Year ending 31 July 2022

Our vision is to help shape a better world through everything we do, driven by the ambition, wisdom and impact of our students and staff.

Year ending 31 July 2022

Our vision is to help shape a better world through everything we do, driven by the ambition, wisdom and impact of our students and staff.

It has been a year of significant change, but one through which the University has emerged stronger and more resilient than ever, with a refreshed sense of purpose. We have come through two years of significant challenges caused by the pandemic, which were dealt with professionally and compassionately. We are very grateful to the stewardship of Professor Liz Stuart, who served as Vice-Chancellor between March 2021 and December 2021. In January 2022, we were delighted to welcome Professor Sarah Greer as our new Vice-Chancellor.

As we navigate the considerable challenges ahead, I am confident that we will be successful. The Board and the leadership team, supported by our dedicated academic and professional service staff, have been developing a new strategy that I believe will move the University of Winchester forward to new successes.

We are pleased that the hard work that we have put into developing a good and responsive relationship with our students is beginning to be evidenced externally. The National Student Survey rates us as 62nd out of 130 UK universities for overall satisfaction, up from 105th. We were delighted that our students feel strongly that they belong to a community of staff and students, putting us in the top 30 universities in the country for this measure.

While this is definitely a period of change in the world, we are confident that with hard work and prudence, the University can navigate the challenges ahead. We are taking all necessary steps to ensure that we remain financially sustainable, particularly in the current economic climate, whilst recognising the need to make appropriate investment for

I would like to express my huge gratitude to all the Winchester staff and our leadership team for their dedication and resilience, and for ensuring our Winchester community spirit continues to thrive. I would also like to thank all of my fellow governors who continue to focus on the governance and strategic development of the University, working closely with the leadership team. Although we are facing change, we will not waver in our mission to educate, to advance knowledge and serve the common good. We are also determined to realise our vision to help shape a better world through everything we do. It is the right time to revisit our University strategy and to be agile to ensure we continue to deliver those clear objectives.

Finally, I would like to offer my thanks on behalf of the whole University to Alan Titchmarsh, who stood down as Chancellor after six years of hard work. It was an honour and a delight to have him hold this important office for us, and we are delighted that he has agreed to continue his service to the University as Chancellor Emeritus.

I was delighted to join the University in January, at the start of a new year, and as we began to emerge from the daily impact of the global pandemic. It has been a real pleasure to see our campus come back to life, welcoming our students back to fully face to face teaching. We have been particularly pleased to see our new landmark teaching building, the West Downs Centre, completed in the pandemic, throw open its doors to our new nursing students, who are enjoying learning their profession in their state-of-the-art clinical simulation suites.

There is no doubt that the year has presented the world with new and serious challenges. As a University of Sanctuary, we have welcomed Ukrainian students and staff to the city and to our University community. We will continue to work with our colleagues across the city’s organisations for as long as it takes to support Ukrainian students to enable them to continue their education and, hopefully, one day return to their homeland to make an outstanding contribution to society.

We are also seeking to manage the rising costs to the University, caused by the challenging economic situation, whilst trying to mitigate the impact of the rising cost of living on our students and staff. The uncertainty and anxiety caused by these current circumstances are very real and likely to continue for some time.

Nonetheless, we are optimistic about the future. We are taking the opportunity to review and clarify our University Strategy, and to refocus on our core mission: to educate, to advance knowledge and to serve the common good. This is as important today as it has always been, and it will give us the confidence and ability to navigate the next few challenging years. Most importantly, a renewed focus on transformational education will ensure that our graduates can face the future with confidence, knowing that they are equipped with the knowledge, skills, and resilience to enable them to succeed. They are tomorrow’s thinkers, creators and problem solvers. We are confident they will be ready to meet the challenges we face and thrive despite them.

This year we have begun to lay the firm foundations for our future success, and we have seen the early signs of green shoots of that success already in improved externally assessed metrics, such as the National Student Survey. There is plenty of hard work ahead, but I am confident that with a sustained and determined focus, by a committed and confident University community of staff, we can succeed.

FINANCIAL HIGHLIGHTS (£M) Total Revenue

2021-22

86.3

ACADEMIC STAFF (Headcount)

2021-22 2020-21 411 388

STUDENT NUMBERS

2020-21 84.4 2021-22 2020-21 8,248 8,142

EBITDA* (£M)

2021-22

12.7

CAPITAL EXPENDITURE (£M)

2021-22 2020-21 6.4 3.1

PROFESSIONAL SERVICE STAFF (Headcount)

2021-22 2020-21 562 564

STUDENT NUMBERS Total students (full-time equivalents)

2020-21 16.3 of students study full-time 6% are international students 18% of students are postgraduates

To educate, advance knowledge and serve the common good. Our original mission has never been more important than in today’s world, as we seek to deliver transformational education to our students, research to shape and inform the world in which we live and service to our local community, city and region.

We’re passionate about seeing staff and students succeed and flourish, so they feel encouraged to help others and empowered to make a real difference in the world. To achieve this, we seek to provide a challenging and supportive environment that encourages ambition, nurtures the embrace of equality, diversity and inclusivity, develops wisdom for a fulfilling life and embeds the knowledge needed for a successful career. Our staff and students will have the resilience and resourcefulness to seize the opportunities and face the challenges of life. We are committed to working globally to fight for equality, integrity and justice. Together, we will uphold the dignity and wellbeing of others, whoever they are and whatever their background.

We love and respect the planet and all life. In alignment with the UN Sustainable Development Goals, we strive to meet the needs of the present without compromising the ability of future generations to meet their own needs. We seek to nurture a love and value for all life and the planet, and challenge all staff and students to adopt this as second nature. Staff and students are empowered to change the world for the better, challenge convention with compassion and stand up for what they believe to be true.

Together, we aim to explore the mysteries of life and grow wisdom and love. We celebrate our Anglican Christian foundation and welcome people of all faiths and none. In a world in which religion is often associated with exclusivity and anti-intellectualism, we seek to model ways of being religious that are inclusive and intellectually robust. We believe that everyone should be encouraged to express themselves through a unique collage of values, disciplines and practices. Our staff and students will have the opportunity to experience and reflect on the creativity, beauty and compassion in life.

During 2021/22 we began the development of our new strategy which will be launched in January 2023. We have continued to operate within our Vision, Values and Mission. This annual report brings together highlights and developments under each section of our mission: To Educate, Advance Knowledge, and Serve the Common Good.

One of our primary aims as a university is to provide an outstanding educational experience for our students. Through our portfolio of undergraduate and postgraduate courses, we build within our students a deep understanding and love of subject together with wider skills for life to help set them up to succeed while they are studying with us and after they graduate.

As a university we are passionate about the quality of our teaching, and the springboard that our programmes provide into successful and fulfilling lives.

Guaranteeing students have an excellent academic experience and prospective students have the confidence to apply for a place means high levels of student satisfaction is key to the University’s continuing success. The University’s NSS 2022 results are more positive than the previous year’s as the University’s ‘Overall Satisfaction’ increased substantially, from 70% to 76%. As a result, Winchester climbed from 105th to 62nd position in the sector (130 UK universities) for ‘Overall Satisfaction’.

