Zenith Maintains Position as ‘Best Corporate Governance Financial Services’ in Africa

are now renowned.

The award, which was published in the Spring 2023 edition of The Ethical Boardroom magazine, was in recognition of the bank’s adherence to global best practices and institutionalisation of corporate governance, setting an industry-wide

example of best practices in that field. Speaking on the recognition, the Group Managing Director/Chief Executive of Zenith Bank Plc, Dr. Ebenezer Onyeagwu, was quoted in a statement yesterday, to have said: “I am extremely pleased that

Zenith Bank has been awarded the Ethical Boardroom Corporate Governance Award as a regional governance champion for the fourth year running. No doubt, the bank’s board has pioneered the exemplary governance culture for which we

us to strengthen this culture internally and advocate for good governance at every forum.”

He dedicated the award to the Founder and Group Chairman, Jim

“Indeed, this recognition reflects our steadfast commitment, discipline and high ethos in the conduct of our business and dedication to the principles of good corporate governance. This award will motivate Continued on page 10

www.thisdaylive.com Wednesday 31 May, 2023 Vol 28. No 10276. Price: N250 TRUTH & REASON

Nume Ekeghe For the fourth consecutive year, Zenith Bank Plc has been named as the Best Corporate Governance 'Financial Services' Africa 2023 by the Ethical Boardroom. CBN Gov Seeks Urgent Debt Management Reforms at State Levels Amid Increasing Exposure ... Page 10 Investors React Positively as Tinubu Meets Emefiele, Kyari, Labour over Petrol Subsidy EMI LOKAN… PRESIDENTIAL GUARD OF HONOUR WELCOMES TINUBU TO HIS OFFICE... President Bola Ahmed Tinubu inspecting the guard of honour formally welcoming him to the Presidential Villa, Abuja.. yesterday Stock market gains N1.51tn, naira appreciates as Eurobonds rally NLC, TUC express outrage, describe pronouncement as insensitive Shettima: We must end fuel subsidy now else it will end Nigeria NNPC, NMDPRA, others back move Kyari: FG owes national oil company N2.8tn subsidy fund Says govt couldn't pay subsidy bills since February 2022 Declares licences to be issued soon to marketers to import fuel NEITI laments N13.6tn subsidy, seeks people-oriented programmes Lawmakers, MOMAN, DAPPMAN, IPMAN hail president Labour party faults approach President Directs DSS to Vacate EFCC’s Office Immediately ... Page 8 10th Assembly: Northern Alliance Alleges ‘Undemocratic Moves’ to Stop Betara, Yari... Page 40 Story on page 5

in Fourth Consecutive Year

WEDNESDAY MAY 31, 2023 • THISDAY 2

WEDNESDAY MAY 31, 2023 • THISDAY 3

WEDNESDAY MAY 31, 2023 • THISDAY 4

Group News Editor: Goddy Egene

Email:

PRESIDENTIAL INAUGURAL BALL...

L-R, Executive Chairman, Geregu Power PLC, Mr Femi Otedola; Chairman Chagoury Group, Gilbert Chagoury; Chairman, Dangote Group, Aliko Dangote; His Majesty Olu of Warri Kingdom, Ogiame Atuwatse III; his wife, Olori Atuwatse III with Chairman, Belema Oil, Tein Jack-Rich; during the Presidential Inaugural ball in Aso Villa... on Monday

INVESTORS REACT POSITIVELY AS TINUBU MEETS EMEFIELE, KYARI, LABOUR OVER PETROL SUBSIDY

Deji Elumoye, Onyebuchi Ezigbo, Emmanuel Addeh, Emameh Gabriel, Udora Orizu in Abuja, Nume Ekeghe, Peter Uzoho and Kayode Tokede in Lagos

Investors in both the equities and money market yesterday responded positively to the pronouncements by President Bola Tinubu in his inaugural speech.

Specifically, the stock market appreciated as investors gained N1.51 trillion, apparently in response to Bola Tinubu's signalling of plans to unify foreign exchange rates. Also, the naira appreciated on the parallel market as it gained N5 to close at N765/$1

yesterday, up from the N770/ $1 it traded the previous day.

However, Tinubu; the Governor of the Central Bank of Nigeria (CBN) and the Group Chief Executive Officer of the Nigerian National Petroleum Company Limited (NNPC), Mele Kyari, yesterday met to strategise on how to engage members of the Nigeria Labour Congress (NLC) and the Trade Union Congress (TUC), to resolve the looming agitation against the phasing out of the petrol subsidy regime, which was among the pronouncements by the president on Monday, reliable Villa sources told THISDAY.

However, it is not certain how the

talks with the two labour unions went or when further talks and expected to hold.

Also yesterday a Tinubu Support group attempted to clarify the President's stance on the controversial policy, saying subsidy was already removed by the previous administration as the 2023 budget for fuel subsidy was planned and approved to last only for the first half of the year.

The group explained: “The public is advised to note that President Bola Tinubu’s declaration that “subsidy is gone” is neither a new development nor an action of his new administration.

“He was merely communicating the status quo, considering that the previous administration’s budget for fuel subsidy was planned and approved to last for only the first half of the year.

“Effectively, this means that by the end of June, the federal government will be without funds to continue the subsidy regime, translating to its termination. The panic-buying that has ensued as a result of the communication is needless; it will not take immediate effect.”

Members of the organised Labour under the aegis of the Nigeria NLC and TUC, had yesterday, described the pronouncement by President Bola

Governors Warn Fuel Marketers against Hoarding, Price Hike

Deploy special monitoring teams

Peter Uzoho in Lagos, Olusegun

Samuel in Yenagoa, Yinka Kolawole in Osogbo, Hammed Shittu in Ilorin and Gbenga Sodeinde in Ado Ekiti

Kwara State Governor and Chairman of the Nigeria Governors’ Forum (NGF), AbdulRahman AbdulRazaq; Bayelsa State Governor, Senator Douye Diri, and Osun State Governor, Senator Ademola Adeleke, have cautioned oil marketers to avoid imposing needless hardship on the citizens through creation of artificial fuel scarcity in states across the country.

Similarly, Governor Godwin Obaseki of Edo State and Governor, Mr. Biodun Oyebanji of Ekiti State have threaten to clamp down oil marketers hoarding petrol in their respective states to create artificial scarcity and price hike

The governors gave the warning in separate statements yesterday.

The oil marketers had resorted to hoarded and hiked prices immediately President Bola Tinubu announced in his inaugural speech that fuel subsidy was over.

AbdulRazaq, said, he was seriously concerned about reports of sudden fuel scarcity in different parts of the state, stressing that it was totally uncalled for.

In a statement issued in Ilorin, that was signed by the governor’s Chief Press Secretary, Mr. Rafiu Ajakaye, AbdulRazaq, however asked marketers to immediately discharge fuel to the public under the normal pricing system since they had bought what they currently have at subsidised rates.

He stated: “Creating artificial scarcity amounts to intentional misrepresentation of the statement of President Bola Ahmed Tinubu, on the question of fuel subsidy. The people should not be made to undergo any hardship.

"The governor urges the marketers to desist from anything that qualifies

as economic sabotage of the people.

"Hoarding fuel bought at subsidised price and creating panic in the state is opportunistic and will not be condoned.

"The Deputy Governor Mr. Kayode Alabi will be leading a task force to ensure that no fuel marketer causes undue hardship to the citizens in Kwara State."

AbdulRazaq added, "Fuel stations are to note that the Task Force will dip into their pits. Any filling stations found to be hoarding fuel will have their Certificate of Occupancy (CofO) revoked, among other penalties."

Diri, also directed oil marketers in the state against hoarding and raising price of petrol.

In a statement issued by his Chief Press Secretary, Mr. Daniel Alabrah, the Bayelsa governor warned that his administration would take stern measures against any filling station that flout the directive.

He said the government had received reports that filling stations in the state capital had hiked the pump price of petrol above the usual price of between N193 and N250 per litre and now being sold at N500 per litre and above.

Marketers in the state were said to have reacted to the pronouncement by Tinubu during his inauguration on Monday, that the federal government subsidy on petrol “was gone.”

The Bayelsa governor said it was wicked for oil marketers to swiftly seek to profiteer at the detriment of the people following a mere pronouncement that had not taken effect.

He noted that the pump price of petrol was a significant determinant of the cost of goods and services in the country and that his administration would not allow the people of Bayelsa to suffer undue hardship from the profiteering activities of greedy businessmen.

Diri said he had directed the Ministry of Mineral Resources and the petroleum task force in the state to shut down any filling station hoarding the product or caught selling above the usual price.

He said: “I have directed the relevant ministry and the state’s task force on petroleum to ensure that all filling stations sell petrol within the usual price range.

“I have equally directed that any filling station that flouts this directive or fails to revert to the usual price be shut down. We will take further stern measures against any station that defaults.

Also, Osun State Government yesterday vowed to arrest and prosecute oil marketers who hoard fuel in a bid to create artificial scarcity in the state.

A statement issued by the spokesperson for Adeleke, Olawale

Rasheed, yesterday, noted that a Special Monitoring Team would move around the state to ensure that all filling stations complied with the directive.

The stern warning came on the heels of reported deliberate hoarding of petrol by fuel dealers in the state.

The statement read, “The attention of the Osun State Government has been drawn to the deliberate hoarding of PMS by the fuel dealers within the State as a result of the statement from the Inaugural Speech of the new President of the Federal Republic of Nigeria, Asiwaju Bola Ahmed Tinubu on the removal of fuel subsidy, thereby causing unnecessary hardship for the people in the state.

“This deliberate action is not only inhumane, but unpatriotic and will not be allowed by the government.

Tinubu, that petrol subsidy was over as outrageous and insensitive to the economic plight Nigerian masses were being subjected to.

But in swift reaction, the Vice President, Kashim Shettima, yesterday justified the urgent need to end fuel subsidy regime in the country, saying the policy must be phased out for the survival of the country.

Also, in their separate reactions in Abuja, the Nigerian National Petroleum Company Limited (NNPC) and the Nigerian Upstream and Midstream Regulatory Authority (NMDPRA), called for calm, insisting that while there was ‘potential’ change in price, the country had enough stock in its storage facilities.

Emphasising reasons to support the move to eliminate petrol subsidy, the Group Chief Executive Officer (GCEO), NNPCL, Mele Kyari, disclosed that the federal govern- ment was indebted to the national oil company to the tune of N2.8 trillion in fuel subsidy payments.

However, the chaotic reaction to the removal of petrol subsidy announced by Tinubu on Monday, continued yesterday, with many filling stations across the country hoarding the product, while the few that opened to customers sold at exorbitant prices.

THISDAY observed that many filling stations in Abuja and all other states across the country, had vehicles extending several kilometres as retailers continued hoarding the product.

Following the hike in pump price, commercial transporters also hiked their trip fares across the country in response to the developments. The price of the product, it was gathered, now ranges from between N220 to N500.

Commuters were also stranded at various bus stops, as they waited to board commercial vehicles which had hiked fares from between 50 and 100 per cent.

Investors React Positively to Tinubu’s Economic Policy Direction

Investors in both the equities and

money market yesterday responded positively to the pronouncements by President Bola Tinubu in his inaugural speech.

Specifically, the stock market appreciated as investors gained N1.51 trillion, apparently in response to Bola Tinubu's signalling of plans to unify foreign exchange rates.

Also, the naira appreciated on the parallel market as it gained N5 to close at N765/$1 yesterday, up from the N770/ $1 it traded the previous day.

