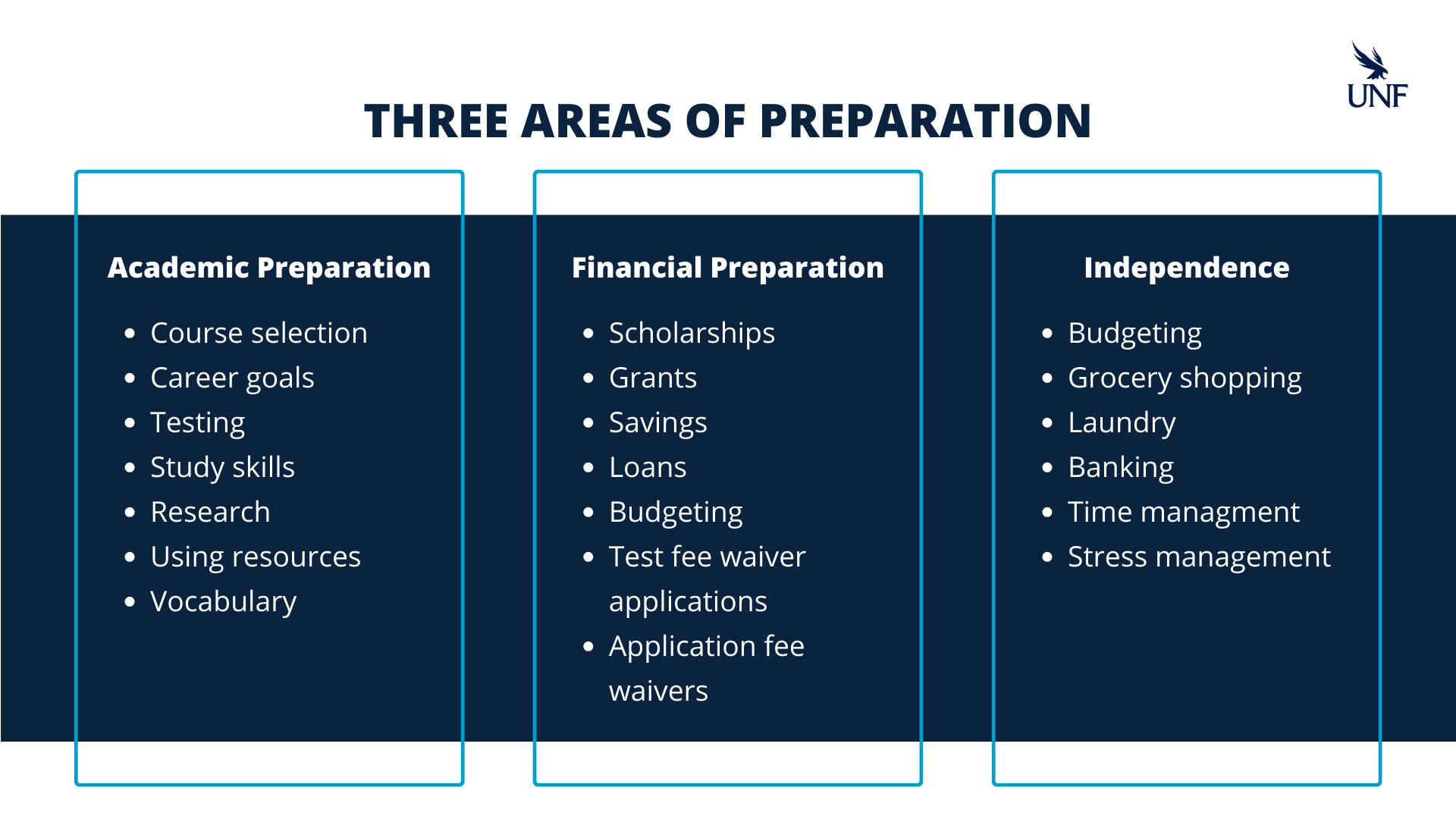

PREPARING FOR HIGH SCHOOL ACCELERATION PROGRAMS

Middle School Promotion Requirements & Reminders

Enrollment in a High School Course, While in Middle School

High School Acceleration Program

Benefits

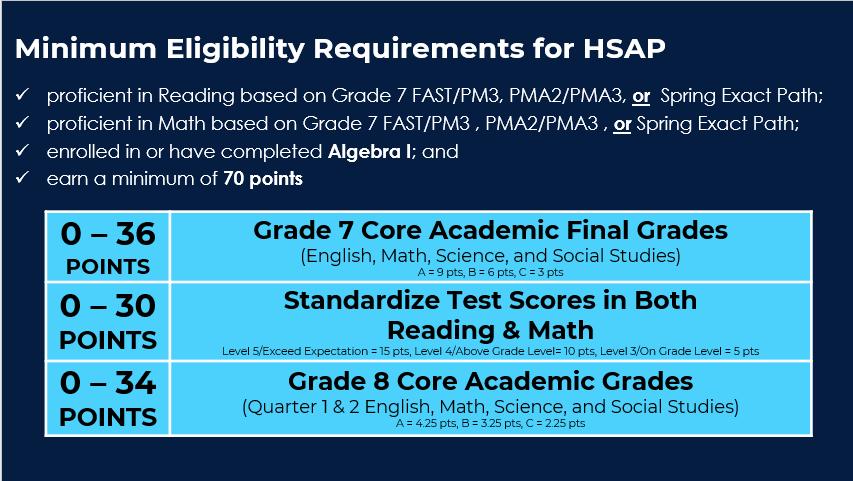

Minimum Eligibility Information

Keys to Success

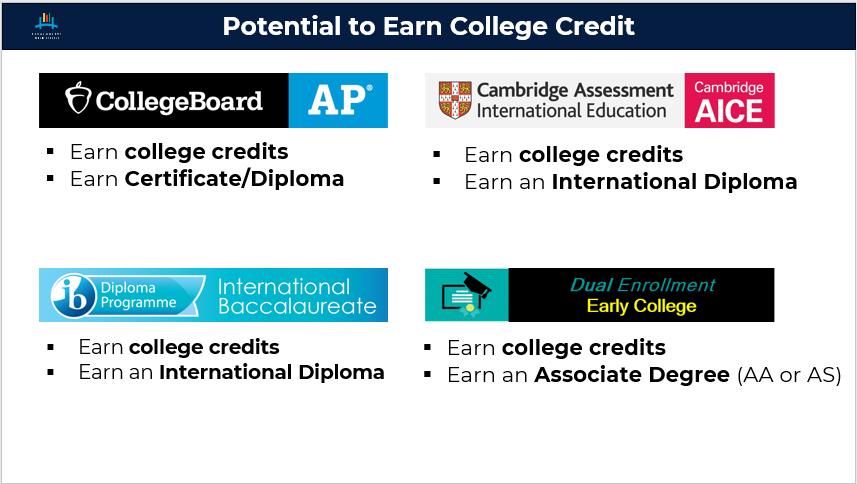

DCPS High School Acceleration Programs

DCPS High School Acceleration Program

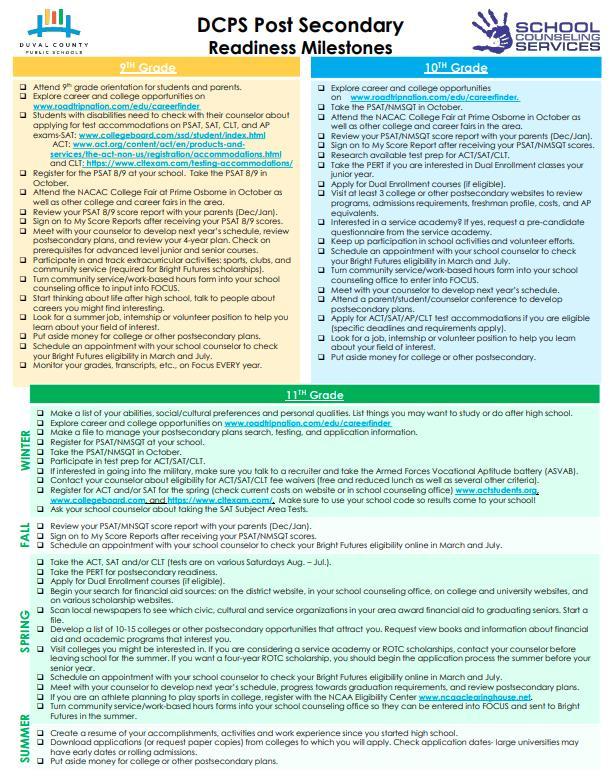

Website Information Contact Me

Please Remember the following information

y for College?

Dual enrollment is an acceleration mechanism that allows student to pursue an advanced curriculum relevant to their postsecondary interests. Dual enrollment provides high school students the opportunity to earn college credit while simultaneously earning high school credit through dual enrollment. Colleges and universities that offer dual enrollment courses to Duval County Public School students must do so by way of an articulation agreement, which describes the parameters for which the students may participate.

Initial Eligibility

• Be a Florida resident and a U. S. citizen or eligible noncitizen, as determined by the student’s postsecondary institution

• Complete the Florida Financial Aid Application (FFAA) during senior year of high school beginning October 1, but no later than August 31 after high school graduation

