Nevada AG Aaron Ford Focused on Serving the State Now; Stays Mum on His Future Plans Volume 8 Issue 6 Oakland A’s Plan Move to Las Vegas Strip FORMULA 1 A Quick Look at the Fastest Race in the World

EDITOR IN CHIEF

PRESTON P. REZAEE, ESQ.

PUBLISHER

TYLER MORGAN, ESQ.

DIRECTOR OF OPERATIONS

JEFFRY COLLINS, ESQ.

MARKETING

DIANA COLLINS

CREATIVE DIRECTOR

BRANDON PIERCE

ADVERTISING

INFO@VEGASLEGALMAGAZINE.COM

CALL 702-222-3476

CONTRIBUTORS

ADAM D. KEMPER, ESQ.

MARK FIERRO

JEFF HANEY

VALERIE MILLER

MARK MARTIAK

DONOVAN THIESSEN, CPA

DON LOGAY

MYRON MARTIN

ANDREW CASH, M.D.

DAN HERRERA

JEFFRY COLLINS, ESQ.

31 COVER STORY:

NEVADA AG AARON FORD

LAW 12 | COURT OF PUBLIC OPINION 17 | MEET THE INCUMBENT: JUDGE CARLI KIERNY 20 | FROM PUBLIC DEFENDER TO SPEAKER OF THE NEVADA ASSEMBLY: STEVE YEAGER 30 | COVER STORY: NEVADA AG AARON FORD BUSINESS 42 | STATE OF THE MARKET 46 | MORTGAGE RATES RISE WITH THE SUMMER HEAT 50 | OAKLAND A’S PLAN MOVE TO THE STRIP 52 | Q&A WITH THE OAKLAND ATHLETICS 54 | STEVE WYNN SETTLEMENT 60 | INFLATION REDUCTION ACT 66 | SEC V RIPPLE INC. LIFESTYLE 74 | FORMULA 1 80 | THE SMITH CENTER 82 | VEGAS FIRSTS 88 | WHEN TO SEEK ORTHOPEDIC CARE 91 | HUMOR 42 74 Contents COPO STATE OF THE MARKET FORMULA 1 12 West Harmon Zone / Courtesy F1 Las Vegas Grand Prix

THE EDITOR

Welcome to another compelling issue of Vegas Legal Magazine, where we delve into the nexus of law, business, and lifestyle in the heart of the Silver State. This issue is packed with insights, interviews, and investigations that offer a multifaceted perspective on the evolving narrative of our dynamic community.

In the law section, we turn the spotlight on Attorney General Aaron Ford. Our cover story explores his journey from humble beginnings to becoming one of the most influential legal minds in Nevada. We go in-depth to examine his roles, challenges, and the ground-breaking cases that have marked his tenure. This is an exclusive look into the life and mindset of a public servant who has an enormous impact on our legal framework.

Switching gears to our business section, the talk of the town has been about the Oakland A’s and their proposed move to Las Vegas. This is not just a sports story; it’s a business saga that could reshape the economic landscape of our city. Our feature outlines what this move means for local businesses, taxpayers, and of course, baseball fans. We’ve got expert commentary on the potential legal hurdles and economic incentives that are part of such a monumental shift.

Steve Wynn, a name synonymous with Las Vegas, finds focus in our business segment as well. You might think you know all there is to know about Wynn’s gaming empire, but our investigative piece uncovers facets of his career that have seldom been discussed. How did he revolutionize the casino industry, and what is his lasting legacy? Find out in this issue.

Beyond these highlights, we continue to bring you timely updates, op-eds, and features that touch on the core issues that matter to our readership. Whether you are a legal scholar, a business mogul, or someone interested in the kaleidoscopic lifestyle that Vegas offers, we have something for you.

We are committed to offering a platform that is as diverse and vibrant as the community we serve. As we navigate the complexities of our modern world, it’s crucial to have a nuanced understanding of the changing scenarios in law, business, and lifestyle. And that’s what we strive to provide.

Your support makes this all possible. We invite you to engage with us, share your thoughts, and be a part of this ongoing conversation. Thank you for being a valued member of our Vegas Legal Magazine community.

FROM

LETTER

VEGASLEGALMAGAZINE.COM | 5

PUBLISHER

Welcome to the latest edition of Vegas Legal Magazine, the premium source for law, business, and lifestyle insights in the vibrant city of Las Vegas and beyond. In this issue, we bring you a medley of thought-provoking and informative features, interviews, and analyses that not only inspire but also challenge the status quo.

In our law section, we’re excited to present an exclusive interview with Judge Carli Kierny, a powerhouse of legal acumen and intellect who has been reshaping the justice system in Nevada. Kierny’s progressive stance on restorative justice has caught the attention of both supporters and critics alike, and our deep-dive into her philosophy and career promises to stimulate compelling conversations.

Joining Judge Kierny is a profile of Steve Yeager, Speaker of the Nevada Assembly. His tenacious efforts on criminal justice reform and his unyielding commitment to a balanced budget have been noteworthy. In our feature, Yeager opens up about the road ahead for Nevada, highlighting the challenges and opportunities that lie in the legislative landscape.

Switching gears to business, we delve into the ever-dynamic Las Vegas real estate market. With the city becoming a buzzing hub for businesses and residential purposes, our experts weigh in on what to expect in the coming months, especially in a post-pandemic world. Will the skyrocketing prices sustain? How are policies likely to adapt? We tackle these questions and more.

Cryptocurrency has become an undeniable force in global finance, and Nevada is no exception. As lawmakers and business leaders discuss potential regulations and their impact, our feature on the future of cryptocurrency regulations aims to demystify the jargon and offer clear, actionable insights. Whether you’re an investor, an entrepreneur, or someone merely curious, this piece is designed to enlighten you on where we’re heading in this brave new digital world.

No issue of Vegas Legal Magazine would be complete without a glance at lifestyle, and we have a couple of very special pieces for you this time around. First, we offer you a curated list of ‘Vegas Firsts’—the trailblazers, the visionaries, and the monuments that have contributed to making Las Vegas the iconic city it is today.

