& BEAUTIFUL BOLD

SPECIALTY STORE ADVANTAGE AN MR RETAIL SURVEY

TAILORED CLOTHING MAINTAINING THE GAINS

WHO’S THE BOSS? MENSWEAR COUPLES TELL ALL

JEANEOLOGY: 2023 AND ME DENIM GUIDE

SPECIALTY STORE ADVANTAGE AN MR RETAIL SURVEY

TAILORED CLOTHING MAINTAINING THE GAINS

WHO’S THE BOSS? MENSWEAR COUPLES TELL ALL

JEANEOLOGY: 2023 AND ME DENIM GUIDE

SUN/MON/TUE

February 5-7, 2023

THE MART, CHICAGO

The Chicago Collective is the Premier National Menswear show in North America, hosting the top brands and retailers from around the world. Join us this February where you will see the best brands, attend the iconic opening night party, enjoy exciting events and amenities, and so much more.

DEBUTING MARCH 5-7, 2023

March 5-7, 2023 SUN/MON/TUE

THE MART, CHICAGO

The Chicago Collective Women’s Edition will feature everything you love about Chicago Collective, including an easy to shop floor, a fun opening night party, special pop-up events and our popular buyer hotel reimbursement program.

chicagocollective.com

14 Shining Stars

Why we think 2023 is the year of the specialty store.

22 Denim Days

Are jeans the new streetwear?

27 Talking Tailored

The latest trends as men return to dressing up.

52 Love Stories

Love, live, work... how these couples in menswear keep it together.

4 Editor’s Letter Compelling success.

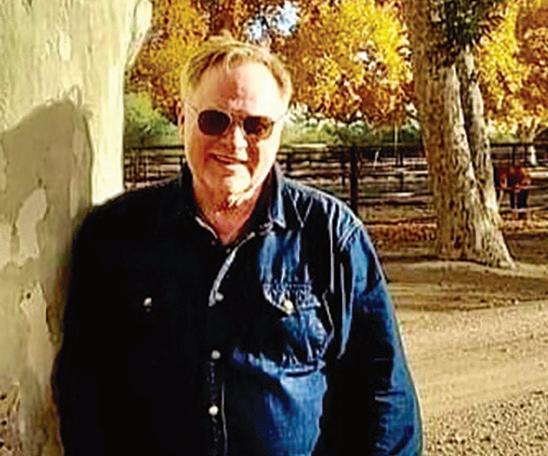

6 Missing Lee Leonard

An industry tribute.

8 Fashion Futures

Notes from the market.

12 Great Reads Nick Hilton’s lessons.

42 Fashion Layer it on.

56 Last Word

A footwear tale from the briny depths.

EDITOR-IN-CHIEF KAREN ALBERG GROSSMAN

FASHION & CONTENT EDITOR JOHN RUSSEL JONES

CONTRIBUTING EDITOR MICHAEL MACKO

CREATIVE DIRECTORS NANCY CAMPBELL

TREVETT MCCANDLISS

CONTRIBUTING ART DIRECTORS FRANCI BERMAN

ROSEMARY O’CONNELL

GROUP PUBLISHER LIZETTE CHIN

ASSOCIATE PUBLISHER CHARLES GARONE

PRODUCTION MANAGERS LAURIE GUPTILL, FERN MESHULAM, KATHY WENZLER

MARKETING & PRODUCTION SPECIALIST CATHERINE ROSARIO

OFFICE MANAGER PENNY BOAG

ACCOUNTING KASIE CARLETON, URSZULA JANECZKO

TINA ANIVERSARIO NORDSTROM

JUSTIN BERKOWITZ BLOOMINGDALE’S

SAM GLASER STITCHED

KARL-EDWIN GUERRE NO CHASER/GUERRISMS

KATIE LIU & MICHAEL KREIMAN BLACK DOG 8 SHOWROOM ALAN LEINEN HALLS

STEVE PRUITT BLACKS RETAIL

CHAIRMAN CARROLL V. DOWDEN

PRESIDENT & CEO MARK DOWDEN

CHIEF FINANCIAL OFFICER/VICE PRESIDENT STEVEN RESNICK SENIOR VICE PRESIDENT RITA GUARNA

VICE PRESIDENTS LIZETTE CHIN, NIGEL EDELSHAIN THOMAS FLANNERY, NOELLE HEFFERNAN, COLEMAN MCCARTAN, BELINDA PINA, MARIA REGAN, DIANE VOJCANN

ONE MAYNARD DRIVE, PARK RIDGE, NJ 07656 WWW.MR-MAG.COM • WWW.WAINSCOTMEDIA.COM

On our cover: coat: Schott, jacket: Scofield Tacoma, shirt: Abercrombie & Fitch, scarf: Raffi. Model: Ryan Winter, New York Model Management. Styling: Michael Macko. Photography: Chris Fucile. Grooming: Robert Bradley.

ing into a store with compelling product and educated (low-pressure) sellers who can give you real information? A special thanks to the many dozens of independent retailers who took the time to thoroughly answer our survey. Looking ahead, we hope to feature several of these stores, and others, in an online series.

heart-warming as we do.

There’s no doubt about it: 2022 was the Year of the Specialty Store and we optimists at MR believe that 2023 could be another great one. Of course, we’re aware of the many challenges that specialty retailers are up against these days; our independent store survey in this issue (page 14, continued online) discusses many of them. But the fact remains that department stores are closing doors left and right, investing in online rather than finding and training passionate sellers. While online shopping is not disappearing, the luster has been fading for both sellers and shoppers. As early internet adopter Greg Shugar noted in our January issue, “Without the in-person contact, it’s nearly impossible for online brands to develop a true relationship with the customer.”

And don’t we know it! As consumers, is there anything more satisfying than walk-

Surprising some, tailored clothing was the star performer for independent stores in 2022. According to data provided by Blacks Retail, spring ’22 suit business was up 68 percent, fall up 13 percent. In formalwear, spring increases were a staggering 121 percent, fall saw gains of 59 percent, with similarly impressive stats for sportscoats, soft coats and dress trousers, all with maintained margins at, or close to, 60 percent. For more insight on tailored clothing, check out this month’s special section (page 27) sponsored by Peerless. While clothing business has been largely wedding-driven of late, smart retailers are promoting a whole new way to dress featuring soft unstructured jackets in luxury fabrics. It’s been a homerun for merchants with distinctive product, presented with impact.

For our fun piece in this issue (page 52), a nod to Valentine’s Day, we profile couples working together in the men’s fashion business. (And I thought people go to work to get away from their partners…) We hope you find their stories as

And speaking of heart-warming, as one of many who adored Lee Leonard of DLS, I’m in a state of shock and sadness at his sudden passing. The hardest part for me as I digest the outpouring of love from our menswear community: I don’t think Lee ever realized how much he mattered to so many. And so, a reminder: nothing is promised us. Each day is a gift; live it fully and with purpose. And never miss a chance to tell your friends and loved ones how much they mean to you.

—Karen, John, Lizette, Charles, and Michael“IS THERE ANYTHING MORE SATISFYING THAN WALKING INTO A STORE WITH COMPELLING PRODUCT AND EDUCATED (LOW-PRESSURE) SELLERS?

PHOTO BY ROSE CALLAHAN

THE MENSWEAR INDUSTRY IS DEEPLY SADDENED BY THE SUDDEN PASSING OF MEN’S FASHION VETERAN LEE LEONARD, WHO DIED OF A HEART ATTACK ON DECEMBER 31 AT HIS APARTMENT IN NYC. LEE WAS AN ACTOR, A TOUR GUIDE, A LOVER OF ALL THINGS ITALIAN, AND A CARING FRIEND TO SO MANY. HERE, A FEW TRIBUTES TO THE SOFT-SPOKEN GENTLEMAN WITH A BIG LAUGH, AND AN EVEN BIGGER HEART.

“It must be at least 30 years since I met Lee and the DLS team, but it was just this past June that I really got to know Lee and he told me about his heart condition. It was he who insisted that I go to Florence, which was the best trip to Italy I’ve ever taken because of Lee’s passion for the city. Because Lee loved what he was doing, we fell in love with Lee.”

“Lee was a great business partner and a dear friend with a big heart! He was part of our weekend crew in Long Beach and everyone loved him. Our weekends were full of fun, beach, poker, backgammon, chess and of course lots of cocktails. Lee’s outgoing personality and kind gentle soul coupled with his acting abilities made him a real hit with the ladies. Most importantly, he loved our industry, the people, relationships and was always on the hunt for the next big brand. I will most miss his jovial laugh and his genuine friendship.”

“It really hurts to talk about Lee in the past tense. He was always so positive and encouraging. One story: we were with a group of retailers in Naples, Italy. After dinner, there was music in the hotel bar. While David dozed off on a comfortable chair, drowsy from jet lag and wine, Lee (always the ladies’ man) danced the night away with Ellen. Lee never let David forget how much Ellen enjoyed dancing with him!”

“LEONARDO, YOU WILL BE MISSED BY SO MANY. WHEREVER YOU WALKED, THE SIDEWALKS SMILED.”

