Subscribe to Upsize Minnesota at www.upsizemag.com/subscribe

“It’s actually taken some people out of poverty. People are able to launch and scale their businesses without the cost, which I find invaluable.”

ALSO: CHATTING WITH CHATGPT DRAWING UP STRONG CONTRACTS BENEFITS OF A MINNESOTA CUP WIN

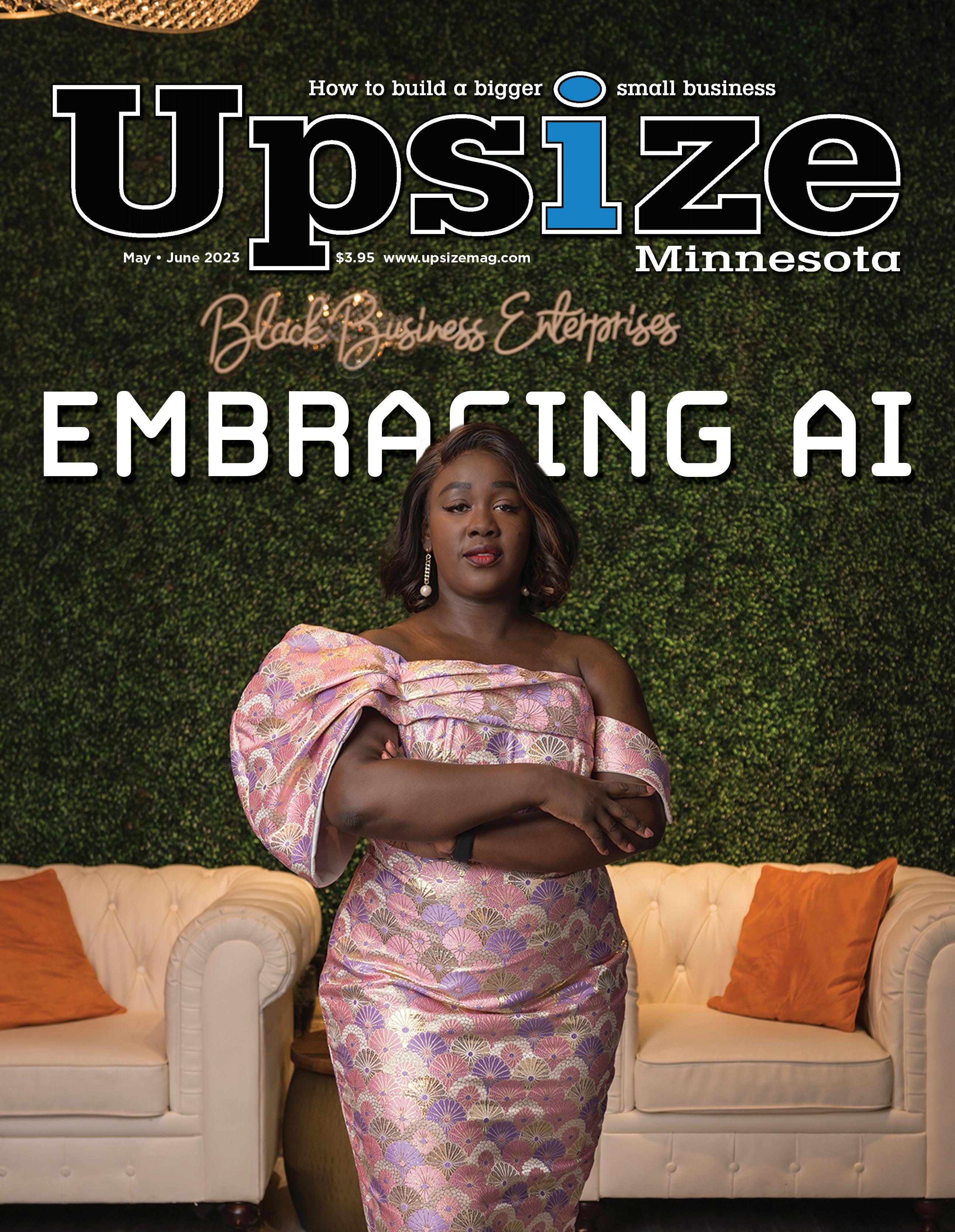

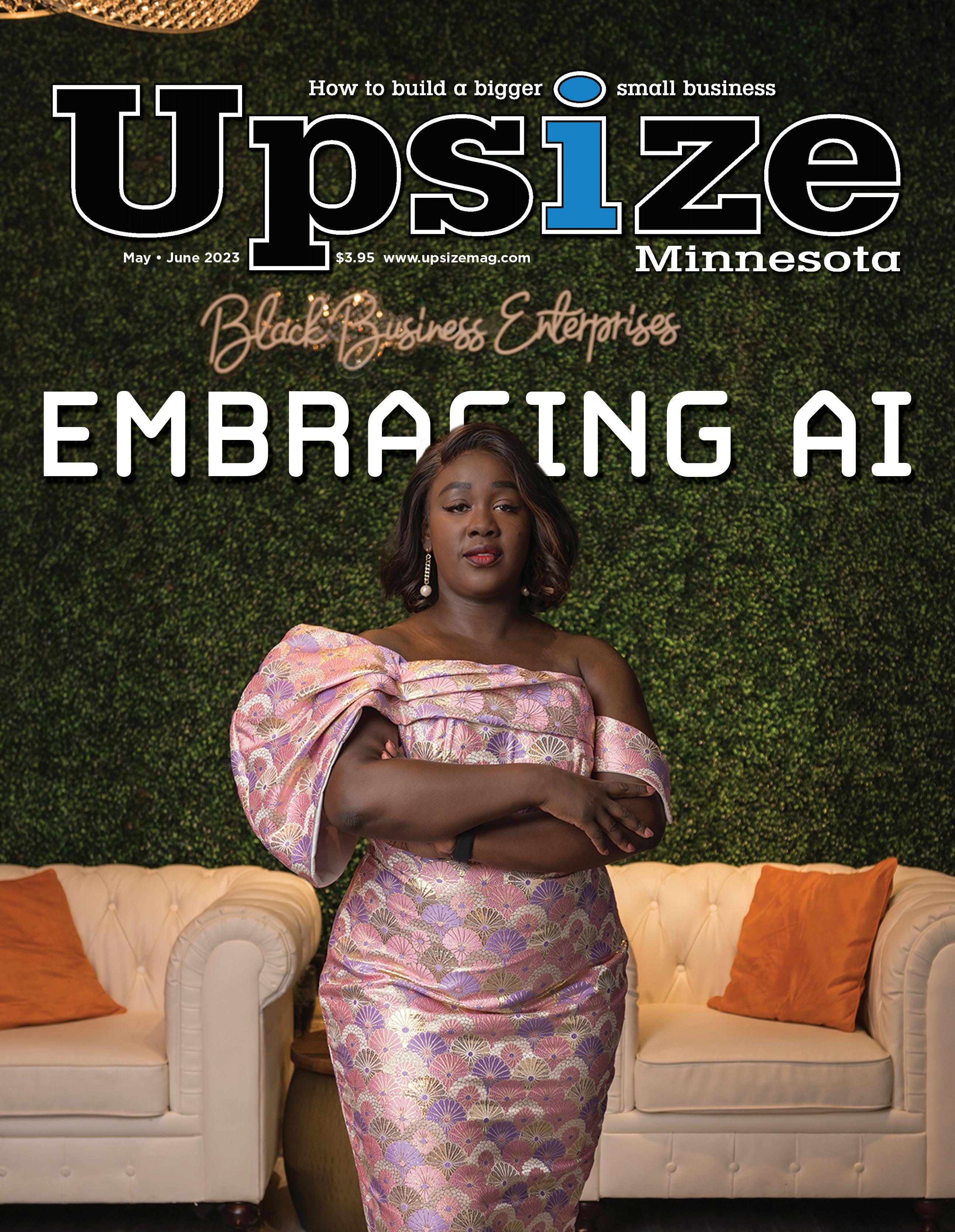

Nancy Korsah, president and CEO of Black Business Enterprises

As a community bank the time and effort we invest in our community doesn’t show up on a spreadsheet, it shows up in our hearts. It’s why you’ll find our bankers and employees helping pack meals for Every Meal, a local volunteer organization dedicated to filling food gaps for school-age kids who are food-insecure. Because being able to have a positive impact on kids’ lives is what making the possible, possible is all about.

crown-bank.com EDINA • 6600 FRANCE AVENUE S • 952-285-5800 | CROWN-BANK.COM MEMBER FDIC EQUAL HOUSING LENDER

The returns on certain investments are incalculable.