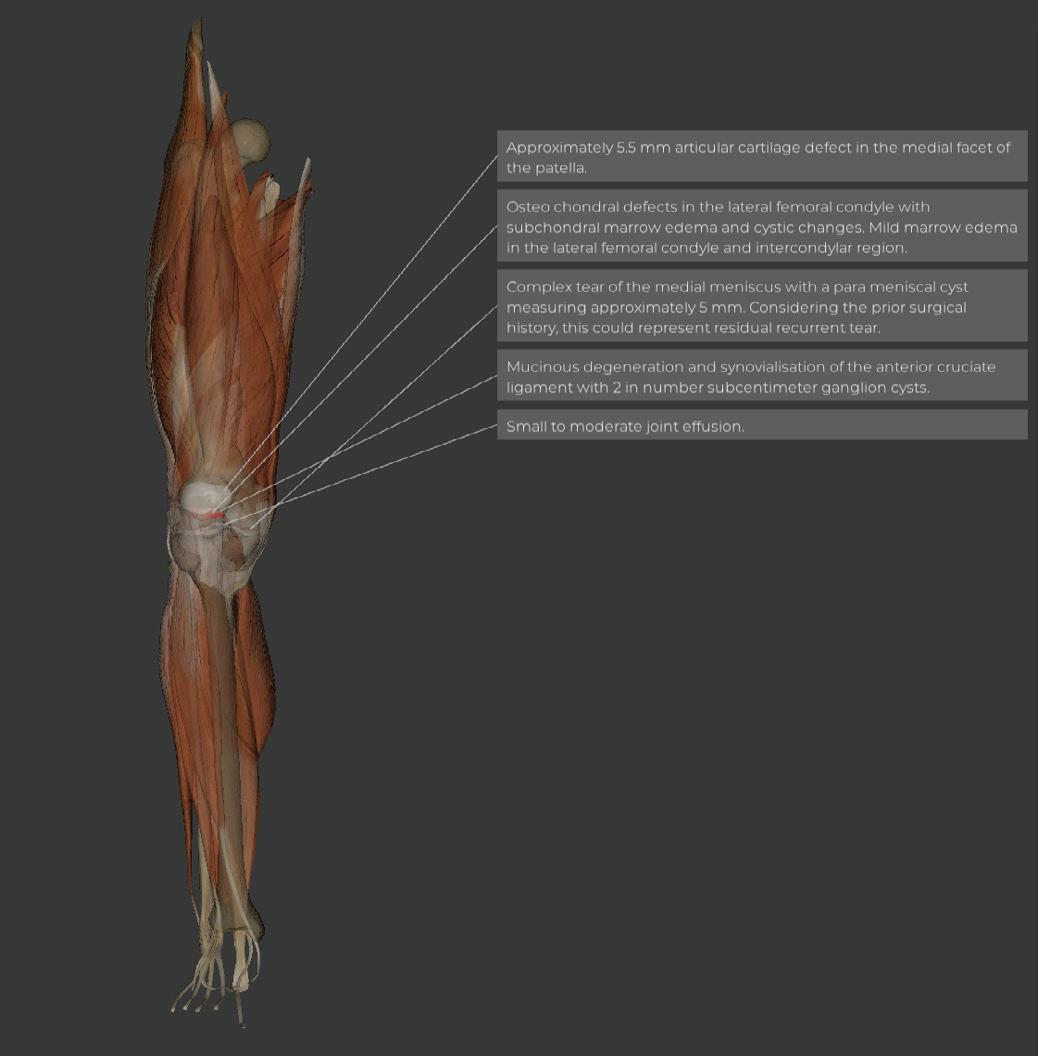

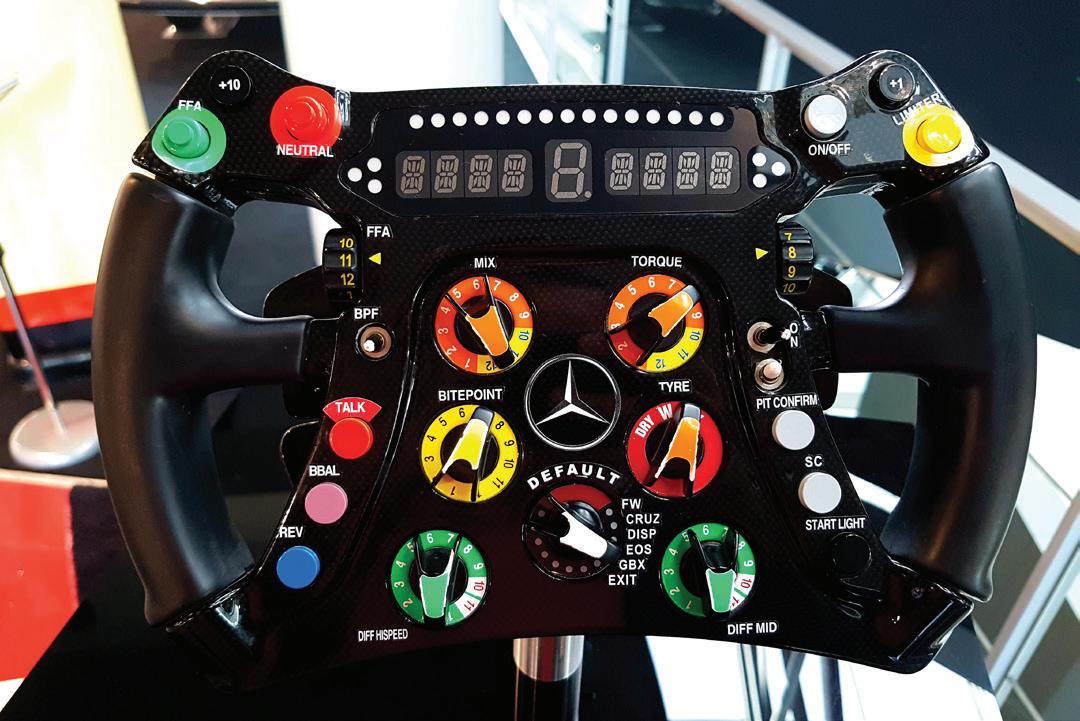

Finally, hold onto your hats because FORMULA 1 racing is coming to Las Vegas! We take you behind the scenes, sharing the thrills and spills in the world of F1 racing and what this means for the city. Whether you are a motorsport fan or not, the excitement is contagious, and the economic implications for Las Vegas are substantial.

Thank you for choosing Vegas Legal Magazine as your trusted source of information and perspectives. We strive to live up to your expectations in delivering the quality and breadth of content you deserve. Your continued readership and support fuel our commitment to excellence.

VEGASLEGALMAGAZINE.COM | 7

LETTER FROM THE

ABOUT US

First Legal is the first comprehensive File Thru Trial™ solutions firm For over 30 years, we have offered a streamlined experience with fast turnaround.

Our five divisions work together to tackle every assignment with precision and excellence.

YOU CAN TRUST!

FILE THRU TRIAL™

INVESTIGATIONS RECORDS DIGITAL Skip Trace Surveillance & Sub Rosa Difficult Service of Process Subpoena & Authorization Services Document Management Deposition Officer Services Scanning & Copying eDiscovery Data Processing & Review Get in touch | 702.671.4002 | www.firstlegal.com | info@firstlegal.com COURT & PROCESS Court Filing Research Service of Process First Legal simplifies the litigation process from File Thru Trial™

the beginning to end of the litigation process or at any point in between, we are here for you.

broad range of services

simplify your workload. DEPOSITIONS Court Reporting Legal Videography Trial Services CA PI: 24171, AZ PI: 1551710, NV LICENSE: NV PI-PS: 1452, FIRM NO: 094F

From

Our

help

LAW

law is reason free from passion.” – Baruch Spinoza

“The

COURT OF PUBLIC OPINION

By Mark Fierro and Jeff Haney

It started with a brisk spring evening walk — just a quick walk around the neighborhood in what seems like a very safe community. On the night of April 14, 2022, Maria Cervantes Alvarado took her usual brisk walking trip around the community in Rhodes Ranch. She got to a familiar intersection, entered the same crosswalk that she always passes — but this time when she entered the crosswalk there was a car sitting at the stop sign.

As Maria walked past, the car suddenly accelerated, striking the 41-year-old mother of three and knocking her more than 20 feet. The blow was hard enough to crack the bumper and the lights on the car. Maria’s head struck the cement and asphalt hard enough to open

a nasty gash on her forehead. She sustained other injuries as well. This is the part that we have a pretty good understanding of, as police responded to the scene and filed a detailed report. They know that the driver started to pull away from the scene of the accident but neighbors yelled for him to stop.

Police officers who responded to the scene said that, in their estimation, the intersection “was limited in lighting,” according to the official report. As luck would have it, one of Maria’s friends happened by and recognized her. In the emotionally fraught discussion that followed, Maria asked her friend to tell her son that she was OK and that she would be home as soon as she could. That is not what transpired: Maria’s

12 | VEGASLEGALMAGAZINE.COM

friend brought her son to the accident scene, he was traumatized by what he saw, and he was further traumatized when his mother left the scene in an ambulance. It’s at this point that the crash goes from being just an accident with injuries to an incident with some real twists and turns.

With more than $100,000 in initial direct medical expense, Maria sought the help of an attorney and she reached out to the De Castroverde Law Group.

Albright is a former prosecutor with the Clark County District Attorney’s office. He knows his way around an accident with injury scene. What you are about to learn next is the real shocker, even for a veteran former DA prosecutor. An attorney for Rhodes Ranch explained that the Homeowners Association at Rhodes Ranch did not have insurance at the time of the accident. The HOA’s attorney said that for some reason the HOA had let their insurance lapse.

A point of disclosure here: Our firm, Fierro Communications, works with Albright and the De Castroverde Law Group on this case and we have some pretty strong feelings about the way the victim was treated by the HOA. This is where the story goes from bad to worse.

After suffering from fallout from her injuries for more than a year including recurring headaches and other medical issues, Maria was in for the surprise of her life when the lawsuit was filed on her behalf. Her name and the fact that she was suing was plastered all over the Rhodes Ranch clubhouse. It also ended up on various Rhodes Ranch social media outlets including Facebook and Nextdoor. On top of being bruised, sutured and battered, Maria was stunned. She started seeing nasty comments about her accident, particularly on social media, even though she was the victim here. Neighbors were complaining because their HOA rates could go up — HOA officials implied as much.

“As we dug a little deeper, we found out that, throughout the years, as you can imagine with a community of this size, there has been litigation from time to time, yet not once, in anything that I found, have they ever called an emergency board meeting or ever sent out a notice like this or posted such a notice in the community clubhouse areas,” Albright said. “Not once — let alone a notice that includes the actual name of an individual who lives in the neighborhood and rubs shoulders with those people, whose kids go to school with those people, with the same kids that also live in that neighborhood.”

Maria had contributed nothing in any way to cause this accident. The only thing she had to show for it was a handful of nearly insurmountable medical bills — yet HOA members were pointing the finger at her. She was understandably scared: Her neighbors know where she lives. Her children go to school

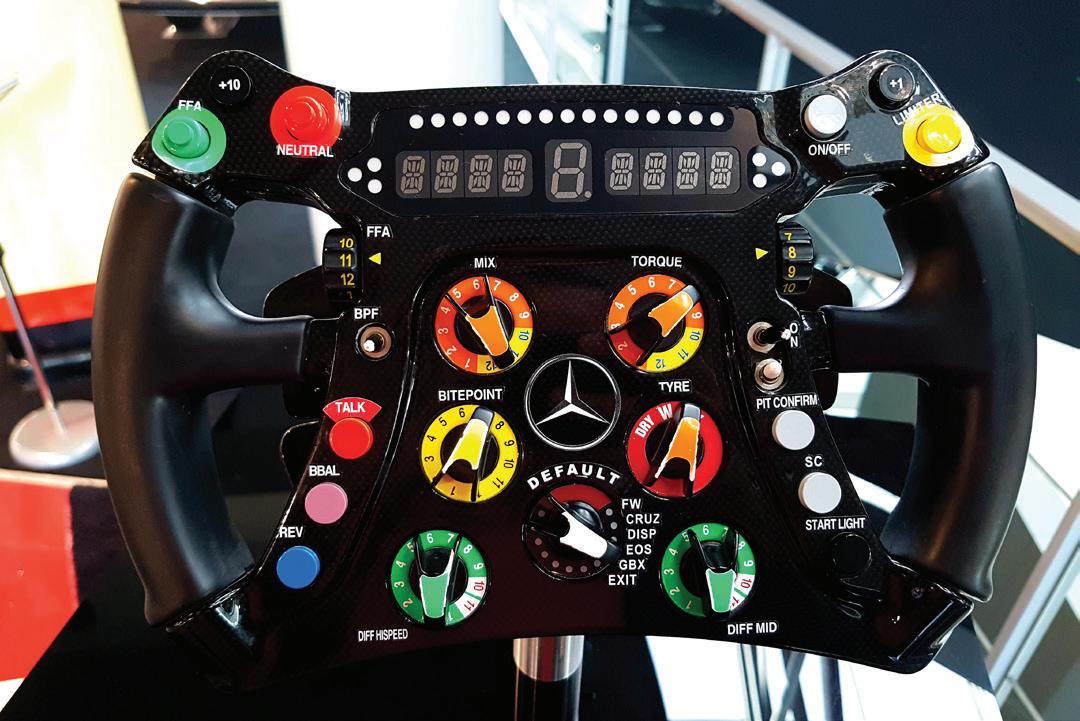

VEGASLEGALMAGAZINE.COM | 13

with children from the neighborhood. Both she and her husband work in the neighborhood.

