4

6

Welcome note from SAIA

Welcome note from IISA

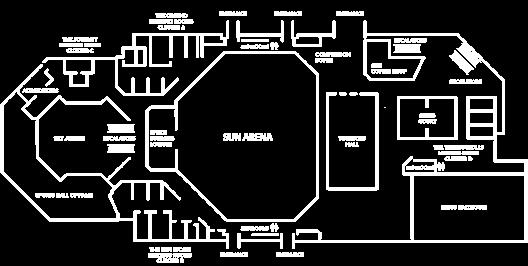

Floor Plan

Programme

IISA Membership

Santam – Partnership For Risk and Resilience

Hollard – Road Safety Initiatives

Discovery – Pothole Patrol

About our speakers and panellists

About our sponsors

About our exhibitors

IISA/SAIA/FIA info page

General information

Pearson Chief Executive Officer, South African Insurance Association

The South African Insurance Association (SAIA) and our partner, the Insurance Institute of South Africa (IISA) are thrilled to welcome you back to the industry’s flagship event. Yet again, Sun City will be a hive of activity as delegates convene for what will be a rewarding encounter. Even more exciting, is that this year’s AIE edition marks the 50th anniversary of the conference, a great milestone for an event which is a highlight on the insurance industry annual calendar. The African Insurance Exchange (AIE) has, and continues to be a platform for knowledge sharing, insightful discussions and networking with likeminded individuals who share the same aspirations for the industry.

This year is no different, the conference has an amazing line-up of speakers carefully selected to give insight on the important topics that are pertinent in the changing insurance landscape. According to a report by Deloitte Africa, the South African economy is still under pressure, reeling from supply challenges in the electricity and logistics sectors. The outlook for 2024 remains somewhat toned down and is dependent on the swiftness of structural reforms, largely to address challenges brought about by loadshedding. It is therefore imperative for the industry to gather in this manner to discuss the impact of an economic slowdown and approaches to building operational resilience.

Despite the challenges, the industry has demonstrated its resilience and relevance in the face of numerous significant loss events over the past three years. From the persistent impacts of the COVID-19 pandemic to escalating climate-related events and economic uncertainties, each hurdle has tested our resilience. Yet, we have remained steadfast and even more determined to find innovative solutions to address

indisputable, the industry now faces a critical challenge, that of mitigating escalating systemic risks and developing collaborative resilience solutions. The industry continues to grapple with adverse weather-related perils as witnessed during a recent tornado in KwaZulu Natal, which led to the loss of lives and damage to property and infrastructure. Flooding in many parts of South Africa is also no longer an uncommon occurrence thus requiring the insurance industry to constantly evaluate its products to ensure that they align with such risk.

Cyber-attacks are also a growing concern for the industry as incidents of client data breaches are on the rise, calling for stringent data protection regulations. Additionally, technological advancements which are necessary in the digital era also pose added risks, which require discussions on how business and society can navigate embracing technology, whilst also maintaining the reputational integrity of the industry.

Delegates to this year’s conference will be treated to valuable insights that are necessary in navigating through changing trends and identifying the opportunities that lie within. We look forward to engaging with you in the various discussion and plenary sessions during our time together. Furthermore, with the 2024 conference being our golden jubilee, I also hope that you will partake and enjoy in the festivities to mark 50 years of collaboration, innovation and excellence in the insurance industry.

Best Wishes

Viviene Pearson

Thokozile Mahlangu Chief Executive Officer,Insurance Institute of South Africa

Dear AIE delegate

We made it! Through all the ups and downs of the past half-century, we have arrived at the 50th African Insurance Exchange… and it promises to be incredible!

shortage in our country, we aim to enhance employment opportunities and social security, ultimately contributing to the sustainability of both the industry and the economy.

A warm welcome on behalf of the Insurance Institute of South Africa to AIE 2024. Our golden jubilee theme – Foundation. Foster. Fearless. – speaks to our core principles as an industry, our commitment to nurturing and growth, and our willingness to confront emerging challenges and opportunities. In other words: we’re here, we’re growing and we’re doing amazing things despite the challenges we face!

As usual, we are delivering something for everyone at this year’s AIE. Our speakers and panellists come from across the industry. They will discuss a variety of topics, including our evolution and future as an industry, as well as contemporary issues such as AI, ESG, alternative energy, the protection gap and cyber risks.

This year’s keynote will be delivered by former deputy president of South Africa, Phumzile Mlambo-Ngcuka. Her talk will focus on transformational leadership that inspires positive changes, empowering and inspiring people to accomplish positive change through collaborative engagements.

Furthermore, we look forward to recognising a number of stalwarts who have contributed to the IISA and set the foundation for where we are today. These incredible individuals are Mr David Harpur, Ms Margaret Nienaber and Ms Delphine Traoré. We would like to express our deepest appreciation for their significant contributions to the IISA. Their dedication, hard work and unwavering commitment to excellence have inspired and motivated countless individuals in the industry. We salute you!

For those who can’t join us at Sun City, the conference feed will be streamed live via web link, which means you can join us from literally anywhere in the world.

As the Insurance Institute of South Africa (IISA), our mission is to strengthen the insurance industry through comprehensive skills development and professional exposure. By addressing the skills

The African Insurance Exchange 2024 serves as a pivotal platform for insurance professionals to grow and learn collaboratively, in alignment with the IISA’s mission. This large-scale gathering not only elevates the profile of the insurance industry but also reinforces the sense of community and belonging within it locally, on the rest of the continent, and globally.

Our organising committee has curated a bumper conference that promises to be both enjoyable and educational, offering ample opportunities to reconnect with old friends and forge new connections. A heartfelt thanks to the team for their tireless efforts in making this event possible.

Finally, we extend our deepest gratitude to our generous sponsors and exhibitors, whose ongoing support is crucial to the success of the African Insurance Exchange.

Their invaluable backing of the conference goes beyond supporting our financial needs. They have also provided subject matter experts to be part of the programme and have sent through delegates to join us at this auspicious event.

Whether you are attending in person or virtually, we encourage you to engage with our sponsors and exhibitors during and after the conference.

We wish you an enriching and enjoyable African Insurance Exchange 2024!

Warm golden jubilee regards,

Thokozile Mahlangu Chief Executive Officer Insurance Institute of South Africa

SKY TRAIN

DISABLED FACILITIES

NOT ACCESSIBLE TO DISABLED

MEDICAL ASSISTANCE

SMOKING CASINO

NON-SMOKING CASINO

RESTROOMS

GOLF COURSE

EXHIBITOR & STAND NUMBER:

Old Mutual Insure - Digital Hub

Elite Risk - Pamper Pod

A1 - JMR Software

A2 - Iceye

A3 & A4 - Santam

A5 - Lightstone

A6 - Search Works 360

A7 & A8 - Software Solutions Partner

A9 – Earnix

A10 – Octomate

A11 & A12 – Rand Mutual

A13 – R oot

B1 & B2 - Sapiens

B3 & B4 - Plumblink

B5 - DGC Glass

C1 - Milpark

C2 – The Nairobi Declaration of Sustainable Insurance

C3 - Hyland

C4 & C5 - ISB Optimus

SEERS COURT 1

Lloyd’s – ‘Meet the Market’ Underwriting Room

SEERS COURT 1

D1 & D2 – Kwikot

D3 – Inseta

D4 – Payat

D5 & D6 – Europcar

D7 – GIFS

D8 – Infobip

Golf Day at the Gary Player Country Club

07:30 - 17:00 Golf

Visit the AIE 2024 virtual platform for more details on each session.

