RESEARCH

IN ACTION

Winter 2024

INSIDE THIS ISSUE

Writing a New Playbook for an Uncertain Future

How Rudeness Impacts

Performance in the Workplace

Proximity Bias: How Exposure to Public Foreclosures

Influences Mortgage Loans

The Future of Race and Consumer Research

Writing a New Playbook for an Uncertain Future

A few years ago, business and marketing gurus like Simon Sinek challenged companies to understand their “why” of doing business. But Violina Rindova of the Merage School at UC Irvine, and Luis L. Martins of the McCombs School of Business at UT Austin, push this idea even further in their paper “Moral Imagination, the Collective Desirable, and Strategic Purpose,” published in Strategy Science earlier this year.

“Sinek was spot-on about the importance of the ‘why’ question,” Rindova says. “Having a deeply articulated corporate purpose answers this question deliberately and strategically. Sinek works backward from something that’s observable—the ‘what’—to something that may or may not be explicit. Our argument is that purpose makes the ‘why’ explicit and communicable. Importantly, purpose is not just customer-focused. It should be the company’s approach to thinking about creating value that considers everybody in its stakeholder ecosystem. It’s not just the ‘why’ of the product; it’s the ‘why’ of how we engage with our stakeholders.”

Their article is part of Rindova’s larger research agenda, which is focused on firm strategy under uncertainty, as well as the role of stakeholder relations in how companies imagine and create the future. “This particular article is focused on moral imagination,” says Rindova. “It is about a different way of thinking about how we imagine the future—through moral imagination and stakeholders’ engagement in a way that the firm’s strategy might actually build positive—and ultimately collaborative—relationships with stakeholders. It’s not just the creation of a statement; it’s a set of practices and blueprints people have to learn.”

Rindova and Martins contribute to the literature on corporate purpose in management research from a very different strategic perspective. “Corporate purpose nowadays is largely defined as the reason why a firm exists,” Rindova says. “We felt this static definition is closer to a mission statement. To be strategic, purpose has to be dynamic.”

Thinking Differently

As far as Rindova and Martins are concerned, a company’s purpose should be dynamic if it is to be strategic. “Strategy should always be dynamic,” Rindova says. “So, if that is the case, why don’t strategists make something as essential as purpose more dynamic? We developed the concept of ‘collective desirable’ to explain how strategists can update their own frameworks about how to create value.

Our argument is that by engaging stakeholders in a collaborative dialogue, strategists could actually develop a completely different understanding of what future-oriented actions might create value. They will end up having a more dynamic theory of how their firm could create value in different stakeholder contexts, with all of their complexity and variety.”

So far, these ideas are largely still theoretical, meaning no data support their arguments. “We understand most companies do not do things this way,” Rindova says, “and there may not be a large number of examples of companies that have implemented everything we’re suggesting to the fullest extent. But we know enough to theorize that if companies could reimagine new ways to approach purpose—and strategy, as we’re suggesting—they might find new opportunities to create growth in categories where the status quo is already well established and find better alignment with their stakeholders.”

Expanded Horizons

Successful firms always look to innovate, but they don’t necessarily look to innovate beyond product development. “Clearly we can see that when companies get closer to their customers, they gain new insights,” Rindova says. “What we’re asking is, ‘What if a company could cast a broader net, understanding the variety of perspectives across stakeholders, and synthesize all of this through their own unique resources and capabilities?’ Not just to innovate one product but to create a whole different system of innovative exchanges. That’s our thinking.”

Rindova and Martins also believe purpose statements are something companies should consider expanding beyond the HR department. “Companies that emphasize purpose tend to see that as something that helps employees see their jobs as more meaningful and motivating, but our argument is this is actually something that could be motivating for suppliers and customers as well. Could that purpose be motivating for cities and communities? Could this be something we could not only create but lead in some ways? Would that purpose offer you some opportunities you’re not aware of yet?”

