STONEGATE CENTER

PLAINVIEW, TX (LUBBOCK MSA)

22,563VPD

Stonegate Center (As-Is)

1001 N I-27

Plainview, TX 79072

OFFERING SUMMARY

2 FINANCIAL ANALYSIS STONEGATE CENTER - PLAINVIEW, TX PRICING & FINANCIAL ANALYSIS

Price $4,420,000 Cap Rate 6.82% Net Operating Income $301,063 Price PSF $23.02 Occupancy 47.52% Year Built 1986 Gross Leasable Area 191,977 SF Lot Size 40 Acres

3 FINANCIAL ANALYSIS STONEGATE CENTER - PLAINVIEW, TX PRICING & FINANCIAL ANALYSIS PROJECTED INCOME & EXPENSES CURRENT PSF Base Rent - Occupied Space 48% $497,676 $2.59 GROSS POTENTIAL RENT $497,676 $2.59 Expense Reimbursements Real Estate Taxes $17,837 $0.09 Insurance $20,726 $0.11 CAM $32,342 $0.17 Management Fee -Total Expense Reimbursements $70,905 $0.37 GROSS POTENTIAL INCOME $568,581 $2.96 EFFECTIVE GROSS REVENUE $568,581 $2.96 Operating Expenses Real Estate Taxes ($115,449) ($0.60) Insurance ($76,839) ($0.40) CAM ($58,180) ($0.30) Management Fee 3.00% ($17,050) ($0.09) Total Recoverable Expenses ($267,518) ($1.39) Net Operating Income $301,063 $1.57 EXPENSES CURRENT PSF Real Estate Taxes $115,449 $0.60 Insurance $76,839 $0.40 Total CAM $58,180 $0.30 Management Fee 3.00% $17,050 $0.09 Total Expenses $267,518 $1.39 For Financing Options, Please Contact: Greg Holley | Managing Partner High St Capital (O) 469-998-7200 | (C) 714.514.2990 gholley@highstcapital.com PRICING & FINANCIAL ANALYSIS (AS-IS)

4 FINANCIAL ANALYSIS STONEGATE CENTER - PLAINVIEW, TX RENT ROLL Suite Tenant SQ FT % of SQFT Start End Annual Rent PSF Escalation Date Escalation Amount Options Option Amount Lease Type 202 Vacant 1,049 0.55% - - - - - - - -204 Vacant 1,522 0.79% - - - - - - - -206 Eyewear Outlet 1,527 0.80% 05/01/2006 04/30/2027 $12,000 $7.86 - - -Taxes/ Insurance 208 Vacant 1,140 0.59% - - - - - - - -210 Vacant 1,875 0.98% - - - - - - - -212 Vacant 700 0.36% - - - - - - - -214 Vacant 1,900 0.99% - - - - - - - -216 Vacant 3,150 1.64% - - - - - - - -220 Vacant 1,292 0.67% - - - - - - - -222 Vacant 1,786 0.93% - - - - - - - -224 Vacant 2,863 1.49% - - - - - - - -228 Vacant 4,140 2.16% - - - - - - - -230 Vacant 1,380 0.72% - - - - - - - -232 State Department 5,966 3.11% 09/01/2012 08/31/2032 $52,968 $8.88 - $9.77 - - Gross 238 Mia's Italian Restaurant 3,220 1.68% 09/01/2010 09/30/2026 $26,460 $8.22 - - - - Gross 242 Vacant 1,840 0.96% - - - - - - - -244 Kyla's Uptown Tans 2,836 1.48% 01/01/2021 04/30/2027 $18,420 $6.50 - - - - Gross 30 Plainview Furniture Exchange 34,596 18.02% 05/01/2021 09/30/2026 $84,000 $2.43 - - -NNN (Excl MGMT) 70 Vacant 12,283 6.40% - - - - - - -RENT ROLL (AS-IS)

