ROCKETING START TO 2024 TMM 02 | 2024 | www.tmmonline.nz New mortgage adviser podcast! NEW TMM PODCAST SERIES IT'S TIME YOU HAD A GOOD HARD LOOK MY BIZ: ELISE VINE 28 25

your LINK to a better advice business! The Kiwi Owned and operated Aggregator providing you with the broadest choice in the NZ Market 0800 466 784 www.lfg.co.nz MORTGAGE INSURANCE KIWISAVER & INVESTMENT FIRE & GENERAL INSURANCE

OPERATE UNDER THE LINK FAP

As an Authorised Body under the Link FAP you will have access to our FAP resources, audits, file reviews & compliance support.

SUPPORT FOR YOUR OWN FAP

Aggregate through us using your own FAP licence with options to utilise our systems, processes and compliance support.

BRAND

Use your own brand or use ours. (Mortgage, Insurance & Invest Link)

A SIMPLE TRANSFER PROCESS

A simple online form & streamlined process for a hassle-free transition.

BUILT IN COMPLIANCE PROCESS

LFG Advisers have access to our market leading CRM, Advice Link, providing comprehensive mortgage & insurance workflow management, automated record keeping and much more.

COMPETITIVE PRICING OPTIONS

We have competitive pricing options to suit all adviser businesses.

ACCESS TO GROUP PI SCHEME

Quality wording and very competitive pricing options

BUILD A PASSIVE INCOME

Utilise our in-house Fire & General business (FG Link) and Kiwisaver & Investment business (Invest Link) to create a passive income through referrals.

SUCCESSION PLANNING OPTIONS

Talk to us if you are looking at selling your book or looking at options to join a larger group.

Sourcing non-bank finance for your prime clients? If the rates are double digits, there may be a better fit.

Keen to know more?

Contact the property lending specialists at Resimac.

Contents.

06 EDITORIAL

Good times ahead.

We’re well into 2024 and it’s started well for mortgage advisers. Sally Lindsay checks in with advisers in the north and south to find out how things are going and what they are focusing on.

10 NEWS

Advisers' account for growing number of bank mortgages; New home equity release product launched and new leader at Loan Market.

12 PEOPLE

Loan Market gets new leader; Financial Advice NZ competitor names its NZ boss; Avanti adds a BDM, Bizcap gets NZ country head and more.

14 PROPERTY NEWS

Sally Lindsay rounds up the latest property news.

18 REGULATION

How to get ready for the Financial Markets Authority’s Regulatory Returns.

30 SALES AND MARKETING

It’s a new financial year but instead of a normal audit, it's time for a marketing one.

16 HOUSING COMMENTARY

What’s happening in the housing market.

32 INSURANCE

Partners Life talks about its new Income Protection campaign.

05 www.tmmonline.nz

MY BUSINESS LEAD

FEATURES UP FRONT COLUMNS

FROM INTROVERT TO MORTGAGE WHIZ BETTER BUSINESS CONFERENCE BETTER BUSINESS PODCAST ROCKETING START TO 2024 FOR ADVISERS Pics from this year’s TMM Better Business Conference See what John Moody from Basecorp is thinking about this year.

28 26 25

First up thanks to all those who attended and supported the 5th annual TMM Better Business conference. We have had some great feedback and have already started work on next year’s event.

It’s always a pleasure to bring together mortgage advisers from different groups to enjoy a day totally focussed on your sector.

In keeping with our Better Business theme, and our goal to help you grow your business, we have launched the Better Business Podcast series. In this first episode we talk to Basecorp chief financial officer John Moody about the non-bank sector.

He provides a really good rundown on how it has fared over the past year and what the opportunities are for advisers at the moment.

You can read a synopsis of our discussion on page 25 of this issue.

Coming back to the TMM conference a key takeout was that the mortgage adviser space is in pretty good shape and continues to increase the market share with the banks.

(As an aside I am often asked where are the banks when it comes to conference and the magazine? It’s a question I can’t answer as they are all given opportunities to be involved and all say no. Often, they claim they have no money which you have to laugh at when you see the billions of dollars of profits they make each year).

There seems to be palpable relief that the property market is picking up, regulatory concerns are easing and Kiwis continue to seek out professional advice.

Plus we are a year into the new

financial advice regime and things seems far more settled than 18 months ago. The next challenge is filing Regulatory Returns with the Financial Markets Authority.

You can find out more about this, and some tips on page 18.

After the TMM Better Business Conference I attended the Financial Advice NZ conference. The chair, Heather Roy, made a strong pitch that Financial Advice NZ was the voice of advisers in New Zealand, but with the arrival of the Australian association FBAA is potentially a challenge.

FinAdvice’s new chief executive Nick Hakes will have this high up on his to-do list.

But at the end of the day, it is you, the mortgage advisers, who will decide which association to back and whether there is a need for an association at all.

It’s not a question I plan to volunteer and answer – at this stage - other than to say mortgage advisers need a strong voice.

Mortgage advice is going through lots of change, but the overall feeling is things are settling down and moving in the right direction and customers are benefiting from the work you do.

Keep it up!

Philip Macalister Publisher

TMM 02 | 2024 06 Head office & Advertising 1448A Hinemoa Street, Rotorua PO Box 2011, Rotorua P: 07 349 1920 E: philip@tmmonline.nz Publisher Philip Macalister Staff writers Sally Lindsay Contributors Paul Watkins, Kip Hanna, Jenny Ruth Design Michelle Veysey Subscriptions Jing Tao P: 07 349 1920 E: subscriptions@tarawera.co.nz ISSN 1176-2063 (Print) ISSN 2537-799X (Online) TMM is published by Tarawera Publishing Ltd (TPL). TPL also publishes online money management magazine Good Returns www. goodreturns.co.nz and ASSET magazine. All contents of TMM are copyright Tarawera Publishing Ltd. Any reproduction without prior written permission is strictly prohibited. TMM welcomes opinions from all readers on its editorial. If you would like to comment on articles, columns, or regularly appearing pieces in TMM, or on other issues, please send your comments to: editor@tmmonline. nz How to update your mailing address Make sure you don't miss an issue by changing your address. Go to: tarawera.co.nz/coa OFF TO A GOOD START

UP FRONT EDITORIAL

NZHL Group a Year On

BY KIP HANNA

Ayear ago, NZHL finalised the investment in LFG, forming the NZHL Group. The aim was to provide advisers and clients with the best possible options and leverage the collective strength of the group - regardless of whether the adviser is using a full support model or a nonbranded adviser-led model.

As a comprehensive adviser group, we cover the market and prioritise providing the right support for our clients - this is crucial as clients increasingly demand quicker responses and more personalised, bespoke, detailed advice from their advisers.

We're witnessing growth in the market despite the ongoing volatility in interest rates, which underscores the resilient and dynamic nature of our industry. We take pride in supporting everyday Kiwis with options as the market landscape evolves.

Integrating digital tools with human interaction is paramount - we believe in enhancing the adviser (and client) experience with technology which enables them to provide advice best for their clients or to support clients in making informed financial decisions.

For advisers, navigating regulatory changes remains a continuous process. The ongoing consolidation in the adviser market reflects a trend where many seek the stability and security offered by experienced, large groups. Having strong shareholder support and access to innovative technology is key to keeping up to date.

The evolution of the adviser market will continue, with a select few as dominant players. At NZHL Group, we are fortunate to have a supportive shareholder who aligns with our ambitious growth plans. We are willing, ready, and able to adapt to the market, leveraging our capability, strength, and scale.

2024 marks a year of growth. We are harnessing the opportunity to grow all parts of NZHL Group,

BY POOLING OUR RESOURCES, WE HAVE ENHANCED EFFICIENCIES ACROSS COMPLIANCE, FINANCE, BACK-OFFICE OPERATIONS, TRAINING AND DEVELOPMENT, HUMAN RESOURCES, AND MARKETING.

with the strategic rationale behind the group largely driven by revenue opportunities.

Each segment of NZHL Group offers a distinct proposition:

• NZHL provides a high-touch, client-centric experience offering personalised advisory services across home loans and insurance, alongside coaching and DebtNav—a unique proprietary online debt management tool. NZHL advisers benefit from support of a CRM (Advicelink) tailored to their needs.

• LFG offers a range of branded and non-branded solutions to support advisers with their business across home loans and insurance.

• Advicelink is an adviser platform and CRM, with a focus on industry compliance and due diligence. It provides advisers with a comprehensive, easy-tonavigate platform for all stages of the advisory process.

• Fire General Link specialises in providing commercial and personal fire and general insurance solutions bespoke to clients' needs.

A year on, the benefits are clear. By pooling our resources, we have enhanced efficiencies across compliance, finance, back-office operations, training and development, human resources, and marketing.

