Executive Summary

Financial Analysis

Property Description

Location Overview

Portfolio & Performance

Executive Summary

Financial Analysis

Property Description

Location Overview

Portfolio & Performance

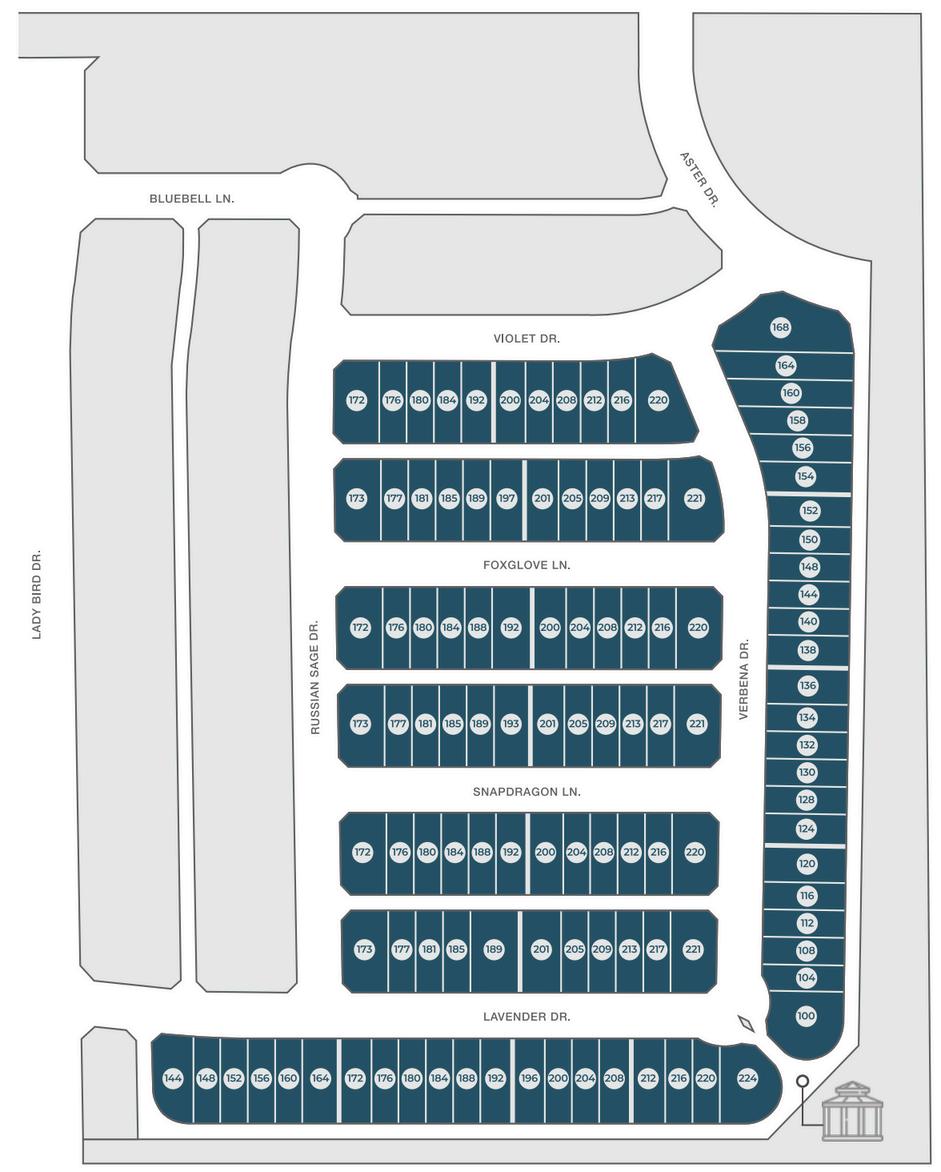

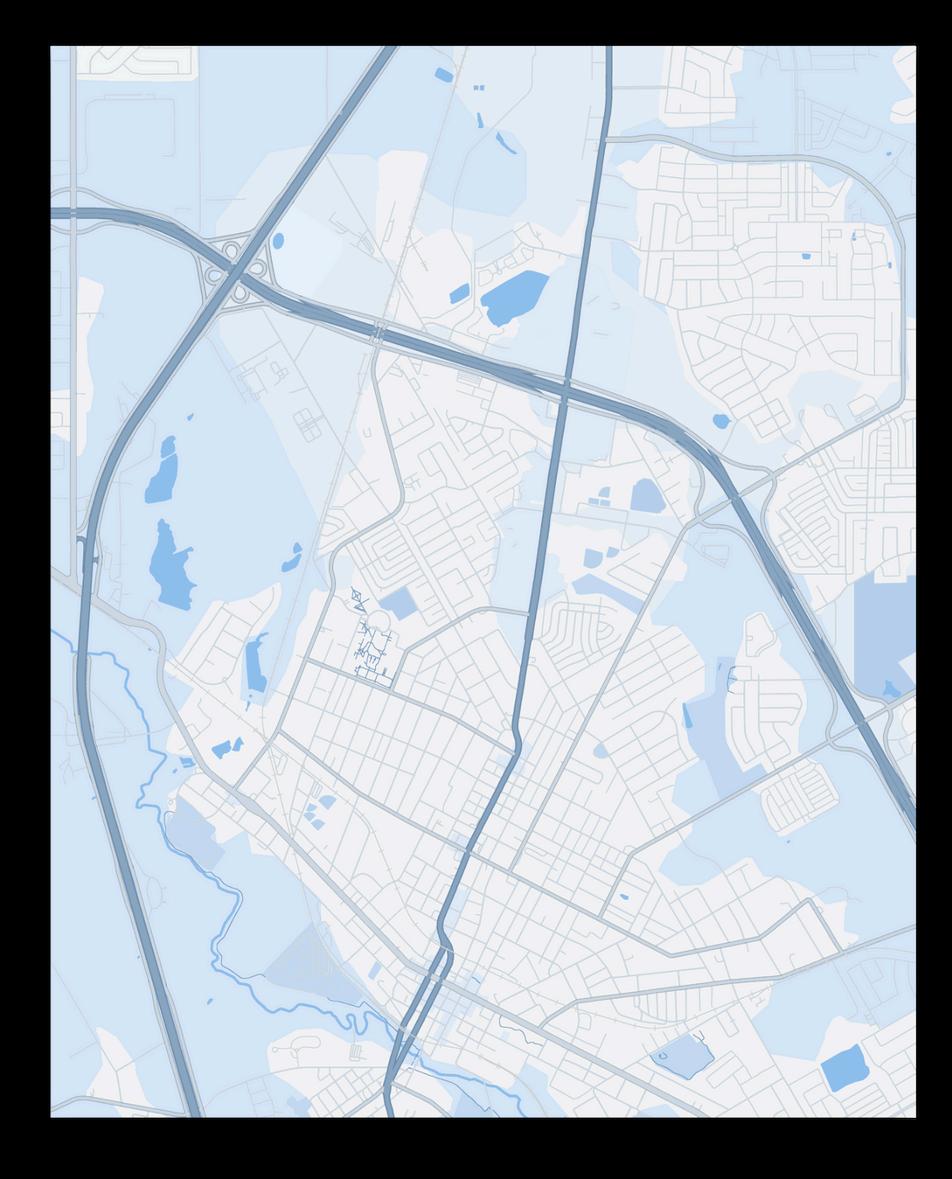

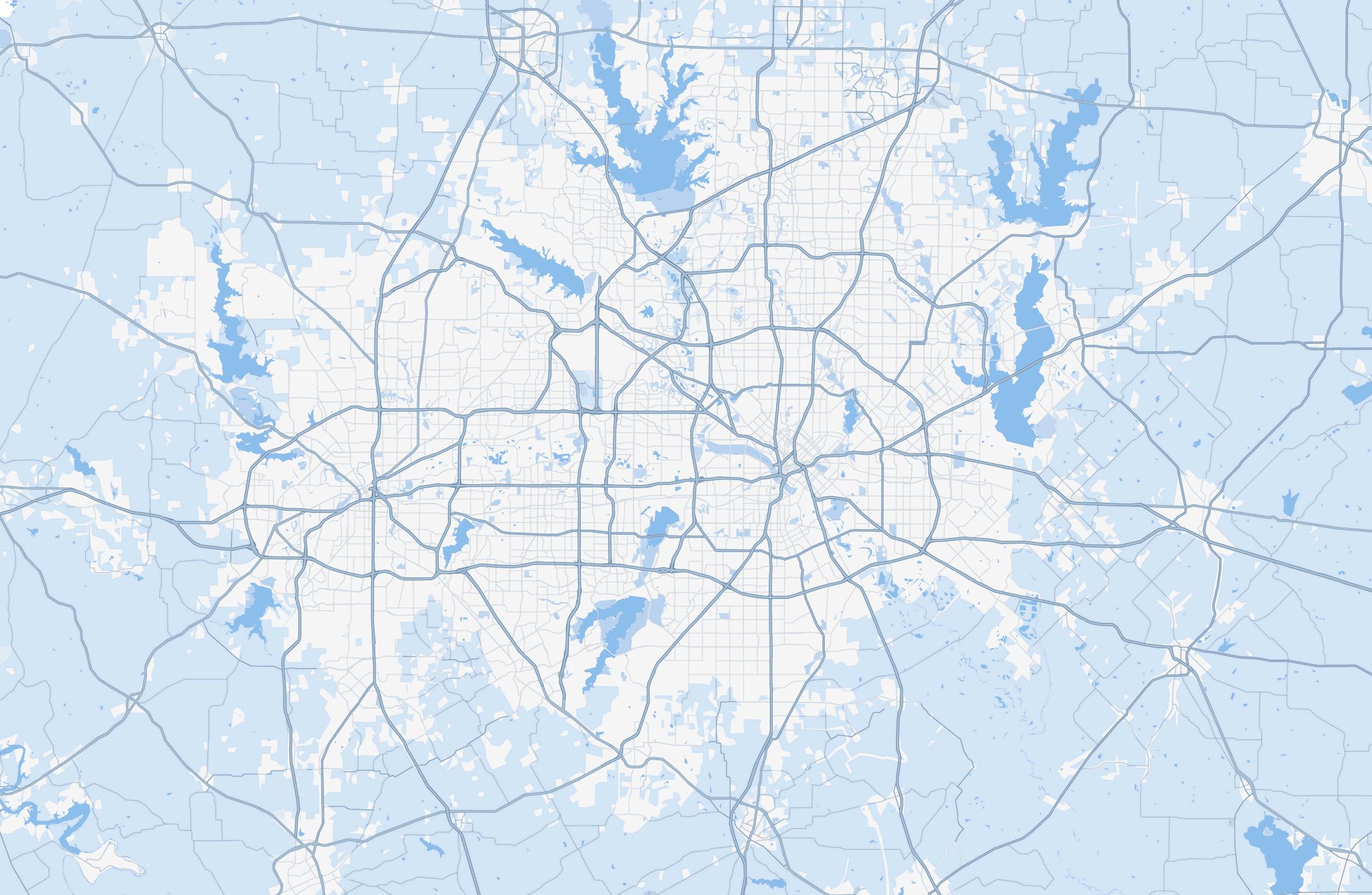

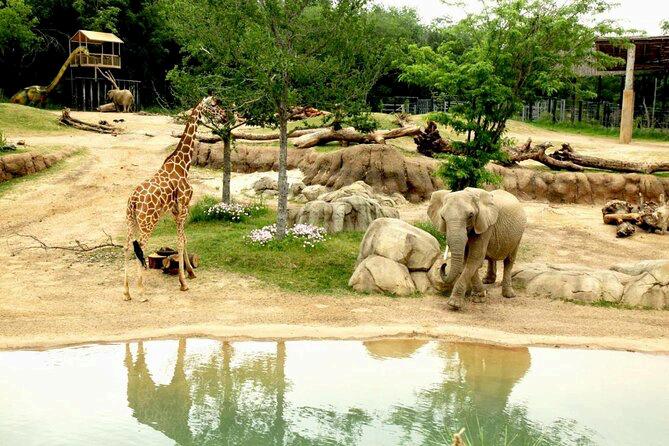

Viking Capital presents The Townhomes at Bluebonnet Trails, a 114-unit, build-to-rent community in the DFW Metroplex. Completed in two phases (2020 and 2021), the property offers direct access to US-287 and I-35, connecting residents to major economic hubs, including Baylor Scott & White Medical Center, with only a 25-minute commute to downtown Dallas.

The Ellis County submarket benefits from DFW's growth, with a five-year rent increase of 5.6% and a 96.3% occupancy rate. The surrounding area features over 2,000 businesses and a median household income exceeding $74,000.

