the Ultimate Guide to... GETTING ON THE LADDER, THE PROPERTY MARKET AND HELP TO BUY rsttimebuyermag.com February/ March 2023 £3.95 771758 973014 9 02> “It's vital that you research the buying process so you know what costs are coming up” BE MINE! OUR VALENTINES TOP PICKS LONDON LIVING RENT WIN! A 2L TUB OF V33 RENOVATION MULTI-SURFACE PAINT WORTH £42 ENERGY SAVING TIPS AND TRICKS THE MORTGAGE MARKET UNRAVELLED THE LOWDOWN ON STAMP DUTY Peter Komolafe Financial expert, coach, TV presenter and author

EDITORIAL – 020 3488 7754

Editor-in-Chief SARAH GARRETT sarahg@spmgroup.co.uk

Editor LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Editorial Assistant and Head of Special Events KATIE WRIGHT

Editorial and Special Events Assistant SOPHIE MUNNERY

Creative Director RYAN BEAL

Sub Editor KAY HILL

Social Media KATIE WRIGHT, SOPHIE MUNNERY

Contributors

CHRIS CLARK, DEBBIE CLARK, BILL DHARIWAL, KAY HILL, JONNIE IRWIN, SOPHIE MUNNERY, LAURA DEANOSGOOD, CORALIE PHELAN, MIKE PRIOR, GINETTA VEDRICKAS, KATIE WRIGHT

ADVERTISING – 020 3488 7754

Director of Advertising/Exhibition Sales

LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Special Events KATIE WRIGHT

– First Time Buyer Home Show

– First Time Buyer Readers’ Awards katie@ rsttimebuyermag.co.uk

Accounts accounts@ultimateguidecompany.com

Managing Director SARAH GARRETT sarahg@spmgroup.co.uk

Public Relations RACHEL COLGAN rachel@building-relations.co.uk

SUBSCRIPTIONS

020 3488 7754

SWITCHBOARD

020 3488 7754

All advertising copy for April/May 2023 must be received before 6 March 2023. Send all copy to: lynda @ firsttimebuyermag.co.uk

The content of this publication, either in whole or in part, may not be reproduced, stored in a data retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without prior permission from the publishers. Opinions expressed in First Time Buyer magazine are not necessarily those of the publishers.

© The Ultimate Guide Company Ltd 2008-2023. The Ultimate Guide Company Ltd t/a First Time Buyer magazine will take no responsibility for any loss/ claim resulting from a transaction with one of our advertisers/media partners.

Welcome

Happy New Year! I hope you all had a wonderful festive time with friends and family at Christmas. Many of you will be planning on buying your first home this year, which is a very exciting prospect. We do know how challenging it can be though, and research by Pocket Living has found that the situation is particularly challenging for Londoners. The findings are fascinating, so go to pages 2428 where we also highlight some affordable homes in the capital and within an easy commute, which I hope you find of interest.

If you can’t afford to buy your first dream home at the moment, then London Living Rent might be the answer to help you eventually get on the property ladder. It is an excellent scheme and well worth considering, so do turn to pages 30-32 where we explain how it works and who is eligible.

There were some changes to Stamp Duty last year which is great news for first timers. Please turn to pages 88-89 where we explain what these changes are and how they will help you.

I hope you enjoy this issue which is packed with information and help on buying your first home – enjoy!

Until next time, happy house hunting

firsttimebuyeronline @firsttimebuyer

EDITOR’S PICKS…

I am so keen to get myself a new home and be right back where I belong, in Essex.

In order to save for the deposit, you can still use a Lifetime ISA to buy your rst home or save for later life.

Jonnie Irwin, Jonnie’s World, page 9

London Living Rent is a crucial foothold in the renting to homeownership pipeline.

Esaiyas Mollallegn, Save and buy with London Living Rent, page 30

Jason GordonCampbell, House Hunter, page 16

Buying a home for the rst time takes you out of your comfort zone.

Faye Winter, At home with, page14

Buying in a regeneration zone can provide a variety of bene ts, both nancial and lifestyle-related.

Kalumba Musambachime, Developer’s doctor, page 18

EDITOR’S LETTER First Time Buyer February/March 2023 3

73

For sale – the best FTB properties

What’s in…

HOMEPAGE

9 Words from Jonnie

TV presenter and property expert Jonnie Irwin gives his views on the housing market.

10

FTB loves…

A round-up of our favourite romantic buys for Valentine’s Day.

12 Living

Be right on trend with the Colour of the Year to give you inspiration

72

Hannah Tomaselli, 27, and Dillon Hamill, 25, moved to Reading two years ago and were renting in Caversham, a suburb of Reading. They loved the area but they were keen to settle down and take a step on to the property ladder in the city they had come to call home.

when buying accessories for your new home.

14 At home with…

Faye Winter

Passionate about property and interiors, Faye Winter was a highly successful estate agent and lettings manager for many years before she became a finalist on ITVs Love Island in 2021. She bought her first home when she was just 18 and is currently looking to buy with her partner, Teddy. She talks to Lynda Clark about her life, her first home and gives some useful advice for anyone trying to get on the property ladder.

16

House Hunter

We try to find a home for Jason Gordon-Campbell who is searching for a property in Essex.

18 Developer’s doctor

Kalumba Musambachime, Head of Sales & Build to Rent at Network Homes answers your question.

FEATURED

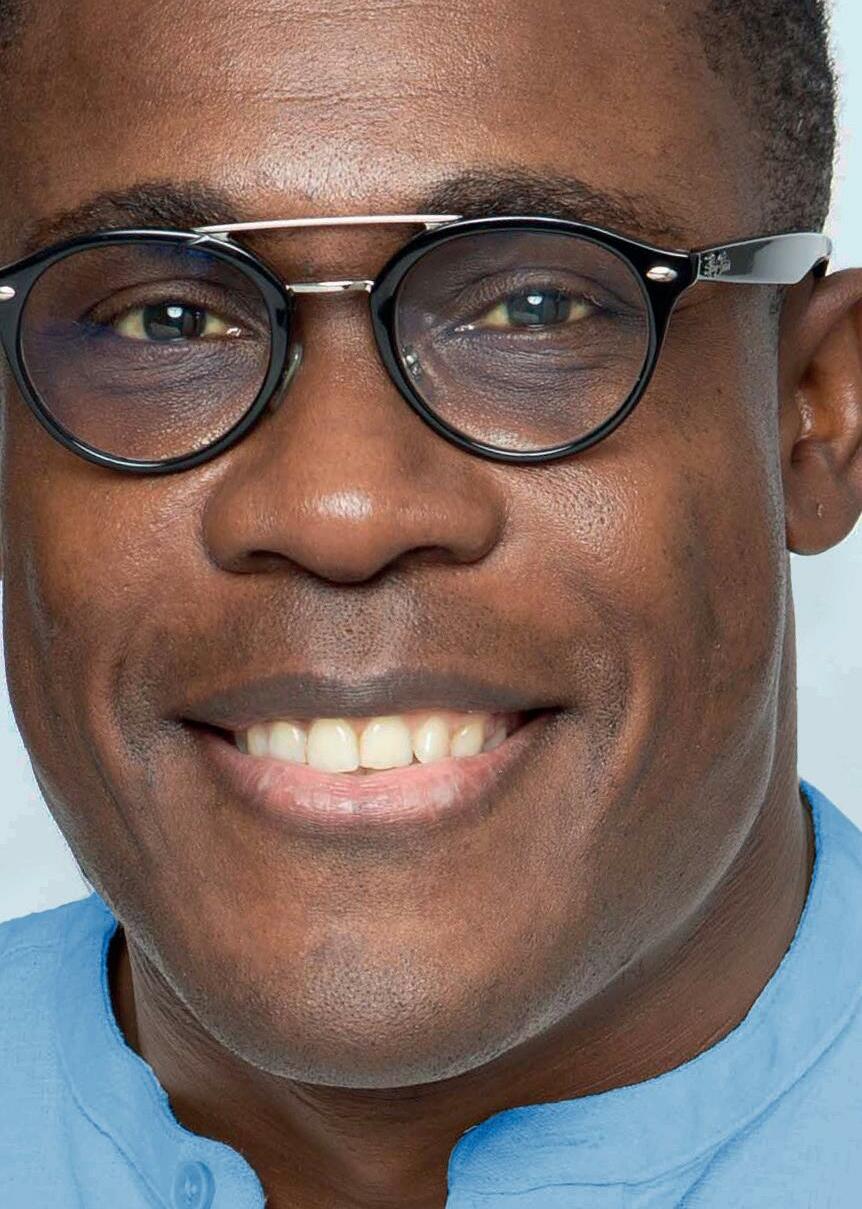

20 The View: Peter Komolafe

Peter Komolafe is a financial expert, financial coach and TV personality whose personal journey is the driving force behind his passion for helping people. He founded Conversation of Money in 2020, a YouTube channel, and runs a weekly podcast. He talks to Lynda Clark about his fascinating life, his career and gives some excellent advice to first time buyers.

24 Capital Conundrum

The current cost-of-living crisis has

hit the UK hard. Research by Pocket Living has found that the situation is particularly challenging for those wanting to set up home in London. Debbie Clark looks at the research findings and highlights some of the affordable homes and locations in and around the capital that could be the perfect solution.

30 Save and buy with London Living Rent

If you are struggling to get on the housing ladder then London Living Rent might be the answer to help you eventually buy a home of your own. We give you the lowdown on how it works and who is eligible.

CONTENTS 4 First Time Buyer February/March 2023 FEBRUARY/MARCH 2023 / ISSUE 99 / FIRSTTIMEBUYERMAG.CO.UK

Cover photo © Mike Prior

Guide

terms

Coralie Phelan, Partner and Head of New Build Homes at Prince Evans Solicitors LLP, explains the key conveyancing terms used at each stage of the transaction. 100 Directory Where and how to contact your homebuying agents or providers. 106 20 Questions We ask 20 quick-fire questions to a legal expert and in this issue

Coralie Phelan, Partner and Head of New Build Homes at Prince Evans Solicitors, is in the spotlight.

CONTENTS First Time Buyer February/March 2023 5

20 20

PETER

KOMOLAFE, PAGE

81

Highlighting

Buying

together?