Alignment is crucial for a group to realise its full potential—this includes shared goals and strategy, as well as unified branding and marketing approach.

LFG has increased compliance support, faster turnaround times, and expanded revenue opportunities. Likewise, for NZHL, the group has fostered stronger relationships with suppliers, given access to a sought-after technology platform, and enabled us to offer more options to our clients— increasing revenue opportunities for the business and our advisers alike.

If you're an adviser in need of support or technology to develop and grow your business – there are options to suit your needs and goals. Reach out; the time is now - 2024 is a year of growth.

ABOUT NZHL

NZHL Group is a Kiwi-owned, respected, and trusted brand - a purpose-driven (financial freedom, faster) home loan and insurance network that offers a solution to support advisers and help put Kiwis in a better financial position.

Part of Kiwi Group Capital Ltd (KGC) which is 100% Government owned, NZHL Group operates with an Independent Board and local business owners nationwide. ✚

Kip Hanna is the CEO at NZHL and has written this opinion piece based on his experience. This article is intended to be general in nature and should not replace

07 www.tmmonline.nz

Why won't ASB tell us how much it writes with advisers?

ASB Bank is the only one of the four majors that refuses to disclose any information about how much business it does with mortgage advisers but even it admits advisers were unhappy with its pricing through much of last year.

“Mortgage brokers – the feedback we're getting from brokers is that they love the ASB service.”

But they also want fast turn-around times and “very competitive” pricing, and that hasn't changed, “that's a feature of the broker market,” chief executive Vittoria Shortt said in February when ASB released its financial results.

“Over the last six months, they would've liked us to be more competitive on pricing.”

The impact on ASB's mortgage book of its refusal to meet the market on price was stark.

ASB's half-yearly disclosure statement showed its on-balance-sheet mortgage book shrank by $518 million between June 30 and December 31 last

year after growing by $674 million in the previous six months.

More recently, ASB has been much more “in the pack” with its mortgage pricing – it's one-year rate of 7.24% in mid-March matched that of ANZ, BNZ, Co-operative Bank, SBS and TSB with the only local bank undercutting it being Heartland Bank's online only offer of 6.69%.

Kiwibank's one-year rate was a single point higher at 7.25% while Westpac's was 7.29%.

And talking of Kiwibank, it more than took up the slack from ASB's effective absence from the market.

Although Kiwibank's market share of the mortgage market is just 7.4%, it wrote nearly a quarter of all bank mortgages in the six months ended December

Chief executive Steve Jurkovich attributed the brisk business to both Kiwibank's competitive pricing and its developing relationship with brokers.

And, at a time when the housing market remained subdued, much of Kiwibank's business was refinancing rather than customers making new purchases.

Kiwibank didn't start dealing with advisers until late 2020 but said in

New home equity release product

Mortgage advisers are about to get a new, and

innovative home equity release option.

Lifetime Retirement Income is about to launch a home equity release product which is based on an equity model, rather that is debt funded one like that offered by Heartland Bank.

Lifetime Home is based on the French model where the company buys a slice of equity and then pays the homeowner a fortnightly payment.

Lifetime founder and managing director, Ralph Stewart, says

the payments will be made on a Tuesday each fortnight, just like NZ Superannuation payments.

Lifetime launched the product at TMM’s Better Business conference. Stewart says the model fits with the company’s vision of providing products which give customers regular income in retirement.

Stewart says there will be 1.2 million in retirement in

Lifetime says its average client currently has around $250,000 invested with the company. After forecasting mortality rates this average client would be able to get $500 every fortnight from the scheme until age 95.

February last year that adviser were accounting for about 65% of new mortgage lending.

It then had 133 accredited advisers, another 40 going through training programmes and another 100 in its pipeline.

Now, the bank says it has about 800 accredited advisers and attributes much of its outsized growth to them.

“We’re increasingly seeing customers using mortgage advisers to assist with their home buying journey. This is in part a response to market uncertainty driven by high interest rates and regulatory changes,” such as the Credit Contracts and Consumer Finance Act.

The other three major banks continue to increase their dependence on advisers for new business with ANZ reporting that 60% of its new lending in the year ended September 30 was originated by advisers while BNZ, which is still playing catchup after years of refusing to deal with advisers, reporting they accounted for 48.1% of new business in the same year.

Westpac is somewhere in between but it only reports the percentage of its total book that advisers account for –51.9% at September 30.

“Our goal is take their capital and stretch it across their life.”

While Lifetime will have an equity stake in the house things like rates and maintainence will be the responsibility of the home owner.

He says Lifetime Home will pay advisers a referral fee of $1250 for each deal.

TMM 02 | 2024 08 UP FRONT NEWS

Learn more about Lifetime Home online at tmmonline.nz/video

RALPH STEWART

Loan Market gets new leader

Loan Market has appointed Nicole Ferguson as its new national director to drive support and growth for Loan Market businesses and advisers.

Loan Market executive chairman Sam White said Ferguson will lead the Loan Market New Zealand business.

"Her extensive expertise growing businesses, along with her solid understanding of how advisers harness tech to save hours writing deals while staying safe, will help us achieve our mission of becoming the most trusted and liked consumer brand in finance.”

Ferguson is recognised within Loan Market for her leadership and deep understanding of technology, innovation, and process improvement, the company says in a statement.

"Her commitment to delivering the six promises Loan Market makes to

its advisers — save you time, keep you safe, diversify your revenue, help you find and keep clients, grow your business and drive Loan Market as the number one consumer finance brand in finance - is at the core of her new

role."

Her focus will be on harnessing MyCRM, with the rollout of more timesaving features to set new standards of excellence for advisers and their clients. She will also drive the introduction of transformative business growth services, including Kaizen Workshops, Business Builders, and Profit Pulse coaching.

She has a proven track record of addressing adviser challenges and driving growth, notably during her tenure as State Director for Loan Market Victoria and Tasmania.

Ferguson said, "I'm thrilled to join the New Zealand community and bring all my learnings of what businesses and advisers have told me they need to help their business ambitions. I’m keen to make sure our technology and business platform, MyCRM, not only meets but exceeds our advisers’ expectations and be a hands-on, responsive leader to support the Loan Market businesses”.

Advisers pan ComCom bank report

Mortgage advisers have responded scathingly to accusations by the Commerce Commission that they are at risk of being “unduly influenced” by the commissions the banks pay them for placing mortgages.

One adviser said that ComCom chairman John Small's comments were yet another example of those at the legislative and compliance level having “absolutely no idea of reality.”

A number of TMM readers objected to Small continuing to talk about mortgage brokers because legislation now deems them to be financial advisers and they are required to have passed Level 5 of the New Zealand Certificate in Financial Services before they can operate.

Small should be made to “go on a friggin' Level 5 advice course so he knows what he's talking about next time someone from the media gives him a call," one said.

Small told journalists that while he didn't think "brokers" are ignoring customers' needs, he is concerned about inadequate disclosure of the conflicts of interest they face.

“We know that any given broker will work through an aggregator platform and will have access to some banks but not all banks. I'm not sure if you went to a mortgage broker that they would tell you that,” Small said.

“From the broker's point of view, they will get different amounts of money from different banks. I'm not sure when you go to a mortgage broker that they would declare that to you,” he said.

The ComCom is recommending that the Financial Markets Authority should monitor this sort of disclosure more closely and that it should issue guidelines for brokers.

A number of advisers said legislation already mandates that they disclose commissions and the banks they can work with but that there is very little difference between lenders in how much commission they pay.

“The banks we can work with are

disclosed in our disclosure statement,” one said. “The fees we receive from each bank are clearly stated in our disclosure statement which is provided at the beginning of the advice process.”

Another said the majority of mortgage advisers ``operate with integrity and are focused on the needs of their customers first.”

A number of advisers were less than complimentary about Small: “Someone small is trying to act big,” said one, while another said Small had been caught napping, “nay caught sleeping,” and had revealed his ignorance of how advisers operate.

A number also took issue with ComCom's call for Kiwibank to be provided with more capital so that it could act as a “maverick” disruptor of the major banks.

Small, as a government employee, was “biased” towards the governmentowned bank, said one adviser while another said the fact that Kiwibank needs more capital showed “the government's experiment owning a bank hasn't worked.”