Innovative Pioneers

One barrier Rindova sees to her innovative ideas being embraced and implemented on a wider scale stems from the fact that, so far, only a few companies have taken this novel approach. Simply put, many leaders are

4 THE PAUL MERAGE SCHOOL OF BUSINESS

waiting for someone else to blaze the trail and prove the concept so they can copy the formula. “I think a lot of business practices can become settled if not inertial,” Rindova says. “It’s easier to copy something than it is to create and implement something new. Innovation comes with a lot more uncertainty. However, it’s also the case that when firms do innovate strategically, they can experience disproportionate gains. So, in principle, firms have incentives to do things differently. The only question is how differently, and in what way differently? This is what we want to explore.”

Inspiring Ideas

Most companies see stakeholders as something they need to manage, but what if engaging them on a deeper level could lead to greater innovation? “We argue that purpose is a coordinating mechanism,” Rindova says. “It’s direction-giving. It tells everyone this is where we’re going, which helps with evaluation and selection from investors, from employees who want to be part of this kind of organization. By making the statement, you’ve already moved away from pure economic reasoning. You’re saying that where you’re going matters—the ‘why’—and it’s also coordinating because other likeminded people who see the value of that direction are attracted to this focal point.”

Rethinking how to engage stakeholders and how to expand the company’s purpose is only the beginning. Rindova and Martins want companies to rethink their approach to strategy as well. “The reason this is different from the way we normally talk about strategy is that this

is about what you will do in the future,” she says. “It’s not a competitive analysis of how we will win market share. It is a statement about how we will create value differently, which brings more uncertainty. They go handin-hand: the notion that you will do something different and manage more uncertainty. Having processes like the one we propose in the paper is a way to manage that uncertainty.”

Looking Forward

What’s needed, as Rindova sees it, is a whole new way of thinking about the future. “It’s not just about how to develop your purpose but how to think with a new set of concepts,” she says. “I teach a course on strategic innovation, and when I first started teaching it to executives, many of them said, ‘I didn’t know I was creative or that I’m allowed to be creative.’ There is a whole ideology about business being rational and calculative, which always operates on the past and the present. This is a bit of a blind spot, I think. Executives should ask themselves if they think about the future as an extrapolation of the present or as something that could be different. That’s where the creative part begins.”

Final Thoughts

“This is not a paper about how firms develop strategies,” Rindova says. “It’s about how firms operate in a world that is increasingly disrupted by multiple uncertainties. This means executives cannot continue to rely on their old playbooks. Our paper offers one perspective on what a new playbook for strategy could look like. I believe one of the key chapters in that new playbook is about moral imagination and purpose.”

Violina Rindova holds the Dean’s Leadership Circle Chair. Prior the joining the Paul Merage School of Business, she was on the faculty of the Marshall School of Business, USC, where she held the Captain Henry W. Simonsen Chair in Strategic Entrepreneurship and served as a Research Director of the Greif Center for Entrepreneurial Studies; and the faculty of the McCombs School of Business, where she held the Zlotnik Family Chair in Entrepreneurship and Herb Kelleher Chair in Entrepreneurship and served as the Director of the Herb Kelleher Center for Entrepreneurship, Growth and Renewal. She holds a PhD in Management from the Stern School of Business, New York University, an MBA from Madrid Business School, Spain, and a JD from Kliment Ohridski University, Sofia, Bulgaria.

RESEARCH IN ACTION WINTER 2024 5 OPT-IN to read more from the Merage School.

How Rudeness Impacts Performance in the Workplace

In her recent research paper, “Do You Pass It On? The Effect of Perceived Incivility on Task Performance and the Performance Evaluations of Others,” published in Organization Management Journal, Professor Jone Pearce of the UCI Paul Merage School of Business, discovered rudeness can have a significant impact on job performance, morale, and the workplace environment.

Researchers have known for some time that if you’re rude to someone in a face-to-face setting, their work performance suffers. However, according to new research from Pearce and her coauthors—Kimberly McCarthy, PhD, California State University, San Marcos; John Morton, PhD, UCI; and Sarah Lyon, PhD, University of San Diego—email rudeness creates an even greater negative result.

Electronic Impact

The original inspiration for their research came from McCarthy. As Pearce says, “She has a very technical background in Silicon Valley, so the impact of technology on interpersonal communications really interests her. So when she proposed this topic as her dissertation, I thought it sounded like something worth investigating.

“We started off by taking a look at the existing research on the impact of face-to-face rudeness. We essentially used a slight variant of that data.”

