meetings

Global

Industry day

BRETT OETTING

President and CEO

Visit corpus Christi

President and CEO

Visit corpus Christi

meetings

Global

Industry day

Executive Vice President Tourism Economics

ERIK EVJEN

The Outlook for Travel as Challenges Mount

Erik Evjen Executive VP Tourism Economics eevjen@tourismeconomics.com

Forecast storyline

Travel showed signs of resilience and recovery in 2023

The industry enters 2024 facing two key challenges

1. Slowing economy

2. Weakening finances

Forecast storyline

Travel showed signs of resilience and recovery in 2023

The industry enters 2024 facing two key challenges

1. Slowing economy

2. Weakening finances

After months of slowdown, was February the turning point?

National Travel Indicators

February 2024

8

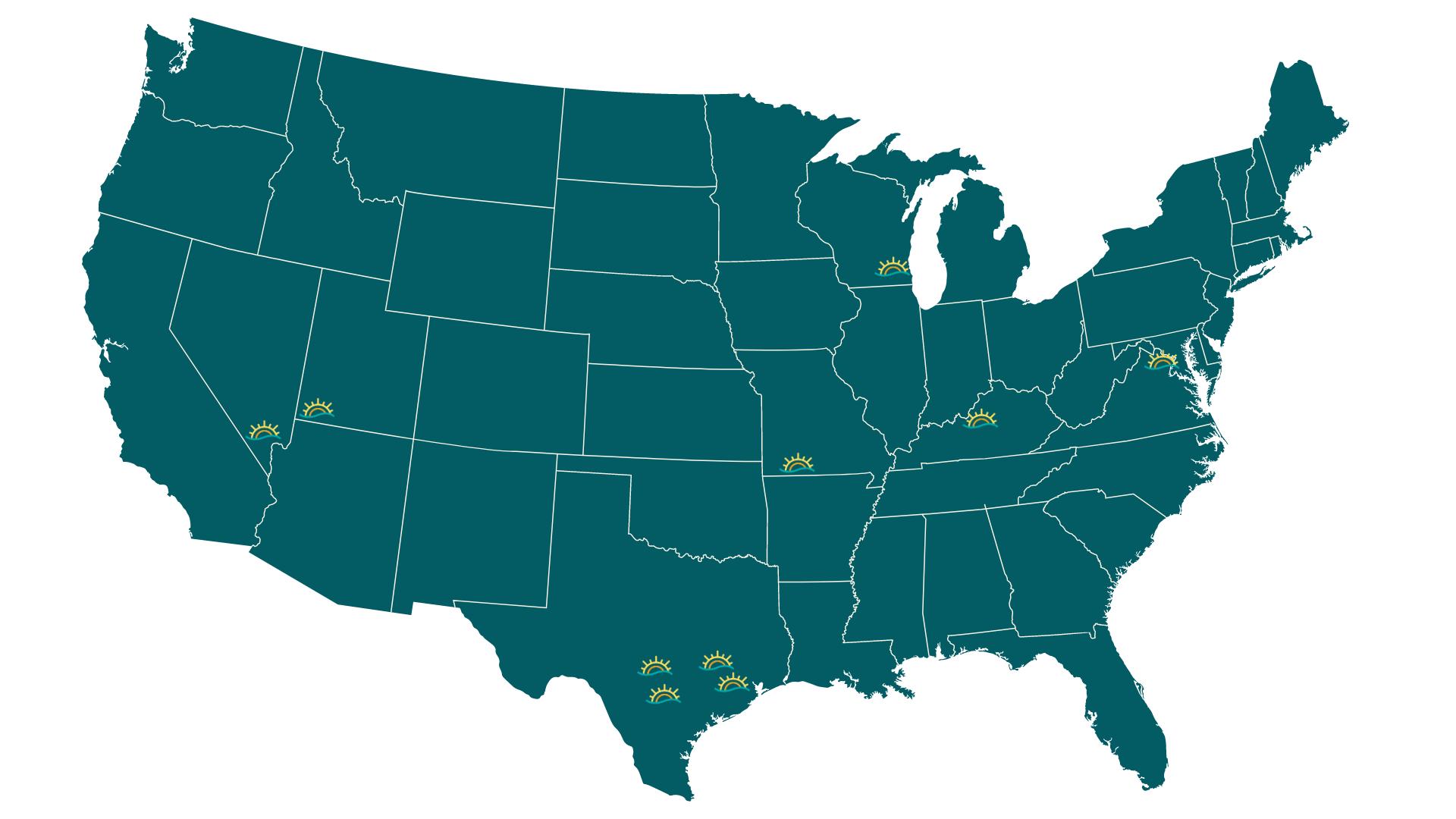

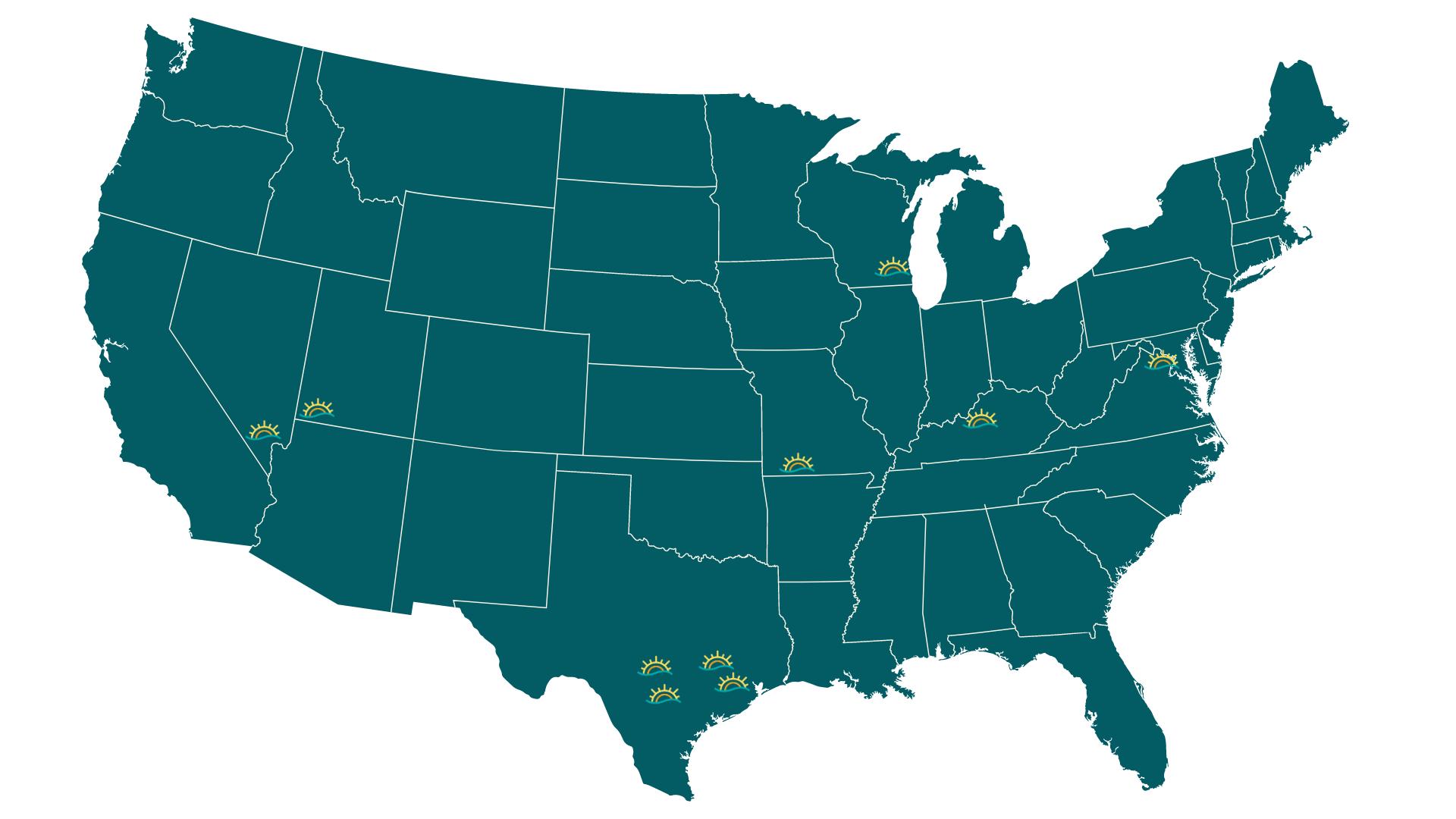

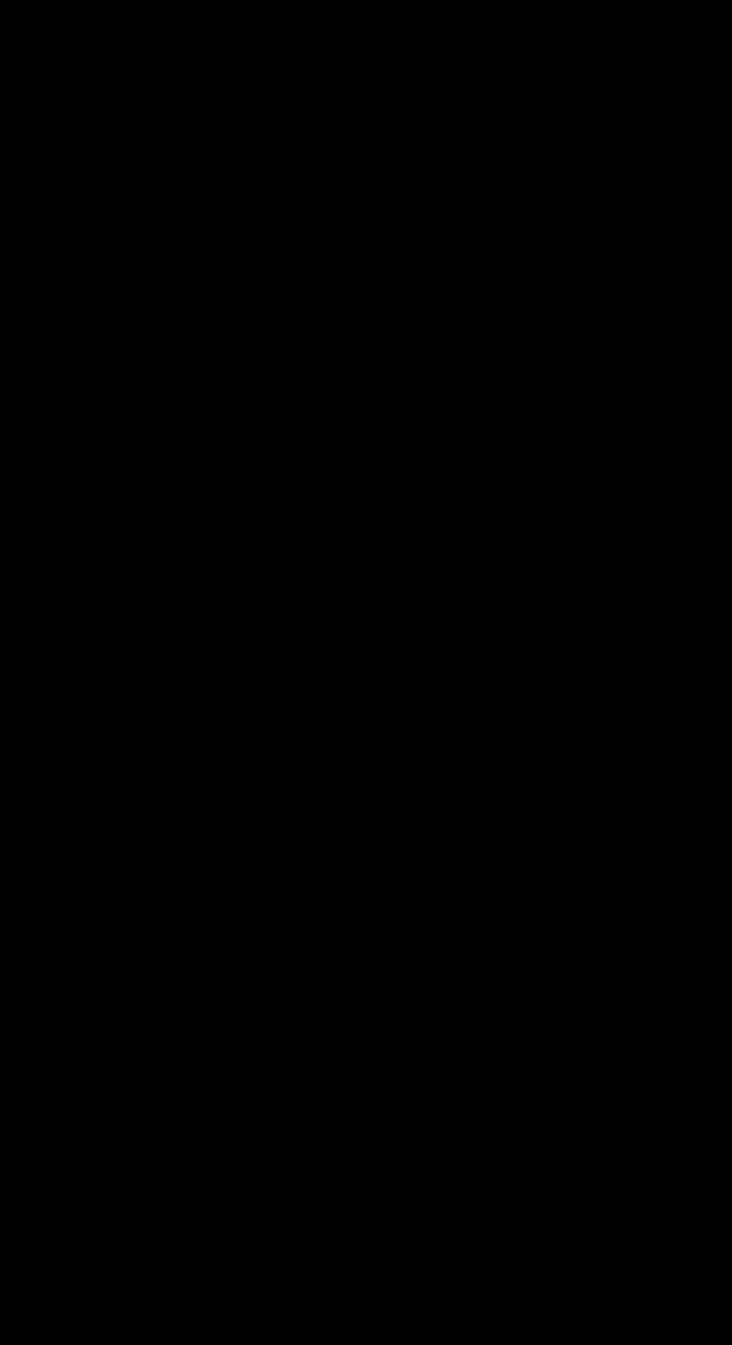

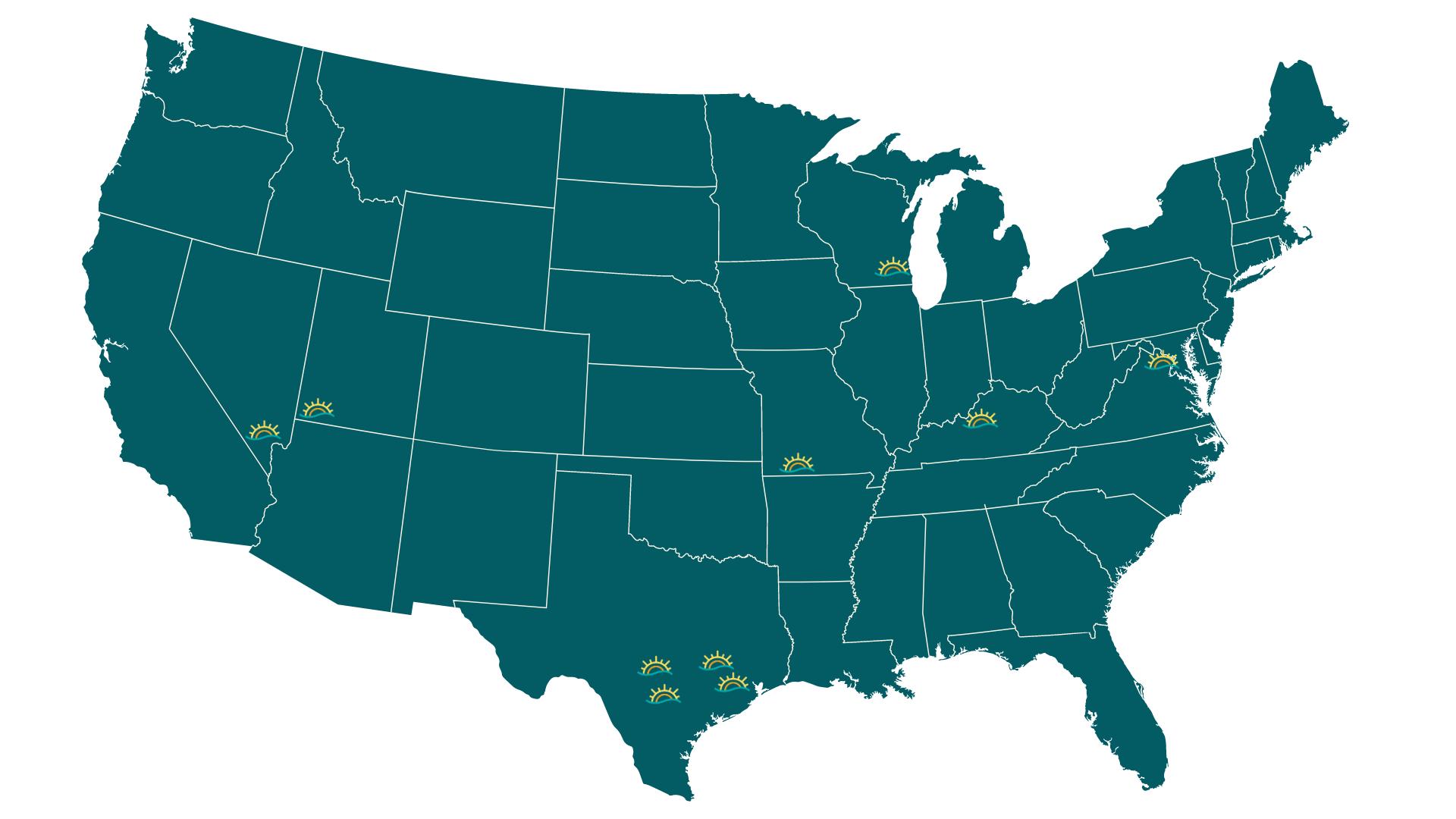

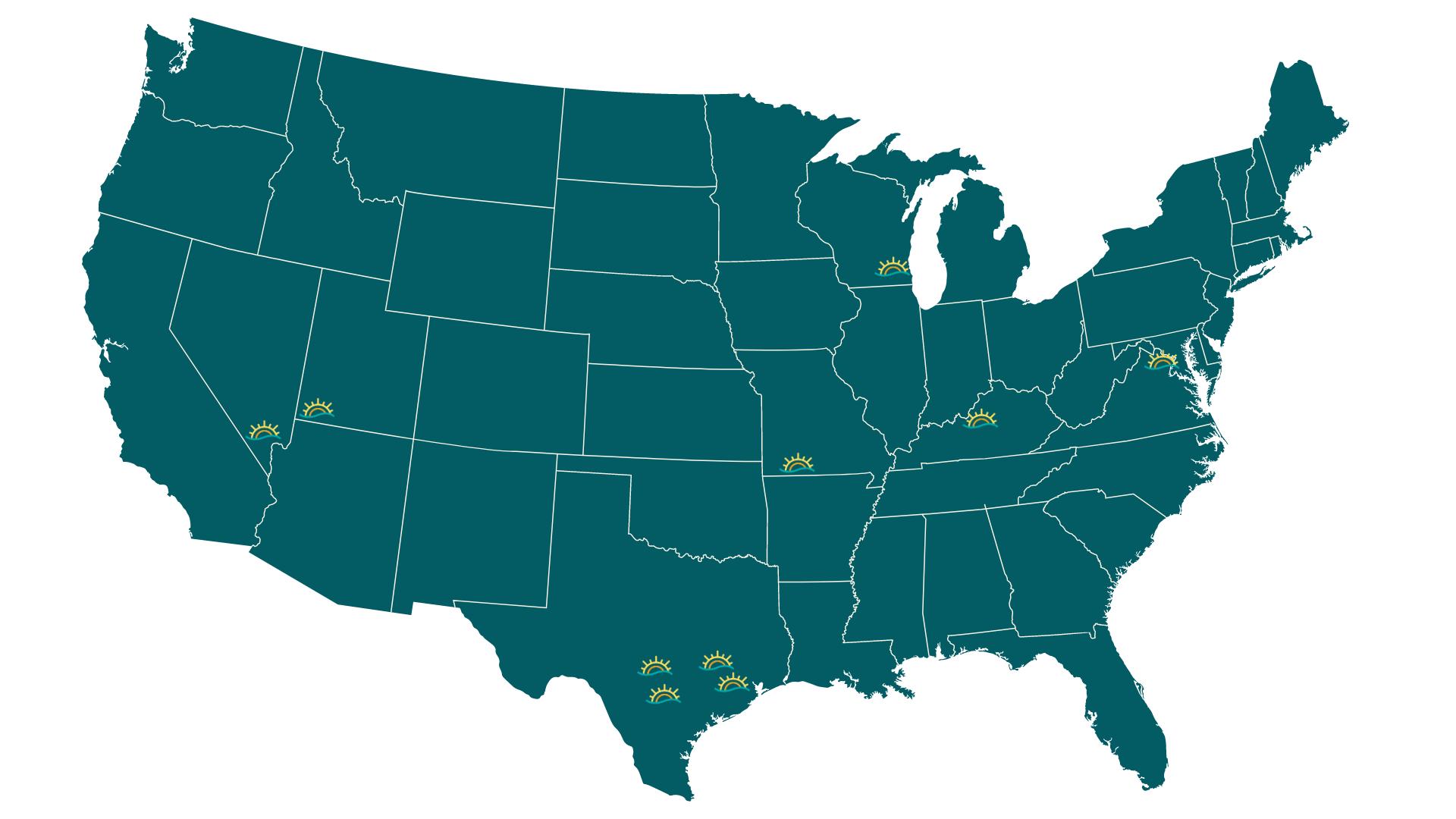

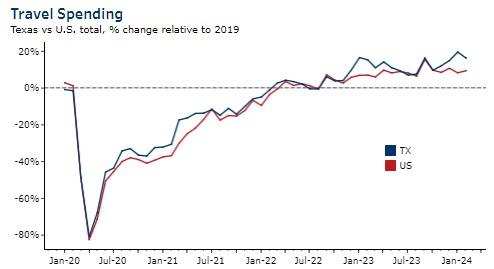

TX continue to outperform the national average

Source: Tourism Economics

9

16% 9%

US hotel demand nearly fully recovered in 2023

US Hotel Room Demand (Annual) % of 2019 level

64% 88% 97% 98% 2020 2021 2022 2023

