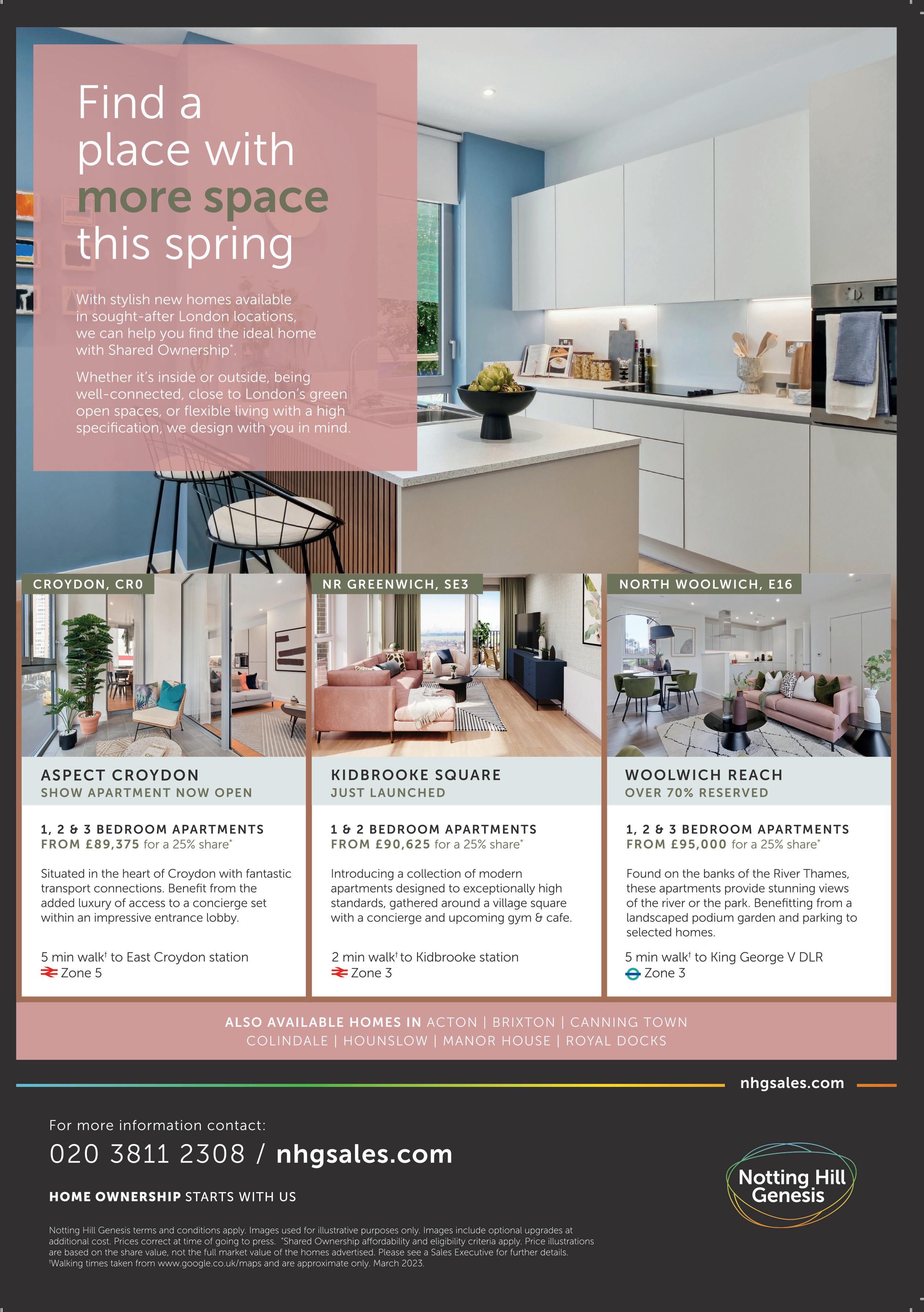

Kidbrooke Square Kidbrooke, south east London

FROM

Residents at this landmark development in Kent enjoy riverside and castle views, great commuter links and a range of stylish properties to choose from. The site, which will eventually comprise 1,400 new homes, will also include a 2.5km river walkway and 10 acres of open space, including play areas and landscaping. Homes will range from apartments to two, three, four and ve bedroom family houses, with open-plan living spaces, optimal natural light and private outdoor spaces. Trains into London St Pancras take just 37 minutes.

countrysideproperties.com

Casper and I have always loved riverside walks, runs and cycles, so this looks like an excellent spot for that. The properties themselves are super stylish and really appeal to us, too. In terms of getting around, the train links are great for Casper getting to meetings − and Rochester is in quite a good spot for seeing all of our families, too, as well as exploring Kent and beyond. Getting to know the area, the local sites and lovely surroundings would be a perfect way to spend the weekends here.”

With speedy travel into London and green surroundings, Ashmere offers a best-of-both worlds lifestyle. Properties range from one and two bedroom apartments to three and four bedroom family homes. Located 1.5 miles from Ebbs eet International station, trains to London St Pancras take as little as 17 minutes. Green spaces, walking and cycling routes are on the doorstep, with stunning countryside nearby. Local facilities are plentiful, with Bluewater shopping centre, eating out and entertainment, good schools and outdoor pursuits within a short drive.

countrysidepartnerships.com

This really does look like a fantastic place to live. With so many new homes in the area I think there would be a strong community feel, which is something we’re really keen to nd. As we’re always happy to be outside, we love that there’s an urban park within the development and that so much care has been taken to provide so much for residents on site. The links to London are excellent, while getting to Sevenoaks to see friends and family would only take around 20 minutes in the car.”