CONTENTS

May • June 2023 • Vol. 22 No. 3 • www.upsizemag.com

PAGE 16

Cover story

ChatGPT is the most well known artificial intelligence platform at present. It and a collection of other AI offerings are providing revenue enhancement and saving time and money for small business owners schooled in their use.

BY ANDREW TELLIJOHN

BY ANDREW TELLIJOHN

Cover photograph by Tom Dunn

PAGE 4

Founder’s Forum:

Upsize Founding Editor Beth Ewen visits with Chad Ellingboe, CEO of Galley Group and founder of the North Loop Galley food hall, which is looking for new entrepreneurial chefs

PAGE 4

Staff list:

Who’s who at Upsize magazine and how to reach us.

Upsize Minnesota (USPS 024-029) is published bi-monthly by Broad Axe Media, 2908 W 71 1/2 St., Richfield, MN 55423. Periodicals postage paid at St. Paul, MN and additional mailing offices.

Postmaster: Send address changes to Upsize Minnesota, PO Box 23238, Richfield, MN 55423-0238

BUSINESS BUILDERS

PAGE 6

BANKING

Recent events indicate, companies should prepare for the possibility their banks could go bankrupt

by Matthew Bialick, MJB Law Firm

PAGE 8 LAW

Tips for creating strong business agreements and contracts by Bryce Riddle, Bassford Remele PA

PAGE 10

MANAGEMENT

Explaining the role of CFO and determining whether your company might need one by Cathy Sedacca, Integrated Consulting Services

PAGE 12

MERGERS AND ACQUISITIONS

What to look for when you’re looking for a lender by Ann Franklin, Fidelity Bank

PAGE 14

PLANNING

Factors to consider to ensure increased income positively affects your life

by Nick Scheibel, JNBA Financial Advisors

COLUMNS

PAGE 22

CATCHING UP

BKB Floral Foam Inc. Chief Technology Officer David Goldfeld talks with Upsize about how mentorship derived from the company’s participation in the Minnesota Cup accelerated its growth

Get more from your money.

Credit cards make purchasing convenient and simple. The right card also gives your business purchasing power to drive growth.

Our experts can help make sure you have the right U.S. Bank credit card to meet your business’s spending needs.

Start earning more without doing more. Scan the QR code or visit usbank.com/bankerconnect to request your complimentary analysis and consultation.

Bank

The creditor and issuer of these cards is U.S. Bank National Association, pursuant to a license from Visa U.S.A. Inc. or Mastercard International Incorporated, and the card is available to United States residents only. Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated. ©2023 U.S.

FOUNDING PUBLISHER

Wes Bergstrom

EDITOR AND PUBLISHER

Andrew Tellijohn atellijohn@upsizemag.com

FOUNDING EDITOR

Beth Ewen bewen@upsizemag.com

DESIGN DIRECTOR

Jonathan Hankin jhankin@upsizemag.com

CHIEF FINANCIAL OFFICER

Dan O’Connell dano@upsizemag.com

PHOTOGRAPHER

Tom Dunn tom@tomdunnphoto.com

HOW TO REACH US

To subscribe visit www.upsizemag.com/subscribe

With story ideas email Andrew Tellijohn, atellijohn@upsizemag.com

To advertise email Andrew Tellijohn, advertising@upsizemag.com

To order reprints backissues@upsizemag.com

To order extra or back issues email backissues@upsizemag.com

To suggest Web resource links, info@upsizemag.com

BROAD AXE MEDIA

P.O. Box 23238 Richfield, MN 55423

Main: 612.827.5290 www.upsizemag.com

© 2023 Upsize Minnesota Inc.

all rights reserved

Galley Group calls for aspiring chefs

The folks behind the North Loop Galley food hall in Minneapolis are putting out a call for entrepreneurial chefs to launch their restaurant concepts with “minimal upfront cost, maximum brand exposure and dedicated ongoing support,” as the Pittsburgh-based outfit calls it.

I call it a cool idea in the fast-growing food hall space, kind of like a tech company accelerator but for chefs. Chefs can apply by emailing press@galleygrp.com.

North Loop Galley has been open since 2019 and this is their first call for chefs in Minneapolis as earlier concepts start to age out.

“Part of the premise is these kitchens aren’t meant to stay forever. They’re meant to grow and expand, and eventually move into a brick-and-mortar space” of their own, says Chad Ellingboe, CEO of Galley Group. “We’re looking toward the future where we’ll have a space available.”

He’s been in restaurants since graduating from college, joined the Galley Group in 2017 and took over as CEO in 2020. They also have two locations in Pittsburgh, Federal Galley and Galley Bakery Square, and one in development in Newport, Ky.

North Loop Galley is “a similar style and demographic as Pittsburgh, a good mix of demographics of white collar versus blue collar, the background of the city, a lot of similarities. It kind of has that same vibe as Minneapolis as well,” he said.

The locations operate the same, each with four kitchens and a centralized bar program. There’s no fixed rent or CAM charges (common area maintenance) and Galley Group takes a 30 percent cut of its vendors’ net sales. “All the utilities are covered, the space taxes are covered, the licensing for the POS (point of sale) systems are covered, and we provide the front of house staff, the bussers, the dishwashers and the management.” Chefs cover food and their labor.

Not all of Galley Group’s food halls

have worked. A location in Detroit, Fort Street Galley, opened and closed in 14 months in February 2020, as did Galley Group’s Cleveland food hall at about the same time, and the two co-founders left the company.

At the time, JP Garcia, a chef who ran the Filipino stall in Fort Street Galley, told the Detroit Free Press the 30 percent cut “is really a killer. I’ve worked the stall every single day since day one. And that was probably the only way I was able to survive, because I could control those labor costs.”

In other words, aspiring chefs, do your homework. Wrectangle Pizza, Ono Hawaiian Plates, Ottimo and ramen noodle shop Kawae are operating in North Loop Galley now, which means a sleuthing trip is both easy and delicious. The same goes for other food halls springing up in the Twin Cities — Keg & Case at the former Schmidt Brewery; Market at Malcolm Yards inside the historic Harris Machinery Co. in Minneapolis; and Graze Provisions & Libations in downtown Minneapolis with a rooftop deck, to name a few.

At the North Loop Galley, Ellingboe says his goal is “finding chefs that have that entrepreneurial spirit and are really looking to grow a brand or have an interesting concept but are looking to branch out. This is kind of that lowcost, low-risk scenario where they can be a little bit more creative to further develop a new brand.”

—Beth Ewen founding editor bewen@upsizemag.com

4 UPSIZE MAY • JUNE 2023 www.upsizemag.com

A client-first and conflict-free philosophy: that’s how JNBA Financial Advisors has operated since our founding days over 40 years ago. Since we began tracking in 2001, we have been fortunate to maintain a client-retention rate of 97 percent. In addition, Barron’shas ranked JNBA and CEO Richard S. Brown in the top two in Minnesota on its Top 1,200 list for seven consecutive years. And, Barron’shas ranked JNBA and CEO Richard S. Brown as a Top 100 Independent Advisor in the country for eight consecutive years.

To learn more about how advice driven by advocacy®could help you and your family, begin a conversation with our team by calling us or visiting JNBA.com.

of Barron‘smagazine. Barron‘sis a trademark of Dow Jones & Company, Inc. All Rights Reserved. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any professional designation, certification, degree, or license, membership in any professional organization, or any amount of prior experience or success, should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if JNBA is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/ methodology, to the extent applicable). Unless expressly indicated to the contrary, JNBA did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of JNBA by any of its clients. ANY QUESTIONS: JNBA’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking. Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by JNBA Financial Advisors, LLC (“JNBA”)) or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation or prove successful. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Please see important disclosure information at www.jnba.com/disclosure.