86

88

90

Peter Komolafe 79 Competition Nine lucky winners have the chance to win a 2L tub of Renovation Multi-Surface paint from V33, in a colour of their choice, worth £42. REGULARS 80 First home, first meal Created by Chris Mackett, Tom Kerridge Group Head Chef, this delicious recipe for Toad in the Hole served with roasted onion and ale gravy is the perfect choice on a cold winter’s day.

Inspector Gadget

some products and tips to save energy. 82

a property

Bill Dhariwal, Solicitor and Managing Director of Lawcomm, explains the important legal considerations and what documents you will need. 84 Ask Emilia Emilia is the Sales Director at Metro Finance. Here she answers some of the most common questions asked.

Finance Kay Hill looks at the latest moves in the mortgage market.

Market With the changes to Stamp Duty, Ginetta Vedrickas considers how this will impact first time buyers.

Agony Agent All your property questions answered by our panel of experts. 93 Buyer’s

Check out FTB’s Buyer’s Guide, which walks you through the property process. 98 Conveyancing

all first time buyers need to know

I ALWAYS WANTED TO HELP PEOPLE AND ADVISE THEM ON WHAT YOU CAN DO WITH YOUR MONEY 34 Hotspot We look at Horsham as a place to live.

Mailbox

HOW LONG DOES A MORTGAGE OFFER LAST?

I have recently had a mortgage offer but I am not quite in a position to accept it just yet. How long does a mortgage offer last for?

Laura Capon

FTB says: Every mortgage offer is slightly different, so the period of time your mortgage offer is valid for will vary from lender to lender. One thing they do all have in common, however, is that they are valid for a fixed period. In the vast majority of cases this will be three months but for new builds it is often six months when bought off-plan, as the mortgage criteria can be more complex. You may also be able to extend the offer for a new build property if you haven’t accepted within the time frame. It’s always advisable to talk to a mortgage adviser who will point you in the right direction once they know what kind of property you are looking for and the time frames you are looking to work within.

DO ALL MORTGAGES HAVE ARRANGEMENT FEES?

Having recently visited the bank to talk about mortgages I was offered a mortgage that comes with a mortgage arrangement fee. What does a mortgage arrangement fee cover and do all mortgage applications come with one?

This month’s star letter prize wins an Elegance post box, available in 10 colours from leading security specialist Burg-Wächter, worth £35. Choose from –white, black, pillarbox red, green, silver, Chartwell green, anthracite, midnight blue, French grey, antique cream.

Stylish, yet reliable and manufactured from high-quality powder-coated galvanised steel, your post box is weather resistant ensuring your post is protected for years to come.

Big enough for C4 envelopes, the drop front opening makes it extremely easy to collect your mail, while a sleek post design embossed at the front gives it a touch of elegance.

burg.biz/uk

Isabelle O’Sullivan

FTB says: All fees associated with your mortgage should be outlined in your mortgage illustration document, which breaks down each fee, explaining what it is and how much it will cost you. A mortgage arrangement fee is what you pay the lender to set up your mortgage and most mortgages will have one. The cost can vary significantly, although on average it will cost around £1,000. You can usually choose between paying the arrangement fee upfront or adding it to the mortgage but it will ultimately cost more to do the latter as you will pay interest on it over a period of time.

WRITE TO US!

Please send us your questions, comments and suggestions concerning property, or the articles in First Time Buyer magazine.

lynda@firsttimebuyermag.co.uk

HOUSE VIEWING TIPS

In the next few months, I am going to start looking at potential properties for my first home. Is there anything I should be particularly looking out for when I’m being shown around? Ismail Farley

FTB says: A good tip is to write down what is important for you in your home before you make any visits. Be prepared though, a home might not be able to tick every single box but it should give you some indication on whether or not the property will suit your needs. Whether it be lots of storage space, a big kitchen or stylish bathroom, everyone has their own preferences. A show home is a great place to start as you can get a real flavour for the potential of a property rather than an empty shell of a newly built house without anything in it. Be sure to ask questions if you are being shown around as well, and again, perhaps have some of these prepared before your visit. Finally, don’t jump at the first property you view no matter how nice it may seem. It is good to see a range of properties so you can make a better judgement on one of the biggest decisions of your life.

MEANING OF CREDIT SCORE AND CREDIT REPORT

While looking for a mortgage I have come across the terms “credit score” and “credit report”. Is there are difference between the two and, if so, what are the differences?

Jacob Frost

FTB: Your credit report is the detailed record of all your financial behaviour. A credit score is a number, calculated by credit reference agencies and lenders, which sums up the information in that report. Your credit report tells the story of how you’ve handled credit in the past. Looking at your report allows credit providers to answer important questions

about your financial habits that will affect your ability to gain a mortgage and under what terms. It takes into account your current debts, whether or not you pay your debts on time and whether or not you tend to take on more debt than you can afford to repay. Your credit report isn’t the only data a credit provider will use to make a decision though. The information you provide in your application and other factors like your income are all important too.

VISIT OUR WEBSITE

For everything you need to know about buying for the first time, go to firsttimebuyermag.com

LETTERS First Time Buyer February/March 2023 7

TV presenter and property expert Jonnie Irwin gives his thoughts and views on first time buyers and the housing market

Most of us like a good moan, don’t we? I find myself often at it, needlessly having a thought or making a comment that helps nobody, especially myself. Maybe it’s the inclement weather that moulds our subconscious, but as soon as the thermometer goes too low or too high, someone’s bellyaching! In a life where many of us live in comparative comfort compared to those in other countries around the world, we often find something to whinge about – and the more we do it, the gloomier our outlook becomes.

Conversely, I recently filmed with a crew on Escape to the Country and to a person, every member of the small team was unfathomably positive. Perhaps that’s something to do with their youth, but it was infectious, and I’ve thought about it quite a bit since. Don’t get me wrong, there’s still room for a bit of cynicism in short doses, but I’ve become more aware of negative vibes everywhere, and surprise, surprise, culprit number one is …our press!

Of course, there’s plenty of truth to the bounty of bad news out there to report on, but when it comes to financial outlook, focusing on just the negative can be dangerous. Those predicting the future of the financial or property markets find it easier to predict a downturn. After all, most markets are cyclical so the commentators will eventually be proved right.

It’s a brave prediction forecasting anything positive out there at the moment, but there are signs of movement in the market and help out there which should be good news to buyers.

Firstly, in order to save for the deposit, you can still use a Lifetime ISA (Individual Savings Account) to buy your first home or save for later life. You must be 18 or over, but under 40, to open a Lifetime ISA. If you can tighten your belt elsewhere you’ll be able to save up to £4,000 each year, until you’re 50. You must make your first payment into your ISA before you’re 40. Way too late for me!

The Government will then add a 25% bonus to your savings, up to a maximum of £1,000 per year. The Lifetime ISA limit of £4,000 counts towards your annual ISA limit. This is £20,000 for the 2022 to 2023 tax year. You can hold cash or stocks and shares in your Lifetime ISA, or have a combination of both. When you turn 50, you will not be able to pay into your Lifetime ISA or earn the 25% bonus.

As for the current UK mortgage market, the headlines reporting

on mortgage products being suddenly taken off the shelves is still fresh in the mind, so its perhaps arguably harder and less headlinegrabbing to paint a truthful and more positive image.

It’s true that interest rates are higher, but it doesn’t mean that mortgage lending is restricted or problematic. The mortgage is the product, the interest rate is a result of outside forces.

The cost of supplying mortgages has increased. It’s also why you can see action being taken by lenders and mortgage fixed rates being lowered. Reflecting this fact, several lenders are cutting margins, alongside small reductions in costs of funds. In other words, when a lender cuts margins, it means they are hungry to lend. Just like the car seller must sell cars, the lender “must” sell mortgages. Hold on, that’s good news isn’t it?

Right now, mortgage lending is healthy. The number of low deposit mortgages currently available demonstrates this. For shared ownership alone there are 99 mortgage products with just a 5% deposit! I didn’t see this on the news, I learnt it from Jon Lord at Metro Finance. This type of lending would disappear in a low liquidity market, just like it did in the financial crash back in 2008/09 when there were virtually zero low deposit mortgages.

Current times are nothing like a financial crash. Of course, affordability is a challenge –we all have “shorter arms and deeper pockets”, hence why shared ownership demand has increased, because it helps make the unaffordable, affordable. And why we’ve seen new lenders enter this sector in the last month. As an aside, lenders would not enter new sectors in a climate of restricted lending.

And, of course, interest rates are higher, but are they actually “high”? I don’t want to sound like an old grandpa, but even I remember paying 7%. When based against long term averages, 5% seems about right.

Obviously, the increases have been more sudden than desired, yet mortgage lenders are in their usual highly competitive battle to keep them as low as possible, especially on longer five-year fixed rates.

As we shiver through the winter you might not feel this is the time for you to buy a home, but when you are ready, I assure you that mortgage lenders not only want to lend, they need to, and face similar challenges of higher interest costs and higher overall costs.

OPINION First Time Buyer February/March 2023 9

WORLD

Remember love isn’t just for Valentine’s Day, it should be for the other 364 days too! But just in case you need to remember to sprinkle a little romance, you could treat that someone special, whatever your relationship status, on 14 February with our FTB 14 top picks to set the romantic mood…

Bunch

Heart

FTB LOVES 10 First Time Buyer February/March 2023

of roses letterbox, £27.50, Biscuiteersbiscuiteers.com Honeycomb hanging heart, £7.99, Ginger Ray gingerray.co.uk

garland

Lights4fun

& Me bunting

Ginger Ray gingerray.co.uk

Ginger

socks, £2.99, New Looknewlook.com Neroli, lime and bergamot LED light up candle, £10, Marks & Spencer marksandspencer.com Felt heart

, £19.99,

light4fun.co.uk You

, £6.99,

Heart cupcake toppers, £5.99,

Ray gingerray.co.uk

FTB LOVES First Time Buyer February/March 2023 11

of love chocolates, £11.95, Biscuiteers biscuiteers.com

napkins, £3.99, Ginger Ray gingerray.co.uk

heart wall sign, £49.99, Lights4fun light4fun.co.uk Velvet jewellery box, £11, Accessorize accessorize.com

heart curtain, £16.99, Lights4fun light4fun.co.uk

heart wreath, £34.99, Lights4fun light4fun.co.uk

mini heart pull through hoops, £12, Bryony Bel. bryonybel.com

Box

Heart

Neon

Felt

Berry

Eva

2023 COLOUR OF THE YEAR INSPIRED

Looking to add something new this year, transforming a space or planning to move into your new home? The "Colour of the Year" may give some inspiration! If you fancy an earthy, glowing tone inspired from the natural world, check out Dulux’s "Wild Wonder" or if you are looking for a luxurious magenta, take a look at Pantone’s "Viva Magenta". Whatever your style, bright and bold or cool and neutral, we have something for you!