“After the accident, I didn’t feel it was safe for my kids to run around or go outside,” Maria told us. “If what happened to me as an adult was happening, then what is going to happen to them, as kids? I don’t feel it’s safe for them to go out for a run or a walk at night, even though we live in the neighborhood. It is supposed to be a really nice and safe community, but we really don’t feel like that anymore.”

At a time in our country when ringing the wrong doorbell or pulling into the wrong driveway can change your life forever, HOA officials seemed to be pointing the finger at Maria at the worst possible time.

“What we’re trying to do is clean up their mess,” Albright said. “We want the people who have only seen the notice and think that it’s Maria’s fault to know the truth. We want them to know the facts behind the actual incident and that the lighting at the intersection was insufficient. We’ve had an engineer out there who says that the lighting on that corner was insufficient and not to code. That’s also the fault and the problem of the HOA.

“We also want them to know the extent of Maria’s injuries, to see the photos of her in the hospital with her neck braced and the gash in her head actively bleeding. It’s horrendous. We also need the people to know that they didn’t have insurance. Maria is not the villain in this story. What we’re trying to do is let her neighbors and her employers and the people who live by her, who may be blaming her, to know the truth.”

Orlando De Castroverde, a partner at De Castroverde Law Group, said he and his colleagues at the firm were shocked by what their investigation into the matter uncovered. “There was not sufficient lighting where Maria was hit,”

De Castroverde said. “That’s when we realized this accident was a result of those dangerous conditions. Then, with their messaging, the HOA flipped it and made Maria out to be the bad person, instead of acknowledging their responsibilities — then, on top of it, the fact they were not carrying insurance, which is a prerequisite. So the way I see it, there is a lot of irony in the way the HOA is going about it. The HOA is supposed to be protecting the residents of the community, not leaving them exposed to harm and damage.”

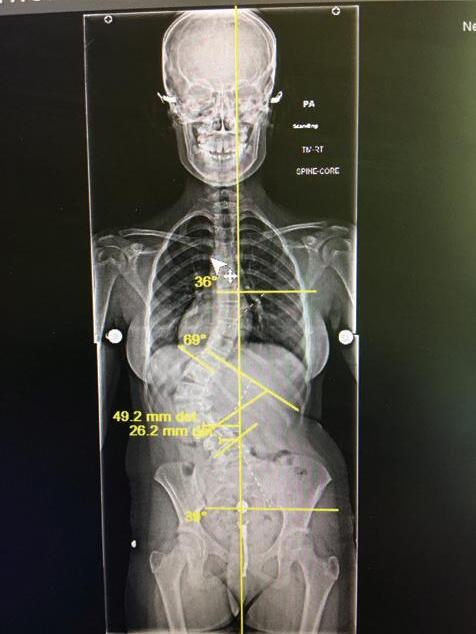

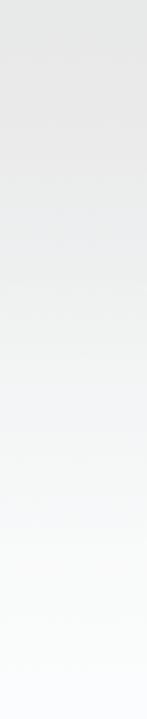

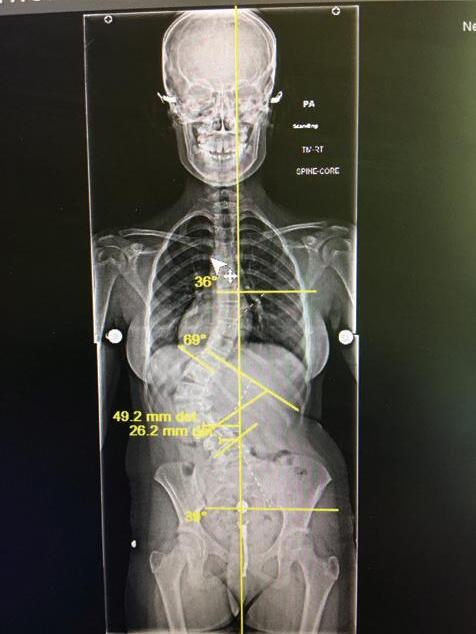

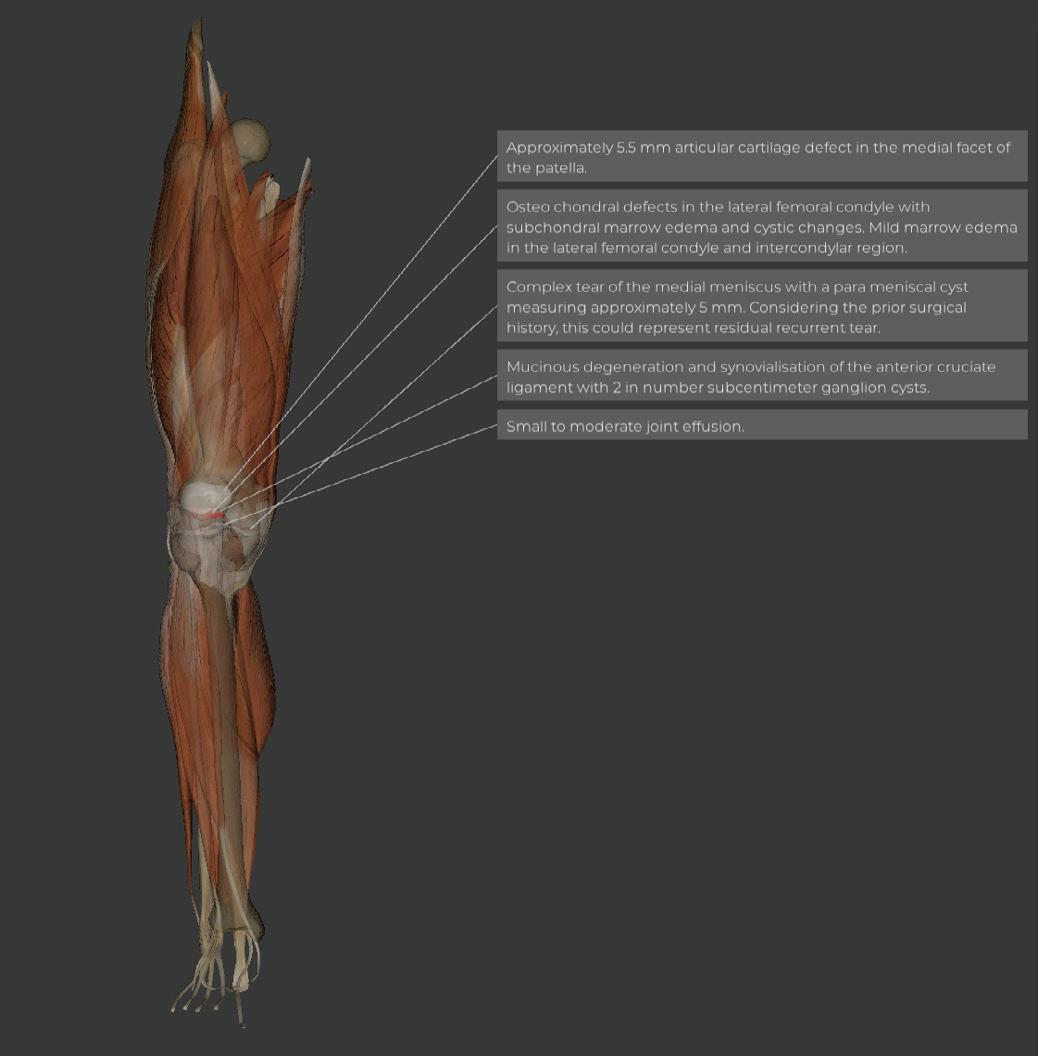

If there was any bright spot in the story, it was at this point that the Las Vegas ReviewJournal covered the story. Reporting by Katelyn Newberg seemed to bring some sanity to the online discussion. Follow-up social media posting included comments such as:

• “I am livid. Someone needs to be held accountable for allowing the liability insurance to lapse.”

• “Where is the [HOA board] president now with this possible lawsuit, which now allegedly adds bullying [of the victim] of all things?”

• “Time for a change, no more board members that don’t live in [Rhodes Ranch]. Also we need live, in-person meetings so we can hold everyone accountable.”

The need to blame seems to grow every day and the extensive role that social media plays in our lives makes the fuse of runaway emotion burn 1,000 times hotter. Maria didn’t do anything wrong. She was simply going out for a walk in her own neighborhood where she should have felt protected. Instead, Maria Cervantes Alvarado feels more victimized than ever.

Mark Fierro began his career as a reporter/ anchor at KLAS-TV, the CBS television station in Las Vegas. He worked at the U.S. House of Representatives in Washington, D.C. He served

14 | VEGASLEGALMAGAZINE.COM

as communications consultant on IPO road shows on Wall Street. He provided litigation support for the Michael Jackson death trial. He is president of Fierro Communications, Inc., which conducts mock juries and focus groups in addition to public relations and marketing. Fierro is the author of several books including “Road Rage: The Senseless Murder of Tammy Meyers.” He has made numerous appearances on national TV news programs.

Jeff Haney serves as Executive Vice President of Operations for Fierro Communications, where he works on developing and directing all media, marketing, research, consulting and public relations strategies for Fierro Communications’ clients including those in business, government, the legal field and cutting-edge high technology in Las Vegas.

Judge Carli Kierny MEET THE INCUMBENT

In this edition of Meet the Incumbent, we interview Judge Carli Kierny, department 2 of District Court.

Prior to taking the bench in department 2 of District Court, Judge Carli Kierny spent the last 10 years with the Clark County Public Defender’s Office, including five years on the sexual assault team. She served as the public defender representative on the countywide Criminal Justice Coordination Committee dedicated to improving probation outcomes. She began her legal career as a public defender in Champaign County, trying dozens of misdemeanor and felony cases. She also served as a volunteer with the SafeNest PS 417 program to provide resources to prevent lethal domestic violence incidents. As a law student, she tried several cases as a clerk with the Cook County Homicide Task Force and worked on the exoneration of a man who was wrongfully convicted as a student with the Chicago-Kent Law Clinic. Judge Kierny received a bachelor’s degree in communications from the University of Illinois at Urbana-Champaign, and a juris doctor degree from Chicago-Kent College of Law.

