Watch VCA Highlights

Value Chain Asia (VCA) is the brainchild of my decade-long experience of meaningful conversations with the “logistics and supply chain” industry’s stakeholders.

Since 2011, I have been given the privilege of sitting down with leaders with remarkable stories to tell and insights to share. Their wisdom gave me an invaluable stance on how the industry reshapes and unfolds itself amidst the challenging business landscape. Wherein the fundamentals on the emphasis of talents remain critical.

Flash forward to today, what started as a concept birthed from my professional calling as a founder of Hatch Asia, an HR consulting company in Singapore, has turned into a platform of endless possibilities.

I am more than thrilled to have launched VCA, as I’ve developed a relentless passion for the logistics and supply chain industry. The emergence of VCA is a milestone that

celebrates the establishment of a common ground where voices are to be heard, and knowledge can be shared.

For us, VCA is not just a mere platform, it’s an arbiter of the present and a beacon of the future.

For editorial inquiries, contact editorial@ valuechainasia.com

Sincerely,

Amos Tay Editor-in-Chief

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) EDITOR’S WORD 2

“

WHO ARE WE?

STAFF WRITER

EDITOR-IN-CHIEF

AMOS TAY

MANAGING EDITOR & DIGITAL MARKETING SPECIALIST

CHARLENE JOANINO

CONTRIBUTING WRITER & EDITOR

KEN TNG

CONTRIBUTING WRITER

NICOLE TRETWER

TRISHA ANJANETTE BALLADARES

KRISKA GATDULA

ALGIN MICHAEL SABAC

GRAPHIC DESIGNER

YASMIN ISMONO

SOCIAL MEDIA SPECIALISTS

LAURENCE BACIA

KAMIYA GARCIA

3

CONTENTS

LOGISTICS

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 4

28 06

13

Electrifying mobility for the logistics industry

18

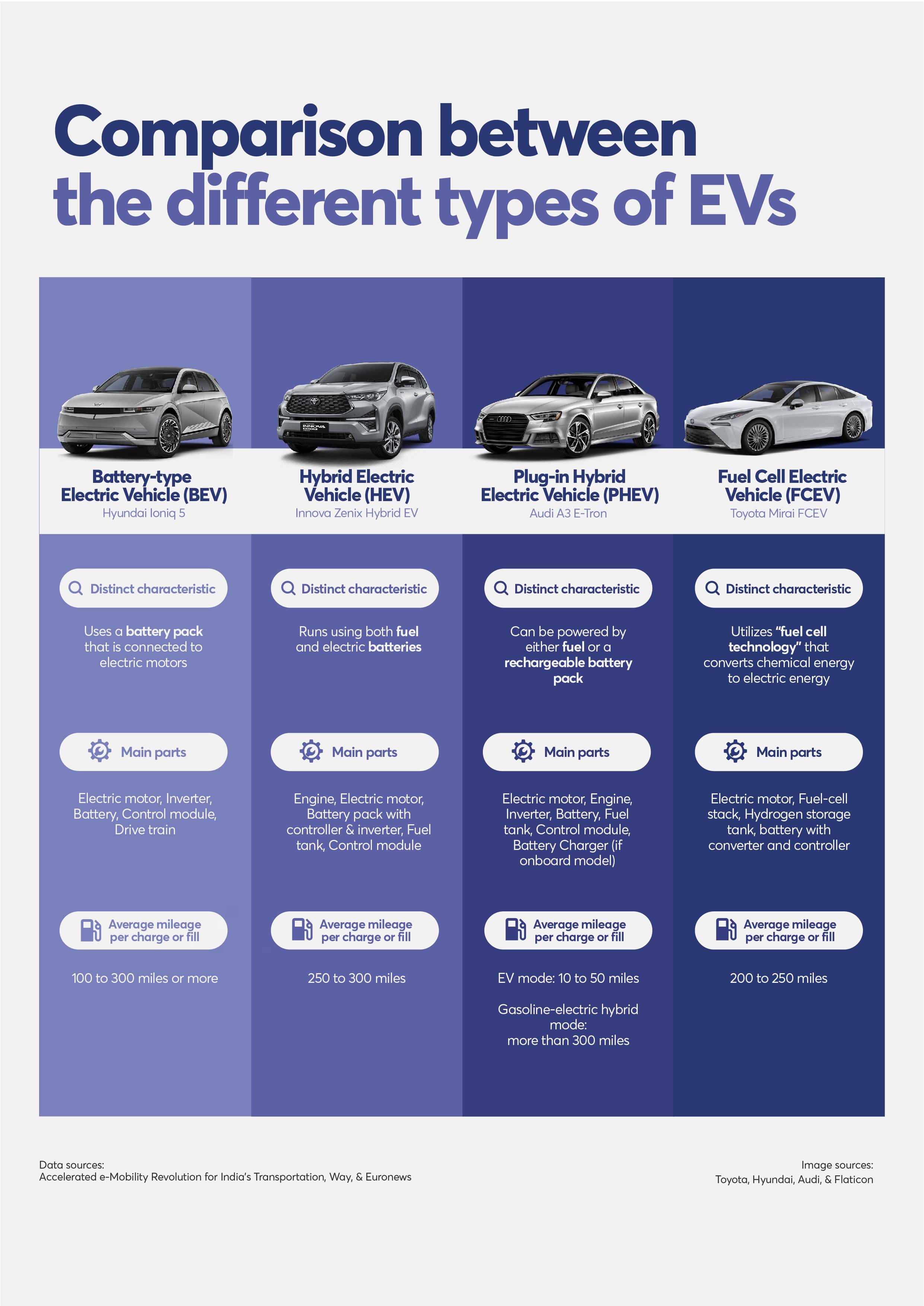

: Are EVs truly the future of the auto market?

: A look at the development of the EV ecosystem

10: Debunking EV misconceptions that may impede supply chain strategy

SUPPLY

CHAIN EVENTS

24: On ushering a transportation revolution: Are electric cars better for the envronment?

Electric vehicle market in Asia, to thrive in the next few years

INSIDE STORY THE COVER

22: SCL Indonesia caps off with success, preludes Kenya event

SUPPLY CHAIN CHAMPIONS SPOTLIGHT

How does a BYD electric car fare in the global arena?

TECHNOLOGY

39: The innovations rendered by the integration of new technologies in EVs

44: Digital supply chain boosts operational efficiency and raises risk concerns

TRENDS & GEOPOLITICS

51: On EV industry race: Who will dominate the Southeast Asian market?

54: Asia’s faces EV mass adoption challenges

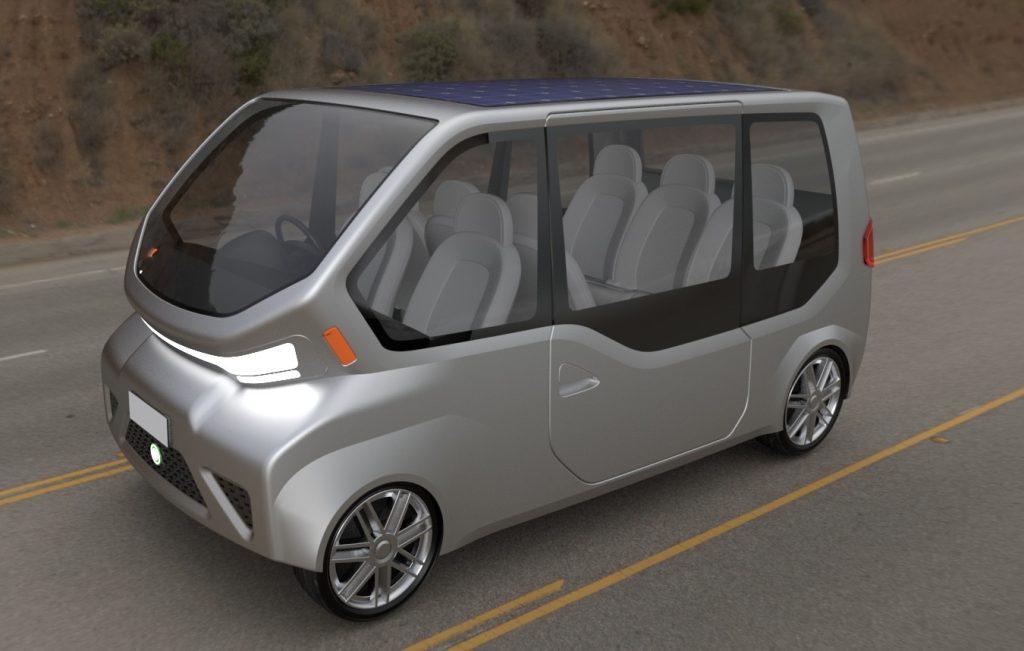

SOOORYA renders new uptake on EVs for the ridesharing sector

HUMAN RESOURCES

57: EV adoption scale up demand for skilled workers and professionals

5 35 47

Electric vehicle market in Asia, to thrive in the next few years

BY CHARLENE JOANINO AND KEN TNG

Theelectric vehicle (EV) market in Asia is growing as governments push for more sustainable transportation options in the automobile supply chain. This push for EVs aligns with global sustainability efforts to reduce dependence on fossil fuels and promote a cleaner environment at the midst of escalating climate change.

Subsidies, tax breaks, implementing zero-emission mandates, and investing in

EV ecosystems have aided to possible market growth. According to Statista’s Mobility Market Outlook, the Asia Pacific EV market can grow around USD 207 billion by 2023.

This growth is in line with the global trend as per the report by SCM Globe. Electric car sales worldwide rose by more than 40% in 2020 compared to the previous year. Prior, the market was valued at USD 229 billion in 2021. It can reach up to USD 777 billion by 2027.