5 FINANCIAL ANALYSIS STONEGATE CENTER - PLAINVIEW, TX RENT ROLL Suite Tenant SQ FT % of SQFT Start End Annual Rent PSF Escalation Date Escalation Amount Options Option Amount Lease Type 800 Taqueria Jalisco 5,333 2.78% 10/01/2003 MTM $82,548 $15.48 - - -NNN (Excl MGMT) 820 Vacant 900 0.47% - - - - - - -830-835 Vacant 1,750 0.91% - - - - - - -840 Subway 1,400 0.73% 01/01/1990 06/30/2027 $15,600 $11.14 - - 1x5 not to exceed 10% NNN (Excl MGMT) 850 Empire Super Buffet 3,798 1.98% 10/01/2009 09/30/2024 $41,400 $10.90 - - -NNN (Excl MGMT) Anchor - A Vacant 60,643 31.59% - - - - - - -Anchor - B Tractor Supply 32,548 16.95% 04/05/2007 04/04/2027 $164,280 $5.05 - - - - Tractor Storage Vacant 540 0.28% - - - - - - -Occupied 91,224 47.51% $497,676 $5.46 Vacant 100,753 52.48% Total 191,977 100.00% RENT ROLL (AS-IS)

Stonegate Center (Proforma)

1701 W 5th St Plainview, TX 79072

6 FINANCIAL ANALYSIS STONEGATE CENTER - PLAINVIEW, TX PRICING & FINANCIAL ANALYSIS

Price $4,420,000 Cap Rate 18.85% Net Operating Income $832,494 Price PSF $23.02 Occupancy 100% Year Built 1986 Gross Leasable Area 191,977 SF Lot Size 40 Acres

OFFERING SUMMARY

7 FINANCIAL ANALYSIS STONEGATE CENTER - PLAINVIEW, TX PRICING & FINANCIAL ANALYSIS PROFORMA INCOME & EXPENSES CURRENT PSF Base Rent - Occupied Space 48% $495,052 $2.58 Base Rent - Lease Up Space 52% $615,979 $3.21 GROSS POTENTIAL RENT $1,111,031 $5.79 Expense Reimbursements Real Estate Taxes $40,528 $0.21 Insurance $51,498 $0.27 CAM $80,441 $0.42 Management Fee $10,634 $0.06 Total Expense Reimbursements $183,101 $0.95 GROSS POTENTIAL INCOME $1,294,132 $6.74 Vacancy Factor 15.00% ($194,119) ($1.01) EFFECTIVE GROSS REVENUE $1,100,012 $5.73 Operating Expenses Real Estate Taxes ($115,449) ($0.60) Insurance ($76,839) ($0.40) CAM ($58,180) ($0.30) Management Fee 1.55% ($17,050) ($0.09) Total Recoverable Expenses ($267,518) ($1.39) Net Operating Income $832,494 $4.34 EXPENSES CURRENT PSF Real Estate Taxes $115,449 $0.60 Insurance $76,839 $0.40 Total CAM $58,180 $0.30 Management Fee 3.00% $17,050 $0.09 Total Expenses $267,518 $1.39 For Financing Options, Please Contact: Greg Holley | Managing Partner High St Capital (O) 469-998-7200 | (C) 714.514.2990 gholley@highstcapital.com PRICING & FINANCIAL ANALYSIS (PROFORMA)

