L E X I N G T O N ' S L O W E S T

R E S C R I P T I O N P R I C E S *

•8 locations on and off campus, plus a Specialty Pharmacy.

• Free mail delivery on most prescriptions.

• Durable medical equipment, including CPAPS, BiPAPS and accessories.

•One-stop testing and treatment for flu, Strep, COVID & UTIs* .

• Vaccinations, including for flu, COVID and shingles, and shots needed for international travel.

*Visit our website to learn more.

Got question about our locations or services?

Scan this QR code to request a call from our Lexington-based call center.

Ready to transfer your prescriptions to us?

Just scan this QR code and fill out the form. We’ll do the rest.

CREATE CHANGE WITH A DOLLAR A DAY.

The idea is simple. You give $365—a dollar a day—to make our community better. Your donation is pooled with other BGCF365 members to make a powerful grantmaking engine. You’ll meet quarterly to network and learn about community issues. Then, once a year, you decide together which local nonprofit organizations will receive $30,000 in grants!

Since 2017, BGCF365 has awarded $150,000 to Lexington nonprofits and is accepting new members year round! Our next event is in May, and you won’t want to miss it. Join BGCF365 today! Learn more and sign up at bgcf.org/BGCF365.

172 Photos: Out + About

174 Photos: Toyota Bluegrass Stakes Day

176 Photos: Keeneland Spring Meet

178 Photos: Baptist Health Grand Opening

180 Photos: Christies of the BG Anniversary

182 Photos: Lexington Forum Breakfast

184 Photos: Coach Pope Introduction

186 Photos: Lexington Children's Museum

188 TOP in Winchester: Mrs. Roper Romp!

465 East High St., Ste. 201 Lexington, KY 40507

(859) 543-8677

topsinlex.com/subscribe

“May is the month of expectation, the month of wishes, the month of hope.” This perfectly befitting quote by Emily Bronte says it all, as we celebrate graduates, moms, and brides during this glorious time of year. As we search for the perfect gift for our favorite people, we need look no further than right here in beautiful Lexington, KY. These inspired gift ideas speak from the heart, and a little personalization goes a long way. Enjoy!

For the Perfect Monogram:

Pillows, Luxury Bath Towels, Linens, + Robes (Available at Saddle Stitches on Clay Avenue)

Exclusive Lexington Weezie Towel Retailer!

When You Want to Splurge a Little:

Sterling Silver Bujukan Link Chain Bracelet (Available at Rivard Fine Jewelry)

For the Luxury Loungewear Ladies:

Silks, Gowns, + Travel Accessories (Available at Syers Browning)

For the Bride-to-Be Keepsake:

Just Married Ornament (Available at Queen Bee)

Don’t Forget the Fellas for Graduation:

Race Day Needlepoint Belt by Smathers + Branson (Available at Logan’s of Lexington)

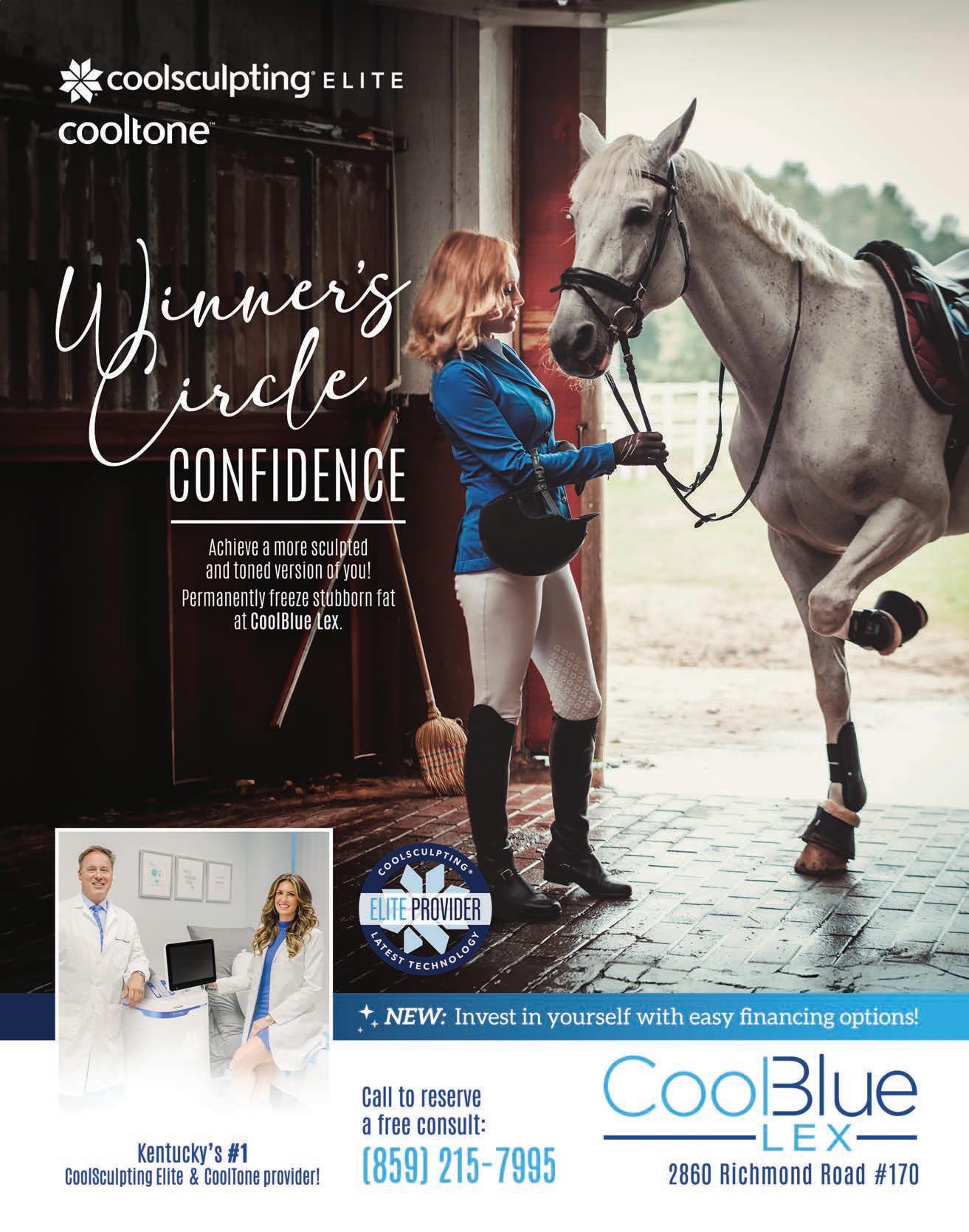

Do you ever struggle to justify spending money on yourself?

Sug ed ad :

Studies show that most people can easily part with small sums of cash to “treat” themselves. But it can be harder to justify bigger expenditures for ourselves, regardless of whether the expense is something we simply want or something we genuinely need. Feelings of guilt arise, along with the ugly little voice in the back of our heads that tells us we’re being selfish.

A common tactic in therapy is to put your best friend in your shoes, so to speak. Imagine if your friend was debating on whether or not they should spend money on themselves: wouldn’t you tell them to go for it? Wouldn’t you assure them that they’re not being selfish at all, that they deserve it?

If you truly need something, be it a medical procedure or reliable transportation, spending money isn’t a matter of selfishness or greed; it’s a necessity. Paying for a necessity actually benefits everyone around you. You know how airlines advise you to put on your own oxygen mask before helping others? It’s the same with your everyday needs; if you aren’t taken care of, you can’t take care of anyone else.

Investing in your work life can be rewarding on many levels. The costs of professional development, memberships to networking groups or going back to school can pay off in the long run. More than that, they help broaden your horizons and enrich you as a person. That’s worth the price of admission!

Many people struggle to save money because they feel like that money should be put toward more immediate concerns. While paying down debt and meeting your needs is important, saving for the future is absolutely essential. Consider it paying your future self. Moreover, you should have a small emergency savings set aside in case everything in your life goes sideways. “What if” is an uncomfortable question, but it’s worth asking: “What if the worst happens?” You deserve to have the security that an emergency fund could provide.

One area many people struggle to spend money on? Their appearance. It’s hard to justify these expenses as anything but self-serving. But... what’s so bad about that? Confidence spreads throughout all areas of your life. Consider it an investment in your power!

Experiences are priceless – even if your favorite airline seems all too eager to put a price on your fun. While you shouldn’t go into debt to have fun, you should set aside money and PTO to ensure that you are able to enjoy your one incredible life!

Studies show that intentional acts of indulgence have a positive effect on our mental health and overall well-being. While everything must be done in moderation, having an occasional “treat yourself” moment can provide an immediate mood boost and combat long-term stress. Whether it’s a massage or that designer bag you’ve been eyeing, you deserve to gift yourself that joy. •

Each month, we’re featuring the products, events and local hot spots that local familiar faces are excited about. From their signature fragrance to what they consider the absolute best drink in town, find out what Local Tastemakers are LOVING this month...

What is your#1 can’t-miss event in Central Kentucky each year?

The Nutcracker at the Lexington Opera House

What’s the most beautiful place in the region? I can only pick one!?!? OK . . . Keeneland

What’s your favorite local store or boutique?

Savané Silver

What’s always in your bag/pocket?