INSIDE STORY

6

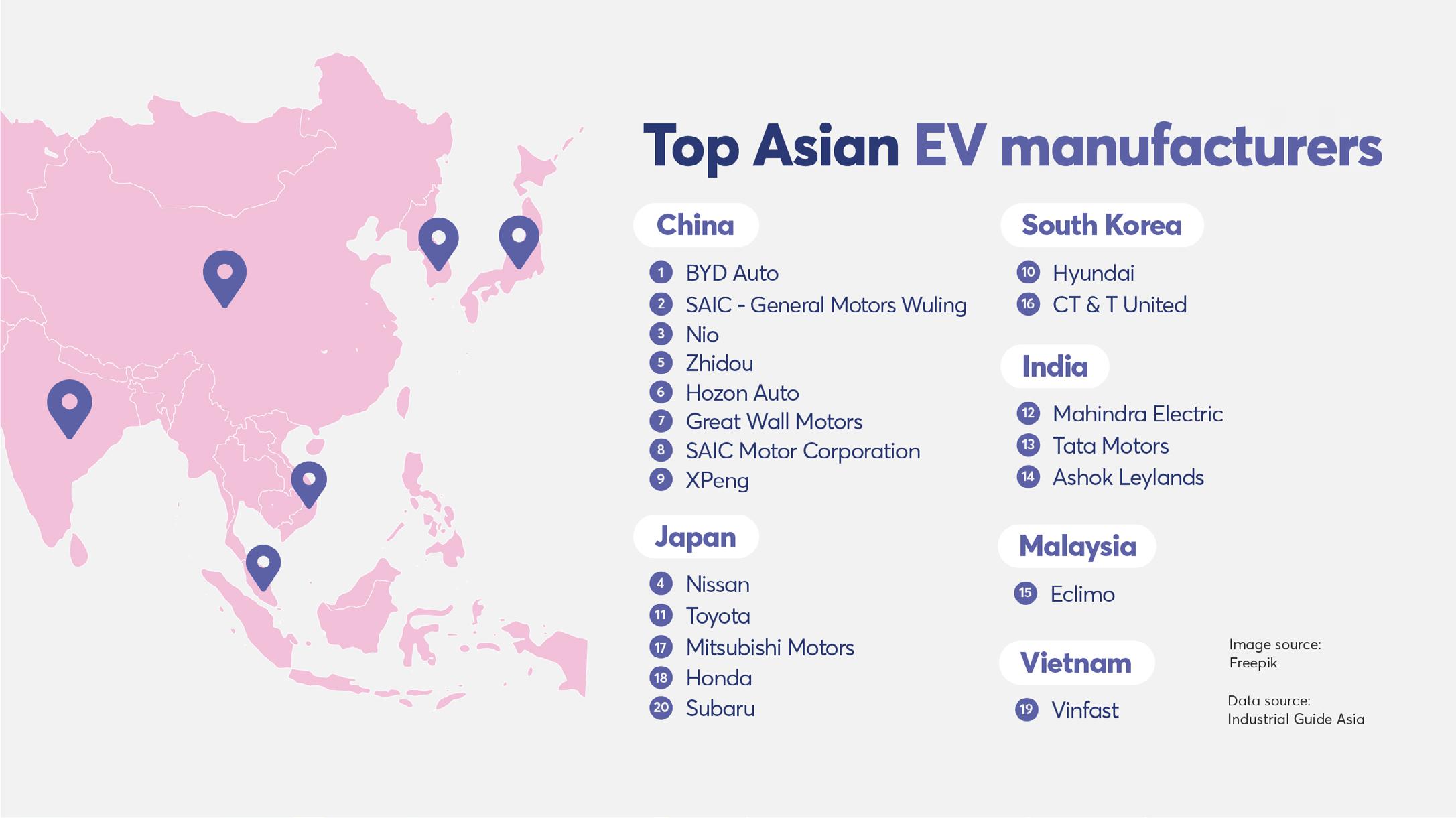

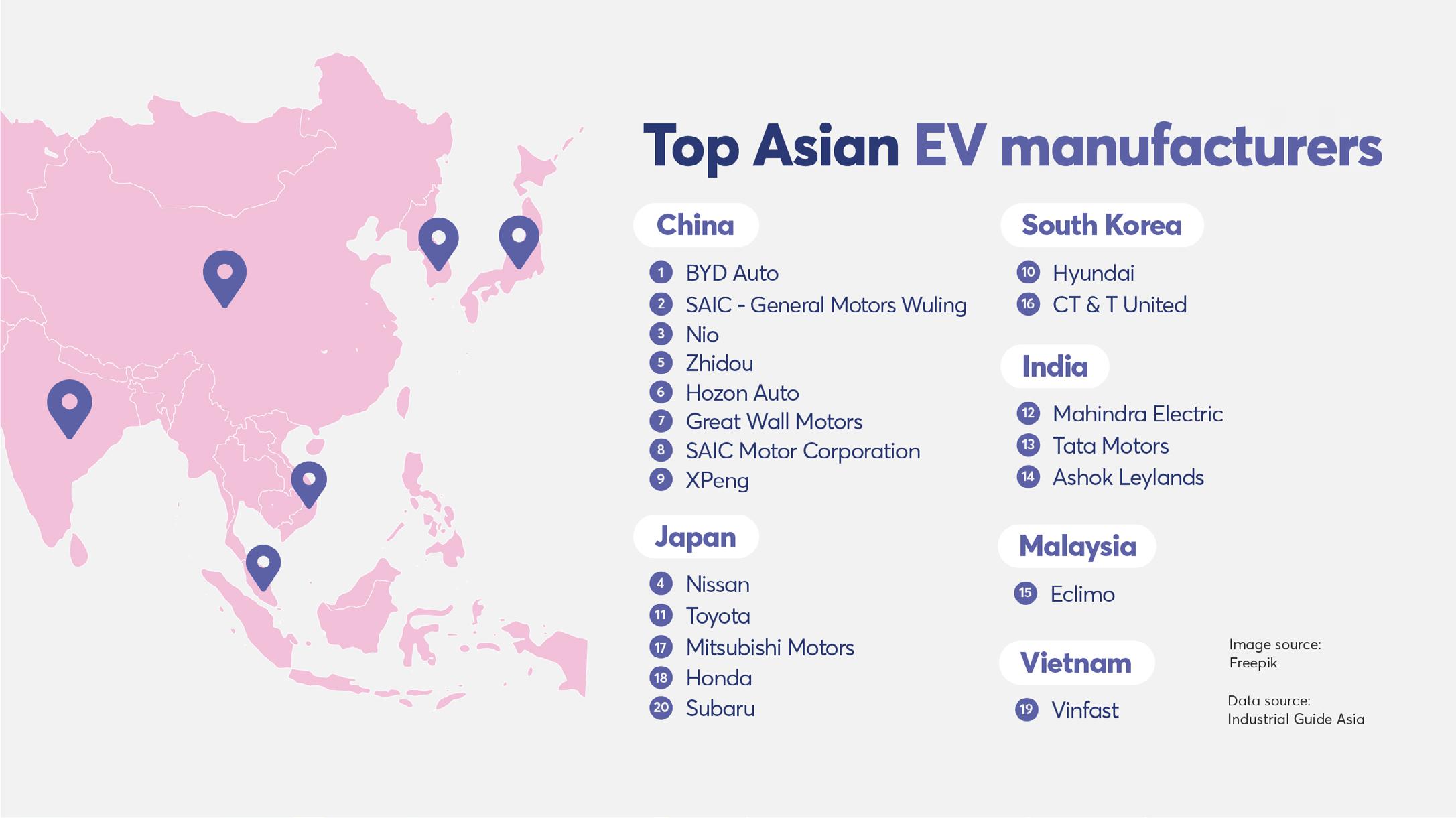

Manufacturers of EV

A key player in the EV market is China, which accounts for 60% of global EV exports. Notably, based on Industrial Guide Asia‘s round-up, many leading EV manufacturers are situated in the said country.

Meanwhile, Thailand is emerging as a major hub for the production of EV. Prominent Asian brands such as Toyota, Nissan, and Honda operate in the country. Its distance to Indonesia, a nickel producer for EV batteries, also aids to its growth in the industry.

The Asian EV market is being boost by various policies and incentives. These are tax cuts, subsidies, and other forms of financial support.

Policies help usher the production and usage of EVs in markets across Asia. Countries such as India and Vietnam have particularly gained from these policies.

With the growing popularity of EVs, many newcomers to the industry are also investing in this technology. One such company is Foxconn, Apple’s largest supplier. Foxconn announced its plan to build an EV factory in Thailand by 2024. The target annual production is 150,000 EVs by 2030.

In line with this target, Foxconn and Geely Holding Group signed a strategic cooperative agreement in January 2021 to create a joint venture company that will provide OEM and consulting services for vehicles, parts, drive systems, and platforms to global automotive and ridesharing companies.

Traditional car companies are also shifting. As EVs become more mainstream, parts suppliers of internal combustion engines have found their businesses at risk of disruption.

For instance, Thailand’s top auto parts manufacturer, Yamaha Motor Parts, is feeling the heat. By specializing in exhaust systems for internal combustion engines, the company is at risk of losing its primary revenue source. In a bid to stay competitive, the company is broadening its reach. It has invested in components of EVs, such as battery packs, to diversify its product portfolio.

Automobile supply chain

The Asian auto supply chain, particularly the EV market, is a vital player in the global market for electric cars. Characterized by its vertical integration, select key stakeholders control every aspect of the value chain. They manage from getting raw materials to producing finished products.

Another unique quality of the Asian auto industry is its dominance over research and development (R&D) of solidstate batteries, which often account for about 30-40% of the price of an EV.

The Asia Fund Managers state that the solid-state battery market will hit USD 3.4 billion by 2030, with a compound annual growth rate of 18%. Japan is the current leader in R&D for solid-state batteries. Such ushers six companies among the top 10 patent holders, including Toyota, Panasonic, and Idemitsu Kosan.

In fact, Japan claims almost 68% of solid-state battery patents, with the United States coming in second at 16%. South Korea follows closely behind at 12%. Although China falls behind in the industry, significant investments in R&D for solid-state batteries are being made. Wherein, companies like Eve Energy lead the way in producing new technologies and expanding production.

This level of control has enabled Asian producers to make electric cars at a lower cost than other regions. Moreover, Asia has ample reserve of raw materials for EV production, such as lithium and cobalt, which are used in batteries. Such post a challenge for other markets, including Europe and the United States, to compete in the industry.

Currently, China is the leading producer of these elements in the region. In addition, the country has taken steps to secure mineral supplies abroad while heavily subsidizing its battery manufacturers.

Francis Wedin, the CEO of Vulcan Energy, a company that produces lithium for EVs in Germany.

Asia is a major hub for the production of EVs, with significant factories based in countries such as China, South Korea, Japan, and Thailand. Many Asian countries also have a large market for EVs, particularly in the exports section.

The economic impact of EVs

The EV automotive ecosystem, which includes various parts of electric cars, such as batteries, charging stations, and service providers has positively impacted the region’s economy.