In addition, the University improved year-on-year in 25 of the 27 questions in the survey and four courses achieved 100% Overall Satisfaction. This year’s successes have already fed into university league tables as Winchester climbed 19 positions from 106th= to 87th In the Times Good University Guide 2023, primarily due to increases in its student satisfaction

Central to everything we do is the delivery of courses which propel students onto successful and fulfilling lives after graduation. Employability is woven through our curriculum and course teams work very closely with our Careers Service. In the latest Graduate Outcomes survey (2019/2020) the University maintained its ‘employed or further study’ metric at 90% and is in the top quartile in the sector (130 universities) for this metric. Further, we are joint second in the South East region for employment or further study.

The University continually strives to improve its progression TEF metric. The latest TEF data indicates almost seven out of ten (68%) of Winchester’s leavers to be in graduate level employment or further study, comfortably above its benchmark of 66.8%.

In 2021/22 the University had 8,248 students across all levels of study, a 1.3% increase from the previous year. Within these figures there have been some changes in the courses students are opting to study, with, for example, growth in courses in our Faculty of Health and Wellbeing and decline in some courses in the arts and humanities.

The University saw a trebling of the relatively small number of international students coming to study Master’s degrees with us.

In response to this growth in numbers, the University has established a number of new staffing posts to support all international students and prepare them for a successful start and completion of their academic career with us. We anticipate that this will continue to be an area of growth for the University in the next five years.

In the year of this report, the University was made up of the following faculties:

• Faculty of Arts

• Faculty of Business, Law and Digital Technologies

• Faculty of Education

• Faculty of Health and Wellbeing

• Faculty of Humanities and Social Sciences

Throughout the year, the University conducted a data-led Portfolio Review to clarify and streamline our undergraduate course offering.

We currently have a wide range of undergraduate and postgraduate courses delivered across five faculties, each led by a separate Dean and faculty admin support.

FACULTY OF EDUCATION AND THE ARTS

The Faculty of Education and the Arts comprises four academic departments: Education and Childhood Studies; Performing Arts; the School of Media and Film, and the Institute of Education. Rigorous, creative programmes, with well resourced facilities, provide handson, fulfilling student experiences and an outstanding foundation for professional life after graduation. The Institute of Education has a wide range of ITT provision (undergraduate, campus-based PGCE and School Direct PGCE) which prepares our students for careers in primary or secondary teaching, and the attainment of Qualified Teacher Status.

FACULTY OF BUSINESS AND DIGITAL TECHNOLOGIES

This faculty spans a wide range of disciplines including Accounting, Business Management, Digital Media, Event Management, Fashion, Law, Marketing, Cyber Security, and Computer Science. The Faculty are proud to support and share extensive links with the professional and business community, ensuring that what we teach is relevant and that graduates possess essential employability skills.

FACULTY OF LAW, CRIME AND JUSTICE

Newly formed in 2022, this faculty brings together courses in Law, Criminology, Policing, and Forensics. Committed to professionally focused education, the Faculty’s plans are to ensure the University is making the most of the synergies between these areas.

This faculty offers research-led teaching and outstanding support across numerous disciplines: Anthropology, Archaeology, Criminology, Forensic Studies, Geography, History, Politics, Psychology, Sociology, Theology and Religion, and Philosophy. The faculty is driven by passionate inquiry into what makes us human, and members are actively engaged in impactful research through our research centres, consultancies and public engagement.

The Faculty of Health and Wellbeing is home to our students studying to attain qualifications in Physiotherapy, Nutrition and Dietetics, Nursing, Social Work, and Sport. This follows our pledge between the University and Hampshire Hospitals NHS Foundation Trust to work together to help address the growing demand for healthcare professionals in the region. From this partnership, students gain access to cuttingedge medical equipment, on-thejob training and teaching spaces within the Royal Hampshire County Hospital in Winchester, Andover and Basingstoke, supported by dedicated space in our West Downs building.

The University has been growing its provision of courses within the Faculty of Health and Wellbeing, working closely with the NHS regionally. Our first cohort of Physiotherapy students successfully graduated from the University in October 2021.

The 2021/22 academic year was also the final year for our first cohort of nursing students. Working closely with local NHS providers, the University introduced the registered nurse degree apprenticeship (RNDA) in September 2021. At the ribbon cutting ceremony, Professor Greer was joined by Alex Whitfield, Chief Executive of Hampshire Hospitals NHS Foundation Trust (HHFT), which is one of a number of NHS providers that the University partners with, student nurses, the Mayor of Winchester and Mary Edwards, Chair of the Board.

We were joined by NHS staff, the Mayor of Winchester and other

dignitaries to open our state-of-theart clinical skills training facilities in the University’s West Downs Centre in April 2022. The new facilities are supporting the popular and fastgrowing nursing courses at the University, which are helping address the shortage in nurses in the region. The facilities, which are used by the 380 student nurses currently studying at the University, comprise two five-bed simulation hospital ward units with hi-tech medical mannequins and an active living centre, set up like a flat with kitchen, bathroom and bedroom. There is also a therapy room, a simulated GP surgery and classroom spaces. The opening also provided an opportunity for the University to thank NHS colleagues, staff and students for their work on the frontline during the pandemic.

To support expansion in this important area, in November 2021, we were awarded £1.1m from the

Office for Students’ Capital Funding Bid. Our bid was built around our vision ‘to positively influence the lives of individuals, families, communities and organisations by translating world-leading research and outstanding education into effective policy and practice’, and our strategy of growth in Nursing and Allied Health Professions. It provided funding for two projects to help facilitate the growth in our provision, including conversion of the third floor of the new West Downs Centre to provide several specialist workspaces and simulated environments to provide learning, teaching and assessment opportunities across a number of healthcare disciplines including nursing, and health and social care. The second project covered by the bid was the adaptation and refurbishment of an existing Victorian building called Holm Lodge, which is being adapted to house the newly launched nutrition and dietetics BSc (Hons) course.

Cyzel, who is in her final year studying on the BN (Hons) Nursing (Adult) degree course is one of just seven student nurses from around the country nominated for the Mary Seacole Award for outstanding contribution to diversity and inclusion.

The Award recognises a student who has made an exceptional contribution to creating a supportive and inclusive environment for their patients and/ or other students and staff, showing compassion and understanding of the needs of those from diverse backgrounds.

Some of the reasons for Cyzel’s nomination include her involvement in the University’s HEART group (Health

Education and Social Work AntiRacist Transformers), providing a safe space for students to talk about their personal experiences in their study and practice. She is also a champion of Breaking Through, a studentfocused group proving another forum to talk about issues that are often uncomfortable to confront.

Speaking about her shortlisting, Cyzel said: “I couldn’t and still struggle to believe it, that I have been nominated for an award at the Student Nursing Times Awards. It’s unbelievable but I am so humbled and feel so blessed for the recognition for all my work for equity, diversity and inclusion. I really believe that only together we will overcome the prejudices, discrimination, racism and colourism; making the world a much better place for the future generations to come. This nomination isn’t just for me, it’s for all the other Cyzels out there that are changing the world every day, with little acts of kindness. Especially for those that champion equity, diversity and inclusion and may have felt on many occasions, uninvited and unseen at the table.”

Ian Winkworth, Programme Leader, BN (Hons) Nursing (Adult) degree course, said: “Here at the University of Winchester we pride ourselves not only in producing the highquality nurses for the future, but also students who are socially and politically engaged and motivated. Cyzel is a prime example of this and from the beginning of the course has been an active voice for students and nursing with her student role with the Royal College of Nursing, placement with the Florence Nightingale Foundation, being Co-Chair of our Student Committee and also being an active member of the Hampshire and Isle of Wight Student Council.

“Cyzel is a real advocate for social justice and we are incredibly proud of what she has achieved as a student nurse, which has culminated in her nomination for the Nursing Times award.