An ultrasound picture of my soon-to-be-here grandson... and business cards!

What is your signature fragrance?

Chanel No. 5

What are three products that are on your wishlist right now?

New deck furniture for my new deck! Baby crib for my new grandbaby! Shoes... always shoes!

FRIDAY FUN: LexArts HOP presented by VisitLex!

If you know the basics of handling your finances, much of the generic money advice you find online may seem silly or juvenile. You've heard the advice—and made up your own mind—about making coffee at home and skipping drinks at social events.

Ready for some money tips that feel a little more advanced? While we'd never claim to have it all figured out, we can share the advice we've gotten that felt like an "AHA!" moment.

by Amanda Harper

Making time to think about your finances sounds about as much fun as scheduling a root canal. But just as you keep track of doctor's appointments and vehicle maintenance, you must keep track of financial to-do list items. Some money maintenance tasks, such as quarterly taxes, are regular and have fixed due dates. But much of minding your money is up to you to remember to tackle. Rather than leaving it up to chance, why not make calendar reminders for yourself?

Here are some items that you may want to set aside a date to consider or handle. If you're not sure which are necessary for you, ask your trusted financial expert!

• Pull your free annual credit report

• Schedule a meeting with your financial advisor(s)

• Make your maximum retirement contribution

• Review your financial goals with your family

• Assess and plan for quarterly/yearly taxes

• Review insurance policies

• Review your FSA/HSA

• Finalize charitable contributions for the year

I think it's a fair bet that we all aim to save more money and grow our wealth. But it's hard to stick to goals—or celebrate your successes—if you don't have a clear picture of what winning looks like.

Skip nebulous, poorly defined goals. Instead, set specific goalposts with real numbers and timelines. We suggest sticking to smaller, more manageable objectives with shorter timelines. This allows you to see your success in real time and feel confident that it is possible! When you hit your target, set the next one and keep that forward momentum.

Impulse shopping is a reality of our lives—it's unavoidable. So, rather than feeling guilt and dread, we encourage you to create a few rules or mantras that can help you navigate these impulses just a little more mindfully. That way, you can be sure that the things you buy will be used and loved, with no regrets!

For many shoppers, it's helpful to have a list of "nobuy" categories of products that they simply don't need. Personally, I don't need to add a single short dress, pair of pants or sweater to my already overstuffed closet.

Studies consistently show that sales drive impulse spending and buyer's remorse more than anything else.

Before adding that "bargain" to your cart, ask yourself whether you would love it just as much if it weren't on sale. Very often, these are items we wouldn't have looked at twice if they weren't under that "50% OFF" sign. Buy what you love, not what's on sale.

There are tons of experts waiting to help you navigate financial matters. Obviously, having a wealth management, financial planner or investment advisor in your corner is the best way to ensure you're making the right money moves. Suppose you don't already have a financial expert you meet with regularly. In that case, many offer one-time financial "checkup" appointments to answer your questions, set up a preliminary game plan and make you feel more confident.

But you may not know that you likely have some experts in your corner already. Your bank or credit union may offer free financial guidance. (If you're shopping around for a bank, consider whether they provide this when deciding on the future home for your money.) Your workplace retirement plan likely includes free help from the vendor that manages the plan. If you have an online brokerage tool, it likely includes resources to educate you on investing. And it goes without saying that the internet offers a wealth of information – just be sure it's a reliable, expert, trustworthy source.

It's good advice to negotiate your salary at regular intervals and when interviewing for a new role. But have you considered negotiating other aspects of your work "perks" and compensation? Vacation time, reimbursements, commissions, job titles, special projects, retirement benefits matching, remote work days, professional development, severance and more may all be negotiable. There are many potential ways you can increase what you get from your career.

So much of the discourse around credit cards is negative. And it's true, they can be your worst enemy. But in today's world, a credit card can actually be a financial safeguard as well as a benefit to your credit – so long as you pay the balance off in full every month and try to stay below 30% of your card's spending limit.

We've all had the dreaded fraudulent activity alert on our debit cards. It's stressful and scary when your account has potentially been compromised. Your whole life goes on hold until the situation is resolved.

However, this moment is still somewhat stressful with a credit card, but you're not immediately cut off from your money. Credit cards also offer a level of consumer protection that debit cards don't always provide. Especially if you shop online, a credit card places a wall between thieves and your money. While it doesn't mean you'll never get another fraudulent activity alert, it does mean that you'll still be able to make purchases –and your checking account won't be drained. That kind of peace of mind isn't exactly priceless, but it is nice.

This sounds counter-intuitive; after all, the first piece of financial advice you got was probably "save more money." Having some money in your savings account is absolutely essential. But having too much money just sitting there means you may be missing out on opportunities for that money to grow.

For the risk-averse saver, one tactic may be to move "overflow" savings into a high-yield savings account. This means the money will accrue more interest. The drawbacks of these accounts is that there are often limits to the number of withdrawals and it can lack the perks of a traditional savings account. It's also just not the most efficient way to grow your wealth; a target date fund may be more effective for you.

When it comes to your money, it's essential to know that you're getting the best possible service for the best price. From car insurance to wealth management, it's worth occasionally shopping around. While it's very important to bear in mind the trust and warm relationship you have with your current vendors, Just remember: cheaper does not always mean better. If a new vendor offers a much, much better deal, be skeptical and ask lots of questions.

Warren Buffet famously said, "The biggest thing about making money is time. You don't have to be particularly smart; you just have to be patient."

In times of financial uncertainty, it can be tempting to make drastic moves. If you're feeling uncertain, meet with your financial team to have a conversation. But if they advise caution and patience, take their advice –and a deep breath. It's going to be fine!

“Fearless” Investing: How to pick a financial advisor as a female investor.

Move over, pop queens and quarterbacks. The real power couple is you and your financial advisor, working together to build women’s wealth across generations. We sat down with Beth Prewitt and Caroline French of Bank of the Bluegrass & Trust Co. to learn how.

Q: “You need to calm down.” How do you stay centered amid fi nancial chaos and reactive decision making?

Caroline (C): Female clients have traditionally been underserved—women generally could not take out loans without a male co-signer until 1974, and the wealth management field has shown an increasing demand for female leadership.

Beth (B): You have to ignore the stock market day-trader mindset because getting caught up in the latest fads and instant gratification is a losing game for most people, and it can lead to a lot of anxiety. Having a financial advisor to discuss high-stress moments like inflation and market fluctuations can be a huge source of support in moments of crisis. What you don’t want to do is be reactive.

A.V.P. Private Banking Specialist Wealth Management Advisor

We focus on long-term strategies that stay focused on the goals you’ve shared with us—not on making quick, risky gains.

Q: What are your “wildest dreams,” and how can your fi nancial advisor help you achieve them?

C: It starts with openness and honesty about your goals and your current financial situation. Our most emotional asset is our money. There’s a reason why so many couples split because of finances.

B: We’ll help you develop a plan that’s nimble, fluid, and flexible enough to adapt to your life. Whether you want to maximize your 401k, grow your business, buy your dream house, or send your kids to college, we can build a plan to make all these things possible. Once you and your advisor develop a plan, you want to meet at least annually and see how you’re tracking, and update it at least every five years.

C: As things in your life change, your financial plan should change too. If you buy property, build a family, shift careers,

or decide you want to retire early, talk to your advisor to make sure your plan shifts with you. This is where Wealth Management and Private Banking work together to coordinate daily banking with future financial planning.

B: That’s how we build wealth from generation to generation. The first steps are always the hardest—but in a year, or five, or twenty, you’ll be so glad you did it. And when you have the right people in your court, you’re setting yourself up for success.

Let us help you fi nd your “end game.” Trust the “Best Bank in Town.” Come see Caroline, Beth, and the rest of the experts at Bank of the Bluegrass & Trust Co. We’ll help you build a solid fi nancial strategy that works for you. Are you “... ready for it?” Call (859) 233-4500 today!

1 Bank of the Bluegrass. Member FDIC. Equal Housing Lender. Bank NMLS ID# 421548. Offer of credit is subject to credit approval.

2 Bank of the Bluegrass & Trust Co. | Wealth Management. Insurance products, investment products and securities are: NOT FDIC Insured | NOT Guaranteed by the Bank | MAY Lose Value | NOT Insured by any Federal Government Agency

You work hard for your money and deserve for it to be managed with the utmost care and attention. Look no further than to your TOP Financal Professionals of 2024! Whether you’re on the hunt for traditional banking, wealth management, business or personal planning, these local money pros o er the best strategies and support to give you con dence in achieving your nancial goals.

It is our mission to develop long-term relationships with our clients through excellent service, personalized solutions, and trust. We are committed to helping clients effectively manage their wealth, achieve their financial objectives, and secure their financial future. Our team boasts over 50 years of combined experience and currently manages over $250 million in assets. We offer a variety of services. Our retirement planning services include 401(K) rollovers, customized income strategies and tailored growth portfolios. We provide estate planning as well as tax planning guidance. For those planning for a child’s future education, we can help you do so with confidence.

Peter McFarland, Senior Portfolio Manager, brings over 28 years of experience to Meridian Wealth Management. He started with American Express Financial Advisors in Milwaukee, Wisconsin. After relocating to Kentucky, Peter worked in the Lexington Central Investment Center from 1998 to 2011. During this time, he was named a Top 50 Advisor in the country by Bank Investment Consultant Magazine from 2007-2011. After moving to UBS Financial Services, Inc. in 2012, he grew his business over 300 percent. He was named Forbes Best-In-State Wealth Advisors in 2019, 2020, 2021 and 2023.