Advice driven by advocacy ® MINNEAPOLIS: 952.844.0995 | DULUTH: 218.249.0044 | BONITA SPRINGS, FL: 800.675.4793 | JNBA.COM Advisor JNBA Financial Advisors We’re not part of a big bank or brokerage firm. Our boutique, independent firm has been providing unbiased advice for more than 40 years. JNBA is a fiduciary, which means we have a legal responsibility to act in our clients’ best interest in everything we do. Nick Scheibel, CFP®

seen in the 2/22/10, 2/21/11, 2/20/12, 2/18/13, 2/24/14, 2/23/15, 8/24/15, 3/7/16, 8/29/16, 3/6/17, 9/18/17, 3/12/18, 9/17/18, 3/11/19, 9/16/19, 3/16/20, 9/14/20, 3/15/21, 9/20/21, 3/14/22, 9/19/22, & 3/13/23 issues

As

A business owner’s guide to surviving a bank crisis

Manage your cash flow in a few simple steps

by Matthew Bialick

Craig Veurink

Hearing about bank failures, a potential destabilization of certain segments of the banking industry and a possible broader destabilization of the economy can be very unnerving for business owners. Risk mitigation is always important and challenging, but it becomes exponentially more so when entering a volatile and uncertain economic landscape brought on by other unprecedented events.

However, in at least one regard, this budding banking crisis merely brings to light a risk that has been hidden in plain sight all along — that your bank might fail, causing a loss of funds that you assumed were safe.

TIPS

the same entity does not add to the FDIC insurance total; it is a $250,000 limit per entity.

• Having multiple account types (e.g. a checking account and savings account) does not add to the FDIC insurance total; it is a $250,000 limit per entity.

TIPS

1. Set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future

1. The first is to avoid exceeding the Federal Deposit Insurance Corp. insurance limit of $250,000. If you get to that level, open an account at another bank.

2. Put cash flow before profits. It might seem counterintuitive, but if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix

2. Ensure your values are in line with your bank. If you can’t find information you are seeking via talking with your banker or checking its website, you should question your banking relationship.

Small businesses are usually founded by entrepreneurs who have a unique vision and a passion that drives them to work late hours, take chances and believe in what they’re doing. But, just as Thomas Edison once said that genius is 1 percent inspiration and 99 percent perspiration, successfully running a small business requires rolling up your sleeves and putting in significant time on more mundane, day-today matters.

As scary as this sounds, it is not a cause for panic, just reflection and careful planning. A comprehensive plan should address both first-order effects (i.e. what happens if your bank fails) and second-order effects (i.e. what happens if a banking crisis creates general economic instability or adversely affects customers, business affiliates or debtors of your business).

“When

• Having one account in the name of the business owner and separate account in the name of a sole proprietorship or dba does not add to the FDIC insurance total; it is a $250,000 total limit.

do I start to turn a profit?”

Rather than wonder, set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future.

2. Put cash-flow management before profits

• Having one account in the name of the business owner and a separate account in the name of a corporation or LLC with a separate tax ID number does add to the FDIC total; it is a $250,000 limit for the business owner’s account and a separate $250,000 limit for the business entity’s account.

Dealing with first order effects.

You can be driven, impassioned and have a great idea to fill a niche or serve customers in new ways, but if you don’t attend to the details of the business, you can create for yourself a heap of problems.

There are three main ways to mitigate the direct risk to your business associated with a bank you work with failing.

This might seem counterintuitive, since profits are how you survive. However, if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix. Keep things organized and well managed so you can be ready for whatever success comes your way.

3. Utilize operating lines of credit to mitigate the need to keep cash on hand exceeding $250,000.

3. Secure credit ahead of time. Most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected

4. Consider using a payroll service. Having the professionals take care of collecting payroll taxes saves them an enormous amount of time, helps streamline their cash flow

4. The risk of a dispute rises during challenging economic times, so ensure you have in place strong documentation memorializing contracts, agreements and understandings with business partners.

Here, we’ll look at one of the most important of these business details: managing cash flow. Especially for early startups, knowing how much cash is coming in and going out, and accurately forecasting sales and expenses, is key to maintaining your company’s health.

The first is to avoid exceeding the Federal Deposit Insurance Corp. (FDIC) insurance limit — $250,000 — at any one bank. If you have one account at one bank the analysis is simple — does the account exceed $250,000? If no, it is all insured.

No matter where you are in your business, keep these things top of mind:

5. Be decisive in addressing defaults and other problems with business affiliates to avoid harming your business.

5. Schedule your payments. Don’t go delinquent but do divide your payments into categories such as “must pay,” “important to pay” and “flexible payment terms.” This can help keep sufficient cash on hand.

1. Know when you will break even

If yes, then it is insured only up to $250,000. Things get more complicated with multiple different accounts at the same bank, but the following general rules of thumb apply:

Every small business owner keeps at the front of their mind the question:

• Having multiple accounts for

If you are currently exceeding FDIC limits at a single bank, the easiest way to deal with the situation is to open a bank account at a new bank (or banks) and transfer funds to the new bank in an amount such that there is not more than $250,000 at any one bank.

3. Secure credit ahead of time

Too often, small business owners wait until they need it to secure credit. This can cause a lot of unnecessary stress, or worse. Talk to experienced business owners in your area and industry ahead of time to know how much revenue you’ll need up front. Take a realistic look at the situation and plan. You might have sufficient cash reserves or a rich uncle who is only a call away, but most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected.

The second way to mitigate the risk is to vet your current bank to ensure alignment with your values, philosophies and risk preferences. A banking relationship is a business relationship like any other and you need to know who you are dealing with and feel confident that they will be a strong business partner for many years to come. This information can be obtained through talking with your banker and visiting the bank’s website. If you are not able to get satisfactory answers to your questions from

6 www.upsizemag.com UPSIZE MAY • JUNE 2023

BUSINESS

BUILDERS banking

6 www.upsizemag.com UPSIZE NOVEMBER • DECEMBER 2022

BUSINESS BUILDERS banking

these sources, that lack of information itself speaks volumes.

The third way to mitigate risk is to utilize operating lines of credit to reduce the need for cash on hand that exceeds $250,000. All businesses need access to sufficient operating capital and a number of businesses will choose to keep an amount on hand in excess of $250,000 to meet their operating needs. Instead, those businesses should consider reducing cash reserves to an amount under $250,000 and then utilizing shortterm lines of credit to bridge the gap between making payables and collecting receivables.

By switching to short-term operating lines, many businesses will be able to reduce working capital to such a level that the operating account remains within FDIC limits.

Dealing with second order effects

Second order effects of a potential banking crisis are those associated with general economic instability and adverse effects to customers, business affiliates or debtors of your business arising from that economic instability. The best way to deal with these effects for many businesses is to focus on documentation and decisiveness.

“Documentation” refers to properly memorializing contracts, agreements and understandings between your business and its customers, suppliers and business associates. In good times, it may not matter whether contracts are tight, accurately reflect a true course of dealing and give adequate protection to your business, because there may be a low likelihood that a dispute will arise. In troubled and uncertain times, this risk of a dispute arising may increase

exponentially, so the importance of having appropriate contracts in place likewise increases exponentially.

A related concept is “security.” Security is what a business takes as collateral to ensure payment or performance by a party that owes that business money. Security is taken through the execution of a statutorily compliant security agreement. The corresponding security interest then needs to be “perfected” through the filing of a Uniform Commercial Code (UCC) financing statement. A business should consider taking and perfecting a security interest in the assets of a debtor any time the risk of non-payment is a significant issue.

“Decisiveness” refers to addressing defaults or other problems with business affiliates swiftly enough that those problems do not result in tangible harm to your business. This can mean something as simple as moving to a different supplier when an existing one is showing signs of instability or restructuring an existing contract with a struggling business affiliate.

This can also mean something more drastic, such as bringing a lawsuit or collection action against a business affiliate who is in default expeditiously enough that the lawsuit or collection action can be completed, or a settlement can be reached, prior to the affiliate’s insolvency or bankruptcy.

Contact: Matthew Bialick is a partner with MJB Law Firm: 952.239.3095; matthew@mjblawmn.com; www,mjblawmn.com; in/matthew-bialick-35b7a438

7 www.upsizemag.com MAY • JUNE 2023 UPSIZE

“Your bank might fail, causing a loss of funds that you assumed were safe. As scary as this sounds, it is not a cause for panic, just reflection and careful planning.”

