Your guide to Medicare 2025

Open enrollment is here!

If you are 65 or older, this guide contains the info and advice you’ll need to get everything sorted for the coming year.

A SPEC I AL AD VE RT ISING SEC TION OF TIMES TO TA L MEDIA

Number

What’sinside... BY the NUMBERS Medicare in Florida

Medicare Advantage

Percentage of Medicare enrollees with access to a Medicare Advantage plan with a $0 premium: 100% Number

Percentage of seniors with access to a Medicare Advantage plan: 100% Lowest monthly premium for a Medicare

Medicare Part D

Percentage of Medicare enrollees with a stand-alone Medicare prescription drug plan with access to a plan with a lower premium than what they paid in 2024: 71.5%

Percentage of Medicare enrollees with a stand-alone Medicare prescription drug plan who get help from programs such as the State Health Insurance Assistance Program, Medicare Savings Programs, or the Low-Income Subsidy program: 25.8%

Lowest

Toni Says: Can I use my HSA card to pay my Medicare premium?

BY TONI KING

DearToni,

My Medicare starts Oct. 1 and I received my first bill, due on Sept. 25, about a week ago. This bill is for three months (Oct. 1 – Dec. 31) and is over $525. I currently have more than $10,000 on my Health Savings Account (HSA) debit card through my past employer, and I was wondering if Medicare will accept payments made with an HSA debit card.

I am not at my full retirement age; I still work and make more than Social Security allows without having to pay a penalty. So I can’t start my Social Security check so that my Medicare premium can be deducted monthly. How can I pay that premium amount by the due date?

–Janice, Little Rock, Arkansas

Hello Janice:

I have good news for you because Medicare offers four ways to pay your premium online and having an HSA account is one of them. Janice, you should open a medicare.gov account since you are not receiving your Social Security check. The ways of paying are using an HSA card, a credit/ debit card or an ACH debit from your checking or savings account. Medicare’s payment service is free.

Once you open your Medicare account at medicare.gov, you can arrange to pay your bill using your HSA, credit/debit card or bank account by clicking on the box “Pay my premium” under “What do you want to do?” To have your Medicare Part B premium set up to be paid on a monthly basis, visit “Medicare.gov Easy Pay”

Medicare offers four ways to pay your premium

online and having an HSA account is one of them.

and elect monthly payments. It takes about six to eight weeks for the “Medicare Easy Pay” form to process. Be sure that you keep up with your monthly premiums, so your Medicare parts A and B are not terminated before the Easy Pay form is activated.

Readers, I urge everyone on Medicare to stay current with your Medicare premium. By missing a premium payment, Medicare beneficiaries can lose their benefits and may be charged a penalty when they re-enroll.

To create a medicare.gov online account, you must have applied for Medicare Part A and have your assigned Medicare number. On your Medicare account is information such as:

• Your Medicare Part A and B enrollment dates

• What Medicare Part D prescription drug plan or Medicare Advantage plan you are enrolled in

• Options to pay your Medicare premium, view your Medicare claims, print your Medicare card and much more

Medicare Part D prescription drug plan premiums are managed

by the Medicare Part D prescription drug company. Medicare beneficiaries can pay their Medicare prescription drug premium either directly to the prescription drug company by check or credit card, or by deductions from their Social Security payments.

Like Janice, many Americans do not realize that they can pay their Part B premiums monthly when not receiving their Social Security check by following the rules governed by Medicare. Take your time and study this

Medicare rule.

I would advise readers enrolling or already enrolled in Medicare to visit medicare.gov to open a Medicare account. (Chapter 1 of Toni’s “Medicare Survival Guide Advanced” edition explains how to enroll in Medicare properly and receive your Medicare number to open a medicare .gov account whether turning 65 or past 65 and still working.)

Toni King is an author and columnist on Medicare and health insur-

ance issues. She has spent nearly 30 years as a top sales leader in the field. For a Medicare checkup, call the Toni Says call center at 832-519-8664 or email info@ tonisays.com regarding your Medicare plans and options. Toni Says Medicare Survival Guide Advanced edition is available at tonisays.com. Toni’s Medicare Moments articles have just been released: familytalktoday.com/ medicare-moments.

MEDICARE 2025 Ask Toni

Toni Says: Medicare rules

BY TONI KING

Dear Toni,

My sister Sally has been qualified for Social Security Disability for the past 24 months, due to having heart issues, and is receiving her Social Security check. Last week, she received a letter saying that she will be enrolled in Medicare parts A and B beginning Nov. 1. She is 64 and her individual health insurance plan ends when her Medicare begins.

Sally does not turn 65 until next May and is not sure what she should do regarding picking a Medicare plan to begin in November. Should she enroll in a Medicare Advantage plan or a Medicare supplement? My concern is regarding her expensive prescriptions, and I am not able to find any

help online. Please advise Sally’s options are. Thanks, –Karen, Dallas,

Hello Karen:

Enrolling in the correct care plan, either original Me with a supplement and alone Medicare Part D plan Medicare Advantage plan Part D included, when so has a serious health condit be extremely complicated. sister’s current specialists an scriptions are what the To Medicare team would foc during a Medicare consulta

Since Sally’s Medicare will gin Nov. 1 and Medicare’s 2025 prescription drug plan information won’t be released until Tuespla Sally prescriptions. Since Sally is reaching her 25th month on Social Security Disabili-

y y pass es, the individual is automatically enrolled in Medicare parts A and B to begin on the first day of the 25th month. This is the case with Sally’s Medicare. Even though she will not turn 65 until May, Sally’s Medicare will begin Nov. 1. Each state has different Medicare supplement plans available to those under 65. In Texas, only Medicare supplement Plan A is available to those under 65.

If you are under 65, on SSD and enrolling in Medicare for the first time, during a Toni Says Medicare consultation, we advise you to discuss with your medical professionals and facilities which Medicare Advantage plan they accept.

I’ve had my own SSD experience because my sister was on an MAPD plan until she turned 65. During her Medigap/Medicare supplement Open Enrollment period, I signed her up for a Medicare supplement Plan G, and she had eye surgery with a physician that we could choose. Readers, always explore your Medicare options when turning 65, because what you don’t know WILL hurt you.

Toni King is an author and columnist on Medicare and health insurance issues. She has spent nearly 30 years as a top sales leader in the field. For a Medicare checkup, call the Toni Says call center at 832-519-8664 or email info@tonisays.com regarding your Medicare plans and options.

Toni Says “Medicare Survival Guide Advanced” edition is available at tonisays.com. Toni’s Medicare Moments articles have just been released: familytalk today.com/medicare-moments.

Medicare Advantage Prescription Drug (MAPD) plans help to cover the Medicare costs that Medicare does not pay for. The MAPD plan will have deductibles, copays, and out-of-pocket costs (up to a maximum) that the Medicare enrollee will have to pay. This type of plan includes a prescription drug plan. Again, always verify that your health care professionals and facilities accept and will bill the MAPD you’ve picked. Turning 65 and on Social urity Disability: Karen, I good news for you and Salbecause when she turns 65 May, she will have a second dicare supplement enrollment which is called the Medigap/ dicare supplement Open Enrollment period. She will not have answer any health questions because she will have just turned same as anyone who is just 65 and is enrolling in both dicare parts A and B. Those on Security Disability will qualduring a six-month period that the month one turns 65 for Medicare supplement plans A-N.

