CONNECTICUT KEY PERFORMANCE INDICATORS

By: Adrielys Gomez ’22Prepared by the New Haven Economic Performance Laboratory Online at www.universityofnewhaveneconlab.org in association with the Department of Economics and Business Analytics

Pompea College of Business University of New Haven

This report is generously underwritten by the Pompea College of Business Advisory Board.

Connecticut Key Performance Indicators

New Haven Region Economic Performance Index

Income Inequality In Connecticut - Gini Coefficient

The Real Gross Domestic Product

Unemployment

Connecticut And Its Love For Sports Betting

Opinion: Connecticut’s Gas Holiday

Opinion: Should We Continue the Child Tax Credit?

Opinion: The War on Time: Why Standardized DST is the Right Move

About the New Haven Economic Performance Laboratory

Any opinion in this report is that of the author and does not necessarily reflect the opinion of the University of New Haven or the Pompea College of Business.

The Connecticut unemployment rate stood at 4.9 percent in February 2022. However, since February 2020, the number of working individuals plus those actively looking for work in Connecticut's labor force has shrunk by 92,000 persons. That is more than 10 percent of the country's losses, despite the state only making up one percent of the population. At the same time, the number of job opportunities in the state increased by 64 percent from December 2020 to 110,000 in December. Although the unemployment rate is showing signs of improvement, it is nearly two percentage points higher than the national average and remains persistently high.

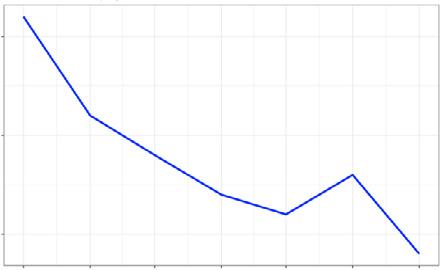

Labor Force Participation in Connecticut

Labor Force Participation Rate (Percent).

Continuing COVID-19 issues, insufficient and misaligned workforce development efforts, supply chain disruptions, altering job and career expectations, the state's high prices, and an aging population are all contributing to the crisis. Many of these causes are structural and precede the pandemic. Still, COVID-19 has hastened the impact of other causes, particularly the aging workforce and the shift in attitudes regarding work and careers, which are partly generational.

Connecticut is a high-cost state, with CNBC’s 2021 America's Top States for Business ranking it as the eighth most costly state to live in and the sixth most expensive state in which to run a business. 1 Workplace regulations are responsible for many of these costs and eroding our economy's basic base. Consider that between 2016 and 2021, the state legislature passed 28 COVID-19 mandates and debated another 122, despite sluggish job, population, and GDP growth. According to workers’ compensation data, Connecticut's workplaces are among the safest in the country. According to third-quarter 2021 figures, wages and salaries climbed by about 10 percent

year over year. According to the CBIA/Marcum 2021 Survey of Connecticut Businesses, employers are investing in hiring, and training and retention are major objectives. Policymakers must follow suit.

In recent years, the state has placed a more considerable emphasis on workforce development, including the formation of the Governor's Workforce Council, which includes representatives from the public and private sectors and is charged with formulating workforce strategy and policy.

Federal pandemic relief funds provide a once-in-a-lifetime chance to make the investments needed to fix many of our economy's fundamental weaknesses, such as the state's new $70 million CareerConneCT training program. However, there is a huge need for such programs. Staffers at CareerConneCT are now sifting through more than $250 million in grant applications, which is entirely overcrowded. The economic data are clear: the state is lagging the region, the country, and much of the rest of the globe. The pandemic exacerbated structural problems that had already harmed Connecticut’s capacity to compete. Progress has been made, and hope is rising, but there's still a long way to go.

More collaboration and coordination between the public and private sectors, more resources, and most crucially, broader awareness and acknowledgment from the state legislature are all required to resolve this situation. Small businesses, for example, have been struck the hardest by the crisis and urgently require access to programs such as the manufacturing apprenticeship tax

Unemployment Rate in Percents

Connecticut Unemployment Rate

credit and the research and development tax credit to encourage talent investment. Connecticut should also exempt training programs from sales taxes, and remove barriers to reentering the workforce for recently jailed persons.

More costly regulations exacerbate an already difficult position by pushing up expenses, imposing administrative burdens on small businesses, and confirming outdated ideas about the state's business climate. These are the last things the state can afford. Businesses cannot match the unprecedented demand for their products and services if these jobs stay vacant. The ensuing domino effect, sending consumers out of state or forcing Connecticut businesses to relocate and develop elsewhere, has the potential to be devastating. The attention of legislators should be on this catastrophe. In this session, there is no more pressing subject. The state must make it simpler to generate employment and maintain citizens and businesses in the state, paving the way for an economic recovery that draws new residents and businesses while maximizing the state's wonderful assets and expanding prospects.

