Be a part of an inspired enclave of semi-detached and single-family mountain homes.

A neighbourhood proudly connected by parks, ponds, trails, and nature preservation areas. At the heart of Windfall is “The Shed,” a vibrant gathering place available year-round, features outdoor pools, and serves as the perfect community hub. The essence of Blue Mountain living –a lifestyle of luxury, leisure, and natural beauty.

WAYNE KARL EDITOR-IN-CHIEF Active Life Magazine

EMAIL: wayne.karl@nexthome.ca

TWITTER: @WayneKarl

Location, location, location. When you’re in the market for a new home or condo, this golden rule of real estate is among your key determining factors.

Sure, what to buy, based on your budget, finances and needs. But where to buy, based on proximity to work, family, transportation and transit infrastructure, desired amenities and other considerations. And, of course, affordability here, too.

Increasingly, though, that last point is being influenced by development charges and other fees – known as growth charges – which provide important funding for municipalities, for new roads, transit and libraries and other community needs. Other than property taxes or user fees, they are the main source of funding municipalities use to pay for growth-related infrastructure.

“The DC system in Ontario performs a vital function, both legally and in provision of housing supportive infrastructure,” says Dave Wilkes, president and CEO of the Building Industry and Land Development Association (BILD). Somewhere along the way over the last few decades, though, DCs have gotten wildly out of control.

“Given the relative scale of DCs in dollar terms, the current housing crisis, the need to reduce complexity and the opportunity to learn from best practices from other jurisdictions, an update of the DC Act is significantly overdue and must be completed with a sense of urgency.”

For example, as Wilkes writes in his column on page 50, one GTA municipality has “famously increased its DCs by more than 6,000 per cent over the last 30 years.” (Step forward, City of Toronto).

Imagine paying $65 for a cup coffee, or $1.2 million for a car. That’s what such increases would mean if we applied the same rate to other purchases. “In other words, the stakes and the cost implications are much more profound today, and the need for cost controls have never been higher.”

Municipalities, therefore, have to pay attention. They must act.

Thankfully, some of them are.

In November 2024, the City of Vaughan adopted a plan to bring these costs down, and Mississauga more recently did the same (see page 12).

Development charges are a complicated subject, and likely not one you as a prospective homebuyer have thought much about. Until now, because they’re impossible to avoid as an influence on the cost of your home.

So, what can you do, as a prospective new-home buyer?

Well, first, pay closer attention to the subject as you go about your new home search. Second, it’s well within your right to contact your city councillor and question them on the issue. Tell them you want the city to keep municipal costs lower than comparable municipalities. And if they can’t…

Third, you may take your homebuying decision elsewhere.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm based in Toronto. thinkhomewise.com

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

Mark Cullen is a Member of the Order of Canada, and provides gardening advice to more than two million Canadians each week. Ben Cullen’s specialty is food gardening. markcullen.com; Facebook @MarkCullenGardening and Pinterest @MarkCullenGardening.

Greg Gazin is a syndicated tech columnist, blogger, podcaster, and contributes to canoe.com, Troy Media and Active Life magazine. gadgetguy.ca

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

Linda Mazur is an award-winning designer and Principal of Linda Mazur Design Group. With almost two decades of experience this in demand multi-disciplinary design firm is known for creating relaxed, stylish spaces and full-scale design builds throughout the GTA and Canada. lindamazurdesign.com @LindaMazurGroup

Jayson Schwarz LL.M. is a Toronto real estate lawyer and partner in the law firm Schwarz Law Partners LLP. Visit online at schwarzlaw.ca or email info@schwarzlaw.ca with your questions, concerns, critiques and quandaries.

Dave Wilkes is President and CEO of the Building Industry and Land Development Association (BILD), the voice of the homebuilding, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter, @bildgta or visit bildgta.ca.

SENIOR VICE-PRESIDENT, SALES, NEXTHOME

Hope McLarnon

416.708.7987 hope.mclarnon@nexthome.ca

DIRECTOR OF SALES, ONTARIO, NEXTHOME Natalie Chin 416.881.4288 natalie.chin@nexthome.ca

SENIOR MEDIA CONSULTANTS Amanda Bell 416.830.2911 amanda.bell@nexthome.ca

EDITORIAL DIRECTOR

Amanda Pereira

EDITOR-IN-CHIEF – GREATER TORONTO AREA

Wayne Karl wayne.karl@nexthome.ca

CONTRIBUTORS

Jesse Abrams, Mike Collins-Williams, Ben and Mark Cullen, Debbie Cosic, Sara Duck, Greg Gazin, Barbara Lawlor, Linda Mazur, Jayson Schwarz, Dave Wilkes

EXECUTIVE MEDIA CONSULTANTS

Jacky Hill, Michael Rosset

VICE-PRESIDENT, MARKETING – GTA Leanne Speers

MANAGER CUSTOMER SALES/SERVICE

Marilyn Watling

SALES & MARKETING CO-ORDINATOR

Gary Chilvers

BUSINESS DEVELOPMENT MANAGER

Josh Rosset

DISTRIBUTION distributionteam@nexthome.ca

ACCOUNTING INQUIRIES accountingteam@nexthome.ca

DIRECTOR OF PRINT MEDIA Lauren Reid–Sachs VICE-PRESIDENT, PRODUCTION – GTA Lisa Kelly

PRODUCTION MANAGER – GTA Yvonne Poon

GRAPHIC DESIGNER & PRE-PRESS COORDINATOR Hannah Yarkony

Published by nexthome.ca

Advertising Call 1.866.532.2588 ext. 1 for rates and information. Fax: 1.888.861.5038

Circulation Highly targeted, free distribution network aimed at real estate buyers using street level boxes, racking and Toronto Star in-home delivery.

Canadian subscriptions 1 year = 6 issues – $35 (inc. HST). Canada Post – Canadian Publications Mail Sales Product Agreement 40065416.

Copyright 2025 All rights reserved. All copyright and other intellectual property rights in the contents hereof are the property of NextHome, and not that of the individual client. The customer has purchased the right of reproduction in NextHome and does not have the right to reproduce the ad or photo in any other place or publication without the previous written consent of NextHome.

Editorial Submissions from interested parties will be considered. Please submit to the editor at editorial@nexthome.ca.

Terms and Indemnification Advertisers and contributors: NextHome is not responsible for typographical errors, mistakes, or misprints. By approving your content and/ or submitting content for circulation, advertisers and contributors agree to indemnify and hold harmless NextHome and its parent company from any claims, liabilities, losses, and expenses (including legal fees) arising out of or in connection with the content provided, including but not limited to any claims of copyright infringement, unauthorized reproduction, or inaccuracies in the content. Advertisers acknowledge that they have the necessary rights, permissions, and licenses to provide the content for circulation, and they bear full responsibility for the content’s accuracy, legality, and compliance with applicable laws upon approval. Contributors acknowledge NextHome reserves the right to omit and modify their submissions at the publisher’s discretion.

The Toronto Regional Real Estate Board’s (TRREB) Market Outlook and Year in Review report reveals that a well-supplied housing market will keep average annual home price growth at the rate inflation, with the average selling price increasing moderately in the GTA over the course of the year.

“A growing number of homebuyers will take advantage of lower borrowing costs as we move toward the 2025 spring market, resulting in increased transactions and a moderate uptick in average selling prices in 2025,” says TRREB Chief Market Analyst Jason Mercer. “However, the positive impact of lower mortgage rates could be reduced, at least temporarily, by the negative impact of trade disruptions on the economy and consumer confidence.”

For 2025, TRREB forecasts:

• A total of 76,000 home sales in 2025, up by 12.4 per cent over 2024. Lower borrowing costs coupled with ample supply will improve affordability and prompt more buyers to move off the sidelines.

• The average selling price to reach $1.14 million, up by 2.6 per cent over 2024, for all home types combined.

Price growth will be stronger for single-family homes, as compared to the well-supplied condo apartment market.

