IGNACIO GARCÍA DE OLALLA and

Christian Andvik

Christian Andvik

Christian Andvik

Christian Andvik

©Universitetsforlaget2023

ISBN978-82-15-05813-9

Allrightsreserved.Nopartofthispublicationmaybereproduced,storedinaretrievalsystem,or transmittedinanyformorbyanymeans,electronic,mechanicalorphotocopying,recording,orotherwise, withoutthepriorpermissionofUniversitetsforlaget.EnquiriesshouldbesenttotheRightsDepartment, Universitetsforlaget,Oslo,attheaddressbelow.

Universitetsforlaget

P.O.Box508Sentrum

NO-0105Oslo

Norway www.universitetsforlaget.no

Coverdesign:MetteGundersen

Prepress:AITGrafiskAS

Binding:BokbinderietJohnsen

Typeset:MinionPro,11/13.5pt

Papir:90gArcticMatt

PrintedinNorwaybyAksellAS

Afterreadingthischapteryoushouldbeableto:

• understandwhatfinancialstatementanalysisis

• understandwhatvaluationis

• haveanoverviewaboutthestepsinbusinessanalysis

• knowwhatstakeholdersare,andunderstandthefocusofwhatwecallequity-orientedstakeholders

• understandthestructureofthebook

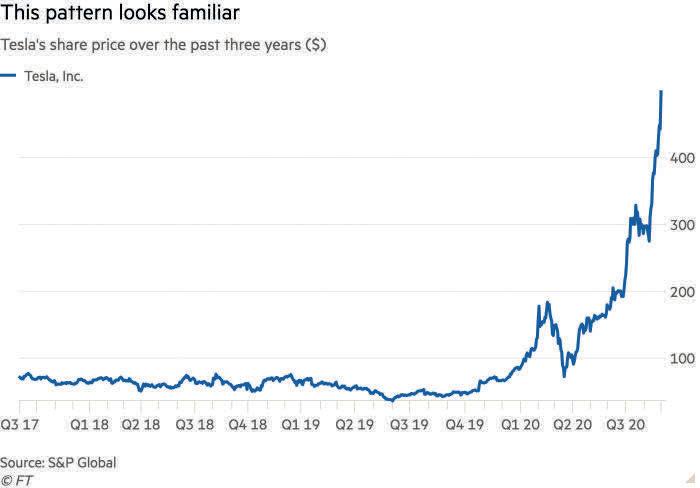

Figure1.1 Thisgraph showsthepriceof Tesla’sstockfrom August2017to August2020when thearticlewaswritten.Thegraphis retrievedfromPowell (2020)

Considerthefollowingcase:

Tesla,Inc.isanAmericancompanyspecializingintheproductionofelectricvehicles andcleanenergy.OnSeptember1,2020,the FinancialTimes publishedanarticletitled “Teslaisnuts,willitevercrash?”1 Atthattime,themarketcapitalizationofTeslawas $463billion.Meanwhile,GeneralMotorsmarketcapitalizationwas$42.19billion.In 2019,GMhadshipped7.7millionvehicleswhileTeslahadshippedjustover360000. Teslahadreported$800millionoffreecashflowovertheprevious12months,while Johnson&Johnson,Walmart,andVisahadreported$17.2bn,$23bn,and$11.5bnof freecashflowrespectively.However,Teslawasvaluedhigherthanthosethreecompanies.

Theauthorofthearticlewaspuzzledaboutthesenumbersandwonderedwhenthe firmstockwouldmovetofundamentals(ifever).AsofApril13,2021,Tesla’sstock closingpricewas$762.32,i.e.,$264higherthantheclosingpricewhenthearticlewas written($498.32asofAugust31,2020).Giventhissituation,thefollowingquestions arenatural:

•IsTesla’spricereasonable?

•WhyisTesla’spricesohighevenifitshistoricalperformancehasbeeneitherpooror modest?

•WhatisthemarketassumingaboutTesla’sfuturetojustifythisprice?

•IsTesla’sstockovervalued,undervalued,orfairlyvalued?