1 https://www.cbia.com/news/economy/innovation-workforcepandemic-response-lift-cnbc-business-climate-rank/

NEW HAVEN REGION ECONOMIC PERFORMANCE INDEX

By: Jamie Hickey and John WattersThe New Haven Region Economic Performance (NHREP) Index, updated in February 2022, measures the performance and prosperity of the economy in the New Haven Region over the past six months. The goal of the NHREP Index is to use multiple variables to determine the economy's performance. These variables include education & health services for employees in New Haven, New Haven building permits, unemployment benefits claims, average weekly hours of work, and the average weekly earnings of all New Haven employees. It should be noted that just like the previous versions of the NHREP Index, COVID-19 restrictions put into place by local and state government have affected the region's economic performance and, therefore, have been factored into the results.

Figure 1: New Haven Region Economic Performance

As shown in Figure 1, the start of the COVID-19 pandemic resulted in a steep decrease in the region's economic performance, with the NHREP Index finally beginning to increase in the middle of 2020, arguably as the result of the federal government’s COVID-19 relief plans. In 2021, Figure 1 shows that the region’s performance continued to trend upwards; factors of this upward trend could be attributed to COVID-19 vaccines and boosters being widely distributed and states loosening regulations and finally reopening their economies. With successful vaccine rates, businesses across the region were able to open back up, and construction has resumed. The easing of restrictions affected weekly earnings, weekly hours, unemployment, and building permits. The

Figure 2: New Haven Region Economic Performance and 12-Month Forecast

Month

government’s handling of the coronavirus has allowed the region to trend upwards in 2021 as it continued to ease restrictions.

The 2022 forecast model for the New Haven region's economic performance is represented in Figure 2; the forecast is a statistical model used to predict outcomes. Based on the forecast model, it is anticipated that the index will be more volatile than the last NHREP Index, It appears there will be some points of increased performance, but on overall decreased performance, with a point forecast of 204 and 201. The blue line on the graph is the predicted forecast and appears to be going up and down over the course of the next six months, but given the many external factors that play a role in the index, we have confidence intervals that show us our confidence range. In August 2022, we are 80 percent confident that the index will be between 166 and 236, and we are 95 percent

confident that it will be within a range of 147 and 255. Both the 80 percent and 95 percent confidence intervals are extremely large, and the region's economic performance outcome will fall within these ranges as noted in Table 1. It must be noted that the forecast is created using several lagged observations of time series, so it is possible the forecast is not entirely accurate due to external factors that may be unpredictable.

Important factors to consider over the next few months that will influence the region's economic performance will be the ability to cool down inflation rates and supply chain issues. On May 4, the fed raised rates by half a percentage point, the greatest single hike in two decades. Prior to this recent rate hike, US national inflation was topping forecasts at 8.5 percent and was at its highest since 1981, driven by energy, food, shelter, and new vehicles. Some of the economic hardship in the greater New Haven region can likely be attributed to this, and less aggressive measures may need to accompany the rate hike to reign them in further.

Jamie Hickey ’22

Major: Behavioral Economics with a Finance Minor

Hometown: Port Jefferson, NY

In addition to the rate hike, the central bank outlined a plan to eventually reduce bond holdings by $95 billion per month. These coupled announcements will have immediate implications on the state and local economies; however, it is too soon to determine if these raises in interest rates will positively or negatively affect the region's economic performance as the economy is still in a fragile post-COVID-19 state. These recent commitments will almost certainly influence forecasts as more data becomes available and shift the results in Figures 1 and 2.

John Watters ’22

Major: Business Analytics

Hometown: Niantic, CT

SALARY GROWTH IN CONNECTICUT IN 2021

By: Austin FerentzyThe current minimum wage in Connecticut is $13.00 per hour, which is $5.75 more than the Federal minimum wage, $7.25 per hour. On a 40-hour workweek, this equates to $520 gross pay and annually $27,040, both before taxes. This July 1, the minimum wage will rise to $14 per hour, and it will again rise next year to $15, on June 1, 2023. With the 2022 rate change Connecticut will become the fifth-highest paying state in terms of minimum wage, following only behind California, Washington, Massachusetts, and New York.

The 2021 Q1 Occupational Employment & Wage Statistics (OEWS) survey conducted by the Connecticut Department of Labor sourced salary data from 1,540,870 active employees from a diverse range of industries. This survey found the median hourly wage to be $25.22, up from $23.93 in 2020, a 5.4% increase over the previous year. This follows a positive trend since 2013, which has seen an increasing margin of growth for median wages of 2% or more. Compared to the national 2021 hourly median of $22 and hourly average of $28, Connecticut is trending 14-15% above the

OCCUPATIONAL WAGES

Median Average Entry Level

WAGE PERCENTILE RANGES

10th 90th

H A H A H A H A H A

$25.22

national average in both categories, which is unlikely to change in the short term. With the minimum wage yet to grow to $15 in 2023, Connecticut continues to sit as the state with the third-highest national income of $80,530, and second-highest average income per household of $113,031.