—ANDY MALLOR, ANDREW DAVIS—VINCE GONZALES, VINCE GONZALES INC. DAVID AND ELLEN LEVY, LEVY’S NASHVILLE —LARRY AND ARLEEN ALBERT, MAINLINE CUSTOM

“It was the summer of 2010. After a long day navigating Pitti, Lee brought a group of DLS stores to my office in Piazza Ognissanti. My office was on the third floor overlooking the river, with an elevator that was only 2.2 by 5 feet. Opening the elevator door, I was flooded with Lee’s large laugh and the image of a very hot and tired guy, stuck in that tiny space and on crutches, obviously in pain after his recent knee surgery gone wrong. Still in good spirits and laughing at his predicament, his only goal was to get his team some cocktails.”

—SHAYNE REGAN, BORGO28 INC.“Lee started as a client, but became a dear friend. For the past 20 years, the highlight of my year was putting together the DLS fashion book. The care and professionalism your team brought to the project reflected your respect for each client, your desire for the success of each store. Lee, I will miss our conversations, from the weather to global peace. I will miss the advice you always provided, reflecting your caring heart. I know that one day we’ll continue our work for all the stores in the sky.”

“Lee was the cheerleader, the one who got us all going at early morning meetings, the one who had the uncanny ability to mix calm with excitement. He could be persistent, persuasive and a nudge all at the same time and never get you upset. Our industry will be a little less rich without him; may his memory always be for a blessing.”

—DANA KATZ, MILTONS“How do we sum up the partnership, friendship and love we had with Lee for more than 50 years? Lee and Fred go back to a time before DLS when they worked together in DC; I came to know Lee when Fred asked him to join our office two years into the business. Lee became a dear friend: lively, thoughtful, an anchor. An extremely private person himself, he was always there for us through both bright and dark moments and will remain a part of us for all time.”

“Lee and I shared a bond, and I’m fortunate to say he was my friend in every way. He was a voice of reason when my enthusiasm about a project consumed me. He helped me see the bigger picture. We shared many trips to Italy, meals, and laughs. My biggest regret is that I was unable to take him to Istanbul, a city he really wanted to explore and photograph. I have lost a friend and mentor; we all have lost a sweet, gentle soul.”

—MICHAEL DURU, MICHAEL DURU CLOTHIERS“I was fortunate to share many Italy trips with Lee. From unique product ideas to industry insight and inspiration, Lee was a wealth of knowledge. As each Italian evening ended with limoncello or grappa, I say ‘Salute and ciao my friend. May we meet at a menswear show on the other side!’”

“LEE, YOU HAVE LEFT A BIG HOLE IN MANY HEARTS. I WILL FOREVER CHERISH YOUR GUIDANCE, KINDNESS AND SUPPORT, YOUR BOISTEROUS LAUGHTER AND PASSION FOR OUR INDUSTRY.”

—RUTH GRAVES, STEP USA

—MIKE ZACK, DALLAS RETAILER

“LEE WILL BE GREATLY MISSED, BUT HE LEFT SO MUCH WISDOM AND TEACHING AND COACHING BEHIND THAT IN A VERY REAL SENSE, HIS LEGACY LIVES ON .”

—WENDY THOMPSON, MAJESTIC—BOB DONA, OPTIMUM GRAPHICS —VIRGINIA SANDQUIST, FRED DERRING, DLS

Why is it that anything designated a “gift” seems to become automatically tacky? I always try to follow the tenet of not giving anything I wouldn’t want to receive. So I was hugely disappointed when I started a search for Valentine’s Day gift options and came up with a lot of naughty underwear and heart-shaped candles. Surely we can do better than that! So my search changed to discovering the one perfect Valentine’s Day gift that everyone would like, that you could share on social media and that would not break the bank.

I found it from our friends Imogene + Willie down in Nashville, who themselves (Carrie and Matthew) are a Valentine’s love story: friends in 6th grade, married 20 years later. They started the Imogene + Willie line in a defunct service station, primarily because they couldn’t find the perfect jeans for their imperfect bodies. Then came T-shirts. This one, with the imperfect heart, is the perfect gift for anyone. At $68, you can afford to treat your Valentine to some takeout as well. For more information, please check out https://imogeneandwillie.com.

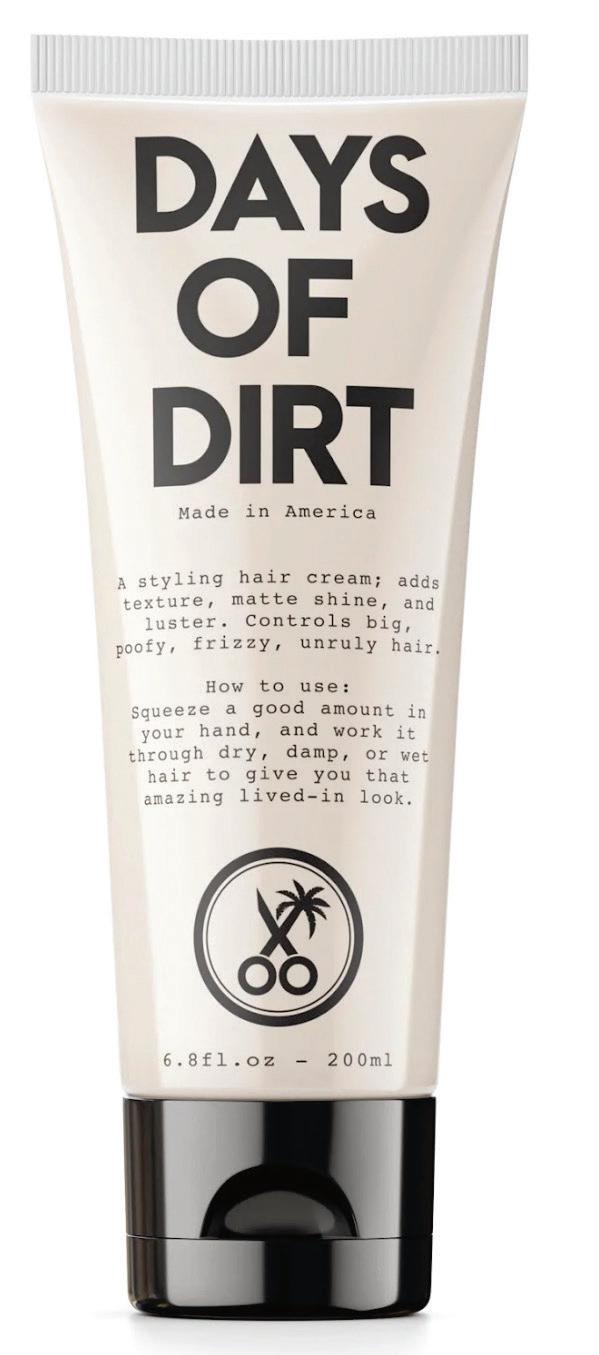

In an old quote by author Myrtle Reed, one of her characters says, “I’ve just washed my hair and can’t do a thing with it!” While seeming frivolous, it holds a kernel of truth.

There’s much talk in the grooming industry about how often you should wash your hair for optimum health and growth. On the days you do lather, rinse and repeat, more care must be paid to which follow-up product and how much to use.

A styling cream called Days of Dirt might make you think twice about using it: you just cleaned your hair, why make it dirty again? Counterintuitive for sure, but the ingredients are all the good things that make freshly washed hair look less fluffy, more sleek and lived in.

And while the product speaks for itself, one should know that

it comes from the talented mind and hands of Jason Schneidman, a Southern California native and celebrity stylist known as the Men’s Groomer (@themensgroomer), who tends the manes of such marquee heads as Andrew Garfield, Bruno Mars, Jonah Hill, Jimmy Fallon, and K. J. Apa.

Schneidman, who has been clean and sober for many years, also takes to the streets to provide haircuts and the return of dignity to the homeless. He created a foundation to fund the work, which is fueled by sales of his grooming products, and says, “I’m using what God gave me and what I learned early on in recovery to change someone’s life. That’s the power of a haircut.” For more information or to purchase Days of Dirt, please visit https://californiaborn.com.

In 1978, a 14-year-old me bought my first concert shirt at the Nassau Coliseum. Unfortunately, my best friend and I missed the ELO concert, having misjudged the travel time from New Jersey to Long Island. As our empty bus pulled into the parking lot, people poured out the doors. We swam upstream to the lobby, nursing our wounds with $8.99 T-shirts purchased out of large cardboard boxes in the lobby.

In the past 25 years, concert merchandise has changed tremendously. One can now show one’s band loyalty with items from the lowly mass-produced T-shirt, button, and patch to high-end designer products, many with unexpected fashion twists.

Those concert tees can now cost $140 or more, but in a vintage wash so soft you won’t want to take it off. The fact that it comes from a brand like John Varvatos, whose NY flagship store is the former CBGB nightclub, adds to its validity.

Nixon has collaborated with the Rolling Stones, resulting in a collec-

tion of watches ranging from $150 to our favorite, the Rolling Stone Primacy, at $1,600. Only 250 were made, individually numbered and including a unique woven tongue logo along with an anti-glare sapphire crystal, scratch-resistant coating and a 10 ATM/100 m water rating.

