Don’t Think Twice. Just Do DUO! DUO2 is packed with unique amenities like an inspiring Content Creation Room, Yoga Studio, covered Rooftop Patio, and more. Tower 2 will transform Downtown Brampton into a walkable, connected neighbourhood steps from the LRT and Sheridan College.

STUDIO, 1 & 2 BED + FLEX AND 3 BED CONDOS FROM THE $400s

*Prices, specifications and information is subject to change without notice. E.&O.E.

WAYNE KARL

EDITOR-IN-CHIEF

Condo Life Magazine

EMAIL: wayne.karl@nexthome.ca

TWITTER: @WayneKarl

Summer is over and fall is around the corner, by temperature as well as calendar, and the Bank of Canada again reduced interest rates recently.

It’s a natural period of transition, as we edge out of the warmer – and typically, in the context of real estate, slower months.

Most experts expected the BoC to introduce its third straight rate reduction on Sept. 4, helping to inspire more homebuying activity for those who are prepared, and giving those sitting on the sidelines the little nudge they might need.

All of this is good news as we look ahead to the final few months of 2024 and into 2025.

“The fall market is usually a good early indicator for activity as we look ahead to early 2025, and we’re headed toward more healthy territory,”

Christopher Alexander, president of ReMax Canada, says in the realty firm’s 2024 Fall Housing Market Outlook (see page 11). “With interest rates starting to ease, buyers are beginning to come off the sidelines.”

Atypically, perhaps, for this year compared to previous years, is that this period is also characterized by larger systemic challenges beyond market dynamics. Housing supply and affordability remain serious long-term challenges – so much so that the Building Industry and Land Development Association (BILD) is calling for urgent government action.

“The (July 2024 new home sales) numbers present a clear picture and signal the need for an urgent response from government,” says Justin Sherwood, senior vice-president of communications and stakeholder relations at BILD. “Changes in interest rates will not solve what is an ongoing structural problem, particularly evident in the GTA.”

Alexander concurs, for the resale market. “Ultimately, for the long-term health of Canada’s housing market, we need a national housing strategy developed in collaboration between all levels of government, that’s more strategic and visionary in how we can use existing lands and real estate to boost supply.

“Despite some consumer confidence starting to return to the market this season, the reality is Canadians are still grappling with some serious housing affordability challenges rooted in lack of supply,” he says. “Yes, borrowing is becoming less expensive, but this won’t make housing affordable in the long run. Markets ebb and flow, and as buyers re-enter the market and absorb inventory, we’ll see more upward pressure on price.”

Complex issues, indeed. But opportunities for new-home buyers remain, as other content in this issue explores.

For those prepared and ready to make their move, this window of opportunity may not be open indefinitely. Activity is picking up, and so too, likely in some markets, will purchase prices.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm based in Toronto. thinkhomewise.com

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

Linda Mazur is an award-winning designer and Principal of Linda Mazur Design Group. With almost two decades of experience this in demand multi-disciplinary design firm is known for creating relaxed, stylish spaces and full-scale design builds throughout the GTA and Canada. lindamazurdesign.com @LindaMazurGroup

Jennifer Pearce, TRREB President, is a Broker and Owner with ReMax Rouge River Realty Ltd., a family owned and operated brokerage. She is a secondgeneration realtor and has been licensed since 2000. trreb.ca

Lisa Rogers is Executive Vice-President of Design for Dunpar Homes. Lisa has shared her style and design expertise on popular television programs such as Canadian Living TV, House & Home TV and The Shopping Channel. Lisa is also a regular guest expert on CityTV’s Cityline. dunparhomes.com.

Jayson Schwarz LL.M. is a Toronto real estate lawyer and partner in the law firm Schwarz Law LLP. He can be reached by visiting schwarzlaw.ca or by email at info@schwarzlaw.ca or phone at 416.486.2040.

Dave Wilkes is president and CEO of the Building Industry and Land Development Association (BILD), the voice of the home building, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter at @bildgta or visit bildgta.ca

SENIOR VICE-PRESIDENT, SALES, NEXTHOME

Hope McLarnon

416.708.7987 hope.mclarnon@nexthome.ca

DIRECTOR OF SALES, ONTARIO, NEXTHOME Natalie Chin 416.881.4288 natalie.chin@nexthome.ca

SENIOR MEDIA CONSULTANTS Amanda Bell 416.830.2911 amanda.bell@nexthome.ca

EDITORIAL DIRECTOR

Amanda Pereira

EDITOR-IN-CHIEF – GREATER TORONTO AREA

Wayne Karl wayne.karl@nexthome.ca

CONTRIBUTORS

Jesse Abrams, Mike Collins-Williams, Debbie Cosic, Barbara Lawlor, Linda Mazur, Ben Myers, Jennifer Pearce, Lisa Rogers, Jayson Schwarz, Dave Wilkes

EXECUTIVE MEDIA CONSULTANTS

Jacky Hill, Michael Rosset

VICE-PRESIDENT, MARKETING – GTA Leanne Speers

MANAGER CUSTOMER SALES/SERVICE

Marilyn Watling

SALES & MARKETING CO-ORDINATOR

Gary Chilvers

BUSINESS DEVELOPMENT MANAGER

Josh Rosset

DISTRIBUTION distributionteam@nexthome.ca

ACCOUNTING INQUIRIES accountingteam@nexthome.ca

DIRECTOR OF PRINT MEDIA Lauren Reid–Sachs

VICE-PRESIDENT, PRODUCTION – GTA Lisa Kelly

PRODUCTION MANAGER – GTA Yvonne Poon

GRAPHIC DESIGNER & PRE-PRESS COORDINATOR Hannah Yarkony

GRAPHIC DESIGNER Mike Terentiev

up

Advertising Call 1.866.532.2588 ext. 1 for rates and information. Fax: 1.888.861.5038

Circulation Highly targeted, free distribution network aimed at real estate buyers using street level boxes, racking and Toronto Star in-home delivery.

Canadian subscriptions 1 year = 13 issues – $70 (inc. HST). Canada Post – Canadian Publications Mail Sales Product Agreement 40065416.

Copyright 2024 All rights reserved. All copyright and other intellectual property rights in the contents hereof are the property of NextHome, and not that of the individual client. The customer has purchased the right of reproduction in NextHome and does not have the right to reproduce the ad or photo in any other place or publication without the previous written consent of NextHome.

Editorial Submissions from interested parties will be considered. Please submit to the editor at editorial@nexthome.ca.

Terms and Indemnification Advertisers and contributors: NextHome is not responsible for typographical errors, mistakes, or misprints. By approving your content and/ or submitting content for circulation, advertisers and contributors agree to indemnify and hold harmless NextHome and its parent company from any claims, liabilities, losses, and expenses (including legal fees) arising out of or in connection with the content provided, including but not limited to any claims of copyright infringement, unauthorized reproduction, or inaccuracies in the content. Advertisers acknowledge that they have the necessary rights, permissions, and licenses to provide the content for circulation, and they bear full responsibility for the content’s accuracy, legality, and compliance with applicable laws upon approval. Contributors acknowledge NextHome reserves the right to omit and modify their submissions at the publisher’s discretion.

The federal government has announced what it says are the boldest mortgage reforms in decades, designed to address housing affordability and make homeownership more affordable for more Canadians.

Deputy Prime Minister and Minister of Finance Chrystia Freeland announced on Sept. 16 a suite of reforms to mortgage rules to make mortgages more affordable for Canadians and put homeownership within reach:

• Increasing the $1-million price cap for insured mortgages to $1.5 million, effective Dec. 15, 2024, to reflect current housing market realities and help more Canadians qualify for a mortgage with a downpayment below 20 per cent. Increasing the insured-mortgage cap – which has not been adjusted since 2012 – to $1.5 million will help more Canadians buy a home.

• Expanding eligibility for 30-year mortgage amortizations to all firsttime homebuyers and to all buyers of new builds, effective Dec. 15, 2024, to reduce the cost of monthly mortgage payments and help more Canadians buy a home. By helping Canadians buy new builds, including condos, the government is announcing another measure to incentivize more new home construction and tackle the housing

shortage. This builds on the Budget 2024 commitment, which came into effect on Aug. 1, 2024, permitting 30-year mortgage amortizations for first-time homebuyers purchasing new builds, including condos.