With the 90th percentile earner making $59.17 per hour, roughly $120–125,000 yearly, it should be noted the average chief executive hourly rate was nearly double that, at $116.89 per hour, or $243,140 annually. Although the CT-OEWS-21 highlights only 570 chief executives in their survey, the report was unable to list a median hourly wage because the parameters exempted values over $208,000. This disparity is not unexpected because Connecticut has a GINI value of .507, which is above the national average of .478. Connecticut’s livable wage is currently $18.72 for a single adult with no children, which is $5.72 above the current minimum and just shy of matching the poverty rate of $6.19. FRED has also tracked a percentage change in income equality in New Haven County of about 2% in 10 years, from 14.89% in 2010 to 16.56% in 2020.

Despite this, wage growth has been on a positive trend for the state for several years. Motivated by Governor Lamont signing the minimum wage increase bill in 2019, further evidence is seen in how the state continues to recover from the COVID-19

pandemic. With a high of 11.6% in May of 2020, Connecticut has seen a significant drop in unemployment, currently resting at 4.3%, which is lower than New York's 4.7% but still above Massachusetts' 3.8%. As the state recovers further and the economy returns to normal, Connecticut will continue to see positive wage growth in relation to other Northeast states and the national average trending into 2023. It is important that Connecticut policymakers continue their push to match the minimum and livable wage by the 2023 deadline.

Austin Ferentzy

Major: Behavioral Economics, with a minor in Data Analytics Hometown: Easton, CT

REFERENCES

https://www.minimum-wage.org/connecticut https://www.salary.com/research/minimum-wage/connecticut https://www1.ctdol.state.ct.us/lmi/wages/statewide2020. asp#totalindustries

https://www1.ctdol.state.ct.us/lmi/wages/20201/0901000009/ 00-0000.htm

https://www.bls.gov/oes/current/oes_nat.htm#00-0000 https://www.bls.gov/oes/current/oes_ct.htm

https://datausa.io/profile/geo/connecticut/ https://fred.stlouisfed.org/series/2020RATIO009009 https://data.ct.gov/stories/s/Connecticut-Economic-RecoveryDashboard-Home/9nw5-zuuw/

INCOME INEQUALITY IN CONNECTICUT - GINI COEFFICIENT

By: Julia M. BattinoDefining Gini Coefficient

The Gini coefficient measures the extent to which the distribution of income among individuals within an economy deviates from perfectly equal distribution.1 It is calculated using the Lorenz curve with the percent share of income on the vertical axis and the percent share of population on the horizontal axis.2 That being said, Gini coefficient is the area between the Lorenz curve, the actual income distribution, and the line of perfect income equality.3 For example, if 60 percent of the state’s population owns 60 percent of the state's wealth, then there is a coefficient of 0 and perfect equality. When groups of citizens have a lower share of income, the Gini coefficient will increase, meaning greater income inequality.

Connecticut Displayed Higher Income Inequality than US in 2010-2021

Data were collected from 2010 to 2021 through the United States Census4. Figure 1 compares Connecticut's Gini coefficient against two surrounding states as well as the US in 2010–2021. Connecticut has had lower Gini coefficients than New York

for the past 11 years. However, Massachusetts and the US have remained below Connecticut during that time frame. Connecticut has an average upward trend in its Gini coefficient. However, from 2019 to 2021, Connecticut saw a steep drop in the Gini coefficient. In 2021, Connecticut reported a Gini coefficient of 49 percent, compared to the US at 48 percent.

Figure 1: Gini Coefficient 2010–2021

Figure 1: Gini Coefficient 2010–2021

According to The State of Working Connecticut report, from 1979 to 2020, a worker in the 90th percentile saw an increase of 67 percent in hourly wage, but a worker in the 10th percentile only saw an increase of 18 percent.5 The growing increase in disparity of income is a cause for concern in Connecticut. The report states wage inequality is also a key contributor to income inequality. In 2020, 30 percent of total jobs lost in Connecticut were those of low-wage jobs such as leisure and hospitality. Because of the greater loss of jobs for low-wage employees, the disparity of income equality also grew.

Figure 2:

Forecast of Gini Coefficient for Connecticut Shows Cause for Change

Figure 2 represents a forecast of Connecticut’s Gini coefficient for the next 10 years. The forecast was done using a simple exponential smoothing analytical model for nonseasonal data to predict future values. The darker red line within the forecast represents the predicted Gini coefficient in Connecticut for the next 10 years. The

value predicted, 0.4942, is a slight increase from 0.49 in 2021. The shaded area around that line represents a 90 percent confidence interval to give a range for the forecast due to external factors. We are 90 percent confident that in 2025, the Gini coefficient in Connecticut will lie between 0.482 and 0.508. Although the Gini coefficient in Connecticut is expected to remain relatively consistent based on past values, this is still a cause for concern.

Connecticut should plan to lower the Gini coefficient in the coming years. Connecticut's Gini coefficient has historically been higher than the US average and should have a goal to become lower than the US. According to a journal article by the Peterson Institute for International Economics, there are some policies that states can implement to help improve income inequality. This includes tax policies, education policies, and labor policies.5 Examples of tax policies include expanding the Child Tax Credit and the Earned Income Tax Credit and providing tax credits for more research and development. Examples of education policies include improving access to quality higher education and providing more job training. Examples of labor policies include raising the minimum wage and giving employees more bargaining power at companies. Through new policies, Connecticut can look to lower its Gini coefficient in the coming years.