Jeremy Chase, AAMS® Senior Portfolio Manager, joined Meridian Wealth Management in 2023. Jeremy has over 15 years of Financial Services industry experience. He earned his Bachelor of Arts in Business Administration from Transylvania University. Prior to Meridian he was a Financial Advisor with UBS Financial Services, Inc. in Lexington, KY. He uses his experience to help his clients navigate the complexities of the markets, create unique income and savings strategies, customized investment management and goals-based retirement planning.

Lauren Hazard, Wealth Management Services Associate, joined Meridian Wealth Management in February of 2023, bringing 11 years of experience in the financial services industry and maintains a Series 66 license along with both the Health and Life Insurance licenses. Before joining Meridian, she spent 10 years as a Wealth Management Associate at UBS Financial Services, Inc. Lauren graduated from the University of Kentucky where she earned a Bachelor of Science in Accounting.

Jessica Barnes, CFP® and Wealth Management Services Associate, joined Meridian Wealth Management in 2023, bringing with her seven years of experience at UBS Financial Services, Inc. as a Registered Client Services Associate. In addition to be being a CFP® Professional, Jessica holds her Series 66 license as well as both Kentucky Health & Life Insurance licenses. Jessica graduated from the University of Kentucky where she earned her Bachelor’s Degree in Finance.

“Credibility and integrity are the most important traits in business,” said Camden Skidmore, the Lexington market president of South Central Bank. “It is essential to deliver on your commitments to build trust with your clients. Over-promising and under-delivering can damage relationships and reputation, so it is critical to be honest and realistic in what you hope to achieve.”

With a history dating back to 1889, South Central Bank has grown to do much more than just provide sound banking services for its customers. It strengthens the communities it services by supporting nonprofits, charitable causes, local families and small businesses.

Skidmore and his team have lived out their commitment through helping countless neighbors achieve their financial dreams. Their dedication to 24/7 availability, technological innovation and personalized service underscores that commitment — ensuring clients have a lifeline, no matter what obstacles they face.

“Watching my clients, my staff or an organization where I volunteer achieve their goals motivates me as a leader,” Skidmore concluded. “There is nothing more rewarding than being a part of a team that succeeds.”

South Central Bank is excited to announce a new location coming soon.

859.223.0170

386 Waller Ave. Ste. 110 | Lexington, KY SouthCentralBank.com

Chris Evans

First State Bank of the Southeast has been supporting Kentuckians for over a century, and EVP-Chief Mortgage Officer Chris Evans remains committed to their reputation of trusted banking services and care of its valued customers.

As a full-service community bank, First State Bank offers a wide range of financial products and services, including residential mortgage loans, online banking, USDA loans, and more.

“One of our best attributes is communication,” says Evans.

“By maintaining an elevated level of communication with all clients, we provide solutions tailored to their needs so they can do business the way they want to do business. Bottom line, we offer great products and great service. You do not have to choose.”

As a born and raised Lexingtonian, 30+ year banking and mortgage veteran with First State Bank’s 100+ year history backing him up, Evans is more than qualified for his focus on the residential mortgage division in the central Kentucky market. “In thirty plus years of lending, I have helped so many people from all economic backgrounds achieve the dream of homeownership. However, I have not achieved this by myself. I am fortunate to have been surrounded by experienced lending groups throughout my career.”

Founded in 2014 as an independent firm, Alliance Financial Planning advocates for clients to ensure they are getting customized advice and finding the right approach for their specific needs. Alliance finds the greatest reward in helping clients pursue their personal goals and creating a tailored plan to see these goals through.

This year, Alliance wants people to not get sidetracked by headlines and news stories pertaining to finances. They believe it’s crucial for individuals to work with a professional in order to keep the emotions out of their investments, particularly as election years can bring out a lot of chaos.

“At Alliance Financial Planning, it is our intention to have a firm that is committed to excellence in every aspect of our business. Our dedication and passion for your financial concerns are the cornerstones of our firm.”

Alliance Financial Planning loves doing business in the Lexington area and looks forward to continuing to make the community a better and more financially stable place.

Diane Verhalen has been an LPL Financial Advisor since 2006 and is also the owner of Alliance Financial Planning. She is a graduate of University of Kentucky, holds her series 7 and 66 through LPL Financial, is a CERTIFIED FINANCIAL PLANNER Practitioner, and has her Life and Health licenses.

Lucas McAvoy has been with Alliance Financial Planning since 2020, and graduated from Centre College. He holds his series 7 and 66 through LPL Financial, is a Chartered Retirement Plans SpecialistTM Professional conferred by the College for Financial Planning, and has his Life and Health Licenses.

Kelli Newman joined Alliance Financial Planning in 2023 and has been in the insurance business for over 20 years. She is a graduate of the University of Kentucky, holds her series 7 and 66 through LPL Financial and has her Life and Health Licenses.

Mutual funds, Stocks, ETFs, Bonds

Annuities

Unit Investment Trusts

Alternative Investments

Structured Products

CD’s

College Savings Plans

IRA & Roth IRA

Retirement Plans

Brokerage Accounts

Managed Accounts

FINANCIAL PLANNING

Retirement Plans

401(k) Planning

403(b) Planning

College Plans

Estate Plans

Profit Sharing Plans

BUSINESS PLANNING

Employee Benefit Planning

Retirement Plan Design

Executive Benefit Planning

Executive Bonus PLans

Key Person Planning

Cumberland Valley National Bank (CVNB) has been a trusted partner and neighbor in the bluegrass since 1904. They provide Kentuckians with depository services, treasury management, and commercial lending solutions. Their Vice President, of Commercial Lending, Vance Marshall, is responsible for working with local business owners, investors, and real estate professionals.

Like the rest of his team at CVNB, Vance finds reward in providing individuals and businesses with the relationships, ideas, and financial solutions they need to accomplish their goals. In order to help Kentuckians reach those this year, Vance advises to “play the long game” and take this time to preserve capital or invest, depending on the individual or business’s goals.

CVNB understands the great advantage in working within our booming and diverse economy. “Lexington is the best little big city in the country. The wonderful people, the growing economy, and the beautiful horse farms make it the best place in the country to live and do business!”

Suzanne Powell

With over two decades as a financial advisor, Suzanne Powell, Vice President of Meridian Wealth Management, has earned a reputation for always answering her client’s calls. “At Meridian Wealth Management, I love the relationships I have built with my clients, and they appreciate me, my consistent communication, and the wealth management process we have in place,” Suzanne explains. The foundation of this process includes a strategic longterm plan, proper diversification, and budgeting risk based on the specific goals and needs of each client.

Powell opened an office in The Villages in Florida—which caters to clients 55 and up, who need the peace of mind that comes from working with a skilled fiduciary advisor. She says, “We love that our clients have the opportunity to live their best lives because of the planning and guidance that we bring to every advisory client relationship.”

Suzanne is enthusiastic about empowering women with the knowledge they need to make informed financial moves. Lots of this valuable advice can be found in her book

The Ultimate Money Moves for Women over 50 (available at Suzannepowell.com/book and on audiobook).

859.806.8368

W Main St, Ste 450 | Lexington, KY SuzannePowell.com

With its unique combination of expertise, engagement, and locality, Republic Bank & Trust has kept Central Kentucky financially supported for over 40 years and counting. With headquarters just an hour away in Louisville, their local mortgage team focuses on offering home loan mortgage products throughout Kentucky and other states.

Charlotte Price, MLO, Eduardo Vazquez, MLO, Dawn Skelton, AVP, MLO, Nick Adams, MLO and Rebecca Elliott have a combined 75 years of experience between them to help make dream homes happen. “We absolutely love seeing our clients at the closing table. The excitement that clients have at closing, whether buying their first home or their dream home, makes our job so rewarding.

We work closely with our clients to make sure their mortgage loan process goes smoothly.”

The five experts are local housing market pros because they know living in Kentucky. “We love helping members of the communities where we live and work to become homeowners and long-term clients of the bank.”

Because their entire team lives in the Central Kentucky market, their advice is relevant and personalized. Rebecca Elliott, VP Sales Manager, says “The housing market is still hot, so if you are in the market to buy, be sure to be prepared so you don’t miss out on the home of your dreams. Your Realtor will encourage you to get prequalified to buy. Remember to have your current pay stubs, w-2s, tax returns and bank statements handy.”

John Lee York works as a financial advisor with his father, Lawrence York, at ProActive Advisors, LLC. A graduate of UK where he studied Business and Political Science, John now has five years of working as a financial advisor and is working on his Certified Financial Planner credential. In his spare time, John enjoys sports, the outdoors, travel, and his big, red Golden Retriever, Leo.

ProActive Advisors is a dedicated Wealth Management Advisory firm that operates under a fiduciary standard of care. We provide advanced financial planning and money management services utilizing a Family Office-styled approach. Like the ultrarich Family Office concept with specialized professionals employed to address investment, tax, and legal matters, ProActive offers a cost-beneficial clone in their Virtual Family Office combining their expertise in core financial planning and investment management with third-party resources curated to address complex issues in tax and legal matters.