This was just as sovereign dollar- denominated bonds rallied.

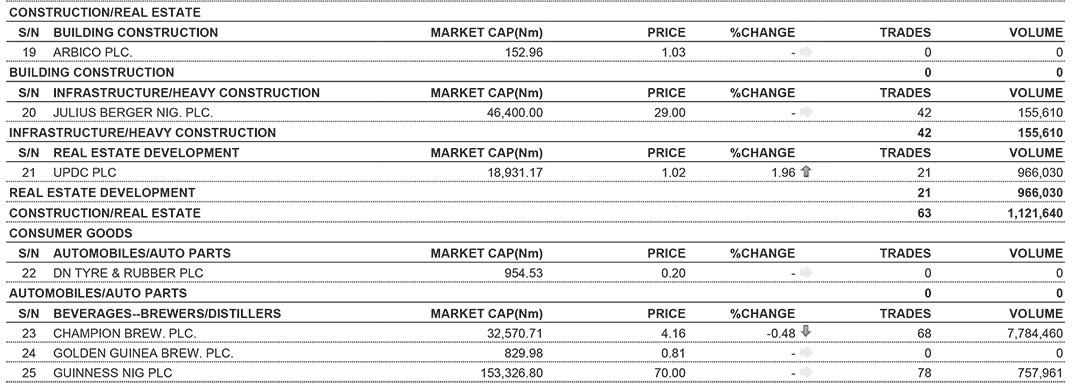

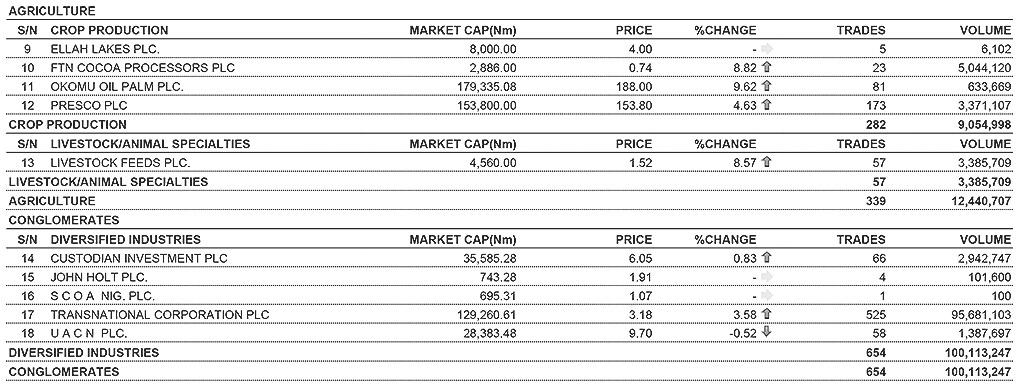

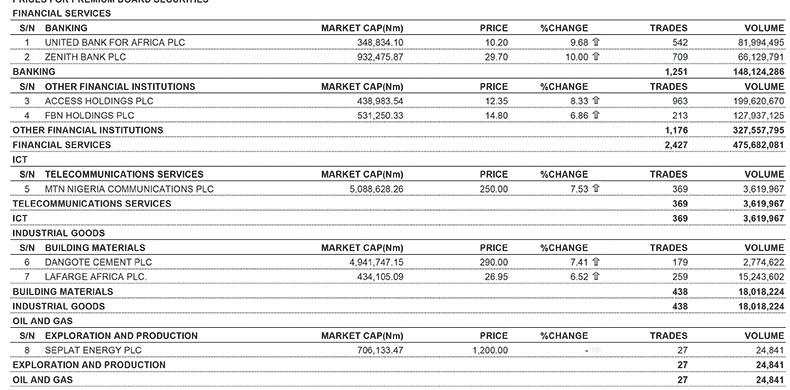

The market capitalisation opened for trading at N28.845 trillion yesterday, gaining N1.51trillion or 5.23per cent to close at N30.350 trillion, while the NGX All-Share Index gained 5.23 per cent or 2,764.47 basis points to 55,738.35 basis points from 52,973.88 basis points it opened for trading.

The 5.23 per cent recorded yesterday was the biggest single-day gain since November 12, 2020.

Tinubu in his inaugural address had commended the decision of the outgoing administration of President Muhmmadu Buhari in phasing out the petrol subsidy regime which has increasingly favoured the rich more than the poor.

Tinubu had said: “Subsidy can no longer justify its ever-increasing costs in the wake of drying resources. We shall instead re-channel the funds into better investment in public infrastructure, education, health care, and jobs that will materially improve the lives of millions.”

He added that, “The Central Bank must work towards a unified exchange rate. This will direct funds away from arbitrage into meaningful investment in the plant, equipment and jobs that power the real economy.

“Interest rates need to be reduced to increase investment and consumer purchasing in ways that sustain the economy at a higher level.”

According to industry experts and multilateral lenders like the International Monetary Fund (IMF),

Cisco, NITDA Partner to Bridge Digital Skills Gap in Nigeria

Cisco and the National Information Technology Development Agency (NITDA) in Nigeria have signed a memorandum of understanding (MoU) with the aim to support Nigeria’s digital transformation agenda and contribute towards digital skills training and development.

This was disclosed in a statement made available to THISDAY, yesterday.

As part of the collaboration, Cisco’s Incubation and Innovation Centre in Lagos called Cisco EDGE, would be used to stimulate innovation and support digitisation initiatives, providing a space where local partners could showcase technologies and host client events.

Within the Cisco EDGE program, the Innovate pillar provides re-

sources and tools to local innovators and entrepreneurs to help them develop more secure, intelligent, and connected solutions. The second pillar, called Cisco EDGE Educate, was aimed at transforming the lives of learners, educators, and communities through technology and by offering education and career opportunities.

The MoU forms part of the Cisco Country Digital Acceleration (CDA) program where Cisco and NITDA plan to work together to promote and further expand Cisco Networking Academy in Nigeria.

The CDA was founded in 2015 and has since evolved into programs in 50 countries, with over 1500 active or completed projects—encompassing over two-thirds of the world’s population and 75 percent of global

Gross Domestic Product (GDP).

The Vice President for Middle East & Africa at Cisco, Reem Asaad, was quoted to have said: “Cisco has a responsibility to both its customers and the greater global community to help solve challenges that impact our daily lives.

“We accomplish this by providing intelligent and innovative solutions, offering training and education opportunities, empowering communities through digital transformation, and enabling them to participate in the global digital economy.

“We are looking forward to working with NITDA to help accelerate digitisation in Nigeria.”

For her part, NITDA’s Acting Director, Digital Literacy and Capacity Development Department, Dr. Amina Sambo said: “As the

agency responsible for regulating and developing Nigeria’s use of information technology, NITDA looks forward to the impact of this engagement.

“By collaborating with industry leaders like Cisco, we can empower and equip Nigerians with the knowledge and resources they need to participate in the national and global digital economies.”

Established in 1997, Cisco’s Networking Academy offers high-quality IT training and hands-on learning opportunities in 190 countries.

Over 17.5 million learners worldwide have participated in Cisco Networking Academy courses, and in Nigeria, over 411,000 students have been enrolled, 44 per cent of whom are women.

WEDNESDAY, THISDAY 5 Continues online

on page 30

Continued

NEWS

0803 350 6821, 0809 7777 322, 0807 401 0580

Goddy.egene@thisdaylive.com,

SHETTIMA RESUMES AT THE VILLA...

Adesina: Global Interest Rates Impacted on Portfolio Investments in Africa Negatively

Outflow of portfolio investments rose to $27.5bn in 2021

Ugo Aliogo with agency report

The President, African Development Bank Group (AFDB), Dr. Akinwumi Adesina, has stated that rising global interest rates have had negative effects on portfolio investments in Africa, with outflow of portfolio investments increasing from $8.1 billion in 2020, to $27.5 billion in 2021.

He however, stated that remittances continued to help boost recovery, as this increased across several countries due to better than expected economic recovery in migrant destination countries, noting that remittances increased from $84 billion in 2020 to $95.6 billion in 2021.

Adesina, who disclosed recently at the at the Launch of the African Economic Outlook 2023, during the 2023 Annual Meetings of the African Development Bank Group, recently, at Sharm El Sheikh, Egypt, stated that the war in Ukraine, had led to a shrinking of net Official Development Assistance (ODA) to Africa.

He added that Net ODA to Africa declined by 7.4 per cent in real terms from $36.6 billion in 2021, to $34 billion, which was

the lowest level in the past 12 years. This, he said calls for greater efforts in Africa to mobilise more domestic resources.

He revealed that it was critical to ensure coordinated debt treatment between official and private creditors and ensure that the G20 Common Framework works for African countries, while stating that other policy recommendations included industrial policies to accelerate diversification of economies, and expansion of regional trade to lower exposure to global volatilities.

The AfDB President said Africa was being short-changed by climate finance, noting that the continent would need between $235–$250 billion annually through 2030, to meet investments under its Nationally Determined Contributions, “yet, Africa received just about $30 billion in climate finance.”

According to him, “Of particular concern: Public climate finance is six times that of private finance. Private flows of climate finance in Africa are the lowest in the world. Africa’s private financing gap is estimated to reach $213 billion annually through 2030.

“This implies that private sector

climate financing will need to increase by 36 percent annually.

This explains why the theme of our Annual Meetings is focussed on this issue.

“The report recommends several ways to attract private climate financing, including green bonds, debt-for-nature swaps, green banks, blended finance, and carbon markets.

“As we gather today, the world is facing multiple challenges, including climate change, inflation driven by higher prices of energy, commodities, and disruption of

supply chains due to the ongoing Russia-Ukraine war.

“And the tightening of monetary policies in the US and Europe has led to rising interest rates that are compounding debt service payments for African countries.

“The report shows that in the face of these challenges, African economies have demonstrated remarkable resilience. The continent achieved an average growth rate of 3.8 percent in 2022, with projected average growth of 4.1 per cent for 2023–2024. This surpasses the global average of 3.4 per cent in

2022.

“African countries that are exporting oil have experienced a boost in growth as global oil prices have remained high. However, resource-intensive countries experienced a deceleration of growth because of their lack of diversification and the lower prices of commodities, especially minerals due to weak global growth. Nonresource-intensive countries with more diversification experienced higher growth.”

He added: “African economies are moving in the right direction.

Five of the six pre-pandemic topperforming economies are set to be back in the league of the world’s 10 fastest-growing economies in 2023–2024.

“External financial inflows to Africa-including foreign direct and portfolio investment, official development assistance, and remittances have rebounded by approximately 20 percent, reaching $216.5 billion (or 7.5 percent of GDP) in 2021. This is up from $179.9 billion (or 7.4 percent of GDP) in 2020 during the peak of the COVID-19 pandemic.”

We Didn't Ask Tinubu to Sack Emefiele, CSOs Clarify

CD rally support for new administration

Sunday Aborisade in Abuja

The Coalition of Civil Society Groups yesterday, clarified that it had not called for the sacking of Mr. Godwin Emefiele as the Governor of Central Bank of Nigeria (CBN).

The new President of the Coalition, Mr. Olakunle Oladimeji, made

the clarification in his acceptance speech after he was declared as the successor to the former head of the CSOs, Etuk Bassey Williams. Oladimeji, said the call for the sacking of Emefiele was a unilateral decision of Williams.