According to the market research did by Statista, revenue in the EV industry could reach USD 207.50 billion in 2023. It could grow at a yearly rate of 14.85%. Furthermore, the EV market unit sales can reach more than eight million vehicles in 2027. From an international outlook, the most revenue will come from China.

The development of the industry has also led to the creation of numerous jobs. It includes opportunities in the manufacturing and assembly of electric cars as well as in the automobile supply chain and service sectors.

The rising demand for EVs in Asia has also fuelled investment in charging infrastructures, which are necessary for the widespread adoption of electric cars in the region. Research and Markets estimate that in AsiaPacific, the EV charging stations market is expected to

“

There’s a lot of ground to make up. China has been several chess moves ahead for a while now,

said

7

reach USD 69.57 billion by 2029. It will have a compound annual growth rate of 30.8% during the forecast period of 2022 to 2029.

Support and investment are essential to achieve parity in the total cost of ownership between electric and internal combustion engine vehicles. Both aid in low-cost electric vehicle models and distribution infrastructure.

The Asia-Pacific is experiencing a surge in the production of EVs. This is thanks to a combination of supportive policies and incentives, as well as an abundance of raw materials in the region.

Favorable trade policies that support the import and export of EV components, coupled with an independent automobile supply chain, have also played a crucial role in the market’s growth.

The vertical integration in the Asian EV supply chain has enabled manufacturers to produce electric cars at a lower cost while also providing improved efficiency, control over the production process and the ability to quickly respond to changes in market demand.

As a result, integrating EVs into the automobile supply chain in Asia may increase jobs as well as investment in charging infrastructure and battery manufacturers. However, more support and investment are essential to increase the adoption of EVs in emerging markets like India and Southeast Asia.

Such include government incentives for consumers to purchase EVs, funding for infrastructure development and investment in the R&D of EV technology. V

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 8

“

The total cost of ownership of electric vehicles relative to internal combustion engines varies significantly amongst weaker market segments due to factors such as operating range, internal combustion alternatives, and access to charging infrastructure. These factors require new investments, which are slowed by coordination challenges impacting the economy.

said Randheer Singh, Director of Electric Mobility and Senior team member for Advanced Chemistry Cells Program at the National Institute for Transforming India (NITI) Aayog, in an interview with CNBC.

9

Debunking EV misconception that may impede supply chain strategy

BY KRISKA GATDULA

VALIDATED BY QUEK YANG THEE OF REPUBLIC POLYTECHNIC

Often, the supply chain strategy of an EV company is affected by the marketability of EVs. Marketing initiatives help steer demand. Without demand, the movement within the EV ecosystem could fail, which can impact the EV supply chain.

In this case, misconceptions may demotivate consumers to buy EVs. Hence, it is essential

to raise awareness about EVs and their characteristics. Especially since Asian countries are beginning to lean towards EVs as sustainable transportation solutions.

Mainly, EVs have caused concerns regarding their cost-effectiveness, reliability, economic value, and environmental impact against internal combustion engine vehicles (ICEVs).

CHAIN

SUPPLY

10

Russell Hensley, co-leader of the McKinsey Center for Future

Hensley added that vehicles are the second largest investment that a household makes. Therefore, buying a car is a decision that takes much consideration. By knowing what affects the consumer behavior, an effective supply chain strategy can be implemented by companies.

MYTH 1: EVs’ environmental footprint is greater than ICEVs

The manufacturing of an EV indeed creates more emissions than the production of an ICEV. However, the emission of an EV is just a third of the lifetime emission of a gasoline-powered automobile, even after accounting for EV battery production and disposal.

Air pollution from factories during battery production accounts for most EV emissions. Notably, according to the United States (US) Department of Energy, EVs convert over 77% of electrical energy from the grid to power the wheels.

Select Asian countries have recognized the positive environmental impact of EVs and are investing in encouraging EV adoption. Thailand, India, Vietnam, China, South Korea, Philippines, Malaysia, and Singapore are among those ushering sustainable transportation solutions, particularly EV promotion where supply chain strategy plays a vital role.

MYTH 2: EV batteries are unsafe

Battery Management System (BMS) enables monitoring of battery temperature and performance. It aids in maintenance that could prevent electric car problems relating to batteries.

The BMS includes management of the charging or discharging of the battery pack and controls the temperature range as it functions. Therefore, BMS help in the avoidance of EV battery overheating.

According to Quek Yang Thee of Republic Polytechnic, usually, the traction battery is able to operate at ambient temperature in the range of -30⁰C to 65⁰C. Ideally, the commonly-used Li-ion battery has an operational range

of 20⁰C to 40⁰C. EV operating out of this range will have negative impact on the vehicle range.

Yang Thee added that there are thermal sensors that sense the temperature of the batteries. They will trigger cooling system to maintain the battery at acceptable temperature. Meanwhile, the Artificial Intelligence in the vehicle will alarm the driver or even shut down operation when the temperature is way too high.

Moreover, electric batteries are included on EVs only after a series of safety verifications like crash and combustion tests. EV suppliers do such initiatives to ensure that the batteries do not pose a threat to the users.

MYTH 3: EV batteries need multiple replacements and are non-recyclable

Once depleted, EV batteries can be recycled or repurposed as storage units. EV batteries can be recycled to extract out the rare earth material. These are valuable elements in making EV batteries like lithium, cobalt, and nickel.

Yang Thee, shared that a good example is that some EV batteries’ second lives comprise being the energy storage for a solar powered charging station.

In fact, electric car makers like Tesla and Chevrolet offer warranties upon reaching eight years. The latter considers up to 100,000 miles, while Tesla can be as high as 150,000. The move was to mitigate concerns about EVs needing multiple replacements.

MYTH 4: EVs do not provide enough mileage

The speed of an EV is no different from its gas-powered counterpart, which normally can run 25 km to 50 km per liter. EVs range is 95 km to 685 km per charge.

For example, according to the Korea Transportation Safety Authority, automobiles in South Korea travel an average of 43.9 kilometers daily. Such makes EVs suitable for everyday use, which is advantageous for EV suppliers.

“For vehicle range, we will reach a ‘good enough’ number, especially as charging infrastructure gets built out in more and more places,” noted Scott Case, CEO of Recurrent, a US-based automotive ventures portfolio company.

Distinctively, an EV accelerates quickly, as the electric motor generates 100 % of its available torque instantly. In comparison, an ICEV must ‘rev up’ to reach its maximum torque and power.

Thus, further showcasing that EVs are one of the best sustainable transportation solutions in the automobile industry.

“

Adoption has not gone faster because there is a hesitation in pivoting from something so trustworthy in the internalcombustion engine to something relatively new technology,

said

Mobility in the Americas.

11

MYTH 5: EV takes forever to charge EVs as transportation alternatives

The charging of an EV depends on various factors like current charge level, battery size, and power output of the charging station. An EV can be charged using different levels, level 1 (120 V), level 2 (208 V – 240 V), and level 3 (400 V – 900 V).

Charging stations with level 2 and level 3 voltages are faster alternatives for charging EVs. They can set a range of 19 kilometers to 1900 kilometers per hour.

A fully depleted EV has a longer charging time for a level 1 outlet at home. Considering the range and average kilometers EV drivers travel daily, such a situation is rare.

On the side, good-capacity batteries from EV suppliers, paired with a small charger, would increase the time needed to charge the battery, irrespective of the outlet capacity.

Debunking EV-related myths not only help improve supply chain strategy of companies, it also help consumers make informed choices and bridge the barrier to adopting newer technologies. It opens up possibilities for improving the future of customer experience in the supply chain automobile industry.

The deployment of EVs is an excellent initiative by select governments to reduce carbon emissions. Wherein, sustainability and zero-emission goals are pushing Asian countries to adopt EVs as an alternative to ICEVs.

EVs aid in reducing reliance on fossil fuels, improving air quality, and are becoming a cost-effective transportation option. Dispelling EV myths will encourage more people to adopt EVs as everyday cars. V

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 12

A look at the development of the EV ecosystem

BY CHARLENE JOANINO

Transportation across the world has come a long way toward the emergence of an electric vehicle (EV) ecosystem. From the early steam engines to the prevalent gasoline-fueled engines, now, electric-powered vehicles have emerged.

With the advent of EVs, we face a new era of the transportation revolution in Asia, in which a cleaner and greener future is within reach. Yet to move forward, there is a need to look at the past. It provides a prelude and overall view of the development of the EV ecosystem within the automotive industry.

Early inventions

After a myriad of attempts, French army captain Nicolas Joseph-Cugnot has made the "fardier à vapeur." It is the world's first working full-size "self-propelled mechanical land vehicle" that marks a transportation revolution.

In the early 1800s, Richard Trevithick developed the “first high-pressure steam engine and first working railway steam locomotive,” which marked a turning point for the commercialization of steam engine vehicles.

Modernization of vehicles

Scottish inventor Robert Anderson developed a motorized carriage in the early 1830s. However, the batteries he had used were not rechargeable. In the same decade, Robert Davidson built a prototype of his electric locomotive.

By the 1840s, Davidson had finished “Galvani,” an enhanced version of his prototype. It can tow six tons at 4 mph and run 1.5 miles.

Then, German Engineer Nicalaus Otto invented a gasoline-fueled four-stroke cycle engine in the 1860s. It was an alternative to steam engine, which was prevalent at the time.

Leaping into the 1880s, Karl Benz developed the “world’s first practical automobile” with an internal combustion engine. It first hit the road by mid-decade and a year later, Benz had his patent.

Meanwhile, it was Engineer Ferdinand Porsche who invented the first hybrid car. It was a two-wheel drive that used a gas engine and an electric motor in the 1890s.

The first mass-produced electric vehicle (EV) was Honda Insight. Said car hit the roads of the United States in the 1900s.

By the 1980s, the Japanese automotive industry experienced a “Golden Age” marked by significant advancements in technology and manufacturing

Continued in page 15

13 SUPPLY CHAIN

Into the future practices. One of the key factors driving this progress was a focus on supply chain efficiency.

Noteworthy Japanese concepts like Gemba, Kaizen, and Just-in-Time or JIT were used in the decade. Whereas, said concepts aid in producing more vehicles quickly and with greater precision than their competitors.

Moving into the 21st Century

The Revolutionary Electric Vehicle Alternative, or REVA, went out in 2002. It was produced by the Reva Electric Car Company as the “first zero polluting EV” in India.

In 2003, the entrance of Tesla Motors into the electric transportation market became a significant driver of electric automobile adoption. Prior to Tesla’s entry, EVs were generally viewed as niche products with limited appeal to mainstream customers.

