GINSBURG GETS LUDLOW APPROVAL, SUBMITS PLAN FOR NEW BUILDING

BY PETER KATZ Pkatz@westfairinc.com

BY PETER KATZ Pkatz@westfairinc.com

The Yonkers Planning Board has approved plans for Ginsburg Development Companies (GDC) to construct an apartment tower in the Ludlow section of the city at 150 Downing St. Immediately after the vote, GDC unveiled details of its plan for a second building in the Ludlow section, adjacent to the Metro-

North tracks and about one-half block from the Ludlow train station at 70 Pier St.

The second building, with an estimated construction cost of $11.5 million, would be four stories with 36 apartments over a ground floor that would include retail space as well as the building’s lobby and amenities for residents. There would be indoor parking for 35 cars, one fewer space than zoning requires. A

variance would be needed.

The 70 Pier St. site formerly was home to an office and garage used by the Yonkers Parking Authority that GDC purchased in June of 2017. Adjacent is a municipal parking lot with spaces for 14 vehicles.

GDC proposes taking over the parking lot and incorporating its 14 spaces along with seven additional permit spaces and 16 new metered paces into a new

layout. Ginsburg also would undertake revitalization of the existing city park known as Abe Cohen Plaza.

The newly approved plans for 150 Downing St. call for a seven-story building over two levels of parking. It would have 131 one-bedroom units and 77 two-bedroom units for a total of 208 apartments. There would be 229 parking spaces provided. The cost of the building is estimat-

ed at $65 million. GDC estimated that the project will result in 625 construction jobs. When completed, there would be five full-time employees and four part-time employees at the property.

The roots of the project extend from 2016 when Yonkers issued a Request for Proposals to sell the property at 150 Downing St. in the Ludlow section of the city. GDC was

Fairfield County’s annual Giving Day event to end after a 10-year run

BY PHIL HALL Phall@westfairinc.com

On Feb. 23, Fairfield County’s Community Foundation (FCCF) will host its 10th annual Giving Day, the 24-hour virtual fundraising marathon that helps connect local nonprofits with donors eager to support their missions.

By all measurements,

Giving Day has been a successful fundraising vehicle. Since 2014, the event has raised $13.75 million — and last year was a record-breaking feat with approximately 17,000 donations that generated more than $2 million.

This year’s Giving Day will include the participation of nearly 400 local nonprofits — a complete list is on the FCGives. org website. The giving window

will open on the FCGives.org website at 12 a.m. on Feb. 23 and run through 11:59 p.m. that day; a minimum donation of $10 is required.

FCCF President and CEO Mendi Blue Paca is looking to the Giving Day event with bittersweet feelings. On one hand, she is expecting another triumphant turnout by donors eager to assist local organizations. However, the FCCF has decided

that this year’s event will be the last.

“It’s an event that has generated a lot of momentum over the years and a lot of dollars and a lot of unity and spirit,” Blue Paca told the Business Journals. “But the foundation is continually evaluating all of our initiatives and we always want to make sure that it is the best use of our limited human capital resources and financial

capital, and that we’re meeting the needs of our partners in the most timely ways.”

During this evaluation process, Blue Paca heard comments from some of the FCCF’s partners who praised the Giving Day mission, but there were also comments from other partners who were concerned about working from “a heavy list” with hundreds

westfaironline.com February 20, 2023

Right, rendering of 150 Downing St., Yonkers. Left, rendering of GDC’s proposed building at 70 Pier St., Yonkers.

GIVING DAY 6 GINSBURG 6

Cluster townhome development proposed for Peekskill

BY PETER KATZ

BY PETER KATZ

Pkatz@westfairinc.com

The entity Peekskill Views LLC, located in Spring Valley, is proposing to build a residential cluster development in Peekskill that would have 33 homes in 13 buildings. The units would be individually owned and there would be a homeowner’s association that would own the land. Each of the homes would have three bedrooms and a twocar garage. It’s currently estimated the townhomes would be priced from $525,000 to $625,000.

A preliminary presentation on the project was made to Peekskill’s Common Council by Attorney Jody Cross of the White Plains-based law firm Zarin & Steinmetz and Joseph P. Modafferi Jr., of Armonk-based JMC Planning.

The development site is at 1130 Frost Lane, a 13-acre parcel that was purchased by Peekskill Views LLC for $1.1 million in July 2021, according to records on file with the Westchester County Clerk’s Office.

Modafferi told the Common Council that six of the 13 buildings would be semi-detached and have two units each while the other seven buildings each would be have three attached units. He said that the proposal would leave approximately eight acres, 58% of

the site, undisturbed except for a walking trail that would be built for residents to use. He said that the proposal would not require a special permit from the council and that site plan and environmental approvals would be sought from the city’s Planning Commission. He pointed out that the 33 proposed homes would be less than the 45 dwelling units that are permitted under existing zoning.

Cross said that one zoning variance would be required for a setback that is only 10 feet instead of the required 30 feet. It would be for an amenity area for recreational use by tenants.

“Otherwise it is zoning compliant,” Cross said. “There’s a parking ratio (required) of two spaces per unit. We’re proposing 4.36. There’s a two-car garage and a two-car driveway so technically you could fit four cars. There is visitor parking and parking by the amenities on the interior road.”

Cross said that while up to 30% of the land could be covered, the proposal is to cover only 7.79% of the land. She said amenities would include a playground, outdoor seating, pickleball and handball courts, a fitness area and a dog park.

Modafferi said that each unit would be about 2,000 square feet. He said that the applicant started working on the proposal in the spring of 2021 with a plan for 45

units as allowed.

“Frost Lane runs along the southerly side of the site,” Modafferi said. “Frost Lane itself from east to west changes in elevation from 358 (feet) to 351 (feet). So, our driveway is coming in at 351 (feet). At the top of the site the elevation is 433 (feet), so it’s got some good grade change across the site.”

Modafferi said that about 130 to 140 new trees would be planted in accordance with a landscaping plan and that approximately 1,000 trees six inches or larger in diameter would be retained on the site. He said that some of the trees on the site that were examined by an arborist were determined to be invasive species.

“In terms of utilities, electric and telecommunications is available in Frost Lane,” Modafferi said. “We are proposing to do that underground into the site. Sanitary and water is available in Frost Lane. We’re looking at extensions of both of those, probably

We

extensions, into our private driveway.”

Modafferi said that a traffic study found that during morning and afternoon peak hours there would be roughly one vehicle leaving or arriving at the site every three or four minutes. He said that any traffic impact on neighborhood intersections would be very limited.

“We’ll be using heat pumps in order to minimize the use of fossil fuels,” Modafferi said. “The code requires that we provide two workforce and one affordable unit. We anticipate 20 to 21 new school children from this project. Property taxes are expected to increase by approximately $500,000.”

Cross emphasized that the developer intends to preserve a large portion of the site and would be willing to discuss providing a conservation easement to Peekskill should it be deemed necessary.

Publisher Dee DelBello

Co-Publisher/Creative Dan Viteri

Associate Publisher Anne Jordan NEWS Fairfield Bureau Chief & Senior Enterprise Editor • Phil Hall

Copy and Video Editor • Peter Katz Senior Reporter • Bill Heltzel Reporters Edward Arriaza, Pamela Brown, Georgette Gouveia, Peter Katz, Justin McGown Research Coordinator • Luis Flores

ART & PRODUCTION

Creative Director Dan Viteri Art Director Sarafina Pavlak

ADVERTISING SALES Manager • Anne Jordan Metro Sales & Custom Publishing Director Barbara Hanlon Marketing & Events Coordinator Natalie Holland Marketing Coordinator • Carolyn Meaney Marketing Partners • Mary Connor, Larissa Lobo

AUDIENCE DEVELOPMENT Manager • Daniella Volpacchio Research Assistant • Sarah Kimmer

ADMINISTRATION

Contracted CFO Services Adornetto & Company L.L.C.

Westchester County Business Journal (USPS# 7100) Fairfield County Business Journal (USPS# 5830) is published Weekly, 52 times a year by Westfair Communications, Inc., 44 Smith Avenue, Suite #2, Mount Kisco, NY 10549. Periodicals Postage rates paid at White Plains, NY, USA 10610.

POSTMASTER: Send address changes to: Westchester County Business Journal and Fairfield County Business Journal: by Westfair Communications, Inc., 4 Smith Avenue, Suite #2, Mount Kisco, NY 10549. © 2022 Westfair Communications Inc. All rights reserved. Reproduction in whole or in part without written permission is prohibited.

A MEMBER OF

MAIN OFFICE TELEPHONE 914-694-3600 OFFICE FAX 914-694-3699 EDITORIAL EMAIL Phall@westfairinc.com WRITE TO 4 Smith Ave., Suite No. 2 Mount Kisco, NY 10549

don’t create gimmicks to enrich ourselves; we enrich our readers with news about where they live and work.

Top, rendering of townhouses proposed for Frost Lane in Peekskill. Joseph Modaferri Jr. at Peekskill Common Council public

Connecticut’s housing crisis is discussed within Fairfield’s Pine Tree Apartments

BY JUSTIN MCGOWN jmcgown@westfairinc.com

BY JUSTIN MCGOWN jmcgown@westfairinc.com

U.S. Rep. Jim Himes joined elected officials from Fairfield and surrounding communities on Feb. 13 to learn more about the Pine Trees Apartments in Fairfield and to discuss the ongoing housing crisis in Connecticut.

The event was hosted by the Fairfield Housing Corp., Partnership for Strong Communities and Fairfield County’s Center for Housing Opportunity (FCCHO).