We are deeply committed as a University to actively encouraging and supporting all students who have academic potential and ability to progress to higher education.

We have two key aims related to widening access into higher education which are; to work with local communities to increase the low rates of progression into higher education and to increase the diversity of our student body and close the gaps in participation in HE for students from under represented groups.

We currently work with over 30 local primary and secondary schools in areas with low levels of progression into higher education. We deliver a programme of sustained outreach activities via our UWIN Aspire Programme, including raising attainment initiatives in literacy and English Language. In 2021 we launched the First Star Scholars programme for a cohort of 30 careexperienced young people to join us on a four-year programme focusing on academic attainment through a series of Summer Schools and monthly Saturday Schools.

As founders of the Service Children’s Progression (SCiP) Alliance, we provide events and activities to support veterans, spouses and children from military service families access higher education via tailored activities and events.

We offer financial and support packages to care-leavers; estranged students; young adult carers, students seeking sanctuary and Gypsy Roma Traveller Showman and Boaters (GTRSB as of 2021 entry). Packages take account of background via contextualised admissions, provide designated support staff, access to year-round housing and financial support. All students in receipt of one of these support packages, including income-

based bursaries, are given transition support and buddying schemes. Last year, we also extended a support package, including accommodation and fee waivers, for a small cohort of Afghanistan students and their families.

Students from low-income families can also access our income-based bursaries. Students on our targeted support packages are also eligible to access the income-based bursaries if they meet the criteria. The bursary is evaluated each year with evidence suggesting that students find financial support reduces anxiety and enables them to actively engage in their studies.

The University has a Compact Scheme in place which includes staff development for Compact Coordinators in partner institutions to raise awareness of routes into University and to learn about curriculum developments, financial support and special measures to support applicants from target groups. These measures include taking into account special circumstances or contextual information for applicants from target groups identified as potentially benefiting from a tailored entry offer, guarantee of an invitation to interview, priority for student housing

and contacting our Student Services department to ensure a smooth transition from school/college to the University. In 2019/20, 307 applicants benefited from a Compact offer.

Each year we recruit a growing number of students from widening participation backgrounds onto our foundation year courses. In 2021/22, 70% of our foundation year students come from a priority WP target group, 62% are first-in-family to attend the university and over 30% are considered mature on entry. We value the ability to offer students who would have traditionally struggled to access higher education a specialised programme that better prepares them for degree level study in a university environment. We fear that without this route these students may have otherwise failed to access HE or dropped out without the additional tailored support.

In March 2022, the University joined a coalition of more than 30 organisations and individuals to launch the Young Carers Alliance, a new network which aims to provide a stronger collective voice for young carers and those who support them.

of Winchester academic Lim Teoh has been recognised with a prestigious fellowship in recognition of his commitment to excellence in learning and teaching.

Lim Teoh, Head of Learning and Teaching in the Faculty of Business, Law and Digital Technologies and senior lecturer in Accounting and Taxation, joins 54 new National Teaching Fellows across the country.

The National Teaching Fellowship Scheme (NTFS) celebrates and recognises individuals who have made an outstanding impact on student outcomes and teaching in higher education.

Throughout the year, the University continued to both directly deal with the impact from Covid-19 and build back from the pandemic years.

Leading into the 2021/22 academic year, we had a ‘Project September’ team drawn together from colleagues across the institution to prepare for a full return to campus life for staff and students with faceto-face teaching and no social distancing. Recognising that some students and staff wished to continue to observe a level of separation from others, we provided a special lanyard for students and staff to signal to others that they would like to maintain their personal space. We hosted several pop-up vaccination centres during the year, including during Welcome Week for

Successful individuals also demonstrate impact and engagement beyond their immediate academic or professional role and a commitment to, and impact of, ongoing professional development with regards to teaching and learning and/or learning support.

Lim receives the fellowship for the way he has transformed traditional teaching practice into a more interesting and effective approach through the use of digital technologies, offering new solutions to engage students towards greater success.

He has won numerous teaching awards in recognition of his creative and innovative practices to enhance students’ learning. Prior to his academic career, Lim worked for a Big Four accounting firm in auditing and business consultancy for six years.

new students. Staff open meetings were held to communicate all the decisions being made and the challenges being considered while also giving staff the opportunity to raise concerns or solutions with the team.

With the rise Omicron variant prior to Christmas 2021, the University was well prepared to respond to changing Government guidance. We were pleased that the Government made it clear that face-to-face teaching should continue, and we put in place measures to ensure we are able to provide in-person teaching for all students.

To support those students staying both in halls and in the wider community within the city, we reinstated our Staying in Winchester Teams group which was initially set up to support students over the

Christmas 2020 break. This provided students with a space to connect with others local to them over the closure period and also provides a dedicated space for staff to promote local activities and engage with those students directly. Students self selected to join the Teams group which was managed by some of our Wardens and Student Listeners. The group promoted, amongst other things, wellbeing resources such as Student Space, Winchester Trees Trails and services at the Cathedral. Over Christmas and New Year, our Wardens team hosted in-person Christmas Cafés where students were able to meet together to watch films, see some friendly faces and share food and our Student Listeners offered online sessions for students to attend if they were feeling isolated and wanted to chat, or if they had specific concerns to raise.

There have been many useful lessons

learnt during the pandemic which have informed and enhanced the way we are now teaching and supporting students. Feedback from students was clear that recordings of lectures during the pandemic were beneficial to their learning, allowing them to go back and re-watch sessions as they work through their course. While all teaching sessions have been faceto-face, we are continuing to record teaching sessions to help with their learning.

Similarly, the integration of MS Teams into the University means that where students prefer to have one-toone meetings online, whether it be with academic or student support teams, we are now able to offer that. However, the majority of students are choosing to meet face-to-face.

Virtual placements, which were established during the previous lockdowns, have continued to benefit students learning on professional courses such as physiotherapy and nursing. In July 2022, a four-week virtual and simulated placement event for Nursing students took place in the clinical skills training facility in the West Downs Centre. Nursing students took part in a community simulation day, involving practice partners, which included a GP scenario and a community nurse visit to review a cellulitis case. There was also an acute medical ward simulation scenario; a service improvement hackathon, solving scenarios with lived experience experts, and virtual wards working with Hampshire Hospitals NHS Foundation Trust.

The virtual placements culminated in an awards and celebrations day on 22 July.

As part of the event, over 70 people attended Leading the Way in Digital Health, a conference hosted by the Faculty of Health and Wellbeing at the University Business School on Tuesday 19 July, 2022. Topics included expert lived experience, telehealth, the future digital workforce, new innovations in wearable devices, virtual wards and more.

Innovations established during the pandemic have also contributed to improvements to other elements of the student experience, for example, providing online sessions supporting incoming students as they prepare for higher education over the summer months.

In Autumn 2021, the University launched the Department of Student Support and Success, which encompasses the entire student journey from pre-arrival through to graduate employment and, at its

core, has the mission to support students to succeed. With the new department we also launched our Student Support and Success Adviser (SSSA) initiative, building on the learning from the Faculty Wellbeing and Employability Tutor trial. Each faculty has a dedicated SSSA, centrally managed but working out of the faculty.

The SSSAs work to preemptively support students with their academic success, catching students who may be at risk of failure before their situation becomes critical. The SSSAs provide wellbeing support to students and also support faculty colleagues with extenuating circumstances and Support to Study processes. In their first year of operation, the SSSAs are already making a positive impact on student retention and success.