09 www.tmmonline.nz

✚

NICOLE FERGUSON

Unpacking bank mortgage lending

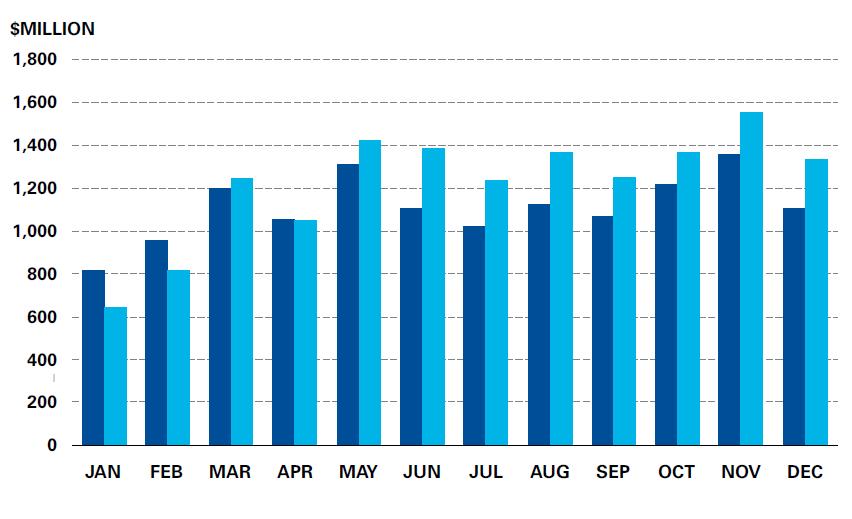

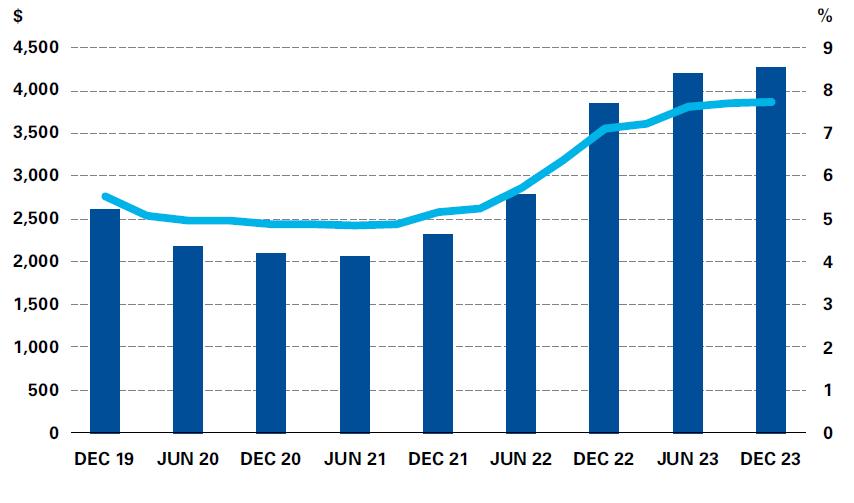

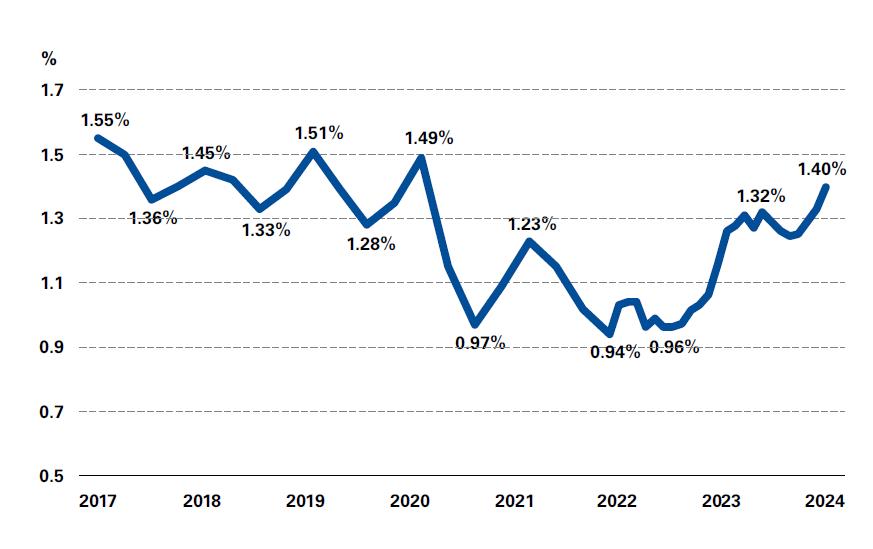

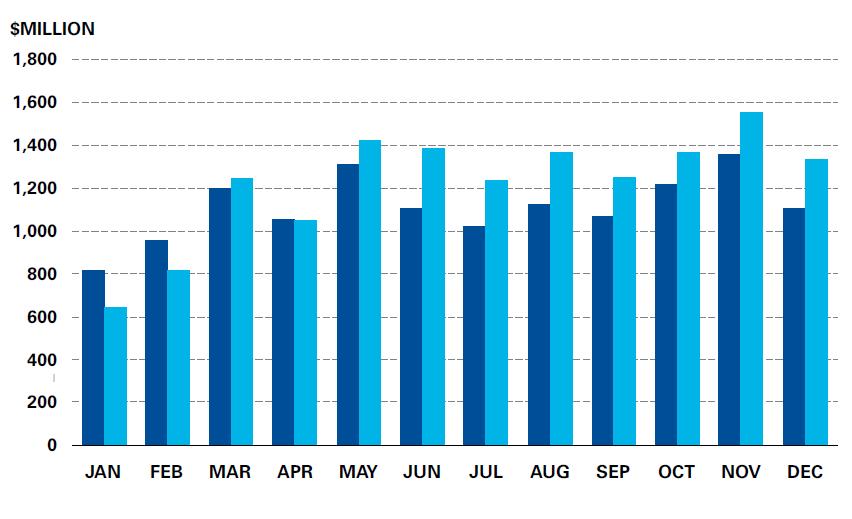

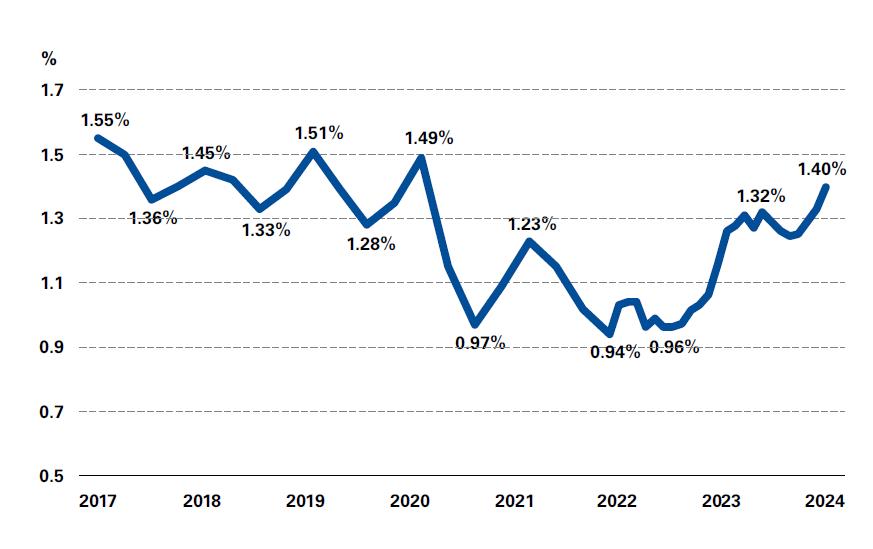

KPMG has released its latest FIPS report examines in detail how banks performed in 2023. We have, with permission, selected the following graphs which give mortgage advisers an insight into where lending is growing and which banks are increasing their market share.

TMM 02 | 2024 010 UP FRONT NEWS

Lending to investors picked up in the second half of last year and, during this period, was slightly higher than 2022.

Property investors have embraced interest only lending as interest rates increased and tax rules were tightened.

First home buyers share of lending has grown over the year and was well ahead of 2022.

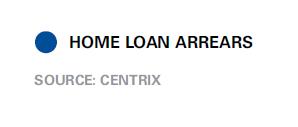

Arrears have increased after hitting lows in 2021-22, but are now sitting closer to historic levels.

011 www.tmmonline.nz bruce@fico co.nz finn@fico co.nz scott@fico co.nz | | | www fico co.nz 035489932 10 Nile Street, Nelson 7010 We understand that deals can change: we're flexible, responsive and we work with advisers to get deals over the line Up to 65% LVR with the ability to lend against supporting second mortgage security. Fico Finance is here to help you find funding fast. Pricing from 11.95% p.a. +2% fee

People on the move

FAMNZ v FANZ; New association appoints old hand

An Australian mortgage adviser association has set up shop in New Zealand with a name very similar to FANZ and its new country head is an ex-FANZ staffer.

The newly formed Finance and Mortgage Advisers Association of New Zealand (FAMNZ) has appointed Leigh Hodgetts as its country manager.