These new measures build on the strengthened Canadian Mortgage Charter, announced in Budget 2024, which allows all insured mortgage holders to switch lenders at renewal without being subject to another mortgage stress test. Not having to requalify when renewing with a different lender increases mortgage competition and enables more Canadians, with insured mortgages, to switch to the best, cheapest deal.

These measures are the most significant mortgage reforms in decades and part of the federal government’s plan to build nearly four million new homes – the most ambitious housing plan in Canadian history – to help more Canadians become homeowners. The government will bring forward regulatory amendments to implement these proposals, with further details to be announced in the coming weeks.

As the federal government works to make mortgages more affordable so more Canadians can become homeowners, it is also taking bold action to protect the rights of homebuyers and renters. As announced in Budget 2024, the government released the blueprints for a Renters’ Bill of Rights and a Home Buyers’ Bill of Rights.

These new blueprints will protect renters from unfair practices, make leases simpler, and increase price transparency; and help make the process of buying a home, fairer, more open and more transparent. The government is working with provinces and territories to implement these blueprints by leveraging the $5 billion in funding available to provinces and

territories through the new Canada Housing Infrastructure Fund.

As part of these negotiations, the federal government is calling on provinces and territories to implement measures such as protecting Canadians from renovictions and blind bidding, standardizing lease agreements, making sales price history available on title searches, and much more – to make the housing market fairer across the country.

“We have taken bold action to help more Canadians afford a down payment, including with the Tax-Free First Home Savings Account, through which more than 750,000 Canadians have already started saving,” says Freeland. “Building on our action to help you afford a down payment, we are now making the boldest mortgages reforms in decades to unlock homeownership for younger Canadians. We are increasing the insured mortgage cap to reflect home prices in more expensive cities, allowing homebuyers more time to pay off their mortgage, and helping homeowners switch lenders to find the lowest interest rate at renewal.”

National home sales increased in June following the Bank of Canada’s first interest rate cut since 2020, and activity posted another small gain in August on the heels of the second rate cut in late July, but the bigger picture appears to be a market mostly stuck in a holding pattern, according to the Canadian Real Estate Association.

Home sales recorded over Canadian MLS Systems edged up by 1.3 per cent on a month-over-month basis in August 2024, reaching their highest level since January and their second highest in over a year.

“Despite some fledgling signs of life to kick off the long-awaited monetary policy easing cycle, Canadian housing market activity still looks to be stuck in the same holding pattern it’s been in all year,” says Shaun Cathcart, CREA’s senior economist. “That said, with ever more friendly interest rates now all but guaranteed later this year and into 2025, it makes sense that prospective buyers might continue to hold off for improved affordability, especially since prices are still well behaved in most of the country.”

There were about 177,450 properties listed for sale on all Canadian MLS Systems at the end of August 2024, up 18.8 per cent from a year earlier but still more than 10 per cent below historical averages of about 200,000 listings for this time of the year.

New listings posted a 1.1-percent month-over-month increase in August. For the second month in a row, the national increase was led by a much-needed boost in new supply in Calgary. New listings were also up in Edmonton, offsetting a decline in the Greater Toronto Area.

With sales rising by only slightly more than new listings in August, the national sales-to-new listings ratio moved up to 53 per cent, almost unchanged from 52.9 per cent in July.

In fact, the measure has barely moved from its current level since April. The long-term average for the national sales-to-new listings ratio is 55 per cent, with a sales-to-new listings ratio between 45 and 65 per cent generally consistent with balanced housing market conditions.

“With more interest rate cuts now expected between now and next summer, the stage is set for a faster return of demand, but we’re clearly not there just yet,” says James Mabey, Chair of CREA. “There are typically four times in any given year that see a burst of new supply that can excite the market and draw buyers off the sidelines, and those are the first weeks of April, May, June and September. So, the first week of September saw not only a third rate cut, but also a lot of new properties for buyers to consider.”

There were 4.1 months of inventory on a national basis at the end of August 2024, down from 4.2 months at the end of July. Continuing the theme of the market being in a holding pattern, this measure of market balance has been rangebound between 3.8 months and 4.2 months since last October. The long-

term average is about five months of inventory.

The non-seasonally adjusted National Composite MLS HPI stood 3.9 per cent below August 2023. This mostly reflects price gains last spring and summer that were followed by declines in the second half of last year. As such, it’s mostly likely that year-over-year comparisons will improve from this point on, CREA says.

The actual (not seasonally adjusted) national average home price was $649,100 in August 2024, almost unchanged (0.1 per cent) from August 2023.

Greater Toronto Area (GTA) new home sales in July remained slow, recording an all-time low for the month with very few new project releases and steadily increasing months of inventory, the Building Industry and Land Development Association (BILD) reports.

There were 654 new home sales in July which was down 48 per cent from July 2023 and 70 per cent below the 10-year average, according to Altus Group, BILD’s official source for new home market intelligence.

“The numbers present a clear picture and signal the need for an urgent response from government,” says Justin Sherwood, senior vicepresident of communications and stakeholder relations at BILD. “Changes in interest rates will not solve what is an ongoing structural problem, particularly evident in the GTA. The cost to build, driven by excessive government fees and taxes, is simply too high. Without immediate action by government, new construction activity will continue to slow and the GTA’s housing shortage will reach unprecedented levels over the next few years.”

“GTA new homes sales in July 2024 sank to another record monthly low as buyers remained unwilling to leave

the sidelines,” says Edward Jegg, research manager with Altus Group. “Further expected decreases in interest rates in the coming months, along with elevated inventories, means there will be plenty of opportunities once consumer confidence improves.”

Condominium apartments, including units in low-, mediumand highrise buildings, stacked townhouses and loft units, accounted for 287 units sold in July, down 67 per cent from July 2023 and 81 per cent below the 10-year average.

There were 367 single-family home sales in July, down one per cent from July 2023 but 42 per cent below the 10-year average. Single-family homes include detached, linked and semi-detached houses and townhouses (excluding stacked townhouses).

Total new home remaining inventory increased compared to the previous month, to 21,660 units. This includes 17,445 condominium apartment units

and 4,215 single-family dwellings. This represents a combined inventory level of 15 months, based on average sales for the last 12 months. This is a high inventory level, maintaining the trend seen since autumn 2023 of remaining inventory levels near or just above the 20,000-unit mark. Months of inventory are increasing not because the number of new units coming to market is dramatically increasing, but rather because sales are continually decreasing. This is an unhealthy situation, because as interest rates decrease, sales will return but it will take longer for new building to recover, setting up a future supply/ demand imbalance.

Benchmark prices decreased in July for both single-family homes and condominium units compared to the previous year. The benchmark price for new condominiums was $1.02 million, which was down six per cent over the last 12 months, while new single-family homes were $1.58 million, down five per cent.

With the long-anticipated decline in interest rates finally starting to materialize, early indicators from brokers and agents across Canada suggest steady housing market activity this fall. Average sale prices across all housing types are expected to increase between one and six per cent in the majority of regions by year’s end, according to ReMax’s 2024 Fall Housing Market Outlook.

Ahead of the Bank of Canada (BoC) interest rate announcement on Sept. 4, two in 10 Canadians (16 per cent) said they will feel more comfortable engaging in the real estate market once they see there is more than a 100-basis-point cut to the BoC’s lending rate between now and the end of the year, according to a Leger survey commissioned by ReMax as part of the report.

“The fall market is usually a good early indicator for activity as we look ahead to early 2025, and we’re headed toward more healthy territory,” says Christopher Alexander, president of ReMax Canada. “With interest rates starting to ease, buyers are beginning to come off the sidelines. That’s not to say the fall market will be in full swing according to historic standards. Consumers will drive that trend, so we’ll need to see a bigger move by the Bank of Canada for that to happen.”

Ahead of further anticipated interest rate cuts by the Bank of Canada, it seems that even the mere prospect of lower rates has boosted confidence among first-time homebuyers, with 25 per cent of Canadians actively saving for a home purchase and confident they will be able to buy soon (with the majority being younger Millennials and Gen Zs aged 18 to 24, at 35 per cent).

