Executive Summary

Financial Analysis

Property Description

Location Overview

Portfolio & Performance

Introducing Avondale Hills, a luxurious 240-unit apartment community built in 2022-2023. This A-class asset is hyper-connected via the neighboring MARTA transit station. Sitting directly in the path of progress, the property benefits from Atlanta's extensive amenities and economic growth.

Avondale Hills is surrounded by vibrant development and economic growth. The robust job market driving tenant demand is fueled by an influx of top-tier corporations, including Google, Microsoft, and JP Morgan,

Avondale Hills offers a modern living experience with premium amenities, positioning it as a best-in-class property. Avondale Hills offers a lower-risk strategy to add value by increasing belowmarket rents and stabilizing expenses and occupancy. At a 30%+ discount to replacement cost, Viking Capital is buying this property at an extremely competitive basis.

Viking Capital proudly presents Avondale Hills, a standout investment in one of Atlanta's premier submarkets.

3 YEARS $14,600,000 $1,500,000 $9,500,000 $3,600,00 $10,500,000 OFFERING summary

EXPENSE RATIO (T-12)

PHYSICAL OCCUPANCY

DSCR YR 1

DSCR AVG.

PURCHASE PRICE

240 UNITS

186,960

2023 YEAR BUILT AVG UNIT SF RENTABLE SF

779

CONSTRUCTION:

STORY, WRAPPED 5

340 PARKING: STRUCTURED PARKING SPACES

Private structured parking

Luxer package system

Valet trash service

Community walking trails

Indoor bicycle storage

Storage units

Resort style pool

Outdoor kitchen

Modern Fitness Center

Clubhouse

Billiards room

Latch smart entry

Public transit-focused

New leases are 3%, $40 higher than in-place rents.

Trailing 3 month occupancy surge demonstrates strong leasing momentum.

Minimal concessions (0.1% on T12, 0.4% on T3).

Purchase price 30%+ below replacement cost on new construction.

Attractive tax abatement

Operational efficiencies

Uplevel amenities

Organic appreciation from increased new development in the submarket.

Increase rents to market price.

Viking Capital owns 10 other properties and 2,000 doors in ATL MSA.

Optionality to exit as a portfolio with other Viking ATL properties increasing liquidity, and appealing to institutional buyers.

PROPERTY SUMMARY

Completed

Total Units

Average Unit Size (SF)

Physical Occupancy

Avg. Effective Rents

New Move-Ins (30 days)

THREE-TIERED

THREE-TIERED

A three-tiered return structure gives investors options when placing their equity. Investors have the ability to invest in either tier of equity

Class A, Class B, Reserve Class, or a combination of Class A and Class B. Diversifying in both A and B classes allows for a risk-adjusted, blended return.

$58,500,000 $38,700,000 $25,100,000

LOAN PRINCIPAL $38,700,000

FIXED OR ADJUSTABLE FIXED AMORTIZING PERIOD 30 YEARS

PRIME LOCATION & CONNECTIVITY:

This A-class asset is strategically located in a hyper-connected area along the path of progress. Residents benefit from Atlanta's extensive amenities and economic growth.

NEWER PRODUCT WITH BELOW MARKET RENTS:

Newer asset with below-market rents, offering premium amenities and room for competitive rent increases.

STRONG COST BASIS:

This off-market deal, discounted by $20 million, was brought to Viking Capital because of our strong reputation for execution.

LOW-RISK FUNDAMENTALS:

This property supports the flight-to-quality during volatile economic times by offering a high-quality asset with strong demand in a thriving submarket

ECONOMIES OF SCALE:

With over 2,000 units in Atlanta, Viking Capital leverages economies of scale to drive operational efficiencies, organic appreciation, and enhanced property value.

3 YEAR HOLD:

Strong returns in less time giving you opportunity to redeploy capital more quickly.

Private structured parking

Luxury package system

Valet trash service

Community walking trails

Indoor bicycle storage

Storage units

Resort style pool

Outdoor kitchen

Fitness center w/ interactive equipment

Clubhouse

Billiards room

Latch smart community

Public Transit focused community

46Units19%

137Units57%

2Bedroom

137Units24%

Unit Mix

Weighted towards one and twobedroom units, Avondale Hills attracts the young professionals prevalent in the market.