• Earn a standard Florida high school diploma, or its equivalent, from a Florida public high school or a registered private high school

• Not have been found guilty of, or pled nolo contendere to, a felony charge

• Be accepted by and enroll as a degree- or certificate-seeking student at an eligible Florida public or independent postsecondary institution

• Enroll in at least six non-remedial semester hours (or the equivalent in quarter or clock hours) per term

• If not funded in the academic year immediately following high school graduation, apply within five years of high school graduation to have your award reinstated.

Financial aid is any resource that can assist in offsetting the cost of attending college.

What are the sources of Financial aid?

• Federal Government

• States

• Schools/ Institutions

• Private sources

Scholarships and Grants

• Repayment is not required

• Applications may be necessary

Work-Study and Loans

• Part-time on- or off-campus jobs

• Repayment is required for loans

NEED-BASED TALENT-BASED MERIT-BASED NON-NEED-BASED

Based on financial need determined by FAFSA

• Pell

• FSAG

• Subsidized loan

Based in a special talent or skill

• Athletic

• Musical

• Artistic

Based strictly on GPA and/or test scores

• Bright Futures

• UNF Presidential

• Everything else

Need-based award that allows a student to work part-time for an institution or within the community.

Need-based (subsidized) and non-need-based (unsubsidized) loans that have to be repaid.

Non-need-based credit loans for which parents can apply.

FAFSA - Free Application for Federal Student Aid

• Application - Available in October for the 2025-2026 aid year

• Takes approximately 30 minutes to complete

• Needs to be renewed each year

• Priority consideration is January 15

• https://studentaid.gov

• Adjusted gross income

• Taxes paid

• Some untaxed income

• Cash, savings, checkings

• Investments, excluding retirement and IRAs

• Real estate, excluding primary residence

• Parents

• Siblings

• Others for whom parents provide more than 50% of support financially for the aid year in question

Financial Aid Application (FFAA)

• Takes approximately 15 minutes to complete

• www.floridastudentfinancialaid.org

• Must apply before August 31 the year of high school graduation

It is important for UNF to have for:

- Bright Futures

- Florida Pre-Paid

Student Aid Index (SAI)

Cost of Attendance (COA)

FSA Contributor

Financial Student Aid ID (FSA ID)

The Student Aid Index (SAI) is an eligibility index number that your college’s or career school’s financial aid office uses to determine how much federal student aid you would receive if you attended the school.