He, thereafter, called on Newspaper Proprietors Association of Nigeria and other newspaper

regulatory agencies to probe the news item as reported by a newspaper.

He categorically declared that there was no protest planned by the coalition against the Central Bank of Nigeria and its Governor.

He said, “At this juncture, it is important to state categorically that the Coalition of Civil Society Groups

Navy Releases Large Oil Tanker to Idun Maritime

Blessing Ibunge in Port Harcourt

About nine months after MT Heroic Idun, a large crude oil tanker was arrested and seized alongside its 26 foreign crew, the Nigerian Navy has released and handed over the vessel to its owner, Idun Maritime Limited.

The release of the vessel came after the international firm had fulfilled the conditions of the plea bargain agreement held with the government.

The large motor tanker with its crew on board had resisted arrests by the Nigerian Navy Ship Gongola, near the Akpo oilfield offshore Nigeria and but were later arrested in Equatorial Guinea in August 2022.

On arrest, the vessel and the 26 foreigners were brought back to Nigeria for prosecution in November 2022, on three count

charge, including attempted oil theft. The trial was held before a federal High Court in Port Harcourt, Rivers State.

The vessel and her 26 foreign crew in January 2023, had pleaded guilty and elected voluntarily to enter into a plea bargain agreement with the Federal Republic of Nigeria as well as make restitution to the federal government, in the interest of justice, the public and for public policy interest in line with Section 270 (5) (a) of the Administration of Criminal Justice Act 2015.

The convicted vessel, MT Heroic Idun and its owners were to pay conviction fines and restitution to the federal government and make a public apology to the Federal Republic, while the government agreed not to further criminally prosecute and/or investigate the vessel, her owners, charterers or her crew in the matter of her crime

against the state. All these being the conditions of the plea bargain without which the vessel and its crew would not be released.

The convicted vessel, having satisfied the conditions of the plea bargain was handed over officially at the weekend, to the owners, Idun Maritime Limited offshore on the Atlantic coast of Rivers State.

Handing over the vessel, the Commanding Officer, Forward Operating Base, Bonny, Navy Captain Mohammed Adamu, said prosecuting the vessel under the Suppression of Piracy and Other Maritime Offences (SPOMO) Act, 2019 further demonstrated the Nigerian Navy’s practical commitment to end oil theft in the country.

Adamu who spoke on board the vessel, vowed that the Nigerian Navy under the leadership of

the Chief of the Naval Staff, Vice Admiral Awwal Gambo, would continue to work in synergy with other Maritime Law Enforcement Agencies, navies of the Gulf of Guinea states and strategic partners of Nigeria to ensure that Nigeria derives the maximum benefit from its natural resources in her vast maritime area.

He said: "The subsequent transfer of the ship from Equatorial Guinea after she had escaped Nigerian waters and her prosecution under the Suppression of Piracy and Other Maritime Offences (SPOMO) Act, 2019 further demonstrated the Nigerian Navy’s practical commitment to ensure that only valid and authorised vessels were allowed to carry out export of crude oil or gas at the various oil terminals and this is with a view to enhancing energy security governance in the country for improved national prosperity as

directed by the Federal government of Nigeria.

"Pertinently, MT Heroic Idun having fulfilled all the aforementioned conditions of the plea bargain to the satisfaction of the Federal High Court has been released today Saturday 27 May 2023 to its owners, Idun Maritime Limited with the consent of the court and approval of the Federal government of Nigeria”.

Adamu said the Nigerian Navy would not fail to bring to book those whose operation infringe on the provisions of the SPOMO Act and all maritime laws and conventions acceded to by the Federal Republic of Nigeria.

The Captain of the convicted vessel, Mr Tanuj Mehta, who spoke, revealed that they were treated professionally by the Nigerian Navy and was pleased that they would be returning back to their country.

did not plan any protest against the CBN Governor or the CBN because there was no reason to organise such protest.

"However where any such blackmailing or extortionist plans to protest against the CBN exits, it is hereby called off and members of the public are urged to disregard any such plan for any purported protest.”

Oladimeji urged Nigerians to support the new administration led by President Bola Tinubu to achieve its plans of revamping the nation's economy, provide welfare for the citizenry and guarantee security.

Meanwhile, the Campaign for Democracy, (CD) has advised Tinubu not to let Nigerians down, by exhibiting boldness and bravery in taking decisions that would benefit the people devoid of tribe or language difference.

The CD President, Mr. Ifeanyi Odili, made the appeal in a statement he made available to journalists in Abuja, yesterday.

He said, "We have listened, carefully, to his maiden broadcast at the Eagle Square during the swearing-in ceremony, we applaud his decisive drive towards the popular station of collective togetherness and your frank submissions on the subject of progressive nationalism.

"However, we view his pronouncement on the petrol subsidy issue as one that will, undoubtedly, lead to a cut-throat hike in fuel price."

6 WEDNESDAY, THISDAY NEWS

Vice President Kashim Shettima's first day in office

WEDNESDAY MAY 31, 2023 • THISDAY 7

SANWO-OLU'S FIRST DAY AT WORK TO BEGIN HIS SECOND TERM...

... yesterday

Tinubu Directs DSS to Vacate EFCC’s Office Immediately

The structure belongs to us since NSO days, says security agency Anti-graft

Deji Elumoye, Kingsley Nwezeh

in Abuja and Sunday Ehigiator

President Bola Tinubu, yesterday, directed the Department of State Security Service (DSS) to immediately vacate the office of the Economic and Financial Crimes Commission in Ikoyi, Lagos.

According to a release from the State House, Abuja, by Tunde Rahman, the president gave the directive when reports that DSS officials had stormed the EFCC office located on Awolowo Road, Ikoyi, Lagos preventing officials of the anti-graft agency from accessing their work place, was brought to his attention.

President Tinubu said if there were issues between the two important agencies of government, they would be resolved amicably.

Two federal agencies, the DSS and the EFCC clashed yesterday over the ownership of the office complex.

There were reports that the DSS prevented officials of the anti-graft agency from gaining access to their office in Ikoyi, blocking the whole building and placing an armoured tank at the front of the building.

“They even placed an armoured tank just to scare us away,” a source at the office said.

While DSS laid claim to the ownership of the building, EFCC

said there were ongoing discussions between the two agencies.

But a statement by DSS said the agency was only occupying its facility.

The statement by the DSS spokesman, Dr Peter Afunanya, said, "Awolowo Road was NSO headquarters. SSS/DSS started from there. It is a common knowledge. It is a historical fact. Check it out. There is no rivalry between the service and the EFCC over and about anything.

"The attention of the Department of State Services (DSS) has been drawn to some media reports that it barricaded the EFCC from entering its Lagos office. It is not

correct that the DSS barricaded EFCC from entering its office. No. It is not true. The service is only occupying its own facility, where it is carrying out its official and statutory responsibility.

"By the way, there is no controversy over No 15A Awolowo Road as being insinuated by the media. Did the EFCC tell you it is contesting the ownership of the building? I will be surprised if it is contesting the ownership. Awolowo Road was NSO headquarters. SSS/DSS started from there. It is a common knowledge. It is a historical fact. Check it out.

"There is no rivalry between the service and the EFCC over

China Launches New Crew into Space, Including First Civilian Astronaut

China yesterday launched a new three-person crew for its orbiting space station, with an eye to putting astronauts on the moon before the end of the decade.

The Shenzhou 16 spacecraft lifted off from the Jiuquan launch center on the edge of the Gobi Desert in northwestern China atop a Long March 2-F rocket just after 9:30 a.m.

According to the CNN, the crew, including China's first civilian astronaut, would overlap briefly with three now aboard the Tiangong station, who would then return to earth after completing their six-month mission.

A third module was added to the station in November, and space program officials on Monday said they have plans to expand it, along with launching a crewed mission to the moon before 2030.

China built its own space station after it was excluded from the International Space Station, largely due to U.S. concerns over the Chinese space programs' intimate ties with the People's Liberation Army, the military branch of the ruling Communist Party.

China's first manned space mission in 2003, made it the third country after the former Soviet Union and the United States to put a person into space under its own resources.

On the latest mission, payload expert Gui Haichao, a professor at Beijing's top aerospace research institute, would join mission commander Major General

Jing Haipeng, who is making his fourth flight to space, and spacecraft engineer Zhu Yangzhu.

The crew would stay aboard the station for around five months, during which they would conduct scientific experiments and regular maintenance.

The mission comes against the background of a rivalry with the US for reaching new milestones in space. That has been largely

friendly, but also reflects their sharpening competition for leadership and influence in the technology, military and diplomatic fields.

China has broken out in some areas, however, bringing samples back from the lunar surface for the first time in decades and landing a rover on the less explored far side of the moon.

The US, meanwhile, aims to

put astronauts back on the lunar surface by the end of 2025, as part of a renewed commitment to crewed missions, aided by private sector players such as SpaceX and Blue Origin.

In addition to their lunar programs, the two countries have also separately landed rovers on Mars, and China plans to follow the US in landing a spacecraft on an asteroid.

and about anything. Please do not create any imaginary one. They are great partners working for the good of the nation. Dismiss any falsehood of a fight," it said.

But the EFCC countered the claim and confirmed that DSS deployed Armoured Personnel Carriers (APC), blocking staff of the commission from gaining access to the building.

A statement by the spokesman of the commission, Wilson Uwujaren, said by so doing the DSS hampered its operations.

"The operatives of the Lagos Command of the Economic and Financial Crimes Commission, EFCC, arrived at their office on No. 15 Awolowo Road, Ikoyi, this morning, May 30, 2023, to be denied entry by agents of the Department of State Services, DSS, who had barricaded the entrance with armoured personnel carriers.

"This development is strange to the commission given that we have cohabited with the DSS in that facility for 20 years without incident. By denying operatives access to their offices, the commission’s operations at its largest hub with over 500 personnel, hundreds of exhibits and many suspects in detention have been disrupted.

"Cases scheduled for court hearing today have been aborted, while many suspects, who had been invited for questioning are left unattended. Even more alarming is that suspects in detention

are left without care with grave implications for their rights as inmates," it said.

The commission further said, "All of these have wider implications for the nation’s fight against economic and financial crimes. The siege is inconsistent with the synergy expected of agencies working for the same government and nation, especially when there are ongoing discussions on the matter."

Yet, in a separate statement, the DSS said the EFCC had reached out to it on the matter.

"It may be recalled that the media had earlier today (30/05/2023) reported a barricade of EFCC Lagos office by the Department of State Services (DSS). The service hereby informs the public that the leadership of EFCC has reached out to it for a final resolution of issues surrounding the property under reference.

"For the avoidance of doubt, it is important to note that the commission does not use the 15 Awolowo Road DSS-owned property as holding facility for its suspects. As such, the service never hindered the commission’s access to its suspects anywhere.

"While the service has accepted the commission’s entreaties and certain concessions, sections of the media are advised to apply restraint in their reportage of the matter in order to avoid instigating any rancours between the two agencies," it said.

Lawmakers Demand Virement of N373m N'Assembly e-Library, Dashboard Finance to Library Trust Fund

Okay refund of N16bn federal projects funds for Borno

Udora Orizu in Abuja

The House of Representatives has demanded the urgent virement of N373 million for the National Assembly e-Library and Dashboard provided in the 2022/2023 Appropriation Acts as take-off grant for the National Assembly Library Trust Fund.

Out of the amount, N255 million is for National Assembly E-library while N118 million is for Dashboard.