Source: STR

US Air Travel

TSA PAX counts, % recovered vs same period in in 2019 (index, 2019=100)

Source: TSA

5 11220 40 60 80 100 120 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24

US air travel has fully recovered

Forecast storyline

Travel showed signs of resilience and recovery in 2023

The industry enters 2024 facing two key challenges

1. Slowing economy

2. Weakening finances

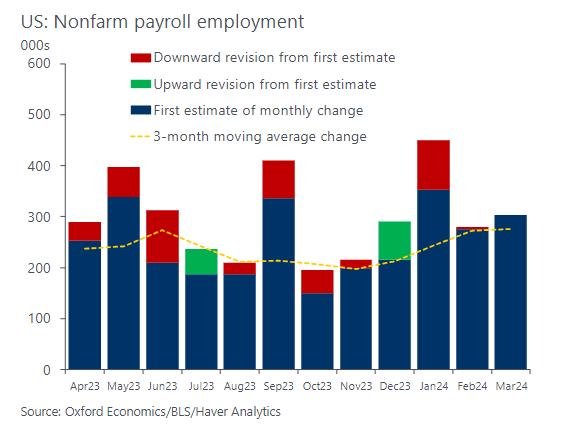

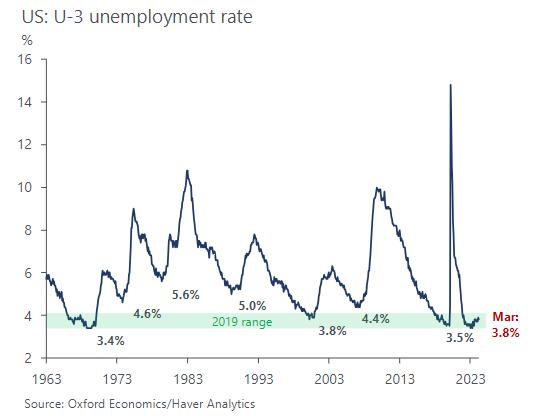

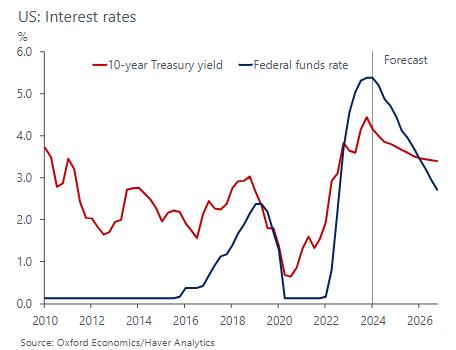

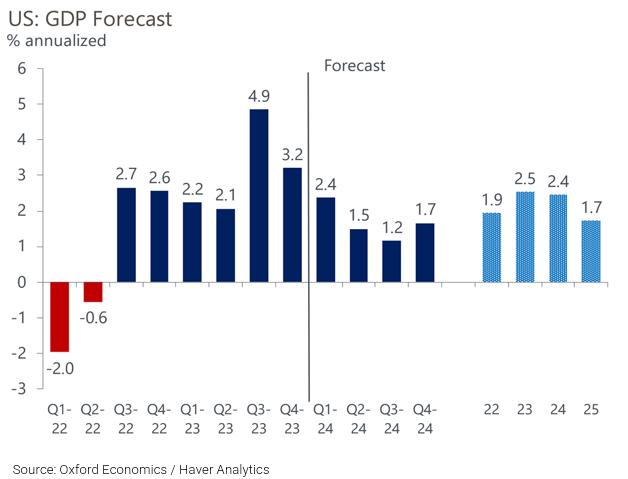

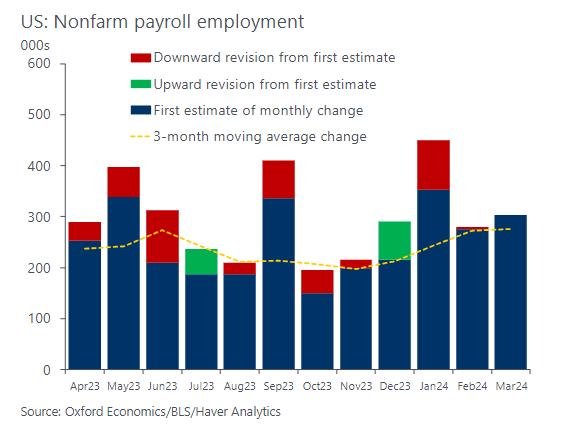

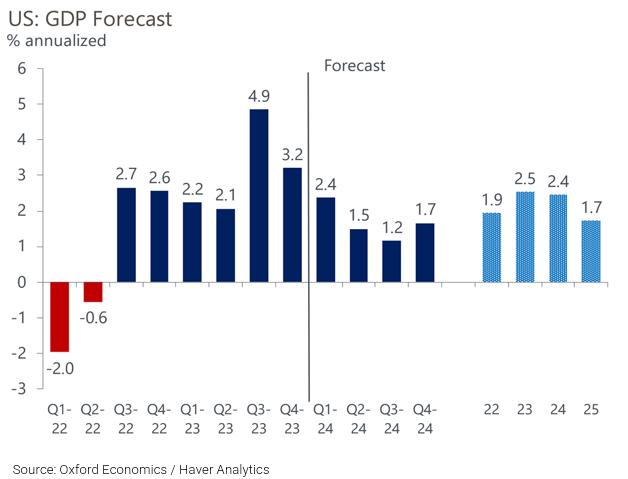

A slowing economy

Labor market remains positive

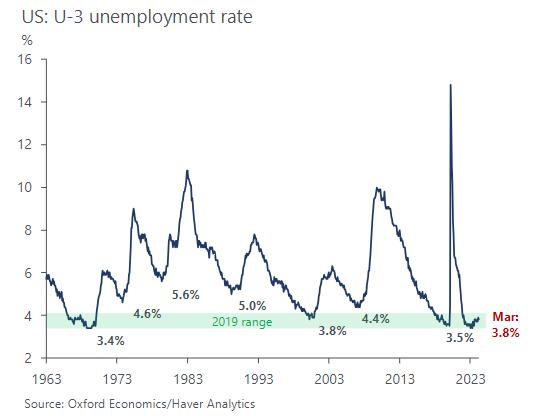

Unemployment: historically low but ticking up

Forward signals: market is normalizing

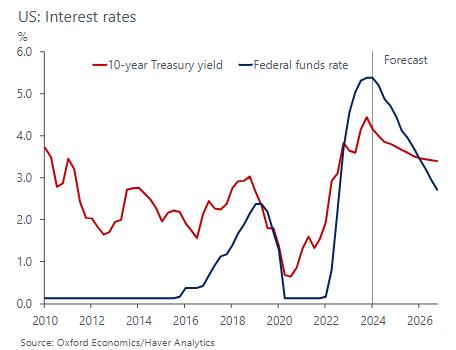

Higher interest rates continue to leave their mark

The benefit of excess savings will diminish in 2024

US : Estimated excess savings

Source : Oxford Economics /Haver Analytics $,bns

Upward revision to excess savings (LHS)

Excess savings (pre -revisions, LHS)

• Excess savings are more concentrated among the wealthiest households.