Vegas Legal Magazine: What does being a judge mean to you?

Judge Kierny: While I may be the judge elected to my seat, the courtroom still belongs to the people of Nevada and the litigants who appear in front of me. In order to not let those people down, I need to be prepared, work hard, follow the law, and make the best decisions possible with the information available to me at the time. Making literally hundreds of decisions a week means that sometimes I will get things wrong, and I need to stay humble enough to admit when that happened and fix my mistakes.

VLM: Why did you become a judge?

JK: At the time I ran, there were a lot of judges

who had practiced as either District Attorneys or civil practitioners representing companies. As a public defender, I had represented real people with serious problems, and I thought that was an important attribute to bring to the bench.

VLM: What has been the most memorable case you have presided over as a judge?

JK: When I started as a homicide judge, I had a case involving a former model who was accused of killing her much-older boyfriend. There was a lot of national media attention on the case, including Dateline, and every court date required a lot of planning for all the cameras and observers. That case taught me that everything changes when the cameras are on!

VLM: How do you exercise judicial discretion where there is ambiguity in legal authority?

JK: For example, how likely are you to sanction a litigant who violates a procedural rule, e.g. failing to file a document in a timely manner? I know I sound like a lawyer here, but it depends on the situation! If the violation caused prejudice to the opposing party, a sanction may be

appropriate. However, if there’s no real harm, I remember that we are all humans trying to do the best we can on any given day, and likely will not impose a sanction.

VLM: What was the most memorable case you tried as an attorney before taking the bench?

JK: As a young public defender, I tried a homicide case where the alleged victim’s body was never found. It was a very unusual case and resulted in a Not Guilty verdict. It was the only case I ever got to try with my mentor in the office before he passed away. Our client moved back to the Midwest, opened a restaurant and started a family, and has never been in trouble since. Additionally, one of the prosecutors on the case is now a DC judge. She swore me in to the bench and I am lucky enough to try homicide cases alongside her today.

VLM; Have you ever experienced a situation where you had to support a legal position that conflicted with your personal beliefs? If so, how did you handle it?

JK: Luckily, I haven’t had this situation come up yet. However, when it does, I will do what the law demands I do and follow controlling law.

VLM: Has there ever been a situation that tested the limits of your patience?

JK: Do you have any advice for handling those moments? There have been a few instances where lawyers or litigants have treated me disrespectfully, and it can be very hard to take. However, I always remember that the person who is being disrespectful may be fighting battles I know nothing about and try to keep my cool. When they are finished, I issue my ruling and firmly move on.

VLM: Do you have any attorney pet peeves?

JK: Unnecessary continuances! If we’re all present in court and a case has to be continued because an attorney hasn’t done what they need to do, I get impatient. Additionally, continuing trials that are already years old is frustrating. The people whose lives are affected by this litigation cannot move on until we go to trial, and it seems unfair to continually move these

trials without seriously good cause.

VLM: What is your best piece of advice for litigants and/or attorneys?

JK: I really appreciate when parties litigate issues ahead of time and don’t just spring them on the court in trial. Other than that, just be prepared and be cordial to each other!

VLM: What is your passion outside of law?

JK: My family, my three dogs, spinning, hiking, swimming, and watching football/ Netflix documentaries.

VLM: Finally…what do you love most about Vegas?

JK: Las Vegas is a city that is always willing to try a new idea. There’s so many activities to do, from the bright lights of the Strip to the outdoor adventures of the desert and mountains. The people are open-minded and caring, and have been beyond welcoming to this Chicago transplant! I can’t imagine living anywhere else.

18 | VEGASLEGALMAGAZINE.COM

THE CURE FOR YOUR CRIMINAL CASE 701-7800 (702)

DUIdoctor.com

Attorney Adam M. Vander Heyden, Esq.

From Public Defender to Speaker of the Nevada Assembly: Steve Yeager

Whenit comes to enshrining constitutional rights to all Americans regardless of financial status, public defenders are absolutely vital. When one is unable to afford an attorney, the Public Defender’s Office will provide them with legal representation in the decisions and actions of the courtroom that can oftentimes be confusing to someone who doesn’t have a Juris Doctorate. The importance of the services provided by public defenders cannot be understated when it comes to ensuring that American courthouses don’t turn into a kangaroo court where the defendant doesn’t have any adequate form of representation.

And luckily for the pursuit of fair and equal justice in future lawmaking, a decent number of former public defenders have become elected officials in very high-ranking positions within not only several state Legislature bodies but also serving as judges

By: Josh Kasoff

By: Josh Kasoff

in courtrooms that range in jurisdiction and power from appellate courts, to U.S District Courts across the country and with the recent addition of Justice Ketanji Brown Jackson, The United States Supreme Court as well. In fact, Justice Brown Jackson is the first former federal public defender to serve on the Supreme Court.

Fortunately for the future lawmaking of a politically purple state such as Nevada, a former public defender who served for eight years is now serving as the very powerful Speaker of the Nevada Assembly. Not only that, but the public defender turned politician has also served as either chair or vice chair in numerous vital Nevada Assembly committees such as the Judiciary, the Growth and Infrastructure and the Redistricting and Elections Committees.

20 | VEGASLEGALMAGAZINE.COM

“I wasn’t sure that I wanted to be a lawyer growing up.” Speaker Steve Yeager recollected. “I applied to law school not knowing exactly whether I wanted to be a lawyer or what type of law I would practice. I just wasn’t ready to get out there and start a career just yet and I don’t think I have any lawyers in my family. So it was a career choice that was pretty unique for me.”

Following his graduation from Cornell Law School in 2004, Yeager practiced commercial litigation law for large companies in Phoenix as well as insurance defense and class action work. Although not previously having practiced criminal law, Yeager took a position with the Clark County Public Defender’s Office in March of 2009 and relocated to Las Vegas. During his tenure with the Public Defender’s Office, Yeager personally witnessed the many damaging flaws and often-occuring injustices of the American criminal justice system.

“It was apparent to me right when I got into that work that the criminal justice system was very uneven. It seems people who committed the same type of crime or were in the same situation ended up getting treated very differently when it came to different sentences and sometimes whether or not they would even be charged. A huge takeaway for me was the overarching theme for me of seeing criminal law at work where some people were punished too harshly and others weren’t punished harshly enough.”

Given his lengthy tenure at the Public Defender’s Office, Yeager dealt with many of the overprosecuted cannabis-related cases in the several years before Question 2 passed and legalized the plant. One such case in 2011 or 2012 involved a woman who had been charged with multiple charges of cannabis trafficking despite the fact that the defendant was a medical marijuana cardholder. The defendant was accused of providing cannabis for other medical patients, as medical dispensaries were yet to open and patients had no retail way to procure their cannabis. The defendant system to distribute cannabis resembled more of a co-op instead of a retail dispensary and this operation was apparently run in an unsophisticated and unorganized manner. Ultimately, she’d be charged with felonies due to undercover officers visiting her shop and being able to purchase products from her.

“It seemed very over the top,” Yeager recalled, “as she was facing life in prison when she was really just

trying to help other patients.”

By 2013, the Nevada Legislature had finally authorized the opening of medical dispensaries and Yeager was able to significantly reduce his client’s punishment. Through meeting with the District Attorney at the time, the client didn’t receive a single felony conviction or have to serve prison time.

“That experience showed me that there was a lot of power in the Legislative process. If the 2013 Legislature had not authorized dispensaries, I think the case would have ended a lot differently. It would’ve been a high stakes case where we’d have to go to trial and convince a jury that she shouldn’t spend life in prison over trying to provide cannabis to other cannabis patients.”

The Clark County Public Defender’s Office would also be incredibly influential for Yeager’s successful foray into Nevada politics.

“I was really recruited into politics.” Yeager joked. “I was just doing my job at the Public Defender’s Office, blissfully unaware of what was happening politically. Then a couple of people reached out and asked if I would be interested in lobbying on behalf of the Public Defender’s Office in Carson City. Every session, the office would send someone up there to lobby for criminal justice issues. I was chosen to be part of the Clark County lobbying team and that was the first time I ever went to Carson City and saw the Legislature in person. Even then, I didn’t intend to run for office. But it turned out that my

Assemblyman decided not to run for re-election, so it became an open seat.”

Unfortunately, Yeager won the Democratic Party’s primary but didn’t win his first general election in 2014, as District 9’s election went in favor of the Republican candidate David M. Gardner. This loss didn’t impact Yeager’s drive, as he went up to Carson City again in 2015 to once again lobby the now Republican-led Assembly on behalf of the Public Defender’s Office. One of the major types of legislation that Yeager lobbied for on behalf of the Public Defender’s Office were bills related to the opening of medical cannabis dispensaries as well as other bills related to progressive mental health and substance abuse treatment services in Nevada.

“Anything we could do to provide offenders with treatment and diversion and then making sure the criminal justice system and the criminal code itself was fair in the way it was administered. A lot of it was procedural and substance in terms of criminal law, but I was able to expand and go into mental health and healthcare bills because that’s usually a part of what’s going on with someone when they get involved in the criminal justice system. And I

had a very different lobbying experience in 2015 and decided to once again run for office in 2016. Thankfully, I’ve been successful ever since.”

After the reverse of the 2014 election occurring and Yeager winning the 2016 election for District 9 against Gardner by nearly 3,000 votes, Yeager continued to advocate for the same type of bills that he lobbied for during his time with the Public Defender’s Office. In the four Legislature sessions that Yeager has served in the Assembly for, the Assemblyman has increasingly become one of if not the strongest legislative ally and champion for cannabis reform and the strengthening of the Nevada cannabis industry.

“My goal has always been to move the industry forward and to find the right balance between having businesses that can thrive and having supply for customers but also having appropriate regulatory oversight.”