These new homes are positioned opposite Kidbrooke Village − an area that has bene ted from a great deal of regeneration and features brand new shops, local amenities and an award-winning park. The studio, one and two bedroom homes here are sleek and contemporary, with thoughtfully designed living spaces − which lead to private outside spaces − along with stylish, neutral decor. Upmarket Blackheath and world-famous Greenwich are comfortably close, while Kidbrooke railway station is seconds from the front door, for trains to London Bridge in just 15 minutes.

nhg.org.uk

THE NEXT STEP

“Kidbrooke Square seems like the right choice for us and we’d like to get the process of reserving and buying a home moving as quickly as possible. We have spoken to the shared ownership team and hope to have a mortgage offer sorted very soon.”

This is a really great location for us − close to some of our all-time favourite places, including Greenwich Park and Blackheath village. It’s the perfect balance of London and Kent for us as the Kent countryside is right on the doorstep and the city centre is so easy to reach. It’s great that the homes are so close to Kidbrooke station as it just makes getting around so easy. And, of course, the properties are lovely − just our style. We really like the sleek kitchens, with great open-plan living areas, plus there’s loads of light. Cator Park is right on the doorstep and would be perfect for enjoying the sun come the summer time.”

Homepage FIRST RUNG First Time Buyer April/May 2023 17

*Based on a 25% share of the full market value of £382,500

FROM £247,500

£295,000

£95,625*

Michelle Chidgey is Head of Sales and Marketing at OX Place, the wholly owned development company of Oxford City Council Michelle has over 24 years’ experience within the affordable housing sector, predominantly at senior management level, leading Sales and Development teams for: The Guinness Partnership, Hastoe Housing Association, First Wessex (now Vivid) and A2 Dominion. Michelle has worked on the provision of housing both nationally and regionally within urban and more rural parts of the country. Now, she is concentrating on meeting the need for affordable housing in Oxford

QI’m a recently graduated nurse, living with my partner outside of Oxford. I’d prefer to be nearer to the city, but prices are exceptionally high, even to rent. We’d love to buy somewhere but imagine that this could mean an even longer commute. What advice would you give to someone trying to get on the property ladder in such an expensive city?

AIn 2016, Oxford City Council established OX Place as its own housing company to create high-quality, genuinely affordable homes in the city. At OX Place, we’re responsible for building the homes local people need. Our profits are re-invested back into the city, to provide essential services for local people, and into building more homes for people who need them. As well as building homes to rent via Oxford City Council, we build homes you can buy outright, as well as homes you can buy a percentage of, known as shared ownership.

We also build council-owned rented homes for those who need a safe, high-quality, affordable rental home in the city. We provide affordable homes for the people of Oxford which include key workers, such as nurses, doctors, university researchers and local school teachers. In short, we build high-quality, beautiful and sustainable homes that people in Oxford can actually afford to own and rent.

I would like to say that I was over the moon to be invited to join OX Place, as it’s an exciting time for Local Authorities (and in particular OCC) that are growing their expertise in the delivery of a more diverse range of affordable living options and helping people like yourself.

I am especially keen to promote the benefits of shared ownership, which could well be the best option for you. Shared ownership is when you buy a percentage of the home and rent the rest. This enables you to get on the property ladder with an initial percentage share (of the

outright purchase price) which is currently from as little as 25% and with just a 5% deposit on your share. The remaining share is owned by Oxford City Council, with rent payable on the share the council owns. The reality is you could be purchasing your share of say a £300,000 home from as little as £75,000 (subject to a mortgage assessment) with a deposit of only £3,750. You can buy more shares at any time (called staircasing) through to outright ownership in most cases. From my experience

FROM £98,750* (SHARED OWNERSHIP) £535,000 (PRIVATE SALE)

Standing proudly in the heart of Oxford’s historic city centre, Bridges Cross is a brand new development of contemporary apartments providing a unique opportunity to call this sought-after location home. Bridges Cross hosts 10 private sale two and three bedroom apartments starting from £535,000. There are also eight one bedroom apartments available to buy through shared ownership with a 25% share from £98,750.

it is an aspirational product that performs really well in high-value areas such as Oxford. My first projects with OX Place have all been oversubscribed and have responded to Oxfordbased residents from different backgrounds who wouldn’t otherwise have been able to buy a home of their own in the city.

We’re looking forward to selling more shared ownership homes on a future programme of schemes across the city in areas such as Littlemore, Iffley, Cowley and Marston.

Bene ting from views of Oxford’s world-renowned architecture, alongside high street shopping and wider connections, Bridges Cross is the perfect city-centre location to call home.

From a bird’s eye view, Bridges Cross sits equidistant between Botley Bridge and Magdalen Bridge in Oxford, a few minutes’ walk from the very centre of the city, bene ting from the huge range of culture, connections and shopping Oxford has to offer.

For further information or to arrange a viewing please contact the Breckon & Breckon New Homes Team on 01865 261 222 or email newhomes@breckon.co.uk

*Based on a 25% share with a full market value of £395,000

April/May 2023

Oxford, Bridges Cross

Michelle Chidgey, Head of Sales & Marketing, Ox Place

FLYING HIGH!