The Ipsos polling results on buying and selling intentions show:

• 28 per cent of survey respondents said they are likely to buy a home in 2025. Nine per cent of these respondents are very likely to purchase a home this year. These results matched intentions for 2024.

• First-time buyers accounted for 42 per cent of intending homebuyers.

• On average, homeowners rented for 8.5 years before purchasing their first home.

However, 25 per cent of homeowners said they rented for two years or less before buying.

• Intended down payments remain substantial, at an average of 28 per cent of the purchase price.

• 37 per cent of survey respondents said they are likely to sell a home in 2025, with 14 per cent very likely to sell. This result was in line with 2024 polling.

• The great majority of poll respondents said that high taxes are making homeownership less affordable, and if taxes continue to increase many will have to adjust their home buying intentions.

“As we look to the future, prioritizing housing diversity and supply remains paramount,” says TRREB President Elechia Barry-Sproule. “Encouraging the development of missing-middle housing – such as townhomes, duplexes, and lowrise multi-unit buildings – is critical to delivering a range of attainable options for individuals and families. Purpose-built rentals also play a vital role in ensuring everyone has access to a place they can call home.”

The report also unveils new research on traffic congestion and its staggering societal and economic impact on GTA residents. In addition,

solutions to reduce the Landlord and Tenant Board backlog are presented alongside policy recommendations aimed at addressing issues within Ontario’s tax, development charge and municipal funding frameworks.

“At TRREB, we believe the solution starts with collaboration,” says TRREB CEO John DiMichele. “Traffic congestion and affordability are interconnected challenges that require integrated approaches. The current system of high development charges, taxes and administrative hurdles only exacerbates the issues. This stalls progress on building the housing supply we need to support our growing communities.”

GTA realtors reported 3,847 home sales through TRREB’s MLS system in January 2025, down by 7.9 per cent compared to the same period last year. New listings amounted to 12,392 – up by 48.6 per cent yearover-year. On a seasonally adjusted basis, January sales were up monthover-month compared to December 2024. The MLS Home Price Index Composite benchmark was up by 0.44 per cent year-over year in January 2025. The average selling price, at $1.04 million, was up by 1.5 per cent over January 2024.

The Bank of Canada again reduced its influential policy rate in its latest announcement on Jan. 29, this time by 25 basis points, for the sixth consecutive reduction. The rate now sits at 3.00 per cent, down from 5.00 per cent in April 2024.

This move sets the stage – or at least the hope – for possible further reductions in the coming months to spur the market.

“A rate cut is always welcome news, while a greater reduction would have been even better,” says Debbie Cosic, founder and CEO of In2ition Realty. “The Bank of Canada’s decision is a move that sets a positive tone for the year ahead and signals a potential shift in market conditions.”

“The Bank of Canada (decision) will further increase borrowing capacity for homebuyers and benefit mortgage holders whose loans are coming up for renewal,” adds Phil Soper, president and CEO of Royal LePage. “This latest decrease arrives just before the spring housing market – when demand typically picks up –which should spur buying and selling activity in the weeks ahead.”

“Over the past year, declining interest rates have given Canadians a renewed confidence to enter the housing market,” says Samantha Villiard, vice-president, ReMax Canada. “Despite the ongoing affordability crisis rooted in a lack of housing supply – many Canadians still see the long-term value in homeownership, and so the anticipated decline could prompt greater market activity for the remainder of Q1 and heading into Q2.”

At press time, potential U.S. tariffs were put on hold, leaving Canadians a little weary about the upcoming months.

“The looming promise of hefty tariffs by the United States government is a source of uncertainty

for the central bank and consumers alike,” says Soper.

“We believe the Bank of Canada’s focus will be a decided shift from an inflation battle to avoiding an economic downturn. A recession resulting from a tariff tit-for-tat could prompt additional cuts in the shortterm to stimulate the economy. Though Canada’s housing market would be insulated for the most part from trade turmoil, economic challenges could eventually cause activity to slow.”

“Of course, we’ll be keeping an eye on economic factors like the potential tariff situation and how it unfolds,” adds Cosic. “But regardless of what’s to come, let’s take this momentum and run with it. Rates are lower, incentives are still strong, and there are some incredible deals to be had.

“If you’ve been waiting for the right time to get into the market – whether you’re a first-time buyer, a moveup buyer or an investor – this is the moment to act. The landscape is shifting, and those who take advantage early will be in the best position moving forward.”

Mississauga City Council recently approved a motion from Mayor Caroyln Parrish to make Mississauga housing more affordable, including with incentives to kick-start development and get more homes built quickly.

The motion details important financial changes to boost the supply of housing – including new rental housing – for Mississauga families.

Among other items, the motion will:

• Temporarily lower municipal residential development charges (DCs) by 50 per cent in the City of Mississauga for all residential construction prior to Nov. 13, 2026. On a new single-family home this equates to a reduction of $28,108 and represents the single-largest reduction of development charges by any municipality in Ontario.

• Temporarily defer the payment of development charges until first occupancy resulting in saving on financing costs.

• Temporarily eliminating development charges on three-bedroom purposebuilt rental residential apartment projects, thereby incenting this type of crucial development.

Development charges and other fees – also known as growth charges – provide important funding for municipalities to pay for infrastructure for new homes such new roads, transit and libraries. Other than property taxes or user fees, they are the main source of funding Mississauga currently uses to pay for growth-related infrastructure.

The motion requests that the Region of Peel consider matching the DC incentives adopted by the City. In addition, to spur the creation of Mississauga rental housing, the motion calls on the Region to implement a new multi-residential tax subclass. This new tax subclass would reduce property taxes by up to 35 per cent for new purpose-built rental housing.

• The price of an average home in Mississauga is approximately $1.4 million for a detached home or $600,000 for a condo.

• While development charges in Mississauga make up about 10 per cent of the cost of a new condo –fees, taxes and charges from all levels of government total about 25 per cent of the cost of a new GTA home.

• The City’s current development charge rate for a residential condo is $38,316 per unit. With a 50-percent reduction, the charge would be $19,158 per unit.

• Development charges from the Region of Peel, GO Transit and school boards total an additional $59,884 for an apartment (condo) unit.

By cutting these charges, the City says it is aiming to address the housing crisis head-on by getting homebuilding back on track in Mississauga.

As a longer-term solution, the City is calling on the provincial and federal governments to adequately fund growth-related infrastructure for municipalities and provide much needed funding for affordable housing.

“Council took a bold step to help build more homes and make them

more affordable for Mississauga residents,” says Parrish. “In a crisis of this magnitude, we must act now. Reducing development charges – and eliminating them for family units in rental developments – will help get shovels in the ground immediately.

“However, to tackle this housing crisis, collective action is crucial. I’m calling other levels of government to come to the table. More development will make our City stronger. We need to ensure more access to housing for every income level – this is critical to a healthy economy, safe communities and a dynamic Mississauga for our residents.”

The Building Industry and Land Development Assocation (BILD) applauds the move.

“The City of Mississauga is walking the walk when it comes to new housing,” says President and CEO Dave Wilkes. “BILD and its members echo (Mississauga’s) call to the Region of Peel to consider matching the actions of the City. We would also like to acknowledge and thank the federal government for its direct financial support of Mississauga’s efforts. We encourage all regions, cities and towns in the GTA to follow the vision and lead of Mississauga.”

Elevated interest rates and economic and political uncertainty weren’t enough to seriously hamper the housing market in Canada in the fourth quarter of 2024, as the aggregate price of a home increased 3.8 per cent year-over-year to $819,600, according to the Royal LePage House Price Survey.

On a quarter-over-quarter basis, the national aggregate home price remained essentially flat, rising a modest 0.5 per cent. While activity began to flourish again in the final months of 2024, following sluggish demand in most major markets over the summer, home price appreciation remained in check last quarter.