The college or career school will determine your financial need by subtracting your SAI from the cost of attendance.

COA is the amount it will cost a student to go to school.

If you’re attending school at least half time, the COA is the estimate of tuition and fees

•books, course materials, supplies, and equipment;

•cost of housing and food (or living expenses);

•transportation expenses;

•loan fees (excluding any loan fees for non-federal student loans);

•miscellaneous expenses (including a reasonable amount for the documented cost of a personal computer);

•allowance for childcare or other dependent care;

•costs related to a disability;

•costs of obtaining a license, certification, or a first professional credential; and

•reasonable costs for eligible study abroad programs.

The FSA ID is a username and password combination you use to log in to U.S. Department of Education (ED) online systems. You’ll use your FSA ID every year you fill out a Free Application for Federal Student Aid (FAFSA®) form and for the lifetime of your federal student loans

You’ll need your full name, and date of birth. You’ll also need to create a memorable username and password, and complete challenge questions and answers so you can retrieve your account information if you forget it.

“Contributor” is a new term being introduced on the 2024–25 FAFSA form. A contributor is anyone (you, your spouse, your biological or adoptive parent, or your parent’s spouse) who is required to provide information on the FAFSA form, sign the FAFSA form, and provide consent and approval to have their federal tax information transferred directly from the IRS into the form.

The University of North Florida offers scholarships to undergraduate freshmen (first-time-in-college) and transfer students. We are committed to helping students finance their college education. Whether you are seeking a scholarship based on academic achievements or financial need, we offer various options!

Scholarship awarding cannot be guaranteed and will only be done on a funds-available basis.

Florida Need-Based Scholarships (Freshmen)

Florida Resident Merit-Based (Freshmen)

Jacksonville Commitment (Freshmen)

Florida Pre-Collegiate A.A. (Freshmen)

Florida Transfer Student Scholarships

First Generation (Freshmen and Transfers)

Non-Resident Merit-Based Waivers (Freshmen and Transfers)