Charlie Lamdin is the founder of home moving website bestagent.co.uk and also presents the Moving Home with Charlie broadcasts on YouTube. His fascinating life has certainly had its ups and downs as he explains to Lynda Clark. He tells her about his interesting career, his love of planes and has some very good advice for first time buyers

THE VIEW

20 First Time Buyer April/May 2023

Photos: Belinda Lawley

THE VIEW First Time Buyer April/May 2023 21

"I AM PASSIONATE ABOUT TRYING TO END HOMELESSNESS AND I AM WORKING WITH LOCAL COUNCILS TO TRY TO HELP THIS TERRIBLE SITUATION"

"ALWAYS TRY TO HAVE A MORTGAGE IN PRINCIPLE READY WHEN YOU MAKE AN OFFER ON A HOME AS IT IS FAR MORE LIKELY THAT THE OFFER WILL BE ACCEPTED BECAUSE YOU ARE READY TO GO"

"THE THRILL OF FLYING A SEAPLANE IN PLACES LIKE THE FJORDS IN NORWAY, ALASKA AND MAINE AND NOT EVEN KNOWING WHERE YOU’RE GOING TO LAND IN THE WILDERNESS IS INCREDIBLE. IT’S A PROPER ADVENTURE"

THE VIEW 22 First Time Buyer April/May 2023

Over the years I have done some fascinating interviews with all sorts of people. But, when I went on to Zoom to interview Charlie, I was totally surprised! He was standing in an airfield by one of his planes looking totally relaxed and very much at home – this must have been one of the strangest but most exciting interviews I have ever done!

Charlie’s birth father was a world-famous Portuguese concert pianist and when Charlie was very young his mother and father divorced. His father went to Brazil in 1980 and has never been seen again. When he was five his mother remarried. “I had a charmed childhood and lived in Sussex in an old farmhouse with the extended family and I had a very happy time. When I was just eight years old I was sent to boarding school, which wasn’t the best but I made some incredible lifelong friends there. I then went to Charterhouse but I was very badly bullied and that time was not a happy one for me. I then went to Stowe and was eventually expelled despite even worse bullying and did my A-levels at a tutorial college in Brighton. That was great fun and Adele’s ex-husband, Simon Konecki, was a close friend back then.

“My first job was working for a notorious kitchen company. I went on an intensive sales course and was paid commission only. The first kitchen I sold was to a single mum for £10,000. She couldn’t afford it, but I got £600 commission. It made me feel very guilty and uneasy about the whole way the company operated, so I quit.”

At just 19 he was ready to face the bigger world of employment and he got a job as an insurance broker in the city. After a year, he was invited to spend two months in the Caribbean with his girlfriend and decided to leave.

When he got back, through one of his stepfather's contacts, he then started another job as a Junior Broker with one of the largest brokers on LIFFE (London International Financial Futures Exchange). “It was absolutely crazy, there were 2,000 people in one room, shouting at each other and talking on the phones doing deals. It was bedlam. It was a totally male-dominated society with very few women and those women that worked there had a very tough time. Again, I was physically and mentally bullied – I had my drinks spiked and was screamed at and demoralised by some of the other traders – it was really awful. Eventually one of the directors publicly accused me of something I didn’t do. Because I publicly defended myself he didn’t like it, and fired me. But I got six months' pay and it was a huge relief!”

At this time, many of his school friends had finished university and were planning on spending the summer partying and having fun before they settled into work. “I knew they would be having the best summer so I decided to join them and after my last terrible working

experience I knew I could never work for anyone ever again as I am just not the type of person to sit in an office all day.”

For the next five years Charlie ran a mobile car washing company from the back of his Land Rover in Sussex. “It was very, very hard work as we were open seven days a week and washing cars is a very physical job –believe me! I got the contract for valeting VW dealerships and also had a hand car wash in Crawley. I had 16 people working for me with so many different characters including exconvicts. We had some really good customers but there were gangsters trying to muscle in on the business so I had to watch my back. I learned a lot about the real world.”

It was then that Charlie inherited £25,000 from his grandfather and decided to buy his first property. “I kept £1,500 back for conveyancing fees which left me with £23,500. I saw a flat which was on the market for £35,000 and I decided to make an offer, telling the estate agent that was all I had, and amazingly it was accepted. I did quite a lot of work on it and rented it out. It was unbelievable that the tenant who I rented it to bought it a year later for £55,000 so I made a decent profit. I then bought again in Hastings and did exactly the same thing and again the tenant bought it – incredible. Sadly, I got meningitis and it took me a very long time to recover and I had to leave the car washing business.”

In 1998, he started Datography with a techie entrepreneur partner. They invented the first one-stop virtual tour, professional photography and floor plan service to estate agents in both London and Sydney, Australia. Foxtons, then privately owned, copied the idea and Charlie sued them for copyright infringement and won an out-of-court settlement. The company grew and they gained 16 investors but sadly he ended up falling out with his investors and partners and Charlie ending up losing his job, his shares and the company imploded.

Never to be beaten, in 2003 he started up a new competitor, BPM, with an old friend. They grew even faster, reaching 120 staff in three countries. “We were open 24 hours a day and could turn the photos and floorplans around in super-quick time. But my former partners first tried to bury me in litigation and when they failed they asked me to merge my new business with Datograpy. I absolutely refused as I didn’t want a repeat of what had happened before.”