18:00 - 23:00 Welcome cocktail

Conference Facilitator Ms Tumelo Mothotoane

MONDAY

21/07 22/07

08:00 - 08:20 Welcome procession Day 1 Business Sessions

08:20 - 08:35 Welcome address and setting the scene: Ms Thokozile Mahlangu

08:40 - 08:55 Recognition award: Mr Collin Molepe

09:00 - 09:45 Key note address: Dr Phumzile Mlambo-Ngcuka

09:50 - 10:30 The foundations of insurance, evolution and looking ahead Ms Dawn Miller; Commercial Director at Lloyds of London

10:30 - 10:45 Networking and tea break

10:45 - 11:45 The evolution of insurance (How the evolution of insurance is shaping the fundamentals of the business of insurance)

Ms Dawn Miller - Commercial Director at Lloyds of London

Collin Molepe to fascilitate the discussion

Nico Conradie - CEO at MunichRe

Thabo Twalo - Chief Underwiting Officer at Santam

11:45 - 12:45 Insurers evolving to address the changing operating environment and greater societal impact

Andrew Warren, Insurance Leader at Delloitte

Bianca Radzilani, Executive Head for Insurance Partnerships at Bryte

Soul Abraham, Chief Executive Officer : Retail business at OMI

12:45 - 13:45 Lunch and Networking

13:45 - 14:45 Will generative AI be part of everyday life?

Shaheed Petersen - Senior Accountant Advisory Services, KPMG

Cliff de Wit, Netstar Chief Thechonoly Officer

Robert Attwell, CEO at Discovery Insure

14:45 - 15:45 Is ESG embedded into business operations and corporate strategies to create value?

Martine Botha Senior Manager Sustainable Finance -

Kershia Singh, Head of the Policy Support Department at FCSA

15:45 - 16:45 Reimagining life insurance

Yazeed Adams, Head of Strategy, Governance and Transformation at MiWay Life

Eugene Strauss, Managing Executive: Absa Life insurance

Elaine Markus, Head, Insurance Products at Standard Bank Insurance Brokers

16:50 - 17:30 IISA AGM

End of day 1 Business sessions

18:30 - 23:30 Gala dinner

09:00 - 09:50 The future of healthcare is brighter than ever

Ana Endres, Chief Digital Officer at Discovery Health

Doug Rix , Head of Underwriting R&D,

09:50 - 10:45 Alternative energy solutions

Moosi Molefi, Managing Director at Old Mutual Short Tem Insurance Botswana,

Daniel Schroeder, Senior Risk Engineer at Allianz

Thato Serapelo, Renewable Energy Specialist, Bryte Insurance

10:45 - 11:00 Networking and tea break

11:00 - 11:50 Operational resilience in a changing environment

Ben April, Associate Director, KPMG

Shaka Zwane , Head of Insurance & Fiduciary at SBIB

Jessica Kutumela, Chief Risk Officer: Guardrisk Insurance Group & IISA board member

11:50 - 12:45 The growing protection gap is indicative of insurers struggling to design products fit for the evolving risks

Angela Jack, Executive Head: Specialty, Broking & Risk Solutions -AON

Henrico Botha, Senior Vice President, Guy Carpenter

Hayley Clarke, Chief Acturial Officer, Sasria SOC Limited

12:45 - 13:50 Optimising technology to supplement human capital

Dr. Candice Hartley (PhD), Head of People at KPMG

Portia Mogale, Managing Executive: Human Capital at Sanlam

Ian Chauvet, Founder & Principal Consultant –Thrive People & Strategy

13:50 - 14:30 Lunch and Networking

14:30 - 15:25 Navigating the Competition or Coopetition Paradox to Foster Innovation in the Insurance Industry

Marianne Wagener , Competition Lawyer

Trina Bowser, Managing Director in Accenture Consulting’s Insurance Practice

15:25 - 16:10 Could cyber attacks lead to a pandemic?

Charl Ueckermann, Group CEO of Aves

16:10 - 17:00 Closing talk

Danny Myburg, MD of Cyanre the Digital Forensic Lab, Dee Chetty, Chief Product Officer at TransUnion,

Carolyn Steyn – South African media personality and founder of the non-profit organisation, 67 Blankets for Nelson Mandela Day

Farewell party: 20:00 - 23:30

IISA’s unique selling point is: A partner of choice in professional development.

IISA’s purpose is to elevate the credibility of the insurance profession: support, empower, and connect professionals within the Financial Services sector, fostering growth, development, and success.

IISA’s value proposition to members and corporate partners:

1. Industry Recognition:

Widely acknowledged and respected professional body within the industry, providing members with a mark of quality, prestige and expertise that enhances their professional reputation.

2. Credibility and Trust:

Being a member enhances an individual’s credibility and demonstrates commitment to professionalism, continuing development, and ethical standards.

3. 3. Advocacy and Representation:

Act as a strong advocate for members’ interests and the industry as a whole, representing their concerns to government bodies, regulatory authorities, and other relevant stakeholders, influencing policies and decisions that impact the profession.

4. Continuing Professional Development:

Offer exclusive, cutting-edge training programs tailored to the specific needs of members and the industry, helping them to stay ahead of industry trends and developments, regulations, and best practices through training, workshops, seminars, and conferences.

5. Access to Resources and Publications:

Access to wealth of resources including research papers, industry publications, journals, and other valuable resources. This allows professionals to stay informed about emerging trends, research findings, and industry insights.

6. Networking and Collaboration Opportunities: Provide a platform for members to connect, collaborate, and learn from other professionals in the field, facilitating valuable networking opportunities and the exchange of ideas.

As a professional accredited by the IISA, you enjoy all the above listed benefits. You can become a professional member through the academic approach or through Recognition of Prior earning (RPL).

There are three designation that the IISA offers:

• Licentiate – one needs to have an NQF 5 with at least three years’ experience, or three years’ experience with evidence of knowledge areas and competencies.

• Associate – NQF 6 with five years’ experience or seven years’ experience with evidence of knowledge areas and competencies.

• Fellow – NQF 7 with seven years’ experience or ten years’ experience with evidence of knowledge areas and competencies and must have practiced as an Associate for at least two years and be in good standing with regards to CPD compliance and membership fees.

It is imperative that all professionals within the industry to be accredited as this denotes one’s level of expertise and commitment to continuous development as well as elevation of the credibility of the holder of the designations.

Professionals are therefore invited to take the next step in their career development and become accredited professionals by reaching out to the IISA at communications@iisa.co.za or sales@iisa.co.za.

We look forward to welcoming you all as accredited professionals.

people benefited from the P4RR initiative

66 000 people reached with targeted disaster risk education

14 municipalities participated in the CSIR’s GreenBook rollout

Our broad range of insurance solutions, stretching into all areas of general insurance, across personal, commercial, agriculture and specialist markets.

We have been offering insurance for over 105 years and over this time, we have made it our business to understand what is important to our clients and the risks they face. This is why over 80 of the top 100 JSE-listed companies trust us to protect their businesses.

Hollard - Road Safety Initiatives

Hollard Trucking is a specialist division of Hollard Insure that offer comprehensive insurance for heavy motor vehicles. It is committed to improving road safety in South Africa, and one such way is through the Hollard Highway Heroes initiative.

Hollard Trucking is a specialist division of Hollard Insure that offer comprehensive insurance for heavy motor vehicles. It is committed to improving road safety in South Africa, and one such way is through the Hollard Highway Heroes initiative.

It was launched to address the road fatalities and destruction of assets, infrastructure, and property caused by heavy motor vehicle accidents in South Africa. Hollard Highway Heroes is a transformative annual competition that requires truck and bus driver to internalise good driving habits and rewards those who go above and beyond to not only deliver their cargo and passengers safely and on time but also to drive responsibly, looking out for other road users and safeguarding their fleet owners.

It was launched to address the road fatalities and destruction of assets, infrastructure, and property caused by heavy motor vehicle accidents in South Africa. Hollard Highway Heroes is a transformative annual competition that requires truck and bus driver to internalise good driving habits and rewards those who go above and beyond to not only deliver their cargo and passengers safely and on time but also to drive responsibly, looking out for other road users and safeguarding their fleet owners.

With a focus on road safety, Hollard Highway Heroes meaningfully impacts all road users in South Africa. In addition to participating drivers, the initiative aims to inspire non-participating colleagues to emulate these safety behaviours. This programme also aims to drive financial value for participants through lowering fuel and maintenance costs and reduce accidents. To extend the impact, the competition was opened to bus drivers for the first-time last year and to all fleet owners across the country regardless of whether they are insured with Hollard or not.