Tea tray, £29, Fy!

Mataram wall mirror, £72, Fy!

Woven placements, set of 2, £18, Fy!

Chalk paint, from £6.95, Annie Sloan

Leafy paradise removable wallpaper, from £32 sq m, Wallsauce

Olive branch napkins, set of 4, £33, Sophie Allport

Wire pendant light, £69, Cuckooland

Pink vase, £29.99, Dobbies

Natural rattan side table, £145, Fy!

Homepage LIVING 12 First Time Buyer February/March 2023

Homepage LIVING First Time Buyer February/March 2023 13 CONTACTS » Annie Sloan anniesloan.com » B&Q diy.com » Bean Bag Bazaar beanbagbazaar.co.uk » Benjamin Moore benjaminmoorepaint.co.uk » Blinds 2go blinds-2go.co.uk » Cuckooland cuckooland.com » Desenio desenio.co.uk » Dobbies dobbies.com » Fy! iamfy.co » Julian Charles juliancharles.co.uk » Purlfrost purlfrost.com » Sazy sazy.com » Sofa sofa.com » Sophie Allport sophieallport.com » Wall Sauce wallsauce.com

Wine paint, from £20, Benjamin Moore Beanbag recliner, £39.99, Beanbag Bazaar Jack armchair from £299, sofa.com Geo handmade bowl, £24, Sazy Bee print throw, £15, Julian Charles

Place poster, £14.95, Desenio

effect window lm, £20, Purlfrost

lampshade, £30, B&Q

cushion, £20, Blinds 2go

Cherry

The

Glass

Trio

Magenta

At home with: Faye Winter

Faye Winter is passionate about property and interiors and was a highly successful estate agent and lettings manager for many years before she became a finalist on ITVs Love Island in 2021. She bought her first home when she was just 18 and is currently looking to buy with her partner, Teddy, next year. She has over 1.2 million social media followers and is an Ambassador for Guide Dogs UK. She talks to Lynda Clark about her life, her first home and gives some useful advice for anyone trying to get on the property ladder

Photos by Gavin Glave

Photos by Gavin Glave

FTB: Tell us about your first step on the property ladder

FW: I was 18 and bought a shared ownership home, which was a great way to get started on my property journey. I staircased to 100% so I owned it outright and it worked really well for me. When I decided to sell I could have converted it back to shared ownership but a lovely lady decided she wanted to buy it outright. I think shared ownership is brilliant and I can’t praise the scheme enough.

FTB: Did you go on to buy another home?

FW: I bought a three bedroom house, which was stunning and everything I ever wanted. After this I decided to return home and live with my parents.

FTB: Where are you living now?

FW: I am looking to buy with my partner, Teddy, who I met on Love Island. He originally comes from High Wycombe and has never bought before so it is quite frustrating because we can’t use any of the FTB schemes. We want to find the right property for us, in the right location that will work for us both, so we are looking around. But, with the change in interest rates and the state of the property market in general, we are watching the situation at the moment but would like to buy next year. We are renting but I am very keen to get back on the property ladder. I also have an idea to buy something in Devon, which is

Homepage LIVING 14 First Time Buyer February/March 2023

“DON’T PUSH YOURSELF TOO FAR AND IF IT DOESN’T WORK OUT SOMETHING ELSE WILL ALWAYS TURN UP”

where I am originally from, that I could turn into an Airbnb. I love the countryside and it would be perfect to have a little bolthole. We have recently got a puppy, Bonnie, and I know she would love it down there too.

FTB: Tell us about your career

FW: I finished school when I was 16 and was always interested in sales. I firstly thought about going into car sales but that’s a very male-dominated industry. So, I got an apprenticeship in an estate agency. It was a foot in the door and I learnt everything there was to know. I worked there for five years and then decided to move on to a more corporate agency. I then decided to move to an independent estate agent, East of Exe, and because of all the knowledge I had I was able to sell homes and also do lettings and rentals so I could flip between the two and always hit my targets. I was in great demand and many clients insisted I look after them and I had so many referrals. One of the things I really care about is customer service, especially if you are helping a first time buyer. It is so scary for them and they need lots of help and advice, which I was delighted to do. I also used to give them a hand when it came to the interior of the property they were buying. None of them had much money to kit out their home so I enjoyed giving them hints and tips of how to design it on a budget. I also loved talking to prospective buyers and sellers and visiting properties. I stayed there for three years and it was a wonderful job.

FTB: You were a contestant on Love Island – was that something you had dreamt of doing?

FW: I loved my job and loved my life so I was really 50/50 about it. It was an experience and I met my partner, Teddy, who is the love of my life. I was then on Celebrity MasterChef which was so out of my comfort zone. I’m a pub grub girl from Devon but I made it through to the semifinals, which was quite an achievement. I would now like to get back into property as I am not your typical Love Islander. I have a few plans and ideas, so it’s a question of watch this space!

FTB: Tell us about your work with Guide Dogs UK?

FW: I used to board guide dogs for four and half years before I went on to Love Island and I am now an Ambassador. They do amazing work and I would board dogs in the evenings and weekends. They go to guide dog school during the day, so it worked well when I was working full time and I really loved having them and helping. I am now campaigning to raise funds and I worked on a collaboration with the fashion

chain New Look and produced a New Look Edit and donated part of my fee to them.

FTB: What advice do you have for FTBs?

FW: Don’t push yourself too far and if it doesn’t work out something else will always turn up. Get a Mortgage in Principle and don’t stress if it runs out, just make sure you get another one. Buying a home should be your passion project so stick to what you really want. Decide what your priorities are, and if you want a large kitchen/diner as an entertaining space and smaller bedrooms, for example, then hold out for that. Make a list of things that are important to you. It

could be location, green space, parking, near to shops or schools – whatever it is, you should decide what works for you. Buying a home for the first time takes you out of your comfort zone as it is the biggest and most costly thing you will ever buy, but try not to put pressure on yourself. Sometimes we can be blinded by something that is cheaper but if it’s not the home of your dreams you are bound to be unhappy, so take it slowly and steadily and you will get there in the end.

Follow Faye on Instagram

@faye__winter

@faye__home

Homepage LIVING First Time Buyer February/March 2023 15

“I WAS 18 AND BOUGHT A SHARED OWNERSHIP HOME, WHICH WAS A GREAT WAY TO GET STARTED ON MY PROPERTY JOURNEY”

The HOUSE HUNTER

This month FTB goes on the hunt with Jason Gordon-Campbell who is looking for a one bedroom apartment close to his hometown of Chelmsford, Essex, with good local facilities and transport links high on the list of priorities

What we found…

THE COUNTRYSIDE CONNECTION THE WILDCARD

PROFILE

Name Jason Gordon-Campbell, 30 Occupation Account manager

Maximum budget £290,000

Requirements A one bedroom home in Essex, within a 20-minute drive of Chelmsford. Outdoor space, good local facilities and rail links to London are a must

What he wanted…

I grew up just outside of Chelmsford in Essex and I have lots of family and friends in the area – many still in Chelmsford. Even though I’ve been renting in London for the past ve years I tend to spend a lot of my time travelling out to Essex to see my friends and family, to play football and go out. I really want to buy my own place and my home county is calling! I’m looking for an apartment and only need one bedroom – though two would obviously be even better. I work from home the majority of the time but have to travel into London once or twice a month. Being close to transport links would be ideal, as being able to travel easily into the city or to other towns in Essex on occasion without driving would be great. I have a budget of around £290,000.”

Aylett’s Green Kelvedon, Essex Nola Shen eld, Essex

Aylett’s Green Kelvedon, Essex Nola Shen eld, Essex

FROM £234,950

FROM £353,000

The pretty town of Kelvedon is home to this new collection of properties, which range from one and two bedroom apartments to two to ve bedroom houses. This sought-after location is popular for its history, picturesque surrounds and convenient travel links – the railway station is less than 500m away. Chelmsford and Colchester are 20 minutes’ drive, while London Liverpool Street is under an hour by train. The apartments are bright and spacious, with stylish kitchens, hallway storage and an en suite from the main bedroom in some of the two bedroom homes.

cala.co.uk

Perfectly located for commuters, with rail connections and stunning countryside on tap, this is a bestof-both-worlds location. The gated development, which is home to a collection of one, two and three bedroom apartments, sits between the suburbs of Brentwood, Hutton Mount and Shen eld, all of which offer shops, restaurants and green spaces. The apartments are beautifully designed, with openplan living spaces opening to a private balcony and oak ooring throughout. Shen eld station, with services to Stratford in 15 minutes, is a just a 15-minute walk.

fairview.co.uk

fairview.co.uk

What he thought…

This is a pretty good location for me –Chelmsford is a pretty quick drive from Kelvedon, and Mersea Beach and Colchester are also really easy to get to. I spent a lot of my childhood on the Essex coast as my parents really love it – especially Mersea and Clacton –and I’d enjoy being close enough to visit the seaside regularly. Kelvedon looks really nice, and though it’s quite a rural location there are shops, pubs and the railway station almost on the doorstep, so it’s a best-of-both-worlds situation for me!”

I used to work in Shen eld and know it well. This is a really great area for putting down roots and there’s loads to see and do in the surrounding areas. I have friends locally too, which is a bonus. The apartments are really attractive, with great styling and natural light. It’s great they have balconies too, as I love the idea of eating al fresco in the warmer months. It only takes 25 minutes by train into London Liverpool Street from here –and Chelmsford is also only around a 20-minute drive, so it’s win-win!”

16 First Time Buyer February/March 2023 Homepage FIRST RUNG

THE WATERSIDE WONDER THE NEW COMMUNITY

FROM £81,250

FROM £290,000

First choice!

