The Chicago Collective is the Premier National Menswear show in North America, hosting the top brands and retailers from around the world. Join us this February where you will see the best brands, attend the iconic opening night party, enjoy exciting events and amenities, and so much more.

With this print issue, our first in a very long time, we’re excited to bring back the in-depth analytical features, directional fashion, and industry personalities that we know you expect from us. We’re always listening, so let us know what you like, what you want to see that you don’t, and what you’d rather not see again. Of course, we’ll continue to bring you our daily digital reports to keep you current on industry news and all things menswear.

In this issue, our new Fashion Futures section features emerging brands and unique concepts that we believe will inspire you. For another round-up piece, we highlight the people, concepts, and trends mostly likely to impact men's fashion in 2023.

To recognize the 150th anniversary of the legendary Bloomingdale’s, we interviewed EVP Dan Leppo and men’s fashion director Justin Berkowitz. Among the store’s

historic claims to fame: in 1898, they were the first to install an elevator, and soon an escalator; in 1947, they introduced their famous model rooms showcasing furniture vignettes with guest curators like Frank Gehry and Federico Fellini; in 1959, Marvin Traub launched annual international fairs, bringing to 59th and Lex the fashion, food, art, and music of Italy, France, India, China, Spain, Japan... And don’t forget that in 1967, they gambled on a collection of wide ties, revolutionary at the time, from a gutsy new designer named Ralph Lauren, to whom they gave his own shop. How to stay on the cutting edge of cool for 150 years? Respect for the past with an eye toward the future, a strategy the talented Bloomingdale’s team continues to validate.

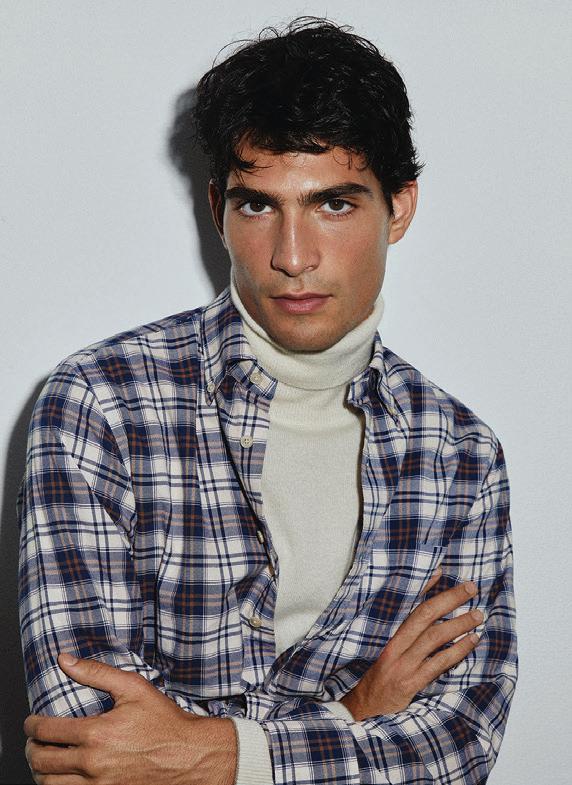

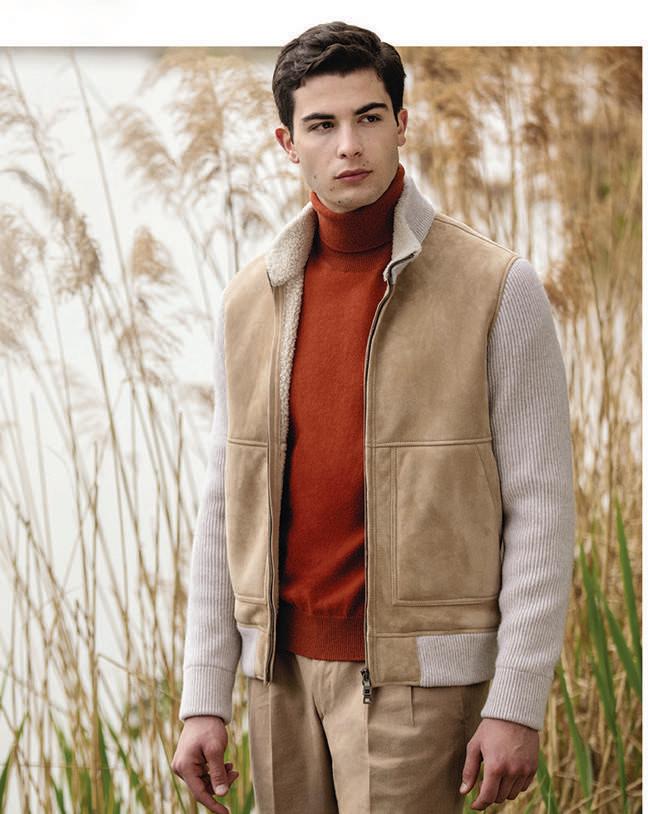

Baby, it’s cold outside! In this month’s outerwear feature, MR examines this trend- and technology-driven category from both retailer and vendor perspectives. The good news: never has the market looked so strong, with a plethora of beautiful vests, parkas, jackets, and the unexpected return of the topcoat! But one question still plagues me: why must retailers mark down fall outerwear before the weather gets cold? Steep price cuts on Labor Day, Columbus Day, Black Friday… With demand for outerwear peaking first quarter, why can’t we as an industry work together to change the cadence and push

back the price promotions? It’s not a new question; what is the answer?