The was sequel to the adoption of a motion of urgent public importance moved by Hon. Gaza Gbefwi at plenary yesterday.

Moving the motion, Gbefwi, said the National Assembly Library Trust Fund was established by the National Assembly Library Trust Fund Act, 2022, for the provision of library

equipment, and for the provision of state-of-the-art library equipment and other related facilities for the retraining of legislators, amongst others.

He said all things have been set in place for the take-off and running of the National Assembly Library Trust Fund such as the constitution of the Board of Trustees, the appointment of an Executive Secretary for the Trust Fund amongst others.

The lawmaker said in the Appropriation Act, 2022, the sum of N255 million and N118 million were appropriated for the National Assembly e-Library and Dashboard respectively, while no sum was appropriated for the National Assembly Library Trust Fund.

He explained: "Aware that the

management of the e-Library and the provision of electronic library facilities thereto falls within the exclusive mandate of the National Assembly Library Trust Fund, and forms the basis for the establishment of the Trust Fund by this House.

“Concerned that any further delay in the in the virement of the sums appropriated for the National Assembly E-Library and Dashboard respectively will impede the smooth take-off of the Trust Fund and invariably affect the attainment of the objectives of the Act in the 2022/2023 financial year."

Adopting the motion, the House resolved that the N255 million and N118 million appropriated for the National Assembly e-Library and Dashboard respectively, in the

Appropriation Act, 2022/2023 be vired to the recurrent account of the National Assembly Library Trust Fund as part of the initial take off grant.

Meanwhile, the House of Representatives has approved the promissory note issuance to settle outstanding claims and liabilities for Borno State Government in the sum of N16.77 billion for federal projects executed.

This was sequel to the consideration and adoption of a report of the Committee on Aids, Loans and Debt Management by the Committee of Supply at plenary yesterday.

The report as laid by chairman of the Committee on Aids, Loans and Debt Management, Hon. Ahmed Dayyabu, showed that all of the listed

projects were actually executed by the Borno State Government.

It stated that the roads and flyover bridge were constructed in line with the contract specifications and huge resources were expended on the execution of the projects. The Federal Ministry of Works and Housing inspected and ascertained that the quality of work done met the required standards.

"Borno State began construction of the federal roads in 2014. Only the Damboa-Chibok-Mbalala (30Km) Road Phase I (one) was eligible for reimbursement as it was awarded before the President’s directive of 29th July 2016 which suspended assessment of requests for refund on projects carried out without the federal government's approval.

8 WEDNESDAY, THISDAY NEWS

shocked over siege, says it’s endangered

L-R: Permanent Secretary, Ministry of Women Affairs and Poverty Alleviation, Mrs Yewande Kalesanwo; her counterpart in Public Service Office, Mrs Olasunkanmi Oyegbola; Deputy Governor, Dr Obafemi Hamzat; Permanent Secretary, Civil Service Commission, Mrs Aderemi Dapo-Thomas and Governor Babajide Sanwo-Olu during the governor’s second term first day of work at the Secretariat, Alausa,

WEDNESDAY MAY 31, 2023 • THISDAY 9

Emefiele Seeks Urgent Debt Management Reforms at State Levels Amid Increasing Exposure

James Emejo in Abuja

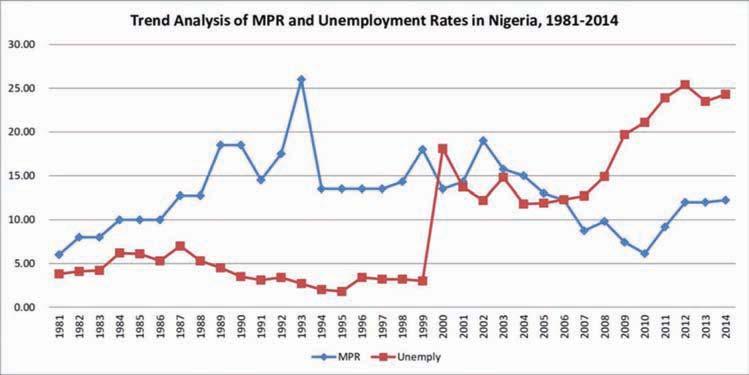

The Governor of Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, yesterday, urged the sub-national governments to urgently strengthen their capacity for debt management and boost transparency around the institutional framework for borrowing. Emefiele said state institutions generally lacked sufficient capacity to execute their statutory obligations, adding that the increasing size and risk exposure of state debt portfolios underscored the urgent need for sound debt management practices and increased capacity among subnational government

agencies. Speaking at the opening of the Sub-national Debt Management Performance Assessment Training for participants from states and FCT, organised by the West African Institute for Financial and Economic Management (WAIFEM), in collaboration with the World Bank and International Monetary Fund (IMF), Emefiele said states’ legal, regulatory and procedural frameworks for borrowing was incomplete, stressing that capacity limitations further impeded the efficacy and efficiency of public debt management.

Represented by the CBN Director, Monetary Policy Department, Dr.

Hassan Mahmud, the CBN governor noted that, substantial progress had been made in enhancing state-level debt management institutions and practices since 2007, particularly with the establishment of Debt Management Units (DMUs) in all the state governments and FCT.

He pointed out that significant challenges remained in the management of borrowing, debt recording, public financial management reform, and the development of debt management capacity.

He said state government legislation in Nigeria does not adequately define the purposes of subnational borrowing or regulate the issuance

of sovereign guarantees, posing substantial fiscal risks.

Emefiele said, “As of July 2019, only seven out of the 36 states had completed subnational debt management performance assessments (DeMPAs).

“These assessments comprehensively evaluate the government's debt management functions across five areas, and dimensions. The states of Cross River, Edo, Lagos, Kaduna, Kano, Niger, 13 indicators and 31 Ondo, and the FCT participated in the DeMPAs between 2013 and 2018.”

According to him, the DeMPAs revealed significant weaknesses in institutions and practices of sub-

national debt management in the country, adding that, on the average, only three of the 31 dimensions of debt management as defined by the DeMPA methodology were satisfied by the states.

Emefiele added that in nearly all the 13 indicators, including governance quality, borrowing processes, financial management, and operational risk control, the states performed below the global average.

He said, “In particular, the legal and institutional framework, audit functions, coordination with fiscal policy, and recordkeeping of debt exhibit serious deficiencies.

“The federal authorities and

INVESTORS REACT POSITIVELY AS TINUBU MEETS EMEFIELE, KYARI, LABOUR OVER PETROL SUBSIDY

the harmonisation of the rates and removal of subsidy would improve the attraction of foreign capital and also help the government channel useful funds into more productive ventures like infrastructural investment, education and healthcare.