1 Powell(2020).

Toanswerthesequestions,weneedtounderstandhowthemarketvalueofacompany isestimated.Tovalueafirm,wemustmakeextensiveuseofitsannualreports.Weneed tobeabletounderstandwhattheannualreportssay,andwhattheydonotsay.Therefore,weneedtohaveacertainunderstandingofthelanguageofbusiness–i.e.,accounting.Wealsoneedtobeabletoextracttherightinformationfromthereports,which requiresseveralsteps.Wefirstneedtomakeabusinessstrategyanalysistounderstand thefirm,theindustry,andtheeconomyinwhichitoperates.Then,weperforman accountingqualityanalysis,andafterthatwereformulatetheincomestatement,balancesheet,andfindthefreecashflowssowehavethemunderasuitableformatfor analysis.Wethenmakeananalysisoftheprofitability,thegrowth,andtheliquidityof thefirm.Thereformulationoftheannualreportsandtheanalysisofprofitability, growth,andliquidityfallintowhatwecallfinancialstatementanalysis.Afterthis,we makeforecastsoftheincomestatement,balancesheet,andfreecashflowsthatwe expecttooccurinthefuture.Todothis,weneedtoconsidermuchoftheinformation fromthefinancialstatementanalysis,togetherwiththestrategicanalysisofthefirm. Onlyafterallthepreviousstepshavebeenthoroughlyimplementedcanwetakethings furtherandapplyvaluationmodelstoourforecastfinancialstatementsandestimatethe marketvalueofthefirm.

Thisbookisintendedtoprovidethereaderwithenoughknowledgeandself-confidencetoanswertheabovequestionsformanydifferenttypesoffirms.Weareassumingbasicpreviousknowledgeofeitherfinanceoraccounting.Therequiredconceptsin financewillbeintroducedandexplainedastheyappear.Ofcourse,ifthereaderis alreadyfamiliarwithaconcept,theyarewelcometoskipthatspecificpartandcontinue withthemainbodyofthetext.However,itisneverabadideatoquicklyreviewconcepts,evenwhenonethinkstheyareverybasic.Thenecessaryknowledgeinaccounting andbookkeepingwillbepresentedinChapter2.Whensolvingexamples,cases,and exercises,wewillmakeextensiveuseofExcel.ThereaderwillbepresentedwithdifferentExcelapplicationswhentheyappear.

Asbrieflyexplainedintheprevioussection,thebusinessanalysisprocessconsistsof severalsteps.Letusbemorespecificandexplorewhatthedifferentstepsareintended touncover.Notethatthesestepsmightbelistedinadifferentorderinothersources, andsomestepsinthosesourcesmightincludeseveralofthestepsenumeratedhere. However,attheendoftheday,theoutcomeisthesame.

Thefirststepistomakea businessstrategyanalysis.Thepurposeofthisistounderstandtheeconomyandtheindustrywherethefirmoperates.Theanalystneedsto understandthefirm’sstrengthsandweaknesses,aswellasitsstrategyforcreating sustainablecompetitiveadvantage.Itisnotenoughtoknoweverythingaboutacompany.Theyalsoneedtounderstanditsindustryandtheeconomicforcesthatarelikely toaffectitsindustryandthefirmitself.Aproperbusinessstrategyanalysiswillallow theanalysttoperformabetterassessmentofaccountingqualityby,forexample,the identificationofkeyaccountingpolicies.Italsoprovidestheanalystwithmoreinformationtoevaluatewhetherthehistoricalandcurrentperformanceofthefirmis

satisfactory.Furthermore,ithelpstheanalystassesswhetherthecurrentlevelsofprofitabilityandgrowtharesustainableinthefutureand/orforhowlong.Aproperbusiness strategyanalysisalsoprovidestheanalystwithenoughknowledgeaboutwhattoexpect ofthecompanyinthefuture;thatis,itenablesthemtomakesoundandrealisticforecastassumptions.

Thesecondstepistomakean accountingqualityanalysis.Thereadermighthave readorheardaboutsomefinancialreportingscandalsinthepastsuchasEnronor Parmalat.Whentheanalystusesreportedfinancialstatementdata,theyareassuming thatthesegiveacorrectandunbiasedpictureoftheeconomicrealityofthefirminthe currentperiodandareinformativeabouttheprofitabilityandrisksthatthefirmwill encounterinthefuture.However,asthoseaforementionedscandalsshow,theymustbe awareofpossibleaccountingdistortions.Notethatalthoughthestatementsarenot fraudulent,theymightstillnotindicatethefutureearningpotentialcorrectly.Through accountingqualityanalysis,theanalysttriestoanswerquestionssuchas:

•Wherecanaccountingflexibilitybefound?