ProActive Advisors strives to help clients improve their financial lives through a process that can be project oriented or ongoing & comprehensive. Their value-added being their knowledge and resourcefulness in scrutinizing financial details and working to keep money compounding. Indeed Lawrence York, a Morningstar recognized Five Star Fund manager, shuns what he calls “Conventional” investment practices” that set fixed account allocations and rebalance back to them. Instead, they proactively monitor prices and value managing accounts to get the best reward-for-risk balance.

859.263.1117

826 Euclid Ave. #306 | Lexington, KY ProActiveAdvisors.com

Lisa R. Highley

Helping the Central Kentucky community fulfill their dreams is what drives Lisa Highley, VP of Lending at UK Federal Credit Union, and her highlyskilled team, everyday.

UKFCU is a full-service financial institution that provides exceptional service to their over 105,000+ members. Started by six UK College of Agriculture professors in 1937, UK Federal Credit Union (UKFCU) partners closely with the school and areas beyond the university.

Lisa has been in lending for the past 18 years of her financial career. “Sometimes, we are lending money for what people need, such as a car to get to work. Other times, we are lending money for what people desire, such as a boat or ATV or financing a home improvement project. Regardless of the reason, we are helping someone and that is fulfilling.”

Lisa wants to leave readers with the advice to plan for retirement. “As a society, we have not done a great job at this. Some Americans have no savings for retirement. If you work for a company that offers a match, take advantage of that. Meet with a financial planner to see if you are on target for retiring at the age you desire or what changes you need to make to meet that goal.”

859.264.4200 1730 Alysheba Way | Lexington, KY UKFCU.org

Kimberly Bussell

Forcht Bank is one of the largest privately held banks in Kentucky. Their 3 loan production offices—and 23 banking centers across Kentucky and Cincinnati— have $1.5 billion in total assets.

Kimberly Bussell, Marketing Director for the bank, says, “Forcht Bank’s mission is to exceed our customer’s expectations by delivering a happier banking experience.” They stand by this commitment through their personal banking services, loans, investment assistance, and business solutions like merchant services and treasury management. In addition, Forcht continues to put customers’ minds at ease with their digital banking and fraud protection services.

Unique marketing efforts, such as large forks in front of branches with holidaythemed toppers and their ice cream van which makes stops around town, are what set Forcht Bank apart, turning everyday transactions into experiences, where banking becomes not just a necessity, but a memorable moment worth sharing.

In Kimberly’s unique role, she has the opportunity to mix her analytical and artistic side to best serve Lexington in a creative way. She views it a privilege to provide for a community she loves to live in. “Horses, bourbon, beautiful landscapes, while also boasting a lively downtown scene with an impressive mix of arts, music, shopping, and dining options... It’s too hard to pick a favorite. I love it all.”

859.810.6797

2404 Sir Barton Way | Lexington, KY ForchtBank.com

PICTURED LEFT TO RIGHT:

Selina Shepherd, CTFA, Wealth Advisor

Alicia Cox, Private Banking

Louis Prichard, Central Kentucky Market President

Lucien Kinsolving, Private Banking

Alicia Jordan, Private Banking

Chad Rudzik, CTFA, Wealth Advisor

Kevin Lane, Private Banking

Carman, CEO

The JCC Group is a consortium of companies focused on providing the best services to the Lexington Hispanic community in Bookkeeping, Payroll, Tax, and Accounting, as well as Insurance and IT Consulting. JCC Accounting Solutions, LLP, JCC Insurance Group, LLC, and JCC Consulting Group, LLC were born out of the need in our city for well-educated and skilled professionals to service this community in Lexington.

The JCC Group started as JCC Consulting Group in June of 2006, initially focused on providing services to Nonprofit and Governmental organizations. However, due to our expertise in the areas of bookkeeping, payroll and tax, we eventually focused on these areas within the Hispanic community where bilingual services are a must.

JCC Consulting initially served the highly specialized nonprofit accounting needs of many great organizations such as Community Action Council, Hope Center, United Way of the Bluegrass, Council of State Government, Girl Scouts of Kentucky Wilderness Road, 10 of the 16 Area Development Districts in Kentucky, and many Cities and County Governments in Kentucky, Virginia, West Virginia,

Indiana, Illinois, and Tennessee. JCC Consulting provides Sales, Implementation, Training, and Support for Fund Accounting Systems as well as IT support and even Website development.

As we established ourselves as experts in the nonprofit sector, we identified a vast need for competent, welltrained, and skilled professionals in the accounting, bookkeeping, and tax preparation areas. We began offering these services as part of JCC Consulting Group in Late 2010. By 2014, accounting services outpaced the growth of JCC Consulting. As a result, in 2016 we spun off our bookkeeping services and created JCC Accounting, which has become the premier accounting and bookkeeping services provider in Lexington and surrounding areas. We understand that bookkeeping is essential to the vitality and long-term success of any small business.

JCC quickly identified the need for a seasoned Insurance professional to be not only an agent to our current clients seeking commercial insurance but also a number of potential businesses in the areas of commercial general liability insurance and Worker’s Compensation insurance; JCC Insurance fills that need.

JCC Accounting has recently expanded by adding Victor Castro as partner. Victor has been instrumental in all areas of growth in the accounting realm of the company. Victor works tirelessly with Juan and Francisco to ensure all accounting clients of The JCC Group are well served and taken great care of.

From the beginning of The JCC Group, our founder, Juan Carlos Castro (hence the initials), wanted to use his many years of experience in the accounting arena to ensure that Nonprofit organizations and Hispanic small business owners had a reliable and well-versed professional able to help small and medium-sized organizations with their bookkeeping, payroll, sales tax, and local Net Profit reporting needs.

After a successful career in the hospitality industry, where Juan worked for the Hilton and Marriot corporations – including The Seelbach in Louisville, KY – Juan continued graduate school at Eastern Kentucky University, earning a master’s degree in business administration with an emphasis in accounting in 2000.

Juan has worked with nonprofit organizations since 1995, first as an accountant for Jewish Hospital in Louisville and Lexington, then later as a consultant with a regional CPA firm in Lexington. In 2005, Juan was the first VicePresident of Finance and Administration for the newly merged Bluegrass Community and Technical College. He successfully led a team from several departments and disciplines to attain accreditation from the Southern

Association of Colleges and Schools (SACS) as a single institution. Juan and his team were able to accomplish this within 16 months of the initial merger.

After leaving BCTC, Juan started The JCC Group. Juan spends most of his time with JCC Accounting Solutions, LLP, where they concentrate on helping companies to succeed through sound financial planning, monthly bookkeeping, in-depth financial analysis, payroll processing, and tax preparation. He is also the founder of the JCC Consulting Group and a general partner for JCC Insurance Group.

In 2005, Juan became the first Hispanic to join a selected group of Kentuckians as a member of Leadership Kentucky. In 2017, Juan was appointed by Governor Bevin to the Board of Regents at Eastern Kentucky University, where he chaired the Diversity, Equity, and Inclusion committee. He also served on the Finance and Audit committees and the Diversity, Equity, and Inclusion Committee at EKU’s Board of Regents. Governor Bevin also conferred Juan the honor of being named a Kentucky Colonel for his continuing effort on behalf of the Commonwealth of Kentucky.

In August of 2020, Lexington Mayor appointed Juan to the Downtown Lexington Management Board to serve as a voice for the Hispanic community in Lexington. He currently serves as the treasurer for that organization. In February of 2022, the mayor of Lexington also appointed Juan to the Permanent Commission for Racial Justice and Equality where he serves as chair of the Education and Economic Opportunities sub-committee.

In the past, Juan has also volunteered with a number of nonprofit organizations, including the Girl Scouts, United Way, and the Lexington Hispanic Education Association, where he served as treasurer for five years and is now the Chairman of the board of Directors. Additionally, Juan has also volunteered with the Dia de la Mujer Latina, Newport Aquarium, The World Equestrian Games, The Breeders Cup, Real Men Read program at Coventry Oak Elementary, Boys of Color, The IRS VITA Program, Bryan Station High School Band Association, and The Committee on Equal Opportunity at the Council for Post-Secondary Education. Juan also volunteers with Lemonade International as their Financial Director, Greater Gardenside Association as treasurer, Casa de la Cultura de Lexington, and Lexington Community Radio (RadioLex).

In October 2017, Francisco Joined the JCC Group as the manager for JCC Accounting in order to provide better service to our clients and streamline processes. In 2019, we decided to open our insurance agency, as our clients

needed a Spanish-speaking agent to help them navigate the sometimes difficult waters of the Commercial Insurance world.

While it took nearly six months for his licenses to transfer from Texas to Florida, we started our independent Insurance Agency in 2019. We worried 2020 would be the end of JCC Insurance. To our surprise, clients started coming – and kept on coming – in spite of the Covid restrictions.

2021 brought a lot of changes and adjustments. Francisco was asked to focus full-time on the Insurance agency. Smart Choice, our umbrella company, recognized JCC Insurance as a member of the Leadership Agent Club. We were event featured in the national Smart Choice Magazine. That recognition was quickly followed by other accolades, such as being named the top Independent Insurance agency in Kentucky under Liberty Mutual Commercial Lines. This year, we have been named one of the fastest-growing independent agencies in the state. JCC Insurance continues to be recognized as a leader in the commercial insurance realm, serving the Hispanic Community of Lexington and surrounding areas.