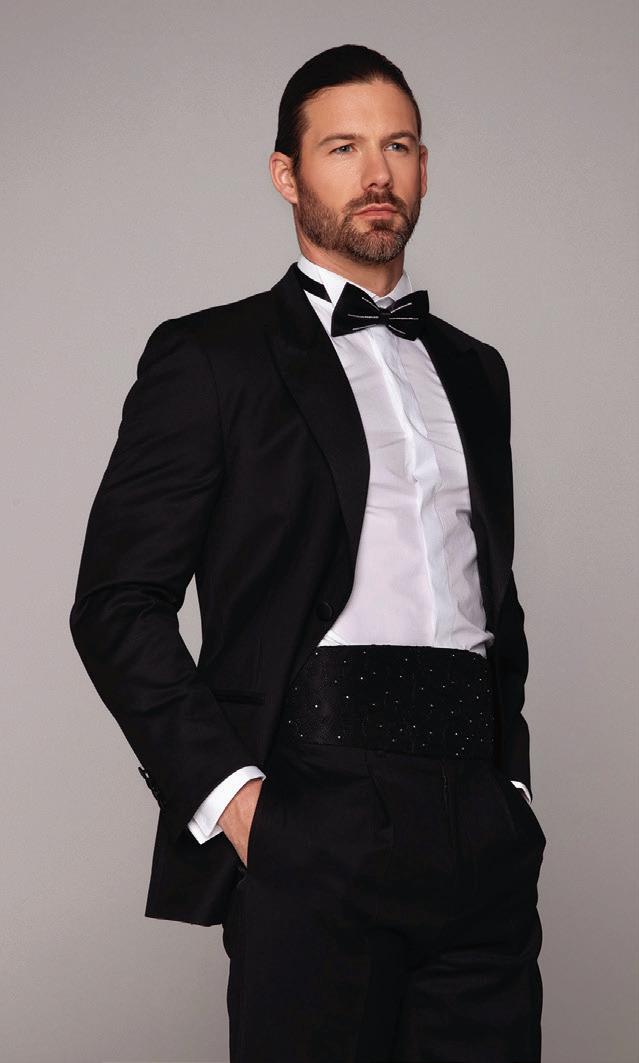

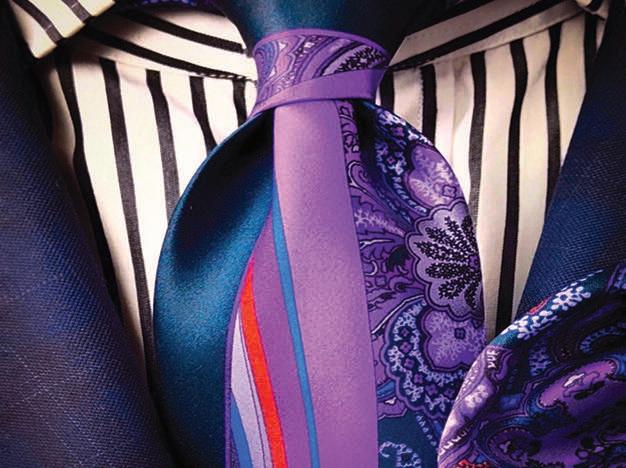

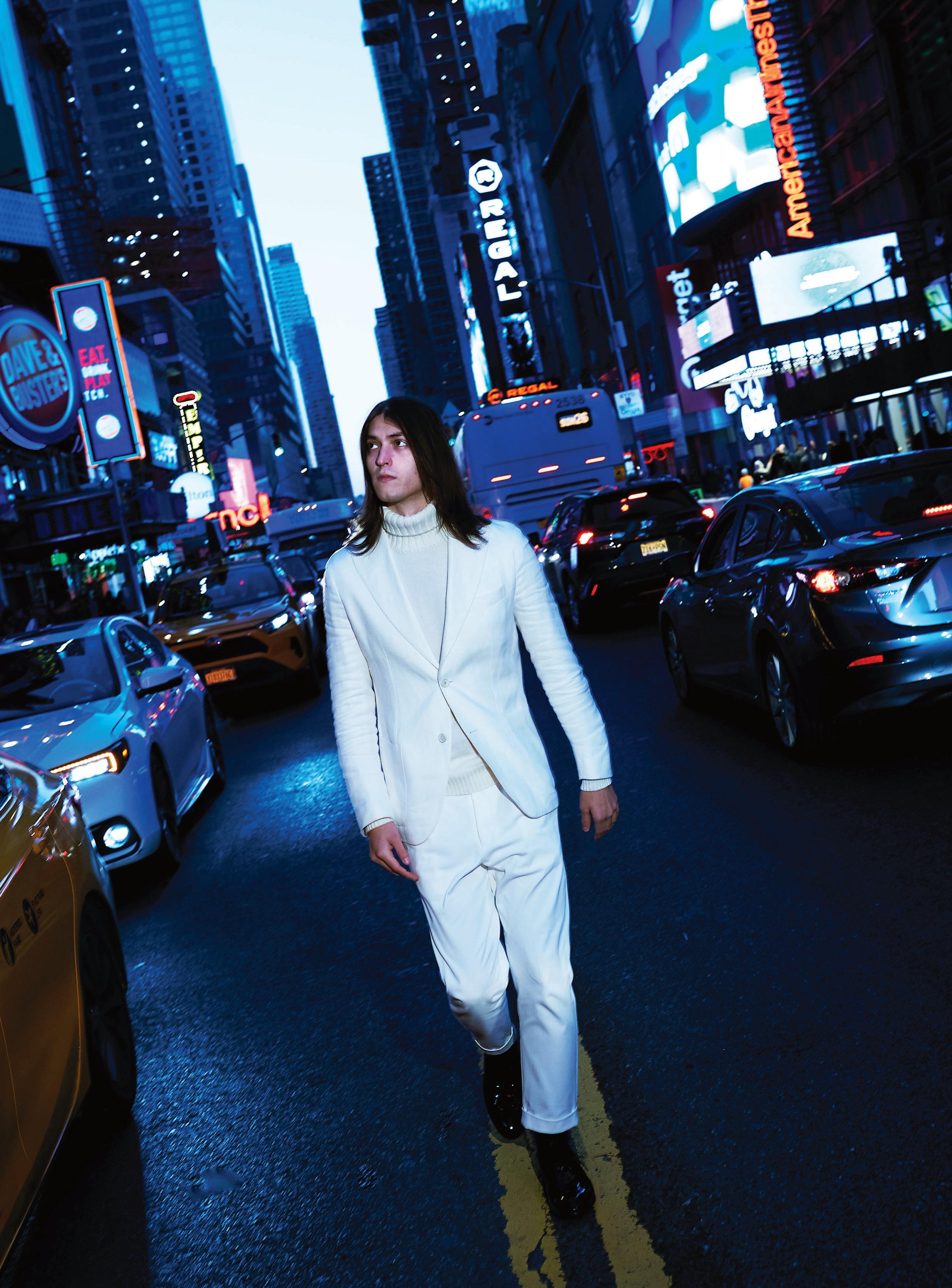

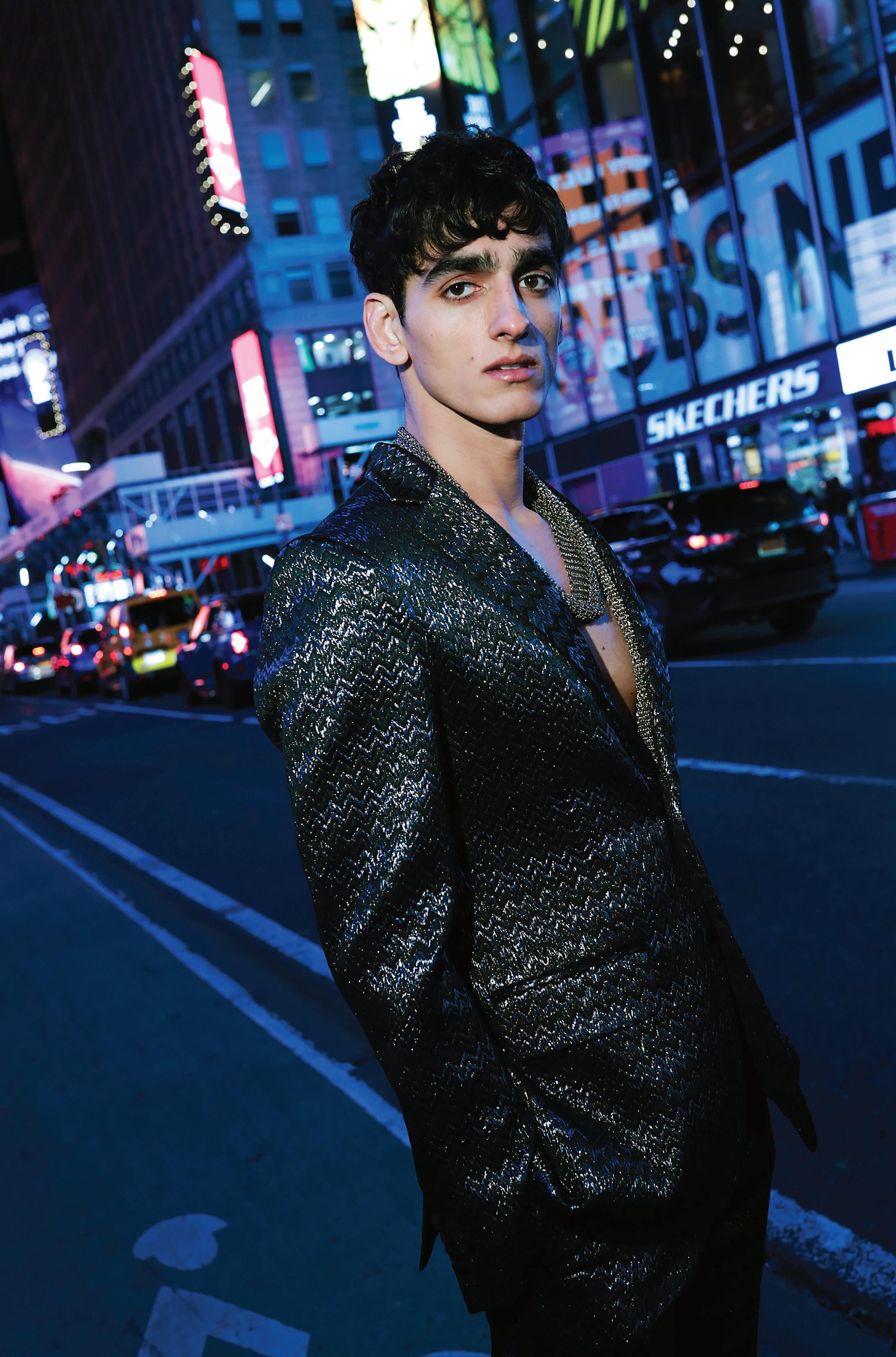

Finally, our January fashion shoot takes a fresh look at formalwear against the colorful, eclectic, and sometimes gritty energy of Times Square. Since most guys already own a classic tux, what might they add to their formalwear wardrobes to express some personality? Our goal is to portray possibilities beyond the predictable.

From our MR team to yours, wishing you a year filled with good health, caring friends, family harmony, ringing cash registers, and endless possibilities.

—Karen, John, Lizette, Charles, and Michael

“RESPECT FOR THE PAST WITH AN EYE TOWARD THE FUTURE : IT’S WORKED FOR BLOOMINGDALE’S FOR 150 YEARS, AND SHOULD GET THEM THROUGH THE NEXT 150.”

of the original “disruptors.”

Back then, the big-box department stores didn’t have websites. Or if they did, they were selling a very limited number of SKUs. Brooks Brothers and Jos. A. Bank were barely participating in e-commerce. By the time they all started to bulk up their online offerings and invest in e-commerce infrastructure (2008-2010), they were already years behind native online brands, with a lot of learning still to do.

solutely unheard of just five years ago. Most native online brands, in order to expand or even survive, need to open at least one or two stores. And yet very few of us can afford to do so.

It’s said that a customer has to see your ad seven times before he simply clicks on your website. Even then, the likelihood of him ordering is just 2 percent. So you can imagine how much money is thrown at marketing before finally landing a new customer.

I’VE BEEN SELLING menswear on the internet since 2004.

So think of my perspective on e-commerce in the same way you’d think about how George Washington would be able to discuss American history if he were still alive today. Because I’ve pretty much been here since the e-commerce revolution, and I’ve seen it all.

There was a time when people like me would look at people like you (brickand-mortar store owners) and think how you guys were dinosaurs. Antiquated. Leaving money on the table by not opening your own e-commerce shop. And we were right. But not so much anymore.

In the early 2000s, the internet was much like the U.S. was back in the early 1800s. Mostly undiscovered. Undeveloped. Few people occupying the space — either as stores or as consumers.

I was one of the first to build a menswear brand natively online. I was one

By then, early online brands like us already understood the e-commerce shopper. We mastered digital marketing. We figured out how to leverage the media to drive traffic and customers to our websites. It was a glorious time.

But things have changed.

For online brands, customer acquisition has never been more challenging

And without the in-person contact, it’s nearly impossible for online brands to develop a true relationship with the customer. Don’t listen to the noise of building “online communities” and “customer engagement.” Yes, it’s a thing, but it’s nothing compared to what you brick-and-mortar merchants have created with your well curated stores, special events, and exceptional customer service.

So as 2023 begins and you contemplate going online, my advice is simple: enjoy the grass where you are. It just might be a darker shade of green than ours has become.

and expensive. That’s because digital marketing has become less targeted (via new privacy standards). Customers have become less brand-curious and now everyone and their mother (sometimes literally!) can sell their wares online.

In fact, it’s now believed that it costs less to acquire a new customer through the opening of a brick-and-mortar shop than to acquire a new customer through online advertising — something ab-

Greg Shugar is the owner of Beau Ties of Vermont, an American-made neckwear and accessories company based in Middlebury, Vermont. In 2004, he and his wife founded The Tie Bar, one of the first ever direct-to-consumer menswear brands. The company was acquired by a private-equity firm in 2013. Greg is also an active investor and teaches entrepreneurship at the Florida Atlantic University School of Business.

“FOR ONLINE BRANDS,

ACQUISITION HAS NEVER BEEN MORE CHALLENGING.”

true friendships. They’ve created an in-store ambiance that upscale customers are happy to support, giving them a clear advantage over their larger competitors.

With a recession looming and prices rising, what’s your crystal ball on the menswear business?

Although the economy will likely struggle a bit, I believe independent stores will continue to flourish. 1) With the money they’ve put into the business since the pandemic, they’re in a better position to weather an economic slowdown. 2) They have good people who they pay well who are committed to the business. 3) They’re able to procure unique product, delivered in top-notch fashion and displayed with commitment and style! 4) They have sellers with the tools and knowledge to help customers put new looks together. 5) They’ve developed a made-to-measure/custom business over the past two to three years that creates loyalty and continues to grow. 6) Suit sales have been the best ever these past 18 months. 6) Independent stores have passionate owners who love what they do. Without that passion, most of these stores would have closed years ago.

What’s the state of the menswear business in independent specialty stores these days?