REFERENCES

1 https://stats.oecd.org/glossary/detail.asp?ID=4842

2 https://worldpopulationreview.com/country-rankings/gini-coefficientby-country

3 https://economictheoryblog.com/2018/05/20/the-lorenz-curve/

4 https://data.census.gov/cedsci/table?q=gini%20index&g=0400000US 09,25,36&tid=ACSDT5Y2020.B19083

5 https://ctvoices.org/publication/the-state-of-workingconnecticut-2021/

6 https://www.piie.com/microsites/how-fix-economic-inequality

Julia M. Battino

Major: Business Analytics Minor Economics

Hometown: Haddonfield, NJ.

THE REAL GROSS DOMESTIC PRODUCT

By: Eimy MenaThe real gross domestic product, (GDP), is the monetary market value of all final goods and services produced in a country over a year. The real GDP is a useful tool because it measures economic output and allows the government and others to understand and track the economy's progress. Overall, GDP is a measure of economic growth, and well-being.

The year 2020 was a difficult for the US economy. COVID-19 had a significant negative impact. The GDP was estimated to be 241.05 billion US dollars. Since March 2020, the road to economic recovery has been difficult. The economy was expected to expand significantly in 2021. In addition to the removal of restrictions, consumer spending increased, albeit slowly, as COVID-19 cases continued to occur during the first half of the year. This economic improvement was aided by the reopening of some establishments and businesses.

On June 25, 2021, the U.S. Bureau of Economic Analysis (BEA) reported that GDP increased in all 50 states in the first quarter, with the U.S. economy expanding 6.4 percent after recovering from the pandemic. The economy's continued recovery aided by government responses to the COVID-19 pandemic were reflected in the second quarter. Furthermore, the rise in real GDP corresponds to an increase in the following: personal consumption expenditures (PCE); nonresidential fixed investment, which reflected increases in intellectual property; increases in the export in goods and services; and federal government spending.

Figure 1. Real Gross Domestic Product from 2019–2021.

Real GDP reflected an upward trend. According to the U.S. BEA, there was a 6.6 percent increase year over year. The increase reflected the economy's continued recovery and more people getting vaccinated, as well as government assistance payments. The increase in PCE and exports is responsible for the positive GDP growth.

The third quarter saw an increase in private inventory investment, among other things. However, there was a slowdown in real GDP

when compared to the previous quarter. The reason for this slowdown was the drop in demand for motor vehicles and food services.

According to the U.S. BEA, the fourth quarter saw an increase in 47 states of real GDP. The nation's real GDP increased at a 6.9 percent annual rate. Some of the highlights and reasons for this increase include a 7.1 percent increase in real estate and rental and a 12.3 percent increase in professional, scientific, and technical services nationally. The below figures illustrate the improved economic conditions as reflected by real GDP.

Although the data indicates positive economic performance, real GDP has limitations when it comes to forecasting the economy's health. One of the major problems with real GDP, according to "Ecological Economics," is that it interprets every expense as a positive. Furthermore, it makes no distinction between welfare-enhancing and welfare-reducing activity. Another disadvantage of real GDP is that it was developed during the Great

Figure 2. Real Gross Domestic Product 2018–2021. Figure from BEA.gov

Depression and World War II. Furthermore, real GDP only measures market transactions.

For another measure of the economy, to provide insight that possible using real GDP, it must provide measurement of improvement of the quality of life. Although there are many obstacles to replacing GDP with any other method, there is one successor that has been slowly gaining recognition among many economists: Genuine Progress Indicator (GPI). Although GDP is a measure of current output, GPI is intended to measure economic progress generated by economic activity .(Kubiszewski et al., 2013).

GPI is not a perfect measurement, and it has limitations. Overall, the replacement of real GDP will be a matter of time, as will be the advancement of the GPI.

REFERENCES

News release. Gross Domestic Product by State, 4th Quarter 2021 and Year 2021 (Preliminary) | U.S. Bureau of Economic Analysis (BEA). (n.d.). Retrieved April 23, 2022, from https://www.bea.gov/news/2022/grossdomestic-product-state-4th-quarter-2021-and-year-2021-preliminary Costanza, R., Kubiszewski, I., Giovannini, E., Lovins, H., McGlade, J., Pickett, K. E., Ragnarsdóttir, K. V., Roberts, D., De Vogli, R., & Wilkinson, R. (2014). Development: Time to leave GDP behind. Nature, 505(7483), 283–285. https://doi.org/10.1038/505283a

Most information was taken from the official page BEA.GOV.