The new Pine Tree Apartments, located at 15 Pine Tree Lane just off the Black Rock Turnpike, replaced a series of older brick buildings. The complex features contemporary two-story houses, with handicap accessible first-floor apartments and additional units above. The property is also dotted with rain gardens and meadows of native plants.

Kiley Gosselin, executive director of the Partnership for Strong Communities, welcomed the officials to the meeting in the community building that serves as the heart of the Pine Trees facility.

“We already had a housing shortage in Connecticut,” said Gosselin about the pre-pandemic housing market. “Rents are increasing, home prices are increasing, and there are so many inflationary pressures on the development’s space. We really have a tough housing market and tough conditions, especially for folks in low- and moderate-income categories who are really struggling to maintain housing and find housing here.”

Gosselin noted that while the complex hosting the meeting was exemplary, it is only part of the solution to the state’s housing problems. She supported solutions that promote “housing portability,” such as voucher programs, which are tied to households instead of specific housing units.

“We can do more both at the federal level in terms of investment and also the state level in terms of making sure we have the resources we need to create more beautiful properties like this and ensure people who are already housed aren’t rent-burdened,” she said.

Specifically, Gosselin asked the gathered officials for their support on increasing investment in the state’s rental assistance program and pushing for the use of vouchers as an additional finance stream for future developments.

Aicha Woods, director of the FCCHO, said that a diversity of approaches under a “collective impact model” was necessary, and recommended looking at the issue from

a regional rather than municipal viewpoint.

“Fairfield County lacks 25,000 units of affordable housing,” Woods said. “In order to start really making an impact in tackling that it really requires a cross sector collective approach. If you think about folks who are cost burdened, that also has a tremendous economic impact on the local economy because they don’t have money to spend elsewhere. We’re also hearing from many employers that one of the primary drivers of the labor shortage is affordable housing, particularly here in Fairfield County.”

“We need friends to address the affordable housing prices here in our state,” added Carol Martin, executive director of the Fairfield Housing Authority, which is based out of the Pine Tree Lane property. “We’re lucky enough to live in a high-cost community, which brings tons of social benefit, but it’s also a place where we need to grow and create more affordable units, as lovely as Pine Trees turned out to be. The Housing Choice Voucher Program the Fairfield Housing Authority runs now serves close to 110 families. When I started back in 2012, we had about 65 families.”

Himes thanked the local organizations for arranging the meeting and stated how difficult it has become to “talk about housing enough anywhere in this country.”

“I’m just off the Select Committee on Economic Disparity,” Himes said, referring to the Select Committee on Economic Disparity and Fairness in Growth, one of several committees shut down after Republicans took control of the U.S. House

of Representatives. “Two things jumped out at me if we’re going to get serious about addressing economic disparity. One is better care for our youngest Americans, we need affordable available childcare. The other one is housing.”

“It doesn’t help a lot of people if you have a vibrant economic area like the Stamford metropolitan area or Fairfield County, but nobody can afford to move there,” Himes added. “However here is where I go off script — the fundamental problem in this country on housing is a supply problem. People estimate that we’re somewhere in between three and 5 million units short nationally, and 30,000 apparently in the county. So, we have a huge supply issue, and we need to subsidize more. I’m just obsessed with the notion that we need to find ways to recreate Pine Trees apartments around the county, around the state. It’s an uncomfortable conversation for me because the federal government doesn’t have a lot to do with zoning or state subsidies.”

Himes then asked for input from the local officials and experts who were gathered there. In addition to the leaders and employees of community organizations facing the housing crisis, the meeting was also attended by elected leaders, including Fairfield First Selectwoman Brenda Kupchick, State Sen. Tony Hwang and state Reps. Jennifer Leeper and Sarah Keitt.

The discussion saw all in attendance agree that a housing crisis was underway across the state. However, the issue of 8-30g, the state law that allows developers to

bypass local zoning regulations for residential developments containing at least 30% deed restricted affordable housing units came up quickly and was the subject of some division.

The local Democrats, such as Keitt and Leeper, referred to 8-30g as a flawed but necessary tool, while the Republicans in attendance, notably Kupchick and Hwang, argued the law’s drawbacks needed to be weighed more heavily and implied it benefited developers more than the unhoused.

Those associated with the community organizations expressed a range of opinions on the law, and generally tried to steer the conversation back towards other possible policy solutions.

“What concerns me about this conversation,” Himes said, “is we are talking onesies and twosies. Four units here, 12 units there. If the number is 30,000 for the county, we need to be talking about hundreds of units in Fairfield, right? And in Greenwich we need to be talking about hundreds. In Bridgeport we probably need to be talking about thousands of units.”

Himes posed the question of how to achieve those numbers to the members of the community organizations. Telling them to set aside political differences and questions of financing, he wanted to know if they were achievable.

The only consensus to emerge: increase housing supply overall, even for higher and middle-income individuals, and there will be at least some improvement for all housing seekers.

FEBRUARY 20, 2023 FCBJ 3 WCBJ

A view of the new Pine Trees complex. Photo by Justin McGown.

Inclusionary zoning concerns prompts debate at Ridgefield PZC meeting

BY JUSTIN MCGOWN jmcgown@westfairinc.com

Atext amendment

which would grant the Ridgefield Planning and Zoning Commission (PZC) the power to allow developers some latitude with aspects of the zoning code if they include a minimum percentage of affordable housing units was hotly debated during a recent commission meeting.

The practice, known as inclusionary zoning, proved intensely controversial with some Ridgefield residents and inspired both impassioned debate and accusations of corruption, falsehoods and claims the Connecticut government is engaging in communist plots.

The text amendment itself only allows for a small change to the Ridgefield zoning code. If passed, it would allow multifamily housing developers to designate at least 15% of the units as affordable housing — as defined by the Connecticut Department of Housing — and to petition the town’s PZC for exemptions from

other aspects of Ridgefield’s zoning code.

Those exemptions include permitting higher overall density for the project, higher ratios of coverage to lot area, and reduced parking requirements. Alternatively, developments consisting solely of single-family dwellings can pay a per-unit fee to convert affordable units to market-rate units. That fee is presently set at 300% the median annual income for the Danbury metro area. The PZC would have the power to reject any of these requests.

The text amendment drew 28 written comments between the publication of the first draft in November and the most recent meeting. Chairman Robert Hendrick, who noted the number of comments was unusually high, said the amendment was designed to decrease the likelihood of large affordable housing developments such as those permitted under 8-30g.

“Inclusionary zoning is a concept that planning and zoning commissions were empowered to

adopt around the same time as the famous 8-30g law came into state statute,” Hendrick said.

The law permits housing developers to bypass local zoning codes other than those pertaining to health and safety, provided at least 30% of the units are deed-restricted affordable housing units. However, if a town or city is able to make sufficient progress toward having 10% of its overall housing supply deemed affordable by the state, it can impose a four-year moratorium on 8-30g construction. Progress toward that goal and a new moratorium after the previous one expired in 2018 is a key goal of the amendment, according to Hendrick.

“It doesn’t actually create any new apartment buildings in residential areas,” he stressed. “It doesn’t create apartment buildings at all, actually. It doesn’t pack our schools. It doesn’t add any particular residences despite the hyperbole out there. The regulation is not by itself increasing the population in Ridgefield or increasing pressure on anything in terms of our

infrastructure.”

“I would encourage the commission to pursue this goal,” said Mack Reid, the only member of the public to speak out in favor of the amendment during the meeting. “People are always afraid of change, we moved here in 1955 and I remember my mother freaking out because they were going to pave Cooper Hill Road, and we survived that.”

Another resident, Linda Lavelle, complained that outside interests such as large real estate developers were funding the bills and research promoting affordable housing. She argued that the state’s regulations are “ignoring what people have always done to achieve affordability, like taking on roommates, working two jobs like my dad, and learning additional job skills like I had to do with three kids to support.”

Instead, Lavelle urged the town to pursue a “biennial housing assessment” and to encourage the state subsidize repairs of single-family homes.

“We need to fight this if we

don’t want to become a socialist, communistic (society) governed by one titular head,” proclaimed Thomas Pesce, a resident who also railed against the PZC for accepting the terms set by the state. He argued that various condos in town, which he had seen listed for sale should qualify as sufficient affordable housing, though multiple members of the commission told him that they did not fit the “capital ‘A’ affordable” criteria set by the state.

“We have our own destiny to consider,” Pesce declared as the conversation grew heated and members of the audience corrected him on his math.

“You may have your own destiny, but not your own regulation,” replied John Katz, the longest-serving member of the commission.

The commission ultimately decided to table discussion of the matter, hoping to hear from the Board of Selectmen before their next scheduled meeting on Feb 21 when they would propose revisions to the amendment.

4 FEBRUARY 20, 2023 FCBJ WCBJ

The Ridgefield Planning and Zoning Commission.

Photo by Justin McGown.

Judge upholds 16-year effort by IRS to collect from New Rochelle tax fraudster

BY BILL HELTZEL Bheltzel@westfairinc.com

BY BILL HELTZEL Bheltzel@westfairinc.com

Afederal judge has denied the latest effort by New Rochelle businessman Philip Colasuonno to block the Internal Revenue Service from collecting tax penalties owed in a 2007 tax fraud case.

On Jan. 27, U.S. Magistrate Judge Judith C. McCarthy denied Colasuonno’s motion to dismiss an IRS lawsuit to collect $2.5 million, ruling that the agency filed the case in time to beat the statute of limitations.

Colasuonno, a former certified public accountant, has been resisting the tax obligation for 16 years.

In 2007 he was accused of conspiracy to commit tax fraud and preparing false tax returns.