On the flipside, dropping interest rates now may prove too little, too late for some current homeowners, with 14 per cent saying they need to renew their mortgage soon, and with

the current higher interest rate, they may need to sell their home.

When it comes to financial savings, the Leger survey revealed that while a home purchase is listed among the top three priorities for 25 per cent of Canadians, it has taken a back seat to day-to-day expenses such as utilities and food (58 per cent) and travel (45 per cent).

In the search for affordability, onequarter of Canadians say that they are considering moving to another country (28 per cent) and 25 per cent say they are reconsidering whether to have children or start a family due to housing affordability challenges.

“Despite some consumer confidence starting to return to the market this season, the reality is Canadians are still grappling with some serious housing affordability challenges rooted in lack of supply,” says Alexander. “Yes, borrowing is becoming less expensive, but this won’t make housing affordable in the long run. Markets ebb and flow, and as buyers re-enter the market and absorb inventory, we’ll see more upward pressure on price.

“Ultimately, for the long-term health of Canada’s housing market, we need a national housing strategy developed in collaboration between all levels of government, that’s more strategic and visionary in how we can use existing lands and real estate to boost supply. In the meantime, buyers would be wise to work with an experienced real estate agent to help navigate those cyclical market ups and downs that often accompany this push and pull of supply and demand.”

Despite interest rate cuts, low housing supply continues to impact multiple markets across Ontario, keeping prices high. However, some buyers are gaining more confidence as mortgage rates decrease and are slowly re-entering the market heading into fall, keeping prices relatively stable in comparison to

the year prior, ReMax says. Housing supply is expected to become a larger issue once further interest rate cuts motivate buyers on the sidelines to re-enter the market and spark more competition.

Across Ontario, 12 regions are expecting average residential prices to remain flat or increase modestly heading into the fall. Increasing markets include Brampton, Mississauga and Barrie (each rising five per cent), Peterborough, York Region and Kingston (three per cent), Niagara (two per cent), and Durham Region and Ottawa (one per cent).

Citing runaway bureaucracy, endless red tape, exorbitant taxes and a slow and dysfunctional approvals system, the Residential Construction Council of Ontario (RESCON) says immediate action is necessary to build more homes, and is taking its own steps to do it.

“In many ways, we are still in the dark ages when it comes to housing approvals,” says Richard Lyall, president of RESCON. “The residential construction industry is handcuffed by the extensive labyrinth of restrictive rules, cumbersome processes and exorbitant fees. It’s like a self-inflicted wound. Plans that have been developed lack focus and vision and it will take a serious epiphany to turn the situation around.”

To spark discussion and tackle the crisis, RESCON is hosting its fourth annual online housing summit on Wednesday, Oct. 9, from 12:30 to 4:30 p.m. The public is invited to tune in to the free online event and can register at eventbrite.ca. The summit will feature an exciting lineup of elected officials, senior public service decisionmakers, housing sector thought leaders and influencers, public opinion analysts and others who will discuss challenges, opportunities and policy changes that are required to get the housing sector back on track.

Discussions and presentations will cover a number of topics, including taxes, fees and levies, public policy initiatives, public opinion surveys, market analysis and potential solutions. Confirmed speakers include Toronto Mayor Olivia Chow, Guelph Mayor Cam Guthrie, Oshawa Mayor Dan Carter, Barrie Mayor Alex Nuttall, London Mayor Josh Morgan, Tony Irwin of the Federation of Rental-housing Providers of Ontario (FRPO), Jason Mercer of the Toronto Regional Real Estate Board (TRREB), Marlon Bray of Clark Construction Management, David Coletto of Abacus Research, David Amborski of TMU, Corey Pacht of Fitzrovia, architect Naama Blonder, and Jag

Sharma2, deputy city manager, development and growth services at the City of Toronto. Sponsors are FRPO, TRREB and Enbridge.

RESCON says it is hoping that the event will spark ideas, discussions and action to boost housing supply.

“We are in the midst of Canada’s worst-ever housing affordability and supply crisis,” says Lyall. “Housing starts are down, the condo market is deteriorating to levels not seen since the recession in the 1990s, and we are falling far short of the number of homes that need to be built to make housing affordable and attainable. Approval timelines are growing longer and taxes on a new home are jawdropping, as they now account for 31 per cent of the price tag, which is only adding insult to injury.”

In the last six months, for example, the population in Ontario grew by 200,000, but the province had only 37,425 housing starts. That’s 6,577 fewer units from the same period in 2023.

“Approval timelines, meanwhile, have grown longer not shorter, which only adds to the cost of buying a new home,” adds Lyall. “The system is completely off the rails. It’s like we are on the wrong track and witnessing a slow-moving train wreck. Immediate and urgent action is needed.”

Whether you’re thinking about demolition or decoration, the 2024 Fall Home Show is your one-stop destination for home improvement.

Returning to the Enercare Centre at Exhibition Place from Sept. 27 to 29, the Fall Home Show features more than 250 vendors and experts offering services, education and free advice on everything from sustainable building materials and energyefficient appliances to the latest in cutting-edge automotive security. Browse for design and decorating inspiration with seasonal tablescapes, and get into the Halloween spirit with free activities such as painting your own pumpkins and participating in ghost tours around the haunted Exhibition grounds, led by paranormal investigators.

New speaker additions to the Main Stage this fall include:

• Tips To Prevent Car Theft: Moderated by Stephanie Henry, Breakfast Television’s traffic reporter and automotive service

technician, the Canadian Automobile Association (CAA) and Toronto Police Services will share tips on safeguarding your car to protect against the steep rise in at-home car thefts.

• Net-Zero Homes Plus Tips to Protect Your Home in the Face of Climate Change: Beyond sustainable materials and energy efficiency, net-zero homes enhance quality of life, ensure clean air, and boost resilience to climate change. Todd Talbot (Love It or List It Vancouver hit the Main Stage to share his insights on why passive homes are the future.

• Organizing for Busy F

Like New Year’s resolutions, the back-to-school organizational plans are often short-lived.

Professional organizer Nicola Masterson shares practical tips for organizing based on how you live rather than forcing your life to fit around organizational methods.

Plus, catch more of your favourite TV personalities, including Michael Holmes Jr., Sherry Holmes, Frankie Flowers, Steven Sabados, Sarah Gunn and Desta Ostapyk, all on hand to provide design inspiration and renovation tips to elevate your space and seasonal style.

Tickets for the Fall Home Show are now on sale at fallhomeshow.com.

52pick-up.com

25 years in the making – Exclusive story from Emblem’s founder and CEO

Growing up in Ottawa, Kash Pashootan showed entrepreneurial spirit early on, running multiple paper routes, hiring family and friends and doing deals with the local businesses. Now CEO of Emblem Developments, Pashootan has been doing things right since he was 12 years old.

What do falling interest rates mean for buyers in the short and long term?

In recent months, we’ve seen a downward trend in interest rates that’s expected to continue. Understanding how these rate drops impact the market, both in the short and long term, can help homebuyers, especially firsttimers, strategically plan a way to finally make their entrance.

Introducing the Wellings of Whitby – an active community for adults 55-plus

In the ever-evolving realm of senior living, Wellings of Whitby, by Nautical Lands Group, stands out as a beacon of active retirement living reimagined for a new generation. The first of two phases is set to unveil this fall, offering 400 apartment suites and a myriad of amenities for a lifestyle characterized by growth, connection, convenience and a profound sense of community.

New-home buyers need federal HST rebate program that actually delivers One of the established methods to provide some relief for new-home buyers is the federal GST/HST New Housing Rebate – but it has become painfully clear that the program is outof-date.

Navigating the GTA housing market

The Bank of Canada did what we all hoped on July 24 – instituting its second consecutive interest rate cut, reducing the policy rate by 25 basis points to 4.25 per cent. The hope is that the move kicks off a notable pick-up in homebuying – and building – and that the reduction is the first of many.

Set at the gateway to cottage country, just minutes from downtown Barrie and the South Shore of Kempenfelt Bay, FOUR10 Yonge showcases an exciting collection of all-new urban townhomes.

Featuring floorplans of up to 2,100 sq. ft. with stunning rooftop terraces of up to 500 sq. ft., interior highlights include flowing sun-filled interiors spread over three magnificent levels, spacious 2 and 3 bedroom layouts, generous gourmet-inspired kitchens with every convenience close at hand, private primary bedroom retreats, and a choice of direct access single or double car garages.