THE HISTORIC LOCATION

L&Q at The Arbour Chelmsford, Essex

FROM £66,750*

This landmark development covers almost 443 acres and stretches along 2km of breath-taking southfacing River Thames. Among the many new homes and facilities at Barking Riverside sits L&Q’s range of stylish and well-sized one and two bedroom apartments, complete with balcony or terrace, video door entry and bicycle storage. The river is key to life here, with magni cent views, riverside shops and cafes, as well as Thames Clipper boat services directly into central London. On site facilities will include a new Overground station, school and parkland.

lqhomes.co.uk

*Based on a 25% share of the full market value of £325,000

Wow, what a stunning location, right on the river! I love the idea of travelling into the city by boat, I’d never get bored of riverside runs and walks, and I think there would be a real sense of community here. The apartments have a clean, contemporary look, and there’s a good choice of layouts. It’s great that there are balconies, especially with all those Thames-side sunsets to take in. I like that both London and Essex are both so easily accessed; overall, it’s in a really great spot.”

Beam Park forms part of a brand new neighbourhood in the recently regenerated suburb of Rainham, designed with community in mind. Amenities including schools, medical, faith and leisure facilities, as well as purpose-built open spaces, are all geared towards encouraging interaction between residents. London Fenchurch Street can be reached in just 21 minutes from nearby Dagenham Dock station. Portland House, on the east side of the development, contains a range of high speci cation one and two bedroom homes, many with balconies.

beampark.com

There is so much on offer here, with a gym, cycle routes, parkland and lots of shops and cafes planned. There’s a nature reserve really close by, which I know I’d be visiting a lot, and that my nieces would absolutely love to explore. The apartments themselves have a de nite sense of luxury about them and are really appealing. There are some tall buildings within the development – with some apartments available on 15th oor – the views must be fantastic and I nd the idea of living so high up quite enticing.”

These new one and two bedroom apartments form part of the award-winning Beaulieu development situated just outside Chelmsford. Created on the site of Henry VIII’s summer residence, this new community bene ts from a range of facilities including new schools, shops, cafes, public open spaces and bus routes – as well as an abundance of green space. The apartments are thoughtfully designed, with openplan living spaces, tted wardrobe in the well-sized bedroom and separate utility room. Chelmsford can be reached in eight minutes by car, while London Liverpool Street is just over 30 minutes by train.

lqhomes.co.uk

*Based on a 30% share of the full market value of £222,500

THE NEXT STEP

“I am so keen to get myself a new home and be right back where I belong, in Essex! My parents will come and view the development and apartments with me, then I hope to get a one bedroom home secured as soon as possible.”

These apartments seem to be offering everything that I’m looking for – the location is great, and with parks, green space, shops and cafes on tap, I feel I could achieve the lifestyle I want. I do tend to drive a lot, and getting around from here is super easy. I can get to football, friends and my parents within well under 20 minutes. What is really cool though, is that there’s a dedicated bus service for residents – which makes going out or commuting into London that bit easier and more reliable. I know that my sister and her kids will love to visit me here, too, as there are playgrounds and parks within the development – perfect!”

Homepage FIRST RUNG First Time Buyer February/March 2023 17

Barking Riverside east London

Portland House Beam Park, Rainham

QI’m looking to buy my first home.

I have seen a few properties that I am interested in, but they are located in areas that are currently undergoing large redevelopment projects, so it is difficult to get a good feel for the local area. What are the benefits of buying a new home in a regeneration area?

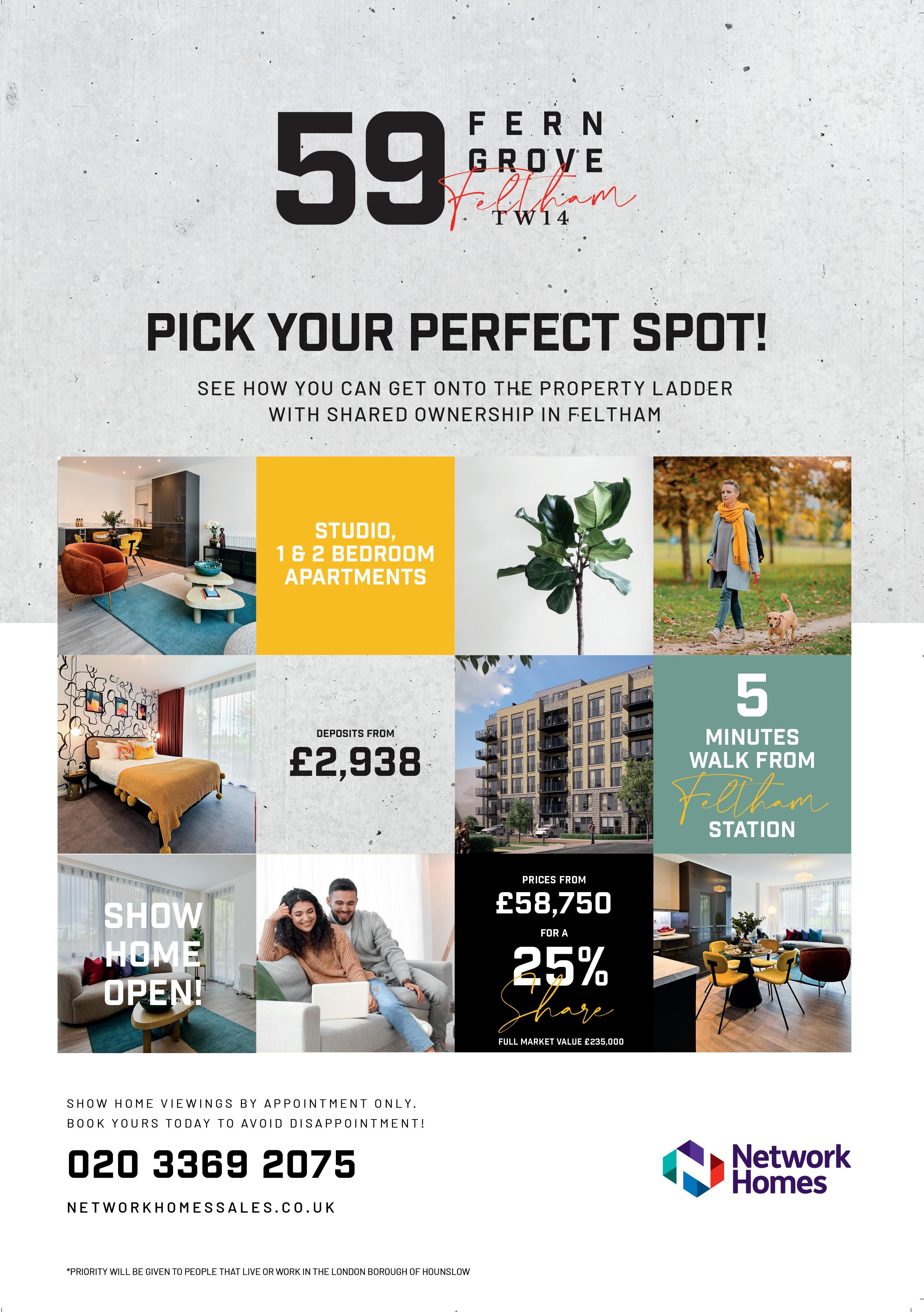

ABuying in a regeneration zone can provide a variety of benefits, both financial and lifestyle-related. If you find a property that you are keen to make your own, don’t be put off by the surrounding regeneration works.

New housing is a key part of many regeneration plans to meet changes in demand. The way that we use our homes evolves over time. For example, working from home is becoming increasingly common, requiring us to think about new ways to use our space effectively. New build homes are carefully designed to support the lifestyle of the current buyers and so may be better suited to your needs than older properties.

Not only are you able to secure a modern property that is better designed to cater to a 21st century lifestyle, but you may also be able to apply for certain financial options that would not be available for older properties. Shared ownership, for example, is only available on selected new build homes and resale properties where the previous owner purchased through shared ownership. Under this scheme, you are able to buy a percentage share of your home and pay a reduced rent on the remaining share. You are then able to buy additional shares in the future up to 100% and full ownership, as and when you can afford to do so.

Another benefit of buying in a regeneration zone is that you know that you are buying in an area that is being reimagined to best meet the needs of the local community. This may include projects aimed at improving transport

infrastructure, green space, leisure facilities and/or employment opportunities.

Once complete, such projects provide a vibrant backdrop for the community to thrive in, creating an exciting place to call home. You can often find detailed plans online so you can see what has been proposed and when work is expected to be completed.

For example, we have a couple of upcoming developments in Edgware in north London (ICON and Edgware Parade). The area has recently benefited from a £5m regeneration project that has added playgrounds and active zone areas to Silkstream Park and Montrose Playing Fields, as well as a wetland area that combines a tranquil retreat from the city with habitats from a variety of local wildlife. Future

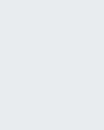

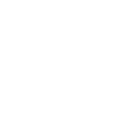

Network Homes is excited to be offering shared ownership apartments in two landmark developments in the heart of north London – Icon and Edgware Parade.

The London Borough of Barnet, in north west London, is fast becoming a Zone 5 hotspot for great places to live. Identi ed in the London Plan as one of the capital’s 35 major centres, there are exciting plans for Edgware, with improvements to cycle lanes, public realm appearance, a new swimming pool and a cinema.

regeneration work has also been announced for the town centre, aimed at enhancing the Broadway Shopping Centre and the surrounding bus station and garages. Buyers at ICON and Edgware Parade will therefore be perfectly positioned to enjoy a variety of new amenities in the years to come.

As a charitable housing association that has been committed to providing safe, secure and affordable homes since 1974, Network Homes believes that regeneration areas provide an incredible opportunity for first time buyers looking to get on to the property ladder.

For more information, please visit networkhomessales.co.uk or contact Network Homes on sales@networkhomes.org.uk or 0300 373 3000.

FROM £TBC

Edgware has always been a prime place to live and work. A good range of excellent schools and lots of green outdoor space nearby make this a soughtafter area for families and commuters alike. Not only are the developments located close to the shopping district, you can also access the underground at Edgware and Burnt Oak stations from where you can reach central London in just over 30 minutes, and there’s access to TFL’s 24-hour bus service.

Icon and Edgware Parade, Edgware

You will never be bored with so much on offer! Whatever your mood there is always something to do in the local area and beyond. The new neighbourhood offers a vibrant community where you can really belong. To the south, the hustle and bustle of central London is only 10 miles away, but you are also within easy reach of Hertfordshire’s peaceful greenbelt countryside to the north.