We provide our graduates with careers advice for life, with mentoring and advice as they move through the early years of their careers and beyond.

This year we celebrated our success in the Research Excellence Framework 2021 (REF2021), benefitting from a substantial investment in research since the previous assessment exercise. We returned 126% more staff to the REF in 2022, which contributed to a significant increase in institutional research power, representing one of the top 20 highest increases nationally.

Our proportion of 4*research, judged to be world leading in terms of originality, significance and rigour has increased threefold since the last REF in 2014.

There were clear institutional strengths, such as in Education, which produced the 2nd largest increase in research power rank nationally, moving us up 26 places to 36th in the country. Theology and Religious Studies also performed particularly strongly in the REF, with almost a quarter of research ranked 4* or world leading, ranking joint 3rd in the country for impact.

Due to the improved REF submission, the University will receive a 61% increase in Research England funding in 2021/22, moving to £1,798,146 in 2022/23 compared to £1,116,974 in 21/22. Mainstream Quality Related Funding (QRF) will increase from £847,654 to £1,489,169.

In 2021/22, Research & Innovation income, over and above that received from Research England, increased by more than 25% in 2021/22, compared to the previous year, from £1,716,874 to £2,149,706, with increases across all areas (grants, consultancy, and CPD).

2021/22 also saw significant success for the Doctoral School, recording its largest annual number of doctoral completions (30).

In 2021/22 Research & Innovation undertook a major review of all monitoring, audit and reporting processes relating to R&I income. This review directly impacted on the HE-BCI reportable data influencing KEF and HEIF, its success is reflected both in improved Knowledge Exchange Framework (KEF) results in KEF2 and increased Higher Education Innovation Funding (HEIF), from £269,320 to £308,977.

The University is making very clear progress in at least six of the metrics in KEF2, particularly in the CPD & grad start-up perspective, where the University is above the cluster average for one perspective. However, this improvement only reflects the number of start-ups, rather than their success. The need for the increased number of start-ups to generate income will be a priority area for 2022-23.

Most of Winchester’s KEF2 metrics are either equal to or above the cluster (M) average quintile for the relevant perspective.

Following the results of REF2021, a Research Review was initiated. The first phase of which explored the viability of UoAs and Research Centres, the second of which will revise the promotion and progression pathways for academics. Our focus for the coming year is on research excellence, as we consider the results of the recent assessment exercise and plan for future growth.

With substantial new data in hand, especially REF2021 and KEF2 results, the strong and developing team in R&I are well prepared to deliver on major institutional priorities for Research & innovation determined by the new University Strategy in 2023.

The HELP (Health Enhancing Lifestyle Programme) is a community-based exercise and education programme that supports the health, wellbeing and recovery of individuals diagnosed with stroke.

This programme is a collaboration between the University of Winchester, National Institute for Health Research (NIHR) Applied Research Collaboration (ARC) Wessex, Hampshire Hospitals NHS Foundation Trust, and in particular the Hyper-Acute Stroke Unit, and Hobbs Rehabilitation, an independent provider of neurophysiotherapy.

The programme has been running for 3.5 years, and during academic year 2021/22, the programme resumed the delivery of face-to-face exercise classes following a short hiatus whereby only online exercise classes were delivered due to the Covid-19 pandemic.

Data collected from participants in the programme is embedded within a Health Research Authority ethically approved research study. Findings from this study will be available in academic year 2023/24.

University researchers are currently working on a project dedicated to unearthing indigenous Caribbean contributions to Western botanical knowledge, as one of ten projects funded by the Arts and Humanities Research Council (AHRC) and the Natural Environment Research Council (NERC) as part of their ‘Hidden histories of environmental science’ call which seeks to understand how the future of modern environmental science can be informed by the past.

This project will digitise the Dr Alexander Anderson archives held by the Linnean Society and the Natural History Museum, including his important Hortus St Vincentii which details the plants growing in St. Vincent’s Botanical Garden (SVBG) in 1800, and includes a number of botanical illustrations. Several of these are by John Tyley, a young African-Caribbean man; at this time, it was very unusual for botanical illustrations to be signed, especially by an African-Caribbean.

Digitisation of Anderson’s Caribbean natural histories, and his details of plants growing in the SVBG, will allow global on-line access to these important historic resources for the first time. The project will also interrogate the digitised archive against wider material; letters sent by Anderson held at Kew Gardens, and receipts relating to SVBG and further plant catalogues held at the National Archive.

The entire Anderson archive will then be analysed to detect and document the contributions made by the indigenous (Carib/Garifuna) and enslaved African peoples whose knowledge and physical labour fed into successful development of SVBG, and western scientific knowledge more generally.

We are proud to be the University of the city of Winchester, and to make a significant contribution to the city and wider region. Independent economic impact analysis has shown that the University contributes more than £266m to the regional economy. We are a major local employer, and also the provider of a much needed local workforce, contributing nearly 10,000 jobs a year into the regional economy.

We work hard to support the community in many different ways. The University holds the Social Enterprise Gold Mark in recognition of its works as a social enterprise, creating benefits for people and the planet. Additionally, in 2021, the University of Winchester Business School was awarded the Small Business Charter Award in recognition of its support for small businesses, student entrepreneurship, and its commitment to the local economy.

We are also a provider of the Help to Grow: Management programme, a UK government initiative to help small- and medium-sized businesses boost their business performance and growth potential. We are an active corporate supporter of the work of the Winchester Business Improvement District to sustain and grow business in the city. Each of these initiatives underlines the University’s commitment to the local business community and to being a good corporate citizen.

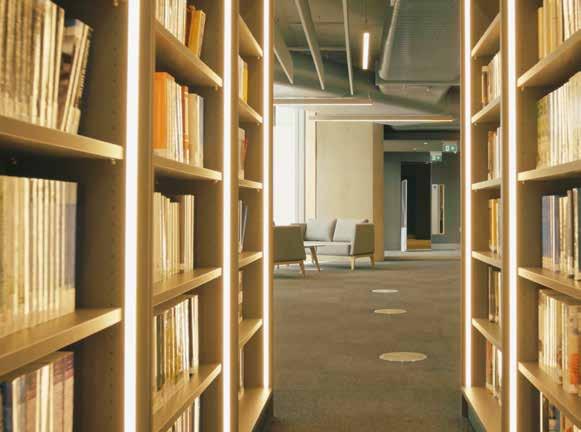

The city of Winchester is regularly voted as one of the best places to live in the UK. The University campus

is also a compelling mix of old and new, offering a traditional learning environment with a stunning contemporary twist. Our most recent development is the £50 million learning and teaching building, the West Downs Centre.

Opened in 2021, the Centre, which has strong green credentials, this building was one of the first university projects in the UK to be registered for WELL Certification, an accreditation scheme recognising buildings that support and advance human health and wellbeing. The West Downs Centre has won a number of national and international awards, including the coveted World Architecture News Gold Award and the Civic Trust award, where the judges recognised not just the enhancement of the University teaching facilities and campus, but also of the wider neighbourhood.

The University’s Faculty of Health and Wellbeing, launched in 2019, is already making a significant positive impact. In partnership with Hampshire Hospitals NHS Foundation Trust, the University launched a Global Health Hub, bringing together the academic, clinical, charitable and educational skills of their staff to undertake collaborative health work across the world.

One of the first projects initiated by the Hub aims to help improve palliative care in Ghana. Currently, the project team is working with Ghanaian colleagues to collaborate on future plans to build hospices across the country, whilst undertaking research and data gathering exercises. The project looks to support a future nursing and knowledge exchange programme alongside academic work over the coming years.