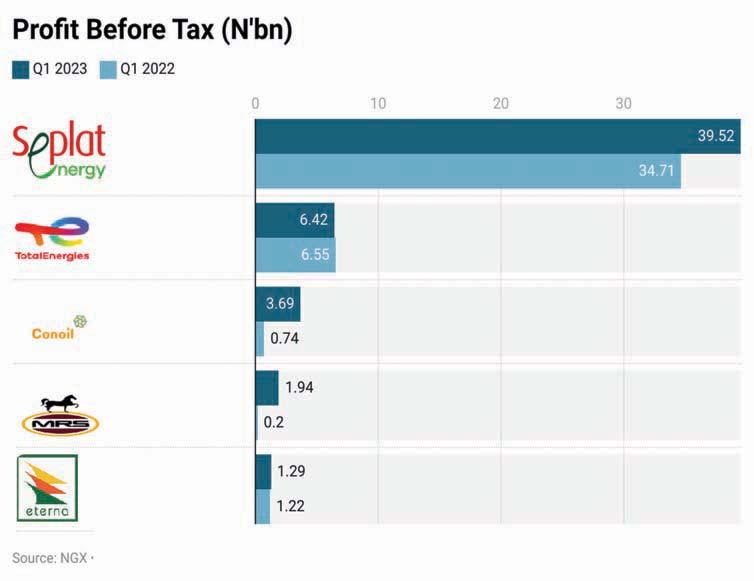

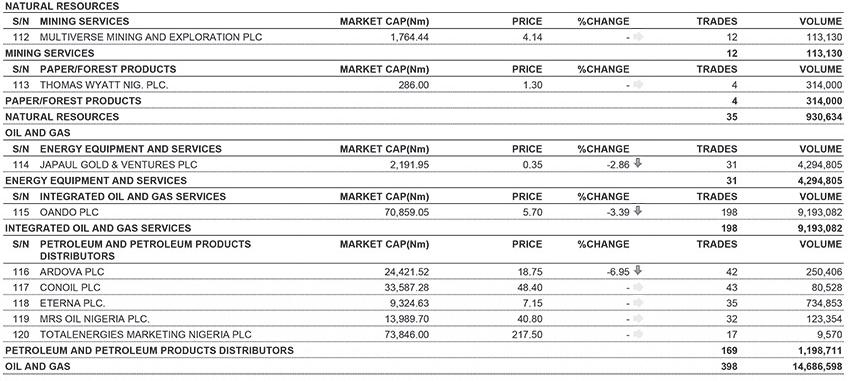

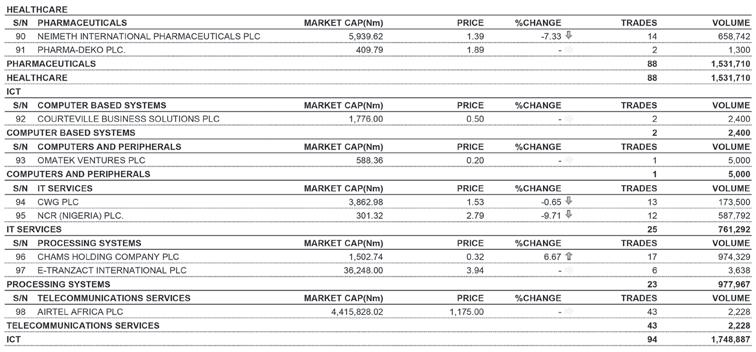

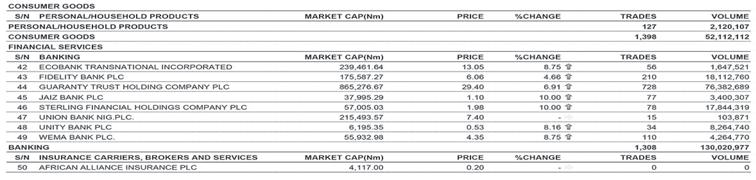

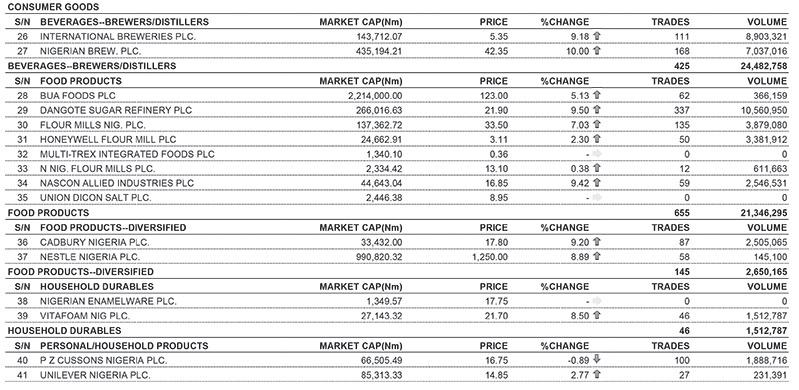

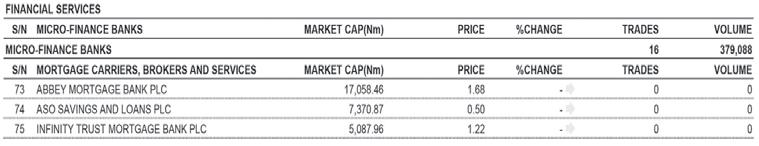

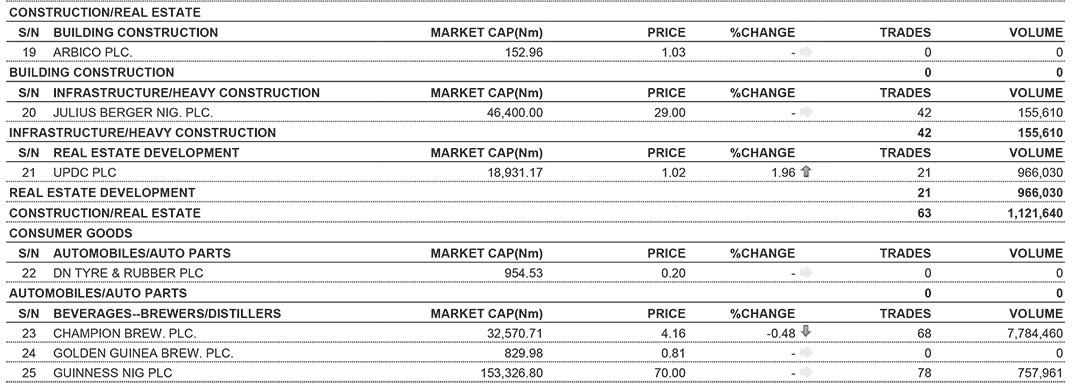

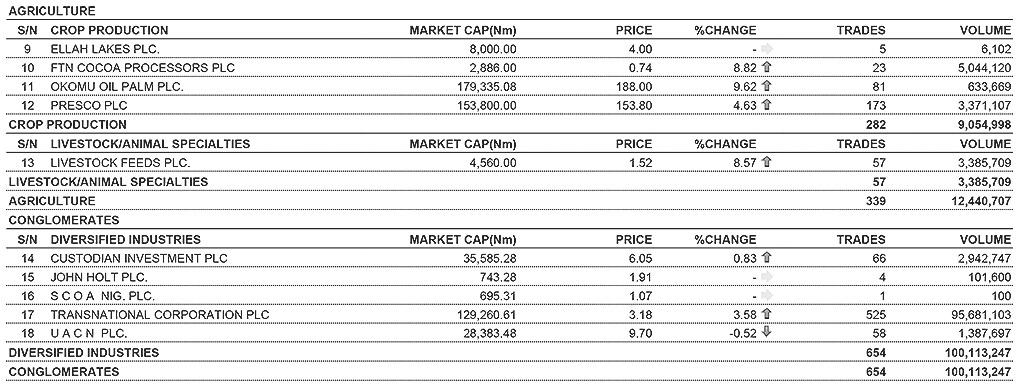

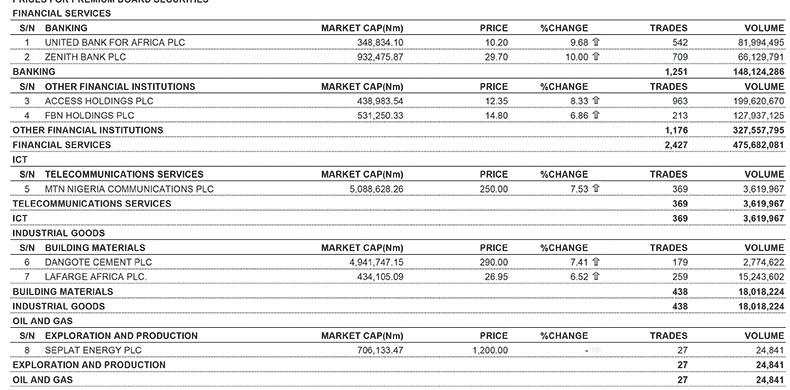

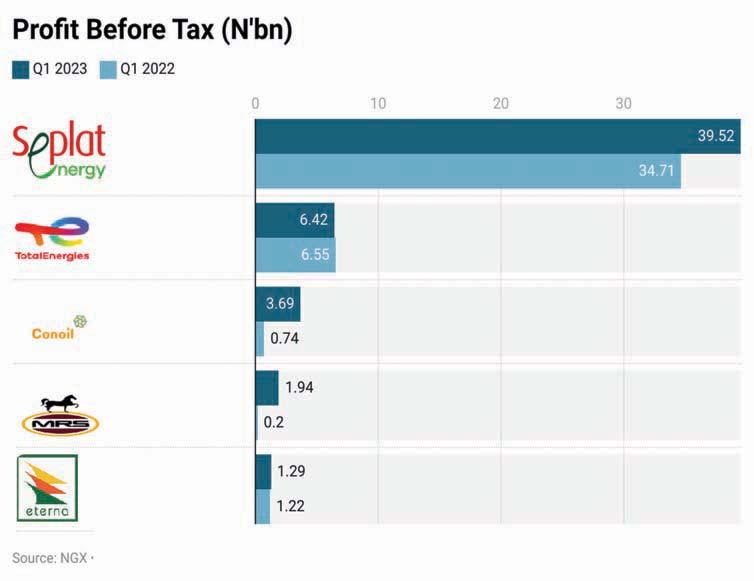

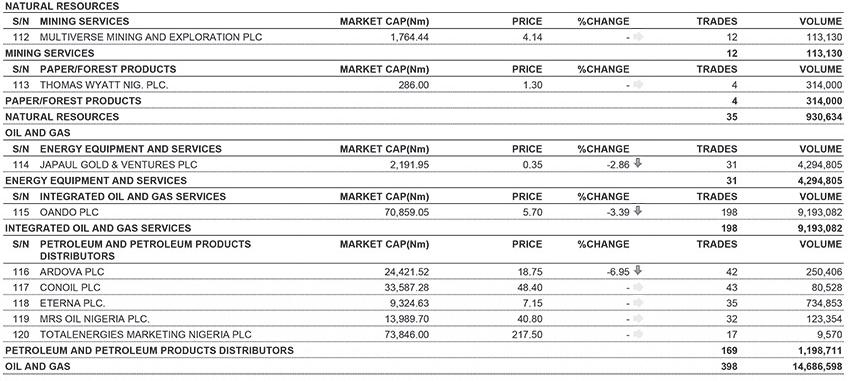

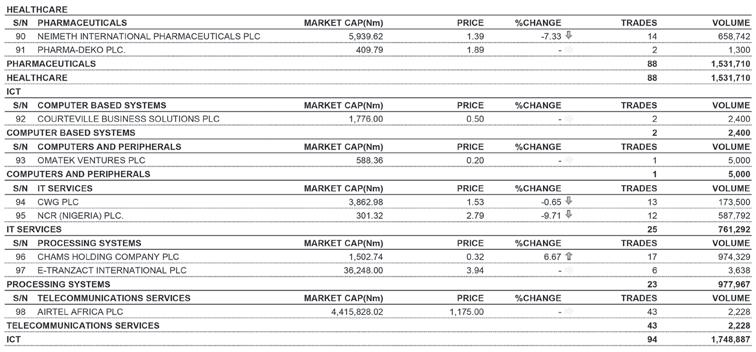

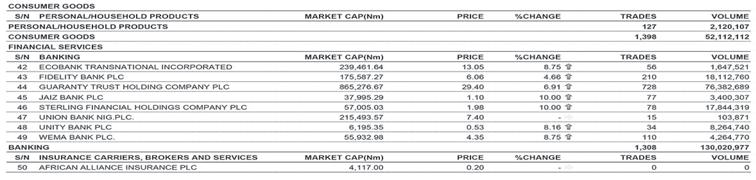

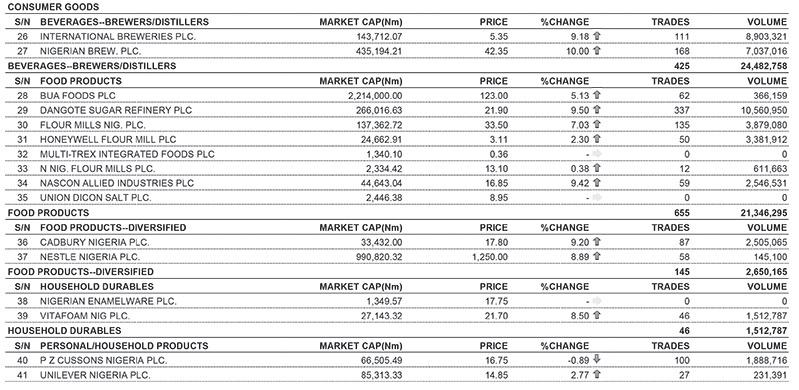

In yesterday stock market trading, the market breadth index was significantly positive with 64 gainers against 12 losers. Eight stocks including Transcorp Hotels Plc, Jaiz Bank Plc, Nigerian Breweries, Eterna, Zenith bank, FCMB Group, Sterling Bank and Deapcap gained 10per cent to top gainers yesterday.

Access Corporation added 8.33per cent to close at N12.35 per share, becoming the most actively traded stock with about 200 million units of shares worth about N2.4 billion.

Sector Performances revealed that the NGX Banking Index expanded by 8.20 per cent, driven by the gains printed in Sterling Bank, Zenith Bank, and Jaiz bank which gained 10 per cent

NGX Industrial Index advanced by 7.41per cent, on the back of the positive sentiment seen in Dangote Cement which rose by 7.41per cent, Lafarge Africa appreciated by 6.52 per cent and Berger gained 5.75per cent.

NGX Consumer Goods Index rose by 6.41per cent, caused by the increase in prices of Nigerian Breweries (+10 per cent), Dangote Sugar (+9.50per cent) and Nascon (+9.42 per cent).

In addition, NGX Oil and Gas Index increased by 4.04per cent, due to the bullish trend observed in ETERNA (10 per cent), CONOIL (+9.91 per cent) and Total (+9.24 per cent).

According to analysts at InvestmentOne Research, “The local bourse closed positive today due to the buy-interests recorded across major sectors.

“Going forward, we expect investors’ sentiments to be swayed by the search for real positive returns and developments in the interest rate space.

“We reiterate that this may be a great period to pick up some quality names with a medium to long-term investment horizon.”

Prof. Uche Uwaleke of Nasarawa State University, in chat with THISDAY backed the move by this present administration to remove petrol subsidy.

Uwaleke said fuel subsidy have proven to be unstainable. He also supported the unification of exchange rates in the country. According to

him, “I equally support unification of exchange rates because doing so will discourage round-tripping, and bring more transparency to the forex market which supports foreign investments.

“However, in order to minimise the negative impact on the livelihoods, issues of fuel subsidy and exchange rates unification which he mentioned in the speech should be handled with care.”

He, thus, calls for stakeholders’ engagement in the new administration.

“To this end, I suggest an im- mediate constitution of an ‘economic policies’ coordinating committee’ made up of economic and finance experts,” he added.

NLC, TUC Kick against Petrol Subsidy Removal

Members of the organised Labour under the aegis of the Nigeria NLC and TUC, had yesterday, described the pronouncement by President Bola Tinubu, that petrol subsidy was over as outrageous and insensitive to the economic plight Nigerian masses were being subjected to.