“There are several converging factors revitalizing Canada’s real estate market and making homeownership more attainable,” says Phil Soper, president and CEO, Royal LePage. “Interest rates have fallen sharply in recent months, with further reductions expected in 2025. We believe the Bank of Canada could lower rates by another 100 basis points by year end, steadily improving affordability. At the same time, new mortgage rules are already helping younger Canadians by increasing borrowing power and reducing monthly carrying costs.

“While geopolitical uncertainty and concerns over the Trump administration’s proposed trade policies may weigh on consumer confidence, residential real estate remains largely insulated from such external pressures in the short term,” he adds. “Canada’s housing market is fundamentally driven by domestic factors. With strong full-time job growth, improving housing supply in key markets, and more accessible financing, we expect healthy activity levels to persist, even as broader economic challenges unfold.”

Broken out by housing type, the national median price of a single-

family detached home increased 4.9 per cent year-over-year to $855,900, while the median price of a condominium increased 1.5 per cent to $592,700. On a quarter-overquarter basis, home prices remained virtually flat, with the median price of a single-family detached home increasing a modest 0.6 per cent, and the median price of a condominium rising just 0.4 per cent.

“Year-over-year activity levels were up sharply in Canada’s largest cities during the fourth quarter, with national home sales volumes exceeding the 10-year moving average for the first time since the post-pandemic market slowdown began three years ago,” says Soper. “As sidelined buyers regained confidence and took advantage of improved affordability, momentum built steadily through the final months of 2024.

“We expect stronger demand to persist through the winter, setting the stage for an early and active spring season,” says Soper.

The resignation of Prime Minister Justin Trudeau and the prorogation of government on Jan. 6 has raised the prospect of an early federal election.

“The critical need for housing in Canada transcends political cycles,” says Soper. “The next government must prioritize addressing the supply crisis, which affects millions of Canadians seeking affordable shelter and stability for their families.”

In December, Royal LePage issued its 2025 Market Survey Forecast, projecting that the aggregate price of a home in Canada will increase 6.0 per cent in the fourth quarter of 2025, compared to the same quarter in 2024.

The aggregate price of a home in the GTA increased 2.3 per cent year-over-year to $1.14 million in

the fourth quarter of 2024. On a quarterly basis, the price decreased slightly by 0.6 per cent.

Broken out by housing type, the median price of a single-family detached home increased 3.9 per cent year-over-year to $1.42 million in the fourth quarter of 2024, while condominiums dipped 0.7 per cent to $714,600.

“Declining lending rates and changes to mortgage regulations will make it easier for buyers in Toronto and the surrounding regions to take their time and find the right deal for them,” says Shawn Zigelstein, broker and leader of Team Zold, Royal LePage Your Community Realty.

Zigelstein notes that activity in the townhome segment is currently leading the market, due to the property type’s relative affordability. Meanwhile, condominium sales have continued to stagnate.

In the city of Toronto, the aggregate price of a home decreased 1.7 per cent year-over-year to $1.09 million in the fourth quarter of 2024, while the median price of a single-family detached home rose a modest 1.2 per cent to $1.62 million, and condos decreased 2.7 per cent to $681,200.

Royal LePage is forecasting that the aggregate price of a home in the GTA will increase 5.0 per cent in the fourth quarter of 2025, compared to the same quarter last year.

Fieldgate Retirement Living – exceptional senior housing in Muskoka and elsewhere

With stunning landscapes and vibrant communities, Muskoka has become a coveted destination for those looking to enjoy the tranquility of nature. The region is covered with more than 1,600 lakes, offering countless opportunities for boating, fishing and swimming. For these reasons and many more, Muskoka is an ideal place for retirees seeking a peaceful and fulfilling lifestyle.

New rules make mortgage renewals easier for Canadians

The Office of the Superintendent of Financial Institutions (OSFI) recently announced a new rule for uninsured mortgages in Canada. Uninsured mortgages no longer require stresstesting at renewal, which could save Canadian homeowners thousands of dollars. Here’s what you need to know.

7 late-season tips for your food garden

We’ve been thinking about food a lot lately. Every time we are in our gardens, we are reminded that the food we grew with such pride through the summer is melting away into pockets of rot. But we are here to tell you that in fall, there is an encore happening in your garden and celebration is not finished.

How to stay one step ahead of costly water damage

Water damage can ruin property, weaken structures and create hidden health risks, making it costly in the long run. Fortunately, affordable technology such as the Flo Smart Water Monitor and Shutoff by Moen is here to help.

Development and growth putting Collingwood on the four-seasons map

Collingwood has long been a popular vacation destination, mostly as a weekend winter getaway to enjoy some of the best skiing in Ontario at The Blue Mountains, or golf and cycling in summer. But there’s a lot more happening in this part of Simcoe County, situated on the Nottawasaga Bay at the Southern Georgian Bay Region. A beautiful natural location will do that.

It’s been quite the start to 2025 already, with federal and provincial politics and all kinds of other agenda items piling up on housing files.

All this activity, then, seems quite fitting for a report that examines the outlook for the upcoming year. There already were enough matters for would-be homebuyers to think about: New home supply, interest rates, inflation and the economy. We didn’t need federal politics, as it pertains to housing policy, added to the list, but here we are.

Let’s come back to this, though, for even on this topic, there are some good reasons homebuyers can feel positive about 2025, and for the market in general to embrace it as the year of the turnaround.

Several factors are swinging back in the market’s favour.

The Bank of Canada reduced its policy rate five times in 2024, and once already this year. The rate now sits at

by WAYNE KARL

3.00 per cent, and most experts predict more cuts in 2025.

BoC’s reductions have been helpful and are likely to stimulate the Greater Toronto and Hamilton housing market in the short term by increasing buyer affordability, says Mike CollinsWilliams, CEO of the West End Home Builders’ Association (WEHBA). “As we move through 2025, sustained lower rates will assist to stabilize market, prompting recovery and growth in both sales and new construction activity across the region.”

2025 RATE ANNOUNCEMENTS

March 12

April 16

June 4

July 30

Sept 17

Oct 29

Dec 10

Debbie Cosic, CEO and founder of In2ition Realty, agrees, but says lower rates are just a start.

“It is a clear signal that we are moving in the right direction, offering

much-needed relief for borrowers, and a glimmer of hope for a recovering real estate market in 2025,” she says. “Lower interest rates will provide breathing room for homeowners and prospective buyers, fostering renewed activity in the housing market.

“We need governments to step in and banks to step up. Extended amortization rates are essential to tackle the affordability crisis we’re facing. Why is it that commercial loans in Canada can secure 50-year amortizations through CMHC-insured funds, yet this option isn’t extended to the residential market, where it’s so desperately needed?”

Simply put, Collins-Wiliams adds, achieving middle-class housing affordability is impossible with the current tax burden on new housing. “All levels of government need to come to the table and work with industry to drastically reduce taxes, fees and charges on new housing.” And this brings us to…

Housing policy is a hot topic in Canada, and certainly in the GTHA and elsewhere in Ontario.

Homebuyers, builders, lenders and industry associations all have a stake in this important matter. And it’s up to government – federal, provincial and municipal – to truly understand the issues and address them with meaningful and effective measures.

From the “promises, promises” department, two important initiatives were suggested recently – though by opposition parties.

In the fall, the federal Conservatives tabled a proposal to remove the GST on new homes with a purchase price of less than $1 million. WEHBA and Canadian Home Builders’ Association (CHBA) say they have been advocating for years with all major parties for a change to GST thresholds, and are encouraged that such initiatives would address what has been a major contributor to housing affordability challenges.

“The GST thresholds haven’t changed since the introduction of the GST in 1991,” says CHBA CEO Kevin Lee. “Since then, house prices have more than doubled. Removing the GST on new homes will help improve affordability and enable more supply.”

The other important recent initiative came at the provincial level, from Bonnie Crombie, leader of the Ontario Liberals. On Dec. 11, Crombie announced More Homes You Can Afford, a plan to make buying or renting a home more affordable.