In the Summer of 2022, some of our student and staff physiotherapists supported world-class athletes competing in the Commonwealth Games 2022 in Birmingham (28 July - 8 August, 2022). Physiotherapists played a significant part in the successful delivery of the Games, with volunteers treating both athletes and spectators.

A month before the Commonwealth Games began, Fijian Commonwealth and Olympic swimmer Cheyenne Rova was attending a training camp at the Winchester Sport and Leisure Park at Bar End, when she started to develop shoulder pain that prevented her training.

On behalf of the University’s Winchester Health Clinic (based in the Leisure Park) first-year BSc (Hons) Physiotherapy students Josh Jones and Ellie Gribben undertook an initial assessment with Cheyenne to gain an insight into her training schedule and current physical function, as well as starting to hypothesise what her injury might be.

With the support of The University’s Health Clinic Manager Liam Newton, Cheyenne was further assessed and a treatment plan was developed to help get her back to fitness.

Liam said: “As the start of the Games was so close, we were able to see Cheyenne weekly over four weeks during which Josh and Ellie assisted in the progression of her treatment and got her back to being able to swim pain free.

“It was a fantastic opportunity for both of them to see the demands and commitment of an elite swimmer

prior to a major sporting competition.”

“Sadly, Cheyenne did not win a medal, but to have even got to the Games is a huge achievement given that she was unable to swim a month before. That said, this was a unique experience for two of our first-year Physiotherapy students,” he added.

Ellie said: “Treating Cheyenne as a professional swimmer was a great experience to have as a student in physiotherapy. It gave me an insight into how I would approach a more advanced case in the elite sporting field as a physio in the future.”

The Winchester Health Clinic has been set up by the University of Winchester to provide high-quality physiotherapy assessment and treatment to the local community. Undergraduate students on the BSc (Hons) Physiotherapy degree programme work alongside Health and Care Professions Councilaccredited (HCPC) Physiotherapy practitioners in the Clinic during placements as part of their studies.

In April 2022, we opened our clinical skills training facilities at the West Downs Centre, bringing state-of-theart nursing education to the heart of

our campus. We are working closely with hospital trusts across the region to deliver the workforce of the future, meeting local needs by educating outstanding and compassionate health professionals. Our students also help to maintain the health of the local population, for example, by offering high quality and accessible physiotherapy assessment and treatment in the Winchester Health Clinic.

In addition, the University is conducting research on ways to tackle loneliness in Hampshire as part of a coalition which received a share of almost £5 million allocated by the Department for Transport for pilot projects to understand how transport can play a role to help people feel less lonely. The coalition received £566,876 to deliver three projects aimed at reducing loneliness amongst rural and urban populations in the county.

We work closely with local schools in a variety of ways. Sometimes this is in collaboration with other local organisations, such as in August, when ginkgo seeds from a tree that

survived the nuclear attacks on Japan at the end of World War Two were planted at the University, as part of an international peace project. The joint Ginkgo Tree Project between the University, the Winchester Mayoralty and Winchester members of SGI-UK, aims to promote peace, anti-bullying and sustainability in schools.

We have educated outstanding teachers for over 180 years, and we are the proud sponsor of the University of Winchester Academy Trust, which comprises five fantastic primary schools. Just as the University is driven by its values, these schools deliver values-based education and seek to provide children with an inspirational education. The partnership has led to some exciting joint projects. For example, this year, a new ‘Creativity Collaborative’ led by the University and the University of Winchester Academy Trust secured a £360,000 grant from Arts Council England to revolutionise creativity across the curriculum in schools.

The University continues to make a significant contribution to the cultural life of the university city of Winchester. We produce high quality musical and theatre productions, contributing to the programme at the Theatre Royal.

We sponsor local festivals such as the Hat Fair and Winchester Fashion Week. We are also proud to work with our artist-in-residence, the award-winning Blue Apple Theatre company.

A striking art installation was created in the University of Winchester’s West Downs Gallery in the summer of 2022, with visitors from the community working with artists on a sculptural work representing sanctuary.

‘Open Sanctuary’ was a sculpture made from hundreds of individual ceramic balls which, formed a circular space for visitors to sit quietly and meditate on what ‘searching for sanctuary’ means for them.

In a series of workshops led by artists Fiamma Colonna Montagu and Sam Selwyn Bazeley, participants were guided through a meditation whilst creating a ceramic ball using natural clays. After firing, each ball will be slotted onto a large circular armature to slowly build the sculpture, until the work is complete.

The hope is that after the exhibition the sculpture will find a permanent home in the city of Winchester as a space for residents and visitors alike to gather, whatever their faith, to be able to meditate on what ‘searching for sanctuary’ means for them individually.

The University is committed to working across all academic disciplines and support services to help address the development challenges facing the world today. We work extensively with partners inside and outside Higher Education to address Global Goals. The University is also committed to continuing our PRIME Business School status.

EMBEDDING THE SDGS ACROSS THE WHOLE INSTITUTION

We are committed to supporting the United Nations Sustainable Development Goals (SDGs) –‘recognising that ending poverty and other deprivations must go hand in hand with strategies that improve health and education, reduce inequality, and spur economic growth- while tackling climate change and working to preserve our oceans and forests’ by 2030. (SDGs. un.org/goals)

Our continued commitment to embedding the SDGs in all our

Undergraduate and Postgraduate programmes underlines our growth, passion and commitment. It enables our students to embark on future careers with a sustainable development focus. In addition, it fosters our academics to identify research and partnerships to help realise the SDGs, particularly where solutions are most urgently needed.

COLLABORATIVE APPROACH FOR DEVELOPING RESPONSIBLE MANAGEMENT EDUCATION

A collaborative approach to developing responsible management education continues at Winchester,

including working with other valuebased organisations committed to embedding the SDGs. One example of this is the Students Organising for Sustainability (SOS)- the sustainable charity of the UK National Union of Students (NUS) and its ‘Responsible Futures’ Programme. This takes a whole institution approach and uses the framework encompassing both the SDGs and the University’s values. Using this process has ensured that the SDGs are embedded across all the faculties of the University.

We are widely recognised as one of the leading universities in the UK for environmental sustainability and carbon management. We aim to become the lowest-carbon UK university campus by 2025. Having solely used 100% renewable energy since 2008, our new low carbon plant and equipment will save just over 2.7 million kWh a year. We recently joined the Carbon Coalition, a sector group dedicated to offsetting emissions through leveraging combined buying power. Our commitment to sustainability extends into the curriculum, with climate change education being rolled out across all courses. Aligned to this are measures covering carbon emissions, water usage, and the amount of waste produced by the institution.

In 2020/21 we were awarded a grant of £3.12m from the Public Sector Decarbonisation Scheme, to help us to become one of the most carbon-efficient universities in the UK. This signalled the start of our significant capital investment programme in innovative low carbon plant and equipment.

The programme is nearing completion and has seen the replacement of 35 gas boilers with low energy air source heat pumps; a lighting upgrade to replace existing older-style lighting with low energy LEDs; an upgrade to the Building Management System to optimise energy consumption in buildings; and the installation of two large solar photovoltaic arrays designed to produce on-site electricity generation at peak times.

This grant underlines the significant progress we have made since 2006 when we started our move away from fossil fuels, by reducing our emissions, increasing investment in energy efficiency measures, increasing installation of renewables, switching to electric vehicles and the procurement of renewable electricity.