Hodgetts worked as Professional Development, Standards and Policy Manager at Financial Advice NZ (FANZ) two years ago and has also held roles at Astute, ANZ, BNZ

Mortgage adviser takes out financial literacy award

Prominent social media poster William Tieu won Financial Advice NZ's financial literacy award at its recent conference.

Tieu saw a gap in financial literacy and the need for tailored guidance. This was particularly critical during

Bizcap appoints NZ general manager

Australian small business lender Bizcap has appointed its first New Zealand general manager.

and Kiwi Adviser Network. She also spent time with the Financial Markets Authority as manager, retail operations.

FAMNZ is the New Zealand arm of the Finance Brokers Association of Australia. FBAA managing director Peter White said the appointment of Hodgetts was “testimony to the positive way FAMNZ is being viewed across the nation and also highlights the standard we want to set within the sector.”

lockdowns and Tieu used online media channels to develop a voice to continue to inform people about financial options.

This was very important during a time of uncertainty, and it grew financial literacy in New Zealand while giving people peace of mind through considering multiple options in their

Camilla Tumai is the new general manager for New Zealand.

Tumai brings a wealth of handson experience, having worked as an adviser, business owner and leader within the finance sector.

She was Head of Partnerships and Adviser Engagement at AdviceFirst’s retail and group insurance channels, the founder and general manager at IKONIK, a KiwiSaver and insurance

“We are here to represent mortgage advisers better than ever before by expanding the market share for advisers, increasing professionalism and lifting standards,” he said.

Hodgett said she will immediately be providing members with access to high quality professional development and educational initiatives.

“Advisers have never received the education, support and benefits that FAMNZ will provide, because we are a committed association by advisers for advisers.”

She said the association has already started engagement with regulators and has commenced discussions around clawbacks and other issues that are important to advisers.

“I will be talking to advisers, aggregators and other industry professionals to hear their concerns and to do whatever it takes to lift the market share for advisers,” she said.

unique situations.

This audience has grown and today Tieu has 92,000 TikTok followers and hundreds of Instagram followers with ages from 16 years to over 50 years.

Tieu spoke at last month's TMM Better Business conference and gave delegates an insight into what he does, how it started along with tips about making your own videos.

In his previous career, as a Civil Engineer, Tieu built pipelines, and bridges and solved mathematical problems. “This is very similar to financial advisers. Both professions aim to assist our clients in solving the problems they face and to guide them through the process.”

specialist, and presently serves as a board member at Quality Product Research (Quotemonster).

Added to those role she was also the inaugural recipient of the Financial Advice New Zealand Excellence in Advice award, in recognition of her “thought leadership, service excellence, innovation and services to the advice profession”.

TMM 02 | 2024 012

LEIGH HODGETTS

WILLIAM

TIEU

Got a new appointment you would like to tell advisers about? Email details and a pic to editor@tarawera.co.nz UP FRONT PEOPLE

Advice Link gets new head

NZHL Group has appointed a head of distribution and product development for Advice Link as it eyes further expansion.

After 16 years with Link Financial Group (LFG) Kelly Brough has transitioned within the group to head of distribution and product development at Advice Link.

Brough's journey with LFG started at Mortgage Link before moving to her

New BDM for Avanti Finance

Avanti has appointed a new property business development manager for Auckland, Bay of Plenty and Waikato regions.

Richard Speir brings more than 40 years’ experience across a range of functions, including banking, treasury and marketing, and has extensive leadership experience.

Ring the Belle

Annabelle (Belle) Lewis is the latest winner of the Astute new member of the year award.

Her journey from a masters degree in international relations and diplomacy to becoming a successful mortgage adviser showcases her adaptability and commitment to making a positive impact in people’s lives.

In the face of the challenges posed by the Covid-19 pandemic, Lewis strategically pivoted her career aspirations towards financial advising. Her dedication and hard work have paid off, not only with prestigious accolades but also in the meaningful relationships she builds with her clients.

Her approach to her work extends

pivotal national sales manager role at LFG, culminating in this significant move.

NZHL became a major shareholder and investor in Advice Link NZ in 2023, recognising the New Zealand financial services market needed a locally owned high-quality CRM.

NZHL Group’s ambition for Advice Link to become the leading New Zealand financial services CRM is underpinned by the establishment of this new role, NZHL Group chief executive Kip Hanna says.

"We`re extremely fortunate to tap into Kelly`s extensive experience and knowledge of the Advice Link system and our network and market needs. This uniquely positions Kelly to drive

Avanti general manager Property, Ian Boyce, says; “Richard’s experience and the results he’s achieved over the

beyond mere transactions; she sees herself as a guide and support system for her clients through the often stressful process of securing a mortgage. Her genuine desire to help people achieve their dreams has led to numerous success stories, such as assisting a first-time homebuyer in securing their dream home just before Christmas.

forward the growth and success of Advice Link as we gear up to launch to the broader New Zealand financial services market while ensuring ongoing prioritisation of delivery and development improvements to our current users at LFG and NZHL," Hanna says.

years are just what we were looking for. With Richard on board, the team will go from strength to strength, helping our introducers continue to grow their businesses and get more New Zealanders into homes they can call their own.”

“This is an exciting time to be joining the team at Avanti Finance,” Speir says. “The success they’ve had to date and the direction they're heading definitely attracted me to the role. I’m looking forward to getting out on the road, meeting all the advisers in my region and supporting them in their work to help our customers achieve their financial goals.”

As part of the Mortgage Express team for the past two years, Lewis has thrived in an environment that fosters collaboration and growth. Establishing her own business, Annabelle Financial Solutions Limited, has been a significant milestone in her career, enabling her to expand her services and pursue her vision for sustainable growth.

Looking ahead, Belle aims to further expand her business and continue making a positive impact in her clients’ lives. ✚

013 www.tmmonline.nz

RICHARD SPEIR

ANNABELLE LEWIS

KELLY BROUGH

Time to regulate property managers: REINZ

The Real Estate Institute (REINZ) pushing strongly for property managers to be regulated.

It told Parliament’s Social Services and Community Committee that it is imperative property managers should be regulated.

Its submission was made amidst growing concerns over the need for better standards and accountability within the property management sector.

Nearly one in three households rent, with half of those properties managed by a professional property manager.

REINZ chief executive Jen Baird said “with the housing market facing unprecedented challenges and concerns about rental properties' standards and management practices, regulatory measures have become imperative.”

In its verbal submission, REINZ stressed the importance of striking a balance between regulatory oversight and operational flexibility for property managers.

Baird says the Residential Tenancies Act is complex, and there are no minimum standards for staff training, which has resulted in underinvestment in this area.

“There is a lack of formal checks on what happens to client funds,

and instances of bond fraud are too common. Some residential property management businesses do not separate general business expenses from client funds, which makes it difficult to protect client funds.

“Apart from the disputes tribunal, there is no other formal avenue for landlords to raise their concerns about property managers' failures to perform with reasonable skill and care.

“There is also a variance in the quality of services that property managers offer,” Baird says.

“Without some form of regulatory intervention, it is unlikely that many of these issues will be self-correcting.”

Detractors of the Residential Property Managers Bill say increased regulation will lead to higher fees for property management services.

REINZ says reputable property managers already have a number of the requirements (insurance and a trust account) in place so additional costs will be small. These costs are unlikely to add material costs at a per-property level and it does not expect there to be wholesale rent increases due to the regulation.

“People may choose to manage properties themselves, but it doesn’t seem a rational argument to suggest this will occur because of the added cost of this regulation,” Baird says.

“Managing a property requires an understanding of many different pieces of legislation, requires good people skills, and you need to be available to your tenant if there are issues. This is also a competitive market, and fee level is already a competitive space for residential property managers.

She says without the Bill, the property management industry will continue to manage billions in assets and rent without regulations, leading to potential harm for property owners and tenants.

This includes inadequate protection for bond and rental money, renting non-compliant spaces, increased dispute resolution costs, negative impact on tenant wellbeing, and insecure tenure affecting children's academic performance and health.

Reinstatement of tax-deductibility not a tax cut: NZPIF

New Zealand Property Investors Federation (NZPIF)

Horsburgh says reinstatement of interest deductibility for landlords is not a tax cut.

From April 1 property investors will be able to claim 80% of mortgage interest payments.

He says this brings investors back in line with every other business in

the country, where interest costs are a legitimate deductible expense.

“In the existing economic climate, renting has emerged as a more costeffective alternative to property ownership and reinstatement of interest deductibility is of crucial significance to the rental sector.

“The policy is fair. It is not a 'tax cut' for property investors; rather, it ensures that property investors contribute their fair share of taxes on profits. It will also have positive implications renters, as it mitigates the upward pressure on rental

prices.