A standout band/brand collab is the Grateful Dead tie-dyed version of the iconic Perfecto motorcycle jacket, made from a medium-weight, hand-dyed calf suede. The blueand-fuchsia-tanned hides are then tied in a bullseye pattern and dyed black to create unique one-of-a-kind

patterns on the suede that are then cut and sewn into jackets. There’s also exclusive lightning hardware and a black bandana lining, all for $1,275.

Finally, you are too late to get a pair of Vans x Led Zeppelins for the original drop price, but they are readily available on resale sites like GOAT, averaging around $250, depending on the size. The SK8-Hi honors the 50th anniversary of the band’s self-titled debut album in a black canvas and leather upper detailed with artwork from the album cover, capturing the demise of the Hindenburg airship.

Retailers might have noticed a favorite men’s jewelry brand is no longer around, but not to worry, M. Cohen has evolved into the new name of MAOR, the designer’s first name. Cohen began to develop this eponymous fine jewelry brand in early 2017 with a desire to create a unisex, jewelry range with luxe materials - gold, diamonds, and precious stones. At the time this was a niche market, but MAOR is now on trend as jewelry couples can share, no matter their gender or pronoun preferences. To see more of the collection visit: https://www.maorofficial.com/

By Karen Alberg Grossman

By Karen Alberg Grossman

A newly published book by Nick Hilton, son of the late legendary clothing maker Norman Hilton, has captivated me to the point that I can’t review it: it’s just too good (and it makes me cry!). Yes, it gives profound insight into the men’s clothing industry, but more than that, it’s about how to find one’s rightful place in the universe and how family dynamics can seriously screw us up. Instead of me struggling to summarize, I give you the author with some thoughts.

“There’s lots of stuff in the book about business and families that’s meant to teach, and lots of amusing stories and characters meant to entertain. But the heart of it is that life is like being given the gift of an instrument and the responsibility to play it as well as we can. Overcoming wrong thinking, eliminating destructive habits, finding a spiritual path is the way to find one’s right place in life, a place you can know only once you’ve arrived there…

“The behavior of our parents that nurtures and instructs us, we tend to mimic; the way they behave which confuses, embarrasses, or hurts us we do the opposite of, even if detrimental. My father was really smart, with impeccable taste and marketing savvy. I learned a lot from him about what to do, and what not to…

“When I came into the clothing business, the Ivy League look in menswear, for which my father’s brand was iconic, was about to be displaced by a new ‘fashion.’ The retailers who resisted that change soon failed, while

those who embraced it thrived. The typical ‘traditional’ retailer, who had built a business on soft-shoulder suits and Shetland sweaters, complained about the new way people dressed and had no idea how to recreate themselves.

“Perhaps the key lesson I’ve learned is the truth of the French saying Plus ça change, plus c’est la même chose . The trick in our business is to stay alert to the emerging trends and interpret them in a way that appeals to your existing customer. Go too far too fast and you alienate him; too slow and you lose him to the fashion stores. Only a small percentage of men are interested in dressing well; marketing to the general public might work for Amazon, but we can address only our small audience—often only their wives or partners. The audience is unique to every locale.

“Dressing well is an indication of an individual’s respect for himself, for his work and/ or social environment, and for the people he associates with. We live in a disrespectful, iconoclastic, resentful age, and the culture created by the mass media and reflected in the social sphere makes it easy, acceptable even, to dress like a slob. One is tempted to suggest the organization of an industry-wide public relations effort among designers, retailers, manufacturers, and the media to pool resources to speak with one voice. But I’m skeptical that we could find a consensus as to what dressing well should look like, which is the source of the problem. So, one man at a time.…”

Editor’s note: The book is available on Amazon; Nick Hilton can be reached at nick@nickhilton.com.

Nick Hilton’s new book has received rave reviews. Writes R.R. Reno, “This is a book about a life in clothing that sheds light on the deeper loves that make life worth living.”

ACCORDING TO MR research, independent menswear stores had a banner year in 2022 and are preparing for another in 2023. Although planned increases are decidedly more modest than last year’s, most merchants would be delighted just to maintain their record high sales volume (and record high cash-on-hand), considering the significant challenges they are dealing with.

By almost all accounts, 2022 was an exceptional year through mid-October, at which point sales slowed considerably. According to Mastercard SpendingPulse, shoppers cut back

sharply on retail spending in November, with overall sales dropping 0.6 percent, but then rallied in December, perhaps responding to price promotions, for a 7.6 percent holiday sales increase. But according to year-end estimates from our mostly upscale retail respondents, 2022 increases in menswear far exceeded the norm, averaging 30 percent and ranging from 4 to 100 percent. Plans for the first half of 2023 were somewhat mixed, with 9 percent of independent retailers planning down (average 5 percent), 14 percent planning flat, and 77 percent planning up an average

8 percent (2–20 percent range).

Editor’s note: This is part 1 of a 2-part feature, to run in full on mr-mag.com. Our sample of independent retailers comprises large and small menswear stores across the U.S., some legendary, some new to us but highly recommended. Some are city stores, some suburban, some resort. Some date back a century, some just a few years. Some store owners are young risk-takers, while most are older and (hopefully) wiser. But whatever their orientation, these retailers were surprisingly open to expressing their hopes and fears, their

strategies and solutions, and their genuine passion for the business. What’s more, they were remarkably willing to share success secrets and offer heartfelt advice. It’s a spirit of generosity and camaraderie that should make us all proud to be part of the men’s fashion community.

The dictionary defines mission statement as “a formal summary of the aims and values of a company, organization, or individual.” MR believes that creating a strong mission statement helps keep businesses on track and focused on key goals. Here, a few examples we found inspiring.

From Andy Mallor at Andrew Davis in Bloomington, Ind.: “Our business is customer-focused and relationship-based. Our mission is to help customers do three things: develop style confidence, obtain quality and value, and have fun in our store.”

Greg Walsh and Dana Swindler at MP3 in Minneapolis, Minn., say, “We’re dedicated to building a one-of-a-kind retail gallery where the curious are rewarded, where style is limitless, where everyone is welcome to find pieces of themselves amongst our assortment, and where life is celebrated as the greatest form of art.”

And from Rick and Jim Penn at Puritan Cape Cod in Hyannis, Mass.: “Earn the relationship. We need to earn the relationship every day with our customers, our employees, and our community.”

From David Perlis at Perlis in New Orleans, Baton Rouge and Mandeville, La.: “To provide compelling merchandise with

“IT’S HARDER THAN EVER TO FIND YOUNG PEOPLE INTERESTED IN RETAIL.”

—DAVID PERLIS, PERLIS LA.

an excellent value proposition at a variety of pricepoints presented in a comfortable shopping environment by a knowledgeable and friendly staff. Our focus is on building long-term relationships for the betterment of our customers, our employees and our family.”

Ben Belton at Benjamin’s in Morganton, N.C.: “Our mission is to create a collection with an artistic twist. Our customers have come to expect the unexpected, be it a royal blue python jacket or a red stretch leather belt.”

Harley Hooper at Harley’s in Tyler, Texas writes, “Our goal is to provide the best service and the most unique assortments of men’s tailored clothing and sportswear.”

Says Dennis Jaworski at Palmettoes in Hilton Head, S.C.: I work to “make a friend and create a relationship. Making the sale is a bonus.”

And says Keith Kinkade at Kinkade’s in Ridgeland, Miss., “Our store is based on three guiding principles: quality, integrity, and excellence. I learned these over 30

years ago from my Dad. He also taught me to work hard every day and take the extra step to make others feel valued and seen.”

And finally, from Murry Penner of M.Penner, Houston, Tex., simply: “To help men live their best lives in style.”

When asked what specifically has accounted for their store’s longevity and/or recent success, most respondents alluded to a strong staff, exceptional customer service, community involvement, a merchandise mix geared to regional tastes and a certain amount of risk-taking. Many mentioned strong vendor partnerships and unique and/ or exclusive product. For several, it’s very much about the persona of the store owner.

In the merchants’ own words, here are a few of the more thoughtful responses. From Trey Kraus at Carltons in Rehoboth Beach, Del.: “1. Don’t get stuck on initial or maintained margin: you deposit gross profit dollars. 2. You can’t sell from an empty truck: inventory is our weapon to defeat online stores. In a world of instant gratification, you need selection and depth of sizes. 3. Evolve: focus on current trends and personalized service.” At David Wood in Portland, Maine, David Hodgkins and Sarah Hutchinson Brown strive to make shopping fun and efficient. Their DW Fit Kit strategy is their main

weapon: “You don’t need a lot of clothes, just the right clothes.”

Steve Bratteli at Mr. Ooley’s in Oklahoma City, Okla., believes it’s about “plenty of saying yes to our customers, and a large selection of buy-now fashion.”