There’s no question that independent specialty merchants who weathered the pandemic are doing exceptionally well, putting more money into the business than ever before. Between PPP dollars, forgiven long-term loans, and slow repayment plans, things were looking really good until sales showed some weakness mid-October 2022. But business had been better than ever for fall/winter 2021, followed by a strong spring 2022. Retailers had low inventories but managed to turn goods faster with fewer markdowns.

Meanwhile, their ace in the hole: independent merchants continued to provide exceptional customer service. While they were once competing with professional sales associates and excellent training programs at better department stores, these days, you can hardly find a salesperson on a department store selling floor. Meanwhile, specialty merchants continue to shop the market with specific clients in mind, curate compelling assortments, and turn business relationships into

So you’re optimistic?

Yes. While independent retailers will of course be somewhat impacted by a recession, I’ve never seen them this financially healthy in my 50 years in menswear. I believe they’ll pass the price increases on to their customers, but I don’t think that will be a deterrent to upscale shoppers who are seeing increases at supermarkets and gas stations but they’re not doing without.

What’s the most important thing independent merchants can be doing to maintain excitement on the selling floor and subsequent sales increases?

I think they need to focus on the recent trend of combining tailored clothing, sportswear, and outerwear. It’s a whole new way to dress that most guys have not yet mastered and includes shirtjacs, quilted vests, soft sportcoats, and accessories. With the advantage of well-trained sellers, the independent stores can own this business.

Dallas is your ultimate luxury lifestyle market with 850+ curated brands and more categories to explore than ever before. Find everything from tailored softwear and fresh contemporary to fine Italian luxury and elevated outdoor plus trending footwear, alluring accessories, western lines and more. Don’t miss your chance to see what everyone’s talking about.

Source from a juried selection of emerging trends from leading brands such as: Baja Llama, Ben Sherman, Billy Reid, BRAX, CHERVO, David Donahue, Duck Camp, Emanuel Berg, FRAME Denim, Hook & Tackle, Magnanni, Vineyard Vines, Wolf & Shepherd, and many more. Inspiration Starts Here.

The motto of actor Dan Levy’s DL Eyewear brand is “see with love.” It’s inscribed inside every frame as a daily reminder for people to live their lives with kindness and empathy. The brand’s commitment to helping others is reflected in its support of Local Initiatives Support Corporation (LISC), an organization that assists small businesses including those owned by women, people of color, members of the LGBTQIA+ community, and entrepreneurs in disadvantaged communities.

DL Eyewear is the result of decades of Dan experimenting with his own eyewear. “Essentially, eyewear should be fun. The thrill of matching a frame to your mood. The exploration of personal style. The building of an optical wardrobe. I wanted to create special yet accessible frames that people would love to wear and collect.”

To do so, the company releases frames when they’re ready rather than on a seasonal schedule. They pride themselves on investing time and care in every element—from addressing a multitude of face shapes to arriving at the perfect name. Rose, for instance, is for all the Moiras out there, wigs optional. (For the uninitiated, tune into Schitt’s Creek.)

This past June, when Target started selling chest binders (which for those unfamiliar are compression garments used to make a person’s presenting gender and gender identity more compatible) you could say that transitional dressing had made huge strides. But Bindle & Keep has been providing custom tailoring to all kinds of bodies in an inclusive, non-judgmental environment for more than a decade.

Run by Daniel Friedman, the founder and tailor, and Rae Dunn, clothier and de-facto ambassador for the brand, the company in 2016 was the subject of a documentary produced by Lena Dunham entitled “Suited.” Using classic techniques, the company crafts their suits out of an ethical workshop in Thailand. The thought that goes into tailoring a traditional man’s suit on a non-traditional body rests on the understanding that since men’s and women’s bodies are different, an off-the-rack suit is unlikely to be a perfect fit.

New consultations take two hours and are completely private; they can be done in person or virtually over Zoom. “Everyone is triggered by something about their own body,” Friedman said, “whether it’s a teen who is transitioning or a cisgender man who feels like their body is, for some reason, irregular. There are no body types that we don’t take. These are all just measurements, and we can measure anybody.”

Bindle & Keep suits start at $995, (jacket, $664; pants, $332) and go up to the $1595 - $3595 range for specialty fabrics such as Holland & Sherry and Scabal. They also offer custom shirting ($185 - $205) and discounts when purchasing three suits.

From top to bottom, The Walker in Electric Blue, the Highland in Smoke, and the Chorley in black. All images courtesy of DL Eyewear

Why would a guy give up an executive retail career (Lands’ End, Belk, Kohl’s) to launch a new polo shirt?

“I wanted to devote myself to something that would make my kids proud,” explains Chris Kolbe, co-founder with Christian Arkins of new eco-luxury brand HyperNatural, hitting top retailers in March. “We wanted to create something that improves upon nature with minimal harm to the planet.”

Kolbe explains it further: “After two years of R&D at the raw fiber/yarn level, we’ve taken Supima cotton — the softest in the world — and added jade stone to cool the skin, and crab shells to eliminate odor, thereby reducing washings. It’s ‘natural performance’ with no harmful chemicals, polyester, or plastics. The result is a soft, luxurious proprietary fabric that’s 95 percent biodegradable, 50 percent made from regenerative waste, and 0 percent virgin polyester or plastics.”

Comfortable, well-crafted, and finely detailed, the polos ($135 to $165 suggested retail) will launch for spring ’23 in top independent stores and at Nordstrom.

“We wanted to keep it simple,” says Kolbe. “Four styles in two knits (pique and jersey), two fits, 29 colors, and one amazing fabric.” For info: chris.kolbe@ hypernaturalstyle.com. — KAG

After two years of R&D at the raw fiber/yarn level, check out the most comfortable, most sustainable polo yet.

From

Afrosurf, the popular book by Cape Town native Selema Masekela (also founder of lifestyle brand Mama Wata) showcases a vibrant, but previously unseen, segment of the surf and skate community. While the book focuses on Africa, the surf and skate community within the African American community is also thriving in the U.S. Mami Wata’s eponymous brand is sold at his pop-up in Venice Beach and also at Saks and Nordstrom. His vibrant graphics resonate with both the surf and après surf sets.Another black-owned surf/skate brand, The Rad Black Kids recently launched both in The Park (Macy’s shop-in-shop for exciting new menswear brands), and in Bloomingdales. The collection features Thulani Ngazimbi’s Moyo sneakers, decorated with a lightning bolt shooting down the side. While the contemporary concept of surfing was created by the Polynesians who settled in Hawaii, the centuries-old African practice of wave-riding — on boards and in canoes — evolved independently, in multiple spots along the West African coast. Included in the rise of black surf culture are surfing organizations such as Black Surfers Collective, Black Surfers Association, and Laru Beya Collective, which encourage surfing and water safety among underserved youth in the Rockaways in New York.People of African descent are reclaiming lost traditions. The contemporary practice of surfing derives from Polynesians who settled in Hawaii.https://mamiwatasurf.com/https:// www.theradblackkids.com/ http://www.blacksurferscollective.org/ https://bsarockaway.org/

Thulani with While created Hawaii,

The TAP Group is a new retail-centric multi-brand showroom bringing top designer brands from around the globe to the North American marketplace. Headed by Tony Lucia, Andrew Weisbrot, and Paul Buckter (acronym TAP), these three industry veterans can boast decades of wholesale and retail experience at some of the world’s leading fashion brands, including Brioni, Canali, Giorgio Armani, Hugo Boss, Escada, Bloomingdale’s, Barneys, Boyds, and Garmany.

Weisbrot explains the concept: “Working closely with both department and specialty stores, we’re constantly looking for white space opportunities. As seasoned retailers, we work not only on selling in our products but also on helping retailers sell through to their customers. Our goal is always increased sell thrus and higher margins. We’re involved in every step of the process, from market research to sales pipeline development to client outreach to sales planning and account management.”

Launching with four fabulous brands — Windsor (a new-to-theU.S. 120-year-old affordable luxury brand from Switzerland), Benson (casual lifestyle), Malcom (luxury

Toasting a new business: Andrew Weisbrot, Tony Lucia, and Paul Buckter

trousers), and Matinique (contemporary sportswear) — TAP is hoping to tap in to a new attitude in upscale menswear. “We want to put the fun back,” says Weisbrot. “To reinstate the camaraderie, the parties, the glamour, for a new generation. I’m still seeing too many depressed people since Covid, both retail sellers tired of too much sameness and buyers tired of big brands shoving stuff down their throats. That’s not what we’re about. We want to create a fun place to hang out, laugh, and have fun. We’re about beautiful product, customer relationships, and selling the dream.”

TAP’s temporary showroom during NYC market will be at 547 Broadway. They’ll also be in Chicago and Dallas. For more info: bluewateroutfittersllc@gmail.com — KAG

There are few people I trust enough to completely change my daily grooming routine. Chris Salgardo happens to be one of them, and fortunately for men everywhere, he just launched a new premium skincare collection.

Atwater offers high-performance, superior-quality skincare essentials that are smart, simple, and solve every day grooming concerns. My current concern is dull, winter skin and I must say that after a week of using Atwater products exclusively, my skin looks a little brighter, less gray.

Salgardo, who for years was president of the Kiehl’s brand, used his knowledge of simple packaging and products with clean, non-toxic, highly effective formulas to deliver results. It was designed to be uncomplicated and easy to use, which it is.

Collections are organized around skin-type and regimen: Skin Armor, Heavy Armor, Oil Regulator, Smooth Target and Clean Impact. Prices are reasonable: Facial Moisturizer ($35), Eye Moisturizer ($29), Face Scrub ($25), Lip Moisturizer ($12), Facial Cleansing Bar ($18), Shaving Cream ($18) and Body Cleansing Scrub Bar ($17). The brand is available at Nordstrom and at Atwaterskin.com.

Madhappy, the LVMH Ventures-backed fashion brand, is creating a new template for what a clothing brand could and should be. More importantly, they’re making the world a better place, one hoodie at a time.

The brand evolved out of the observation that people, primarily the young, need positive messaging to promote mental health and combat the negativity across social media.

Since their 2017 launch, Madhappy’s co-founders (Noah Raf, Peiman Raf, and Joshua Sitt) have created pop-up stores across the U.S., amassing a cult Instagram following of people who identify with the brand messaging and product.