0 500 1000 1500 2000 2500 3000 Jun20 Dec 20 Jun21 Dec21 Jun22 Dec 22 Jun23

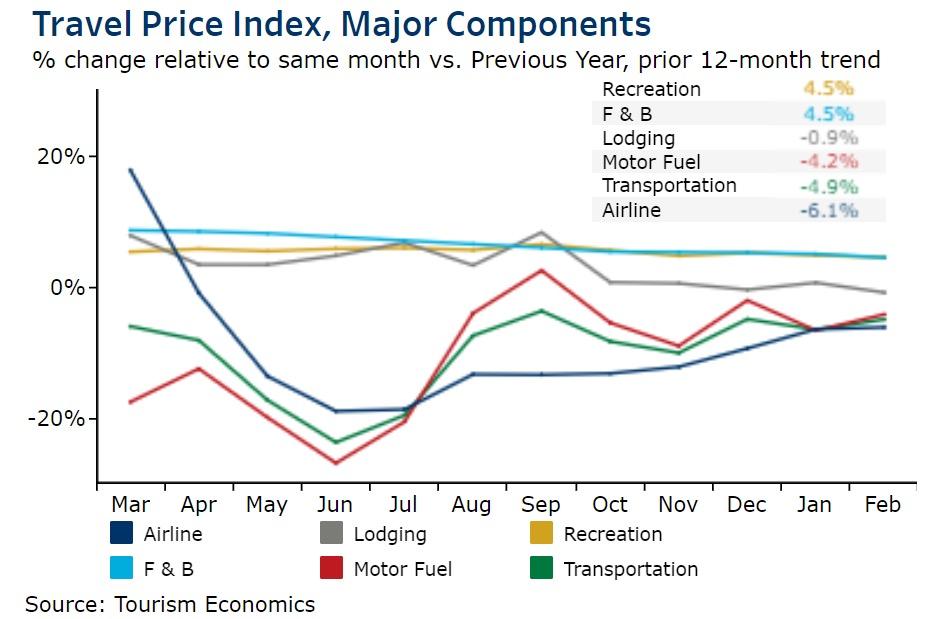

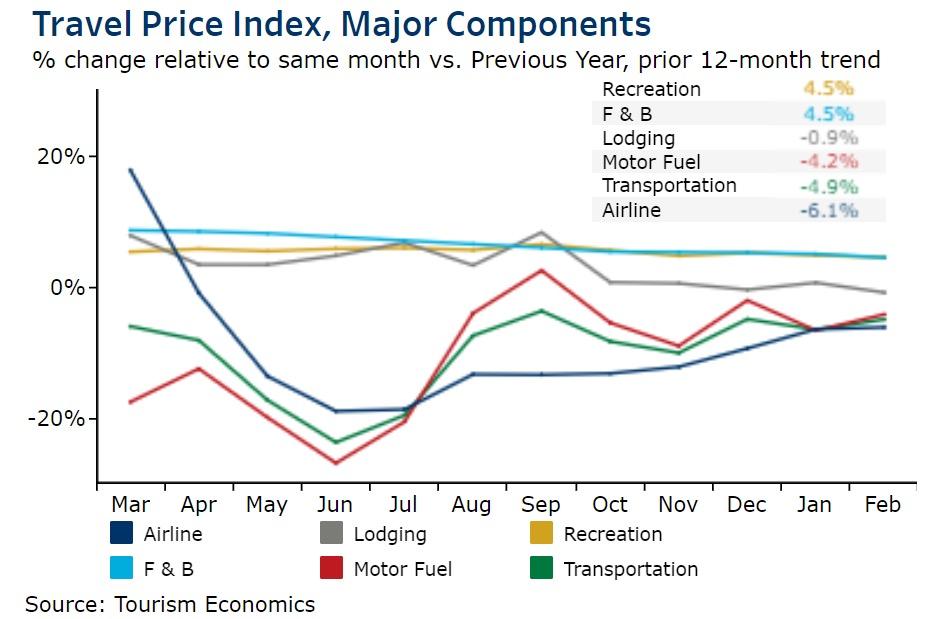

Travel costs are contracting

GDP set to slow as we move through 2024

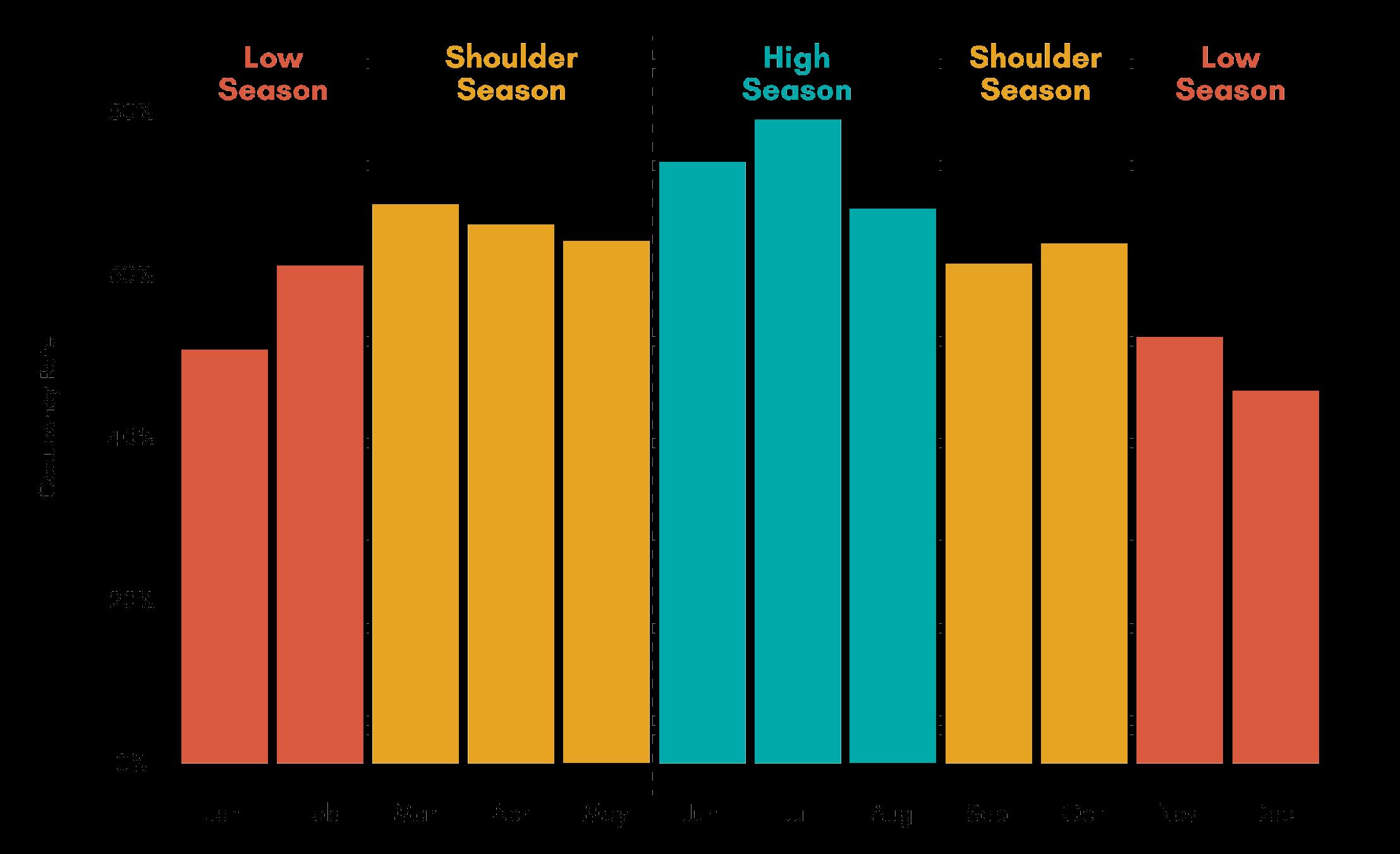

Leisure Travel

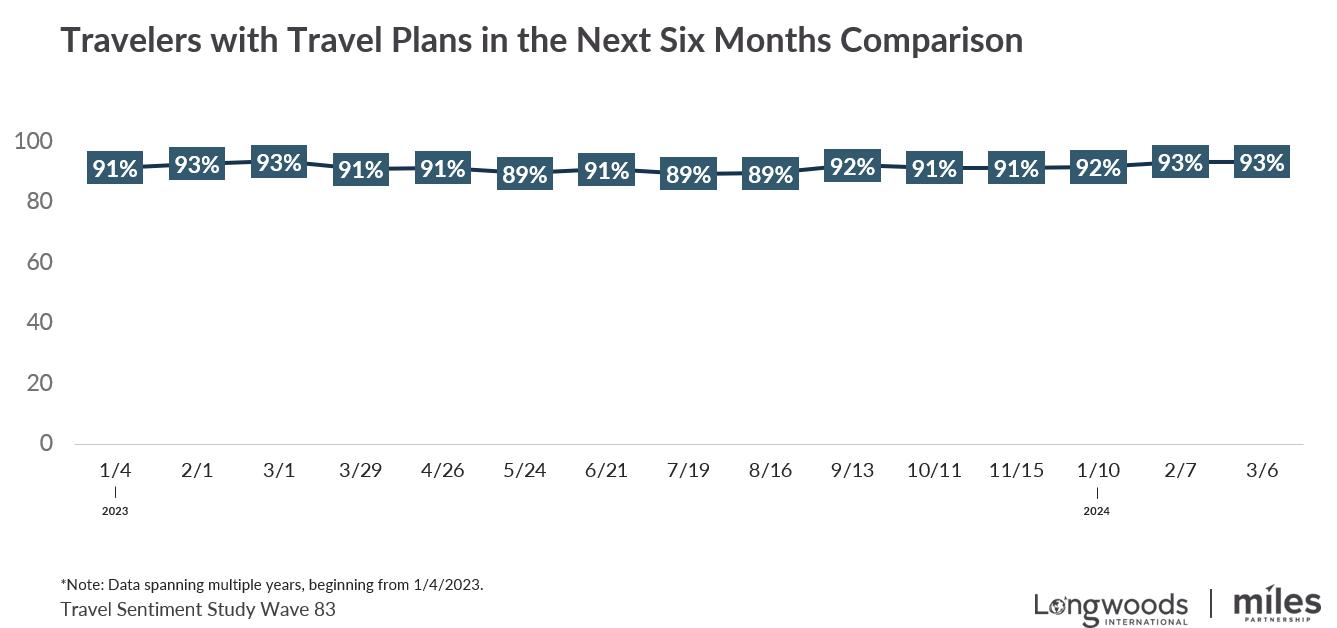