Jim and Connie Ockert at Khaki’s of Carmel in California are leaning heavily on unique brands. Jim also narrates frequent videos of newly arrived fashion, developing their own product and presenting it with impact via fabulous windows and 65 mannequins strategically placed throughout the store. Says Jim, “With encouragement from Connie, I’m aggressively seeking out fashion that’s distinctive and different. After all those months of pandemic shutdowns in California, we need to ignite sparks, to get off the beaten trail and create excitement.”

Penner maintains his exceptional year was based on genuine respect for his employees, customers and vendors. “Without any one of these three, it all fails, or at the very least it’s no fun. Our employees have our full support and trust to do whatever it takes to achieve our mission.” Wally Naymon from Kilgore Trout in Cleveland, Ohio credits “a wonderful team of professionals who care deeply about the clients.” From Marshall Simon at Gwynn’s in Mount Pleasant, S.C.: “We have great associates who go above and beyond to deliver outstanding service.” Ken Metzger at Metzger’s in Mobile, Ala., says it’s about “trust without game playing.” Offers Scott Moorman from Moorman Clothiers

Does it still make sense to analyze business by category when today’s “New Wardrobe” parameters defy classification? Is a lined overshirt or quilted vest crafted by a clothing maker considered sportswear, outerwear or tailored clothing? Most interesting about the survey results is not the averages but the range of responses. For example, tailored clothing ranged from 11

to 60 percent of menswear volume, according to store; furnishings from 3 to 21 percent.

As might be expected, after such a strong year in 2022, few retailers are making major changes in their focus, with tailored clothing projections down just slightly. Even so, retailers are hoping that on-time deliveries and EDI replenishment will maintain or even increase last year’s tailored clothing volume.

in Iowa: “We take care of people. We love what we do, and it shows.” And from David Rubenstein of Rubensteins in New Orleans, La.: “It’s all about change, so take the risk. Be prepared to push or pull your customers forward.”

The Choolani family at Peter Renney’s in Portland, Maine, lost their dad and store founder in 2016.“Our work ethic comes from him,” affirm Jyoti, Neenu and Megha. “He founded the business in 1975, basing it on customer service and honesty. We watched him work in the store with our mom for 30 years, dealing with both highs and lows. His resilience and desire to grow the business with integrity are in the forefront of our minds every day.”

Geoffrey Michel from The Met in Sarasota, Fla., attributes his success to being present. “The best fertilizer for a business is the owner’s footprint. Working directly with clients and staff tells you so much more than a report. Brenda personally signs every check, which is very important to our expense management.”

Howard Vogt at Rodes in Louisville, Ky., says it succinctly: “Our success is due to our people: they deliver smiles and confidence. They make our customers look and feel great!” From Jaworski: “We’ve managed to create a clublike ambiance in the store, with a grand piano, a working bar, and numerous seating areas. We’ve built a reputation as ‘the club without dues.’”

And from Walsh and Swindler at MP3 in Minneapolis, Minnesota: “We started small with no retail background, which helped us to make mistakes more quickly, and then forge ahead to correct. We listen to what our customers tell us they want. The lifestyle component was inherent from the

start: we’ve had an interior design business since 1994, adding furniture in ’01, men’s in ’07, women’s in 2020. It all came together before lifestyle became a trend.”

Retailers are divided: Narrow and deep or broad and shallow? Recognized brands or private label? Obviously, establishing strong partnerships with key vendors is essential in this era of supply chain backups. However, vendor demands for high minimums and other prerequisites are becoming intolerable for many merchants, especially since these same brands are increasing their D2C business, thereby competing directly with the stores that have nurtured and supported them over the years.

For most surveyed stores, their top three menswear brands contribute an average of 33 percent to their total menswear volume, ranging from 20 to 70 percent according to store. In almost 30 percent, their top three vendors combine to contribute half or more of their total menswear volume. That’s a lot of dollars to risk losing, so many retailers are begrudgingly accepting high minimums from their major suppliers. Others are developing their own brands.

Says Belton, “I don’t lean on any single brand: I shop by emotion; I try to be a merchant, not just a retailer. I believe in taking chances, and that too early is better than too late.”

The top brands cited by our decidedly upscale specialty store sample: Jack Victor, Canali, Zegna, Peter Millar and Isaia. Also listed: Coppley, Stenstroms, Cucinelli, LBM, Eleventy, Munro, Byron, Faherty, HSM, Hickey Freeman, Samuelsohn, Magnanni, Eton, Etro, 34 Heritage, Johnnie-O, Emanuel Berg, Hagen,

“AFTER MONTHS OF SHUTDOWNS IN CALIFORNIA, WE NEED TO IGNITE SPARKS, TO GET OFF THE BEATEN TRAIL AND CREATE EXCITEMENT.”

—JIM OCKERT, KHAKIS CARMELAbove: Martin Patrick 3 has perfected Lifestyle Merchandising. Below: Jim from Khakis understands impact displays.

Hiltl, David Donahue, Sand, Gimo’s, Brax, Ballin, Meyer, Peerless, Paul&Shark, Robert Graham, Alden, Alberto, True Grit, Tommy Bahama, Raffi, Greyson, Dion, Relwen, Tailor Stitch, On Running, Lululemon and a slew of smaller Italian brands, including Baldessari, Fideli, Fradi, Etro, Pescarolo, Sartorio, Enrico Mandelli and Barmas.

Among the current challenges cited by Penner, rapidly rising product prices and rising costs of doing business. “To be sure, margins are good right now but this won’t last forever; there are certainly limits to what people will pay for clothes.”

Kraus concisely sums up the challenges independent retailers now face: “Competing with local stores, competing with our own vendors, the weather, inflation and staffing. These days, few people want to work for any price!”

Notes Belton: “We’re seeing fewer customers coming in, but fortunately, they’re buying multiple items at higher tickets. We’re also seeing more new faces.”

Mallor lists his challenges as follows: “Late shipments, increased costs and staffing issues.We must stay passionate about the human experience that the staff creates for customers. If that keeps growing, so will the numbers. But with much frustration among customers not getting their custom orders in 6 to 8 weeks, how we handle the frustration is key.”

Simon feels most challenged by competition from his vendors. “Consequently, we’re making Gwynn’s the brand, curating the best of the best from 150+ vendors.” Says Naymon, “Our business is all about sellers and sewers. We’re working hard at finding and developing the best talent.” And from Walsh and Swindler at MP3: “Hiring is becoming more of a challenge than usual, both entry level and senior positions. Since the retail industry has consolidated over the last several years, it’s tough to find people truly vested and interested in retail.” Perlis agrees: “My biggest concern over the next decade is personnel. It’s harder than ever to find young people interested in retail. I’m spending more time than ever networking. More than 20 percent of our workforce is in the twilight of their careers.”

“The challenge is finding vendors with stock available,” offers Bratteli.“And vendors who can produce custom orders in a timely manner and ship seasonal orders early.”

The team at Peter Renney’s also bemoans supply chain setbacks. “Getting certain products and fabrics in a timely manner has been a problem. But our vendors are doing a great job communicating potential issues so we can prepare accordingly.”

“Inventory is the issue,” agrees Rubenstein. “Getting refilled on stock merchandise is a struggle. Fortunately, our customers are buying what we have, but we’ve missed a lot of sales due to missing solid suits, navy blazers, white dress shirts. Hiring personnel is also difficult, especially tailors and

—NICK HILTON, HILTONS PRINCETON, NEW JERSEY

Q. What has your role with ITA in NY been for the past four years? My teams and I have defined innovative marketing strategies to support Italian brands in the U.S. as they bounced back from the pandemic. As a coordinator of the Italian Trade Agency (ITA) offices in the US (New York, Chicago, LA, Miami, and Houston) I focused on expanding reach into new regional areas and speeding up programs benefiting the Italian economy.

Q. What has your experience with ITA been prior to NY? Having started in 1981, this year marks my 42nd year of service to ITA. I have been posted in several offices abroad in South Korea, Malaysia, Taiwan and the People’s Republic of China. My service in China as Italian Trade Commissioner lasted for an exceptional 12 years, and I contributed to the impressive infiltration of ‘Made in Italy’ products there. I was also posted in the Rome headquarters as Director of the Promotion Division from 2000 to 2003 and Director of Marketing from 2015 to 2019.

Q. How did the unprecedented global pandemic during your NY tenure affect your work? Though one of the hardest hit countries, Italy registered a tremendous, expectation-exceeding economic bounce back in exports. ITA, under the guidance of the Italian Ministry of Foreign Affairs and International Cooperation, dedicated great attention to digital B2B solutions designed to keep the communication channel between Italian and U.S. companies open during Covid and beyond – considering the export results over the last two years, we can say we were successful.

Q. How have you seen trade between Italy and the U.S. evolve in the past 4 years? Thanks to the resilience of the Italian entrepreneurs - and the Italian government - we have seen growth in Italian exports to the U.S. across many sectors, with fashion as a top performer. At the end of 2022 we estimate 15% growth, while 2021 ended with approximately 54% growth. Combined, the total export from Italy to the U.S. has shown continual growth and we estimate an all-time record of export around $70 billion to end 2022.

