8 minute read

Quilting for a Cause

PebbleCreek women create sensory mats for dementia patients

BY LAUREN SERRATO

For some, quilting is a hobby that helps pass the time. However, for the women of the PebbleCreek Quilters, they use their quilting and sewing skills to make a difference in the West Valley.

The Goodyear group create sensory mats for those in need at Hospice of the Valley. Speci cally, the quilts were made for dementia patients.

As dementia patients often spend hours sitting or lying down, many times they nd themselves bored or anxious about the uncertainty of their environment or those around them. Studies have shown that dementia patients bene t from sensory interventions as an alternative to reduce their agitation.

“Sensory mats are designed to help reduce that agitation and to provide a sense of calm for people with dementia and those in the end stage of life,” says Patsy Wagner, head of the community service initiative with the PebbleCreek Quilters.

“They are often aggressive or frustrated because they can’t do a variety of basic things. Or they’re fearful. They’re fearful of what might happen to them or what the future will bring, or they’re just plain bored because their bodies don’t move like they used to move.”

The women assembled their fabrics and made nearly 40 dget blankets for Hospice of the Valley patients.

The quilts are adorned with a variety of items, including empty thread spools, zippers, ribbons, buttons, lace, fringe, Velcro and bells. Each item was added to help activate and stimulate the patients’ ability to feel, move and listen.

“Ours are pretty cool. We created mats that are 22 by 22 so they sit on a person’s lap, and they put out a whole variety of colors and textures and di erent types of fabric. The mat itself was designed to help with the senses,” Wagner says.

The quilters were tickled about receiving a thank-you card from Hospice of the Valley. The quilts were also a hit with other members of the PebbleCreek community.

“We put our nished mats in our display window just because they’re a new product, and several of our residents came up and said something like, ‘My mom needs one of these.’ Everybody was just very curious about them when they were in the window. A lot of people ended up knowing somebody that needs something like this. It was really a very popular item,” Wagner says.

This isn’t the rst time the PebbleCreek Quilters created for a cause.

“I think just about everybody in PebbleCreek feels that we’re very fortunate, and it’s really our responsibility as human beings to help out people who aren’t so fortunate. We feel that it’s our pleasure to help these people. And besides that, how many quilts can you use?” Wagner says with a laugh, joking she has run out of friends and family to gift quilts to.

For Wagner, she says a major reason she moved into PebbleCreek ve years ago was to join the quilting group.

While she admits to loving the access she has to machines like the long arm, it’s the relationships she has within the group of women that has made all the di erence.

“It’s the camaraderie. I mean, it’s just great to go up there to the Creative Arts Center, spend a couple of hours with other cultures and almost always learn something new,” Wagner says.

“It’s just amazing to sit and talk to people who have the same love that you have. It’s really wonderful.”

The PebbleCreek Quilters in Goodyear create sensory mats for those in need at Hospice of the Valley. (Submitted photo)