Among other benefits, Crombie says, the plan would:

Eliminate the provincial land transfer tax: For first-time homebuyers and seniors downsizing – saving families and seniors on average $13,500 off the cost of a new home.

Scrap development charges: On new middle-class housing, and replace them with the Better Communities Fund to ensure that the province invests in and benefits from sustainable municipal growth.

Like the federal Conservative proposal, Crombie’s plan is just an idea at the moment, not a policy by a government that can actually implement it. But it’s getting huge support.

“The plan focuses on key population groups, including firsttime homebuyers, seniors looking to downsize, and people looking to rent a home they can afford,” the Ontario Home Builders’ Association (OHBA) says.

Richard Lyall, president of the Residential Construction Council of Ontario (RESCON), is even more direct.

“It’s a bold move and the right call,” he told Active Life. “(Development charges) have exploded in the last decade. A 1,000-per-cent increase. Incomes have been left in the dust and housing affordability has been crushed. No other jurisdiction does this. The growth has been a runaway train.”

More locally, the issue of development charges and other fees is an issue that, as Building Industry and Land Development Association (BILD) President and CEO Dave Wilkes says must be addressed.

New homes are subject to a multitude of fees and charges collected by the municipality, such as DCs and other fees that amount to burdensome costs for new-home buyers.

Some good news on this front came in November 2024 when the City of Vaughan adopted a plan to bring these costs down.

Mayor Steven Del Duca and council approved reductions to the City’s development charges, which have been among the highest in the GTA.

Facing a market with fundamental challenges, well prepared builders are more than ready for the 2025 turnaround. And for patient and informed homebuyers, there are

plenty of opportunities in both highand lowrise homes.

“I think 2025 is heading in the right direction,” says Kelly Anderson, sales and marketing manager at Silvergate Homes.

“There is a lot of demand out there for housing – new buyers, downsizers, right-sizers – they all want to purchase and are just waiting for the right time. The right time for a lot of these people might be spring – so builders should gear up and get ready for a busy market. There are a lot of builders out there with fabulous projects, so buyers should see some excellent options. That, mixed with lower rates, should spice things up for 2025.”

“I believe 2025 will bring healthier sales volume compared to recent years, but the recovery will be gradual, allowing time for buyer confidence to rebuild,” adds Richard Mariani, sales and marketing manager of CountryWide Homes.

In September 2024, the federal government announced bold mortgage reforms to address housing affordability and make homeownership more affordable for more Canadians.

The changes included:

• IIncreasing the $1-million price cap for insured mortgages to $1.5 million, to reflect current housing market realities and help more Canadians qualify for a mortgage with a down payment of less than 20 per cent.

• Expanding eligibility for 30-year mortgage amortizations to all firsttime homebuyers and to all buyers of new builds. By helping Canadians buy new builds, including condos, the government is announcing another measure to incentivize more new home construction and tackle the housing shortage. This builds on the Budget 2024 commitment permitting 30-year mortgage amortizations for firsttime homebuyers purchasing new builds, including condos.

It’s the simple things. It’s a walk through nature when life gets too busy. It’s a family hike along the river to reconnect. It’s a dinner out with friends at a delicious local restaurant. It’s coming home to a slower pace of life, one that offers charm, serenity, nature and picturesque living.

Welcome to Dunnville, a charming town along the banks of the Grand River – and home to Meritage Landing, a new community by

Mountainview Building Group.

Meritage Landing exclusively features coveted, bungalow townhomes built with the exceptional craftsmanship and incredible building standards that are the hallmark of all Mountainview homes.

Dunnville is a town where every day feels like a breath of fresh air. Whether you’re out walking the trails, paddling along the river, or simply soaking in the peaceful atmosphere from your porch, you’ll discover what makes this area so special. The community is designed for those who crave a harmonious blend of modern living and natural beauty, where everything you need is just a short walk or drive away.

With closings in 2026, at Meritage Landing you’ll choose from masterfully designed, and coveted bungalow floorplans created with modern living and style in mind.

Starward is a stunning bungalow exterior home, featuring two

bedrooms (or one bedroom plus den) and one bathroom. It boasts abundant natural light, with large windows throughout, a spacious open-concept Great Room and kitchen featuring a centre island. Starward is the perfect space for hosting family and friends, creating new traditions, and making lasting memories.

Newport is a two-bedroom (or one-bedroom plus den), onebathroom bungalow where you’ll live large in an exceptionally designed home. With rooms designed for entertaining, relaxing and functional living, enjoy open concept dining and living space, spacious kitchen with centre.

You’ll fall in love with the endless options for customizing your new home. At Meritage Landing, you’ll feel empowered to create a home that perfectly reflects your style, meets your family’s needs, and fits your budget. With expert guidance from

your dedicated architectural designer and design consultant, we’ll help you bring your vision to life and build a home that’s uniquely yours, from your floorplan to the finishing touches. Whether it’s reimagining layouts or selecting from premium finishes in our award-winning Design House, Mountainview ensures your new home will be designed for the life you want to live.

At Meritage Landing in Dunnville, you’ll live the way you always dreamed you would – surrounded by nature in a quaint and walkable community that’s just blocks away from the river with picturesque views, eclectic shops and a simple pace of living. There’s plenty of greenspace, trails and parks to connect with nature, including Byng Island Conservation Area just across the river, where you’ll find opportunities to hike, boat or fish along the Grand River.

Dunnville is ideally located a short drive from the shores of Lake Erie and slightly less than an hour from Hamilton and Niagara. Whether you want to stay close to home or explore the surrounding areas, enjoy the perfect combination of small-town, peaceful living and modern conveniences.

Mountainview Building Group has more than 45 years of experience building quality family homes and is one of the largest and most respected builders in the Golden Horseshoe. The company’s exceptional communities, modern home designs and commitment to customers have won it countless industry awards,

including 2024 OHBA Builder of the Year and Best Design Centre, the prestigious 2024 Avid Service Award (Avid Ratings recognize builders from across North America that provide an extraordinary homebuying experience), 2023 NHBA Builder of the Year, and 2023 National Awards for Housing Excellence, just to name a few. However, it’s the happy homeowners, repeat customers and referrals that mean the most. Time and again, couples and families choose Mountainview communities to call home.

Meritage Landing offers a unique opportunity to embrace a lifestyle that’s full of nature, tranquility and community. The homes at Meritage

Landing are more than just a place to live – they are a place to thrive. Whether you’re downsizing to enjoy a more relaxed lifestyle or buying your first home, you’ll find the perfect space to settle into a welcoming community that feels like home from the moment you arrive. With proximity to nature, modern conveniences and a commitment to quality, your dream home awaits at Meritage Landing.

Treat yourself to a simpler life and discover luxury small-town living at Meritage Landing. For more information or to register now, call 289.783.9537 or visit meritagelanding.com.

by WAYNE KARL

In the world of senior living, enriching the experiences of residents is everything. With a focus on helping people embrace a lifestyle characterized by growth, connection, convenience and a profound sense of community, Nautical Lands Group has found a way to stand out.

With Wellings Plus communities in Whitby, Calgary and Stittsville, Ont., Nautical Lands says it is the fastest-growing provider of 55-plus residential housing in Canada.

We spoke with Vice-President of Marketing Natalie Tommy for further insights on Nautical Lands, and why seniors should consider Wellings and the company’s other offerings.

How are things coming along at Wellings of Whitby? I understand the first phase launched in the fall… We are thrilled to be open and the members that are now living with us are enjoying their new homes and the camaraderie of their new neighbours. One of the most heartfelt things we see and are part of, is members pulling tables together to enjoy dinner with each other. This sense of connection in community transforms people right

in front of our eyes. We often hear members say they didn’t realize they were alone so much, until they weren’t. Smiles are usually in abundance.