Register your interest at networkhomessales.co.uk

Kalumba Musambachime is currently Head of Sales & Build to Rent at Network Homes. He has more than 15 years of experience in the residential property sector, working primarily in the areas of day-today operational management, portfolio management and sales. In addition to working for some of the UK’s largest housing associations, he has significant experience of working in the build to rent and private residential letting sectors. In his role as Head of Sales & Build to Rent, he has had to play a key role in ensuring that the affordable homes for sale by Network Homes are delivered in the right locations and at affordable prices

Kalumba Musambachime is currently Head of Sales & Build to Rent at Network Homes. He has more than 15 years of experience in the residential property sector, working primarily in the areas of day-today operational management, portfolio management and sales. In addition to working for some of the UK’s largest housing associations, he has significant experience of working in the build to rent and private residential letting sectors. In his role as Head of Sales & Build to Rent, he has had to play a key role in ensuring that the affordable homes for sale by Network Homes are delivered in the right locations and at affordable prices

February/March 2023

Kalumba Musambachime, Head of Sales & Build to Rent, Network Homes

A LIFE LESS ORDINARY!

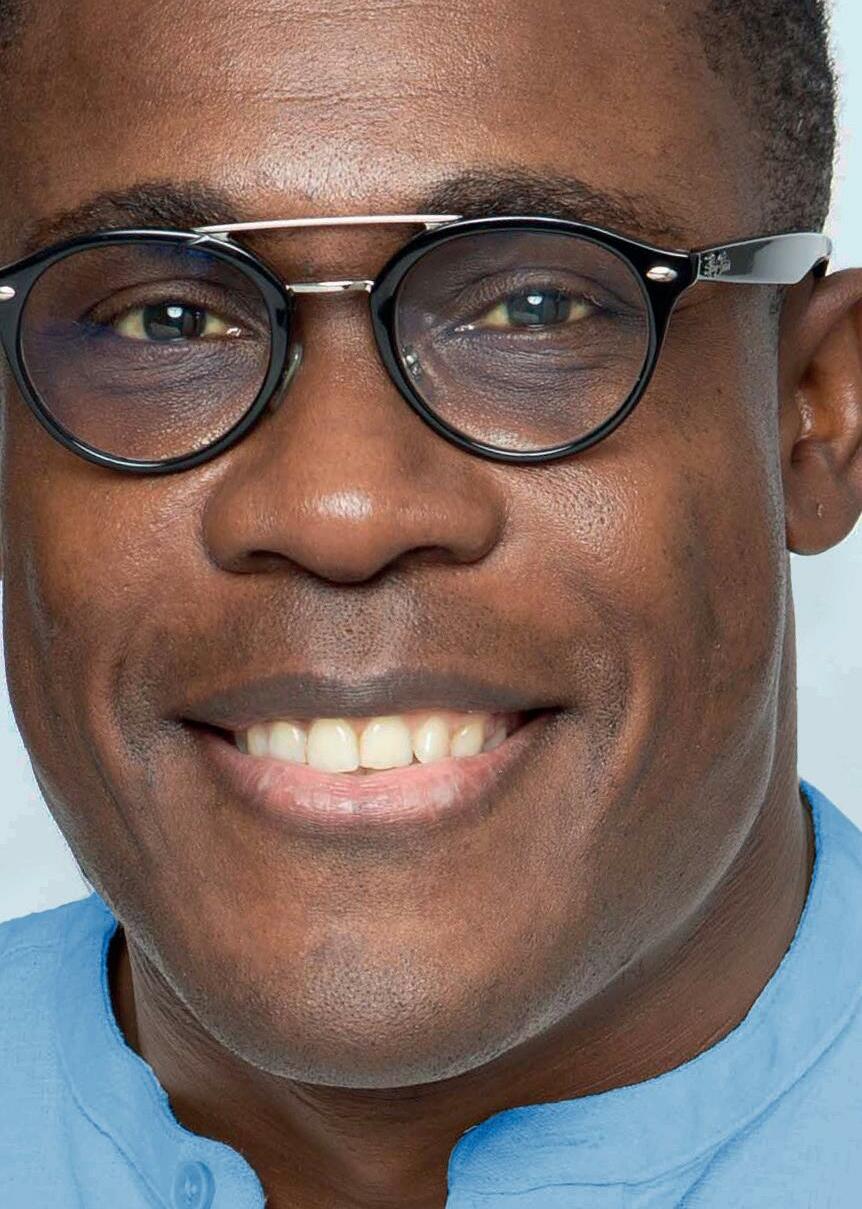

Peter Komolafe is a financial expert, financial coach and TV personality whose personal journey is the driving force behind his passion for helping people. In 2020 he founded Conversation of Money on a YouTube channel, and runs a weekly podcast. Since the launch they have gained over 1.8 million views and downloads. He talks to Lynda Clark about his incredible life, his career, and offers some excellent advice to first time buyers

THE VIEW

20 First Time Buyer February/March 2023

THE VIEW First Time Buyer February/March 2023 21

"SPEAK TO A MORTGAGE ADVISER TO GET A CLEAR PICTURE OF WHAT YOU CAN AFFORD"

If I say I was "blown away" after hearing Peter’s life story it would be a complete understatement. His fortitude, bravery and resilience is quite incredible. Peter’s parents came to England from Nigeria in the 1970s to study and work. He was born in 1979 but they already had three older boys and they felt they just couldn’t look after him. At that time, it was common for people to advertise in the newspaper for foster parents and when he was three months old he was fostered to a family in Hastings. He only got to see his parents once a year for two weeks in the summer holidays, but his life with his new family was very good and they treated him like he was their own.

By the time Peter was eight, his father had moved back to Nigeria and he was told that his father had booked him a flight to visit them so that he could get to know his brothers. Peter thought he was going for a couple of weeks but once there, they told him he wouldn’t be returning to England or his foster parents.

He said, “I was so young but I had to get a plane all by myself to Lagos and when I arrived there were some people holding up my name to take me to the place where my family lived. It was pretty scary! I had no idea that it would be 10 years before I went back to the airport to fly home. I was so unhappy and I didn’t want to speak Nigerian and always insisted that my parents spoke to me in English. It was hard because I looked the same as everyone else but somehow I was different. I was targeted at school and I just couldn’t adjust to the culture. All in all, I just didn’t want to be there. I never had any contact with my English foster parents either but I never forgot them.”

He finished his schooling and did well in science and physics and because Peter suffers from sickle cell anaemia his father wanted him to train to be a doctor to research the condition and hopefully help to find some sort of cure. Eventually, after two long years in limbo between applying for university and potentially coming back to the UK, his father cobbled together enough money for a plane ticket.

Peter was very excited about the prospect of returning home and his father told him his flight would be in a couple of weeks but then a few days later he came home from work and told Peter that actually

the flight was leaving in two hours. “I was in shock and had to quickly pack a bag with a few things and my dad gave me £50. It all happened so fast that I had no time to really think things through. I never had a plan of what I was going to do. I knew I was heading to my foster parents' address but had no idea if they still lived there or had moved. It wasn’t until the plane started its descent that panic started to set in.”

Peter never saw his father again and when he arrived at Heathrow he got a train to Hastings and found the house where he used to live. “It was about midday when I got there but nobody was in and I had no idea what to do. It was October and chilly but I sat in the alleyway by the side of the house for hours waiting for them to hopefully come home. Luckily a neighbour saw me and recognised me and explained that my foster family were at work and would be back soon. I was very happy to see them again but things had moved on and although they took me in for a couple of months they couldn’t offer me a home for longer. Of course, the £50 my father gave me had run out so I had no money and I looked so young and helpless. Shortly after leaving my foster parents I became homeless and slept on the streets. I was desperate – I had no money, no family and no friends but most importantly I had no permanent address, so I couldn’t get a job and I couldn’t claim any benefits.

“When you are on the streets you become very suspicious of everyone, but one night I was sleeping on a bench when a complete stranger spoke to me and said I would freeze to death if I stayed there. He offered to take me to his parents’ home and promised they would be happy for me to stay. I had to trust him as I knew I couldn’t survive for much longer. They welcomed me into their home and I started to try to turn my life around. The trouble was I had got into some serious debts and I was in trouble. When I was homeless I went into survival mode and had no choice but to issue cheques that I knew would bounce and the police started to make enquiries!

"Finally, because I had an address, I could get Jobseekers' Allowance, which helped a lot, but they insisted I apply for a job. They told me I had to go for an interview at a building society and if I refused then I would lose my allowance. I had no choice, so I tried to make myself

look scruffy and wore jeans, trainers and a leather jacket, which is obviously not what they would expect you to wear. The lady who interviewed me was very nice and we are still in touch. She said she wanted to give me a chance as she saw something in me and offered me the job even though I explained I had racked up so many debts.”

He started as a cashier in the Portman Building Society which is now Nationwide. As he was good at talking to people and very good with figures he prospered. He then moved up and became a sales consultant for them and eventually moved to NatWest where again he did very well. In 2012, Peter decided he should move to London. He wanted to progress and had always had a dream of working in Canary Wharf. He had no degree though, and he thought it would be useless, but he was approached by a recruitment consultant who had seen his CV online. They told him they might have the perfect job for him and it was based in Canary Wharf!

“I always watched The Apprentice on TV and remember the rolling shot over Canary Wharf and the pointed roof of One Canada Square. On the recruitment day, I turned up 20 minutes early to make a good impression but there were 25 other people already there who were more qualified than I was. So, I was shocked when eventually I found I had got the job – it was my dream come true and it was on the 50th floor at One Canada Square, right in the heart of Canary Wharf!

"I worked very hard and eventually after five years was on the executive team of a Fortune 100 company. I started on £28,000 a year as a telephone consultant and quickly learned that the guy who I was supporting on the phone was earning over £100,000 a year. I thought to myself that I was being a mug and I could easily do his job. I think I have a great deal of resilience which stemmed from my childhood and a spirit of never giving up. Eventually I left as I qualified to be a financial adviser in 2017. I always wanted to help people and advise them on what you can do with your money.”

Then in 2020, Peter founded Conversation of Money on a YouTube channel and did a weekly podcast. “I wanted to share my knowledge and break down what is a very complex subject into easy-to-understand language. I gained so much experience and understanding during the 15 years I was working that I wanted to have conversations that I would have loved to have had when I was in my 20s. Since the launch they have both gained over 28 million impressions and over 1.8 million views and downloads. “I am passionate about sharing the knowledge I gained through my career and the personal lessons I learnt along the way.”