Francisco also volunteers in the community and is currently the President of the Greater Gardenside Association, a resident and businesses neighborhood association. In this position, he has been instrumental in bringing our businesses and neighbors together under a common goal. The GGA also participates in the Community Farmers Market every Wednesday from June to September. In this position, he has also worked with Casa de la Cultura Lexington to bring the festival Viva Mexico to our area, and last year, we had the largest attendance to date. Francisco also volunteers as an Ambassador with Commerce Lexington and is an active member of Gideons International.

In the past, Francisco has also served as a teacher in 3 different Spanish-speaking Bible Institutes and continues to volunteer with many different Hispanic Churches in Kentucky and Ohio. Francisco was also the Regional Director of The Spanish Concilio of the Church of God of Anderson, Indiana. Francisco continually works with different praise and worship teams throughout Kentucky and Ohio and serves as one of the musicians in his local church in Winchester. •

Which updates have the best ROI when you sell?

The best reason to do a home renovation is to make your home more enjoyable and livable for you and your family. But the next-best reason is to improve your home’s resale value.

The annual Cost vs. Value report for 2023 by Remodeling looks at what value homeowners have recouped through home remodels once they sell the home. They average the national cost of each project versus the average resale value in our region to determine the ROI each renovation might net.

While it’s worth considering the amount you may recoup in the sale of your home, it’s also important to remember that you will be using the spaces in the here and now. So if a renovation “only” nets a 75% return on your cost, weigh that against how much personal value you got from the space. We’ll bet you will agree that the remodel was 100% worth the investment!

We all know how cumbersome a heavy, dated, poorly installed garage door can be – to say nothing of how much they negatively impact your home’s appearance. Homeowners are looking for garage doors installed in more modular sections. They also want them installed on heavy-duty tracks with motorized garage door openers (this study assumes you are reusing your old garage door opener; your return might be slightly lower if you need a new one). Still, getting your money back – and then some – ain’t bad!

Average Cost Recouped: 108.8%

Potential buyers’ first impression of your home is its exterior. Old, worn siding tends to give the impression that everything within is just as run-down; replacing the siding makes your whole home look refreshed. Buyers also love knowing it likely won’t need replacing any time soon. The type of siding you utilize matters, but the return average is between 80-100%!

In the Lexington market, buyers favor vinyl (103.5% cost recouped) and manufactured stone veneer (102%).

Average Cost Recouped: 102%

Real estate agents agree that, more than anything else, kitchens are what sell a house in our market. Completing a minor, midrange remodel to your kitchen can increase the sellability of your home.

However, there does seem to be a point of diminishing returns with this remodel. In Lexington, the study showed that $25k kitchen remodels generally resulted in a 100% value return; $75k kitchen remodels dropped to 45% recouped for the homeowners. While a stunning kitchen will get potential buyers’ attention, what they’re willing to spend on a kitchen doesn’t increase by much. The study is clear: renovate your kitchen for your own enjoyment, but don’t expect a big return on a major overhaul. Still, a great kitchen is – almost – priceless.

Average Cost Recouped: 100.5%

According to realtor.com, some kitchen updates are a better investment than others. They ranked some of the areas of a kitchen renovation that have the strongest chance of increasing a home’s resale value – as well as the ones that fall flat.

GOOD ROI: New Cabinets

What’s the first thing anyone notices when walking into a kitchen? The cabinets. They make or break the overall style and feel of the space. Because of the changing nature of kitchen trends, the style of your cabinets immediately reveals exactly when they were installed.

GOOD ROI: Increasing Counter Space

Buyers notice how much counter space a kitchen has – or doesn’t have. Experts agree that extra prep space is key when it comes to a kitchen’s value. If your kitchen lacks in surface area, try adding an island or extending a surface outward.

GOOD ROI: Skylight

Does your kitchen need a little oomph? Skylights bring in sunshine and help make the space look larger. Installation of a skylight typically yields more resale value than the expense!

GOOD ROI: Flooring

If your kitchen’s flooring is dated, aging or low-quality, replacing it can mean a big payoff. According to realtor.com, this can provide up to an 80% ROI.

BAD ROI: Overspending on Countertops

While replacing your countertops generally has a positive impact on the appearance – and your enjoyment – of the kitchen, the most expensive materials don’t always mean a good return.

BAD ROI: Funky Choices

While you should personalize your spaces to your tastes, every “out-there” choice is a potential turn-off for future buyers –especially in the kitchen.

BAD ROI: Luxuries

While your dream kitchen may include pricy bells and whistles like a built-in nugget ice maker, wine fridge and trash compactor, that doesn’t mean your home’s future buyer will be willing to pay for it. Absolutely get these luxe upgrades for your own enjoyment… just don’t expect them to pay off later.

Buyers love a home with curb appeal. Homeowners who remove their existing entry door and reframe the opening to accommodate a door with sidelights recoup most of their expense. Remodeling recommends utilizing a fiberglass door blank that matches the entry for the best return. If you’ve been thinking about upgrading your home’s entrance, this project is worth looking into!

Average Cost Recouped: 95.4%

Many homes rely on old, outdated furnaces. Converting your home’s system to an eco-friendly heat pump can mean lower utility bills and more enjoyment year-round (heat pumps also replace your air conditioner.)

In the Lexington market, this tends to result in a 76% return. While that may not sound like much, we’re assuming you’re most likely only going to replace this system when your existing furnace and/or air conditioning unit go kaput. You’ll get the rest of that value in personal enjoyment now, as well as some bonus savings on your electric or gas bill.

Average Cost Recouped: 76.3%

Outdated, leaking roofs are an item that you need to replace right away. So, aside from your own enjoyment of your home, what return will you see when you go to sell? On average, the resale value for asphalt shingles was highest, but metal roofing saw a 41.5% ROI.

Replacing old, worn roofing not only protects your home but also improves its overall appearance. Potential buyers will also love knowing that this isn’t something they’ll have to do in the near future.

Average Cost Recouped: 71.6%

Buyers love steel doors, as they are beautiful, sturdy and eco-friendly. While the phrase “steel door” may mentally conjure a bank vault or factory, these doors come in a variety of styles that can fit any décor. While the return was so-so in the central Kentucky market, the national average was a 100% ROI; we look for this number to trend upwards in our market in the coming years – get ahead of the trend!

Average Cost Recouped: 68.2%

If kitchens are what sell a home first, real estate agents agree that beautiful bathrooms help seal the deal in the central Kentucky market.

Much like kitchens, money spent on bathroom remodels can face a cliff of diminishing returns. This is another case where you should focus your remodel on creating a space you will truly love and enjoy.

Average Cost Recouped: 62.3%

Insulated windows are a renovation that can make all the difference in your enjoyment of your home, especially if your current windows already need replacing. From reducing noise to making your home more energy efficient, you will be glad you made the swap. Fortunately, this upgrade also has a decent ROI. Buyers in our market prefer vinyl windows, but wood windows still see a 56.7% return.

Average Cost Recouped: 63.8%

If your home doesn’t currently have a deck, adding one will certainly increase the fun-factor of your living space. While the cost recouped at sale isn’t among the highest on this list, it’s still worth considering this home upgrade. Buyers in our market seem to prefer wood decks, as the ROI falls to 38% for composite construction; that said, if you’re not selling anytime soon, the durability of composite materials may win out in terms of your own value over time. •

Average Cost Recouped: 53%

$ 1,150,000 • 3 BED • 3.5 BATH • 3,609 SF | LEXINGTON, KY

This charming Southern Style home sits on .91 acre treed lot at the end of a cul de sac in the popular Warrenton Woods neighborhood. The home has been beautifully & extensively updated by the current owners! The interior features 9’ ceilings, large formal Living & Dining Room with new wainscoting, spacious Family Room with fireplace and built in shelving & cabinetry and huge remodeled Kitchen with granite plus new granite counter top on island. The second level features a spacious Primary Bedroom & Bath plus upgraded closet. There are 3 other Bedrooms and a full Bath. The walkout Basement offers a large Rec Room with fireplace, full Bath and 2 Bedrooms. A 2 car garage, large deck, pergola and stone & masonry walkways complete this very livable home. PENDING

128 EAST THIRD STREET • Rusty & Rachel Underwood

$864,900 • 2 BED • 2.5 BATH • 3,205 SF | LEXINGTON, KY

This historic gem from 1880 offers the perfect combination of old and new nestled in the heart of downtown Lexington. A meticulous renovation boasts a kitchen with quartz countertops and AGA appliances in an open concept living space overlooking a spacious living room, complete with a wood-burning fireplace and double doors leading to the enclosed brick courtyard. Enjoy the utmost convenience of this location with easy access to downtown’s shopping, entertainment, dining, and more! Enjoy the flexibility of B-2A zoning. CONTINGENT

United Real Estate Bluegrass

$1,200,000 • 3 BED • 3.5 BATH • 4,226 SF

WINCHESTER, KY

Jeanna Wright | Realty One Group Bluegrass

$425,000 • 4 BED • 3 BATH • 2,458 SF

LEXINGTON, KY

Christie’s International Real Estate® Bluegrass

$599,900 • 4 BED • 3.5 BATH • 3,966 SF

DANVILLE, KY

500 NORTH BROADWAY

CG Group | Keller Williams Bluegrass

$649,000 • 5 BED • 2 BATH • 4,663 SF LEXINGTON, KY

Cathy Davis | Justice Real Estate

$1,999,000 • 3 BED • 2 BATH • 100 ACRES BOURBON COUNTY

3293

Bluegrass Properties Groups

$489,900 • 4 BED • 2 BATH • 2,200 SF LEXINGTON, KY

$1,570,000 • 5 BED • 3.5 BATH • 10,720 SF

Over 10,000 total square feet! Midway Kentucky may be one of the most idyllic villages in Central Kentucky . This property is situated right in the heart of the Midway area just minutes from Woodford Reserve. Not only will you awaken every morning to green pastures and the sounds of nature but you will be surrounded by Kentucky’s most stunning countryside,a peaceful way of life, and a lodge like atmosphere.This home was created to appreciate nature. The wooded area has a natural spring and is great for trails and 4 wheeling. Gently spanning a good portion of these 11 acres you’ll find all brick exterior, detailed custom construction, the most stunning ‘’Grove Park Inn like’’ stone fireplaces, geothermal heat and air, a floor plan providing dual primary suites on one floor, and many additional features.