With a focus on road safety, Hollard Highway Heroes meaningfully impacts all road users in South Africa. In addition to participating drivers, the initiative aims to inspire non-participating colleagues to emulate these safety behaviours. This programme also aims to drive financial value for participants through lowering fuel and maintenance costs and reduce accidents. To extend the impact, the competition was opened to bus drivers for the first-time last year and to all fleet owners across the country regardless of whether they are insured with Hollard or not.

Hollard Risk Services Bureau

The Hollard Risk Services – Trucking Bureau will be ten years old this year. The purpose of the Bureau is to actively monitor and report on high-risk driving behaviours. The Bureau has two main functions namely the live monitoring function (24 -hour live monitoring on 20+ tracking systems) and the reporting function (daily, weekly and monthly historic reporting on bad driving behaviours). The Bureau currently monitors over 6000 trucks with over 40 000 high-risk alarms (impact Alerts, battery disconnects, jamming alerts, panic alarms) received monthly and roughly 3500 phone calls made. The reports being sent out daily, weekly and monthly consist of driver behaviour scorecards (speeding, harsh-braking, fatigue driving) and various other bad driving behaviour indicators. The reporting function also administers and facilitates the rewards card programme and the Highway Heroes campaign.

The Hollard Risk Services – Trucking Bureau will be ten years old this year. The purpose of the Bureau is to actively monitor and report on high-risk driving behaviours. The Bureau has two main functions namely the live monitoring function (24 -hour live monitoring on 20+ tracking systems) and the reporting function (daily, weekly and monthly historic reporting on bad driving behaviours). The Bureau currently monitors over 6000 trucks with over 40 000 high-risk alarms (impact Alerts, battery disconnects, jamming alerts, panic alarms) received monthly and roughly 3500 phone calls made. The reports being sent out daily, weekly and monthly consist of driver behaviour scorecards (speeding, harsh-braking, fatigue driving) and various other bad driving behaviour indicators. The reporting function also administers and facilitates the rewards card programme and the Highway Heroes campaign.

The Pothole Patrol team have filled over 219 000 potholes since the initiative started in 2021,

• There have been over 20 600 app downloads since launch, with more than 67 000 potholes reported through the app to date.

• Through the initiative, Discovery Insure clients have made a potential saving of 21% from expected pothole claims

• Discovery Insure data showed a 26% drop in pothole-related claims in Johannesburg from May to December 2021, compared with an increase of 45% in the rest of Gauteng over the same period.

• In 2022, pothole-related incidents per 100 km increased by 29% throughout the country, while it remained flat in Johannesburg.

• As at June 2023, Discovery estimates that the monthly impact of pothole damage in South Africa has a resulting effect of about R500-million a month, equates to buying 550 000 brand new tyres monthly.

The Discovery Pothole Patrol operates seven days a week, focusing on major (high traffic/high risk) roads in Johannesburg that are known to have potholes and those reported on the Pothole Patrol app.

Discovery and Avis have together launched the Discovery Pothole Patrol Academy. The academy is an Inseta co-funded and accredited skills development programme offered in the form of a 12-month learnership currently employing and training 24 learners.

The learners, upon completion will receive an accredited NQF 3 : Construction Roadworks certificate. It aims to empower youth with viable skills that can be used after the training and to improve their income-generating prospects.

Dawn Miller

Commercial Director | Lloyd’s

Dawn joined Lloyd’s in 2022 and oversees Lloyd’s global network across the Americas, Asia Pacific Middle East & Africa (APMEA) and European Regions. She is responsible for our Global Network governance, market development, strategic engagement with key trading partners, and New Entrants into the Lloyd’s Market. She also leads on Strategy & Innovation at Lloyd’s, including the Lloyd’s Lab. Dawn has over 25 years of experience working in the global insurance industry with oversight of underwriting, distribution, clients, and strategy, including leadership positions at CHUBB, AXA, AIG and WTW. Having started her career in Washington D.C., Dawn has since taken on senior positions in London, Houston, New York, Paris, Dubai, San Francisco and Zurich.

Dawn is chair of the Board of Trustees for the Insurance Industry Charitable Foundation UK (IICF UK), sits on the Steering Committee for Maths4Girls as well as the Executive Council of the International Insurance Society (IIS).

Robert Attwell

Chief Executive Officer, Discovery Insure

Robert Atwell is the Chief Executive Officer of Discovery Insure. He has a BSc Actuarial Science and Mathematical Statistics and a BSc Honours Actuarial Science (Cum Laude) from the University of the Witwatersrand. Whilst working full-time, Robert also completed a Higher Diploma in Taxation (Cum Laude) and participated in an Accelerated Development Programme at London Business School. He currently serves on the board of Cambridge Mobile Telematics, the world’s largest telematics provider, and SAIA.

Nico Conradie Chief Executive Officer, Munich Re of Africa

Nico obtained M.Sc. degree from the University of Northwest in South Africa. He has over 30 years’ experience in the reinsurance industry. He commenced his professional career in reinsurance at Hannover

Re Africa (previously Hollandia Reinsurance Group) in 1991 where he held various roles including Treaty Underwriter, Non-Life General Manager and Managing Director for Hannover Life Re Africa.

He joined Munich Re of Africa as the Executive Manager for the Life Reinsurance Division in 2003. In 2011, he moved to Munich Re Group Australasia as the General Manager for the Life Reinsurance Division. Nico was appointed as the Chief Executive Officer of Munich Re of Africa in 2016.

“As the soil, however rich it may be, cannot be productive without cultivation, so the mind without culture can never produce good fruit”

– Seneca the Younger

Executive: Insurance Partnerships

Bryte Insurance Company Limited (South Africa)

Bianca Radzilani is an admitted attorney with 16 years post articles experience. She practised as an attorney for 3 years and was employed as a legal adviser at a commercial property company for 2½ years. She commenced her career in insurance with Liberty Group Limited as a senior legal adviser. She was thereafter employed at Bryte Insurance Company Limited as Executive: Legal, Compliance and Company Secretariat.

She then joined Guardrisk Insurance Limited as the Managing Executive: Governance. Legal and Compliance. She is currently employed as the Executive for Insurance Partnerships at Bryte Insurance Company Limited. She has experience in asset management, complex commercial contracts, dispute resolution, life, non-life and microinsurance insurance and pensions funds, litigation, competition act-related matters, anti-money laundering, strategy and commercial structuring and solutioning. She enjoys travelling with her family, the art of baking, reading and playing golf. She is

Collin has more than 25 years of experience across banking, medical insurance, and short-term insurance sectors of the financial services industry. He has acquired and developed his technical and leadership skills through experiential learning and continuous training. Supported by an entrepreneurial mind-set, his specialization includes business strategy, business optimization, cost control, waste elimination and process improvement and project execution.

He is accustomed to leading large scale transformation programmes that are geared towards changing the operational and technology landscapes of an organization. Collin has held executive positions at Bryte Insurance, Discovery Health as well as previously with Absa Insurance. He is currently CEO of Absa Insurance and holds executive directorships on various Absa Insurance boards.

Collin completed an MBA with Henley Business School; Lean and Six Sigma with BMGI; Associate in Management Practice with UCT Graduate School of Business; Programme in Economics & Public Finance and Financial Management with UNISA. He is a member of the OSTI Board.

He is passionate about people, process improvement and change management and leads teams through motivation to achieve a common purpose. More importantly, he enjoys youth development.

Grant Fraser Managing Director | Netstar

Grant Fraser is a seasoned executive leader with over 14 years of experience, recently appointed as the Managing Director for Netstar within the JSE-listed technology group Altron, effective from January 2023. His journey to this pivotal role has been marked by notable achievements and strategic contributions across various sectors.

Prior to his tenure at Amecor, Fraser held the position of Chief Operating Officer at Mix Telematics Africa, where he played a vital role in transforming the company into one of the foremost stolen vehicle recovery (SVR) and telematics enterprises in Africa. His responsibilities encompassed overseeing subscriber growth and retention strategies, particularly within fleet and consumer segments, thereby solidifying Mix Telematics’ position as a market leader.