Prosecutors described companies owned by Colasuonno and family members as “thoroughly infected with criminality.”

For four years, for instance, Colasuonno failed to remit taxes for income, Social Security and Medicare on the wages of employees of American Armored Car Ltd., of Elmsford. The tax obligations were disguised by paying employees in cash for overtime work and accounting for the payments as outside services.

Colasuonno pleaded guilty. He was sentenced to time served and five years of supervised release and he was ordered to pay $781,467 in restitution.

In 2009, in filed for Chapter 7 bankruptcy protection.

In 2011, Colasuonno was sentenced to prison for four months for violating probation by failing to make a good faith effort to make restitution payments. Also in 2011, while the bankruptcy case was pending, the IRS assessed penalties and filed a $1,747,190 federal tax lien.

Ten years later, on December 20, 2021, U.S. Attorney Damian Williams filed an action on behalf of the IRS to collect taxes and penalties that totaled nearly $2.5 million.

Colasuonno claimed that the lawsuit was not filed in time.

Typically, the IRS has 10 years after a tax is assessed to sue for collection, Judge McCarthy noted.

But Bankruptcy automatically stops ordinary creditors from filing collection efforts for claims that arose before the bankruptcy case began.

Colasuonno argued that the IRS violated that ban by filing a federal tax lien while his bankruptcy case was pending. And when the IRS collection case was filed, it was more than 10 years after the tax lien was filed and there-

fore was not done in time. But federal tax liens are created automatically when a taxpayer neglects or refuses to pay taxes after a demand is made, the judge said. They exist regardless of whether the IRS publicly files the lien. And when collection efforts are suspended during an active bankruptcy case, the government may sue for

collection 10 years and six months after the bankruptcy case ends.

Colasuonno’s bankruptcy case was discharged in July 2011 and the government had until January 20, 2022 to file the collection case. It beat the deadline by a month.

Colasuonno, now 72, could have challenged the IRS in bankruptcy court, McCarthy said, but he failed to do so and now it is probably too late.

“The instant collection action,” McCarthy said, “was timely filed.”

FEBRUARY 20, 2023 FCBJ 5 WCBJ PRESENTED BY: BRONZE SPONSOR: For more information or sponsorship inquiries, contact Barbara Hanlon at bhanlon@westfairinc.com or 914-358-0766. For event information, contact Natalie Holland at nholland@westfairinc.com. WestfairOnline NOMINATE NOW AWARDS PRESENTATION SUBMISSION DEADLINE NOMINATE AT: NOMINATE A CANDIDATE (PERHAPS YOURSELF) WHO IS: CHAMBER PARTNERS: Darien Chamber of Commerce | Wilton Chamber of Commerce | Greater Norwalk Chamber of Commerce Fairfield Chamber of Commerce | Greater Valley Chamber of Commerce | Ridgefield Chamber of Commerce | Westport-Weston Chamber of Commerce Greater Danbury Chamber of Commerce | Greenwich Chamber of Commerce | Bridgeport Regional Business Council | Stamford Chamber of Commerce APRIL 7 JUNE 15 westfaironline.com/40under40 • Over 25 and under 40 years of age

A dynamic industry leader who’s part of the county’s business growth

Living or working in Fairfield County and has not previosly won this competition

•

•

the successful respondent and in 2017 the city approved selling the site that formerly had been used by the Department of Public Works to GDC for approximately $3 million.

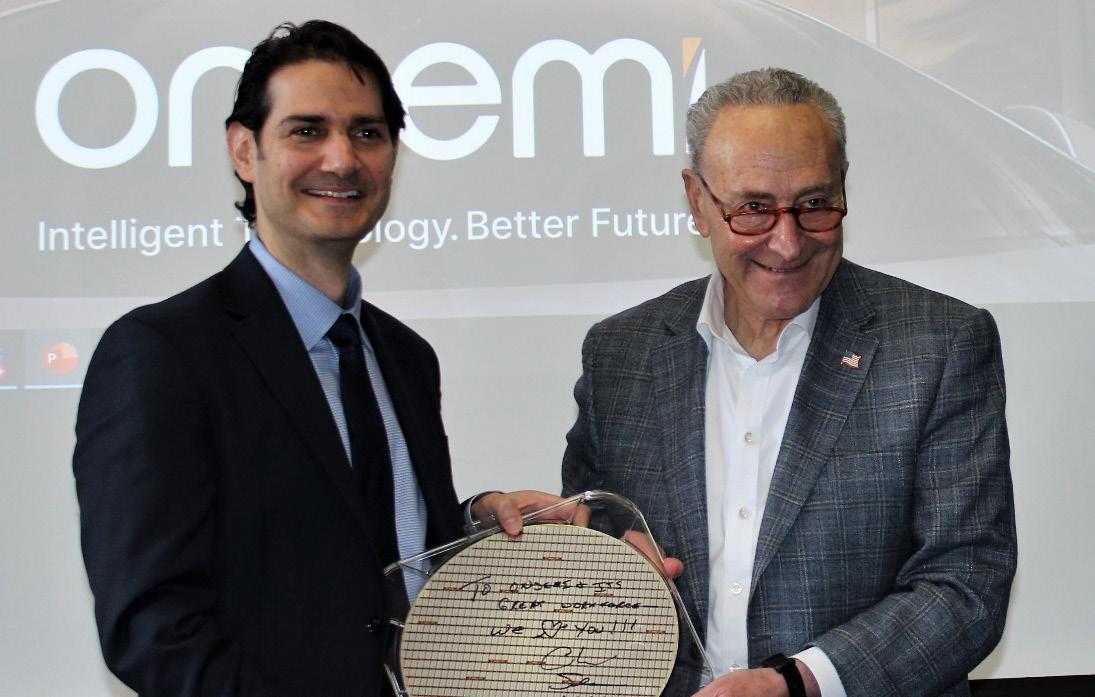

Jim Surdoval of GDC said that the property for the 70 Pier St. proposal parallels the Metro-North tracks and a fence owned by the Metropolitan Transportation Authority (MTA) would remain in place as a safety measure. He said GDC would like to work with the MTA to enhance the appearance of the fence.

“This project is a bit of a companion to 150 Downing St.,” Surdoval said. “It is a 36-unit building, which is very small for GDC, but nonetheless a very important project because this is the train station gateway arrival area. The goal is to create ... a very attractive arrival point with people coming to the new GDC building on Downing Street and the other development that will happen in the area. The current residents that live in the area will have a mixed-use building with neighborhood retail as well as a new upgraded Abe Cohen Plaza park.”

Leoncio Torres, vice president of architecture and design for GDC, said that there would be new paving, landscaping, sidewalks, benches, lighting, an entrance arch, a new flagpole, a sculpture and a new clock tower at Abe Cohen Plaza.

“We basically have a modest club room and business center as well as a fitness center for the residents of the

of organizations vying for attention and dollars. Blue Paca admitted that “maybe the ROI wasn’t super great for them,” and a review process was undertaken to determine how the wider nonprofit environment within Fairfield County felt about the event.

“We didn’t want to base it on yearend surveys and anecdotal pieces of information,” she said, noting the FCCF conducted multiple focus groups over a two-year period that concluded at the end of 2022.

“We also surveyed about 700 organizations that participated in Giving Day over the years,” she continued. “And the real sentiment, overwhelmingly, even for those who raised money, was that the ROI really was very limited. For the organizations, very few were raising more than $5,000. And then when they were coupling that with the amount of investment to really ramp up the infrastructure to participate, it wasn’t high.”

Blue Paca also observed that the fund-

property,” Torres said in describing the ground floor layout. “We’re also proposing to leave some retail space that would be accessible from the public street. The building is fully electric. We use a very highly efficient heat pump system which provides cooling and heating and then we’re looking to see if we can install solar panels on this project as well.”

Torres said that there would be a second-floor outdoor amenity space for

tenants and noted that the apartments would have large windows and balconies. He said that the lower front facade of the building would use metal panels.

Surdoval said that GDC has agreed to enter into a maintenance agreement with the city regarding the Abe Cohen Plaza. He said that GDC would be open to either the city or GDC doing the actual maintenance work, whichever the parks department prefers.

“We just need to sit down and talk to the parks department and work it out,” Surdoval said. “Whether we do it or they do it we’re willing to fund it.”

Both of the GDC buildings are in the area covered by the city’s Ludlow Street Transit Oriented Development Plan, which is designed to guide reviving the area. The plan’s area is approximately 35 acres and almost entirely within ¼-mile of the Metro-North train station.

were not present when Giving Day launched.

Moving forward, Giving Day will not be replaced with a specific event — instead, FCCF will realign its focus to meet the ongoing needs of the local nonprofit environment. Blue Paca pointed to the FCCF’s new strategic plan, titled “Fairfield County Forward,” as the cornerstone of its strategy and emphasized the responsive programming of its Center for Nonprofit Excellence to assist organizations that need operational aid.

raising landscape had evolved since 2014 — at that time, online fundraising was still something of a novelty. The Covid-19 pandemic created the considerations that

“We are also scaling up our support for leaders of color and grassroots organizations,” she said. “Those tend to be the organizations that still don’t have

necessarily the type of fundraising infrastructure that that one might need. If you were to think of the organizations that most would benefit from our funding support, it would be in those categories. So, we are going to be launching a very targeted support capacity building program for those leaders that will go a lot deeper.”

As for the last go-round of Giving Day, Blue Paca is hoping the annual event will close on a high note.