$379,900 • 4 BED • 3 BATH • 2,202 SF

With over 30 years of building experience in Madison County, Payne Homes are renowned for their award-winning functional floor plans, premium STANDARD features and meticulous attention to energy-efficient details. The Merrick III Plan is our model home for a reason! This open concept ranch plan features a bonus second level that boasts a 4th BR (or family room), 3rd full BA, walk in closet & walk in attic storage. Magnolia Pointe offers a unique location in Richmond with a dog park, family park, fishing lakes and walking trails.

Paris Pike is the beating heart of Horse Country. With rolling meadows, this area is home to many of the area’s most storied horse farms. There, you’ll find Black Diamond Farm. Resting on 62 pristine Kentucky acres, this stunning farm is ready to start its next chapter... by Amanda Harper | courtesy photos

The main estate sprawls over 17,000 sq.ft. overlooking the pond. Its exterior hints at the home’s grand, welcoming style. Arched windows offer views of the sweeping landscape in every direction.

The heart-stopping entryway features hand-carved and raised paneled woodwork. A 2-story gallery reaches up to a stunning balustrade, allowing an overlook of the 32’ floor-to-ceiling curved window. A massive Swarovski crystal chandelier illuminates an intricately detailed coffered ceiling and the raised platform, which houses a baby grand piano.

Two fireplaces flank the main sitting area, creating two intimate conversation spaces. A small sitting room is cleverly decorated with nods to the farm’s equestrian pedigree. There are several breakfast nooks and dining spaces throughout the house.

The main kitchen is a chef’s delight with updated appliances. Black granite countertops offset the dark, rich woods utilized throughout. The home also offers a catering kitchen designed for entertaining, with an exterior entrance for outdoor catering.

The beautiful primary suite is like a world unto itself. Dramatic vaulted and beamed ceilings make the space grand. Anchored by two fireplaces, the suite includes sitting areas and a small office. The solarium overlooks the pond.

Moving through to the fairytale bathroom, the owners can enjoy heated marble floors and a cozy, oversized tub. Nearby, a wonderfully organized walk-in closet and vanity room make getting ready a luxury experience.

Black Diamond Farm’s Executive Wing is perfect for conducting business at home. A reception area with private entrance leads to the stunning, spacious office with a welcoming fireplace. The conference room can accommodate your work meetings. Walk through to the billiard room for more casual brainstorming sessions.

The lower level is an elegant playground easily accessed by stairs or elevator. A full pub-style bar is sculpted from dark cherry wood and topped with black granite counters. The hammered copper sinks bring more of that Old World luxury to the space. The expansive wine cellar includes a tasting area and wet bar. The game room leads to a home theater, as well as a full spa, complete with a sauna, steam room and exercise room.

It’s almost inadequate to describe the stunning 13,000 sq.ft. structure as a “pool house.” Above the in-ground pool and dual Whirlpool jacuzzis are 72 retractable skylights. Men’s and women’s changing rooms make guests feel comfortable. Attached is a full catering kitchen, plenty of space for entertaining and 3,000 sq.ft. of living space. This oasis is surrounded by a large brick patio. Nearby is a charming and well-appointed guest house, ensuring that Black Diamond Farm is ready to make history with its new owners.

Status: For Sale

Address: 3591 Paris Pike, Lexington

Bedrooms: 10

Bathrooms: 12 full, 6 partial

Main Estate: 17,000 sq.ft.

Barn Capacity: 18 stalls

Pool House: 13,000 sq.ft.

Guest Quarters: 1,500 sq.ft.

Year Built: 1992

Fencing: Plank, Stone/Rock

Features: 2-story entry, chef’s kitchen, catering kitchen, large pool house/entertainment area, private executive wing, brick patio, guest accommodations, horse barn, ample parking, hand-carved millwork, 4-car garage with 2-bedroom guest apartment, pastures, vaulted and beamed ceilings, lofts that overlook main spaces, billiard room, wet bars, game room, sauna

List Price: $7,499,00

Contact: Kassie Bennett, 859-559-5969 | kassiesells.com

Services Include:

•Landscape Design/Installation

•Spring/Fall Clean Up

•Patios-Retaining Walls-Pergolas

•Outdoor Kitchens

•Tree Work

•Drainage Repair

•Fencing/Decks

•Artificial Turf & Sod

•Leveling

•Hardscapes

Our takeout steam pots provide you with the opportunity to experience our Low Country Seafood Boil.

Just add water or the beer of your choice and place the pot on your cooktop. In about 40 minutes, you can be enjoying your very own Low Country Seafood Boil right at home!

All-wrhite kitchens are viewed as something of a “safe” choice. But when done with care, white cabinetry can become the backbone of something truly magical.

These homeowners used gold light fixtures throughout this house, which helped steer the metal choices in the kitchen. White walls reflect the abundant natural light pouring in. A single wooden column brings the warmth of the flooring up through the space.

The large window shade is a simple, yet effective showstopper. The bold fabric completely changes the tone of the space, offering an exciting bolt of energy.

Interesting tile is very much on-trend right now. This backsplash adds depth and texture in a space that would otherwise get lost. Now, it’s a stunning focal point.

In a neutral room, a well-chosen fabric can make all the difference. This chinoiserie window shade speaks for itself against the light walls. Patterns like this also give you endless options for accessorizing.

Curvy details soften the sharp, clean lines of this kitchen, from the draw pulls to these cane-bottomed chairs. It’s an inspired choice that creates beautiful contrast and ground the otherwise airy space.

Bowls and platters obviously have a ton of utility in a kitchen or dining area. But they don’t have to be boring! Interesting shapes, textures and materials can make these useful items a source of style in your space. We particularly love irregular shapes.

(available from The Front Porch)

Thoughtfully choosing your metal accents can add lots of personality to your spaces. This mid-century inspired pendant light adds a curvy element that feels like a thoroughly modern take on a timeless throwback.

Progress Lighting Mid-Century Modern Pendant (available from Wiseway Supply)

DETAIL MOSAIC TILE

Tile is interesting again! Designers are turning to intricate, Deco-inspired tile patterns to spruce up kitchen backsplashes – as well as bathrooms, vanities and more. We love looks that utilize a mix of materials. It’s a luxe touch that upgrades absolutely any space it’s utilized in.

&

We weren’t going to leave you hanging, wondering where to find this fabric. Of course it’s Schumacher! This pattern comes in other colorways, but we think the Jade is truly unbeatable.

In a minimalist space, every square inch of décor must be used wisely. We love this porcelain vase because it adds subtle texture. It comes with a square inset that you place stems through, making the art of floral arranging a snap for anyone!

With dining chairs, tiny details make all the difference. The cane seats and extra metal curves make these puppies completely stunning. It’s a mixture of contemporary lines with a retro touch that your guests will just adore.

Ton 14 Caned Dining Side Chair (available from Williams-Sonoma)

when booked at time of estimate

Quiet luxury, old money style, elevated minimalism; call it what you want, this trend isn't leaving anytime soon. The aesthetic that results from investing in quality pieces—instead of having a huge wardrobe—creates an elevated look praised by influencers and stylish elites alike. We're breaking this trend down to the basics have you looking your best this season!

By Chloe Day

Your mama got this one right: less is best. One of the most important features of this trend is its ease. No need to add lots of glitz and glam! Keep your accessories simple.

The color scheme for this look is triedand-true! Look for kelly green, navy, white, and khaki-colored pieces in either plain or striped patterns.

When all else fails, look for buttons. Whether it's a classic button-down or a dress with refi ned rivets, this feature can make any outfit feel a little more elevated!

Need extra advice? "The Official Preppy Handbook" serves as the rulebook for this trend. From go-to pieces to etiquette tips, editor Lisa Birnbach has you covered!

The Official Preppy Handbook (Available at Amazon)

When it comes to fashion, Lexington's boutique scene has you covered; no matter the occasion.

Shop these summer picks from a few of our favorite local stores to stock your closet for whatever comes across your calendar!