Sadly, the financial crisis of 2008 finished BPM off and he started his third tech start-up. “I offered an amazing service and had clients all over the country. I had access to data which gave me an insight on how residential sales and lettings were going which was invaluable to any estate agent.”

Always up for a new venture, Charlie was also the drummer for Lloyd Grossman’s

punk band, The New Forbidden. He married singer/songwriter Liz Cass in 2006, which ended in an amicable divorce two years later. But he then found a new passion, flying light aircraft. “I absolutely love planes and I got my private pilot's licence in 2010 and then in 2014 I got a seaplane rating too. There is nothing quite like it and I am totally hooked on flying. The thrill of flying a seaplane in places like the fjords in Norway, Alaska and Maine and not even knowing where you’re going to land in the wilderness is incredible. It’s a proper adventure.

"I have three children with my partner Annemarie, who are seven, six and seven months old and they are home schooled. My dream is to fly my family around the world in a seaplane. The older two are ahead in reading and maths and we encourage positive, challenging play. We are basing it on the Finnish system of parenting and it’s working very well.”

In 2016 Charlie started his own software development company in Lisbon, Portugal, where he also has family. BestAgent, a national property website, is now fully operational and connects movers and agents in a new way. “I have been in the business for a long time and with all my knowledge I want to make the experience of buying and selling property the best it can be for everyone. I have started three YouTube channels. Charlie Lamdin’s Vlog is a personal diary channel which documents my family and flying adventures, BestAgent is a property industry channel for estate agents and finally there is Moving Home with Charlie where I share my insights and knowledge with homemovers. It gets over 200,000 views a month and I have 25,000 followers on TikTok.”

Charlie has some excellent advice for first time buyers. “Firstly, view as many properties as you can as it’s the only way to know what’s really happening in the area you want to live. Always try to have a Mortgage in Principle ready when you make an offer on a home as it is far more likely that the offer will be accepted because you are ready to go. Do not overpay for a home even though you think you can afford it. If you go way beyond your initial budget it often leads to you being in negative equity. Finally, be nice to estate agents – by being reasonable and respectful to them you will find that they will treat you in the same way and they will give you priority if a suitable home comes on the market.”

“My goal is that everyone should have a home of their own. I am passionate about trying to end homelessness and I am working with local councils to try to help this terrible situation. I am on a mission and once I get started on something I just won’t stop.”

bestagent.co.uk

mhwc.co.uk

youtube.com/movinghomewithcharlie

THE VIEW First Time Buyer April/May 2023 23

SINGLES ARE DOING IT FOR THEMSELVES!

Single

and hoping to get a foot on the

property ladder

In the survey of over 2,600 users on sharetobuy.com, 57% of respondents confirmed that they are looking to buy a property solo. Buying without the support of a partner, friend or family member bucks the UK trend; national statistics suggest that couples – both with and without dependent children – were the most common household type among homeowners in 2022, making up 59% of all mortgagors.

So why this significant difference? The upfront costs – 77% of respondents to the survey said they did not think they could currently afford to buy a property on the open market without the help of alternative homeownership schemes. Given that the average deposit for a single person on the open market is now £74,402, this is hardly a surprise. In stark contrast, the average deposit for a one bedroom London apartment on the Share to Buy portal is currently sitting at just £8,652.

In the current financial climate, this additional support is more important than ever for many prospective buyers – 71% of hopeful shared ownership buyers say the cost-of-living crisis has reduced the amount of money they are able to save for a deposit each month.

Nick Lieb, Head of Operations at Share to Buy, comments, “It’s no secret that this is a difficult time for those looking to buy a home, with interest rates skyrocketing, and the cost-of-living crisis impacting how much money people can realistically save each month.

“The results of our survey are clear –affordable homeownership options, such as shared ownership, are now completely critical, allowing thousands of first time buyers to purchase a property in a climate where they otherwise wouldn’t have been able to. It is unmistakable that demand is still strong – 60% of our surveyed users plan to buy in 2023, and with the help of shared ownership they aren’t as restricted by sky high deposits and ever-changing mortgage rates. The fact that the majority of hopeful shared ownership buyers are purchasing on their own is testament to how significant the support of this scheme really is.”

While the property market continues to face economic uncertainty, first time buyers remain unwavering in their goal of securing their own home. Taking increasing interest rates in their stride, they are undeterred and looking at how to overcome any financial obstacles faced. Since 76% of

survey respondents confirmed they have not received any money from parents or family members to put towards their deposit, it is crucial that financial support is available from an outside source.

As a Government-backed scheme, shared ownership enables buyers to purchase a share in a home, paying a mortgage on the part they own and a subsided rent on the rest. As the buyer only needs a mortgage on the share that they are purchasing, the amount of money required for a deposit is often substantially lower when compared to buying a private sale home. This allows hopeful homeowners to take a step on to the property ladder at a much more realistic price.

If you’re planning on buying a property alone, do your research; make sure you know what support is available. Share to Buy is the UK’s leading independent website for first time buyers, and a great place to start. The site lists over 12,000 homes available through alternative housing schemes every year, as well as providing a wealth of independent information and how-to guides for budding buyers. Owning a property in 2023 may be more realistic than you realise, and even save you money each month, long term.