Peter was approached to appear as a

THE VIEW 22 First Time Buyer February/March 2023

"I ALWAYS WATCHED THE APPRENTICE ON TV AND REMEMBER THE ROLLING SHOT OVER CANARY WHARF AND THE POINTED ROOF OF ONE CANADA SQUARE"

financial expert on Channel 4's Secret Spenders and is a regular contributor on Lorraine on ITV. He contributes to news stories with GB News, The Express, The Sun, The Times and the BBC World Service He also appears on Steph’s Packed Lunch on Channel 4 every Tuesday.

He bought his first home, which is a four bedroom house on three floors. “It’s not my dream home but it’s got enough room if anyone wants to stay and it’s a great start. There is also plenty of space to work which is good too." He has some sound advice for first time buyers, “Speak to a mortgage adviser to get a clear picture of what you can afford. Get a good idea of what you actually want to buy and what location you want. If you can live outside of London you will find that properties are much more affordable. Get a Lifetime ISA and also be realistic about how much you can save for a deposit. Take each stage in bite-sized chunks so you don’t get overwhelmed and you will make more progress than you think, if you are disciplined.”

Peter’s story is inspiring to say the least. Looking back at his erratic upbringing and desperate times, it’s amazing that he is so warm and passionate about sharing his knowledge and helping people – his future is looking very bright indeed!

Website – peterkomolafe.com Instagram – peterkomolafe YouTube – Peter Komolafe

Peter’s new book, The Money Basics: How to Become Your Own Financial Hero, will be published by Harper Collins on 16 March

THE VIEW First Time Buyer February/March 2023 23

CAPITAL CONUNDRUM

The current cost-of-living crisis has hit the UK hard and has obvious implications for all those looking to invest in their first home. Research by Pocket Living has found that the situation is particularly challenging for Londoners, with over a quarter (27%) of the 25 to 45-year-old renters polled considering leaving in the next 12 months. We look at what London has to offer, the barriers to buying in the city, and the options available for those who are keen to continue to call London home or to live within reach

THE DREAM

Pocket Living’s research found that transport links are of high importance to buyers, with 65% of respondents noting they are particularly important when selecting a location to live in. The accessibility of the capital is therefore key to its appeal. This is followed by parks and green spaces (49%), which the city has in droves. When it comes to the home itself, 62% of buyers view "space" as being particularly important to them when buying a property, followed by "access to transport" (59%), "storage" (53%) and "Wi-Fi" (46%).

Buyers are also looking to the future when making their plans; for many the decision to have children is impacted by whether or not they own a home. Almost six in 10 (59%) of non-homeowners say they'd be more likely to have children within the next five years if they owned their home, and almost half (46%) of homeowners claim they were motivated to buy due to their desire to have children. Conversely, 46% of renters say that not owning their home is one of the biggest barriers to considering having children. Of the homeowners polled, approximately seven in 10 claim owning a home has improved both their stability in life and quality of life.

THE BARRIERS

Many first time buyers choose to settle outside of the city, but sadly 54% of those

currently planning to leave don’t want to – an increase of 11% in just a year. A huge majority (71%) of these agree they are less likely to afford a home as a direct result of the cost-of-living crisis, and 69% say the current economic climate is delaying their plans to buy their first home.

Of course, London property prices remain by far the biggest obstacle to homeownership for renters (60%). Of the homeowners polled, over half (55%) received financial help from their parents to raise a deposit, and those who have bought in the past two years have spent an average of £594,288 on their home, raising an average deposit of 22.1%. These figures are simply unobtainable for many, with 39% claiming they can’t raise a deposit, and 36% saying they can’t afford the mortgage. In fact, 52% have seen a decrease in the amount of money they can save, and a concerning 26% are increasingly in debt.

THE OPTIONS

Over half of renters (51%) feel they would have to sacrifice too much if they were to move outside of London to afford a home, so what hope is there? Savvy renters looking to get on the property ladder are already making changes to their lifestyle in an attempt to stay in the city; 60% have reduced the number of times they are eating out each month and 54% either have or plan to lower their household heating usage.

Marc Vlessing, Chief Executive Officer

at Pocket Living, comments, “There are hundreds of thousands of hardworking people trying to get their foot on the housing ladder, who are currently hampered by high London property prices, the ability to raise a deposit and a lack of quality homes in London. Our aim has always been to help these people find a place of their own in their local area and as many Londoners battle increasing rents, bills and the price of everyday services, genuinely affordable housing in accessible areas will become even more vital.”

There are developers committed to providing high-quality, affordable housing, and there are schemes designed specifically to support first time buyers to access that housing, so before making a big move out of the city we would encourage our readers to assess their finances, have a look at the schemes available to them and speak to a broker – you may be pleasantly surprised.

Alternatively, it may be that you simply can’t afford the home you want in the capital, in which case you will need to be very honest with yourself about what compromises you are willing to make in order to secure your first home.

What is it you feel you would be sacrificing by leaving London, and can it be found elsewhere? If you had good transport links, could a home further afield work for you? Would the extra space you could afford give you the option to work from home? Consider carefully what your priorities are long term, and work from there.

CAPITAL COMMUTE 24 First Time Buyer February/March 2023

CASE STUDY

BRIGHTON

Home X

Home X is an exciting new neighbourhood, forming a key part of the Preston Barracks Regeneration on Lewes Road. The range of homes includes studio, one and two bedroom apartments plus three bedroom triplexes. A selection of homes have private outside space in the form of a balcony or terrace, while all residents have access to beautiful landscaped podium gardens. Internally, homes are light lled with a high-quality speci cation, including sleek matt blue tted kitchens with integrated appliances. As part of Home X’s travel plan, residents will also bene t from two years’ free car club membership and choice of either a Network Saver ticket, £150 bike voucher or 12 months BTN Bikeshare membership.