However, Tesla’s success in developing highperformance EVs with long ranges and advanced features has helped shift perceptions. It generated greater interest in transportation alternatives for internal combustion engine vehicles (ICEVs).

Notably, the Tesla Roadster was released in 2008. Coinciding in the same year, BYD, a Chinese manufacturer, released the “world’s first mass-produced plug-in hybrid electric vehicle (PHEV).”

By 2009, the Mitsubishi i-MiEV became known as the “world’s first modern highway-capable EV” that was massproduced. It was first released in Japan.

On the side, the Nissan Leaf gained the moniker “world’s all-time top-selling EV” and won several awards. Based on an early 2019 press release by Nissan, the Leaf became the first EV to go beyond more than 400,000 sales since its release in 2010.

Select governments and companies not only in Asia but worldwide are recognizing EVs as a sustainable means of traversing roads. More related efforts are becoming apparent such as promotions and investments.

In 2020, the Environmental Protection Agency (EPA) announced new standards that required automakers to improve fuel efficiency by 1.5% annually. Then, in 2021, the European Commission proposed a new set of regulations that would ban the sale of new ICEVs in the EU by 2035.

These regulatory changes signal a growing focus on sustainability and cleaner alternatives. They drive the shift towards EVs and the development of more efficient and environmentally-friendly supply chain automotive.

Several efforts progressing the EV ecosystem are underway across the world in 2022. Headlining the stint in Asia are China and South Korea.

In China, for example, the government is ushering the development of a national charging network, with plans to build 4.8 million charging points by 2025. Also, China is currently the largest producer of EV batteries, with local manufacturers such as CATL and BYD dominating the market.

Meanwhile, electric utility companies in South Korea are collaborating with automakers and charging infrastructure providers to build a nationwide charging network. Manufacturers, such as LG Chem and Samsung SDI, are investing significantly in battery production.

Overall, the rise of EVs is transforming the automotive industry. As more countries in Asia invest in EVs, further developments in charging infrastructure, battery production, and other related services may soon be apparent.

Such will create new business opportunities and provide new transportation insights towards a more sustainable future. In 2023, the EV ecosystem will continue to evolve due to the gradual production of EV innovations. V

15

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 16

17

SUPPLY CHAIN

Are EVs truly the future of the auto market?

BY KEN TNG

Asthe world moves towards sustainability, the electric vehicle (EV) industry is gaining momentum in the auto market. EV promotions are being done by select public and private entities globally. These efforts have led to a paradigm shift in the automotive industry.

In recent years, EV supply chain operations are continuously rendering and adopting innovations. Such growth swerves limitless potential. Hence, EVs are slowly but surely becoming the alternative for internal combustion engine vehicles (ICEVs) and the auto industry’s future.

The creation of the United Nations Framework Convention on Climate Change in 1992; the Kyoto Protocol, 1997; and Paris Agreement, 2015 have pressed forward issues on detrimental human consumption of natural resources, one in which climate change has been a consequence.

In the past three decades, world leaders have continuously delved into the topic of climate change. Together, they have been developing counter-initiatives against global warming. Now, there are technologies readily available in the market that can aid in alleviating the strain on the environment.

There are more than 1.7 billion motor vehicles on the roads globally. It accounts for more than 20% of global CO2 emissions. Hence, it makes perfect sense that one of the key technologies in recent times addresses how both people and goods moves using sustainable cars.

As such, EVs usher the hope that they may aid in solving the woes of sustainability faced by the transportation sector and in climate change mitigation. The exponential growth of EVs on the roads is now apparent due to the successes of brands like Tesla and BYD.

There are approximately 13 million EVs globally by the end of 2021. The number renders a significant margin from only about 100,000 EVs in 2012 that were plying roads worldwide. However, EVs introduction is not without its fair share of obstacles and challenges in which supply chains play a major role.

Gaining a better grasp of EV supply chain visibility in Asia and worldwide is crucial in deploying and adopting EVs. Visibility aid in the optimization of operations.

The production of EVs requires a complex supply chain. It includes several materials, with a particular focus on EV battery components. Batteries need rare earth materials such as lithium, cobalt, and nickel. All of these raw resources are from specific regions around the world.

About 98% of global lithium production takes place in Australia, Latin America, and China. Cobalt production happens in the Democratic Republic of Congo (DRC), Russia, and Australia. Nickel production occurs in Indonesia, the Philippines, New Caledonia, Russia, and Australia.

Many source countries of raw materials for EV batteries have weak labor laws. Also, they often have poor working conditions, low wages, and rampant exploitation of vulnerable workers.

Likewise, geopolitical issues also affect the EV battery supply chain. One example is the ongoing conflict between Ukraine and Russia. It has led to concerns about the supply of critical materials, such as nickel and cobalt, which are produced in said regions.

Meanwhile, the environmental concerns of mining such metals are also a significant issue. The extraction of these critical raw materials often has environmental impacts, including deforestation, soil erosion, and water pollution.

The concerns pose significant risks to the supply chain of raw materials. In turn, there are calls for greater transparency and accountability in the production of EV components.

Raw material extraction Battery

As mentioned above, one of the most critical components of EV production is the batteries powering the vehicle. They account for a significant portion of the production cost. As EV production scales up, ensuring the quality and reliability of battery components remains a major challenge for manufacturers.

China dominates EV battery production with around 60% of the global share. Such has been attributed to the government’s support for the industry. It includes subsidies,

Continued in page 33

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 18

Ken has thrived in the supply chain and management consulting space for more than ten years. With a strong focus on performance improvement and operational excellence, he is currently promoting commercial excellence in DHL Supply Chain (DSC).