The brand’s website hosts a blog that focuses on mental health and wellness, including interviews with celebrities and influencers, and podcasts and sponsored panel discussions centered on the issues. They clearly state on their website that they are “not experts or medical professionals, but guides - raising awareness and accessibility so that people can better identify what they’re going through and seek help when needed. Mental health affects us all, and the sooner we view it as a normal part of our everyday lives, the sooner we can get people the support they need.” Which is then driven home with their trademark Feel Together.

If you want to try a more traditional form of “retail therapy” on the Madhappy website, you’ll find comfortable/casual clothes leaning heavily towards fleece and a winter sport capsule with Columbia. https://www.madhappy.com/

A Madhappy Advertisement from AW/22, Courtesy of Madhappy.

Just opened on January 2, 2023, Market Market is a new 40,000-square-foot vintage emporium in a former Stein Mart in Palm Springs. Founder James Morelos has included home goods and clothing curated by such notables as RTH founder Rene Holguin and vintage menswear icon Maurizio Donadi. Nothing in the space is new.

The Morelos business model is based on the traditional shop-inshop, turn-key format, with each brand paying a flat fee for its space. Morelos takes care of the back of house and operations, optimizing the attraction of a group of brands together under one roof.

Morelos learned about shop-inshops as a teen shopping at Ron Herman, who essentially created the concept. The Mojave Flea founder had a full-circle experience earlier this year when he created his own pop-up for three months, featuring a curated collection of high-end brands and designers. Since opening his first store in Palm Springs in 2021, Morelos has expanded to Joshua Tree and will soon be in Berkeley and The Hudson Valley.

https://www.shopmarketmarket. com/

THE SWEET LIFE. Everyone knows how it translates but few understand what it really means. Sometimes associated with physical pleasure and self-indulgence, the phrase also alludes to luxury fashion that’s elegant and sexy.

Which is why menswear merchants across the country continue to sing the praises of Italian clothing. “Most of our brands are Italian,” says Dan Farrington of Mitchell stores. “Our customers perceive and appreciate the value of made-in-Italy.” “We’re always looking for new vendors with new ideas. And let’s face it: the Italians do it best,” agrees Eliot Rabin from Peter Elliot NYC. Notes Craig DeLongy from John Craig stores in Florida, “The demand for Italian menswear is stronger than ever…” And from Larry Rosen at Harry Rosen stores, “Italian-made menswear has always been a cornerstone of our offerings. Our customers truly appreciate the craftsmanship and sense of style.”

But beyond fashion, La Dolce Vita also refers to savoring life, taking pleasure in the simple things, being mindful of each moment, and looking glamorous in the process. As retail consultant Fred Derring puts it, “It’s been said that Americans work to live while Italians live to work. You can see their passion and creativity in the clothes they produce.”

We look forward to seeing you at the Chicago Collective (February 5-7) to share with you the many exciting fall 2023 offerings from 62+ luxury Italian brands exhibiting at the show. Cheers!

Salvatore Martorana

Booth 6095

Vitaliano, Booth 3096 Italo Ferretti Booth 5095

Mazzarelli Camicie Booth 6105

Mauro Blasi Booth 2114

Sealup Milano 1935 Booth 3093

Salvatore Martorana

Booth 6095

Vitaliano, Booth 3096 Italo Ferretti Booth 5095

Mazzarelli Camicie Booth 6105

Mauro Blasi Booth 2114

Sealup Milano 1935 Booth 3093

Bresciani 1970 Booth 4094

Ortigni 1930, Booth 3101

Montechiaro Booth 5099

Taccaliti Booth 3119

Gala’, Booth 3107

Andrea Bossi Booth 5100

Gran Sasso, Booth 2124

Toscano Booth 5105

Flower Mountain Booth 3109

Skudomade Italia. Booth 3094

Pasotti Booth 5096

Sinclair Booth 2126

Silvio Fiorello, Booth 3121

Altamodabelt Booth 3105

Bresciani 1970 Booth 4094

Ortigni 1930, Booth 3101

Montechiaro Booth 5099

Taccaliti Booth 3119

Gala’, Booth 3107

Andrea Bossi Booth 5100

Gran Sasso, Booth 2124

Toscano Booth 5105

Flower Mountain Booth 3109

Skudomade Italia. Booth 3094

Pasotti Booth 5096

Sinclair Booth 2126

Silvio Fiorello, Booth 3121

Altamodabelt Booth 3105

“LIKE NO OTHER store in the world” has been its slogan for decades. Having just celebrated its first century and a half in business, VP/GMM Dan Leppo reveals how Bloomingdale’s stays “of the moment” and attempts to articulate the magic of this special store.

What, in your opinion, makes Bloomingdale’s like no other store?

The first factor is the people: we’re blessed with the most gifted and passionate individuals in the world. Based on a reputation that attracts top talent, coupled with an exceptional training program, we’re able to go out and find them, to nurture and build them. We put tremendous effort and energy into building great people.

Number two: We’ve amassed a following of customers who hold us to the highest standards of being “of the moment,” allowing us to play in many different arenas. It’s certainly about fashion but it’s also about popular culture, e.g., our partnership with the TV phenomenon Bridgerton this past year. The connection to popular culture is a key part of the energy you feel in our stores.

My hope for the next 150 years is that we continue to be “of the moment,” playing in the zeitgeist of whatever is resonating in our customers’ minds at that moment. You know, I came into the business well before the internet at a time when specialty stores were predicted to be the death of department stores (even before the internet was predicted to be the death of department stores). But if

you’re a monolithic specialty store with a focused point of view and the fashion direction moves against you, it’s very hard to pivot. If you’re a department store with broad assortments, with the ability to get inside the customer’s head and the agility to move left or right, up or down, you can pivot as needed. It’s like the old saying in hockey: “Pass the puck to where the players are heading, not to where they are now.”

So where is men’s fashion heading? What’s the most exciting change in menswear?

The most exciting change is that men are more engaged in how they put themselves together than at any prior time, certainly in my career. And instead of business and leisure wardrobes being two separate monolithic concepts, it’s become a very fluid blend.

Where we’ve spent enormous energy and effort is in building a broader, more diversified offering in tailored clothing, reflecting this new fluidity. Our focus on nested suits includes more color, texture, and pattern. We emphasize a third layering piece, be it a great sportcoat or Harrington jacket. Elevated sportswear components like cashmere knits and beautiful linens have a definite place in this new hybrid wardrobe.

What was your most recent personal purchase in menswear?

I’d rather not play favorites among our apparel brands, but fortunately I don’t have to. Truth is that just this past Saturday, I bought an incredible umbrella from a British brand we carry, Fox Umbrellas, crafted in London. It’s a plaid umbrella with a briarwood handle, a true work of art.

And your business wardrobe consists of what these days?

I almost always wear a jacket or sportcoat. I’m comfortable mixing sportcoats with jeans, a polished cardigan, a dressier Harrington or some kind of lightweight jacket. I’m the guy who never gets on a plane without a sportcoat—both for the polish and for the pockets for somewhere to put my stuff!

How did Bloomingdale’s menswear fare during the pandemic? How have the past three years changed your product mix and/or the way you do business?

Business these past three years has been a roller coaster. There were certainly times when we got monolithic in what we sold. At the height of the pandemic, business

was loungewear-based. Then it was streetwear-based or logo-based. But through it all, we tried to maintain a balanced offering. We spent much energy and effort finding the right mix.

We also took several risks. For example, at the height of Covid, we brought in Zegna. Then nine months into the pandemic, we brought in Tod’s. Then toward the end, we brought in Boglioli and Peter Millar. At the same time, we doubled down on Rag & Bone and continued to build Helmut. In other words, we used the moment to bring in brands that we believed would prove important to us in the long run. This was risky because, for example, at the moment we brought in Tod’s footwear, men were wearing sneakers and pool slides. But as we moved into a different cycle, Tod’s became a great resource for moc-style shoes.

But beyond specific product, Covid brought us the realization that we could become more agile. My hope is that we hold on to this agility so we can continue to react closer to the hilt. Clearly, in a world of social media, customers are evolving more quickly than ever. Information travels at lightning speed, and that information influences what customers want to buy.

Will this ultimately mean more markdowns?

Not necessarily. We hold on to liquidity so we have the financial means to react to what’s happening in the business. We’re fortunate to be part of a bigger corporation that makes this possible. We acknowledge mistakes quickly; we move through slow-moving product quickly, leveraging our own outlets to do this. We believe in taking ownership of our business.

How problematic have supply chain slowdowns been for you?

To some degree, it’s been feast or famine, but as merchants, we rely on our partners in the market to collaborate closely on how we can get the best possible assortments in the moment for our customers. And fortunately, certain moves we made during the pandemic greatly benefited us during the worst supply chain backlogs.

For example?

For example, early in the pandemic, we maintained our commitment to tailored clothing. We decided that our tailored business had very little wrong with it; the problem was, quite frankly, lack of demand, especially during the front half of 2020. So we held on to core items and fashion pieces: instead of taking them out of the mix, we just waited. We’re fortunate that, as part of Macy’s, we had the financial coverage to bring in receipts as business returned.

As another example, I didn’t markdown Canali, a special brand for us since we were the first store in the U.S. to carry it. I worked it out with Giorgio that we’d hold hands together and wait. And when the

business bounced back, as it did in May/ June 2020, we had the right inventory while our competition had cut tailored from two thirds of their doors.

What’s selling best now in menswear?

The momentum for the past year has been in the classic, dressier end of sportswear. Guys are going to the office, to meetings, to restaurants. There’s a shift from classic suits (still selling for weddings and events) to elevated sportswear with perhaps a tailored jacket or more interesting trouser or laceup oxford instead of sneakers. This more

In 1886 came the visionary move uptown to 59th Street and Lexington Avenue. The store expanded steadily, and by the 1920s, Bloomingdale’s converted an entire city block.

It started with a 19th-century fad the hoop skirt, the first item that Joseph and Lyman Bloomingdale carried in their Ladies’ Notions Shop on New York’s Lower East Side. Their East Side Bazaar sold a wide variety of European fashions, possibly making them the first ever “Department Store.”

polished look has been strong for a while.

Your new footwear floor looks amazing!

I’ve known Louis [DiGiacomo] for so many years, and when I saw the fabulous shoe floor Saks opened at its flagship, I was determined to one-up it.