Measured Response

By looking at responses that included a rudeness condition from undergraduate students at two different universities, Pearce and McCarthy examined how email impacted the students involved. “In the study, the subjects were all together in one room with a confederate who was in on the experiment,” says Pearce. That confederate asked a simple question of the experimenter, which was then responded to in one group rudely and in another group in a more civil tone. “There were a total of four groups: two groups who received the rude response, two that received the normal response, and out of those groups, some who were communicated to by email and some face-to-face,” Pearce explains.

Reduced Productivity

In the first study, they found people who received rude communication performed more poorly. “The really interesting thing to us was that, if the rudeness came as

an email, their performance on the task was significantly worse than if it came face-to-face,” says Pearce. In the second study, under the same conditions, the groups had to watch a video of someone practicing a speech. For those who experienced rude communication prior to the evaluation, they scored the person more harshly than those who did not. “The implication is that, if your boss just came out of a meeting where they got chewed out by their boss, it’s going to reflect poorly on how they evaluate your performance,” Pearce says. “Or if, let’s say, a faculty member at UCI received a rude comment from someone and then sat down to evaluate applications for admission to the school, they’re more likely to grade more harshly. Even though these are innocent bystanders who have nothing to do with the rudeness, they may still have to suffer the consequences. It really proves the old notion that if someone is nasty to you at work, you are more likely to go home and kick the dog.”

Environmental Concerns

The implication of this research is rudeness in the workplace is never an isolated incident. “The concern is that not only will workers perform poorly—which is bad enough in itself—but they’re also going to judge other people more harshly,” says Pearce. We’ve all heard the mantra “hurt people hurt people,” and according to this research, it’s certainly true. “The problem with email, as we know, is people think they’re more anonymous,” says Pearce.

“You can be rude face-to-face and undercut it with a shrug or a smile, but with email you

8 THE PAUL MERAGE SCHOOL OF BUSINESS

Trickle Down

can’t do any of that. We also know from previous research that people tend to over-interpret email communications, and they overreact.”

Because so much of corporate communications is done via email, the need to self-regulate is even greater. “The truth is people may not even be trying to be rude,” Pearce says, “but they’re rushed, or they’re frustrated about something, and it comes across as rudeness to the other person.”

The bottom line, then, seems to be that corporate environments based on rudeness can expect to produce less than those that are more encouraging and positive. Managers who are abusive to their employees are most likely being yelled at by their bosses too, and the entire organization suffers from the top to the bottom. “The implication is that if your boss is a jerk, it’s more than likely the organization that’s creating that environment,” Pearce says. “If so, you might want to look for another job because replacing that supervisor won’t fix the problem if the rudeness starts at the top.”

Solution-Oriented

Pearce also suggests corporations that want to identify and eliminate rude behaviors in the workplace may

want to consider asking employees about rudeness on surveys. “Instead of just asking workers if they like their job or the usual stuff,” she says, “it might be a good idea to ask them if they’ve experienced rude behavior from a customer or from a coworker or a supervisor.”

Best Results

Thanks to this research, the negative impact of rudeness on employee performance is clear. “A lot of managers believe—I think falsely—that if they’re rude and aggressive with subordinates, they’ll produce more,” Pearce says, “but this research, and several other studies, have proved this is really not the case. Being rude will actually get them to produce less and perhaps even quit eventually. Simply put, people who receive rude emails are much more likely to have lower performance on their work, but they are also more likely to evaluate the performance of others more harshly.”

Jone L. Pearce, is distinguished professor emerita of organization and management at the University of California, Irvine. She conducts research on how workplace interpersonal processes may be affected by political structures and organizational policies and practices. Her work has appeared in over 100 scholarly publications such as the Academy of Management Journal, Academy of Management Review, Journal of Applied Psychology, Organization Science; she has edited several volumes and written several books. She currently serves on several editorial boards and is a Fellow of the Academy of Management, the International Association of Applied Psychology, the American Psychological Association (Div 14, SIOP), the Association for Psychological Science and the British Academy of Management.

RESEARCH IN ACTION WINTER 2024 9 OPT-IN to read more from the Merage School.