“I would love to see this be the greatest Giving Day we’ve had yet because it has been an awesome 10-year run,” she said. “There will be a kickoff event at Norwalk Art Space the morning of Giving Day, and we are hoping to bring together all the partners that have been a part of this 10-year journey to celebrate all that we’ve accomplished collectively as a community. It is our goal and our hope that that folks will register one last time and join us in surpassing our recent Giving Day totals.”

6 FEBRUARY 20, 2023 FCBJ WCBJ

Rendering of 70 Pier St. as seen from the Metro-North tracks.

1

1 Ginsburg—

Giving Day—

Mendi Blue Paca. Contributed photo.

Mixed reactions to Lamont’s budget proposals

BY PHIL HALL Phall@westfairinc.com

Gov. Ned Lamont’s proposed biennial state budget was greeted with cautious optimism and undiluted concern by leading business and social organizations across the state — and a section of the budget that raised the notion of education cuts was greeted by a potential retaliatory action by the president of the University of Connecticut.

The governor’s proposed budget would spend more than $50.5 billion over the next two years while maintaining fiscal guardrails for another decade and enacting the first reduction in the state income tax since 1996. The full budget proposal can be accessed here.

Carol Platt Liebau, president of the Yankee Institute, a Hartford-based libertarian think tank, applauded Lamont’s proposed renewal of the state’s budget controls by noting this “bipartisan agreement will continue to impose guardrails designed to ensure the state can’t spend more than the economy can support, and its citizens can afford … For over two decades, lawmakers refused to fully implement the cap.”

Eric Gjede, vice president for public

policy at the Connecticut Business and Industry Association (CBIA), believed the Lamont proposals had merit, but expressed concern about their transition from concept to legislative action.

“We see a lot of positives in this budget proposal, particularly the individual tax relief measures and the full restoration of the pass-through entity tax credit — which will give struggling small businesses a much-needed boost,” he said. “It’s critical that policymakers fully leverage the state’s robust fiscal health and continue pursuing solutions for addressing the labor shortage crisis and positioning our economy for strong growth. As the budget proposal moves through the legislative process, we also urge lawmakers to allow small businesses access to R&D tax credits, repeal the sales tax on workforce training, and finally sunset the temporary corporate tax surcharge, which has long sent the wrong message about our business climate.”

The Connecticut Conference of Municipalities (CCM) issued an unattributed statement expressing satisfaction the proposed budget “acknowledged that current education aid to municipalities is insufficient to meet the needs of our students and that additional funding to address this must be a priority as

negotiations move forward.” However, the CCM expressed disappointment “that there is not more in the budget to address the regressive nature of the property tax and provide municipalities with additional financial support or mandate relief that would enable towns and cities to enact meaningful reductions to the property tax.”

AARP Connecticut State Director Nora Duncan praised Lamont for putting “a strong emphasis on protecting patients and reigning in unsustainable health care cost growth. His plans to increase transparency for pharmaceutical manufacturers and to join an interstate consortium to purchase prescription drugs at a discounted rate will help lower medication prices for consumers.”

But Duncan also warned that Lamont’s proposed income tax reductions “do not include a fix for the existing ‘benefit cliff’ for retirement income tax exemptions. Under current law, older adults become ineligible for the tax exemption on retirement income if they earn even one penny of income over the cutoff (currently $75,000 for an individual and $100,000 for a married couple) in any given year and can face a significantly higher tax liability than their gain in income.” Duncan also faulted the gover-

nor for not focusing on making “reforms in the generation market to lower the cost of standard electric service offered by the state’s two electric distribution companies.”

Perhaps the biggest critic of the Lamont proposals was UConn President Radenka Maric, who voiced her displeasure about proposed funding cuts to her school — Lamont’s proposed budet includes a $160 million cut to UConn’s Fiscal Year 2024 funding and an estimated $200 million cut for the school’s Fiscal Year 2025 funding. Madic warned she would withdraw UConn from playing in Hartford’s XL Center as a cost-cutting measure.

“We play at the XL Center, and we pay to play there, so the money that we generate there doesn’t go to us and athletics, it goes to Connecticut,” said Maric in a report by UConn’s Daily Campus student newspaper. “When I go and talk to owners of the restaurants, hotels and the parking lots, they say that (their) business only spikes when UConn is playing in Hartford, and that’s when they generate revenue. So, I was telling the governor, if there is a cut that I have to do, I’m not going to put the cuts on academic quality, I will do the cuts and make the decision to pull out of the XL.”

FEBRUARY 20, 2023 FCBJ 7 WCBJ

Spending to save on home renovations

BY CAMI WEINSTEIN

The real estate market may have cooled, but home renovations and decorating are still moving at a busy pace. After homeowners purchase their homes, whether upsizing or downsizing, there’s plenty of work to be done — especially when the previous owner has not updated the space in 20 or more years. Floors, paint jobs, kitchen cabinetry, bathroom tiles and fixtures can all get worn out over time and need a refresh.

When it comes to the actual renovation, two things factor in — budget and time. It’s often difficult to get past TV shows that make everything happen in the blink of an eye. Or prices so astonishingly low that it seems to cost only the price of a dinner to renovate your entire house. So almost everyone wants the project completed yesterday for a lowball figure. Bringing in professionals can save you time and headaches while helping with unrealistic expectations. Yes, there are places where you can save money. But in other

areas, spending money on better finishes, hardware and appliances is the prudent way to go for the long haul.

The items I often recommend splurging on are good appliances — the workhorses of your home. They keep everything running smoothly. Do you really want to be late for work because your washing machine or refrigerator is on the fritz? I also recommend good cabinetry. Cheaper cabinetry often has hardware that will not hold up to everyday use, and the cabinet paint or stain is often poor quality and can easily rub off. You don’t want to spend a lot of money on cabinetry and then have it look worn out in a couple of years.

One area to save money on in a kitchen or bathroom renovation is on machine-made tiles. There are many beautiful machinemade tiles that will update your home and not break the bank.

If a tight budget is hindering your ability to do everything at once, I recommend getting the messiest work done first. That would

be the floors. If your floors need to be refinished, do them before moving in. Then paint all the rooms that you are able to. If you can’t decide on colors, paint the rooms a neutral color. You can easily go back in and paint the room’s walls a different color or wallpaper later. At that point, only the walls will need to be done.

This gets the dustiest and messiest work out of the way. If you have small children, complete their rooms first. Children like to feel settled, often to the point where they don’t like having their rooms redecorated until they are practically getting their driver’s licenses. Although everyone loves adorable wallpaper or pastel colors for kids’ rooms, they do grow out of that phase so quickly. Use paint or wallpapers that will give your children’s room décor some longevity and that will save you money in the long run.

Beautifully made furniture can stand up to years of use. I am always amazed that some clients think they can just toss

out inexpensive poorly made furniture in a couple of years and purchase new furnishings again. I love beautifully made furniture and fabrics and refurbish or replace them only after years of use. It’s also better for the environment. My sofa is on its third or fourth reupholstering. The frame and workmanship have given us years of use and comfort. I chose a classic shape, and it moves easily between traditional and transitional styles. I still love it after 15 years of use.

When doing renovations, stick with a timeless style, knowing that you can easily update your look. In the end, you will save both time and money because you will not be doing projects over and over again. Definitely do some research on the finishes, for example, that you are planning to use in your home and how to care for them.

Ultimately, use what can stand up to your lifestyle and enjoy living in your new — or newly remade — home.

For more, call Cami at 914-447-6904 or email Cami@camidesigns.com.

8 FEBRUARY 20, 2023 FCBJ WCBJ

One place you’ll want to spend money on is in the kitchen where good cabinetry and appliances can save you in the long run, writes Westfair interior design columnist Cami Weinstein.

New bicycle parking option for Norwalk’s train commuters

BY JUSTIN MCGOWN jmcgown@westfairinc.com

The Norwalk Parking Authority advanced its rebranding as Park Norwalk with the grand opening of a new space for bicyclists at the South Norwalk train station.

A small section of the station’s garage, equivalent to the dimensions of approximately two parking spaces, has been set aside and consists of a newly painted blue floor with 10 sturdy metal posts alongside a fixed bike pump and repair station. The designated section can offer a secure bicycle space for up to 20 commuters.

“It’s really great that we were able to capture this portion of the garage and give it such a vital use,” said Eric Graves, the chairman of the board of directors for Park Norwalk. “The bike stations were located in a fairly remote area of the garage and by bringing them

here adjacent to both the main doors and the main vehicular entry for the garage we were able to include elements like the pump and repair station.”

Graves described bicycle parking as a vital component of plans to improve parking across the city.

“By providing that,” continued Graves, “we want to indicate to cyclists that they can count on knowing that it’s here, and that the Parking authority is working throughout the city on the upgrading and replacement of facilities like pay meters. Those efforts are intended to make parking more convenient and accessible whether they’re in their car or on a bike.”

Alongside the in-garage parking, a bike rack emulating the SONO sign at the corner of Main and Washington streets was installed at the New Haven bound side of the station. A train-shaped rack was also installed at the East Norwalk Train station.

According to Jim Travers, the city’s director of transportation, mobility and parking, the sacrifice of two parking spaces is an easy trade to make when considering the overall return on investment.

“We did the painting in-house, we worked with Sherwin-Williams to determine an appropriate paint for the floor, and we worked with a local company for the decals on the wall,” he said. “The racks are roughly $200 a piece. So, for about $1,000 and a couple gallons of paint I think we now have a really great looking facility that frees up 20 spaces and improves the access to the station itself.”

“In a way it modernizes the facility,” Travers added, “and I think anything that makes your environment feel better makes everybody’s ultimate parking experience better, whether that’s on a car, a bike, or on public transportation.”