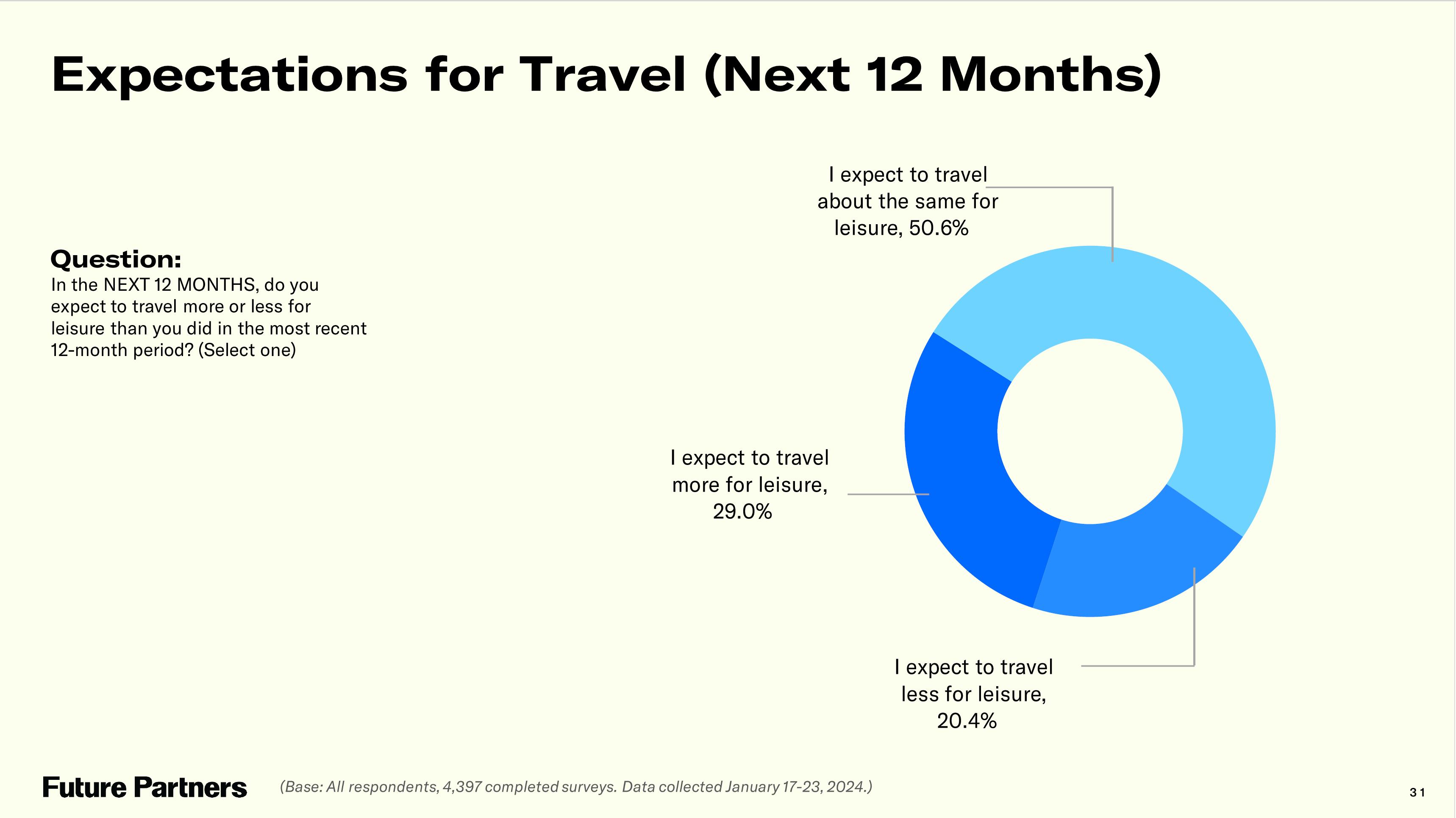

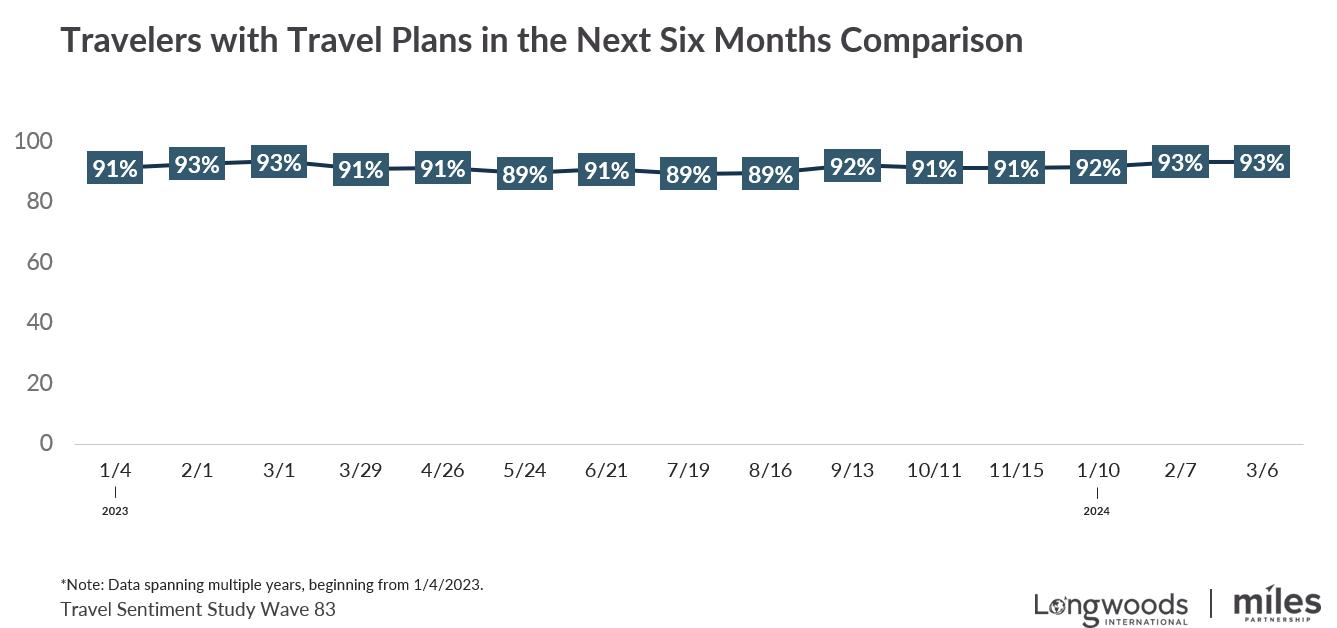

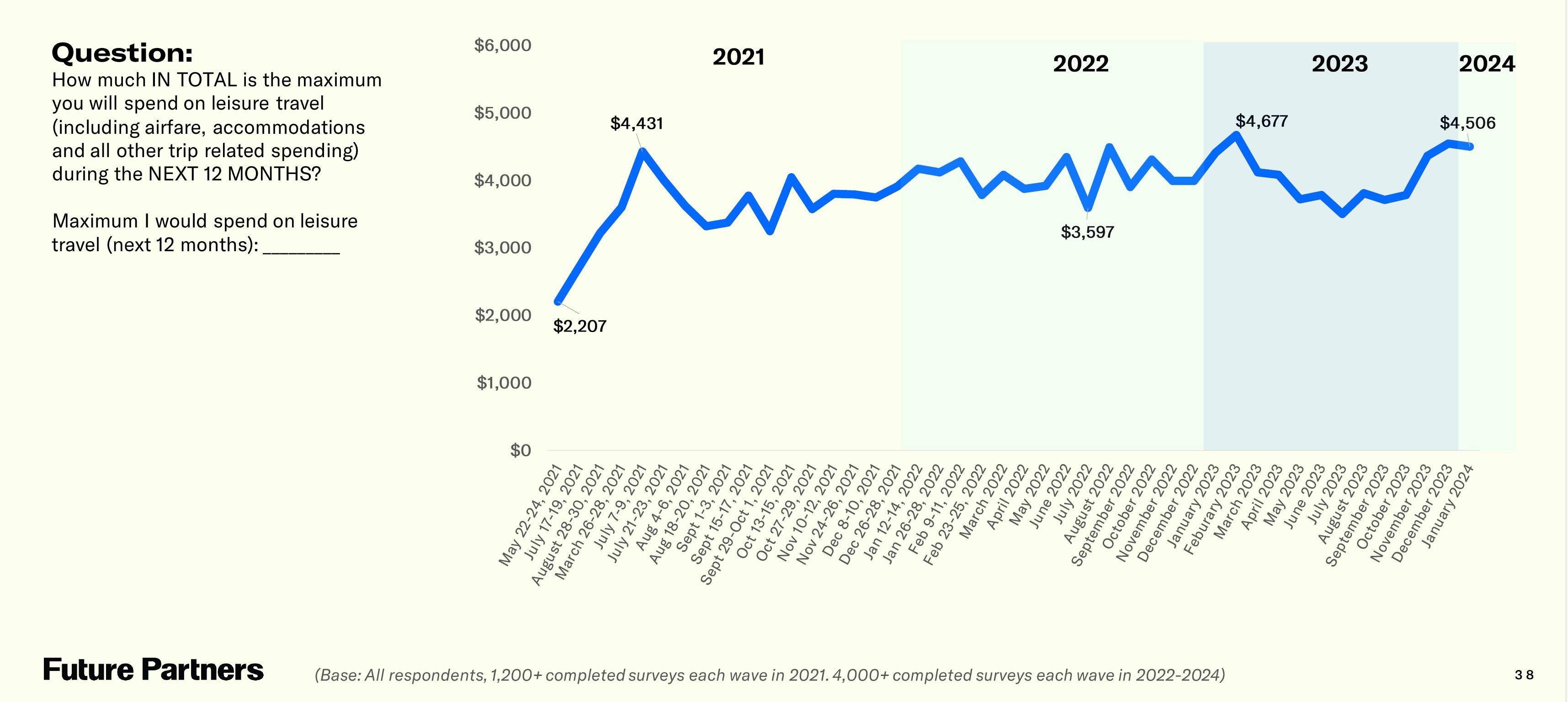

Travel planning remains stable

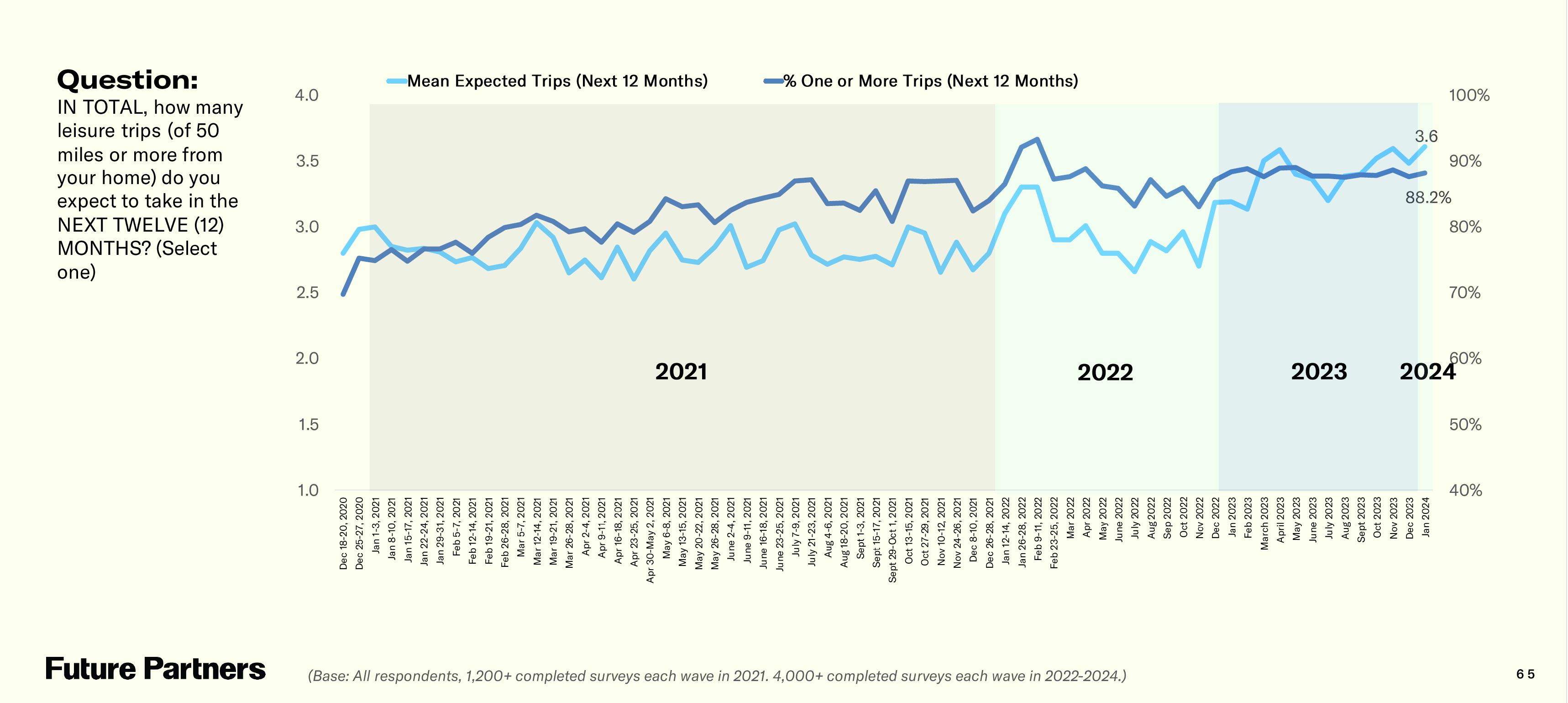

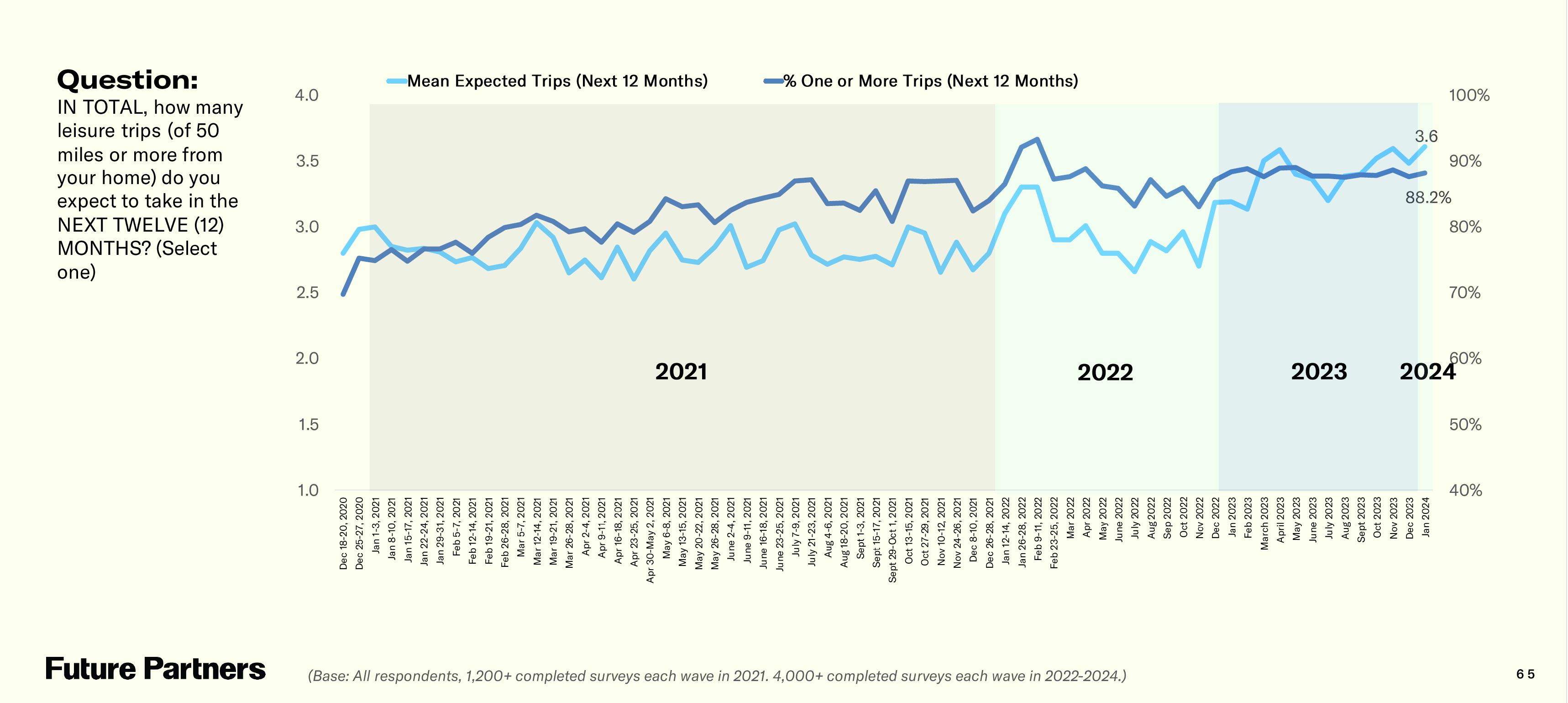

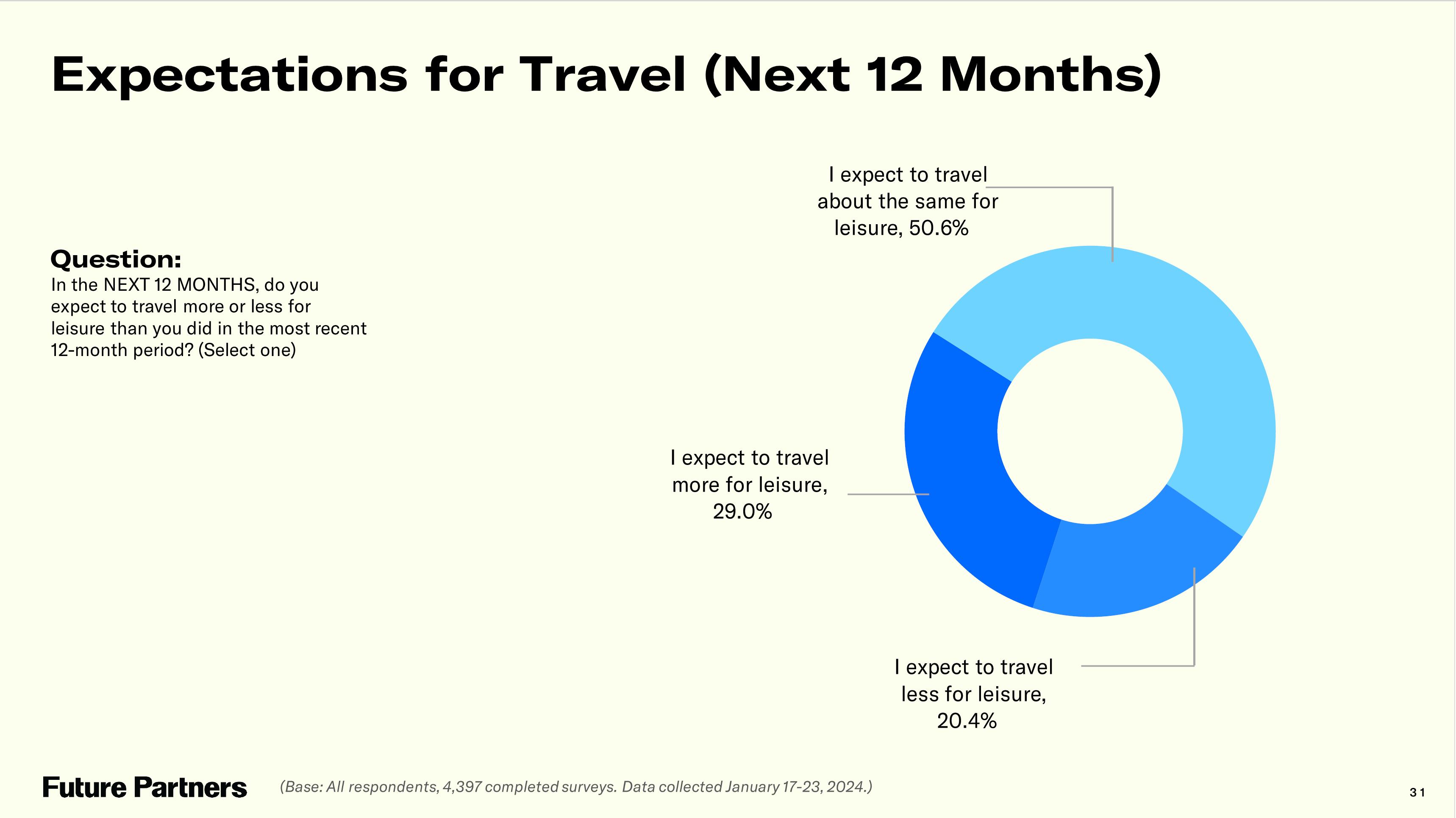

Leisure trip expectations hit a new high