home-x.co.uk 0333 210 0437

CROYDON

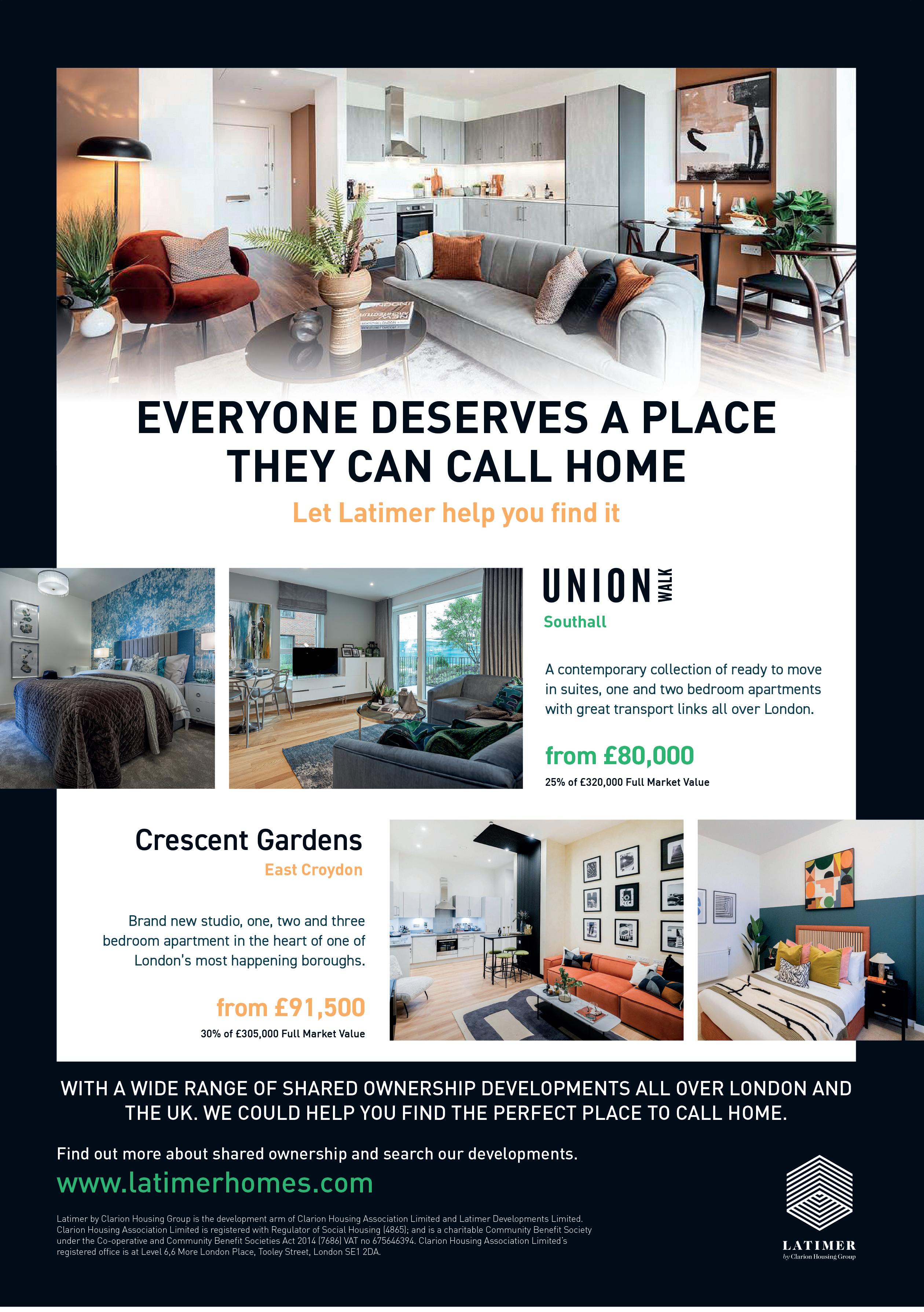

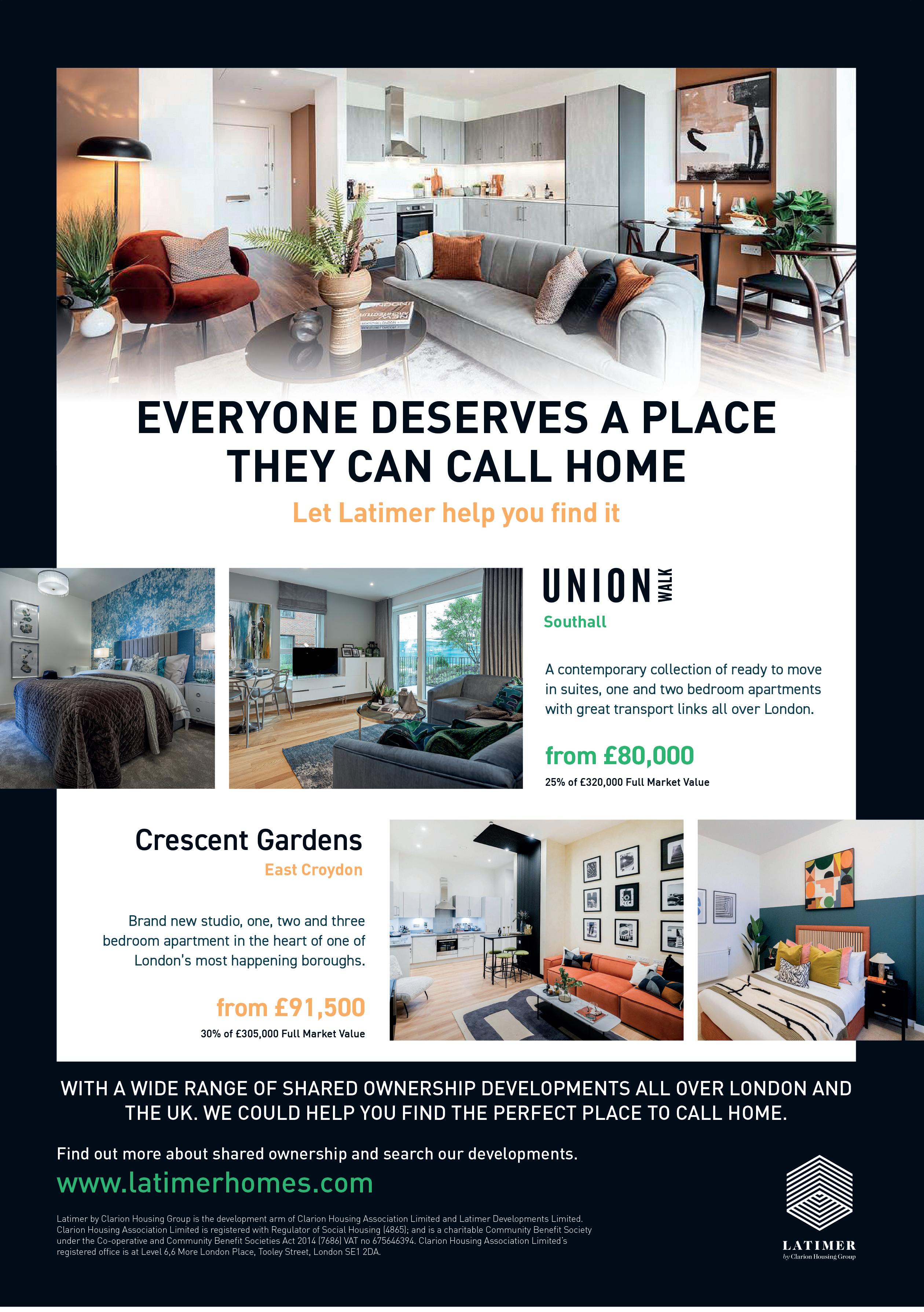

Crescent Gardens

Croydon has been named the London Borough of Culture of 2023 and these 79 shared ownership apartments by Latimer are located in its exciting new urban culture quarter. The new studio, one, two and three bedroom apartments at Crescent Gardens deliver accessibly priced housing without sacri cing on design. High-quality xtures and ttings come as standard in these generously proportioned apartments, which all enjoy private outdoor space. Residents can reach East Croydon railway station in a few minutes via a new station entrance, with direct trains to Clapham Junction in nine minutes and London Victoria and Gatwick in just 15 minutes.

latimerhomes.com/new-build-homes/london/croydon 0300 100 0309

SOUTHALL, EALING

Union Walk at The Green Quarter

Buyers can choose from a collection of contemporary suites plus one and two bedroom apartments in this development along the Grand Union Canal, which will feature tree-lined avenues, 2,500 freshly planted trees and living green roofs to enhance the biodiversity of the area. Residents will also bene t from a buzzing community including a new school, retail and leisure hub, restaurants, cinema and two new parks. The homes are nished to an excellent standard, with modern-day living at their core. Inside, openplan living areas enable exible lifestyles, while stylish kitchens come complete with a range of integrated appliances. Many homes also bene t from private balconies.

latimerhomes.com/new-build-homes/london/ealing/union-walk-at-the-greenquarter 0300 100 0309

First time buyer Rhianne, 28, and her partner Sam, 29, had been renting a one bedroom at in Hampshire, but rising house prices meant buying a home in the south east was out of reach. Now, having purchased a three bedroom semi-detached house through the shared ownership scheme at Weston Woods by Latimer in Crewe, Cheshire, the couple have space to grow and are enjoying their new lives in the countryside.

Rhianne says, “House prices in Hampshire and the south east had rocketed and showed no sign of coming back down so we explored alternative avenues. With contemporary hybrid working, I realised we were no longer geographically constricted by work commitments. With my role as Global Visual Communication Manager at Reiss, I have the exibility to live outside of the heavily priced areas surrounding London and Sam did too.”

After discovering the Weston Woods site, Rhianne and Sam’s journey from viewing to completion took just six months. Rhianne recalls, “After the viewing, we knew this was the home for us. I am the sole mortgage holder and bought a 45% share of the property which has a full market value of £205,000 and required just a 5% deposit. Our monthly outgoing is about £100 less than our one bedroom rental in Hampshire, which my friends and family can hardly believe. For a lower monthly cost, we now have three bedrooms, a lovely garden and so much more storage space than our rental offered. I plan to staircase in the future and hope to eventually own 100% of my home, something which wouldn’t have been possible had we stayed near London.”

The couple are making the most of the location and rural life of South Crewe, and particularly enjoy the village community feel, “where everyone says hello to one another and helps each other out”. Rhianne continues, “The home itself is absolutely beautiful. It’s fresh, spacious and is in a wonderful location. We have converted one of the rooms into a home of ce and the other is used for guests. Our garden looks on to an area of green space which come spring will look incredible. We have made our home warm, cosy and full of colour and indoor plants.” The commute is no bother either. “I’m well positioned to reach all the big cities like Birmingham and Manchester,” Rhianne explains, “and a ticket to London is £40, nearly the same as when I was in Hampshire.”

As a rst time buyer and solo mortgage holder, Rhianne was particularly grateful for the Latimer sales team’s support and professionalism. “My experience was brilliant, it showed that buying a home is possible and can be a seamless process if you have a helpful sales team and make use of the shared ownership scheme.” In fact, Rhianne loves her home so much, she is documenting their new build journey on her home Instagram account @village_newbuild

CAPITAL COMMUTE First Time Buyer February/March 2023 25

FROM £105,875* FROM £90,675* FROM £66,875* *Based on a 35% share of the full market value of £302,500

on a 30% share of the full market value of £302,500

on

value of

*Based

*Based

a 25% share of the full market

£267,500

Hristina, a business management student, and Vladamir, a lorry driver, have bought the house of their dreams with a 30% price reduction, thanks to a Government-funded scheme. The First Homes scheme allows buyers to own 100% of their home but pay 30% less than its market value, with the Government supplementing the rest. The discount will apply to the home forever, so when selling, the home must be sold to another rst time buyer at 30% less than the market value at the time of sale.

Housebuilder Chestnut Homes is the rst in Lincolnshire to offer the First Homes scheme, aimed at helping rst time buyers get on the property ladder. Helene Key, Sales Manager at Chestnut Homes, said, “The First Homes scheme is a brilliant way for rst time buyers to get on to the property ladder. The Government support will make a huge difference to the overall cost and may even allow some to purchase a home sooner than planned. We’re proud to be the rst housebuilder in Lincolnshire to offer the scheme, and we’re delighted we could help Hristina and Vladamir nd the right home for their family.”

The couple are the rst recipients of the scheme at Chestnut Homes’ development, The Quadrant, in Boston. To be eligible for the scheme, buyers must be able to get a mortgage for at least half the price of the home and be part of a household where the total income is no more than £80,000. Hristina and Vladamir, who have two children, had originally hoped to buy a family home using the Help to Buy scheme but found out they didn’t meet all the requirements.

Hristina recalls, “One day we were driving home and stumbled across a Chestnut Homes development and it felt like fate. We knew we wanted to buy soon, so we decided to pop in and speak to the sales staff to nd out what we could get. We were told we couldn’t use Help to Buy on this occasion, which was disheartening until we were told about the First Homes scheme. We had never heard of it before, and it happened that we t the criteria.”

Hristina adds, “After the pandemic, so many people lost their jobs and we had to reassess our dream of getting our own home. I can’t thank Chestnut Homes enough because no matter what silly questions we had, their staff supported us throughout the entire process. Even when we moved in, they checked in multiple times to make sure we were settling in. We’re so thankful we came across The Quadrant and without their recommendation, we wouldn’t have found our dream home.”