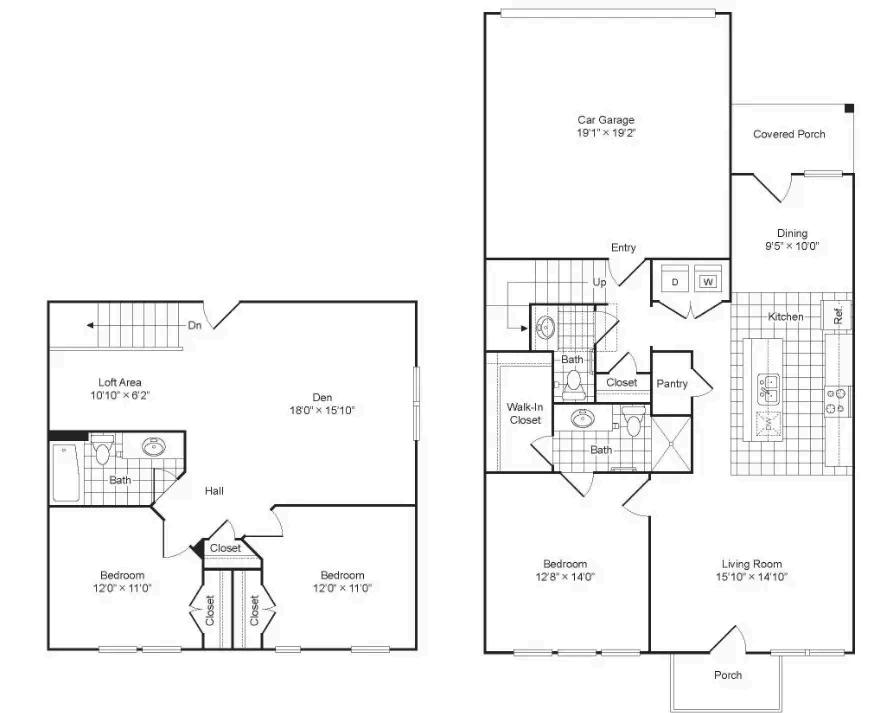

The Townhomes offer spacious three- and four-bedroom floorplans, averaging 1,843 square feet—the largest in Ellis County. Units include stainless steel appliances, granite countertops, wood-style flooring, private patios, and attached garages catering to a family-oriented tenant base.

With minimal new supply and a low-density design that combines the benefits of multifamily living with a single-family feel, The Townhomes at Bluebonnet Trails is a prime investment opportunity.

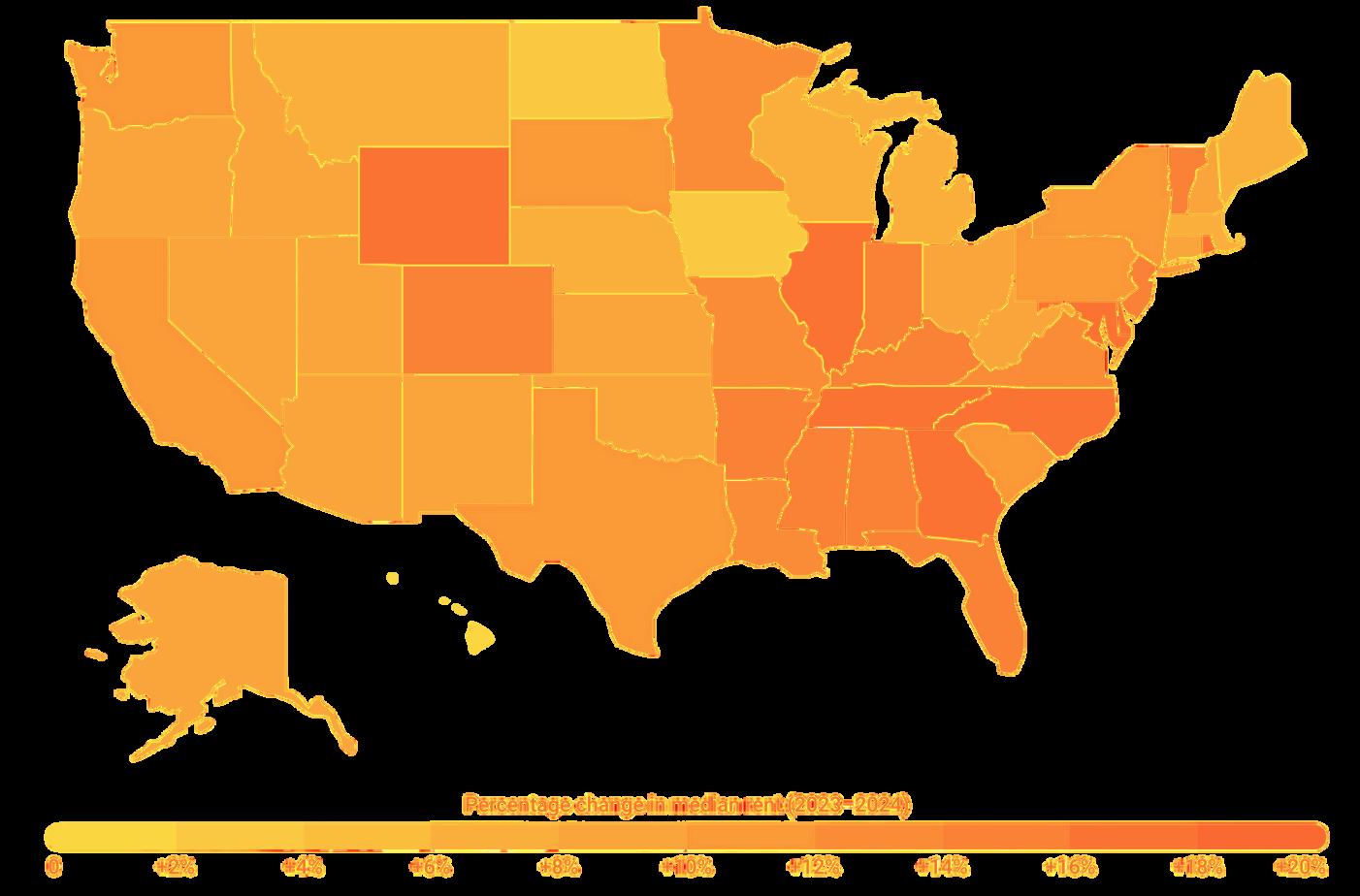

As housing affordability continues to erode, build-to-rent (BTR) communities are experiencing unprecedented growth across the United States. This trend is especially notable in high-growth submarkets where population increases, economic expansion, and rising home prices intersect. In 2023, approximately 78,000 new BTR homes were delivered, with the southern region accounting for nearly 50% of these completions. The sector saw a 20% increase in new BTR units compared to 2022, and projections indicate that BTR properties will represent nearly 17% of all new homes built annually by 2027.

Current economic conditions and interest rate trends make BTR properties an attractive alternative to traditional homeownership. High barriers to entering the home buying market—such as low inventory, elevated prices, and rising mortgage rates—favor BTR options. For example, in Waxahachie, DFW, the average monthly mortgage payment is $3,924, while the average rent for a BTR home is considerably lower at $2,113.

National Rent Trends: U.S. rents for BTR properties have increased by 3% year-over-year as of June 2023.