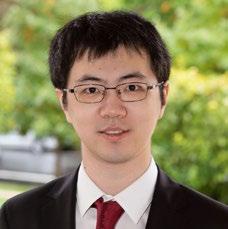

Proximity Bias: How Exposure to Public Foreclosures Influences Mortgage Loans

After the 2008 housing foreclosure crisis, people were curious how adverse conditions led to severe credit shortages and what could be learned to avoid similar recovery challenges in the future.

Until now most of the research in this area has focused more on the fundamental macroeconomic channels. However, a recent study by Dean’s Professor of Finance Yuhai Xuan at The UCI Paul Merage School of Business took a more micro-level, behavioral approach to examine the biases of individual loan officers.

RESEARCH IN ACTION WINTER 2024 11 OPT-IN to read more from the Merage School.

Xuan partnered with co-authors, Da (Derek) Huo of the University of Hong Kong, Bo Sun of the University of Virginia, and Mingzhu Tai of the University of Hong Kong to study the question in more depth. Their article, “Lending Next to the Courthouse: Exposure to Adverse Events and Mortgage Lending Decisions”, soon to be published in The Journal of Financial and Quantitative Analysis, explores how adverse market conditions might have influenced loan officers’ risk taking when they decide whether to accept or reject applications.

“We were interested in studying a behavioral channel in the financial market,” says Xuan, “and exploring how individual decision-makers are influenced by adverse market conditions through this behavioral channel. In this study, our concern was in credit markets and mortgage applications.”

Proximity Effect

To find their answers, Xuan and his co-authors knew they needed what’s known as a shock. “We needed to see if the decision makers acted differently depending on the location of their branch office and how that might affect their individual risk-taking behaviors,” says Xuan. “Within the same neighborhood or county, we needed differentiation between individuals at various loan offices.”

That differentiation ended up revolving around a unique phenomenon: public foreclosures. “We know that foreclosure events are sometimes held openly on the steps of the courthouse. So, if we think about the loan officer who works nearby, who sees these foreclosures happening on his way to work or on a lunch break, they might be more likely to feel that things must be really bad financially,” says Xuan. “Moreso than someone who only hears reports on the news or in conversations at work, we were curious about how experiencing these foreclosure events firsthand might influence individual decision makers.”

Public Exposure

Using the loan-level data they had obtained, Xuan and his team began mapping the locations of the banks in their study. “We measured the distance between those branches and the nearest courthouse,” he says. “From there we started looking at loan rejection rates and how they corresponded to the branch proximity to the county courthouse where foreclosures were held publicly.”

One might think that proximity to the courthouse wouldn’t matter since everyone is exposed to the same kind of news reporting, and most loan officers have the same basic ideas about how the economy is doing, so the salience of these public foreclosure events might not even have a significant impact on their decisions. But what Xuan and his team found was something quite the opposite.

“As soon as we did the first pass on the data, the result was very robust,” Xuan says. “It turns out that mortgage application rejection rates are more sensitive to foreclosure intensity when loan officers are more exposed to foreclosure news—meaning when they are close enough to a courthouse, they are more likely to reject a loan application when foreclosure events are more intensively held outside this courthouse. This is in spite of the same housing market and bank fundamentals across the country.”

Stronger Performance

A secondary result was that loans from those branches that were closer to the courthouses had lower default rates. This is consistent with higher lending standards being applied. “If we compare a loan officer working at a branch next to the courthouse versus another loan officer, working for the same bank, in the same county, at a branch farther away from the courthouse, it seems to be that the only difference here is the level of exposure to the foreclosure news by simply working nearer to the place where foreclosures are being conducted in the public view,” Xuan says.

“We looked at which counties actually hold these foreclosures in public,” he says. “Some of these

12 THE PAUL MERAGE SCHOOL OF BUSINESS

foreclosures are now online, or indoors, in many counties. In those cases, it wouldn’t have the same impact. But for those counties that do hold foreclosures outside and in public, the effect was there.”

Big Impact

This exposure to public foreclosures on the courthouse steps had a significant impact on the individual loan officers in their study. This exposure makes the loan officers who are nearer the courthouse more risk averse, which makes them more stringent when applying standards to loan applications. “That means they reject more applications than other officers, even though they’re working for the same banks located in the same counties,” Xuan says. “Incidentally, loans that were approved by those loan officers were less likely to default because the loan officers were less lenient. That was the big punch line.”