In his new role at Netstar, Fraser is poised to capitalise on the company’s legacy as a trailblazer in vehicle asset connectivity and protection. His vision is centered on leveraging innovative technology to provide cutting-edge fleet management solutions, software services, and vehicle tracking solutions. His appointment has been hailed by Altron Group Chief Executive Werner Kapp, who lauded Fraser’s drive, strategic acumen, and customer-centric approach, affirming his belief that Fraser will steer Netstar towards a future marked by sustained growth and innovation. With a track record of success and a commitment to excellence, Grant Fraser stands poised to lead Netstar into a new era of innovation and market leadership, driven by a relentless pursuit of customer satisfaction and technological advancement.

At Old Mutual Insure, we take pride in our tradition of service, quality, and a comprehensive range of non-life insurance products tailored to meet personal, commercial, and corporate needs. With over 179 years of experience, we are one of South Africa’s oldest non-life insurers.

Our purpose is to protect mutually positive futures every day. Through our multi-channel distribution networks and partnerships, we provide policies that cover property damage, personal accidents, agriculture, engineering, liability, marine, motor accidents, health, travel, credit protection, and trade credit risks.

Join us and pursue your dreams and ambitions with confidence, knowing that caring for what matters most to you is our top priority.

Contact your broker today or visit ominsure.co.za for more information.

Andrew is a Director at Deloitte Africa. He is the insurance sector advisory lead and business leader of the Financial Services Advisory business unit, a team that focuses on quantitative and regulatory advice and assurance to the financial services industry. He has experience in both senior executive leadership in, and consulting to, the insurance and savings industry in South Africa. His client delivery focus is on implementing regulatory and strategic changes in the insurance industry. As insurance sector lead, he brings all of Deloitte’s capabilities more effectively into the African non-banking financial services industry.

Managing Director | Old Mutual Short-term Insurance | Botswana

Mosimanegape Molefi joined Old Mutual Short-term Insurance Botswana in 2023, bringing over 17 years of experience in the actuarial domain.

With a career spanning various facets of the actuarial world, Mosimanegape has proven his versatility. From pensions to life insurance, short-term insurance to medical aids, social security, and unconventional domains such as mining and telecommunications, he has consistently demonstrated his prowess as a seasoned actuarial professional. He held significant roles at Ernst & Young LLP in London, Deloitte Consulting Johannesburg and Debswana.

Shaheed Petersen

CA (SA) for Corporate Division | KPMG Shaheed is a CA (SA) working in the Corporate Finance division of a Big 4 firm. He’s passionate about fintech, artificial intelligence, big data, blockchain and the metaverse. Shaheed enjoys writing about how these technologies impact finance and has written articles about topics such as the accounting treatment of non-fungible tokens, insurance in the metaverse, and generative AI in insurance. As a panellist at the African Insurance Exchange 2024, he looks forward to sharing practical insights on the evolving landscape of insurance and everyday life in a digital era.

Mosimanegape Molefi’s commitment to continuous growth and expertise is evident in his extensive academic achievements. He has earned prestigious qualifications, including the Chartered Enterprise Risk Actuary (CERA Global) designation and a Fellowship with the Institute of Actuaries (UK). His academic journey is further enriched with fellowships, post-graduate diplomas, and certificates in actuarial techniques, finance, and investments.

These credentials, along with his Bachelor of Commerce in Actuarial Studies from Macquarie University in Australia, underscore his dedication to stayingat the forefront of his field.

Mosimanegape Molefi’s leadership in the actuarial community is a testament to his influence and recognition. Since December 2019, he has served as the Chairperson of the Botswana Actuarial Society, a role that highlights his ability to guide and shape the industry. Additionally, his membership in the IFoA (UK) African Actuarial Standards Committee since April 2019 further demonstrates his commitment to maintaining high professional standards.

Eugene Strauss

Managing Executive | Absa Life

I am a business leader who works with Executives, Boards and teams to enable personal and business growth by identifying opportunities for growth through analysis and strategic orientation. I love to continuously develop and stretch myself and I am a natural change agent for culturalled growth. I have a passion for developing people to unlock their full potential.

Currently Managing Executive for Absa Life (since 2019). Responsible for setting strategic direction and leading the executive team of the Life insurance business of the Absa Group and a member of the Executive Committee of Absa Product Solutions Cluster. Co-developed an exciting growth strategy, underpinned by a strong organizational culture currently in execution. Key responsibilities include overall direction and leadership of the executive team as well as ensuring that the culture, people and capabilities are in place and aligned to our goals to deliver value for all stakeholders.

Previously Chief Financial Officer (CFO) of Wealth, Investment Management and Insurance (WIMI) (6 years). As CFO I operated as a trusted right hand to Chief Executives. I apply insights, data and strategic awareness to advise and formulate decisions regarding the strategy and performance of the Group of businesses.

More than 15 years’ experience in various leadership roles within the Financial Services industry, also holding the following notable positions during my career: CFO of Absa Life; Head of finance and data support: Individual Life at the Liberty Group and Financial Management roles in Absa, Liberty Group and Capital Alliance Life.

I am a member of the South African Institute of Chartered Accountants CA(SA) and obtained a Masters level qualification (PGD) in Strategy and Innovation from the University of Oxford. I also hold a B.Com (Accounting) and B.Com (Honours) (Accounting) from the University of Pretoria.

In an ever-changing world, one full of uncertainty and increasing risk, still, we all need peace of mind. Through our partnership with agent companies and brokers, Sasria supports the advice-led approach to help deliver on our promise –when things go bad, we make good.

As South Africa’s only special risk insurer, Sasria is committed to creating and maintaining impactful partnerships. We value your diligence and the role you play in providing an exceptional service on our array of product offerings.

Your dedication inspires us to create stronger and simplified collaborations with you, so that together, we can seamlessly cater to our clients’ needs.

For more information on how to make special risk insurance less risky, visit sasria.co.za

Head of Personal Products: Life & Non-life Insurance | Standard Bank

Elaine Markus boasts an impressive 25-year tenure in the financial services industry, with extensive expertise in personal lines insurance and insurance operations management across South Africa and the African continent.

Her 19-year tenure at the Standard Bank Group has seen her take on the position of Head of Personal Products: Life and Non-Life Insurance. Throughout her career, Elaine has led high-performing teams, driving sustained business success and growth. Currently pursuing her Master’s in Corporate Strategy, Elaine holds a BCom Degree, BCom Honours in Business Management, and various other qualifications, including an Information Technology Diploma.

Additionally, she has completed the executive development programs at the Wharton School of Business, University of Pennsylvania, and earned a Digital Leadership certification from the Massachusetts University of Technology. Elaine is a strategic, people-driven leader with a passion for unlocking sustained value. She excels at leading teams to achieve strategic goals, driving business growth and fostering partnerships for the development of innovative products and ecosystems.

Group Chief Executive Officer | AVeS Cyber International

Charl Ueckermann currently serves as the Group Chief Executive Officer at AVeS Cyber International and assists organisations with strategic IT solutions. He has more than 27 years’ of in-depth experience in the IT industry, specialising in banking, government,

automotive, manufacturing & telecom industry verticals. Charl has a proven track record in IT and business strategy in the SMB and Enterprise markets.

Charl has a background in numerous technical, theoretical, and other business areas in the IT industry and is committed to adding value and exceeding expectations through creative idea generation, collaborative problem-solving, and disciplined decision-making. His goal is to build a world-class team who can solve problems using technology, people and processes.

Shaka Zwane

Head: Insurance and Fiduciary | Standard Bank South Africa

Shaka Zwane is a seasoned banking and insurance executive with over 29 years of business experience. He presently leads the insurance and fiduciary business at Standard Bank of South Africa. He has extensive banking experience in private, high-networth, business and commercial, as well as offshore banking, most of which has been acquired through jobs in distribution and executive strategic roles. Shaka diversified into the insurance, financial advisory, and fiduciary sectors later in his career, holding multiple senior positions from 2017 until the present. He also serves on various boards, including Standard Bank Insurance Brokers, Standard Trust Limited, and Standard Bank Umbrella Fund, to name a few.