One of the most groundbreaking bills that Yeager sponsored and pushed through multiple committee meetings for the Nevada cannabis industry was the 2021 Assembly Bill 341. With this bill, Nevada

lawmakers authorized the opening and operation of cannabis consumption lounges. Besides giving designated and memorable consumption spaces to the millions of annual visitors that Las Vegas and Reno receive along with the thousands of locals that consume cannabis, AB 341 also provides the currently turbulent industry with a new business avenue for significant revenue and job creation simultaneously.

“I think AB 341 was very important because as the readers may know, when Nevada passed legal cannabis, there was a prohibition from consuming it in public. So in Las Vegas, we have a big problem where we have 40 million tourists a year but nowhere for them to consume because hotels generally turn cannabis away because they’re worried about federal legality with their gaming licenses. To me, it didn’t make sense that we didn’t have a place where all these people could consume.”

Beyond just the glitz of glamour of Las Vegas tourism, AB 341 could help Nevadans who aren’t allowed to consume cannabis in their own home, such as Section 8/federally subsidized housing recipients due to the Schedule I status of the plant or overly strict landlords that prohibit smoking in their properties.

“With other cannabis legislation, it’s just trying to get the system right. Originally, Nevada cannabis started as being regulated by the Department of Health and Human Services, then over to the Department of Taxation and neither of those are where it really belongs. So we created the Cannabis Compliance Board and we’re looking at the gaming structure as a model where we have a separate agency that will oversee the cannabis industry.

I think the initial legislation that we passed wasn’t perfect, but we’re going back every session to figure out what the right balance is. Appropriate regulation, but we also have to have an environment where consumers have choice and don’t have to pay exorbitant prices and businesses can thrive in this market. But that’s always tricky with a new industry.”

The Nevada cannabis industry gained a considerable advantage during the first days of the 2023 Nevada

Legislative Session when Assemblyman Yeager was sworn in as Speaker of the Assembly. The advantage has already paid off for the industry, as several different cannabis-related bills passed this session. One such bill, Senate Bill 277, doubled the daily purchasing limits for Nevada cannabis consumers and Senate Bill 328 which changes the procedure in which new CCB board members are appointed as well as the qualifications and terms of those members.

Yeager hypothesizes there could be future change to Nevada’s cannabis industry, from possibly an expansion of the consumption lounge program to a change in how the industry and its business owners are taxed. And whenever younger representatives truly take power and there’s cannabis reform on the federal level, Nevada will have years of quality experience to become a national powerhouse.

The reform of cannabis’ current Schedule I status on the Controlled Substances List alone would be a tremendous reform. Currently, cannabis companies across the country have steep trouble at utilizing proper banking services, cannabis employees themselves cannot receive a federally backed mortgage loan, US veterans may be at risk of losing their VA benefits and there’s several more issues regarding 2nd Amendment rights in relation to cannabis possession and usage. Even a simple reform at the federal level would have legislative and policy-altering shockwaves across multiple departments of the American federal government.

“I think Nevada is in a unique place because if there was a relaxation of the federal prohibition, there would be unique opportunities for Nevada to work with other states and companies.”

Josh Kasoff can be reached at joshkasoffwriting@ gmail.com.

VEGASLEGALMAGAZINE.COM | 23

145 MILES IN 5 DAYS

Beginning on July 12th, I will run 145 miles over five days from Milwaukee, WI to Valparaiso, IN which is approximately a marathon a day.

Why I'm Running

This is very important to me as my sister-in-law was diagnosed with MS and lives with the daily effects.

In addition to running, I have committed to raising $10,000. Consider supporting my run here:

MS Run the US is dedicated to raising awareness and funds for those living with multiple sclerosis (MS) to provide hope, to aid those living with disability from the disease and to support research to stop it.

msruntheus.org

“De Becker Investigations provides timely, cost-effective, and superlative professional services performed with the utmost discretion.”

James J.

Esq.

THE JIMMERSON LAW FIRM

ee ations, m has of highprivate ada, it f investigative services for over 20 years. Hal de Becker’s clientele range from distinguished attorneys and law firms from around the globe, casino moguls, high-profile entertainers, professional athletes, Fortune 500 companies and private individuals who all share one goal: to be provided with the absolute truth!

“I am extremely pleased with the work by Hal and his staff at De Becker Investigations. Hal and his team were assigned to locate someone who had committed criminal fraud against me They were not only able to find him quickly but also when he fled they were able to locate him in a different state ”

Brian Valentine Senior Vice President AMAZON.COM

Brian Valentine Senior Vice President AMAZON.COM

“My clients and I extend our greatest appreciation to De Becker Investigations for the thoroughly professional and efficient manner in which they conducted their investigation.”

Donald J. Campbell, Esq. CAMPBELL & WILLIAMS

Donald J. Campbell, Esq. CAMPBELL & WILLIAMS

DEBECKERINVESTIGATIONS.COM info@debeckerinvestigations.com Direct:

702.982.5200 Toll Free: 800.608.6155

Jimmerson,

Nevada Attorney General Aaron Ford is Focused on Serving the State Now; Stays Mum on His Future Plans

Aaron Ford likes protecting Nevadans. Whether it be protecting consumers against scams, or safeguarding residents from deadly fentanyl, keeping Nevadans safe is a top priority for the state attorney general.

Ford first spoke to Vegas Legal Magazine in 2018, while running for his first term as Nevada’s AG. In November of last year, Ford won a second term in office. His victory in November solidified his status as a state politician on the rise.

In this follow-up story, Ford talks about what he still wants to accomplish as Nevada’s AG. But can we expect Ford to run for senate, or Nevada governor, in the future? Aaron Ford says he just

By: Valerie Miller

wants to concentrate on the job at hand.

“Right now, my focus is on serving the people of Nevada as their attorney general,” he responds. “It’s been the best job I’ve ever had, and I look forward to continuing the pursuit of justice in all we do.”

A Look Back at How It All Started

Aaron Ford didn’t take the traditional path to becoming a lawyer, lawmaker and now attorney general of Nevada.

A Dallas native, now 51, Aaron Ford became “the man of the house” as a teen after his parents split up. His parents’ divorce meant that

VEGASLEGALMAGAZINE.COM | 31

Aaron had to watch his younger siblings while his mother worked nights.

Money was tight. But his mother, Denise Cliaborne, put Aaron in the Saturday-school program, Project Upward Bound, which helps students become the first in their families to go on to graduate college.

Aaron Ford later received a scholarship to Texas A&M University, where he would earn his bachelor’s degree. But while in college, Ford became a father at 21. After the relationship with his then-girlfriend ended, Ford took custody of his son Avery and raised him. Those times were tough, and this resulted in Ford seeking public assistance, including the food stamp program now known as the “SNAP.” Ford also received assistance in raising his son through the Woman Infants and Children program, or WIC, and Section 8 housing.

The road to where Ford is today was far from smooth. While in his 20s, he had a number of brushes with the law. Aaron’s life took a positive turn when he met his future wife, Berna, in 1994. The couple are now both lawyers, and are raising four boys, including the Ford’s nephew. The Fords first landed in Las Vegas in 2000, and moved around for jobs. The couple permanently moved back to Las Vegas in 2007. Before joining Eglet Prince, Aaron Ford was a partner at the Snell & Wilmer law firm’s Las Vegas office. He previously also worked as a middle school math teacher.

Ford recalls how he got involved in politics in the first place: “It started off with my oldest son posing somewhat of a ‘gotcha question’ when I moved the family back to Las Vegas in 2007. He’s in medical school now,” he explains. “But he knew then that he wanted to be a doctor, and with the Clark County School District being ranked so poorly, he asked why moving here would be best for the family.”

Ford says he knew he had to be part of the solution: “My involvement with public service started then and there, when I decided I needed to get involved with what was happening with education in our state,” he continues. “(This was) not just for my family, but for all of Nevada’s families.”

Now settling into his second term as Nevada’s top law enforcement official, Aaron Ford answered a wide range of questions about his stances on issues, as well as his top priorities in his second term as the state’s AG.

Vegas Legal Magazine: As Nevada’s attorney general, can you discuss what your main goals and objectives were for the 2023 Nevada legislative session?

Aaron Ford: We had quite a few goals for the 2023 Legislative session, including protecting victims of domestic violence, ensuring our office has jurisdiction to combat organized retail crime, and combatting the fentanyl epidemic.

32 | VEGASLEGALMAGAZINE.COM

Assembly Bill 51 removes the 24-hour arrest rule for battery domestic violence cases, and instead allows an officer to make a probable cause arrest for seven days. The new 7-day arrest rule will apply to violations of Temporary Protection Orders, Emergency Protection Orders and stalking as well.

Assembly Bill 50 specifically added authority for our office to investigate and prosecute organized retail crime, which will allow us to be an active partner with other law enforcement agencies in combating the rising waive of organized retail crime in Nevada.

Lastly, Senate Bill 35 reduces the weights involved in fentanyl trafficking offenses from 100 grams, to: 28-42 grams for a category B felony with a minimum one year and a max of 10 years in prison; 42-100 grams for a category B felony with a minimum of 2 years and a max of 15 years imprisonment. SB 35 also requires prisons and jails to allow medication-assisted treatment for prisons.

Senate Bill 35 is the product of extensive work with stakeholders and is meant to avoid a repeat of the failed “war on drugs” strategy.

VLM: What do you think were your main accomplishments during your first term in office?

AF: My first term brought challenges that nobody could have predicted. A year and a half into my first term, the COVID-19 pandemic threw the entire country into an unprecedented period. I will forever be proud of my staff who worked long hours to ensure our state kept running smoothly and took on extra work responding to the eviction crisis, and reports of fraud by those who sought to take advantage of the situation.

At the same time, our nation was confronted with the reality of police brutality when we

witnessed the murder of George Floyd and killing of Breonna Taylor. Tensions were high between law enforcement and many traditionally disenfranchised communities. I listened to and engaged both at virtual town hall meetings.