A more balanced and sustainable rental market will result, he says.

"By helping to alleviate the financial strain on property owners, a more conducive environment is created for affordable housing and stability for tenants."

The federation says it views these developments as a pivotal step to encourage greater participation and investment in the rental sector, leading to improved housing availability and affordability for tenants.

UP FRONT PROPERTY NEWS

executive committee member Tim

TMM 05 | 2023 014

JEN BAIRD

Delicate balance for borrowers

KPMG’s latest financial institutions performance survey found the economic situation is delicately balanced with many borrowers feeling significant pressure.

KPMG banking partner John Kensington says people are feeling worn out due to the constant uncertainty and range of challenges they have faced all packed into a relatively short timeframe.

“In addition to these challenging times and the resulting pressure, these accumulated events have led people to become more outspoken about the things they do not like.

“What we have is an economy that has seen a significant amount of upheaval and change and yet it is still faced with a significant amount of uncertainty. Most people feel the indicators show we must be near the top of the inflation

and interest rate curves, but we cannot be sure.

“There is now a slow sinking realisation that we might be in this for a longer haul.”

While most people have managed to date, Kensington says there is now a real question as to how much longer can they deal with the level of inflation, heightened interest rates and the impact this has on residual income.

“To date the economy has handled all of these challenges, but there will need to be some relief in the near future. The biggest questions are how far away is it until we see some relief and what form will it come in and will it come in time?”

Kensington says New Zealanders have shown themselves to be particularly resilient in finding ways to deal with increased costs.

However, the first signs of financial stress are starting to show up in some of the more recent economic figures around past dues and impairments and there is a real risk that more mortgages

could hit trouble over the next year.

He says the one shining light that has provided a shock absorber for these challenging impacts has been the level of employment, which has remained strong.

KMPG’s survey shows an increase in banks’ provisioning levels as protection against future loan problems. Although interest rates have risen over the past 18 months and inflation is proving hard to get under control, many mortgage borrowers had been able to get ahead on their mortgaes while interest rates were low.

That buffer might be running out in some cases and there is no relief from high interest rates on the horizon, with the RBNZ predicting it will not come until next year.

For those in employment that has a steady income that might not be a worry as it gives them more opportunity to negotiate with their bank, but for people who lose their employment it will be difficult, Kensington says. ✚

015 www.tmmonline.nz

individual finances Chat to our property lending team 0800 33 33 20 | avantifinance.co.nz/property individual people Life happens. Circumstances change. Unique to each of us. That’s why at Avanti Finance we take a personal approach to financing, and it can make all the di erence in finding your clients a solution that fits their needs, whether they’re a first home buyer, investor or small business. Lending criteria, fees, terms and conditions apply

LOGJAM OF HOUSES FOR SALE

BY SALLY LINDSAY

New listings of houses for sale are flooding the property market while buyers are thin on the ground

Listings at Auckland’s biggest agency, Barfoot & Thompson, have hit an 11year peak, rising from 1,221 in January to 5,382 at the end of February.

This comes at the same time the major banks are dropping interest rates, although not to any great degree, but keeping them competitive.

Not since 2013 has the city had so many residential properties available for sale, Peter Thompson, Barfoot & Thompson managing director says.

Last year, the number of new monthly listings averaged only 1,325 and have nearly doubled to 2,255 during February this year.

However, new owners are not thick on the ground. Thompson says there more homes for sale than there are active buyers. The agency sold just 633 homes in February. However, that is up 54% on February last year when the market was in the doldrums.

Barfoot and Thompson had 2,255 new listings in February, the highest number in any month of the year since November 2021, which was the peak of the housing boom.

"This build-up of homes started in August and in the past six months has reached the point where buyers have

rarely had such a depth of choice.”

Thompson says this is due to a combination of a high number of new homes reaching the market, owner-occupiers moving forward with relocation plans as the market reemerges from the downward cycle and the normal hesitancy of buyers trying to get their timing right in terms of price and mortgage rate.

Spread out

The new listings boom is right across the country.

Property website realestate.co.nz had 11,788 new listings in February, a 44.8% increase compared to last year and the highest number received since 2017.

That pushed the total number of residential properties available for sale on the website to 31,424 at the end of February, up 8.1% on February last year, when listings hit an all-time low since records began in 2007.

That means the amount of stock on the market at the end of February was the highest it has been in any month of the year since June 2015.

It was also the only time since November 2015 that the total number of residential properties for sale has been above 30,000.

New listings were up across all 19 regions, with the most significant increases in Northland, up 94.6%; Coromandel, up 85.3%; Wellington,

up 76.6%; Hawke’s Bay, up 75.4%; and, Auckland, up 64%.

Realestate.co.nz spokeswoman Vanessa Williams says as the country navigates ongoing economic challenges, it is refreshing to see the property market looking more stable.

“With no change to the OCR and gentle easing of interest rates by some of the larger retail banks, it will be interesting to see how these factors play out for the property market in the coming months.”

Buyers’ hesitant

Economist Tony Alexander says his latest real estate agents survey shows buyers’ hesitancy is for several reasons.

First, the impact of weak growth in our economy appears to be affecting people’s feelings of job security.

A year ago 10% of agents said buyers were worried about their jobs and incomes. That has risen to 23% - the highest reading since September 2020.

That means continued weakness in household spending and hesitancy about taking on a mortgage.

Alexander says it also means the Reserve Bank will begin to feel more confident about the pace of wages growth slowing down. That in turn reinforces the chances of monetary policy easing in the second half of this year and not, as the Reserve Bank predicts, the middle of 2025.

TMM 02 | 2024 016

UP FRONT HOUSING COMMENTARY

across the survey’s history.

Of those thinking it’s a good/bad time to buy, expectations that another upcycle is underway could be behind the good outweighing the bad this quarter, Kim Lundy, an ASB senior economist says.

“Following a decent house price downturn there could be some ‘bargains’ to be snatched up before prices rise too far.”

Hamilton, Tauranga, and Christchurch having marginal 0.1% rises, while Dunedin and Auckland ticked up by 0.2%. Wellington saw a stronger 0.6% rise, but that was after a below-average result in January.

CoreLogic chief property economist, Kelvin Davidson says the recent sets of muted house price figures show that this isn't a straight-line market recovery.

Another factor is renewed worries about interest rates. A year ago 84% of agents said buyers were worried about interest rates. That level of concern tracked lower to reach just 43% a month ago, which was the lowest such reading since September 2021. But now 61% of agents say those interest rate worries are back, even though banks have been making small cuts to their fixed mortgage rates.

The third factor in play he says is well over a year ago he wrote the housing market’s recovery would be assisted by the activation of a queue of buyers, which has been building since late 2021. That queue got activated in the first half of last year at the same time a queue of frustrated sellers was also been activated. “This sellers queue appears more motivated to make a sale than the queue of buyers. We are back into a buyer’s market again.”

Neither a good nor bad time

Buyers are firmly on the fence as to whether now is a good time to being buying a house.

ASB’s latest Housing Confidence Survey taken over three months to the end of January shows recent patterns persisting, with survey respondents largely split on whether it’s a good time to buy a house.

Interestingly, 51% of the respondents think it’s neither a good nor bad time to buy. This is a pattern ASB has seen

However, ASB doesn’t expect sentiment around buying to get too positive while debt servicing costs remain elevated. And even accounting for the recent correction in house prices, policy changes, affordability of the upfront purchase price remains a constraint for many households. There are also conflicting signals for prospective buyers with high debt servicing costs and possible debt-toincome restrictions.

Continued price increases expected

Meanwhile most Kiwis are expecting a rise in house prices, the ASB survey shows.

A net 51% of survey respondents are confident house prices will keep rising, the highest reading since October, just before the most recent housing market drop.

ASB says many Kiwis believe the market slump is done and dusted.

Aucklanders are the most confident the tide has turned, with a net 56% respondents expecting higher house prices ahead.

The last time net house price expectations were at this level, annual house price growth was running at almost 30%. During January this year, annual growth was a more muted 2.2%.

Lundy says while the bank thinks house prices are likely to continue rising, it is not forecasting the type of froth seen in the last upswing.

Not a lot of froth

It’s a sentiment also running through CoreLogic’s latest House Price Index.

Although house prices were up 0.3% in February, rising for the fifth consecutive month, the pace of gains is down from November's 0.4% rise and December's 1% increase.

The average property value across the country now stands at $930,495, up 2.8% from September's trough, but still 10.8% below the recent peak.

Most of the main centres were relatively subdued in February, with

"Given that mortgage rates remain high and property sales volumes through January remained at near record lows, buyers and sellers are still taking their time and this is flowing through to more subdued value growth," he says.

