8 minute read

4.4 Illuminating international trade: The role of FATF and AML/KYC in combating financial crimes

In the shadows of the interconnected world of international trade lies a pervasive threat that silently endangers the security of global markets. Financial crimes, with their detrimental effects on stability and integrity, cast a dark cloud over the world economy, threatening the trust upon which international trade relies. From money laundering to terrorist financing, illicit activities can have far-reaching consequences.

Amidst these challenges, organisations like the Financial Action Task Force (FATF) along with the policies of Anti-Money Laundering (AML) and Know Your Customer (KYC) have emerged as crucial lines of defence, protecting the global financial systems.

But what exactly is the role of FATF and AML/KYC in combating these crimes? How do they contribute to the reliability and transparency of international trade?

In partnership with the ICC UAE’s annual conference, TFG’s Editor, Deepesh Patel, had an insightful discussion with Mohammed

Daoud, Director and Industry Practice Lead at Moody’s to understand the role of FATF and KYC/AML in the relentless fight against financial crimes.

The global guardian against financial crime: The FATF mission

The Financial Action Task Force (FATF) is an intergovernmental organisation established by the G7 summit in 1989. It serves as the global watchdog for money laundering and terrorist financing, promoting the implementation of AML/CFT procedures.

The FATF encourages jurisdictions worldwide to incorporate measures combating illicit financial activities into their legislative frameworks through a set of recommendations known as the “40 plus nine” recommendations. By advocating for updated laws, the FATF facilitates a country’s ability to freeze assets, close accounts, and conduct thorough investigations.

Moreover, every few years, the FATF conducts a mutual evaluation, which is a review process to assess if a country has effectively implemented new legislation, policies, and supervision against those crimes. Based on this evaluation, a country may pass, or be placed on a scrutiny or grey list in a bid to help the country improve its efforts in fighting money laundering and terrorist financing.

According to Daoud, the enforcement of FATF regulations has evolved over the years. Initially, the focus was primarily on tier-one banks and large financial institutions. However, Daoud clarified that this approach has gradually changed and expanded to encompass cross-border remittances due to their perceived high risk.

Establishing KYC guidelines and customer due diligence has been instrumental in mitigating these risks. Subsequently, the insurance sector and capital markets were also impacted by enforcement measures. Most recently, the nonfinancial sector has come under scrutiny, with countries facing more stringent evaluations.

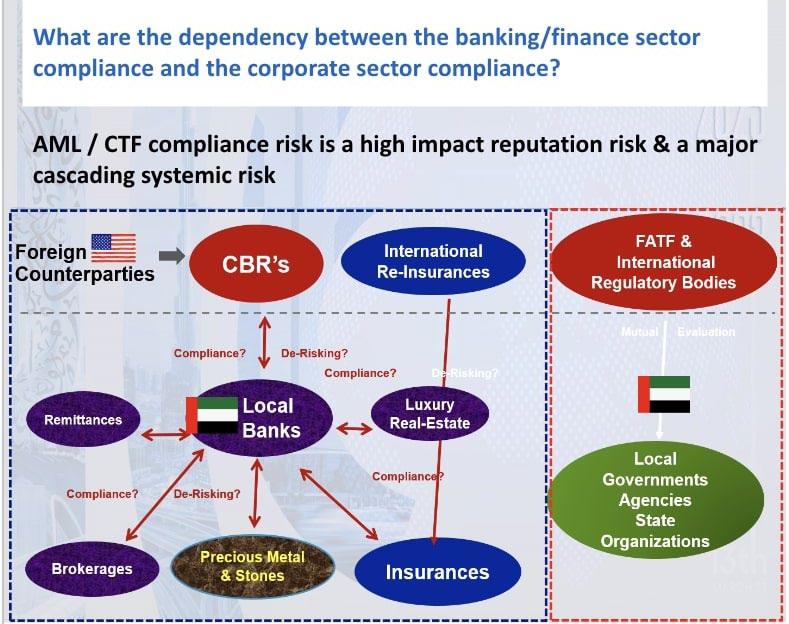

The interdependence of banking and corporate sector compliance: Defying the cascading risks

In today’s global economy, the banking and corporate sectors are intricately interconnected, forming a symbiotic relationship that significantly impacts financial stability and regulatory compliance. This close interdependence between these two sectors creates a delicate balance, where the failure to uphold compliance standards in one sector can trigger a cascading effect of risks throughout the entire financial system.