19 THE CONTRIBUTING AUTHOR

Ken Tng

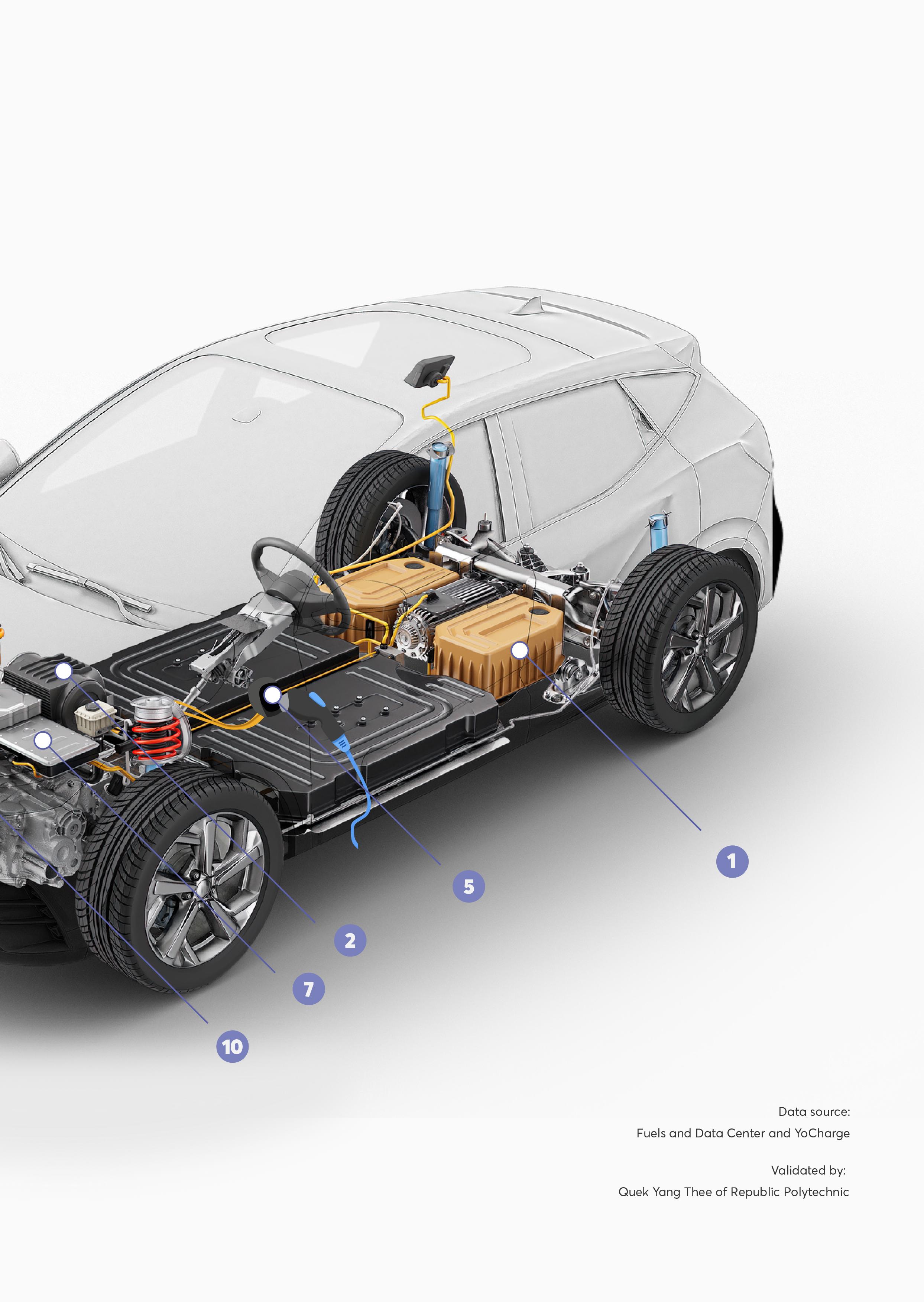

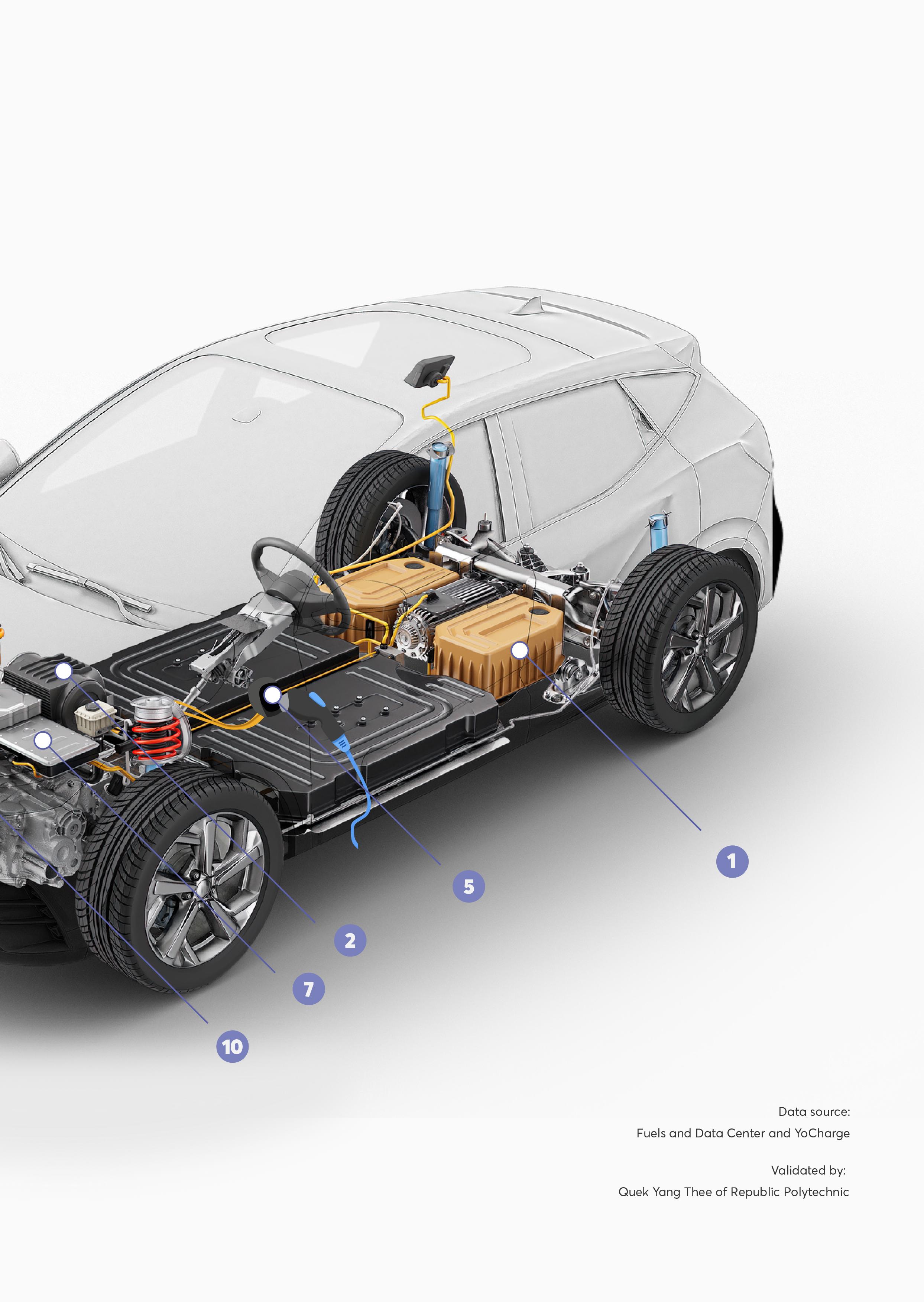

Components of an EV

1. Traction battery pack – Also known as electric vehicle battery (EVB), the traction battery pack serves as an electrical storage system that powers an EV’s electric motors

2. DC-DC Converter – Renders the required voltage in charging the auxiliary battery and distributes the battery’s power accordingly

3. Electric motor – Enables the wheels of an EV to rotate by turning electrical energy into kinetic energy

4. Power inverter -Transforms a battery’s DC power into AC power

5. Charge port – Intended for charging the battery pack

6. Onboard charger – Turns AC supply to DC supply and monitors as well as controls a battery pack’s internal current flow

7. Controller – Regulates the electrical energy provisioned by batteries into electric motors

8. Auxiliary batteries – These batteries can serve as an alternative to the main battery and enable car charging

9. Thermal system (cooling) – Maintains the temperature of an EV’s main components

10. Transmission – Moves the electric motor‘s mechanical power to the wheels

20

21

SCL Indonesia caps off with success, preludes Kenya event

BY CHARLENE JOANINO

More than 200 delegates joined the latest edition of Supply Chain and Logistics (SCL) Indonesia held in Jakarta, last May 3 to 4. This year’s theme was “Building Robust End-to-End

Supply Chains.” In line with SCL Indonesia, another event will happen in Nairobi, Kenya on August 17 to 19.

EVENTS

22

“The event involves engaging discussions on how to take supply chains to the next level using a blend of supply chain expertise and the latest technology offerings,” said Harsh Pawar, focal person of SCL Indonesia and part of Infinity Expo, a business media company, which spearheaded the event.

He added that SCL Indonesia’s roster of over 30 speakers had delved on technology solutions. These are for building high-efficiency supply chains using Blockchain, Artificial Intelligence (AI), Internet of Things (IoT), Telematics, and other related topics.

The speakers underlined their experiences and best practices in designing smart warehouses, building supply chain visibility, and leveraging big data analytics.

According to Pawar, SCL Indonesia included case studies based on the perspectives of users who had successfully applied these changes to transform their supply chains.

Among the talks were about “Industry 4.0” and “Imperatives to Connect Your Manufacturing Ecosystem To Optimise Processes.” Pawar also noted the increasing

importance for manufacturing lead enterprises to develop smart factories.

“With a deeper understanding of IoT and AI-connected manufacturing, and resilient supply chains, you will be able to create new levels of growth,” he said.

A highlight is the focus on streamlining supply chain effective transport and warehouse management strategies done by Keyfiled. Also, a noteworthy part of the event was IBM’s sharing of insights on building autonomous intelligence into the supply chain.

Infinity Expo has been doing SCL events across the world. They are a top-tier company that connects people across the supply chain and logistics industry.

For more information on the upcoming SCL event in Kenya, visit https://bit.ly/KenyaSCLBrochure or register at http://kenyascl.com.

23

V

On ushering a transportation revolution: Are electric cars better for the environment?

BY ALGIN MICHAEL SABAC

BY ALGIN MICHAEL SABAC

Electric cars are making a case in a transportation revolution as motorists look for a sustainable means of hitting the road. Using electricity instead of gasoline makes electric vehicles (EVs) in Asia cost-efficient. It also renders decarburization. In fact, in every

EV, carbon dioxide is reduced by 1.5 million grams every year.

At present, the Asian vehicles market is on track toward significant growth and is creating chances for value creation across the supply chain. The said market is steered by technology, energy, and financial players who deliver value propositions.

24 LOGISTICS

EV’s stake in going ‘Green’

In every Asian country, EVs’ entry into the market and the level of adoption are affected by the government, which is a key stakeholder in supply chains. Specifically, a government’s power to render laws, restrictions, and subsidies could either progress or hamper the EV transportation revolution.

China, Japan, and South Korea have made comprehensive policy frameworks to support EV adoption. Meanwhile, emerging Asian countries like Thailand and Indonesia have set targets for EV production.

Emerging Asian markets are also becoming the largest micro-mobility hubs where electric two-wheelers (E2Ws) are a predominant mode of land travel. By 2030, India and Indonesia are projected to become the world’s second and third-largest E2W markets. They may have more than 60% annual growth rate.

According to Susan Anenberg of George Washington University, PM2.5, and global ozone-related premature mortality from vehicle tailpipe emissions increased from 361,000 in 2010 to 385,000 in 2015, which is one of the major causes of air pollution and climate change. PM2.5, a particulate matter, badly affects health, while Nitrogen oxides (NOx) may damage crops and aid in causing acid rain.

Although NOx limits have been apparent in major markets, traditional vehicles emit much more NOx in actual driving situations. India, China, Europe, and the United States are the four biggest vehicle markets. They have an estimated 70% impact on the said consequences.

Utilizing EVs usher lesser carbon production than

traditional vehicles. It’s one way of alleviating the said effects. EVs are much cleaner and more environmentally friendly. It’s because they lack internal combustion engines and instead rely on electric economy motors.

Notably, EVs’ emissions will continue to decline as the power grid continues to transition toward renewable energy sources. Doing so will help reduce air pollution and usher a transportation revolution.

Alleviating global warming

Electric cars produce half of the greenhouse gas emissions of a regular car. On average, EVs are about 30% cleaner than vehicles with internal combustion engines that burn fuel. Such makes EVs better options in transportation services.

“We discover that today’s typical electric vehicles emit only half as much greenhouse gas as a traditional passenger vehicle. This finding supports government initiatives to promote electric vehicles as a component of their carbon reduction plans

25

Dale Hall, a Senior International Council on Clean Transportation Researcher, stated.

Many Asian countries are taking the effort to become eco-friendly. Singapore (SG) is aiming to have fully electric vehicles on its roads by 2040. Such is part of SG’s commitment to address climate change.

However, it will take a while as only a small portion of the current private vehicles in SG run on lower-emission hybrid engines or are fully electric.

The Indian government promote the production and use of EVs in the nation by improving charging infrastructures. There are now 1640 public EV charging stations in India. The government initially focus on nine megacities and then had more public EV charging posts across the country.

Indonesia, one of the world’s top carbon polluters, aims to reduce its pollution by 29% by 2030. Said country hopes to achieve net-zero emissions by 2060 or sooner under the Paris Agreement to fight climate change. In order to achieve this goal, there is a need for more investment in Indonesia’s forestry and energy sectors. This would be possible through international climate finance.

As one of the world’s largest greenhouse gas producers and a rapidly growing economy, Indonesia has the potential to boost its economy and at the frontline of the transportation revolution. It also can reduce its deficit, create jobs, and improve its air and water quality through climate action. A total electric vehicle ecosystem can help gain that in a larger aspect.

Danny Marks, an Assistant Professor at Dublin City University, predicted that the dual biodiesel and current EV policies would no longer be fitting after ten years. He also added that increasing EV production should be a priority to achieve global climate goals.

Acclimatization of Asian vehicles

Producing EV motors can help progress Asia’s economy and protect the environment. Electric cars cut expensive oil imports and lessen air pollution.

More than 7 million died prematurely from air pollution in 2022 globally, and 2.4 million casualties are from Southeast Asia. Said death tolls are from the tiny diesel soot and gas emissions from cars and trucks. In this sense, EVs can aid in lessening the said impact.

The benefits of the transportation revolution on EV to the environment arise from reduced damages relative to the gasoline vehicle it replaces. Compared to a gasolinepowered vehicle, air pollution due to an electric car is lesser.

However, EVs also produce pollution during production. This is due to the fact that the complex and large batteries used in EVs require a lot of energy to produce.