How will your customers react to the notable price increases they’ll encounter for fall ‘23?

Although we’re fortunate to have customers with financial elasticity, we realize that people at all levels are feeling the pinch to varying degrees. I mean, they look at their 401Ks and they don’t feel so great.

We seek out product with perceived value, which does not necessarily mean inexpensive. Perceived value could be a Canali suit, a Zegna cashmere knit, an Italian linen shirt. Our customer expectations

are extremely high, so we focus on great value, not low prices.

How does the current political divisiveness in our country and the troubled state of the world impact what you do?

On a personal level, it all weighs on me. But I believe that as retailers, we can’t dwell on what we can’t control. Our job is to offer customers product that excites them, service that engages them, and experiences that become memorable, inspiring them to shop. I can be personally distraught about what’s happening in the world, but I can’t let it distract my team from their focus: finding product that’s more fabulous than ever, marketing that engages like never before, and events that delight and inspire.

It seems you’re doing plenty of events to celebrate 150 years.

We are. The best part of this anniversary is

1940s and 50s

Lights, Camera, Action! Print ads couldn’t say it all: the store had to be experienced. Bloomingdale’s became the stage for gala events and fashion shows, including “Woman of the Year, 1947.” With music, lighting, and sophistication, it was retail as theater, a concept Marvin Traub continued with his over-the-top countrywide promotions.

1900-1910

Read All About It Flexing his marketing muscle, Lyman created splashy ad campaigns to bring people through the door. People started seeing the “All Cars Transfer to Bloomingdale’s” slogan everywhere — on billboards, delivery wagons, even ladies’ beach umbrellas.

that it allowed us to wrap our arms around our customers in new ways. For example, we partnered with our friends at Ralph Lauren and — with our leadership teams, some of Polo’s professional and Olympic athletes, and many of our best customers — took over the Polo Bar. It was a wonderful experience for our customers and great for our relationship with the Ralph Lauren organization. They saw the power of our shared customers, and we realized that there’s more of this that we could be doing as we aspire to turn 150 years from a moment into a movement. The anniversary has put a spotlight on our longevity and relevance.

Could you talk a bit about your online business?

We don’t share numbers, but the web has become our most significant selling location. So, we’re certainly focused on it, but it’s more about

More Than a Store, a Destination

By the ’70s, everyone was stopping by 59th Street and Lexington Avenue for a look, including Queen Elizabeth. People came to see and be seen, viewing cutting-edge designers like Ralph Lauren, Perry Ellis, and Norma Kamali. Fashionable young women would hang out in the men’s department to meet eligible bachelors!

Always finding new ways to be creative, the Bloomingdale’s team came up with the first designer shopping bags in 1961, now collector’s items. In 1967, Bloomingdale’s introduced Ralph Lauren, a partnership that’s stronger than ever these days. They were also the first store in the States to bring in Canali, a powerhouse Italian brand and longtime partner.

how do we meet the customer where the customer wants to shop: in store, online, or some hybrid thereof. It’s also about inserting humanity into the digital experience.

And for this we have a great playbook: if you look at our bridal registry, it all starts online, but then we bring in a registry consultant to work with the couple. Where we do that, the couple inevitably chooses to register for a more significant spend because we add value. For example, if they register for 12 plates, we’ll suggest 14 so that down the road when a few break, they’ll have replacements that may no longer be available from the maker.

We certainly want them to spend more with us, but we also want their friends to shop with us, so the shopping experience must be beyond exceptional.

Could you discuss the new Bloomie’s concept, your move to smaller stores?

Over the years, I have asked people how many stores they think Bloomingdale’s has. The response I typically get is somewhere around 100. We actually have 30 full-line stores and 20 outlets. We believe we have a true opportunity to expand our footprint but not necessarily with 150,000-square-foot stores.

We opened our first smaller-format (25,000 square feet) Bloomie’s store in Fairfax, Virginia. We already had great full-line stores in Tysons Corner and Chevy Chase, Maryland, but we wanted a local lifestyle center with high repeat business and same-day delivery in the trading area. It also drives much ecomm business. Our second Bloomie’s is a 50,000-square-foot store in Skokie, Illinois. Next, we’ll be filling in our map by opening in markets

2000+

Bloomingdale’s continues to lead the way with exclusive merchandise, customized services, and alternative shopping venues. Carrying on the founders’ dream, the company still finds ways to set its stores apart, with “one foot in the present, and one in the future.” Under extant CEO Tony Spring, Bloomingdale’s has opened smaller format stores and has invested big time in technology, fulfillment, and digital experiences.

we’re not yet in—and there are many!

With more than 200 menswear brands, you’re probably not seeking out more. So how does an emerging brand approach you for consideration?

We always want to view what’s out there; we’re always looking for the next big thing. We have a robust merchant organization and a fashion office whose job it is to look at new collections. And we’re not so hard to reach: Anyone on LinkedIn can find contact info for me and my teams. We’re also at many of the trade shows. So having a conversation with us is not the hard part; the hard part is exciting us with product we don’t already have, something that brings a new lens onto the selling floor. To become part of our mix, it’s always about great product that will excite our customers and that’s not

already duplicated in our assortments.

What’s the biggest mistake you’ve made in terms of selecting product?

On private brands, especially European brands, I’ve jumped in too quickly without considering all implications and logistics. At times, I brought in the right look but not the right fit. Or in the case of a collection, I lacked the wherewithal to bring in all the pieces at the same time for maximum impact on the selling floor. My job is to get it right more than I get it wrong, but I’m likely to get it wrong plenty of times. That said, you can’t be afraid to get into the batter’s box and swing!

What can your vendors do to make your life easier? (much laughter at the question)

As a retailer, I apparently spend much time making vendors’ lives difficult so I’m not all that comfortable asking them to make mine easier!

But seriously, what I need from the market is: 1. Creativity; 2. Ingenuity; and 3. Execution. I’ve been doing this for a long time, and I feel it’s my job as a partner to give genuine feedback, to articulate our goals and challenges with clarity upfront so that our partners can choose to participate in the solutions or not.

What keeps you up at night?

Holding on to our relevance. It’s largely the push and pull of accomplishing short- versus long-term goals. While we’re always comparing business to last year, I want to make sure my team has enough of a forward view, with one foot in the past and one building our future.

I’m lucky enough to work at a store where I stand on the backs of giants: great merchants like Marvin Traub, Mike Gould, David Fisher (who built our reputation in men’s), and now Tony Spring. All those who came before left this wonderful legacy that I get to capitalize on. Before I became GMM when I worked with David, he would often say, “Never let it be said that the best times at Bloomingdale’s were under my watch; that’s your job now.”

And now that I’m in the late fall of my career (after all, MR gave me a Lifetime Achievement Award several years back), I say the same to my teams. Building and inspiring the next generation of Bloomingdale’s execs, creating concepts that have the same gravitas with customers as those from our past, that’s their job now, and that’s how we’ll hold on to our relevance.

Do more fashion-forward assortments mean higher markdowns?

Not at all. If we learned one thing during the pandemic, it was to consider what the customer needs in his wardrobe. There’s still such a backlog of social events, at least through next year, that formalwear will remain a bigger piece of our tailored clothing business. We’ve been able to add more variety: four or five different models in black tuxedos, for example. A lot more color, pattern, velvet, clean dinner jackets…

What’s happening in outerwear? Since it’s 75 degrees on a mid-November afternoon, it’s almost a rhetorical question. Outerwear is a seasonal business, and clearly, the season has not yet started. That said, the biggest piece of our mix is down-filled, but so far we see an outsized contribution from wools, leathers and suedes, bomber jackets, chore coats, overshirts, pieces that can be worn inside or out, as lightweight outerwear or sportswear.

next change, but it won’t happen immediately. While fashion changes by the season in women’s, it’s by the decade in men’s.”

How’s footwear business?

Dress shoes are definitely back! Loafers did incredibly well this fall: the guy who was buying a clean white sneaker was also buying a clean loafer. The guy who likes bolder streetwear-inspired sneakers is now buying bolder loafers. Sneakers are still very important, but the big shift is to dressier styles. Hero items for us are Birkenstocks and Boston clogs.

How would you describe your personal style and what was your most recent purchase? I’m definitely modern-classic. I believe in a wardrobe of building blocks where pieces can mix and blend in various ways. I’ll wear a great cashmere sweater with either sweats or wool trousers. My most recent purchase: a Massimo Alba hip-length jacket, straight bottom, three pockets, in a beautiful blueon-blue herringbone. It’s these kinds of “third pieces” that are driving sales this season.

What’s been the biggest change since the pandemic?

The biggest change is that men now have the freedom to present themselves any way they want and it’s all good. I think it’s more the internet than the pandemic, but the work-from-home wave definitely moved us more casual.

But viewing through a longer lens, when you look back at the history of men’s fashion, so much has been based on uniforms, whether army green fatigues or classic blue suits! Now that we’re actually moving away from uniforms (except for weddings and events), men can use clothing to express themselves however they choose. There’s still a level of formality to it, and it’s our job to define the parameters and suggest great choices.

Can you discuss the biggest shifts by category, starting with tailored clothing?

The biggest shift is a hard turn toward truly dressy styles in both nested suits and sportcoats. There’s been a definite shift away from leisure to a balanced mix of classic and fashion. Before the pandemic, we carried a couple of fashion SKUs to keep the floor interesting but most tailored clothing was basic. Now, there’s a more equal split, with half the business in more seasonal fabrics, colors, patterns, and updated models for guys who don’t have to wear suits but are choosing to do so for various reasons.

What about pants and jeans? Any trends here?

Denim at this moment is very clean and office appropriate. Fewer holes, less destruction, minimal rips and repairs. Five-pocket is still the predominant model, but we do see a possible shift in silhouette for 2023. Women have already moved away from skinny styles to embrace several new models, like high-rise, pleats, wide legs, and crops. While it’s unlikely men will go for the extreme options, straight could certainly replace skinny for fall 2023. A more shaped and relaxed style is also on the horizon. We’re on the precipice of the

What are you doing to get more young guys into the store? Is luxury streetwear important to your mix? We’re very focused on offering the best product at a variety of prices, whether it’s a $150 jean or a $2,500 blazer. We find the best version within different price ranges so there’s value for every point of view, be it classic or contemporary.