Regional Dynamics: In DFW, rental prices for BTR homes have risen by 25% since 2021.

Future Projections: BTR rents are expected to grow by 20% from 2023 to 2027

PURCHASE PRICE

$35.2 M 5 YEAR

$16,900,000

$1,700,000

$11,000,000

$4,200,000

Attached 2 car garage with driveway

3-4 Bedroom, 2-Story

Townhomes

Second floor den and loft space

Private fenced yard

Small covered back patio

Pond with picnic area

Granite countertops

Custom cabinetry

Walk-in closets

Walk-in pantry

Stainless steel appliances

Washer & dryer hookups

This clear core-plus strategy mitigates risk through investing in the path to progress for the expanding DFW market.

We aim to increase rents to align more competitively with the area, targeting immediate rent increases of over $200 within the first year of acquisition.

The interior capex business plan includes a Smart Tech package is available for $31 per month, and washer and dryer units can be added for an additional $48 per month, with plans to equip 25 units.

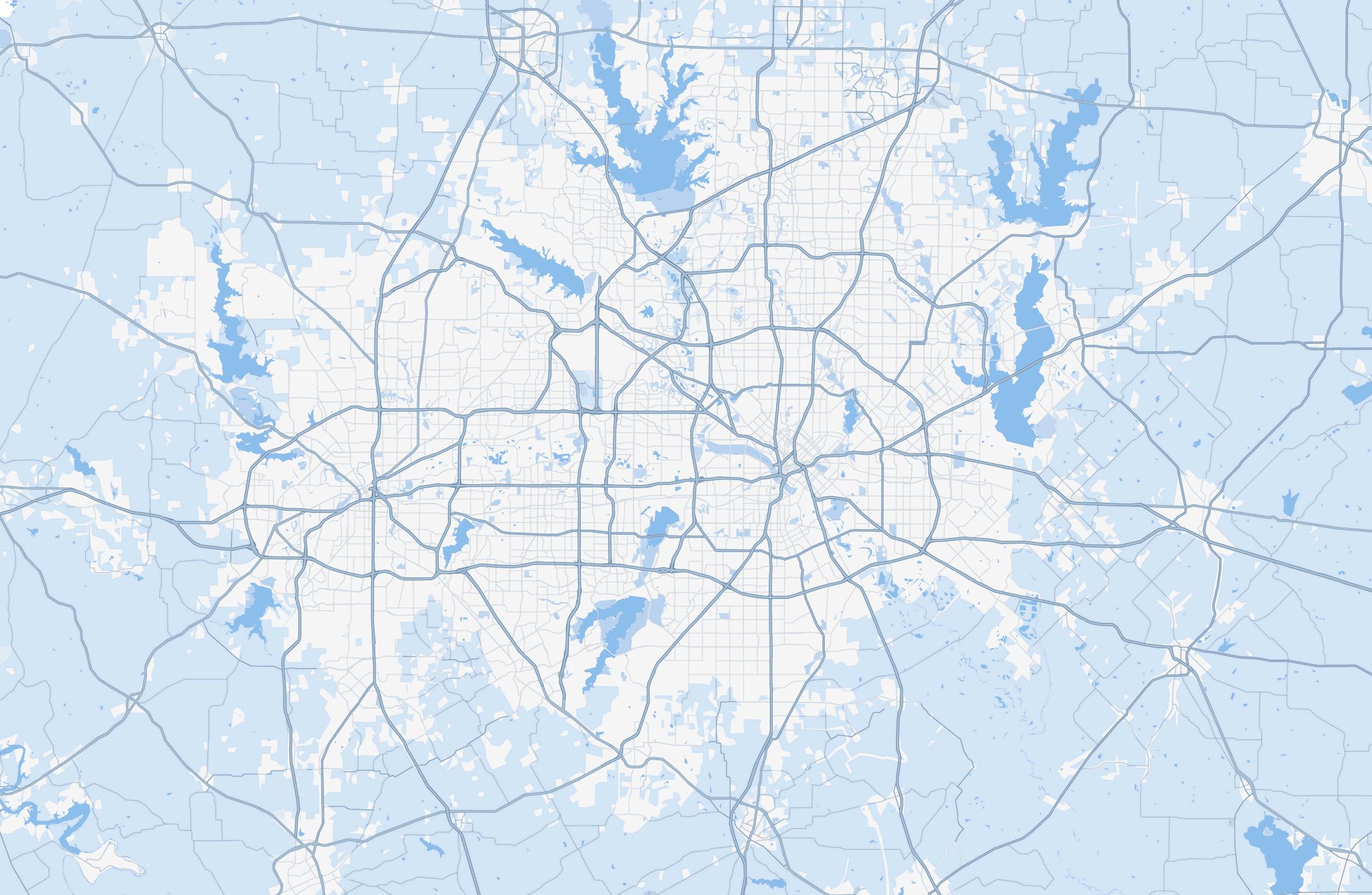

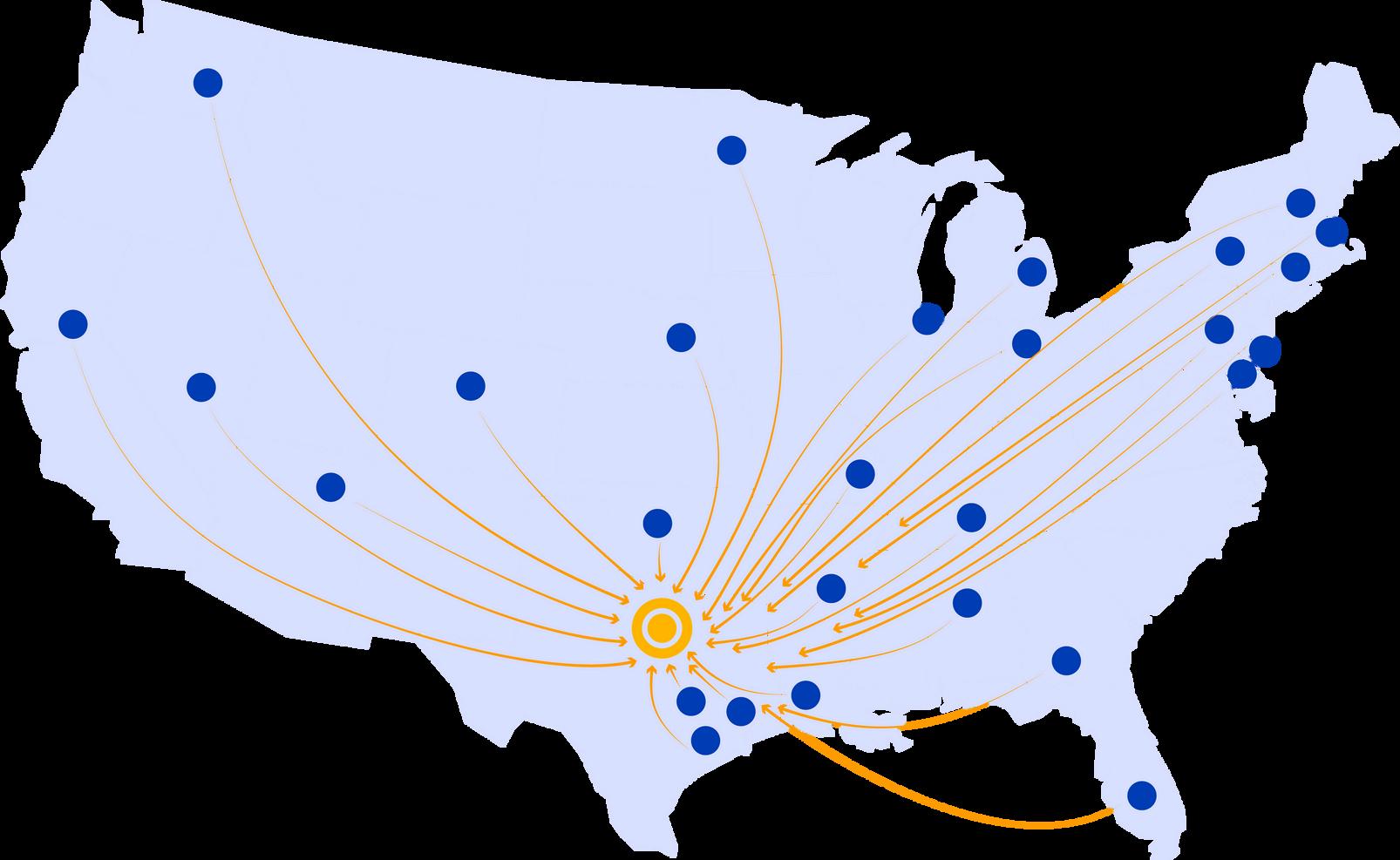

Dallas-Fort Worth has gained over 120,000 new residents annually since 2020, fueled by strong job growth and affordable housing, making it the fastest-growing U.S. metro and leader in job creation.

The addition of new major employers, entertainment centers, and exceptional demographics has driven continued growth.

PROPERTY SUMMARY = $240 PER UNIT IMMEDIATELY

A three-tiered return structure gives investors options when placing their equity. Investors have the ability to invest in either tier of equity Class A, Class B, Reserve Class, or a combination of Class A and Class B. Diversifying in both A and B classes allows for a risk-adjusted, blended return.

Annual Percent Return

Percent Return

Distribution

LOAN PRINCIPAL $23,760,000

LOAN TO VALUE 66% LTV

INTEREST RATE 5.20%

FIXED OR ADJUSTABLE Fixed

AMORTIZING PERIOD 30

INTEREST ONLY 12 MONTHS

PRIME LOCATION

DFW TOPS THE CHARTS AS THE #1 CITY FOR DOMESTIC MIGRATION, AND #1 FOR LARGEST POPULATION GROWTH IN THE UNITED STATES. DFW HAS GROWN AT MORE THAN 53 TIMES THE NATIONAL AVERAGE, MAKING IT A HIGHLY DESIRABLE DESTINATION.

HIGH-QUALITY ASSET WITH BELOW MARKET RENTS