The response has been excellent since we introduced the model four years ago. Construction delays have been plentiful but now we are getting settled in the first half of the building and the community is coming to life. We are unique in the lifestyle we offer active adults over 55, in that we don’t offer healthcare. Wellings is where you belong, long before you need a retirement home. Full kitchens, guest suites, fitness gym, bars, restaurants, floor-to-ceiling windows and premium finishes are just the beginning.

Right from the beginning we have placed our members at the heart of all the decisions, and have a general manager with a hospitality background that is extensive. We are proud to be cooking and preparing all the food and beverage offerings on site, in our own kitchens, using our own recipes, many of which have come from our members. For example, The Sage Owl Bistro on the first floor is serving comfort foods

such as burgers and pizza, as well as more elevated food selections that include salmon, steak and seafood. The pizza oven is now functioning, and the choices expand based on the requests of the members. Once phase two opens this spring, we will have two more dining options – and an outdoor terrace that’s licensed.

What does the second phase entail, and how will it differ from phase one, if at all?

Phase two will open in spring, and all suites and dining spaces are currently being finished. Phase two adds more dining and more apartment suites.

You have mentioned that the concept behind your communities is based on residents feeling seen, valued, heard and appreciated. Where does this philosophy originate, and how does it show up in Wellings of Whitby or your other communities?

We started operating traditional retirement homes with care more than 20 years ago. One of the recurring requests from residents was to be able to live in a community, and not take the care portion. Unfortunately,

that model just doesn’t work. The Wellings model was born after many focus groups and requests to have this option. Wellings is where you want to be, not where you need to be.

At the core, we understand what every human being needs to thrive, and particularly thrive as we age. Freedom to design the lifestyle you want on your own terms, connection with like-minded people who are at a similar age, independence and a community that celebrates and respects you. In North America, productivity is highly valued, and when most people make decisions to retire or “refire” into a second career or passion they have, they become less visible.

Wellings, along with our members, are committed to creating a community that is greater than the sum of its parts. We’ve raised more than $100,000 for charities that are important to our members. We are a stronger voice for seniors in all our communities.

We put the goals of the future, for our members, at the heart of our communities, design choices, food and beverage offerings, fitness programming and staffing choices. This all creates a sense of belonging and a stronger, happier community at large.

How do you select which locations you choose for development?

We study the market research and search out areas that are underserved. We started in rural Ontario, wanting to keep seniors in the communities they raised their families and worked in.

What was it about Whitby that led you to commit to Wellings of Whitby?

Location is walkable to services and shops. It’s easy to get to, and not far from the major arteries. It has a lot of community amenities that seniors like.

How does Wellings of Whitby differ from what else might be available in that market?

We are a true 55-plus model. Most of our competition is care based, attracting older seniors who need care. Think of us has more of a hotel feel. You decide how you want to spend your days, enjoy the underground heated parking, concierge services and when you want to eat and with whom you want to eat with. We have some activities, but encourage the members to start social clubs of their own.

We also are 100 per cent rental communities.

a personal note

How do you occupy your time when not at the office?

What else about Nautical Lands would you like prospective residents to know?

Nautical Lands Group is a Canadian company that is wholly focused on seniors residential housing options. We are 23-plus years old and have communities in Ontario and Alberta.

What’s next for Nautical Lands?

We have a lot of properties throughout Alberta and Ontario. A full list of locations is available at wellingscommunity.com.

nlgc.com

I visit with family and friends, walk our Australian Shepherd, Tinkerbell, paint landscapes and travel when I am able.

What do you consider your greatest inspiration, personally or professionally?

Just one? Nature is a constant source of inspiration. It’s resilient, re-invents itself, and is always adapting. The women I choose to surround myself with are strong. My mother and sister are shining examples of courage, resilience, strength and compassion. My dad inspired me to work hard, be undaunted by failure, trust your instincts and do what lights you up. And currently, our ambassador, Kathie Donovan, has inspired me to grow, accept who I am, embrace compassion and kindness and to prepare for my own “refiring.” My co-workers at Nautical Lands and Wellings have inspired me to collaborate more and trust that together we are stronger.

What’s on your reading, podcast or TV binge watch these days?

The Let Them Theory by Mel Robbins, The Gifts of Imperfection by Brene Brown, The Psychology of Colour… generally anything about colour, and Why We Talk, by BJ Bueno. Next up Open When, by Dr Julie Smith.

On TV, the Queer Eye new series, Ray Donovan, Landscape Artist of the Year and anything on the DIY channels.

As we move into 2025, Canadian homeowners renewing their mortgages may face a new reality: Higher interest rates compared to their initial mortgage terms. While this might seem daunting, it’s also an opportunity to reassess your financial situation and make

decisions that align with your current goals. A mortgage renewal is more than just signing on the dotted line – it’s a chance to shop around, negotiate and take control of your financial future.

There are some essential tips and strategies to help you navigate mortgage renewals in today’s high interest rate environment. Whether you’re a first-time renewer or an experienced homeowner, these insights can save you money and reduce financial stress.

Mortgage renewals happen when your current mortgage term ends, and you need to secure a new term for the remaining balance. In 2025, many Canadian homeowners will be renewing at rates significantly higher than they locked in five years ago. For context, mortgage rates in 2020 hit historic lows, with some fixed rates dipping below two per cent. Fast-forward to today, and fixed rates are hovering around four

“

” A mortgage renewal is more than just signing on the dotted line – it’s a chance to shop around, negotiate and take control of your financial future.

per cent or more, putting upward pressure on monthly payments. If your term is ending soon, it’s crucial to approach your renewal with a strategy to minimize financial impact.

1. Start early: Don’t Wait Until the Last Minute Lenders generally send renewal letters two to four months before your renewal data, but waiting until then limits your options. Begin exploring renewal opportunities at least four to six months before your term expires. This gives you time to compare rates, shop around, and lock in the best deal.

Pro tip: Lenders allow you to secure a new mortgage up to 120 days before your renewal date that will be held until your renewal. If rates rise during this period, you’re protected. If rates drop, you can often negotiate own further.

2. Shop around for the best rate

While your current lender may offer convenience, don’t assume they’ll give you the best deal. Shopping around with other lenders or working with a mortgage broker can reveal competitive rates and terms. Mortgage brokers, such as our team at Homewise, in particular, have access to multiple lenders and can

help you find a product tailored to your needs.

Why this matters in 2025: Higher rates mean even small differences in your mortgage rate can have a significant impact on your monthly payments and overall interest costs.

3. Consider extending your amortization period

If higher rates are stretching your budget, extending your amortization period could help lower your monthly payments. For instance, if you have 20 years left on your mortgage, you could extend it to 25 years, reducing your payment burden in the short term.

Things to keep in mind:

• While extending your amortization reduces monthly payments, it increases the total interest you’ll pay over the life of your mortgage.

• You can always shorten your amortization later or make extra payments when rates stabilize or your financial situation improves.

4. Evaluate your financial goals

Mortgage renewals are a great time to reassess your financial goals. Are you planning to stay in your current home long-term, or are you considering selling in the near future? Your plans can influence whether you choose a fixed or variable rate, the length of your term, and other features such as prepayment flexibility.

Fixed vs. variable in 2025:

• Fixed rates offer stability in today’s uncertain environment.

• Variable rates might still be attractive for those expecting rate cuts later in the year but come with more risk if rates remain high.

5. Negotiate with your current lender Don’t accept your lender’s first renewal offer without negotiation. Many lenders are willing to match or beat competitive offers, but they won’t do so unless you ask. Use quotes from other lenders or brokers to leverage a better rate or more favorable terms.

If you’re in a position to do so, making a lump sum payment or increasing your monthly payments before or during renewal can help reduce your principal and save on interest over time. Many lenders allow up to 15 to 20 per cent of your original principal to be paid off each year without penalties.

• Rising household debt: Higher rates mean higher payments, so consider your overall debt load and budget carefully.