1 | Beaded Earrings, $39

2 | Striped Maxi Dress, $98

3 | Beaded Headband, $42

4 | Rattan Ribbon Purse, $129

5 | Beaded Bracelets, $48

If your idea of the “classic American girl” includes a trusty pair of jeans, you aren’t alone. Since the 1800s, denim has been a staple in closets across the United States, and for good reason. A good pair of jeans can stand against time (as proven by the decades-old pairs in many of our closets) and often outlast fast-fading trends. This spring, we’re taking a deep-dive into three of our favorite denim trends that you’ll be able to rock all year long!

By Chloe Day

See ya later skinny and low-waisted jeans; you were never that comfortable anyways. Now more than ever, people are turning to the mid and high-rise styles popular in the 1970s, 1980s, 1990s, and early 2000s. Are you starting to see a trend here? If you asked the younger ladies of our office—myself included—they haven’t owned a pair of skinny jeans in the last decade. Wider fits are much more forgiving, easier to move in, and won’t make you feel like you’re wearing a scuba suit every time you step into the sun.

Loving Pops of Red this Season!

Baggy Pleated Dad Jeans, Available from Levi’s

Fall in love with a pair that has the perfect length but is a bit big in the waist? Tailoring your clothes to fit perfectly is an easy, inexpensive fi x. Remember, your clothes should fit your body; not the other way around!

For a more accentuated waist, look for pleats! They allow for more movement in your hips and legs while slimming your figure and faking the look of a typical trouser.

Swap your standard denim mini skirt for something with an unexpected silhouette. The adjustable waist on this style means you can stay comfortable, regardless of how your body moves and changes throughout the day!

3.1 Phillip Lim

Why choose just one denim piece when you can rock multiple? Affectionately coined the “Canadian Tuxedo” after Bill Crosby donned the look in 1951, the denim-on-denim look still holds strong in today’s trends. We like to switch up the standard skinny-jeans-and-jean-jacket look of the early 2010s with a pair of looser-fit jeans and a denim shacket!

Denim isn’t just for pants. We love mixing up our outfits with unexpected pieces and new takes on the classics. Whether you prefer a clean skirt or a pair of distressed sandals, these picks are sure to enhance your usual outfit rotation.

It's hard to pick our favorite thing about these shoes, but to name a few: the mule style, the bows on top, and the denim material, obviously!

Annalee Bow Slide Flats, Available at Draper James

We already loved the Crosby Bag, but this new Denim color takes the cake! Keep everything you need on hand (and in style) with its convertible straps. Crosby Sling, Similar Available at Olive You

Looking to spruce up pieces already on-hand? Visible mending is a technique based on the Japanese craft of “boro,” which uses scraps of fabric and a running stitch to repair clothing. Unlike many methods of mending, one of the goals of visible mending is to show off the recycled fabric and stitching. If you’re trying this technique yourself, use embroidery floss and fabrics that match your style to bring wellloved pieces back to life!

Ready or not, swimsuit season is creeping towards us. But instead of stressing about fitting a certain style or trend, we’re taking control of our suits this year by finding the best fit for our body type.

Sounds simple, but how do you know exactly what to look for? Just follow our lead...

——— By Erin Oliver

Take the time to branch out & discover a new favorite silhouette.

Do you need a suit for a backyard barbeque? Anniversary getaway? Safe neighborhood pool staple? By narrowing down the atmosphere of the suit, you can better navigate the perfect type.

By taking advantage of adjustable straps and ties, you’d be surprised just how much those adjustments can alter the suit’s look & support.

We’ve all been there, but wearing a suit best built for your body type is much more flattering than a suit that will be out of style next season. And besides… confidence never goes out of style!

We’ll be the first to say it, wearing any type of swimsuit is vulnerable! Because of that, invest in a few solid choices that you can wear over and over again, without fear of premature stretching out and fraying.

Try an asymmetrical suit, or take advantage of the color blocking, and “retro” style trends.

Try padded tops for extra lift, or smaller tops that don’t need much support, like bandeaus and scoop tops. Or, look for tops with ruffles & patterns around the bust.

Look for less coverage for the illusion of a shapelier figure. Try tie-side bottoms to enhance your curves and tighten to your own shape.

Search for tops with underwire or molded cups for ultimate comfort & support.

Customized Pool Tote, Available at Over The Moon

Relaxed-Fit Beach Shirt, Available at J. Crew

GlowScreen Face and Body, Available at Sephora

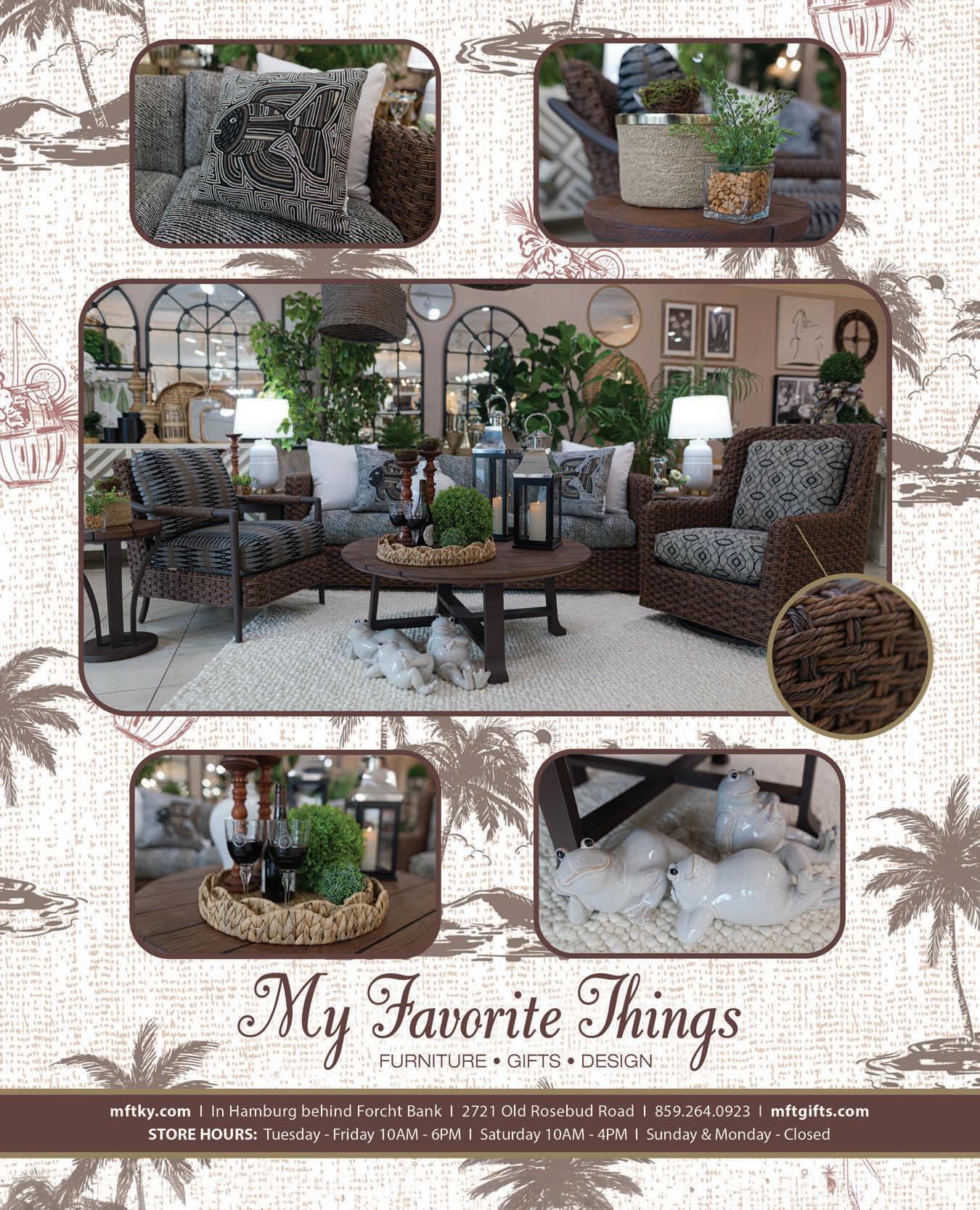

Neon Lights Corkcicle Mug, Available at My Favorite Things

Jakeline Palm Hat, Available at Peggy's Gifts & Accessories

Savaii Sandals, Similar

Available at Olive You Boutique

Enzo Cover-Up Pant, Available at Peppermint Palm

by: Erin Oliver

As we welcome warmer temps with open arms, we must also embrace the reality of sandal season. Instead of feeling funny about our feet, let’s treat ourselves to some local and at-home foot care to help you step confidently into the season.

, $17, Avail able at

A good foot detox has been found to relieve aches, support blood circulation, and even improve stress levels. Detoxes can look like an Epsom salt bath, foot mask, or in-shower scrub.

We love all of the Epsom Salt Soaking Solutions from Dr. Teal's, but the Relax and Relief formula ($15) takes the cake for soothing achy feet!

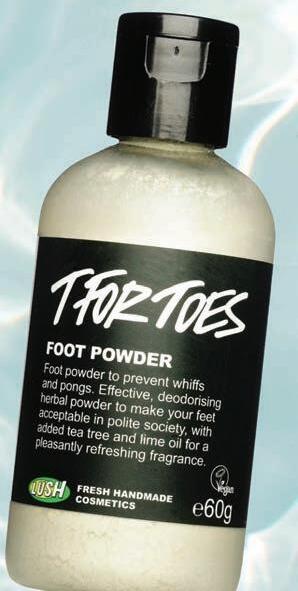

If you fear odor is your issue, try a natural foot powder, like the T for Toes formula from Lush Cosmetics ($12).