PebbleCreek Quilters

pebblecreekquilters.org

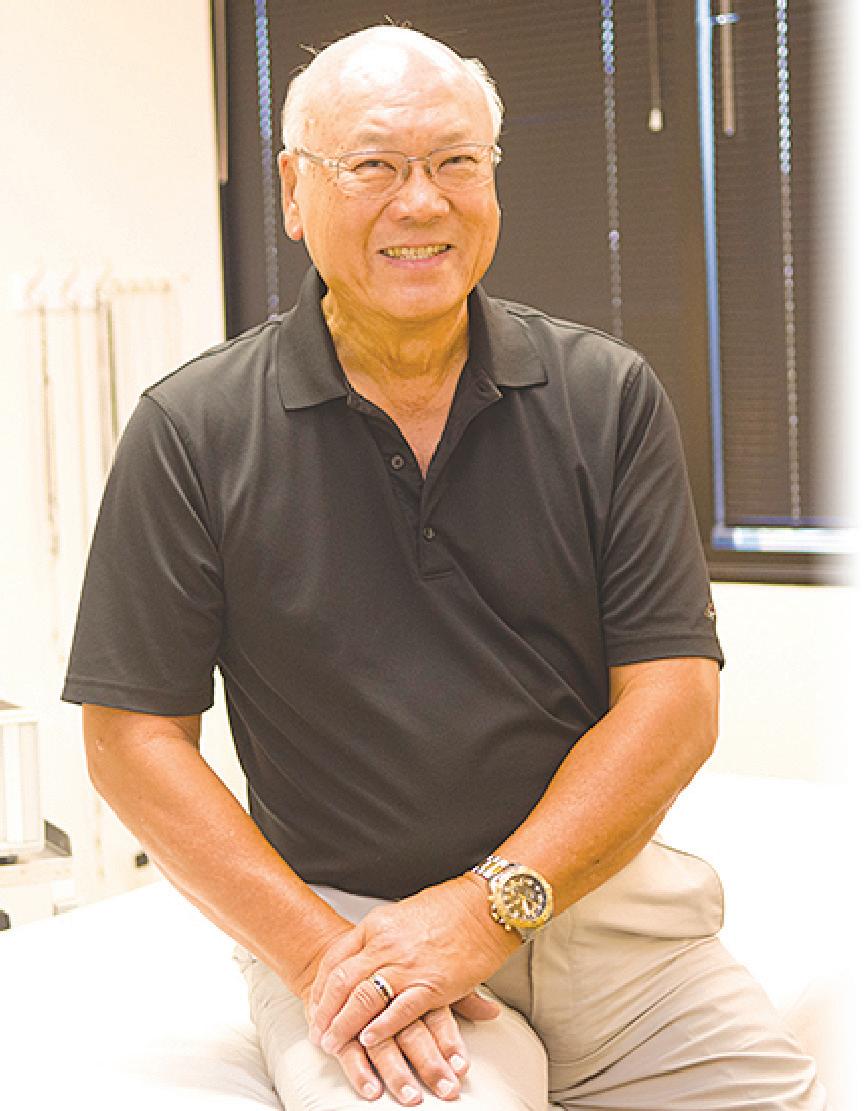

Hope...continued from page 8 tolerate any muscle relaxants or pain killers, he turned to alternative ways to manage his back pain and spasms.

Fast forward to 1972, and Oei was practicing family medicine. Within six months, he observed an increase in chronic pain su erers — and his interest was piqued.

Upon moving to Scottsdale in 1984, Oei was introduced to microcurrent electrical therapy and low-level cold laser, modalities that he would soon discover led to, when combined, “exponential results” in treating pain.

In 2007, Oei then formed Laser Health Technologies, a company that helped develop the LaserTouchOne, a rst-of-its-kind product that is clinically proven to be 93% e ective in reducing pain.

Considered a safe alternative to medication or surgery, the product has since been cleared by the FDA for prescription and for over-the-counter use.

“It’s safe and easy to use and available without a prescription. In addition, the LaserTouchOne is portable and personal — delivering drug-free, pain-free relief — and is as easy to hold and use as an electric toothbrush,” Oei said in 2010, at the time of the product’s FDA clearance for direct-to-consumer OTC distribution.

After opening the Eureka Pain Relief Clinic and o ering noninvasive and nonopioid treatments, Oei began training other therapists. In 2018, nally opened Hope Clinic.

“It was always a dream to be able to treat more people and, most importantly, share it with other therapists and (teach) other professionals how to do it, since this is not something that you would nd in mainstream medicine,” Oei explains.

Looking ahead, Oei hopes to not only expand Hope Clinic throughout Arizona — and worldwide — but also help others understand their pain, instead of, as he puts it, opting for a “Band-Aid therapy” that helps people feel better with temporary pain relief but doesn’t restore or heal the body.

“I want people to understand that this is not the instruments. It’s really what we do to help the body do the work. We have a phenomenal body,” Oei says.

“I tell patients, ‘Your miracle is your body, because it was designed to repair and heal.’”