2, 3 & 4 Bedroom Urban Townhomes With Rooftop Terraces. Up To 2,100 Sq. Ft.

Register Today At masonhomes.ca

NATURE-INSPIRED COMMUNITY IS RISING IN THE BAYVIEW VILLAGE NEIGHBOURHOOD

Construction of Amexon’s The Residences at Central Park is well underway on Sheppard Avenue in the east end of the prestigious Bayview Village neighbourhood. Central Park is a vibrant, mixed-use condominium community where urban life meets and marries with the natural world – residents enjoy proximity to a range of urban conveniences, and also have direct access to the East Don Parkland’s sprawling, forested ravine that embraces the property in lush nature.

This master-planned development is one of the largest residential projects currently under construction in Toronto. The first residential building in this 12-acre, environmentally sustainable community is sold out, with phase two launching soon. Buyers are responding with enthusiasm for a variety of reasons, including Central Park’s excellent location, forward-thinking Green features, and an array of indoor and outdoor amenities offering lifestyle opportunities for all ages.

The Ontario Home Builders’ Association (OHBA) has awarded Central Park with the coveted Project of the Year Award – People’s Choice. This highly sought-after award recognizes project excellence and is given to a company that exemplifies outstanding professionalism and integrity with its business, community and the industry at large. “Our project team includes a group of talented consultants including CORE Architects Inc. and II BY IV Design,” says Amexon’s Executive Sales Manager Jason Shiff.

Central Park is just down the street from Bayview Village Shopping Centre, offering everything from upscale restaurants and retail to lifestyle and wellness venues. And getting around the city, the GTA and beyond will be incredibly convenient – the Leslie subway station and relocated Oriole GO station are situated at Central Park, so residents have public transit available right at their front door. In addition, Yorkdale, Fairview Mall, golf courses, parks and

other destinations are within easy reach with Hwy. 401, the 404 and Don Valley Parkway close by.

At the heart of the community, is the award-winning Central Park Common – a landscaped, threeacre urban park that will resemble a traditional village green. Destined to become a social hub to meet with friends and neighbours, this park will feature pedestrian-friendly streets lined with bike paths, casual dining venues, fountains, reflecting pools

and year-round programming that will include a farmers’ market and iceskating rink. Other highlights include retail space, restaurants and services including on-site daycare facilities.

The East Don Parkland’s 500 acres of lush, urban forest embraces Central Park, making nature a neighbour and elevating an active lifestyle in this prime Toronto location.

“Central Park is a nature-inspired, upscale community unlike anything else in Toronto,” says Shiff. “Central

Park will be a quiet oasis in vibrant urban surroundings, where outdoor lovers are going to be able to immerse themselves in nature all year long. The ravine is part of the Don River Valley parklands where there’s a network of walking and cycling trails to explore that lead all the way downtown. And the trails are beautiful during all four seasons, so residents can enjoy outdoor pastimes to the fullest, like hiking, biking, birding and cross-country skiing. The opportunities for a high quality of life in this upscale community are exceptional.”

With environmental sustainability high on the priority list, Central Park has been recognized by the Building Industry and Land Development Association (BILD) as a finalist for the Green Builder of the Year award. The entire community will be constructed to Amexon’s Green Development Standard incorporating industryleading Green features. Setting a new standard in the sustainability arena, Central Park is the first largescale project of its kind in Canada to include EV charging stations in all parking areas for residents, visitors and office tenants, as well as retail patrons for the restaurants and cafes. All in all, there will be more than 1,500 charging stations installed. Additionally, there will be on-site auto- and bike-share options available. The towers’ design features reflective solar panels that supplement the building’s energy

needs, and Green roofs that reduce energy consumption. Thermal building envelopes minimize energy usage and next-generation mechanical systems incorporate advanced airflow and filtration.

The visionary design of Central Park is another attraction for prospective residents. Amexon enlisted an award-winning team to craft what is sure to become a local landmark. CORE Architects has created a striking exterior for the condominium towers that focuses on an intimate connection with nature – the façades feature an organic leaflike design in a continual

interplay of sun and shade, and six-ft.-deep balconies offer inspiring views of the Toronto skyline and meandering East Don Parkland ravine through floor-to-ceiling windows. Central Park’s design features an elegant, hotel-inspired, port-cochere entry, with an artisan-designed fountain, original art installation and lush landscaping by renowned Cosburn Nauboris Landscape Architects. These architectural highlights express a harmonious coexistence between sparkling glass and nature, setting this condominium residence apart as something truly visionary.

Suite and amenity interiors by II BY IV DESIGN are both warm and sophisticated, with modern features and finishes grounded in natural materials and earthy colours. The focus was on capturing the allure and comfort of nature, uniting a love of the outdoors and creative living. The effect is new and fresh, evoking a conception of classic modernism.

All Central Park residents will have the use of 55,000 sq. ft. of fitness, wellness, leisure and social amenity

space. A highlight is The Park Club, where fitness enthusiasts can access indoor and outdoor saltwater pools, a state-of-the-art fitness club and half-court basketball. Families are sure to make great use of the screening room/theatre, ice-skating rink, piano lounge, bowling alley, private event space, hobby studio and kids’ club. Guest suites will be available to accommodate friends and family members.

Among the other leisureinspired amenities will be rooftop Zen gardens, barbecue areas, golf simulator, a yoga studio, recording/ media studio and pet daycare/ grooming facilities. The Park Club will include a 5,000-sq.-ft. coworking space, catering to the evolving needs of professionals who are working remotely, that will foster networking and productivity for either a hybrid work model or growing your own business, with smart technology, meeting rooms, hot desks and a business centre –giving new meaning to “working from home.”

The community will eventually encompass more than 1,500 suites in one- to three-bedroom plus den layouts, in sizes from 439 to 1,200 sq. ft. Features and finishes include nine-ft.-high ceilings and European-inspired kitchen

cabinetry by II BY IV DESIGN. Best of all, these living spaces incorporate flow-through layouts that make the most of spectacular views from the floor-to-ceiling windows and generous outdoor balconies. Prices begin from the $700,000s.

Amexon Development Corp. is one of Toronto’s most prominent and innovative real estate developers, building their reputation as a multiaward-winning firm by delivering superior-quality properties. The firm owns and manages an impressive portfolio of office, retail, industrial, hotel and residential properties.

Amexon’s award-winning, mustsee 10,000-sq.-ft., all-glass Central Park Presentation Centre is located at 1200 Sheppard Ave. E., Toronto. Flooded with natural light through its floor-to-ceiling glass walls, the centre was built to be a permanent fixture, with plans for it to serve in future as a community event venue once the site is built out. Visitors can indulge in gallery-like surroundings that include kitchen, bathroom and walk-in closet vignettes, and explore a curated selection of premium interior finishes and high-end appointments that come standard here.

For more information, call 416.252.3000 or visit centralparktoronto.com.

The GTA housing market is grappling with a range of challenges, from affordability concerns to market slowdowns and difficulties for developers and lenders. With fluctuating land costs, confusing government policies and shifting buyer preferences, the question arises: How can the industry strike a balance between housing affordability and profitability in today’s economic landscape?

These topics were the focus of a recent industry event hosted by Norm Li, where key experts discussed the state of the housing market. These

themes were explored further in Episode 70 of the Toronto Under Construction podcast, featuring guests Bryceson Dodge from Empirical Capital, Adit Kumar from Anbros Financial, and Richard Munroe from Atrium Mortgage Investment Corp.

The discussion started with the ubiquitous topic of affordability. People’s ability to afford housing has been a concern in the GTA for years. Several factors have contributed to rising prices, including government policies, taxes and development fees, which often make up a significant portion of construction costs. In fact, nearly a third of new construction costs are attributed to taxes and fees, which inevitably get passed on to the end user. These financial burdens, alongside negative public sentiment about new housing, have added pressure to the market.

Despite these challenges, there are solutions. Expanding into suburban areas, where land costs are lower, has allowed builders to deliver more affordable housing. Areas such as Kitchener-Waterloo and Hamilton, once considered peripheral to the GTA, have seen significant growth as more people adopt hybrid work models, spending less time in the office.