Latin American & Caribbean (LAC) Scholarship

Visit UNF: Scholarships for more information

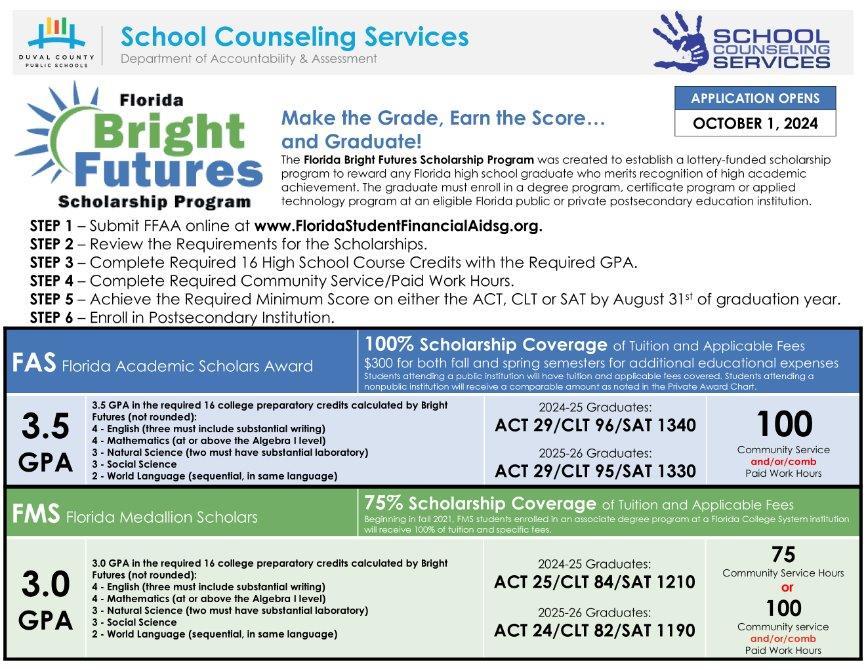

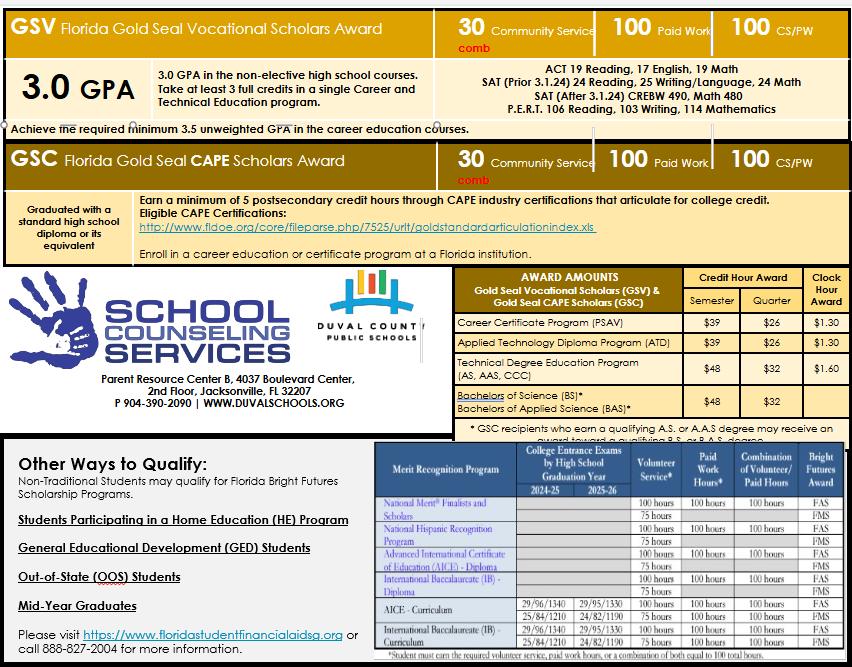

24-25 BRIGHT FUTURES INITIAL ELIGIBILITY

Florida Academic Scholars (FAS)