THE POWER OF ONE 24 First Time Buyer April/May 2023

this year? Shared ownership may be your answer. A new survey from leading property portal Share to Buy has made the surprising revelation that the majority of prospective shared ownership buyers are actually planning to purchase their new home alone. Debbie Clark looks at the findings

FOREST GATE Earlham Square

Two and three bedroom apartments are available on this established leafy road in Forest Gate. All homes offer Zanussi integrated fridgefreezer, dishwasher, hob and oven, as well as a freestanding washer-dryer. The development is designed to be people focused, with close attention paid to the quality of outside space as well as the interiors; all apartments have their own private balcony or terrace, and landscaped courtyards interlink the buildings. Earlham Square is conveniently located just minutes from a range of local amenities, including Forest Gate station –offering fast, frequent rail connections to the city and surrounding counties.

newhomes.gatewayhousing.org.uk/developments/earlham-square 020 3376 6455

NORWICH Broadland Fields

Legal & General Affordable Homes is offering newly built, energy-ef cient, two-storey three and four bedroom homes at Broadland Fields on the edge of Norwich. All homes include modern, open-plan living areas, full of natural light.

Kitchens are streamlined and well equipped, with integrated appliances and ample workspace. Finished to a high speci cation, every home also has space for a home of ce, and includes two parking bays and a garden.

landgah.com/scheme/broadland- elds 01603 385 340

HARROW Harrow and Wealdstone Heights

FROM £152,500* FROM £112,000* FROM £81,250*

Located in the heart of Harrow, Origin housing is offering a brand new collection of 81 contemporary one and two bedroom apartments. Every apartment at Harrow and Wealdstone Heights has access to a private balcony, with a further communal roof terrace offering a view of London’s skyline. Impressive eco-credentials for the development include a ground source heat pump and solar panels used to power communal lighting. A central public realm will accompany the new homes; residents will have access to landscaped green spaces including new play areas and mature planting. Perfect for commuters, the development is located just a few minutes’ walk from Harrow & Wealdstone station. Residents will bene t from easy connections into central London, with journeys to Euston taking just 12 minutes.

originhousingsales.co.uk/harrow-wealdstone-heights 0300 323 0325

Sarah, 46, has recently purchased a 35% share of a two bedroom semi-detached house at The Arbour in Beaulieu, Chelmsford, through L&Q. After a turbulent period of renting privately in Chelmsford, with partner Darren and her 13-year-old son Harry, she is nally settled.

Sarah explains, “I’ve always privately rented, and I think once you’re on the ‘renting boat’ it’s really hard to get off it. I never thought I’d be able to afford to buy a house, so renting always felt like the only option. I used to look at friends my age who had their own place and felt like they were all sorted, and we weren’t in the same position.

“Unfortunately, over the years we’ve had a few landlords kick us out – either they were selling the place or wanted the property back for whatever reason. In every new place we lived in I was always expecting a call saying, ‘you need to leave’. It was really horrible and unsettling.”

Sarah had heard of shared ownership but assumed she wouldn’t qualify. In fact, she was so sceptical that it was actually her sister who phoned L&Q initially. She recalls, “It was like some sort of miracle unfolding. I kept thinking we wouldn’t be eligible, but we progressed through each stage of the application and all of our nancials were approved – I couldn’t believe it. At Easter, all three of us went to view the show home, and it was incredible. The property was brand new, the rooms were so large, and the location was perfect. We put an offer in straight away.”

The timelines were tight between the family’s rental contract ending and the house being ready to move in to but, Sarah says, the team at L&Q did absolutely everything they could to make sure the house was ready. It’s safe to say the family are happier now than they ever have been. “I cannot nd a fault,” says Sarah. “The house is so lovely, and the area is amazing. It feels incredibly safe here – there are loads of footpaths and cycle paths, so Harry can now cycle to school in the morning, and I’m not concerned about it at all.”

Most importantly, Sarah knows she will be at The Arbour long-term – no longer needing to move house every few years. She concludes, “The luxury of shared ownership is that no one can ask us to leave any more. I’ve been on the edge for years expecting that call, but now I nally feel settled knowing that this house is mine. I feel so much more positive these days.”

THE POWER OF ONE First Time Buyer April/May 2023 25 CASE STUDY

*Based on a 25% share of the full market value of £610,000

*Based on a 40% share of the full market value of £280,000

*Based on a 25% share of the full market value of £325,000

ABBEY WOOD Southmere

FROM £121,500*

Southmere is one of the rst milestones in Peabody’s ambitious regeneration of Thamesmead, a project delivering over 500 homes as well a public square, a library, tness studio, cafe and other commercial and community spaces to follow.

Overlooking the iconic Southmere Lake, the development is conveniently located just a 10-minute walk from Abbey Wood station. Residents bene t from more than double the amount of green space per person than the London average and direct access to the podium garden.

peabodysales.co.uk/developments/southmere

020 3369 2170

CHELMSFORD

The Arbour

FROM £78,750*

L&Q is launching an exclusive collection of one and two bedroom shared ownership apartments at The Arbour, forming part of the award-winning Beaulieu neighbourhood.

The apartments have been designed to minimise energy consumption and are available in three different speci cations: Classic Contemporary, Timeless Warmth and Cool Style. Kitchens come with integrated appliances including an oven, hob, fridge-freezer, dishwasher and washing machine.

Nestled within the 176 acres of green public space that make up Beaulieu, The Arbour is ideally situated for those who enjoy exploring the outdoors. A seven-minute drive away is the bustling hub of Chelmsford with a vast array of cafes, restaurants and bars, plus a good selection of independent and high street shops including John Lewis.

A short walk away is Beaulieu Square, offering a number of essential shops and facilities on the doorstep, such as a day nursery, Sainsbury's Local and takeaway options.