8 FINANCIAL ANALYSIS STONEGATE CENTER - PLAINVIEW, TX RENT ROLL RENT ROLL (PROFORMA) Suite Tenant SQ FT % of SQFT Start End Annual Rent PSF Escalation Date Escalation Amount Options Option Lease Type 202 Lease Up 1,049 0.55% 04/01/2024 03/31/2029 $11,539 $11.00 - - - - NNN 204 Lease Up 1,522 0.79% 04/01/2024 03/31/2029 $16,742 $11.00 - - - - NNN 206 Eyewear Outlet 1,527 0.80% 05/01/2006 04/30/2027 $18,003 $11.79 - - -Taxes/ Insurance 208 Lease Up 1,140 0.59% 04/01/2024 03/31/2029 $12,540 $11.00 - - - - NNN 210 Lease Up 1,875 0.98% 04/01/2024 03/31/2029 $20,625 $11.00 - - - - NNN 212 Lease Up 700 0.36% 04/01/2024 03/31/2029 $7,700 $11.00 - - - - NNN 214 Lease Up 1,900 0.99% 04/01/2024 03/31/2029 $20,900 $11.00 - - - - NNN 216 Lease Up 3,150 1.64% 04/01/2024 03/31/2029 $28,350 $9.00 - - - - NNN 220 Lease Up 1,292 0.67% 04/01/2024 03/31/2029 $14,212 $11.00 - - - - NNN 222 Lease Up 1,786 0.93% 04/01/2024 03/31/2029 $19,646 $11.00 - - - - NNN 224 Lease Up 2,863 1.49% 04/01/2024 03/31/2029 $28,630 $10.00 - - - - NNN 228 Lease Up 4,140 2.16% 04/01/2024 03/31/2029 $37,260 $9.00 - - - - NNN 230 Lease Up 1,380 0.72% 04/01/2024 03/31/2029 $15,180 $11.00 - - - - NNN 232 State Department 5,966 3.11% 09/01/2012 08/31/2032 $52,978 $8.88 09/01/2027 $9.77 - - Gross 238 Mia's Italian Restaurant 3,220 1.68% 09/01/2010 09/30/2026 $25,213 $7.83 - - - - Gross 242 Lease Up 1,840 0.96% 04/01/2024 03/31/2029 $20,240 $11.00 - - - - NNN 244 Kyla's Uptown Tans 2,836 1.48% 01/01/2021 04/30/2027 $17,101 $6.03 - - - - Gross 30 Plainview Furniture Exchange 34,596 18.02% 05/01/2021 09/30/2026 $77,841 $2.25 - - -NNN (Excl MGMT) 70 Lease Up 12,283 6.40% 04/01/2024 03/31/2029 $84,753 $6.90 - - - - NNN

9 FINANCIAL ANALYSIS STONEGATE CENTER - PLAINVIEW, TX RENT ROLL Suite Tenant SQ FT % of SQFT Start End Annual Rent PSF Escalation Date Escalation Amount Options Option Amount Lease Type 800 Taqueria Jalisco 5,333 2.78% 10/01/2003 MTM $82,555 $15.48 - - -NNN (Excl MGMT) 820 Lease Up 900 0.47% 04/01/2024 03/31/2029 $9,900 $11.00 - - - - NNN 830-835 Lease Up 1,750 0.91% 04/01/2024 03/31/2029 $19,250 $11.00 - - - - NNN 840 Subway 1,400 0.73% 01/01/1990 06/30/2027 $15,596 $11.14 - - 1x5 not to exceed 10% NNN (Excl MGMT) 850 Empire Super Buffet 3,798 1.98% 10/01/2009 09/30/2024 $41,398 $10.90 - - -NNN (Excl MGMT) Anchor - A Lease Up 60,643 31.59% 04/01/2024 03/31/2029 $242,572 $4.00 - - - - NNN Anchor - B Tractor Supply 32,548 16.95% 04/05/2007 04/04/2027 $164,367 $5.05 - - - - Tractor Storage Lease Up 540 0.28% 04/01/2024 03/31/2029 $5,940 $11.00 - - - - NNN Occupied 91,224 47.51% $1,111,031 $12.18 Vacant 100,753 52.48% Total 191,977 100.00% RENT ROLL (PROFORMA)

DBA Mia’s Italian Restaurant

Locations 1

Public/Private Private

Line of Business

Tired of the same old meals? Enjoy Plainview’s best pizzas at some of the top pizza restaurants in the area. Mia’s Pizzeria & Restaurant remains one of the most popular in Plainview thanks to its fresh offerings and classic pizzas. Give their menu a try and see what all the fuss is about. If you’re feeling hungry, don’t hesitate. Enjoy the top dishes Plainview has to offer. Enjoy the perenially popular Hand Tossed New York Style Mia’s Cheese Pizza at this establishment. One taste, and you’ll see why it’s a local favorite. It’s not just pizza. Try fried cheese sticks for a delicious addition to your meal. Even the biggest appetite can be satisfied here.