I was compelled to create real change in law enforcement practices, and subsequently brought forth two reform bills that passed unanimously in the state legislature. Assembly Bill 58 allows my office to investigate potential systemic discrimination in police departments, and Senate Bill 50 puts limits to the use of noknock warrants by police.

VLM: What are your priorities for your second term as Nevada’s attorney general?

AF: My priority in this second term is the same as it was for my first term, “justice.” Everything we do at the office of the attorney general is about securing and enforcing justice. Whether it’s obtaining a settlement for the state or prosecuting fraudsters, our job is justice, and that will always be my top priority.

VLM: I know you have proposed changes to

VEGASLEGALMAGAZINE.COM | 33

the laws pertaining to fentanyl possession in Nevada. Can you please talk about the importance of lowering the legal limits on the amount of fentanyl possessed by a person, for the purposes of drug-classification charges and stiffer sentencing?

AF: At the outset, let me note that we did not propose a law about “possession” of fentanyl. Rather, in the 2023 legislative session, my office reduced the amount of fentanyl required for a person to be charged with “trafficking.” Under Senate Bill 35, a low-level fentanyl trafficking charge now ranges from 28 grams to less than 42 grams, and high-level fentanyl trafficking charge ranges from 42 grams to less than 100 grams. Before this bill passed, a person had to be in possession of 100 grams of fentanyl to be charged with trafficking. The bill also creates a new crime that applies to persons who sells to another person a mixture containing fentanyl and another controlled substance and who: One,. knows that the mixture contains fentanyl; and two, intentionally fails to inform the purchaser that the mixture contains fentanyl.

These increases are absolutely not meant to impact those who are suffering from addiction. We were very clear from the outset that this bill was not being introduced to replicate the “War on Drugs” that has seen many people in need of treatment being sentenced to extraordinarily long prison terms.

But the bill’s provisions are meant to give law enforcement the tools to go after those who are distributing fentanyl, with no consideration of its extreme lethality.

VLM: Nevada has received millions of dollars in opioid-settlement money. To what types of programs would you like to see those funds applied?

AF: With our recent settlement with Walgreens, the amount of money that my office has

brought into Nevada through these settlements has topped $1.1 billion. I’m extremely proud of the work my office has done in this area, and I want to especially highlight the work done by my chief of my Bureau of Consumer Protection, Mark Krueger, and my Consumer Advocate Ernest Figueroa.

Eglet Adams, our outside counsel, was also an extraordinary force in our work to hold these corporations accountable for the harms inflicted to Nevadans. This firm dedicated a full two-thirds of its personnel to this case, and it expended thousands of hours preparing this case for trial. They were a key part of our wins. Settlement dollars will be appropriated to mitigate the devastating impacts of the opioid epidemic through the Fund for a Resilient Nevada, and the One Nevada Agreement. I want to thank the members of the Advisory Committee for a Resilient Nevada and the Substance Use Response Group Communities for their commitment to proper stewardship of these funds.

VLM: Gun rights and public safety are hot topics right now. How do you plan to balance protecting the Second Amendment rights of residents with the pressure – from some factions -- to implement stricter gun-control laws in Nevada?

AF: Supporting the Second Amendment and advocating for common-sense gun safety measures are not mutually exclusive. For example, measures to keep firearms out of the hands of those afflicted by mental illness do not conflict with the rights of law-abiding Americans to legally access firearms.

But while common-sense gun safety measures can and will reduce gun violence, we must also address the underlying issues that lead to gun violence. These can range from domestic violence to, again, mental health concerns. We have to work together to stop gun violence,

34 | VEGASLEGALMAGAZINE.COM

but there are many who do not engage in good faith arguments on this issue. We cannot simply throw our hands up and allow the ongoing plague of gun violence to continue.

VLM: Nevada is a state that has the death penalty, however executions in Nevada have been on hold for quite a while now. Even when a condemned prisoner requests to have his death sentence carried out, the state’s hands seem tied. Can you please talk about the current status of capital punishment in Nevada, and where you think the battle over the death penalty is headed in our state?

AF: Well, I have been clear in past comments that while I personally oppose the death penalty, I will enforce the law as written in my job as attorney general. I sincerely hope there is further policy discussion on this issue. In the meantime, I have a duty to the State of Nevada to do the job I was elected to do, which is to uphold the law. As long as I am attorney general, I will ensure that any executions carried out in Nevada pass constitutional muster.

VLM: You have talked about criminal justice reform, while at the same time pledging to enforce Nevada’s existing laws. Can you please explain more about what your plan would include?

AF: I’ve said this before, but I think it’s a good example. When I was growing up, in the neighborhoods I was in, sometimes you wanted the police to show up because something bad had happened, but other times bad things happened because the police showed up. There was a dichotomy in how people viewed police.

I’m interested in lessening that dichotomy, in ensuring that police are viewed as part of the communities they’re serving and do not cause concern on their arrival. Listen, nobody wants to live in an unsafe neighborhood, so law enforcement as a concept is a necessary part of our society. Police fill an important role as community caretakers, but to perform that

role effectively, there must be trust between law enforcement and the communities that we serve. As attorney general, I’ll continue trying to ensure that trust is realized.

VLM: Can you please explain to the readers what types of cases your office handles, as opposed to those cases handled by city or county law enforcement?

AF: The Nevada Attorney General’s office handles a wide variety of cases. People should think of us as the attorney for state government agencies and representation for the people of Nevada in service of public interest. We also investigate and prosecute certain crimes that violate state law.

VLM: You have argued in favor of police body cameras in Nevada. Can you please discuss the importance of law enforcement officers wearing body cameras?

AF: Police body cameras offer transparency and accountability when an officer’s actions come into question in the line of duty. These cameras are important because they help law enforcement learn from mistakes, and help their leaders understand exactly what areas of training need to be implemented or reinforced. If an officer acts improperly or illegally, cameras serve as a record of their actions. Police body cameras also serve to protect law enforcement from untruthful claims of misconduct by the public. Any officer who is doing their job with integrity and according to training protocols should see body cameras a validation tool for all of their hard work.

This is important for marginalized communities which have been, historically, the targets of police impropriety, because there is that added layer of accountability. Obviously, body cameras are not a universal fix for accountability, but they are a step in the right direction.

VLM: Election integrity has been a big concern in Nevada since the pandemic. What steps has your office taken to ensure that we have safe

and secure elections in the Silver State?

AF: I stand behind the work my office does to protect the integrity of Nevada’s elections. I urge anyone with a credible allegation of voter fraud to contact my office. While voter fraud can happen, it is exceedingly rare, and I will prosecute to the fullest extent of the law anyone who might try to interfere with our free and fair elections.

As you may recall, there was abundant rhetoric alleging mass voter fraud in the 2016 and 2020 presidential election cycles. However, when evidence came to bare, only two instances of voter fraud were uncovered. My office prosecuted those two individuals.

In 2021, for example, we prosecuted a Las Vegas man who had cast his deceased wife’s ballot. It was a particularly egregious case because that gentleman had spread inaccurate information beforehand that was meant to cast doubt on Nevada’s free and fair elections.

VLM: It’s been a year now since the U.S. Supreme Court overturned Roe v. Wade (with the Dobbs’ decision), leaving abortion rights

issues to the states to decide. Abortion is already a right protected in the Nevada Constitution. Therefore, do you see any legal impact on Nevada from the Supreme Court decision?

AF: The right to an abortion is protected in Nevada, and I will take any steps necessary to protect those in our state who wish to access reproductive health care services. I do, however, want to stress that Nevadans must be vigilant against efforts to strip away this right. Due to the Dobbs’ decision, there are no longer any federally protected rights to abortion care. As such, a national law restricting abortion could supersede Nevada law. There are groups that would absolutely push such a law, and we must not let them erode our rights even further. In addition, restrictions on abortion services in other states could see Nevada become a destination for those who cannot access these services otherwise. While we welcome all to our state, we will not aid any state in investigating or prosecuting those who come to Nevada for an abortion. I want to thank these providers for their work and their commitment to individual health-care decisions.

VLM: You were recently on a list of people

banned from entering Russia. I don’t believe the list included a reason for the ban. Why do you think you were banned from entering Russia, and what are your feelings on it?

AF: I can’t speculate as to why I was banned from entering the Russian Federation. It wasn’t on my bucket list of places to visit so; the ban doesn’t bother me in the least.

VLM: What are your future goals, after completing this term as Nevada’s attorney general? Would you ever consider a run for governor or senate in the future?

AF: Right now, my focus is on serving the people of Nevada as their attorney general. It’s been the best job I’ve ever had, and I look forward to continuing the pursuit of justice in all we do.

VLM: Can you please discuss how your life experiences brought you to this point, of being Nevada’s attorney general?

AF: It started off with my oldest son posing somewhat of a “gotcha question” when I moved the family back to Las Vegas in 2007. He’s in medical school now but he knew then that he wanted to be a doctor, and with Clark County School District being ranked so poorly, he asked why moving here would be best for the family.

My involvement with public service started then and there, when I decided I needed to get involved with what was happening with education in our state. (This was) not just for my family, but for all of Nevada’s families. My dedication to Nevada, and the people who live here only deepens with each year. Now, here I am 16 years later, serving as the state attorney general.

Valerie Miller is a Las Vegas Valley-based awardwinning journalist. She can be reached at (702) 683-3986 or valeriemusicmagic@yahoo.com.

VEGASLEGALMAGAZINE.COM | 37

AG Ford at Fentanyl Awareness Summit

AG Ford with students from the Upward Bound Program for College Prep Saturday

AG Ford speaking on the footsteps of the Reno courthouse after Charles Sullivan sentencing

Business

“Success is walking from failure to failure with no loss of enthusiasm.”