The facts about the $35 insulin copay cap in Medicare

BY JULIETTE CUBANSKI AND TRICIA NEUMAN KFF HEALTH NEWS

In a recent post on his social media platform, former President Donald Trump claimed credit for lowering insulin copayments to $35 for “millions of Americans,” stating inaccurately that President Biden had “nothing to do with it.” This brief walks through the facts about actions taken under both the Trump and Biden administrations related to capping insulin copayments for people with Medicare and explains the differences between their approaches.

What did the Trump administration do?

In 2020, the Trump administration established a voluntary, time-limited model under the

Center for Medicare and Medicaid Innovation known as the Part D Senior Savings Model. Under this model, participating Medicare Part D prescription drug plans covered at least one of each dosage form and type of insulin product at no more than $35 per month. The model was in effect from 2021 through 2023, and less than half of all Part D plans chose to participate in each year.

What did the Biden administration do?

In 2022, President Biden signed into law the Inflation Reduction Act, which included a provision that requires all Part D plans to

Continued, next page

charge no more than $35 per month for all covered insulin products, and also limits cost sharing for insulin covered under Part B to $35 per month. Deductibles no longer apply to insulins under Part D or Part B. These provisions took effect in 2023 (Jan. 1 for Part D; July 1 for Part B).

What are the key differences between these approaches?

There are three key differences between these approaches (Fig. 1):

Applies to all Part D plans?

The Trump administration’s model relied on voluntary Part D plan participation, while the Biden administration copay cap applies under all Part D plans. In 2022, a total of 2,159 Part D plans participated in the Trump administration’s model, including both standalone prescription drug plans and Medicare Advantage drug plans, which is 38% of all Part D plans that year. Under the Inflation Re-

duction Act, the $3 available in all 6,0 available in 2024.

Applies to all lins in Part D? Un administration’s model, ing plans were not er all insulin produc monthly copayment one of each dosage and insulin type short-acting, intermedia and long-acting). Un administration, the in Part D extends products that a Pa Part D and Part administration’s only to insulin covered D. The Biden adminis pay cap applies to insulins covered under both Part D and Part B.

While Trump claimed that he extended lower insulin pricing to “millions of Americans,” CMS estimates that around 800,000 insulin

the $35 copay cap under President Biden’s Inflation Reduction Act provision is available to all insulin users enrolled in all Medicare Part D plans – an estimated 3.3 million in 2020, based on KFF estimates –as well as those who take insulins

Part B. administration’s copay model had a reach than the insunow in place under Reduction Act that en signed into law, model was voluntary Part D plans could their covered insuthey wanted to make e $35 monthly coinsulin copay cap under the Inflation insulin users in all y no more than $35 any insulin product Part D plan.

vember election for people who need insulin:

President Biden has proposed to extend the $35 monthly cap on insulin out-of-pocket costs to people with commercial insurance. The Biden administration

and Senate Democrats included a similar provision in the Inflation Reduction Act, but that provision was stripped from the final legislation after the vast majority of Republicans voted to remove it. According to KFF analysis, more than 1 in 4 insulin users in the individual and small group markets and about 1 in 5 insulin users with large employer coverage paid, on average, more than $35 per month out-of-pocket for insulin in 2018.

The House Republican Study Committee proposed a full repeal of the Inflation Reduction Act in its FY2025 budget proposal. While it is unclear whether Trump supports repealing this law in its entirety, doing so would eliminate the $35 insulin copay cap for millions of insulin users with Medicare and leave in its place only voluntary efforts offered by the three major insulin manufacturers, which apply to many people irrespective of their health coverage.

Toni Says: Which Medicare option is right for you?

BY TONI KING

Reader alert: The Centers for Medicare & Medicaid Services released information about 2025 Medicare Advantage and stand-alone drug plans in early October Some information may have changed. To be sure you have the most recent updates, visit medicare.gov. You can access individual plans for more details in the Medicare Plan Finder at medicare.gov/plancompare/#/?year=2025&lang=en.

Hello Toni:

Thank you for teaching us the value of finding the right Medicare option for my husband, Clint, and me. When he retired at age 70 a few months ago, Clint was determined to go with the Medicare Advantage PPO plan because it had a $0 monthly premium and thought there was no difference between a Medicare supplement and a PPO plan except cost.

Last week, Clint received a life-changing diagnosis of terminal lung cancer. Had we chosen the PPO Advantage route, then Clint and his medical team would not be in control of his health care. Please let your readers know of our situation because health care needs can change in a flash, like Clint’s did! Thanks, Toni –Raquel, Springfield, Missouri

Hi Raquel:

Americans need to understand that there are differences between original Medicare and a Medicare supplement and Medicare Advantage PPO plans other than the premium.

With original Medicare, there is not a network of any kind; you have the freedom to use any health care provider/facility that will bill Medicare. The Medicare supplement that you enroll in will pay for

...your health care needs can change overnight. Be sure to review your options carefully, because with Medicare, what you don’t know WILL hurt you!

the out-of-pocket costs not covered by Medicare parts A and B. With a Medicare Advantage PPO (MA PPO) plan with low premiums, there are lower costs for in-network providers/facilities but higher out-of-pocket costs for out-of-network benefits. To review 2025 Medicare Advantage (MA) PPO plan out-of-pocket costs, check your new 2025 Medicare & You handbook or search www .medicare.gov.

Most people on an MA PPO plan never consider they may pay an out-of-network health care provider/facility for their medical claim. In these changing medical times, many providers or facilities are out of network.

Below are differences between a Medicare supplement and Medicare Advantage PPO plan:

Medicare Supplement:

1. Medicare supplements work directly with original Medicare. Medicare pays its share of the Medicare-approved amount for “medically necessary” covered health care costs.

2. The supplement you pick will pay its share of the medical claim for the health care provider/facility providing the medical care.

3. Medicare Part D prescription drug plans are not included in a Medicare supplement. It is important to have your stand-alone Medicare (Part D) prescription drug plan begin the same month the supplement does.

4. The downside to a Medicare supplement is the monthly premium can increase each year.

Medicare Advantage PPO Plan:

1. To qualify for any Medicare Advantage plan, you must be enrolled in both Medicare parts A & B and must live in the service area

six months out of the year.

2. Medicare pays the insurance company a specific dollar amount every month for your medical care to the Medicare Advantage Prescription Drug (MAPD) plan you are enrolled in.

3. When you go to the doctor, hospital or visit your pharmacist, you must only use your Medicare Advantage Plan insurance card, not your Medicare (red, white and blue) card.

4. A Medicare Advantage Plan must provide all your Part A and Part B benefits, and some Medicare Advantage plans have Part D prescription drug plans included.

5. “Extra” benefits such as a gym membership, dental and vi-

sion may be offered.