•Howappropriatearethefirm’schoicesofaccountingpoliciesandestimates?

•Dothesedeferfromthechoicescompetitorsinthesameindustrymake? Ifso,whyisthis?Isthisjustifiable?

•Dothemanagershaveincentivestodistortreportedincome?

•Arethediscussionsfoundinthereportscredible?

Giventheaccountingqualityanalysis,theanalystmightconsideradjustingsome reportednumbers.Forexample,ifafirmisdepreciatingitsbuildingsassumingauseful lifeof20years,whileitscompetitorsassumeausefullifeof25,theanalystmightadjust thedepreciationexpensedeveryperiodtoenhanceaccountingquality.

Thethirdstepisto reformulatetheincomestatementandthebalancesheet,andfind thefreecashflow.Theannualreportsastheyappearreportedbythecompaniesare preparedinaformatthatismoreadequateforcreditanalysisthanforvaluationpurposes.Afirmconsistsofoperatingactivities(includinginvestmentsinoperations)and financingactivities.Theanalystneedstodistinguishbetweenoperatingandfinancing itemsandgroupthemtogetherintheincomestatementandinthebalancesheet.The logicbehindthisisthatthemaincomponentofsustainablevaluecreationofafirmisits operatingactivities.Inotherwords,theanalystwantstofindouthowmuchcapitalthe firmhasinvestedinitsoperationsandhowmuchoperatingprofitandfreecashflow thefirmgenerateswiththatinvestedcapital.

Thefourthstepisthe estimationofthecostofcapital.Todrawconclusionsaboutthe profitabilityofafirm,theanalystneedstoknowwhatthefirm’sstakeholdersrequireas aminimuminreturnfortheirinvestment.Whenaninvestorbuysstocksinafirm,they expecttobecompensatedfortherisktheyaretaking.Thisiswhatwecalltherequired rateofreturn.Bycomparinghowmuchthecompanyisgivinginreturnwiththis requiredrateorreturn,theinvestorcanassesstheadequacyoftheprofitabilityofthe firm.Tovalueafirm,theanalystneedstoestimatethefuturecashflowsthatthefirm willgenerateandtranslatethemintotoday’smoneybydiscountingthembyanappropriaterequiredrateofreturnthatconsiderstherisksthatthefirmbears.Notethat