As for luxury streetwear, we’re indebted to streetwear manufacturers for adding this graphic, colorful element of street culture to our offerings. Even when customers don’t wear it all together, certain elements define a specific point of view that’s an important part of the mix.

RETAIL STRATEGIST AND former Saks VP Tom Ott recently posted about the dangers of understocked selling floors, a common sight this holiday after bloated inventories in October/November. “Holding off on new receipts is never the answer,” Ott maintains. “Sometimes you need to buy your way out of an issue to create buzz and excitement for the customer.” He goes on to question why retailers don’t bring in outerwear after December since about 40 percent of coat business occurs between January and April. “Work with your resources to hit end-of-season numbers and deliver fresh new goods for Feb 1. Works like a charm: When the snow starts flying, coats do also.”

Acknowledging that outerwear business is weather-related, most retailers have nonetheless noticed that, today more than ever, purchasing is also driven by fashion. With offices opening up and men opting for more presentable office attire, they’re increasingly looking for outerwear long enough to cover their suit jacket or sportcoat. Clearly, many are buying fashion forward outerwear to elevate their image at work.

Fred Derring from DLS explains it well: “Outerwear has grown post-pandemic thanks to more eclectic dress codes for men. Outerwear is now replacing the sportcoat, with guys wearing stylish coats, jackets and vests with a turtleneck, or with a woven shirt and tie. They’re wearing lightweight wool pieces indoors as well as out. These days, it’s about fashion and unique items more than keeping warm.”

In fact, strong early fall ’22 outerwear business in many parts of the country had less to do with the temperature and more with the extent of fashion placed for early delivery. Sophisticated topcoats, classic peacoats, ‘teddy bear’ faux sherpas, plaid and patterns, sherpa-lined flannels, quilted vests, rugged shirtjacs all sold well in September/October, while basic puffers and heavyweight parkas proved disappointing.

“I continue to see customers searching for versatility and timeless style,” says Todd Christiansen from Journeyman, a menswear store opened four years ago in Madison Wisconsin. “They want jackets that deliver performance for a day hike, but stylish enough to wear to dinner. Ease of layering is key. As temperatures go up and down, having a coat that can adapt is very important. I’m finding that bulky (heavily insulated) coats have been downtrending. At the same time,

shirt jackets are increasingly substituting for outerwear. From fleece-lined chore coats to down-insulated CPO shirts, these items can be dressed up or down. Again, versatility is key.

“Looking to Fall 23, I’ll continue to focus on key item jackets that offer timeless style but give the customer many wearing options. When you spend more money

on something, you want it to stay in style and perform. In addition, I’ll be adding some pinnacle pieces, very special items to support customers buying less, but buying better. More and more, customers want items that tell a story, that make you feel good each time you put it on!”

Says Dana Katz from Miltons in Massachusetts, “We’ve been selling functional

outerwear with stretch properties, green qualities, technical warmth and insulators from makers like The North Face, The Recycled Planet, and Barbour. These are items that can be worn both casually and/or over tailored clothing. New colors have been big all season – rich hunter greens, burgundies and great earth tones look fresh; vests have been key add-ons to outfits of all types.”

From David Kositchek of Kositcheks in

Lansing Michigan, “Our overall men’s business is very strong and outerwear is no exception. Our best sellers are from Manto and Holbrook of Sweden.”

Retailer Tom Malvino from Louis Thomas (two stores north of San Francisco) dispels the myth that you can’t sell outerwear in California. “It’s been in the 30s every night for

the past two weeks,” he relates in November. “My customers travel so they need coats. I didn’t invest in topcoats—long heavy coats are too cumbersome for air travel. What’s selling best is all wool anorak-length (midthigh) coats that can cover a sportcoat or suit jacket. Or even a bit longer for more elegance. Our business is mostly in the $495-$795 range.”

Ken Giddon from Rothman’s in New York reports strong sales this season with Parajumpers (“a bit cooler than most brands without being over the edge”), Serge Blanco (“well-priced with a French twist”) and poly-fills from Save the Duck (“still going strong”). He’s also had great reaction to a hybrid piece from LBM, essentially a sportcoat model with leather insert (about $1000 ticket price). In fact, during a Black Friday promotion, five of his customers fought over this item, vying for the honor of Who Wore It Best.

Says Giddon, “I believe fall ’23 will be a strong outerwear season for independent retailers because customers are confused about how to dress for work. They understand casual and they understand dress-up but can’t quite figure out office attire. That’s why specialty stores have the advantage: we offer stylists to explain what to wear with what and how outerwear figures into the overall fashion puzzle. Although we didn’t buy into topcoats for fall ’22 (except for one great model from TailoRed), we’re getting requests for them. I believe topcoats will be the comeback item for fall ’23.”

Dan Farrington at Mitchells Stores agrees. “We’re chasing demand in overcoats and dressier car coats: both were soft last year; we’ll have deeper assortments next year. Casual outerwear and puffers seem to have leveled off.

“Overall, our outerwear business for end-November was running even with last year. (Last year was our best year ever, so flat is something to be happy about!) Brunello Cucinelli, Loro Piana, Zegna, Kiton, and Moncler are driving topline right now. Demand is strong and sales might have been even better with deeper assortments, but supply/delivery issues still linger. We aren’t sure what traffic to expect in the pre-Christmas weeks, so we might end up in perfect inventory position.”

Shannon Stewart from Harry Rosen Canada is also leaning into topcoats, but with some reservations. “There’s no question the weather this fall/winter has changed the

purchasing habits of our clients when it comes to outerwear. We’re definitely seeing more interest in topcoats, which aligns with the return to dressier business wear. At the end of the day, however, a topcoat is not suitable for a snowy weekend or a cold hockey arena! In the last weeks of November, sales in parkas picked up significantly with the change in our weather. Our customers now need several outerwear pieces to satisfy the various aspects of their lifestyles. For next fall, we’ll look at changing the balance and flow of our inventory to offer more appropriate weights for these new weather patterns, which I believe will continue.”

Bottom line, buying outerwear is not just selecting the right fashion; outerwear business needs to be managed. Explains Casey Vieira from g-iii, “Retailers need to make decisions within strict financial guidelines, properly time deliveries, turn goods quickly, manage markdowns to meet both margin

and top-line sales, stay in regular touch with vendors to quickly execute re-orders, and correctly promote slower turning items as needed to keep stock levels in check and stay liquid.”

He stresses the importance of having the right inventory at the right time. “The sales trend was positive through mid-October, then it got warm and there was an unexpected slowdown that continued into November. Thankfully most retailers continued to flow product, rebalance assortments and bring in Q4-appropriate items like parkas. Our fastest turning items are modern, refined looks while our more casual assortment of puffers with unique detailing ($79.99 OTD, $89.99 for hooded version) and jackets with sherpa trim continue to drive volume. Wool is trending well: we expect shorter lengths in twills, herringbones and plaids and longer lengths in laminated melton to drive holiday sales.”

According to Peerless president Dan Orwig, best-booked styles for fall ’23 include

1Push the Topcoat! It’s an item few men have in their closets, and one that perfectly enhances the more polished feeling of fall ’23 men’s fashion. Bring it in early, put it in store windows, and let customers know you believe in it.

Her Turn…Try bringing in (early in the season) a tightly edited assortment of fashion-forward women’s coats from one of your favorite menswear brands. Several menswear merchants who don’t otherwise carry women’s fashion have done well with shopin-shops of unique women’s outerwear.

Retailer Jody Morneault, who does carry women’s in her store, recently created much buzz with female customers modeling fashion coats on the city streets of Hartford.

Fabulous sportcoat with leather insert by LBM, modeled by (clockwise from top) Marc, Eddie, Jose, Rob and Adam.

Make it Fun! Clearly, events ignite purchasing. We love what David Kositchek has done for the past 11 years: an in-store ‘Dapper Dads’ fashion show, with clothing modeled by customers and proceeds going to women’s health at a local hospital.

3Ken Gidden from Rothman’s New York, after several of his customers all fell in love with the same LBM jacket with leather insert, inadvertently turned it into a Who Wore It Best contest. Why not purposely plan a Who Wore It Best event? Have customers try on fashion-forward coats, take and post photos, and gather votes on social media. (So who wore it best?)

a longer length peacoat in a blended wool melton, a fully water-repellent faux shearling, a 40-inch (just above knee) cashmere blend DB topcoat, below-the-knee topcoats (city coats) in interesting fabrics, a duffle stadium coat, and 36-inch all-weather coats. “While we’ve added several new models for fall 2023, topcoats are a best-booked item across all our brands,” he confirms. “It’s been the number one seller this season, generally in the $495-$695 retail range but priced higher for luxury fabrics: $895 in a Loro Piana all-wool and $1295 in all cashmere, both selling well. We project an even stronger season for fashion/luxury outerwear for fall ’23.”

Now a division of Cashmere Outfitters, Cardinal of Canada 1938 has reinvented itself, maintaining the classic DNA of the brand but modernizing with softer, lighter weight fabrics, recycled insulation (primaloft) and more generous fits. “We push the envelope on fabrics,” Cardinal’s designer/artistic director Antoine Charlevoix explains, pointing to a primaloft-lined rubberized model. Other on-trend items include a wooly brushed jersey knit, a primaloft-lined raincoat with zip-out sleeve treatment, and (this editor’s favorite): a relaxed fit 40-inch DB camel topcoat, 80% wool/20% cashmere, that sold out at Nordstrom and Neiman’s well before Black Friday. “Because they’re much lighter weight than they used to be,” notes Antoine, “topcoats have become a layering piece, as stylish over a t-shirt as over a suit.”

Norwegian Wool prides itself on using interesting luxury fabrics like its waterproof wool herringbone coat with down insulation, $1500 suggested retail in wool, $2800 in pure cashmere. We love their waterproof wool/ cashmere shirtjac looks in two different weights, their wool bombers with down insulation and some stylish, sophisticated topcoats. Says founder Michael Berkowitz, who advertises via billboards on MetroNorth trains to Grand Central Station, “Men are clearly upgrading their office attire: now is not the time to dress like a schlump!”

Famous for their military-inspired sheepskins and the leather pilot jacket worn by Tom Cruise in Top Gun and Top Gun: Maverick, the Cockpit business is now a blend of D2C (half their customers are international), military contract, and wholesale around the globe. Jacky Clyman notes that the Top Gun pilot jackets in kids’ sizes at $250 retail

have been a surprise hit!