Readers, as Raquel and Clint discovered, your health care needs can change overnight. Be sure to review your options carefully, because with Medicare, what you don’t know WILL hurt you!

Toni King is an author and columnist on Medicare and health insurance issues. She has spent nearly 30 years as a top sales leader in the field You can attend Toni’s Confused about Medicare AEP Zoom Workshop on Wednesday, Oct. 23 at 4 p.m. CST. To register, visit tonisays.com or call 832-519-8664 for more information.

How to use the Times Medicare charts

What’s in the Medicare Advantage Chart

Type: This chart shows three types of health plans with drug coverage: HMO, PPO and HMO-POS. They are explained below. Counties served: Indicates whether plans are available in Hernando (Her.), Hillsborough (Hills.), Pasco and Pinellas (Pin.) counties

Premium: Medicare recipients can expect to see higher Medicare Part B premiums for 2025. The Centers for Medicare and Medicaid Services is projecting an increase in 2025 from last year’s premium of $174.80 per month to $185 per month, a 5.9% hike.

Part B reduction: Some plans pay part of the monthly Part B premium. This “premium reduction” also called a rebate or a “premium give back” is considered an additional benefit offered by a plan. It’s usually returned to consumers in their monthly Social Security check. The chart indicates whether a plan offers a premium reduction. Since reductions can differ based on each beneficiary’s situation, please contact the insurer to find out the amount.

Drug deductible: In some plans, a deductible is paid before drug coverage kicks in. A drug deductible may not apply to all medications or tiers.

Doctor copay: This is the cost of every visit to the doctor. The first dollar figure is for primary care physicians; the second is for specialists. Costs are listed for physicians inside the network (Net) and outside the network (Out).

Hospital copay: This is the cost every time a patient is admitted to a hospital both inside the network (Net) and outside the network (Out). For outpatient hospital coverage, refer to Medicare’s Plan Finder.

Yearly cost (Est.): Medicare’s estimated out-of-pocket costs under this plan, including the Part B premium and drug costs. It is based on an average person in good health but could vary greatly depending on the actual drugs and services needed. The best way to project costs is to use Medicare’s Plan Finder.

Out-of-pocket cap: The maximum of payments for the year inside the network (Net) and outside the network (Out). The lower the cap, the better. These out-ofpocket limits do not apply to prescription drug costs.

Rating: Medicare rates Medicare Advantage plans from 1 to 5 stars, based on customer satisfaction and certain health measures. The top rating is a 5. People with Medicare can switch into a 5-star plan at any time during the year, even if it’s not during an enrollment period.

What’s not in the chart

Private Fee for Service Plans (PFFS) and Special Needs Plans (SNPs): See explanation below and medicare.gov for details.

Medicare supplement plans: Also known as Medigap, this coverage helps pay some health care costs that original Medicare doesn’t cover. Shop for those plans here (medicare.gov/medigap-supplemental-insurance -plans/#/m?lang=en&%3Byear=2023&year=2025). Copayments for other services: Plans usually charge copayments for drugs, skilled nursing homes, ambulances, emergency rooms and many other services Check individual plans for these details. Goodies: Some plans offer some dental, hearing and vision coverage, exercise classes, transportation to the doctor and other extra benefits. Check plans for details.

Health plans without drugs: A few plans are cheaper because they do not offer drug coverage. Unless one has comparable coverage elsewhere, using these plans can result in stiff penalties if that person ever wants Medicare drug coverage in later years.

Health plans: How they differ

Medicare allows several types of private health plans, which cover all care. Here is how they differ: HMO (Health Maintenance Organization): Generally requires the use of providers within a network A

personal physician usually coordinates care and may need to approve visits to specialists.

PPO (Preferred Provider Organization): Encourages the use of providers within a network, with low copayments, but also allows the use of providers outside the network at a higher cost. Usually allows the use of specialists within the network without prior approval of a personal physician. Some bigger companies allow the use of their PPOs in other states. Verify before signing up.

HMO-POS (HMO-Point of Service): A hybrid between an HMO and PPO. Usually requires staying within a network and may require the approval of a personal physician before seeing network specialists. It may cover some care outside the network. Some POS plans approve very little coverage outside the network, so check plans for details.

PFFS (Private Fee for Service): Has network, but allows members to get care outside the network if the provider will accept the plan’s payment; many do not. Make sure provider will accept payment before incurring bills.

Special Needs Plans: People with certain chronic conditions like diabetes and COPD can sometimes qualify for a Special Needs Plan, which may include extra services for managing their disease. The consumer should make sure they qualify before purchasing. People living in nursing homes may also qualify for special plans, as can those on Medicaid.

What’s in the stand-alone drug chart

Monthly premium: The monthly charge for every Medicare Part D drug plan. This is in addition to Medicare’s monthly Part B premium.

Annual deductible: What is paid out of pocket before coverage begins.

Rating: Medicare rates plans from 1 to 5 stars, based on customer satisfaction and certain health measures. The top rating is a 5.

What’s not in the chart

Medicare health costs: Drug plans are for people on original Medicare who also have expenses for doctors, hospitals and, sometimes, supplemental plans. People with higher incomes may pay higher Part B premiums and drug plan premiums.

Total drug costs: Out-of-pocket costs can vary widely depending on which drugs are needed. For an estimated total cost of different plans, enter the specific drugs into Medicare’s online Plan Finder and search for drug plans.

Changes ahead for Medicare enrollment in 2025

Here’s what Tampa Bay residents who qualify for Medicare need to know when they enroll.

By Donna Winchester

Special to the Times

Medicare will undergo significant changes in 2025 that could affect many of the more than 67 million Americans participating in the federal health insurance program for those 65 and older Some changes will be welcome, such as a reduction in out-of-pocket drug costs. Others, such as potentially higher premiums on some Medicare Advantage plans, call for careful study

The Centers for Medicare & Medicaid Services began unveiling the changes last spring. Premiums, deductibles and other key information were posted in late September ahead of the annual open enrollment period, which began Oct. 15

Eligible individuals have until Dec. 7 to update their plans as well as switch from original Medicare to Medicare Advantage; from Medicare Advantage to original Medicare; from one Medicare Part D prescription drug plan to another; and enroll in a Medicare Part D plan if they did not enroll when they first became eligible for Medicare.

For both first-time enrollees and seasoned veterans, navigating the many options and rules surrounding the programs can be challenging. The Tampa Bay Times’ Medicare Guide breaks down the various parts of Medicare and offers charts for plan comparison to help beneficiaries.

Here are some key points to consider

Beginning in 2025, a new approach will replace previous Medicare Part D phases, including the elimination of the “donut hole” and

a new limit of $2,000 per year for out-of-pocket Part D drug spending. Here’s how the phases will work:

If your Medicare Advantage drug plan or stand-alone Part D plan requires a deductible, you’ll pay 100% of your prescription drug costs until you spend $590, which is the Part D deductible for 2025.