WELWYN GARDEN CITY SO Resi Welwyn Garden City

This collection of new one, two and three bedroom homes forms part of an impressive development around the landmark of the city’s famous Shredded Wheat factory. The light and inviting

are ideal for those who love the vibrancy of modern life surrounded by endless green space. Welwyn

City bridges city and country and sits a 29-minute train journey from London King's

All apartments will bene t from private balconies and terraces to

the local scenery. soresi.co.uk/ nd-a-property/so-resi-welwyn-garden-city 020 8607 0550

TOLWORTH, KINGSTON UPON THAMES Signal Park

Guinness Homes has launched Phase One of its new development in Kingston upon Thames comprising 78 one bedroom apartments, 103 two bedroom apartments, six two bedroom duplex apartments and 24 three bedroom apartments. Situated within a three-minute walk of Tolworth station, Signal Park is strategically located among nearby amenities; its central location is ideal for young people and families. The line leading through Tolworth station takes travellers directly to Waterloo in 31 minutes, stopping at Clapham Junction and Vauxhall beforehand for convenient access into the city. guinnesshomes.co.uk/ nd-a-home/signal-park-tolworth 020 3824 9500

FONTWELL, WEST SUSSEX Fontwell Meadows

Fontwell Meadows is a development of two, three and four bedroom homes located in the village of Fontwell, close to Barnham – a perfect location for semi-rural living. Each home comes with a fully tted modern kitchen and a spacious living area. Homes also bene t from private gardens and a garage or allocated parking. Surrounded by scenic countryside with amenities and several Ofsted-rated Good schools nearby, it is a great location for families.

dandara.com/fontwell 01903 337 449

CAPITAL COMMUTE 26 First Time Buyer February/March 2023 CASE

STUDY

homes

Garden

Cross.

enjoy

FROM £70,000* FROM £88,125* FROM £249,950 *Based on a 25% share of the full market value of £280,000 *Based on a 25% share of the full market value of £352,500

FROM £310,000

HENLOW, BEDFORDSHIRE

Annington – Nene Road

This collection of refurbished mid and end-terrace cottage-style homes include new carpet and ooring throughout, with updated bathrooms. The former MOD homes bene t from good-sized gardens, access to an off-road driveway and dedicated cycle stores. Some homes come tted with an electric vehicle charging point. Arlesey railway station is only a ve-minute drive away from the development, offering services to London King's Cross in 45 minutes.

annington.co.uk/portfolio/sales 01462 459 643

BRACKNELL

SO Resi Bracknell

SO Resi Bracknell

Currently available are a collection of one and two bedroom apartments, located just a twominute walk away from Bracknell train station, SO Resi Bracknell is ideally located for those returning to their city of ces, with London Waterloo under an hour’s commute away.

soresi.co.uk/ nd-a-property/so-resi-bracknell 01462 459 643

FROM

OVAL, LONDON Zone at Oval Village

This chic collection of one and two bedroom shared ownership apartments, by Peabody, are ready to move into. All homes are nished to a high speci cation, with a private balcony and access to signi cant landscaped communal gardens; a city oasis for those who enjoy the great outdoors. Residents also bene t from a concierge service and pay-as-you-go gym. The development is located in Zone 1, within 10 minutes’ walk of Vauxhall, Kennington and Oval stations, offering transport connections via the Northern and Victoria Lines.

sharetobuy.com/developments/4263 020 7021 4842

This beautiful development, by Moat Homes, offers a limited collection of art deco-inspired two and three bedroom houses. The on-site facilities are set to include shops and of ces, a new school, wildlife corridors, a cricket pitch and much more. Canterbury city is 12 minutes away, and the seaside town of Whitstable just 20 minutes. Both Canterbury East and West railway stations provide excellent links into central London, making this the perfect location for rst time buyers looking to embrace country living while maintaining those all-important city connections.

The location of Micklewell Park, on the outskirts of Daventry, was perfect for Ben and his apartment has excellent countryside views from the balcony. He says, “I’m surrounded by the countryside and I’m able to go for scenic walks, without having to travel far. I’m also close enough to shops and everything I need, but far enough to enjoy the outdoors.”

The layout of the apartment was ideal too; it has suf cient space for a big desk, meaning he can work comfortably from home. In fact, his friends and family say it’s much bigger than they expected and are now asking him to host dinner parties and get-togethers!

Ben found the experience of buying his rst home very positive. He says, “My mortgage adviser was fantastic and the team at Orbit Homes were super responsive to any questions I had.”

*Based

on a 30% share of the full market value of £350,000

CAPITAL COMMUTE 28 First Time Buyer February/March 2023

CANTERBURY Ashvine Park

£137,500*

sharetobuy.com/developments/3686 07711 438 500 CASE

FROM £74,250* FROM £105,000*

STUDY

Ben, 24, recently moved into his brand new apartment at Orbit Homes’ agship development, Micklewell Park, in Daventry. Ben had been house sharing with friends and was saving little and often into a Lifetime ISA. His search for a new home began when he had saved enough money for a deposit, and he decided to buy through the shared ownership scheme as it was an affordable way for him to get on to the property ladder.

Asked what advice he would give to someone thinking about getting on to the property ladder with shared ownership, Ben suggests, “Save early and save often. Even if you think you are miles away from your deposit, contribute to that fund whenever you can. You might be closer than you think.” *Based on a 25% share of the full market value of £550,000

*Based on a 30% share of the full market value of £247,500

SAVE AND BUY WITH LONDON LIVING RENT

WHAT IS LONDON LIVING RENT?

London Living Rent is funded by the Mayor. The idea behind London Living Rent is that it is designed to help people to switch from renting to shared ownership.

London Living Rent homes are for middle-income households who want to build up savings to buy a home through shared ownership. Landlords are expected to actively support their tenants into homeownership within 10 years.

London Living Rent homes will be offered on tenancies of a minimum of three years. By offering a below-market rent, tenants are supported to save and given the option to buy their home on a shared ownership basis during their tenancy.

HOW MUCH RENT WILL I PAY FOR A LONDON LIVING RENT HOME?

The amount of rent you pay will vary according to where you choose to live in London.

Across London, the average monthly rent for a two bedroom London Living Rent home is around £1,077 a month, almost

three quarters of the average market rent. The Mayor publishes benchmark London Living Rent levels for every neighbourhood in the capital, which are updated annually.

These are based on a third of average local household incomes and adjusted for the number of bedrooms in each home. So, to ensure family-sized London Living Rent homes are affordable, the rent for a three bedroom home will be set at no more than 10% above the two bedroom rent.

AM I ELIGIBLE FOR A LONDON LIVING RENT HOME?

To be eligible for a London Living Rent home, you must:

Live or work in London

Either have a formal tenancy (for example, in the private rented sector) or live in an informal arrangement with family or friends as a result of struggling with housing costs

Have a maximum household income of £60,000

Not own any other residential home

Be unable to currently buy a home (including through shared ownership) in your local area

LONDON LIVING RENT 30 First Time Buyer February/March 2023

If you can’t afford to buy your first dream home at the moment then London Living Rent might be the answer to help you eventually get on the property ladder

9

9

9

9

9

HOMES AVAILABLE WITH LONDON LIVING RENT

WHITE CITY Macfarlane Place

As part of the iconic Television Centre development, Macfarlane Place sits within the new sought-after hotspot, White City, and features a stylish collection of one and two bedroom apartments available through London Living Rent (due to launch January 2024) and shared ownership (due autumn 2023); including spacious wheelchair-adaptable homes.*

The apartments feature contemporary kitchens, sleek fittings and fixtures, spacious carpeted bedrooms and private outdoor spaces. In addition, the development also benefits from landscaped communal podium gardens.

White City is positioned for excellent transport connections, unrivalled retailing, world-class education facilities, a wealth of social and cultural establishments and an established employment hub. Adjacent to Westfield shopping centre, everything is within easy reach connecting you across the capital by tube, rail, bus and cycle networks.

For more information about Macfarlane Place, register your interest at peabodysales.co.uk

*Wheelchair adaptable apartments available with parking.

NEW RESEARCH ON RENTING PRIVATELY

Market Financial Solutions, the specialist lender, commissioned an independent survey among a nationally representative sample of 2,000 UK adults – 702 respondents were tenants and 211 were landlords. It found that 58% of tenants have seen their rent increased in 2022, with one in two (49%) worried they will not be able to afford rent in 2023.

• 58% of tenants have seen their rent increased in 2022

• 49% are worried that they will not be able to pay rent in 2023

• 48% of landlords have had to increase rents due to rising interest rates and higher mortgage repayments

• 56% would allow flexibility on rental payments in the midst of the cost-of-living crisis

• 77% of tenants say that more needs to be done to control rental prices in the UK

First Time Buyer comments, “With statistics like this, London Living Rent is a very attractive and viable way to rent an affordable home and begin the journey to get on to the property ladder.”

As one of London’s key affordable homes providers, we know that the so-called traditional route to homeownership is no longer accessible to the majority of first time buyers.

London Living Rent is a crucial foothold in the renting to homeownership pipeline for first time buyers, and falls under the umbrella of shared ownership. In a nutshell, this scheme allows first time buyers to rent a high-quality home in London with a secure long-term contract, and most importantly the monthly rental cost is based on a third of average local household incomes and adjusted for the number of bedrooms in each home. We have found that unstable rental housing is a significant hurdle to homeownership, which is why we are offering long-term secure tenancies with capped annual rental increases. The below market average rent will allow tenants to set aside savings in order to build up a deposit and eventually be able to afford to purchase the property themselves through shared ownership. To ensure the scheme is helping the people that need it the most, tenants must have a maximum household income of £60,000 and be ineligible to buy a home through any other means, including shared ownership.

Esaiyas Mollallegn, Head of Marketing, SO Resi

LONDON LIVING RENT First Time Buyer February/March 2023 31

FROM £TBC

EXPERT COMMENT

ISLEWORTH

St John’s Road

1 bedroom apartment from approximately £907.60 per month

2 bedroom apartment from approximately £1,008.44 per month

3 bedroom apartment from approximately £1,109.29 per month Rents are exclusive of bills and council tax. Rents subject to change for 2023-24 financial year.

These spacious and light open-plan one, two and three bedroom apartments are offered by Network Homes through London Living Rent. Living spaces feature high ceilings and there is a fitted wardrobe in the main bedroom. The larger one and two bedroom apartments include an en suite shower room in addition to the main bathroom.

Isleworth is in Zone 4, with six trains an hour taking the 35-minute journey to London Waterloo, so ideal for commuters. The development is close to numerous amenities, with Waterman’s Art Centre on the riverfront which is a cultural hub with live and recorded performances and exhibitions. There is also plenty of green space nearby including Syon Park and Osterley Park. If you are looking to lead a healthy lifestyle then there are plenty of opportunities to keep you fit with Thistledown Tennis and Social Club, St John’s Centre, Osterley Sports and Athletics Centre, Zen Elephant yoga and Isleworth Recreation centre on the doorstep. For all your daily needs there are supermarkets, a post office and pharmacy around the corner.

For more information go to: networkhomes.org.uk/rent-or-buy/find-ahome/st-johns-road-isleworth-1-2-and-3-bedroom-apartments

General Eligibility for London Living Rent at St John’s Road

Eligibility for London Living Rent is restricted to existing private and social renters with a maximum household income of £60,000, without sufficient current savings to purchase a home in the local area.

9

You must be currently living or working in London 9

You must either have a formal tenancy (for example, in the private rental sector) or have an informal arrangement with family or friends as a result of struggling with housing costs 9

Priority will be given to applicants who live or work in the London Borough of Hounslow 9

Your household income must not exceed £60,000 per annum 9

Your gross income must exceed the minimum income requirement for your preferred home which will be:

• £36,000 per annum for a one bedroom home

• £42,000 per annum for a two bedroom home