DBA Subway

Locations 19,573+

Public/Private Private

Line of Business

DBA

Subway is a globally renowned fast-food franchise that has redefined the quickservice restaurant industry with its focus on fresh, customizable sandwiches and salads. Established in 1965 by Fred DeLuca and Dr. Peter Buck, Subway has grown into one of the largest submarine sandwich chains, with thousands of locations spanning over 100 countries. Committed to providing healthier meal options, Subway prides itself on using freshly baked bread, quality ingredients, and a diverse range of toppings to cater to individual tastes and dietary preferences. With a dedication to sustainability and community engagement, Subway continues to evolve and innovate, striving to make fresh, delicious meals accessible to everyone, everywhere.

Tractor Supply Company

Locations 2,200+

Public/Private Private

Line of Business

Tractor Supply Company, established in 1938, stands as the go-to destination for rural lifestyle necessities in the United States. With over 2,000 stores nationwide, TSC caters to the needs of farmers, ranchers, and outdoor enthusiasts alike, offering an extensive range of products including agricultural supplies, pet care essentials, hardware, and workwear. Committed to enhancing the lives of our customers, TSC provides not only quality merchandise but also expert advice and dependable service. Tractor Supply Company’s mission is to be the trusted partner for those who live the rural way of life, fostering connections with communities and supporting the vitality of rural America.

10 PROPERTY DESCRIPTION STONEGATE CENTER - PLAINVIEW, TX TENANT INFORMATION

• 181,977 Square Foot Shopping Center Located in Plainview, TX

• Priced at $23 Per Square Foot – Well Below Replacement Cost

• Located Less Than 1-Mile From Walmart Supercenter

• The Property is Comprised of Three Separate Parcels and is Situated on 40 Acres – Easily Accessible From Multiple Ingress and Egress Point

• 47.5% Leased – Significant Upside Potential in Leasing Vacancies and/or Selling the Parcels Individually

• Average Rent is $5.46 Per Square Foot – Well Below Market Average

• Located Between Lubbock and Amarillo of Interstate 27 – Nicknamed “Ports-to-Plains” Corridor Spanning From Laredo, TX (Mexico Border) to Oklahoma. The I-27 Expansion Will Grow Texas GDP by $17.2 Billion and Create 178,000 Construction Jobs. Click Here for More Information

• Plainview is Home to One of the Largest Walmart Distribution Centers in West Texas with Over 1,500 Employees

• Hale County (including Plainview) Has Been One of the Top Agriculture Producing Counties in the United States. In 2018, Hale County Led the Nation in Cotton Production