However, the labour movement advised the government to adopt an alternative strategy that would not adversely hurt the Nigerian while seeking resolve the issue of subsidy.

In a statement issued in response to Monday's announcement on withdrawal of fuel subsidy by the president during his inaugural speech, NLC, Joe Ajaero, advised Tinubu to reconsider the move instead of daring the people, adding that it could be a costly gamble.

The statement signed by Ajaero, stated that the subsidy removal was ill-timed and violated the condition precedent necessary before such a decision was made.

It said: "We at the NLC are outraged by the pronouncement of President Bola Tinubu removing 'fuel subsidy' without due consultations with critical stake holders or without putting in place palliative measures to cushion the harsh effects of the 'subsidy removal'.

"Within hours of his pronouncement, the nation went into a tailspin due to a combination of service shut downs and product price hike, in some places representing over 300 per cent price adjustment.

"By his insensitive decision, President Tinubu on his inauguration day brought tears and sorrow to millions of Nigerians instead of

hope. He equally devalued the quality of their lives by over 300 per cent and counting."

Describing the subsidy removal as ill-timed, the NLC said the federal government needed to clean up the NNPC.

It said that after doing so, government should then, "proceed to lay the foundation for a mass transit system in the railways and road network with long term bonds and fully develop the energy sector towards revitalising Nigeria’s economy and easing the burden any subsidy removal may have on the people.

"But we know this is more than the fuel subsidy. It is about government’s ideas on the role of money in bettering the lives of people, about the relationship between government and the people and about the primary objective of government’s interaction in the economy.

"It is about whom, among the Nigeria’s various social classes, does government most value.

This is why public reaction has been heated. It is not so much that people have to spend more money. It is because people feel short-changed and sold out".

The NLC stated that what the government claimed to be economic decisions were essentially political ones.

"There is progressive politics, there is progressive economics. As there is elitist politics, there is elitist economics. It all depends on what and who in society government would rather favor. The Jonathan tax represents a new standard in elitism.

"This whole issue boils down to whether government believes the general public is worth a certain level of expenditure.

"However, because the distance between government and the people is far and genuine level of affection is low, government sees no utility in continuing to spend the current level of money on the people. In their mind, the people are not worth the money.

"Government sees more value in “saving” money than in saving the hard-pressed masses.

"If government thrashed the fuel subsidy based on considerations that it will run out of naira then it based its decision on a factor that have not been relevant since the time of the Biafran war," it said.

"If he is expecting a medal for taking this decision, he would certainly be disappointed to receive curses for the people of Nigeria consider

ZENITH MAINTAINS POSITION AS ‘BEST CORPORATE GOVERNANCE FINANCIAL SERVICES’ IN AFRICA IN FOURTH CONSECUTIVE YEAR

Ovia, CFR, for providing the template for an enduring and very successful institution; the Board for their vision and outstanding leadership; the staff for their dedication and commitment; and the bank’s customers for their unwavering loyalty to the brand.

Ethical Boardroom is a trailblazing and leading international magazine that delivers in-depth coverage and critically-astute analysis of global corporate governance issues to help boards stay ahead of the governance curve.

Zenith Bank has been generally adjudged a corporate governance compliant bank by the Nigerian Exchange Group (NGX), hence its listing on the Premium Board of the Exchange. The bank continues to sustain this reputation and reap-

praise its processes to ensure that its business conforms to the highest global standards at all times.

The bank’s track record of excellent performances has continued to earn it numerous awards including being recognised as the Number One Bank in Nigeria by Tier-1 Capital, for the 13th consecutive year, in the 2022 Top 1000 World Banks Ranking published by The Banker Magazine; Bank of the Year (Nigeria) in The Banker's Bank of the Year Awards 2020 and 2022; Best Bank in Nigeria, for three consecutive years from 2020 to 2022, in the Global Finance World's Best Banks Awards; Best Commercial Bank, Nigeria 2021 and 2022 in the World Finance Banking Awards; Best Corporate Governance Bank, Nigeria in the World Finance

this decision not only a slight, but a big betrayal.

"On our part, we are staunchly opposed to this decision and are demanding and immediate withdrawal of this policy.

The implications of this decision are grave for our security and well-being.

"We wonder if President Tinubu gave a thought to why his predecessors in office refused to implement this highly injurious policy decision?

"We also wonder if he also forgot the words he penned down on January 8, 2012, but issued on January 11, 2012."

While reminding Tinubu of the statement he penned against a similar move by the then Jonathan administration to remove fuel subsidy, the NLC urged him to respect his own postulations and economic theories instead of daring the people which could be a costly gamble.

For their part, the TUC also rejected Tinubu's declaration that federal government has removed subsidy on petroleum products.

In its reaction to the president's inaugural speech, the TUC stated: "If by this, he meant increases in pump price and the exploitation of the people by unregulated and exploitative deregulated prices, then it’s a joke taken too far"

In a statement jointly signed by the TUC president, Festus Osifoh and General Secretary, Nuhu Toro, the union said it was taken aback and even horrified, when Tinubu announced the withdrawal of subsidy on petroleum products.

Osifoh said: "While listening to Tinubu’s inaugural address, we were at first encouraged, by his pledge to lead as a servant of the people (and not as a ruler) and to always consult and dialogue, especially on key and knotty national issues.

"But we were subsequently taken aback, even horrified, when he announced the withdrawal of subsidy on petroleum products, if by this, he means increases in pump price and the exploitation of the people by unregulated and exploitative deregulated prices, then it’s a joke taken too far.

"It is not for nothing the Buhari government pushed this to the new administration, but we expect the Tinubu government to be wise on such a sensitive issue and be more explicit in its pronouncement to avoid contradictory interpretation when comparing his written statement, what he said and the provision in 2023 appropriation act.

they are amicably considered and resolved. "Nigerian Workers and indeed mases must not be made to suffer the inefficiency of successive governments.”

The statement said the labour movement was open and ready to dialogue with the Tinubu administration on the fuel subsidy issue, adding that it was in the interest of the people that such a matter is resolved peacefully

"This new administration cannot be seen to be speaking from both sides of its mouth, we urge President Tinubu to be a president with human face.

"Like always, we will stand by the people and their interests. Nigerian workers are hardworking and have remained consistent with productive work regardless of harsh government policies, poor governance and mismanagement of resources that have placed us under difficult living conditions," it added.

Shettima: We Must End Fuel Subsidy Now Else It Will End Nigeria

However, Shettima yesterday justified the urgent need to end fuel subsidy regime in the country.

According to him, the new government had anticipated that there would be serious opposition to its decision to remove fuel subsidy, but noted the pressing need to be resolute in achieving the objective.

Shettima, who made this known while speaking with newsmen on his first day in office at the State House, Abuja, stressed that Nigeria needs to get rid of fuel subsidy, otherwise the subsidy would get rid of the Nigerian nation.

He said the subsidy regime has not benefited the ordinary Nigerian, but was being used to subsidise the lifestyle of the affluent.

He assured that despite the expected opposition from beneficiaries of the subsidy regime, Tinubu, whom he described as a man of strong will and conviction, would frontally address the menace.

The vice president added: "The president has already made pronouncements yesterday (Monday) on the issue of the fuel subsidy. The truth of the matter is that it is either we get rid of subsidy or the fuel subsidy gets rid of the Nigerian nation.

development partners have a crucial role to play as valuable partners in building subnational capacity for debt management in Nigerian states.

“Consequently, this workshop comes at an opportune moment to reinforce the capacity-building agenda for state-level debt management, which is essential to achieving an overall sustainable national debt portfolio.”

Director-General, WAIFEM, Dr. Baba Musa, while speaking, said given that there had been three different shocks affecting the global economy, the development has necessitated an increase in public borrowing.

because as I have always said, there can never be two captains in a ship.

"He is the President and Commander-in-Chief of the Armed Forces. I’m the vice president. Your relevance is directly proportional to the level of your loyalty to the president. This is a gentleman that I have known for well over a decade; that I have interacted closely with.

“Be rest assured that we are going to work harmoniously as a team, as a family for the greater good of our nation", he said.

Shettima said the president was poised to redefine the meaning of modern governance, saying he would provide the needed leadership, but also requested Nigerians to give him and his administration the needed support.

He said: "I believe this generation has a rendezvous with destiny and my principal, Bola Ahmed Tinubu, the President and Commander-in-Chief of the Armed Forces of the Federal Republic of Nigeria, is poised to redefine the meaning and concept of modern governance.”

NNPC, NMDPRA, Others Back FG on Fuel Subsidy Removal

In their separate reactions in Abuja, yesterday, the NNPC and the NMDPRA called for calm, insisting that while there’s ‘potential’ change in price, the country had enough stock in its storage facilities.

While maintaining that Nigerians should not engage in panic buying of the product, Kyari welcomed the declaration by the new president.

According to Kyari, while the apprehension by petrol consumers was understandable, the potential changes to petrol prices were not enough reason for Nigerians to buy more than they require at a time.

Kyari stated that the NNPC would ensure continuous and sufficient supply of petroleum products, particularly Premium Motor Spirit (PMS), noting that the company was monitoring all its distribution networks to ensure compliance.

Corporate Governance Awards 2022; Best Commercial Bank, Nigeria and Best Innovation In Retail Banking, Nigeria in the International Banker 2022 Banking Awards. Also, the bank emerged as the Most Valuable Banking Brand in Nigeria in the Banker Magazine Top 500 Banking Brands 2020 and 2021, and Retail Bank of the year, for three consecutive years from 2020 to 2022, at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards. Similarly, Zenith Bank was named as Bank of the Decade (People's Choice) at the ThisDay Awards 2020, Bank of the Year 2021 by Champion Newspaper, Bank of the Year 2022 by New Telegraph Newspaper, and Most Responsible Organisation in Africa 2021 by SERAS Awards.

"We dare say that this is a very delicate issue that touches on the lives, if not very survival, of particularly the working people, hence ought to have been treated with utmost caution, and should have been preceded by robust dialogue and consultation with, the representatives of the working people, including professionals, market people, students and the poor masses".

The TUC said it expects to wait and allow the matter to resolved through dialogue and consultation.

In addition, it said the Nigerian workers and indeed mases must not be made to suffer the inefficiency of successive governments.

"Accordingly, we hereby demand that President Tinubu should tarry awhile to give room for robust dialogue and consultation and stakeholders engagement, just as he opined in his speech until all issues and questions - and there are a host of them! – to ensure that

"In 2022, we spent $10 billion subsidising the ostentatious lifestyle of the upper class of the society because you and I benefit 90 per cent from oil subsidy. The poor 40 per cent of Nigerians benefit very little and we know the consequences of unveiling a masquerade.

"We will get fierce opposition from those benefitting from the oil subsidy scam, but where there is a will, there is a way. Be rest assured that our President is a man of strong will and conviction.

"In the fullness of time you will appreciate his noble intentions for the nation. The issue of fuel subsidy will be frontally addressed. The earlier we do so, the better", he said.

Commenting on the issue of multiple foreign currency exchange rates, the vice president assured that "we are going to collapse it into one. He further stated that before long, Tinubu would unfold the agenda of the new administration that would benefit all Nigerians.

"So these are two big elephants in the room and as the days go by, we will be unveiling our agenda. He is going to unveil his agenda

“We would like to assure Nigerians that we have sufficient supply of petroleum products, particularly PMS in our country and there is no reason to panic. We understand that people will be scared of potential changes to the price of petrol.