Tanner Thompson, the chairman of the city’s Advisory

Commission for Biking and Walking, arrived for the press conference to launch the space on his own bicycle.

“I want to call out a few things that I’m really excited about here,” Thompson stated. “One of the biggest concerns that keeps people from using a bike to get around town is the question of will their bike be there when they get back

from whatever they’re doing. Having a place where people are confident that their bike will be there when they get back is important. There are people in Norwalk for whom this is their only mode of transportation and providing a safe place for them to bike is not only good for the environment, it’s good for economic equity in Norwalk.”

FEBRUARY 20, 2023 FCBJ 9 WCBJ

Eric Graves, chairman of the board of directors for Park Norwalk, discusses the new facility.

Photo by Justin McGown.

10 FEBRUARY 20, 2023 FCBJ WCBJ

FEBRUARY 20, 2023 FCBJ 11 WCBJ

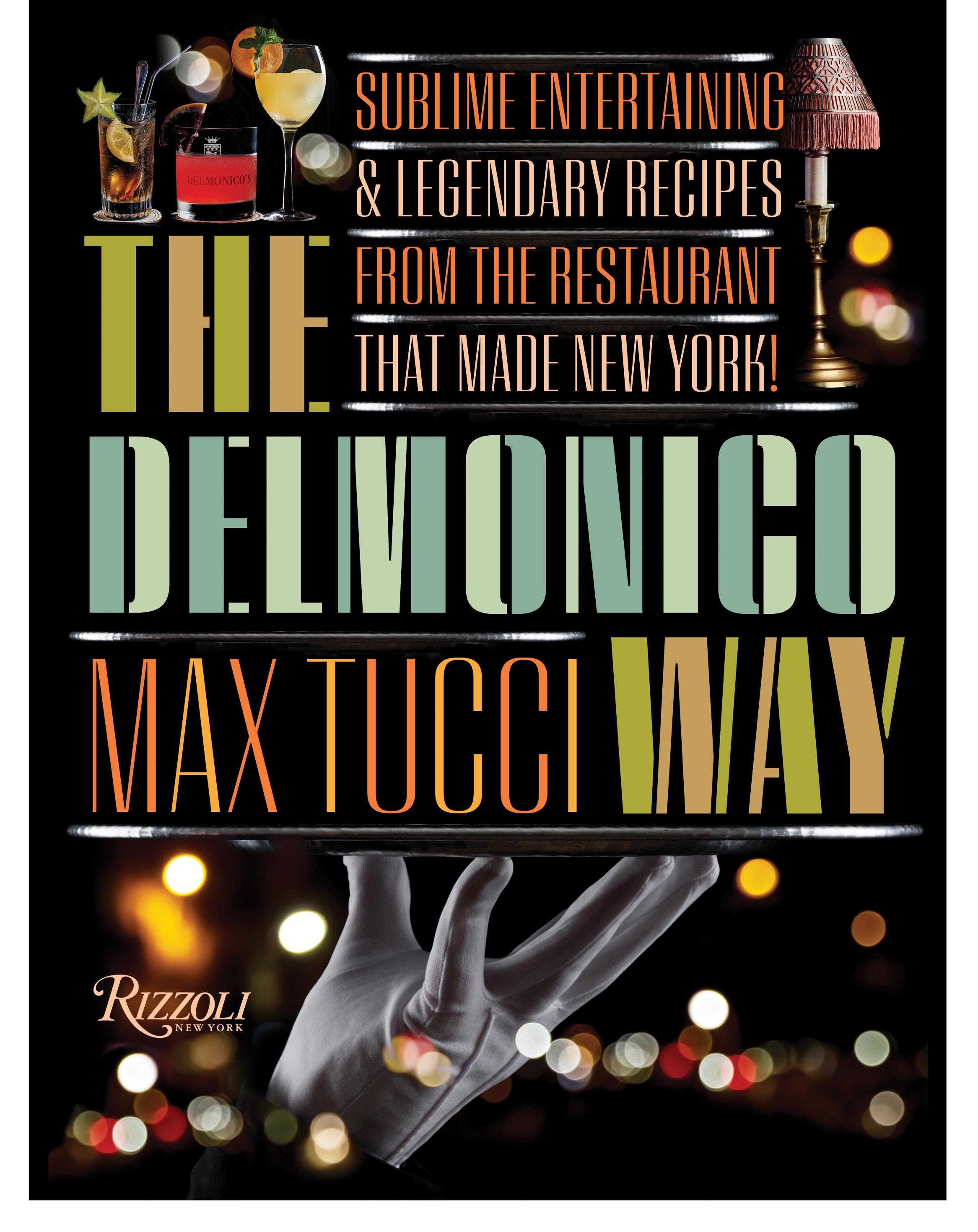

Celebrating the restaurant that made culinary New York – and America

BY GEORGETTE GOUVEIA ggouveia@westfairinc.com

Abraham Lincoln loved its creamy, cheesy potatoes; Harry Truman, its steak; Richard Nixon, its coffee. And although every American president since James Monroe has reportedly dine there, its clientele was not limited to politicians.

Marilyn Monroe adored its grilled grapefruit; Cary Grant, its Port Wine Sangaree cocktail, made just for him; and Rock Hudson, its no-paparazzi privacy, while Wall Street financiers could relish their three-martini power lunches without missing a beat on the Street, thanks to the restaurant’s New York Stock Exchange ticker tape. (Long before coworking spaces, Lehman Brothers had its own dining room there.)

Where the elite would meet — along with anyone looking for a good meal in a hospitable environment, as all were welcomed — was the fabled Delmonico’s in a flatiron building on Beaver and South William streets in Lower Manhattan.

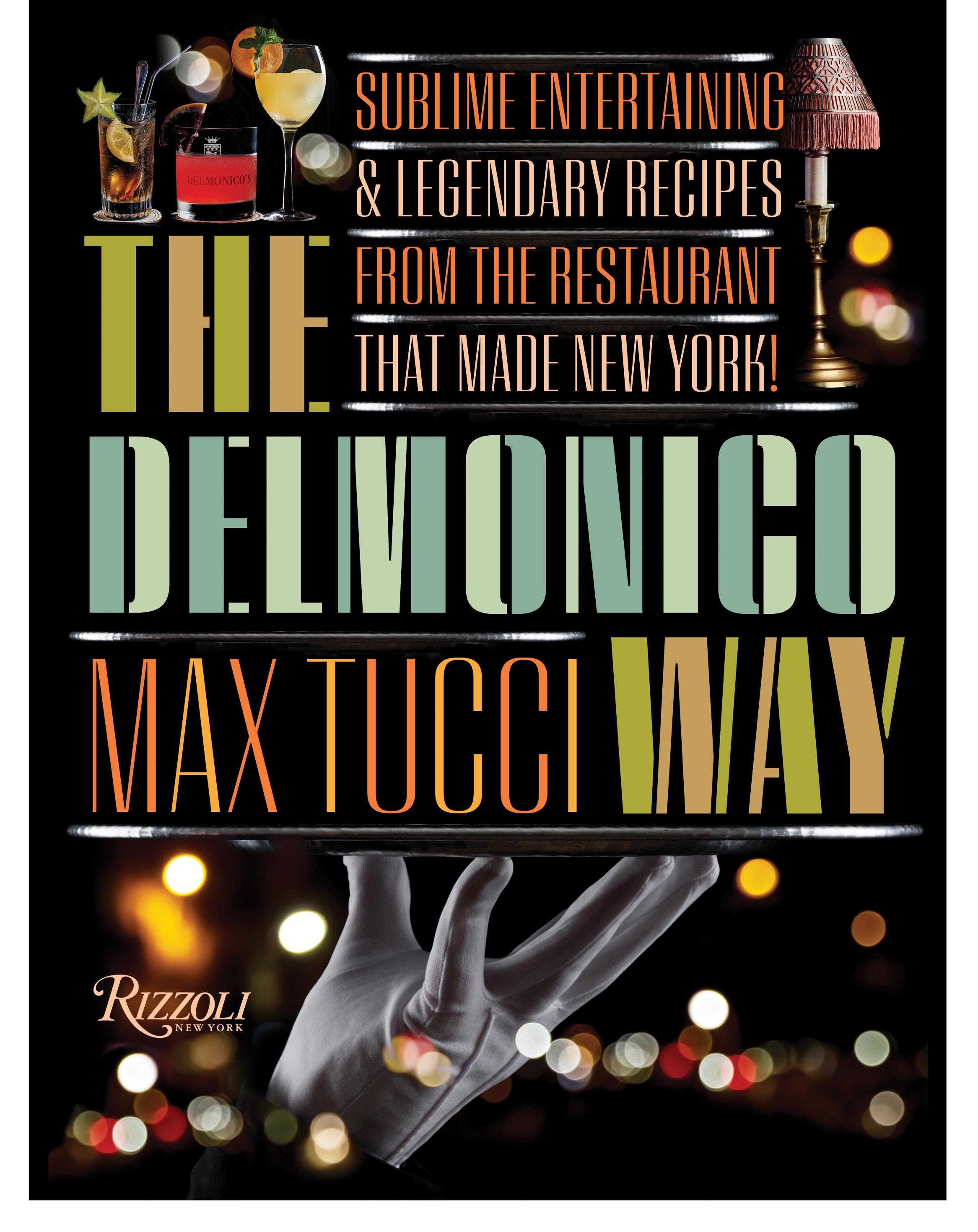

“It was America’s first fine-dining establishment,” said North Salem resident Max Tucci, author of the new book “The Delmonico Way: Sublime Entertaining & Legendary Recipes From the Restaurant That Made New York!” (Rizzoli New York, $45, 208 pages), who’ll appear at an author talk and book-signing on Feb. 21 at Orienta restaurant in Greenwich.