Spacious Floor Plans Modern GE Appliances Granite Countertops Walk-in Closets Full Size Washer and Dryer Smart Locks and Thermostats Private Balcony

PROPERTY

Abberly Onyx

The Arlo

Abberly Skye

Cortland Decatur East

AMLI Decatur

Modera Decatur

AVONDALE HILLS

Inkwell Decatur

Willis Avondale Estates

Notion

Reserve Decatur

The Jade at Avondale

Arcadia Decatur

The Baxter Decatur

AMAZING COST basis

NEW BUILD COST: $360K PER DOOR

COMPARED TO $240K PER DOOR PURCHASE PRICE

Walkable Proximity to the Kensington MARTA Station

Located just 20 minutes from Ponce City Market, the Beltline, and some of Atlanta's most affluent neighborhoods, the Decatur submarket is positioned for growth. As the cost of living in Midtown, Virginia Highlands, and Downtown Atlanta rises, many residents are moving to Decatur for a more affordable alternative that still offers convenient access to jobs and amenities.

NG AFFORDABILITY AT LOWEST LEVELS IN HISTORY

The newly construction townhomes surrounding Avondale Hills have recently sold for between $515,000 and $610,000.

$599,000

$610,000

$515,000

Average home prices in Decatur have increased over

30% since 2020 (Zillow), far outpacing average rent growth over the same period and highlighting the phenomenal growth in the submarket.

Walkable Proximity to the Kensington MARTA Station

ONLY 20 MINUTES FROM HARTSFIELDJACKSON INTERNATIONAL AIRPORT.

2.7 MILLION+ JOBS

AVONDALE HILLS APARTMENTS

35 acres of retail development surrounding Avondale Hills

COMMUNAL GREEN GENERAL RETAIL CONCEPTS

AVONDALE HILLS IS DIRECTLY ACROSS THE STREET FROM THE KENSINGTON DEVELOPMENT

PLANS INCLUDE: RESTAURANTS, COFFEE SHOPS, PHARMACY, BANKS, DRY CLEANERS, AND HAIR SALONS

it is the largest employer in Atlanta with 33,000 employees.

15,000+ Jobs

Headquartere y y ease Control and Prevention (CDC) is the primary national public health agency in the United States. Employing 15,000 people (including 6,000 contractors), common positions include entomologists, physicians, epidemiologists, nurses, public health advisors, toxicologists, and computer scientists. With a nearly $11 billion annual budget, the CDC’s role is expanding and will remain a major employer in Atlanta for years to come.

AVONDALE IS LOCATED JUST 13 MILES FROM 54,000 JOBS WITH THESE TWO ORGANIZATIONS ALONE.

are only two competitive communities (715 units) set to deliver in the 24-month pment pipeline. The relatively low new supply provides runway for future Class A owth and reduces concessionary pressure.

ATLANTA HAS BEEN NICKNAMED THE “SILICON VALLEY OF THE SOUTH.”

Recently, Google has expanded its footprint in Midtown to 500,000 SF and 1,000 employees. Visa plans to hire 1,000 people for its Midtown location and continue to build a large fintech hub in the Southeast.

Strong and Diverse Pool of Talent

Existing Infrastructure Around Georgia Tech

Favorable Business Climate with Tax Incentives

Lower Cost of Living Attracts Established Talent

Vibrant Start-Up Environment

Access to Key Transportation Arteries Such as Hartsfield-Jackson International Airport

Percentage change in median rent (2023–2024): +16.1%

Total change in median rent (2023–2024): +$243

Median rent (2024): $1,753

Median rent (2023): $1,510

Percentage change in median rent (2023–2024): +12.6%

Total change in median rent (2023–2024): +$201

Median rent (2024): $1,793

Median rent (2023): $1,592

6,144,050

9,000,000

8,500,000

8,000,000

7,500,000

7,000,000

6,500,000

6,000,000

5,500,000 5,000,000

Georgia ranks as the #1 State for Leading Workforce Development Programs with over 292,000 students.