The Arbour enjoy easy links by train, with Chelmsford station offering journeys of less than 30 minutes into central London. Beaulieu railway station is set to open in 2026, which will create further transport links across the east of England.

lqhomes.com/beaulieuarbour

WIMBLEDON

The Switch

FROM £133,750*

The Switch is a collection of 181 one to three bedroom apartments, with a selection of two bedroom apartments remaining. All residents have access to communal podium gardens, and most also enjoy private outdoor space. Homes are built to a high speci cation with premium ttings and nishes throughout. With acres of green space to enjoy on the doorstep, including Wimbledon Park and Wandle Meadow Nature Park, and a 20-minute walk to Tooting Bec Food Market for an array of gourmet street food, the location is ideal for those keen to explore their local area.

catalyst.homes/development/the-switch

020 8131 9746

020 3369 2170

NHS Business Manager Kanwal, 46, has just bought a 40% share of her one bedroom shared ownership home through L&Q. Having spent a decade renting in east London, she decided it was time to get on to the property ladder, but it wasn’t as easy as she had expected.

Kanwal explains, “When I rst began my search about a year ago, looking in places like Aldgate East and Hackney, I was dismayed to discover that most properties were out of reach on my single income, or really weren’t very nice! It was disheartening to think that, even after 10 years of renting and saving for a deposit, buying in London might not be a realistic goal for me.”

Kanwal, a baking blogger and founder of the website and Instagram page @incredible.kitchen, recalls, “All the properties I initially viewed did not t my criteria – mainly they were small, cookie cutter sized properties that were poorly laid out and felt very claustrophobic. I was desperate to nd somewhere with a large kitchen, where I would feel inspired while baking and creating blog content.”

Determined, Kanwal spent time researching all of her options. Using the Share to Buy property portal, she arranged viewings for several one bedroom homes across east London. It was L&Q at The Silk District that eventually captured Kanwal’s heart. She says, “I didn’t know Whitechapel particularly well, but the amenities on offer such as the on-site gym and cinema were too good to miss – it’s rare that you see anything like this with rst time buyer homes… The living space and bedrooms were the biggest I had seen, and the kitchen was modern and stylish and even came with integrated appliances – it really ticked all my boxes. L&Q had really thought of the people who would live there, rather than just delivering a collection of buildings.”

She continues, “As a keen baker and cook, having a gorgeous kitchen/dining space has been a dream for hosting dinner parties. Plus, the development is right in the middle of Whitechapel, close to the market where I can source ingredients and less than a 10-minute walk to the station, meaning I’m well-connected to the rest of London. I already feel very settled in my new home. The development is perfect for me – having access to green space has changed the way I live my life and I feel very safe – what more could you ask for? I love this place!”

THE POWER OF ONE 26 First Time Buyer April/May 2023 CASE STUDY

*Based on a 30% share of the full market value of £405,000

*Based on a 25% share of the full market value of £535,000

*Based on a 35% share of the full market value of £225,000

SOUTHALL, EALING

Union Walk at the Green Quarter

One and two bedroom apartments are ready at this exciting new community with a school, retail and leisure hub, restaurants, cinema and parks. Homes are nished to an excellent standard, with exible open-plan living areas and stylish kitchens complete with a range of integrated appliances. Many homes also bene t from private balconies. Outdoor leisure spaces include an amphitheatre, play areas, and tness trails. The development, along the Grand Union Canal, will feature tree-lined avenues, 2,500 freshly planted trees and living green roofs to enhance the biodiversity of the area, located just a ve-minute walk from Southall station.

latimerhomes.com/new-build-homes/london/ ealing/union-walk-at-the-green-quarter 0300 100 0309

WHETSTONE

SO Resi Whetstone

Sitting on the tree-lined Oakleigh Road North in Whetstone, this new development of one and two bedroom apartments from SO Resi is built around an attractive landscaped central courtyard. There are balconies or terraces to each apartment giving a spacious feel and plenty of places to unwind outside. A short stroll will take you to High Road, with its cafe culture, shops and foodie pubs, while the tube station is conveniently positioned just a mile away.

soresi.co.uk

020 8607 0550

*Based on

CASE STUDY

WELWYN GARDEN CITY SO Resi Welwyn Garden City

This selection of one and two bedroom apartments available to purchase with shared ownership forms part of an impressive development created around the landmark Shredded Wheat factory. These light and airy homes are perfect for anyone who loves the vibrancy of modern life surrounded by lots of green spaces. From Welwyn Garden City it takes just a 29-minute train journey to London King’s Cross. All apartments will bene t from a balcony or terrace to enjoy the local scenery.

soresi.co.uk

020 8607 0550

FROM £71,875* *Based on a 25% share of the full market value of £287,500

ENFIELD

Trent Park

Trent Park is a unique development in the north London triangle of Oakwood, Cockfosters, and Hadley Wood. The Kendrick and The Chase Collections available at Trent Park, through Legal & General Affordable Homes, offer a selection of one and two bedroom apartments with generously sized rooms, nished to a high speci cation. These homes are full of natural light, and have been carefully designed to complement the semi-rural setting. It’s hard to believe you’re just a 15-minute drive away from the M25. For commuters, it’s a 26-minute tube journey to King’s Cross from Oakwood station. landgah.com/scheme/trent-park

020 4579 8490

“I discovered that the cost of renting had increased dramatically,” Emma recalls. “Finding a new home had not been on our agenda and my family and I were stuck between not wanting to leave our close community, but being nancially unable to continue renting in the area.”