You’ll pay 25% coinsurance for covered drugs until you’ve paid $2,000 out of pocket. After you’ve hit the $2,000 threshold for out-of-pocket spending on medications, you pay nothing else out of pocket for 2025. Part D enrollees who reach the catastrophic threshold will save about $1,300 on drug costs in 2025 compared to 2024.

The new rule does not apply to out-of-pocket spending on Medicare Part B drugs, which include vaccinations, doctor-administered injections and some outpatient prescription drugs. Chemotherapy treatments may fall into this category

The cap is expected to help millions of seniors according to the Centers for Medicare & Medicaid Services, which reports that more than 1.7 million people, or about 3.5% of those covered by drug plans, already had reached $2,000 in out-of-pocket costs on prescriptions in the first three months of 2024.

But while some Medicare recipients could save thousands of dollars, particularly those taking expensive brand-name drugs, those who don’t use many prescriptions may see their premiums rise. Medicare watchdogs warn that while the change aims to cap costs, some Medicare Advantage plans that include prescription drug programs may change or introduce new premiums, formularies and copays.

They also may increase drug deductibles or reduce benefits.

Insurers may take these actions because, in addition to becoming more responsible for Part D costs due to the $2,000 out-of-pocket cap, they also received a limited increase in government payments for 2025. Keep in mind that Medicare Advantage plans are partly funded by Medicare.

Nevertheless, the Centers for Medicare & Medicaid Services predict that Medicare Advantage enrollment will grow to 35.7 million in 2025, representing nearly 51% of all people enrolled in Medicare, compared to approximately 50% in 2024. Overall, the agency says, average Medicare Advantage premiums are expected to decrease by $1.23, from $18.23 in 2024 to $17 in 2025.

Approximately 60% of Medicare Advantage enrollees in their current plan can expect a zero-dollar premium in 2025 according to the agency. About 83% of enrollees will have the same or lower premium in 2025 if they continue with the same plan Included in that group of enrollees, about 20% will see their premiums decline if they stay with their current plans.

After previously announcing a Part D base beneficiary premium of $36.78, the Centers for Medicare & Medicaid Services announced in late September that the projected average total Part D beneficiary premium is projected to decrease by $7.45 in 2025, from $53.95 in 2024 to $46.50. The average standalone Part D plan total premium is projected to decrease by $1.63 in 2025, from $41.63 in 2024 to $40.

Two relatively small changes for 2025 are aimed at protecting enrollees and their benefits. One is a

crackdown on agents and brokers who sell Medicare policies.

For years, salespeople have received incentives when they enroll Medicare beneficiaries into private insurers’ Medicare Advantage plans. A new rule, meant to disincentivize those who may steer people to insurance plans to earn perks for themselves and not serve the best interests of Medicare beneficiaries, will put an end to this.

The new rule also prevents brokers and agents from receiving “administrative fees” above Medicare’s fixed compensation caps. In most states, that cap has been $611 for new Medicare Advantage sign-ups and $306 for renewals.

Additionally, Medicare Advantage policyholders will begin receiving a mid-year notification reminding them of their plan’s unused supplemental benefits.

A recent study from the Commonwealth Fund showed that 3 in 10 Medicare Advantage members hadn’t used any of their supplemental benefits the previous year, even though an earlier finding showed that supplemental benefits were the most common reason people cited for choosing a Medicare Advantage plan over traditional Medicare.

The “Mid-Year Enrollee Notification of Unused Supplemental Benefits” will list all supplemental benefits the person hasn’t used, the scope and out-of-pocket cost for claiming each one, instructions on how to access the benefits and a customer service number to call for

more information.

On top of these changes, there have been fluctuations within the industry. Some insurance companies are leaving certain markets and ending plan options altogether Humana, for example, announced it would be leaving 13 markets nationwide, leaving about 560,000 recipients in need of a new plan.

Cigna is selling its entire Medicare business, including all Medicare Advantage plans, Medicare Part D prescription drug plans and Medicare Supplement plans. By early 2025, Health Care Service Corporation, licensee of Blue Cross Blue Shield, will own all of Cigna’s Medicare business.

Humana expects to lose 5% of its Medicare Advantage enrollees after leaving unprofitable markets primarily in Florida, North Carolina, Georgia, Texas and Illinois. CVS Health Aetna is preparing to make such significant changes to its 2025 Medicare Advantage plans that it anticipates losing 10% of its membership.

Meanwhile, Mutual of Omaha is leaving the stand-alone drug plan market because of the higher costs associated with the Inflation Reduction Act.

Despite these fluctuations, ample choice in Medicare Advantage will continue, according to the Centers for Medicare & Medicaid Services, which predicts that about 99% of people enrolled in Medicare will have access to at least one Medicare Advantage plan in their area.

With so much change coming, health care advocates are urging seniors new to Medicare to review costs holistically Costs that impact a budget go far beyond monthly premiums. Deductibles, copays and ease of access to services all figure into the final amount paid.

Those who have been using a Medicare plan should review their plan’s annual notice of change carefully They may see a big variation in premiums, copayments and covered drugs during open enrollment this year.

Those looking to switch Medicare Advantage plans should not simply rely on the general description of coverage in the Medicare Plan Finder. Look at the details in the Explanation of Benefits on the plan’s website before making a final decision. Equally important: Confirm that your providers are in our plan’s network.

How Medicare works

Part A and Part B generally are the most popular programs and tend to offer the most free services for individuals who qualify.

PartAcovers inpatient hospital care, nursing home care, hospice care and home health care. These services usually are free, which means there’s no premium to pay.

Part B covers two types of services: those that are medically necessary, such as outpatient hospital care, doctor bills, physical therapy and more; and preventive services and detection of illnesses at an early stage when treatment is likely to work best.

Part B is optional and costs most people a monthly premium, which is projected to increase in 2025 from $174.80 per month to $185, a 5.9% hike. The premium is higher for some, depending on income. The premium is a bit lower for those who choose to have the premium deducted from their Social Security check. Medicare Advantage plans are expected to receive rebates in 2025, which can be used to reduce Part B premiums.

Unless you are still on an employer’s health plan, it makes sense to sign up for Part B when

you first become eligible for Medicare regardless of how healthy you are. You will face a penalty if you decide you need this coverage later – up to 10% for each year you could have had Part B but didn’t sign up for it, a penalty that will last for as long as you have Part B.

Part C refers to Medicare Advantage plans. These plans, subsidized by taxpayers, are managed by private insurance companies through either an HMO (Health Maintenance Organization) or a PPO (Preferred Provider Organization). Individuals choose medical providers from a predetermined list. The plans offer bundles that include Part A, Part B and usually a prescription drug program (Part D).

Most Medicare Advantage plans will continue to offer a wide range of supplemental benefits in 2025, including eyewear, hearing aids, both preventive and comprehensive dental benefits, access to meals, over-the-counter items, fitness benefits and worldwide emergency/urgent coverage.

The Medicare Advantage enrollment process varies slightly by plan, but in all cases, you must be enrolled in Medicare Part A and Part B. If you enroll in a Medicare Advantage plan during the annual enrollment period and later change your mind, you can drop the plan and go back to original Medicare (parts A and B) during the Medicare Annual Disenrollment Period, which is Jan. 1–March 31. If you don’t disenroll during this period,

you must keep your plan for the rest of the year unless you qualify for a Special Enrollment.