THIS NEWLY DEVELOPED BUILD-TO-RENT COMMUNITY OFFERS EXPANSIVE FLOOR PLANS AT BELOW-MARKET RATES, MAKING IT HIGHLY ATTRACTIVE TO THE KEY RENTAL DEMOGRAPHIC IN THE DFW AREA.

DEFINED CORE-PLUS STRATEGY

OFFERING BELOW-MARKET RENTS IN A HIGH-DEMAND LOCATION, THIS BUILD-TO-RENT ASSET PRESENTS A LOWER-RISK INVESTMENT PROFILE WITH CLEAR UPSIDE POTENTIAL.

SUBMARKET RENTAL GROWTH

WITH POPULATION GROWTH SURGING BY 42% SINCE 2010, THIS AREA BENEFITS FROM EXCELLENT SCHOOLS, STRONG INCOME LEVELS, AND A TRAJECTORY OF CONTINUED DEVELOPMENT.

RISK-ADJUSTED RENTER PROFILE

THESE TOWNHOMES APPEAL TO AFFLUENT RENTERS SEEKING THE BENEFITS OF SINGLE-FAMILY LIVING, WHILE ALSO ALLOWING FOR UNDERWRITING PRACTICES AKIN TO TRADITIONAL MULTIFAMILY PROPERTIES. THIS STRATEGIC MIX MEETS PREMIUM DEMAND WHILE DELIVERING STRONG RISK-ADJUSTED RETURNS FOR INVESTORS.

SITE DESCRIPTION

Number of Units Total

Square Feet Average Unit

Size Year Built Number of

Buildings Site Size (acres)

Parking Type

Total Parking Spaces

Parking Ratio

Building Type

Foundation

Framing

Exterior

Roof

Cabinets

Counter

Flooring

Appliances

Washer/Dryer

Electric

Heating/Cooling

Water Heater

Wiring

Plumbing Fire

Electricity

Water/Wastewater

Trash Removal

Pest Control

Landscaping

Cable/Internet

Security

Individually Metered Individual Units

Individual Units

Copper PVC Sprinklered

Resident Paid

Resident Paid

Resident

Property

Resident

Jurisdiction Tax ID Ellis County | City of Waxahachie

Parceled

Open floor plans

European-style cabinetry

Stainless-steel appliances

Granite countertops

Kitchen pantry

Full-size washer and dryer

Generous closet space

Wood & ceramic tile flooring

Ceiling fans

Kitchen island

Built-in shelves

Attached Garage

Large Unit Sizes

3 BEDROOM, 2.5 BATH | 1,788 SF

T H R E E B E

F O U R B E D R O O M

4 BEDROOM, 2.5 BATH | 1,897 SF

Acquisition opportunity well below replacement cost on irreplaceable site:

LAND COST HARD COST SOFT COST

$30,000/unit

$331,740/unit $30,000/unit

ALL-IN COSTS

$470K /UNIT

VIKING COST PER UNIT

$308K /UNIT

$162K DISCOUNT PERUNIT

LONG-TERM RENTAL INCOME FROM MULTIPLE UNITS WITHIN A SINGLE DEVELOPMENT, ENSURING A STEADY CASH FLOW.

INVESTORS BENEFIT FROM REDUCED HANDS-ON MANAGEMENT.