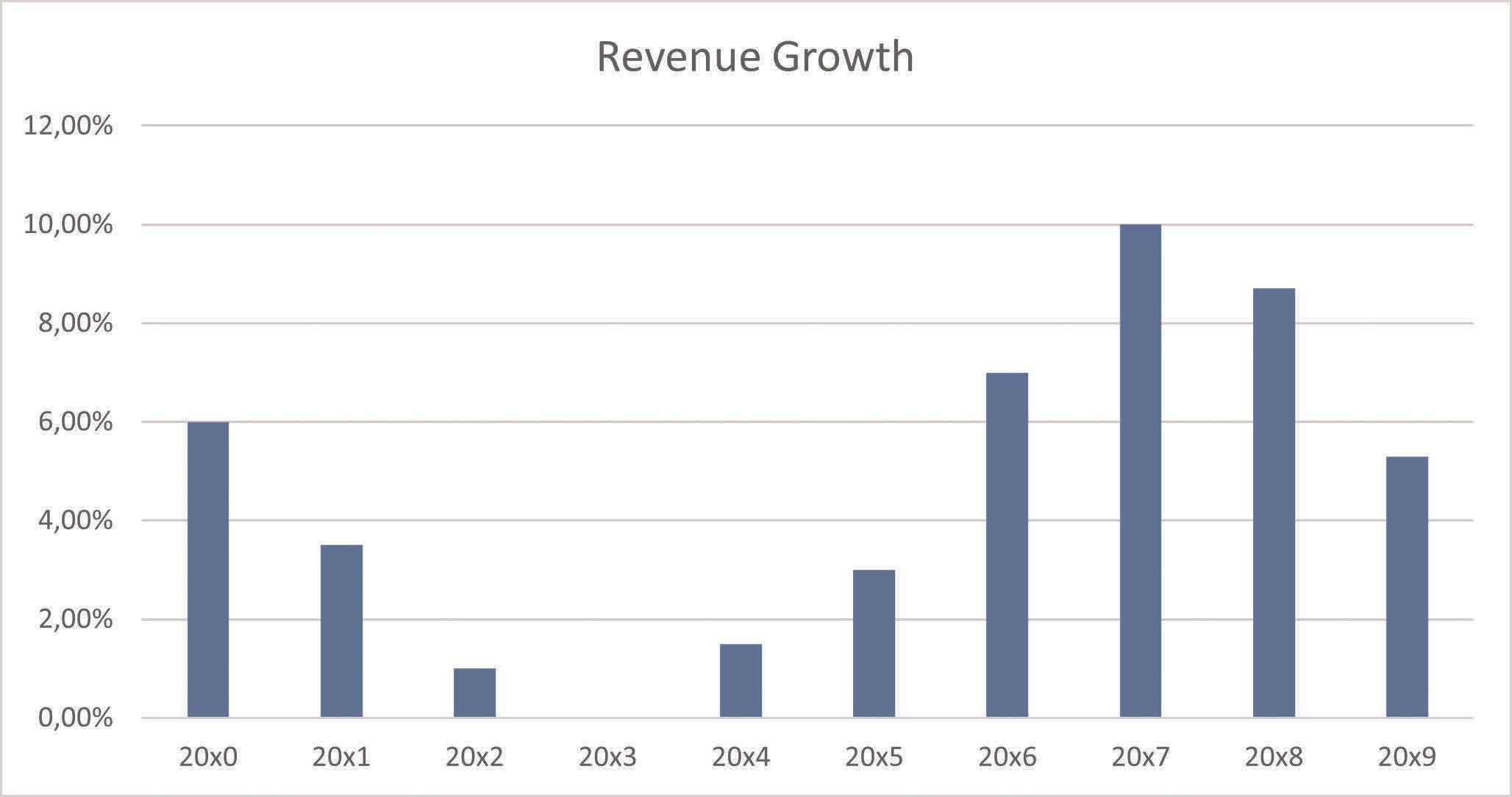

Figure1.2 Thisgraph showsthepastrevenuegrowthrates thatafirmachieved from20x0to20x9.

Giventhehistoryof thefirm,theanalyst hasamaximumrevenuegrowthof10% andaminimumof 0%toassigntotheir forecast.

manytextbooksleavethisstepforlater;thatway,thecostofcapitaldoesn’tappearuntil lateinthetextbook.Thisauthorbelieves,however,thatthecostofcapitalshouldbe studiedearliersothereadercanstartthefinancialstatementanalysisprocessoffirmsas theyreadthebookratherthanwaitinguntilthelaterchapters.

Thefifthstepiswhatisunderstoodas financialstatementanalysis.Financialstatementanalysisusestheinputfromthefirstfourstepsandassessesthepastandcurrent performanceofthecompany.Theanalystevaluatestheperformanceofthefirmregardingdifferentaspects–specifically,profitability,growth,andliquidity.

Thesixthstepistheforecastofthe incomestatement,balancesheet,andfreecash flow.Sofar,theanalysthasbeenanalyzingthepasteconomicperformanceofthefirm. Atthispoint,theychangetheirfocusandtrytopredictwhattheeconomicrealityofthe firmwillbeinthefuture.Theymakeaforecastoftheincomestatement,thebalance sheet,andthefreecashflow.Todothis,theyneedtousetheinputbothfromthe businessstrategyanalysisandfromthefinancialstatementanalysis.Forexample,if theyhavemadeagrowthanalysisanduncoveredthatannualrevenuegrowthinthe last10yearshasoscillatedbetweenamaximumof10%andaminimumof0%,and, giventhestrategicanalysis,theyareextremelyoptimisticabouttherevenuegrowthin thecomingtwoyears,thentheyknowtoexpectarevenuegrowthofaround10%.Note thatthereisalotofsubjectivityhere.Whychoose9.5%andnot8.5%?The10%ceiling is,however,muchmorecertainbecauseofthehistoricalgrowthofthefirm.Theanalyst knowsthat,atthebestoftimes,thisfirmdoesnothaverevenuegrowthofmorethan 10%.Doesthatmeanthattheycannotassumemoregrowththan10%?No,butitneeds tobejustified.Itneedstobebasedonasituationthathasnotoccurredbefore(for example,theybelievethatthefirm’snewproductisgoingtobeahugesuccessinthe market,andthishasnothappenedbeforeinthiscompany).