A HOUSES THE HEADQUARTERS OF 30 NIES IN THE 2021 FORTUNE 500 RDMOSTFORTUNE500 AGGREGATE REVENUE OF MORE THAN $429 BILLION

GEORGIA TECH PRODUCES THE MOST TECHNOLOGY GRADUATES PER YEAR IN THE UNITED STATES

Government

Retail Trade

Health Care

Accomodation and Food Services

Administrative and Support

Professional, Scientific, and Technical Services

Manufacturing

Transportation and Warehousing

Wholesale Trade

Finance and Insurance

Construction

Other Services (except Public Administration) GEORGIA JOB MACHINE CHURNS OUT BETTER-THANAVERAGE MAY WITH

PORT OF BRUNSWICK

Nation’s Busiest for Auto Imports

PORT OF SAVANNAH

Fastest Growing Port in the U. S.

RAILROAD ACCESS

CSX’s Fairburn terminal is the company’s 9th largest

#1 BUSIEST AIRPORT IN THE WORLD

Record Industrial Warehouse Demand

Over 80% of the U.S. is within a 2day truck drive

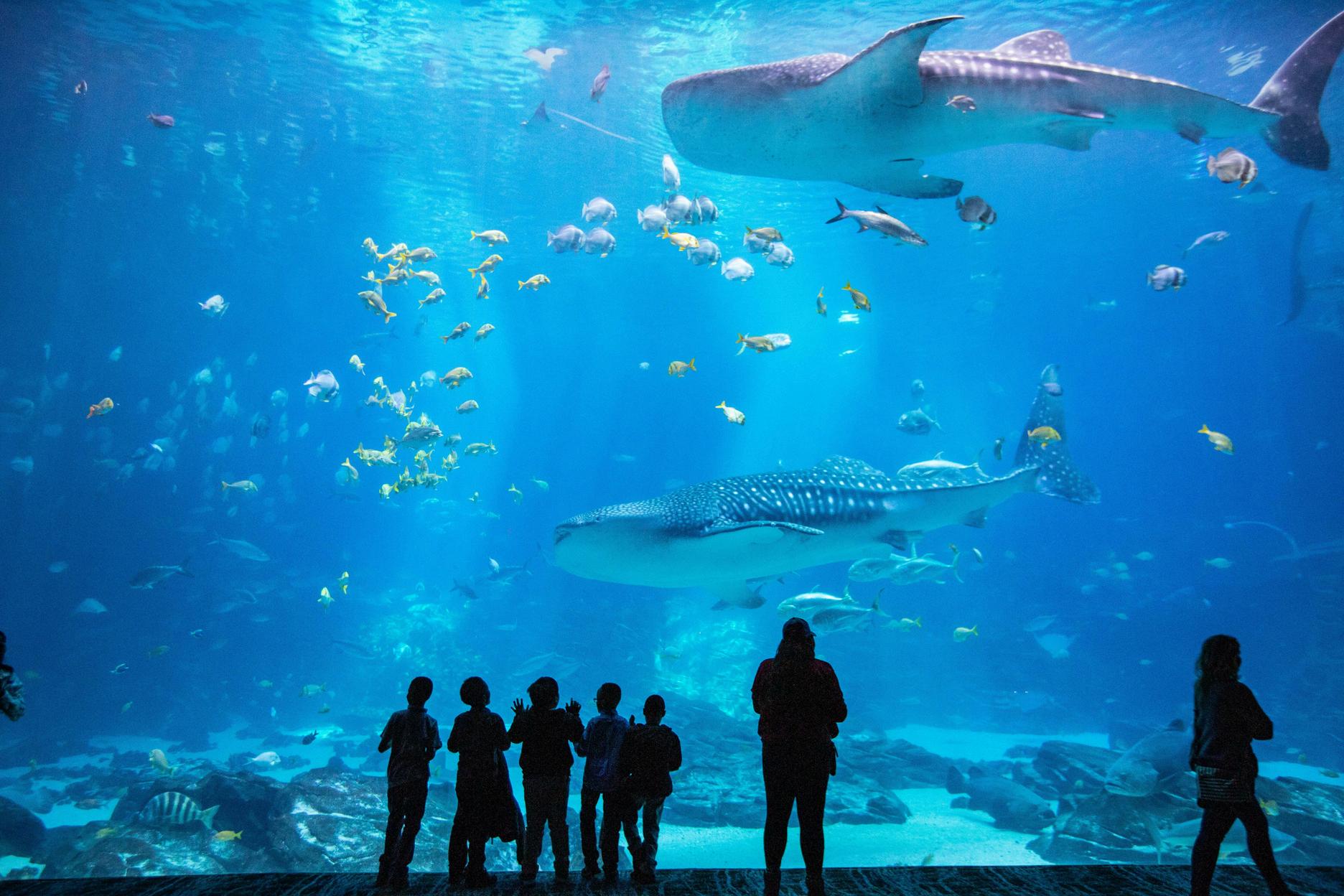

orgia Aquarium

giaAquariumisapublicaquariuminAtlanta, gia,UnitedStates Itexhibitshundredsof esandthousandsofanimalsacrossitsseven rgalleries,allofwhichresideinmorethan11 nUSgallonsofwater.

TheCNNCenterinAtlanta,Georgia isthe internationalheadquartersoftheCableNews Network Themainnewsroomsandstudiosfor severalofCNN'snewschannelsarelocatedinthe building

The Fox Theatre, a former movie palace is a performing arts venue located at 660 Peachtree Street NE in Midtown Atlanta, Georgia, and is the centerpiece of the Fox Theatre Historic District

BILLION

9 B 000 00 0

TOTAL ECONOMIC IMPACT

PASSENGERS PER DAY

EMPLOYEES

FLIGHTS EACH DAY

As Georgia’s largest employer with 63,000 jobs, Hartsfield-Jackson Atlanta International Airport generates an economic impact of $70.9 billion in the state of Georgia and $34.8 billion in metro Atlanta.

GEORGIA’S FILM INDUSTRY PREPARES FOR FURTHER EXPANSION IN 2024

THE GEORGIA FILM OFFICE REPORTS 43 ACTIVE MOVIES AND TV SHOWS IN THE STATE