WITH ALL HOMES SITUATED IN ONE LOCATION, INVESTORS CAN MORE EFFECTIVELY MAINTAIN HIGH OCCUPANCY RATES AND REDUCE TENANT TURNOVER.

OFFERING INVESTORS THE DUAL ADVANTAGE OF PASSIVE INCOME AND ASSET VALUE GROWTH.

OVER$50BILLIONININSTITUTIONAL INVESTMENTINBTRSINCECOVID

DFW INTERNATIONAL AIRPORT

Companies: Amazon, Pepsico, Coca Cola, Life Science Logistics, Aviall, RDHL, Hello Fresh

18,000 acres

2nd busiest airport in the world (passenger traffic)

Employs 60 000 people

3,820 065 sf under construction

Employs over 40,000 people across 1,000 acres

1,968 total medical beds

2 9 million patients a year

Newest development

Parkland Hospital (2015) ‐ 870 beds

DALLAS CBD: (MAJOR EMPLOYERS INCLUDED AT&T, COMERICA BANK, TM ADVERTISING, TENENT HEALTHCARE, KPMG AND MORE)

& distribution project

135,000 working professionals | 13 000+ residents In 2019, best city for jobs (Forbes) 9th largest high-tech job concentration in the country 80,000+ residents live in the City Center (2 Mile radius from downtown)

& WHITE HOSPITAL

0.4k

0.2k 0.0k

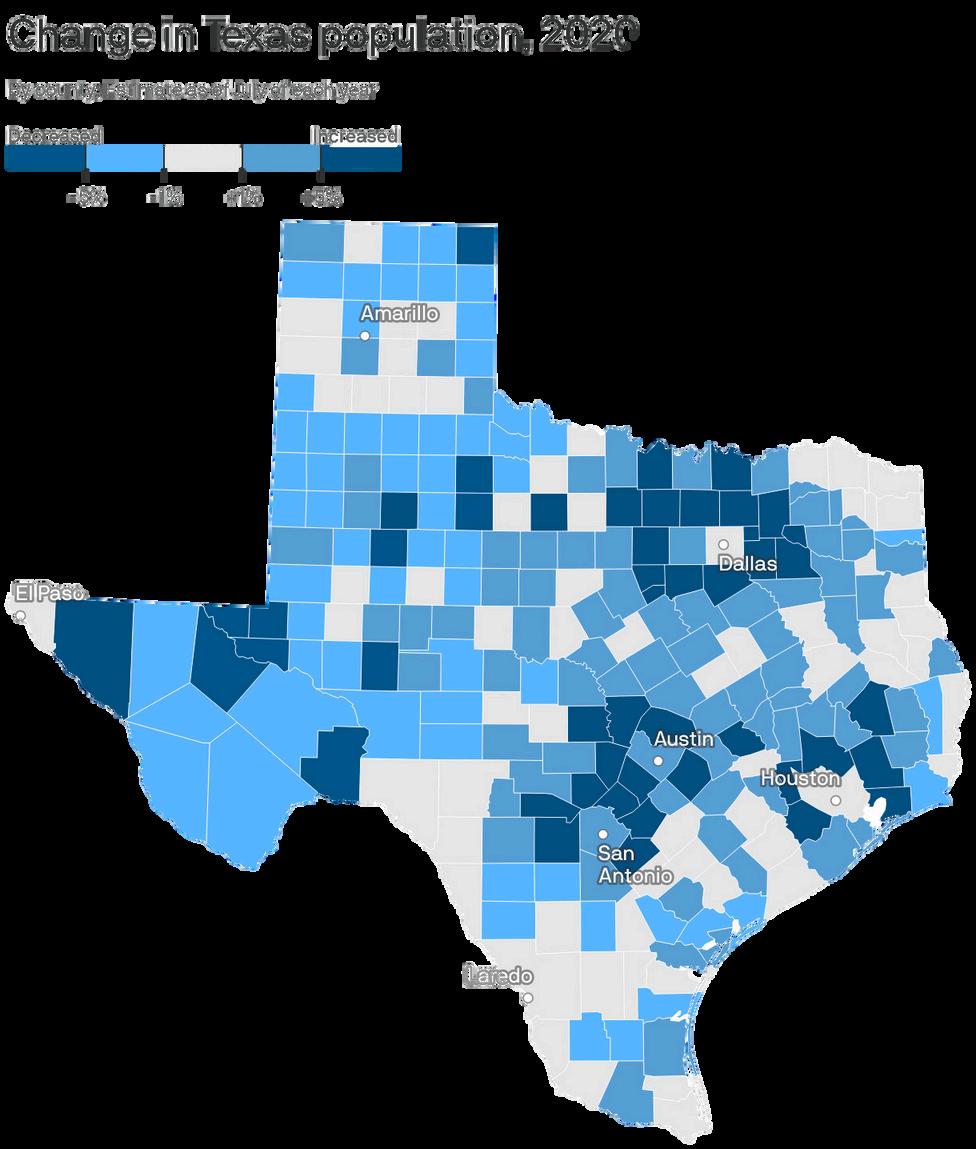

Ellis County experienced 5 year average rent growth of 5.6%

Ellis County has a five year average occupancy rate of 96%

Ellis County had strong absorption in 2023 relative to other submarkets

Ellis County is in the top 25 of largest counties in Texas

The county has seen 40%+ growth since 2010

Ellis county spans over 950+ square miles, with direct access to Dallas and Fort Worth

96.3%

Five Year Avg. Occ. Rate (MPF Q1 2024)

2K+ Businesses (5-mile)

5.6%

Five Year Avg. Rent Growth (MPF Q1 2024)

100K+ Traffic Count - VPD (US-287) (0.5 miles)

20K+ Employees (5-mile)

74K+ Median HH Income (1-mile)

ELLIS COUNTY HAS LED THE METROPLEX IN OCCUPANCY OVER THE PAST FIVE YEARS

1 PERSON EVERY 3.3 MINUTES

18 PEOPLE AN HOUR | 429 PER DAY | 3,015 PER WEEK

ERAGE HOME PRICE

$366,000

TIONAL AVERAGE: $356,048 5.52% ABOVE NATIONALAVG. AVERAGE MONTHLY RENT $1,787 NATIONAL AVERAGE: $1,982 14% BELOW NATIONALAVG. R E N T V S B U Y

RENTERS BY CHOICE:

Many prefer renting to enjoy a single-family lifestyle without the responsibilities of home maintenance.

SHIFTING DEMOGRAPHICS:

Declining homeownership rates among younger and middle-aged adults are making renting a more attractive lifestyle option.

WORK-FROM-HOME DEMAND:

The increased need for private workspaces and flexible layouts is boosting interest in BTR homes.

HIGH INTEREST RATES:

Elevated rates are making homeownership less affordable, driving more people to rent until buying conditions improve.