Compliance within the financial landscape is driven not only by local and international regulators but also by the inherent connectivity of the banking system. When banks engage in cross-border transactions with counterparties in other countries, they are bound to adhere to the regulations of those counterparties’ jurisdictions, particularly in emerging markets that heavily rely on third-party transactions and international currencies like the US dollar.

As Daoud explained, this principle of reciprocity, along with the expectation of shared values and guidelines among business partners, creates a complex compliance network.

While there was once a misconception that banks alone were solely responsible for transaction integrity, regulatory authorities have clarified that the corporate sector also holds liability to adhere to AML principles and KYC. Shifting the focus to the corporate sector recognises the potential misuse of shell companies for illicit activities, prompting the need for thorough due diligence and scrutiny.

Aggregators: Empowering effective compliance screening

Compliance screening plays an indispensable role in safeguarding the integrity of transactions and mitigating risks associated with illicit activities. The utilisation of external sanctions data, not only influences the effectiveness of compliance programs but also determines their ease of implementation. As Daoud highlighted, “There is a lot of external sanctions data that has a significant impact on the easiness and effectiveness of compliance.”

With over 300 lists issued by international regulatory bodies, each with its own set of criteria, navigating the vast array of sanctions lists can be troublesome. This challenge is further compounded by the diverse formats employed by different regulatory bodies such as the OFAC 50% sanctions rule, which extends sanctions to corporate entities with more than 50% ownership by a sanctioned party.

To address the complexity of diverse sanctions lists, aggregators, such as Moody’s, act as intermediaries, curating, standardising, and simplifying the data. Furthermore, aggregator databases not only include sanctions information but also cover the three compliance screening levels: sanctions, politically exposed persons (PEPs), and enhanced due diligence (EDD).

In addition, Daoud emphasised that it is equally essential to consider the impact of compliance regulations on other key actors within the industry. This includes verifying the identity of import-export clients, examining vessels and carriers, and assessing the role of agents, customs, and transport companies.

The complexity of trading operations makes trade-based money laundering a considerable concern, particularly during periods of geopolitical tensions. Instances of shell companies being used to evade sanctions and circumvent scrutiny have been observed, calling for increased diligence and monitoring in the threat finance domain.

Unleashing the power of technology for robust trade finance compliance

Trade finance compliance has undergone a remarkable transformation with the aid of technology, revolutionising processes and elevating compliance standards.

Daoud presented the transformative impact of technology in trade finance, shedding light on the following key applications and the tangible benefits they bring to all stakeholders involved:

KYC and Due Diligence Solutions: Technology-driven solutions streamline customer onboarding and ongoing monitoring, by verifying identities, assessing risk profiles, and ensuring AML/ CFT compliance.

Document Comparison and Reconciliation: Advanced technologies can swiftly scan and analyse complex trade documents, reducing errors and ensuring compliance with documentary credit requirements.

Tracking and Monitoring Systems: Technology empowers institutions to track threat finance over time, identifying patterns, profiling transactions, and uncovering suspicious activities related to dual-use goods or sanctions evasion.

With an abundance of technology-driven solutions, it is apparent that the integration of technology in trade finance heralds a new era of compliance, where streamlined processes and enhanced monitoring capabilities facilitate secure and transparent trade transactions.

4.5

Addressing the container deposit problem to promote intra-African trade

Container deposits tie up a significant amount of cash flow and hinder SMEs from using that liquidity to invest in other areas, and they may also make SMEs reluctant to take on new business opportunities that require container deposits, leading to lost opportunities and constrained growth.

In international trade, shipping containers are vital for transporting goods safely and securely.

To use them, however, many shipping lines require traders to put down deposits - known as container deposits - to safeguard against possible liabilities such as damage, demurrage, or total loss of the container.