11 PROPERTY DESCRIPTION STONEGATE CENTER - PLAINVIEW, TX INVESTMENT HIGHLIGHTS

12 PROPERTY DESCRIPTION STONEGATE CENTER - PLAINVIEW, TX SITE PLAN

13 MARKET OVERVIEW STONEGATE CENTER - PLAINVIEW, TX AERIAL MAP

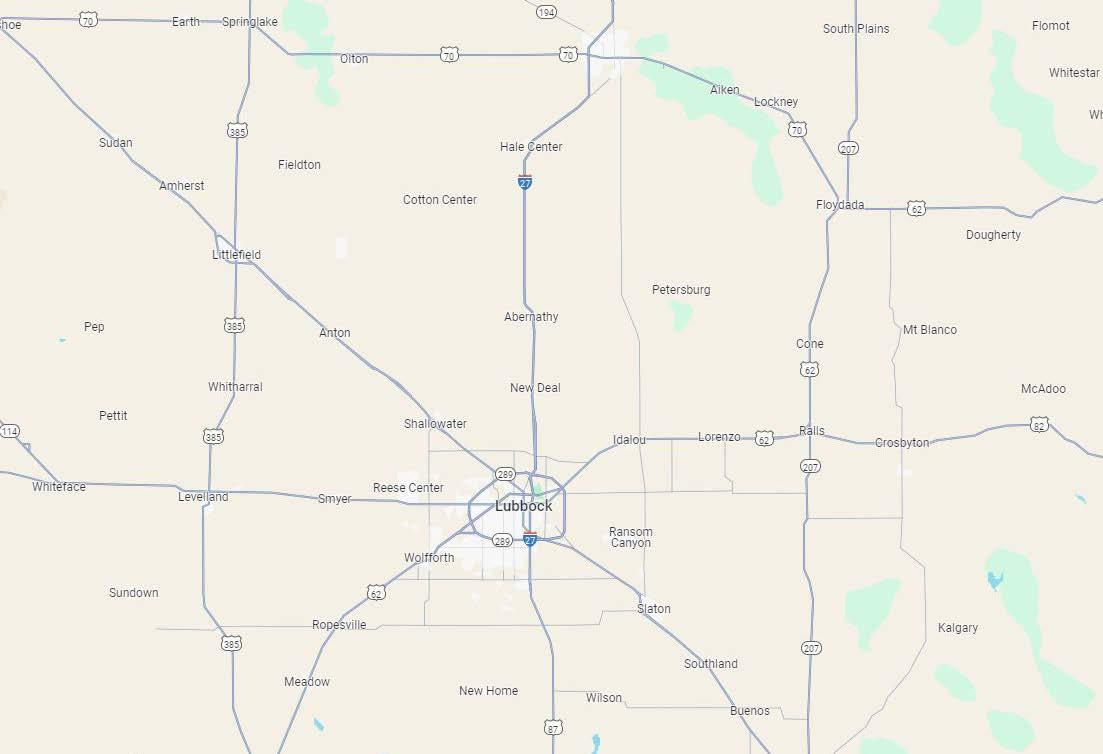

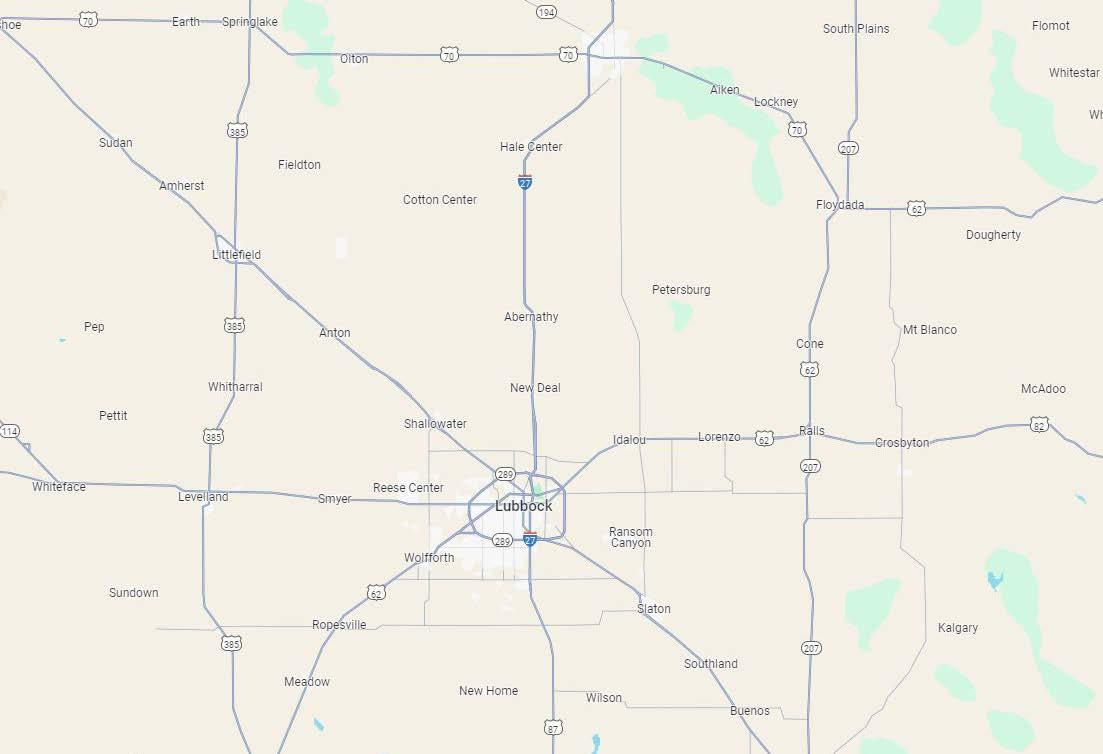

14 MARKET OVERVIEW STONEGATE CENTER - PLAINVIEW, TX REGIONAL MAP

WEST TEXAS PORTFOLIO

NAME CITY SF LIST PRICE PSF AS-IS NOI PROFORMA CAP RATE 26 Mart Shopping Center Amarillo 38,059 $2,615,000 $68.71 $64,978 11.05% Avondale Hall Amarillo 33,380 $1,235,000 $37.00 $104,968Guylane Plaza Dumas 158,546 $8,430,000 $53.17 $494,994 10.39% Hereford Center Hereford 56,593 $3,115,000 $55.04 $165,486 11.95% Rent-A-Center Amarillo 5,895 $615,000 $104.32 $48,816Running Water Draw Plainview 38,280 $1,630,000 $42.58 $82,901 12.80% Sherwood Center San Angelo 30,247 $2,085,000 $68.93 $124,520 11.70% South Tree Center Amarillo 19,799 $700,000 $35.36 - 14.50% Stonegate Center Plainview 191,977 $4,420,000 $23.02 $301,063 18.85% Sunset Plaza San Angelo 37,467 $940,000 $25.09 $3,526 22.40% $25,785,000 $51.32 $1,391,252

Lubbock, TX

OVERVIEW

Lubbock is a city in and the county seat of Lubbock County, Texas. The city is located in the northwestern part of Texas, a region known historically and geographically as the Llano Estacado. Lubbock had an estimate population of 257,141 in 2020, making it the 86th-most populous city in the United States of America and the 11th-most populous city in the state of Texas. The city is the economic center of the Lubbock metropolitan area, which had an estimated 2020 population of 327,424.