5.5%

5-year Avg. annual rent growth (MPF Q1 2024)

6TH LARGEST ECONOMIC OUTPUT

In the country

1.2 million pop. growth since 2010

1,500 3.94M 8M DFW RESIDENTS TOTAL JOBS 2ND BEST CORPORATE HEADQUARTERS

23 Fortune 500 Companies

YOY job growth: 5.6% (31% Higher than National Average)

(12% Higher than National Average) Real estate market in the country (PWC 2023 report)

$75,468

MEDIAN HH INCOME

#1 FOR TOP MARKETS FOR MULTIFAMILY INVESTMENT VOLUME:

$4.17 BILLION

DFW IS THE #1 PREFERRED MARKET BY INVESTORS ACCORDING TO THE 2023 MULTIHOUSING NEWS #1 FOR INVESTOR PROPERTY RETURNS IN 2023

TEXAS RATED #1 FOR FASTEST-GROWING POPULATION IN 2024

16,000,000 2050 PREDICTION:

-Fort Worth-Arlington

s TOP 20 in the US for omestic migration.

TEXAS IS THE WORLD’S 9TH LARGEST ECONOMY WITH $1.985 TRILLION IN GDP

2024 Completion

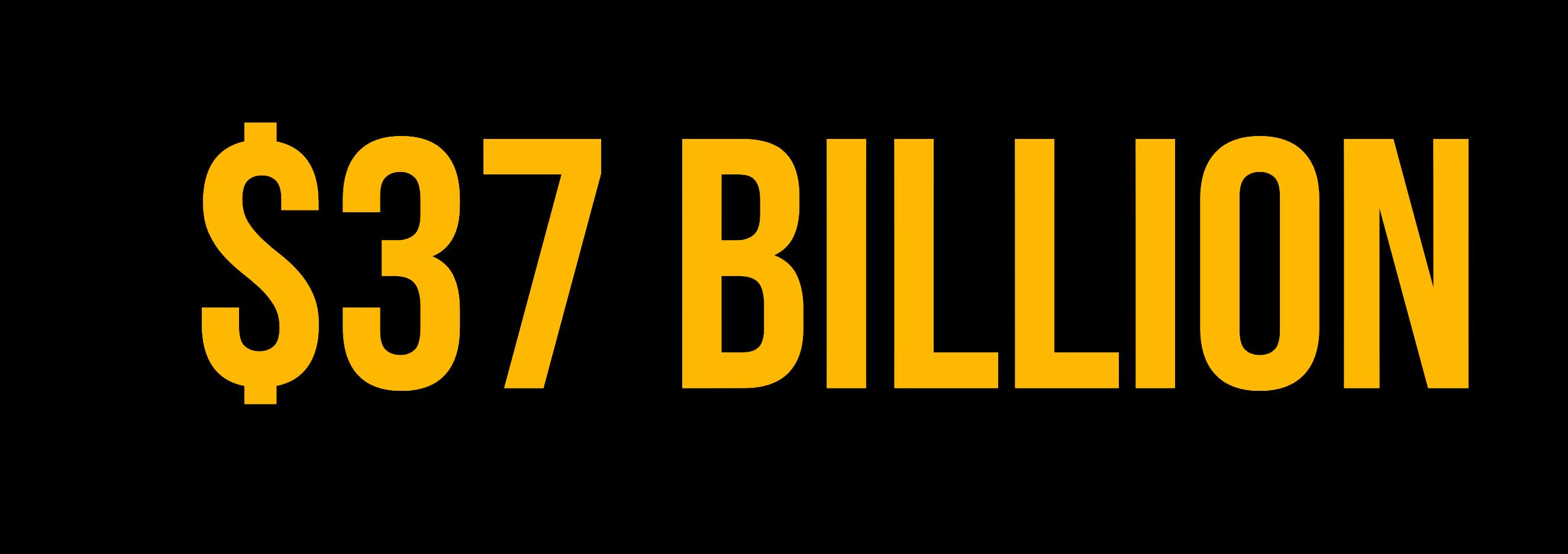

COWBOYS OWNER JERRY JONES IS EXPANDING REAL ESTATE EMPIRE

FAST FACTS

120-acre mixed-use

638,000+ square foot industrial warehouse $29 million project

DALLAS HAS BECOME A MAJOR HIGH-TECH HUB, AND THE FINANCE, INSURANCE, AND TRANSPORTATION SECTORS ARE EXPECTED TO CONTINUE TO EXPAND.

TECHSECTORCONTRIBUTEDASUBSTANTIAL$469.75BILLIONTO TEXAS'SECONOMY,REPRESENTING19.6%OFTHESTATE'STOTALGDP

600,000 NEW JO

IN THE PAST FIVE YEARS, THE HIGHEST AMONG ALL U.S. MARKETS.

NORTH TEXAS' FIRST BLOOD AND MARROW TRANSPLANT PROGRAM

51 HOSPITALS AND MORE THAN 800 PATIENT ACCESS POINTS.

MORE THAN 6,000 ACTIVE PHYSICIANS & 40,000+ EMPLOYEES

ECONOMIC IMPACT OF MORE THAN $2.5 BILLION ANNUALLY & responsible for more than 8% of regional business activity

IN VALUE CREATION AND CATALYZED A 2-ACRE EXPANSION OF THE PARK

$110 MILLION PROJECT

200,000 15,000 1,900+

PASSENGERS PER DAY

EMPLOYEES FLIGHTS EACH DAY

REUNIONTOWER

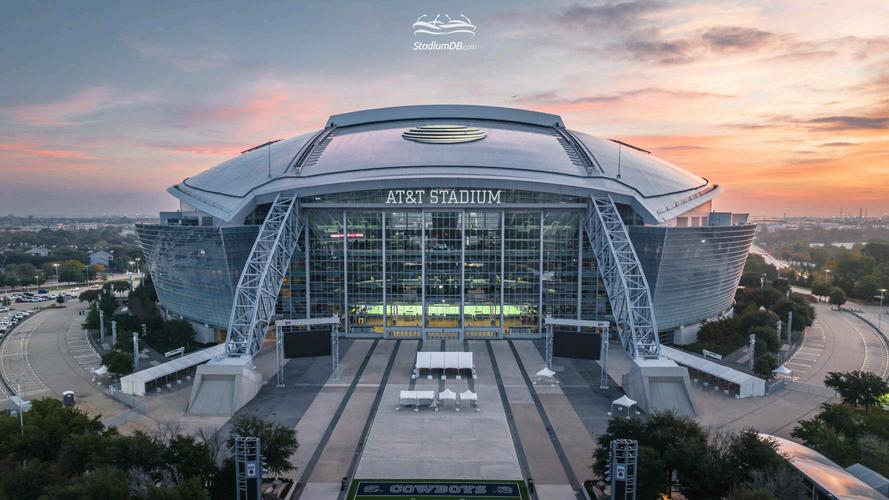

AT&TSTADIUM

$9.6 BILLION

DALLASWORLD AQUARIUM

STOCKYWARDS WATERGARDENS

ONE OF THE FASTEST-GROWING COMMUNITIES WITHIN THE INLAND PORT OF TEXAS

THE SURGE OF NEW WINERIES, TRENDY CAFES, RETAIL HOTSPOTS, AND CUTTING-EDGE

MANUFACTURING IN LANCASTER IS SET TO REVOLUTIONIZE THE LOCAL LIFESTYLE

DRIVING PROPERTY VALUES SKY-HIGH WITH AN ASTONISHING $2.5 BILLION INCREASE IN JUST FOUR YEARS! & CREATED NEARLY 4,000 JOBS