Additionally, the logistics of the operation are complicated, and the mining and processing of materials like lithium and cobalt used in electric car batteries can also aid in causing pollution. More than a third of the CO2 emissions from an EV’s lifetime is due to the said batteries.

Despite this, the air pollution from factories producing EVs is still lesser than traditional cars and it can be one of the air pollution solutions. Also, EVs typically use cleaner electricity sources to charge their batteries and don’t emit emissions while in motion.

The environmental benefits are even greater if electric cars use renewable energy. Hence, it’s no wonder that as Asia gains ground in the EV transportation revolution, it is noticeable that governments are making headway toward their climate change goals.

Due to the entry of EVs into the Asian market, the automotive supply chain has been gradually shifting to usher sustainability by helping preserve the environment.

Now, more than ever, there is a need to intensify efforts to further its market by developing more charging infrastructures. More importantly, joint efforts from the government and private sectors would primarily steer the roll-out as well as adoption of EVs in Asia. V

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023)

26

27

Electrifying mobility for the logistics industry

THE COVER

28 VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023)

INSIGHTS BY JIN CHAN | Blueshark Ecosystem Sdn Bhd Group COO (ASEAN)

Human mobility is undergoing a revolution. At no point in history has there been a more pronounced shift towards cleaner propulsion of transportation since the proliferation of the internal combustion engine (ICE) that produces carbon dioxide and causes pollution.

The logistics and supply chain industry are in many ways at the forefront of this sea of change. Said industry is ahead of the curve as more companies are now beginning to embrace electric vehicles (EVs). They lean towards improved

operational efficiency of deliveries, reduced emissions, and economic benefits of green mobility.

Meanwhile, the fast-paced advancement of EV technology, erecting of infrastructure, government subsidies, tax exemptions, and various economic factors have contributed considerably to EV adoption. In turn, there is an increase in the use of EVs for transporting goods for large and smallscale businesses alike.

29

The benefits of going electric

EVs cost approximately ten times less to ‘refuel’ and can reach 90%-95% energy efficiency compared to ICEs with 17%-21%. They also contain much fewer moving parts than traditional ICE vehicles, reducing maintenance and enhancing reliability.

EVs are also incredibly efficient, converting over 77% of the electrical energy from the grid to driving power compared to 12%-30% power conversion for ICE vehicles. Compared to ICEs, EVs boast significantly lower fuel costs with charging stations and battery swapping proving a more cost-effective way to refuel.

Additionally, EVs use less energy in stop-and-go city traffic. This reduces noise pollution and air pollution making them a highly compelling option for delivery and courier services, helping businesses achieve a better bottom line.

For fleet operators, the concern is not only limited to managing the fleet, but the total costs to do so and to maintain it. For example, there is the cost of procuring the fleet, your capital expenditure.

Also, there are increasingly costly operational expenses like rising fuel costs, depreciation, high repair costs, and days off the road to contend with. Consequently, the impact on consumers is that service quality and customer

satisfaction drop.

EVs can also address the Environmental Social and Governance (ESG) equation Wherein, companies are now required to report and offset their carbon footprint or face penalties.

Maintaining delivery fleets comprise of ICE vehicles is simply not sustainable and going electric can create significant additional value for companies. Meanwhile, EVs can render ongoing cost savings such as lower energy costs, lower capital expenditure, depreciation and repair costs, and improved driver and rider safety.

Barriers to overcome on the road towards industry progress

High vehicle costs render the need for more standardized charging systems to catalyze mass EV supply chain scaling and optimization. There is a lack of charging locations, and long wait times for charging are the top barriers hindering fleets and consumers from adopting EVs.

The shift to EVs will require collective action and an ecosystem of partners, including governments, charging infrastructure providers, automakers, and even consumers

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 30

working cohesively to map out and bridge the transition to EVs.

In 2015, privately owned vehicles accounted for 29.4 million, of which 13.8 million are cars and 13 million are motorcycles. Due to Malaysia’s reliance on these vehicles, the transportation sector in Malaysia is the second biggest polluter of carbon dioxide emissions after electric power generation.

The carbon dioxide from the said vehicles renders 96% of all greenhouse gas emissions. Such serves as a wakeup call for everyone to rethink choices before it escalates into a problem into an unresolvable problem.

The logistics and supply chain industry is a major contributor to this phenomenon. This is due to the huge volumes of ICE vehicles by large fleet operators that ply the first to last mile to keep the country and the economy ticking.

Conditions and factors encouraging EV adoption

Many governments are now driving the shift to EVs via policy and incentives and with the increasing ESG commitment from governments across the region, the EV

agenda is no longer a “nice to have”, but a mandate, and this responsibility is shared at the corporate level.

By adopting an integrated solution to electrify the firstto-last mile, fleet operators can meet their ESG targets and lower TCO, CAPEX/OPEX, and carbon footprint. At the same time, they can enhance their green credentials.

Government policies to support the growth and transition to EVs and related infrastructure are expected to remain prominent market drivers. Malaysia committed to net zero carbon emissions by 2050 at the earliest.

The Low Carbon Mobility Blueprint (LCMB) 2021-2030 aims for EVs to achieve at least a 15% share of the total industry volume (TIV) by 2030. It covers the erection of 10,000 units of charging facilities by 2025.

The Malaysian government’s various initiatives and exemptions for whole import duty, excise duty, and sales tax for locally-assembled EVs until 31 December 2025. In the recent Budget 2023 announcements, they have been also very encouraging for EV adoption and the decarbonisation of the transportation industry in Malaysia. Incentives support EV manufacturers. Thus, they encourage EV adoption while elevating the EV industry and ecosystem expansion.

31

EVs and logistics: electrifying first-tolast mile transport

The logistics sector is an ideal sector to promote EV usage in ASEAN as it operates in targeted areas. Its operations will lead to rapid infrastructure expansion, such as more and greater concentration of charging stations in any given area.

This could lead to wider adoption of EVs by the consumer market, catalyzed by an expanding logistics EV infrastructure. With the rise in popularity of EVs for both the corporate and consumer sectors, it is inconceivable that such expansion would not go hand-in-hand.

With most of the world aiming for carbon neutrality in the future, EVs’ impact on the transportation and logistics industries will become increasingly certain over time. Wherein, ICE vehicles could be phased out sooner than expected.

For example, logistics giant DHL plans to electrify 60% of its overall fleet of vehicles by 2030, with close to 200 EVs in Malaysia alone. Blueshark’s studies compare the riding costs of ICE motorcycles against Blueshark R1 2WEV over 100km in several ASEAN countries.

Given the prevailing petrol price and electricity tariffs, it shows that the Blueshark R1 is eight times cheaper to run over 100km compared to an ICE motorcycle in Malaysia. It is even cheaper in certain neighboring countries.

Additionally, Blueshark had a pilot program with Petronas. It involved 50 p-hailing delivery riders who experienced the R1 Smart Electric Scooter, first-hand over a month on Malaysian roads. They covered 108,000 km.

The 4,080 battery swaps done during the stint were well received with 97% of riders concluding that battery swapping is the way to go. Doing so enabled a faster, easier and cheaper mode of transport. Thus, demonstrating the feasibility of Blueshark’s first-to-last mile electrified platform for the logistics industry.

Blueshark sees 2WEVs and battery-swapping technology as crucial to encourage and hasten the widespread adoption of EVs. They overcome issues

such as long recharge times, range anxiety, and battery lifecycle management.

Also, they are easier to roll out, cheaper to procure, and can assimilate into current lifestyles and practices more so than their four-wheeled counterparts that can’t use battery-swapping technology

Foresights on the logistics industry

Electric mobility is rapidly growing across the world and transportation companies are also converting their existing fleet to serve the first-to-last mile in logistics.

Logistics companies will need to invest in charging infrastructure and adapt their operations to derive the maximum benefit in terms of cost savings and operational efficiency that EVs can provide.

Overall, EVs will positively impact the Malaysian logistics industry in the coming years. The key benefits are reduced emissions, lower capital expenditure, and operating costs, lower energy costs, and increased efficiency.

On the side, the adoption of EVs in the logistics industry could also create opportunities for innovation, such as the development of new charging technologies or the integration of EVs with smart logistics systems.

Electromobility is not merely an ambition. It is a significant move towards a more liveable future. EVs are where the world is heading in terms of how people and goods are transported, invariably and almost certainly, toward an electrified future.

ABOUT

Blueshark Ecosystem Sdn Bhd is an Electric Vehicle (EV) tech mobility company pioneering electromobility and game-changing energy solutions for the world. The company power smart mobility and swappable energy solutions by leading the charge on green mobility and green energy for all.

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023)

V 32

From page 19

investment in research and development, and a large pool of low-cost labor.

However, the US and China conflict over semiconductors has rendered trade sanction on China. The said sanction has caused strained relations between two of the world’s major superpowers.

Battery supply and technology mostly originate from China. Hence, China may hold the chips as retaliation as the world moves towards greater battery consumption.

The lack of global regulations and regulatory bodies governing the circular economy of batteries is also a significant challenge. Currently, there is no clear policy on whether automotive or battery manufacturers should be responsible for the returns of batteries.

This issue has significant implications for the returns supply chain. Also, the policies put in place could impact the supply chain for either industry.

Despite the challenges, advancements in technology to improve the quality, reliability, and efficiency of the production of batteries for EVs. For instance, solidstate batteries use a solid electrolyte instead of a liquid electrolyte. They have the potential to improve battery performance significantly. These batteries are also safer, with reduced risks of leakage or explosion.

Furthermore, there are efforts to develop a circular flow model of the economy for batteries. It involves recycling used batteries to extract valuable materials, which can then be used to produce new batteries. However, the lack of regulatory frameworks and policies to govern the recycling of batteries remains a significant challenge.

EV charging infrastructure for the transportation sector

As the global transition towards sustainability in the auto market accelerates, the supporting charging infrastructure for EVs faces significant supply challenges. With the

exponential increase, infrastructure production struggles to keep up with demand. It places a strain on the industry.

Currently, the three largest producers of chargers are ABB, Siemens, and Schneider Electric. All of which have their main businesses entrenched in other forms of engineering.

This presents a significant barrier to the entry of new suppliers since the cost of competing with established companies may be prohibitive. Also, selling prices may not allow new suppliers to become profitable.

Furthermore, the lack of standardization in the industry is creating further challenges for the supply of charging infrastructure. Adding to the complexity are the fragmented regulations by the governing bodies of different countries.