Lubbock County was founded in 1876. It was named after Thomas Saltus Lubbock, former Texas Ranger and brother of Francis Lubbock, governor of Texas during the Civil War. A small town — known as Old Lubbock, Lubbock or North Town — was established about three miles to the east and merged in 1890 with Monterey, another small town south of the canyon. The city was incorporated in 1909, the same year the first railroad train arrived. Lubbock’s nickname, “Hub City”, derives from it being the economic, education, and health care hub of the multicounty region, north of the Permian

Basin and south of the Texas Panhandle, commonly called the South Plains. The area is the largest contiguous cotton-growing region in the world and is heavily dependent on water drawn from the Ogallala Aquifer for irrigation. The five largest employers in terms of the number of employees are Texas Tech University, Covenant Health System, Lubbock Independent School District, University Medical Center and United Supermarkets. Texas Tech students, faculty, and staff contribute about $1.5 billion to the economy, with about $297.5 million from student shopping alone.

Lubbock is home to Texas Tech University, which was established in 1923 as Texas Technological College. It is the leading institution of the Texas Tech University System and has the seventh-largest enrollment in the state of Texas. It is the only school in Texas to house an undergraduate institution, law school, and medical school at the same location. The Lubbock metropolitan area is also home to Lubbock Christian College, South Plains College and Wayland Baptist University.