– Winston S. Churchill

Business Spotlight

REAL ESTATE AGENTS

BERKSHIRE HATHAWAY: (702) 496-9302

MITCH FULFER, REALTOR

ADG REALTY: (702) 315-6100

KELLER WILLIAMS REALTY: (702) 212-2222

FOSTER REALTY, LLC: (702) 552-0120

XTREME REALTY: (702) 384-7253

LAWYERS

PRESTON P. REZAEE, ESQ.: (702) 222-3476

ROSS GOODMAN, ESQ.: (702) 383-5088

DALLAS HORTON, ESQ.: (702) 380-3100

J. MALCOLM DEVOY, ESQ.: (702) 669-4636

NEDDA GHANDI, ESQ.: (702) 878-1115

AMANDA LAUB, ESQ.: (702) 329- 5282

MORTGAGE COMPANIES

RED ROCK MORTGAGE: (702) 320-9595

ALDERUS MORTGAGE: (702) 255-5783

VALLEY VIEW HOME LOANS: (702) 710-5626

FIRST OPTION MORTGAGE: (702) 669-5400

FAMILY MORTGAGE INC.: (702) 216-3000

DENTISTS

GARDEN COSMETIC & FAMILY: (702) 869-5700

GENTLE DENTAL RANCHO: (702) 680-1009

AFFORDABLE DENTAL: (702) 794-0304

DISCOUNT DENTAL: (702) 386-8811

PEARLY WHITES FAMILY DENTISTRY: (702) 605-7814

Business Spotlight

DOCTORS

DENNIS YUN, M.D.: (702)-386-0882

TEDDY SIM, D.C.: (702) 277-1371

MICHELLE HYLA, D.O.: (702) 386-0882

DR. NEVILLE CAMPBELL, M.D./M.B.A: (702) 476-9700

ANDREW M. CASH, M.D.: (702) 630-3472

CPAS

THE ACCOUNTANT, LLC: (702) 389-2727

DONOVAN THIESSEN, CPA

ELLSWORTH & STOUT: (702) 202-0272

MARK SHERMAN: (702) 645-6318

HALL & ASSOCIATES: (702) 629-1886

SANFORD & COMPANY: (702) 382-1141

LARRY L. BERTSCH: (702) 471-7223

WEALTH MANAGEMENT

REDROCK WEALTH MANAGEMENT: (702) 987-1607

SPARROW WEALTH MANAGEMENT: (877) 330-9191

ARISTA WEALTH MANAGEMENT: (702) 309-9970

CORNERSTONE WEALTH MANAGEMENT: (702) 878-4742

MORGAN STANLEY: (702) 792-2000

SALONS/BARBERS

KAYA BEAUTY: (702) 898-5292

NY HAIR COMPANY: (702) 432-3333

TRUE AVEDA LIFESTYLE SALON & SPA: (702) 364-8783

BOULEVARD BARBER SHOP: (702) 384-1453

MYSTIQUE HAIR STUDIO: (702) 432-6006

Written By Mark Martiak

As of August 11th, the top ten stocks in the S&P 500 accounted for 90% of the index’s year-todate gains. (Elle Caruso, Top 10 Names…ETFTrends. com, 4/5/23) In fact, with the 2Q23 earnings season ending, corporate profits have surprised to the upside, with strength in the consumer sectors, construction, travel, and streaming/gaming. With that being said, the recent broadening has been moderate at best, and mega-cap tech stock valuations remain stretched. The top ten stocks currently account for over 30% of the index, which is down from the peak levels we saw in the spring, but still extremely high relative to the last 25 years. Importantly, and in contrast to their weight in the index, the earnings contribution of these top ten stocks is sitting near its pre-COVID level, but well below the pandemic era highs. Despite this misalignment in weights and earnings, the VIX, which is known as the volatility index, has remained

STATE OF THE MARKET

at historically low levels, perhaps aided by the market becoming increasingly confident in a soft landing for the U.S. economy.

Whether this performance is sustainable hinges on inflation. Any prolonged stickiness in core CPI may push the Fed to maintain a hawkish stance, thereby increasing the odds of a recession. In such a scenario, we would expect to see earnings revised lower, leaving the market, where valuations are already stretched, particularly vulnerable.

Recent strong employment figures and lower inflation data have led the equity market to price a stronger economic growth outlook.

As inflation recedes, the pace of price increases should also decelerate and be less of a tailwind for sales, placing more importance on volumes to

42 | VEGASLEGALMAGAZINE.COM

grow sales. Consensus estimates show that analysts expect 92% of S&P 500 companies will post positive nominal sales growth in 2024 and expect aggregate sales will rise by 4%.1

While many management teams were pessimistic on the economy in late 2022 and following banking stress in March, sentiment has improved. Several companies acknowledged the resilience in the U.S. economy had led them to now expect a soft-landing. But other companies still anticipate a near-term recession, albeit later than previously expected, and some companies continue to incorporate a slowdown in economic growth into their planning and guidance.

Artificial intelligence (AI) continues to be a hot topic for both investors and company managements. The proportion of companies discussing AI on earnings calls soared this quarter. Several management teams explained to Wall Street Analysts how recent increases in demand for AI will boost demand for their products.

Stocks deemed to be AI winners have exhibited robust performance so far this year. In particular, the seven largest stocks in the market are widely considered to be major AI beneficiaries. These stocks have rallied by 59% YTD.

Expected future uses of AI include financial advisory, efficiency improvements, customer personalization, automation, pharmaceuticals, data modeling, and marketing.

Consumer Spending and the Budget Situation:

The Commerce Dept reported in mid-August that consumer spending was up in July as inflation slowed. “The advanced retail sales report showed a seasonally adjusted increase of 0.7% for the month, better than the 0.4% Dow Jones estimate. Excluding autos, sales rose a robust 1%, also against a 0.4% forecast. Both readings were the best monthly gains since January.” As the numbers are not adjusted for inflation, they showed a consumer able to keep ahead of price increases that have been prevalent over the past two years. The consumer price index rose 0.2% on the month, indicating solid demand.2 Up: food service, bars, online retailers, sporting goods. Down: furniture sales, appliances, electronics, vehicle sales, gas stations.3

Much of this consumer spending has been on credit – credit card balances reached $1T for the first time in 2Q23.4

In a series of eleven increases since March 2022, the Fed has taken up its key borrowing rate by 5.25

percentage points to reach its highest level in more than 22 years. Regardless, consumers, who power about two-thirds of the entire $26.8 trillion U.S. economy, have persevered.5

We are entering an era where the national budget will be stretched thin by the Boomers’ retirement, and the basic economic conditions that existed in the 80s and 90s no longer apply, particularly with regards to interest rates. “Interest costs last year were 1.9% of GDP, the highest since 2001. We are projecting this year will be 2.5% of GDP, the highest since 1998.”6

From Washington to Wall Street and Main Street, the U.S. is on the cusp of some big budget challenges. If voters do not hold politicians’ feet to the fire investors will.

Expect the unexpected over the final four months of 2023. The markets dictate the economy, not the other way around. Plan and be disciplined about your asset allocation strategies. When you need to be defensive, cash can be your friend.

If you need to define whether you have any financial blind spots, please reach me directly at mmartiak@ allianceg.com.

Mark Martiak is a New York-based Investment Adviser Representative and Accredited Investment Fiduciary® for AGP / Alliance Global Partners, a registered investment adviser and broker-dealer, Member FINRA | SIPC. Mark is a regular Contributor to VEGAS LEGAL MAGAZINE and has appeared on CNBC’s CLOSING BELL, YAHOO! FINANCE MIDDAY MARKET MOVERS, FOX BUSINESS NETWORK and has been quoted in THE WALL STREET JOURNAL. Check out the Martiak Market Update Podcast wherever you listen to your podcasts.

Such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data is taken from sources believed to be reliable, but no guarantee is given of

its accuracy. Indexes are unmanaged, and investors are not able to invest directly into any index. Past performance is no guarantee of future result.

News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified, when necessary, with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not happen.

U.S. Treasury securities are guaranteed by the federal government as to the principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a priceweighted index composed of thirty widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of five hundred largest, publicly

traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. The market indexes listed are unmanaged and are not available for direct investment.

1 Goldman Sachs Portfolio Strategy Research S&P 500 Beige Book, “3 themes from 2Q 2023 conference calls: AI, US economic growth, and drivers of sales growth (volume vs. pricing),” 8/15/23

2 CNBC.com, “Retail sales increased 0.7% in July, better than expected as consumer spending is holding up,” Jeff Cox, 8/15/23.

3 CNBC.com, “Retail sales increased 0.7% in July, better than expected as consumer spending is holding up,” Jeff Cox, 8/15/23.

4 CNBC.com, “Credit card balances jumped in the second quarter and are above $1 trillion for the first time,” Jeff Cox, 8/8/23.

5 CNBC.com, “Retail sales increased 0.7% in July, better than expected as consumer spending is holding up,” Jeff Cox, 8/15/23.

6 First Trust Monday Morning Outlook, “An Age of Fiscal Limits,” 8/15/23

Mortgage Rates Rise with the Summer Heat

By Daniel Herrera

As the summer heats up and temperatures continue to rise; so are mortgage interest rates. As July wrapped up with very minimal changes to the interest rate environment to start the 3rd quarter, August has not seen such tranquility. Week to week, mortgage rates have continued to rise. Rates in the 3’s were great, 4’s were good, 5’s were nice, 6’s were reasonable but the current normal is heading to 7’s and 8’s. Is it too early to say that we may see rates as high as 9% or possibly in the double digits? Not at all.

Current mortgage rates are at the highest point that our country has experienced over the past 25 years, with no ceiling in sight. Mortgage applications have also continued to decline week over week, over the past 4 weeks. Less homes are becoming available on the market as inventory begins to stagnate. The urgency to find a new

home before school begins has come to an end; thus, the summer sizzle of family relocations has also ended as families welcome their children back into their new school year.