Developers often find themselves blamed for the high cost of housing. However, many are making positive contributions by offering innovative suite designs, such as secondary suites and flexible deposit structures that ease the burden on buyers. But the flipside is that poor acquisition strategies, overpaying for land and focusing on high-profile, high-profit developments have also contributed to the housing crisis.

“ ” The GTA housing market faces several complex challenges, but there are opportunities for growth and improvement.

The question arises: Should developers prioritise affordability or focus on delivering high-quality products for profit? The reality is that developers need to strike a balance. Buyers’ ability to afford new units is not only crucial for the developers’ profitability but also for the health of the market as a whole. High land prices and ambitious construction projects have fuelled the perception that developers are prioritising profit over affordable housing, which has tarnished the industry’s reputation.

Changing public perception about condo living and the development industry is becoming increasingly important. There is a growing recognition that a coordinated effort is needed to educate the public on the benefits of condos and higherdensity housing in urban areas. Developers also need to combat the stigma around poor construction quality by ensuring their projects meet or exceed buyer expectations.

Improving public sentiment is not just about quality control –it’s also about transparency and communication. By addressing these concerns head-on, developers can rebuild trust and showcase the value of well-planned, high-density housing.

In the short term, the GTA housing market is likely to see fewer investor buyers and slower sales. However, the long-term outlook remains more optimistic. Lifestyle shifts – such as the growing trend toward working

from home – are expected to drive future demand, especially in suburban areas. Government policies and an improved mix of housing products are also expected to contribute to this positive shift.

One of the key short-term challenges for developers is that many land purchases made in the past five years have stalled. Weak market conditions have prompted delays in construction, with lenders extending land loans rather than forcing repayment. This highlights how lenders are working alongside developers to maintain market stability and avoid defaults.

Valuing land and determining market value has become another challenge due to a lack of transactions in the development space. Appraisers are finding it difficult to assess values accurately, which in turn affects lending decisions. To mitigate risk, lenders are adjusting loan amounts based on loan-to-value (LTV) ratios when appraisals fall short.

In response to these market conditions, developer priorities have shifted. In the short term, many are focused on survival, operational efficiency and improving public sentiment. In the long term, the focus will shift to delivering the right product mix, improving market absorption data and adopting innovative construction methods to maintain competitiveness and affordability.

Smaller developers, in particular, are being advised to stick to their core strengths. Rather than attempting to downzone or pivot to new types of developments, they should focus on what they do best. This advice underscores the importance of maintaining discipline and avoiding unnecessary risks in an already volatile market.

For developers dealing with unsold inventory, there are several strategies to consider. Some are renting out unsold units, selling them at a discount compared to 2022 prices, or even listing them on platforms such as Airbnb as a temporary solution to

maintain cash flow while waiting for the market to stabilize.

This need to get creative extends to the sales process as well. Broker commissions have become a key factor in moving unsold inventory. Many developers are offering higher commissions and incentives such as exotic trips for agents to push sales. However, this practice has raised concerns about short-sighted decisions, with agents pushing projects that may not be viable longterm. A more balanced approach to commissions, with a focus on the project’s viability, is needed to maintain trust between buyers, agents and developers.

The GTA housing market faces several complex challenges, but there are opportunities for growth and improvement. By focusing on affordability, improving developer practices and fostering better cooperation between lenders and brokers, the industry can navigate the current downturn and prepare for a stronger, more sustainable future. The balance between profitability and affordability will remain a key issue, but with thoughtful strategies and coordinated efforts, the market can emerge from its current challenges with renewed strength.

If you’re looking to buy a new single-family house or condominium this year, do a lot of research, talk to a mortgage broker and get a fulsome understanding of what you can afford and the appropriate value in the neighbourhood you’re exploring. Good luck.

Ben Myers is the President of Bullpen Consulting, a boutique residential real estate advisory firm specializing in condominium and rental apartment market studies, forecasts and valuations for developers, lenders and land owners. Contact him at bullpenconsulting.ca and @benmyers29 on Twitter.

+MORE CONTENT ONLINE nexthome.ca

TIM NG

For this column, I wanted to pull back the curtain and share some insights into our team’s process and operations as we continue to be trailblazers at the forefront of connecting technology and real estate.

After more than a decade of spearheading innovative real estate technology and creating digital experiences through our visualization company ADHOC STUDIO, we set out to bring the antiquated and manual process of new development sales into the digital age.

We conducted focus groups to understand the needs and shortfalls of the sales and marketing process and built the roadmap for the digital future.

We leveraged our extensive industry knowledge and passion for innovation to create Blackline, a robust sales platform that is the perfect union of real estate, technology and results. In less than five years, more than 80,000 units have been sold on our platform by some of the most reputable developers and sales teams across Canada.

As the principal of Blackline, I am always exploring emerging trends and how we can tackle the unique challenges and evolving needs of new development sales. Through ongoing conversations and client feedback, we identify gaps and anticipate future demands across the various markets we operate in.

Our product development process is driven by the invaluable insights from two key sources: Our sales team, who are on the front lines with firsthand market experience, and our client success team, who work closely with our clients daily. Together, they provide a wealth of knowledge, from market trends and consumer behavior to the latest tech advancements.

In regular collaborative sessions, we carefully analyze this information to establish actionable insights. This teamwork ensures that every feature we build is not only innovative, but also deeply rooted in real-world practicality.

Our technology team, made up of visionary software engineers and designers, is passionate about pushing boundaries. Their goal? To create solutions that not only meet but exceed industry standards. We’re focused on optimizing the Blackline experience, making sure every feature we develop drives impactful results –ensuring a smoother, more efficient process for everyone who interacts with the platform.

Our success lies in decisionmaking that prioritizes the most meaningful product improvements. Using agile methodologies, we work collaboratively, refining and enhancing ideas at every stage. We even beta test with our early adopter clients, collecting feedback and finetuning along the way to ensure we are delivering an optimized product with maximum efficiency.

This holistic approach keeps us at the forefront of industry innovation. As we continue to expand and evolve, we are not looking to follow the existing path but create a new one that enhances the client experience when it comes to buying a preconstruction home.

Tim Ng is the Principal and Founder of ADHOC STUDIO and BLACKLINE, an industry-leading digital studio that combines real estate, art and technology. To learn more about ADHOC’s awardwinning renderings and industry leading sales platform, BLACKLINE, visit adhocstudio.ca and blacklineapp.com.

+MORE CONTENT ONLINE nexthome.ca

+ nexthome.ca

Here you are getting ready to make what may be the largest single purchase that you will ever make in your life, when you are confronted by daily doses of anxiety caused by uncertainty and indecision. “What do I do?” you ask yourself.

Don’t be afraid, take your time, do the necessary research to identify the area you like, the services available to you and ensure that there are no hidden matters that could affect your decisions.

Research prospective neighbourhoods for future development, possible restrictions and their potential impact on property values.

Next, have an honest look at your employment situation, speak with your supervisor and make sure things are as secure as you can. If applicable, speak to your significant other and prepare a detailed budget for all your expenses as prospective homeowners. Consider what happens if interest rates rise, and be prepared for exigencies. Open a separate homebuying deposit account, and make weekly contributions to ensure you can maximixe a down payment.

Interest rates appear to be on their way down, but in times of uncertainty, you may have to lower your expectations and move slowly. Buy a small condominium and then look to move every three to five years, as home values may not appreciate as quickly as they have

in the past. Look to live outside the city, and look for job opportunities in smaller communities with more affordable housing.

The decision to buy should be motivated directly according to what you can afford. It may be difficult, but be very selective about nights out and your discretional spending. Prioritize what you want –being able to buy a home.

The next thing to note is that the cost of construction is starting to come down, and builders will be much more amenable to negotiation than they have in many years. Find a builder that is selling to your price range and then worry about what necessities you need in your negotiations to ensure the home will work for you.

When it comes to the professionals you will need to help you with your purchase, consider this checklist:

Whether at your bank or a mortgage broker, find a reputable financial expert you trust and are comfortable with. Find out how much money you can borrow and how much of a deposit you’ll need to put down. This will allow you to focus on homes you can afford. Get a pre-approval in writing so you have something to rely on, because today especially, it is critically important that you do not get caught up in the rush of buying a house beyond your budget. Nothing is worse than living for the house, not living in your home.