• Inflationary pressures: Inflation could influence rates further, so stay informed about market trends.

• Government policies: Keep an eye on government announcements or programs aimed at easing affordability challenges, such as first-time buyer incentives or stress test changes.

Mortgage renewals in 2025 come with unique challenges, but with the right strategies, you can minimize financial strain and secure a deal that works for you. Start early, shop around and don’t hesitate to seek professional advice from a mortgage broker or financial advisor. A proactive approach can make all the difference in navigating this higher rate environment.

Ready to renew your mortgage?

Contact an unbiased mortgage advisor such as one of ours at Homewise to explore your options, compare rates, and ensure you’re getting the best possible deal.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm. thinkhomewise.com

+MORE CONTENT ONLINE nexthome.ca

MARK AND BEN CULLEN

Dirty knees and gardening go together, just not at this time of year. Fact is, many of us “garden” indoors in the Canadian winter. We grow tropical plants, amaryllis, windowsill herbs, bean sprouts and more.

The need to nurture plants through the winter months is a good thing. There is nothing like getting some real dirt under your finger nails.

Here is our primer for mid-winter gardening success:

1. Low light means poor performance. Most tropical plants need sunlight to perform and grow well. The hibiscus that you brought indoors from the patio this fall is looking tired and unhappy about now. Hibiscus, like many flowering tropical plants, prefer high light. This is true for oleander, mandevilla vine, fig trees and citrus trees.

The answer is to give your tropical sun-lover as much light as possible by placing it in a south or west facing window. However, that window receives about 500ft. candles of light on a sunny day this time of year, while in June the same window receives about 2,500-ft. candles.

Before you consider moving closer to the equator, cut the plant back. Mid-winter is the perfect time of year to prune large tropical plants. Pruning thickens and enhances the appearance of the plant. By early May, your tropical plant will be pushing new growth that will explode in the warm early summer temperatures and sunshine. Don’t be discouraged by the appearance of your tropicals this time of year.

2. Less water. As your indoor plants slow down their need for water is reduced. A bit like us, when we are most active, we need to hydrate more often. As a rule of thumb, water indoor plants thoroughly only when

the soil is dry about two to three centimetres below the surface.

3. Tepid water. Plants are like people, and they don’t like cold water. Ever take a cold shower? Didn’t think so. Pour water into a large container before you go to bed and use that the next day to hydrate your thirsty plants. Gardeners using municipal water need to do this to let the fluoride and chlorine dissipate in the form of gas over night. If you use water right from the tap chances are good that a calcium deposit will build up around the root zone of your plants. You see evidence of this on clay pots when a white, powdery substance appears on the outside of the pot.

4. Air dry means white fly. One of the most frequent questions we get this time of year on our website is, “How do I get rid of white fly on my indoor plants?” and the answer is… well, there is no easy answer. White flies are stubborn and once they find their way into your home there is no easy way to get rid of them. Yellow, sticky traps are quite effective at bringing them under control, but

seldom eliminate the problem. Daily misting with a spray atomiser also helps to minimize the problem, as white flies hate water and love the dry atmosphere of a Canadian home mid-winter. Mostly they more of a nuisance than a plant-killer.

5. Re-pot. If you have an indoor plant that is languishing, now is an appropriate time to pot it up into a larger sized container. First, pull the plant out of its existing pot and examine the roots. If they are “hitting the wall” of the pot and twirling round in circles, that is a sign that the plant is under stress.

After you have removed the root mass from the existing pot, pull the roots apart. Get violent, pulling and tearing up to 30 per cent of existing roots to break the root mass free. When it discovers new soil in a clean pot, it will begin putting down new roots.

Pot up one size when re-potting (for example, from an eight- to a 10in. pot) and use quality, new plant soil.

After the plant is in its new home, compact the soil around the roots with a wooden ruler or similar piece

of wood. Push air pockets out, which can trap water and cause root rot. Water thoroughly and don’t begin to fertilize until new growth appears on the top portion of the plant. Finally, keep the foliage of your tropical plants dust free. Use insecticidal soap on a dampened, clean cloth to wipe down dracaena, yucca, schefflera and virtually all leafy plants.

Happy plants, happy home.

And you thought you had the winter off.

Mark Cullen is a Member of the Order of Canada. He reaches more than two million Canadians with his gardening/ environment messages every week. Receive his free monthly newsletter at markcullen.com Ben Cullen is a professional gardener with a keen interest in food gardening and the environment. You can follow both Mark and Ben on Twitter @MarkCullen4, Facebook @MarkCullenGardening and Pinterest @MarkCullenGardening.

+MORE CONTENT ONLINE nexthome.ca

DEBBIE COSIC

Foreign investment in Ontario’s preconstruction market has long been a hot topic, often sparking debates about its role in driving up housing prices. While it’s easy to attribute skyrocketing costs to foreign buyers, the reality is far more nuanced. Understanding the true drivers of

demand in Ontario’s pre-construction market requires dispelling myths and focusing on the data.

One of the most persistent misconceptions is that foreign buyers dominate Ontario’s pre-construction market, buying up condos en masse and driving prices beyond reach for local residents. While foreign buyers have contributed to demand, their share of the market is significantly smaller than perceived. According to

government data, foreign ownership represents only a small percentage of transactions in the housing market. Policies such as the Non- Resident Speculation Tax (NRST), which imposes a 25-per-cent levy on nonresident buyers, have further reduced foreign activity in the sector.

Contrary to popular belief, most pre-construction buyers are domestic investors and end-users. Many of these buyers are Ontarians leveraging local resources and financing to secure properties. They see pre-construction condos as an

opportunity to build equity, secure future housing or generate rental income in a high-demand market.

The real drivers of demand in Ontario’s pre-construction market stem from local factors. A booming population, fueled by immigration and urbanization, has created an insatiable need for housing. The GTA alone absorbs thousands of newcomers each year, many of whom require immediate rental accommodations or are seeking to purchase homes.

Additionally, Ontario’s housing supply remains constrained by factors such as zoning regulations, limited land availability and lengthy approval processes for new developments. These supply-side challenges,

combined with strong population growth, have placed upward pressure on prices and fueled demand for preconstruction properties.

Local investors are the backbone of Ontario’s pre-construction market. They often purchase units with the intention of renting them out, addressing the region’s chronic rental shortages. These investors play a vital role in maintaining the rental stock, especially in urban centres where vacancy rates are low.

Although foreign buyers don’t dominate Ontario’s pre-construction market, they do play a role in funding new developments, adding to the rental supply and supporting

“

” The real drivers of demand in Ontario’s preconstruction market stem from local factors.

economic activity. Restricting their participation slows project launches, reduce rental availability and could deter global investment. However, the primary drivers of demand remain local buyers, immigration-driven population growth and a limited housing supply. Instead of imposing broad restrictions, policymakers should focus on increasing housing availability, streamlining approval processes and improving financing options to create a more balanced market that works for both locals and newcomers. Rather than shutting out foreign buyers, Ontario should adopt policies that encourage responsible investment while prioritizing affordability and supply growth. It’s time to move past myths and address the real challenges shaping Ontario’s housing landscape.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

+MORE CONTENT ONLINE nexthome.ca

GREG GAZIN

If you’re like most of us, you’re constantly on the move – whether staying connected with friends and family, managing tasks or enjoying hobbies. But one thing that can quickly become frustrating is your device’s battery life.

Whether it’s your phone, tablet, notebook, wireless earbuds, does it feel like you’re always reaching for a charger? Worse still, have you noticed that over time, you seem to get less and less use from a full charge before your device needs topping up?

While it might seem like just another part of using electronics, two things are happening:

1. You’re using more battery power.

2. Your battery is losing its capacity. Let’s dive into why this happens and what you can do about it.

Batteries age over time, just like people. For lithium-ion batteries, which power most of your devices, after about 500 charge cycles, your battery retains only 80 per cent of its original capacity and cannot be charged beyond that – and will dwindle further with additional use.