Beaming with an undeniable passion and zest for life, Shaka is instrumental in championing a number of strategic projects in Wealth Management, promotion of a savings culture and other key initiatives within the Insurance industry. A believer in personal development, mentorship for growth and youth development, he believes that the youth are the wealth of our beautiful country and as such should be nurtured and developed in various skills. Shaka is an avid reader who also loves the outdoors and travel. He is a doting father of two - his daughter currently in high school and son completing his university studies.

-Peter Drucker Discover

“The best way to predict the future is to create it.”

Portia Mogale

Managing Executive Human Capital | Sanlam Corporate

Portia is an experienced Business Transformation, Change Management and Human Capital leader. She has worked with organisations, teams, and leaders to develop the skills needed to navigate massive transformative change while driving business results.

Her experience spans multiple industries in Africa and Asia, including mining, management consulting and technology. In her current role as the Human Capital Executive at Sanlam Corporate, she is responsible for defining and leading the delivery of the People strategy. She has a keen interest in designing and enabling organisational cultures that drive high performance while being inclusive and diverse.

Portia holds a BA (Hons) Business Management from the University of Lincoln, is a certified Executive Leadership Coach and a Certified Change Management Practitioner. Portia is a speaker, facilitator on human resilience, wellness in the workplace, and the changing role of human capital.

Thabo Twalo Chief Underwriting Officer | Santam Broker Solutions

Thato is the immediate past president of the Insurance Institute of Gauteng (IIG) and has extensive experience in insurance and reinsurance (+20yrs) having worked for two of the leading global reinsurers (Swiss Re and Munich Re). Within the industry, he has worked in a range of functions including underwriting, actuarial pricing, governance and client management.

Thabo has also been active at an insurance industry level for a number of years. He has chaired the Property Technical Steering Committee at the South African Insurance Association (SAIA) and currently serves on the board of the Fire Protection Association of South Africa (FPASA) Thabo graduated from the University of the Witwatersrand in Economic Sciences, majoring in Mathematical Statistics and Actuarial Science.

Thabo and his wife Nelisa have three children, two girls (8yrs old and a 3yr old) and a boy (5yrs old).

Yazeed Adams

Executive Head of Strategy, Transformation and Governance | MiWayLife

Having first started his career in financial services 20 years ago, Yazeed has moved across disciplines in the insurance and financial services world. He is presently completing his PhD on ‘Insurance in the changing world of regulation and technology’ which reviews the purpose and adoption of new strategies in life insurance. He has been part of teams that set up directto-client insurance businesses for telco’s, banks, and insurers, including launching multiple technologies to support access to insurance and digital adoption.

Having honed his skills in governance and risk management, Yazeed has been regarded as a competent driver of responsible advancement in the insurance sector, seeking better outcomes for consumers and businesses. Currently, he carries the title of Executive head of Strategy, Transformation, and Governance at MiWayLife, a division of Sanlam.

“The best way to predict the future is to create it.”

-Peter Drucker

Daniel Schroeder

Senior Risk Engineer | Allianz Commercial

Daniel is a Professionally Registered Civil (Structural) Engineer with an honours degree in structural engineering from the University of Pretoria. Prior to joining Allianz Daniel was a practicing professional structural engineer. As he performed all site inspections on RSA and Africa-based projects, he has a very good understanding of the African and Middle East construction and engineering market. Since joining AGCS Daniel’s has become an expert on large-scale civil construction projects. He has worked on some of the largest recent projects in Europe and the Middle East.

Prof Danny Myburgh

Kershia Singh

Head of Policy Support: Regulatory Policy Division | The FSCA

Kershia Singh is currently the head of the Policy Support department at the Financial Sector Conduct Authority, within the Regulatory Policy division. Her portfolio involves, amongst others, driving the FSCA’s objectives of supporting financial inclusion and transformation of the South African financial sector, and the development of the FSCA’s approach to sustainable finance. In addition to policy development, the department is also responsible for deepening the FSCA’s customer and market insights to better inform regulatory and supervisory policy and approaches.

MD of Cyanre the Digital Forensic Lab & CyberCom Africa

Danny established and commanded the SAPS’s National Computer Crime Investigation Unit. After his career in law enforcement, he launched three companies specializing in digital forensics, incident response and eDiscovery services of which he is currently the Managing Director. At age 40 he realized that common-sense and qualification by experience can only take you that far - so he completed a BComm Honors degree in Information Systems at UCT and an MComm Forensic Accounting degree at NWU (both completed Cum Laude - to the amazement of both his wife and mother).

Trina Bowser Managing Director | Accenture Consulting: Insurance Practice

Trina is a Client Account Lead responsible for the relationship Accenture has with two Global Property & Casualty Insurance Companies. Trina specializes in guiding clients through dynamic and evolving market conditions, leveraging leadingedge technologies, capabilities, and solutions. With a strong focus on insurance underwriting, she excels in enabling strategic growth, driving large-scale transformation, and implementing operational change to help clients navigate and thrive in a rapidly changing environment.

Cliff de Wit Chief Technology Officer | Netstar

Clifford’s is a qualified Electrical Engineer graduating from WITS university in 1996. His passion for computing led him into financial services, where he worked in a team that launched one of world’s first internet banking solutions in 1998 with Nedbank. He Joined Microsoft in 2000 and in 2009 Clifford took on a director role of running one of the 7 segments within Microsoft South Africa. In this role amongst other things he developed and launched the SA BizSpark start-up program which mentored over 3000 tech start-up’s, manged the Microsoft relationship with South African universities, managed the DevOps business in South Africa, and ran and keynoted several conferences including TechEd, DevDays and Build Tour. After almost 18 years with Microsoft Clifford decided to build a start-up of his own took on the role, of CTO and co-founder. As with many startups this journey had many lessons on how to build a business from the ground up

In his current role Clifford is the CTO of Altron Netstar. In this role, he is responsible for looking after all aspects of the company technology from Hardware to Software and internal IT. Netstar is on an ambitious

Soul Abraham Chief Executive of Retail | Old Mutual Insure

Soul has been with OMI for nearly 10 years in various roles. He has in-depth knowledge of the Personal, Commercial, and Agri sectors in the non-life insurance industry. He is passionate about the industry, and about leveraging technology and data to achieve operational and financial excellence.

In his previously role, he was the Head of Strategy for Old Mutual Insure. He holds an Actuarial Science Honours degree from Wits University and a Post Graduate Diploma in Leadership through the University of Stellenbosch. When he is not at work he loves spending time with his young family. Soul is also an avid golfer and sportsman.

Global Head of Underwriting R&D Core & Innovation | SwissRe

With over 20 years of experience in the financial services and insurance industries across a variety of roles ranging from investment management, underwriting management and leading Swiss Re’s L&H underwriting research. He has played key roles in delivering award-winning products, new risk assessment models and exploration of emerging risks and trends across international markets.

Doug currently focuses on innovation management providing consultancy expertise and delivery of projects across product development, automation & technology utilisation and people development across the underwriting and claims functions.

Dee Chetty

Chief Product Officer | TransUnion

Dee Chetty is the Chief Product Officer at TransUnion Africa and member of the company’s executive team. In this role he helps drive new solutions and product innovation, identifies and incorporates new data assets and usage, and delivers analytical insights for the benefit of African businesses and consumers.

Before joining TransUnion, Chetty was the Chief Marketing and Digital Officer at Philip Morris International. Chetty holds a BSc in Mathematics, Statistics and Computer Science from Osmania University.

Chief Digital Officer | Discovery Health

Ana is the Chief Digital Officer at Discovery Health. She joined Discovery in 2010 and over time headed a number of departments, including: Africa Health Insurance, DiscoveryHealthcare Services (portfolio of healthcare provision businesses - pharmacy, home nursing, health coaching and wellness), Digital Health Platform and Special Projects (which develop, pilot and launch a number of the digital health and innovation programs).

Before joining Discovery, Ana was a strategy consultant at McKinsey&Company and at Dalberg Development Advisors, where she advised a range of clients in Europe, United States and Africa, including financial services companies, public health sector clients and international development financial institutions and foundations.