While these deposits do provide a form of financial security for the shipping lines they can be a major issue for importers and exporters, estimated to cost $1.6 billion annually in East Africa alone, creating trade barriers and significantly impacting SMEs.

To learn more about this issue and explore a new container guarantee solution seeking to serve as an alternative to traditional deposits and help promote trade in East Africa, Trade Finance Global (TFG) spoke with Morgan Lépinoy, Managing Director of Viatrans.

Challenges caused by container deposits

Container deposits tie up a significant amount of cash flow and hinder SMEs from using that liquidity to invest in other areas, and they may also make SMEs reluctant to take on new business opportunities that require container deposits, leading to lost opportunities and constrained growth.

Lépinoy said: “The deposit ranges from hundreds to upwards of a couple of thousand US dollars per container depending on their type and destination and can tie up a significant amount of cash for SMEs, particularly if they need to pay deposits for multiple containers.”

Particularly when compared to larger competitors, the high cost, administrative complexities, and lack of standardisation surrounding container deposits create an expensive, timeconsuming, and burdensome process that puts SMEs at a competitive disadvantage.

To combat this, Viaservice has developed a container guarantee solution In East Africa that addresses these challenges and promotes trade efficiency in the region.

Lépinoy said: “The solution simplifies the payment process, making it easier, more efficient, and cost-effective for shippers to manage their finances. This, in turn, reduces the administrative burden on SMEs and frees up critical working capital that can be used for other important business activities and operations.”

While developing their offering, Viaservice collaborated with key institutional stakeholders, including shipping lines, clearing and forwarding agents, regulators, and trade facilitation agencies in East Africa.

As a result, SMEs can pursue and win new business opportunities that were previously out of reach, fueling their growth and expansion.

About the container guarantee program

Viaservice’s container guarantee solution maintains the liability chain while enhancing compliance and safeguarding commercial relationships.

Lépinoy said: “For SMEs, the solution provides a cost-effective and reliable way to access containers without tying up significant cash flow. For shipping lines, the solution provides a risk-mitigating alternative that does more than deposit towards securing payment, and removing bad debt”

Each guarantee issued is unique and applicable to a specific bill of lading, ensuring accountability, and customers must comply with prior obligations to remain eligible for future guarantees, reinforcing a culture of accountability in the logistics sector.

By acting as a trusted intermediary for advancing charges on behalf of customers, the solution does not remove any obligations from clients but rather enhances the liability chain and promotes compliance.

Numerous SMEs have made use of Viaservice’s container guarantee solution.

For example, a Tanzanian clearing agent was competing to win a large shipment requiring more than 100 containers. The shipping line was asking for a deposit of $1000 per container but the clearing agent could not afford to have $100,000 simply sit idle as a deposit.

Lépinoy said: “Thanks to our container guarantee solution, they did not have to and were able to secure this large business, all while increasing cash flow. They have since levelled the playing field for the company and are now competing for more and more cargo than before.”

This and other success stories demonstrate how the solution provides an alternative allowing SMEs to compete on equal footing with larger companies, seize new business opportunities, and contribute to the growth of intra-African trade.

Future opportunities for container guarantees expansion

Viaservice’s container guarantee solution has already demonstrated effectiveness in East Africa, but its potential extends beyond the region.

As the model gains recognition and success, there is an opportunity to replicate and expand the solution to other regions in Africa facing similar challenges.

By forming partnerships with local stakeholders, governments, and trade facilitation agencies, Viaservice can extend its reach and enable SMEs across the continent to thrive in international trade.

Furthermore, the success of the container guarantee solution opens doors for collaboration with global shipping lines and logistics providers.

By demonstrating the positive impact on SMEs and the overall trade ecosystem, Viaservice can foster partnerships with international players interested in promoting inclusive and efficient trade practices. This collaboration can contribute to the development of standardised container deposit systems that reduce barriers to trade and further facilitate global commerce.

As the solution expands its footprint and gains recognition, it has the potential to shape trade practices not only in East Africa but also across the African continent, fostering inclusive and sustainable economic growth.