It’s important to note that Part A and Part B services under original Medicare come with deductibles and copays. These costs can be covered by buying private Medicare supplement policies known as Medigap. Premiums tend to be high, but the extra coverage can be worth it in the event of catastrophic illness.

Medicare Part D plans help pay for prescription drugs and protect you from high prescription drug costs. If you are eligible for Medicare parts A or B, you are generally also eligible for Medicare Part D.

While all Part D plans are required to cover certain common types of drugs, the specific prescription drugs covered by a Medicare Part D plan vary by plan type and insurance carrier Every plan has its own list of covered medications, called a formulary. Before enrolling, you should review each Medicare Part D plan’s formulary to understand which of your drugs are covered. The drugs you take may not be covered in every Medicare Part D formulary.

★ The star ratings ★

The Centers for Medicare & Medicaid Services uses a star rating system to measure how well Medicare Advantage and Part D plans perform in several categories, including quality of care and customer service. Ratings range from one to five stars, with five being the highest and one being the lowest.

Plans are rated in each category Medicare also assigns plans an overall star rating to summarize the plan’s performance across the board. Medicare reviews plan performance yearly and releases new star ratings each fall, so plan ratings may change from year to year

Original Medicare or Medicare Advantage?

Coverage: original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices and other health care facilities but does not cover benefits like eye exams, most dental care and routine exams. You can

join a separate Medicare drug plan to get Medicare drug coverage (Part D). In most cases, you don’t have to get a service or supply approved ahead of time for original Medicare to cover it.

Medicare Advantage plans must cover all the medically necessary services that original Medicare covers. Most plans offer extra benefits that original Medicare doesn’t cover, such as some routine exams and vision, hearing and dental services. Medicare drug coverage (Part D) is included in most plans. In some cases, you must get a service or supply approved ahead of time for the plan to cover it.

Doctor and hospital choice: original Medicare allows you to see any doctor or hospital that takes Medicare, anywhere in the United States. In most cases, you don’t need a referral to see a specialist.

Medicare Advantage plans in many cases require you to use doctors and other providers who are in the plan’s network, at least for non-emergency care Some plans offer non-emergency coverage out of network but typically at a higher cost. You may need to get a referral to see a specialist.

Cost: For Part B-covered services, original Medicare usually requires you to pay 20% of the Medicare-approved amount after you meet your deductible; this is called your co-insurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan, you’ll pay a separate premium for your Medicare drug coverage (Part D). There is no yearly limit to what you pay out of pocket unless you have supplemental coverage such as Medicare Supplement Insurance (Medigap).

With Medicare Advantage, out-of-pocket costs vary; plans have different costs for certain services. You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium and may help pay all or part of your Part B premium. Most plans include Medicare drug coverage (Part D). Plans have a yearly limit on what you pay out of pocket for services that Medicare

Part A and Part B cover. Once you reach your plan’s limit, you’ll pay nothing for services Part A and Part B cover for the rest of the year

Extra help

In addition to relying on the Medicare Plan Finder, Medicare enrollees can call a toll-free line –1-800-MEDICARE – 24 hours a day, seven days a week, for help in English and Spanish with language support in more than 200 other languages. They also can contact the State Health Insurance Assistance Program for one-on-one assistance.

To help with their Medicare costs, low-income seniors and adults with disabilities may qualify to receive financial assistance from Medicare Savings Programs. These programs help millions of Americans access high-quality health care at a reduced cost, helping to pay Medicare premiums, and may also pay Medicare deductibles, coinsurance, and copayments for those who meet the conditions of eligibility.

The Low-Income Subsidy program is a Medicare program that helps qualifying individuals pay Part D premiums, deductibles, coinsurance and other costs. The program is expanding this year thanks to the Inflation Reduction Act, allowing all eligible enrollees to benefit from no deductible, no premium and fixed lower copayments for certain medications. Enrollees can save nearly $300 per year, on average, according to estimates. Individuals who enroll in MSPs automatically qualify for help affording their prescription drugs through this program.

Still confused?

Florida’s SHINE program is a free offering from the Florida Department of Elder Affairs and the local Area Agency on Aging Specially trained volunteers can assist with Medicare, Medicaid and health insurance questions by providing one-on-one counseling and information. SHINE services are free, unbiased and confidential. Visit the website or call 1-800963-5337 toll-free.

Medicare Advantage plans with drug coverage

H1045-057 Contact: 800-555-5757

H1045-059

Contact: 800-555-5757

from UHC FL-0006 Pasco, Pin.

H1045-028

Contact: 800-555-5757

from UHC FL-0013

H1045-043

Contact: 800-555-5757

from UHC FL-0019 Pasco, Pin.

H2406-011

Contact: 800-555-5757

from UHC FL-0031 Pasco, Pin.

R0759-001

Contact: 800-555-5757

from UHC FL-003P Pin.

H1045-045

Contact: 800-555-5757 Advantage Care HMO Hills., Pin.

H9917-005

Contact: 844-788-8935

H1609-028

Contact: 833-859-6031

Explorer Premier Pasco, Pin.

H5521-437

Contact: 833-859-6031

H1609-067 Pasco, Pin.

Contact: 833-859-6031

H5521-033 Pasco, Pin.

Contact: 833-859-6031

Medicare Advantage plans with drug coverage

H5521-270

Contact: 833-859-6031

H2235-001

Contact: 833-668-7617

H2235-003

Contact: 833-668-7617

H2235-002

Contact: 833-668-7617

H1035-021

Contact: 855-601-9465

Contact: 855-601-9465

H1035-034

Contact: 855-601-9465

Contact:

Medicare Advantage plans with drug coverage

Contact:

H1019-104-2

Contact: 800-794-4105

Pasco,

H1019-103-2 Pasco, Pin.

Contact: 800-794-4105

Cigna Preferred Medicare

H5410-029 Pasco, Pin.

Contact: 800-313-0973

Cigna Preferred Savings HMO

Medicare Pasco, Pin.

H5410-030

Contact: 800-313-0973

Devoted CHOICE GIVEBACK PPO

Florida Pasco, Pin.

H9884-008-000

Contact: 800-376-5889

H1290-036-001 Pasco

Contact: 800-376-5889

H1290-036-002

Contact: 800-376-5889

Medicare Advantage plans with drug coverage

H1290-037-005

Contact: 800-376-5889

H5427-113

Contact: 833-668-2276

H5427-059

Contact: 833-668-2276

H5427-060

Contact: 833-668-2276

H1526-005

Contact: 888-376-6188

Giveback H5216-393 Pasco, Pin.

H5216-393

Contact: 800-833-2364

Giveback H1036-265 Pasco, Pin.

H1036-265

Contact: 800-833-2364 Humana Gold Plus H1036-025

H1036-025 Pasco, Pin.

Contact: 800-833-2364

Giveback H5216-452 Pasco, Pin.