$5 BILLION DEVELOPMENT

Both towers are expected to be completed by 2025, a year before the FIFA World Cup comes to Atlanta.

“It’s going to be big and flashy and fancy and visible. This is going to be a place where you can experience Atlanta culture,”

Centennial Yards Company President Brian McGowan

$17 BILLION ECONOMIC IMPACT

3,000 JOBS

The 500,000-square-foot, full-service, entertainment complex will sit on 40 acres. It will include 12 sound stages, plus office and support space.

State of Georgia hosted 390 productions, represented by 31 feature films, 55 independent films, 241 television and episodic productions, 40 commercials, and 23 music videos between July 1, 2022, and June 30, 2023.

ed its $100M North American HQ in next to Hartsfield-Jackson national Airport and added 400 jobs.

I V I A N E L E C T R I C V E H I C L E S

CASH FLOW DIVERSIFICATION APPRECIATION TAX ADVANTAGES EQUITY

Viking Capital was founded in 2015 and has become a premier multifamily investment firm with agile investment sourcing, structuring, execution, and asset management capabilities and the flexibility to scale and cater to investor preferences. Through its team of acquisitions, asset management, and disposition experts, Viking Capital invests in tier 1, secondary and tertiary markets across the United States.

T A SINGLE DOLL

E ANY CAPITAL C APITAL PRESERV

$869 MILLION

27 In Assets Acquired

5,736 24%

Average LP AAR Properties Acquired Units under Mangement

VikramRaya CEO,Co-Founder

RaviGupta COO,Co-Founder

JudahFuld VPofAcquisitions

TaureanChambers-Hunter OperationsManager

NathanLoy SeniorAcquisitions Associate

EdMonarchik Directorof AssetManagement

AshleyPenrod DirectorofMarketing

AmirNassar InvestorRelations Manager

AmberButler Investor Concierge

ChrisParrinello Directorof InvestorRelations

ChariteeBoyd AssetManagement Analyst