Hope Clinic

15030 N. Hayden Road, Suite 120, Scottsdale 480-659-5470, hopecliniccare.com

PAID ADVERTISEMENT Better read this if you are 62 or older and still making mortgage payments.

More than 1 million seniors have taken advantage of this “retirement secret.”

It’s a well-known fact that for many older Americans, the home is their single biggest asset, often accounting for more than 45% of their total net worth. And with interest rates still near all-time lows while home values remain high, this combination creates the perfect dynamic for getting the most out of your built-up equity.

But, many aren’t taking advantage of this unprecedented period. According to new statistics from the mortgage industry, senior homeowners in the U.S. are now sitting on more than 8.05 trillion dollars* of unused home equity. Not only are people living longer than ever before, but there is also greater uncertainty in the economy. With home prices back up again, ignoring this “hidden wealth” may prove to be short sighted when looking for the best long-term outcome.

All things considered, it’s not surprising that more than a million homeowners have already used a government-insured Home Equity Conversion Mortgage (HECM) loan to turn their home equity into extra cash for retirement.

It’s a fact: no monthly mortgage payments are required with a governmentinsured HECM loan; however the borrowers are still responsible for paying for the maintenance of their home, property taxes, homeowner’s insurance and, if required, their HOA fees.

Today, HECM loans are simply an effective way for homeowners 62 and older to get the extra cash they need to enjoy retirement.

Although today’s HECM loans have been improved to provide even greater financial protection for homeowners, there are still many misconceptions.

For example, a lot of people mistakenly believe the home must be paid off in full in order to qualify for a HECM loan, which is not the case. In fact, one key advantage of a HECM is that the proceeds will first be used to pay off any existing liens on the property, which frees up cash flow, a huge blessing for seniors living on a fixed income. Unfortunately, many senior homeowners who might be better off with a HECM loan don’t even bother to get more information because of rumors they’ve heard.

In fact, a recent survey by American Advisors Group (AAG), the nation’s number one HECM lender, found that over 98% of their clients are satisfied with their loans. While these special loans are not for everyone, they can be a real lifesaver for senior homeowners - especially in times like these.

The cash from a HECM loan can be used for almost any purpose. Other common uses include making home improvements, paying off medical bills or helping other family members. Some people simply need the extra cash for everyday expenses while others are now using it as a safety net for financial emergencies.

If you’re a homeowner age 62 or older, you owe it to yourself to learn more so that you can make the best decision - for your financial future.

Request a FREE Info Kit & DVD Today! Call 800-791-4847 now.

We’re here and ready to help. Homeowners who are interested in learning more can request a FREE Reverse Mortgage Information Kit and DVD by calling toll-free at

800-791-4847

FREE

oved ones

Our new Reverse Mortgage information guides & DVD are now available featuring award-winning actor and paid AAG spokesman,

Tom Selleck.

U.S.A.’s #1 Reverse Mortgage Company

As Featured on:

ABC, CBS, CNN & Fox News

*https://finance.yahoo.com/news/senior-housing-wealth-exceeds-record-154300624.html

Reverse mortgage loan terms include occupying the home as your primary residence, maintaining the home, paying property taxes and homeowners insurance. Although these costs may be substantial, AAG does not establish an escrow account for these payments. However, a set-aside account can be set up for taxes and insurance, and in some cases may be required. Not all interest on a reverse mortgage is tax-deductible and to the extent that it is, such deduction is not available until the loan is partially or fully repaid. AAG charges an origination fee, mortgage insurance premium (where required by HUD), closing costs and servicing fees, rolled into the balance of the loan. AAG charges interest on the balance, which grows over time. When the last borrower or eligible nonborrowing spouse dies, sells the home, permanently moves out, or fails to comply with the loan terms, the loan becomes due and payable (and the property may become subject to foreclosure). When this happens, some or all of the equity in the property no

longer belongs to the borrowers, who may need to sell the home or otherwise repay the loan balance. V2020.12.22