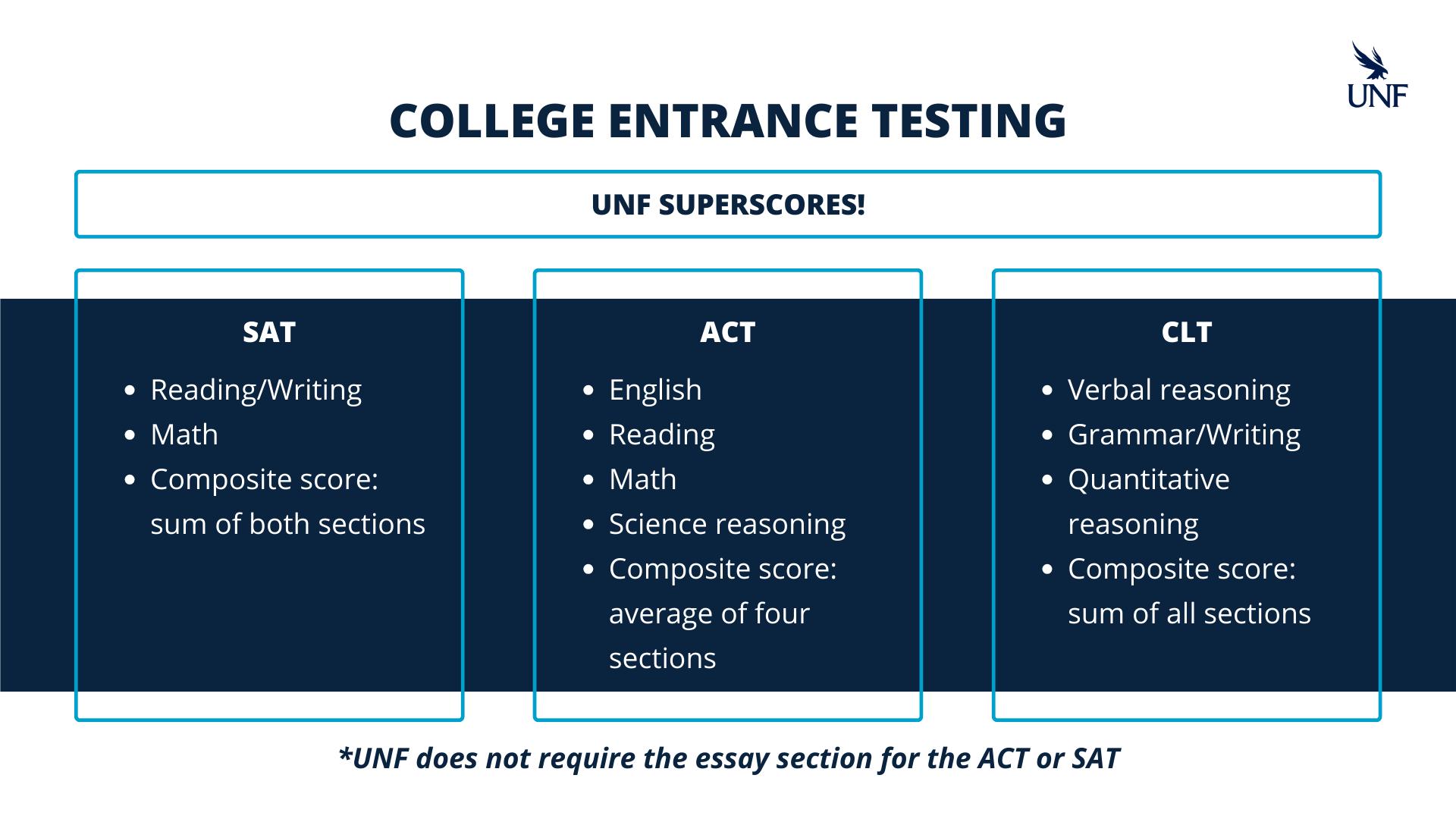

• High school weighted GPA of 3.5

• 29 ACT/1340 SAT/96 CLT

• 100 community service or work hours

Florida Medallion Scholars (FMS)

• High school weighted GPA of 3.0

• 25 ACT/1210 SAT/84 CLT

• 75 Community service hours or 100 work hours

• Complete 15 credit hours during both the fall and spring terms.

• Most UNF scholarships require 15 credit hours per term for renewal each year.

• Since 2009, the Florida legislature has encouraged students to finish a bachelor's degree in a timely manner

• The law requires universities to add a surcharge to each credit hour taken in excess of the total number necessary to complete the degree

• The cost of delaying graduation by even one or two years can be high

• Most scholarships renew for four years; we encourage students to complete a degree in this timeframe, so they are not here without funding

• Chamber of Commerce

• Civic groups/Unions

• High school

• Private corporations

Private scholarships come from a variety of sources. Don't pay for an online scholarship website.

• Private organizations

• Religious organizations

• School district

July

Apply for Admission unf.edu/apply

November 1

Priority application deadline

December

FAFSA opens (Spring and Summer FAFSA open now!)

January 15

Scholarship priority deadline

New Student Orientation May/June

August

Start of fall classes

Florida Application for Financial Aid (FFAA) opens October 1

November 15

First release of admission decisions

January 15

FAFSA priority consideration for Financial Aid

January

Estimated Financial Aid packaging

June

Start of summer classes

*All dates and deadlines are subject to change without notice.

www.studentaid.gov

www.facebook.com/FederalStudentAid

www.twitter.com/FAFSA

www.youtube.com/FederalStudentAid

www.floridastudentfinancialaid.org

www.finaid.org

www.Fastweb.com

www.gmsp.org