H5216-452

Contact: 800-833-2364

HumanaChoice Florida PPO Her., Hills.,

H5216-072 Pasco, Pin.

H5216-072

Contact: 800-833-2364

H5216-304

H5216-304

Contact: 800-833-2364

HumanaChoice R5826-005 Regional Her., Hills.,

R5826-005 PPO Pasco, Pin.

Contact: 800-833-2364

Medicare Advantage plans with drug coverage

HumanaChoice R5826-074 Regional Her., Hills.,

R5826-074 PPO Pasco, Pin.

Contact: 800-833-2364

H5594-032

Contact: 833-668-2306

H5594-001 Pasco, Pin.

Contact: 833-668-2306

H5594-002 Pasco, Pin.

Contact: 833-668-2306

H2962-001

Contact: 855-858-7526

H2962-045

Contact: 855-858-7526

Contact: 833-668-2296

H5471-117 Pasco, Pin.

Contact: 833-668-2296

H9469-008

Contact: 833-668-2380

H5471-078

Contact: 833-668-2296

H0982-009

Contact: 844-447-6547

H1032-200

Contact: 800-225-8017

Contact: 800-225-8017

Stand-alone drug plans

What’s in the stand-alone drug chart

Monthly premium: The monthly charge for every Medicare Part D drug plan. This is in addition to Medicare’s monthly Part B premium.

Annual deductible: What is paid out of pocket before coverage begins.

Rating: Medicare rates plans from 1 to 5 stars, based on customer satisfaction and certain health measures. The top rating is a 5.

What’s not in the chart

Medicare health costs: Drug plans are for people on original Medicare who also have expenses for doctors, hospitals and, sometimes, supplemental plans. People with higher incomes may pay higher Part B premiums and drug plan premiums.

Total drug costs: Out-of-pocket costs can vary widely depending on which drugs are needed. For an estimated total cost of different plans, enter the specific drugs into Medicare’s online Plan Finder and search for drug plans.

AARP Medicare Rx Preferred Enhanced

from UHC

S5921-383

Contact: 800-753-8004

AARP Medicare Rx Saver

from UHC

S5921-356

Contact: 888-867-5564

BlueMedicare

S5904-002

Contact: 855-601-9465

BlueMedicare Premier Rx

S5904-001

Contact: 855-601-9465

Cigna Healthcare Assurance Rx

S5617-053 Contact: 855-952-0709

Cigna Healthcare Extra Rx

1/2 S5617-256 Contact: 855-952-0709

Cigna Healthcare Saver Rx

S5617-361 Contact: 855-952-0709

Clear Spring Health Premier Rx

No data S6946-074 available Contact: 877-364-4566

Clear Spring Health Value Rx

$590 No data S6946-008 available Contact: 877-364-4566

Humana Basic Rx Plan

S5884-105

Contact: 800-706-0872

Humana Premier Rx Plan

S5884-157 Contact: 800-706-0872

Note: Shading on the chart indicates plans offered by the same company.

1/2

1/2

Humana Value Rx Plan

S5884-190 Contact: 800-706-0872

SilverScript Choice

S5601-022

Contact: 833-526-2445

Wellcare Classic

S4802-083

Contact: 800-270-5320

Wellcare Medicare Rx Value Plus

S4802-214

Contact: 800-270-5320

Wellcare Value Script Enhanced

S4802-146

Contact: 800-270-5320

Gardening: A natural solution for chronic lower back pain

BY MEREDITH BAUER UF/IFAS UNIVERSITY OF FLORIDA

Therapeutic horticulture may offer noticeable benefits to patients with chronic lower back pain, according to a recent study from the University of Florida Institute of Food and Agricultural Sciences (UF/IFAS) and the UF College of Medicine.

The interdisciplinary study encouraged chronic lower back pain sufferers to participate in a one-hour therapeutic horticulture session at the Wilmot Botanical Gardens at UF/IFAS, during which trained therapists helped the participants reach, stretch and bend to gather plant clippings. Researchers noted a pronounced improvement in the participants’ well-being after the session. Most substantially, the experience reduced the amount of anxiety that participants felt about movement and exercise as it related to their lower back pain.

“It’s important because gardening is a way to get someone with low back pain moving and interacting and not isolating themselves for fear of pain, in a safe way,” said Leah Diehl, the director of therapeutic horticulture at Wilmot Botanical Gardens and a study author. “Also, could prescribed gardening activities be an alternative to needing to take pain medication for some patients? This preliminary study encourages us to explore that possibility.”

The two-part study, funded by the UF Health Sports Performance Center and published in Alternative Therapies in Health and Medicine, consisted of a survey of 170 patients and a pilot experimental group of nine patients. Most of the people surveyed expressed an in-

All participants believed that gardening improved their overall health and spine motion while reducing their lower back pain.

terest in therapeutic horticulture and believed it could improve their mood and muscle strength, as well as lower their stress levels, increase their movement and enable them to perform self-care activities with less pain.

The results of the study were promising,Diehlsaid. In the pilot session, 44% of patients reported using pain medication to manage their lower back pain, and 66% believed that gardening could provide pain relief. After the horticulture session, many participants experienced improvements in anxiety, spine bending and spine rotation to the left. All participants believed that gardening improved their overall health and spine motion while reducing their lower back pain.

Considering chronic lower back pain is a common disability, impacting patients’ physical and mental well-being, UF researchers hope that more medical professionals will see the benefits of therapeutic horticulture. About 7.5% of people worldwide suffer from lower back pain – about

577 million people – and it is the leading cause of disability globally, according to the International Association for the Study of Pain.

Heather Vincent, Ph.D., vice chair of research for the UF College of Medicine’s Department of Physical Medicine & Rehabilitation and the study’s principal investigator, said gardening can be a nonthreatening way for people who are afraid of pain to stretch and move more.

“When you do different functional and engaging activities that you don’t think are therapeutic but actually are, you can sneak movement in in a way that doesn’t make people fearful,” Vincent said. “As an exercise person, I try hard to find creative ways to keep people who

are in pain from just sitting around. If someone in pain stays sedentary, the pain gets worse.”

Vincent said the forward and side-to-side bending, twisting and rotating activities of gardening –when done properly – are perfect therapeutic lower back exercises.

“Inphysicalmedicineandrehabilitation, we use any type of

approaches that are going to help our patients move more and gain more independence. We’re always on the lookout for who might have the expertise to help people keep moving,” Vincent said. “When we saw what was happening at Wilmot Botanical Gardens, we thought this would be the perfect way to go.”

ABOUT UF/IFAS The mission of the University of Florida Institute of Food and Agricultural Sciences (UF/IFAS) is to develop knowledge relevant to agricultural, human and natural resources and to make that knowledge available to sustain and enhance the quality of human life With more than a dozen research facilities, 67 county Extension offices and award-winning students and faculty in the UF College of Agricultural and Life Sciences, UF/IFAS brings science-based solutions to the state’s agricultural and natural resources industries, and all Florida residents. ifas.ufl.edu | @UF_IFAS

Ways to Stay as You Age

BY SALLY MOE Times Total Media Correspondent

1. Learn new things— the more challenging, the better

If there’s one thing that keeps your brain alive and making new connections, it’s learning something new and challenging. Staying mentally sharp requires taking on unfamiliar activities that provide broad stimulation mentally and socially. Learn a new

into some challenging reading, as well as crosswords, sudoku, cryptoquips and other puzzles.