Thefinalstepis valuation.Inthisstep,theanalystmakesuseofvaluationmodelsto findtheintrinsicvalueofthefirm.Notethatsometimestheymightnotbeinterestedin findingthevalueofthefirm.Forexample,tofindoutifafirmwillgenerateenough

cashtofunditsexpansionplans,theanalystdoesnotneedtovaluetheorganization. TheywouldstopinStep6andtrytoforecastthecashgeneratedbythefirminthe futuretoascertainwhetherthatisenoughtoaffordtheexpansionplans.However,to answerthequestionsraisedintheTeslacase,theanalystneedstomoveonestepfurther anddoavaluationofthefirm.

Thestructureofthebookfollowstheorderofthebusinessanalysisprocesspresented here.TheonlyexceptionisChapter2,whereanintroductiontoaccountingandthe financialstatementsarepresented.

Theknowledgeacquiredinthisbookcanbeappliedtofinancialstatementsprepared underdifferentaccountingstandards.Forexample,Tesla’sstatementsarereported underUSGenerallyAcceptedAccountingPrinciples(USGAAP).However,whenwe presenttopics,wewillusethedefinitions,recognition,measurements,andclassificationissuesaspresentedunderInternationalFinancialReportingStandards(IFRS), developedbytheInternationalAccountingStandardsBoard(IASB).Listedcompanies intheEU,andmanyothercountriessuchasAustralia,HongKong,Russia,Singapore, orSouthAfrica,reportusingIFRS.InNorway,listedfirmsneedtoreportusingIFRS. UnlistedcompaniesthathavelisteddebtsecuritiesatOsloBørsmustalsoreportusing IFRS.OthertypesofNorwegianfirms–forexample,asmallprivatefirm–canchoose toreportusingIFRS,GRS(godregnskapsskikk),orevenSimplifiedIFRS(forenklet IFRS).Inpractice,thismeansthatmostofthecompaniesinNorwaycanchooseto presenttheiraccountsusingoneofthosethreesetsofaccountingrules.2

Althoughthedifferencesbetweendifferentaccountingstandardscanbebroad,allof themsharethesamebasicprinciples.Theknowledgeacquiredinthisbookwillbe applicablenomattertheaccountingstandard.Inanycase,theimplicationsofthedifferencesindifferentaccountingstandardsfortheanalysisarebeyondthescopeofthis book,andtheauthorbelievesthattheyarealsobeyondthescopeofanintroductory bookinfinancialanalysisandvaluation.

Everyindividualorgroupwithaninterestinabusinessiscalledastakeholder.Astakeholdercanbeasupplier,aclient,thegovernment,theshareholders,abankthathaslent moneytothefirm,andmanyothers.Twoimportantgroupsofstakeholdersarethose thatareconcernedabouttheequityofthefirmandthosethatareconcernedaboutthe debtofthefirm.Inthisbook,wewillmainlytaketheperspectiveofthestakeholdersthat areequityoriented.Equity-orientedstakeholdersusuallymakeuseoffinancialinformationtocalculatetheintrinsicvalueofthefirm.Aninvestor,forexample,estimatesthe valueofthecompany’sstockanddecideswhethertobuy,sell,orholdsharesofthefirm. Anotherexamplewouldbeananalystworkingforafirm,whowouldadvisetheircompanyaboutthecorrectbidtomakewhenacquiringanotherfirm.