Take the iPhone 12 Pro, for example. Its battery starts with a capacity of 2,815 milliampere-hours (mAh). After 500 charge cycles, if its health drops to 80 per cent, the new maximum capacity is around 2252

mAh. So, when you charged your phone and it reads 100 per cent, you’re actually only getting 2252 mAh of usable power. Similarly, if you used to get 10 hours of use per day, you’ll now get only eight under same use.

Several factors contribute to battery drain. Newer apps require more power, constant updates, and background processes such as notifications, GPS, messaging and other social media apps can drain power without you realizing it. Screen brightness also plays a huge role –higher brightness means more power usage. Occasionally, software bugs can cause unnecessary power drain as well.

Just like in a car, extreme temperatures affect your device’s battery. Cold weather forces the battery to work harder, while excessive heat accelerates its wear and tear – similar to food spoiling faster in hot weather. Keeping your device in a moderate temperature range is a key to prolonging battery life.

Additionally, knock-offs and cheap third-party chargers and cables can negatively impact charging speed and even damage the battery over time. Low-quality materials and poor voltage regulation can cause overheating or short-circuiting, degrading your battery’s health, damaging your device or even what it’s plugged into – such as your car’s electrical system. A family member

recently experienced this firsthand. It’s not worth risking a $1,000 device or a $2,000 automotive repair bill to save a few bucks.

One simple way to extend battery life is to keep it charged between 20 and 80 per cent. According to Battery University, lithium-ion batteries last longest when their charge stays within this range. Avoid regularly draining it to zero per cent or keeping it at 100 per cent for extended periods.

While fast charging is convenient, slow charging is better for longterm battery health. Slow charging generates less heat, reducing stress on the battery. Many devices now have smart charging features to help with this.

Apple’s Optimized Battery Charging slows charging at 80 per cent and finishes it just before you wake up or need to use your device. Samsung offers a Battery Protection Mode that limits charging to 85 per cent to reduce battery wear, while Adaptive Fast Charging adjusts power delivery for efficient and safe charging. Similarly, Microsoft’s Battery Conservation Mode limits charging to 80 per cent when plugged in for long periods. Check your device’s manual to see if it supports these features.

When we think about battery health, we often focus on smartphones and laptops. But Bluetooth headphones, earbuds and speakers also rely on rechargeable batteries. Unfortunately, when these batteries degrade or fail, many are embedded in the device or accessory and often impossible to replace, rendering them useless. This makes it even more important to follow smart charging habits across all your devices.

There’s a new gadget on the market that helps extend battery life. Leo, developed by Netherlands-based Liion Power BV, is a plug-and-play device designed to prolong the lifespan of lithium-ion batteries in USB-charged devices up to 100 watts.

Leo plugs between your charger and device, intelligently analyzing the battery and automatically setting an optimal charge limit, regulating charging speeds, and scheduling breaks to maintain battery health. If you need fast charging, a button switches Leo into Ghost mode to charge up to 100 per cent.

Recognized with the CES 2025 Innovation Award in the Sustainability and Energy/Power category, Leo is an effective solution for enhancing battery longevity while promoting eco-friendly charging practices.

We rely on our devices daily, so keeping them charged efficiently is crucial. By following simple charging habits – keeping charge between 20 and 80 per cent, avoiding extreme temperatures, and opting for slow charging – you can extend your battery’s life and reduce frustration. Products such as Leo offer additional ways to enhance longevity while maintaining eco-friendly practices.

Remember, batteries are an essential part of our modern tech, but with a little extra care, they can serve us well for much longer. It also keeps them out of the landfill.

According to the International Waste Electrical and Electronic Equipment (WEEE) Forum, a whopping 5.3 billion phones were discarded in 2022. Shockingly, about one-third of smartphones are replaced due to aging batteries. Since for many, gadgets are lifelines, it’s worth thinking about battery health the same way you think about your own well-being.

Greg Gazin is a syndicated tech columnist, blogger, podcaster, and contributes to canoe.com, Troy Media and Active Life magazine. gadgetguy.ca

+MORE CONTENT ONLINE nexthome.ca

BARBARA LAWLOR

Timing really is everything in life, especially when it comes to buying real estate. In this cyclical industry, sales fluctuate, as do prices and availability. A great way to look at any new home or condo purchase is with a long-term outcome in mind. Historically, real estate has proven to be an excellent investment. In a hot market, your return-on-investment

may begin to happen before you even move in; in a softer market, it may take longer. Now is an incredible time to buy. In fact, it has never been better. We are just starting to recover from the year of increasing interest rates and high inflation, and there are deals to be had with low deposits and incentives.

Timing affects home and condo buyers according to their personal circumstances and decision-making styles. Some plan for months and research to the hilt; others walk into a sales centre and make up their minds right away. There are other ways to look at timing as well, such as where in the selling cycle a community is. For example, purchasing from plans means you will enjoy the most choice of lots and designs, or in the case of condominiums, of suites, floors and views.

Getting in early also means you have time (up to three to six years with a condominium) to plan for your move and save money toward your purchase. If you have purchased a smaller home or a condo for

the first time, you can pare down your possessions, check out multipurpose furniture and think about decor so you can make the most of your colour selection appointment. Being able to choose features and finishes is a wonderful perk of buying early. Plus, builders often include Grand Opening specials that can save you thousands. Buying early also means you may earn equity before your occupancy date.

You may, however, opt to wait until a condo or lowrise community has been for sale for a while, to see how well it is being accepted by the buying public. At Baker Real Estate Inc., we usually see a jump in sales when construction starts on a building. For many, this peace-ofmind is priceless, because it means

“ ” Timing affects home and condo buyers according to their personal circumstances and decision-making styles.

the builder has secured enough sales to obtain financing and start building. There are also buyers out there who prefer to purchase late in a community’s or condominium’s sales process, when there are built homes and suites available for quick move-ins. Features and finishes are already installed – and remember that even the standards today result in beautiful, functional surroundings. On a financial note, builders sometimes offer special incentives on the final few homes and suites, plus buying late in the selling cycle means you get to enjoy your new surroundings immediately.

Outstanding architecture, amazing amenities, fantastic features and finishes – all of this can be yours in convenient locations close to public transportation, shopping, entertainment venues and more. You can find something wonderful to accommodate every lifestyle, design preference and pocketbook, and enjoy warranty coverage in the process. Why not build equity while building your future in a new home or condo? And the sooner, the better.

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

+MORE CONTENT ONLINE nexthome.ca

MIKE COLLINS-WILLIAMS

Municipalities are navigating a complex web of financial pressures in 2025. With inflation remaining a significant challenge, the strain on municipal tax levies (or tax rates) has intensified, leaving many residents concerned about the rising cost of living. To address these fiscal pressures without overburdening taxpayers, one effective strategy is to broaden the tax base by increasing housing development. Expanding the housing supply offers a dual advantage: It alleviates the housing shortage while bolstering municipal revenues.

“ ” Progressive municipalities recognize the urgency of reducing barriers to housing development. By prioritizing these efforts, they can tackle the twin challenges of affordability and financial sustainability, setting the stage for a thriving future.

Expanding housing supply does more than provide shelter. It creates opportunities for greater affordability and choice, enabling residents to settle in communities that align with their preferences and needs. Additionally, this expansion distributes municipal costs across a larger pool of taxpayers, reducing the strain on existing residents.

For instance, over the past year, approximately 880,000 jobs across Canada were supported by the new housing and renovation industry, highlighting how housing development contributes not only to municipal revenue but also to the broader economy.

Across Ontario, city and town councils are weighing difficult decisions regarding property tax increases to fund rising operational and capital costs for essential services. Many municipalities are adopting an innovative solution: Driving growth in the city’s tax assessment through new developments. By welcoming more taxpayers, municipalities can generate the necessary revenue to sustain services while minimizing the financial impact on current residents. Residential construction – a significant driver of job creation – has been instrumental in regions such as the Hamilton Census Metropolitan Area (CMA), where nearly 17,000 well-paying jobs are supported by the sector, contributing close to $4 billion to the local economy.