Ana also worked at Johnson & Johnson as an international product manager based in the UK, where she managed a brand of a medical device with annual sales of US$145million, across 38 countries in

Renewable Energy Specialist | Bryte Insurance

Thato Serapelo is a seasoned underwriter who currently Leads Bryte Insurance Company Limited’s Renewable Energy and Africa Desk. His insurance background includes Construction and Engineering Underwriting, Liability and Professional Indemnity (PI) underwriting, as well as Business Development and Account Management specializing in Bonds and Guarantees from his tenure in Insurance broking.

Senior

Botha

Vice President | Guy Carpenter

Henrico studied Bcomm. Law at the University of Stellenbosch and then joined the reinsurance industry straight after. Starting his career 11 years ago as a reinsurance broker at Gallagher Re (ex-Willis Re), where he spent 5 years doing support, facultative and treaty broking. He then joined Guy

Carpenter in 2018 where he’s been leading the structuring, negotiations and placements of some of the country’s biggest insurance

Angela Jack

Executive Head: Speciality, Broking & Risk Solutions | AON South Africa (Pty) Ltd

A dedicated specialist within the Financial Services and Specialty arenas with 24 years’ expertise in the placement of Financial Lines insurances, specifically Directors; Officers Liability, Trustees Liability, Bankers Blanket Bond and Professional Indemnity, Representations and Warranties and Public Offering of Securities. Angela has also managed the wider Aon Specialty team including Marine, Aviation, Construction and Engineering portfolios.

In addition to the Specialty portfolio Angela currently has managerial oversight of the wider Broking and Risk Consulting areas of the Aon portfolio.

Dr Candice Hartley Head of People | KPMG

Dr. Candice is an experienced executive, having held various leadership roles in publicly listed and multinational companies across various sectors nationally, regionally and internationally. Her passion is in growing businesses through ensuring excellence in people management strategies and creating an inclusive world of work.

She holds a Bachelors and Honours degree in Psychology from the University of Johannesburg; a Post Graduate Diploma in Business and an MBA from the University of Pretoria; and completed a PhD in the Faculty of Commerce at the University of Cape Town. Her research interest is in operationalizing HR strategy and understanding the underrepresentation of women in senior management roles in Africa and abroad.

She’s been involve in various community social upliftment programs through active involvement in directing funding to initiatives relate to driving the implementation of SDG goals related to gender; labour; food security; water safety; and education. She participated in the nominations process for selection to the Working Group on discrimination against women and girls, member from African States for the 54th session of the United Nations Human Rights Council; and as a Commissioner for the South-African Human Rights Council

Dr. Candice, was recognised in 2021 for excellence in HR, and named Young CHRO of the Year. In 2022 PeopleHum, USA, recognized as one Top 122 CHROs of 2022 globally and in South Africa as one of the 20 HR Leaders to follow in 2021. In 2022 she was nominated in the category of CEO of the Year and progressed to finalist in the Women of Stature CEO of the Year 2023.

Global Executive | ESG in Financial Services

Martine has worked across the not-for-profit, government and corporate sectors. She has experience working in various international markets including Australia, Indonesia, Hong Kong and South Africa. Martine is currently the Global Financial Services ESG Executive.

Reporting to the Global Head of Financial Services, Martine has been responsible for the development and execution of KPMG’s Go-To-Market strategy for ESG in Banking, Insurance, Private Equity and Asset Management. She has presented on ESG at various external events as well as the boards of several leading South African Banks.

Jessica Kutumela Chief Risk Officer | Guardrisk

Jessica Kutumela is an experienced executive with expert knowledge in risk management, resiliency and compliance management within the financial services industry, spanning over twenty years.

She is the Chief Risk Officer for the Guardrisk Insurance Group, Board member at the Institute of Insurance South Africa, and has served on various Audit and Risk Committee at other organisations.

She has a Masters in Finance and Investment qualification.

Head of Antitrust and Competition, South Africa; Director | Norton Rose Fulbright South Africa Inc

Marianne is the head of our antitrust and competition team, as well as the South African life sciences and healthcare practice. She is experienced in competition and trade law and has significant experience in a variety of regulatory matters and investigations.

Marianne has been ranked in the field of competition law in various top international publications, including Legal500, Chambers Global and Acritas She has been named as one of the top 40 under 40 antitrust lawyers and economists worldwide by Global Competition Review. Chambers Global gives Marianne “strong recognition for her competition law practice, with clients noting her “good communication skills and on-theball approach.”. Marianne has been chosen as one of Financier Worldwide’s POWER PLAYERS: Competition & Antitrust 2020Future Stars and is listed as ‘outstanding lawyer’ on the Thomson Reuters Standout Lawyers database. Marianne focuses on abuse of dominance and cartel investigations, including applications for corporate leniency, dawn raids and subsequent search and seizure litigation and settlement negotiations.

As a leading expert, Marianne contributed to a chapter on merger control in South Africa for Global Legal Insights 2021; and has provided a comparative analysis of European merger regulation in an exclusive chapter in the 2014 International Economic Law and African Development guide. The chapter deals with the jurisdiction of the COMESA Competition Commission for merger transactions. Marianne advises clients in South Africa, Zimbabwe, Zambia, Ghana, Mauritius, Namibia, Botswana and Tanzania, particularly in the insurance, financial services and energy industries.

Hayley Clarke is the Chief Actuarial Officer of Sasria SOC Ltd where she is responsible for the actuarial, quality assurance and business intelligence divisions. Hayley has recently joined Sasria following 12 years at Aon Re where she was an actuary on the Executive Committee. At Aon, Hayley was involved in structuring reinsurance programmes and advising on risk and capital for insurers and reinsurers throughout sub-Saharan Africa.

Hayley is a Fellow Actuary with the Actuarial Society of South Africa and the Institute and Faculty of Actuaries and has recently completed an MSc in Climate Change and Development through SOAS University of London. Hayley is passionate about the topic of climate change and the impact this will have on societies, particularly in Africa.

She has been involved in parametric insurance projects for several African countries with the emphasis on developing solutions to reduce the protection gap and enhance community resilience. She also volunteers for the International Actuarial Association on the Sustainable Development

Benjamin is an Associate Director in the Financial Risk Management and Africa Financial Services Lead for Climate Change, Nature Sustainability Services and Carbon Markets. Benjamin April has over 25 years of international and local working experience at FSB, SARB, ECB, UK PRA, US SEC, ISDA, BIS BCBS, World Bank, UNDP, Stats SA, SA Biodiversity Institute and international regulators, asset managers, international and African banks, sovereign wealth funds, and pension funds across prudential regulations, risk management, audit, and compliance In-depth knowledge of regulations and compliance standards in South Africa, Kenya, Ethiopia, Egypt, Tanzania, Zambia, Uganda, Nigeria, Tunisia, Morocco, Namibia, Botswana, Mozambique, DRC, the UK, European Union, and the USA. Implemented Basel II/III/IV prudential regulations, risk management, and governance in African banking entities, sovereign wealth funds, and pension funds.

Before joining KPMG, he was General Manager for Capital, Liquidity, Recovery & Resolution k, Operational Resilience and BCP, IT, Information Security, Operational RiskMarket Risk, Credit Risk, Climate, Nature, Carbon and Sustainable Finance Regulations at the Banking Association of South Africa: National Treasury Climate Task Team and Carbon Market Working Group; Presidential Climate Commission: Chief Risk Officer roles at Tier 2 banks; Africa Treasury Risk Director for Barclays Capital; Head of Risk at the South African Reserve Bank; Head of Economic Capital Nedbank Group: Senior Audit Manager Barclays Capital and Senior Risk Manager at the Industrial Development Corporation.

Ian Chauvet

Founder & Principal Consultant, Thrive People & Strategy

Ian is the founder and Principal Consultant of Thrive People & Strategy –a specialist Organisation Development and People/Strategy advisory firm based in Johannesburg. He holds a Master’s Degree in Organisational Psychology and has extensive consulting experience across multiple industries in the fields of Organisation Development, Organisational Strategy, Human Resources Management, Talent Management and Change Management.