Look around for a lawyer who focuses on residential real estate in

their firm. Check Google reviews and rankings, and look in real estate magazines such as Condo Life and HOMES. Ensure the lawyer does more than just close your deal. You want someone who will explain the different kinds of ownership, why you should have a will before closing and other matters. Make sure they actually review your offer and all associated costs.

3. REALTOR:

Look for an experience realtor who knows the area you’re looking in, as well as the type of home you’re purchasing. Don’t just use a family friend or distant relative. Research potential realtors online, and get referrals from other homebuyers they’ve worked with.

Once you’ve found that perfect home, let your lawyer know so they are prepared to review the offer when received.

By fully and properly preparing for buying a home, you will change any potential anxiety and fear into excitement and a sense of accomplishment. Good luck.

Jayson Schwarz LL.M. is a Toronto real estate lawyer and partner in the law firm Schwarz Law Partners LLP. Visit online at schwarzlaw.ca or email info@schwarzlaw.ca with your questions, concerns, critiques and quandaries.

+MORE CONTENT ONLINE nexthome.ca

RIZ DHANJI

The real estate market, especially in the Greater Toronto Area, has always been a hot topic of conversation,

and for good reason. In the past three to five years, market shifts have been driven by population growth, with most new immigrants settling in Ontario, creating strong housing demand. For buyers considering getting into the market, especially firsttime homebuyers or local investors, pre-construction condos have always offered a unique opportunity to enter

the market. If you’re on the fence, here’s why now is the perfect time to invest in pre-construction.

MARKET CONDITIONS FAVOUR BUYERS (AT THE MOMENT)

The real estate market can be cyclical, and we are currently in a period where conditions favour buyers more than they have in recent

years. In recent months, we’ve seen a stabilization in home prices, particularly in the condo sector. After several years of rapid price increases, the market has cooled somewhat, making pre-construction condos more accessible to a wider range of buyers.

Developers are also offering never-before seen incentives to entice buyers. With some projects taking longer to sell out, builders are providing flexible deposit structures, capped development charges, lowered closing costs and even upgrades or credit on closing incentives to make their developments more appealing.

“ ” Pre-construction condos are a proven way to build wealth, offering significant financial advantages.

These types of incentives were hard to come by just a few years ago during the height of the real estate market but today, buyers have the advantage in getting more value for their investment.

While interest rates have been a concern for many buyers, it’s important to consider the bigger picture, and that we’re likely looking at a window of opportunity. Yes, rates are higher now than they were at their historic lows, but they are still relatively low compared to long-term averages. Economists are already forecasting that borrowing costs will start to come down faster than expected. In fact, we could see the Bank of Canada reduce its policy rate from the current 4.25 per cent to about three per cent by next July. By 2026, the overnight rate is predicted to average 2.75 per cent, and there’s a good chance we could see five-year mortgage rates dip below three per cent by the end of that year. What this means for buyers is simple: While rates might be higher today, locking in a pre-construction condo now gives you time to ride out the current interest rate environment. By the time your unit is ready for occupancy in a few years, you could be locking in a much more favourable mortgage rate.

This is especially advantageous for first-time buyers and investors, as the extended timeline of preconstruction allows you to plan for your financial future with more confidence. If you’ve been holding off because of current rates, it might be time to reconsider.

Pre-construction condos are a proven way to build wealth, offering significant financial advantages. Buying at today’s prices allows you to lock in your investment in a market poised for growth. By the time your unit is completed, there’s a good chance that the market value of your unit will have increased, potentially providing you with substantial equity returns.

Additionally, new condos attract quality tenants and command higher rental rates due to their modern design and prime locations, boosting your potential return on investment if used as a rental property.

As inflation drives up living costs, real estate remains one of the smartest investments. Preconstruction condos, especially in the GTA, offer stability and longterm growth, safeguarding your buying potential.

Now is the time to seize the opportunity. With favourable market conditions, manageable interest rates and strong potential for appreciation, investing in pre-construction makes sense. Whether you’re a firsttime buyer or an investor, a sales and marketing firm such as RAD Marketing can help you navigate the process and make the most of these opportunities.

Riz Dhanji is Pre-construction Sales and Marketing Specialist at RAD Marketing. radmarketing.ca.

+MORE CONTENT ONLINE nexthome.ca

MIKE COLLINS-WILLIAMS

As you explore ways to improve your home’s energy efficiency, recent advancements in homebuilding technology provide numerous opportunities to enhance comfort and reduce utility expenses. Whether you’re making incremental changes or investing in advanced systems, these innovations help create a more sustainable and cost-effective living environment.

A major innovation in home heating and cooling is the modern heat pump. Heat pumps transfer thermal energy between your home and the outside environment, providing both heating and cooling in one system. Recent advancements, such as variablespeed compressors, allow for precise control of energy usage, adjusting output to meet current needs, which leads to improved efficiency and reduced costs. New refrigerants and improved designs allow heat pumps to function efficiently across wider temperature ranges, making them viable in diverse climates. Many models are also equipped with smart controls, enabling users to optimize performance remotely, further enhancing energy savings.

ENERGY EXCHANGE SYSTEMS:

Energy recovery ventilation (ERV) and heat recovery ventilation (HRV) systems improve indoor air quality while conserving energy by transferring heat and moisture between outgoing and incoming

air. This reduces the energy needed to heat or cool incoming air by pre-conditioning it. ERV systems are particularly effective in climates requiring both heating and cooling, maintaining a balanced indoor environment. HRV systems, optimized for colder climates, recover heat from exhaust air. Both systems enhance comfort and reduce energy consumption by ensuring fresh air circulation without excessive energy loss.

ADVANCED INSULATION:

Insulation is a cornerstone of energy efficiency, and innovations such as aerogel and vacuum-insulated panels now offer exceptional thermal resistance with minimal thickness. Aerogel is one of the lightest and most effective insulating materials, offering superior thermal performance. Vacuum-insulated panels deliver similar benefits while maintaining a sleek profile. Enhanced versions of traditional materials such as spray foam and cellulose now offer better air sealing and reduced thermal bridging, minimizing heat loss and decreasing the demand on heating and cooling systems, ultimately lowering energy bills.

Passive cooling methods focus on reducing indoor temperatures without relying heavily on mechanical air conditioning. Techniques include reflective roofing materials, lightcolored paints to minimize heat absorption, and strategic shading from overhangs or awnings to block direct sunlight. Placement of windows and the use of operable vents can promote natural ventilation, facilitating cross-breezes. Advances in window technology, such as low-emissivity

(Low-E) coatings and thermochromic glass, further enhance passive cooling by regulating heat transfer. These strategies reduce the need for air conditioning and create a more comfortable indoor environment.

Smart home technology further enhances energy efficiency. Smart thermostats can learn your schedule, optimize temperature settings and be controlled remotely, reducing heating and cooling costs. Energy management systems monitor real-time energy use and provide recommendations for improving efficiency. Additionally, smart lighting and appliances can be programmed to operate only when needed, reducing overall energy consumption. The ability to manage these systems via apps or voice commands adds convenience, making energyefficient living more accessible and user-friendly.

By incorporating modern heat pumps, advanced insulation, energy exchange systems, passive cooling techniques, and smart home technologies, you can significantly improve your home’s energy efficiency and comfort. Whether you choose to make small upgrades or pursue a comprehensive energyefficient design, these advancements align with your goals for a more ecofriendly, cost-effective home.

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

+MORE CONTENT ONLINE nexthome.ca

JENNIFER PEARCE

The Toronto Regional Real Estate Board website (trreb.ca) is your gateway to a wide range of Greater Toronto Area (GTA) housing market resources designed to cater to realtors and their clients, including buyers, sellers, landlords, tenants and business owners, plus anyone looking to stay informed on the latest real estate market trends.

Explore our up-to-date information on the GTA real estate market. With our monthly Market Watch report published on trreb.ca, you gain detailed insights about sales activity, average prices and new listings. Our market reports help you to keep pace with in-depth real estate trends across the region. Plus, drill down further with our condo, commercial, and rental reports.