Matthew Bialick

MJB Law Firm

Ten tips for creating strong business agreements and contracts

Manage your cash flow in a few simple steps

by Craig Veurink

by Bryce Riddle

TIPS

Agreements are supposed to make things easier by reducing risk and avoiding litigation. Unfortunately, that’s not always how things work out because people often make very simple mistakes when entering agreements.

This article highlights some of the most common and expensive mistakes people make that push them into expensive and risky litigation.

1. Put the agreement in writing

Although oral agreements can be legally binding, they’re often difficult to enforce and lack crucial details both parties need or want to fulfill both ends of the bargain. A written agreement is less risky than an oral one because a document clearly spells out each party’s rights and obligations in case of confusion or disagreement.

and capitalize each defined word in the agreement.

4. Define the scope of the agreement

and obligations of the parties

TIPS

1. Set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future

1. Written agreements are less risky than oral agreements as they clearly spell out each party’s rights and obligations.

2. Put cash flow before profits. It might seem counterintuitive, but if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix

2. Ambiguity has been the cause of death for many contracts throughout history. To avoid that fate, it’s important you keep contract language as clear and simple as possible.

3. Money is often contentious so the financial terms of the deal should be spelled out in detail.

3. Secure credit ahead of time. Most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected

4. In performance-based contracts, it’s important to outline the potential scope of damages if a party fails to satisfy their end of the agreement. Specifying downstream damages puts the other party on notice of risks you face.

4. Consider using a payroll service. Having the professionals take care of collecting payroll taxes saves them an enormous amount of time, helps streamline their cash flow

5. Schedule your payments. Don’t go delinquent but do divide your payments into categories such as “must pay,” “important to pay” and “flexible payment terms.” This can help keep sufficient cash on hand.

5. Identify how you will handle disputes, including any potential alternative dispute resolution techniques outside the court.

2. Use clear and concise language

Small businesses are usually founded by entrepreneurs who have a unique vision and a passion that drives them to work late hours, take chances and believe in what they’re doing. But, just as Thomas Edison once said that genius is 1 percent inspiration and 99 percent perspiration, successfully running a small business requires rolling up your sleeves and putting in significant time on more mundane, day-today matters.

You can be driven, impassioned and have a great idea to fill a niche or serve customers in new ways, but if you don’t attend to the details of the business, you can create for yourself a heap of problems.

Ambiguity has been the cause of death for many contracts throughout history. To avoid that fate, it’s important you keep contract language as clear and simple as possible. Businesses do not need to use legalese for an agreement to be legally binding. Instead, use short sentences structured with numbered headings. Similarly, cut unnecessary words or phrases. If a term can be simplified, do it.

3. Use recitals and define important terms

Here, we’ll look at one of the most important of these business details: managing cash flow. Especially for early startups, knowing how much cash is coming in and going out, and accurately forecasting sales and expenses, is key to maintaining your company’s health.

No matter where you are in your business, keep these things top of mind:

1. Know when you will break even

Every small business owner keeps at the front of their mind the question:

An often-overlooked part of agreements is to include recitals and definitions. Recitals provide context for the agreement and identify the correct legal names of the parties to the contract, which is important for identifying who is responsible for performing which obligations under the agreement. Definitions are helpful in situations where industry-specific terms of art apply or where words potentially have multiple meanings. Once defined, stick with your definitions

The body of the agreement should spell out the rights and obligations of each party in detail. Don’t leave anything out of the contract that was negotiated or agreed upon, as any omitted terms will be next to impossible to enforce. Contracts are largely interpreted based on the “four corners” of the document, not what the parties said during negotiations. To the extent obligations are expected, they should be described in detail in the contract.

“When do I start to turn a profit?”

Rather than wonder, set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future.

5. Specify payment obligations

Specifying who pays whom, when such payments must be made and the condition for making payments is critical. Money is often a contentious issue, so this part should be very detailed. There are several ways to structure payments, such as in installments, upon completion of work, to your satisfaction, upon delivery or minimum acceptance rates. Whatever you decide, identify it in your contract and state the dates, times and requirements. Consider including a method of payment as well.

2. Put cash-flow management before profits

This might seem counterintuitive, since profits are how you survive. However, if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix. Keep things organized and well managed so you can be ready for whatever success comes your way.

6.

Agree

3. Secure credit ahead of time

on circumstances that constitute a breach and how to terminate the contract

Contract-based lawsuits often concern a breach and if the contract was terminated. Clearly articulating what constitutes a breach and then setting forth the circumstances in which the parties can terminate the contract is a sensible approach to preventing misunderstandings between the parties and avoiding protracted litigation. For instance, if one party misses too many important deadlines, the contract should make clear that the offending party is in breach and enable the other

Too often, small business owners wait until they need it to secure credit. This can cause a lot of unnecessary stress, or worse. Talk to experienced business owners in your area and industry ahead of time to know how much revenue you’ll need up front. Take a realistic look at the situation and plan. You might have sufficient cash reserves or a rich uncle who is only a call away, but most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected.

8 www.upsizemag.com UPSIZE MAY • JUNE 2023

BUSINESS BUILDERS law

6 www.upsizemag.com UPSIZE NOVEMBER • DECEMBER 2022

BUSINESS BUILDERS banking

party to terminate the contract without being considered in breach itself.

7. Include jurisdictional and venue provisions

If you and another party are located in different states or you sell your products/services in multiple states, you should choose a specific state’s laws to govern any potential disputes arising under the contract. Ideally, this would be the state in which you reside or have your principal place of business so as to reduce the need for travel and for the sake of familiarity with those laws. You should also specify where any disputes should be heard.

recover monetary damages.

8.

Agree on a way to resolve disputes

Write into your agreement what you and the other party will do if something goes wrong. In addition to having a court resolve any potential disputes, parties may also elect to enter into binding arbitration or mediation instead of going to court. This should also include where the dispute must be heard if alternative dispute resolution is elected.

9. Identify potential scope of damages, including attorneys’ fees and costs

In performance-based contracts, it is particularly important to outline what the potential scope of damages can be if a party fails to satisfy their end of the agreement. Specifying potential damages, such as not being able to fulfill downstream orders or losing the value of another contract, puts the other party on notice of risks you face if they were to breach the contract and enables the non-breaching party to

Some contracts also contain “fee shifting provisions.” Under the “American Rule,” parties are responsible for their own attorneys’ fees unless the contract or statute says the party can recover its fees and costs. Consider adding a fee-shift provision if you have concerns that the other party will not honor its obligations and there is minimal risk the feeshift provision could be weaponized against you. However, think twice about adding or agreeing to a fee-shift provision if you are a larger company. Fee-shift provisions level the playing field between small and large companies – and that’s not a good thing if you’re the large company. It may also prolong litigation because both parties are convinced they will recover their fees as the prevailing party.

10. Hire an attorney to review your contracts

It is up to you to understand the importance of the agreement you are entering into. And while you must use your judgment to determine whether you need an attorney who focuses on such work, it oftentimes is beneficial to have an attorney review the contract before it is executed. Doing so may raise questions that were not considered by either party and can prevent larger and costlier legal disputes down the road.

Shareholder Kyle Willems also contributed to this article.

Nothing in this article constitutes legal advice. An attorney-client relationship does not exist between the authors, Bassford Remele P.A. and any readers.

Contact: Bryce Riddle is a business litigation attorney with Bassford Remele: 612.376.1624; briddle@bassford.com; www.bassford.com; in/bryce-riddle-5383b137. Kyle Willems is a shareholder at Bassford Remele: 612.376.1604; kwillems@bassford.com; www.bassford.com; in/kylewillems

9

MAY • JUNE 2023 UPSIZE

www.upsizemag.com

“Ambiguity has been the cause of death for many contracts throughout history.

To avoid that fate, it’s important you keep contract language as clear and simple as possible.”

Bryce Riddle

Bassford Remele PA

Do I Need a CFO?

by Cathy Sedacca

Manage your cash flow in a few simple steps

by Craig Veurink

TIPS

1. Set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future

People I speak with often have no idea what a chief financial officer (CFO) does, let alone why their business would need one. They typically have a bookkeeper or controller, who handle day-today transactions and oversee the general ledger, accounts payable, accounts receivable, payroll and financial reporting.