Former United Nations Under- SecretaryGeneral and Executive Director of UN Women

Phumzile Mlambo-Ngcuka obtained a qualification in Gender Policy and Planning from the University College London (in1988), A master’s degree in philosophy and planning from the University of Cape Town (awarded in 2003),

A doctorate in Technology and Education from Warwick University (awarded in 2013). She has authored several scholarly and other opinion pieces, including in the Harvard International Review.

Carolyn Steyn

South African media personality and founder of the non-profit organisation, 67 Blankets for Nelson Mandela Day

Philanthropist, arts patron and media personality Carolyn was born in Johannesburg. She holds an honours degree in Speech and Drama from the University of the Witwatersrand and a Teacher’s Licentiate in Speech and Drama qualification from the University of South Africa.

67 Blankets for Nelson Mandela Day (or ’67 Blankets’) started in December 2013, when Nelson Mandela’s former assistant, Zelda la Grange, challenged Carolyn to knit or sew 67 blankets to support the annual Mandela Day (18 July) to be donated to those in need.

She was awarded Honorary Doctorates from the following South African institutions: Witwatersrand Technikon (2003) one of the precursor institutions of the University of Johannesburg (UJ), the University of the Western Cape (2007), Nelson Mandela University (2014), the University of Fort Hare (2016), Wits University (2019) and Rhodes University (2020). She was inducted as a Hauser Leader at the Harvard University Kennedy School And received an honorary doctorate from Edinburgh University. She was a lecturer at the Mpumalanga Teachers Training College (1980 - 1981) and thereafter became a teacher at the Ohlange High School (1981 - 1983).

• She then moved to Geneva to take up the position as the coordinator at the World YWCA, where she

• established a global programme for young women (1984 - 1989). In 1989, she returned to Cape Town where she spearheaded TEAM, an ecumenical organisation that focused on upskilling women.

• Opened the World University Service in South Africa, where she promoted Education and rural development. Dr. Mlambo-Ngcuka worked tirelessly on programmes and policies to reduce inequality as a member of the first democratically elected South African Parliament (1994 - 1996), then as Deputy Minister in the Department of Trade and

Industry (1996 - 1999), Became Minister of Minerals and Energy (1999 - 2005), and finally a Deputy President of South Africa (2005 - 2008).

She became head of the United Nations entity that is dedicated to gender equality and Empowerment of women, she was ranked as Under Secretary General. A global advocate for women and girls.

Dr. Mlambo-Ngcuka continues to be engaged and affiliated with organisations committed to education, women empowerment and gender e quality. Such affiliations include the Umlambo Foundation (Founder), She Is in the board of the global organisation Women Deliver, Global Citizen, Chancellor of the University of Johannesburg and Chairperson of International Olympics Committee human rights .

Tumelo Mothotoane is a South African media professional and entrepreneur who is determined to inspire a culture of dialogue between Africa and the world.

With over 13 years of experience as a broadcasting professional, Tumelo’s career spans withinthe community, regional, national to international television and radio broadcasting industry.

Tumelo Mothotoane is well sought after to render the following services:

• Event MC

• Conference Facilitator

• Panel Moderator

• Voice-Over Talent

• Event Speaker

• Media Trainer

• Communication & Public Speaking Workshops

Protecting your or your client’s business against risk takes strategic insight. It takes innovation and tailored solutions. It takes the pioneering approach of cell captive insurance. Guardrisk offers cover for corporates, small enterprises and municipalities, as well as cover for a variety of industries including marine, construction, motor and many more. The option of a third-party insurance offering lets clients sell insurance cover to their customers, boosting their business’ earning potential and building their brand.

“The best way to predict the future is to create it.”

Tel: +27 11 669 1000 • www.guardrisk.co.za

-Peter Drucker

Workerslife Group is a 100% black-owned South African financial services provider offering life and non-life insurance solutions. Their primary focus is to provide access to diversified insurance products and services that are innovative, simple, and flexible. Workerslife Group tailors products to meet the specific needs of the South African workforce, protecting their future and that of their families.

Discovery Insure, one of South Africa’s fastest growing short term insurance companies, is leading the way in insurance solutions with our state-of-the-art technology and innovations. We offer comprehensive car and home insurance and are committed to creating a nation of great drivers. The internationally recognised Vitality Drive programme, which rewards safe driving, sets us apart. We prioritise finding unique, innovative solutions for clients and financial advisers.

Aon plc (NYSE: AON) exists to shape decisions for the better —to protect and enrich the lives of people around the world. Through actionable analytic insight, globally integrated Risk Capital and Human Capital expertise, and locally relevant solutions, our colleagues in over 120 countries and sovereignties provide our clients with the clarity and confidence to make better risk and people decisions that help protect and grow their businesses.

As trailblazers and market leaders, Graduate Institute of Financial Sciences (GIFS) believes in the transformative power of education to create a better Africa for others to inherit. GIFS is one of South Africa’s foremost financial services education providers, continuing the trusted legacy of the multiple award-winning and multiple award-nominated Masifunde Training Centre (MTC) that had served the industry with distinction for 14 years. In April 2019, MTC rebranded as GIFS, expanding its footprint in Africa and introducing a wider range of accredited and non-accredited programmes designed to spearhead sustainable, positive change by equipping individuals with skills and qualifications needed to excel in the financial services industry.

We are a trusted brand and pioneered the vehicle tracking and stolen vehicle recovery industry in South Africa in 1994. We provide industry-leading stolen vehicle recovery services, advanced vehicle and fleet tracking, great fleet management solutions for all-sized business and commercial fleets, commanding insurance telematics solutions and best-inclass bureau services – in fact, no IoT solution is out of our reach.

Old Mutual Insure is the oldest non-life insurer in South Africa with a history that dates back more than 180 years. We partner with brokers to offer an extensive range of insurance products and solutions to fulfil personal, commercial, and corporate needs. We also provide insurance products for the agriculture, engineering, and marine sectors. As a brand, we promise to do great things as we protect what’s important to our customers and put them first in everything that we do.

Old Mutual Insure Limited is a licensed FSP and non-life insurer.

Santam is the leading general insurer in South Africa with a market share of more than 22%. Our broad range of insurance solutions stretches into all areas of general insurance, across personal, commercial, agriculture, and specialist markets offered through a network of 2 700 intermediaries and direct channels. We have been offering insurance for almost 100 years and over this time, we have made it our business to understand what is important to our clients and the risks they face. This is why over 80 of the top 100 companies trust us to protect their businesses. Our deep-rooted industry expertise coupled with unmatched levels of technical knowledge and skills enable us to help our clients understand and manage risks. When the unfortunate happens, we are there for our clients 24/7 and able to put them in the same position they were before any loss occurred, paying out more claims than any other insurer. In 2022, Santam paid claims to the value of R29.8 billion to businesses and individuals.

Sapiens (NASDAQ: SPNS) empowers finance, particularly insurance, to digitize and innovate, leveraging over 40 years of expertise. Our cloud-based SaaS platform aids digital transformation with pre-integrated, low-code solutions across core, data, and digital realms. Serving 600+ clients globally, we offer comprehensive solutions from core to digital, supported by 5000+ employees worldwide.

Sasria is the only non-life insurer that provides special risk cover to individuals and businesses that own assets in South Africa, as well as government entities. This is unique cover against risks such as civil commotion, public disorder, strikes, riots and terrorism.

Standard Bank Insurance Brokers helps to protect what matters, with comprehensive insurance for businesses and individuals, across long-term and short-term solutions. As a brokerage, Standard Bank Insurance Brokers partners with leading specialist underwriters to bring clients tailored insurance products.

Elite was born in 2018 from the dream to offer something extraordinary to high-net-worth clients. Thanks to broker support, we have shown remarkable growth. Despite facing various challenges the entire industry is facing, we remain committed to sustain and grow the prosperity of the customers, families and communities we serve.

Guardrisk is South Africa’s undisputed market leader in cell captive insurance and risk solutions. We also provide conventional corporate and commercial insurance, microinsurance and specialist lines insurance. LAUNCHPAD, our insurtech initiative, helps insurtech entrepreneurs scale up to the next level.