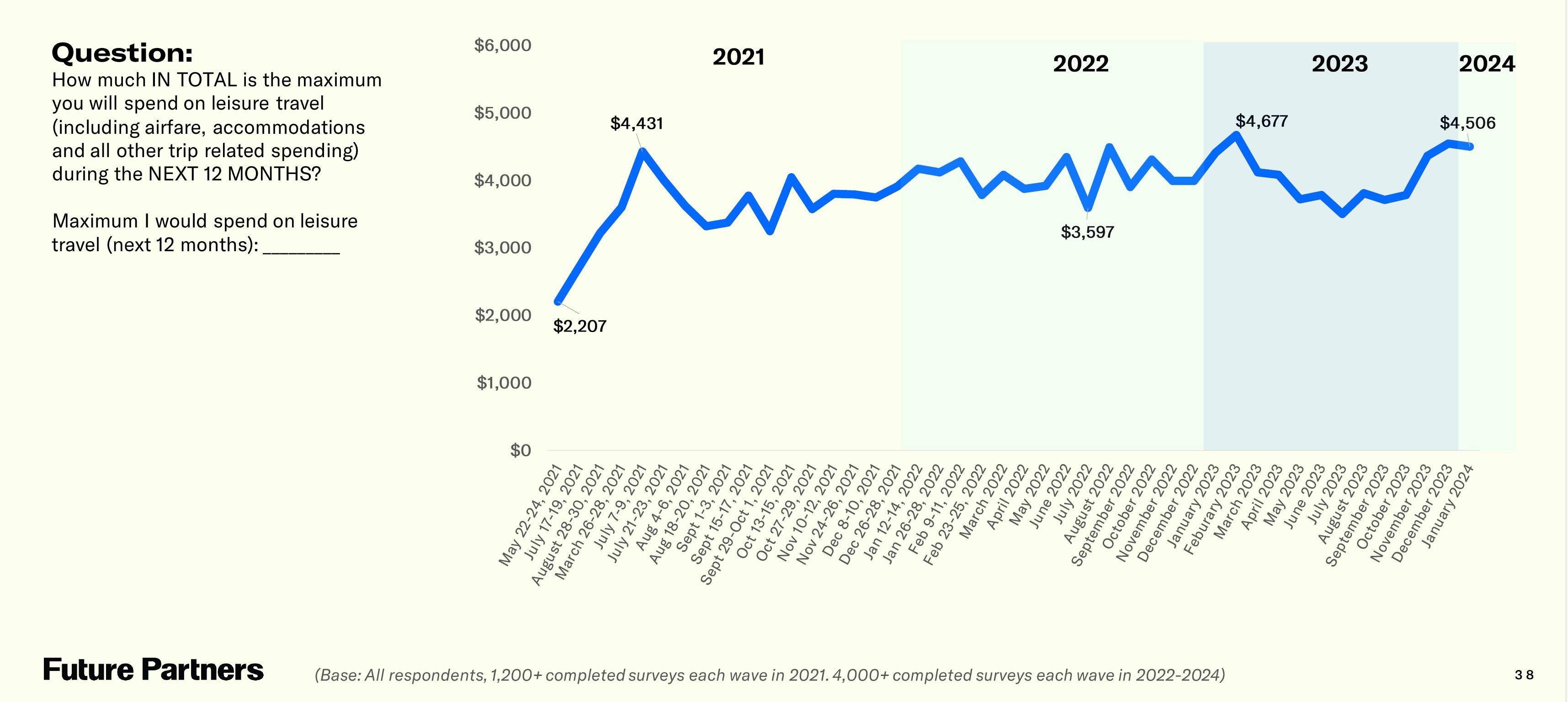

Travel budgets have recovered

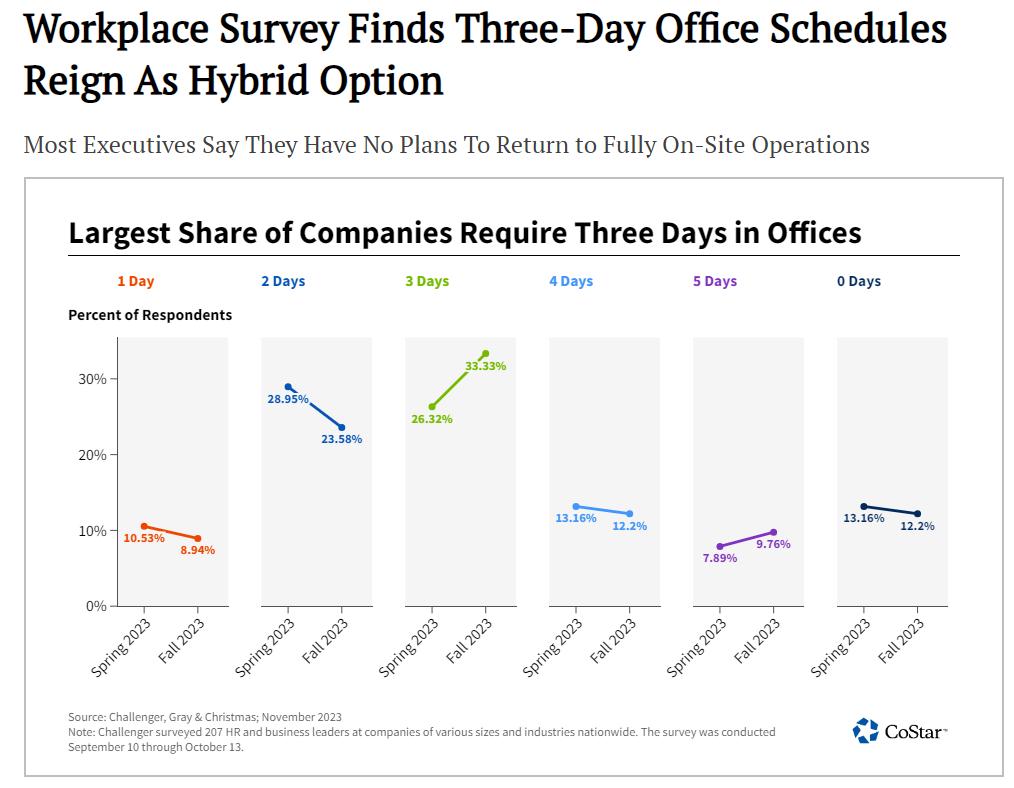

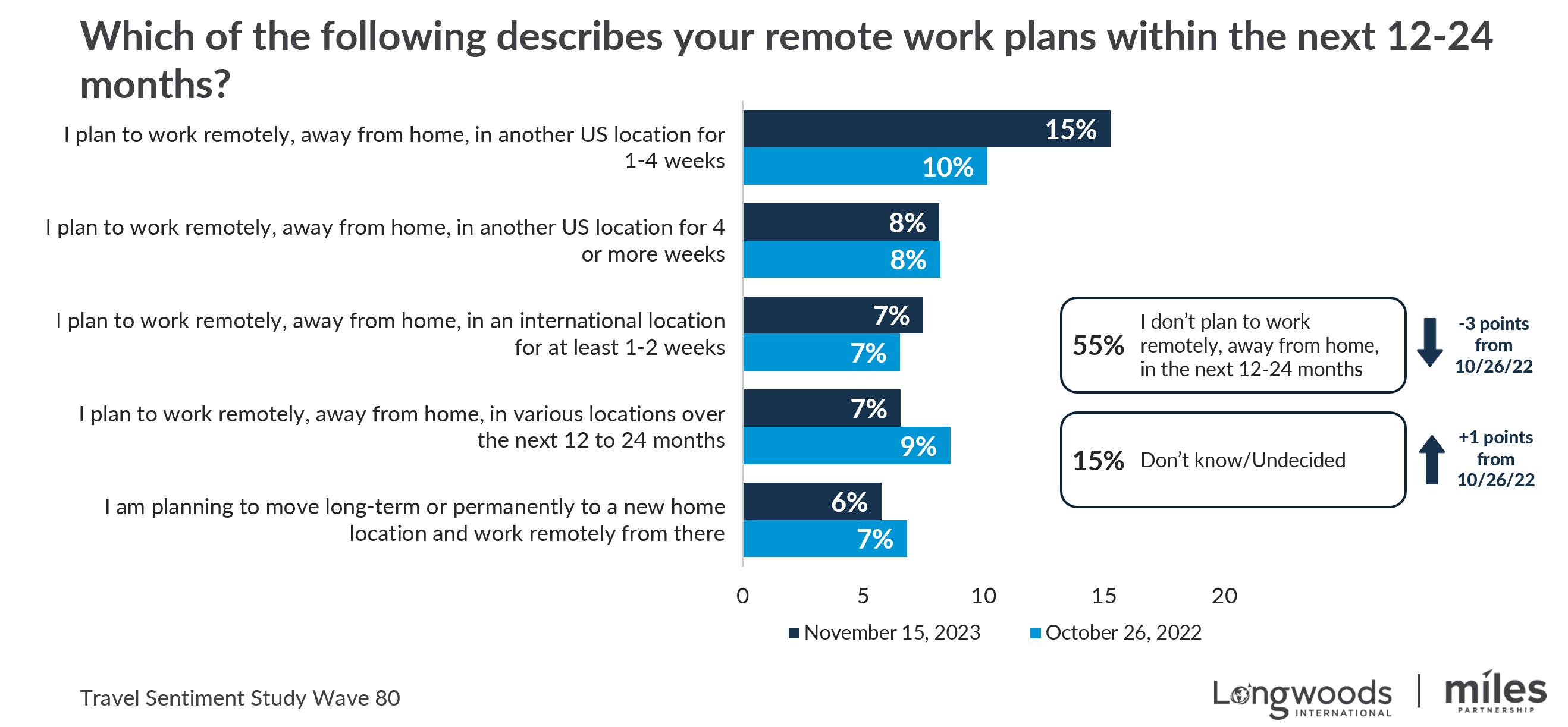

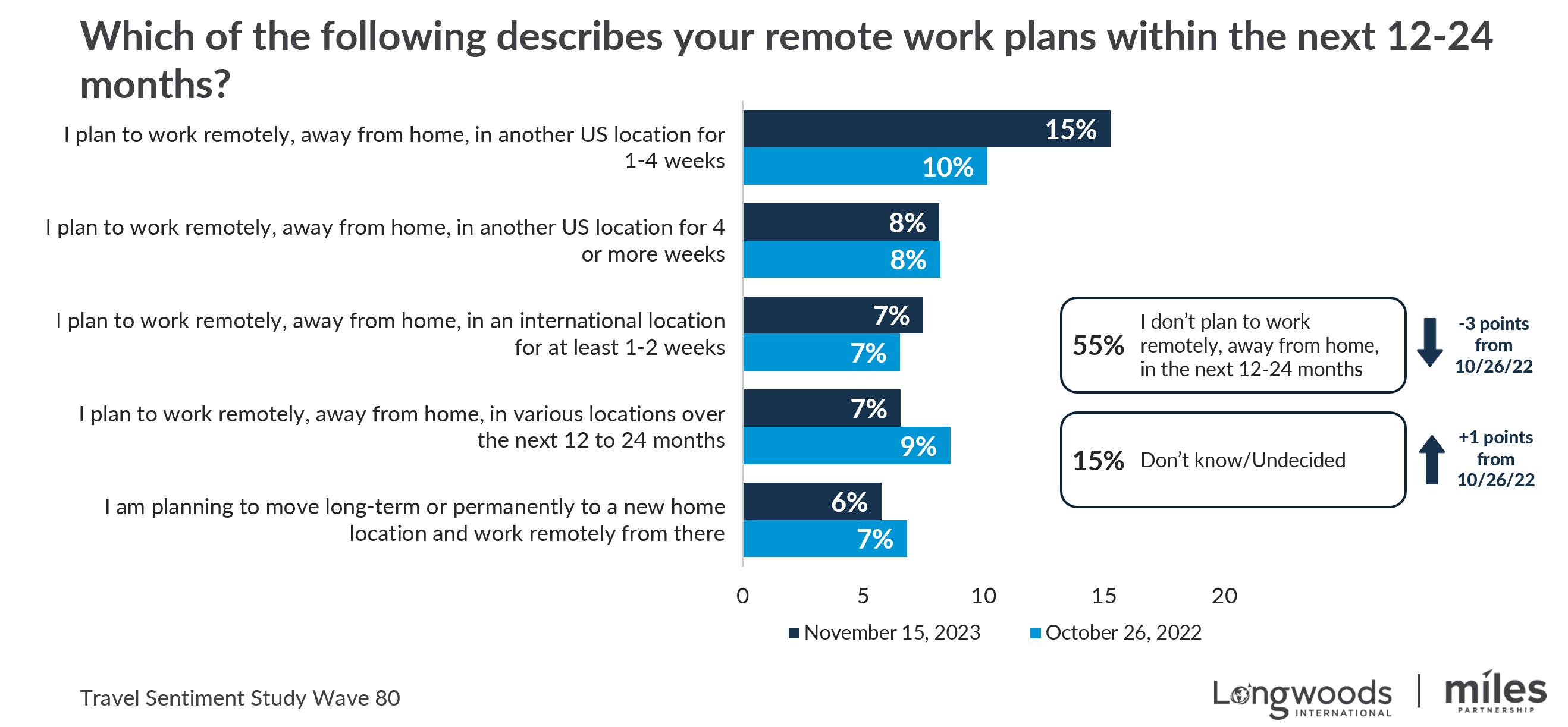

Remote work is a driver of leisure travel

37% intend to travel while working (an increase from 34% in fall 2022)