2 PWC(2020).

1.5OutlineoftheBook

Therestofthebookcontinuesasfollows:

Whilewedonotneedtobeaccountantstodofinancialstatementanalysis,wedoneed tounderstandtheaccountingrulesandbookkeeping.Theintentionofthischapteristo giveyouabasicunderstandingofbookkeepingandputyouinapositiontounderstand thefinancialstatements.Welearnabouthowtransactionsarerecorded(i.e.,debitand creditsystem)andhowthesetransactionsaretransferredtothefinancialstatements. Welearnaboutthestatementoffinancialpositionandtheincomestatementandhow tobuildthemfromourrecordedtransactions.Then,wecontinueourintroductionto accountingbylearningthedetailedcontentoftheincomestatement,thestatementof financialposition(orbalancesheet),thestatementofchangesinequity,andthecashflowstatement,andhowtheseconnectwitheachother.Wealsodeepenourunderstandingofaccrual-basedaccountingandtheimplicationsofthissystemfortheanalyst.

Whenwevalueafirm,weneedtomakeproperforecastsoffutureearningsandcash flow.Inthischapter,welearnsomebasicframeworkstoanalyzethefirm’sbusiness environment,theindustry,thecompetitivestrategy,andthecorporatestrategy.These frameworksallowustohaveabetterunderstandingofwhatwecanexpectfromthe firminthefuture:Areweoptimisticaboutthecomingyears?Arewepessimistic?Ordo webelievethatthecompanyhassomenormalyearsahead?Notethatwestillcannot translatetheseexpectationsintonumbers.Todothis,weneedtocomplementthis informationwithaproperfinancialstatementanalysis,whichwillbethetopicoffuture chapters.

Chapter4–AnalysisofAccountingQuality

Thischapterisintendedasanintroductiontoaccountingqualityanalysis.Welearnto identifyplaceswherethereisaccountingflexibility,andwelearntoevaluateifthe accountingpoliciesandestimatesmadebythefirmarereasonable.Wealsolearnhow toadjustaccountingnumberswhereweidentifyaccountingdistortions.Thisisanintroductorychapter.Webelievethatalthoughthisisatopicthatthereadermusthaveabasic knowledgeabout,itsscopeisfarfromanintroductorytextbookinvaluation.

Chapter5–ReformulationoftheIncomeStatementandtheBalanceSheet

Inthischapter,welearnhowtoreformulatetheincomestatementandthebalancesheet forfinancialstatementanalysisandvaluationpurposes.Weneedtoidentifywhich itemsareoperatingandwhicharefinancingandgroupthemtogether.Welearnto calculatethenetoperatingprofitaftertaxesandthenetoperatingassetswhichare theelementsofthereturnoninvestedcapital–oneoftheratioswelearninChapter7. Wealsoexplorehow,startingfromthereformulatedincomestatementandbalance sheet,tofindthefreecashflowtothefirmandthefreecashflowtoequity.Theknowledgelearnedinthischapterisessentialforfinancialstatementanalysisandvaluation.

Chapter6–CostofCapitalandCapitalStructure

Inthischapter,welearnabouthowwecanestimatethecostofcapitalfordifferent firms.Weintroducethecapitalassetpricingmodelandhowtouseittocalculatethe costofequityandthecostofdebt.Wealsolearnabouttheweightedaveragecostof capital.Wediscusshowthecapitalstructureimpactsthecostofcapital.Mosttextbooks placethischapterinalaterpartofthebook,takingthecostofcapitalasagivenuntil then.We,however,believethatknowinghowtocalculatethecostofcapitalisakey requirementtocarryingoutafinancialstatementanalysis–whichisthetopicofour nextchapters.

Chapter7–ProfitabilityAnalysis

InChapter7,wepresentthemainfinancialratiosusedtoanalyzeprofitability.Welearn howtocalculatethereturnoninvestedcapitalandtodivideitintoitsmaindrivers.We alsolearnthecalculationofthereturnonequityandhowtodecomposeitintoits operatingandfinancialcomponents.Wealsolearnabouttherelationbetweenthe returnonequityandleverage.Inaddition,weintroducetheconceptofeconomicvalue added,andwediscusswhenafirmgeneratespositiveeconomicvalueaddedforits shareholders.Wefinishthechapterbyreviewingsomepopularmeasuresofprofitabilitythatneed,however,tobeinterpretedwithalotofcarebecausetheydon’taccount foroperatingandfinancingcomponents.