During times of economic hardship, economists often talk about how banking fundamentals can hurt the credit supply, but as Xuan’s research shows, there’s an unspoken individual level of bias to consider as well.

Adverse Effects Beyond the Local

Another key finding in their study is something akin to a self-fulfilling prophecy at the individual level in the banking industry. “Our finding suggests a selfperpetuating mechanism of sentiment which operates prominently during seasons of economic downturn and can exacerbate credit contraction and prolong the

economic recovery,” Xuan says.

“What I mean by that is, when things are bad, and when those individual decision makers are exposed more to that bad news, they operate more cautiously. They may want the economy to recover, but it may take longer because they are being more stringent and cutting back the credit supply even more,” Xuan says.

“For example, one of the tests we did was to measure credit supply by bank branches that were closer to courthouses, and we found that they had lower supply than branches of the same bank in the same county that were farther away from the courthouse. Our argument is that there is an effect on lending decision makers that could prolong a credit crunch and delay economic recovery.”

Major Implications

The main takeaway, according to Xuan, is that there is a strong link between the risk-taking behaviors of lending decision makers and their exposure to events of public foreclosures. “This individual bias could actually result in real outcomes and have real implications for performance, credit supply and the economic recovery,” Xuan says. “We all know that everyone is biased but the question to ask is, do we see any real impact on the economy? The answer here is yes, we do see substantial implications. That’s very important.”

“Knowing this, it might help to let loan officers know how their individual perceptions are impacting their decisions,” Xuan says. “If everyone could be exposed to the same level of news regarding the economy and perhaps through additional training, this effect might be reduced in the future.”

RESEARCH IN ACTION WINTER 2024 13 OPT-IN to read more from the Merage School.

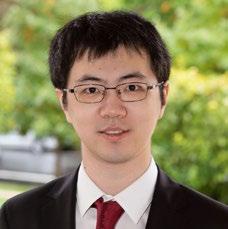

Yuhai Xuan is Dean’s Professor of Finance and Associate Dean of Master’s Programs in The UCI Paul Merage School of Business. He is an Associate Editor of the Journal of Financial Economics, the Journal of Financial and Quantitative Analysis, Management Science, the Journal of Corporate Finance, and the Journal of Empirical Finance. Prior to joining UC Irvine, he served on the faculty of the Harvard Business School and the University of Illinois at Urbana-Champaign.

The Future of Race and Consumer Research

When the Journal of Consumer Research wanted to celebrate their 50th anniversary, their editors asked the community to submit works that would lay the foundation for the next 50 years of their journal. To meet this call, Tonya Williams Bradford of the Merage School at UC Irvine and Sonya A. Grier of the American University of Washington, developed the idea for an article on issues of racial dynamics in the marketplace. Bradford, Grier, and fellow authors—David Crockett, UIC; Guillaume D. Johnson, Dauphine Recherches en Management; and Kevin D. Thomas, UC Santa Cruz—had their article accepted for that 50th anniversary issue of the Journal of Consumer Research to be published in 2024.

As undergraduates, Sonya Grier and Tonya Williams Bradford lived in the same dorm on the same floor at Northwestern University. “Now we’re both professors, and we’re coauthors,” says Bradford. “One of the things Sonya noticed early on in her academic career was there was little representation of race or ethnicity in any of the top marketing journals, and she wondered why this was the case. So she started doing research in this vein and realized very quickly that the top business journals weren’t focused on publishing papers around matters of race.”

Huge Opportunity

The Journal of Consumer Research is one of the top journals in the field that influences scholarship and practice, so the opportunity to submit an article for consideration for their 50th anniversary issue was something about which Bradford and Grier were both excited. “That’s when Sonya and I came together with some other scholars to assess what had been published and create a research agenda that focuses on studying the nature of race in the marketplace,” Bradford says, “and that sets up other scholars to study and publish on this topic in top journals for the next 50

Surprise Discovery

For their article, Bradford, Grier, and their team looked at all of the articles on race that were published in the Journal of Consumer Research during the last 50 years. What they found astonished them all. “Sadly, over the 50-year history of the journal, we found they had published fewer than a dozen articles on race,” Bradford says. “Based on this, we started to wonder, ‘What’s going on?’ and we decided to categorize the reasons why we thought race hadn’t been studied and what we thought should change. So, because there weren’t many articles from JCR, we pulled articles from other fields.”