Eimy Mena ’22

Major: International Business

Hometown: Santo Dgo, Dominican Republic

UNEMPLOYMENT

By: Joseph PoveromoThe extreme levels of unemployment seen by the United States in 2020 and 2021 are over, and the country is left with, for the most part, a recovering economy. A unified effort between the federal, state, and local governments was able to revive economic activity and increase employment across the board. Since May 2020, Connecticut's unemployment has dropped from 11.4 percent

minor money multiplier effect. These issues have been exacerbated by the Ukraine conflict and the increased money multiplier effect due to high unemployment. These issues directly contributed to the hike in inflation, and the employment rate is not helping. The Fed has expressed concern and is planning on an interest rate increase of at least 0.25 percent, but some experts suggest a 0.5 percent increase is on the way. Higher interest rates would certainly have a contractionary effect on the economy and slow inflation to a manageable level. However, one of the issues with this move is the supply side origin of the inflation we see today. Core inflation is at a solid level, but the issue is with food and energy, two items that have become quite scarce with the war in Ukraine and the supply chain crisis. Interest rate increases will have an effect, but not as much as we may hope.

The trend for national unemployment has been going down, looking to stabilize around four to six percent based on the forecast done using R Studio. To forecast unemployment for the next three years the ensemble technique was used to get the most accurate forecast possible.

to 4.6 percent in March 2022, demonstrating an astonishing recovery and a huge employment growth. The spike in employment we see today is due to the massive shortage in labor the country was experiencing months ago. The labor market has adjusted accordingly, and Connecticut has been doing incredibly well with labor participation. Just one year ago, Connecticut’s seasonally adjusted unemployment rate was at 7 percent; this number now stands at only 4.6 percent, showing a 2.4 percentage point increase per year, and matching the US percentage increase; the U.S. has dropped the same amount from to 3.6 percent. The reasons for this drop in unemployment are twofold: correction from the labor shortage; and aggressive fiscal and monetary policy, both of which have put the United States on track to reach pre-pandemic levels.

The labor market shortage experienced just months ago made for an interesting economic problem. Inflation was on the rise, due to government spending and supply chain constraints, but it was not out of control because the labor shortage made for an extremely

The following forecasting models were used: error-trend-seasonal (ETS), autoregressive integrated moving average, neural network nonlinear autoregressive, seasonally adjusted seasonality, Box–Cox transformation, ARMA errors, trend and seasonal, and naïve. The most accurate of these models was the ETS model; therefore, this is the one used to forecast unemployment. The expected four to six percent level of stabilization is good to see because it shows the country is on its way to pre-pandemic unemployment levels.

Joseph Poveromo ’22

Major: Economics with a Philosophy and History Minor

Hometown: Naugatuck, CT

CONNECTICUT AND ITS LOVE FOR SPORTS BETTING

By: Adrielys T. GomezWith sports betting becoming legal in a growing number of states, the controversy over whether this is positive or negative is gaining traction. Although betting can lead to significant financial losses and addiction, it can benefit the economy. The proposal to legalize sports betting is a positive step forward, and individuals all throughout the United States are, therefore, able to wager. Sports betting is currently allowed in 30 states, and bets may be placed at casinos, internet platforms, and other establishments. According to Legal Sports Report, Americans have gambled more than $81 billion on sporting events, teams, and individuals since the U.S. Supreme Court declared that states can pass laws allowing and regulating sports gambling in 2018.

Connecticut’s sports betting handle increased slightly in January, with $158.1 million in wagers recorded by the state’s Department of Consumer Protection. It was a 5.3 percent rise over the previous month’s number of $150.1 million. The Nutmeg State has amassed just shy of $440 million in handling in the three months since its introduction in mid-October, with 96 percent of it coming via online wagering and each report setting a new monthly record. Online wagering applications, such as DraftKings, FanDuel, and SugarHouse (BetRivers) combined to produce more than $10.8 million in gross gaming revenue in the state. The 6.8 percent victory rate was nearly a full percentage point higher than the previous month, resulting in a 21.7 percent rise over December. DraftKings, FanDuel, and SugarHouse (BetRivers), combined to produce more than $10.8 million in gross gaming revenue in the state. The 6.8 percent victory rate was nearly a full percentage point higher than the previous month, resulting in a 21.7 percent rise over December.

When coupled with retail lottery sales, the three online operators claimed the maximum deduction of 25%, resulting in an adjusted revenue total of $8.3 million. In January, Connecticut collected slightly more than $1.1 million in state taxes, bringing the total to over $4.3 million since the policy was implemented.

One of the advantages of allowing sports betting is that when individuals bet on sports, the public benefits from increased funding for public services such as education, which is critical for a well-informed, well-employed society and a robust economy. Streaming providers that are actively extending their offers to appeal to sports betting lovers are benefiting from the expansion of sports betting. The live TV streaming service now offers integrated gambling with game and event broadcasts, which is expected to boost customer retention and attract new users. Sports betting boosts the economy by causing more money to move hands, which benefits investors and the Nutmeg State.

Overall, considering that until Connecticut authorized sports betting in early October, New Jersey was the only state in the Northeast with no limits on how and what people could wager on. Given the aforementioned comeback of sports, the quick income increase was unsurprising. Sports betting is a $150 billion market that has risen dramatically in the previous calendar year, with online sports betting gaining prominence just before the outbreak of COVID-19, which forced major professional sports and NCAA events to be canceled. The exclusive ties between the casinos and sportsbooks materialized rapidly, demonstrating Connecticut’s potential as a sports gambling powerhouse in the Northeast. There are around 20 million verified users between the two companies, which will undoubtedly be expanded once more than 2.4 million Connecticut residents became eligible to gamble.