Q. How has the meaning of ‘Made in Italy’ changed within the last 4 years? For millions of global consumers, ‘Made in Italy’ means high-end product recognized for design, innovation, and quality. The Covid slow down allowed many Italian companies to accelerate digitization, focus on sustainability and preservation, invest in more energy efficient equipment, and improve digital communication - better structuring themselves for the future. Already popular from boomers to millennials, today we are engaged in helping Italian companies win the hearts of sustainability-minded Gen Z.

Q. How is ITA supporting ‘Made in Italy’ menswear at this month’s Chicago Collective? Chicago Collective is a pillar of ITA’s promotion of menswear. Our presence has grown to 62+ Italian companies who will exhibit at February’s show combining sartorial tradition with the most sophisticated manufacturing techniques.

Q. What initiatives are you most proud of from your last 4 years supporting Italian fashion? Chicago Collective is a successful ‘best practice.’ ITA’s presence at Coterie is equally important for the promotion of womenswear. EXTRAITASTYLE.com, our forward-thinking, free, proprietary digital platform, makes it easier for U.S. retailers to discover Italian brands online. Our NYC shopping festival ‘Italy on Madison,’ showcased collaborations with 80+ Italian commercial activities. We also launched 2 promotional campaigns across multiple doors of Saks Fifth Avenue, introducing emerging Italian designers.

Q. What is to come for Italian fashion later this year? Within the fashion sector specifically, we will kick off a nationwide roadshow that allows us to organize events in cities including LA, Dallas, Miami, and Atlanta. ITA will be back in Chicago in August for Chicago Collective, and we’ll be launching a series of additional events promoting Italian footwear.

Q. What is to come for you in the future, personally? Right now, I’m dedicated to finalizing projects with the U.S. teams. Afterwards I hope I can share my experience with new, young talent. I look forward to more time for my hobbies and enjoying life back in Sicily.

continued from page 18

career-oriented sales associates.”

Nick Hilton of Hiltons Princeton, in New Jersey, confides,“Our two biggest challenges are decreasing demand for tailored clothing and the fact that maintaining proper inventory levels will require holding back on initial purchases and choosing vendors who can fill in.”

Michel worries most about escalating costs. “It’s a blessing and a curse to own Class A real estate in a luxury community. We’re currently replacing an elevator and a roof. Property taxes continue to climb. It’s a big responsibility.” Ockert asks himself three questions before every purchase: “Is the merchandise unique/special/exceptional in some way? Is it priced right? Can they deliver? If they ship late, I won’t buy from them again.”

In Norwell, Massachusetts, Carlo Agostino at Natale’s confronts the challenges of working virtually on his own (with two tailors: he’s looking for a third). “The biggest challenge is keeping the tailor shop on pace with demand. The past 18 months have been busier than anticipated. If I had a third tailor, I could do more business, but I feel blessed that we are needed. We’re selling lots of suits, sportcoats and shirts and we tailor it all, which is time-consuming. The other big challenge: most vendors sell direct to the consumer at a lower price. This takes away the value that retailers have tried to establish for these brands. It’s deflating.”

While New Year’s resolutions are often broken before the champagne bubbles start to fizzle, we believe these 2023 goals and strategies are likely to stick.

John Braeger at Garys in Newport Beach,

Calif., plans to “maintain sales with a slight increase, control inventory and turn product for excellent cash flow, and recruit a new sales associate with a passion for the business.” Harry Mayer in Meridian, Miss., is working on “better tools for training our sales team, upgrading our product mix, ambiance and fixturing.”

Dale Parker at J. Parker in Savannah, Ga., is about to “open a fourth store, the first outside of Savannah.” Naymon hopes to “add a seller who personifies our values: passion for fashion, elite customer service, and hospitality. We will continue to reward our associates for their commitment to our growth and stay ever mindful of the numbers to focus on inventory management.”

Ockert resolves to plan realistic growth, to regularly reevaluate suppliers and categories and to get back to shopping Europe. Most importantly, he vows to “control deliveries by not buying from unreliable resources. Late is late; product is expensive.”

Bratteli is increasing correspondence with customers, improving staff training on new products, and reviewing every part of the customer experience to find ways to improve.” Dana Katz from Miltons in

Massachusetts is “gaining the confidence to serve his clients in all their tailored clothing needs.”

Many retailers are hoping to build a stronger social media experience. Says Michel, “The population surge in Florida leaves us with many new customer introductions. We’re considering expanding to a few local locations. We’re also transitioning our software to give our team more efficient yet genuine contact opportunities. We know clients can shop 24/7 from their phones and we want to earn their purchasing.”

At Journeyman in Middleton, Wisc., Todd Christiansen is growing online business by expanding digital marketing and local advertising. Hilton notes four key goals: “Solidify a succession plan; expand tailored and custom prices, both up and down; find a social media platform that works; and train the staff to be custom clothing experts.”

M.J. Daswani in West Hartford, Conn., cites three key goals for 2023: “An enhanced state-of-the-art custom department and tailor shop; strengthening direct sales potential for home/office visits; strengthening relationships with online bloggers, stylists and ambassador programs to create demand in new markets (universities, new living and work communities, networking groups); and exploring CRM options, e.g. letting customers know what’s coming next and creating excitement around those new looks.” From Agostino, it’s “finding sales staff, creating a better marketing plan for online, and increasing outerwear sales January through March when it’s really cold around here but hard to get stock.”

A universal goal is well expressed by Tom Malvino from Louis Thomas near San Francisco: “My goal is to stay flexible in order to react quickly when things change or when opportunity knocks.” He also hopes to “create more awareness via strategic advertising on social media and to focus on the reasons he chose this business in the first place: a passion for fashion, a keen eye for hot items, a true love of people and of forming relationships.”

TO COME IN PART TWO: Online Opportunities, Creating Buzz, The Youth Market, Scare Tactics, Cash Is King, and much more! Find it at mr-mag.com.

AS MEN MOVE away from athleisure and discover there’s less need for traditional tailored clothing or even business casual pants such as khakis, they are making room in their closets for denim. And lots of it, but in updated fits, fabrics, colors, and patterns.

“Clean, work-appropriate and event-appropriate styles are what’s resonating with our customer at the moment,”

says Justin Berkowitz, men’s fashion director for Bloomingdale’s “We’ve seen a downtrend in excessive destruction and in ripped styles that were popular in years past. The customer is looking for more elevated styles that pair well back to overshirts, bombers, or soft tailored jackets for the office.”

“I’ve been hearing a lot of people say 2023 is going to be denim’s big year,

and I believe that’s going to be the case,” says Daniel Mann, president of Jack of Spades. “We cater to men in the 35 to 55 age range, and they’re definitely favoring denim.”

“Denim is popping up everywhere; we saw new iterations at September’s fashion weeks, as well as in recent awards shows,” notes Sedgwick Cole, Global Director of Men’s Design for Lee Jeans.

“Shoppers are both leaning towards nostalgia and looking for comfort by coming back to denim.”

“Denim is the foundation of American fashion, so it’s not surprising that everyone from rock stars to the average guy wants it to be part of their wardrobes,” says Ron Poisson, creative director and co-founder of Cult of Individuality.

Adds Mark D’Angelo, vice president of men’s sales for Liverpool Jeans, whose product retails from $98 to $119, “Denim has finally become a staple in every man’s closet. Whether worn with a blazer, a hoodie, or a sweater, it’s now part of their everyday lives. That’s one big reason we’ve seen growth in our brand from 25 to 40 percent year over year for the past five years.”

“The reality is that most denim customers, especially younger ones, are looking for denim at more accessible prices, which is why our average jean is about $100,” says Zihaad Wells, creative director of True Religion. “We don’t live in the age where the ordinary guy spends $500 on a pair of jeans. We want to be accessible, yet we also want people to buy our product and feel special. And we seem to be succeeding.”

Nonetheless, the denim trend can be seen at every price point and in every strata of society, including high-end designer fashion. “The spring runway shows were filled with interpretations of denim from brands like Prada, Givenchy, Casablanca, Junya Watanabe as well as newer players like Nahmias and Rhude; the fabric took on greater prominence in many collections,” says Bruce Pask, men’s fashion director at Bergdorf Goodman and Neiman Marcus. “The luxury menswear market also embraced the fabrication with brands like Brunello Cucinelli, Zegna, and Canali showing elevated casual and softly tailored denim jackets and jeans.”

Denim offerings are also a growing portion of the business for 34 Heritage, whose denim retails for around $200. “Denim is definitely uptrending in terms of what our retail partners are asking for,” says VP Sales Richard Binder. “This season, denim accounts for 48 percent of our business.”

“WE’VE SEEN A DOWNTREND IN EXCESSIVE DESTRUCTION AND RIPPED STYLES.”

—JUSTIN BERKOWITZ, MEN’S FASHION DIRECTOR, BLOOMINGDALE’SLee’s denim classics look completely modern.

One major reason the denim business is booming – and is expected to grow even further – is that men are no longer simply recycling the jeans that were already in their closets. Fits, fabrications, and colors are all evolving, and the man who wants to keep up with the times isn’t satisfied with the same-old, same-old.