When Rainforest Inc divested the Rainforest trademark, Jack Wu was hoping to retire and play more golf. As it turned out, demand from key retailers has kept him in the outerwear business with the ThermoStyles brand of modern field jackets with built-in heating systems. This proprietary technology allows the wearer to control the temperature inside the jacket via a universal USB rechargeable battery that plugs into a cord in the pocket. Wu points out that these “versatile and lightweight coats travel well, are a great alternative to heavy outerwear, and are selling well at Saks and select upscale stores. Suggested retails run from $156 for the fleece pullover to $700$900 for true parkas.”

Using only certified Canadian white duck down and signature breathable membranes, Nobis claims “optimum fill power to warmth ratio by working with your body’s own heat to offer the perfect insulating environment

against unpredictable elements.”

Save the Duck’s Seth Steinberg is proud that the brand was among the first to add sustainability to the outerwear equation, creating white space that others have jumped into. “We were pioneers,” he recalls, remembering when the brand launched 10 years ago. “Few cared about environmental impact or saving the planet back then. I remember first showing the collection to a group of Southern retailers who hated the logo and reminded me that they shoot ducks so why should they care about saving them… But today, people (especially young people) do care; they’re loyal to brands trying to make a difference.” He also notes that in 2019, Save the Duck was among the first Milan-based companies to receive the highest level of certification for social and environmental impact. Recently purchased by L’Occitane, the company is growing its B2C business and opening stores globally, including a New York flagship in Soho.•

The beginning of the year is always a good time to look at where we’ve been and where we’re going. Here’s our list of the people, things, and trends to watch for 2023.

By Karen Alberg Grossman and John Russel JonesTo misquote election strategist James Carville, the most important thing we see impacting 2023 is “the economy, stupid.”

Last June we saw the highest inflation since 1982, yet consumers —said to still have $1.5 trillion socked away as a result of pandemic stimulus programs are (at mid-December press time) shopping their holiday hearts out. Prices at the pumps are coming down, but those savings are being eaten up in the produce aisle. Although many are anticipating out-ofcontrol fuel bills once winter

really hits, the National Retail Federation scoffs at the idea of a recession, citing nearly 3 percent growth in GDP in the third quarter. Still CEOs are wary, nodding to the Fed raising interest rates, ongoing inflation, and geopolitical concerns. Our thoughts? Sharpen those pencils, pay off debt where possible, be sure to keep some money stashed in savings…and maybe it’s time to start some seeds for that victory garden you’ll want to start in the backyard come spring.

The store practically defined mid-century Madison Avenue style with a touch of international sophistication and Hollywood glamor. Under its current leadership — Executive Chair Paulette Garofolo, President and CEO Trevor Shimpfky, and Creative Director Ralph Auriemma — it’s poised to set the standard for a whole new generation in the C-Suite: After all, the flagship is close to Grand Central Station for a reason. Now owned by Japanese company Mitsui, the brand has maintained a focus on quality since 1938, adroitly launching Phineas Cole to target a younger customer in 2007. Upon assuming the CEO role in 2022, Shimpfky said, “My support of our Creative Director and his unyielding pursuit of product pre-eminence while staying focused on our digital transformation will be my primary goal as I begin my tenure as CEO and President.”

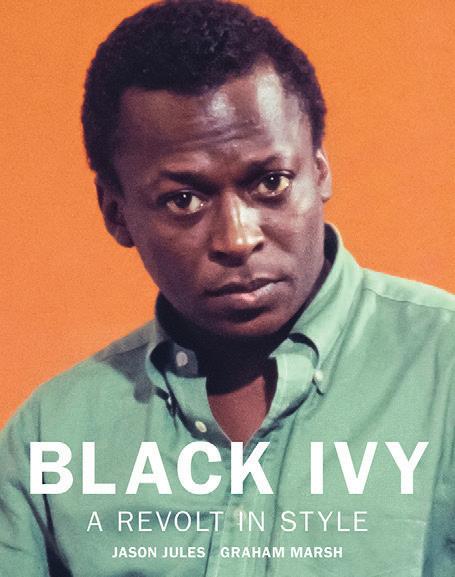

With its roots firmly planted in the post-World War II Ivy League, “preppy” style has always had moments in the limelight, without ever quite going completely out of fashion, really functioning as the backbone of an international menswear aesthetic. It’s been sampled and remixed, finding its way everywhere from grunge to streetwear, even crossing into country and western designs and dandyism. Its taken on an everyman aesthetic without losing any of its elitist overtones. While “The Preppy Handbook” seems more like an artifact, 1965’s Japanese “Take Ivy” and 2022’s “Black Ivy” are required tomes in any fashionisto’s library. The robust return of Brooks Brothers and J. Crew signal its renewed importance for 2023 and beyond.

Alessandro Sartori began his career at the 113-year-old house of Zegna, but when he returned in 2017 after five years at Berluti, he took the brand in a fresh stylistic direction. Never abandoning the company’s roots in luxury and tailored clothing, Sartori has offered a renewed take on what dressing means for modern men. With the purchase of high-end fabric makers, Zegna itself is poised to move from first class to private jet luxury level, and — along with its ownership of Thom Browne and the license of Tom Ford menswear and footwear with Sartori at the helm, we expect the brand to occupy a new primacy at the top of the menswear pyramid.

He took on this role in December 2020, a few months after Authentic Brands Group and Simon Properties brought Brooks Brothers out of bankruptcy for a bargain $325 million. And who better to modernize this longtime outfitter of prep that, for more than two centuries, has helped define American Style?

sales volume. Now that people don’t have to wear suits to work, our success in elevated sportswear has really driven sales. Our customers are buying upscale sportswear, mixing it with tailored pieces, and wearing it for both work and weekends.”

Take a look at this brand’s latest lookbook, and one would assume that it’s an American heritage luxury brand, akin to Ralph Lauren or Tommy Hilfiger (whose first ad campaign we referenced in this title), yet Aimé Leon Dore is still often described as a streetwear brand. With founder Teddy Santis at the helm, the company debuted in 2014, slowly building its reputation through collaborations with New Balance, Porsche, and Woolrich. A year ago LVMH came calling, and the cult brand is now poised for a breakout moment, opening a London location last June, and closing its Mulberry Street store (with a pop-up nearby to feed the machine) for renovations.

For throughout his design career, Bastian has been the poster boy of Modern Prep, occasionally infusing it with an upbeat streetwear sensibility. (In a recent Facebook post, Michael posts a photo of himself wearing a plaid button-down collar shirt under a navy crewneck sweater, with the caption “Still wearing the same stuff I wore in high school and college (but now, thankfully, with a better haircut.)”

The designer explains Brooks Brothers’ healthy sales gains in recent seasons: “A huge win for us these past two years is sportswear overtaking tailored clothing/dress furnishings in

Bastian is most proud of “surviving in this unplanned career” (after studying business, he landed the men’s fashion director spot at Bergdorf’s) and of remaining stylistically relevant. “Change in menswear is slow,” Bastian acknowledges. “I’ve learned you must remain true to yourself: you can’t give up your identity to chase a trend. But inevitably, trends come back: none of the ideas we see now are new to us; they’re all in a Brooks Brothers catalog somewhere in the past 200 years. But the wheels turn slowly in men’s so ironically, your least advanced customers and your most advanced customers are sometimes buying the exact same things.”

Menswear brand SO.TY is out to redefine and disrupt the apparel industry as we know it. Dr. Corneil [Neil] Montgomery founded the brand — with Charles Harbiston as its Chief Fashion Director as the fashion arm of Sovereignty Company, a sustainable circular social enterprise and nonprofit that empowers fashion entrepreneurs of color to collectively solve climate change and inclusion challenges. The collection is about eco responsibility, gender affirmation, size inclusivity, and race and class equity to infuse thoughtfulness into the business of luxury goods. And isn’t that what we should all be about?

As a society, we’ve progressed through the generational stages of grief from the denial of Boomers, the depression of Millennials, and have now arrived at the Acceptance of Gen Z. A generation that takes little for granted about the future, they are just now coming into their power at the ballot box and at the retail counter. As a collective, they’ve left behind myopic views on

shopping, armed themselves with the collective knowledge of TikTok, and adopted purchasing habits that consider sustainability, inclusivity, cultural awareness, and authenticity. For brands, the greatest struggle they face to reach this group will be overcoming their awareness of the manipulation tactics of traditional marketing and getting through to them with the most elusive of advertising trends: honesty. Brett Edward Stout

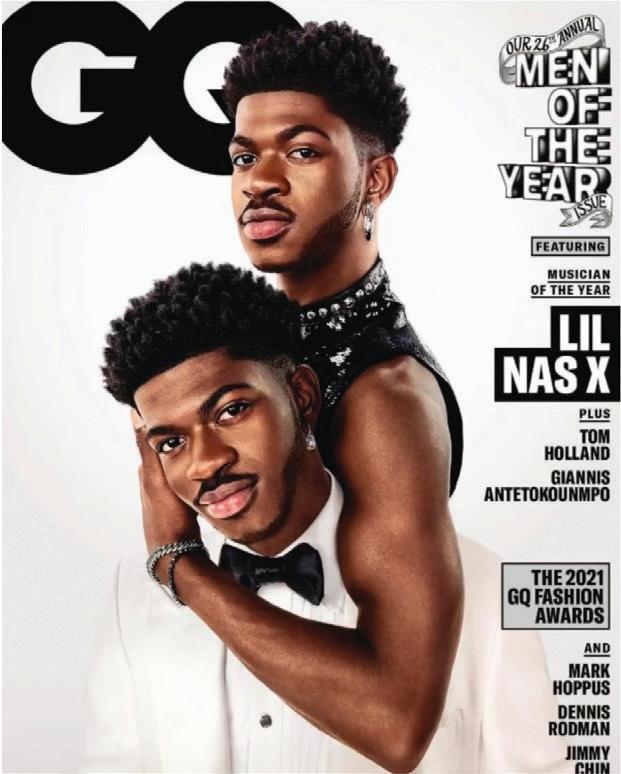

With the post-‘me too’ culture demanding that men change, Will Welch faced some tough challenges taking over the Editor in Chief spot at GQ magazine. Knowing that the magazine could no longer rest on its laurels, shooting fancy designer suits and hoping that readers would keep reading and subscribing, Welch has been forging a whole new path.