TIPS

1. CFOs convert the business owner’s vision of the future into a financial plan and they measure progress on that plan.

2. Put cash flow before profits. It might seem counterintuitive, but if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix

2. Growth businesses need a CFO. Planning and forecasting are critical and ensuring plentiful cash, investing in growth opportunities and planning for downturns are critical.

3. Secure credit ahead of time. Most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected

3. CFOs aid with strategy, provide insight into strategic decision making and have tools to assess business opportunities to aid in making informed decisions.

4. Consider using a payroll service. Having the professionals take care of collecting payroll taxes saves them an enormous amount of time, helps streamline their cash flow

4. CFOs also mitigate risk, helping identify risks in advance and coming up with problems to overcome them.

Small businesses are usually founded by entrepreneurs who have a unique vision and a passion that drives them to work late hours, take chances and believe in what they’re doing. But, just as Thomas Edison once said that genius is 1 percent inspiration and 99 percent perspiration, successfully running a small business requires rolling up your sleeves and putting in significant time on more mundane, day-today matters.

They also have a certified public accountant (CPA) firm who prepares and files tax documents, and may assist with financial planning and provide some advice throughout the year.

You can be driven, impassioned and have a great idea to fill a niche or serve customers in new ways, but if you don’t attend to the details of the business, you can create for yourself a heap of problems.

But when it comes to understanding and actively managing the financial health and strategy of the business, they’re missing the mark. This becomes particularly important as a business grows and becomes more complex.

Here, we’ll look at one of the most important of these business details: managing cash flow. Especially for early startups, knowing how much cash is coming in and going out, and accurately forecasting sales and expenses, is key to maintaining your company’s health.

Without financial leadership small, growing businesses can run the risk of mismanaging expenses, making uninformed decisions, running out of cash and being unable to obtain financing.

No matter where you are in your business, keep these things top of mind:

What does a CFO do?

measure progress on that plan. They ensure that reporting accurately reflects the activities and health of the business and they can provide specific insight and explanation regarding results.

“When do I start to turn a profit?”

Rather than wonder, set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future.

A CFO plays a key role in managing cash flow, which may include raising capital, negotiating financing agreements and managing relationships with bankers, investors and other finance sources.

2. Put cash-flow management before profits

This might seem counterintuitive, since profits are how you survive. However, if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix. Keep things organized and well managed so you can be ready for whatever success comes your way.

As a member of the leadership team, the CFO provides relevant financial input and advice to the executive team, board of directors and other key stakeholders. In a smaller business, a CFO is a valuable sounding board for the myriad decisions that need to be made daily.

3. Secure credit ahead of time

How do I know if my business needs a CFO?

5. Schedule your payments. Don’t go delinquent but do divide your payments into categories such as “must pay,” “important to pay” and “flexible payment terms.” This can help keep sufficient cash on hand.

5. If resources are limited, consider a fractional CFO, a part-time person split amongst three to five different companies, to hold down the role.

1. Know when you will break even

Every small business owner keeps at the front of their mind the question:

CFOs provide leadership on financial strategy. They convert the business owner’s vision of the future into a financial plan and they

A business needs a CFO if they want to grow. Planning and forecasting are critical components of a growing business. Making sure that a business has enough cash to cover expenses, invest in growth opportunities and weather economic downturns is critical to success.

A CFO aids with strategy. They provide valuable insight into strategic decision making. They have the tools and expertise to assess

Too often, small business owners wait until they need it to secure credit. This can cause a lot of unnecessary stress, or worse. Talk to experienced business owners in your area and industry ahead of time to know how much revenue you’ll need up front. Take a realistic look at the situation and plan. You might have sufficient cash reserves or a rich uncle who is only a call away, but most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected.

10 www.upsizemag.com UPSIZE MAY • JUNE 2023

BUSINESS BUILDERS management

6 www.upsizemag.com UPSIZE NOVEMBER • DECEMBER 2022

BUSINESS BUILDERS banking

business opportunities and help business owners to make informed decisions.

As a business grows so does the need to manage risk. A CFO helps business owners manage risks by identifying potential issues in advance and developing strategies to mitigate them. This can include managing cash flow, monitoring expenses and maintaining compliance with financial regulations.

When the business has a need for external funding or investment, it may be time to hire a CFO. CFOs ensure accurate financial reporting and can present financial information in a clear and compelling way.

What is a fractional CFO?

A fractional CFO is like hiring a highly qualified professional on a very part-time basis. Picture splitting a CFO with three to five other small businesses.

In general, fractional professionals are a great answer for almost all business types and sizes. While this is not a new concept, the world of fractional professionals has grown significantly since 2020 and doesn’t appear to be slowing.

Fractional professionals provide a win/win in flexibility and control for both sides. Employers avoid the added costs of a full-time employee and have the flexibility to assign work as needed and reduce down time.

The fractional employee gains the ability to choose their work, build in variety and enjoy the flexibility of working on their terms.

A fractional CFO has financial expertise, often from a variety of industries, and can bring their knowledge and experience to a small business at a fraction of the cost.

Think of fractional help as a permanent member of the team who provides a fraction of their time at a fraction of their cost, versus contract help that is typically filling a role for a specified period of time, either to work on a special project or to cover for an absence.

How much does a factional CFO cost?

Fractional CFOs can be especially practical for small businesses when they aren’t large enough to require full-time financial expertise and can’t afford the six-figure salary that an experienced CFO requires.

Fees vary from hourly rates to monthly retainers. It is important to interview candidates and find the right fit, both in terms of experience and personality as well as cost and expectations.

CFOs can help small businesses achieve financial stability, growth and long-term success by providing strategic financial guidance and management.

Having an experienced CFO who has the perspective of helping a variety of growing companies in multiple industries can be an invaluable asset to have as a small business navigates the challenges of growing, thriving and ultimately building value.

Contact: Cathy Sedacca is managing director at Integrated Consulting Services: 612.802.1784; cathy.sedacca@integrated-consulting.net; www.integrated-consulting.net.

11

MAY • JUNE 2023 UPSIZE

www.upsizemag.com

“A CFO aids with strategy. They provide valuable insight into strategic decision making.

They have the tools and expertise to assess business opportunities and help business owners to make informed decisions.”

Cathy Sedacca Integrated Consulting Services LLC

& acquisitions

Finding the right lender

by Ann Franklin

Manage your cash flow in a few simple steps

by Craig Veurink

Preparing for an acquisition or another business transition is a pivotal moment for business owners. For owners doing their first acquisition there is a lot of unfamiliar territory to cover — from valuing the business they are acquiring to reviewing their internal controls to understanding how to pay for it.

Working with an experienced lender who has their best interests in mind is crucial when it comes to successfully, confidently and efficiently closing a business acquisition.

TIPS

TIPS

complex process of acquiring a business. They can offer valuable insights on market trends, deal structures and financing options.

In addition, a bank with strong experience in acquisition financing for closely held businesses that is well networked with multiple outside advisers and consultants can make helpful connections when the borrower needs to supplement their expertise.

1. Set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future

1. Don’t accept a cookie-cutter approach. Business owners should look for lenders who work to understand their goals and tailor solutions to their needs.

Small businesses are usually founded by entrepreneurs who have a unique vision and a passion that drives them to work late hours, take chances and believe in what they’re doing. But, just as Thomas Edison once said that genius is 1 percent inspiration and 99 percent perspiration, successfully running a small business requires rolling up your sleeves and putting in significant time on more mundane, day-today matters.

2. Experienced lenders know the complexities that come along with deals and can offer insights on market trends, deal structures and financing.

2. Put cash flow before profits. It might seem counterintuitive, but if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix

3. Volatility in the current market increases deal complexity and makes finding creative, experienced help even more important.

3. Secure credit ahead of time. Most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected

Business owners should look for a lender who works to understand their goals so they can tailor a financing solution that meets the business’s specific needs and financial situation. Because transactions are dynamic, with terms and conditions evolving throughout the process, business owners will want to have access to the decision makers at their bank. Connections to lending decision makers will help business owners overcome the inevitable roadblocks that pop up during a transaction.

You can be driven, impassioned and have a great idea to fill a niche or serve customers in new ways, but if you don’t attend to the details of the business, you can create for yourself a heap of problems.