We have used 100% renewable electricity since 2008 and switched to 100% green gas in September 2020, making us almost carbon neutral from energy sources. 2021/22 also saw onsite electrical generation increase of 105% with the installation of a further 151Kw of solar photovoltaic panels.

“

Once installed, the low carbon plant and equipment will support savings of over 500 tonnes of carbon dioxide a year, with Scope 1 and 2 emissions falling to almost zero, which equals financial savings of up to £100k

Gavin Hunter Chief Operating Officer

Each year People and Planet (the UK’s largest student campaign network) release a University League table ranking all UK universities by environmental and ethical performance.

In the 2021/22 league table the University of Winchester successfully achieved 1st class university status- ranking 26th out of 154 universities.

We are delighted to announce that in July 2022 we were officially awarded our Plastic Free University status from national charity Surfers Against Sewage (SAS).

This award of ‘Plastic Free Communities’ Status highlights the work and commitment as an institution we have made to tackling single-use plastics. It by no means signals we are plastic-free, and we do not claim to be, but we are clear that we view SUP as a problem and have made a commitment to do what we can feasibly to remove them from our operations.

The university has achieved zero waste to landfill since 2013 and 2021/22 saw significant improvements in its recycling rate, reaching 75% of its total waste generated. This percentage increase has been helped in part by the introduction of food waste recycling in all halls of residence.

The University of Winchester has been recognised for its hedgehog-friendly campus with a prestigious Gold Hedgehog Friendly award from the British Hedgehog Preservation Society (BHPS).

The Gold award comes after three years’ hard work which began in 2019 and has seen students and staff create hedgehog friendly habitats, set up feeding stations and help to survey hedgehog activity on campus.

The many initiatives undertaken as part of creating a hedgehog-friendly environment included a collaboration between the University and neighbouring Royal Hampshire County Hospital (RHCH) to make Burma Road – which bisects the University’s main campus and the RHCH site - the first in Winchester to install road signs requesting drivers to slow down in case there are hedgehogs crossing.

The University of Winchester is one of 13 universities across the UK to achieve Gold status in 2022.

The accreditation follows the team’s successful Bronze accreditation in the 2019/20 academic year and a Silver accreditation in 2021.

By the end of 2021/22, 48% of fleet vehicles had been switched to electric vehicles as part of our journey towards our target of net-zero carbon emissions by 2025.

In 2020/21 Winchester joined the Carbon Coalition led by the Environment Association of Universities and Colleges. This sector group worked together to improve the process for gathering scope 3 emissions data and also set up a catalogue of good quality and verified carbon sequestration and retirement opportunities for the member organisations. 2021 saw the university’s first procurement of carbon credits which equated to our verifiable scope 3 emissions from waste, water and business travel and the remaining scope 1 emissions from internal combustion fleet vehicles.

The university has committed to do the same going forward for each reporting year, with carbon credits to be purchased for the same emissions sources.

The Office for Students terms and conditions of funding for higher education institutions (ref 2019.12) requires our Board of Governors to demonstrate that it uses public funds for proper purposes and seeks to achieve value for money from public funds.

At Winchester, the responsibility for value for money is delegated to management and the Board’s responsibility is discharged through proper scrutiny of Winchester’s affairs and through exercising appropriate oversight of strategies and policies.

At Winchester, we believe that there is a clear relationship between how we create value and the value for money we provide to stakeholders. Value for money is about maximising the value generated from our financial capital.

We also deliver a value impact for society and have a strategic target to foster stronger recruitment from groups currently under-represented in higher education, by working to raise aspirations and break down barriers to participate, such as those created by culture, geography, social and economic factors.

Direct cost savings are achieved through active contract engagement, management and robust tender processes. The University promotes purchasing professionalism in engaging with its suppliers. It is responsible for establishing and managing effective commercial arrangements to deliver Winchesters purchasing requirements at best value for money against time, quality and budget.

Winchester also benefits from a number of local and national purchasing consortia and partnerships to secure competitive commodity prices and discounts on our strategic and high-spend areas of our business. Through these consortia and frameworks, we are able to realise significant savings and to strongly influence supplier behaviour.

For example, we expensed approx. £4.5m of addressable spend through our Southern Universities Purchasing Consortium (SUPC) frameworks in 2021/22, realising over £600k of savings. The majority of Winchester’s SUPC addressable spend is associated with computer supplies and services, the remainder based on furniture, library, travel, catering and publications. Other purchasing consortia and framework providers used by Winchester include:

• GOV.UK – via Crown Commercial Services (CCS)

• Eduserv – for the purchase of software licences

• iESE – construction framework

• JISC – for broadband purchasing

• NHS – TDS Framework

• Southern Universities Construction Consultancy Affinity Group (SUCCAG)

• The Energy Consortium (TEC)

• The Society of College, National and University Libraries (SCONUL)

• TUCO – the leading professional membership body for in-house caterers

• CPC - Crescent Purchasing Consortium - Education sector purchasing frameworks

The aforementioned organisations consistently offer the sector value for money, often through rates specifically negotiated for the Higher Education sector.

By channelling approximately 30% of the value of our addressable spend through framework agreements arranged by higher education and public sector purchasing consortia, we ensure that our suppliers have been stringently reviewed for anti-modern slavery compliance. The particular business and supply chains which may pose particular risks in terms of slavery are in IT and AV equipment, construction and uniform/clothing supplies, the majority of which are purchased through these frameworks.

Winchester’s procurement strategies are well developed and aligned with the institution’s sustainability policies. The University has robust procurement policies, and sustainability has been embedded into these practices. Staff involved in buying activities have been fully trained on our procurement approach and how this should align with Winchester’s environmental objectives. Limiting the impact of our procurement activity on the environment is at the forefront of all our engagements with our supply markets.

The strength of these policies was reflected over the past year where we have continually selected suppliers through competitive process using award criteria heavily weighted in support of environmental and sustainability criteria in line with university values. A good example of this was the recently awarded Travel contract. This was a key service for the University and an extensively used requirement. Environmental and Sustainability criteria were weighted at a significant 20% and this had the impact of not only deciding the right company to partner with, but also in dramatically shaping the nature of how the University makes travel decisions throughout its activities.

Our new travel partner will always provide a combination of extensive content, intellectual routing, and logic engines meaning the University will always be presented with the best price and the most environmentally sustainable options.

Over the last 12 months the University has carried out 16 full tenders. All contracts have been carried out in line with Public Contract regulations ensuring the University remains fully compliant in these areas of expenditure. They have been awarded against value for money criteria that focused on whole life costs, quality and service levels as opposed to price alone.

Stakeholder engagement is carried out through tender user groups. It forms an extremely important part of the value for money process, ensuring end user expertise is combined with a commercial professional procurement approach. For example, with Winchester’s travel management requirements. A diverse user group was formed to agree policy around using the service before going to tender. Issues such as managing carbon footprint, using trains whenever possible instead of flying, and even decisions around the need to travel, have all been discussed, debated and incorporated into the tender, along with CO2 reporting.

Winchester has a strong reputation of supporting many Fairtrade initiatives, particularly in catering and hospitality. We have been able to tap into many TUCO contracts which have delivered a host of products to staff and students. We have also set out to establish these initiatives in other areas, such as clothing. It is our aspiration to use environmentally and sustainably resourced clothing wherever possible, whether they are Fairtrade, WRAP or Fit for Purpose products. We are committed to the principles of sustainable development, environmental management and protection of biodiversity.