REFERENCES

Adrielys Gomez ’22

Major: Behavioral Economics

Hometown: Guaynabo, Puerto Rico

Connecticut’s Gas Holiday

BY: JAMIE HICKEYA s of April 1, emergency legislation went into effect with a unanimous vote from the state’s house and senate, suspending the Connecticut’s excise tax of $0.25 per gallon on gas. The suspension is set to run until November 2022, and it expects all retailers to reduce their per gallon rate, accordingly; failure to do so would be classified as an “unfair or deceptive trade practice.” Georgia, Maryland, and New York have also implemented or have plans to implement a suspension of the excise sales tax on gas in the coming months.

Now, what exactly is an excise tax? It is a tax imposed on goods or services and can be imposed upon the manufacturer, retailer,

or consumer. In Connecticut, the gasoline excise tax is imposed upon the sale of gasoline and goes toward the State’s annual budget. Retailers pay this tax upon purchasing the supply needed and directly pass the cost on to consumers. Connecticut gasoline prices also include the US federal motor fuel excise tax of $0.18 per gallon, which goes toward the funding of the Federal Highway Administration. These excise taxes are already intertwined with the prices consumers see at the pumps, and with the suspension of the state tax, Connecticut lawmakers hope consumers have some form of relief from these record-high prices.

With the focus on consumers’ benefits, many overlook the impact

OPINION

Figure 1: U.S. Regular All Formulations Retail Gasoline Prices Dollars per Gallon

on local gas station retailers. As of April 1, gas stations were expected for their cost per gallon to be down $0.25; however, most of these retailers already paid the tax when they purchased their supply, it was expected that retailers would lose $3.5 million on the first day of the tax holiday from not being able to charge consumers for the tax they had already paid. Many retailers are trying to stay afloat just like consumers, and although they support this tax holiday, they want lawmakers to make this right. Maryland, for example, offered gas station credits when implementing their gas holiday, and local gas stations here in Connecticut hope they can achieve the same.

Another thing to keep in mind about the tax holiday is the period it will end. As you can see from Figure 1, gas prices tend to be higher in the warmer months as more consumers go out and do things. In combination with likely higher gas prices as spring and summer progress, the tax holiday ending, and gas stations wanting to make

up for lost revenue, it is expected that Connecticut gas prices will be extremely high, and it might be in the state’s best interest to follow other states’ plans. For example, Connecticut should extend the tax holiday until the end of the year like in New York; this will eliminate the $0.25 increase adding to an already higher gas price season. The state should also follow Maryland in offering gas station credits so gas station owners are not suffering from offsetting consumer costs.

https://fred.stlouisfed.org/series/GASREGW https://www.forbes.com/advisor/personal-finance/which-statessuspending-gas-tax/ https://www.salestaxhandbook.com/connecticut/gasoline-fuel https://www.irs.gov/businesses/small-businesses-self-employed/excisetax https://ctmirror.org/2022/03/30/ct-gas-tax-holiday-is-causingconfusion-for-locally-owned-stations/

Jamie Hickey ’22

Major: Behavioral Economics with a Finance Minor

Hometown: Port Jefferson, NY

Should We Continue the Child Tax Credit?

BY: EIMY MENAThe Child Tax Credit was established in 1997 as part of the Tax Relief Act to allow eligible recipients to receive tax credit support for each child. The tax credit is available to assist low-income families in meeting their financial obligations. The child tax credit is a significant component today, and many people regard it as a valuable government asset for keeping children out of poverty. According to the official poverty measure, 11.6 million children — or 16 percent of all kids in the country — were living in poverty in 2020. Since 2019, the number of children has increased by more than a million. (Bureau, 2022).

Because of COVID-19, this payment is now available to a greater number of families than previously. Since the start of the pandemic, the child tax credit amount has increased from $2,000 to as much as $3,600 per child under the age of six and $3,000 per child up to 17. It aims to

support families who have suffered from unemployment and lack of child care. Prior to the pandemic, families had to have made at least $2,500 in earned income to be eligible to receive any credit (Jagoda & Folley, 2021). But this has changed with the new government.

Regardless, there has been a continuing matter as places are opening up, and mask mandates are being lifted, with more people getting vaccinated. Today, the credit has reverted to $2,000 per child with no monthly payments. This reversion has caused many families to gather outside and protest for their rights to receive better payments. In fact, only families that meet certain requirements will be eligible for an extension of the expanded child tax credit (LorieKonish, 2022).

This is important to know because President Joe Biden has made it clear that his priority is to provide more benefits and increase the child tax credit. But nevertheless, there has been a dispute from many people, especially on the part of Senator Joe Machin.