Always ask a TRREB member realtor for expert advice tailored to your

specific homebuying, selling or commercial property needs. Our dedicated page on trreb.ca simplifies your journey and provides the clarity you need on available government programs, city services, buyer representation agreement and more.

Learn how we’re fostering a healthy business environment for realtors and their clients. In one click you can discover our work with all levels of government to improve housing affordability and supply. Read our latest positions and gain a leg up in navigating the world of housing.

With more than a century of expertise backing TRREB, the information we provide is trusted, accurate and upto-date. Whether you’re browsing through market reports, catching up on the latest housing statements or exploring our comprehensive buying and selling resources, there’s something for everyone.

Visit trreb.ca for the latest look into the housing market and to connect with a TRREB member realtor.

Jennifer Pearce, TRREB President, is a Broker and Owner with ReMax Rouge River Realty Ltd., a family owned and operated brokerage. She is a secondgeneration realtor and has been licensed since 2000. trreb.ca

+MORE CONTENT ONLINE nexthome.ca

Interest rates have always been a topic of conversation in the real estate world, and rightly so. After a period of significant hikes, we are now witnessing a downward trend. The phrase “What goes up must come down” has never been more relevant as we experience the third rate drop in Canada this year. This shift in the interest rate landscape is creating a unique window of opportunity for prospective homebuyers and investors to enter the market.

“

DEBBIE COSIC

Over the past few years, we saw a rapid increase in interest rates as the Bank of Canada aimed to curb inflation and stabilize the economy. These rate hikes had a cooling effect on the

” The Bank of Canada has now implemented its third rate cut this year, signaling a more balanced approach to economic growth and monetary policy.

housing market, making borrowing more expensive and pushing some buyers to the sidelines. However, in recent months, there has been a notable shift. The Bank of Canada has now implemented its third rate cut this year, signaling a more balanced approach to economic growth and monetary policy.

So, why is this happening? The primary reason is that inflation has begun to stabilize, and the Canadian economy is showing signs of resilience. The central bank recognizes that maintaining highinterest rates could stifle growth and strain consumers. Lowering rates aims to encourage borrowing and spending, both of which are critical for sustained economic growth. For potential homebuyers, this is welcome news. Lower interest

“

” Lower interest rates mean reduced mortgage costs, making homeownership more accessible.

rates mean reduced mortgage costs, making homeownership more accessible. With the recent rate cuts, monthly mortgage payments have become more affordable, allowing more Canadians to enter the market or upgrade to a home that better suits their needs. Moreover, with the possibility of rates dropping further, locking in a mortgage now could

mean significant savings over the life of a loan.

Now is a particularly good time to buy property for several reasons. Firstly, market conditions are more favourable for buyers. With rates coming down, there is less competition than during peak periods of low interest rates. This translates into a more balanced market where buyers have more negotiating power. Sellers, including builders are also more motivated, which can result in better deals and incentives that weren’t availble just a few months ago.

Additionally, real estate remains one of the most reliable long-term investments. With the uncertainty surrounding other investment vehicles, such as stocks and bonds, real estate offers a tangible asset that has historically appreciated over time. As interest rates decrease, the potential for property value growth increases, making it an ideal time to buy.

In2ition Realty has a plethora of pre-construction projects across the GTA, offering incredible deals to match these favorable conditions. Whether you’re looking for a starter home, an investment property or an upgrade, we have options that cater to every need and budget.

To explore these opportunities, visit in2ition.ca or follow us on social media at @in2itionrealty for the latest updates and insights. Don’t miss out –now is the time to make your move in this dynamic market.

Make your move now and position yourself for success in a market that is ripe with opportunity.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

+MORE CONTENT ONLINE nexthome.ca

So far, this has been an interesting year in real estate. In the face of changing parameters, owning a home is still the Canadian dream for most people. Financially, a house or condominium is a tangible asset, rather than figures on paper. You can touch it, see it and take care of your

investment over time. Homeowners also earn equity, which gives them financial options. Despite the ups and downs of real estate cycles, just look at the return-on-investment it has brought over the decades.

In January, Valour Group, District REIT and Pro Fund Mortgages

reported the results of a survey that showed Canadians are strongly engaged in real estate investing. In fact, 87 per cent of survey participants reported that they feel more comfortable investing in real estate than in publicly traded stocks.

In April of this year, the results of the 30th annual RBC Home Ownership Poll showed that 60 per cent of Canadians under the age of 65 look at homeownership as a good investment. This statistic is up from 53 per cent in 2023. The poll mentions that inflation was compromising the ability of half the survey respondents

to save for a down payment, but with inflation down now, that is changing.

It was more good news in August, as the Conference Board of Canada shared the results of its index of national consumer confidence. Opinions on making major purchases such as a home remained at restrained levels, but that had improved over the previous few months. The percentage of people expressing optimism or uncertainty was much higher, and the percentage of those believing it was a bad time to purchase a home was lower.

Financial considerations aside, there are many psychological benefits to homeownership. There is pride of ownership, for example, that cannot be replicated by renting. Whether a purchaser chooses to live in a lowrise community or a condominium, that person enjoys a sense of belonging. Owning brings with it a sense of permanency that many call “putting down roots.” Recent surveys also show that most homeowners consider comfort and safety in their homes and communities extremely important. In other words, a family’s surroundings are considered as much a part of “home” as their house or condo. That is why so many residential developers spend time and effort ensuring their homes and condos are situated in areas where people want to live.

Empty-nesters who have accumulated “stuff” for decades often decide to sell their longtime family home and buy a condo suite or more compact home. When they buy early from designs, they can make the most of their waiting time to make the transition psychologically, as well as physically.

As challenging as real estate prices have become, we are hearing a shift in the conversations of first-time buyers today. They are realizing the same thing we all knew when we purchased homes decades ago –that to own a home or condo, they will have to forego some of the luxuries they may take for granted. For financial and psychological reasons, they want to pursue the Canadian dream.

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

If you’re considering purchasing a home for the first time in Canada, now is a particularly interesting time in the real estate market. This month, Canada cut rates to 4.25 per cent, and the U.S. was slated to lower rates on

Sept. 18. This marks the first time in years that both countries are aligned on rate drops, which is likely to prompt a bigger discussion about the changing outlook for the market.

Historically, the real estate market tends to slow down during the summer, but the fall often brings a

shift. With more rate cuts expected this year and a “comeback” in market activity, it is likely that we may see an uptick in both buyer interest and inventory levels.

The potential for lower interest rates means borrowing could become more affordable. For first-time buyers, this is a key advantage. With both fixed and variable rates expected to drop, borrowing costs could

decrease, making homeownership a lot more accessible compared to the last little while. With the market also currently experiencing a period of lower competition and thus more inventory, this scenario gives firsttime buyers the opportunity to take

“ ”

Whether you’re considering a fixed or variable-rate mortgage, it’s essential to shop around for the right option. Lower rates could mean you might save a significant amount over the life of your mortgage.

advantage of more choices and potentially lower prices. In fact, prices have been dropping for some homes that have lingered on the market, encouraging buyers to act more opportunistically.

WHAT SHOULD BUYERS DO NEXT? Get pre-approved

With rate cuts on the horizon, getting pre-approved for a mortgage can now position you well for the coming changes. Getting into the market is ideal, especially if prices drop further. However, if things get competitive, this could also drive prices up. Whether you’re buying for the first time or renewing your mortgage, talk to an unbiased mortgage advisor who can help you shop around.

Explore your options

Whether you’re considering a fixed or variable-rate mortgage, it’s essential to shop around for the right option. Lower rates could mean you might save a significant amount over the life of your mortgage.

Keep a close eye on the market

As media attention increases around the impending rate cuts and more buyers enter the market, competition may heat up. Acting now can help you avoid the potential rush and benefit from current lower prices and increased inventory.

Consider different property types

If you’re looking at condos, there is a substantial amount of inventory available. This could be a favourable time to explore condo options, which might offer better value and more choices compared to single-family homes. As prices have been dropping and could drop further.

The coming months could offer a unique window of opportunity for first-time buyers in Canada. With expected interest rate reductions and a potentially more dynamic market, now is a great time to assess your options and get pre-approved. Being proactive could help you secure a good deal and navigate a more competitive market landscape with confidence. Overall, doing the diligence to be prepared to buy is the best way to be opportunistic in a time when prices and interest rates are dropping.