"For first home buyers, there are still significant challenges in saving a deposit and satisfying loan serviceability criteria. Investors are also facing challenges from high mortgage rates too, while even existing owner-occupiers looking to move up the ladder still need to assess their finances closely.”

The dream has ended for many

Meanwhile as it becomes increasingly difficult for New Zealanders to get on the property ladder, new research commissioned by Kiwi Property reveals that Kiwis’ attitudes to how and where we live are changing, and many, particularly the younger generation, no longer believe home ownership represents the ‘Kiwi dream’.

Renting is on the rise with more than half of Aucklanders over the age of 15 living in rental accommodation.

According to the survey, fewer 18 to 29-year-olds (59%) consider owning a home as the Kiwi dream, in contrast to those aged 30+ (70%). Additionally, the majority of the 1,000 people surveyed aged 18 plus, who hadn’t yet bought a house, reported feeling that residential prices and the cost of living were major obstacles to them doing so.

A lack of quality properties (51%), security of tenure (51%), and inconsistent or unexpected rent increases (48%) are the top three barriers renters face in New Zealand, and impact their willingness to rent, the research shows.

A remarkable 85% of survey respondents said they would prefer to rent if common downsides to renting were removed, such as quarterly inspections, having to move out on short notice, strict rules on customising the property and restrictions on owning pets. ✚

017 www.tmmonline.nz

GETTING READY FOR REGULATORY RETURNS

BY SALLY LINDSAY

Although FMA chief executive Samantha Barrass recently described the licensing of financial advisers one of the “most successful transitions” she has seen in her career, they still have yearly hurdles to clear.

All FAP licensees have to start completing annual regulatory returns – the first being for the year ending 30 June to be submitted to the FMA by 30 September.

While it may seem many months away, the return has a series of questions to give the FMA an up-todate understanding of the nature, size and complexity of the financial advice provider service, including mortgage advisers, many of whom Barrass described as being relatively new to the licensed regulatory tent.

Licensed advisers need to provide information in their regulatory returns on topics as wide ranging as replacement business, cyber security threats, skills or training level of an

adviser, and the types of financial advice products provided. The number of complaints as of 1 July 2023 will also need to be provided.

The reporting requirements are tailored to the three different classes of licences, reflecting the different business models within the financial advice sector.

The regulatory return questions can be found on the FMA website under Finance Professionals and include five key parts: business and infrastructure; licensed activities; complaints; outsourcing; and business continuity and tech systems.

After considering industry feedback, the FMA says it has proceeded with a balanced reporting option that includes fewer questions than proposed, as well as refinements to some questions.

Some of the proposed questions have been withdrawn as they are better suited for future one-off requests or thematic reviews.

‘...if FAPs fail to file a return they will be failing the third standard condition of holding a FAP licence and that could result in the removal of their licence.’

Relevant

FAPs only need to answer questions relevant to their licence class and the financial services they provide. The FMA says it is committed to an approach that does not treat regulation as a “one size-fits-all” compliance exercise.

However, if FAPs fail to file a return they will be failing the third standard condition of holding a FAP licence and that could result in the removal of their licence.

The FMA says good record keeping is at the heart of the regulatory returns. If that hasn’t been done advisers will not be able to give an honest assessment of their systems and ability to produce good governance reports, Ryan Edwards, The Adviser Platform managing director says.

“Advisers who have gone through the process of getting a license need to demonstrate that they’re following the policies and processes they’ve put in place and good record keeping and governance means they will have the data at hand to answer the regulatory questions.”

He says some advisers might be struggling to provide a view of all the work they have put in.

“While the financial services industry found itself in turbulent times with the introduction of FAP licensing, the real challenge is running a business and documenting the

TMM 02 | 2024 018

UP FRONT REGULATION

hard work done in advising clients to the satisfaction of the regulators,” Edwards says.

“FAPs need to be running a compliant business with good governance and oversight before they can provide best service to clients and demonstrate that in regulatory returns."

He says this doesn’t mean a random file review every now and then. It’s about having an in-depth understanding of the business, being across all the details, being able to demonstrate and attest to the fact that the FAP is operating in line with documented policies and processes.

“For example, is the business meeting all its objectives, or does it need to proactively invest in services to help with areas that are not a strong suit –such as admin or record keeping?”

The Financial Services Council (FSC) has a number of resources to help advisers, including slides on the issues and challenges FAPs new face, documenting business policies, advice process, documents and compliance, business continuity and cyber security, compliance framework and compliance assurance programme.

Duties and obligations

The FMA says whether a FAP is doing record keeping internally or outsourcing, records must be created in a timely manner and be maintained adequately in relation to financial advice.

This helps a FAP demonstrate it is complying with its duties and obligations. Poor record keeping has consistently been identified by the FMA as an area of concern.

In the absence of records, FAPs may have to rely on advisers’ memories of any actions and conversations with clients when providing evidence to show compliance with their obligations.

This will not meet the FMA’s requirements. It expects FAPs to understand the purpose of record keeping, and that their records can demonstrate they are meeting their duties and obligations.

Processes, systems and controls for keeping records should be appropriate for the organisation and need not be overly complex, the FMA says.

For example, recording financial advice given to clients could be supported by a list of steps setting out the information that must be captured at the different stages of the advice process by persons giving advice on a FAP’s behalf. It could also take the form of a digital tool that helps guide the advice process and requires relevant records to be submitted before progressing to the next stage of the interaction, the FMA says.

Monitoring

The information provided in the regulatory returns will set the focus for the FMA’s risk-based monitoring, which it says is necessary to effectively

5 TIPS FOR GETTING THEM DONE PROPERLY

Read the details and guidance if you have any questions.

Plan ahead, make sure you have the proper data points in place now.

Review your complaints ahead of time, make sure your complaints register is adequate and you can easily extract the data points required.

Make sure you read the questions and the answer set fully.

Don't sweat it, most smaller FAP's should be able to answer these pretty easily. If you are not confident call Compliance Refinery and we will give you a hand!

supervise full FAP licence holders.

The FMA have also started to undertake monitoring visits at adviser offices, where it assesses areas such as business records, client files, processes, and other documentation to check that a FAP is meeting its license obligations.

It says it is helpful if adviser businesses have a constructive, open and honest approach; make staff available during the monitoring or onsite visit to answer questions about the business, financial advice service and files; timely access to client files and other documents relevant to financial advice services; and, taking a proactive approach to talking about any issues the FMA should be aware of. ✚

019 www.tmmonline.nz

2024SEPTEMBER 2024SEPTEMBER

Rocketing start to 2024 for advisers

Some advisers have just logged their biggest month ever, and confidence is high. Will the upward trends continue? And what’s the best way to expand an advice business in the current climate?

BY SALLY LINDSAY

It’s been a rocketing start to the year for many mortgage advisers. Many mortgage-advice businesses had a shaky 2023, with high compliance costs, increasing overheads on comparatively low commissions, and mortgage-only advisers not being able to deduct GST expenses, making it difficult to turn a dollar.

The beginning of this year has been completely different for many, starting with enquiries, particularly from firsthome buyers, turning into live deals much more quickly – even compared to when interest rates were notably lower this time last year.

Biggest month ever

Whangarei-based Key Mortgages director and mortgage adviser Jeremy Andrews says February was the company’s biggest month ever.

He says increasing lending figures this year should go some way to making up for an abysmal 2023.

He says although house prices have dropped about 18% over the past two years, inflation has reduced the effective value of mortgage dollars even further, which seems to be spurring on a little FOMO (fear of missing out) - even amongst investors, who are

popping up more often.

“Despite the OCR being held at 5.5% last month, the FOOP (fear of over paying) seems to have gone.”

Due to the surge in those interested in buying, Andrews says his business is seeing banks’ mortgage-application turnaround times stretching to the point where they are holding off again on 80% LVR pre-approvals to new clients.

Kris Pedersen of Auckland-based Kris Pedersen Mortgages, which deals mainly with property investors, says the start to the year has been busy.

“Last year, investors wanted to make sure there was going to be a change of government - and interest rates had peaked. Now there’s been a change: there’s far more investor confidence in the market and many more looking to buy.”

While there has been more activity in the market, adviceHQ director and mortgage adviser David Green says the urgency to do deals is not quite there yet.

“We are hearing a lot of agents are run off their feet doing appraisals, more properties are coming to the market and buyers are circling, but the actual number of deals coming through doesn’t show a lot of urgency

from buyers.”

Squirrel Mortgages chief executive David Cunningham says a gradual recovery in property-market activity this year will help mortgage advisers.

“There will be a fall in interest rates during the course of this year, and that will stimulate some interest in buying activity. We're bumping along at sort of 40-year lows in house buying, similar to levels in 1990 and post the global financial crisis (GFC).