16 MARKET OVERVIEW STONEGATE CENTER - PLAINVIEW, TX MARKET SUMMARY

17 MARKET OVERVIEW STONEGATE CENTER - PLAINVIEW, TX DEMOGRAPHIC STATISTICS

1 Mile 3 Mile 5 Mile Population 2010 Population 6,597 24,645 26,394 2023 Population 5,753 21,349 22,910 2028 Population Projection 5,585 20,693 22,218 Median Age 31.1 33.2 33.5 Bachelor's Degree or Higher 20% 16% 16% U.S. Armed Forces 0 0 0 Population by Race White 5,150 19,026 20,399 Black 322 1,269 1,403 American Indian/Alaskan Native 117 450 469 Asian 37 175 184 Hawaiian & Pacific Islander 14 58 59 Two or More Races 113 371 396 Hispanic Origin 3,647 13,901 14,757 Housing Median Home Value $74,311 $80,829 $81,557 Median Year Built 1956 1965 1965 1 Mile 3 Mile 5 Mile Households: 2010 Households 2,179 8,201 8,658 2023 Households 1,902 7,127 7,539 2028 Household Projection 1,840 6,894 7,295 Owner Occupied 1,044 4,274 4,544 Renter Occupied 796 2,619 2,751 Avg Household Size 2.8 2.8 2.8 Avg Household Vehicles 2 2 2 Total Consumer Spending $50.7M $185.2M $197.6M Income Avg Household Income $64,487 $60,365 $60,671 Median Household Income $53,029 $48,469 $49,017 < $25,000 383 1,918 1,980 $25,000 - 50,000 506 1,746 1,856 $50,000 - 75,000 400 1,382 1,497 $75,000 - 100,000 349 1,028 1,082 $100,000 - 125,000 88 359 381 $125,000 - 150,000 68 291 315 $150,000 - 200,000 72 293 314 $200,000+ 35 109 113

Demographic data © CoStar 2024

CONFIDENTIALITY AGREEMENT

The information contained in the following offering memorandum is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from STRIVE and it should not be made available to any other person or entity without the written consent of STRIVE. By taking possession of and reviewing the information contained herein the recipient agrees to hold and treat all such information in the strictest confidence. The recipient further agrees that recipient will not photocopy or duplicate any part of the offering memorandum. If you have no interest in the subject property at this time, please return this offering memorandum to STRIVE.

This offering memorandum has been prepared to provide summary, unverified financial and physical information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. STRIVE has not made any investigation, and makes no warranty or representation with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the property and improvements, the presence or absence of contaminating substances, PCBs or asbestos, the compliance with local, state and federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property. The information contained in this offering memorandum has been obtained from sources we believe to be reliable; however, STRIVE has not verified, and will not verify, any of the information contained herein, nor has STRIVE conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. Prospective buyers shall be responsible for their costs and expenses of investigating the subject property.

ALL PROPERTY SHOWINGS ARE BY APPOINTMENT ONLY. PLEASE CONTACT STRIVE AGENT FOR MORE DETAILS.

Commercial Disclaimer

STRIVE hereby advises all prospective purchasers of commercial property as follows:

The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable. However, STRIVE has not and will not verify any of this information, nor has STRIVE conducted any investigation regarding these matters. STRIVE makes no guarantee, warranty or representation whatsoever about the accuracy or completeness of any information provided.

As the Buyer of a commercial property, it is the Buyer’s responsibility to independently confirm the accuracy and completeness of all material information before completing any purchase. This Marketing Brochure is not a substitute for your thorough due diligence investigation of this investment opportunity. STRIVE expressly denies any obligation to conduct a due diligence examination of this Property for Buyer.