Having initially assumed the shared ownership scheme was for homebuyers in their 20s or 30s, Emma was delighted to discover that they met the requirements for it after all, and the family have managed to stay in the community they love.

A self-confessed “new build convert”, Emma admits, “I was previously sceptical of new builds but with a little persuasion from Paul I agreed to view one and my mind was instantly changed. I was so impressed with Oak Point that we decided to buy a two bedroom semi-detached house off-plan.”

Their positive experience didn’t end there. Emma enthuses, “When it came to completion day, my expectations were exceeded and we’ve been over the moon since we moved in here in January. Although we didn’t want to move house at rst, our new home is so impressive and I can see that what started out as a stressful situation actually happened for a reason. The modern features of our house are fantastic and I love all the high-tech appliances. We would never have these luxuries if we were still renting. This home is working so well with my family’s day-to-day lifestyle and we’re happier than ever.”

Emma is also loving the views. “I can look out of my window and revel in the remarkable views of the South Downs,” she says. “There is so much sky when I look up and they’ve recently planted daffodil bulbs which are already adding beautiful splashes of yellow to the gardens here. I also like to take the short walk down some steps to a local farm shop and during the day I sit in the garden surrounded by nature and I can hear the donkeys, sheep and horses roaming in their nearby eld.”

THE POWER OF ONE 28 First Time Buyer April/May 2023

*Based on a 25% share of the full market value of £317,500

FROM £79,375* FROM £100,000* FROM £110,625* a 25% share of the full market value of £400,000 *Based on a 25% share of the full market value of £442,500

Emma, 53, and her partner Paul, 57, are now the proud owners of a beautiful two bedroom home at Latimer’s Oak Point in Portslade. During 14 years spent renting, Paul, Emma and her son Josh, bene ted from the unusual situation of their monthly payment not increasing once, but when their landlady was forced to sell, their low rent bubble burst!

RENT HAPPY!

Network Homes is passionate about helping every first time buyer and because it realises it can be tough to raise a deposit, the organisation is offering London Living Rent at some of its developments, which is the perfect way to save and buy.

Funded by the Mayor, the idea behind London Living Rent is to help people switch from renting to shared ownership. It is designed for people who want to build up their savings to eventually buy a home through shared ownership.

Offered on tenancies of a minimum of three years, first time buyers are offered below-market rent and are supported to save and given the option to buy their home on a shared ownership basis during their tenancy. The amount of rent they pay will vary according to where they want to live in London but it is substantially less than private sector rents and the Mayor publishes

benchmark levels for every neighbourhood in the capital, which are updated annually. These are based on a third of average local household’s incomes and adjusted by the number of bedrooms in each home.

AM I ELIGIBLE FOR A LONDON LIVING RENT HOME?

To be eligible for a London Living Rent home, you must:

Live or work in London

Either have a formal tenancy (for example, in the private rented sector) or live in an informal arrangement with family or friends as a result of struggling with housing costs

Have a maximum household income of £60,000

Not own any other residential property.

Network Homes was invited to pilot the rst London Living Rent development at Le Bon Court in Harrow. Over ve years, in a 23-apartment development, three residents now own a par-share in their rented home, ve are in the process of buying a share and a further 10 have gone on to buy their own home elsewhere.

Across London, the average monthly rent for a two bedroom London Living Rent home is around £1,077 a month, almost three-quarters of the average market level. The rent levels are derived from average local incomes and ward-level house prices, with the rent for a two bedroom property generally based on one-third of the local average household income.

Unlike standard 12-month private sector rental agreements, Network Homes offers longer assured shorthold tenancies of up to three years, to give residents peace of mind and security while they save. London Living Rent rental contracts can be renewed, if needed, for up to 10 years after the launch of each scheme, during which time residents will be able to gradually build up their purchase deposit.

Juliana Goode, Senior Build to Rent Manager

LONDON LIVING RENT 30 First Time Buyer April/May 2023

We know how hard it is to save for a deposit to buy your first home, but London Living Rent could be the answer to help you eventually take that step on the property ladder

EXPERT COMMENT

Living Rent

ISLEWORTH, HOUNSLOW

St John’s Road

Network Homes' brand new development of one, two and three bedroom homes is available with London Living Rent. Perfectly located for your journey from renting to owning your own home, these light and airy apartments in west London (Zone 4) are the perfect choice for city, nature, culture and leisure and a quick and easy commute – who could ask for more?

Easy access to the tube and rail networks puts central London within easy reach. Locally, there is a host of leisure opportunities to enjoy including Waterman’s Arts Centre on the riverfront, which is a cultural hub showing live and recorded performances and exhibitions. Those who enjoy the great outdoors will be spoilt for choice, with many walking and cycling routes within easy reach. Syon Park offers 40 acres of gardens to wander in and Osterley Park also has acres of parkland to explore. For all your daily shopping needs there are supermarkets, plus a post of ce and pharmacy around the corner and many independent outlets nearby too. In addition, there is also a great selection of pubs, cafes and restaurants on the doorstep.

The high-speci cation, open-plan apartments are spacious and light, with high ceilings in all the living spaces. The larger two and three bedroom homes include an en suite shower room, in addition to the main bathroom. Kitchens come with integrated appliances including a fridgefreezer, dishwasher and washer-dryer. Each apartment also comes with a balcony or garden.