CREATE OVER 150 JOBS BY 2029.

OMES WITH SIGNIFICANT BACKING FROM THE CITY, A $2.4 MILLION ECONOMIC INCENTIVES PACKAGE.

LARGEST FROZEN MEXICAN FOOD MANUFACTURER IN THE UNITED STATES

50,000 SQUARE FOOT FACILITY

$20M EXPANSION

EXPECTED TO CREATE AT LEAST 125 JOBS BY 2026

HOSTING NINE GAMES, INCLUDING FOUR KNOCKOUT-STAGE MATCHES & 3,000 TEMPORARY JOBS

THE PROJECT, ESTIMATED TO COST $12 MILLION, IS EXPECTED TO CREATE AROUND 250 JOBS.

HEXAGON PURUS ASA - NORWEGIAN INNOVATOR IN BATTERY AND POWER SYSTEMS FOR ELECTRIC VEHICLES, IS TRANSFORMING A 216,000-SQUARE-FOOT FACILITY IN MESQUITE.

CARE FOR OVER 3 MILLION CHILDREN IN THE DALLAS-FORT WORTH AREA BY 2032

4.5-MILLION-SQUARE-FOOT CAMPUS

$168 MILLION SINCE 2009 IN SALARIES

ADDING AN $8 MILLION EDIBLE GARDEN

THE 2-ACRE GARDEN, SCHEDULED TO BE COMPLETED NEXT FALL, WILL INCLUDE: ECONOMIC IMPACT $116 MILLION

A 3,600-SQUARE-FOOT PAVILION WITH A DINING AREA AND TEACHING KITCHEN ORCHARD A VINEYARD,

a space of wonder and discovery where art comes alive 6,000 JOBS

ECONOMIC IMPACT

$340 MILLION

DALLAS zoo

ECONOMIC IMPACT

$245 MILLION 3,354 JOBS

ECONOMIC IMPACT

$15 BILLION +256,000 JOBS

Serves as a key driver of tourism, with attendees supporting local businesses such as restaurants, hotels, and retail outlets.

$116.5 MILLION, 56-ACRE PROJECT

OVERALL PROJECT INCLUDES $4 MILLION IN UPGRADES TO THE RODEO COMPLEX

INCLUDING A NEW SOUND SYSTEM AND NEW CONCRETE FLOORS

130,000 SQUARE FEET RETAIL AND ENTERTAINMENT COMPLEX MORE THAN 330 HOMES, TOWNHOUSES AND SINGLE-FAMILY BUNGALOWS

TOTAL STUDENT POPULATION IN NORTH TEXAS EXCEEDS 180,000 STUDENTS

UNIVERSITY OF NORTH TEXAS

NORTH TEXAS HIGHER

NORTHTEXASUNIVERSITIESENGAGEINGROUNDBREAKINGRESEARCHINFIELDSLIKEBIOTECHNOLOGY, ENGINEERING,ANDSUSTAINABILITY,DRIVINGINNOVATIONANDECONOMICGROWTH ANNUAL ECONOMIC IMPACT $27BILLION

DALLASCOMMUNITY COLLEGE & $9.8BILLION UNIVERSITIES COMMUNITYCOLLEGES

OVER$9BILLION.

$100 MILLION seat revenue

THE DALLAS COWBOYS ARE THE WORLD'S MOST VALUABLE SPORTS TEAM, WITH AN ENTERPRISE VALUE : & $150 MILLION from sponsors AT&T's naming rights alone yield the Cowboys a reported $17 - $19 MILLION per year

TOTAL ECONOMIC IMPACT

$1 BILLION+

2024 MLB ALL-STAR GAME

$90MILLION

TOTAL ECONOMIC IMPACT

$1.8BILLION

ANNUAL ECONOMIC IMPACT $1 BILLION 11,000 JOBS

ANNUAL ECONOMIC IMPACT

$80.9 MILLION

ANNUAL ECONOMIC IMPACT

$300 MILLION

XFINITY U.S. GYMNASTICS CHAMPIONSHIPS

NCAA WOMEN’S BASKETBALL

CROSSFIT GAMES ANNUAL ECONOMIC IMPACT $142

The opening of the $500 million PGA Frisco development

THE GOLF COURSES, TOURNAMENTS, HOTEL, AND CONFERENCE CENTER ARE ESTIMATED TO HAVE AN ECONOMIC IMPACT OF MORE THAN $2.5 BILLION OVER THE NEXT 20 YEARS.

660ACREGOLFRESORT

ESTIMATED ECONOMIC IMPACT

$2.5 BILLION

M O V E S T O D F W

FreshRealm produces meal kits for popular brands like Blue Apron and Amazon Fresh, & Marley Spoon

88,000-square-foot

CASH FLOW DIVERSIFICATION APPRECIATION TAX ADVANTAGES EQUITY

Viking Capital was founded in 2015 and has become a premier multifamily investment firm with agile investment sourcing, structuring, execution, and asset management capabilities and the flexibility to scale and cater to investor preferences. Through its team of acquisitions, asset management, and disposition experts, Viking Capital invests in tier 1, secondary, and tertiary markets across the United States.

VikramRaya CEO Co-Founder

RaviGupta COO,Co-Founder

AmirNassar InvestorRelations Manager

SamanthaParrinello GrowthMarketing Manager

JudahFuld VPofAcquisitions

EdMonarchik Directorof AssetManagement

ChariteeBoyd AssetManagementAnalyst

AmberButler InvestorConcierge

AshleyPenrod DirectorofMarketing

AnjaArvin Graphic&Web DesignSpecialist

ChrisParrinello Directorof InvestorRelations

HaydenWalters InvestorRelationsAssociate

Taurean Chambers-Hunter OperationsManager

JackJohnson AcquisitionsAnalyst