Dinner at 8:10

Indeed, it would be hard to overestimate the effect Delmonico’s had on American hospitality and cuisine in the course of a century under the direction of two different families, including Tucci’s own.

Before Swiss brothers John and Peter Del-Monico opened their restaurant in 1830 — it began as their pastry shop three years earlier — Americans ate British-style food in taverns and inns. Delmonico’s introduced them to French-flavored but locally sourced cuisine announced on menus printed in French and English and served on white tablecloths. The celebrated, and less so, took note. Charles Dickens and Mark Twain dined there. And women — who heretofore could not eat in a restaurant unless accompanied by a man — struck out on their own there, with the first women’s power lunch, a meeting of the philanthropic Sorosis Club, taking place on April 20, 1868.

But no discussion of the first incarnation of Delmonico’s would be complete without a

mention of Nikola Tesla. Creator of the wireless, perfector of alternating current (which keeps the electricity on) — the man whose name and 1870 engine design survive in a brand of electric vehicles — Tesla would dine at Delmonico’s every night, calling ahead for a dinner that could be served only by the head waiter at precisely 8:10. Changing several pairs of white gloves throughout the course of the meal, the scientist had his dinner and returned to work, refreshed by yet another Delmonico experience.

‘All are welcome’

That iteration of Delmonico’s came to an end with Prohibition in 1923. But an exciting new chapter was about to begin, courtesy of an innovative Tuscan immigrant, Oscar Tucci, Max’s grandfather. Operating Delmonico’s for seven years as a basement speakeasy — in which customers traded “Delmonico dollars” for drinks made from liquor that Oscar’s wife, Sesta, would hide in their baby Mario’s carriage — Oscar would restore Delmonico’s dining glory when Prohibition was repealed in 1933. Indeed, Max said, many of what we consider classic American dishes — the Wedge Salad, Chicken à la King, Oysters Rockefeller, Lobster Newberg and Baked Alaska, among them — were created or promoted at Delmonico’s. As Max’s father, Mario, and tough-minded Aunt Mary — “she was my Auntie Mame, an iron fist in a lace glove, doing all the books” — joined the business, new generations of power brokers and celebrities flocked to the restaurant.

“(Burlesque queen) Gypsy Rose Lee (who once did an impromptu striptease that ended with her wearing a menu), (actresses) Eva Gabor and Marlene Dietrich would come in,” Max recalled. It was where Hollywood and Wall Street would meet, along with everyone else, he added. For key to “The Delmonico Way” — beyond the sumptuous dining, swanky décor and glittering patrons — was an inclusive approach to hospitality.

“My grandfather Oscar would set a table for the homeless and feed them,” Max recalled, adding that among Delmonico’s patrons was trans activist and performer Christine Jorgensen. “Oscar said that ‘All are welcome at my table.’”

Oscar died in 1969 on his birthday, June 4, and Delmonico’s survived him until the early 1980s when New York City’s financial and crime problems led the Tuccis to close the restaurant in Manhattan — giving it another life in Greenwich, where Mario had an estate at Indian Harbor that once

Bolognese Al Coltello

The original Delmonico’s was a French restaurant, but when Oscar (Tucci) took over, he incorporated Italian traditions into the menu, including authentic Bolognese ragù. Beatrice Tosti, chef and owner of Il Posto Accanto, says the only trick is to take your time.

Ingredients:

• 1 cup dried porcini mushrooms

• ¼ cup plus 1 tablespoon extra-virgin olive oil

• 6 ounces pancetta, cut into ½-inch dice

• 1 sweet Italian sausage, casing removed and crumbled

• 2 medium carrots, finely chopped

• 2 ribs celery, finely chopped

• 2 medium yellow onions, finely chopped

• 2 pounds beef skirt or chuck, cut into ½-inch dice

• 12 ounces pork shoulder, cut into ½-inch dice

• 12 ounces veal shoulder, cut into ½-inch dice

• Salt to taste

• 2 cups dry red wine

• 2 28-ounce cans crushed tomatoes

• Freshly ground black pepper to taste

Directions:

Soak the mushrooms in 2 1/2 cups warm water until pliable. Place in a large heavy pot over medium-low heat. Add the olive oil, pancetta and sausage and cook until just golden. Add the carrots, celery and onions and cook, stirring occasionally, until the onion is translucent. Add the beef, pork and veal and cook over medium heat, stirring occasionally, until the meat begins to stick to the bottom of the pan, 5 to 10 minutes.

Drain the mushrooms. Strain the liquid to remove any grit. Chop the mushrooms into 1/2-inch dice. Add the chopped mushrooms and their liquid and season generously with salt. Cook, stirring occasionally, for 10 minutes. Add the wine and cook, stirring occasionally, until reduced completely, about 10 additional minutes. Add the tomatoes. Adjust salt and season with pepper and bring to boil, then reduce the heat as low as possible so that it is just barely simmering with a bubble breaking the surface occasionally and cook uncovered, stirring occasionally, until rich and dense, at least 2 hours.

Makes 2 to 2 ½ cups, enough for 6 servings.

12 FEBRUARY 20, 2023 FCBJ WCBJ

Bolognese Al Coltello. Photograph and recipe reprinted with permission from Max Tucci’s “The Delmonico Way.”

belonged to financier (and Delmonico’s regular) J.P. Morgan. The restaurant lasted there at 55 Arch St. from 1983 until Mario died of a massive stroke in ’87 on Max’s birthday, Feb. 14.

Meanwhile, Delmonico’s in Manhattan passed through other hands, although the Tuccis retained ownership of the building and licensing. Shuttered since the pandemic, Delmonico’s is slated to reopen this fall, Max said, hinting that he may be involved in this next chapter.

Meanwhile, he added, “the Delmonico way” survived in those restaurateurs whose skills were honed at the restaurant, including Sirio Maccioni (Le Cirque), Tony May (San Domenico, the Rainbow Room); Lello Arpaia (Lello and Scarlatti); and Harry Poulakaktos (Harry’s at Hanover Square). They in turn would train such restaurateurs as Daniel Boulud, Geoffrey Zakarian, Odette Fada, Donatella Arpaia and Scott Conant.

It is, Max writes in the book, “a unique family tree of the culinary industry” — with the author himself as one of the branches.

‘The Delmonico Way’ in North Salem

“To talk about the present, we talk about the past,” Max said when we talked with him by phone as he basked in the afterglow of “The Grammy Awards” at the home of “CSI: Miami” star Eva LaRue. Max had been invited by friend Clive Davis, the record producer and Pound Ridge resident, to attend his annual pre-awards party at The Beverly Hilton in Beverly Hills, where “celebrities dripped from the chandeliers,” and Davis’ post-awards party at the Polo Lounge at The Beverly Hills Hotel, which didn’t wind down until 2:30 a.m.

As he unwound, Max — who combines an engaging manner with a philosophical air — recalled his relationship with a restaurant that has remained a touchstone. There were chores at Delmonico’s, like cleaning the ashtrays — and fun times like swiping pastries with sister Nicoletta and playing amid the coatroom furs. Still, Max’s earliest professional ventures had more to do with mother Gina’s groundbreaking fashion career than his father’s culinary one. (She was the executive vice president of Maximilian Furs.) At 15, Max — who attended The Harvey School in Katonah and St. Luke’s School in New Canaan — became the assistant to fashion photographer, model scout and agency owner Beth Boldt, who discovered Naomi Campbell. Fashion photography led to designing, public relations, a stint on “America’s Next Top Model With Tyra Banks” and contributions to books by Al Roker, psychologist Grace Cornish and wellness expert Sister Jenna.

For 15 years, he’s been the host of the “Max & Friends” podcast — part recipes and recipes for life; dishes and dish. Around the time “Max & Friends” launched, the long probate of his father’s estate came to end, giving him access to “the treasure trove” that was Delmonico’s vault. The book he subsequently created would be rejected by 18 publishers. But, Max said, “rejection is protection.” At a Delmonico’s party he threw for Whoopi Goldberg’s 2019 book “The Unqualified Hostess: I Do It My Way So You Can Too!”, Max met Rizzoli New York publisher Charles Miers, who asked, “Why don’t you have a book about this place?” Max replied, “That’s because you haven’t published it.”

It was Goldberg who told Max, living

in Laurel Canyon in the Hollywood Hills at the time, “You’re a New Yorker. You need to get back to New York.” In 2021, Max purchased the North Salem estate of the late artist Daniel Greene, with plans to turn the antique dairy farm’s 6,000-square-foot barn, formerly Greene’s studio and school, into a space for “Delmonico Way” dinners and other culinary experiences as well as for rent. https://www.peerspace.com/pages/ listings/62029f92bdb172000d4094fd?sort_ order=2

Max — who divides his time among North Salem; Boulder; Colorado; Florida and Florence, Italy — will also be charting “The Delmonico Way at Sea” with Variety Cruises to Greece in the summer of 2024.

Delmonico’s sails on.

The team at Orienta launched the sip and shop luncheon event program on Dec. 1, partnering with fashion and accessories designers, entrepreneurs and local artisans from across the New York metro area. Lunch events are scheduled on a weekly basis. For more, visit orientarestaurant.com/lunchevents.

“The Delmonico Way” book signing and conversation with women’s executive empowerment coach Christine Mulhearne takes place from 11:45 a.m. to 2:30 p.m. Tuesday, Feb. 21, at Orienta restaurant in Greenwich. A donation to Food Rescue (foodrescue.us/ site/food-rescue-us-fairfield-county) will be made for each book purchased through the event and each lunch reservation made. To order the cookbook through this event, email wedgesaladllc@gmail.com and include in the subject line, Orienta event. For reservations, call 203-489-3394 or email info@ orientarestaurant.com.