“The recovery will be gradual and there'll be a modest increase in house prices. Those two things are supportive of a turning market and better than a housing-market boom.”

Constant change still ahead

Green says mortgage advisers have been through the wringer in the past couple of years in terms of regulatory and licensing changes. Many are looking forward to just being able to focus on client outcomes.

“Change is constant, but advisers are feeling like there's been a lot of change for the sake of change rather than an outcomes focus.

“While we will always be aware of our compliance obligations, we want to focus more on clients,” he says.

Changes this year should improve

TMM 02 | 2024 020

FEATURE LEAD

‘Despite the OCR being held at 5.5%, the FOOP - fear of over paying - seems to have gone’ Jeremy Andrews

advisers’ businesses. Regulatory changes – most for the better – will be introduced from next month, surging immigration will mean more demand for houses and rentals, and banking reforms will make it easier for clients.

Investors will be able to claim 60% of their mortgage-interest payments as a tax deduction in the 2023/2024 tax year; the Brightline test will be pulled back to two years from July; the prescriptive affordability requirements for lower risk lending will be removed from the Credit Contracts and Consumer Finance Act (CCCFA); house prices are up quarter-on-quarter in 90% of suburbs nationwide, although sales have nosedived; immigration surged to a record 126,000 people flooding into the country in December… and the country’s four main banks will introduce open banking in May.

Pedersen says the changes are essential: many potential buyers are still struggling to get through banks’ affordability criteria because interest rates are high, and consequently the test-rates banks use are even higher.

Fly in the ointment

There is one fly in the ointment, though.

If interest rates fall, the Reserve

Bank’s debt-to-income restrictions, expected to be introduced in the middle of year, will take over and become the affordability measure, rather than the existing problem of the banks’ test rates.

Pedersen says there is more mortgage-related pain and stress coming through, although he had expected more last year. He says mortgage holders are definitely feeling the pinch from higher interest rates.

“There are people under pressure with their mortgages, which is what the Reserve Bank always wanted by ratcheting the OCR up, but on the flipside there are investors in a good position and ready to look at buying opportunities.”

The supply of stock could become an issue again, Andrews predicts.

“Investors who have not sold could be hanging on for property values to increase or waiting for the Brightline test to fall from 10 to two years. The Brightline and tax-deductibility rules will no longer favour new builds, which won’t encourage new supply as much either.

“Throw in DTIs and comparatively eye-watering weekly mortgage repayments, compared to a few years ago, and it will be more of an

issue of who can get approval to buy those properties.”

Certainty on interest rates is a key issue for advisers this year, according to David Green. Clarity around the interest deductibility and Brightline tax rules for investment properties is also needed, he says.

“How those issues play out will dictate activity in the property and finance markets.”

How to expand

Despite the vagaries of running a mortgage-advice business, Jeremy Andrews says there are many options for expanding.

“New advisers can join either a big group or brand to leverage off scale - or a smaller advice firm for more tailored mentoring.”

He says businesses can scale up using strategies and structures ranging from that of a typical law-firm hierarchy to where there’s a primary adviser name with several support staff, either locally or remotely.

“A business can focus on growth and competing for the highest newlending volumes, or looking after and maintaining a smaller loyal client base.

“It’s certainly one of the most rewarding and at the same time high-

021 www.tmmonline.nz

pressure businesses.

Andrews says he is finding it tough to attract the right person with a great attitude to expand his own business.

“Maintaining the best reputation is key.”

Pedersen is also interviewing for more staff for the business he can see he is missing.

“We have been so busy and there are definitely more deals to be done.”

To expand income, he says some advice firms will push into areas they may not normally operate in – for example, a first-time adviser beginning to specialise, or several one-man companies banding together to share costs and resources.

“The process of putting a mortgage application together, and gathering the documentation required, is a lot more comprehensive than it was a few years ago. Regulations have made mortgage applications a lot more complicated than they need to be.

“A lot of the process takes quite a bit longer and an increasing number of advisers are going to need their own loan writers. The industry might see several mortgage advisers join forces and employ a loan writer between them.”

Green says looking at more service lines is one way a business can grow, but warns it can add more red tape and regulation.

“It makes the economics more challenging.”

He says there are always opportunities to expand through mergers and acquisitions, and some of the bigger advisory players have done just that.

“A number of those deals happened last year.”

Squirrel Mortgages has been expanding by growing its adviser force for a decade.

“It sort of ebbs and flows,” says Cunningham. “That is our strategy.

“We have exited all insurance business and have a relationship with a third party who sits in our office.

“We got out for two reasons – one is a single-minded focus on the advisory business and mortgages, and secondly there’s a lot more compliance and regulatory risk in the insurance space, so we are leaving it to specialists.”

Education top of mind

Education is top of mind when new advisers are hired, although Pedersen thinks it has gone too far.

“Compliance and regulation have gone massively overboard, and I personally don’t think it has enhanced the client experience that much,” he says, adding that compliance needs to be streamlined.

“Is all this needed, or has it just been put in for the sake of red tape and regulation? It takes a huge amount of time to basically stay on top of everything, and keeps advisers away from doing business.”

Andrews says more consistency between education providers, and also better access for those who can’t make in-person meetings, should be an easy improvement to make, while Green, who has been in favour of mortgage advice becoming a profession, says the industry needs to take a close look at other professions to see what is required: degrees, professional qualifications, professional associations and the like.

The expectation should be for advisers to maintain and develop their skill and capability, Cunningham says: it should be just part of the landscape to do 20-40 hours a year of continuing professional development.

Squirrel has been active in this area.

“The only difference is we now capture it in an online training register, so it has more visibility.

“For the industry, what's now required is a lot more training,” he

says.

For some firms, that will mean doing what they've always been doing. Others will have to focus on finding opportunities.

“At Squirrel, we get a lot of speakers come along and we arrange sessions consistently throughout the year. You've got to go and hunt those things out. For example, a small firm should be able to cover professional development off by sending advisers to bank economics presentations or product-training sessions and things like that.”

AI helping mortgage advisers

One new aspect that is helping mortgage advisers to some extent is artificial intelligence (AI).

adviceHQ is using AI not necessarily to write content but to edit it. Green says there are efficiencies to be found in using the new technology.

He says there have been a number of banks overseas that have tried online mortgage propositions, and they’ve all come up against the same complexities: differences between freehold and leasehold, apartments and rural, for example.

“Every person buying a property is different and every property is different.

“Perhaps AI can play a part in the more straightforward vanilla deals, but that is such a small percentage of what we see as mortgage advisers.

“Independent advice from a mortgage adviser will never be overtaken by AI. We will always have a place, as buying a property is not the same as buying a book from Amazon,” Green says.

“It is mainly a six or seven figure purchase that means a years’ long decision for most buyers.”

‘The recovery will be gradual and there'll be a modest increase in house prices. Those two things are supportive of a turning market and better than a housing-market boom’

TMM 02 | 2024 022 FEATURE LEAD

DAVID CUNNINGHAM

Cunningham says it can require a significant investment and capability, although there are free models that can be used.

For instance, as part of reviewing a risk policy, he asked an AI programme to write a policy - and it provided an “excellent solution.”

Cunningham knew it was up to scratch because he had a good understanding of risk from having worked at banks.

“Using AI is a great opportunity

to leverage efficiency. It doesn’t replace a human in terms of customer interaction, but it does create efficiency for the adviser in that it can make highquality, detailed notes of meetings.

“An adviser can paste it into the client’s file and meet the compliance requirements as well. It’s brilliant.”

AI power for everyday tasks

Simple AI tools for everyday tasks are actually the most powerful. They can profoundly change an adviser’s life,

‘Independent advice from a mortgage adviser will never be overtaken by AI. We will always have a place, as buying a property is not the same as buying a book from Amazon’

David Green

says Cunningham says.

However, at the complex end of the market, an adviser will always be needed. While automated tools for mortgages have been around for a while, that’s not really the zone for most advisory firms, he says.

He wouldn’t discount an empathetic AI engine one day doing what an adviser does, but it is a way off yet.