Infrastructure manufacturers will need to adopt different standards when supplying in different countries. It causes the need to have multiple different manufacturing approaches. This means that the supply of charging infrastructure is already tight, and these regulations are only making it tighter.

Standardization will reduce costs and provide greater accessibility to consumers, ultimately driving demand for EVs. Thus, there needs to be greater collaboration between auto manufacturers and charging infrastructure producers to standardize charging systems for EVs in the auto market.

Governments can also play a key role in supporting the industry by providing incentives and implementing regulations. The initiative will promote the development and expansion of charging infrastructure.

Addressing the need for skilled labor

The production of EVs should have a paradigm shift in manufacturing technology, and new battery technology must advance at a rapid pace. Additionally, modern vehicles require software and hardware integration, which

33

requires skilled developers.

Conventional manufacturing technologies in automotive production are outdated. Moreover, companies will need to train and upskill their existing workforce or hire new employees with the necessary skills, which can be timeconsuming.

Battery technology needs to evolve constantly to become more efficient and streamline the manufacturing practices of EV battery manufacturers. Doing such will aid in achieving economies of scale and bring down the cost of battery production.

This fast-paced evolution renders the need for highly skilled and talented individuals. However, there is a shortage of such talent in the market, and companies may find attracting and retaining skilled employees challenging.

Moreover, modern vehicles require many different computer programs to run, from the timing of fuel injection to how much oxygen your engine receives. With the advent of vehicle electrification, this need is even more significant.

Talented software developers are in demand in the EV industry. They are needed to ensure electric motors are running at optimum efficiency. Also, they make the user interface in the infotainment system user-friendly and the software and hardware integration more seamless than ever.

Although there is no lack of skilled software developers in the market, finding talent that is entrenched within the requirements of the auto industry and transportation sector is challenging.

Skilled labor shortage can significantly impact the EV industry’s development and growth. Companies will face certain challenges if they cannot find the necessary skills within their workforce or through external hires.

Said challenges may slow down or lessen efficiency in production, raise quality issues, and increase production costs. Furthermore, skilled labor shortage can delay the innovation and development of new technologies. It will ultimately impact the competitiveness of the EV industry.

Working with specialized logistics suppliers

The production of EVs is quite different from that of traditional gasoline vehicles. It requires specialized logistics solutions. One of the primary challenges is the transportation of EV batteries.

Unlike traditional automotive parts, batteries are quite large, heavy, and classified as dangerous goods. As such, transporting them across continents requires new methods of packaging and movement. Additionally, the speed and delivery reliability of the transportation of batteries poses a significant challenge.

In addition to transportation, warehousing and supply chain solutions also need to be refreshed by third-party

logistics providers due to the dangerous nature of batteries. These logistics providers will also have to ensure compliance with the various regulations governing the storage of batteries across the different countries they are looking to operate in.

Another challenge faced by specialized logistics suppliers is the remapping of spare parts logistics networks for both auto and infrastructure manufacturers. All the requirements for where the parts must be and what service level agreements should be relooked. These are crucial, especially for infrastructure manufacturers with differing service levels agreed upon with local governments or private companies.

Finally, there is a lack of returns logistics providers as the industry comes to terms with which stakeholder should be the responsible party. The lack of clarity in this regard has significant implications for the returns supply chain.

Toward better EV supply chain optimization

In conclusion, the EV sector is a growing industry that continues to attract new stakeholders. Wherein, the growth trajectory of these sustainable cars shows no signs of slowing down.

However, as the industry continues to expand, it is important that world governing bodies introduce rules and regulations in a well-thought-out and coordinated manner. This will ensure that new products are safely introduced to the market while minimizing any potential negative impact on the environment and society.

Furthermore, third-party logistics providers have an important role to play in the EV industry. By looking into new solutions and services, they can support battery, vehicle, and charging infrastructure manufacturers in multiple ways, such as in achieving efficiency in production.

Additionally, the supply chain industry must adopt new technologies to ensure these services are sustainable and environmentally friendly. They should refresh their transport fleets with EVs and adopt green warehousing. Doing so can ensure that the logistical and transportation support does not offset the positive changes brought about by the EV industry.

As the demand for sustainable cars and the EV industry grows, all stakeholders must work together toward success. It involves not only manufacturers and logistics and supply chain management providers but also policymakers and regulators.

With the right approach, the EV industry has the potential to revolutionize the transportation sector. It will also help achieve a more sustainable future.

It is important to be mindful of the challenges in the paradigm shift in the auto market and work proactively to address them. With collaboration, innovation, and a shared commitment to sustainability, the EV industry will be progressive for generations to come.

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 34

V

How does a BYD electric car fare in the global arena?

BY CHARLENE JOANINO AND ALGIN MICHAEL SABAC

When it comes to the roster of choices, China’s BYD electric car is one that is hard to miss. BYD, short for “Build Your Dreams”, is a leading Chinese manufacturer of electric vehicles (EVs), rechargeable BYD batteries, and various other products.

In the Asian market, BYD’s influence is particularly significant. The company’s success in China has aided in the surge in EV adoption. It ushered other automakers to follow suit and compete. This intense

competition has pushed the industry towards rapid innovation and development, making Asia a hotbed for EV technology.

The company’s BYD EV portfolio includes a range of vehicles, including passenger cars, buses, trucks, and forklifts. BYD also produces its own BYD battery system, energy storage solution, solar panel, and BYD charging station. Wherein, BYD’s Blade Battery has become one of the soughtafter commodities of other automakers.

35 SUPPLY CHAIN CHAMPIONS

A distinct approach

BYD’s uniqueness lies in its vertically integrated business model, which allows the company to control every aspect of its EV production. This involves from BYD battery manufacturing to vehicle assembly. Thereby, ensuring higher quality and cost-efficient offerings.

As reported by PanDaily, lithium carbonate prices skyrocketed during 2022 and battery supply became inadequate. Automobile manufacturers had no choice but to accept higher battery costs. And there lies BYD’s key advantage which is the ability to produce its own BYD batteries at lower costs than competitors.

BYD has also been successful in developing innovative solutions for the transportation sector. One of which is the company’s e-platform 3.0. This modular platform enables rapid development and customization of EVs and allows BYD to cater to various markets.

BYD has been steadily increasing its presence in the global EV market, with a strong focus on Europe and Latin America. The company’s strategy includes forming strategic partnerships with local governments and businesses, and the development of charging infrastructure to promote the adoption of EVs.

Electric cars and expansion

BYD’s product lineup includes both full EVs and plug-in hybrids, offering consumers a wide range of choices. The plug-in hybrids, such as BYD hybrid SUV Qin and Tang, combine the benefits of electric power with the flexibility of a gasoline engine, making them attractive to prospective buyers.

Additionally, BYD’s electric cars use AI to analyze data from various sensors in the car and predict when maintenance will be needed. This helps drivers to schedule maintenance before issues become serious, which improves the reliability and longevity of the car.

According to Reuters, the said Chinese firm intends to accelerate sales both domestically and internationally through its latest lineup of battery electric vehicle (BEV) products, including the Seal model.

Meanwhile, Bloomberg shared that BYD intends to build plants in three Southeast Asian nations, including Vietnam, the Philippines, and Indonesia. The Chinese automotive powerhouse is reportedly in the “advanced stage of negotiations” with the Philippines, according to an interview with the Philippines’ Department of Trade and Industry’s IDG Undersecretary Ceferino Rodolfo.

“The mere fact that BYD is scouting for auto manufacturing sites in Southeast Asia highlights how global it is setting its sights,” said Taylor Ogan, CEO of China-based hedge fund Snow Bull Capital.

Battery technology

At the heart of BYD’s EVs is the company’s proprietary battery technology, known as “Blade Battery.” This BYD battery technology utilizes lithium iron phosphate (LFP) material, offering enhanced safety and performance compared to traditional battery designs.

BYD’s Blade Battery boasts several advantages over traditional lithium-ion batteries, such as higher energy density, longer and excellent cycle life, high strength, cost-

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 36

effectiveness, and outstanding performance even at low temperatures.

This ultra-safe battery has successfully passed penetration and crash tests without catching fire or producing flames, redefining EV safety standards and addressing self-combustion concerns.

The Blade Battery is not only used in BYD’s EVs but is also supplied to other automakers. The battery’s design

also boasts increased space utilization, achieving a 50% improvement in the cell-to-pack ratio compared to previous models.

Additionally, the new design reduces the number of components by 40%, resulting in a 30% cost reduction for the battery pack. Because of that, BYD’s Blade Battery offers a safer, more efficient, and cost-effective solution for electric vehicles.

37

BYD in the present era

In the global arena, BYD has managed to hold its own against established Western competitors such as Tesla, Volkswagen, and General Motors. The company’s unique selling points are its vertical integration, innovative e-platform, and proprietary battery technology. These have enabled it to compete on equal footing with its Western counterparts.

BYD’s relentless pursuit of innovation and global expansion is likely to help the company maintain its strong position in the market. The company’s commitment to sustainability and environmental responsibility has set an example for the industry, It encourages other manufacturers to adopt greener practices and invest in clean energy solutions.

In addition to its progress in the automotive sector, BYD is also making strides in other areas, such as renewable energy and energy storage, further highlighting the company’s dedication to creating a sustainable future. These advancements are expected to complement the growth of the EV industry and contribute to the global

shift toward clean energy.

Through its innovative technologies, commitment to sustainability, and global strategic expansion, BYD is set to play a pivotal role in shaping the future of transportation and clean energy.

BYD, a high-tech enterprise in China, specializes in IT, automobile, and new energy. BYD Auto is known as one of the leading global EV brands. In the field of new energy, BYD has developed green products such as solar farm, battery energy storage station, EV, and LED.

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 38

ABOUT

V

The innovations rendered by the integration of new technologies in EVs

BY TRISHA AJANETTE BALLADARES

VALIDATED BY QUEK YANG THEE OF REPUBLIC POLYTECHNIC

Constant advancements in Asia’s land transportation sector are underway with the adoption of new technologies in EVs. The utilization of Artificial Intelligence (AI) and the Internet of Things (IoT) are expected to improve the driving experience of motorists and play a vital role in the land transportation timeline of the future.

Mainly, EV market-related initiatives lean toward enhanced digital and sustainable solutions. IoT and AI may usher higher-performing electric vehicles by allowing more efficient data collection and decision-making processes.

Continued in page 41

TECHNOLOGY

39

40 VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023)

From page 39

One of the leading companies in the manufacturing of electric cars, Tesla, Inc., has been using Artificial Intelligence of Things (AIoT) to optimize their EV supply equipment and enhance the customer experience. AIoT renders combination of AI and Iot features to progress business processes.