“We’re not dictating a particular style to our readers,” he recently told The New

York Times. “Instead, we’re going to show different forms of self-expression, almost a mood board, and let you find yourself in it. GQ is no longer about giving style tips and sex advice…”

But since GQ is still a fashion magazine, and since men still need styling direction (and sex advice!), perhaps today more than ever, it remains to be seen how well this strategy will work for GQ. We wish them much luck!

Time was that a buyer could get most of a season’s work done at either the wide-ranging New

York market or the massive Las Vegas events. That said, The Chicago Collective, under the steadfast direction of Vice President Bruce Schedler, has created an event with a friendly but exciting vibe that keeps the focus on leaving paper. Last August’s show featured a large Italian Trade Agency presence, prompting at least one attendee to pronounce the Chicago Collective “The Pitti Uomo of the U.S.A.”

vegan fashion before it became trendy and always a passionate animal care activist.

Named creative director in May of 2021, Supreme alum and Noah co-founder Brendon Babenzien’s first Spring collection, for 2022, was an immediate success with an updated preppy look that hit the sweet spot between classic and trendy. The designer offered updated fits (the brand had been criticized for going too slim) and a selection that appealed to stalwart customers and new Millenial and Gen Z fans alike. The online edit would make Lisa Birnbach (“The Official Preppy Handbook”) proud with its mix of stories about skiing, a Beams Plus collaboration, and Long Island’s North Fork Polar Bears Club. While we’ll see how things play out for fourth quarter, early indicators show the brand doing well for Fall 2022.

There are a few people in our industry who were intent on doing good before doing good became fashionable. Designer and industry activist John Bartlett is by all accounts one of those few.

Among his favorite quotes: “Leap and the net will appear” and “The quieter you become, the more you will hear…”

He’s earned a BA from Harvard and an AA in men’s fashion from FIT. Industry awards include Best New Fashion Designer from CFDA and Designer of the Year from AFAA. In addition to launching his namesake brand in the 1990s, he’s been design director for Ghurka, Liz Claiborne and Byblos. He was a voice for

At Marist College, his current job has been to elevate the design and merchandising programs, incorporating digital and summer interning opportunities for the students. He also just launched a gender-neutral line of accessories, bags and totes, created by women in recovery (unshattered.org) with a goal to provide pathways toward sustained sobriety and economic independence. A percentage of sales will also go to animal rescue programs.

“Everything in life is so connected,” Bartlett observes, describing some of his other projects and passions. These include a dive into next-generation materials, inclusion work on gender roles and body positivity, course development re: Fashion & Social Justice, certification to teach yoga and meditation, and, after losing the love of his life six years ago, meeting his new soulmate, a lovely man from Vermont who happens to be a great vegan cook!

Remember back in 1995 or so when you couldn’t open your mailbox without floppy discs or CDs from AOL spilling out? When was the last time you checked your MySpace page? The internet has taken charge of the world as we know it, particulary as routed through our laptops and smart phones, demanding most of our waking hours for everything from instantaneous global communication to banking and finance to Pokeman GO (Gotcha!). Get ready for Web3, a decentralized experience that promises yet another revolution in the way we shop, entertain ourselves, and interact with each other. While many of us don’t yet have a solid grasp on what it is, brands from Bloomingdale’s to Vogue to Gucci are already experimenting with the platform.

WHEN WE FIRST looked at illustrating the current trends in men’s formal wear for this issue, we did a deep dive into images from the red carpets of Hollywood, New York, and Cannes, as well as the Super Bowl of fashion, the Met Gala. The results were very interesting. If you imagined men’s fashion as a meter, with the classically elegant and always appropriate looking George Clooney at one end and the over-the-top, flamboyant Billy Porter on the other end, all the interest lies in the middle.

Look at Trevor Noah, wearing his traditional tuxedo trousers, but paired with a sublime pink velvet double-breasted dinner jacket, making just enough of a statement to make us stop swiping through social media and take it all in. We’ve been telling men to break up their suits for years and now that includes his formal wear: Very few people need to buy a new tuxedo, but not everyone has a velvet dinner jacket in their wardrobe. This is the season to change that.

There are also beautifully textured evening jackets with subtle shine and details from brands like Tallia and Paisley & Gray as you will see in our story. If your customer wants to make a bigger statement, you can opt for a full tartan tuxedo like the version we feature from Brooks Brothers, now under the design stewardship of Michael Bastian. We’ve paired a few of our tuxedos with

merino turtlenecks, another new trend on the red carpet that brings us to our next theme – formal underpinnings no longer have to be a stiff pleated white shirt and studs. They can be a pink Oxford cloth or, depending on the event, a casual shirt. A formal jacket can also

be paired with a fine gauge knit t-shirt, like the ones we used from Left Coast Tee. Your customer can even opt out of a shirt all-together, although we don’t recommend this for everyone unless blessed with perfect pecs.

Black tie also doesn’t have to be black. A big trend on the runways was the all-white tuxedo, which is beautifully represented in our story by Eleventy (a look that I almost had a breakdown styling as the model walked through the grit and traffic of Times Square, hoping it would not get dirty). We also feature a beautiful tuxedo in dark blue from Tommy Hilfiger and, as Christian Dior once said, “Midnight Blue is the only color that could ever compete with black”.

Pretty in Pink Trevor Noah on the red carpet at the 64th annual Grammy Awards

It’s currently a big trend to add some sparkle to the lapel. Sure celebrities get access to high jewelry without a problem, but us mere mortals can look to brands like Tateossian and vintage to find a stick or lapel pin to add some shine to our special nights.

The summary is that it’s a great time for formal wear. Look past the black when shopping and embrace color, texture, and shine to give your customer something new to try and, if he’s hesitant, just Google “Trevor Noah Pink Jacket,” and show it to his wife. He’ll buy it.

This page: black tuxedo by Dunhill; “celebration” slippers by Stubbs & Wootton; sunglasses by RayBan; silk flower pin by M&S Schmalberg; pearl necklace and earring by M. Cohen Opposite, left to right: turquoise metallic suit by Any Old Iron Nashville; pima cotton shirt by LeftCoast Tee; pink rhinestone pin, vintage; pink cropped jacket and pants by ORTTU; silver necklace with three stones by Mixology NYC by Alison Hessert

Left to right: metallic jacket and velvet track pants by Tallia; metallic shirt by Atelier Cillian; floral shorts suit and pink shirt by Paisley & Gray; metallic trench coat by ORTTU; pink silk flower pin by M&S Schmalberg; brown velvet jacket and tuxedo pants by Tallia; white merino turtleneck by Brooks Brothers; dogwood silk flower pin by M&S Schmalberg

This page: navy metallic suit by Atelier Cillian; silver mesh scarf by Mixology NYC by Alison Hessert Opposite, left to right: pearl embellished suit by ORTTU; pima cotton shirt by Left Coast Tee; polka dot flower pin by M&S Schmalberg; pearl necklace, bracelets and ring by M. Cohen; sleeveless metallic tweed suit by Atelier Cillian; lapel pin, vintage.

This page: jacket with studded trim, tuxedo pants, and shirt all by Tallia; velvet ribbon tie is stylist’s own; cowboy hat by Stetson; gloves by Hestra; velvet flower pin by M&S Schmalberg Opposite: plaid tuxedo by Brooks Brothers; merino wool turtleneck by Alan Paine; shoes by Gucci

Models: Ali Aksahin, Aubrey James, and Jamison Stadie all with Union Model Management; casting by Jahn Hall; grooming by Robert Bradley; prop styling by Kevin Heidkamp; photography assistants: Leandro Gonzalez and Arthur Roldan.

This page: jacket with studded trim, tuxedo pants, and shirt all by Tallia; velvet ribbon tie is stylist’s own; cowboy hat by Stetson; gloves by Hestra; velvet flower pin by M&S Schmalberg Opposite: plaid tuxedo by Brooks Brothers; merino wool turtleneck by Alan Paine; shoes by Gucci

Models: Ali Aksahin, Aubrey James, and Jamison Stadie all with Union Model Management; casting by Jahn Hall; grooming by Robert Bradley; prop styling by Kevin Heidkamp; photography assistants: Leandro Gonzalez and Arthur Roldan.

OFTEN A NEGLECTED CATEGORY in even the finest menswear stores, non-apparel gifts inspire impulse purchasing, thus providing volume, profit, and lots of year-round buzz for smart retailers who nurture this business. Gifts can be tabletop, gadgets, leather goods, jewelry, art, antiques, handcrafted goods, writing implements, picture frames, grooming products, and even foodstuffs. With no dealing in sizes, return rates are notably lower than for apparel.

Ted Silver from Weiss & Goldring in Alexandria, La., was an early adopter and is famous for selling all manner of gifts from Baccarat crystal to specialty foods. Miller Brothers in Atlanta believes so strongly in the category that they’ve opened a separate gift store.

Greg Miller (who owns both stores with his brother Robby; his daughter Madison and nephew Cole have recently joined the team, bringing a next-generation perspective) explains how it evolved. “I always loved clothes and always worked in the business: Oxxford, Mark Shale, and Barneys. Robby worked 10 years at H. Stockton. We never thought we’d own a store. We rented space in a showroom and did lots of home

and office visits. But 17 years ago, we had the opportunity to buy the building we’re in now. Thanks to the amazing clientele in Buckhead, business is thriving. We’re up 38 percent this year over a record 2021. Our menswear mix is now 40 percent tailored, 60 percent sportswear.”

Greg continues to explain that, because the main store is small (1,450 square feet of selling space), they never had enough room for gifts. But this past November, an 1,800-square-foot space opened up in the one spot they really wanted, 100 yards from the main store.

“Business has been amazing since Day 1,” says Miller. “The new store focus is on eclectic, always evolving product that you can’t find anywhere else.” Early assortments feature antiques, coffee-table books, candles, cutting boards from Provence, umbrellas, Native American jewelry, unique handmade jewelry, locally crafted handbags, even high-end cast-iron skillets, and a great collection of antique bourbon decanters. Greg proudly notes that he just sold an old painted metal Rolling Stones sign.

As it’s been said, “It’s not just a gift; it’s giving your soul a lift.” And there’s no time like the present.