“But that is not enough for people to rush to fuel stations to buy more than what they need. We are watching all the distribution networks, and support facilities and we believe that normalcy will be restored very soon,” he noted.

The NNPC chief executive reiterated that the company had been using some of its cash flow to make subsidy payments which had constituted a huge burden on the company’s finances.

“We welcome the decision of Mr. President to announce that the subsidy on PMS is over and this has really been a major challenge for the NNPC’s continued operation. We have been funding the subsidy from the cash flow of the NNPC.

“We believe that this decision will free resources for the NNPC to continue to do the great works that this company will do for our country. It allows us to continue to function as a very commercial entity. We welcome this development,” he added.

Continued on page 42

TEN 10 WEDNESDAY, THISDAY

The,respectively.

WEDNESDAY MAY 31, 2023 • THISDAY 11

TINUBU RESUMES...

Osun Court Sentences Ile-Ife Prince, Adedoyin, Two Others to Death by Hanging over OAU Student’s Murder

Yinka Kolawole in Osogbo

The Osun State High Court yesterday sentenced the Founder of Hilton Hotel, Ile-Ife, Dr. Ramon Adedoyin, to death by hanging over the murder of Timothy Adegoke, a student of the Obafemi Awolowo University, Ile-Ife.

Justice Adepele Ojo, while delivering his judgement on the case equally sentenced two staff of the hotel, Adeniyi Aderogba and Kazeem Oyetunde to death by hanging.

On the other hand, the court discharged and acquitted three of the staff while the seven defendant would hear her sentencing today, following pleas by both the prosecution and defendant counsels.

Adedoyin was charged along with six of his workers, Magdalene Chiefuna, Adeniyi Aderogba, Oluwole Lawrence, Oyetunde Kazeem Adebayo Kunle and Adedeji Adesola, as first to seventh defendants, and were docked on 18-count which included murder, conspiracy, oath of secrecy among others.

The Chief Judge of the State, Justice Adepele Ojo, in her judgement yesterday, discharged three

defendants – Magdalene Chiefuna, Lawrence Oluwole and Adedeji Adesola – were from the counts of conspiracy to murder. However, they were found culpable of other counts in the charge.

Adedoyin was found culpable and convicted of counts 1, 2, 3, 7, 9, 15 and 16.

The court held that the second autopsy reports signed by two pathologists from Obafemi Awolowo University Teaching Hospital was thwarted as the court held that, “it’s a report by persons with vested interest.”

Justice Ojo established that late Timothy Adegoke lodged in the Hilton hotel and paid into the account of the 7th defendant.

“I found the first defendant (Ramon Adedoyin) culpable of the conspiracy to murder and murder,” the judge added, stating that the court held that evidence presented before the court placed Oyetunde Kazeem “squarely among those who perpetrated the acts,” and was found guilty of the counts.

Seventh defendant (Adedeji Adesola) was “carefully chorographed into the act. The circumstance around her were not strong to found her

culpable of the count 1, 2, and 3.”

The 1st, 3rd and 5th defendants were said to be culpable of the offence of conspiracy to improperly, indecently dumping of the deceased body and are guilty as charged.

Justice Ojo also said Adedoyin’s decision not to enter the witness box meant he agreed to the murder charge pressed against him by the

prosecution. He dismissed the alibi pleaded on his behalf by his counsel, who said the hotel owner was in Abuja for many days around the time of the death of the late Adegoke.

The chief judge of Osun State, held that Abdulraman Adedoyin, Kazeem Oyetunde and Adeniyi Aderogba were guilty of the charges

against them and were sentenced to death by hanging. They were also sentenced to serve different years of jail terms for other offences committed such as conspiracy and unlawful interference with the deceased body in an attempt to cover up.

Adepele-Ojo held that the vehicle, (hilux van) which was used by the

accused persons to convey the body of Adegoke to where he was buried, as well as the hotel belonging to Adedoyin be forfeited to the state. She also held that the children of late Timothy Adegoke’s education be placed under sponsorship of Abdulraman Adedoyin’s estate up to university level and completion of National Youths Service Corp.

Court Affirms FG's No Work, No Pay Rule

Faults imposition of IPPIS

It was a mixed feelings, yesterday, for lecturers in the nation's universities following a judgment of the National Industrial Court, which on the one hand held that it was within the right of the federal government to refuse to pay workers, who embark on strike and on the other, faulted the federal government's imposition of the Integrated Payroll and Personnel Information System (IPPIS) on lecturers.

President of the National Industrial Court, Justice Benedict Kanyip, on while delivering ruling in the suit filed by the federal government against the Academic Staff Union of Universities (ASUU), held that the "no work no pay" rule enforced by the federal government against members of ASUU last year was within the ambit of the law.

However, on the IPPIS issue, the court held that it is a violation of University Autonomy for the federal government to impose the

platform on members of ASUU, who reserve the right to determine how their salaries should be paid.

The union had called out its members on an industrial action on February 14, 2022, to press home their demands on the federal government.

The demands included funding for the revitalisation of public universities, payment of earned academic allowances, and adoption of the University Transparency Accountability Solution (UTAS)

Shell, NNPC, Others Unveil 16 More Community Devt Trusts as PIA's Gains Deepen in Niger Delta

Peter Uzoho

Peter Uzoho

In consolidation of the gains of the Petroleum Industry Act (PIA) in the oil producing Niger Delta, eight Host Community Development Trusts (HCDTs) have been unveiled in Rivers State by the joint venture (JV) partners comprising the Nigerian National Petroleum Company Limited (NNPC), Shell Petroleum Development Company (SPDC), TotalEnergies and the Nigerian Agip Oil Company (NAOC), otherwise called the SPDC JV. Shell in a statement issued yesterday, stated that the same number of HCDTs had already been unveiled in Yenagoa, Bayelsa State and that the latest eight unveiled brings to 16 the number of Trusts that have been presented to the public out of the 22 incorporated in the joint venture’s areas of

operations in Imo, Rivers, Delta and Bayelsa States.

“The Rivers State Government welcomes the establishment of Trusts and will support them to achieve their objectives,” said the acting Permanent Secretary, Rivers State Ministry of Chieftaincy and Community Affairs, Mrs. Blessing Orlukwo, who represented the Commissioner at the unveiling ceremony, was quoted to have said at the event

Commenting on the development, Deputy Managing Director of SPDC, Mr. Wessel de Haas, said: “The hope of SPDC, as the operator of the joint venture, is that the unveiling of the Trusts will set the tone for a better narrative and the dawn of a new era in the Niger Delta.”

Highlighting the impact of crude theft, pipeline vandalism and social unrest on the operations of oil com-

panies, de Haas enjoined members of the HCDTs to take advantage of the grievance-resolving provisions of the PIA and ensure hitch-free oil and gas explorations and production activities to guarantee funding for the trusts.

He said communities should not allow “internal strife and chieftaincy struggles to negatively impact the setting up of or operations of Trusts in their areas.”

The SPDC, expressed its hopes to incorporate a total of 33 Community Trusts in its areas of operation.

The Chief Upstream Investment Officer, NNPC Upstream Investment Management Services (NUIMS), Mr. Bala Wunti, who was represented by Deputy Manager, External Relations, Mrs. Bunmi Lawson, advised the Trusts “to demonstrate efficiency and expertise in executing projects using means that amplify standard and quality and ensuring that the al-

located funds are used for impactful initiatives that address the identified needs of the communities.”

In an address, the Chief Executive Officer of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Mr. Gbenga Komolafe, described the SPDC-operated joint venture as ‘first among peers’ for the early incorporation of 22 out of a total 33 community trusts.

Represented by NUPRC’s Assistant Director, Host Community, Mr. Olatokunbo Karimu, Komolafe said: “It is our hope that the peace and harmony exhibited by the communities under the HCDTs will be sustained during the day-to-day management of the affairs of Trusts, to address the developmental needs of impacted host communities in oil-producing areas.”

Chairman of one of the Trusts, Chief Mike Enwukwe, who responded on behalf of his colleagues,

said the trustees would serve with diligence and accountability to continue to earn the confidence and cooperation of communities.

The PIA was enacted in August 2021 and is changing the interface between oil companies and their host communities. SPDC, on behalf of the joint venture, is managing a seamless transition from the Global Memorandum of Understanding (GMoU) initiative which it introduced in 2006, to the new dispensation. The process includes engaging hundreds of communities and community leaders on the provisions of the PIA.

While oil companies are expected to fund the Community Trusts from three per cent of their operating expenditure in the preceding year, the PIA penalises acts of vandalism, sabotage, and civil unrest by communities with appropriate deductions from the allocated funds.

as a preferred payment option instead of the Integrated Payroll and Personnel Information System (IPPIS).

Other demands were the payment of promotion arrears and the renegotiation of the 2009 ASUU-FGN Agreement.

Minister of Labour and Employment at the time, Chris Ngige, had dragged ASUU to the National Industrial Court, seeking an order of the court to restrain striking lecturers from further continuing with the strike.

The legal action was occasioned by the refusal of the striking workers to go back to the classroom despite, a ruling of the National Industrial Court on September 21, last year, which had ordered them to resume work.

After no breakthrough in negotiations between ASUU and the federal government, the Appeal Court ordered the striking lecturers to resume duty immediately.

The court also granted ASUU “conditional leave to appeal the order of the Industrial Court, while insisting that ASUU must obey the order of the lower court with effect from October 7”.

Consequently, ASUU, in compliance with the Appeal Court order called off its strike sometime in October.

The federal government, however, insisted that the lecturers would not be paid for the 8 months that they were on strike, insisting on its ‘no work, no pay’ policy.

Ngige, in defence of the half salary paid to the lecturers last October, said they were paid on a pro-rata basis for the 18 days they worked.