“When do I start to turn a profit?”

Rather than wonder, set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future.

2. Put cash-flow management before profits

As businesses navigate the current period of increasing economic uncertainty and interest rate volatility, transactions can get more complex. Lenders need to get creative to help owners meet their goals. Responsive lenders who can get to a decision quickly are more important than ever in this market environment. Working with a bank that specializes in supporting growing businesses can facilitate all aspects of a transaction — it’s banking that takes businesses to the next level, with a personalized touch.

This might seem counterintuitive, since profits are how you survive. However, if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix. Keep things organized and well managed so you can be ready for whatever success comes your way.

4. Asset-based, cash flow or SBA loans all are options for closing deals. Several factors, including the buyer’s experience, access to liquidity, and available collateral will determine the final recommendation.

4. Consider using a payroll service. Having the professionals take care of collecting payroll taxes saves them an enormous amount of time, helps streamline their cash flow

5. Schedule your payments. Don’t go delinquent but do divide your payments into categories such as “must pay,” “important to pay” and “flexible payment terms.” This can help keep sufficient cash on hand.

5. Bank relationships should be long-term. Owners should have confidence banks will work with them through good and challenging times.

Here, we’ll look at one of the most important of these business details: managing cash flow. Especially for early startups, knowing how much cash is coming in and going out, and accurately forecasting sales and expenses, is key to maintaining your company’s health.

No matter where you are in your business, keep these things top of mind:

The ideal lender should view their role as bringing a full toolkit of financing options and business expertise to the transaction conversation. Experienced lenders know that a transaction can be more than a business deal — it’s a step toward greater opportunity, faster growth, new products and markets. It also can potentially bring greater risk to the business. Bankers are there to help business owners make the most of this exciting time.

What to look for?

1. Know when you will break even

Every small business owner keeps at the front of their mind the question:

An experienced lender will have the necessary knowledge and expertise to help business owners navigate the

The most helpful lenders will take the time to understand the borrower’s objectives. A team-based approach to lending can be particularly helpful in getting to a creative solution — not just an individual lender’s preferred product. Each lender will bring their specialized expertise and financing solutions to the discussion to determine the best fit for the business and transaction.

3. Secure credit ahead of time

Too often, small business owners wait until they need it to secure credit. This can cause a lot of unnecessary stress, or worse. Talk to experienced business owners in your area and industry ahead of time to know how much revenue you’ll need up front. Take a realistic look at the situation and plan. You might have sufficient cash reserves or a rich uncle who is only a call away, but most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected.

Ultimately, they may present a range of financing options that could include SBA loans, traditional assetbased loans or cash flow loans. SBA loans are most often the best solution for many acquisition transactions involving closely held businesses, but there are times when a conventional structure, unconnected to SBA, makes

12 www.upsizemag.com UPSIZE MAY • JUNE 2023

BUSINESS BUILDERS mergers

6 www.upsizemag.com UPSIZE NOVEMBER • DECEMBER 2022

BUSINESS BUILDERS banking

more sense.

Several factors, including the buyer’s experience, access to liquidity and available collateral will determine the final recommendation. Because each business owner and opportunity is unique, look for bankers who tailor the experience to the situation and what is best now and in the future.

A good lender helps business owners understand the nuances of various financing options from upfront paperwork requirements to alternative financing structures to ongoing compliance. There’s a laundry list of variables when it comes to determining the best approach to acquisition financing. Here are a few that a lender may review:

• Does the acquisition have a significant amount of blue sky (goodwill and other intangibles) or is the deal largely supported by tangible assets? Intangible assets can introduce more “air balls” into the transaction which will need to be managed. An experienced lender knows how to pin down those air balls while preserving flexibility in financing options. They may suggest various credit enhancements, such as an SBA guarantee, as part of getting to the right structure for the transaction.

• What is the seller willing to do to enable a successful transaction? The seller plays an important role in a successfully executed transaction. They may choose to finance part of the transaction and they may offer to stay on after the transaction is closed to help with the transition. A seasoned lender can help the buyer understand how different financing options will fit best in the various scenarios.

• What is the buyer’s relevant experience in the to-be-acquired business? A lender is assessing the risk of the proposed transaction and the buyer’s ability to run the combined business and meet financial targets. A less experienced buyer can be bolstered by a longer seller transition period post-transaction. A well-connected lender with a good reputation will often have an incredible network of partners who can advise buyers on financial and other integration areas, ongoing financial management, business operations and legal matters.

The transaction is just the beginning of a banking relationship. Experienced lenders can offer ongoing support and advice, helping the business owner achieve their goals and succeed in the long run. Business owners should look for a lender who will invest in the relationship upfront to ensure a smooth transaction to set up the business owner for future growth and success, because a successful business and banking relationship recognizes it must be about more than a transaction.

Business owners should have confidence that their banker will be alongside them through the good and challenging times because, as bankers, we partner with business owners we believe in and want to see them achieve and surpass their goals.

Contact: Ann Franklin is vice president of SBA lending at Fidelity Bank: 952.831.6600; ann.franklin@fidelitybankmn.com; www.fidelitybankmn.com; in/ann-franklin-819b539

13 www.upsizemag.com MAY • JUNE 2023 UPSIZE

“Business owners should look for a lender who works to understand their goals so they can tailor a financing solution that meets the business’s specific needs and financial situation.”

Ann Franklin Fidelity Bank

planning

BUSINESS BUILDERS

Five tips for navigating income increases

Manage your cash flow in a few simple steps

Craig Veurink

by Nick Scheibel

TIPS

TIPS

1. Whether it’s being made partner or paying off a loan, make sure you review your cash flow and other financial areas to ensure you’re optimizing additional income.

1. Set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future

2. Inventory your monthly bills to see if you are charged for anything you are not using.

2. Put cash flow before profits. It might seem counterintuitive, but if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix

3. It might make sense with new responsibilities to see if outsourcing activities like landscaping, house cleaning or tax preparation might help you find extra time.

3. Secure credit ahead of time. Most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected

4. Equity opportunities within your company help you share in its success but can also cause income fluctuations. You may need to start making estimated tax payments. And understand how a sale might affect you.

4. Consider using a payroll service. Having the professionals take care of collecting payroll taxes saves them an enormous amount of time, helps streamline their cash flow

As you advance through your career, significant changes to responsibility and title may result in meaningful increases in compensation. While a bigger salary will mean more cash flow in your checking account, it is also an opportunity to consider how the increased income affects your long-term plans.

Small businesses are usually founded by entrepreneurs who have a unique vision and a passion that drives them to work late hours, take chances and believe in what they’re doing. But, just as Thomas Edison once said that genius is 1 percent inspiration and 99 percent perspiration, successfully running a small business requires rolling up your sleeves and putting in significant time on more mundane, day-today matters.

Whether you have become a partner or co-owner at your firm, been promoted into an executive role or paid off a loan with a large monthly payment, we suggest you review the following areas to ensure you are still on track for your goals and have optimized where you spend your additional income:

You can be driven, impassioned and have a great idea to fill a niche or serve customers in new ways, but if you don’t attend to the details of the business, you can create for yourself a heap of problems.

Review your month-to-month cash flow.

Here, we’ll look at one of the most important of these business details: managing cash flow. Especially for early startups, knowing how much cash is coming in and going out, and accurately forecasting sales and expenses, is key to maintaining your company’s health.

Make sure you are taking advantage of opportunities to defer income that are available through your employer or business.

“When do I start to turn a profit?”

Rather than wonder, set a realistic goal for when you want to break even. This will help you to focus your efforts and provide a numerical benchmark for projecting your cash flow in the near future.

2. Put cash-flow management before profits

This might seem counterintuitive, since profits are how you survive. However, if you aren’t organizing your cash flow, you’ll run into problems that a profitable quarter might not be able to fix. Keep things organized and well managed so you can be ready for whatever success comes your way.

For example, if you have been making Roth contributions to your retirement account, it may be time to switch to traditional contributions to reduce your taxable income. You may also be eligible for other employer-sponsored deferral opportunities such as a deferred compensation plan or an employee stock purchase plan. If you work with a financial adviser or tax professional, be sure to discuss these various deferral opportunities to help you optimize tax efficient savings.