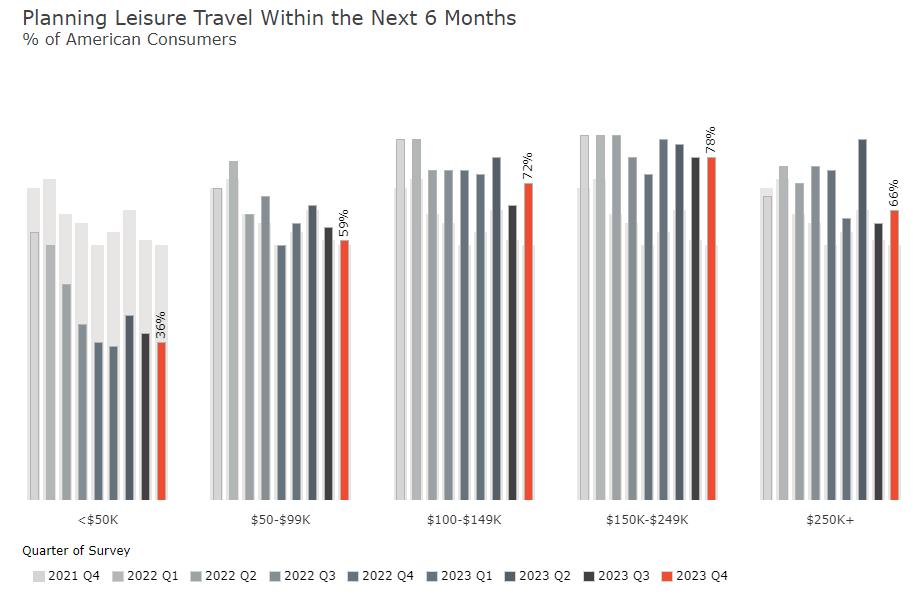

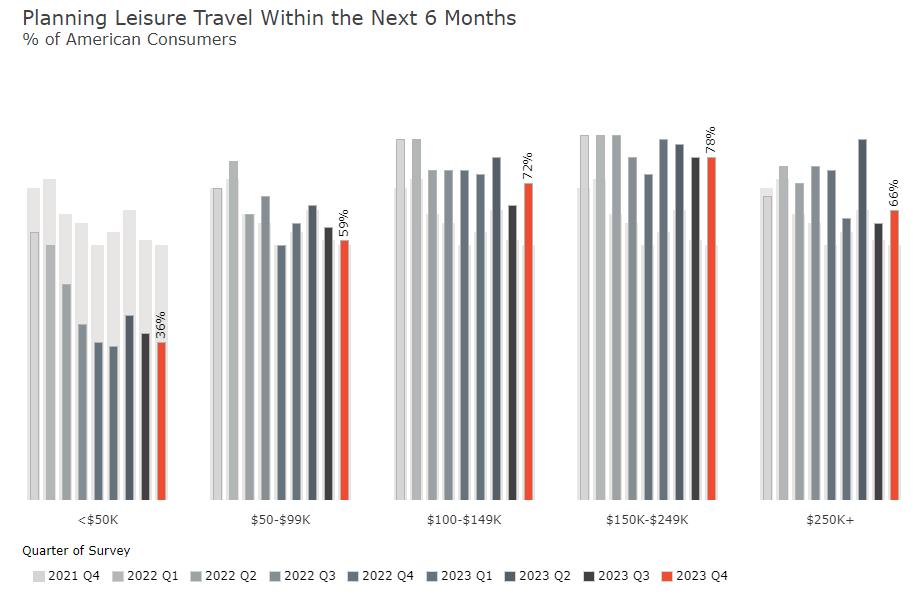

Intentions resilient among high income earners

28

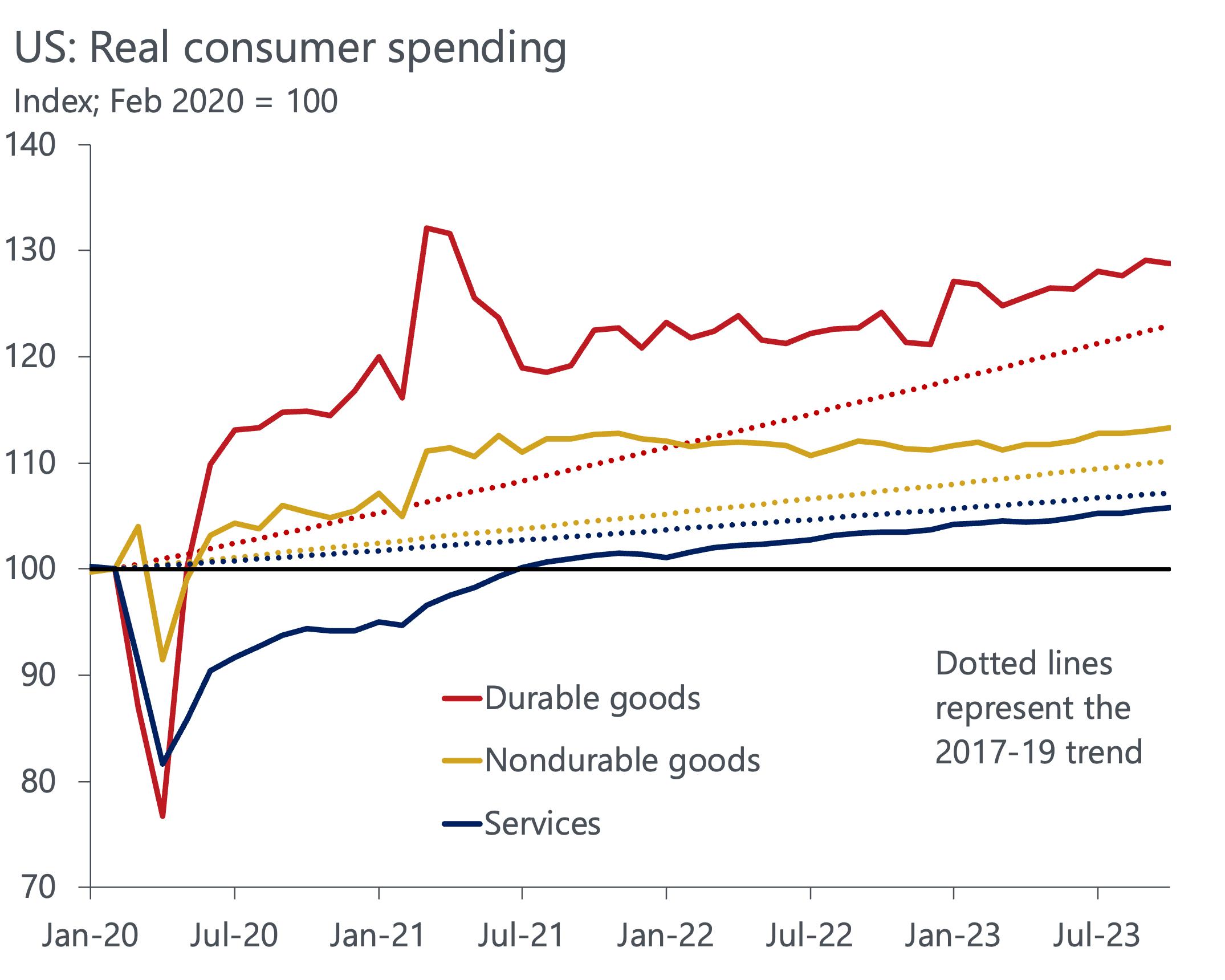

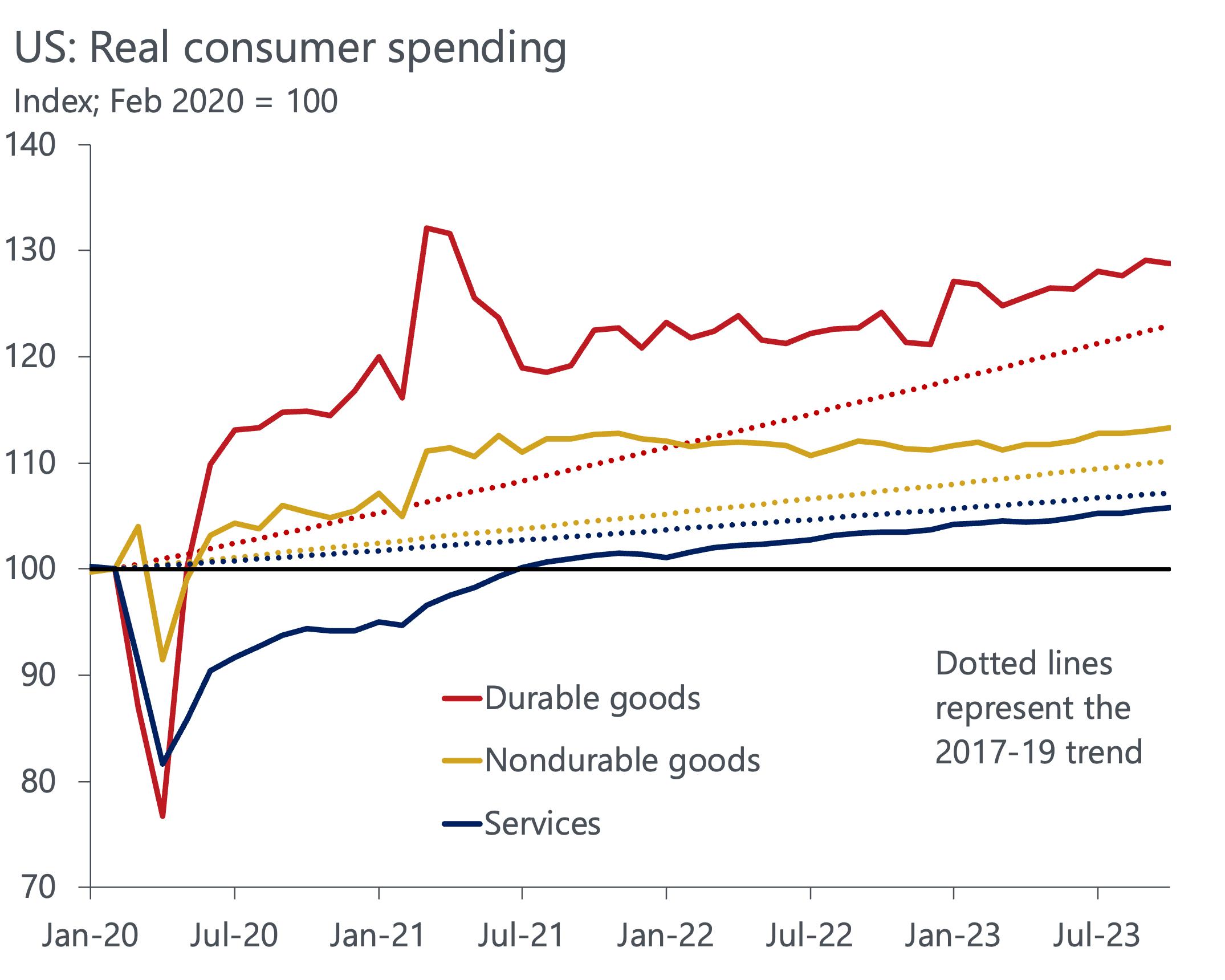

Upside for spending on travel, experiences, and other services

Domestic leisure travel slows to just 1.9% growth in 2024

U.S. DOMESTIC TRIPS

The continuing return of business travel will lead to 89% of prepandemic levels in 2023, and 95% in 2024.

Business and leisure trips

Note: Domestic trips only

Source: Tourism Economics

30

39 54 80 89 95 99 102 104 76 96 101 102 104 107 109 112 0 20 40 60 80 100 120 2020 2021 2022 2023 2024 2025 2026 2027

Business Leisure

Index (2019=100) Forecast

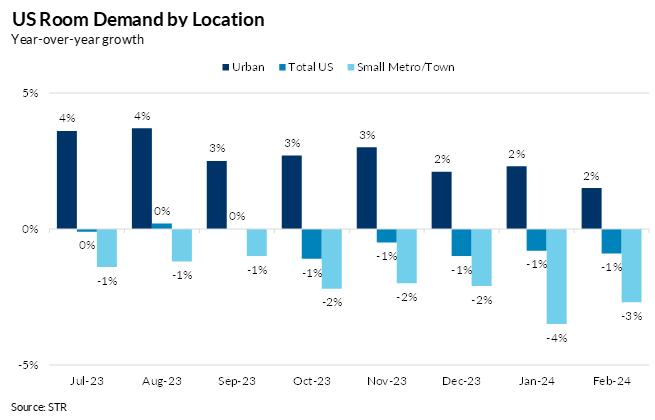

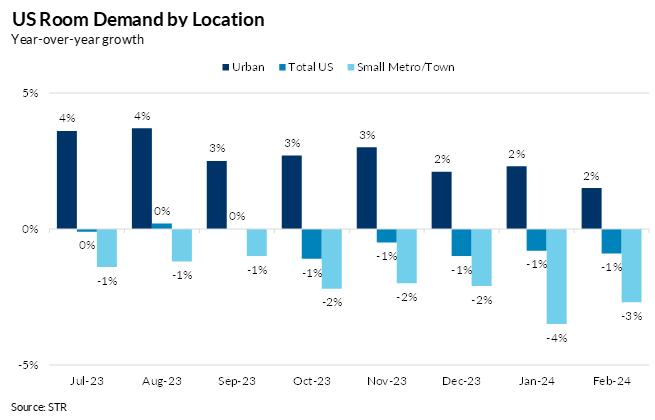

A correction in distribution of demand was inevitable

Business & Group Travel

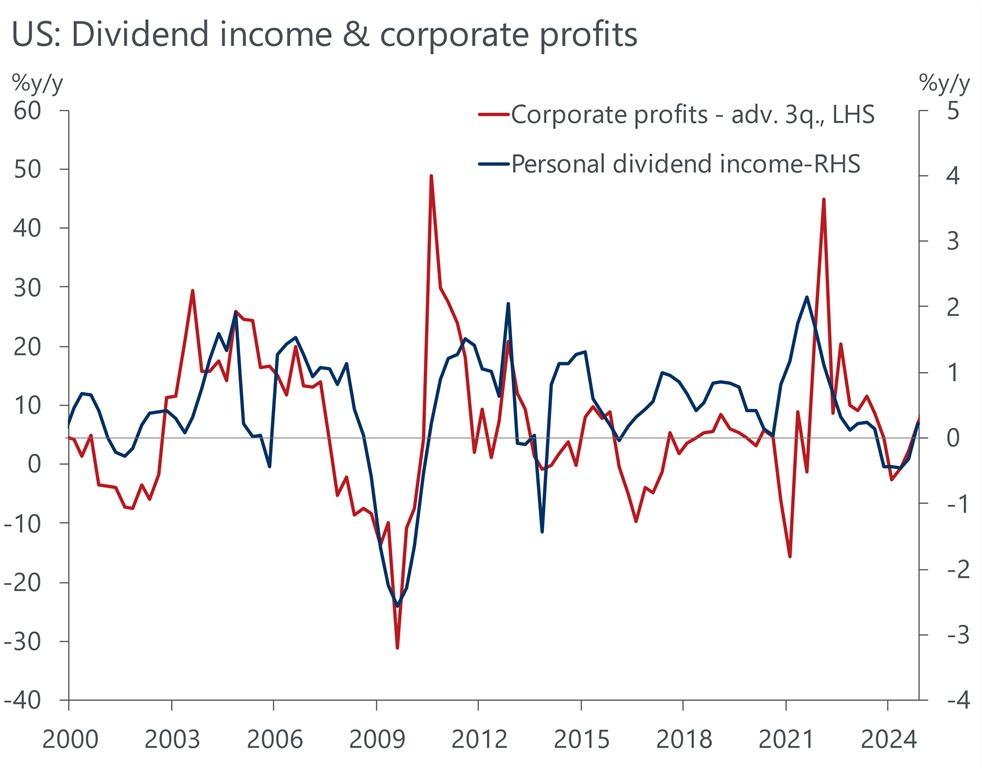

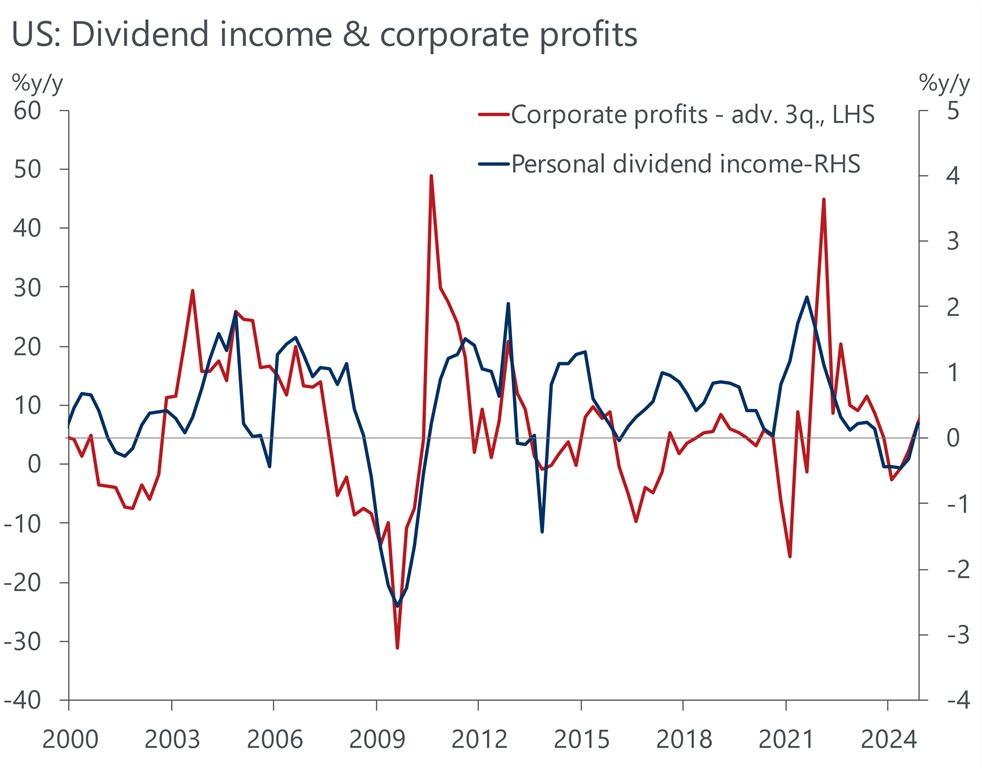

Fall in profits would usually pull down business travel

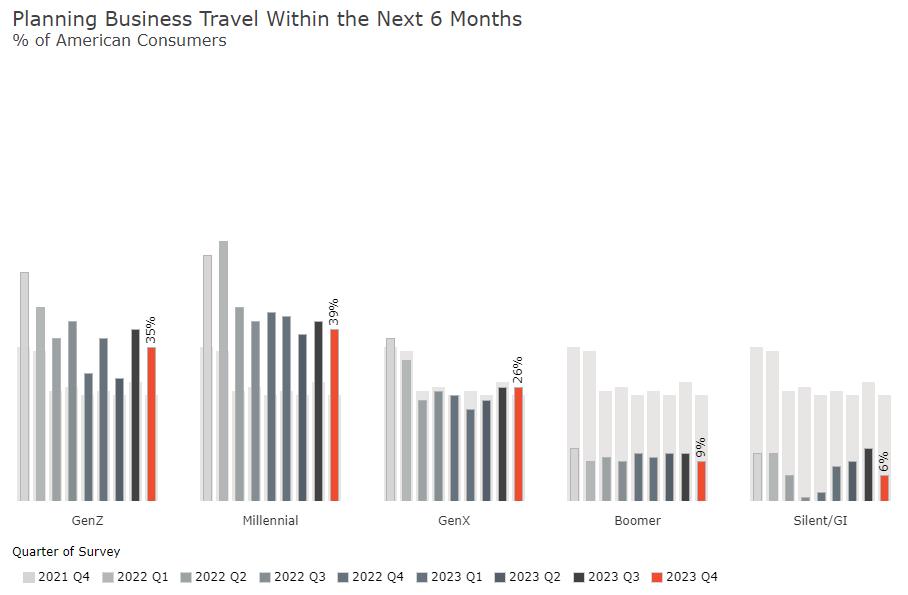

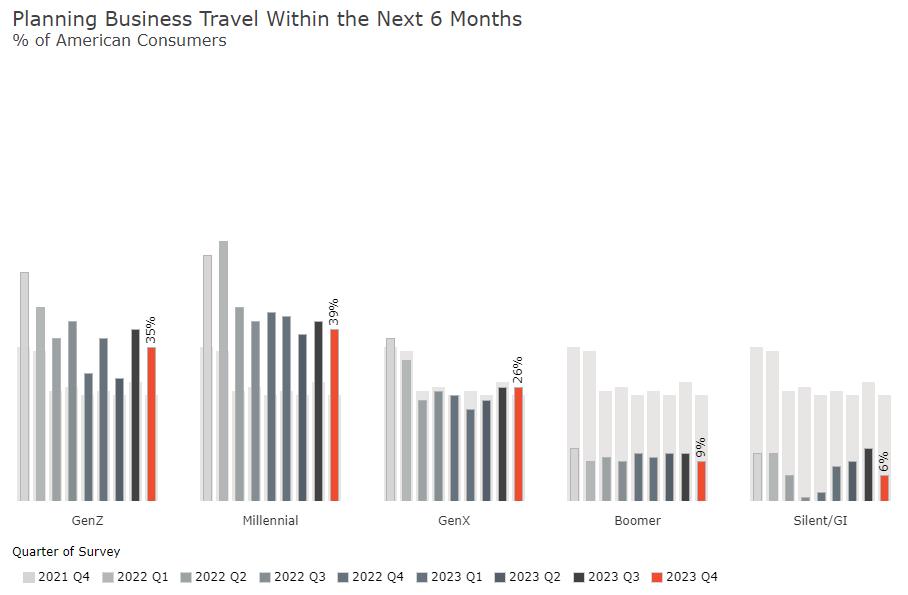

Business travel plans are strengthening

“Group is shaping up to have another solid year in 2024. …revenues pacing up nearly 13% globally and 11% in the U.S. and Canada on a year-over-year basis, driven by robust increases in both room nights and ADR.”