Tesla cars make use of software that enables autopilot and self-driving modes. In addition, the IoT-enabled overthe-air update system allows the EV to update itself, thus reducing the need to visit car dealerships for repairs and bug fixing.

With the increased number of vehicles on the road, traffic congestion is a problem in cities around the world. AIoT-integrated drones can help resolve issues like these easily.

The drones connected to the IoT network can collect and transmit traffic data which AI analyses to make accurate decisions like adjusting the speed limit and traffic lights without any human involvement.

“The EV industry will advance considerably due to the induction of Artificial Intelligence as it will make the life of riders easy and convenient. Auto manufacturers are rapidly upgrading their existing production systems by incorporating AI platforms. These companies are increasingly focusing on developing autonomous vehicles to improve passenger mobility,” said Nischal Chaudhary, founder of Batt: RE Electric Mobility, in an interview given to CircuitDigest.

Automation maximizes efficiency

IoT and AI may increase the reliability of EVs through automated processes, accessible support networks, and better user experience models.

IoT is rapidly expanding, and the unstructured data collected by IoT, can be turned into structured information

having actionable insight with the help of AI data analytics tools.

A user experience example of this is IoT sensors within the EV can collect data about relevant metrics like the tire pressure of the EV, and AI can predict when the tire pressure is low related to the owner’s typical usage pattern. Based on the analyzed data notifying drivers to inflate the tires or pay a visit to the nearest service center is possible.

Advanced user experience technology combined with machine learning algorithms, such as in a user experience workshop, provides insights into traffic patterns and road conditions. It helps drivers in avoiding any obstacles ahead. Drivers can receive commands on when to speed up or slow down.

IoT technologies allow users to access maps and other information while driving. Apart from integrated IoT in EVs, a smartphone connected to the internet can act as an in-car-GPS system.

EVs can utilize AI and IoT to locate the closest charging stations on days of rain and poor visibility. Drivers can get real-time weather updates, directions to the closest charging stations, and route suggestions to steer clear of dangerous driving zones with IoT sensors and AI algorithms.

Also, EVs can have a secure connection to charge their vehicles utilizing cloud computing and IoT technologies. These are made possible through cryptography, which ensures both the charging structure and the vehicles using it are safe from cyber-attacks.

Tracking daily energy consumption charging points also helps drivers in electric vehicle maintenance by monitoring the battery’s health and detecting any issues early on.

AI is a modern approach in dealing with issues like the low battery as AI in the EV will automatically switch to battery mode and recharge the batteries.

41

Improvement of battery performance

IoT and AI can improve EV battery performance by monitoring and managing energy use. This user experience technology allows EV owners to drive long distances without needing to stop multiple times to recharge during their journey.

In countries like India, most EV companies are moving towards Li-ion battery packs for their vehicles as they have a longer life and higher energy density

One of the challenges in using Li-ion batteries is the need to monitor the temperature at which the charging and discharging of these batteries occur.

Li-ion batteries are expensive, and damage to these would prove very costly. The temperatures of such batteries could be regulated easily with the use of sensors in IoT and AI-based battery management systems (BMS).

“The battery pack in an EV typically consists of numerous individual battery cells connected together in series to achieve the desired voltage. The voltage output of an EV battery pack depends on the number of cells in the series connection,” Quek Yang Tee of Republic Polytechnic shared.

He added that traction power is a power source for

hazards.

The high voltage levels in EVs can be dangerous, and close monitoring of the voltage is needed to prevent electrocution to the driver through direct or indirect contact

Battery Management System (BMS) is a technology designed to provide insight into the battery and optimize its performance.

BMS assists electric vehicle maintenance by providing insight into the battery and environmental operations and helps prevent lethal hazards.

“Batteries have redefined almost every aspect of our lives, from powering mobile devices and EVs to enabling the transformation of our electric utilities. They also serve as a cornerstone in the battle against climate change –the most crucial challenge facing our world today,” said Dr. Christina Lampe-Onnerud, Founder and Chief Technology Officer of Boston-Power, during her Sweden King’s medal acceptance speech.

Machine learning algorithms can be used to monitor the health of a battery over time by analyzing factors such as temperature and voltage. It ensures that the battery is always in the best condition, which improves performance and safety

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 42

Reduction of carbon footprint

Innovations like AI and IoT that assist in decarburizing energy sources are on-demand. Out of the 100 polluted cities in the world, 93 are in Asia.

The land transportation sector is one of the largest emitters of greenhouse gases and a significant roadblock in achieving net zero emissions in these countries. Therefore, there is a need to mitigate the impact of climate change which is affected by pollution.

AI and IoT reduce carbon footprint by analyzing vast energy-related data like traffic patterns, energy bills, and weather conditions and mapping out the most effective way to travel using the least amount of energy.

AI and IoT also make it easier to make rechargeable vehicles that do not rely on combustion. These enable scaling public transport and reducing individual vehicles on the road, thus reducing the carbon footprint.

Yamato Transport Co, Ltd. has recently partnered with Commercial Japan Partnership Technologies

Corporation (CJPT) to study the standardization and commercialization of rechargeable and replaceable cartridge batteries. Battery Electric Vehicle (BEV) makes use of these cartridge batteries.

This initiative aims to reduce the company’s carbon footprint and promote the usage of EV in Japan. The company had earlier rolled out the implementation of EVs for parcel deliveries in 2019.

Overall, as the land transportation industry in Asian countries gradually welcomes the shift to electric cars, IoT and AI solutions rapidly bolster EVs’ capabilities. These elements enhance customer experience and also usher safety on the road.

On the side, the new breed of EVs with the said tech advancements can assist in decarburizing energy sources help in EV battery management. With the growing need for sustainable and convenient modes of transportation, the EV market is projected to grow profoundly in the coming years and transform the land transportation sector in Asia. V

43

Digital supply chain boosts efficiency and raises risk concerns

BY NICOLE TRETWER

BY NICOLE TRETWER

More businesses are now integrating digital supply chain initiatives into their operations. In Asia,

digitalization is at the forefront of ushering the shift to the dubbed “supply chain 4.0.” It is where new technologies play a crucial role in streamlining business processes. An example is the collaboration between Malaysian Airlines and GE Digital, which is a software and Internet of things (IoT) services provider. GE Digital’s Fuel Insight and Fuelpulse aviation software aid in catering to the airline’s initiatives on sustainability as well as in the modernization of its fuel efficiency program.

Although Malaysian Airlines have yet to release further data on the said cooperation, GE Digital’s past partners from the supply chain network have shown positive results. Among others, Gerdau, a steel producer, was able to get their return on investment in 8 months, almost half of the initial 18 months target.

The total savings of Gerdau reached $4.5 million in a year for an investment of $1.5 million. Gerdau also experienced a 5% lower freight cost. Also the raw material inventory became faster, from 3 days to 7 minutes.

Meanwhile, according to a survey done by the Hongkong and Shanghai Banking Corporation (HBSC) with over 400 financial decision-makers from organizations across nine markets in Asia Pacific, 76% are expecting to increase levels of supply chain digitization.

Digital supply chains are geared to be a faster and more effective alternative to traditional models. Unlike the latter, which notes production and distribution, a digital supply chain focuses on consumer needs.

With the application of the IoT, automation, and networking, digital supply chain management renders customer-centric workflows. Wherein, the focus is on responsiveness, recognition, and resilience, which are essential in logistics and supply chain management.

The use of various digital supply chain technology enables micro-segmentation and mass customization, where customers are managed in smaller segments. It allows customers to choose from multiple products that fit their particular needs.

Pros of using digital technology in supply chain

A digital supply chain usher efficiency by eliminating the need for manual processes. Tools such as cloud computing, artificial intelligence, and blockchain make planning and managing the operation of a supply chain company easier.

Notably, access to the external and internal data structures provides better visibility into the supply chain management from getting materials to product delivery. The gained visibility will help to learn more about how supply chains operate while lowering the risk involved.

“As many companies move into a recovery stage (after the pandemic) to stabilize supply chain operations and manage demand-side shocks, the opportunity to seek renewal through new, longer-term digital strategies also arises,”Anne Petterd, Head of International Commercial & Trade, Asia Pacific at Baker Mckenzie, an international law firm It lessens downtime and increases communication efficiency. In this case, making decisions becomes quicker

VALUE CHAIN ASIA | VOL. 1, ISSUE NO. 1 (2023) 44 TECHNOLOGY

operational concerns

due to the reduced delivery time of updates and will result in faster operations. Furthermore, the monitoring of products in a digital supply chain industry 4.0 will be easier with better reverse flow.

The COVID -19 crisis has made the gap in traditional supply chain management in sudden situations apparent. This raised the need to analyze supply chain resilience and alternative supply chain network for crucial parts and materials.

For example Apple aims to have sustainable production. In 2021, they were forced to cut back on their production due to the global chip shortage caused by a lack of supply of parts. Apple is now breaking away from their traditional chip makers and opting to use in-house chips. Another effort that they did is to diversify production by doing production in India and Vietnam. In the past, Apple have relied only in China. Through diversification and usage of in-house chip parts, they can address concerns related to supply in the future.

Post-pandemic conditions have forced companies to choose between “just-in-time” (JIT) and “just-in-case” (JIC)

inventory management and manufacturing models. Both ushers supply chain agility that aid in their ability to adapt to changing market conditions.

The JIT model enables companies to prevent going beyond usual production. It reduces wastage and production costs.

“The pandemic made it apparent that supply chain managers can no longer simply focus on striking a balance between cost and performance. Instead, additional elements such as agility, resilience or sustainability need to be considered,”Dr. Matthias Hodel, SVP, Global Head Customer Development Integrated Logistics at Kuehne+Nagel noted.

He added that digital technologies enable JIT models to meet these new requirements. Such a supply chain will not only be cost-efficient but also more agile and more resilient.

Meanwhile, the JIC model protects organizations from unexpected supply delays. It also shields against more demand, or dealing with a spike in the cost of materials. Organizations can improve their operations to adapt through data-driven technologies in supply chain management. These are machine learning and predictive analytics.

Overall, digitalization can augment JIC and JIT models when they are used in supply chain management. As per the report by IoT analytics, market insights, and business intelligence provider, the digital supply chain is expected to grow at 8.1% ever year from 2022 to 2027.

Cons in Supply Chain 4.0