Consumers are seeing little to no incentive to sell their homes and buy a new home. If a family sells their current home that they have a 4% interest rate on and buys a larger home at a 7% interest rate, even if they finance the SAME amount on their mortgage, they would be paying approximately $800 more monthly (based on a $400,000 loan). Realistically, in order to get a bigger and better home, the typical consumer would be financing a larger amount on their mortgage for a more expensive home. This is where the stagnation begins. Consumers are more willing to stay in a home simply due to the fact that they will not increase their financial overhead. This does not

mean that there are no homes available and that no one is willing to buy.

With the growing cost incurred in owning a home, we also see that rents begin to rise across the board. The average rent has increased 2% in the Las Vegas valley in 2023 alone. The average 2 bedroom apartment median rent is currently around $1600 in Las Vegas. The rent increases between Fall 2020 through Spring of 2022 were between 25-40% (depending on region) and have stabilized at the higher rate. The median market rate, as of August 2023, on home rentals is hovering around $2000 within Las Vegas. This number is slightly lower than at this same time last year (approximately $150 lower than August of 2022). But remember, paying rent is the equivalent of paying 100% interest.

As of June of this year, Las Vegas home prices are down around 5.2% from last year while sitting at a median sales price of $412,000. On average, homes are receiving two offers and sell after being listed for around 38 days. Last June, these same homes were selling for more while only being on the market for 18 days on average. In June of 2022, 1,326 homes were sold whereas only 1,146 homes were sold this June. As many Americans look to relocate out of their current cities, 2% of the nation’s searches were for homes in Las Vegas. The number one location for Los Angelinos was also Las Vegas over other big cities such as San Francisco and Seattle.

The Las Vegas real estate market is one of the most dynamic and constantly changing markets in the U.S. A major factor contributing to the growth of the Las Vegas valley is the strong job market. There are many industries that drive the Las Vegas job market but the constant growth in gaming, entertainment and hospitality seem to be the major players for the Entertainment Capital of the World. With the growth of the city and the influx of more residents, the natural demand for homes also continues to grow, which in turn, also causes an increase in the value of homes. The state of Nevada is also a no income tax state which automatically provides a little more “bang for your buck” in the Silver State.

All in all, Las Vegas is still growing and will continue to grow. The rate of growth is slowing down but in reality, it does not feel that way. If you drive around town, regardless of the neighborhood, you will see new construction throughout the valley. Turn the corner, a new restaurant; drive 2 miles, new model homes; drive the strip, another casino breaking ground. With new attractions, such as the future Las Vegas A’s Major League Baseball team and the hosting of the Super Bowl and F1 Racing, the valley will continue to grow. Consumers will continue to need housing and rates are only one obstacle in the purchasing process. People will continue to buy, builders will continue to develop new neighborhoods and the Las Vegas Valley will continue to grow.

Herrera is the Senior Mortgage Loan Specialist at Laser Mortgage. He can be reached at 714.878.3112 or daniel.herrera@ lasermortgage.com

Daniel

Daniel

The Oakland A’s Plan Big League Move to Las Vegas Strip

By: Valerie Miller

Las Vegas is closer to getting its own “Field of Dreams.” After decades of trying to lure Major League Baseball to Southern Nevada, the Oakland Athletics have struck a deal to build a new ballpark on the Las Vegas Strip.

The A’s have committed to relocate to Las Vegas and build a $1.5 billion, 30,000-seat stadium on at least nine acres on the site of the Tropicana hotel. That site is 35 acres in total.

Bally’s, which owns the Tropicana, has offered the A’s the nine acres for free. That planned stadium land is worth $180 million. Bally’s, which also owns Gaming and Leisure, Inc., has given the A’s the

additional option of more land for a retractable roof.

In June, the Nevada Legislature passed Senate Bill 1, which would allow for $380 million of public funds to go to the A’s planned stadium. Nevada Gov. Joe Lombardo signed the bill into law the same month.

The A’s organization is planning to have the new Las Vegas ballpark opened by 2028. Construction would begin by 2025. While the A’s will play in Oakland through the 2024 season, the team has not determined where they will play the three seasons after that – and prior to the Las Vegas’

50 | VEGASLEGALMAGAZINE.COM

ballpark’s 2028 opening – according to the Athletics organization.

Why Las Vegas?

Las Vegas has become a boom town for professional sports with the NHL expansion of the Vegas Golden Knights in 2017, followed by the NFL’s Raiders arrival in 2020. The Raiders also departed Oakland for Las Vegas. Add to that the Super Bowl coming to Las Vegas in February, along with the Formula 1 race in November, and Las Vegas has become “a sports and entertainment capital of the world,” the Athletics’ organization says.

Major League Baseball, or MLB, also gave the A’s a push toward a Vegas relocation after two years of talks in Oakland, according to the baseball club.

“At the same time, MLB asked us to consider a new venue in the alternate market of Las Vegas,” the Athletics state. “The MLB and the (Major League Baseball Players Association) imposed a deadline of January 2024 to secure a binding agreement for a new ballpark.”

The lack of a deal in Oakland, combined with the Bally’s land offer, made Las Vegas the frontrunner for the A’s new ballpark, the A’s organization maintains. The passage of SB 1 for the $380

million in public funding solidified the move to Las Vegas.

The economic impact of the A’s move to Las Vegas is estimated to be $1.3 billion, including stadium construction jobs, the Athletics state.

Stephen Miller, the director of the UNLV Center for Business and Economic Research, has studied sports and their economic impact on Las Vegas. He says there is still a lot that is unknown about the impact of the A’s big league move to Las Vegas. This makes it hard for him to determine what kind of money having the team in Las Vegas will bring in – once the stadium construction is complete.

“Do attendees substitute buying A’s tickets for some other recreational expenditure, such as a round of golf or dinner and a movie? If so, then it may be a zero-sum game,” Miller says. “Also, the stadium is small at 30,000-plus (seats), but it does fit into the range of seating venues in Las Vegas.”

“Finally, will the A’s attract visitors to Vegas to attend games and stay around for a few days?” Miller asks. “If ‘yes,’ then that is a boost to Vegas’ number one industry, tourism.”

Valerie Miller is a Las Vegas Valley-based awardwinning journalist. She can be reached at (702) 6833986 or valeriemusicmagic@yahoo.com.

The Oakland Athletics Major League Baseball

Club Talks About the Planned Move to Las Vegas

As the landscape of professional sports continues to evolve, Las Vegas is quickly becoming a hotbed for franchises looking to capitalize on the city’s unique blend of entertainment and growing local enthusiasm for sports. The Oakland A’s, a Major League Baseball institution with over a century of history, have recently set their sights on the neon lights of Vegas, in a move that has fans, lawmakers, and entrepreneurs buzzing with anticipation. We sat down with key figures from the organization to discuss this potential relocation, examining the motivations, challenges, and the economic ripple effects such a monumental shift could generate.

Vegas Legal Magazine: What were the major reasons the Oakland Athletics decided to leave Oakland and move to Las Vegas?

Oakland Athletics: After four years of working exclusively on a new ballpark in Oakland, (Major League Baseball) expressed concern about the rate of progress in Oakland. At the same time, MLB also asked us to consider a new venue in the alternate market of Las Vegas. We spent two years on parallel paths in Oakland and Las Vegas. MLB and the (Major League Baseball Players Association) together

By: Valerie Miller

imposed a deadline of January 2024 to secure a binding agreement for a new ballpark. Given the January 2024 deadline and the absence of a deal in Oakland, our efforts in Las Vegas intensified. In May 2023, Bally’s announced a deal to provide nine acres of land on the site of the Tropicana Hotel on the Las Vegas Strip for a new ballpark. In June 2023, the Nevada Legislature passed, and Gov. Joe Lombardo signed SB 1 into law, providing a publicprivate partnership in support of a new ballpark at the site of the Tropicana Hotel on the Las Vegas Strip.

VLM: If the A’s franchise ownership decided that staying in Oakland was not a viable option for the future, why was Las Vegas selected over other cities that also desired to have a major league baseball team?

OA: MLB provided the alternate market of Las Vegas. Bringing baseball to Vegas will secure its place as a sports and entertainment capital of the world. Vegas has seen tremendous success with the [NHL’s Vegas Golden] Knights, [WNBA’s Las Vegas] Aces, [NFL’s Las Vegas] Raiders, [National Finals Rodeo] and soon, [Formula 1 racing].

52 | VEGASLEGALMAGAZINE.COM

VLM: Tax breaks, and public funding, for stadiums work in many different ways. While the NFL’s (nowLas Vegas) Raiders received millions – for their stadium -- through an extra room tax for Nevada visitors, the A’s tax funding will work a different way. Can you talk about how the tax funding for the A’s new Las Vegas ballpark will be structured?

OA: The public contribution to Allegiant Stadium was funded by an increase in the existing room tax in Las Vegas. The public contribution to the A’s new ballpark is being funded by a combination of transferable tax credits from the State of Nevada, and bonds that will be issued by Clark County. A majority of the transferable tax credits -- and all of the bonds issued by Clark County -- will be repaid by taxes that are specifically generated from the building and operation of the new A’s ballpark.

VLM: The A’s will be playing in Oakland at least through the 2024 season. As the Las Vegas ballpark is not expected to be completed until 2028, where will the A’s play after the 2024 season – and prior to the new ballpark’s completion?

OA: Where we will play in the interim has yet to be determined.

VLM: What kind of a boost do you expect the Las Vegas economy to get from the A’s move to Las Vegas?

OA: A 30,000-fan capacity ballpark creates a unique venue for year-round use. The ballpark is expected to attract 2.5 million annual visitors and fans, including an estimated 400,000 new incremental tourist visitors to Las Vegas. During construction, the project will create 16,000 construction jobs for local residents. The A’s new ballpark will require approximately 14,600 jobs over a three-year construction period, will support 5,400 jobs on an annual basis, and have $1.3 billion in annual economic impact.

VLM: The A’s have plans for an approximately 30,000-seat ballpark to be built on the Las Vegas Strip. This will be one of the smallest major league baseball stadiums or ballparks. Can you please discuss why team ownership decided to go for a smaller venue? What are the benefits of the smaller seating capacity?