Defining Terms

The first thing Bradford and Grier did was talk about race as a political or social construct. “It’s not biological,” says Bradford. “Race is typically about enforcing some artificial hierarchy in society.”

The team looked at literature in the social sciences.

“We started thinking about why the issue of race is so important,” she says, “because when people think about race, they often think about color: black and white. We don’t tend to think about race as something that influences social experiences globally, not just in the United States, so we also discuss race outside of the United States and talk about how race plays a role in consumer behavior and marketplace experiences globally.”

Context Matters

As they wrote their article, Bradford wondered why it was that people didn’t seem to consider race as something that matters in the marketplace.

“Psychologists who study cognition say a brain is a brain,” Bradford says, “but they forget context influences how our brains operate. Context makes some things possible and not others, for example. The irony here is, when we think about gender, we’re keen to say we recognize gender differences, but we don’t examine differences in terms of race.”

“I’m an anthropologist, and one of the things that makes anthropology interesting is how we take what

16 THE PAUL MERAGE SCHOOL OF BUSINESS

may be viewed as foreign and make it accessible. Something that’s happening on some remote island might seem strange, for example, but an anthropologist can compare that activity to something we can relate to like washing dishes or making dinner. That translation makes foreign experiences more accessible. Researchers need to invest time to understand the context around behaviors. It is necessary and important to be sensitive and respectful of those who share their personal experiences–particularly around race where experiences may cause pain.”

Creating Blueprints

In the article, Bradford, Grier, and their fellow researchers created a roadmap for studying race in consumer research. “We synthesized the three main dimensions where race has been studied,” Bradford says. “We identified how race structures consumption, how consumers navigate racialized markets, and we talked about consumer resistance to notions of race. At the same time, we recognized these aren’t separate and distinct dimensions, but there is some overlap between all of them. This allowed us to codify what’s in the literature, and to begin thinking about what should be donemoving forward.”

Wide Influence

When Bradford thinks about the impact of this work, she’s very optimistic about the possibilities. “People are mixing and mingling much more than they were 50 years ago when we first started publishing consumer research,” she says. “All of this influences how people consume and their experiences in markets. I think it’s

important for scholarship to provide understanding to our practitioner colleagues so they are able to make data-informed decisions about how to attract various types of consumers who might have different experiences due to race.”

“People often think about race scholarship as something that only racialized consumers care about. But I think it’s important for all of us to be aware this really impacts everybody. It’s not some niche phenomenon. This has implications for markets in significant ways that haven’t yet been contemplated.”

Future Hopes

The main impact Bradford and her co-authors want is for how increased understanding of race can produce richer research. “One thing I’m very hopeful about is that our article helps us reduce the amount of ignorance— not understanding or knowing—and encourages people to have a desire to do research that creates better experiences for all consumers.”

Final Thoughts

“One of the things we do in this paper is provide people with a framework to do research on race in markets and consumer behavior in a way that is meaningful and impactful,” Bradford says. “We want to provide guidance that allows an opportunity for a broader set of stories to be told about race, consumption, and marketplace experiences.”

RESEARCH IN ACTION WINTER 2024 17 OPT-IN to read more from the Merage School.

Tonya Williams Bradford is Associate Professor and Inclusive Excellence Term Chair Professor (2021 –2024). She earned her PhD (as well as her MBA and BA) at Northwestern University. Her research focuses on rituals and identity across phenomenon including gifting (e.g., registry, organ, charitable), relationships with money, communities (e.g., tailgating and support), acculturation, and consumer-brand relationships.

Research Abstracts

Latest Published Work by Merage School Faculty Members

Accounting Abstracts

Professor Patricia Wellmeyer and Professor Emeritus Mort Pincus

Title: “Do Client Managers Strategically Manage Earnings in Response to Auditors’ Quantitative Materiality Threshold Disclosures?”