NEWS 12 WEDNESDAY, THISDAY

Alex Enumah in Abuja

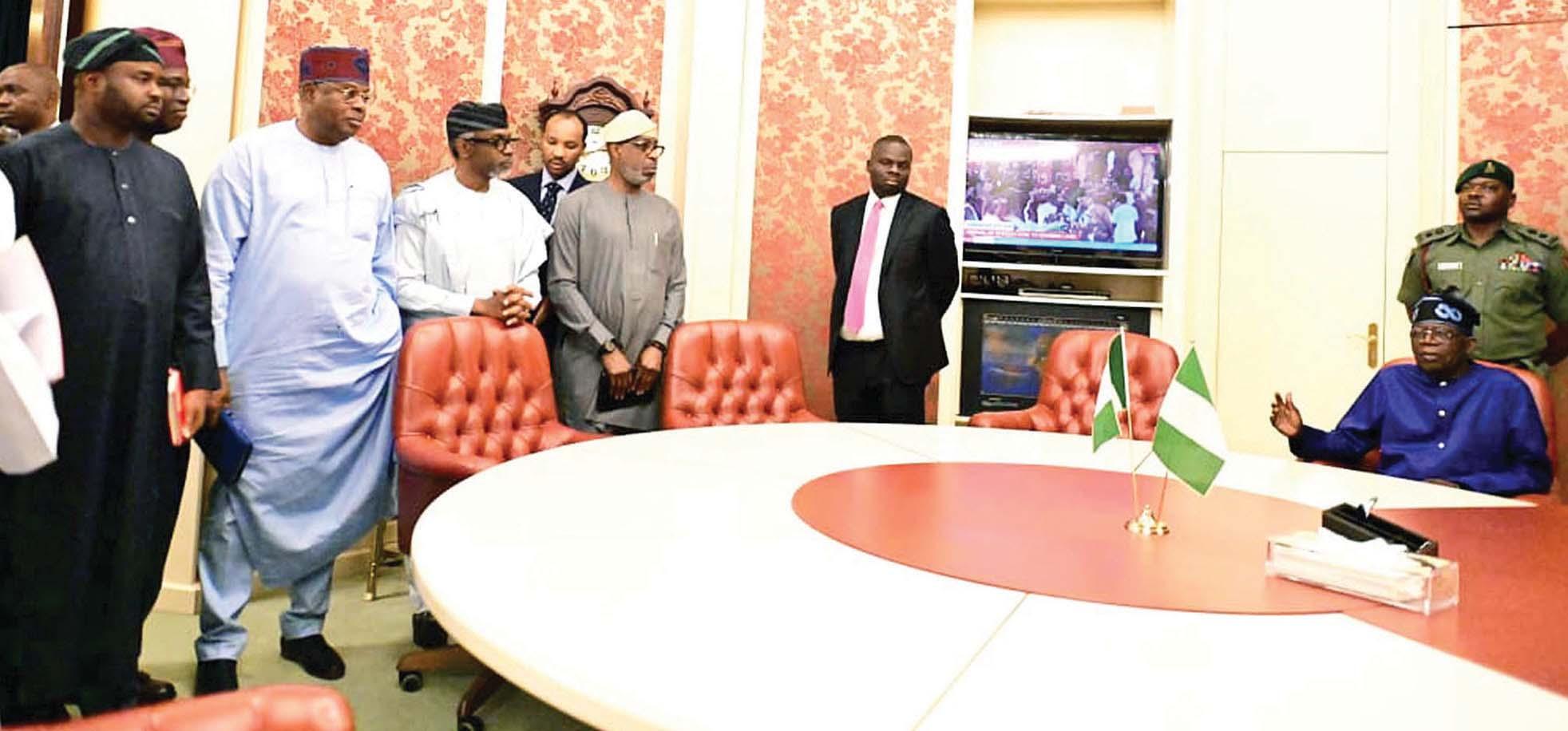

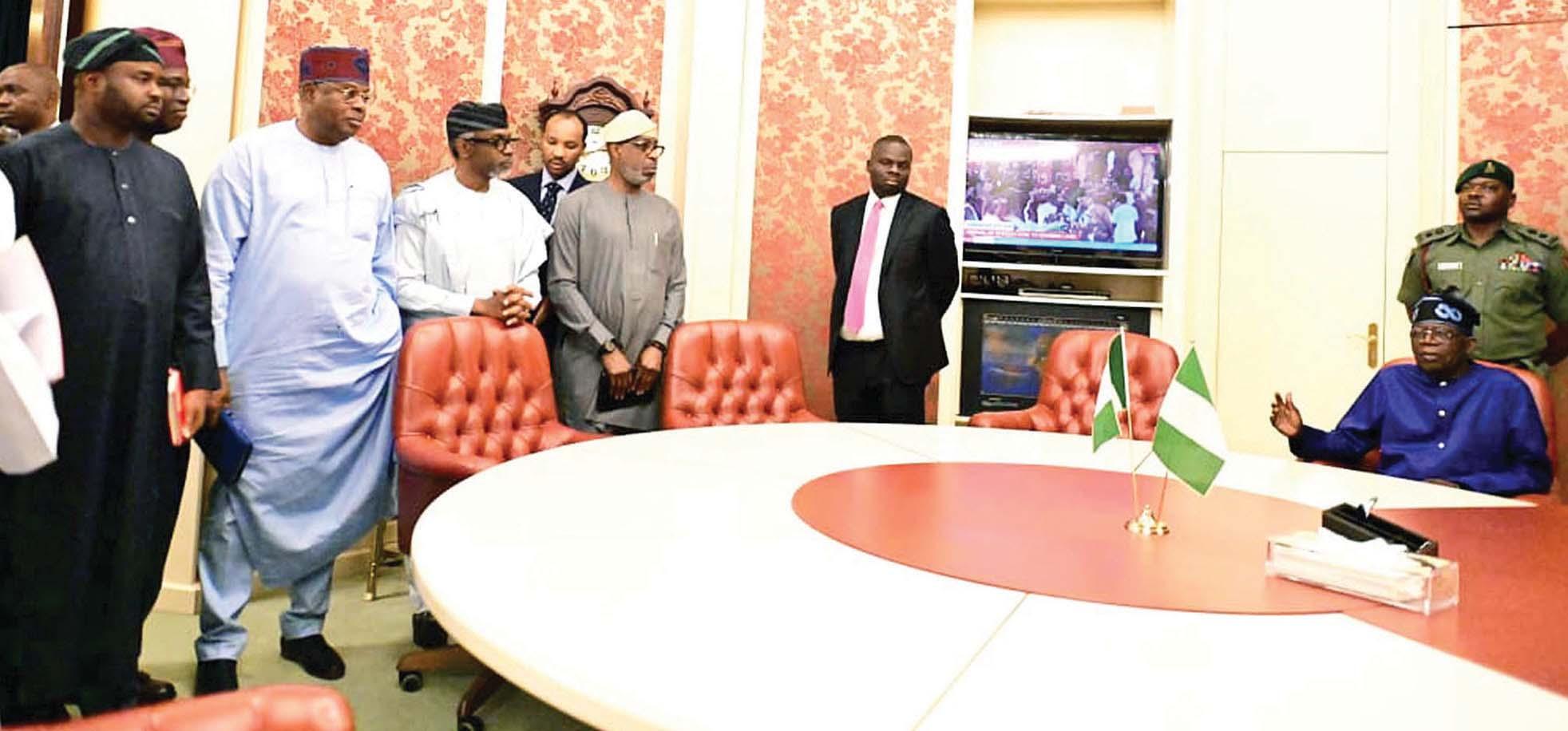

President Bola Ahmed Tinubu in his office at the Presidential Villa, surrounded by Senator Tokunbo Abiru James Faleke, Femi Gbajabiamila , Dele Alake and others in Abuja... yesterday

WEDNESDAY MAY 31, 2023 • THISDAY 13

WEDNESDAY MAY 31, 2023 • THISDAY 14

WEDNESDAY MAY 31, 2023 • THISDAY 15

10th N’Assembly Speakership: Will Odds Favour Abass, Kalu?

With about two weeks to the inauguration of the 10th National Assembly, the aspiration of the All Progressive Congress, APC consensus candidates for Speaker, Deputy Speaker positions is garnering the needed support as many members-elect, Governors, CSOs, and other stakeholders are endorsing them.

The ruling party’s National Working Committee, NWC had on May 8 released their list of consensus candidates for the four parliamentary slots. The APC in the zoning plans, endorsed Senator Godswill Akpabio from the South-South geo-political zone as the President of the 10th Senate while Senator Barau Jibrin from the North-West was picked as his Deputy.

Also in the House of Representatives, the party endorsed Tajudeen Abass from the North-West as the Speaker and Benjamin Kalu from the South-East as Deputy Speaker.

Since the announcement, other aspirants for the office of the Senate President, Speaker of the House of Representatives, several members-elect, and some key stakeholders have been simmering with resentment.

The anger was more evident in the green chamber particularly, as the aggrieved aspirants formed a group known as the G-7, with a plan to rebel against the party’s choice and select their own consensus candidates.

But despite their decision to forge ahead, it appears Abass/Kalu are favoured in the eyes of their colleagues and party stakeholders, as endorsements have been flying in from all corners.

Honour by Parliamentary Monitoring Organisation

Long before campaigns for National Assembly leadership began a Parliamentary Monitoring Organisation, OrderPaper Nigeria, and its partners through their annual performance appraisals beamed light on the importance of performance, capacity and character as a criteria into the race for National Assembly leadership.

The MVP Hall of Fame initiative, which is in furtherance of OrderPaper’s contributions to legislative strengthening and promotion of improved service delivery in the National Assembly, aims at identifying and sustaining a distinct class of legislators who are performance-driven, excellence-inspired, and public-spirited.

The annual appraisals focused exclusively on the core legislative function of

law-making, and consideration for the MVP nomination and subsequent shortlisting essentially applied the criteria of Value, Impact, and Productivity in rating the contributions of those shortlisted.

The team of panelists that conducted the selection had Prof. Ladi Hamalai, a former director general of NILDS, as the head with Prof. Ali Ahmad, a former lawmaker, Ikechukwu Uwanna, Auwal Musa Rafsanjani, Amos Dunia, Kemi Yesufu as members, while Oke Epia is the founder.

Endorsement By Memberselect

On the campaign side, the number of members-elect, that accompanied the duo on visit to the APC national headquarters, and Vice President Kassim Shettima is a testament that Abass and Kalu are loved.

While the aggrieved aspirants were describing Abass in particular as “unpopular”, members-elect showed up in solidarity with five full coaster buses, as they accompanied Abass and Kalu to visit the Vice President and most recently the Party’s National Chairman.

During the visit to APC national secretariat, the large number of members-elect that attended the session were too many to count as, despite the large size of the NWC conference room, many members-elect couldn’t find seats.

Probably not believing that majority of the people present are all members-elect, the APC

Chairman Abdullahi Adamu had to insist that all members-elect should introduce themselves individually, which they did.

He was shocked to see that even members of PDP, NNPP, LP, APGA etc were part of the delegation. It took members of the team close to 30 minutes to introduce themselves.

At the meeting, Abass and Kalu informed the party’s NWC that over 250 members-elect are currently working with them ahead of the June 13 inauguration.

Also, recently, one of the speakership aspirants and former member of the G-7, Hon. Ado Doguwa, withdrew from the race to join the campaign trail of Abbas and Kalu.

Declaring his support, Doguwa said he and two other aspirants Hon. Makki Yalleman and Hon. Abdulraheem Olawuyi had seen reasons to join the APC preferred candidates.

According to him: “I have benefited from party arrangements, this kind of arrangement. I’m majority leader courtesy of my party. So, it’s only fair to stand beside my party’s decision. Time has come for me to pay back. We are here individually and collectively to support Tajudeen. We are surrendering our speakership ambition. The selection process of Abass is not biased and he and Kalu are qualified to be speaker and deputy”.

The most recent and momentous endorsement came from the spokesman of the Coalition of United Political Parties, CUPP and member-elect representing Ideato North South Federal Constituency, Hon. Ikenga Ugochinyere.

He and 62 other members-elect who announced that they are backing Abass and Kalu as Speaker, Deputy Speaker of the incoming 10th Assembly called on the other candidates in the race who were banking on opposition votes to stage a rebellion against the Tajudeen Abbas/

Benjamin Kalu ticket to withdraw from the race as the opposition votes they were banking on would no longer be available for them.

While describing Abass and Kalu as men of integrity, and competence to preside over the affairs of the 10th House of Representatives, Ugochinyere said it is time for national development, growth and stability and not the time for party politics.

Governors Endorsement

Aside CSOs and lawmakers, declaring support for the duo, they have also gotten the blessing of some outgoing and incoming governors.

During courtesy visits, the Governor of Nasarawa State, Abdullahi Sule, said he and his counterparts from the ruling All Progressives Congress (APC) in the North would not go against the choice of the president-elect regarding the leadership of the 10th National Assembly.

Sule said as a governor, he also has preferred candidates for the leadership of his State Assembly and that nobody would disagree with him on such decision.

According to him, they are loyal party members who would want the new Tinubu administration to succeed.