Other Max Tucci events include a Feb. 23 luncheon/cooking demonstration and author talk at Baldanza at the Schoolhouse in Wilton baldanzarestaurants.com; a March 2 author talk and book signing at Elm Street Books in New Canaan elmstreetbooks.com; and an April 30 author talk at the Jay Heritage Center in Rye. JayHeritageCenter.org

Follow him on Instagram @maxtucci and @thedelmonicoway.

FEBRUARY 20, 2023 FCBJ 13 WCBJ

Max Tucci’s “The Delmonico Way: Sublime Entertaining & Legendary Recipes From the Restaurant That Made New York!” (Rizzoli New York, $45, 208 pages). Book cover and interior design by Roberto de Vicq. Recipe photography by Jennifer Arce.

Max Tucci, author of “The Delmonico Way,” will take part in a book signing and conversation with women’s executive empowerment coach Christine Mulhearne 11:45 a.m. to 2:30 p.m.

Tuesday, Feb. 21, at Orienta restaurant in Greenwich.

Courtesy Dara Avenius Photography.

WRITER

Taxable vs. nontaxable income

BY NORMAN G. GRILL

Is there a hard-and-fast-rule about what income is taxable and what income is not? The quick answer is that all income is taxable unless the law specifically excludes it. But there’s more to it than that.

Taxable income includes any money you receive, such as wages, tips and unemployment compensation. It can also include noncash income from property or services. For example, both parties in a barter exchange must include the fair market value of goods or services received as income on their tax return.

Nontaxable Income

Here are some types of income that are usually not taxable:

• Gifts and inheritances

• Child support payments

• Welfare benefits

• Damage awards for physical injury or sickness

• Cash rebates from a dealer or manufacturer for an item you buy

• Reimbursements for qualified adoption expenses

In addition, some types of income are not taxable except under certain conditions, including:

• Life insurance proceeds paid to you are usually not taxable. But if you redeem a life insurance policy for cash, any amount that is more than the cost of the policy is taxable.

• Income from a qualified scholarship is normally not taxable; that is, amounts you use for certain costs, such as tuition and required books, are not taxable. However, amounts used for room and board are taxable.

• If you received a state or local income tax refund, the amount might be taxable. You should have received a 2022 Form 1099-G from the agency that made the payment to you. If you didn’t get it by mail, the agency might have provided the form electronically. Contact them to find out how to get the form. Be sure to report any taxable refund you received even if you did not receive Form 1099-G.

Tip Income

If you get tips from customers, you must pay federal income tax on any tips you

receive. The value of noncash tips, such as tickets, passes, or other items of value, are also subject to income tax.

You must include the total of all tips you received during the year on your income tax return, such as tips received directly from customers, tips added to credit cards, and your share of tips received under a tip-splitting agreement with other employees.

Bartering Income

Bartering is trading one product or service for another. Small businesses sometimes barter to get products or services they need. For example, a plumber might trade plumbing work with a dentist for dental services. Typically, there is no cash exchange; however, if you barter, the value of products or services from bartering is considered taxable income by the IRS.

Barter and trade dollars are the same as real dollars for tax purposes and must be reported on a tax return. Both parties must report as income the fair market value of the product or service they get.

The tax rules may vary based on the type of bartering. Barterers may owe income taxes, self-employment taxes, employment

taxes, or excise taxes on their bartering income. How you report bartering on a tax return also varies. For example, if you are in a trade or business, you normally report it on Form 1040, Schedule C, Profit or Loss from Business.

Taxes can be complicated and time consuming and costly if you make mistakes. This column is for information only and should not be taken as advice. Contact a tax professional if you have questions.

Norman G. Grill is managing partner of Grill & Partners LLC, certified public accountants and consultants to closely held companies and high-net-worth individuals, with offices in Fairfield and Darien.

Reporter sues West Point and its athletics program for public records

BY BILL HELTZEL Bheltzel@westfairinc.com

Anational sports journalist is suing West Point and a separate athletics organization for records that would shed light on their sports programs.

Daniel Libit accused the United States Military Academy and the Army West Point Athletic Association of violating the federal Freedom of Information Act, in a complaint filed Feb. 1 in U.S. District Court in White Plains, for allegedly denying access to public records.

West Point has taken the position that the records are not subject to disclosure because they belong to the athletic association, according to the complaint. The association claims that it is not subject to the public records law because it is a private nonprofit organization.

“This two-step machination to declare whole categories of the federal military institution’s records off-limits to public view violates FOIA (Freedom of Information Act.),” Libit claims.

West Point and athletic association offi-

cials did not reply to an email requesting their sides of the dispute.

Libit writes for Sportico, an online news service, and he is the founder and co-editor of The Intercollegiate, a college sports news organization that says it covers “the issues that truly matter.”

He is trying to understand relationships between the service academies and intercollegiate sports, according to the complaint, and is seeking records such as coaches’ salaries and merchandising and multimedia contracts.

Over the past 12 months he has submitted several FOIA requests to the academy and athletic association and has been denied each time.

He traces the logjam back to 2010 when Congress enacted legislation that allows the service academies to outsource their athletics programs to nonprofit corporations. The idea was to enable the academies to increase their fundraising so as to keep pace with other major college sports programs.

In 2015, three West Point alumni created the Army West Point Athletic Association. Congress, according to the complaint, set

strict federal oversight on the association as a condition of allowing the association to run West Point athletics.

John M. McHugh, a former secretary of the Army and a former congressman who co-sponsored the legislation has stated, according to the complaint, that the arrangement was not intended to shield information from the public.

By early 2017 the association had received approval for tax-exempt status from the Internal Revenue Service, and West Point granted it control of the athletics programs.

West Point had required the association to place the academy’s commandant, dean, and director of admissions on its board. The academy selected a new athletic director who was simultaneously made president and CEO of the association. Most of the academy’s athletic department employees, as well as various support services and equipment, were transferred to the association.

The secretary of the Army retained the right to review the association’s finances, the complaint states.

For two years, the athletic association

filed annual IRS tax forms that are public records and that reveal financial information and activities. But in 2018, according to the complaint, the association petitioned the IRS to be exempted from filing the tax form on the grounds that it is a government unit or an affiliate of a government unit.

But when Libit submitted FOIA requests to the Army West Point Athletic Association, he says, an official responded that it is a private company and a nonfederal entity that is not subject to the public records law.

When Libit submitted FOIA requests, the West Point public records officer claimed that the military academy no longer has purview over athletic records and referred the journalist to the nonprofit athletic association.

Libit argues that the athletic association is controlled by and enmeshed within the military academy.

He is asking the court to declare that both entities are agencies subject to the public records law and to order them to disclose records unless they are specifically exempted by law.

Libit is represented by Yale Law School’s Media Freedom & Information Access Clinic.

14 FEBRUARY 20, 2023 FCBJ WCBJ

CONTRIBUTING

| By

G. Grill

Norman

Photo by Steve Buissinne / Pixabay.

Bulería’s glorious taste of Spain

BY JEREMY WAYNE jwayne@westfairinc.com

BY JEREMY WAYNE jwayne@westfairinc.com

Located across two tidy stone and red brick buildings on Main Street in Tuckahoe is Bulería, with handy parking at the rear. Arriving without a reservation on a Monday night, we are lucky to snag one of the restaurant’s last available tables. Who knew this tapas and wine bar, barely two months old, would be quite so jumping?

Coats barely off, our server Roberto approaches with a wide smile, a menu and a wine and cocktail list. “I recommend you try a Spanish Old Fashioned,” he says, by way of introduction. That would be nice, I’ve no doubt, but let’s take a moment here. It’s a great cocktail list, that’s for sure. Boy, could I do with a “Stress Reliever” — bourbon, cherry liqueur, absinthe and dark walnut bitters — or better yet, “A Day in Ibiza” — mezcal, aperol and pineapple syrup. But we settle on a “Lost in Seville,” a sort of Spanish Negroni made with Quinta Jerez vermouth and a dash of elderflower. It is excellent.

As for Seville and Jerez, we’re going to be hearing a lot about these places as the evening unfolds. Owner Luca Balestrieri, an Italian by birth, fell in love with Andalusia, the southernmost autonomous region in peninsular Spain, when he moved to Jerez — home of the Spanish Riding School — to further his love of the equestrian arts. It’s where he also developed a passion for flamenco, from which the restaurant takes its name — bulería being the most classic flamenco style of Jerez. A beautiful painting of a flamenco dancer in a dramatic twirl and flurry of skirts actually dominates the main dining room, while stylish retro posters, original paintings and collages of Spanish guitarists grace other walls.

Back at the table, meanwhile, a basket of bread has been placed along with an unmarked bottle of olive oil. Both the bread and the oil — grassy notes, low acidity — are superb. On another occasion I could sip my cocktail, pour a generous saucer of the oil, trawl a few slices of the sourdough through it and go home a happy man, but tonight there are many dishes we have to try.

TABLE TALK JEREMY WAYNE

Hotel consultant, travel writer and longtime restaurant editor for Condé Nast, Jeremy Wayne loves casual, unpretentious restaurants serving food which is genuinely seasonal, local and sustainable, while simultaneously lamenting the disappearance of linen tablecloths and the demise of the three-martini lunch. “These are the two sides of my split restaurant personality,” he confides, while also fessing up to his personal travel mantra. “The day to book your next vacation,” says Jeremy, is the day you come home from one.”