Jesse

Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm. thinkhomewise.com

+MORE CONTENT ONLINE nexthome.ca

HIGHER STYLE. HIGHER STANDARDS. HIGHER VALUE.

Introducing High Line Condos, an intimate six-storey condo next door to Churchill Meadows’ protected forest and moments from Erin Mills Town Centre. With stunning architecture, an impressive array of stylish suites, panoramic rooftop terrace and abundance of surrounding greenery - this is the carefree condo lifestyle and attainable luxury you’ve always wanted.

STARTING FROM $599,900

PRESENTATION CENTRE & MODEL SUITE HOURS: MONDAY - THURSDAY 12PM - 6PM I FRIDAY CLOSED SATURDAY & SUNDAY 12PM - 5PM

by LINDA MAZUR

Fall is upon us and it’s bringing with it the desire to change up our decor and cosy up for the cooler weather. Adding a touch of autumnal colours to your home can be easier than you think; we just have to look to the great outdoors with its abundance of inspiration, and it’s easy to become

motivated to create a new look for our home.

The wonderful shades of oranges, cranberries and golds we find in nature alone are enough to inspire our creativity. Blend these colours with the deep smokey blues, earthy reds, sultry purples and plums, or

the ashy browns that are trending this year to create a stunning look for your home. Pair these trending colours with a layering of textures, fabrics and patterns to create the perfect aesthetic. This season presents us with a multitude of design inspirations, but it also ushers

in a time when we desire “more” in our surroundings. With the cooler weather comes the natural inclination is to layer, whether it be our wardrobe or our decor.

As we survey our rooms, the airy light sheers on our windows suddenly begin to look a little out of place. The weight and warmth of layering a pair of heavy weight velvet side panels might just fill the void and add a great splash of colour at the same time. A beautiful textured wool throw and the addition of a couple of extra toss cushions in bold patterns will add a spark of life to your sofa. As daylight begins to minimize and our flowers have died off, the need to continue the beauty of the colours and textures we have enjoyed throughout the summer months outdoors begin to work their way in. Transfer these influences in to beautifully patterned fabrics, and inspirational accent pieces that will layer up and continue to put a smile on your face throughout the more indoor months. A bunch of dried flowers from the garden can spice up your shelf displays. Change up the look of your accessories and incorporate a metallic tray on your coffee table with a stack of books, floral detail and a great abstract “objet d’art” for that punctuated layered look. The same can be said for your kitchen. Bring your cutting board and oil bottles out of your cupboards to display on the counter with a plant or bowl of fruit. If you are comfortable with a more neutral minimalistic design palette, then stay with that, but you should definitely have some fun with textures and patterns. Perhaps a lush faux fur throw, a basket of wood by the fireplace or some rough-hewn wood detail will find their way into your decor and create for you a classic, warm and elegant aesthetic.

The fall season is a favourite of many, including me. This is a time when less does not always

equal more, so layer up and create some cosiness and warmth in your home for the seasons ahead. The next time you’re out for a walk

have a good look around at the changes happening in nature to find your inspiration… and bring the outdoors in.

Linda Mazur is an award-winning, nationally publicized designer and Principal of Linda Mazur Design Group. With almost two decades of experience this in demand multi-disciplinary design firm is known for creating relaxed, stylish spaces and full-scale design builds within Toronto, the GTA and throughout Canada. lindamazurdesign.com @LindaMazurGroup

by LISA ROGERS

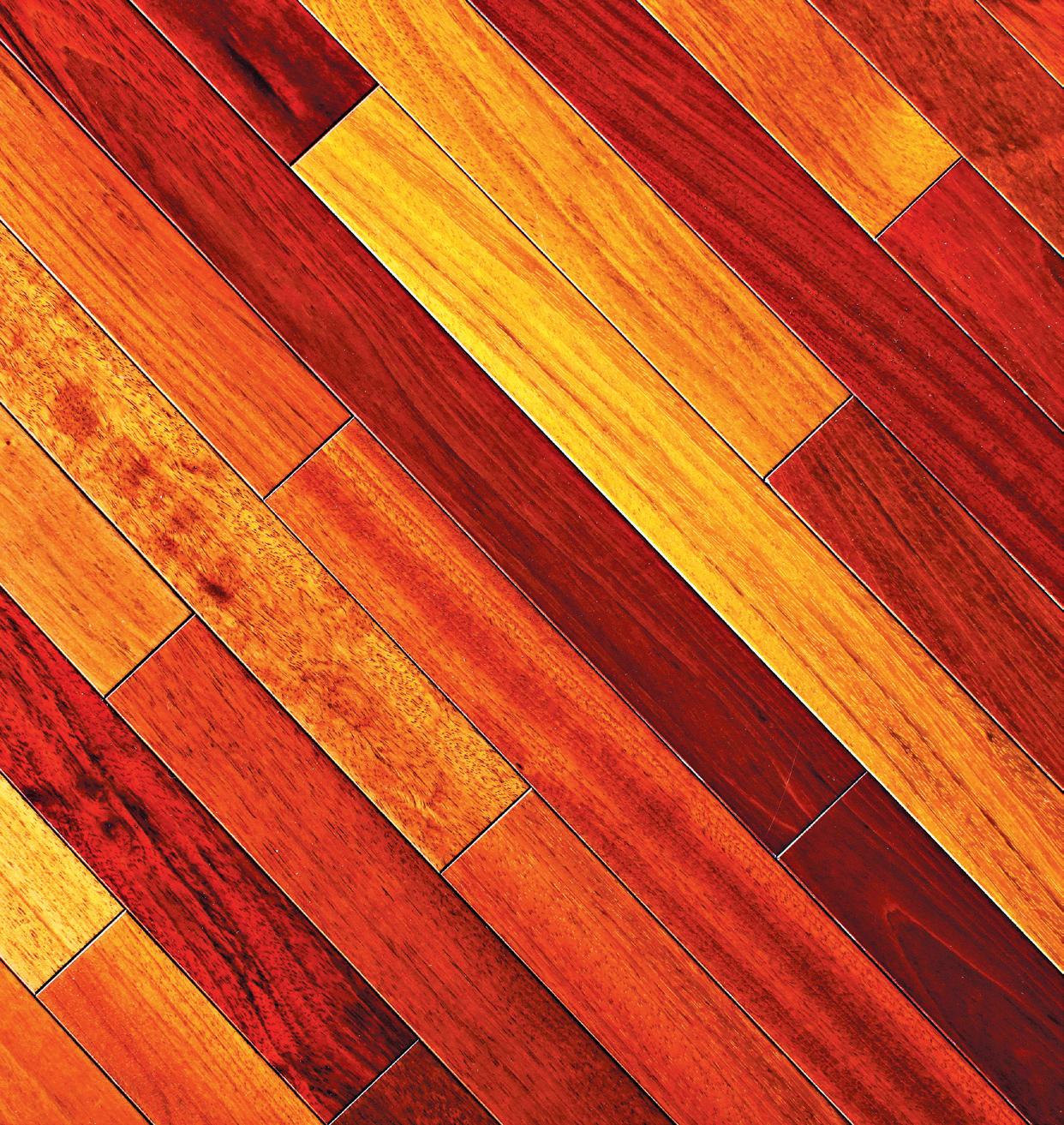

Now that summer is over and we are approaching cooler climes, it’s a great time to think about changing or installing new hardwood floors. There are so many to choose from, and it’s not only the type of wood, but the layout that is also important. Hardwood is the foundation for your whole condo home: It’s what warms up your space and adds harmony to each room, tying everything together. I run hardwood everywhere, even my

bathrooms, which sometimes shocks people, but to me, it counterbalances cold surfaces and adds a real depth of feel and comfort to my home.

So many options

Herringbone is a timeless hardwood, and it’s also quite trendy right now. If I were to use this particular hardwood, I would save it for one special room in my house, whether

that be a foyer or a sitting room. Because it’s a bold pattern, you wouldn’t want to run it throughout too many areas as it can overwhelm your space. It’s also a little more expensive to lay herringbone, so you want to consider that as well.