Marsh is the world’s leading insurance broker and risk advisor. With over 45,000 colleagues operating in 130 countries, Marsh serves commercial and individual clients with data-driven risk solutions and advisory services and helps our clients and colleagues grow and nurture the prosperity of our communities by helping them build the confidence to thrive and providing a distinct perspective. Marsh is a business of Marsh McLennan (NYSE: MMC), the world’s leading professional services firm in the areas of risk, strategy and people. Marsh McLennan helps clients navigate an increasingly dynamic and complex environment through four market-leading businesses: Marsh, Guy Carpenter, Mercer and Oliver Wyman.

Europ Assistance SA was established in 1984 and currently offers the most comprehensive portfolio of products in the country, primarily focused on emergency assistance services. Our Mission and our DNA has not changed since, in that, we deliver our customers from distress to relief anytime, anywhere and our vision to be the most reliable care company in the world embodies our strategic objectives. We are a CARE business delivered by our people using state of the art technology.

Company description (50-word profile): Infobip is a market-leading full-stack communications platform-as-a-service with a global reach across six continents. As the world’s most connected communications platform, we help democratize global communications and digital interactions, such as customer support and sales, to enable businesses to transform their customer relationships, increase loyalty and grow.

Avis Rent A Car is South Africa’s leading car rental brand with a track record of over 55 years. It provides a variety of products and services to a wide range of customers. From a selection of vehicles ranging from Car rental, Van Rental, Luxury Car and Chauffeur Driven Services.

Chery South Africa is the Manufacturer and distributor of Chery Automobiles and Aftermarket services and parts.

The Insurance Sector Education and Training Authority (INSETA, is one of twenty-one SETAs focused on developing skills in the insurance and related sectors. It aims to enhance the employability and productivity of the workforce through education, training, and development initiatives, contributing to the growth and transformation of the industry.

Enabling organizations to anticipate, adapt, and respond to risks, and capitalize on opportunities for growth. marsh.com

Marsh Proprietary Limited is one of the Marsh & McLennan Companies, together with Guy Carpenter, Mercer, and Oliver Wyman.

This document is not intended to be taken as advice regarding any individual situation and should not be relied upon as such. The information contained herein is based on sources we believe reliable, but we make no representation or warranty as to its accuracy. Marsh Proprietary Limited shall have no obligation to update this publication and shall have no liability to you or any other party arising out of this publication or any matter contained herein. Any statements concerning actuarial, tax, accounting, or legal matters are based solely on our experience as insurance brokers and risk consultants and are not to be relied upon as actuarial, accounting, tax, or legal advice, for which you should consult your own professional advisors. Any modeling, analytics, or projections are subject to inherent uncertainty, and the Marsh Analysis could be materially affected if any underlying assumptions, conditions, information, or factors are inaccurate or incomplete or should change.

Marsh Proprietary Limited makes no representation or warranty concerning the application of policy wordings or the financial condition or solvency of insurers or re-insurers. Marsh Proprietary Limited makes no assurances regarding the availability, cost, or terms of insurance coverage.

Marsh Proprietary Limited is an authorised financial services provider and regulated by the Financial Sector Conduct Authority (FSCA) (FSP Licence: 8414).

The content of this document is subject to copyright protection. Reproduction of the content, or any part of it, other than for non-commercial educational or personal use only is prohibited without prior written consent from Marsh Proprietary Limited.

Copyright © 2024 Marsh Proprietary Limited. All rights reserved. 24-291939.

ABSA Insurance is a leading and award winning insurer, offering a range of insurance products to individuals, families, and businesses. ABSA Insurance is committed to providing its customers with expertise, guidance, and innovative solutions to manage risk and achieve financial stability. ABSA Insurance is a trusted brand in the insurance industry, known for its reliability and customer-centric approach.

We’re a special risk insurance provider, operating at Hollard’s preferred underwriter for specialty products. iTOO’s a home for UMA’s, niche-start ups, innovators and outside the box thinkers.

We are active investors in insurance underwriting businesses, with a 20 year track record. We are well established risk underwriters, with market leading diverse product range and we are backed by cradle to grave infrastructure. We invest in specialty businesses, led by like minded entrepreuneur experts.

Allianz Global Corporate & Specialty (AGCS) is a leading global corporate insurance carrier and a key business unit of Allianz Group. We provide risk consultancy, PropertyCasualty insurance solutions and alternative risk transfer for a wide spectrum of commercial, corporate and specialty risks across 10 dedicated lines of business.

CN&CO is an independent brand consultancy offering a broad spectrum of specialist marketing, public relations, eventing and recruitment services – among other things – to clients in a variety of industries. We are proud to be the official event organisers of the African Insurance Exchange, which we manage from end to end. More at www.cnandco.com.

Emeritus Reinsurance is a leading pan-African reinsurance company with decades of experience in the reinsurance industry. The company provides innovative and comprehensive reinsurance solutions designed to give stakeholders peace of mind and financial stability. Emeritus Re’s geographical network ensures that the company has a deep understanding of diverse markets and risk classes.

Established in 2005, Genoa is a niche market liability/casualty specialist. We pride ourselves on entering professional market segments and taking up meaningful market share therein. Our in-house product specialists identified numerous ways in which these niche products could be improved, and it was through these innovative policy amendments that we were able to build up significant market share in the liability space. Built, Cyber, Fiduciary, Financial, Legal, Medical (including institutions), Miscellaneous, Restructuring

Company description (50-word profile) Lloyd’s is the world’s leading insurance and reinsurance marketplace. Through the collective intelligence and risk-sharing expertise of the market’s underwriters and brokers, Lloyd’s helps to create a braver world. The Lloyd’s market provides the leadership and insight to anticipate and understand risk, and the knowledge to develop relevant, new and innovative forms of insurance for customers globally. And it promises a trusted, enduring partnership built on the confidence that Lloyd’s protects what matters most: helping people, businesses and communities to recover in times of need.

MiWay Insurance is a licensed non-life insurer that offers motor, household, homeowners, business, and liability insurance. Our purpose is to help people do more of what they love. We do this by providing products, services, and solutions that enable you to enjoy life on your own terms. Live Your Way with MiWay.

Munich Reinsurance Company of Africa Limited (MRoA) is one of the leading reinsures on the African continent with over 40 clients having its central hub in Johannesburg and a regional office focusing on services to its Life clients in Cape Town and has been operating in South Africa for over 50 years.

Its line of business includes giving a full scope of services in treaty and facultative support for Life Business, expertise to Life and Non-Life clients in the areas of product development, pricing, claims management, capital management, risk management, new business processing, medical research and underwriting.

Munich Reinsurance Company of Africa prides itself in sharing its Global expertise and launched a training initiative, Leadership Inspiring Mutual Advancement (LIMA) in 2019, which is offered to clients with the aim of contributing to the development of skills and (re) insurance tools, thought leadership, sustainable business solutions and offers networking opportunities for talented insurance industry practitioners in the African continent.

Standard Bank Insurance Brokers helps to protect what matters, with comprehensive insurance for businesses and individuals, across long-term and short-term solutions. As a brokerage, Standard Bank Insurance Brokers partners with leading specialist underwriters to bring clients tailored insurance products.

Swiss Re Ltd is a Swiss reinsurance company founded in 1863 and headquartered in Zürich, Switzerland. It is one of the world’s largest reinsurers, as measured by gross premiums written. Swiss Re operates through around 80 offices in 29 countries and employs over 14,000 people.

Discovery Insure, one of South Africa’s fastest growing short term insurance companies, is leading the way in insurance solutions with our state-of-the-art technology and innovations. We offer comprehensive car and home insurance and are committed to creating a nation of great drivers. The internationally recognised Vitality Drive programme, which rewards safe driving, sets us apart. We prioritise finding unique, innovative solutions for clients and financial advisers.

EasyEquities is an online investing platform that provides educational, engaging and easy access to financial services. Now in its tenth year, EasyEquities has grown a community of South African investors to 2 million strong. With the ability to invest in local and international stocks, property, crypto and unit trusts; as well as access credit and life insurance, EasyEquities enables anyone to grow and protect their wealth.