Who doesn’t love a relaxing pedi? Lavish Nails Organic Spa believes if your feet are uncomfortable, your whole body will be too. Treat yourself to their signature Milk & Honey Pedicure and a bright springy polish to keep your whole self happy. If your feet need a little extra lovin, Lexington Podiatry offers a wide range of surgical and non-surgical remedy options for heels, arches, toes, and toenails.

Keep your feet happy and healthy with the Intensive Dry Skin and Calluses Treatment (Mod Pod, $132). Toenails need some repair? Try their Total Nail Renewal Oil to get back on track (Mod Pod, $36).

When you’re not strutting those new slides, go for a stable sneaker to keep those feet supported. While these styles are made for running, we like to keep a pair of these around for when we'll be on our feet all day or have more errands to run than hours in the day!

By investing in your feet now, you can stride confidently in style later! These are a few of our favorite summer slip-ons to keep you on the move. Sayonara sandal season jitters!

Have you felt bombarded with skincare tips and products from the internet the past few years? We sure have. While it's important to pay attention to your skin health, the countless products and endless recommendations often make a simple skincare routine add up to a whole lot more than expected. That’s why we’re trusting the experts, skipping the trial-and-error, and incorporating dermatologist-recommended skin care products into our daily routines. Regardless of your age or gender, these products—though investments—are sure to keep your steps simple and effective amidst the skincare chaos!

By Erin Oliver + Chloe Day

If you take to heart just one thing from this article, let it be this: healthy skin starts from within. There are many skin-affecting factors we can't control (i.e. the stress that comes with the busy spring season or the environmental pollutants in our air), experts agree that the best way to improve skin's texture and elasticity is by staying hydrated. Have a hard time drinking plain water? We love Liquid IV's Hydration Multiplier for an added burst of flavor!

Our second pro tip: watch your base. All skincare and makeup products are either skincare or water-based. When you mix the two, your products won't blend together and will pill or look blotchy. The good news is that you don't have to be a dermatologist to know the difference between the two. Siliconebased products will have ingredients ending in "-siloxane" or "-icone" high up on their ingredient lists. You'll likely see water as the fi rst ingredient in most liquids and creams, but that doesn't guarantee your product is water based, so be sure to keep an eye out for those key suffi xes. Don't see them on the list? Your product is water-based! It doesn't matter too much which base you pick, but be sure to check with your doc if you have concerns!

Start your day with a micellar water to cleanse the skin of any grime or product from the evening before.

Sensibio H2O Micellar Water, Bioderma $18.90

Next comes a vitaminpacked serum. These types of products promise to protect against environmental damages, correcting uneven skin tones, calm inflammation, and reverse signs of aging.

Daily Power Defense, ZO Skin Health $108.00

Time for our favorite part: a super nourishing and creamy moisturizer. RESIST Barrier Repair Advanced Moisturizer, Paula's Choice $38.00

Hydrating Eye Cream, First Aid Beauty $30.00 Forever Eye Mask, Dieux $25.00

Use a rich eye cream that contains hyaluronic acid for brightness and hydration. Need an extra boost? These reusable eye masks will ensure every last drop soaks in and can be paired with any eye cream

You can’t get dermatologist endorsed products without some SPF! This formula contains super hydrating ingredients and works great as a makeup primer.

Hydrating Face SPF 50, La Roche Posay $39.99

Don’t forget about the lips! Hyaluronic Acid + Peptide Lip Booster, Paula's Choice $33.00

Bonus Tip: opt for makeup products that are still skin conscious. Cloud Set Powder, Kosas $35.00

For big makeup days, experts like to use two different cleansers ensure all our glam is gone.

Natural Cleansing Balm, Farmacy $36.00

Gentle Foaming Moisturizing Wash, La Roche Posay $17.99

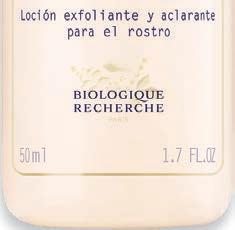

Some derms like to use a toner after their cleanse, saying the vitamins in reputable brands are thorough and aid in maintaining our skin’s proper pH.

Lotion P50 Original 1970, Biologique Recherche $88.00

Before hitting the pillow, use a soothing cream to lock-in moisture all night long.

We all know dermatologists love high-quality retinol, and that hasn’t changed! If you haven’t tried it already, incorporate these capsules into your bedtime routine to build collagen and improve discoloration.

Retinol Ceramide Capsules, Elizabeth Arden $95.00

Moisture Treatment, SkinBetter Science $155.00

If you haven't tried a toner before and want to test the waters, we'd recommend starting with something a little more wallet-friendly. This formula will save you money without sacrificing quality!

Cleansing Pads, Humphreys $10.25

Last but certainly not least, dab on a rich ointment that combats dryness and chapped lips. This works great as an overnight lip mask, but is also great to have on hand for hydration throughout the day!

Multipurpose Superbalm, Lanolips $16.95

April showers bring May flowers— and an extra special day of celebrating the women who raised us. Whether you're planning to celebrate with a special dinner, showering someone with gifts and flowers, or just taking time in memoriam, you are joining people in over 100 countries around the world in celebrating moms.

The TOPS team is extra proud of our mothers and wanted to take time to reflect on the traditions, advice, and life lessons we learned from them. Keep reading to see what each staff member cherishes most around this holiday!

By Chloe Day

Amanda Harper, VP of Production, learned a "beauty" tip, but considers it life advice: if you have painful cuticles and hangnails – or you're prone to picking yours – use Neosporin as a cuticle cream. Not only does it moisturize, but it helps heal any wounds and prevents them from becoming infected.

Erin Oliver, Administrative Assistant, and her mom have a tradition of trying—and ranking—Lexington’s best margarita stops. The restaurant in the lead right now? Corto Lima on Limestone.

Fran Elsen, Editor-in-Chief, learned a few routines that are pretty simple; but still hold true every single day. She was taught at a very young age to make the bed every morning. Doing this fi rst thing every day starts the day with a feeling of accomplishment and jumpstarts one’s energy early. The other “lesson” she was taught (especially when she started using make-up in her early teen years) is to never go to bed without washing your face fi rst. Ever. She still does this every night, no matter how tired, how late, or where she is. Words of advice: "Don't let anyone tell you that you can't do something."

Vicki Evans, VP of Community Relations, has a mom who insists you should work a normal work week, like 9-5. Then enjoy the rest of your time away from the office doing the things you enjoy most. Your career should be just that… your career…. Not the main focus of your life.

Stephanie Gilmore, Photographer, has a mom who hosts the most amazing dinner parties–like she's Martha Stewart–plans fun games for the family to play on Christmas Eve, cans the best dilly beans all the granddaughters fight over, she's an amazing seamstress (she used to sew us all matching outfits for Christmas), loves to cross stitch, keeps meticulously manicured flower gardens, and can teach you all about astronomy, or ornithology. She’s the warm hug that holds everyone together. Now that Stephanie and her mom live in separate cities, she dreams of going home to snuggle on her mom’s couch for the world’s best back scratch.

Joseph Yarber, Digital Specialist, was taught to always work hard—no matter what you do in life.

Chloe Day, Graphic Designer, has a mother who has always been a style icon and beauty guru. Whether it was teaching her how to put on eyeliner, sharing her (extensive) collection of shoes, or handmaking the perfect bracelet, she always knows how to look puttogether. Even though she’s outgrown most of her mother’s shoes now, she still looks forward to going home and sharing makeup tips and their favorite fi nds with each other.

Keith Yarber, Publisher, learned by his mother’s example to treat everyone equally with dignity and respect, especially those who need it most.

Keni Parks, Photographer, grew up with a mom who was the wife of a minister, and took in over 35 foster kids throughout her childhood. They did not have a lot of money, but she never remembers feeling like she lacked for anything. The message she always remembers most from her mom’s life and influence, is “You can’t take anything to Heaven except people!”

Gari Lynn Rossi, Account Executive, has a mom who prioritizes honesty and kindness. Those who have met Gari Lynn know she holds this advice close to her heart!

Jennifer Baker, Account Executive, says that her mom is her biggest cheerleader on the good days, and her biggest supporter on the bad ones. She always says, “think about it before you do it” and Jennifer has never been in a fi st fight, so best advice ever!

Carmen Siguenza, Photographer, says that any time she gave her mom good news she would say, "Ay Gracias a Dios," which means, "oh thanks be to God!" This is something Carmen started to say in her late 20's because she truly believes God IS good, & always present throughout all of life's ups and downs!

Diana Gevedon, Business Manager, has a mom who believes life is too short to surround yourself with friends who don’t respect, appreciate, and value you.

Woody Phillips, Photographer, says his mom was fortunate to not have to work. She was a great example of a stay-at-home Mom and housewife. She instilled in him and his older sisters the importance of love and close family values. This has carried over into their adult lives and their families.

(According to the National Retail Federation) $35 Bi ion

Spent on Gifts for Mother's Day in the U.S. last year

(According to the FOX Business) 122 Mi ion

Phone Calls Made on Mother's Day Every Year