The menu divides into sections — charcuterie and cheese boards, paellas, salads and hot and cold tapas. To start, we enjoy jamón Ibérico, that particular delicacy from the acorn-fed, black-hoofed pig, which comes in a generous portion, wafer-thin with its own extraordinary sweetness. It finds a natural accompaniment with warm Marcona almonds prinked with paprika and assorted Spanish olives. We’re wild, too, about wild Gulf shrimp with white wine and chili and mejillones — sautéed PEI (Prince Edward Island) mussels with guindilla peppers and chorizo from Spain’s

Basque country.

Little cubes of chorizo appear, too, this time with beans, in a wonderful dish of Little Neck clams, a Spanish version of moules marinières, where the spoon to drink the broth is as important as the fork to spear the mollusks.

Our cocktails are long finished by this point, and we move on to glasses of Bodega Lagar de Besada Albariño, a white wine, and Castillo de Monseran, a Grenache from Aragon, which we’ve extracted from the long, international list. It’s a small gripe, but I would have appreciated a greater selection of Spanish wine in this authentically Spanish environment.

Neither appetites nor time allow for a paella — the dish serves two and takes 45 minutes to prepare. But the “marinera” paella, a classic combo with clams, mussels,

scallops and squid cooked with beguiling heady saffron rice, wins plaudits from the next table and is a good reason alone to return.

Instead, we share a generous churrasco skirt steak, cooked over white-hot coals, a relatively inexpensive cut but a lovely piece of meat rendered and made tender by the flash cooking. Rosemary potatoes, cut into little obelisks, which come with it, have a crisp outside and soft interior, the whole dish under a wreath of rosemary sprigs.

Looking at the dessert menu, I’m intrigued by the first item, called Noah’s Cookie Stash, a double chocolate chip cookie with strawberry ice cream. It’s not going to be my choice or my guest’s, but I want to know who Noah is. He of the ark? Turns out, he’s the owner’s son. Well, young Noah knows what he likes, and what fun to be immortalized on a menu. For us, though, it’s crème caramel, or flan, that most typical of Spanish desserts, a dense, eggy version here, served with a dollop of cream on top that purists might balk at but which we rather love, along with the most exquisitely-sliced strawberry you ever did see.

In addition to comfortable chairs and some banquette seating, the restaurant boasts a beautiful L-shaped bar with a wonderful backdrop, spirits on one side and wine bottles, lined up like soldiers, on the other, the two walls dramatically separated by a benign-looking bull — an image of a bull, that is to say.

Although Bulería is not currently open for lunch, or even brunch, I can’t help thinking that if it were to open at lunchtime, as is the Spanish style — offering an inexpensive menu del día, say, with food of this glorious standard — I’m certain people would beat a pathway to its door. Then again, I’m no restaurateur and owner Luca certainly isn’t asking me. As things stand, at least for now you’ll have to beat a pathway to Tuckahoe for dinner. “Make reservations” is my advice.

For more, visit buleriatapas.com.

FEBRUARY 20, 2023 FCBJ 15 WCBJ

Gambas al ajillo. Photograph by Jeremy Wayne.

The bar at Bulería. Courtesy Bulería.

Bulería street sign. Courtesy Bulería.

TOGETHER WE GROW

ECONOMIC OUTLOOK 2023

We are thrilled to announce the in-person return of this event!

Please join us for a conversation with Alexandra Daum, Commissioner Designate, CT Department of Economic & Community Development, and Chris DiPentima, President & CEO, CBIA; along with your Greater Valley Chamber President, Bill Purcell, about a range of issues impacting YOUR business and the Connecticut economy. Discussion topics will include the State budget, current economic trends, workforce shortages, legislative policies, and the state's economic development strategy.

Friday, February 24, 7:30 to 9:30 AM EST Brownson Country Club, Shelton Check-in/Breakfast/Networking - 7:30 to 8:00 am; Program: 8:00 am

Members: $40; All Others $60 visit http://bit. ly/ValleyChamberEvents for complete details and to register to attend.

FUEL - VALLEY YOUNG PROFESSIONALS - CONNECT

Join us for a private party at Quail & Ale Neighborhood Pub. Admission includes delicious food, great networking, board games and more. Cash Bar.

About our destination: The Quail & Ale is the newest addition to the Naugatuck Valley’s exciting restaurant scene. Located in the historic “brewery building” the Quail & Ale is a casual and unique dining experience.

Wednesday, February 22nd 5:30 to 7:00 PM

Quail & Ale Neighborhood Pub, Derby Scan the QR Code or visit http://bit. ly/ValleyChamberEvents for complete details and to register to attend.

TOGETHER WE GROW

16 FEBRUARY 20, 2023 FCBJ WCBJ

FAIRFIELD COUNTY

TOGETHER WE GROW

SPRING GALA FUNDRAISER

Wilton Library's Spring Gala fundraiser will be held on Saturday, April 22, 2023 from 6:30-11:00pm at Rolling Hills Country Club in Wilton.

Tickets for the event will go on sale in early March. The Gala promises to be an elegant and entertaining evening bringing multiple generations together to celebrate with dinner, dancing to live music by Coverland Band, and appealing auctions. We will also honor four distinguished individuals responsible for making Wilton Library the cornerstone of our community.

The Library is offering sponsorship and advertising opportunities to all members of our community. This is a great chance to get your company or organization’s name in front of the library’s 12,000+ followers. And your support is tax deductible!

2023 ECONOMIC FORECAST MEETING

The Wilton Chamber of Commerce proudly presents a 2023 Economic Forecast Meeting on Tuesday March 28th from 5:30-6:30 pm at the Wilton Library. The meeting will be led by Peter Denious, President and C.E.O. of AdvanceCT, a private nonprofit economic development corporation, driving job creation and new capital investment in Connecticut through business

attraction, retention, and expansion efforts, in close cooperation with state, regional and local partners.

There is no charge, but registration is required and space is limited. Registration is available through the Wilton Chamber of Commerce’s event page: https://wiltonchamber.com/event-detail/economic-forecast-meeting-2023/

ANNUAL RVNAHEALTH WELLNESS FAIR

Save the date of the Annual RVNAhealth Wellness Fair on Saturday March 25, 2023. This is a mission-driven community event that provides expertise from head to toe. The Fair features: a range of free health screenings; a field of medical experts and professionals (available for Q & A) and valuable information.

For further information and to register: https://rvnahealth.org/event/rvnahealth-wellness-fair/

FEBRUARY 20, 2023 FCBJ 17 WCBJ BRING RESUMES AND DRESS FOR SUCCESS! 100’S OF FANTASTIC JOB OPPORTUNITIES Questions? 203.743.5565 or info@danburychamber.com Visit the WCSU Career Success Center website for more information. FREE - Open to the public March 1 from 3 to 6 p.m. DANBURY FAIR MALL • CENTER COURT LOWER LEVEL CAREER FAIR Ce ebrating 120 Years GREATER DANBURY

FAIRFIELD COUNTY

New data affirms too many companies are not taking cybersecurity seriously

BY PHIL HALL Phall@westfairinc.com

Cybersecurity concerns become more acute with each passing year, but is the corporate world taking the threat seriously?

The newly published Deloitte Center for Controllership study found roughly half (48.8%) of the 1,100 C-suite and other executives interviewed for the data research expected the quantity and depth of cyber events targeting their organizations’ accounting and financial data to increase in the year ahead, but only 20.3% of those polled said their organizations’ accounting and finance teams were working closely and consistently with their peers in cybersecurity.

During the past 12 months, 34.5% of polled executives reported their organizations’ accounting and financial data weretargeted by cyber adversaries. Within that group, 22% experienced at least one such cyber event and 12.5% experienced more than one.

Looking to the year ahead, 39.5% of respondents expected to increase the amount of collaboration between their finance and cyber teams. Currently, 42.7% of polled executives said their organizations’ finance and cyber teams only work together as needed with inconsistent closeness and consistency, while 11.1% said that no such cooperation exists in their organizations.

“Accounting and financial data is the

Cybersecurity

lifeblood of organizational operations — and often meant to be kept confidential outside of highly regulated public disclosures for publicly traded organizations,” said Temano Shurland, a Deloitte Risk & Financial Advisory principal in finance transformation. “While there may not have been much need for accounting, finance and cyber teams to work closely in the past, recent years have shown that’s no longer the case. We strongly recommend that these teams try to ‘learn each other’s languages’ and tighten their working relationships across silos.”

Elsewhere in the financial services world, the Cyber Bank Heists report published by Contrast Security found 60% of major financial institutions were victimized by destructive attacks. The study found 64% of these institutions experienced an increase in application attacks, while 50% experienced attacks against their APIs.

Of the institutions that were targeted, 48% experienced an increase in wire transfer fraud and 50% have detected campaigns to steal nonpublic market information. More than half (54%) of the financial institutions were most concerned with the cyber threat posed by Russia, while 72% planned to invest more in application security in 2023. Contrast Security, a code security platform company headquartered in Los Altos, California, culled its data from global Tier 1 financial institutions (those with a minimum of $200 billion in assets) and Tier 2 financial

institutions (those with between $5 billion and over $10 billion in assets).

“The financial sector needs to shift its thinking when it comes to attacks, as geo-political tensions manifest via cyberattacks,” said Contrast’s Senior Vice President of Cyber Strategy Tom Kellermann. “Cybercrime cartels are modernizing their criminal conspiracies so as to steal non-market information and destroy the integrity of sensitive data within financial institutions. This is no longer a question of duty of care but rather a duty of loyalty to the digital safety of customers.”

The Greatest Dangers