3. Secure credit ahead of time

5. Schedule your payments. Don’t go delinquent but do divide your payments into categories such as “must pay,” “important to pay” and “flexible payment terms.” This can help keep sufficient cash on hand.

5. As your net profits grow, you may also want to consider executive deferred compensation programs that can provide you as the majority owner with tax benefits along with those team members and minority partners participating in the program.

No matter where you are in your business, keep these things top of mind:

1. Know when you will break even

Every small business owner keeps at the front of their mind the question:

If you are building excess cash in your checking account, you may want to consider other vehicles for your cash that earn a higher rate of interest, such as online savings accounts or CDs. If you find the opposite is true for you and that, as your income has increased you have taken on expenses that are stretching the monthly budget, you’ll want to inventory your recurring monthly bills to see if there are items you can eliminate, such as subscriptions you never use.

With an increased income, consider paying for conveniences to help manage your day-to-day schedule.

After a significant change to compensation, it can be worthwhile to consider how best to optimize the new cash flow to remain on track toward your long-term goals while finding opportunities to pay for help with responsibilities at home. If there are certain tasks that you are finding harder to complete given your increased professional responsibilities, consider outsourc -

Too often, small business owners wait until they need it to secure credit. This can cause a lot of unnecessary stress, or worse. Talk to experienced business owners in your area and industry ahead of time to know how much revenue you’ll need up front. Take a realistic look at the situation and plan. You might have sufficient cash reserves or a rich uncle who is only a call away, but most small business owners should secure as much credit as possible. This is the best way to be prepared for the unexpected.

14 www.upsizemag.com UPSIZE MAY • JUNE 2023

6 www.upsizemag.com UPSIZE NOVEMBER • DECEMBER 2022

BUSINESS

BUILDERS banking

ing where you can. For you it might be landscaping, house cleaning or someone to prepare your taxes.

If you have a goal of retiring early, make sure you are saving for retirement outside of your employer retirement plans. In most cases, you cannot access these plans until you are age 59 ½, so if you want to retire before then it is important to build up some after-tax investments as well.

If you have received equity in your company through a partnership buy-in, stock grants or an employee stock purchase plan, consider the impacts to your cash flow and taxes.

Equity in your company allows you to share in the firm’s success, but it can also mean your income will vary from year to year and even from quarter to quarter. You may need to start making estimated tax payments to cover your tax liability, and it’s important to understand how an eventual sale of the company could impact your individual financial and tax situation.

These considerations aren’t just for key employees. If you own a business and you are considering bringing team members on as partners or promoting them to an executive role with increased compensation and benefits, you will want to think about how the factors above will impact your ability

to retain your top talent. How you structure equity awards and executive benefits will impact their cash flow, taxation and ultimately their job satisfaction. As your net profits grow, you may also want to consider executive deferred compensation programs that can provide you, as the majority owner, with tax benefits along with those team members and minority partners participating in the program.

Certainly, there are many ways in which increased income can positively affect your life and lifestyle. By taking even a few minutes to initially review various aspects of your finances, even a small increase can have a strong impact on your overall financial plan.

JNBA is not an accountant nor an attorney and no portion of the above should be construed as accounting or legal advice. All accounting or legal issues should be addressed with an accounting or legal professional of your choosing. Please see important disclosure information at jnba.com/ disclosure.

Contact: Nick Scheibel is a certified financial planner with JNBA Financial Advisors: 952.844.0995; nick.scheibel@jnba.com; www.jnba.com; in/nickscheibel

15 www.upsizemag.com MAY • JUNE 2023 UPSIZE

“There are many ways in which increased income can positively affect your life and lifestyle. By taking even a few minutes to initially review various aspects of your finances, even a small increase can have a strong impact on your overall financial plan.”

Nick Scheibel

JNBA Financial Advisors

Embracing ChatGPT

Artificial intelligence engines saving time, boosting productivity

Heather Manley has three jobs. Her main gig is leading On-Demand Group, a technology consulting service for individuals and projects.

Then she has two side projects: Heather’s Dirty Goodness Inc., which she started to create quality seasonings low in salt for her dad, and Crooked Water Spirits, a national spirits company.

So, while dedicated to growing all three, she doesn’t have a lot of free time right now to dedicate to marketing and social media for her spirits brand.

But that’s becoming less of a problem. No, she didn’t run out and hire someone to handle it full-time. She plugged the details of what she wanted into ChatGPT and, within minutes, the artificial intelligence-driven bot had pumped out the framework she needed for several posts.

She had to refine them. ChatGPT is prone to the occasional factual error and it doesn’t include any context or emotion in its copy. But Manley was able to use its framework to create, in a few hours, several posts for the Crooked Water Spirits website that, had she started from scratch, would have taken her a couple weeks.

“I’m just cutting out what I feel is irrelevant or too ‘textbooky,’” she says. “I removed quite a bit and then put in my own opinion and flavor.”

Artificial intelligence (AI) I isn’t going to solve all the world’s problems but it’s more than catching on. Many small business owners have discovered a variety of ways in which ChatGPT and other AI sources can help them create content, solve problems and become more efficient.

“I wrote three blogs and two social posts in an hour, where I haven’t done one for two years, because I couldn’t find the mental bandwidth,” Manley says. “I love to write but I’m not super great at it, so it takes me a long time to put together content.”

Marketing, HR, SEO, oh my

Much as with Manley’s distillery, Sam Dillard says she

by Andrew Tellijohn

photographs by Tom Dunn

hasn’t found a lot of use yet for ChatGPT. But the operations manager and co-owner lists off a handful of ways in which the AI bot has made life easier for St. Paul-based Dillard Movers.

She’s in the process of learning how to use it more and will diversify that use over time.

“The one place we’ve found to use for it is in our marketing,” she says. “We use it to create catchy social media posts. We’ve used it to put together verbiage for our website. It’s extensive the uses we’ve found for marketing.”

It’s a time saver on the writing side, it helps keep a schedule so company officials know when to post, and it helps generate fresh ideas, she says. And, between ChatGPT and some other AI tools, Dillard has created some inexpensive commercials for the company, as well.

English is a second language for Dillard’s assistant, so ChatGPT has helped with proofreading such content, says Dillard, who adds that as the moving company puts together its blog, it will likely contribute content, too.

It also helps with search engine optimization .

“It allows us to put keywords in that will show up a bit more,” Dillard says. “SEO, as a small company, that’s one of our biggest struggles. We find that it’s really hard to get found when there are companies that are our competitors and they have thousands of dollars to plug into marketing every month. We don’t. So, we’ve used it, or we are trying to use it, in ways that can help make the work easier but also be able to cover more ground than if we would have to create content ourselves constantly.”

It also came in handy recently for a human resources function, as well. As Dillard Movers was growing, she wanted to put together an employee manual, but didn’t really have a great idea how to start.

“It helped in creating some HR protocols that we would hand our employees,” she says. “I was able to put together, within maybe about an hour, a handbook I could hand out to our workers as they come on board.

www.upsizemag.com 16 UPSIZE MAY • JUNE 2023

Nancy Korsah, president and CEO of Black Business Enterprises, loves artificial intelligence and teaches other small business owners how they can use it to grow their companies.

COVER STORY

“Where I would’ve had to think of how to write this, what’s the layout, what’s important to include, I was essentially able to say ‘Okay, write me the main points of an employee handbook for a moving company that I can give my workers,’” she says. “It just spit it out within minutes and I was able to grab that, put it in a Word document, expound on it, remove things that didn’t apply and add some more stuff. Within an hour I had my manual. It’s really, really easy.”

Leveling the playing field

Like others, John Arms currently uses ChatGPT as a time saver to help with writing for websites and blogs.

“Its current utility is time saving,” says Arms, the co-founder of Voyageur U. “You can feed it some information, it’s going to pop out four or five pages. The quality is high. It needs writers — it needs somebody to look at it and think about it a little bit for context, to make it a little stronger.”

But it’s the next level that excites him. He’s doing some beta testing with a couple business partners on building an AI technology that can do some strategic marketing planning.

“You’re able to ask it ‘give me more expansive thinking about my market segmentation, give me more expansive thinking about my brand, give me more expansive thinking about my product set,’” he says. “It can get very strategic very quick. It’s as if you can go into a room of thousands of thinkers and ask

them to synthesize some very basic points.”