“We’re seeing that five pocket jean models are leaning more toward a straight fit, a shift from the skinny, more tightly fitting denim that most recently dominated the market,” says Pask.

Adds Neil Rosenthal, co-owner of e-tailer ShopExecutive.com, “I’ve been in menswear for over 40 years, I’ve seen it all. It’s nice to now see a leveling off, of sorts, in denim fit. The consumer is far less interested in jeans that are ultra-baggy or, more recently, excessively tight. I believe this evolution out of the super-skinny trend and into a somewhat looser but still tailored look will serve every body type well.”

“Skinny is slowing down and straight fits are becoming more and more popular,” notes Berkowitz. “At the true trend end of the spectrum, the silhouette change gets even fuller, either with a true wide leg or with a full block on the top that tapers slightly.”

Victor Lytvinenko of Raleigh Denim Workshop says, “Many of our customers seem to want a little more room in the thigh and a little more comfort overall than they have in the past, so we’re responding to that. But the fit we’re most excited about has a higher-rise and a wider leg, which is attracting interest from our more fashion-forward customers.”

“We’ve found that our athletic fit is definitely our best seller,” says Sean O’Connell, Vice President of Men’s Merchandising & Sales for Devil-Dog Dungarees. “Our customer likes to have a little more room in the seat and thigh areas, as well as a more relaxed leg opening.”

“Stretch is the key ingredient for our denim and remains the core of our business,” says Binder. “Those merchants who believe in our stretch denim have greatly increased their buys over the past several seasons. Their consumers are going for the comfort and fit of stretch.”

Says Jack of Spades’ Daniel Mann: “Except for some of the youngest customers, men seem to want jeans that are more relaxed and laid-back. They don’t want anything too tight.”

“We’re basically reducing our number of fits and focusing on the slimmer fit that our customers have always been attracted to,” says Poisson. “But we’re bringing back some looser fits here and there.”

This desire for comfort means that stretch is here to stay, although for some, it could play a less important role than in previous seasons, “Stretch jeans remain bigger, in terms of sales, than a

more traditional fit,” agrees Gary Flynn, president and co-owner of M. Dumas and Sons in Charleston, South Carolina. “But not every guy is looking for stretch anymore. The more mature guy wants to come back to a pure denim feel – all cotton with no elastic. They say they want a jean that feels like a jean.”

Dark blue remains the most popular color for denim and 2023 will see more manufacturers offering blue selvedge jeans, including Raleigh Denim Workshop, Liverpool, and Devil-Dog Dungarees. “For spring, we’re releasing a limited edition selvedge jean. There are only 75 pairs in honor of our 75th anniversary,” says O’Connell. “It’s the first time we’re trying a jean without stretch, although it will fit like our slim/straight jean.”

“Basic blue remains the core color of our denim business,” says 34 Heritage’s Senior Sales Manager Ugur Caymaz, adding that the company has also seen an uptick in sales of black jeans.

“Our customers want the familiar blue denim, although in a lot of different washes. Black pants are also selling well,” says True Religion’s Wells.

Still, customers are beginning to expand their wardrobes – and experiment with other shades “There’s a bit of a push for light-colored and more washed-out denim – like some of the washes you saw 30 years ago” says Flynn. “Starting last fall, we got a lot of requests for light blue for Spring 2023.”

“Colored denim now accounts for about 20 percent of our business, which includes many styles in earth tones, greens, and greys,” notes Liverpool’s D’Angelo.

“We’re doing lots of coated denim, which gives the jeans not just a great look, but a feel of durability,” says Poisson, “For fall, we’re trending darker, including burgundies, pines, and blacks.”

“Denim continues to be the one necessary staple in every man’s wardrobe, which is why I’m happy to see more variety in fabrication, fit, color and washes,” says Beth Zinman, coowner of Shopexecutive. com. “All of this is proof of just how essential a great pair of multi-purpose jeans are to the average guy.”

And to the retailer’s bottom line!

“IT’S ALL ABOUT COMFORT AND STRETCH IN SELLING DENIM TODAY.”

— UGUR CAYMAZ, SENIOR SALES MANAGER, 34 HERITAGE

Clockwise from top left: Coppley, Zanetti Blue, Zanetti, Isaia, Iconics by Samuelsohn, Hickey Freeman.

THERE’S NO QUESTION that tailored clothing was a bright spot in 2022. Merchants across the country reported strong gains, despite supply chain issues that left them short of inventory early in the fall season and (for some) over-inventoried when fall orders were finally shipped.

Reasons for strong year-end increases: offices opening again, lots of spring/summer weddings and a whole new way of dressing that involves softer unstructured jacket-like pieces (can someone please come up with a better name than shackets?) and lightweight outerwear pieces—both categories to be worn indoors and out, dressed up and dressed down.

According to MR research, independent specialty stores in 2022 did an average 35 percent of their total menswear volume in tailored clothing, ranging from 11 to 60 percent. A healthy 29 percent did half or more of their menswear volume in tailored clothing, and 44 percent did a third or more.

According to Blacks Retail data (representing 110 specialty stores), increases (2022 over 2021) were impressive, especially for the spring/summer

season: 68 percent in suits, 121 percent in formalwear, 58 percent in special order, 56 percent in sportcoats, 44 percent in soft coats and 38 percent in dress pants. Look at those maintained margins: 60 percent in suits and dress pants, and 59 percent in formalwear and sportcoats. Yes, plans for spring 2023 are up only in the low single digits, but on top of a record year, that’s worth celebrating.

In the pages that follow: a state-of-the-industry with Peerless president Dan Orwig, a close-up look at Canadian retailer Tip Top Tailors, whose president and CEO Lance Itkoff is gaining share in the still-booming wedding business, an interview with Belk’s GVP Selena Hanks on how they’re setting records in tailored clothing, and insights from various clothing makers on how men will be dressing this fall.

We believe that, even beyond weddings, men want to dress up again. The “new wardrobe” involves creative combinations, much layering, and interesting accessories. It’s an art form that, explained and presented with impact, could prove the dawn of a whole new fashion era for men.

First, sincere condolences on the recent passing of Peerless founder Alvin Segal. How will this loss a ect business at Peerless, and you personally?

It certainly is a huge loss for our company, and for the industry. Mr. Segal loved both, but most importantly, he loved his team. I had the honor of working for him both indirectly and directly for 20 years. During my tenure, I’d o en hear him tell our executive team how proud and happy he was to have this competent and cohesive group running his company. He had the foresight and con dence to allow his team to do their jobs and drive the business. at’s the type of leader he was: a man with the vision to set up his team to carry on his legacy. And that’s what we’ll continue to do.

Re ecting on the last two years, I personally learned so much from Mr. Segal and will continue to be guided by his principles and values. He was a fearless leader, always willing to try new things to evolve the company. He still motivates me every day to never look back, only ahead, and to never be complacent. I’m excited to see what this amazing team can do in the years to come.

How did business turn out for fall/winter '22? What are your projections for 2023?

e Fall '22 season has been very strong, anchored by core. Fortunately, it seems that all retailers had success in tailored and dress clothing. We were able to support our retail partners over the last six months by getting back to optimal inventory levels on core programs. Although we didn’t have all our fall fashion available as early as we may have wanted, there was an amazing reaction once the new product hit the oors. ‘Fashion’ included patterned sport coats in rich color combinations, green and burgundy suits, pants with neat textured patterns and bolder plaids. We also saw a demand for show-stopping high fashion formalwear. We’re in a good position to help our retail partners maximize sales with the right mix of fashion and core going into 2023. In our opinion, the optimum ratio of core to fashion is somewhere close to 65/35. As we move further into 2023, we’ll continue to monitor the market and consumer behavior. We believe the market is still fragile due to in ation pressure and the looming recession. However, we’re con dent that we can maximize opportunities in 2023 by driving core and continuing to focus on and evolve our fashion o ering.

Supply chain challenges have not gone away. We’re still dealing with COVID cases, absenteeism, and the restrictions on Chinese cotton. Our merchandise, sourcing and production teams did an amazing job getting ahead of the global supply challenges for Spring '23. We’ve frontloaded our spring fashion and we expect to be able to o er our retail partners a very fresh and exciting early oor set. We’re optimistic that these fresh new looks combined with the continued strength of occasion dressing will lead to strong, positive results.

Getting down to business at Peerless.

To what extent has the precarious supply chain situation affected pricing?

AURs are holding, but we’ve seen slightly more promotional activity across the board, which is what we had expected. Of course, there are still concerns about consumer confidence and discretionary spending in the months ahead.

So are you planning price increases?

We’re doing everything we can to hold prices from SP23 to F23. Some aspects of the cost of goods have decreased while others have increased. Interest rates are one of the biggest factors as we maintain our inventory levels to support the demands of our customers.

What are your thoughts on proper inventory levels?

It’s certainly a balancing act to weigh the optimism generated by strong clothing sales against the head winds in the economy. We continue to take a cautiously optimistic approach. I consider myself an optimistic person but when it comes to inventory, I use a much more realistic mind set. We like to plan for 80% and chase 20%. We understand the supply chain and how quickly we can and cannot react. The beauty of our model is that we can keep our production cycle fluid from the raw materials through to the finished inventory. The pipeline can be pushed and pulled as needed, thanks to our supply chain partners who are some of the best in the world.