Any projections, opinions, assumptions or estimates used in this Marketing Brochure are for example only and do not represent the current or future performance of this property. The value of a commercial property to you depends on factors that should be evaluated by you and your tax, financial and legal advisors. Buyer and Buyer’s tax, financial, legal, and construction advisors should conduct a careful, independent investigation of any commercial property to determine to your satisfaction with the suitability of the property for your needs.

Like all real estate investments, this investment carries significant risks. Buyer and Buyer’s legal and financial advisors must request and carefully review all legal and financial documents related to the property and tenant. While the tenant’s past performance at this or other locations is an important consideration, it is not a guarantee of future success. Similarly, the lease rate for some properties, including newly-constructed facilities or newly-acquired locations, may be set based on a tenant’s projected sales with little or no record of actual performance, or comparable rents for the area. Returns are not guaranteed; the tenants and any guarantors may fail to pay the lease rent or property taxes, or may fail to comply with other material terms of the lease; cash flow may be interrupted in part or in whole due to market, economic, environmental or other conditions. Regardless of tenants history and lease guarantees, Buyer is responsible for conducting his/her own investigation of all matters affecting the intrinsic value of the property and the value of any long-term leases, including the likelihood of locating replacement tenants if any of the current tenants should default or abandon the property, and the lease terms that Buyer may be able to negotiate with any potential replacement tenants considering the location of the property, and Buyer’s legal ability to make alternate use of the property.

By accepting this Marketing Brochure you agree to release STRIVE and hold it harmless from any kind of claim, cost, expense, or liability arising out of your investigation and/or purchase of this commercial property.

Information About Brokerage Services

Texas law requires all real estate license holders to give the following information about brokerage services to prospective buyers, tenants, sellers and landlords.

TYPES OF REAL ESTATE LICENSE HOLDERS:

• A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

• A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

• Put the interests of the client above all others, including the broker ’s own interests;

• Inform the client of any material information about the property or transaction received by the broker;

• Answer the client’s questions and present any offer to or counter-offer from the client; and

• Treat all parties to a real estate transaction honestly and fairly.

A LICENSE HOLDER CAN REPRESENT A PARTY IN A REAL ESTATE TRANSACTION:

AS AGENT FOR OWNER (SELLER/LANDLORD): The broker becomes the property owner’s agent through an agreement with the owner, usually in a written listing to sell or property management agreement. An owner’s agent must perform the broker’s minimum duties above and must inform the owner of any material information about the property or transaction known by the agent, including information disclosed to the agent or subagent by the buyer or buyer ’s agent.

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any material information about the property or transaction known by the agent, including information disclosed to the agent by th e seller or seller ’s agent.

AS AGENT FOR BOTH - INTERMEDIARY: To act as an intermediary between the parties the broker must first obtain the written agreement of each party to the transaction. The written agreement must state who will pay the broker and, in conspicuous bold or underlined print, set forth the broker’s obligations as an intermediary. A broker who acts as an intermediary:

• Must treat all parties to the transaction impartially and fairly;

• May, with the parties’ written consent, appoint a different license holder associated with the broker to each party (owner and

• buyer) to communicate with, provide opinions and advice to, and carry out the instructions of each party to the transaction.

• Must not, unless specifically authorized in writing to do so by the party, disclose:

ӽ that the owner will accept a price less than the written asking price;

ӽ that the buyer/tenant will pay a price greater than the price submitted in a written offer; and

ӽ any confidential information or any other information that a party specifically instructs the broker in writing not to disclose, unless required to do so by law.

AS SUBAGENT: A license holder acts as a subagent when aiding a buyer in a transaction without an agreement to represent the buyer. A subagent can assist the buyer but does not represent the buyer and must place the interests of the owner first.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

• The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

• Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

LICENSE HOLDER CONTACT INFORMATION: This notice is being provided for information purposes. It does not create an obligation for you to use the broker’s services. Please acknowledge receipt of this notice below and retain a copy for your records.

Regulated by the Texas Real Estate Commission Information available at www.trec.texas.gov

IABS 1-0

469.844.8880 STRIVERE.COM exclusively listed