To register your interest go to: networkhomes.org.uk/londonlivingrent

London

Visit www.networkhomes.org.uk and check your eligibility 1 Exchange contracts and agree a completion date 12 3 How

Register your interest REGISTER 2 Agree your purchase and appoint a Solicitor Reserve a home and move in 6 Verify your affordability with an Independent Financial Advisor Save towards your deposit to buy shares in your home 7 Complete reference checks 5 4 Talk to our recommended Independent Financial Advisor 11 Obtain your mortgage Buy shares in your home through Shared Ownership 8 9 10 Save and staircase! 13 Provide the required information Contact us to review your property value LONDON LIVING RENT First Time Buyer April/May 2023 31

Works

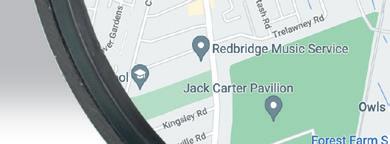

Hainault HOTspot

In north eastern Greater London, nestled between two country parks, sits the suburban community of Hainault. With Liverpool Street and Stratford under 30 minutes away (via the Central Line), the development of new, affordable homes is making the area even more desirable to first time buyers

UNDER THE SPOTLIGHT

Located in the London Borough of Redbridge, and bordering Essex, Hainault is located 12 miles north east of Charing Cross, and three miles east of Woodford. With a wealth of countryside on the doorstep, the area appeals to nature lovers and tness fanatics alike.

Records of the area date back to the 13th century, with Hainault mainly forest owned by the nuns of Barking Abbey, and forming part of the Forest of Essex; Hainault means "wood belonging to a religious community". The area’s timber was predominantly used for building ships and houses but a decline in demand for timber led to an Act of Parliament authorising the deforestation of much of Hainault Forest in 1851. Urban development had begun. The Great Eastern Railway opened a station at Hainault in 1903 on its newly built Ilford to Woodford branch line, but it wasn’t until the late 40s and early 50s that most of the housing in Hainault was built by the London County Council. Hainault station became part of the London underground system in 1948 and it is its location on the Central Line (Zone 4) which makes Hainault perfect for commuters today.

Hainault residents actually bene t from two Central Line stations, with both Hainault and Grange Hill stations under a mile away, offering connections to the city (Liverpool Street and Stratford) in under 30 minutes. Hainault is also

1 The Central Line

2 An abundance of green spaces

3 A strong community feel

4 Nearby West eld Stratford City

5 Celeb spotting in Chigwell!

directly served by London bus routes 150, 247, 362, 462 and N8.

While there is an obvious appeal for those travelling into the city to work, Hainault Business Park, located to the south east of the residential zone, has bene ted hugely from local regeneration. More than 150 companies now operate here, meaning there are plenty of local employment opportunities too. The architecture of Hainault is also shifting, with the likes of Edge, an exciting new collection of apartments from Countryside, leading the way.

OUT AND ABOUT

Hainault has a decent parade of shops including a Tesco Express, bakery, butcher and post office, in addition to a small selection of eateries. While it should be perfectly sufficient for your day-to-day needs, the town of Chigwell – just a short drive or bus ride away – has a broader range of amenities. And, of course, the Central Line means everything the capital has to offer is also within easy access!

new housing in the area is offering even more professionals

As Londoners priced out of town actively seek out relatively affordable corners of their city, the demographic of Hainault is shifting. The vast majority of homes are now owner-occupied, and new housing in the area is offering even more young professionals and families the opportunity to make Hainault their home. For families, there are day nurseries, three primary schools and a secondary school, The Forest Academy (which opened in 2012), all in the immediate vicinity.

If you’re in need of a pamper, neighbouring Chigwell is home to a number of beauty salons and designer boutiques, perhaps unsurprising given its TOWIE links! There are also some fab independent stores, and you’re only about half an hour’s drive from Lakeside. If you aren't driving, no problem – living in Hainault you’re a short tube ride from the shoppers’ paradise of Westfield Stratford City; located just nine stops, or 20 minutes, away, with over 250 shops and 70 restaurants to enjoy.

Chigwell also has a decent selection of evening entertainment, with pubs and restaurants to suit all tastes. However, be warned, if your taste is fine dining you may struggle to get a table at Sheesh; housed in the 16th century Ye Olde Kings Head, and owned by Sir Alan Sugar, this exclusive Turkish dining experience is very

warned, if your taste is

LOCATION 32 First Time Buyer April/May 2023

5 REASONS WE LOVE… HAINAULT

FACT FILE

Average property price in Redbridge (October 2022) − £487,315

Property breakdown*

Detached – £1,068,704

Semi-detached – £689,311

Terraced – £529,055

Flat – £317,314

*According to the Land Registry House Price Index

HOMES ON THE MARKET...

£304,995

FAMOUS RESIDENTS

•

•

•

•

Neighbouring Chigwell is also home to many footballers and minor celebrities!

HAINAULT Edge

Edge is an exciting new collection of high-speci cation one, two and three bedroom apartments ideally located in Hainault (Zone 4). There are two Central Line stations, Hainault and Grange Hill, less than a mile away, which give you connections to London Liverpool Street and Stratford in under 30 minutes.

popular with celebrities. Fortunately, there are plenty of other excellent (and more affordable!) choices from predictably good steak at Miller and Carter, to delicious pizza at Casa Pipino and traditional pub grub at The Three Jolly Wheelers.