To what do you attribute your longevity as still the number one suit maker in North America?

Mr. Segal always put the customer first and we continue to live by that customer-focused mindset. Every day, we look

for new ways to improve our support to our retail partners. Certainly, all credit goes to our incredibly talented teams. In NYC, it’s our professional face-to-face sales team and our highly talented merchandising, marketing and product development teams. In Montreal we have our ENGINE, and all the devoted teams making everything happen behind the scenes. In our Vermont warehouse, it’s our passionate employees who feel completely accountable for pleasing our retail partners. All three locations are inter-dependent, each with a clear role, all in sync with one another. Once the Peerless wheel starts turning, it’s hard to stop it. It’s amazing to watch and be part of. That said, we are never satisfied; we’re always looking for ways to improve.

What is the right fashion direction for fall 2023?

That’s a loaded question. Fashion is subjective and personal to individuals and stores. We’ve seen a great response to our new corduroy sport coats, high shades of velvet, and soft plaids and flannels in fashion separates. We like the wider peak lapels and the double breasted models. Yes, DBs! Everything is softer and more relaxed but still a suit. Men continue to look for fashion and are definitely dressing up more. As a company and as an industry, we must continue to educate the male consumer on different ways to wear the product. We can make the same suit look very sophisticated and then show it in a casual, more playful way. There’s plenty of versatility, which guys respond to if presented correctly. For most men, it’s always easiest to just throw on a suit, but it’s the styling and layering that can open their eyes to a new way of dressing. And excitement about new ways of dressing is what drives additional sales.

“FASHION IS SUBJECTIVE AND PERSONAL.”Peerless has fine-tuned the art of modern classics for fall 2023.

LANCE ITKOFF HAS quite the background in men’s clothing, including buying and management positions at Brooks Brothers, Jos. A. Bank, BonTon, Value City and more. So when he says he’s never seen tailored clothing business as strong as it is now, that’s noteworthy. With more than six years at Tip Top Tailors, a 114-year-old, 79-store chain of men’s clothing stores in Canada, Itkoff is president and CEO. (Tip Top is part of Grafton Apparel, parent company of three separately run Canadian retail chains.) He lives in New Jersey, commutes weekly to Toronto and says he’s fallen in love with Canada, the people and the business practices.

“Doing business in Canada is totally different from in the States,” he explains. “The scale is much smaller so most global companies find it not worth their while, especially with a 9 percent nonresident import tax. We happily support mid-size domestic importers.” As for frequent comparisons with Men’s Wearhouse, Itkoff explains that while the category breakdown might be similar (50 percent suit separates, 30 percent furnishings/accessories, 20 percent sportswear), little else is the same. Tip Top stores are smaller and in malls, with a younger, more fashion-forward focus.

According to Itkoff, the pandemic years forced much soul-searching. “With offices closed and events canceled, no one needed suits, so we essentially had three options:

1) we could do nothing and wait it out; 2) we could cut back on suits and increase our sportswear penetration; or

3) we could double down on suits and own the clothing

business in Canada. We chose option 3, increased our suit offerings and never looked back.”

Tip Top was already redesigning their stores (averaging 3,000 square feet) in 2019, with high-impact faceout displays arranged by style, not size. In addition to suit separates, formalwear accessories are key: ties, bowties, lapel pins, boutonnieres. The company’s website is filled with romantic wedding photography under the general headline “Perfect Moments, Perfectly Dressed.” The average retail on a core suit is $389, but “buy the jacket/get the pants” promotions bring the OTD retail down to $279.

“Since May 2020,” says Itkoff, “business has been all about events. Our biggest challenge has been how to get more inventory. What’s my best-selling white dress shirt? The one we have in stock. We’ve been cleaning out our domestic suppliers as soon as their containers arrive.”

Itkoff notes that 70 percent of units at Tip Top are store brand (G. Grafton), but they also do well with labels like Michael Kors and DKNY ($595 ticket price) and Daniel Hechter ($495), which they have exclusively. "With more variety in the market, men are embracing dress-up with a greater level of style and fashion-savvy. And we’re having fun here at Tip Top, which I believe shows up in our assortments.”

“IN MY ENTIRE CAREER, I'VE NEVER SEEN TAILORED CLOTHING BUSINESS AS STRONG AS IT IS TODAY."

—LANCE ITKOFF, PRESIDENT AND CEO, TIP TOP TAILORSTip Top is doubling down on dress-up. DRESS-UP TAKES OFF AT TIP TOP TAILORS

How’s tailored clothing business?

The momentum has been building for about 18 months and we’ve seen no slowdown yet. Our suit separates programs are key drivers. Just being in stock on core programs led to healthy gains. Customers are willing to pay more for this category and business is back at pre-COVID levels.

Top performers for the season: our exclusive labels in suit separates, seasonal sportcoats, and Lauren tailored clothing. A resurgence in occasion dressing, whether weddings or other milestone events, added a lift in sales. We’re seeing double-digit gains in formalwear and in seasonal sportcoats.

Another element to the dress-up resurgence: dress shirts are particularly strong; even neckwear has seen a lift.

How did supply chain problems impact your business?

Supply chain issues had a significant impact in spring ’22, especially Q1. Some of the issues stretched into early Q3, but for the most part, they’re behind us.

COVID has taught us how nimble we must be. Our team, led by our talented buyer Bill Cowan, learned how to manage a business when it’s not entirely in your control. I’m very proud of how well they’ve weathered the storm.

Now we’re working earlier with key

vendors, placing orders up front on seasonal buys, and providing replenishment projections so our vendor partners can stay ahead of the curve. We’re also holding dollars back to seek out newness, which is more important than ever. Today’s customer wants new.

excitement and newness to the floor. We’re adding several new brands with a different point of view; we’re also dropping a few.

What we’ll need from our vendors is clear lines between brands and less duplication. This will help us maximize sales and inventory based on what the customer is looking for.

What are the biggest challenges you now face?

1| We cannot miss Easter again. Supply chain challenges we hope are, for the most part, over and done. We know there will be exceptions, but overall, we have to land the plane on Q1 this year.

What kind of advertising or events are working best for Belks?

Outside of some targeted weekly events, we’ve not really had to promote or do anything special to drive sales. Because of strong demand, we’re seeing AUR increases. As we move into 2023, we’ll try new ideas to keep the momentum going, to interact and engage more with customers.

What have you seen for fall ’23 that excites you?

Our fall 2023 vendor matrix will have more change than we’ve had in several seasons. We feel great about fall seasonal product, which will add

2 | We need to ride this wave of dress- up with the understanding that it won’t last forever. We think it will continue through 2023, but at some point, the trend will level out. Projecting when that will occur is a bit of a guess, but we will be nimble and adjust as change happens.

Your crystal ball on tailored clothing? There will always be a need for dressing up, but it might not be the traditional suit. I think guys today default to a suit because it’s easier to understand. Getting them back into sport coats and showing them new combinations will be key to sustaining growth.

“TODAY’S CUSTOMER WANTS NEW.”

GVP SELENA HANKS COULD NOT BE HAPPIER .

DESPITE CONTINUED SUPPLY CHAIN PROBLEMS, CLOTHING AND FABRIC MAKERS HAVE COME OUT WITH SOME BEAUTIFUL NEW COLLECTIONS. BUT ARE LATE DELIVERIES KILLING THE BUSINESS?

James Shay, IsaiaThis past fall/holiday season saw a return to super luxe fabrications. Patterned sportcoats and shirt jackets in vicuña blends and luxurious cashmeres were clear drivers this season. Going into fall 2023, the emphasis will be on novelty fabrics in classic silhouettes. Occasion and evening dressing continues to be a focus. The lines between sartorial and sport continue to blur with a focus on elevating the lifestyle.

Although supply remains challenging, we control a large portion of ours for production. That said, deliveries are still trailing a month or so behind pre-pandemic. The solution is simple: deliver the product a little later and come closer to the weather patterns for seasonal goods. That, or convince buyers to place orders even earlier, which is not easy.

The vendor-retailer relationship can be strengthened by partnering together to execute better training for associates, ensuring they are optimally equipped to service their customers.

Jack Banafsheha, ZanettiThe clothing business had a nice uptick these past two years but seems to be facing some headwinds with today’s inflation and economic uncertainty. We sold into some

great stores and had a good year in 2021, an even better one in 2022.

Our business is segmented into three levels: Black Label is the most upscale, still made in Italy but it’s now softer, less structured clothing, not classic sartorial. Zanetti Blue is a lifestyle collection of nice modern suitings and outerwear, also shirt, ties and sportswear. Our ZNT division is opening price young/contemporary—under $200 retails for great-looking suits (7-inch drop) and sportcoats built with comfort and stretch. I believe the growth is in this segment; it offers notably better value than the comparably priced competition.