Chapter8–GrowthAnalysis

Chapter8continuestheexpositionoffinancialstatementanalysisbygettinginto growthanalysis.Theconceptofsustainablegrowthrateispresentedaswellasother indicatorsofgrowth.Wecancalculategrowthinmanyways,andwecanhaveconflictinginformationastowhetherafirmisexperiencinggrowthornot.Westudyhowto measurevalue-creatinggrowth.Wealsoprovideashortintroductiontostockbuybacks andhowtheyareusedtodistributecashtotheshareholdersasanalternativetodividendpayment.Wediscusstheimplicationsofbuybacksonvaluecreation.

Thelastchapterwithinfinancialstatementanalysistakesusintoliquidityanalysis.We learnaboutshort-termandlong-termliquidityanalysisanddifferentratiosthatwecan calculatetoevaluatethese.Wealsoprovidetheimplicationsofgrowthintoliquidity andwhyitisessentialtomonitortheliquidityofgrowingfirms.

Inthischapter,weabandonourhistoricalperspectiveandstarttolookintothefuture. Presentvaluevaluationrequiresthatwehavemadeaforecastoffutureearningsand cashflows.Welearnhowtobuildproformastatementsthatarticulate–i.e.,thatthe left-handsideofthebalancesheetequatestheright-handside,thattheincomestatementisconnectedtothebalancesheetviaretainedearnings,andthatthecashsurplus inthecashflowstatementislinkedtothebalancesheet.Obviously,weneedtobuild ourforecastsonassumptions.Wediscusshowtoputtogetherwhatwehavelearnedso

faraboutbusinessstrategyanalysisandfinancialstatementanalysistomakesound assumptionsforourforecasts.

Chapter11–ValuationI:PresentValueModels

Chapter11discussesdifferentpresentvaluemodels.Wefirststudymodelsthatcalculatethemarketvalueofequitydirectly,specifically,thedividenddiscountmodel,the freecashflowtotheequitymodel,andtheresidualincomemodel.Thenwegothrough themodelsthatfirstestimateenterprisevalueandthencalculatemarketvaluebysubtractingthevalueofnetinterest-bearingdebtfromtheenterprisevalue;specifically,we studythefreecashflowtothefirmmodelandtheeconomicvalue-addedmodel.

Chapter12–ValuationII:ValuationUsingMultiples

Thischaptercoversrelativevaluation.Westudythemostcommonlyappliedmultiples andhowtheycanbeusedinvaluation.Wealsolearnaboutwhatmultiplessuchas price-to-earningsandprice-to-bookmean.Valuationusingmultiplesisastime-consumingasvaluationusingpresentvalue,butitcanbequicklyusedfortestingyour valuation.Wediscussafewapplicationsofthis.

Althoughmostoftheacademicliteratureisfocusedonthevaluationoflistedcompanies,ahugepercentageoffirmsinaneconomyarenon-listed.Inthischapter,we explorethemaindifferencesbetweenlistedandnon-listedfirmsandhowthevaluation differs(slightly)fromthatoflistedcompanies.Forexample,becausewedonothavea historyofstockprices,wecannotusetheusualmethodtocalculatethebetaofequity. Welearnabouthowtohandlethisandothersimilarissues.

This is the introductory book you need to understand financial analysis and valuation. Here you get the basic models and the essential concepts, and you understand how they can be applied, as well as what you can use them for.

In order to make a valuation of a business, you need to go behind the accounting figures. The authors explain in this book what you need to analyse and why it is necessary. They give you a toolbox for the analysis, which includes:

• business strategy

• accounting analysis

• capital cost and capital structure

• profitability

• growth

• liquidity

• forecasts

You need to use different valuation models based on the type of business you are going to value. Here you get good insight into valuation with present value models, market-based valuation, and valuation of private companies.

The book contains a number of illustrative examples, many with a solution in Excel. It also has its own collection of assignments.

Financial analysis and valuation is primarily written for second- and third-year bachelor business students, but is also suitable for first-year master students, and for anyone with an interest in the subject.

Ignacio García de Olalla is an Associate Professor at the Department of Accounting and Operations Management at BI Norwegian Business School, campus Oslo.

Christian Andvik is an Associate Professor at the Department of Accounting and Operations Management at BI Norwegian Business School, campus Bergen.