2. Exercise—with friends

Thirty minutes of aerobic activity most days of the week increases the flow of blood to the brain and can lower the risk of Alzheimer’s by 30% to 50%. Regular exercise is even better for you when you do it with friends, or in a group setting,

er walk your neighborhood with your partner or a friend. Take up Zumba or Jazzercise. Join a water aerobics class. While you’re at it, strengthen your handgrip. Recent medical studies have noted poorer grip strength was associated with increased risk of cognitive decline and dementia. Furthermore, as you age, the stronger your grip, the more likely you are to survive diseases like cancer.

idants, omega-3 fatty acids, and other staples of the Mediterranean diet had a lower risk of developing Alzheimer’s disease (as much as 72% lower) than those who eat more animal proteins, processed foods and sugars. A similar approach that is more targeted to boosting brain health is the MIND diet (a hybrid of the Mediterranean diet and the DASH [Dietary Approaches to Stop Hypertension] diet). MIND stands for Mediternean-DASH Intervention for Neurodegenerative Delay.

has been linked to heart attack and stroke, and more recently an increased risk of Alzheimer’s Turmeric + black pepper, curcumin and CDP-choline may also benefit mental fitness.

4. Pay attention to vitamin D levels

7. Eliminate or reduce your intake of alcohol (One drink per day for women; two drinks per day for men.) Alcohol is implicated in falls and general loss of balance, which can cause fractures, and is a factor in forgetfulness, confusion and depression. Alcohol does not mix well with a number of medications, and heavy alcohol use decreases bone density. Alcohol can weaken your immune system. Heavy drinking over time can raise your blood pressure to unhealthy levels, shrink brain cells and lead to alcohol-related brain damage (ARBD), as well as certain types of dementia.

Studies suggest that healthy vitamin D levels are connected to a lower incidence of Alzheimer’s and dementia. vitamin D may play a role tween muscular and cognitive function. Vitamin D deficiency is rongly linked to muscle weakness and loss. (Whether that’s cause or effect, or both, is still not known.) But eping your levels of vitamin D in the healthy range is a good idea.

8. Quit smoking

Yoga and meditation

If you are not a fan of cancer or emphysema and don’t want to look older than your age quitting smoking is a must and one of the best gifts you can give yourself

9. Believe in yourself

Yoga can improve posture, flexibility, balance and coordination and is beneficial for bone densiand meditation helps reduce stress and improve awareness and mindfulness. Together, they can slow the physical and mental declines often seen with aging. A weekly routine of yoga and meditation may bolster brain activity and help delay cognitive decline.

6. Supplements

Per Dr. Andrew Weil, take a supplement high in folic acid and other B vitamins. They help the body get rid of homocysteine, a toxic amino acid formed by the breakdown of animal protein that

Common myths about aging do not have to become a self-fulfilling prophecy. Focus on personal growth and healthy habits. If you believe in yourself and your natural gifts, keep learning new things, and approach life with a youthful, curious, grateful attitude. These could be some of the most rewarding years of your life.

Information for this article was gathered from health.harvard. edu, cnbc.com, drweil.com, ncbi. nlm.nih.gov, betteraging.com, pubs. niaaa.nih.gov, webmd.com, mayo clinic.org and activepuzzles.com.

Experience the Life-Enhancing Benefits of Meditation

Meditation can offer numerous benefits for seniors, improving both their mental and physical health. Here are some key advantages:

1. Reduces stress and anxiety Meditation helps seniors manage stress by promoting relaxation. Techniques such as mindfulness and deep breathing can reduce feelings of anxiety, creating a sense of calm and emotional balance.

2. Enhances cognitive function

As people age, cognitive decline can become a concern. Meditation has been shown to improve focus, memory and attention. It also increases mental clarity, potentially reducing the risk or severity of conditions like dementia or Alzheimer’s disease.

... meditation can serve as a natural tool for pain management.

3. Improves sleep Many seniors struggle with insomnia or sleep disturbances. Meditation, especially mindfulness-based practices, can help regulate sleep patterns, reduce racing thoughts and improve the overall quality of rest.

4. Lowers blood pressure Mindful breathing and relaxation techniques can help lower blood pressure, reducing the risk of heart disease. This is especially import-

ant for seniors, as cardiovascular health tends to become a greater concern with age.

5. Promotes emotional wellbeing Meditation can foster positive emotions, self-compassion and resilience. This can be beneficial for seniors who might face loneliness or depression. Regular practice often leads to a more positive outlook on life.

8.Improvesrespiratoryhealth

Deep-breathing techniques associated with meditation can improve lung capacity and function. This is especially helpful for seniors with respiratory issues like COPD or asthma.

6. Pain management Chronic pain is common among seniors, and meditation can serve as a natural tool for pain management. Mindfulness meditation, in particular, helps individuals become more aware of and manage their pain, potentially reducing reliance on medications.

7. Increases social interaction

Participating in group meditation sessions can provide seniors with opportunities for social engagement. This reduces feelings of isolation and promotes a sense of community.

9. Boosts immune function Regular meditation has been linked to enhanced immune function, helping the body resist illness and recover more effectively from infections.

10. Increases overall quality of life By reducing stress, improving mental clarity and fostering emotional balance, meditation enhances the overall quality of life for seniors. It allows them to remain more present, mindful and engaged in their daily activities. Incorporating meditation into your daily routine can lead to a healthier, happier aging process. This story was compiled with the assistance of ChatGPT.

MEDICARE 2025 Ask Toni

How can I stop my Medicare Part B?

BY TONI KING

Toni,

I have just enrolled in Medicare parts A and B because I turned 65 in January. I am currently working, with my husband and myself covered under my employer plan

I am being charged a much higher premium for Medicare because our 2021 tax return showed higher earnings. Can you please explain what one turning 65 with employer benefits should do? I made a big mistake enrolling in Medicare and working with employer benefits, and I need assistance to stop my Medicare Part B. Thanks.

–Tammy, Sugar Land, Texas

Tammy,

I have good news for you because Medicare does allow those turning 65 with employer benefits to delay Medicare Part B enrollment without a penalty when you want to enroll in Medicare later. Delaying Medicare does require you to have employer group health coverage from your or your spouse’s employment.

Social Security must interview you to terminate Medicare parts A and/or B, and you can do so by calling your local Social Security office. Discuss with the representative that you need to terminate your Medicare since you are covered by employer’s group health coverage and made a mistake by enrolling in Medicare. You will

need to file Social Security form CMS-1763 to terminate Medicare Part A (hospital) or Part B (medical).

Here are the different Medicare enrollment options:

1. If you are turning 65 and receiving your Social Security check, this is the easiest way to receive your Medicare card. Medicare will mail your card 90 days before you turn 65.