His suggestion to the proposal of President Biden to continue the expanded child tax credit has become a concern for many people. According to Jagoda & Folley (2021), Senator Manchin has suggested requiring taxpayers to be pursuing education or working to be eligible to receive the expanded child tax credit. (Jagoda & Folley, 2021). This would mean child tax care will not be accessible for everyone, and the tax credit’s purpose of aiding low-income families would be missing. You would need to meet more strict requirement to receive a child tax credit.

Senator Manchin argues that he wants to “let the right people receive the aid.” (Jagoda & Folley, 2021). Regardless of his position, President Biden insists that the expanded child tax credit will benefit the families as the economy in the country. And that is the reason President Biden proposed this in his Build Back Better agenda.

Expanding the child tax credit, in my opinion, will benefit a greater number of low-income families. It will aid in the reduction of child poverty and provide more opportunities for those communities. According to data, the poverty rate increased drastically. Between 2019 and 2020, the Hispanic population had a poverty rate of 17 percent. In addition, the poverty rate among Blacks was the highest

Eimy Mena

at 19 percent. (Bureau, 2022). This is critical to understand because the expanded child tax credit has the potential to reduce the annual poverty rate by 45 percent (Acs & Werner).

REFERENCES

Bureau, U. S. C. (2022, March 1). Income and poverty in the United States: 2020. Census.gov. Retrieved March 5, 2022, from https://www.census. gov/library/publications/2021/demo/p60-273.html

Jagoda, N., & Folley, A. (2021, October 20). Democrats at odds with manchin over child tax credit provision. TheHill. Retrieved March 3, 2022, from https://thehill.com/policy/finance/577485-democrats-at-odds-withmanchin-over-child-tax-credit-provision?rl=1

LorieKonish. (2022, March 1). Americans are eager for more monthly child tax credit checks. future payments could come with work requirements. CNBC. Retrieved March 2, 2022, from https://www.cnbc.com/2022/03/01/ future-child-tax-credit-payments-could-come-with-work-requirements. html

Acs, G., & Werner, K. (n.d.). How a permanent expansion of the child tax credit could ... Retrieved March 5, 2022, from https://www.urban.org/ sites/default/files/publication/104626/how-a-permanent-expansionof-the-child-tax-credit-could-affect-poverty.pdf

The War on Time: Why Standardized DST is the Right Move

BY: JOE POVEROMO

BY: JOE POVEROMO

As of March 2022, the U.S. Senate unanimously passed a bill making Daylight Savings Time (DST) permanent, a surprising move, but a smart one. This bill, known as the Sunshine Protection Act, must be passed by the house to take effect, but if passed, it will standardize time around the country by eliminating the “spring

forward” and “fall back” ritual. The possible positives include a lower frequency of car accidents, increased economic activity, and decreased criminal activity. The issues, however, are potential health issues connected to a desynchronized circadian rhythm. So, the question remains, what is the right decision?

Although the cons of this concept seem one-sided, the pros are also important to understand. The United States would eliminate the need to spring forward and fall backward by standardizing DST, saving lives directly and increasing economic prosperity across the board.

The Sunshine Protection Act’s cons are by no means irrelevant but are certainly outnumbered by its pros. Let us begin with the possible negative externalities, namely the biggest problem: health issues. Sleep scientists have determined that standard time is preferable to DST, because the consequences of waking up under DST have been felt before. Nicholas Gordon explains the stance of scientists: experts are worried about DST leaving people, “permanent[ly] out of sync with our natural environment”, and “forcing people to wake up earlier and fall asleep later than their natural body clocks dictate” (Gordon, 2022). To further support this claim, a study was cited in which scientists concluded that people who work night shifts (and are forced to work out of sync) have higher rates of obesity, heart disease, and cancer (Gordon, 2022).

Although the cons of this concept seem one-sided, the pros are also important to understand. The United States would eliminate the need to spring forward and fall backward by standardizing DST, saving lives directly and increasing economic prosperity across the board. According to a 2001 study, the switch from standard time to DST results in an increased frequency of car accidents and fatalities (Varughese, 2001). This increase in traffic accidents has been cited by officials on Capitol Hill as an important reason to implement the change and save lives. Also, the increased exposure to light, although cited as a problem by some, can be seen as a good thing. First, exposure to more sunlight has a direct effect on the economic activity of a community and allows for more interaction and trade later in the day (Hamermesh, 2008). Also, by increasing the amount of light available in the evening, energy consumption is lowered. Although not as much as years prior, there is still a clear difference between energy consumption in standard time and DST. On top of these pros, sunlight later into the day provides a decrease

in criminal activity of up to 7 percent for the entire day and a 27 percent drop during the evening hour that gained extra sunlight (Sanders, 2015). According to Sanders, all these avoided robberies resulted in about 59 million dollars in annual savings, providing an incredibly enticing argument for the transition to permanent DST.

Although the switch to DST has both pros and cons, the potential returns from a switch to DST offer a safer and richer America while simultaneously allowing people to enjoy the sunlight a little longer into the day. The cons of these decisions should not be ignored of course and should be corrected as much as possible. One recommendation I would offer is to increase the recommended cancer screenings and cardiovascular checkups for those who work outside of their circadian sync. This way, the potential issues can be dealt with now, ensuring workers do not suffer from the increase in sunlight and that the policy decision has a more altruistic effect, rather than sacrificing the few for the safety and ease of the many.