Winchester continues to be a proud affiliate member of Electronics Watch, an organisation that aims to improve working conditions in the global electronics industry. The decision was made to ensure that employees working for companies supplying ICT equipment to Winchester are treated fairly, and that the companies themselves operate to an acceptable ethical standard.

Electronics Watch aims to help public sector organisations by being their eyes and ears on the ground in areas of the world where their ICT and electronic products are made. Becoming a member of Electronics Watch is testament to Winchester’s commitment to meeting the highest possible ethical and social standards when it comes to procurement.

Our Modern Slavery Statement is designed to satisfy the requirements of Part 6, Section 54, of the Modern Slavery Act 2015. Winchester’s Financial Regulations, Procurement Policy and Procedures and Ethical Investment Policy state our commitments to the highest standards of ethical conduct in all activities, along with making continuous improvements in this area.

We do not engage in, or condone, the practices of human trafficking, slavery or forced labour. We are committed to improving our business practices to combat modern slavery and human trafficking and to ensure that we are not complicit in any human rights violations. We are committed to zero tolerance of slavery and human trafficking or child labour practices.

We mitigate the risk of modern slavery occurring in our workforce by ensuring that directly employed staff are recruited by following robust HR recruitment policies and checks. There is a whistle-blowing policy in place for members of staff to raise any concerns about wrongdoing by Winchester. Staff employed on a temporary staff basis via agencies are only recruited through established sources who can provide assurance that they comply fully with the requirements of legislation relating to the rights and welfare of their candidates and employees. Our Ethical Investment Policy has been developed to reflect Winchester’s commitment to ensuring that our investments are not complicit in any human rights violations. To this extent Winchester does not knowingly invest directly or indirectly in organisations that breach human or animal rights, or that are in breach of the Modern Slavery Act 2015.

Our Modern Slavery Statement is published on our website and reviewed on an annual basis. It can be found at: www.winchester.ac.uk/media/content-assets/ documents/Modern-Slavery-and-Human-TraffickingStatement-2022.pdf

We define risk as the potential effects of uncertainty on achieving objectives, which can take the form of adverse consequences or unexpected opportunities.

As with most institutions, risks are inherent in all activities, Winchester undertakes new risks in pursuit of its strategic objectives. Effective risk management is about ensuring all significant, relevant risks are understood and prioritised as part of standard management practice to increase the probability of successful outcomes, whilst protecting Winchester’s reputation and sustainability. To create longterm value, we must anticipate the risks threatening our institution, customers and stakeholders, whilst still capitalising on new opportunities offered by an ever-changing world.

We must maintain a dialogue with internal and external stakeholders to identify those risks and opportunities. These are illustrated in our Risk Register, which includes vital business and sector risks, as well as some specific to Winchester and key customers and stakeholders.

Our Board of Governors has delegated authority to the Risk and Audit Committee to oversee risk management, including monitoring the Risk Register. This ongoing review enables Winchester to identify material issues that are most likely to affect value creation, strategic

objectives, service delivery and assets. We undertake a systematic and methodical identification of key risks and identify measures to mitigate them. Whilst risk cannot be completely eliminated, the approach of the Risk and Audit Committee is to be ‘risk aware’ rather than ‘risk averse’, by taking intelligent risks to protect strategic objectives. Illustrated in this report is the most recent update of our Risk Register, presented to the Board of Governors on the 6th July 2022.

The risk that, with the Office for Students revised B conditions, one or more of the University’s courses fall below the threshold Standards.

The University has significantly enhanced its approach to Teaching Quality by: restructuring the Academic Quality and Development team to explicitly focus on compliance with the OfS B Conditions and TEF Outcomes, by replacing the Annual Programme Evaluation process with Programme Improvement Plans and by implementing an Action Plan Process for any courses falling below standards. The University has also identified Teaching Quality as a pillar for the new Strategic Plan which is being developed for launch in January 2023 which will ensure Teaching Quality remains at the centre of everything the University does.

The risk that Winchester fails to attract the required number of students to remain sustainable.

On beginning to emerge from the Covid-19 pandemic, we adapted our recruitment activities to be back on campus. Throughout the winter, we continued the return to on-site open days, complimented with the new and enhanced virtual tours, faculty open events, video interviews and additional videos of campus facilities. The introduction of a new brand for Winchester ‘the place to become’ was a key improvement that tripled levels of engagement and resulted in significant growth in applications received. The focus going forwards for the institution is on conversion from applicant to student.

The risk that Winchester sees a high level of student dissatisfaction and a significant decline in student wellbeing.

Student experience and wellbeing are incredibly important to us and during the pandemic continued to be a large concern. Consequently, we reviewed our mental wellbeing support offerings, student enquiries provision and student support policies to build on the provision for the 2021/22 academic year. This included the introduction of ‘Academic Safety Net’ and the extension of additional mental wellbeing support options. With a strong focus on engagement across the institution, we will continue to maintain a high-level of communication with students through strategies including engagement activities, evening and weekend help points for students in libraries, and formal weekly contact with selfisolating students. We are also progressing the development of a digital ‘one-stop shop’ for student enquiries and help.

The risk that Winchester’s income decreases or costs/ provisions increase, and not being able to service Winchester’s debts or satisfy loan covenants sufficiently, putting the financial sustainability of Winchester at risk.

We have identified several mitigations for risks to our financial sustainability as we emerge from the pandemic. We successfully secured £4m of government support through capital project funds. We continue to consider cost reduction options to mitigate inflationary increases beyond expectations. The investment in international student growth is key to revenue growth whilst we also continue to strategically invest in our Health and Wellbeing faculty courses. We will continue to maintain a culture of costeffective control and budget holder responsibility during the year and will also continue to increase our incomegenerating activities, bidding for public and private grants and building on our approach to fundraising.

The risk that Winchester has poor rates of graduatelevel employability compared with the rest of the sector and competitors.

We published our new Graduate Employability and Higher Study Strategy in summer 2020, which outlined how we would ensure that all programmes of study focus on employability and have high graduate employability with our new Winchester Employability fund. We also opened a brand-new Careers and Opportunities Centre on our King Alfred Campus. Both the strategy and the physical space to support students has had a positive impact, significantly increasing the touch points and services available to students. The dedicated career advice sessions and webinars,the two ‘Employability Weeks’ a year, and the offering and promoting of new graduate internship opportunities and work placement modules throughout different programmes are some of the examples of these opportunities.

The failure todeliver adequateIT infrastructureand services alongsidethe right built environment of a kind a quality sufficient to meet the expectations of students and staff.

The rapid growth of the University over the last fifteen years alongside the continual developments in technological solutions and changes in ways of working and learning require both IT and Built Environment infrastructures to continually adapt to be up-to-date, relevant and conducive for students and staff to be successful. To improve the staff and student experience, we developed our mobile app and upgraded our wireless provision across campus. To support home and distance working and learning, we provided staff with University managed laptops and continued to offer our laptop Loan Scheme. To improve the built environment we have delivered new bespoke teaching spaces in Health and Wellbeing including two mock-up wards and a new nutrition and dietetics bespoke teaching space whilst also bringing into full use the brand new West Downs Centre.

The risk that the security of Winchester’s systems and network is compromised, leading to loss of critical services and/ or loss or exposure of sensitive data.

The sector continues to face cyber-attacks which are exploiting out of service and end of life hardware. We continue to preserve our close professional relationship with JISC, working with JANet and Cyber teams to share knowledge, review and mitigate sector-wide IT, information, and data security threats. We also have in place a continued service contract with Orange Cyber Security. We have undertaken a business continuity exercise in cyber incident response and will have implemented all actions from the lessons learned by December 2022.