Marriott, Q4 Earnings Call

Light gray bars represent average of all respondents

Groups have made up a lot of ground

Source: STR

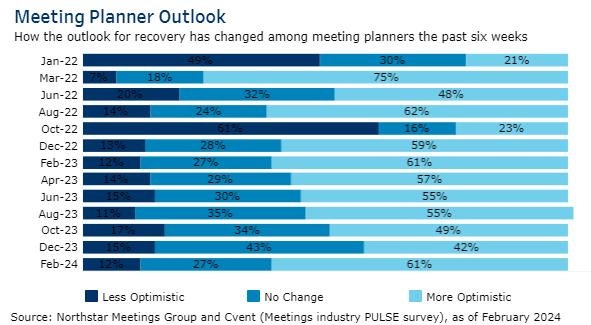

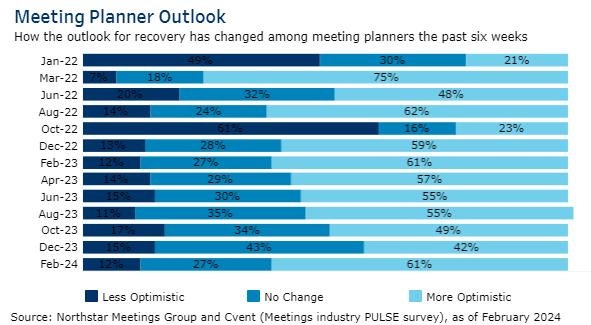

Optimism is building among meeting planners

Upside remains for travel to catch-up to economic growth

Note: Real GDP, seasonally adjusted.

Source: BEA; STR; Oxford Economics

and hotel room demand Index (2019 = 100)

GDP

60 70 80 90 100 110 120 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 2023 Q2 GDP Room demand

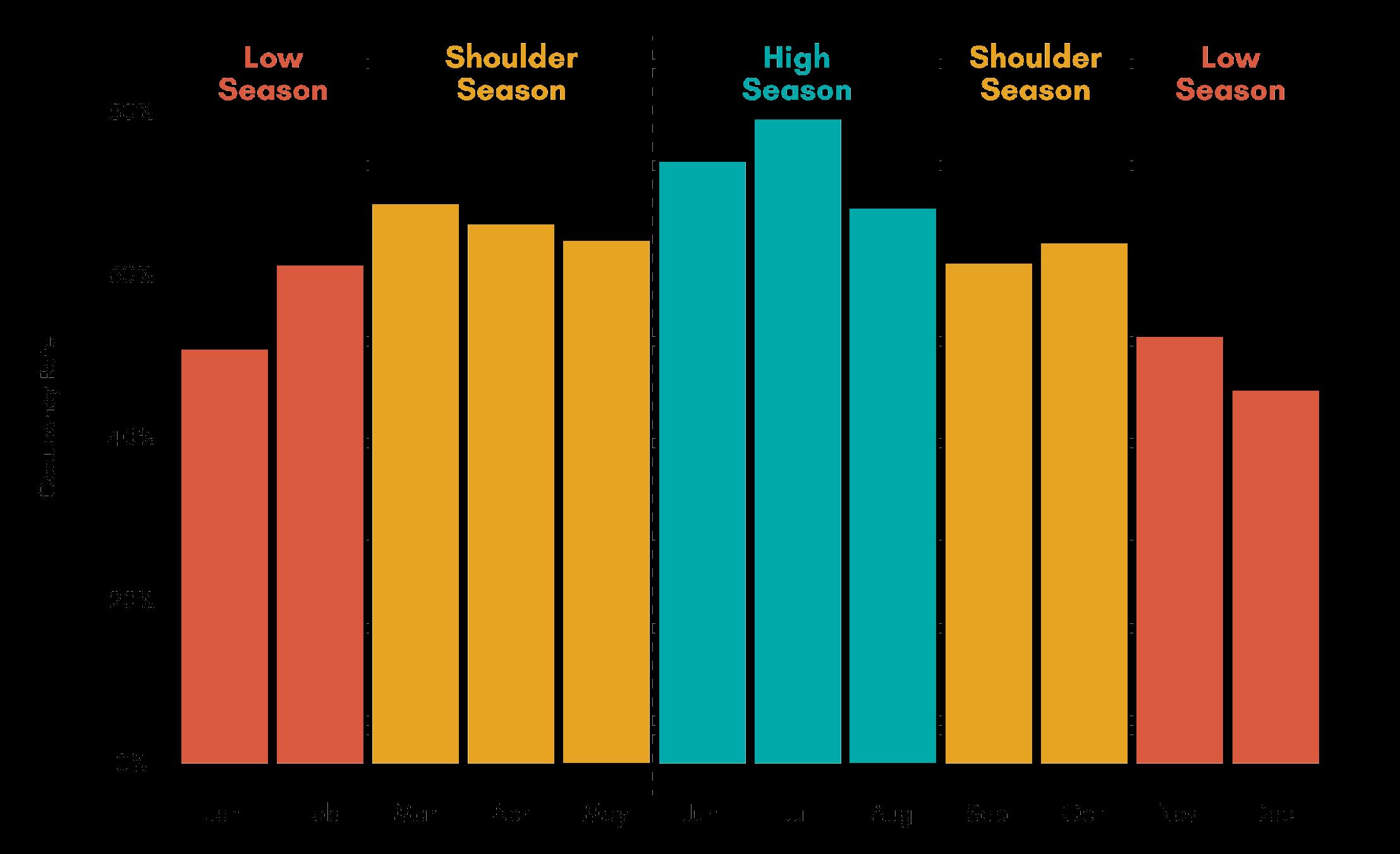

Corpus Christi

Corpus Christi

Demand off to a strong start in 2024

Hotel Room Demand

Corpus Christi, % recovered vs same period in in 2019 (index, 2019=100)

Source: STR

38 11720 40 60 80 100 120 140 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24

Hotel Average Daily Rate (ADR)

Corpus Christi, % recovered vs same period in in 2019 (index, 2019=100)

ADR fell 0.3% YOY in but remained above 2019 levels (9.3%).

Source: STR

11020 40 60 80 100 120 140 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21

Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21

Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24

ADR remains strong

Mar-21

Oct-21

Room revenue outpacing inflation

Hotel Room Revenue

Corpus Christi, % recovered vs same period in in 2019 (index, 2019=100)

Room revenue decreased 2.3%

YOY in 2023, but ended 3.1% above 2019 levels

Source: STR

12920 40 60 80 100 120 140 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24

Air travel outperforming 2019

Corpus Christi Air Travel

TSA PAX counts, % recovered vs same period in in 2019 (index, 2019=100)

Source: TSA

8 11820 40 60 80 100 120 140 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24

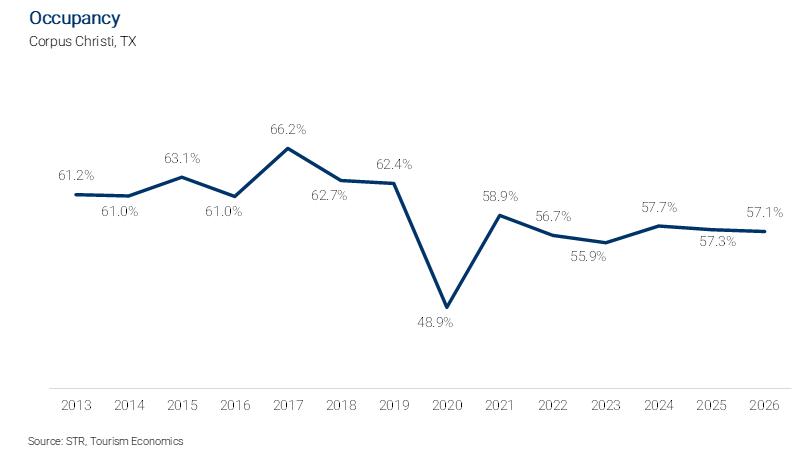

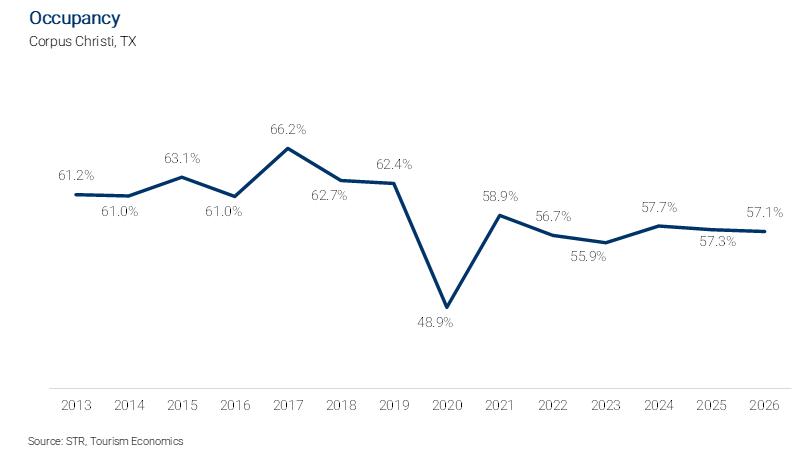

Corpus Christi to bounce back in 2024

Corpus Christi Hotel Forecast

Calendar year

Source: STR (history); Tourism Economics (forecast as of April 2024)

Indicator 2022 2023 % Chg YOY % Chg vs 2019 Occupancy 56.7% 55.9% -1.4% -10,4% ADR $107.09 $106.82 -0.3% 9.3% RevPAR $60.72 $59.73 -1.6% -2.0% Supply 3.3M 3.3M -0.7% 5.3% Demand 1.9M 1.8M -2.1% -5.6% Room Revenue $200M $196M -2.3% 3.1% 2024* % Chg YOY % Chg vs 2019 57.7% 3.3% -7.4% $107.07 1.1% 10.5% $62.34 4.4% 2.3% 3.2M -0.9% 4.3% 1.9M 2.4% -3.4% $202M 3.5% 6.7%

ADR to drive RevPAR growth

Corpus Christi Hotel Forecast

Calendar year % recovered relative to 2019, Index (prior year=100)

Source: STR (history); Tourism Economics (forecast as of April 2024)

78 94 91 90 93 92 92 89 102 110 109 111 113 114 70 97 100 98 102 103 105 0 20 40 60 80 100 120 2020 2021 2022 2023 2024 2025 2026

OCC ADR RevPAR forecast

Occupancy expected to improve in 2024 vs 2023

Room revenue fully recovered. Demand will take time

Corpus Christi Hotel Forecast

Calendar year % recovered relative to 2019, Index (prior year=100)

Source: STR (history); Tourism Economics (forecast as of April 2024)

79 96 96 94 97 98 100 71 98 106 103 107 111 114 0 20 40 60 80 100 120 2020 2021 2022 2023 2024 2025 2026

Demand Room Revenue forecast

Room revenue to continue to grow the next three years

Thank You!