Joseph Poveromo ’22

Major: Economics with a Philosophy and History Minor Hometown: Naugatuck, CT

REFERENCES

Varughese, J., & Allen, R. P. (2001). Fatal accidents following changes in daylight savings time: the American experience. Sleep Medicine, 2(1), 31–36. https://doi.org/10.1016/S1389-9457(00)00032-0

Gordon, N. (2022, March 16). Spring forward or fall back? The U.S. Senate might have made the wrong choice. Fortune. Retrieved May 1, 2022, from https://fortune.com/2022/03/16/daylight-saving-time-sleep-senateprotecting-sunshine-act/ Hamermesh, D. S., Myers, C. K., & Pocock, M. L. (2008). Cues for timing and coordination: Latitude, Letterman, and longitude. Journal of Labor Economics, 26(2), 223–246. https://doi.org/10.1086/525027

Doleac, J. L., Sanders, N. J. (2015); Under the cover of darkness: How ambient light influences criminal activity. The Review of Economics and Statistics 2015, 97 (5). 1093–1103. https://doi.org/10.1162/REST_a_00547

committe d to customer satisfac tion.”

Our mission statement says it all.

Silver Products

Gold Products

ABOUT THE NEW HAVEN ECONOMIC PERFORMANCE LABORATORY

The Connecticut Economic Activity Report is a publication of the Department of Economics and Business Analytics, Pompea College of Business, University of New Haven, 300 Boston Post Road, West Haven, CT 06516. www.universityofnewhaveneconlab.org

Research Staff

Julia M. Battino ’22

Adrielys Gomez ’22

Jamie Hickey ’22 Eimy Mena Medina ’22

Francesca Micallef ’22

Joseph Poveromo ’22

John Watters ’22

Supervising Faculty and Research Directors

Esin Cakan, Ph.D., Professor

Claude Chereau, Ph.D., Practitioner-in-Residence

Patrick Gourley, Ph.D., Assistant Professor

Brian A. Marks, J.D., Ph.D., Senior Lecturer and Executive Director, Entrepreneurship and Innovation Program

A. E. Rodriguez, Ph.D., Professor

Kamal Upadhyaya, Ph.D., Professor

Administrative and Editorial Staff

Esin Cakan, Ph.D., Professor

Anthony Calabro, MBA, Managing Editor

Brian A. Marks, J.D., Ph.D., Senior Lecturer and Executive Director, Entrepreneurship and Innovation Program

A.E. Rodriguez, Ph.D., Chair, Department of Economics and Business Analytics

The research staff are upper-class students in the Department of Economics and Business Analytics. Although all students work under the auspices of the supervising faculty and research directors, each student is individually responsible for interpreting and analyzing the data. The Laboratory is a teaching space, and this report is a product of that space. In addition, staff members work closely with the University of New Haven Economic Collective (http://unheconomicscollective.ning.com), which brings together students, faculty, alumni, and members of the broader community to foster a meaningful and relevant exchange of ideas. A fundamental focus of the Laboratory is to formulate, construct, and examine nontraditional socioeconomic metrics applicable to the southern region of Connecticut by employing traditional empirical methods as well as data and text-mining methods.

The Connecticut Economic Performance Laboratory is affiliated with the University of New Haven Department of Economics and Business Analytics. Any opinions contained herein do not reflect the opinion of the University of New Haven or its Pompea College of Business. The Laboratory and the printing of the report are funded by the Pompea College of Business, the Pompea College of Business Advisory Board, and other sponsors of the Laboratory. If you are interested in supporting this student initiative, please contact Ms. Kimberly Williams, Director of Development, University of New Haven, at kpwilliams@newhaven.edu or +1.203.923.7143

For inquiries or questions about the Connecticut Economic Activity Report, contact:

Anthony Calabro, MBA, Managing Editor acalabro@newhaven.edu

Custom Quick

Cost-effective

POMPEA COLLEGE

300 Boston Post Road

Haven, Connecticut

Your Success Starts Here

AACSB Accredited

AACSB accreditation means that our Pompea College of Business has met a rigorous set of standards.

Graduates from AACSB-accredited schools are recognized and generally receive higher, more competitive salaries.

About the University of New Haven

The University of New Haven, founded on the Yale campus in 1920, is a private, coeducational university situated on the coast of southern New England. It’s a diverse and vibrant community of more than 7,500 students with campuses across the country and around the world.

Within our colleges and schools, students immerse themselves in a transformative, career-focused education across the liberal arts and sciences, fine arts, business, healthcare and health sciences, engi neering, public safety, and public service. More than 100 academic programs are offered, all grounded in a long-standing commitment to collaborative, interdisciplinary, project-based learning.

At the University of New Haven, the experience of learning is both personal and pragmatic, guided by a distinguished faculty who care deeply about individual student success. As leaders in their fields, faculty provide the inspiration and recognition needed for students to fulfill their potential and succeed at whatever they choose to do.