The risk that Winchester is adversely impacted by government policy, funding, and rhetoric.

Our scenario planning and financial modelling have been based on potential Governmental policy changes, and we have maintained close engagement with Universities UK and Guild HE to ensure we understand sector issues and they understand Winchester’s perspective on issues. Daily briefings from WonkHE and other sector sources have helped us to keep abreast of the changing policy landscape. Despite the Government rhetoric of ‘low value’ courses and policy pushes towards HE alternatives (such as FE and vocational training) that threatens to have a negative impact on our reputation,we have achieved Ofsted Outstanding recognition for all aspects of our education provision, an upward trend in PGITE recruitment, and a national reputation for successful consortium leadership and delivery of PgCert SENCO accreditation. We have also appointed a Director of Policy and Projects to ensure are horizon scanning for proposed or actual changes to Government Policy, ensuring the Institution is ahead of and in a position to respond proposed or actual changes as they arise.

A decline in staff motivation and morale could seriously detriment Winchester’s performance by negatively impacting staff commitment, engagement, and willingness to expend discretionary effort.

The Covid-19 pandemic caused generalised anxiety,increased stress and mental health difficulties along with social isolation for some throughout prolonged home working periods. In response, we offered a varied and diverse range of staff wellbeing resources and events,an enhanced wellbeing platform with a huge range of shopping discounts, and a 24/7 employee helpline. We also introduced extra staff counselling provision, a reading week into each semester, and allowed our staff to carry up to 10 days of leave into the next year. Deans, Directors and HoDs were trained as Mental Health First Aiders and made occupational health referrals where appropriate,with assistance and guidance from HR made available to managers on handling people management issues. Work to improve the experience of hybrid teaching for both staff and students is ongoing.

The risk that Winchester has an Ofsted inspection at 2 days’ notice and is unprepared. The consequence of failing an Ofsted inspection will risk our ability to offer degree apprenticeship programmes, and our wider provision.

The new team structure supporting our Apprenticeship programmes, our operational Governance plan and our increased understanding of requirements through staff training and development have significantly strengthened our provision of Apprenticeships against the OfS requirements. The university continues to develop its approach to Apprenticeship provision however, including the implementation of dedicated software to support professional management and reporting. The University continues to engage in Ofsted Action Group meetings, working through recommendations and action plans to continually improve and strengthen this area of our provision.

This is the third year in which COVID-19 has created challenges for our students, staff, other stakeholders and the wider financial environment. As is detailed within the financial analysis, the pandemic has had a significant impact on the financial outturn of the University. However, the University during this turbulent time, remains in a strong financial position in both being able to report a surplus and growth in the year end cash position.

We have confidence as we develop and launch our new strategy in January 2023 that we will be in a strong position to ensure we have an aligned financial plan and resources in place to protect Winchester’s financial position whilst enabling the University to prosper and deliver its 2030 ambitions.

As the impact of the pandemic lessened the second half of the year was affected by higher costs, driven by economic factors including the conflict in Ukraine, which are impacting inflation, foreign currency fluctuations and interest rates. The University faces these new set of challenges in a good financial position.

Key performance indicators (KPIs) are used by the Executive Leadership Team and Board of Governors to assess the University’s performance.

The KPIs cover a number of operational areas from student satisfaction to student employability. The financial KPIs reflect those used by the funding bodies and banks.

EBITDA refers to the Earnings Before Interest, Tax, Depreciation and Amortisation. Earnings are taken before FRS 102 pension adjustments as is common with the sector. This KPI is a strong measure of the University’s ability to generate cash since it is less susceptible than total surplus to changes in non-cash movements (such as depreciation). The EBITDA outturn of £12.7m (2020/21 £16.3m) despite being lower than the previous year still represents a strong performance. Whilst EBITDA can be used as a measure of cash generation, net cash inflow from operating activities provides a clear marker of the cash

the University is generating each year to service its investing and financing activities. The net cash inflow from operating activities for 2021/22 was £12.9m (£17.0m 2020/21) and shows the University’s strength in being able to generate cash during challenging times.

Staffing costs as a percentage of income is reported widely within the HE Sector. However, in recent years this KPI has primarily reflected the impact of pension costs and other on-costs associated with staffing rather than a salary or staff FTE increase. Staffing to income has increased from 53.9% in 2020/21 to 58.0% in 2021/22, comparable to 2018/19. Although some of this increase is due to the one-off adjustment to the USS pension provision.

The net cash to borrowing is derived from the total of cash and investments less the capital amount of bank debt outstanding at the year-end. During the year £1.3m of capital was repaid, whilst cash and investments increased by £6.7m, resulting in the net cash position (i.e cash exceeding borrowing) increasing to £10.2m (2021/22 £2.2m).

Total cash and cash investments at the end of the year was £41.8m (£35.1m 2020/21).

The capital investment in the new £50m West Downs building three years ago resulted in both cash reducing (as a significant element of the cost was funded from internal reserves) and borrowing increasing. The £19 million improvement in cash (and investments) in the last two years has resulted in the University ending the year with over £10m more cash than borrowings. This provides the University with the financial flexibility and headroom to be able to invest in its infrastructure, it’s staff

and its future student offering. This Financial Review puts the year in perspective and outlines our financial environment, finance strategy, financial performance and our future outlook.

Although the University has been able to report strong financial results for 2021/22 during the period of the pandemic, the financial environment in which it operates has, and is set to become, even more challenging.

On the 24th February 2022 the government announced that the tuition fee cap would be frozen for a further two years – up to and including 2025/26. The £9,250 cap has not been adjusted for inflation since 2017/18 and means that by 2025/26 the maximum fee cap will have been frozen for 8 years.

During the time the £9,250 cap has been in place, inflation has been at historically low levels, allowing the University to be able to prosper through increased student numbers whilst controlling its costs. However, inflation has been steadily rising during the year, from 3.2% (CPI) in August to 10.1% in July 2022 and is set to continue to be at high levels in the forthcoming year. The capacity for the University to absorb increased costs whilst maintaining the student experience and quality of teaching will become increasingly challenging.

As well as the re-emergence of inflation, interest rates which have again been at a historically low level since the 2008 banking crisis, have been rising in 2021/22, from 0.1% at the beginning of the financial year to 1.25% by the balance sheet date.

The outlook for interest rates looks increasingly bleak for 2022/23 as interest rates continue to rise. The University has already mitigated the risk of rising interest rates by fixing its bank loans for extended periods. Aside from £10 million of the Triodos Bank loan which is on a variable rate, the remaining £20 million is fixed until 2028. The Allied Irish Bank loan is fixed until 2031.

In England there has in recent years been a demographic downturn in the number of 18 to 21 year-olds, thus reducing the pool of students that could go on to University. This decline has now ceased with the number of 18 to 21 year-olds once again rising and this provides a positive environment for the University to grow its student numbers.

At a local level the University has faced another challenging year, including:

• Difficulties in filling vacancies due to the competitive employment market

• Catering operating on a reduced basis due to the pandemic.

• There was negligible conference activity in summer 2021, although there was a successful summer 2022 conference trade.

• The pandemic restricted the ability to conduct research during the year

• International student recruitment was affected by travel restrictions (e.g to Norway), although the University was successful in its growth of international students from India.

The University continues to undertake a risk review of its supply chains to identify high-risk areas for further contingency planning. Wherever possible, the University seeks to secure local supplies to promote the local community and the environment.