2. If you are turning 65 and NOT receiving your Social Security check – either because you are still working or are not working but waiting past age 65 to receive 100% of your Social Security benefits – you can enroll in Medicare online at ssa.gov/benefits/medicare 90 days before you turn 65.

3. If you are over age 65 and still working or your spouse is still working, you should talk to your (or your spouse’s) employer’s human resources department. Verify whether you should delay enrolling in Part B because you and/or your spouse are on an employer group health plan. When you/ your spouse will no longer be covered by an employer group health plan, have the HR department fill out and sign Social Security form CMS-L564 “Request for Employment Information” and CMS-40B “Application for Medicare Part B.” Call your local Social Security office and fax the forms to justify your delay in enrollment and avoid needless penalties.

Medicare enrollment situations DO matter. Here are a couple:

Working Spouse: If the working spouse is providing health insurance benefits from their current employment group health coverage, then you may want to delay enrolling in Medicare Part B. You might continue to work either part-time or as a self-employed individual while taking advantage

of the coverage provided by your working spouse.

Self-Employed: If you turned 65, were NOT covered under an employer’s group health plan and waited to enroll in Medicare Part B, then you will receive a 10% penalty for each 12-month period that you were not enrolled in Part B. So, if you waited till turning 67 to apply for original Medicare parts A and B, you will pay an additional 20% for your Medicare Part B every month for as long as you are on Medicare or the rest of your life.

Toni King is an author and columnist on Medicare and health insurance issues. She has spent nearly 30 years as a top sales leader in the field. For a Medicare checkup, call the Toni Says call center at 832-519-8664 or email info@tonisays.com regarding your Medicare plans and options. The Toni Says “Medicare Survival Guide Advanced” edition is available at tonisays.com. Toni’s Medicare Moments articles have just been released: familytalk today.com/medicare-moments.

Millions of People with Medicare Will Benefit from the New Out-of-Pocket Drug Spending Cap Over Time

BY JULIETTE CUBANSKI, TRICIA NEUMAN AND ANTHONY DAMICO KFF HEALTH NEWS

In 2025, Medicare beneficiaries will pay no more than $2,000 out of pocket for prescription drugs covered under Part D, Medicare’s outpatient drug benefit. This is due to a provision in the Inflation Reduction Act of 2022, which included several changes to the Medicare Part D program designed to lower patient out-of-pocket costs and reduce what Medicare spends on prescription drugs. This new $2,000 cap (indexed annually to the rate of change in Part D costs) comes on top of the elimination of 5% coinsurance in the catastrophic coverage phase of the Part D benefit, in effect for 2024, which translates to a cap of about $3,300 out of pocket for brand-name drugs. These benefit design changes will save thousands of dollars for people who take high-cost drugs for cancer, rheumatoid arthritis and other serious conditions.

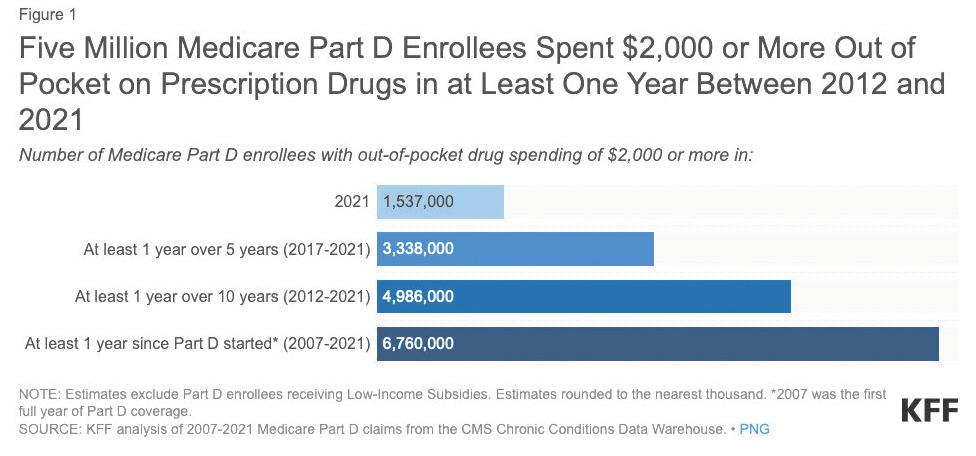

If a $2,000 cap on out-ofpocket drug spending had been in place in 2021, 1.5 million Medicare beneficiaries enrolled in Part D plans would have saved money because they spent $2,000 or more out of pocket on prescription drugs that year This estimate is based on KFF analysis of Medicare Part D prescription drug claims data for enrollees without Part D low-income subsidies in 2021 (the most recent year available for this analysis). Among these 1.5 million enrollees, most (1 million or 68%) spent between $2,000 and $3,000 out of pocket, while

0.3 million (20%) had spending of $3,000 up to $5,000, and 0.2 million (12%) spent $5,000 or more out of pocket.

Over the course of several years, however, far more Part D enrollees will stand to see savings from this new out-of-pocket spending cap than in any single year. A total of 5 million Part D enrollees had out-of-pocket drug costs of $2,000 or more in at least one year during the 10-year period between 2012 and 2021, while 6.8 million Part D enrollees have paid $2,000 or more out of pocket in at least one year since 2007, the first full year of the Part D program (Fig. 1, upper right).

In most states, tens of thousands, if not hundreds of thousands, of Medicare beneficiaries will feel relief from the new Part D out-of-pocket spending cap.

In California, Florida and Texas, more than 100,000 Part D enrollees faced out-of-pocket costs of $2,000 or more in 2021, and in another six states (New York, Pennsylvania, Ohio, Illinois, North Carolina and New Jersey), between 50,000 and 82,000 did so. As at the national level, more Part D enrollees in each state will benefit over time. For example, in Iowa, Louisiana and Maryland, 73,000 Part D enrollees faced out-of-pocket costs of $2,000 or more in at least one year between 2012 and 2021. In Michigan, New Jersey and Georgia, 148,000, 158,000 and 159,000 Part D enrollees, respectively,

People who will be helped include those who have persistently high drug costs over multiple years and others who have high costs in one year but not over time.

spent $2,000 or more in at least one year over this same 10-year period. In Texas, 364,000 Part D enrollees did so; in Florida and California, around 400,000 enrollees or more did so.

Capping out-of-pocket spending will help Part D enrollees with relatively high drug costs, which may include only a relatively small number

of Part D enrollees in any given year but, as this analysis shows, a larger number over time. People who will be helped include those who have persistently high drug costs over multiple years and others who have

high costs in one year but not over time. While a cap on out-ofpocket costs will help millions of Part D enrollees over time, higher plan costs to provide the Part D benefit could also mean higher plan premiums, a dynamic that the Inflation Reduction Act’s premium stabilization provision was designed to mitigate.

Although KFF polling shows that a relatively small share of older adults are aware of the Inflation Reduction Act’s $2,000 cap on outof-pocket drug costs for Part D enrollees that takes effect in 2025, millions of them will benefit from this cap in the years to come.