meetings

Global

Industry day

SUZZANNE RAVITZ

SUZZANNE RAVITZ

Director of Customer Success 2Synergize, a Simpleview Consulting Agency

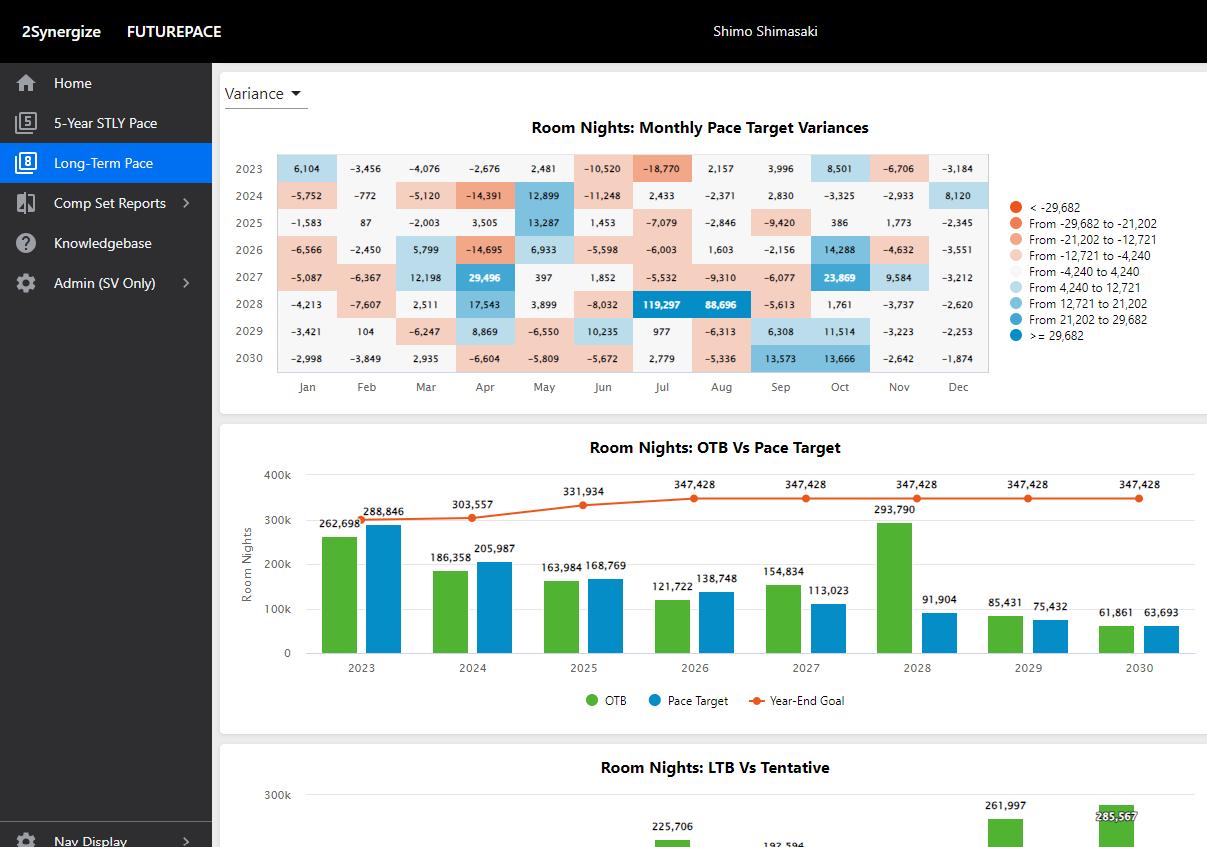

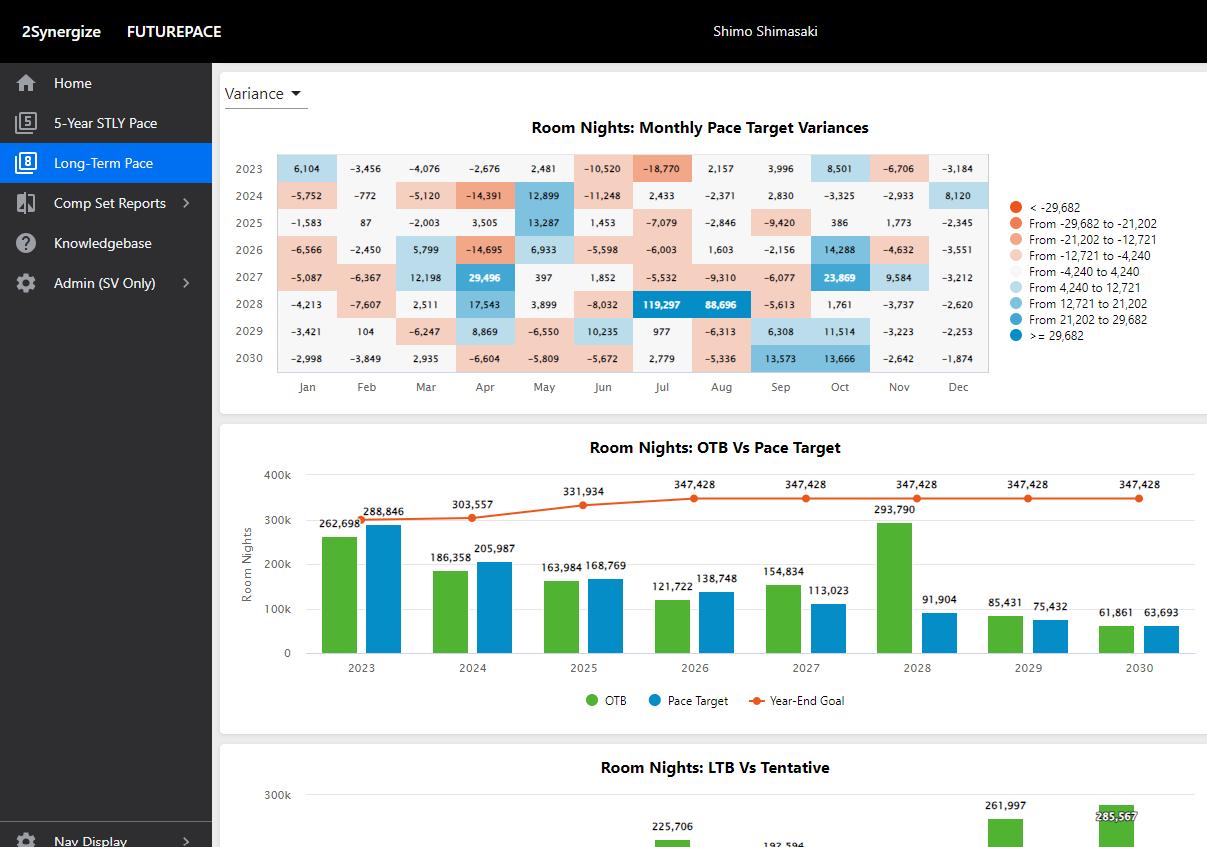

Visit Corpus Christi | 2024 Meetings & Events

Agenda Simpleview Sales Quarterly Year-End 2024

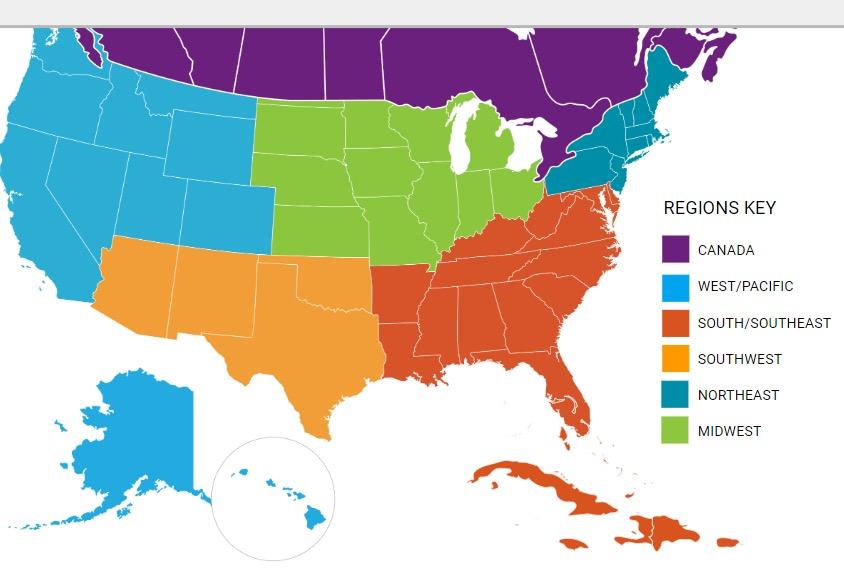

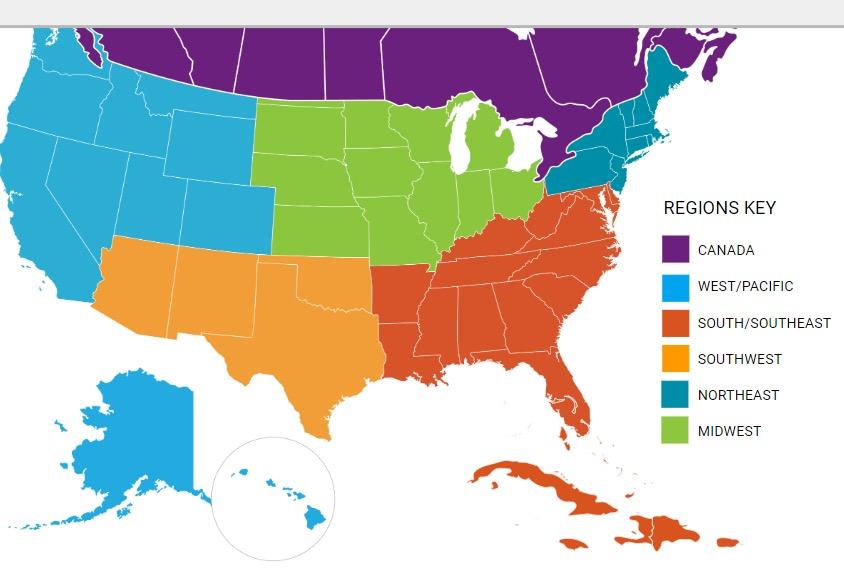

Aggregate and Region

Corpus Christi Competitive Set

About our data…

53

US, Canada, Caribbean

Sales Production

54

Corpus Christi Southwest

US, Canada, Caribbean

55

Lead Generation Up Over 2019

Lead Generation Compared to 2019

56 -9.5% -1.4% 0.9% -1.1% 20.1% 12.0% 6.9% 1.4% 18.9% Q1 Q2 Q3 Q4

2022 2023 2024

2023: +10.2%

Lead Pipeline

Net number of convention center leads in the pipeline through December 2023 to 2019

57

7,920 7,993 1,250 -755 Current Year Next Year 2 Years Out 3 Years Out

Number of Hotel Meeting Leads in the Pipeline through December 2023 compared to 2019 150 913 607 354 22 -145 -134 Current Year Next Year 2 Years Out 3 Years Out 4 Years Out 5 Years Out 6 Years Out

Net

Bookings Compared to 2019

58

Definite Bookings Remain Below 2019 2023: -9.1%

-25.5% -27.0% -16.7% -23.0% -6.4% -8.1% -7.3% -14.6% -3.2% Q1 Q2 Q3 Q4

2023

2022

2024

Definite Room Nights Surpass

in Q1

Booked Room Nights Compared to 2019

59

2019

2024 2023 YTD: -7.2%

-9.5% -26.1% -21.3% -18.4% -3.7% -12.4% -5.9% -5.8% 13.0% Q1 Q2 Q3 Q4

2023

2022

2024

60

+4.7%

Attendance Compared to 2019 -3.3% -33.0% -19.2% -14.9% 32.1% 3.5% -11.7% -2.4% 20.3% Q1 Q2 Q3 Q4

2023 2024

Booked Attendance Shows Growth 2023 YTD:

Booked

2022

Lead and Booking Summary

2023 2024 YTD

61

10.2% -9.1% -7.2% 4.7% 18.9% -3.2% 13.0% 20.3% Lead Volume Definite Bookings Definite Room Nights Definite Attendance

Southwest

Southwest

Southwest– 26 Destinations

Leads are Up for Most Regions

Number of leads by region through December 2023 compared to 2019

-10% 1% 9% 27% 31% 19% Canada Midwest Northeast South/Southeast Southwest West/Pacific

Hotel Meeting Market Segment Changes

Top 10 Southwest market segments: number of hotel meeting leads percentage variance through December 2023 compared to 2019

20.8% 16.2% 33.7% 11.3% 64.9% 31.1% 27.0% 12.0% Job Related

Administration, Public Affairs, and Govt Education Finance & Insurance

Sports & Athletics

Science & Engineering

Tourism Industry

&

Public

Recreation,

Technology,

Meetings, Conventions,

Health

Medical, Pharmaceutical

Convention Center Event Market Segment Changes

Top 10 Southwest market segments: number of convention center event leads percentage variance through December 2023 compared to 2019

14.5% 8.3% 55.8% 0.0% 24.7% 27.4% 1.8% 21.7% Religious/Faith Based Social/Service Clubs, Reunions, Fraternal Education

Administration, Public Affairs, Govt

Sports & Athletics

Related

Public

Recreation,

Job

& Engineering

Technology, Science

& Medical, Pharmaceutical

Health

Bookings are Down, but Not Equally

2023: Number of bookings by region compared to 2019

-23% -10% -8% -8% -3% -13% Canada Midwest Northeast South/Southeast Southwest West/Pacific

Booked Room Nights –Southwest

Booked Room Nights Compared to 2019

2023 YTD:

-4.9%

-18.7% -20.9% -35.4% -13.6% -11.1% -0.3% -15.9% 8.7% -10.2% Q1 Q2 Q3 Q4

2022 2023 2024

2023: Lead Volume and Booking Summary

10.2% -9.1% -7.2% 4.7% 31.0% -3.0% -4.9% 4.4% Lead Volume Definite Bookings Definite Room Nights Definite Attendance Aggregate Southwest

Corpus Christi

Corpus Christi

Leads Surpass to 2019 Levels

Number of Leads compared to 2019 Average 47.2% 47.2% 39.0% 18.9% 47.2% 75.0% 51.2% 18.9% 127.8% Q1 Q2 Q3 Q4 2022 2023 2024

2023: 48.0%

Lead Market Segments 2023

3.8% 3.8% 4.4% 5.4% 6.7% 9.5% Dance/Cheer Water

Commercial or Business Educational Niche Government, Public Administration, Public Affairs Top Market

Trade,

Segments

Definite Bookings Strong for 2023

77.8% 76.9% 78.9% 160.0% 33.3% 46.2% 31.6% 300.0% 55.6% Q1 Q2 Q3 Q4 2022 2023 2024 2023: +65.2%

Lead Volume and Booking Summary 2023

10.2% -9.1% -7.2% 4.7% 31.0% -3.0% -4.9% 4.4% 4.8% 65.2% 72.0% 125.1% Leads Definite Bookings Definite Room Nights Definite Attendance Aggregate Southwest Corpus Christi

Competitive Destination Comparison

Providence

Grand Rapids

Oklahoma City

Chattanooga

Lexington Buffalo

Corpus Christi

Providence

Grand Rapids

Oklahoma City

Chattanooga

Lexington Buffalo

Corpus Christi

Convention Center: Largest

Source: CC website

200,730 162,000 100,800 100,000 100,000 76,500 64,000 Oklahoma City Grand Rapids Chattanooga Lexington Providence Corpus Christi Buffalo

Exhibit Space (GSF)

Competitive CitiesTotal Hotel Rooms

Source: CoStar through 2023

28,974 15,853 15,338 12,924 12,132 12,029 7,765 Oklahoma City Buffalo Grand Rapids Lexington Corpus Christi Chattanooga Providence

Total Full-Service Hotel Rooms

Source: CoStar

8,619 5,678 5,230 4,319 4,257 3,799 2,987 Oklahoma City Grand Rapids Buffalo Providence Lexington Chattanooga Corpus Christi

Competitive CitiesAverage Daily Rate

Source: CoStar through 2023

$153.07 $133.78 $125.89 $115.69 $114.74 $105.34 $95.40 Providence

Buffalo Grand Rapids Lexington Chattanooga Corpus Christi Oklahoma City

Key Takeaways

• Leads are higher compared to 2019

• Short-term business is still strong

• Definite bookings are still down, but up year over year

• The Southwest region has recovered stronger than all other regions

• Corpus Christi leads far surpass 2019

• Partner with Visit Corpus Christi to bring the best meetings and events to the destination

Corpus Christi | 2024 Thank You!

Visit

meetings

Global

Industry day

NICOLE OLIVARES

Vice president of sales & Services

Visit corpus Christi

SALES MISSION

To promote Corpus Christi as the Gulf Coast Capital and premier meeting and convention destination by Marketing our natural resources, first in class facilities, and accommodations.

BY WORKING TOGETHER, WE CAN BRING MORE BUSINESS TO CORPUS CHRISTI, AND EVERYONE BENEFITS.

SALES MARKETING STRUCTURE

MARKET SEGMENTS

• Texas State Association

• National Association

• Government

• Corporate

• SMERF: Social, Military, Education, Religious, and Fraternal

TOP CONVENTION

SALES INITIATIVES

Strategy #1

Continue to develop the SMERF market and expand Association market.

STRATEGY #2

Develop a unified and aligned destination sales approach.

STRATEGY #3

Target new tradeshows, clients, and creative marketing opportunities.

Sales Tradeshows

TOP DESTINATION SERVICES INITIATIVES

Continue to be innovative and at the forefront of industry trends to enhance complimentary service offerings.

Create curated complimentary services and marketing collateral to meet demand.

Collaborate with local stakeholders on health and public

7 OUT OF 10

ATTENDEES EXPRESSED INTEREST COMING BACK FOR A LEISURE TRIP.

SIGNATURE EXPERIENCES

Group incentive program

$51.87

84 , 000 attendees spending

$50 million in local businesses

INSERT KSP GMID VIDEO

Nicole Olivares, Vice President of Sales & Services cell: 361-549-6582 email: nicole@visitcorpuschristi.com Thank you!

meetings

Global

Industry day

President and CEO

Visit corpus Christi

President and CEO

Visit corpus Christi

President and CEO

Visit corpus Christi

President and CEO

Visit corpus Christi

Corpus Christi

Corpus Christi

SUZZANNE RAVITZ

SUZZANNE RAVITZ

Corpus Christi

Corpus Christi

Providence

Grand Rapids

Oklahoma City

Chattanooga

Lexington Buffalo

Corpus Christi

Providence

Grand Rapids

Oklahoma City

Chattanooga

Lexington Buffalo

Corpus Christi