Strategic development, particularly high-density housing, significantly enhances land’s tax productivity. This long-term revenue stream is becoming a cornerstone for municipalities aiming to balance budgets. Take, for example, a vacant downtown lot. The tax revenue generated from such a property is negligible compared to that of a multi-unit residential building developed on the same site.

Encouraging such transformations addresses both fiscal challenges and the critical need for housing. It also illustrates how the housing and renovation industry supports employment across Canada, where it remains a leading source of job creation. Smart municipalities are even looking at using new tools such as Community Improvement Plans to incentivize new development through financial breaks on things such as development charges.

Housing affordability hinges on an interconnected market. Increasing supply across all price points creates a ripple effect, making housing more accessible at every level. Through a process called filtering, new housing options allow higherincome residents to move up the market, freeing up more affordable units for others. This demonstrates the importance of fostering marketdriven solutions alongside affordable housing initiatives to improve overall accessibility.

Progressive municipalities recognize the urgency of reducing barriers to housing development. By prioritizing these efforts, they can tackle the twin challenges of affordability and financial sustainability, setting the stage for a thriving future. In 2025, the need for action is clear: Building more housing is not just about growth –it’s about ensuring a resilient and equitable community for all.

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

+MORE CONTENT ONLINE nexthome.ca

JAYSON SCHWARZ, LLM

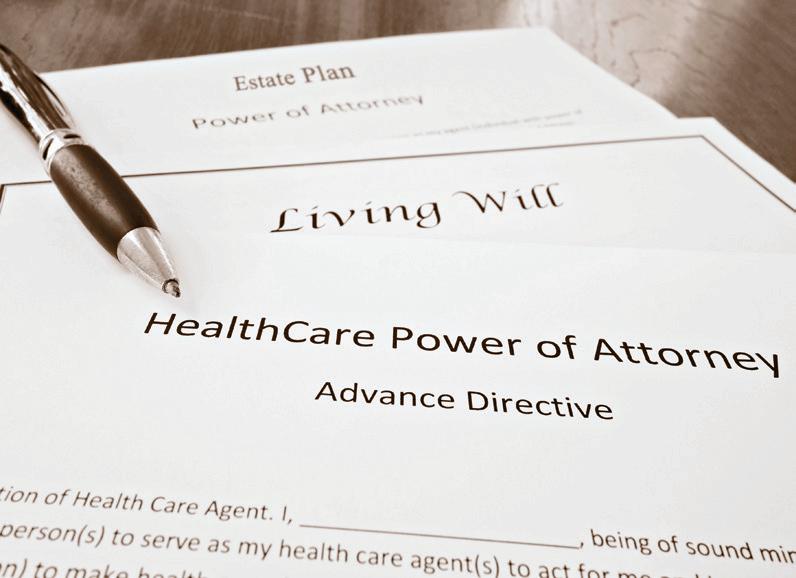

Whether you are a young or an older person, preparing Powers of Attorney and Wills is a necessary evil that everyone not only should do but must do. I stress this because I have seen so many times the mess that is left behind when an individual doesn’t take care of their affairs and a family is left trying to pull the pieces together. This article is not about your Will, it is about preparing Powers of Attorney and not just using printed forms. This became glaringly obvious to me recently when a man suffered a brain aneurism, and his wife was put in the horrible position of having to decide whether to end all life support, effectively leading to the death of her husband.

The husband should have made that decision himself earlier, and spared his wife the horror and guilt. How do we do that?

There are two kinds of Powers of Attorney (POA) that each of us should sign. The first is for financial matters. This POA allows the designated attorney to conduct all financial affairs, as if he or she were that person. This would help, for example, in a case where a person had two broken arms and couldn’t sign cheques. Even with this POA, if you want restrictions and specifics, you need to have the lawyer you retain include these details in the legal document.

The POA for personal care gets even more tricky. This is where you need to think about all of the potential problems that could occur,

and how you want to make decisions on what happens in advance. As an example, here is one kind of clause: I do not wish to be kept alive for any significant period of time if I am in a vegetative state or I am being kept alive by artificial means, unless there is a reasonable chance of my recovery such that I will no longer be in a vegetative state or kept alive by artificial means. Where there is no reasonable chance of recovery, I direct that I be allowed to die and not be kept alive by medications, artificial means or “heroic measures,” and I direct that any such medications, means or measures that would keep me alive in those circumstances be withheld or withdrawn. I do, however, ask that medication, means and measures be mercifully administered to me or medical or surgical procedures be taken to

alleviate suffering even though this may shorten my remaining life. Or, as an example, here is a list to consider: Health care, nutrition, shelter, clothing and hygiene. At our firm, we typically arrange for either a GP or surgeon to be available to review these issues, and be able to discuss them with our clients as part of the process in order that we might incorporate their desires into their POA.

Taking these steps and clarifying these matters now is the best gift you can give your loved ones. Don’t wait.

Jayson Schwarz LLM is the founding senior partner of Schwarz Law Partners LLP. schwarzlaw.ca.

by LINDA MAZUR

Art is quite often thought of as part of the finishing touches of your decor, a last-minute addition or a required space filler on your wall. However, art is more than that, when it is well curated it can transform, establish and elevate any room. It sets the tone of the space while adding to the overall design aesthetic. Art is an expression of personality. It adds visual interest, evokes emotion and can communicate our deepest thoughts.

Understanding the role art plays in your space is important. A vibrant abstract can create energy, a subtle landscape can be calm and peaceful. The colours, textures and forms found in your artwork can be complementary to the surroundings of the room, adding not only visual interest but also depth to the design. It can create a focal point in the space, or add a subtle nuance to a small little corner of a room. It can be the starting point when designing or it could be that extra layer needed when creating a well-curated room.

Many feel that great artwork should stand alone and really have nothing to do with the finished decor of your space. However, when working with clients, I often find that art always will have a greater impact and look better within the space when the decor supports the pieces in questions.

Whether you are working with original art, prints, photography of your family or from your travels or some great vintage pieces you found while thrifting, you need to decide the role these pieces will have within your space. Is the design of your space inspired by your art pieces? Will the art in question be displayed prominently in your space? Will you create a collage wall that blends old and new, abstract and vintage? Does your art collection consist of “objects” that will accompany your framed pieces? However you decide to incorporate these pieces, know that they will certainly add dimension, richness and interest to the area.

So, the question remains, how do you design a space to highlight your art? One of the more classic and easiest ways to coordinate your art selections within your living spaces is drawing on colour. This is not about having your art “match” everything in the space, but rather developing a palette of colour and texture throughout that will help enhance the pieces. This could be a simple repetition of some of the colours found within the piece through paint, fabric and accessories which will help to strengthen the visual impact of the art. A coordination and balance of colour, pattern and texture within your decor will draw you into the room and visually highlight the art.

For a more modern approach, the design of a room can be a bit more restrained, both in colour and composition, allowing the art to become more of an impactful focal point, and with the addition of proper lighting, you can truly make your art piece become the centre of attention. When working with bold or large scaled pieces of art, put some thought in to how you’d like to display these pieces and make the design or decor of your space complement

them instead of just making the art exist. If you are selecting fresh pieces of art for your room, select wisely, in both size and composition. Look to creating groupings or collages with some pieces to avoid simply hanging a single piece per wall. While art is subjective and personal, it does need to vibe with the space it will be in to truly shine.

Art can elevate and complete your interior space. But in the end, artwork should simply make you happy. You can make a bold statement or create a calm and relaxing environment, whichever suits your personality and style best. Be creative with your selections and don’t fear colourful or large-scale pieces. Your art collection is a reflection of you, your life, history, travels and family, so have fun with it and show your true self.