Co-author: Lijie Yao

Accepted at: Accounting Horizons

Expanded audit report regulation in the United Kingdom requires auditor disclosure of client-specific quantitative materiality thresholds (QMTs). The United States decided against requiring this disclosure, concerned that providing clients with visibility into this important audit input could enhance managers’ ability to manage earnings without detection. Using the U.K. setting, we investigate whether clients strategically leverage their auditors’ QMTs to increase income through undetected earnings management. We examine the association between auditor QMT and client earnings management generally and in client settings where a material qualitative factor in the form of heightened earnings management incentives exists. In our general setting, we find a positive relation between auditors’ lagged and current QMTs and clients’ current year accruals-based earnings management. We do not find a relation in our heightened earnings management settings, however, suggesting auditors’ consider qualitative materiality factors and constrain clients’ auditor QMT based earnings management.

Finance Abstracts

Professor Yuhai Xuan

Title: “Governance by One-Lot Shares”

Co-authors: Feng Cao, Rongli Yuan, and Hong Zou

Accepted at: Journal of Financial and Quantitative Analysis (Journal on Financial Times Top 50 list)

We use a novel experiment in China to examine the effects of having a quasi-official investor own a small number of shares on specific firm outcomes. We find that relative to control firms, pilot firms experience an increase in dissenting votes from independent directors, a reduction in tunneling and earnings management activities, and an improvement in merger performance. Independent directors questioned by the quasi-official shareholder in activism events subsequently lose board seats in the director market. Overall, our results shed light on a new mechanism for enhancing the protection of minority shareholders.

18 THE PAUL MERAGE SCHOOL OF BUSINESS

Operations & Decision Technologies Abstracts

Professor Zugaung Gao

Title: “Aggregating Distributed Energy Resources: Efficiency and Market Power”

Co-authors: Khaled Alshehri and John R. Birge

Accepted at: Manufacturing & Service Operations Management (Journal on Financial Times Top 50 list)

The rapid expansion of distributed energy resources (DERs) is one of the most significant changes to electricity systems around the world. Examples of DERs include solar panels, electric storage, thermal storage, combined heat and power plants, etc. Due to the small supply capacities of these DERs, it is impractical for them to participate directly in the wholesale electricity market. We study in this paper the question of how to integrate these DER supplies into the electricity market, with the objective of achieving full market efficiency. We study four aggregation models, where there is an aggregator who, with the knowledge of DERs’ utility functions and generations, procures electricity from DERs, and sells them in the wholesale market. In the first aggregation model, a profit-maximizing aggregator announces a differential two-part pricing policy to the DER owners. We show that this model preserves full market efficiency, i.e., the social welfare achieved by this model is the same as that when DERs participate directly in the wholesale market. In the second aggregation model, the profit-seeking aggregator is forced to impose a uniform two-part pricing policy to prosumers from the same location, and we numerically show that there can be large efficiency loss. In the third (fourth) aggregation model, a uniform (semi-uniform) two-part pricing policy is applied to DER owners, while the aggregator becomes fully regulated but is guaranteed nonnegative (positive) profit. It is shown that these models again achieve full market efficiency. Furthermore, we show that DER aggregation also leads to a reduction on the market power of conventional generators. DER aggregation via profit-seeking and/or regulated aggregators have been investigated by CAISO and NYISO, among others, and the recent FERC Order No. 2222 paved the way for aggregators to bid in the wholesale market. Our four aggregation models may shed light on how DERs should be included in the wholesale electricity market.

RESEARCH IN ACTION WINTER 2024 19 OPT-IN to read more from the Merage School.

Professor Emerita L. Robin Keller

Title: “Counterfeits can Benefit Original Products when People are Caught using Counterfeits”

Co-author: Liangyan Wang (PhD alumna)

Accepted at: Psychology & Marketing

Existing literature has examined the influence of a counterfeit on the original brand in the prior or middle purchase phases. Our work aims to expand the literature by analyzing the post-purchase phase of counterfeit consumption. In four studies, we examine the effects of product message appeal (symbolic vs. utilitarian) and selfconstrual (interdependent vs. independent) on preference changes and purchase intentions of consumers toward original products when they are caught using counterfeits. Individuals with interdependent (vs. independent) self-construal are more likely to increase their preference and purchase intention for original products after being caught using symbolic rather than utilitarian counterfeits. Moreover, face restoration mediates the interaction effect between product message appeal and self-construal on the purchase intent of consumers in procuring original products. The patterns are consistent in both hypothetical scenarios and counterfeit consumption experience. Our work suggests that companies or brand, whose products are often copied or imitated should pay more attention to establishing their unique characteristics and the primary value of their product delivered to the consumers through product design and marketing mix strategies.