Whereas large companies can afford agencies and speakers to help them through marketing like this, AI can level the playing field for small businesses by giving them similar insights at significantly reduced cost.

Arms wrote the book “Bang!” last year to simplify marketing for every business. He and a couple partners are now betatesting an AI tool called Rob Bot that will provide information on customer segmentation, strategy, brand positioning and other aspects of the customer mindset and journey.

“That is a mindblower,” he says. “The most important part of any plan is a customer journey and I can work on that and understand it. I can pull in focus groups and do surveys and that sort of thing. I can have AI do that work for me and, early tests are, it is more expansive than what I would get through the traditional methods in a fraction of the time at a fraction of the cost. … My hope is it becomes very consumable for small businesses.”

Life changing technology

Nancy Korsah, president and CEO of Black Business Enter-

18 www.upsizemag.com UPSIZE MAY • JUNE 2023

ChatGPT helped Heather Manley, CEO of Crooked Water Spirits and head of two other companies, quickly produce content for blogs and social media posts that otherwise would have taken weeks.

ChatGPT use at Dillard Movers has ranged from help with an employee handbook to creating content for blogs and social media, says Sam Dillard, co-owner.

COVER STORY

prises, has fully embraced ChatGPT and is teaching classes on it and other artificial intelligence programs.

The tool isn’t designed to replace people — you always need the human component, she says — but it can help overcome writers block and give you some different perspectives.

Born in Italy, Korsah speaks seven languages, with English being most difficult for her. So, she uses ChatGPT to help communicate with her members. She also used it to write a romance novel that has sold a couple thousand copies.

“It just helps me fine-tune and be able to get things out a lot quicker,” she says. “It has cut down a lot of time that I would’ve otherwise wasted.”

Korsah teaches on several AI softwares out there available to help people create an income stream. One of her favorites helps business create inexpensive marketing campaigns that saved thousands.

Her focus is on working through these techniques with Blackowned businesses, many of which got started on shoestring budgets. The technology can level the playing field considerably for those businesses.

“It has been a life changer for some of these people and it’s actually taken some people out of poverty,” she says. “People are able to launch and scale their businesses without the cost, which I find invaluable.”

She acknowledged that some fear such technologies and that, in some cases, AI is being used to commit fraud. Many have used AI to, for example, create bootlegger Amazon or bank websites that look almost real. Korsah suspects regulators will soon step in and start taking a closer look.

“That’s where my concern is, all these people being duped,” she says.

But she also says AI is only going to gain in prominence, so people would do well to embrace it “so they are not left behind.”

CONTACT:

John Arms is co-founder of Voyageur University: 612.590.1995; john. arms@voyageuru.com; www.voyageuru.com; in/johnarms

Sam Dillard is operations manager and co-owner of Dillard Movers: 651.300.0897; contact@dillardmovers.com; www.dillardmovers.com; in/sam-dillard-68182253

Garrio Harrison is fractional chief revenue officer at Clario and a partner at Curious: garrio@discovercurious.com; www.discovercurious.com; in/garrioharrison

Nancy Korsah is president and CEO of Black Business Enterprises: nancy@ nancykorsah.com; www.nancykorsah.com; in/nancy-korsah

Heather Manley is CEO of On Demand Group and founder and CEO of Crooked Water Spirits: heather.manley@ondemandgroup.com; www.crookedwaterspirits.com; in/ondemandgroup

Many AI tools available

Indeed, ChatGPT has gotten a lot of press in recent months and is probably the best known of the artificial intelligence tools from which small businesses benefit. Garrio Harrison, fractional chief revenue officer at Clario and a partner at Curious, says it is one of many.

So, business owners can use ChatGPT to prep a sales team by having them roleplay with the program, having it mimic likely sales objections coming from personas with different characteristics and teaching salespeople response strategies.

“A tool like this gives them the ability to try different conversations, try different answers to questions, and navigate based on the responses,” Harrison says. “This is something that really good sales folks do.”

But there are myriad more. How about, he says, Midjourney, an AI image generator that has recently taken the internet by storm. It allows people to create images that could pair with content they have written, so instead of spending thousands on stock photography, you can auto-generate your own.

“You’re able to get exactly what you’re thinking about,” he says. “So, if you go, ‘you know, what would be really nice here is a photo of a guy standing on a stage with his arms stretched out and the stage should look like a TED (technology, entertainment, design) stage and I want it to be photorealistic, you can have that photo generated. It would take the tool about a minute tops.”

Or there is Notion AI, which can help with writing, editing, brainstorming, summarizing and more. Harrison takes the transcript of his podcasts, pops them into Notion, and has the tool create his show notes. It could also generate blog or social media posts.

“That’s going to be a game changer for productivity,” he says, adding that he recommends business owners become familiar with the best uses of each tool and figure out how they might apply. Options are many and the benefits can be significant in terms of saving time, generating ideas and, ultimately increasing revenue. “Generative AI is the foundational thing,” he says. “We’re in for a wild ride.

www.upsizemag.com 19 MAY • JUNE 2023 UPSIZE

Garrio Harrison, chief revenue officer at Clario and partner at Curious, says numerous AI tools exist that can be money savers and game changers for small business owners.

Chatting with ChatGPT

Artificial intelligence chatbot talks helping small business

by Andrew Tellijohn

The use of artificial intelligence (AI), such as ChatGPT, can be confusing or even scary to some. But users swear by it. We decided to go to the source itself. Upsize Editor Andy Tellijohn spent a few minutes chatting with ChatGPT about its experiences working with small business owners. Here’s what it had to say.

Tellijohn: I am editor of Upsize Minnesota magazine. I would like to interview you about how you can help small businesses. Would that be alright?

ChatGPT: As an AI language model, I don’t have a physical presence or the ability to speak, but I’m happy to provide you with information on how I can help small businesses. Feel free to ask any questions you may have, and I’ll do my best to provide you with useful insights.

Tellijohn: To those unfamiliar with ChatGPT how would you describe yourself?

ChatGPT: As an AI language model, I am a computer program designed to process and generate human-like language. I have been trained on vast amounts of text data, which enables me to understand and respond to natural language inputs in a wide variety of contexts. I am capable of generating human-like responses to questions, carrying out conversations, generating text in various styles and tones, and even creating original content such as stories, poems, and articles. While I am not a human being, my capabilities allow me to assist individuals and organizations in various ways, from answering questions

and providing advice to generating content and insights.

Tellijohn: How have small business owners utilized ChatGPT to help grow their businesses?

ChatGPT: Small business owners can utilize ChatGPT in various ways to help grow their businesses. Here are some examples:

1. Customer service: ChatGPT can be used to provide customers with fast and accurate answers to their questions and concerns. By integrating ChatGPT into their websites or social media platforms, small businesses can improve their customer service and increase customer satisfaction.

2. Sales and marketing: ChatGPT can assist small businesses in generating leads, creating marketing campaigns, and driving sales. For example, a business could use ChatGPT to provide product recommendations to customers, send personalized follow-up messages, or create engaging social media posts.

3. Content creation: ChatGPT can help small businesses create high-quality content such as blog posts, social media updates, and product descriptions. By providing prompts and suggestions, ChatGPT can help businesses overcome writer’s block and generate ideas for new content.

4. Research and analysis: ChatGPT can assist small businesses in conducting market research and analysis. By processing large amounts of data, ChatGPT can provide insights into customer behavior, market trends, and competitor analysis.

Overall, ChatGPT can help small businesses save time and resources, improve customer engagement, and gain valuable insights into their markets.

20 www.upsizemag.com UPSIZE MAY • JUNE 2023

Tellijohn: For those hesitant or afraid of utilizing the technology, how would you suggest people get started using ChatGPT?

ChatGPT: For those who are hesitant or afraid of utilizing ChatGPT, I would suggest the following steps to get started:

1. Understand what ChatGPT can and cannot do: It’s important to have a clear understanding of what ChatGPT is capable of doing and what its limitations are. While ChatGPT can be a powerful tool, it’s not a substitute for human expertise and judgment.

2. Identify use cases: Think about how ChatGPT can be useful for your business. Are there specific tasks or processes that can be automated or improved by using ChatGPT? For example, customer service, content creation, or market research.