“The experience an adviser brings to the market is worth a lot. That’s why clients come to them.” ✚

023 www.tmmonline.nz

M AK E I T S I M PL E , FAS T W E’L L TA K E A D I FFICU LT DE A L AN D ST RA IG H T F OR W A R D N O N- B AN K MO RT G A G E L EN D IN G 07 839 2999 | info@basecorp.co.nz www.basecorp.co.nz Get in touch now for simple, smar t residential mor tgage solutions. At Basecorp, our brokers know us for our dependability with straightforward and We offer: • Competitive, fair rates • Most approvals within two days of loan application • Strong industry knowledge, experience and relationships developed from over 25 years in the business

TMM 02 | 2024 024 FEATURE LEAD Add another string to your bow. Clients with consumer or business finance needs? Partner with better finance™️ We can help clients who* We help advisers by Taking care of the detail: A simple introduction from you, and our team of 20+ financial advisers take it from there. Keeping you informed: The better finance™ Adviser Portal delivers real-time access to track loan progress, check settlements, commissions and more. Offering strong commercial terms: Give the Or contact Stefan Vujcich 021 221 2983 | 0800 666 061 stefan@better.co.nz | www.better.co.nz/advisers FIND OUT MORE | SCAN TO BOOK A CALL OVER $800 MILLION FINANCED OVER 50,000 CUSTOMERS CLASS 2 FINANCIAL ADVICE PROVIDER NZ OWNED AND OPERATED Approval subject to lending criteria, fees and T&Cs apply. › Need to purchase new wheels, fund a project, consolidate debt and more. › Want to restructure vehicle or consumer lending for home lending purposes.

Are looking for finance to purchase business assets - vehicles, machinery etc › And more…

›

Basecorp and the opportunities for advisers

The latest addition to TMM Online is a monthly podcast for mortgage advisers.

Podcasts are popular with advisers and are a great way to hear directly from lenders, advisers and other key players in the lending sector.

In our first TMM Better Business podcast we talk to Basecorp chief financial officer John Moody.

Moody says last year was a tough year for non-bank lenders due to rapidly rising interest rates. As the bulk of the lending done by non-banks is on floating rates these increases hit borrowers quickly and hard.

While it was tough, Moody says the market is cyclical and when rates come down – as they are slowly starting to do it will be good for non-banks.

In recent years some non-banks tried to push into the prime and near prime markets and take on banks.

Changes to the CCCFA made by the previous government were a tailwind for non-banks.

“It was good for industry and the profile of non-banks,” he says.

However, once they got more comfortable with the regulatory changes they “crowded” non-banks out of prime and near prime.

While Moody notes some of his peers have pulled back from the prime market, Basecorp has always had prime

and continues to offer it an option for advisers.

Moody expects other non-banks to return those categories again as interest rates fall.

The biggest opportunity for advisers in the non-bank space at the moment is short term lending, Moody says.

He notes there has been an increase in activity, with property traders returning along with an increase, in what he calls, needs-based lending such as property development and asset finance.

Basecorp currently has around $200 million to lend at the moment is and looking for deals. ✚

The Podcast can be found on tmmonline. nz and is available on your favourite streaming platforms including Spotify, Google Podcasts, Apple, Iheartradio and SoundCloud.

If you are a lender and would like to appear on TMM’s Better Business Podcast please email philip@tmmonline.nz

025 www.tmmonline.nz

FEATURE BETTER BUSINESS PODCAST

A new podcast series for mortgage advisers. Listen online at tmmonline.nz/podcast

JOHN MOODY

TMM 02 | 2024 026 FEATURE BETTER BUSINESS CONFERENCE PICS TMM BETTER BUSINESS CONFERENCE 2024 2024 20 FEBRUARY Hyundai Marine Sports Centre, Tamaki Drive Auckland Speakers: Tony Alexander Beau Bertoli Independent Economist Prospa CoreLogic Nick Goodall Amanda Stevens Get your ticket NOW. Thank you to our sponsors tmmonline.nz/better-business The one day conference is 100% dedicated to mortgage advice - none of this investment and life insurance stuff. The programme this year features popular economist Tony Alexander and Nick Goodall from Core Logic. Plus we are bringing in an awesome marketing speaker from Australia who you can’t afford to miss.

CoreLogic chief economist Nick Goodall provides a housing market update.

Loanoptions

Amazing keynote speaker Amanda Stevens with TMM MD Philip Macalister (R) and Mortgage Link adviser Karen Renwick (L).

AI brings its product to market.

Father and daughter duo Mike and Kirsten Wong.

Long-term conference supporters Avanti Finance.

Prospa co-founder Beau Bertalli talks about lessons he has learnt in building a business.

Post-conference

Not

SME lender Bizcap raises its profile with New Zealand mortgage advisers.

networking.

a bad spot, huh?

Prospa NZ MD Adrienne Begbie and Finsure NZ country manager Jenny Campbell.

The team from Platinum sponsor Resimac.

The ever-popular economist Tony Alexander opened the conference.

027 www.tmmonline.nz You are protected by responsible lending laws. Because of these protections, the recommendations given to you about home loans are not regulated financial advice. This means that duties and requirements imposed on people who give financial advice do not apply to these recommendations. This includes a duty to comply with a code of conduct and a requirement to be licensed. All applications are subject to Pepper’s credit assessment and loan eligibility criteria and lending limits. Terms, conditions, fees and charges apply. Information provided is factual information only and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser. © Pepper New Zealand Limited NZBN 9429031065153 | NZ Company Number 3416551. Give it the non-bank lender test. Bank said no to your clients’ home loan? Talk to us. 0800 945 658 adviser.peppermoney.co.nz

From introvert to mortgage whiz

Mortgage adviser and Building on Basic’s founder Elise Vine’s favourite thing about the industry is getting a “yes” when others have said “no”. Vine talks to TMM about launching her company in February 2019 to offer a lead adviser service, providing clients with lending, personal risk and investment advice, as well as helping them work with various other specialists.

BY SALLY LINDSAY

What is the biggest issue facing the mortgage

The phasing in of the new licensing system has taken a lot of attention over the past two and-a-half years and with the Credit Contracts and Consumer Finance Act (CCCFA) restrictions, it has taken a lot of energy supporting our clients to get deals across the line. I find that I am doing more work supporting new clients that are coming to me under financial stress, helping them to buy time or hold onto their properties. Stressed clients are vulnerable and this requires more patience and care, and making sure we don’t put them under more pressure as we gather all the required information to support them.

Another issue has been moving from a purely commission basis to charging fees for a service clients are used to having marketed to them as a “free service”. However, with a new licensing system in place, interest rates on

TMM 02 | 2024 028

UP FRONT MY BUSINESS

the way down and the prospect of some rules being relaxed or reversed by the new Government, I’d say the outlook is much rosier than in recent times. The continuing cost of compliance is a challenge, especially for small mortgage advice companies.

What are the main issues facing borrowers?

Both current and prospective borrowers are feeling the impact of high-interest rates. The conservative CCCFA limits for stress-testing lending are also challenging for many, as they find a shortfall between what they need and what they can borrow. For business owners and the self-employed proof of income, making sure they have their financials and IRD up to date can be difficult.

What do you enjoy about the business?

I love working with my clients. For me, it’s about helping them get what they want and then ensuring they are set to get the debt repaid as soon as possible, protecting them on the way through. I also get a lot of enjoyment from providing financial education as part of the service. I believe that the mortgage advice industry has an obligation to empower its clients with financial knowledge shared in an accessible and digestible way.

What prompted you to become a mortgage adviser?

I was a property and wealth coach for 20 years, during which time I worked with several mortgage advisers who could get people a loan but didn’t understand how to structure loans for risk management. I saw an opportunity to give clients a service that ensures their loan is structured to manage risk and to suit their situation and goals best.

What were you doing before that?

Before becoming a mortgage adviser, I spent three years fixing up an earthquake-damaged property. I had purchased an “as is where is” home and was renovating it to make it structurally sound and weathertight. Before that, I provided wealth coaching and helped people build property investment portfolios.

‘I believe that the mortgage advice industry has an obligation to empower its clients with financial knowledge shared in an accessible and digestible way.’

What sort of training did you undertake?

As soon as I decided to become a mortgage adviser, I began my Level 5 Financial Services training. I have all three strands – residential lending, life and health, and investments.

Who did you first work for?

I initially started with Gareth Veale from GV Mortgage and Insurance and then went out on my own, as I wanted to pursue a different approach to Gareth. My business is about clients knowing that achieving financial security is not a set-and-forget activity. Once they have set their financial goals, a plan needs to be created, monitored and managed to ensure they achieve the financial security they desire, whether that is owning their own home or being able to retire with a great income.

What area do you target?

Christchurch and Lyttelton, where I live, are my primary areas. I am originally from Wellington so I have several clients there and a sprinkling around New Zealand and Australia. My main client base is in Christchurch. I also have a special group of clients in Invercargill who are refugees and migrants from Colombia.

Was it difficult to get established?

As I was new to the area then, I had a limited network in Christchurch. I joined a number of networking groups to start building my business locally. I also reached out to the networks I built from my previous businesses. As an introvert, the biggest struggle was putting myself out there while I was still learning the ropes.

What type of clients, i.e., first home buyers, movers or businesses, do you mainly deal with?