Organization and Management Abstracts

Professor Noah Askin

Title: “Disrupted Routines Anticipate Musical Exploration”

Co-authors: Khwan Kim and James A. Evans

Accepted at: Proceedings of the National Academy of Sciences (PNAS)

Understanding and predicting the emergence and evolution of cultural tastes manifested in consumption patterns is of central interest to social scientists, analysts of culture, and purveyors of content. Prior research suggests that taste preferences relate to personality traits, values, shifts in mood, and immigration destination. Understanding everyday patterns of listening and the function music plays in life has remained elusive, however, despite speculation that musical nostalgia may compensate for local disruption. Using more than one hundred million streams of 4 million songs by

20 THE PAUL MERAGE SCHOOL OF BUSINESS

tens of thousands of international listeners from a global music service, we show that breaches in personal routine are systematically associated with personal musical exploration. As people visited new cities and countries, their preferences diversified, converging towards their travel destinations. As people experienced the very different disruptions associated with COVID-19 lockdowns, their preferences diversified further. Personal explorations did not tend to veer toward the global listening average, but away from it, toward distinctive regional musical content. Exposure to novel music explored during periods of routine disruption showed a persistent influence on listeners’ future consumption patterns. Across all of these settings, musical preference reflected rather than compensated for life’s surprises, leaving a lasting legacy on tastes. We explore the relationship between these findings and global patterns of behavior and cultural consumption.

Professor Patrick Bergemann

Title: “How Social Influence Affects Reporting: Toward an Integration of Crime Reporting, Whistleblowing, and Denunciation”

Accepted at: Annual Review of Sociology

Reporting—often by ordinary individuals—is the most common means by which authorities become aware of crimes, misconduct, and other types of deviant behavior. In this paper, I integrate research across a variety of disciplines and domains to review the role of social influence in the decision to report. Such influences operate at the individual, group, and societal levels to shape reporting behavior, as potential reporters respond to both direct and indirect pressures, along with considering the anticipated reactions of others were a report to be made. Together, these influences can either suppress or promote reporting, which shapes who is identified, investigated, and ultimately punished for deviant behavior within organizations, communities, and states.

RESEARCH IN ACTION WINTER 2024 21 OPT-IN to read more from the Merage School.

Awards and Honors

Professor Emerita L. Robin Keller

Award: 2023 Fellow of Society for Risk Analysis

This award is a special recognition for substantial achievement in science or public policy relating to risk analysis and substantial service to the Society for Risk Analysis. Fellows include up to one percent of the Society members per year. This was conferred at the SRA Annual Meeting in Washington DC in December 2023.

Professor Emeritus Terry Shevlin

Award: The Australian Accounting Hall of Fame (induction in March 2024)

The Australian Accounting Hall of Fame award recognizes individuals who are making or have made a significant contribution to the advancement of accounting in Australia. The Australian Accounting Hall of Fame nominations review panel is an independent committee, which consists of some of the most influential and respected accountants from academe, accounting practice, government, and business from around Australia. Their task is to elect the most distinguished accounting practitioners and academics who are considered to have made a significant contribution to the advancement of accounting in Australia.

22 THE PAUL MERAGE SCHOOL OF BUSINESS

Book Chapters

Professor Tonya Williams Bradford and Professor Emerita Mary C. Gilly

Title: “From a Blank Piece of Paper: Starting a Research Project”

Published in: Handbook of Qualitative Research Methods in Marketing, 2nd Edition

This opening chapter in the handbook for the leading qualitative research methods for marketing scholars provides guidance on how to manage the first stages of a research project.

OPT-IN to read more from the Merage School. RESEARCH IN ACTION WINTER 2024 23

Want more Research in Action? Subscribe for monthly articles sent straight to your inbox.

Drive

4293 Pereira

Irvine, CA 92697-3125-30

Illustrations by Emily Young ’20

merage.uci.edu