Yes, the supply chain situation is problematic. We’re in uncharted waters still, although this year will surely be better than last, when delivering a single container jumped from $3,000 to $36,000. But the situation is improving: our costs have come down from both China and Italy. The trick is to work with suppliers you know and trust.

Fall 2022 was tough: In August we got hacked, company-wide, and we were unable to cut for four weeks. Fortunately, stores worked with us on extended delivery dates and we made those. Our goal is to be back to our normal delivery cycle by February. My advice to retailers: Make custom a daily part of your business rather than waiting for special events. Give your staff the knowledge and training to execute, even if it involves taking some risks.

“Make custom a daily part of your business, rather than waiting for special events.”

Tony Maddox, Coppley Apparel

“The vendor-retailer relationship can be strengthened by partnering together to execute better training for associates.”

“We’re in uncharted waters still, although this year will surely be better than last.”

Luigi Bianchi has become a total lifestyle collection; clients are buying pieces from different product categories, thereby offering numerous combinations. Our most exciting new category for fall features travel coats and blazers in weather-resistant fabrics. Such pieces often come with a removable faux vest for extra layering, a solution that’s both practical and fashionable.

As for supply chain, we faced unexpected delays from the Italian fabric mills, which led to challenges planning production. To prevent this from happening again, we bought all our fabric many months in advance to cover the new season’s production. While challenges remain, this investment has helped our business tremendously.

I believe that just about every store that carries tailored clothing today is doing well. We’re in a mode where the consumer is dressing up again, for events, for the office, for just going out.

We expanded our evening wear presentation in anticipation of continued formal events. In addition to classic tuxedos, our dinner jackets have been a home run. Colorful velvets—greens, blues, burgundy—offered in both peak and shawl collar have been well received. They’re in a lush cotton/stretch fabric and retail for $798. We also stock a beautiful navy paisley peak lapel along with an off-white shawl collar dinner jacket, which is flying off the shelves.

Outside of formalwear, we created a 100 percent cashmere knit sportcoat (fabric from Loro Piana) that we offered in a light blue and a pearl gray. These are retailing extremely well. The fabric is so luxurious and light that it feels like you’re wearing a cashmere sweater.

Our best sellers this fall/holiday ’22 season were key item jackets. This category includes 14-micron doeskin, soft city tweeds, wool/ cashmere corduroy, and luxe velvets in jewel tones. Rich colors and textures are proving more important than patterns this fall/holiday season. These looks will be refreshed and updated for fall 2023. Most exciting for fall, we’ve designed a collection of 12 iconic items to commemorate our 100-year anniversary. Each item represents the fusion of heritage and modern style that defines everything by Samuelsohn. It’s a special, timeless collection, and the reaction from retailers has been exceptional. The men’s clothing business is certainly thriving; it seems everyone is doing well. I believe relationships and customer service are key to this success.

Our best sellers for fall ’22 included our new custom outerwear realized in special fabrications like microsuede. A big hit was the new fashion field jacket. Also, we found customers wanted to dress up for holiday events: velvets in rich colors sold well.

Since our business is all custom, the upcoming show season will feature spring ’23 styles, not fall. We’re really excited about our Cool Wool collections and our textured naturals, fabrics that blend bamboo, linen, silk and wool.

We’ve found that stores offering custom are doing extremely well, allowing guys to personalize their look. Options include custom linings, Milanese buttonholes, colorful undercollars, colored storm tabs, elbow patches and more, all of which add value to the suit, and distinction to the man.

As for the supply chain situation, the answer is diversification. We invested in multiple production factories in two geographically different locations. This meant minimal delays for customers receiving their clothing. We also diversified our fabric purchases to mills around the world. When one mill had shutdowns, we were able to offer alternatives.

Our best advice to retailers: make sure you’re important to your suppliers.

“We’ve invested in extensive in-stock programs to support our retail partners.”

“We’re offering guys comfort like they’ve never before felt.”

“Our new Iconics collection represents the fusion of heritage and modern style.”

“Our best advice to retailers: make sure you’re important to your suppliers.”

OU KNOW GEOX amazing shoes not be familiar equally amazing

Currently giving brands a run money, GEOX bines cutting-edge, patented technology with Italian design to create unique footwear and clothing collections that are comfortable, sustainable, and decidedly modern.

About 25 years ago, GEOX founder and president Mario Moretti Polegato conceived revolutionary technology that brought comfort and style together. When on a day of sweltering heat, Polegato discovered that by simply piercing the rubber soles of his shoes with a pocketknife, created a solution to discomfort – breathability. then went on to create high-tech, super-stylish, ultra-comfortable footwear with perforated The science behind the breakthrough technology now known as Geox Respira™. It features a patented membrane that makes both shoes and clothing breathable, allowing for natural thermoregulation (body temperature adjustment). In other words, it keeps you warm cool and cool while looking chic.

Marrying style with comfort is at the heart of fact, in addition to the creative design teams, GEOX a department entirely dedicated to technological and development, and the two work hand in hand. and functional, GEOX collections include casual shoes, sneakers, boots, and outerwear for men as well as a vast assortment of shoes for children. that well-crafted, well-designed outerwear is of every man’s winter wardrobe, GEOX coats made from highly innovative fabrics. All styles men’s shoe and outerwear collections use the

sub-categorized according to benefits: the added comfort of the the rain and snow resistance a line featuring patented technology. comes to design Geox puts attention into the design as the technology, their outerhas the softness and flexibility needed for winter activities, while incorporating the sharp tailoring expected from great Italian design. Geox outerwear can take the owner from canyon to cafe without having to change jacket.

Another pillar of the GEOX philosophy is sustainability. The brand started with the idea of Greek word for “earth” – and creating a better quality of technology and innovation, represented by the X. To help restore environmental balance altered production, GEOX has introduced manufacturing technology, Condition, several recycled even sustainable paddings, EcologicWarm, a synthetic down recycled fibers; it is both therprovides protection from also established numerous initiatives to help conserve natural leave the world a better place GEOX, children are not business but also a big part of available at Neiman MarBloomingdale’s, and many fine as Rothman’s, T&V Garage, information: www.geox.com

Ludwig Mies van der Rohe who once famously said that “God is in the details.” This irony was not lost on me as I studied trousers made by German brand HILTL. The details are breathtaking and once viewed, all other pants pale in comparison. All you’ll ever want to wear is HILTL.

A brief history: HILTL was founded in 1955 by Fritz & Hedwig Hiltl. They manufacture beautifully tailored trousers and slowly grew into a respected clothing brand, first in Germany and then internationally. A quiet brand of stealth luxury, a quote by Fritz is always at the forefront of their company philosophy: “We never want to sell the most trousers, but rather the best. Today, as the brand continues to grow, they are guided by Fritz’s mantra as well as their five principles: Authenticity, Quality, Sustainability, Individuality and Functionality. While these principles might seem diverse, they are actually congruent. Once purchased, these are trousers that you will wear all the time. If they no longer work for you due to a size or lifestyle change, you can pass them on to a family member or friend. It’s a philosophy of having fewer, high-quality garments, the antithesis of fast fashion.

The trouser details are too many to list here but include a heat-sealed button with a long thread shank in a signature red. After being attached, it’s guaranteed to never fall off, backed with the bold assurance of providing no extra button because you’ll never need one. Bar tacked buttonholes, fine-toothed custom zippers and corduroy cut with the pile running down are just a few of the special touches that most men never think about, but HILTL obsesses over.

For their AW/23 collection, pictured here, HILTL was inspired by the strong demand for clothing that is durable, uncomplicated and at the same time modern in design. https://company.hiltl.de/de

Delivering stealth luxury trousers, with only one button ever needed

PHOTOGRAPHY

PHOTOGRAPHY

BY CHRIS FUCILE

STYLING BY MICHAEL MACKO

BY CHRIS FUCILE

STYLING BY MICHAEL MACKO

WHEN DRESSING IN LAYERS FOR WINTER , REMEMBER NOTHING

SUCCEEDS LIKE EXCESS .

Jacket by Timberland; shirt by Coach; pants by Raffi; shorts by Nobis; bag by Loveshine; scarf (in bag) by J. Press; blanket, bear, hat and gloves by Dsquared2; vintage sunglasses.

Jacket by Timberland; shirt by Coach; pants by Raffi; shorts by Nobis; bag by Loveshine; scarf (in bag) by J. Press; blanket, bear, hat and gloves by Dsquared2; vintage sunglasses.

This page: coat by Kenneth Cole; puffer by Sundek; sweater by Orvis; cross-body bag by Coach Opposite: coat by Todd Snyder; suit by Alex Mill; shirt by Gitman Vintage; scarf by Abraham Moon & Sons; hat (in pocket) by Chamula; boots by Hunter; blanket by Begg x Co; vintage bear.

This page: coat by Kenneth Cole; puffer by Sundek; sweater by Orvis; cross-body bag by Coach Opposite: coat by Todd Snyder; suit by Alex Mill; shirt by Gitman Vintage; scarf by Abraham Moon & Sons; hat (in pocket) by Chamula; boots by Hunter; blanket by Begg x Co; vintage bear.